da661fe931d6a0a4e2f8a0da203185b3.ppt

- Количество слайдов: 24

Strategies for successful financings with commercial lenders Ted Kavanagh Director, Mining and Metals Americas January 2009

Strategies for successful financings with commercial lenders Ted Kavanagh Director, Mining and Metals Americas January 2009

Important Notice 2 The information in this document (this “Document”) is for information purposes only. This Document will form part of a verbal briefing by members of the Standard Bank Group (as defined below) and cannot be relied on or used in isolation therefrom. This Document does not constitute an offer of any kind or a solicitation of an offer and does not imply that information contained herein is correct as of any time subsequent to the date of issue. You are to rely on your own independent appraisal of and investigations into all matters and things contemplated by this Document. Whilst every care has been taken in preparing this Document, no representation, warranty or undertaking (express or implied) is given as to the accuracy, completeness or reasonableness of the information or statements contained herein and no responsibility or liability whatsoever is accepted by Standard Bank Plc, Standard New York Securities, Inc. , ZAO Standard Bank or their respective subsidiaries, holding companies or affiliates from time to time (together, the “Standard Bank Group”) for any direct or consequential loss resulting from the use of this Document. All opinions and estimates contained in this Document may be changed after publication at any time without notice. This document has been sent to you for your information only and may not be reproduced or redistributed to any other person. By accepting this document, you agree to be bound by the foregoing limitations. Standard Bank Plc is authorized and regulated in the United Kingdom by the Financial Services Authority (“FSA”) and entered in the FSA’s register (register number 124823). Value Added Tax identification number 625861525. ZAO Standard Bank is authorized and regulated in the Russian Federation by the Central Bank of the Russian Federation (“CBR”) and entered into CBR’s register (register number 3431) and Unified State Register (register number 1027744007246). Standard New York Securities, Inc. is a member of the NASD and SIPC and is not a bank. Standard Bank Plc, Cannon Bridge House, 25 Dowgate Hill, London EC 4 R 2 SB Value Added Tax identification number 625861525

Important Notice 2 The information in this document (this “Document”) is for information purposes only. This Document will form part of a verbal briefing by members of the Standard Bank Group (as defined below) and cannot be relied on or used in isolation therefrom. This Document does not constitute an offer of any kind or a solicitation of an offer and does not imply that information contained herein is correct as of any time subsequent to the date of issue. You are to rely on your own independent appraisal of and investigations into all matters and things contemplated by this Document. Whilst every care has been taken in preparing this Document, no representation, warranty or undertaking (express or implied) is given as to the accuracy, completeness or reasonableness of the information or statements contained herein and no responsibility or liability whatsoever is accepted by Standard Bank Plc, Standard New York Securities, Inc. , ZAO Standard Bank or their respective subsidiaries, holding companies or affiliates from time to time (together, the “Standard Bank Group”) for any direct or consequential loss resulting from the use of this Document. All opinions and estimates contained in this Document may be changed after publication at any time without notice. This document has been sent to you for your information only and may not be reproduced or redistributed to any other person. By accepting this document, you agree to be bound by the foregoing limitations. Standard Bank Plc is authorized and regulated in the United Kingdom by the Financial Services Authority (“FSA”) and entered in the FSA’s register (register number 124823). Value Added Tax identification number 625861525. ZAO Standard Bank is authorized and regulated in the Russian Federation by the Central Bank of the Russian Federation (“CBR”) and entered into CBR’s register (register number 3431) and Unified State Register (register number 1027744007246). Standard New York Securities, Inc. is a member of the NASD and SIPC and is not a bank. Standard Bank Plc, Cannon Bridge House, 25 Dowgate Hill, London EC 4 R 2 SB Value Added Tax identification number 625861525

Agenda 3 § A little bit about Standard Bank § How the current environment impacts new financings § debt availability § deal structure § project finance § Care and maintenance of your existing financing relationships § Financial health in the international banking industry § What can my bank do for me? § Strategies for a successful credit application § Conclusion

Agenda 3 § A little bit about Standard Bank § How the current environment impacts new financings § debt availability § deal structure § project finance § Care and maintenance of your existing financing relationships § Financial health in the international banking industry § What can my bank do for me? § Strategies for a successful credit application § Conclusion

