Важные темы для повторения.ppt

- Количество слайдов: 116

Strategic management Strategy- ideas, decisions, actions that enable a company to succeed Competitive advantage- resources and capabilities that allow company to overcome competitive forces in its industry 1

2

Strategic analysis- goals, objectives, external/ internal environment, intellectual capital (knowledge, patents, relationship, Its etc. ) Strategic formulation- functional level, business level, corporate level, international strategies, entrepreneurial strategy Strategic implementation- control/governance, organizational design, leadership, learning organization, ethics, corporate entrepreneurship/ innovations 3

Strategic Management Analysis Strategic goals (vision, mission, strategic objectives) Internal and external environment of the firm Strategic decisions What industries should we compete in? How should we compete in those industries? Actions Allocate necessary resources Design the organization to bring intended strategies to reality To create and sustain competitive advantages 4

Strategic Management Strategic management is the study of why some firms outperform others How to compete in order to create competitive advantages in the marketplace How to create competitive advantages in the market place Unique and valuable Difficult for competitors to copy or substitute 5

Consistency in Strategic Direction Company vision why are we here? What we want to be? Massively inspiring Long-term Driven by and evokes passion Fundamental statement of the organization’s Company vision Hierarchy of Goals Values Aspiration Goals 6

Coherence in Strategic Direction Mission statements What do we do? Why we exist? Purpose of the company Basis of competition and competitive advantages More specific than vision Focused on the means by which the firm will compete Company vision Mission statements Hierarchy of Goals 7

Coherence in Strategic Direction Strategic objectives Operationalize the mission statement Provide guidance on how the organization can fulfill or move toward the “higher goals” More specific Cover a more well-defined time frame Company vision Mission statements Strategic objectives Hierarchy of Goals 8

Coherence in Strategic Direction Strategic objectives General Measurable Specific Appropriate Realistic Timely Challenging Resolve conflicts that Specific arise Yardstick for rewards and incentives Long Time Horizon Company vision Mission statement Strategic objectives Short Term Horizon Hierarchy of Goals 9

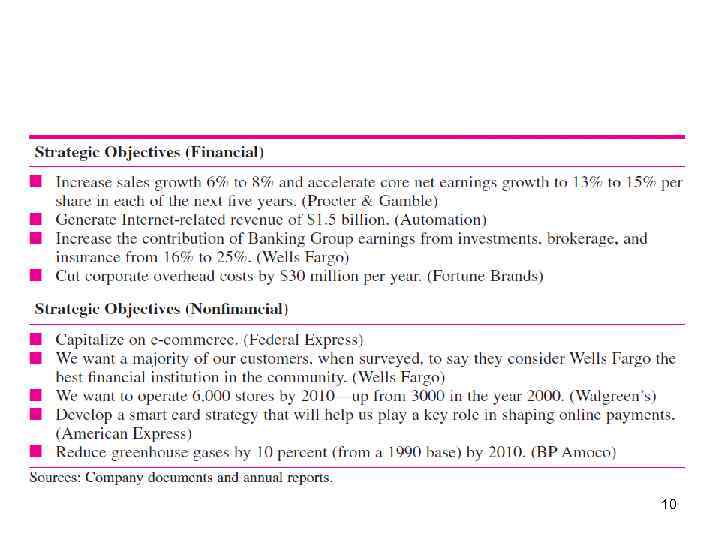

10

The External Environment

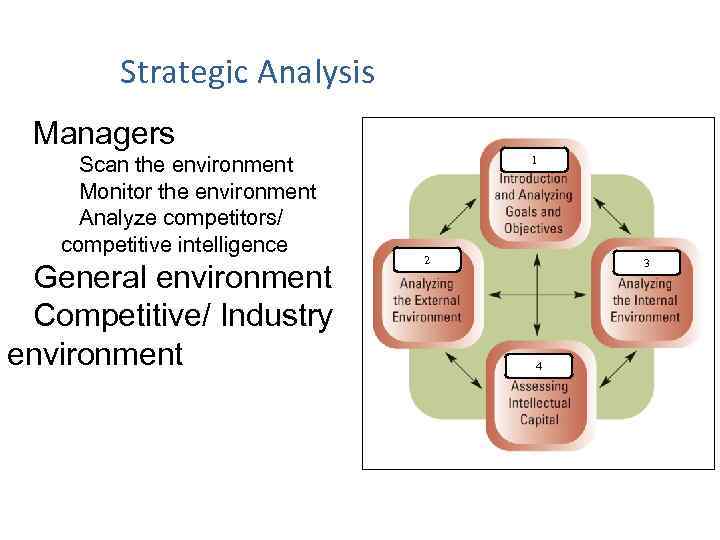

Strategic Analysis Managers Scan the environment Monitor the environment Analyze competitors/ competitive intelligence General environment Competitive/ Industry environment 1 2 3 4

