8641d61e87c7526a5e6d4e43470ee197.ppt

- Количество слайдов: 69

Strategic Technology Management Support: Models 1. Technology Product and Process Life-Cycles 2. Sequential and Simultaneous Innovation Models 3. Technology S-curve 4. Technology and Market Matrices 5. Expert System Decision Support: NEWTECH

Strategic Technology Management Support: Models 1. Technology Product and Process Life-Cycles 2. Sequential and Simultaneous Innovation Models 3. Technology S-curve 4. Technology and Market Matrices 5. Expert System Decision Support: NEWTECH

1. Technology Life Cycle Models • Technology Product LC • Technology Product & Process LC

1. Technology Life Cycle Models • Technology Product LC • Technology Product & Process LC

Technology Product LC The change of sales/revenue/profits of a company/industry/sector in a longer time perspective Main phases: * Introduction; * Growth; * Maturity, and * Decline.

Technology Product LC The change of sales/revenue/profits of a company/industry/sector in a longer time perspective Main phases: * Introduction; * Growth; * Maturity, and * Decline.

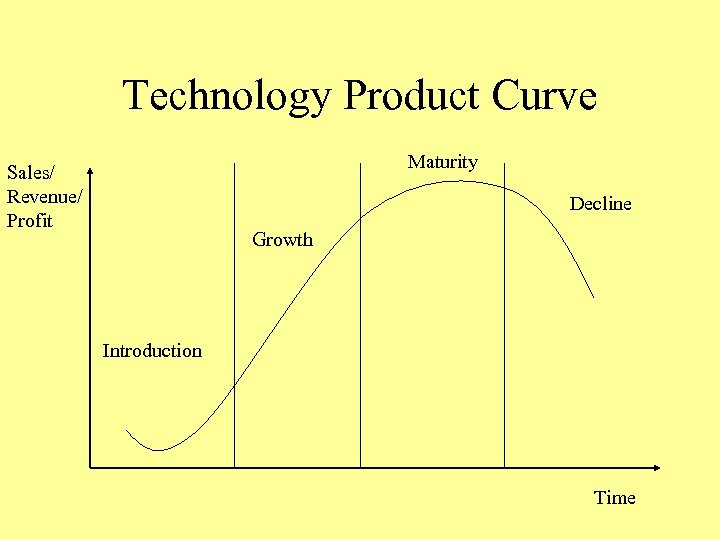

Technology Product Curve Maturity Sales/ Revenue/ Profit Decline Growth Introduction Time

Technology Product Curve Maturity Sales/ Revenue/ Profit Decline Growth Introduction Time

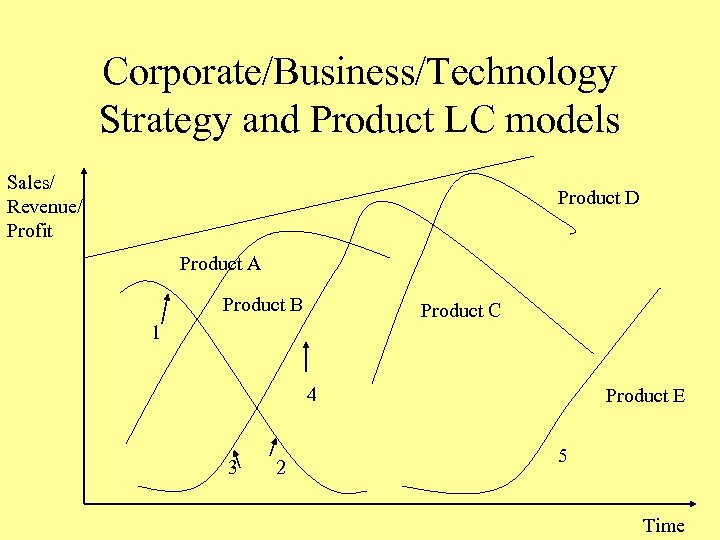

Corporate/Business/Technology Strategy and Product LC models Sales/ Revenue/ Profit Product D Product A Product B Product C 1 4 3 2 Product E 5 Time

Corporate/Business/Technology Strategy and Product LC models Sales/ Revenue/ Profit Product D Product A Product B Product C 1 4 3 2 Product E 5 Time

R&D, Marketing Strategy Options – investment into R&D projects • 1 - Short term development of existing product • 2 - Effort to prolong product life • 3 – Early introduction of the new product • 4 – Late introduction of new product • 5 - Long term development of new product generation

R&D, Marketing Strategy Options – investment into R&D projects • 1 - Short term development of existing product • 2 - Effort to prolong product life • 3 – Early introduction of the new product • 4 – Late introduction of new product • 5 - Long term development of new product generation

Sequential and Simultaneous Innovation Models

Sequential and Simultaneous Innovation Models

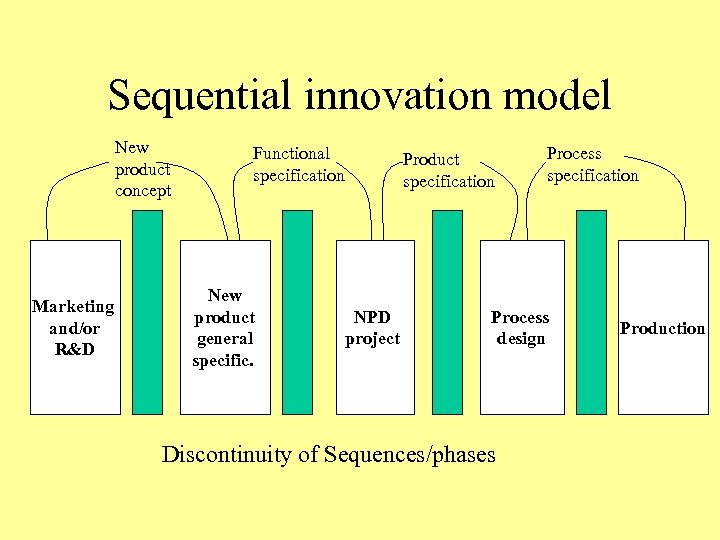

Sequential innovation model New product concept Marketing and/or R&D Functional specification New product general specific. Product specification NPD project Process specification Process design Discontinuity of Sequences/phases Production

Sequential innovation model New product concept Marketing and/or R&D Functional specification New product general specific. Product specification NPD project Process specification Process design Discontinuity of Sequences/phases Production

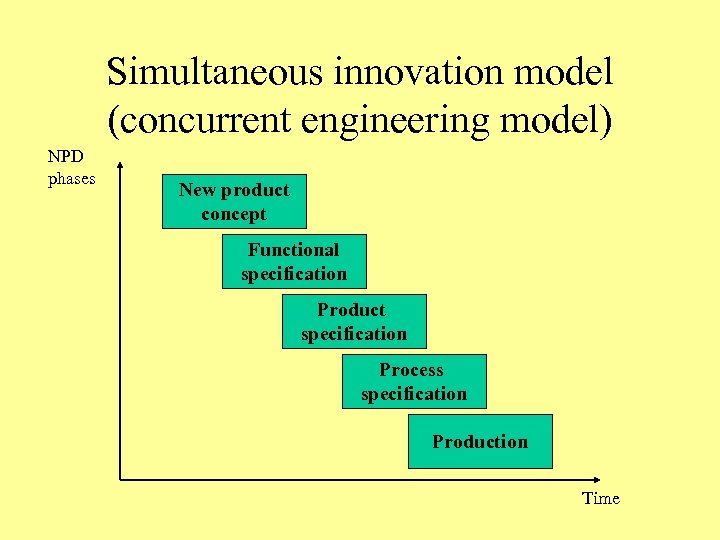

Simultaneous innovation model (concurrent engineering model) NPD phases New product concept Functional specification Product specification Process specification Production Time

Simultaneous innovation model (concurrent engineering model) NPD phases New product concept Functional specification Product specification Process specification Production Time

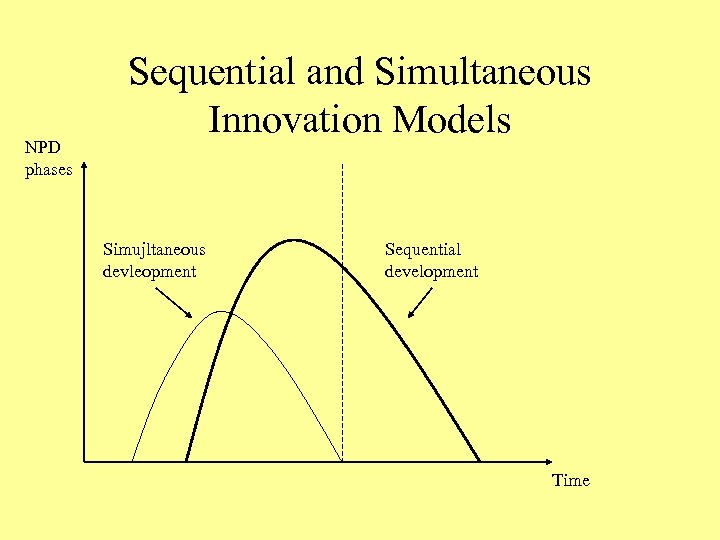

NPD phases Sequential and Simultaneous Innovation Models Simujltaneous devleopment Sequential development Time

NPD phases Sequential and Simultaneous Innovation Models Simujltaneous devleopment Sequential development Time

Simultaneous model: Crossfunctional interdisciplinary teams • NPD realized throughout with representatives of all the functions and organization areas in the earliest phases: • 1. Marketing (customer needs, competitors, special needs and demands); • 2. R&D (activities from idea generation to commercialization, patent protection and Eo. L considerations); • 3. Finance ( investment funds management, financial feasibility studies, costs forecasting and planning); • 4. Legal aspects (external legal conditions, legal protection of intellectual property);

Simultaneous model: Crossfunctional interdisciplinary teams • NPD realized throughout with representatives of all the functions and organization areas in the earliest phases: • 1. Marketing (customer needs, competitors, special needs and demands); • 2. R&D (activities from idea generation to commercialization, patent protection and Eo. L considerations); • 3. Finance ( investment funds management, financial feasibility studies, costs forecasting and planning); • 4. Legal aspects (external legal conditions, legal protection of intellectual property);

Simultaneous model: Crossfunctional interdisciplinary teams • 5. Purchasing & Sales ( relations with suppliers, customers, costs of material and components); • 6. Engineering and Production ( new engineering design, product safety, prototype building, manufacturing/process feasibility studies, resourse flexibility, product service potentials).