Standard Bank 4 § § § § § Largest bank in SA and Africa Focused on high growth economies outside SA Strongly capitalized Strong strategic alliance with ICBC Strong liquidity A- rating Low volatility of trading revenues Total assets US$178 billion (June 2008) Present in 37 countries around the world – Africa; Argentina; Brazil § Result: § Strongly performing share price relative to peers § Ability to tap the markets in market stress § Positive press and analyst reports § Aiming to be the “go to” emerging markets bank

Standard Bank 4 § § § § § Largest bank in SA and Africa Focused on high growth economies outside SA Strongly capitalized Strong strategic alliance with ICBC Strong liquidity A- rating Low volatility of trading revenues Total assets US$178 billion (June 2008) Present in 37 countries around the world – Africa; Argentina; Brazil § Result: § Strongly performing share price relative to peers § Ability to tap the markets in market stress § Positive press and analyst reports § Aiming to be the “go to” emerging markets bank

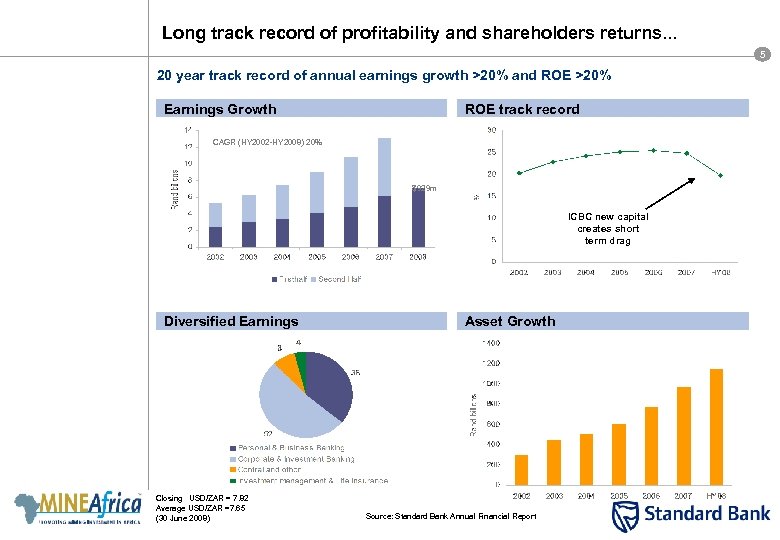

Long track record of profitability and shareholders returns. . . 5 20 year track record of annual earnings growth >20% and ROE >20% Earnings Growth ROE track record CAGR (HY 2002 -HY 2008) 20% $929 m ICBC new capital creates short term drag Diversified Earnings Closing USD/ZAR = 7. 82 Average USD/ZAR =7. 65 (30 June 2008) Asset Growth Source: Standard Bank Annual Financial Report

Long track record of profitability and shareholders returns. . . 5 20 year track record of annual earnings growth >20% and ROE >20% Earnings Growth ROE track record CAGR (HY 2002 -HY 2008) 20% $929 m ICBC new capital creates short term drag Diversified Earnings Closing USD/ZAR = 7. 82 Average USD/ZAR =7. 65 (30 June 2008) Asset Growth Source: Standard Bank Annual Financial Report