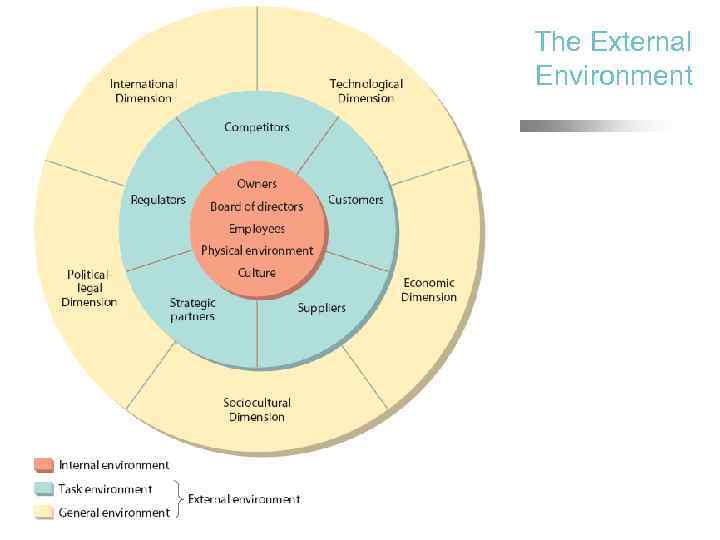

The External Environment

General Environment • Dimensions in the broader society that influence and industry and the firms within it – International – Technological – Economic – Sociocultural – Political/legal

Task Environment • Set of organizations/ groups directly influencing a firm and its competitive actions and competitive responses – Competitors – Customers – Suppliers – Strategic partners – Regulators- agencies and interest groups

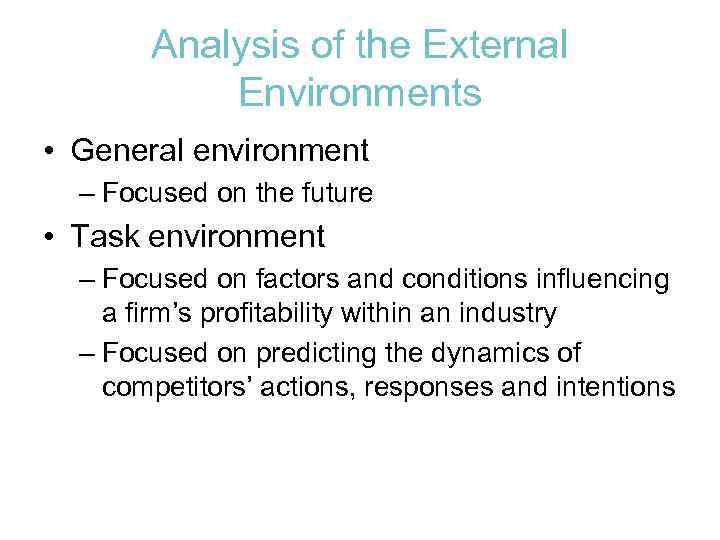

Analysis of the External Environments • General environment – Focused on the future • Task environment – Focused on factors and conditions influencing a firm’s profitability within an industry – Focused on predicting the dynamics of competitors’ actions, responses and intentions

External Environmental Analysis • A continuous process which includes – Scanning for early signals of potential changes and trends in the general environment – Monitoring changes to see if a trend emerges from among those spotted by scanning – Competitive intelligence a firm’s activities of collecting and interpreting data on competitors (strengths and weaknesses) and industry – Forecasting projections of outcomes based on monitored changes and trends – Assessing/evaluating the timing and significance of changes and trends on the strategic management of the firm (scenario analysis)

