a92850245f4423b46a6ce5b97692bc9e.ppt

- Количество слайдов: 12

Strategic issues to be considered • Make or buy • Technology selection • Make-to-stock vs. Make-to-order

Make or Buy • In general, parts that directly relate to the core competencies of the company are usually produced internally. • For parts that could be outsourced, some additional concerns are: – the quality of product and service guaranteed by the vendor – the stability of the vendor in terms of responsiveness and prices – What could be the benefits and/or drawbacks if this unit was produced in-house (e, g, , expand the company’s technology base or strain too much its human resources)? • When the above more qualitative considerations fail to resolve the issue, it can boil down to an economic comparison of the different scenaria.

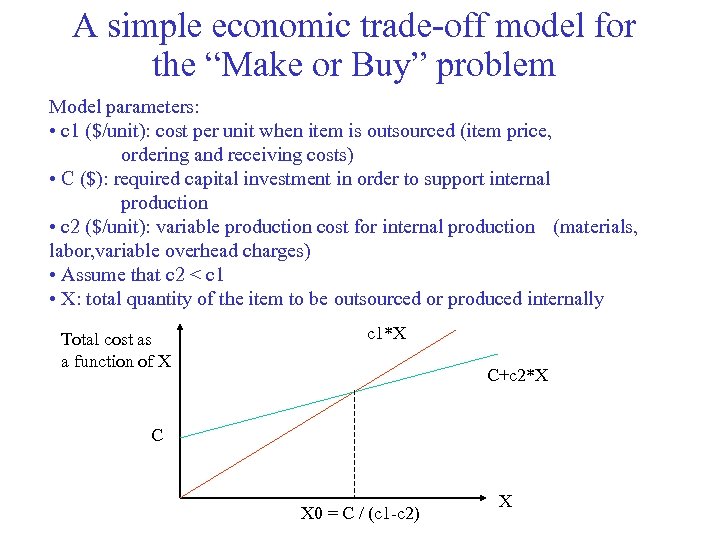

A simple economic trade-off model for the “Make or Buy” problem Model parameters: • c 1 ($/unit): cost per unit when item is outsourced (item price, ordering and receiving costs) • C ($): required capital investment in order to support internal production • c 2 ($/unit): variable production cost for internal production (materials, labor, variable overhead charges) • Assume that c 2 < c 1 • X: total quantity of the item to be outsourced or produced internally Total cost as a function of X c 1*X C+c 2*X C X 0 = C / (c 1 -c 2) X

Model Enhancements • • • Demand uncertainty Quantity-based discounts Stair-step capacity costs Nonlinear variable production costs Supplier limitations

Technology selection • The selected technology must be able to support the quality standards set by the corporate / manufacturing strategy • This decision must take into consideration future expansion plans of the company in terms of – production capacity (i. e. , support volume flexibility) – product portfolio (i. e. , support product flexibility) • It must also consider the overall technological trends in the industry, as well as additional developments (e. g. , economic, legal, etc. ) that might affect the viability of certain choices • For the candidates satisfying the above concerns, the final objective is the minimization of the total (i. e. , deployment plus operational) cost

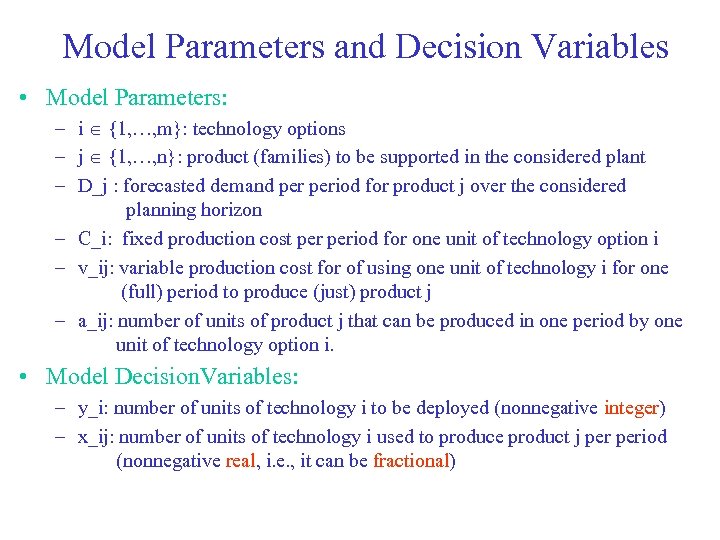

Model Parameters and Decision Variables • Model Parameters: – i {1, …, m}: technology options – j {1, …, n}: product (families) to be supported in the considered plant – D_j : forecasted demand period for product j over the considered planning horizon – C_i: fixed production cost period for one unit of technology option i – v_ij: variable production cost for of using one unit of technology i for one (full) period to produce (just) product j – a_ij: number of units of product j that can be produced in one period by one unit of technology option i. • Model Decision. Variables: – y_i: number of units of technology i to be deployed (nonnegative integer) – x_ij: number of units of technology i used to produce product j period (nonnegative real, i. e. , it can be fractional)