How the current environment impacts new financings… 6

How the current environment impacts new financings… 6

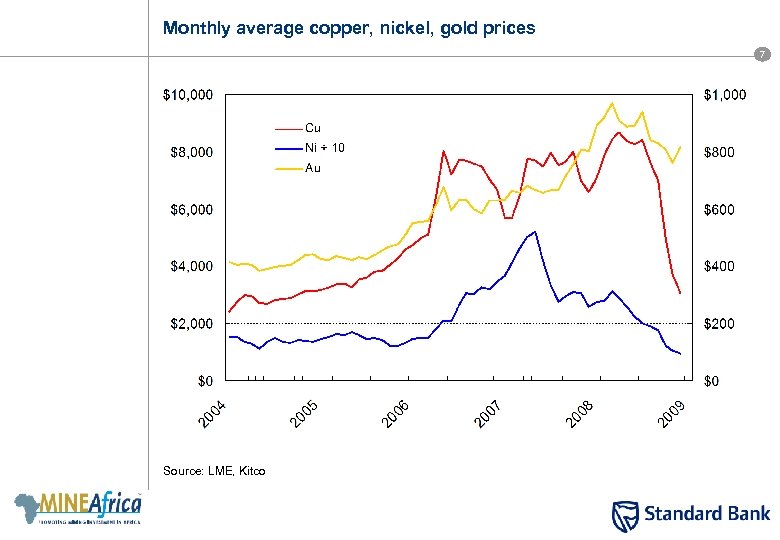

Monthly average copper, nickel, gold prices 7 Source: LME, Kitco

Monthly average copper, nickel, gold prices 7 Source: LME, Kitco

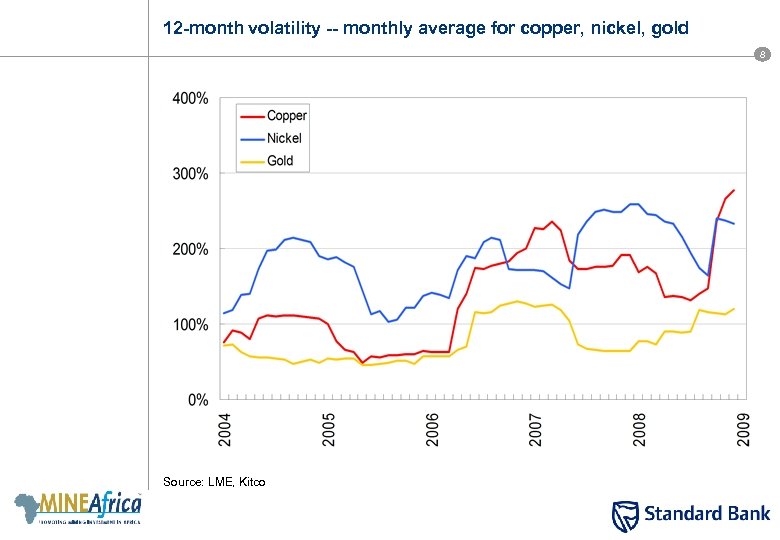

12 -month volatility -- monthly average for copper, nickel, gold 8 Source: LME, Kitco

12 -month volatility -- monthly average for copper, nickel, gold 8 Source: LME, Kitco

Canadian project suspensions/closures 9 § September § Campbell Res. – Copper Rand § October § Ursa Major – Shakespeare § First Nickel – Lockerby § FNX – Levack § North American Palladium – Lac des Iles § Breakwater – Langlois, Myra Falls § Sherritt – Ft Saskatchewan § Liberty – Redstone, Mc. Watters § November § Thompson Crk – Endako § Merit Mining – Greenwood § Xstrata – Craig, Thayer Lindsley § Teck – Trail smelter § Imperial – Mt Polley § December § Vale – Copper Cliff § Acadian – Scotia § First Metals – Fabie § Not to mention projects NOT shut down but limping along

Canadian project suspensions/closures 9 § September § Campbell Res. – Copper Rand § October § Ursa Major – Shakespeare § First Nickel – Lockerby § FNX – Levack § North American Palladium – Lac des Iles § Breakwater – Langlois, Myra Falls § Sherritt – Ft Saskatchewan § Liberty – Redstone, Mc. Watters § November § Thompson Crk – Endako § Merit Mining – Greenwood § Xstrata – Craig, Thayer Lindsley § Teck – Trail smelter § Imperial – Mt Polley § December § Vale – Copper Cliff § Acadian – Scotia § First Metals – Fabie § Not to mention projects NOT shut down but limping along