Simultaneous model: Crossfunctional interdisciplinary teams • 5. Purchasing & Sales ( relations with suppliers, customers, costs of material and components); • 6. Engineering and Production ( new engineering design, product safety, prototype building, manufacturing/process feasibility studies, resourse flexibility, product service potentials).

Managing the new product development process

Managing the new product development process

New products as projects • The conditions for innovation to occur are necessary but insufficient • The process is managed and operated by people • NPD is not the preserve of one department • It involves a variety of people across the organisation • Teams of people and project teams is at the heart of NPD

New products as projects • The conditions for innovation to occur are necessary but insufficient • The process is managed and operated by people • NPD is not the preserve of one department • It involves a variety of people across the organisation • Teams of people and project teams is at the heart of NPD

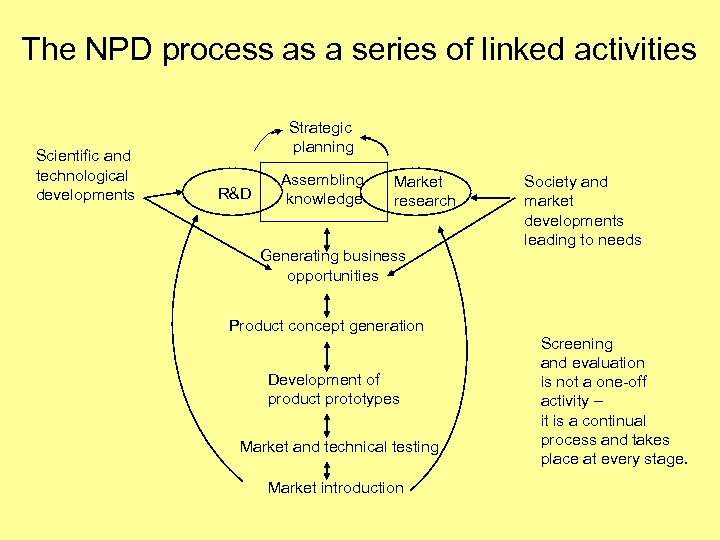

The NPD process as a series of linked activities Scientific and technological developments Strategic planning R&D Assembling knowledge Market research Generating business opportunities Society and market developments leading to needs Product concept generation Development of product prototypes Market and technical testing Market introduction Screening and evaluation is not a one-off activity – it is a continual process and takes place at every stage.

The NPD process as a series of linked activities Scientific and technological developments Strategic planning R&D Assembling knowledge Market research Generating business opportunities Society and market developments leading to needs Product concept generation Development of product prototypes Market and technical testing Market introduction Screening and evaluation is not a one-off activity – it is a continual process and takes place at every stage.

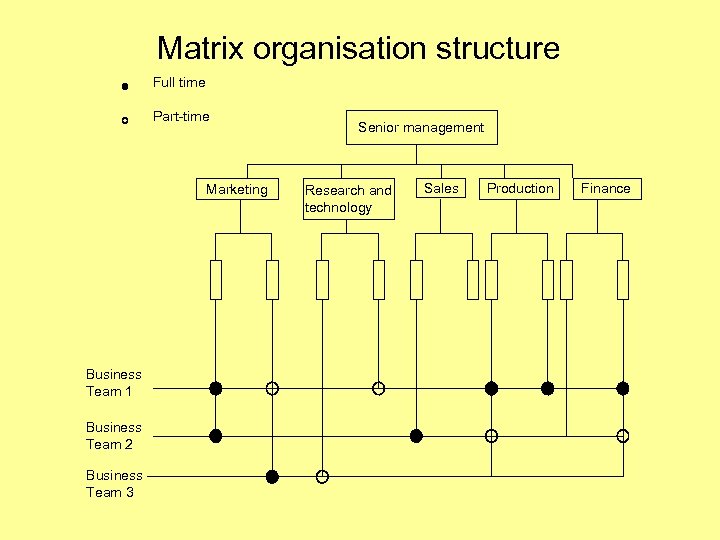

Matrix organisation structure Full time Part-time Marketing Business Team 1 Business Team 2 Business Team 3 Senior management Research and technology Sales Production Finance

Matrix organisation structure Full time Part-time Marketing Business Team 1 Business Team 2 Business Team 3 Senior management Research and technology Sales Production Finance

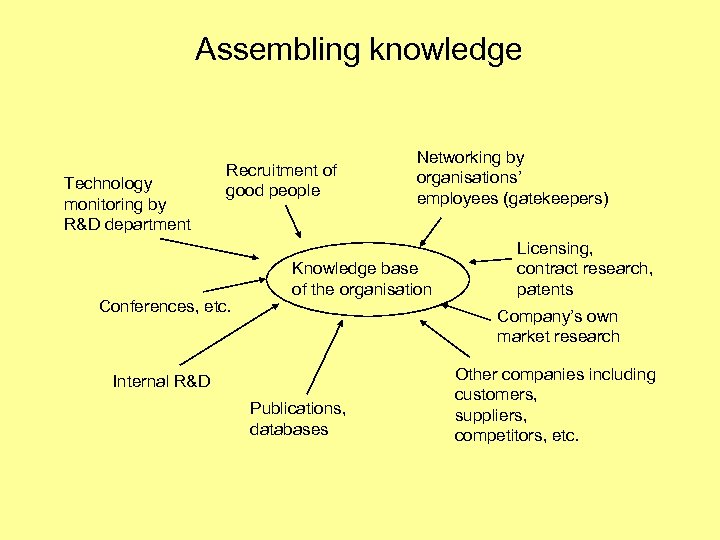

Assembling knowledge Technology monitoring by R&D department Recruitment of good people Conferences, etc. Networking by organisations’ employees (gatekeepers) Knowledge base of the organisation Licensing, contract research, patents Company’s own market research Internal R&D Publications, databases Other companies including customers, suppliers, competitors, etc.

Assembling knowledge Technology monitoring by R&D department Recruitment of good people Conferences, etc. Networking by organisations’ employees (gatekeepers) Knowledge base of the organisation Licensing, contract research, patents Company’s own market research Internal R&D Publications, databases Other companies including customers, suppliers, competitors, etc.

Generating new business opportunities Competitors’ products and reverse engineering Existing Technology products Individuals Generation of business opportunities Brainstorming and synetics senior and top management Unexploited patents customers and vendors

Generating new business opportunities Competitors’ products and reverse engineering Existing Technology products Individuals Generation of business opportunities Brainstorming and synetics senior and top management Unexploited patents customers and vendors

Evaluating research projects Number of research ideas 60 ideas are evaluated for: • Technical feasibility • Financial feasibility • Suitability 12 ideas worthy of evaluation through: Technical evaluation & market research analysis 6 potential products worthy of further development & analysis 3 prototypes for technical & market testing 2 products launched 1 successful product Evaluation of research project ideas

Evaluating research projects Number of research ideas 60 ideas are evaluated for: • Technical feasibility • Financial feasibility • Suitability 12 ideas worthy of evaluation through: Technical evaluation & market research analysis 6 potential products worthy of further development & analysis 3 prototypes for technical & market testing 2 products launched 1 successful product Evaluation of research project ideas

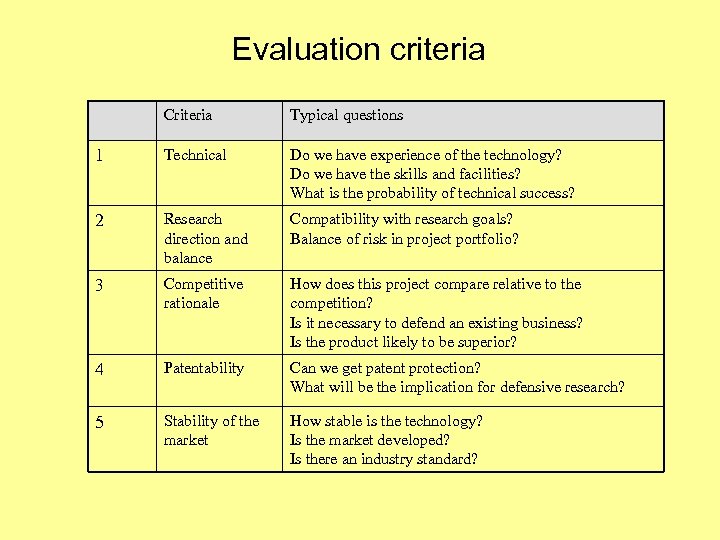

Evaluation criteria Criteria Typical questions 1 Technical Do we have experience of the technology? Do we have the skills and facilities? What is the probability of technical success? 2 Research direction and balance Compatibility with research goals? Balance of risk in project portfolio? 3 Competitive rationale How does this project compare relative to the competition? Is it necessary to defend an existing business? Is the product likely to be superior? 4 Patentability Can we get patent protection? What will be the implication for defensive research? 5 Stability of the market How stable is the technology? Is the market developed? Is there an industry standard?

Evaluation criteria Criteria Typical questions 1 Technical Do we have experience of the technology? Do we have the skills and facilities? What is the probability of technical success? 2 Research direction and balance Compatibility with research goals? Balance of risk in project portfolio? 3 Competitive rationale How does this project compare relative to the competition? Is it necessary to defend an existing business? Is the product likely to be superior? 4 Patentability Can we get patent protection? What will be the implication for defensive research? 5 Stability of the market How stable is the technology? Is the market developed? Is there an industry standard?

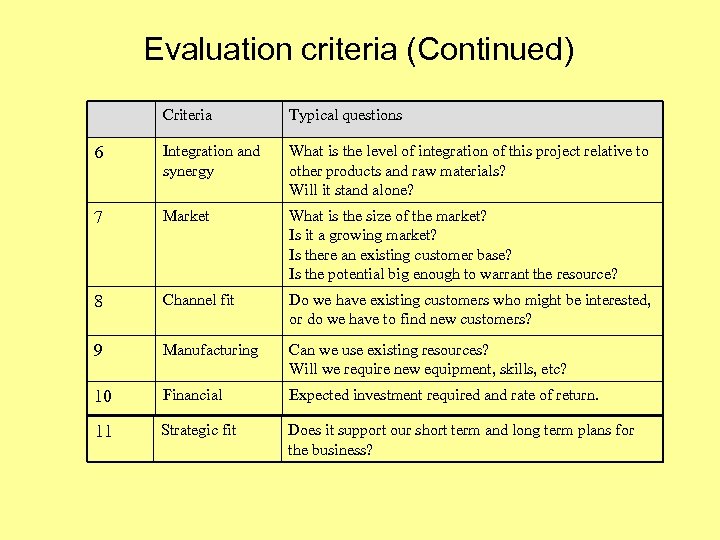

Evaluation criteria (Continued) Criteria Typical questions 6 Integration and synergy What is the level of integration of this project relative to other products and raw materials? Will it stand alone? 7 Market What is the size of the market? Is it a growing market? Is there an existing customer base? Is the potential big enough to warrant the resource? 8 Channel fit Do we have existing customers who might be interested, or do we have to find new customers? 9 Manufacturing Can we use existing resources? Will we require new equipment, skills, etc? 10 Financial Expected investment required and rate of return. 11 Strategic fit Does it support our short term and long term plans for the business?

