1a0cfd0775d731191c8ee226753d6a6d.ppt

- Количество слайдов: 27

Strategic Alliances and Partnerships BM 499 Strategic Management David J. Bryce October 1, 2002

Alliances. How far have we come? n n n “If you think you can go it alone in today’s global economy, you are highly mistaken” (Jack Welch, CEO of GE) “Microsoft can’t make it alone, but together anything is possible. ” (Bill Gates, Chairman of Microsoft) “Our approach is to develop long term relationships with companies that offer a unique advantage with General Motors. The Alliance Strategy is our major thrust. ” (John F. Smith, Jr. , Chairman & CE of General Motors)

Corporate Evolution and Alliances n Moving from Managing a Portfolio of Products. . . n To Managing a Portfolio of Businesses. . . n To Managing a Portfolio of Relationships

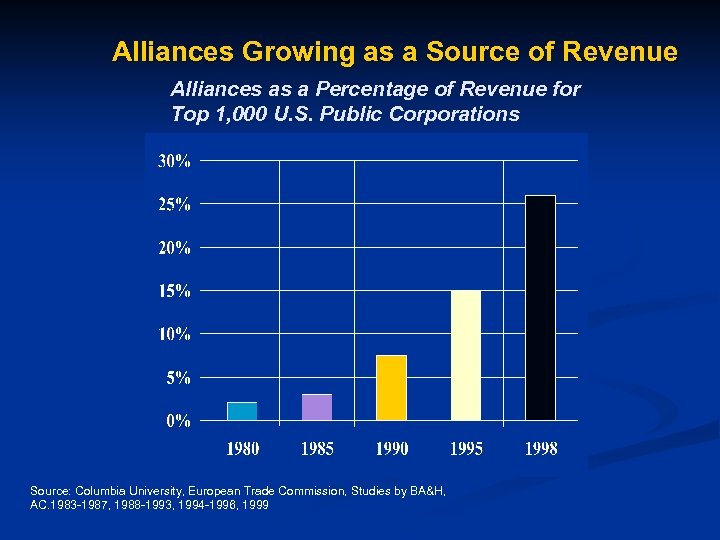

Alliances Growing as a Source of Revenue Alliances as a Percentage of Revenue for Top 1, 000 U. S. Public Corporations Source: Columbia University, European Trade Commission, Studies by BA&H, AC. 1983 -1987, 1988 -1993, 1994 -1996, 1999

Growth in Mergers & Acquisitions vs. Alliances

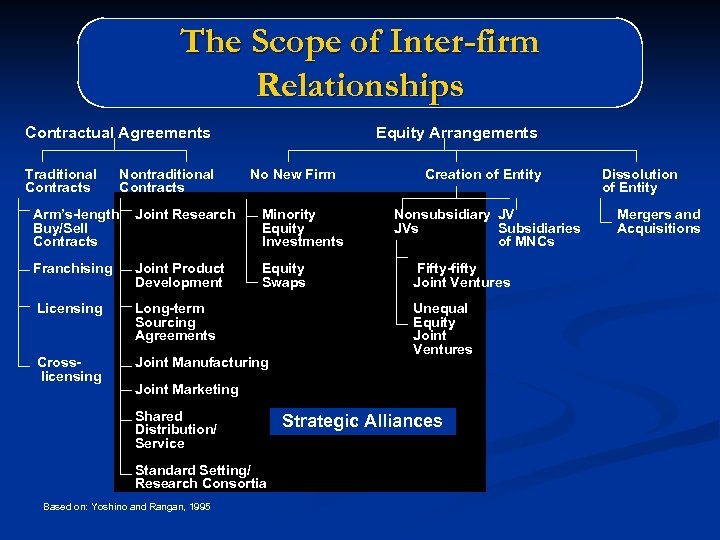

The Scope of Inter-firm Relationships Contractual Agreements Traditional Contracts Nontraditional Contracts Equity Arrangements No New Firm Arm’s-length Buy/Sell Contracts Joint Research Minority Equity Investments Franchising Joint Product Development Equity Swaps Licensing Long-term Sourcing Agreements Crosslicensing Joint Manufacturing Creation of Entity Nonsubsidiary JV JVs Subsidiaries of MNCs Fifty-fifty Joint Ventures Unequal Equity Joint Ventures Joint Marketing Shared Distribution/ Service Standard Setting/ Research Consortia Based on: Yoshino and Rangan, 1995 Strategic Alliances Dissolution of Entity Mergers and Acquisitions