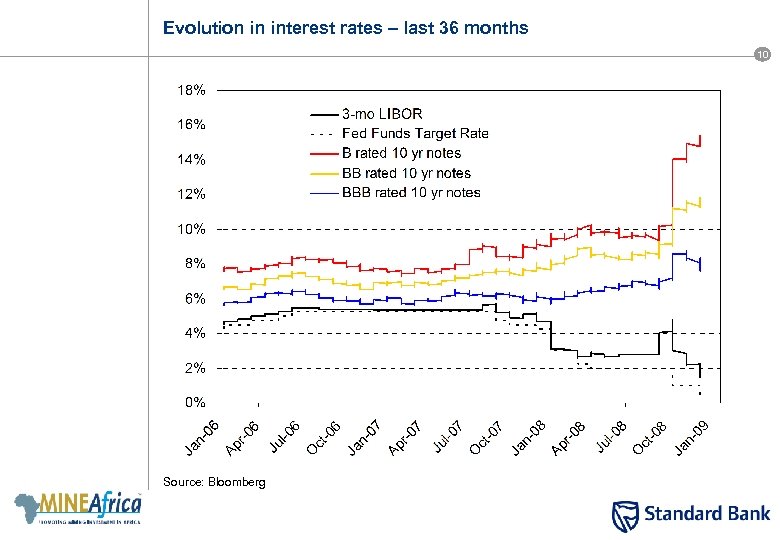

Evolution in interest rates – last 36 months 10 Source: Bloomberg

Evolution in interest rates – last 36 months 10 Source: Bloomberg

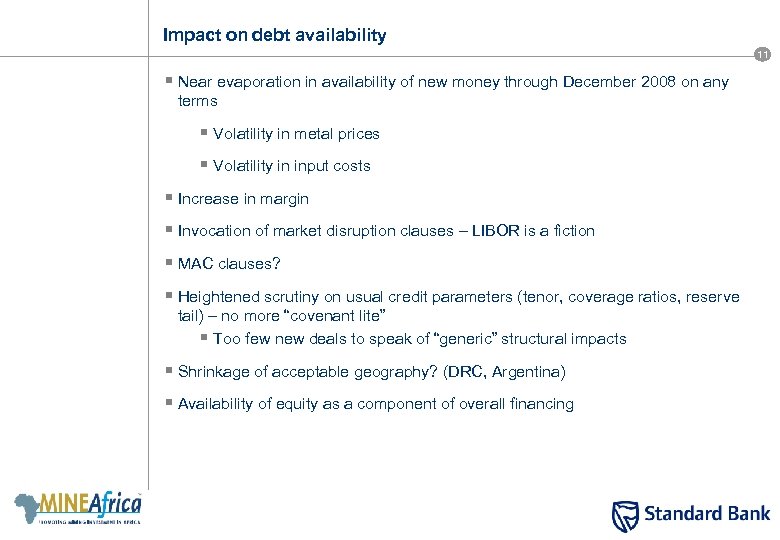

Impact on debt availability 11 § Near evaporation in availability of new money through December 2008 on any terms § Volatility in metal prices § Volatility in input costs § Increase in margin § Invocation of market disruption clauses – LIBOR is a fiction § MAC clauses? § Heightened scrutiny on usual credit parameters (tenor, coverage ratios, reserve tail) – no more “covenant lite” § Too few new deals to speak of “generic” structural impacts § Shrinkage of acceptable geography? (DRC, Argentina) § Availability of equity as a component of overall financing

Impact on debt availability 11 § Near evaporation in availability of new money through December 2008 on any terms § Volatility in metal prices § Volatility in input costs § Increase in margin § Invocation of market disruption clauses – LIBOR is a fiction § MAC clauses? § Heightened scrutiny on usual credit parameters (tenor, coverage ratios, reserve tail) – no more “covenant lite” § Too few new deals to speak of “generic” structural impacts § Shrinkage of acceptable geography? (DRC, Argentina) § Availability of equity as a component of overall financing