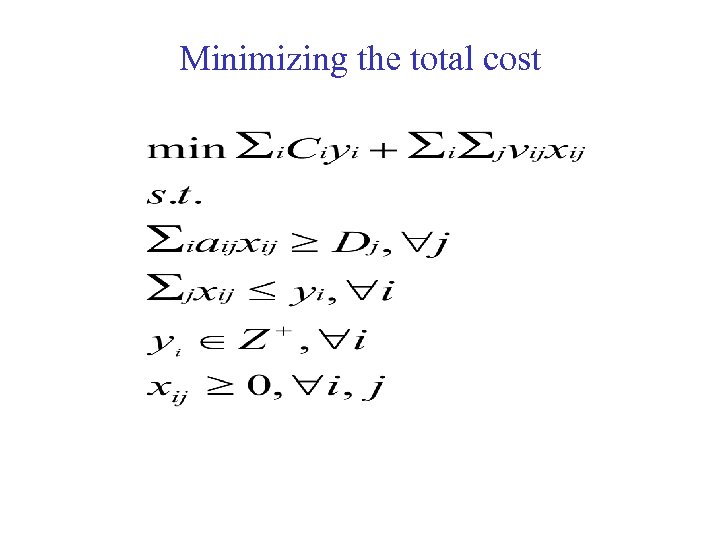

Minimizing the total cost

Make-to-Order vs. Make-to-Stock • Make-to-Order: Orders are produced or procured only upon placement • Make-to-stock: Demand is met from pre-built inventories, which are replenished periodically, through the production / procurement of a new lot of some predefined size Q. • Advantages for make-to-order / Disadvantages for make-to-stock • No need to tie capital in inventories and storage facilities • Guards against obsolescence and spoilage • Enhances the ability to support customization • Disadvantages for make-to-order / Advantages for make-to-stock • Introduces and element of backordering in the company operations => negative psychology to customers => loss of market share (especially if quoted delivery times are too long) • Increases the “pressure” in the company operations and might fail to take advantage of efficiencies that can result from early and good planning, like • optimizing the production / procurement lot sizes • taking advantage of low prices of raw materials or quantity discounts • and using expensive production options like overtime and outsourcing rather than using the existing slack capacity.

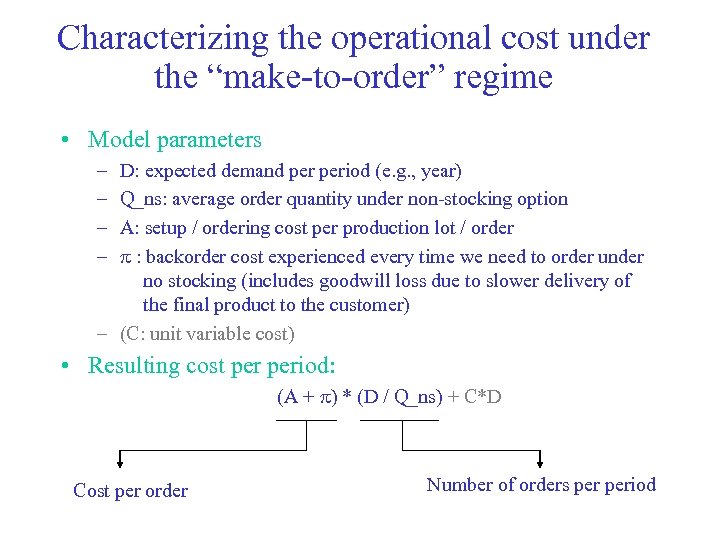

Characterizing the operational cost under the “make-to-order” regime • Model parameters – – D: expected demand period (e. g. , year) Q_ns: average order quantity under non-stocking option A: setup / ordering cost per production lot / order : backorder cost experienced every time we need to order under no stocking (includes goodwill loss due to slower delivery of the final product to the customer) – (C: unit variable cost) • Resulting cost period: (A + ) * (D / Q_ns) + C*D Cost per order Number of orders period