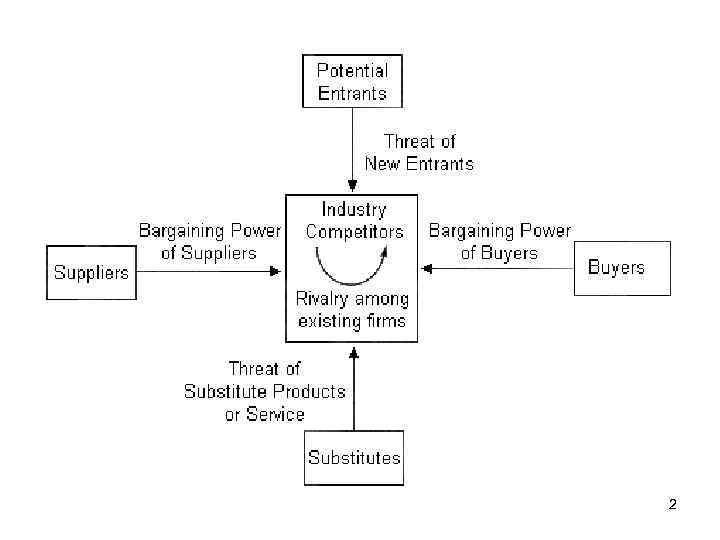

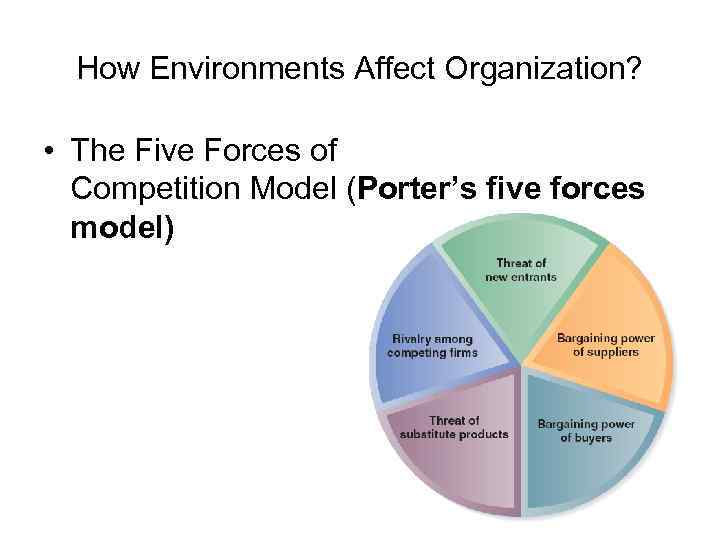

How Environments Affect Organization? • The Five Forces of Competition Model (Porter’s five forces model)

• A PEST analysis most commonly measures a market; a SWOT analysis measures a business unit, a proposition or idea. SWOT analysis measures a business unit or proposition, whereas a PEST analysis measures the market potential and situation, particularly indicating growth or decline, and thereby market attractiveness, business potential, and suitability of access - market potential and 'fit’.

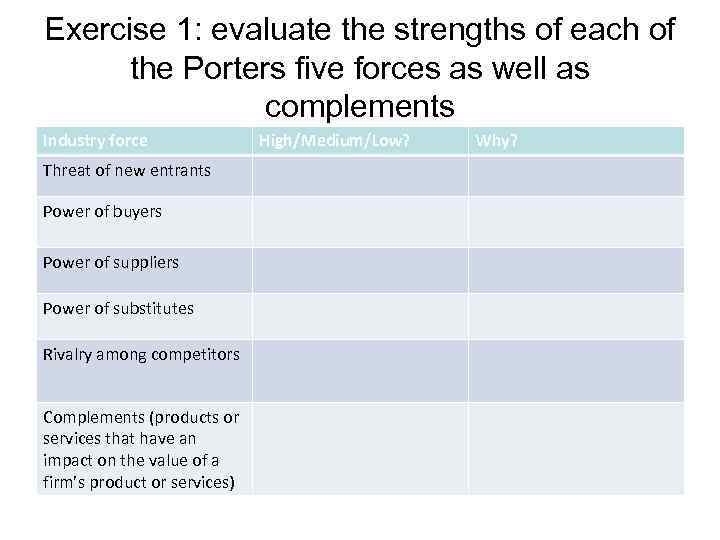

Exercise 1: evaluate the strengths of each of the Porters five forces as well as complements Industry force Threat of new entrants Power of buyers Power of suppliers Power of substitutes Rivalry among competitors Complements (products or services that have an impact on the value of a firm’s product or services) High/Medium/Low? Why?