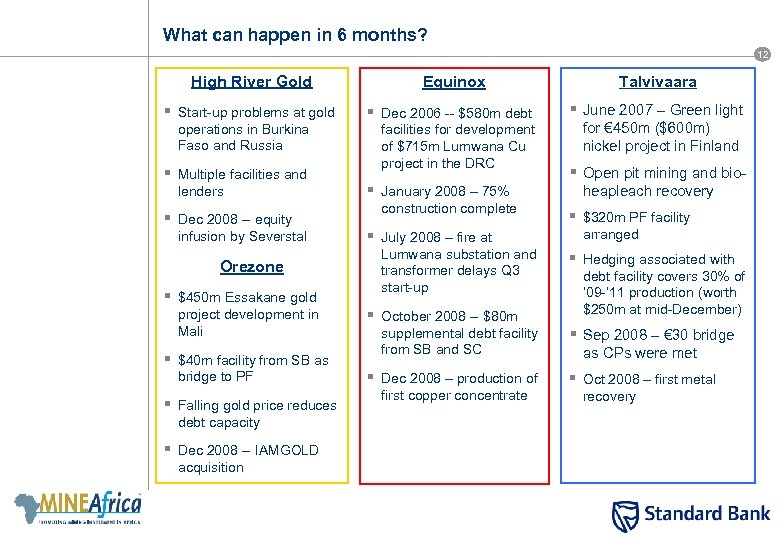

What can happen in 6 months? 12 High River Gold Equinox Talvivaara § Start-up problems at gold § Dec 2006 -- $580 m debt § June 2007 – Green light operations in Burkina Faso and Russia § Multiple facilities and lenders § Dec 2008 -- equity infusion by Severstal Orezone § $450 m Essakane gold project development in Mali § $40 m facility from SB as bridge to PF § Falling gold price reduces debt capacity § Dec 2008 -- IAMGOLD acquisition facilities for development of $715 m Lumwana Cu project in the DRC § January 2008 – 75% construction complete § July 2008 – fire at Lumwana substation and transformer delays Q 3 start-up § October 2008 -- $80 m supplemental debt facility from SB and SC § Dec 2008 – production of first copper concentrate for € 450 m ($600 m) nickel project in Finland § Open pit mining and bioheapleach recovery § $320 m PF facility arranged § Hedging associated with debt facility covers 30% of ’ 09 -’ 11 production (worth $250 m at mid-December) § Sep 2008 – € 30 bridge as CPs were met § Oct 2008 – first metal recovery

What can happen in 6 months? 12 High River Gold Equinox Talvivaara § Start-up problems at gold § Dec 2006 -- $580 m debt § June 2007 – Green light operations in Burkina Faso and Russia § Multiple facilities and lenders § Dec 2008 -- equity infusion by Severstal Orezone § $450 m Essakane gold project development in Mali § $40 m facility from SB as bridge to PF § Falling gold price reduces debt capacity § Dec 2008 -- IAMGOLD acquisition facilities for development of $715 m Lumwana Cu project in the DRC § January 2008 – 75% construction complete § July 2008 – fire at Lumwana substation and transformer delays Q 3 start-up § October 2008 -- $80 m supplemental debt facility from SB and SC § Dec 2008 – production of first copper concentrate for € 450 m ($600 m) nickel project in Finland § Open pit mining and bioheapleach recovery § $320 m PF facility arranged § Hedging associated with debt facility covers 30% of ’ 09 -’ 11 production (worth $250 m at mid-December) § Sep 2008 – € 30 bridge as CPs were met § Oct 2008 – first metal recovery

Care and maintenance of your existing financing arrangements 13

Care and maintenance of your existing financing arrangements 13

Critical elements of relationship 14 § Be proactive! § Communication § Know your credit agreement § covenants § amendments – the third rail § Pricing § Ancillary business

Critical elements of relationship 14 § Be proactive! § Communication § Know your credit agreement § covenants § amendments – the third rail § Pricing § Ancillary business