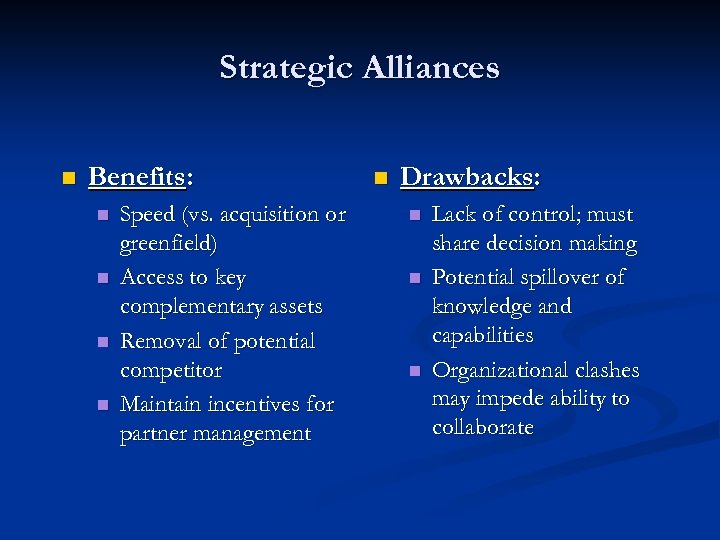

Strategic Alliances n Benefits: n n Speed (vs. acquisition or greenfield) Access to key complementary assets Removal of potential competitor Maintain incentives for partner management n Drawbacks: n n n Lack of control; must share decision making Potential spillover of knowledge and capabilities Organizational clashes may impede ability to collaborate

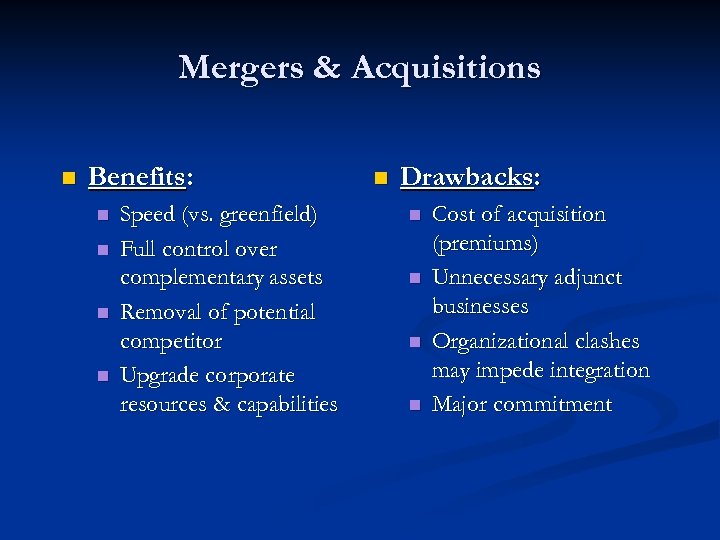

Mergers & Acquisitions n Benefits: n n Speed (vs. greenfield) Full control over complementary assets Removal of potential competitor Upgrade corporate resources & capabilities n Drawbacks: n n Cost of acquisition (premiums) Unnecessary adjunct businesses Organizational clashes may impede integration Major commitment