The Internal Environment

• SWOT analysis • Value-chain analysis • Resource-based view of the firm • Evaluation performance: financial ratio analysis and the balanced scorecard

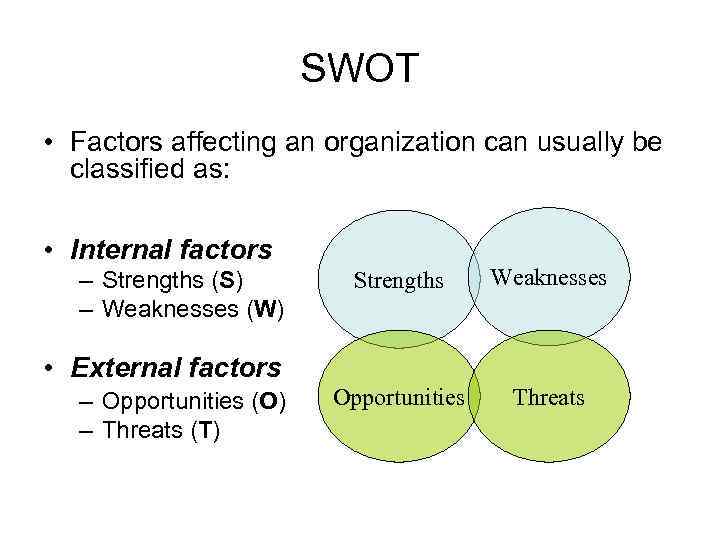

SWOT • Factors affecting an organization can usually be classified as: • Internal factors – Strengths (S) – Weaknesses (W) Strengths Weaknesses Opportunities Threats • External factors – Opportunities (O) – Threats (T)

Major benefits of SWOT analyses • • Simplicity Flexibility Integration and synthesis Lower costs

Value-Chain Analysis • Sequential process of value-creating activities • Value is the amount that buyers are willing to pay for what a firm provides them • Value is measured by total revenue • Firm is profitable to the extent the value it receives exceeds the total costs involved in creating its product or service

The Value Chain Adapted from Exhibit 3. 1 The Value Chain: Primary and Support Activities Source: Adapted with permission of The Free Press, a division of Simon & Schuster, Inc. , from Competitive Advantage: Creating and Sustaining Superior Performance by Michael E. Porter.

Primary Activities Inbound Logistics Associated with receiving, storing and distributing inputs to the product Location of distribution facilities Material and inventory control systems Systems to reduce time to send “returns” to suppliers Warehouse layout and designs

Primary Activities Inbound Logistics Operations Associated with transforming inputs into the final product form Efficient plant operations Appropriate level of automation in manufacturing Quality production control systems Efficient plant layout and workflow design

Primary Activities Inbound Logistics Operations Outbound Logistics Associated with collecting, storing, and distributing the product or service to buyers Effective shipping processes Efficient finished goods warehousing processes Shipping of goods in large lot sizes Quality material handling equipment

Primary Activities Inbound Logistics Operations Outbound Logistics Marketing and Sales Associated with purchases of products and services by end users and the inducements used to get them to make purchases Highly motivated and competent sales force Innovative approaches to promotion and advertising Selection of most appropriate distribution channels Proper identification of customer segments and needs Effective pricing strategies

Primary Activities Inbound Logistics Operations Outbound Logistics Marketing and Sales Service Associated with providing service to enhance or maintain the value of the product Effective use of procedures to solicit customer feedback and to act on information Quick response to customer needs and emergencies Ability to furnish replacement parts Effective management of parts and equipment inventory Quality of service personnel and ongoing training Warranty and guarantee policies

Support Activities General Administration Typically supports the entire value chain and not individual activities Effective planning systems Ability of top management to anticipate and act on key environmental trends and events Ability to obtain low-cost funds for capital expenditures and working capital Excellent relationships with diverse stakeholder groups Ability to coordinate and integrate activities across the value chain Highly visible to inculcate organizational culture, reputation, and values

Support Activities General Administration Human Resource Management Activities involved in the recruiting, hiring, training, development, and compensation of all types of personnel Effective recruiting, development, and retention mechanisms for employees Quality relations with trade unions Quality work environment to maximize overall employee performance and minimize absenteeism Reward and incentive programs to motivate all employees