Financial health of the international banking industry… 15

Financial health of the international banking industry… 15

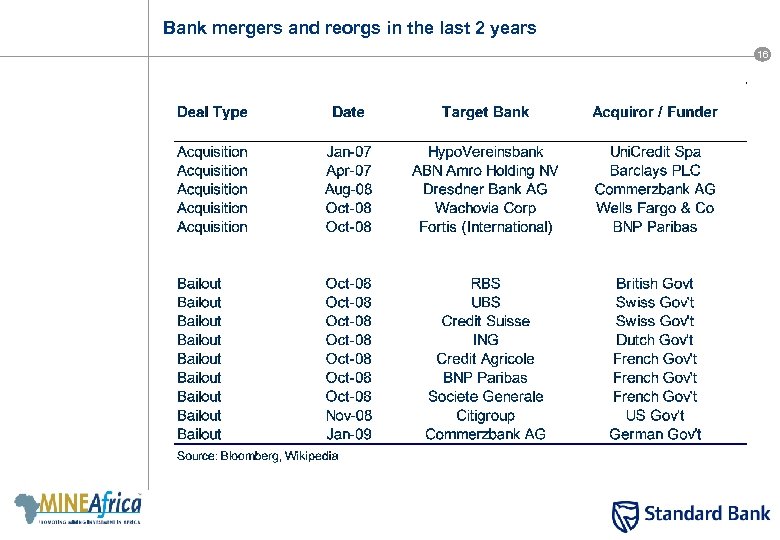

Bank mergers and reorgs in the last 2 years 16

Bank mergers and reorgs in the last 2 years 16

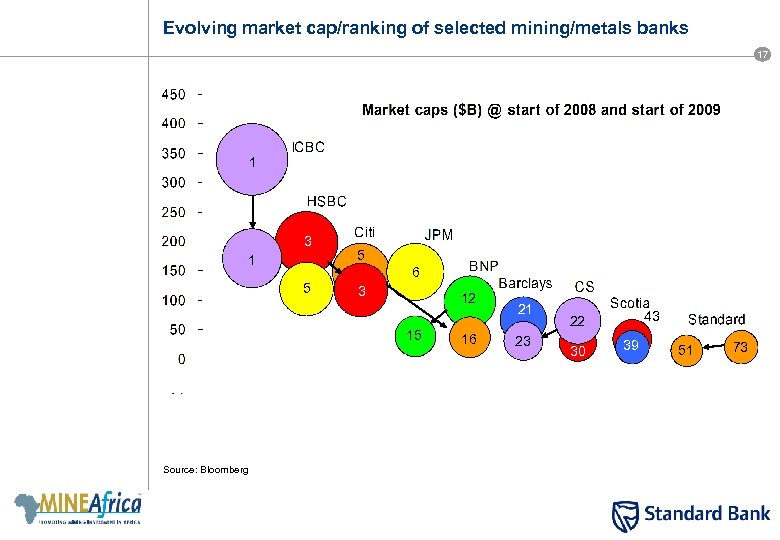

Evolving market cap/ranking of selected mining/metals banks 17 1 3 1 5 6 5 3 12 15 Source: Bloomberg 16 21 23 43 22 30 39 51 73

Evolving market cap/ranking of selected mining/metals banks 17 1 3 1 5 6 5 3 12 15 Source: Bloomberg 16 21 23 43 22 30 39 51 73

What’s up with the banks? 18 § No one is feeling particularly “healthy” § Laser-like concentration on year-end balance sheet (upside for 2009? ) § Re-emphasis on “core” businesses § Aversion to underwriting as opposed to “take and hold” or club deals § Retreat/absorption by investment banks which had been occasional lenders

What’s up with the banks? 18 § No one is feeling particularly “healthy” § Laser-like concentration on year-end balance sheet (upside for 2009? ) § Re-emphasis on “core” businesses § Aversion to underwriting as opposed to “take and hold” or club deals § Retreat/absorption by investment banks which had been occasional lenders

What can my bank do for me… 19

What can my bank do for me… 19

…and how should this impact my choice of service provider? 20 § Familiarity with, and access to, various financing options § Working capital and pre-export financing § Metal loans and swaps § Strategic partners; off-take agreements; sale of royalty § Access to ECAs – EDC, US Ex-Im, ECIC, Kf. W, Sinosure § Metal trading and hedging § Access to capital markets § Broad advisory capability

…and how should this impact my choice of service provider? 20 § Familiarity with, and access to, various financing options § Working capital and pre-export financing § Metal loans and swaps § Strategic partners; off-take agreements; sale of royalty § Access to ECAs – EDC, US Ex-Im, ECIC, Kf. W, Sinosure § Metal trading and hedging § Access to capital markets § Broad advisory capability

Strategies for a successful credit application 21

Strategies for a successful credit application 21

What is the proper approach 22 § Be realistic § Metal prices § Production rates, recovery, etc. § Hedging § User-friendly models § Down-size or staged start-up § Be conservative § Reserves versus resources § Technology § Be cautious § Management; directors; reporting § Pursue multiple avenues § Seek name-brand advisors § Access equity when available § Be patient

What is the proper approach 22 § Be realistic § Metal prices § Production rates, recovery, etc. § Hedging § User-friendly models § Down-size or staged start-up § Be conservative § Reserves versus resources § Technology § Be cautious § Management; directors; reporting § Pursue multiple avenues § Seek name-brand advisors § Access equity when available § Be patient

Conclusions 23

Conclusions 23

Conclusions 24 § Banks have suffered across the board and in the sector, along with their corporate clients § The party is over with respect to rates and terms – overall profitability is key § Focus on robust projects with solid management/operators § Environment will favour capability and commitment on both sides of the table

Conclusions 24 § Banks have suffered across the board and in the sector, along with their corporate clients § The party is over with respect to rates and terms – overall profitability is key § Focus on robust projects with solid management/operators § Environment will favour capability and commitment on both sides of the table