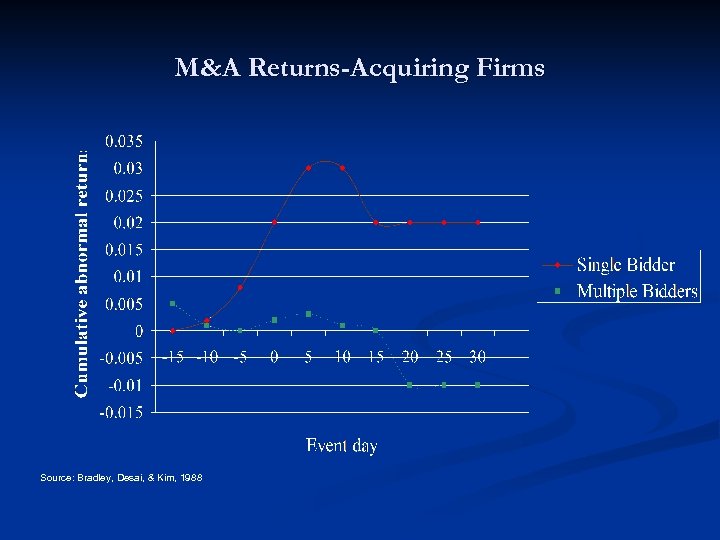

M&A Returns-Acquiring Firms Source: Bradley, Desai, & Kim, 1988

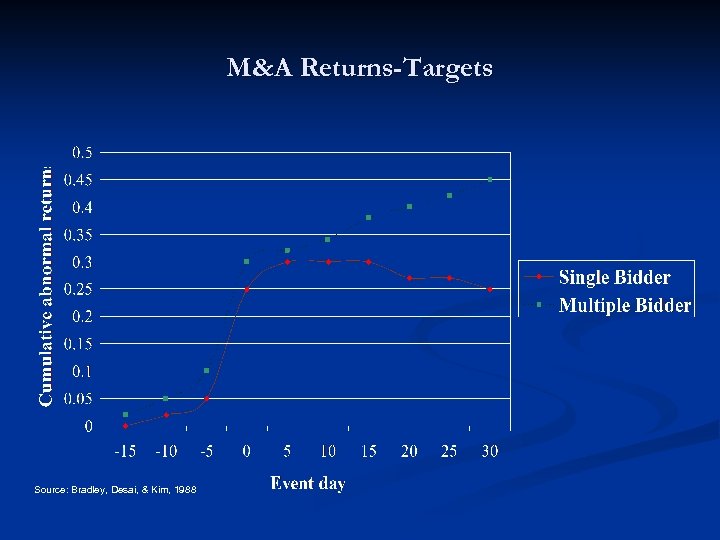

M&A Returns-Targets Source: Bradley, Desai, & Kim, 1988

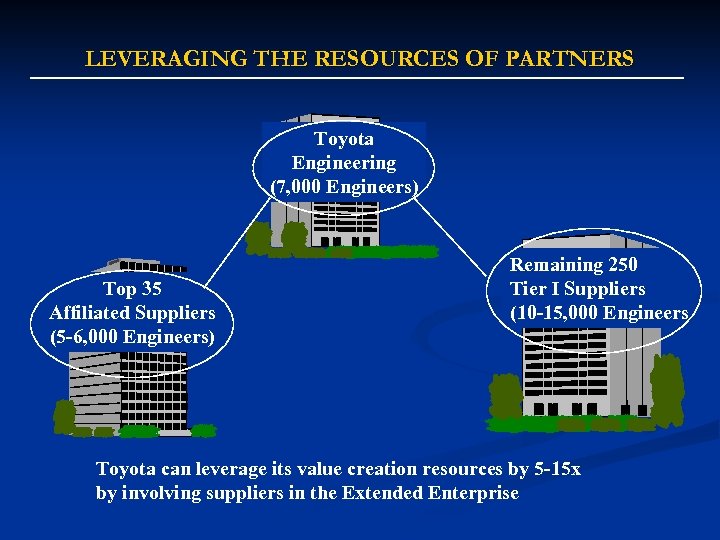

LEVERAGING THE RESOURCES OF PARTNERS Toyota Engineering (7, 000 Engineers) Top 35 Affiliated Suppliers (5 -6, 000 Engineers) Remaining 250 Tier I Suppliers (10 -15, 000 Engineers Toyota can leverage its value creation resources by 5 -15 x by involving suppliers in the Extended Enterprise