Support Activities General Administration Human Resource Management Technology Development Related to a wide range of activities and those embodied in processes and equipment and the product itself Effective R&D activities for process and product initiatives Positive collaborative relationships between R&D and other departments State-of-the art facilities and equipment Culture to enhance creativity and innovation Excellent professional qualifications of personnel Ability to meet critical deadlines

Support Activities General Administration Human Resource Management Technology Development Procurement Function of purchasing inputs used in the firm’s value chain Procurement of raw material inputs Development of collaborative “win-win” relationships with suppliers Effective procedures to purchase advertising and media services Analysis and selection of alternate sources of inputs to minimize dependence on one supplier Ability to make proper lease versus buy decisions

Resource-Based View of the Firm… competitive advantages are due to contribution of strategic resources (valuable, rare, costly to imitate or substitute) Three key types of resources Tangible resources Intangible resources Organizational capabilities

Types of Resources Tangible Resources Relatively easy to identify, and include physical and financial assets used to create value for customers Financial resources Firm’s cash accounts Firm’s capacity to raise equity Firm’s borrowing capacity Physical resources Modern plant and facilities Favorable manufacturing locations State-of-the-art machinery and equipment

Types of Resources Tangible Resources Relatively easy to identify, and include physical and financial assets used to create value for customers Technological resources Trade secrets Innovative production processes Patents, copyrights, trademarks Organizational resources Effective strategic planning processes Excellent evaluation and control systems

Types of Resources Tangible Resources Intangible Resources Difficult for competitors (and the firm itself) to account for or imitate, typically embedded in unique routines and practices that have evolved over time Human Experience and capabilities of employees Trust Managerial skills Firm-specific practices and procedures

Types of Resources Tangible Resources Intangible Resources Difficult for competitors (and the firm itself) to account for or imitate, typically embedded in unique routines and practices that have evolved over time Innovation and creativity Technical and scientific skills Innovation capacities Reputation Brand name Reputation with customers Reputation with suppliers

Types of Resources Tangible Resources Intangible Resources Organizational Capabilities Competencies or skills that a firm employs to transform inputs to outputs, and capacity to combine tangible and intangible resources to attain desired end Outstanding customer service Excellent product development capabilities Innovativeness of products and services Ability to hire, motivate, and retain human capital

Financial Ratio Analysis Five types of financial ratios Short-term solvency or liquidity Long-term solvency measures Asset management (or turnover) Profitability Market value Meaningful ratio analysis must include Analysis of how ratios change over time How ratios are interrelated

Business-Level Strategy: Creating and Sustaining Competitive Advantages

Types of Competitive Advantage and Sustainability Three generic strategies to overcome the five forces and achieve competitive advantage Overall cost leadership Low-cost-positioning Manage relationships throughout the entire value chain Differentiation Create products and/or services that are unique and valued Non-price attributes for which customers will pay an extra amount Focus strategy Narrow product lines, buyer segments, or targeted geographic markets Attain advantages either through differentiation or cost leadership

Three Generic Strategies

Overall Cost Leadership- a competitive advantage base on low cost Integrated tactics Aggressive construction of efficient-scale facilities Cost reductions from experience Tight cost and overhead control Cost minimization in all activities in the firm’s value chain, such as R&D, service, sales force, and advertising Etc…

Value-Chain Activities: Overall Cost Leadership

Differentiation- unique features A firm seeks to be unique in it’s industry along some dimensions that are widely valued by buyers Differentiation can take many forms Prestige or brand image Technology Innovation Features Customer service Dealer network

Value-Chain Activities: Differentiation

Differentiation Firms may differentiate along several dimensions at once (Prestige or brand image, Technology, Innovation, Features, Customer service, Dealer network) Firms achieve and sustain differentiation and above-average profits when price exceed extra costs of being unique Successful differentiation requires integration with all parts of a firm’s value chain An important aspect of differentiation is speed or quick response

Focus = a firm sets out to be best in a segment or group of segments Firm selects a segment or group of segments (niche) and tailors its strategy to serve them Firm achieves competitive advantages by dedicating itself to these segments exclusively Two variants Cost focus Differentiation focus

Combination Strategies: Integrating Overall Low Cost and Differentiation Primary benefit of successful integration of lowcost and differentiation strategies is difficulty it poses for competitors to duplicate or imitate strategy Goal of combination strategy is to provide unique value in an efficient manner