Evaluation criteria (Continued) Criteria Typical questions 6 Integration and synergy What is the level of integration of this project relative to other products and raw materials? Will it stand alone? 7 Market What is the size of the market? Is it a growing market? Is there an existing customer base? Is the potential big enough to warrant the resource? 8 Channel fit Do we have existing customers who might be interested, or do we have to find new customers? 9 Manufacturing Can we use existing resources? Will we require new equipment, skills, etc? 10 Financial Expected investment required and rate of return. 11 Strategic fit Does it support our short term and long term plans for the business?

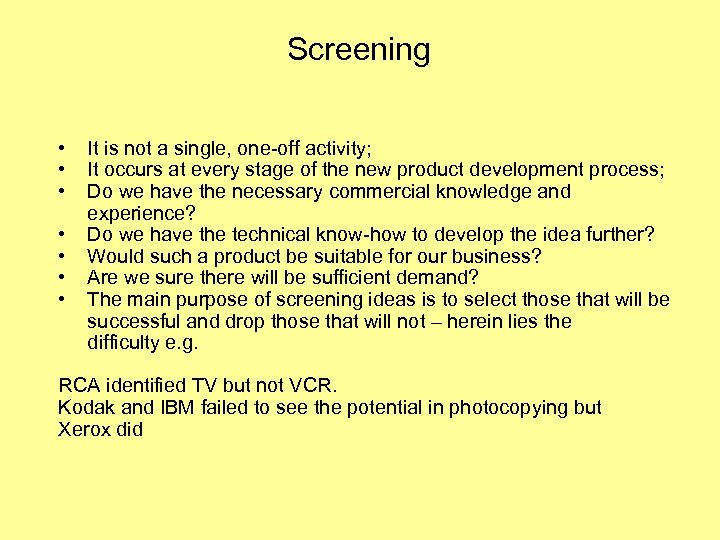

Screening • It is not a single, one-off activity; • It occurs at every stage of the new product development process; • Do we have the necessary commercial knowledge and experience? • Do we have the technical know-how to develop the idea further? • Would such a product be suitable for our business? • Are we sure there will be sufficient demand? • The main purpose of screening ideas is to select those that will be successful and drop those that will not – herein lies the difficulty e. g. RCA identified TV but not VCR. Kodak and IBM failed to see the potential in photocopying but Xerox did

Screening • It is not a single, one-off activity; • It occurs at every stage of the new product development process; • Do we have the necessary commercial knowledge and experience? • Do we have the technical know-how to develop the idea further? • Would such a product be suitable for our business? • Are we sure there will be sufficient demand? • The main purpose of screening ideas is to select those that will be successful and drop those that will not – herein lies the difficulty e. g. RCA identified TV but not VCR. Kodak and IBM failed to see the potential in photocopying but Xerox did

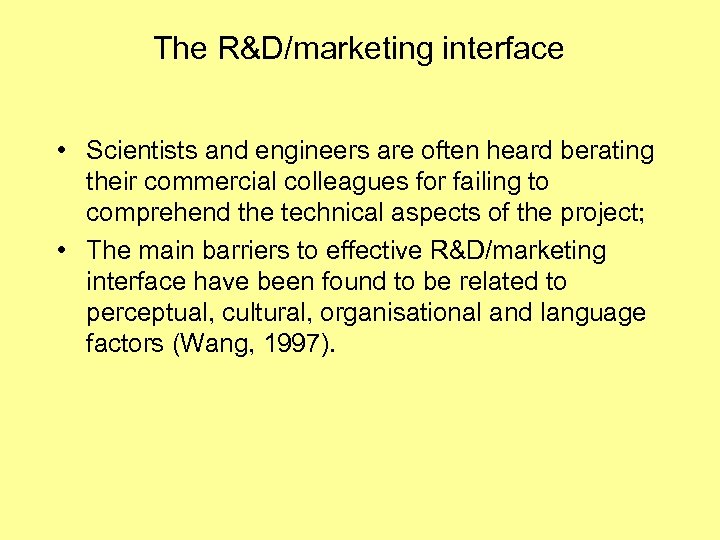

The R&D/marketing interface • Scientists and engineers are often heard berating their commercial colleagues for failing to comprehend the technical aspects of the project; • The main barriers to effective R&D/marketing interface have been found to be related to perceptual, cultural, organisational and language factors (Wang, 1997).

The R&D/marketing interface • Scientists and engineers are often heard berating their commercial colleagues for failing to comprehend the technical aspects of the project; • The main barriers to effective R&D/marketing interface have been found to be related to perceptual, cultural, organisational and language factors (Wang, 1997).

The R&D/marketing interface (Continued) • Cultural difference results from the different training and backgrounds; Marketing managers tend to focus on shorter time spans than R&D managers who adopt much longer time frames for projects; • Language barrier; • The extent of the integration required between marketing and R&D varies between industries.

The R&D/marketing interface (Continued) • Cultural difference results from the different training and backgrounds; Marketing managers tend to focus on shorter time spans than R&D managers who adopt much longer time frames for projects; • Language barrier; • The extent of the integration required between marketing and R&D varies between industries.

Technology Substitution Strategic Analysis • 1) External technology analysis- review of new technology that could substitute existing products based on technology competitor technology analysis, new technology development and technological forecasting; • 2) Timing aspects based on time analysis – the projected moment when new products are expected to be introduced on the market; • 3) Assessment of the rate/pace at which new products will penetrate the market; • 4) Assessment of the timing/moment when new product is to be launched on the market;

Technology Substitution Strategic Analysis • 1) External technology analysis- review of new technology that could substitute existing products based on technology competitor technology analysis, new technology development and technological forecasting; • 2) Timing aspects based on time analysis – the projected moment when new products are expected to be introduced on the market; • 3) Assessment of the rate/pace at which new products will penetrate the market; • 4) Assessment of the timing/moment when new product is to be launched on the market;

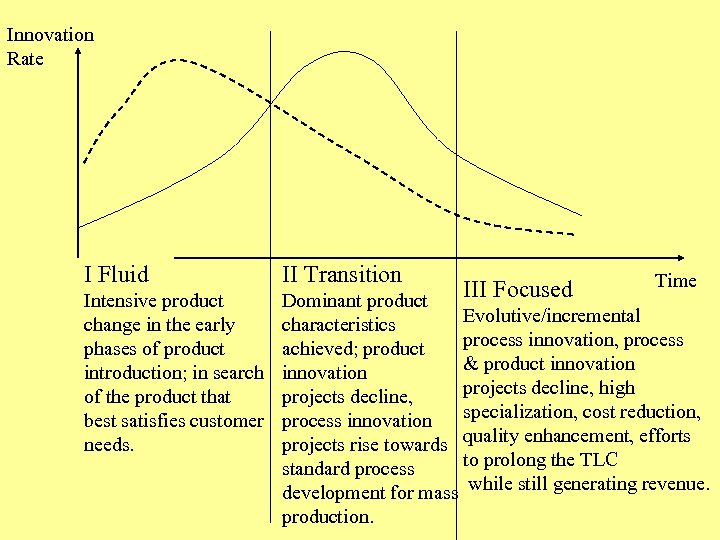

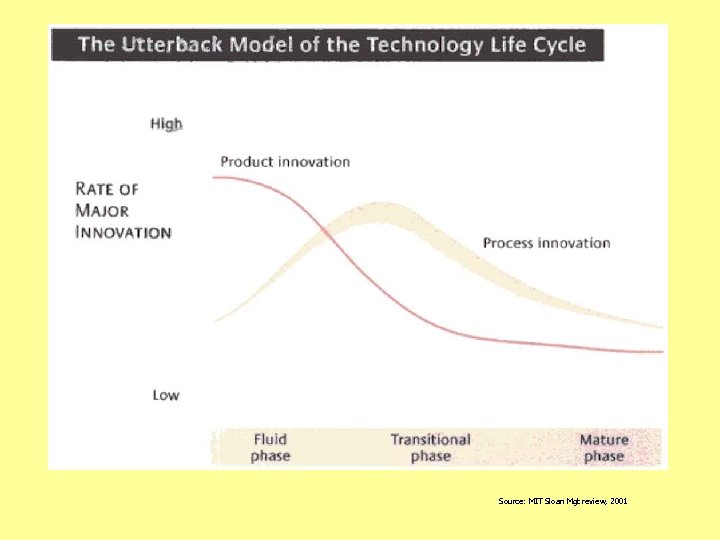

Technology Product & Process LC - TLC • Technology Life cycle is represented by technology product and process innovation dynamics; • The model is based on overall technology life cycle analysis based on detailed view of the product and process innovation potentials within the life cycle.

Technology Product & Process LC - TLC • Technology Life cycle is represented by technology product and process innovation dynamics; • The model is based on overall technology life cycle analysis based on detailed view of the product and process innovation potentials within the life cycle.