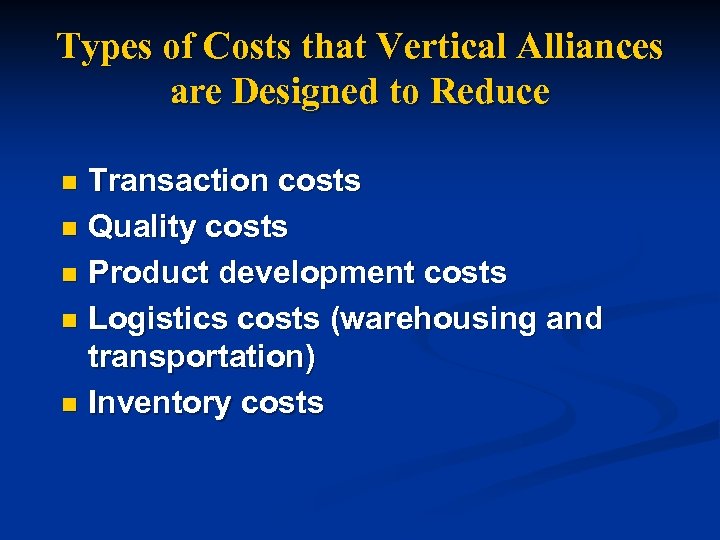

Types of Costs that Vertical Alliances are Designed to Reduce Transaction costs n Quality costs n Product development costs n Logistics costs (warehousing and transportation) n Inventory costs n

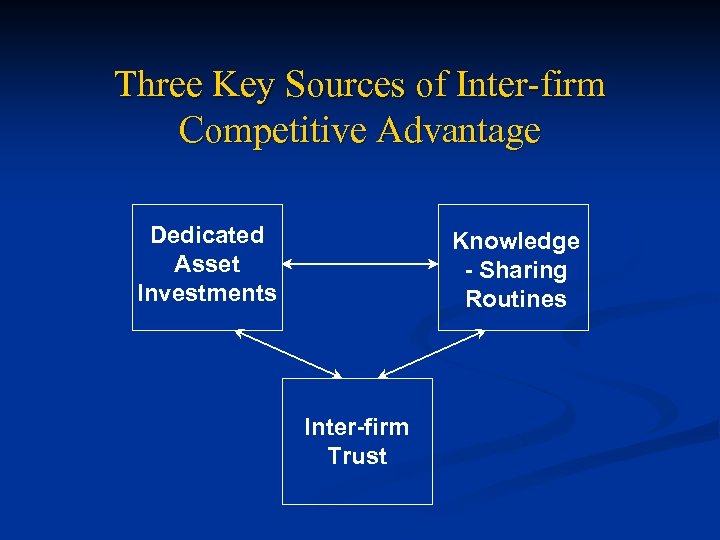

Three Key Sources of Inter-firm Competitive Advantage Dedicated Asset Investments Knowledge - Sharing Routines Inter-firm Trust

CREATING EFFECTIVE PARTNERSHIPS Build trust n Create multiple functional interfaces to facilitate system learning n Make dedicated/customized investments n

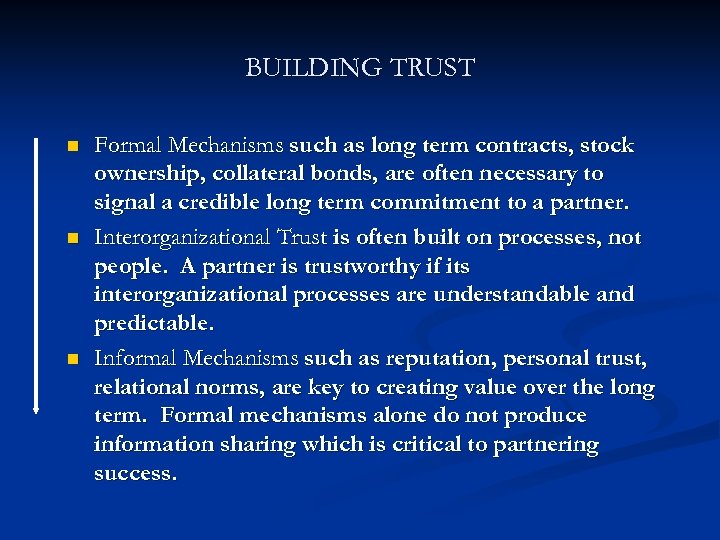

BUILDING TRUST n n n Formal Mechanisms such as long term contracts, stock ownership, collateral bonds, are often necessary to signal a credible long term commitment to a partner. Interorganizational Trust is often built on processes, not people. A partner is trustworthy if its interorganizational processes are understandable and predictable. Informal Mechanisms such as reputation, personal trust, relational norms, are key to creating value over the long term. Formal mechanisms alone do not produce information sharing which is critical to partnering success.