Industry Life-Cycle States: Strategic Implications Life cycle of an industry Introduction Growth Maturity Decline Emphasis on strategies, functional areas, valuecreating activities, and overall objectives varies over the course of an industry life cycle

Stages of the Industry Life Cycle

Stages of the Industry Life Cycle Stage Factor Introduction Growth Maturity Decline Generic strategies Differentiation Overall cost leadership Focus Market growth rate Low Very large Low to moderate Negative Number of segments Very few Some Many Few Intensity of competition Low Increasing Very intense Changing Emphasis on product design Very high High Low to moderate Low

Stages of the Industry Life Cycle Stage Factor Introduction Emphasis on process design Low Major functional area(s) of concern Overall objective Growth Low to moderate Maturity Decline High Low Research and Sales and Development marketing Production General management and finance Increase market share awareness Defend market share and extend product life cycles Consolidate, maintain, harvest, or exit Create consumer demand

Strategies in the Introduction Stage Products are unfamiliar to consumers Market segments not well defined Product features not clearly specified Competition tends to be limited Strategies • Develop product and get users to try it • Generate exposure so product becomes “standard”

Strategies in the Growth Stage Characterized by strong increases in sales Attractive to potential competitors Primary key to success is to build consumer preferences for specific brands Strategies • Brand recognition • Differentiated products • Financial resources to support value-chain activities

Strategies in the Maturity Stage Aggregate industry demand slows Market becomes saturated, few new adopters Direct competition becomes predominant Marginal competitors begin to exit Strategies • Efficient manufacturing operations and process engineering • Low costs (customers become price sensitive)

Strategies in the Decline Stage Industry sales and profits begin to fall Strategic options become dependent on the actions of rivals Strategies • Maintaining • Harvesting • Exiting the market • Consolidation

Corporate-Level Strategy

Two Strategy Levels Business-level Strategy – actions taken to provide value to customers and gain a competitive advantage by exploiting core competencies in specific, individual product or service markets Corporate-level Strategy – actions taken by the firm to gain a competitive advantage by selecting and managing a group of different businesses competing in several industries and product markets

Making Diversification Work • Diversification initiatives must create value for shareholders – – Mergers and acquisitions Strategic alliances Joint ventures Internal development • Diversification should create synergy Business 1 Business 2

The Role of Diversification • Diversification strategies play a major role in the behavior of large firms • Product diversification concerns: – The scope of the industries and markets in which the firm competes – How managers buy, create and sell different businesses to match skills and strengths with opportunities presented to the firm

Diversifying to Enhance Competitiveness • Related Diversification – Economies of scope – Sharing activities – Transferring core competencies – Market power – Vertical integration • Unrelated Diversification: Parenting, Restructuring, and Financial Synergies

Related Diversification • Firm creates value by building upon or extending its: – Resources – Capabilities – Core competencies • Economies of scope – Cost savings that occur when a firm transfers capabilities and competencies developed in one of its businesses to another of its businesses

Vertical Integration: Benefits and Risks

Analyzing Vertical Integration: The Transaction Cost Perspective Negotiating costs Search costs Enforcement costs- terms costs of contract Market transaction Costs of written contract Monitoring costs

Unrelated Diversification: Financial Synergies and Parenting • Most benefits from unrelated diversification are gained from vertical (hierarchical) relationships – Parenting and restructuring of businesses – Allocate resources to optimize – Profitability – Cash flow – Growth – Appropriate human resources practices – Financial controls

Portfolio Management Key Each circle represents one of the firm’s business units Size of circle represents the relative size of the business unit in terms of revenue

Means to Achieve Diversification • Acquisitions or mergers • Pooling resources of other companies with a firm’s own resource base – Joint venture – Strategic alliance • Internal development – New products – New markets – New technology

International Strategy

Four International Operations Strategies Global Strategy (глобальная) standardized product, economies of scale. Transnational strategy (транснациональная): move material, people, ideas, across national boundaries; economies of scale; and cross-cultural learning. International strategy (интернациональная): import/export, or license existing product. Multidomestic strategy (мультинациональная): use existing domestic model globally, franchise, joint venture, subsidiaries.