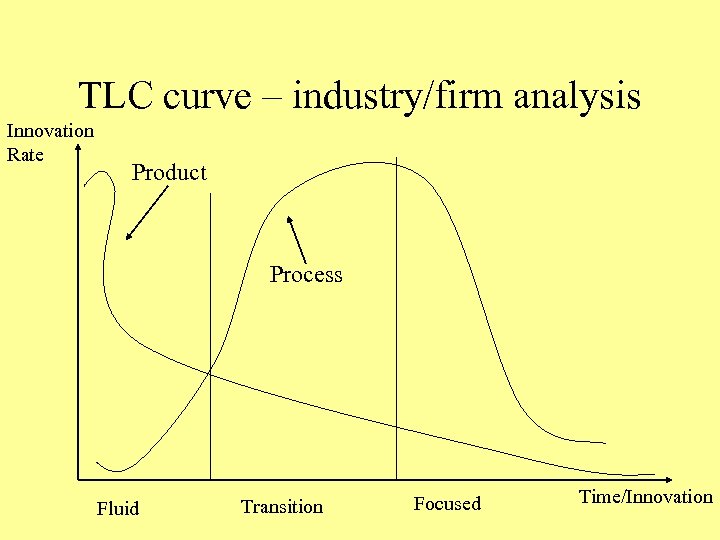

TLC curve – industry/firm analysis Innovation Rate Product Process Fluid Transition Focused Time/Innovation

TLC curve – industry/firm analysis Innovation Rate Product Process Fluid Transition Focused Time/Innovation

TLC – phases based on process & product innovation dynamics • 1. Fluid • 2. Transition (Transmission) • 3. Focused (Specific, Maturity)

TLC – phases based on process & product innovation dynamics • 1. Fluid • 2. Transition (Transmission) • 3. Focused (Specific, Maturity)

Innovation Rate I Fluid II Transition Intensive product change in the early phases of product introduction; in search of the product that best satisfies customer needs. Dominant product Evolutive/incremental characteristics process innovation, process achieved; product & product innovation projects decline, high projects decline, process innovation specialization, cost reduction, projects rise towards quality enhancement, efforts to prolong the TLC standard process development for mass while still generating revenue. production. III Focused Time

Innovation Rate I Fluid II Transition Intensive product change in the early phases of product introduction; in search of the product that best satisfies customer needs. Dominant product Evolutive/incremental characteristics process innovation, process achieved; product & product innovation projects decline, high projects decline, process innovation specialization, cost reduction, projects rise towards quality enhancement, efforts to prolong the TLC standard process development for mass while still generating revenue. production. III Focused Time

Corporate/Business/Functional Strategy and TLC – Fluid phase Strong external orientation, intensive relations with firm environment; high product flexibility with intensive R&D projects coupled with market research (needs, competitors, institutes, laboratories, etc); organizational design oriented at high flexibility – matrix, project structures dominant;

Corporate/Business/Functional Strategy and TLC – Fluid phase Strong external orientation, intensive relations with firm environment; high product flexibility with intensive R&D projects coupled with market research (needs, competitors, institutes, laboratories, etc); organizational design oriented at high flexibility – matrix, project structures dominant;

Corporate/Business/Functional Strategy and TLC – Fluid phase • Dominant market orientation, intensive research of customer needs, competitor actions, demand projections and analysis, new market perspectives, global market penetration • High integrativeness of all functions, parts and domains of organization – marketing, R&D, technology, production, HR; • Multifunctional teams, Matrix/project organizational design

Corporate/Business/Functional Strategy and TLC – Fluid phase • Dominant market orientation, intensive research of customer needs, competitor actions, demand projections and analysis, new market perspectives, global market penetration • High integrativeness of all functions, parts and domains of organization – marketing, R&D, technology, production, HR; • Multifunctional teams, Matrix/project organizational design

Corporate/Business/Functional Strategy and TLC – Transition phase Process innovation becomes dominant oriented at R&D projects leading to cutting costs, enhancing process characteristics and quality. In traditional manufacturing universal equipment is changed and special equipment installed for mass manufacturing and achieving economies of scale. Developing relations in the supply-chain.

Corporate/Business/Functional Strategy and TLC – Transition phase Process innovation becomes dominant oriented at R&D projects leading to cutting costs, enhancing process characteristics and quality. In traditional manufacturing universal equipment is changed and special equipment installed for mass manufacturing and achieving economies of scale. Developing relations in the supply-chain.

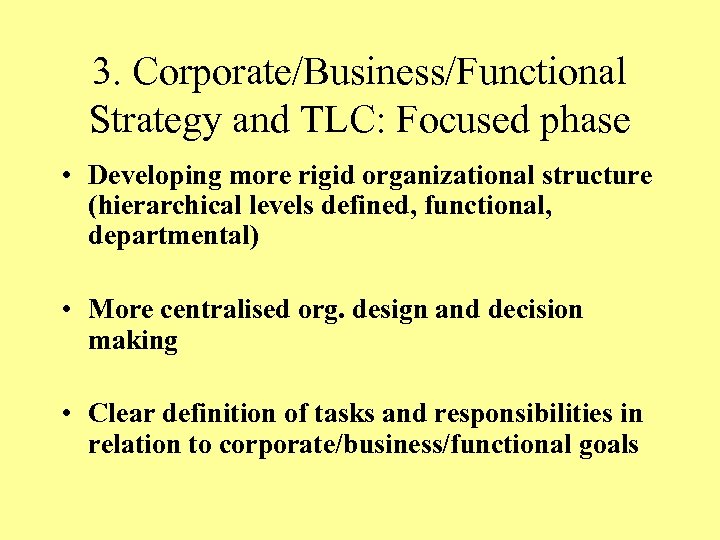

3. Corporate/Business/Functional Strategy and TLC: Focused phase • Developing more rigid organizational structure (hierarchical levels defined, functional, departmental) • More centralised org. design and decision making • Clear definition of tasks and responsibilities in relation to corporate/business/functional goals

3. Corporate/Business/Functional Strategy and TLC: Focused phase • Developing more rigid organizational structure (hierarchical levels defined, functional, departmental) • More centralised org. design and decision making • Clear definition of tasks and responsibilities in relation to corporate/business/functional goals

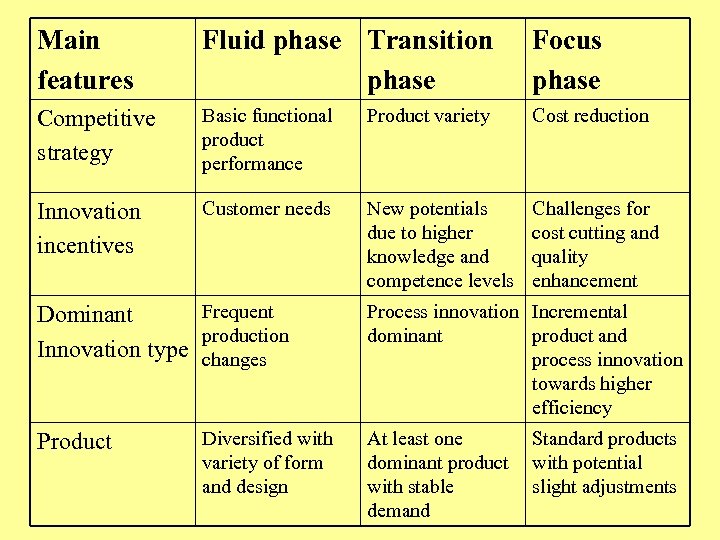

Main features Fluid phase Transition phase Focus phase Competitive strategy Basic functional product performance Product variety Cost reduction Innovation incentives Customer needs New potentials due to higher knowledge and competence levels Challenges for cost cutting and quality enhancement Frequent Dominant production Innovation type changes Product Diversified with variety of form and design Process innovation Incremental dominant product and process innovation towards higher efficiency At least one Standard products dominant product with potential with stable slight adjustments demand

Main features Fluid phase Transition phase Focus phase Competitive strategy Basic functional product performance Product variety Cost reduction Innovation incentives Customer needs New potentials due to higher knowledge and competence levels Challenges for cost cutting and quality enhancement Frequent Dominant production Innovation type changes Product Diversified with variety of form and design Process innovation Incremental dominant product and process innovation towards higher efficiency At least one Standard products dominant product with potential with stable slight adjustments demand

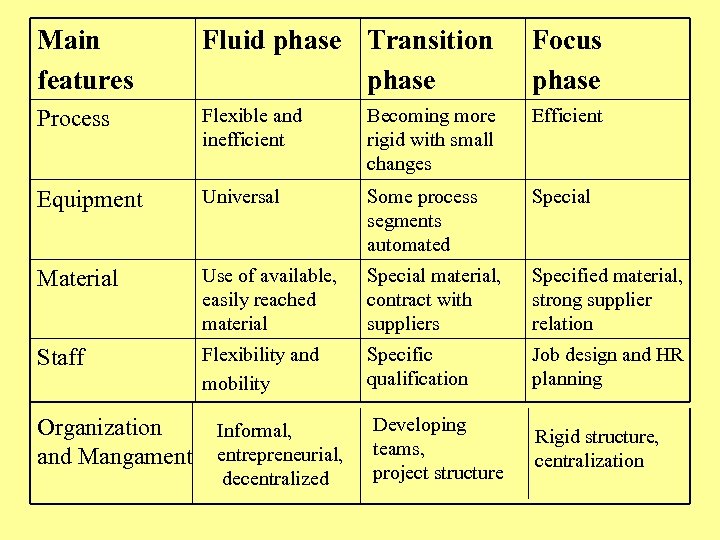

Main features Fluid phase Transition phase Focus phase Process Flexible and inefficient Becoming more rigid with small changes Efficient Equipment Universal Some process segments automated Special Material Use of available, easily reached material Special material, contract with suppliers Specified material, strong supplier relation Staff Flexibility and mobility Specific qualification Job design and HR planning Developing teams, project structure Rigid structure, centralization Organization and Mangament Informal, entrepreneurial, decentralized

Main features Fluid phase Transition phase Focus phase Process Flexible and inefficient Becoming more rigid with small changes Efficient Equipment Universal Some process segments automated Special Material Use of available, easily reached material Special material, contract with suppliers Specified material, strong supplier relation Staff Flexibility and mobility Specific qualification Job design and HR planning Developing teams, project structure Rigid structure, centralization Organization and Mangament Informal, entrepreneurial, decentralized

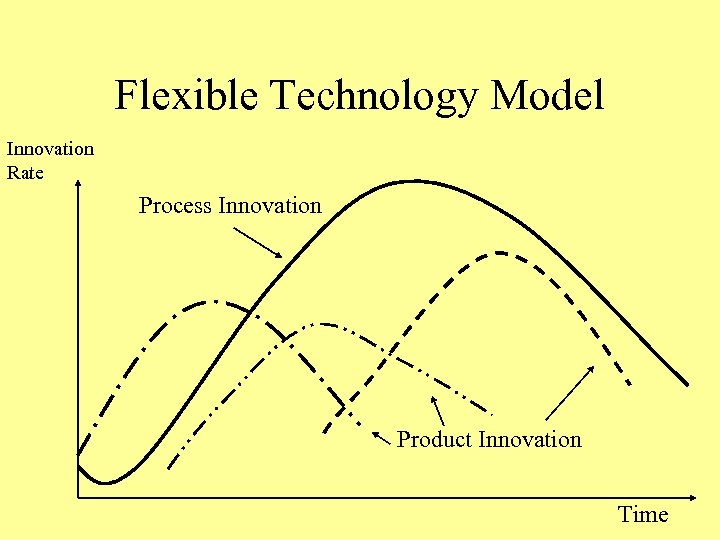

Flexible Technology Model Innovation Rate Process Innovation Product Innovation Time