THE VALUE OF TRUST Increases learning (greater information sharing) n Increases customized investments (willingness to risk tailored investments) n Increases speed to quickly respond to market changes n Lowers transaction costs n

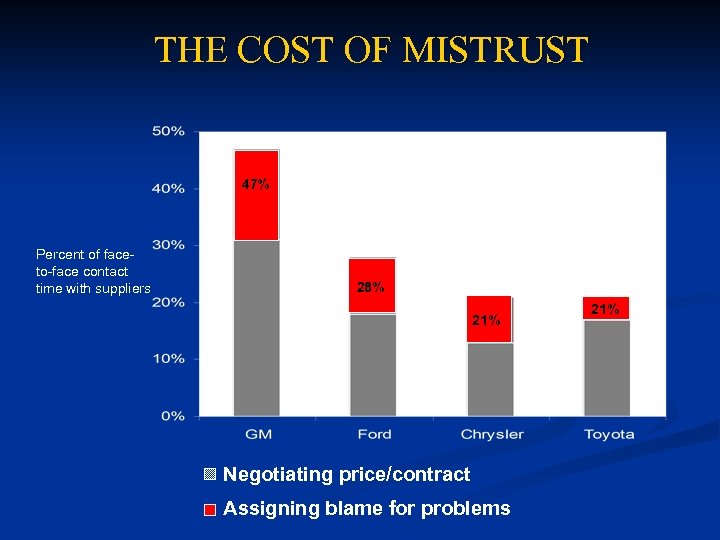

THE COST OF MISTRUST 47% Percent of faceto-face contact time with suppliers 28% 21% Negotiating price/contract Assigning blame for problems 21%

CREATING EFFECTIVE PARTNERSHIPS Build trust n Create multiple interfaces to facilitate learning throughout the network n Make dedicated/customized investments n

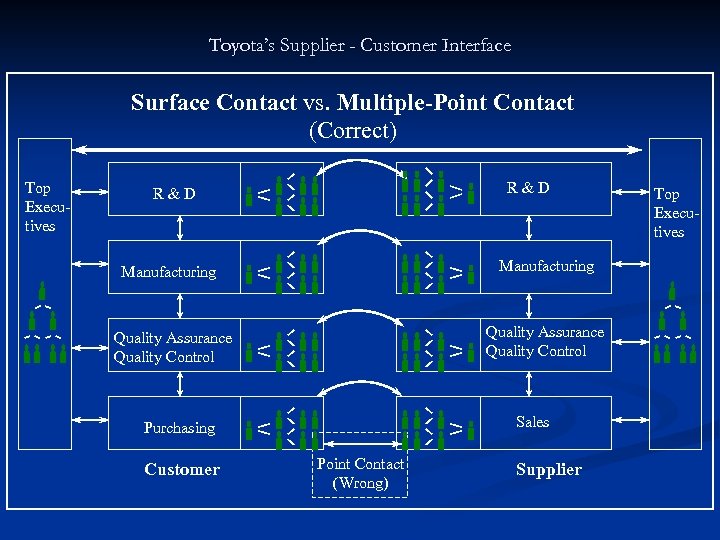

Toyota’s Supplier - Customer Interface Surface Contact vs. Multiple-Point Contact (Correct) Top Executives R&D Manufacturing Quality Assurance Quality Control Sales Purchasing Customer Point Contact (Wrong) Supplier Top Executives

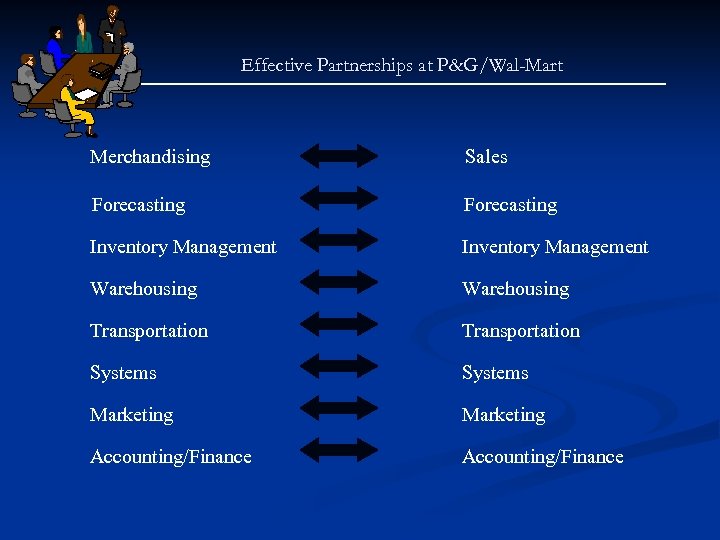

Effective Partnerships at P&G/Wal-Mart Merchandising Sales Forecasting Inventory Management Warehousing Transportation Systems Marketing Accounting/Finance

