Strategic Growth.pptx

- Количество слайдов: 17

Strategic Growth MGU Graduate School of Business Gerald J Rohan December 16, 2011

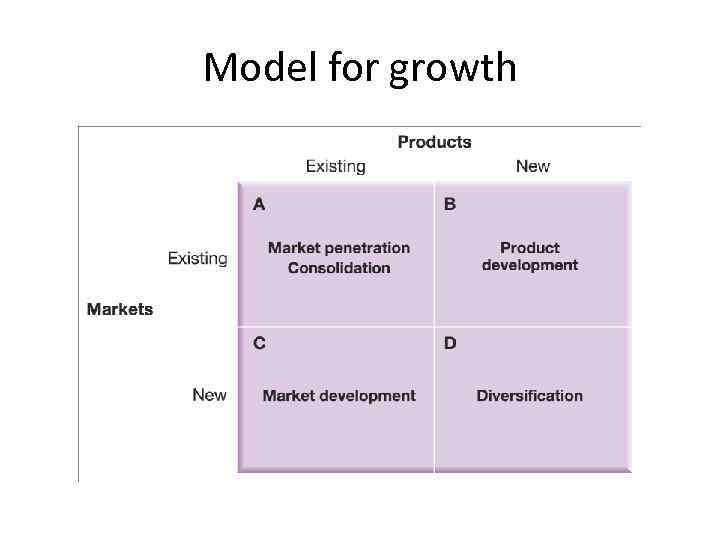

Model for growth

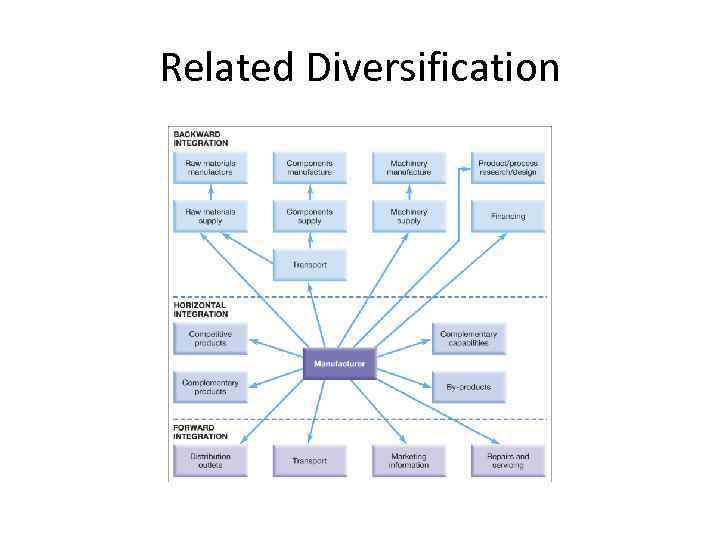

Related Diversification

Reasons for M&A • Geographical growth • Expand into a growing sector • Enter a new market • Acquire brand/additional services • Cost Synergies • Acquire intellectual property or new technology • Investment opportunity • Transformation strategy • Diversify • Other

M&A Success

Successful Mergers 1. Disney-Pixar 2. Sirius/XM radio merger 3. Exxon-Mobil

The other side

The final result

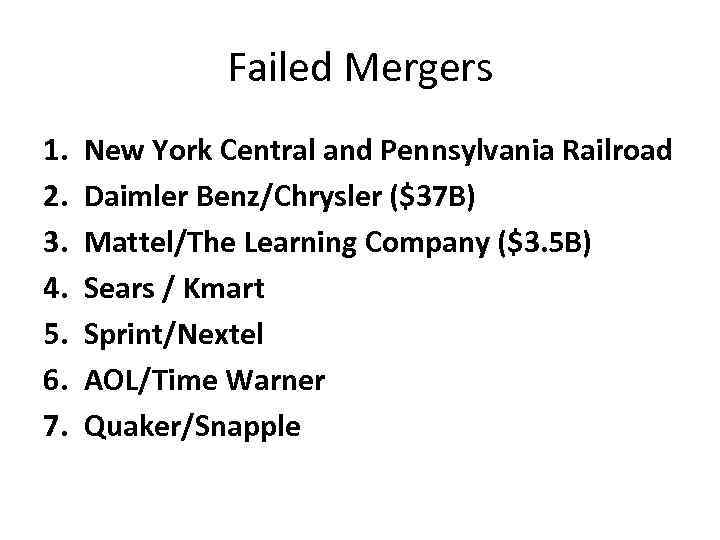

Failed Mergers 1. 2. 3. 4. 5. 6. 7. New York Central and Pennsylvania Railroad Daimler Benz/Chrysler ($37 B) Mattel/The Learning Company ($3. 5 B) Sears / Kmart Sprint/Nextel AOL/Time Warner Quaker/Snapple

Synergy – The Myth “When someone mentions SYNERGY, I hide my wallet” Warren Buffet