Flexible Technology Model Innovation Rate Process Innovation Product Innovation Time

Source: MIT Sloan Mgt review, 2001

Source: MIT Sloan Mgt review, 2001

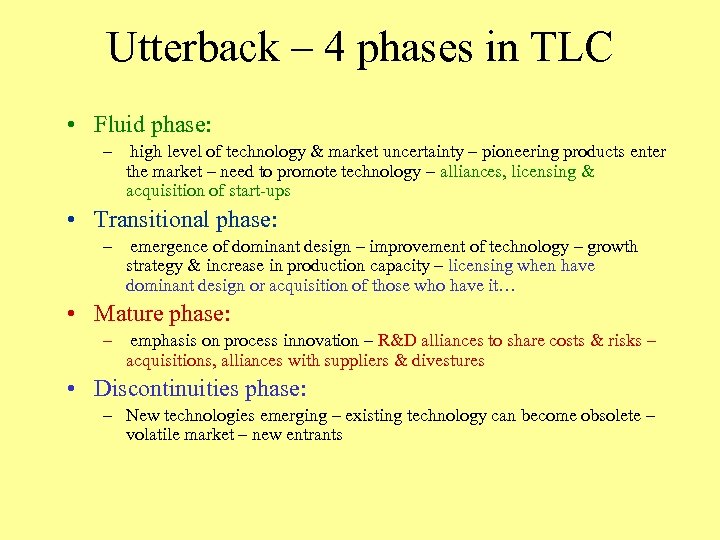

Utterback – 4 phases in TLC • Fluid phase: – high level of technology & market uncertainty – pioneering products enter the market – need to promote technology – alliances, licensing & acquisition of start-ups • Transitional phase: – emergence of dominant design – improvement of technology – growth strategy & increase in production capacity – licensing when have dominant design or acquisition of those who have it… • Mature phase: – emphasis on process innovation – R&D alliances to share costs & risks – acquisitions, alliances with suppliers & divestures • Discontinuities phase: – New technologies emerging – existing technology can become obsolete – volatile market – new entrants

Utterback – 4 phases in TLC • Fluid phase: – high level of technology & market uncertainty – pioneering products enter the market – need to promote technology – alliances, licensing & acquisition of start-ups • Transitional phase: – emergence of dominant design – improvement of technology – growth strategy & increase in production capacity – licensing when have dominant design or acquisition of those who have it… • Mature phase: – emphasis on process innovation – R&D alliances to share costs & risks – acquisitions, alliances with suppliers & divestures • Discontinuities phase: – New technologies emerging – existing technology can become obsolete – volatile market – new entrants

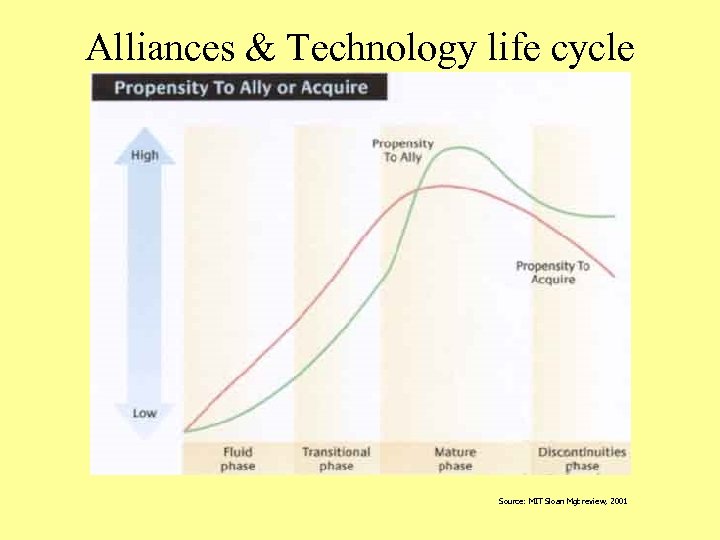

Alliances & Technology life cycle Source: MIT Sloan Mgt review, 2001

Alliances & Technology life cycle Source: MIT Sloan Mgt review, 2001

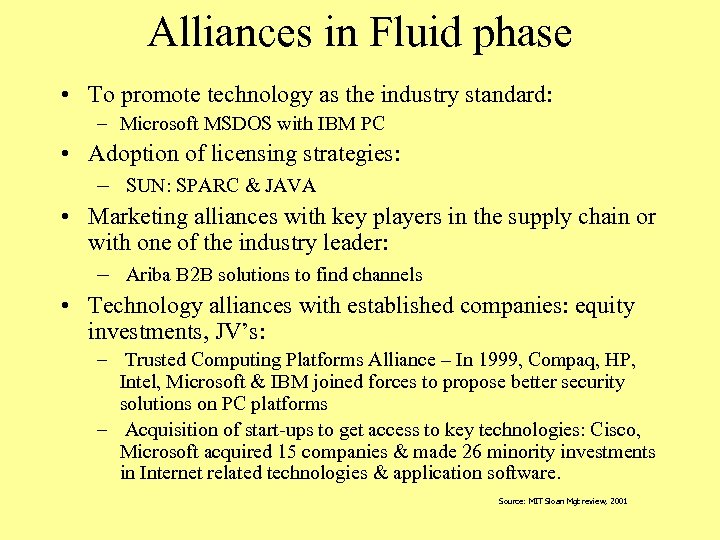

Alliances in Fluid phase • To promote technology as the industry standard: – Microsoft MSDOS with IBM PC • Adoption of licensing strategies: – SUN: SPARC & JAVA • Marketing alliances with key players in the supply chain or with one of the industry leader: – Ariba B 2 B solutions to find channels • Technology alliances with established companies: equity investments, JV’s: – Trusted Computing Platforms Alliance – In 1999, Compaq, HP, Intel, Microsoft & IBM joined forces to propose better security solutions on PC platforms – Acquisition of start-ups to get access to key technologies: Cisco, Microsoft acquired 15 companies & made 26 minority investments in Internet related technologies & application software. Source: MIT Sloan Mgt review, 2001

Alliances in Fluid phase • To promote technology as the industry standard: – Microsoft MSDOS with IBM PC • Adoption of licensing strategies: – SUN: SPARC & JAVA • Marketing alliances with key players in the supply chain or with one of the industry leader: – Ariba B 2 B solutions to find channels • Technology alliances with established companies: equity investments, JV’s: – Trusted Computing Platforms Alliance – In 1999, Compaq, HP, Intel, Microsoft & IBM joined forces to propose better security solutions on PC platforms – Acquisition of start-ups to get access to key technologies: Cisco, Microsoft acquired 15 companies & made 26 minority investments in Internet related technologies & application software. Source: MIT Sloan Mgt review, 2001

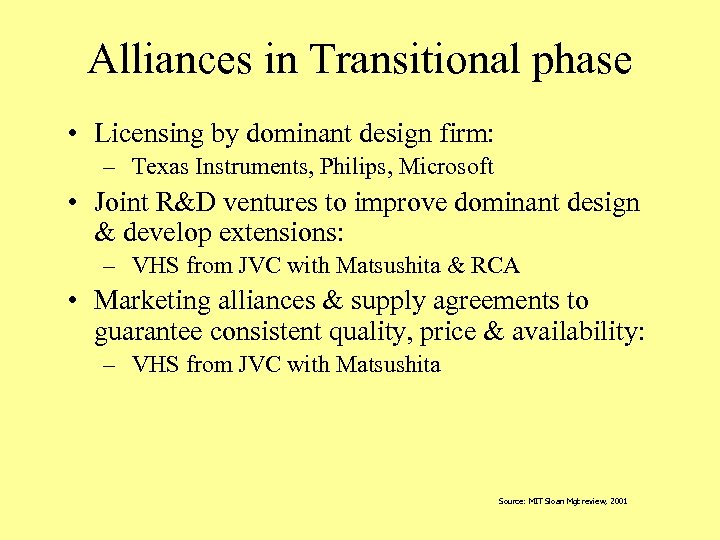

Alliances in Transitional phase • Licensing by dominant design firm: – Texas Instruments, Philips, Microsoft • Joint R&D ventures to improve dominant design & develop extensions: – VHS from JVC with Matsushita & RCA • Marketing alliances & supply agreements to guarantee consistent quality, price & availability: – VHS from JVC with Matsushita Source: MIT Sloan Mgt review, 2001

Alliances in Transitional phase • Licensing by dominant design firm: – Texas Instruments, Philips, Microsoft • Joint R&D ventures to improve dominant design & develop extensions: – VHS from JVC with Matsushita & RCA • Marketing alliances & supply agreements to guarantee consistent quality, price & availability: – VHS from JVC with Matsushita Source: MIT Sloan Mgt review, 2001

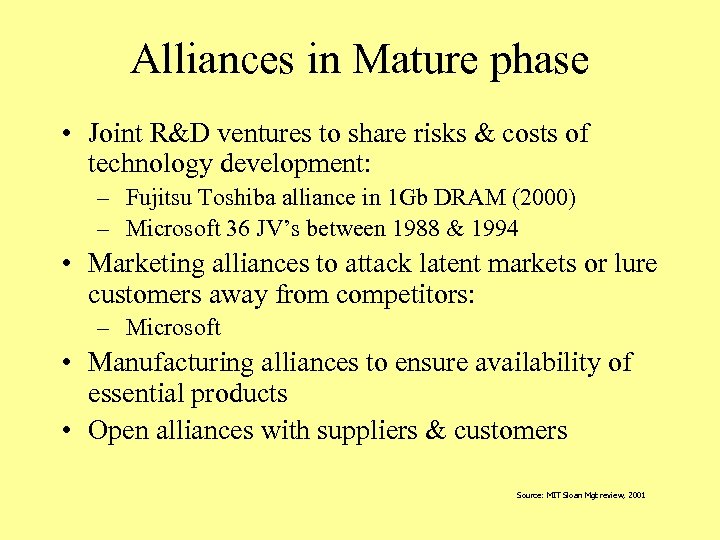

Alliances in Mature phase • Joint R&D ventures to share risks & costs of technology development: – Fujitsu Toshiba alliance in 1 Gb DRAM (2000) – Microsoft 36 JV’s between 1988 & 1994 • Marketing alliances to attack latent markets or lure customers away from competitors: – Microsoft • Manufacturing alliances to ensure availability of essential products • Open alliances with suppliers & customers Source: MIT Sloan Mgt review, 2001