CREATING EFFECTIVE PARTNERSHIPS Build trust n Create multiple functional interfaces to facilitate system learning n Make dedicated/customized asset investments n

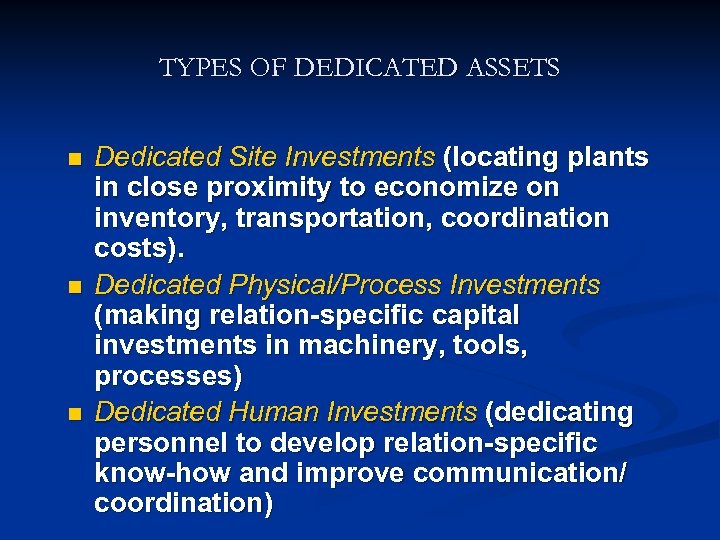

TYPES OF DEDICATED ASSETS n n n Dedicated Site Investments (locating plants in close proximity to economize on inventory, transportation, coordination costs). Dedicated Physical/Process Investments (making relation-specific capital investments in machinery, tools, processes) Dedicated Human Investments (dedicating personnel to develop relation-specific know-how and improve communication/ coordination)

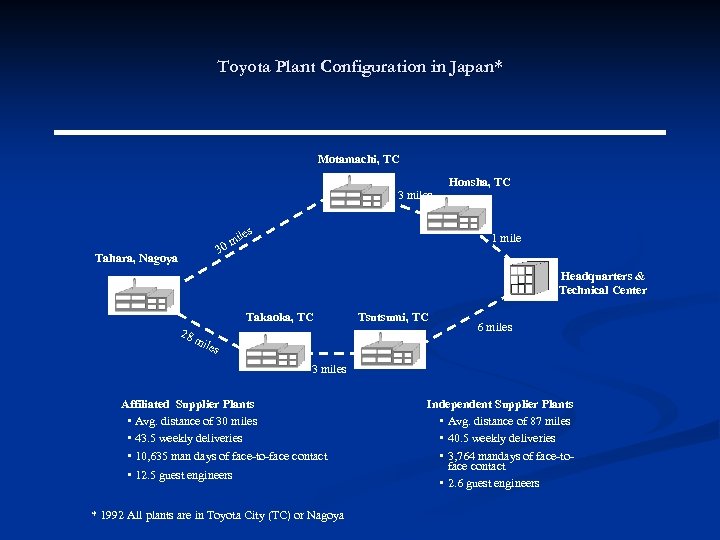

Toyota Plant Configuration in Japan* Motamachi, TC Honsha, TC 3 miles i 0 m 1 mile 3 Tahara, Nagoya Headquarters & Technical Center Takaoka, TC 28 m Tsutsumi, TC 6 miles 3 miles Affiliated Supplier Plants • Avg. distance of 30 miles • 43. 5 weekly deliveries • 10, 635 man days of face-to-face contact • 12. 5 guest engineers * 1992 All plants are in Toyota City (TC) or Nagoya Independent Supplier Plants • Avg. distance of 87 miles • 40. 5 weekly deliveries • 3, 764 mandays of face-toface contact • 2. 6 guest engineers