Items that were more difficult to control • Aligning accounting policies/converting to IFRS • Meeting internal reporting deadlines • Close books in normal timeframe for first two months • Understanding current performance • Obtaining accurate figures from systems • Establishing opening balance sheet • Working with a new finance team • Getting control of bank accounts

HR Items to improve success • • Introduce measures to retain key talent Revise incentive and bonus structures Revise salaries and benefits Relocate staff Reduce workforce Manage employee relationships Revise job gradings Revise pensions arrangements

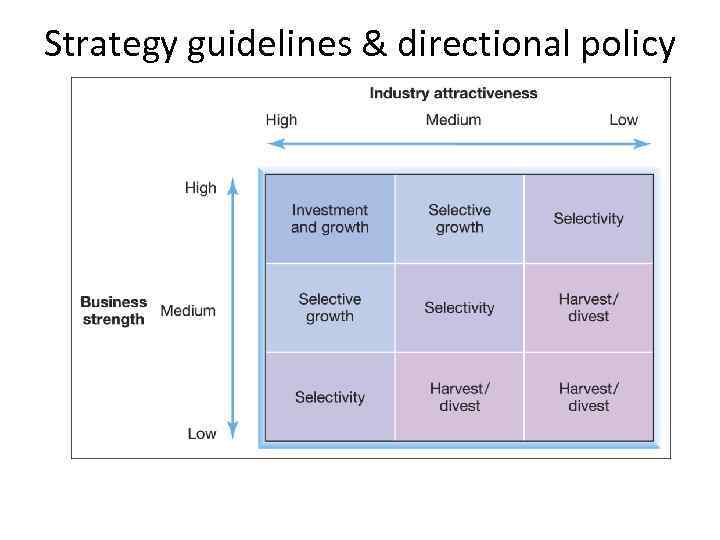

Strategy guidelines & directional policy matrix e

International strategy framework

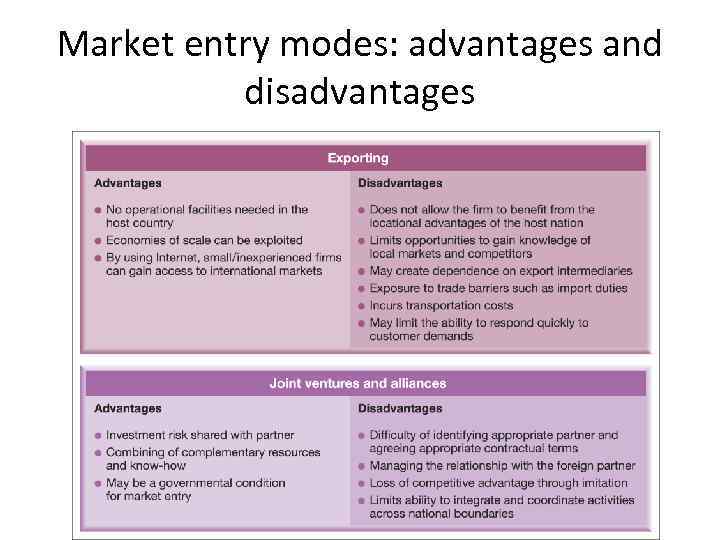

Market entry modes: advantages and disadvantages

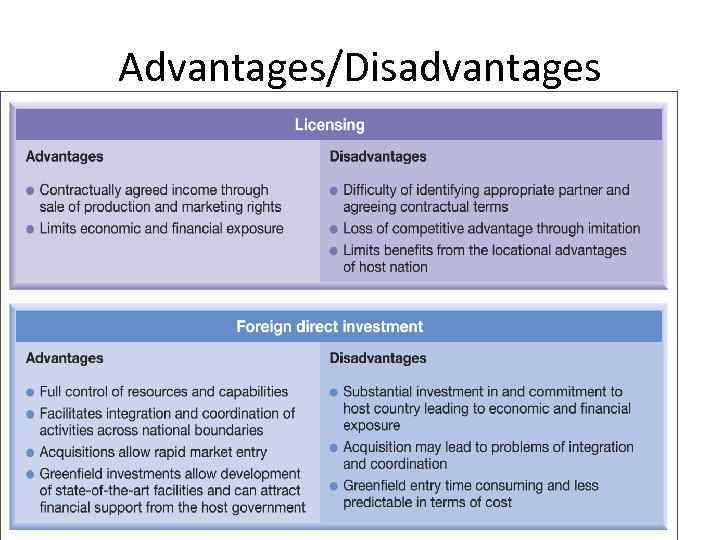

Advantages/Disadvantages

Summary • • • Strategic Growth is necessary Strategic Growth is challenging Strategic Growth is complex Strategic Growth often fails Strategic Growth succeeds when: • All members of management are clear and committed • There are real benefits and no so-called synergies • All assets of the other company are properly evaluated Physical, Financial, Intellectual, Human

Strategic Growth.pptx