Alliances in Mature phase • Joint R&D ventures to share risks & costs of technology development: – Fujitsu Toshiba alliance in 1 Gb DRAM (2000) – Microsoft 36 JV’s between 1988 & 1994 • Marketing alliances to attack latent markets or lure customers away from competitors: – Microsoft • Manufacturing alliances to ensure availability of essential products • Open alliances with suppliers & customers Source: MIT Sloan Mgt review, 2001

Alliances in Discontinuities phase • Marketing alliances to gain market recognition • Licensing by attacker to supply technology: – Microsoft licensing of Windows CE for AT&T set-top boxes - 1999 • Incumbent’s acquisition of the disruptive technology: – Intel: acquisition of 15 companies in networking & communications - 1999/2000 Source: MIT Sloan Mgt review, 2001

Alliances in Discontinuities phase • Marketing alliances to gain market recognition • Licensing by attacker to supply technology: – Microsoft licensing of Windows CE for AT&T set-top boxes - 1999 • Incumbent’s acquisition of the disruptive technology: – Intel: acquisition of 15 companies in networking & communications - 1999/2000 Source: MIT Sloan Mgt review, 2001

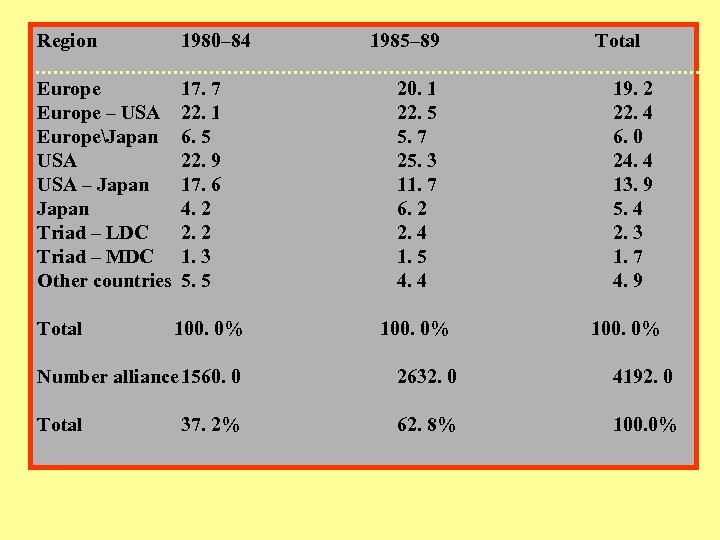

Region 1980– 84 Europe – USA EuropeJapan USA – Japan Triad – LDC Triad – MDC Other countries 17. 7 22. 1 6. 5 22. 9 17. 6 4. 2 2. 2 1. 3 5. 5 Total 100. 0% 1985– 89 20. 1 22. 5 5. 7 25. 3 11. 7 6. 2 2. 4 1. 5 4. 4 100. 0% Total 19. 2 22. 4 6. 0 24. 4 13. 9 5. 4 2. 3 1. 7 4. 9 100. 0% Number alliance 1560. 0 2632. 0 4192. 0 Total 62. 8% 100. 0% 37. 2%

Region 1980– 84 Europe – USA EuropeJapan USA – Japan Triad – LDC Triad – MDC Other countries 17. 7 22. 1 6. 5 22. 9 17. 6 4. 2 2. 2 1. 3 5. 5 Total 100. 0% 1985– 89 20. 1 22. 5 5. 7 25. 3 11. 7 6. 2 2. 4 1. 5 4. 4 100. 0% Total 19. 2 22. 4 6. 0 24. 4 13. 9 5. 4 2. 3 1. 7 4. 9 100. 0% Number alliance 1560. 0 2632. 0 4192. 0 Total 62. 8% 100. 0% 37. 2%

Cooperation with clients Cooperation with competitors Cooperation with Ministries/agencies

Cooperation with clients Cooperation with competitors Cooperation with Ministries/agencies

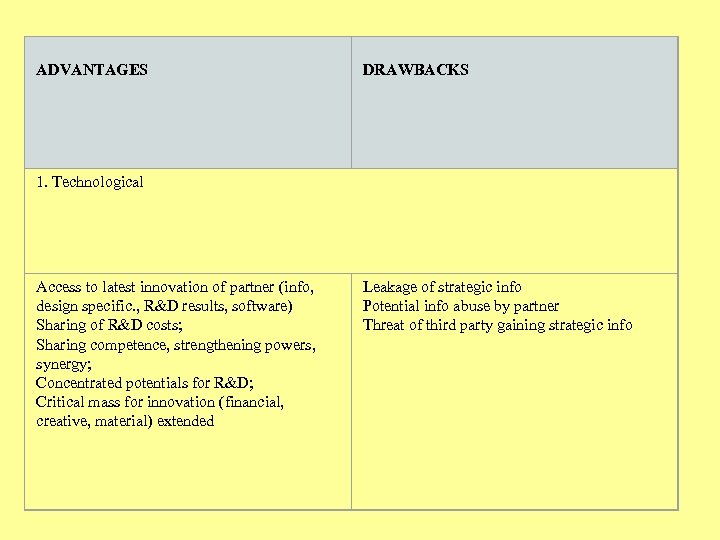

ADVANTAGES DRAWBACKS 1. Technological Access to latest innovation of partner (info, design specific. , R&D results, software) Sharing of R&D costs; Sharing competence, strengthening powers, synergy; Concentrated potentials for R&D; Critical mass for innovation (financial, creative, material) extended Leakage of strategic info Potential info abuse by partner Threat of third party gaining strategic info

ADVANTAGES DRAWBACKS 1. Technological Access to latest innovation of partner (info, design specific. , R&D results, software) Sharing of R&D costs; Sharing competence, strengthening powers, synergy; Concentrated potentials for R&D; Critical mass for innovation (financial, creative, material) extended Leakage of strategic info Potential info abuse by partner Threat of third party gaining strategic info

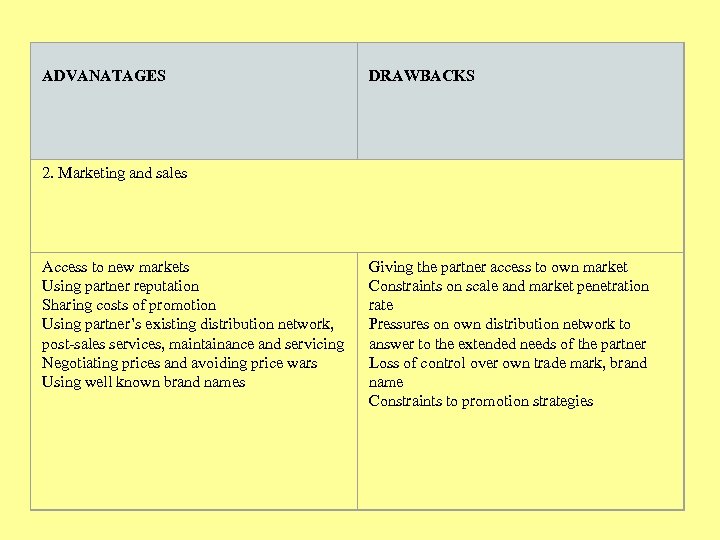

ADVANATAGES DRAWBACKS 2. Marketing and sales Access to new markets Using partner reputation Sharing costs of promotion Using partner’s existing distribution network, post-sales services, maintainance and servicing Negotiating prices and avoiding price wars Using well known brand names Giving the partner access to own market Constraints on scale and market penetration rate Pressures on own distribution network to answer to the extended needs of the partner Loss of control over own trade mark, brand name Constraints to promotion strategies

ADVANATAGES DRAWBACKS 2. Marketing and sales Access to new markets Using partner reputation Sharing costs of promotion Using partner’s existing distribution network, post-sales services, maintainance and servicing Negotiating prices and avoiding price wars Using well known brand names Giving the partner access to own market Constraints on scale and market penetration rate Pressures on own distribution network to answer to the extended needs of the partner Loss of control over own trade mark, brand name Constraints to promotion strategies

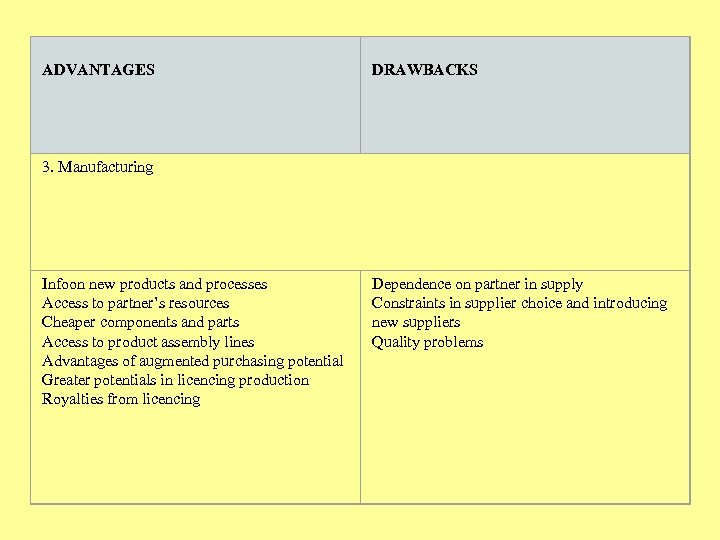

ADVANTAGES DRAWBACKS 3. Manufacturing Infoon new products and processes Access to partner’s resources Cheaper components and parts Access to product assembly lines Advantages of augmented purchasing potential Greater potentials in licencing production Royalties from licencing Dependence on partner in supply Constraints in supplier choice and introducing new suppliers Quality problems

ADVANTAGES DRAWBACKS 3. Manufacturing Infoon new products and processes Access to partner’s resources Cheaper components and parts Access to product assembly lines Advantages of augmented purchasing potential Greater potentials in licencing production Royalties from licencing Dependence on partner in supply Constraints in supplier choice and introducing new suppliers Quality problems