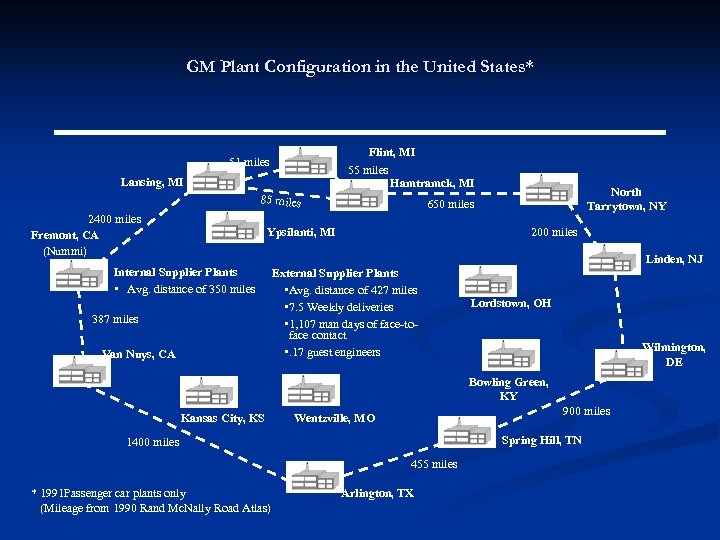

GM Plant Configuration in the United States* Flint, MI 51 miles 55 miles Lansing, MI Hamtramck, MI 85 miles 2400 miles Fremont, CA (Nummi) Ypsilanti, MI Internal Supplier Plants • Avg. distance of 350 miles 387 miles Van Nuys, CA North Tarrytown, NY 650 miles 200 miles External Supplier Plants • Avg. distance of 427 miles • 7. 5 Weekly deliveries • 1, 107 man days of face-toface contact • . 17 guest engineers Linden, NJ Lordstown, OH Wilmington, DE Bowling Green, KY Kansas City, KS 900 miles Wentzville, MO Spring Hill, TN 1400 miles 455 miles * 1991 Passenger car plants only (Mileage from 1990 Rand Mc. Nally Road Atlas) Arlington, TX

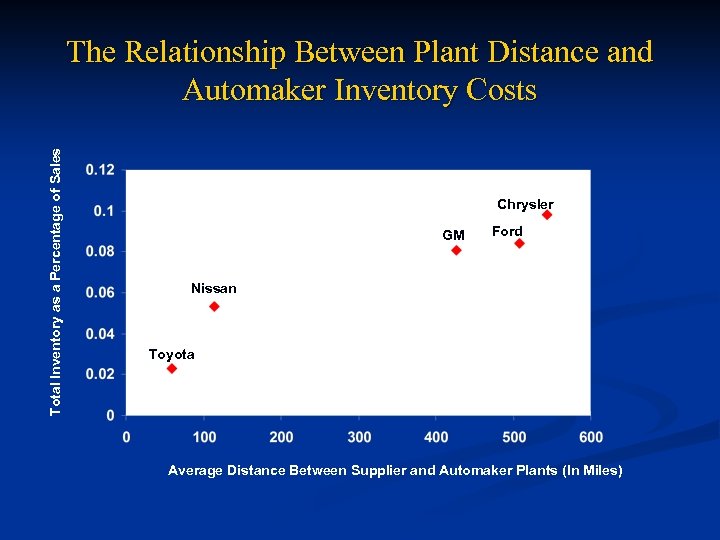

Total Inventory as a Percentage of Sales The Relationship Between Plant Distance and Automaker Inventory Costs Chrysler GM Ford Nissan Toyota Average Distance Between Supplier and Automaker Plants (In Miles)

Horizontal Alliances n Benefits Facilitates access to technologies or customers, especially when these needs may be only temporary n Provides opportunities to rapidly reach scale in needed capabilities n Supplies opportunities for learning that can be put to later use n

Horizontal Alliances n Drawbacks May transfer technologies or know-how that turns a partner into a competitor n The capabilities of a partner may come to substitute for important strategic capabilities that the firm should actively nurture internally n Alliances are sometimes difficult to focus and/or they outlive their usefulness before they’re disbanded, leading to needless consumption of resources n

1a0cfd0775d731191c8ee226753d6a6d.ppt