International Corporate-Level Strategy • Multi-domestic Strategy – Strategic & operating decisions are decentralized to the strategic business unit in each country to tailor products to the local market. • Global Strategy – Assumes more standardization of products across country markets • Transnational Strategy – The firm seeks to achieve both global efficiency and local responsiveness

Choice of International Entry Mode Exporting • Common way to enter new international markets. • No need to establish operations in other nations. • Establish distribution channels through contractual relationships. • • May have high transportation costs. May encounter high import tariffs. May have less control on marketing and distribution. Difficult to customize product.

Choice of International Entry Mode Licensing • Firm authorizes another firm to manufacture & sell its products • Licensing firm is paid a royalty on each unit produced and sold. • Licensee takes risks in manufacturing investments. • Least risky way to enter a foreign market. • Licensing firm loses control over product quality & distribution. • Relatively low profit potential.

Choice of International Entry Mode Strategic Alliances • Enable firms to shares risks and resources to expand into international ventures. • Most joint ventures (JVs) involve a foreign corp. with a new product or technology & a host company with access to distribution or knowledge of local customs, norms or politics. • May experience difficulties in merging disparate cultures. • May not understand the strategic intent of partners or experience divergent goals.

Choice of International Entry Mode Acquisitions • Enable firms to make most rapid international expansion. • Can be very costly. • Legal and regulatory requirements may present barriers to foreign ownership. • Usually require complex and costly negotiations. • Potentially disparate corporate culture.

Choice of International Entry Mode New Wholly-Owned Subsidiary – Greenfield Venture • • Most costly & complex of entry alternatives. Achieves greatest degree of control. Potentially most profitable, if successful. Maintain control over technology, marketing and distribution. • May need to acquire expertise & knowledge that is relevant to host country. Could require hiring host country nationals or consultants at high cost.

Major Risks of International Diversification Political Risk • National government instability may create potential problems for internationally diversified firms. • Potential changes in attitudes or regulations regarding foreign ownership. • Legal authority obtained from previous administration may become invalid. • Potential for nationalization of firms’ assets.

Major Risks of International Diversification Economic Risk • Econ. risks are interdependent with political risks. Differences and fluctuations in international currencies may affect value of assets & liabilities. • This affects prices & thus ability to compete. • Differences in inflation rates may affect inter-nationally diversified firms’ ability to compete. • Enforcing intellectual property rights on CDs, software, etc.

Organizational Structure and Controls

Organizational Structure • Organizational structure specifies: – The firm’s formal reporting relationships, procedures, controls, and authority and decision-making processes – The work to be done and how to do it, given the firm’s strategy or strategies • It is critical to match organizational structure to the firm’s strategy

Organizational Structure • Effective structures provide: – Stability – Flexibility • Structural stability provides: – The capacity required to consistently and predictably manage daily work routines • Structural flexibility provides for: – The opportunity to explore competitive possibilities – The allocation of resources to activities that shape needed competitive advantages

Relationships between Strategy and Structure • Strategy and structure have a corresponding relationship: – Structure flows from or follows the selection of the firm’s strategy but … – Once in place, structure can influence current strategic actions as well as choices about future strategies

Evolutionary Patterns of Strategy and Organizational Structure • Firms grow in predictable patterns: – First by volume – Then by geography – Then integration (vertical, horizontal) – And finally through product/business diversification • A firm’s growth patterns determine its structural form

Evolutionary Patterns of Strategy and Organizational Structure • All organizations require some form of organizational structure to implement and manage their strategies • Firms frequently change their structure as they grow in size and complexity • Three basic structure types: – Simple structure – Functional structure – Multidivisional structure (M-form)

Strategy and Structure Growth Pattern • As firms grow larger and become more complex, structural challenges emerge • Firms’ larger sizes dictate the need for more sophisticated workflows and integrating mechanisms Simple Functional Multidivisional Efficient implementation of formulated strategy

Strategy and Structure: Simple Structure • Owner-manager – Makes all major decisions directly – Monitors all activities • Staff – Serves as an extension of the manager’s supervisor authority • Matched with focus strategies and business-level strategies – Commonly compete by offering a single product line in a single geographic market • Growth creates: – Complexity – Managerial and structural challenges • Owner-managers – Commonly lack organizational skills and experience – Become ineffective in managing the specialized and complex tasks involved with multiple organizational functions