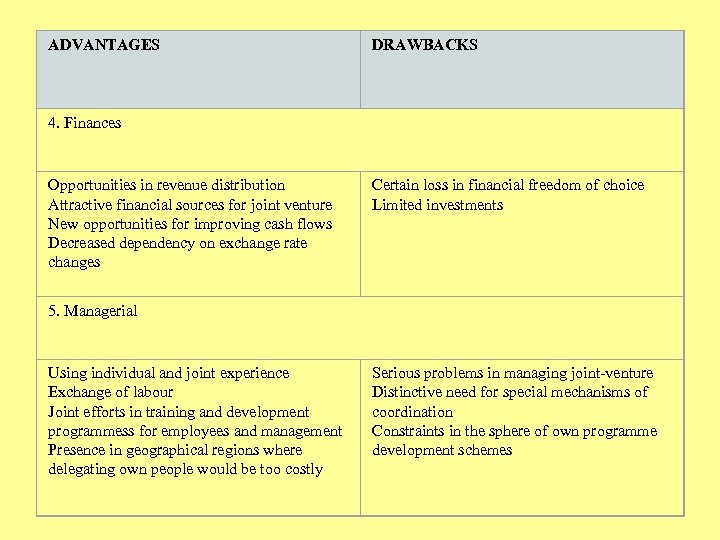

ADVANTAGES DRAWBACKS 4. Finances Opportunities in revenue distribution Attractive financial sources for joint venture New opportunities for improving cash flows Decreased dependency on exchange rate changes Certain loss in financial freedom of choice Limited investments 5. Managerial Using individual and joint experience Exchange of labour Joint efforts in training and development programmess for employees and management Presence in geographical regions where delegating own people would be too costly Serious problems in managing joint-venture Distinctive need for special mechanisms of coordination Constraints in the sphere of own programme development schemes

ADVANTAGES DRAWBACKS 4. Finances Opportunities in revenue distribution Attractive financial sources for joint venture New opportunities for improving cash flows Decreased dependency on exchange rate changes Certain loss in financial freedom of choice Limited investments 5. Managerial Using individual and joint experience Exchange of labour Joint efforts in training and development programmess for employees and management Presence in geographical regions where delegating own people would be too costly Serious problems in managing joint-venture Distinctive need for special mechanisms of coordination Constraints in the sphere of own programme development schemes

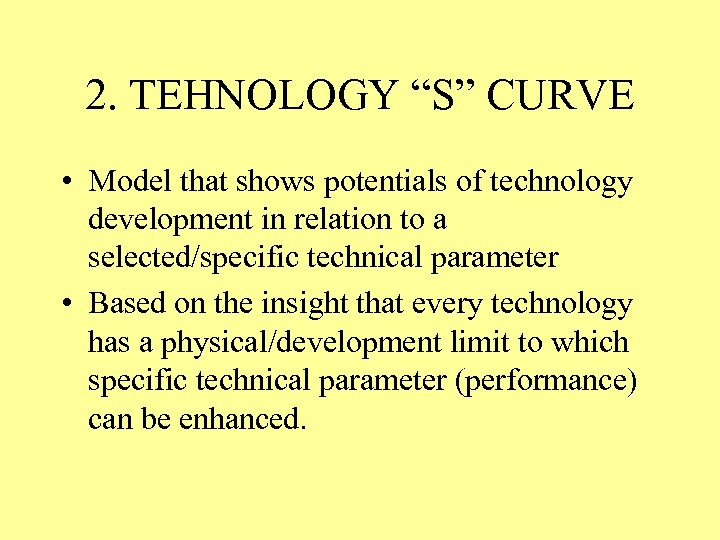

2. TEHNOLOGY “S” CURVE • Model that shows potentials of technology development in relation to a selected/specific technical parameter • Based on the insight that every technology has a physical/development limit to which specific technical parameter (performance) can be enhanced.

2. TEHNOLOGY “S” CURVE • Model that shows potentials of technology development in relation to a selected/specific technical parameter • Based on the insight that every technology has a physical/development limit to which specific technical parameter (performance) can be enhanced.

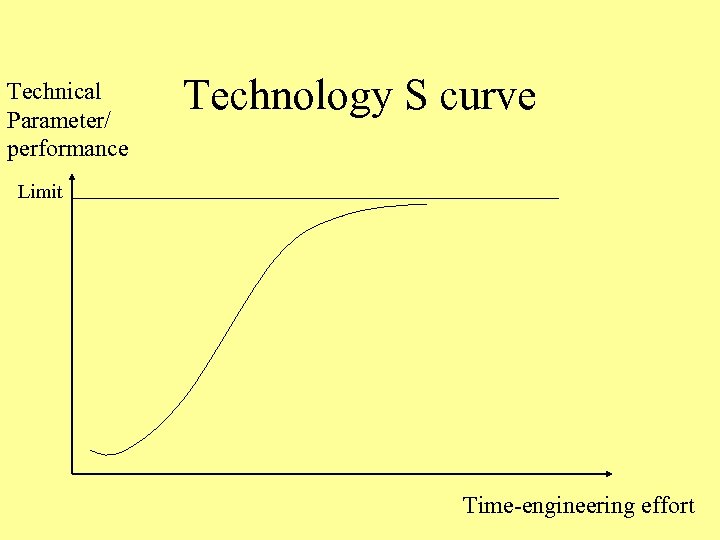

Technical Parameter/ performance Technology S curve Limit Time-engineering effort

Technical Parameter/ performance Technology S curve Limit Time-engineering effort

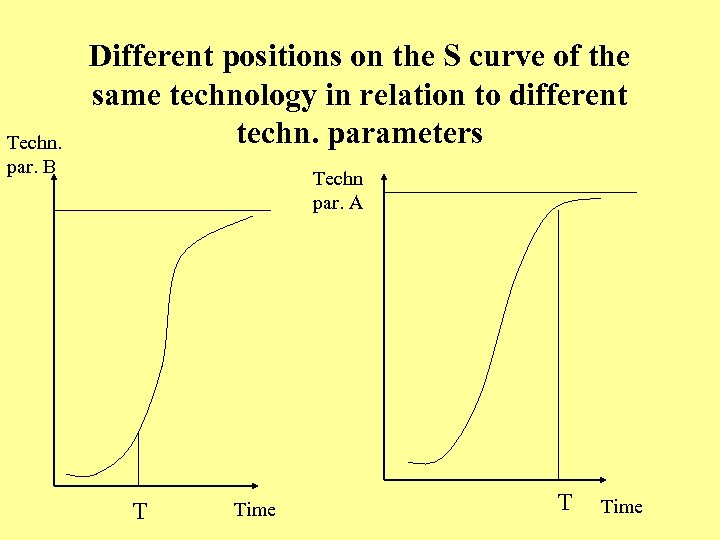

Techn. par. B Different positions on the S curve of the same technology in relation to different techn. parameters Techn par. A T Time

Techn. par. B Different positions on the S curve of the same technology in relation to different techn. parameters Techn par. A T Time

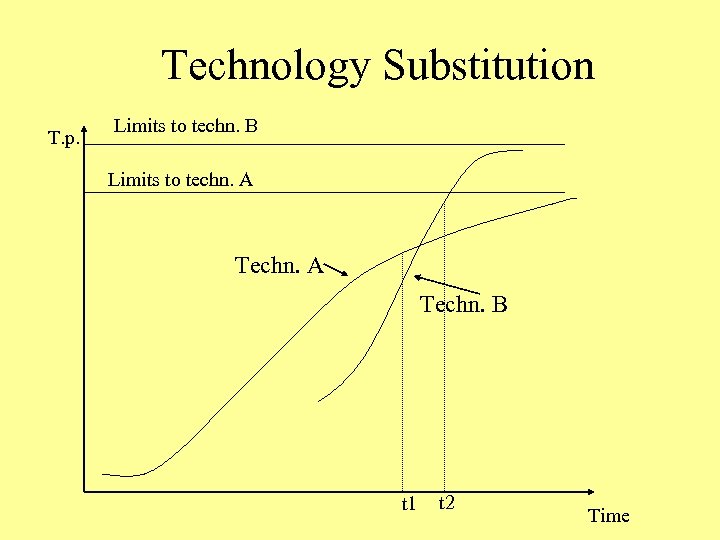

Technology Substitution T. p. Limits to techn. B Limits to techn. A Techn. B t 1 t 2 Time

Technology Substitution T. p. Limits to techn. B Limits to techn. A Techn. B t 1 t 2 Time

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 1. IDENTIFY PRODUCT (GOODS/SERVICES) ATTRIBUTES OF MAJOR SIGNIFICANCE TO MARKET SUCCESS; 2. IDENTIFY RELATIONS BETWEEN PRODUCT ATTRIBUTES AND TECHNICAL PARAMETER/PERFORMANCE;

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 1. IDENTIFY PRODUCT (GOODS/SERVICES) ATTRIBUTES OF MAJOR SIGNIFICANCE TO MARKET SUCCESS; 2. IDENTIFY RELATIONS BETWEEN PRODUCT ATTRIBUTES AND TECHNICAL PARAMETER/PERFORMANCE;

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 3. Define the growth/development limit of the identified parameter – physical limit with given technology; 4. Assess the present position of the selected technical parameter on the S curve and analyse the proximity to the development limit idnetified in previous step;

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 3. Define the growth/development limit of the identified parameter – physical limit with given technology; 4. Assess the present position of the selected technical parameter on the S curve and analyse the proximity to the development limit idnetified in previous step;

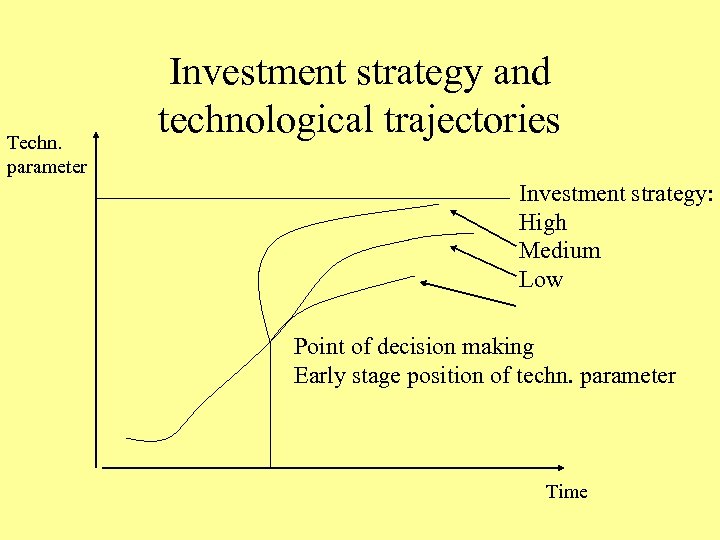

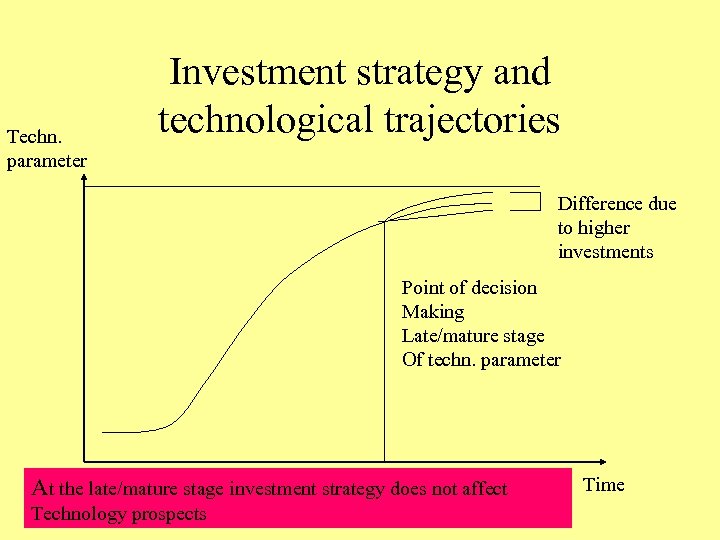

Techn. parameter Investment strategy and technological trajectories Investment strategy: High Medium Low Point of decision making Early stage position of techn. parameter Time