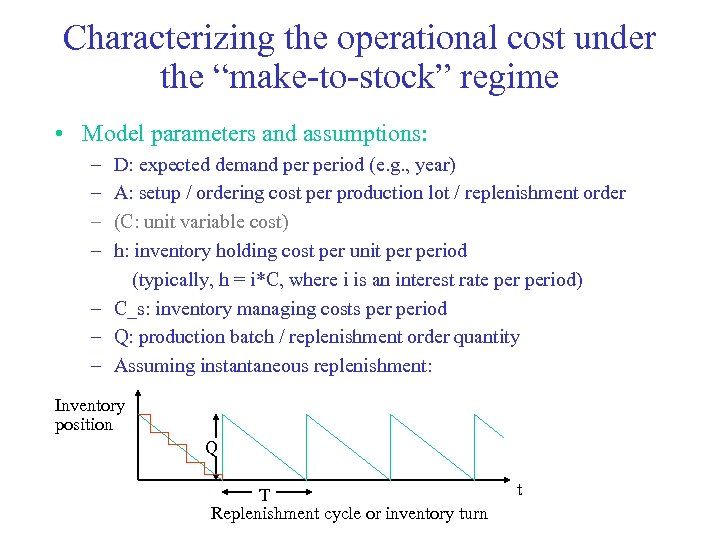

Characterizing the operational cost under the “make-to-stock” regime • Model parameters and assumptions: – – D: expected demand period (e. g. , year) A: setup / ordering cost per production lot / replenishment order (C: unit variable cost) h: inventory holding cost per unit period (typically, h = i*C, where i is an interest rate period) – C_s: inventory managing costs period – Q: production batch / replenishment order quantity – Assuming instantaneous replenishment: Inventory position Q T Replenishment cycle or inventory turn t

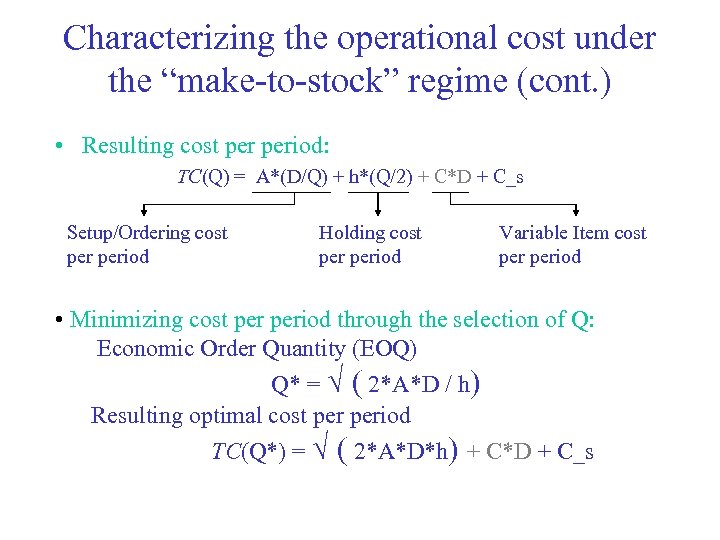

Characterizing the operational cost under the “make-to-stock” regime (cont. ) • Resulting cost period: TC(Q) = A*(D/Q) + h*(Q/2) + C*D + C_s Setup/Ordering cost period Holding cost period Variable Item cost period • Minimizing cost period through the selection of Q: Economic Order Quantity (EOQ) Q* = ( 2*A*D / h) Resulting optimal cost period TC(Q*) = ( 2*A*D*h) + C*D + C_s

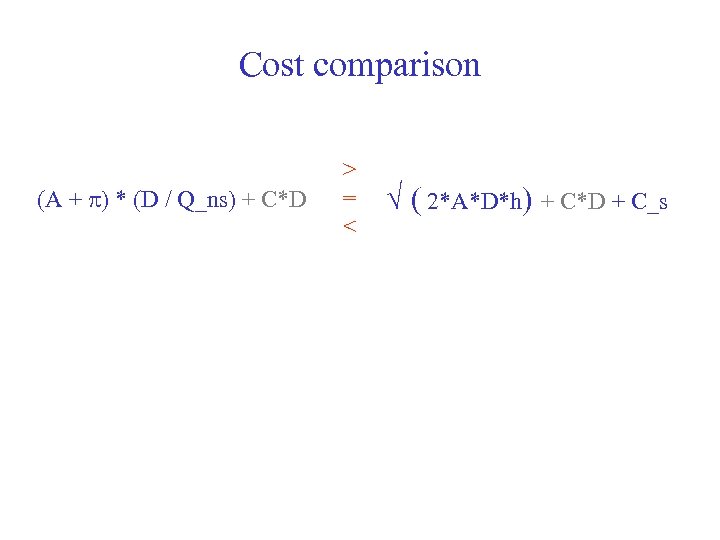

Cost comparison (A + ) * (D / Q_ns) + C*D > = < ( 2*A*D*h) + C*D + C_s

a92850245f4423b46a6ce5b97692bc9e.ppt