Strategy and Structure: Functional Structure • Chief Executive Officer (CEO) – Limited corporate staff • Functional line managers in dominant organizational areas of: – Manufacturing Marketing – Accounting R&D Engineering HR • Supports use of business-level strategies and some corporate-level strategies – Single or dominant business with low levels of diversification

Functional Structure (cont’d) • Differences in orientation among organizational functions can: – Delay or stop communication and coordination – Increase the need for CEO to integrate decisions and actions of business functions – Facilitate career paths and professional development in specialized functional areas – Cause functional-area managers to focus on local versus overall company strategic issues

Strategy and Structure: Multidivisional Structure • Strategic Control – Operating divisions function as separate businesses or profit centers • Top corporate officer delegates responsibilities to division managers – For day-to-day operations – For business-unit strategy • Appropriate as firm grows through diversification

Multidivisional Structure (cont’d) • Three Major Benefits – Corporate officers are able to more accurately monitor the performance of each business, which simplifies the problem of control – Facilitates comparisons between divisions, which improves the resource allocation process – Stimulates managers of poorly performing divisions to look for ways of improving performance

Matching Strategy and Functional Structure • Different forms of the functional organizational structure are matched to: – Cost leadership strategy – Differentiation strategy – Integrated cost leadership/differentiation strategy • Differences in these forms are seen in three important structural characteristics: – Specialization (number and types of jobs) – Centralization (decision-making authority) – Formalization (formal rules and work procedures) 97

Functional Structure for Cost Leadership Strategy Notes: • Operations is the main function • Process engineering is emphasized rather than new product R&D • Relatively large centralized staff coordinates functions • Formalized procedures allow for emergence of a low-cost culture • Overall structure is mechanical; job roles are highly structured

Functional Structure under a Cost Leadership Strategy • Operations is the main function – Process engineering is emphasized over research and development – Large centralized staff oversees activities – Formalized procedures guide actions – Structure is mechanical – Job roles are highly structured

Functional Structure for Implementation of a Differentiation Strategy Notes: • Marketing is the main function for keeping track of new product ideas • New product R&D is emphasized • Most functions are decentralized, but R&D and marketing may have centralized staffs that work closely with each other • Formalization is limited so that new product ideas can emerge easily and change is more readily accomplished • Overall structure is organic; job roles are less structured

Functional Structure under a Differentiation Strategy • Marketing is the main function for tracking new product ideas – New product R&D is emphasized – Most functions are decentralized – Formalization is limited to foster change and promote new ideas – Overall structure is organic – Job roles are less structured

Corporate-Level Strategies and the Multidivisional Structure • A firm’s continuing success that leads to: – Product diversification, or – Market diversification, or – Both product and market diversification • Increasing diversification creates control problems that the functional structure can’t handle – Information processing, coordination – Control

Corporate-Level Strategies and the Multidivisional Structure • Diversification strategy requires firm to change from functional structure to a multidivisional structure • Different levels of diversification create the need for implementation of a unique form of the multidivisional structure

Variations of the Multidivisional Structure

Cooperative Form of Multidivisional Structure: Related. Constrained Strategy Notes • Structural integration devices create tight links among all divisions • Corporate office emphasizes centralized strategic planning, human resources, and marketing to foster cooperation between divisions • R&D is likely to be centralized • • Rewards are subjective and tend to emphasize overall corporate performance in addition to divisional performance • Culture emphasizes cooperative sharing

Worldwide Geographic Area Structure: Multidomestic Strategy Notes: • The perimeter circles indicate decentralization of operations • Emphasis is on differentiation by local demand to fit an area or country culture • Corporate headquarters coordinates financial resources among independent subsidiaries • The organization is like a decentralized federation

Worldwide Product Divisional Structure: Global Strategy Notes • The headquarters’ circle indicates centralization to coordinate information flow among worldwide products • Corporate headquarters uses many intercoordination devices to facilitate global economies of scale and scope • Corporate headquarters also allocates financial resources in a cooperative way • The organization is like a centralized federation

Why Are There Different Types of Organizations? • Depending on what the product or service is, the management has to structure the organization to met the customer’s needs.

Functional or U-Form Design for a Small Manufacturing Company

Conglomerate (H-Form)

Multidivisional (M-Form)

Matrix Organization

Common Organization Designs for International Organizations, A

Common Organization Designs for International Organizations, B

Common Organization Designs for International Organizations, C

Common Organization Designs for International Organizations, D

Важные темы для повторения.ppt