Techn. parameter Investment strategy and technological trajectories Investment strategy: High Medium Low Point of decision making Early stage position of techn. parameter Time

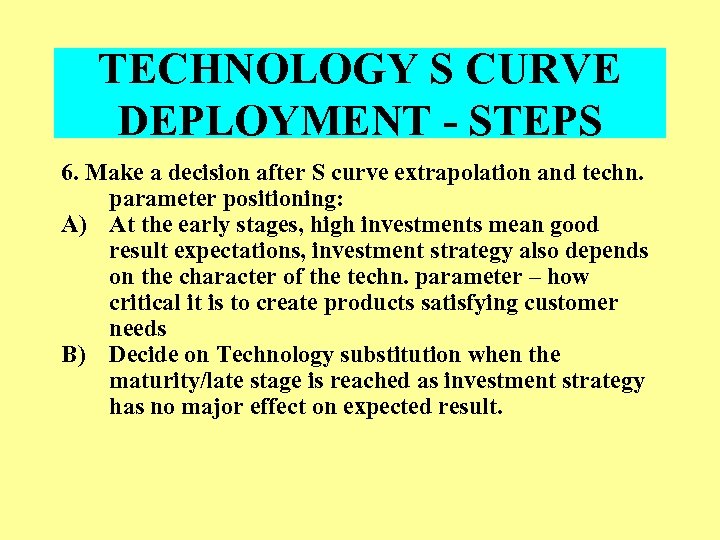

Techn. parameter Investment strategy and technological trajectories Difference due to higher investments Point of decision Making Late/mature stage Of techn. parameter At the late/mature stage investment strategy does not affect Technology prospects Time

Techn. parameter Investment strategy and technological trajectories Difference due to higher investments Point of decision Making Late/mature stage Of techn. parameter At the late/mature stage investment strategy does not affect Technology prospects Time

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 6. Make a decision after S curve extrapolation and techn. parameter positioning: A) At the early stages, high investments mean good result expectations, investment strategy also depends on the character of the techn. parameter – how critical it is to create products satisfying customer needs B) Decide on Technology substitution when the maturity/late stage is reached as investment strategy has no major effect on expected result.

TECHNOLOGY S CURVE DEPLOYMENT - STEPS 6. Make a decision after S curve extrapolation and techn. parameter positioning: A) At the early stages, high investments mean good result expectations, investment strategy also depends on the character of the techn. parameter – how critical it is to create products satisfying customer needs B) Decide on Technology substitution when the maturity/late stage is reached as investment strategy has no major effect on expected result.

3. Technology and Market Matrices

3. Technology and Market Matrices

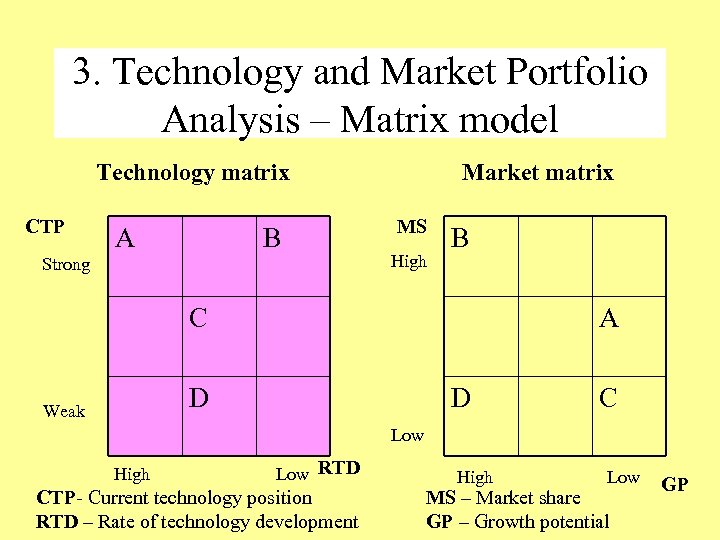

3. Technology and Market Portfolio Analysis – Matrix model Technology matrix CTP A B Strong Market matrix MS High B C A D Weak D C Low High Low RTD CTP- Current technology position RTD – Rate of technology development High Low MS – Market share GP – Growth potential GP

3. Technology and Market Portfolio Analysis – Matrix model Technology matrix CTP A B Strong Market matrix MS High B C A D Weak D C Low High Low RTD CTP- Current technology position RTD – Rate of technology development High Low MS – Market share GP – Growth potential GP

4. Expert System for Decision Support: New tech Expert Choice

4. Expert System for Decision Support: New tech Expert Choice

Decision Support Systems and Expert Systems • Expert Sytems for Decision Support – developed for management of new technology in firms • Technology Decision Making Aalgorithm • Technology alternatives in firms: a) rationalizing, enhancing existing technology, and b) introducing new technology. • The decision is made based on benefits/advantages and weaknesses of each alternative.

Decision Support Systems and Expert Systems • Expert Sytems for Decision Support – developed for management of new technology in firms • Technology Decision Making Aalgorithm • Technology alternatives in firms: a) rationalizing, enhancing existing technology, and b) introducing new technology. • The decision is made based on benefits/advantages and weaknesses of each alternative.

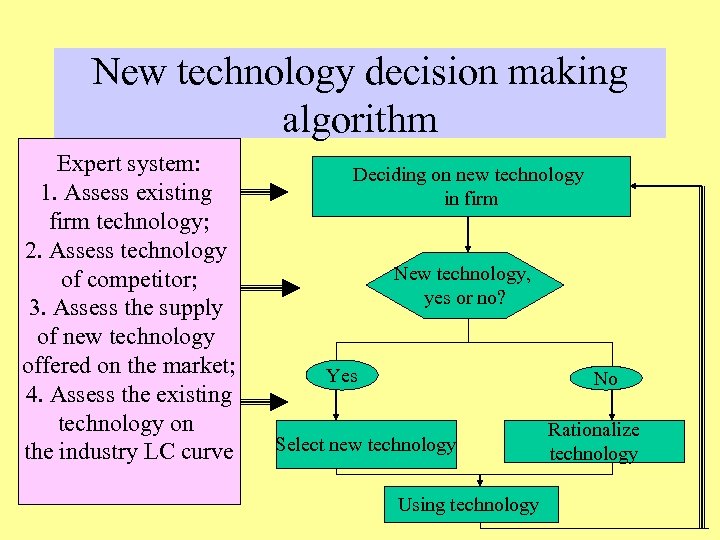

New technology decision making algorithm Expert system: 1. Assess existing firm technology; 2. Assess technology of competitor; 3. Assess the supply of new technology offered on the market; 4. Assess the existing technology on the industry LC curve Deciding on new technology in firm New technology, yes or no? Yes No Select new technology Using technology Rationalize technology

New technology decision making algorithm Expert system: 1. Assess existing firm technology; 2. Assess technology of competitor; 3. Assess the supply of new technology offered on the market; 4. Assess the existing technology on the industry LC curve Deciding on new technology in firm New technology, yes or no? Yes No Select new technology Using technology Rationalize technology

Decision support to technology management • Expert systems are gaining impoertance in management activities; • Expert systems can be viewed as means by which new capability is developed to understand specific knowledge related to the problem and to use that knowledge in an intelligent way so that optimal choice for further action is made.

Decision support to technology management • Expert systems are gaining impoertance in management activities; • Expert systems can be viewed as means by which new capability is developed to understand specific knowledge related to the problem and to use that knowledge in an intelligent way so that optimal choice for further action is made.

Expert Systems are used in the following cases: • (1) When problems in a certain domain are difficult to define analytically, i. e. when they are unstructured; • (2) When the number of feasible solutions is great and optimal choice is to be madeaccording to criteria; • (3) When the knowledge domain is broad and should be used selectively.

Expert Systems are used in the following cases: • (1) When problems in a certain domain are difficult to define analytically, i. e. when they are unstructured; • (2) When the number of feasible solutions is great and optimal choice is to be madeaccording to criteria; • (3) When the knowledge domain is broad and should be used selectively.

NEWTECH Expert Choice (expert system for decision support in technology management) • Software developed in the USA based on software Expert Choice Package • Decision support to the crucial problem of whether to introduce new technology or continue using existing one – New technology: YES or NO • Uses over 100 varaibles to come to resolution of the problem

NEWTECH Expert Choice (expert system for decision support in technology management) • Software developed in the USA based on software Expert Choice Package • Decision support to the crucial problem of whether to introduce new technology or continue using existing one – New technology: YES or NO • Uses over 100 varaibles to come to resolution of the problem

New Tech Model • The managing team provides individual assessment of the rank based on relative importance of variables according to the specific situation in concrete oeganization. Ultimately, as result, a scale is generates with ranking for two alternatives: • 1. Adapt New Technology – ( New Technology YES) • 2. Maintain previous state (New Technology – NO)

New Tech Model • The managing team provides individual assessment of the rank based on relative importance of variables according to the specific situation in concrete oeganization. Ultimately, as result, a scale is generates with ranking for two alternatives: • 1. Adapt New Technology – ( New Technology YES) • 2. Maintain previous state (New Technology – NO)

Model Based on the Model AHP • Analytical Hierarchical Process (AHP) - developed by Satti • Hierarchical/network structures are used for presenting the decision problem, then, priorities are generated based on the decision makers` assessment on the importance/significance of variables in relation to the to decision alternatives • The alternatives are then ranked and their relative position is determined on a specific scale with probability and inconsistency measures.

Model Based on the Model AHP • Analytical Hierarchical Process (AHP) - developed by Satti • Hierarchical/network structures are used for presenting the decision problem, then, priorities are generated based on the decision makers` assessment on the importance/significance of variables in relation to the to decision alternatives • The alternatives are then ranked and their relative position is determined on a specific scale with probability and inconsistency measures.