d15a38d47656cb888457cc38f5208dfd.ppt

- Количество слайдов: 43

Storage & Datamanagement Open Systems KBC Johan Devriendt, hoofd midtiersystemen Johan. Devriendt@kbc. be

Agenda Introduction KBC Group ICT Storage & datamanagement Open Systems Questions & Answers

Agenda Introduction KBC Group ICT Storage & datamanagement Open Systems Questions & Answers

KBC Bank & Insurance Group n Ranking l One of the top 2 banks in Belgium l One of the top 3 insurers in Belgium l One of the top 20 banks in Europe l Leading financial group in Central Europe n Market share in Belgium l Banking : 20 -25% l Insurance : 9% (non-life) 22% (life) n Head office in Brussels n 50. 000 employees n 13. 000 clients

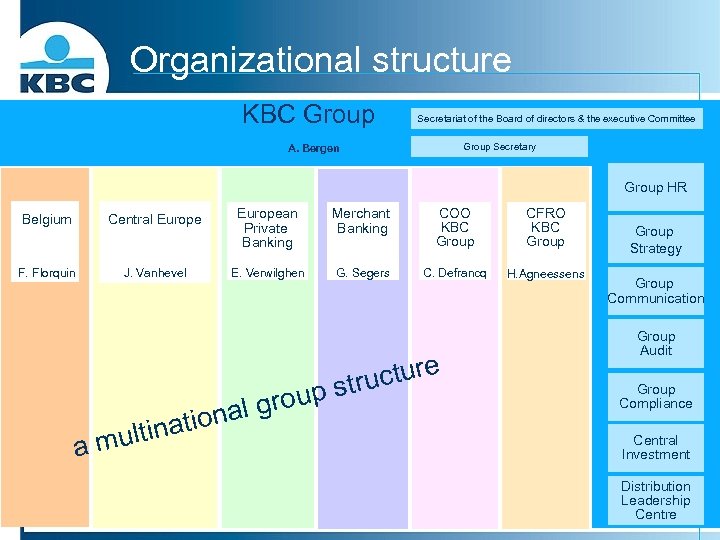

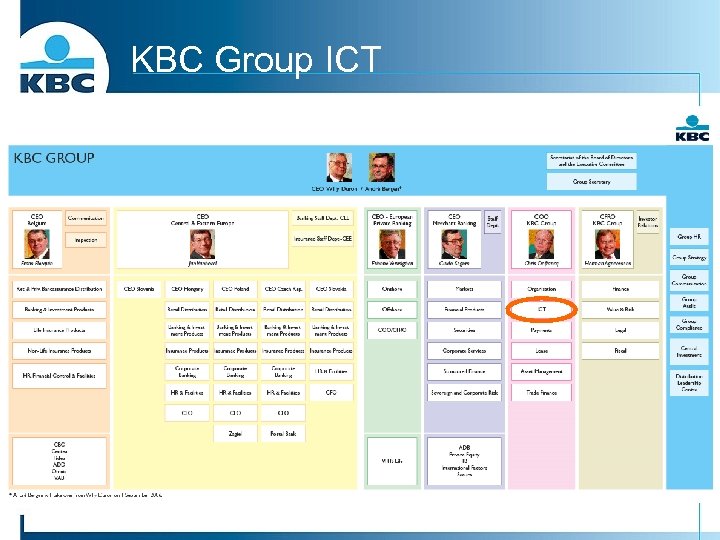

Organizational structure KBC Group Secretariat of the Board of directors & the executive Committee Group Secretary A. Bergen Group HR Belgium Central European Private Banking Merchant Banking COO KBC Group CFRO KBC Group F. Florquin J. Vanhevel E. Verwilghen G. Segers C. Defrancq H. Agneessens o ltinati a mu cture p stru l grou na Group Strategy Group Communication Group Audit Group Compliance Central Investment Distribution Leadership Centre

Market capital Ranking in Euroland 1 2 3 4 5 6 7 8 9 BNP Paribas (35 bn) BSCH (31 bn) BBVA (29 bn) Deutsche Bank (26 bn) ABN AMRO DJ Euro(25 bn) Société Générale (24 bn) Stoxx Banks Unicredito (22 bn) constituent Fortis (22 bn) Crédit Agricole (14 bn) 10 11 Dexia (14 bn) Intesa BCI (12 bn) Allied Irish Banks (12 bn) 12 13 Bank of Ireland (10 bn) 14 KBC (9 bn) 15 16 17 18 19 20 San. Paolo IMI (9 bn) Banco Popular (8 bn) HVB (7 bn) Mediobanca (6 bn) Bca MPS (6 bn) Bco Popular (5 bn) Jan 2006 Dec 2004 Dec 2002 1 2 3 4 5 6 7 8 9 BSCH (57 bn) BNP Paribas (48 bn) BBVA (42 bn) Deutsche Bank (35 bn) Crédit Agricole (35 bn) Société Gén. (34 bn) ABN AMRO (32 bn) Unicredit (27 bn) Fortis (26 bn) 31 -01 -06 1 2 3 4 5 6 7 8 9 BSCH (74 bn) BNP Paribas (63 bn) Unicredito (62 bn) BBVA (57 bn) Deutsche Bank (50 bn) Société Générale (48 bn) Crédit Agricole (44 bn) ABN AMRO (44 bn) Fortis (38 bn) 10 Intesa BCI (21 bn) 11 Dexia (18 bn) 10 Intesa BCI (33 bn) 11 KBC (31 bn) 12 KBC (18 bn) 12 San Paolo IMI (26 bn) 13 San Paolo IMI (15 bn) 14 Allied Irish Banks (12 bn) 13 Dexia (23 bn) 14 HVB (19 bn) 15 16 17 18 19 20 Commerzbank (19 bn) Allied Irish Banks (16 bn) Erste Bank (14 bn) Capitalia (14 bn) Bank of Ireland (13 bn) Nat. Bank of Greece (13 bn) 15 16 17 18 19 20 HVB (12 bn) Bank of Ireland (11 bn) Bco Popular (10 bn) Commerzbank (9 bn) BA-CA (9 bn) Mediobanca (9 bn)

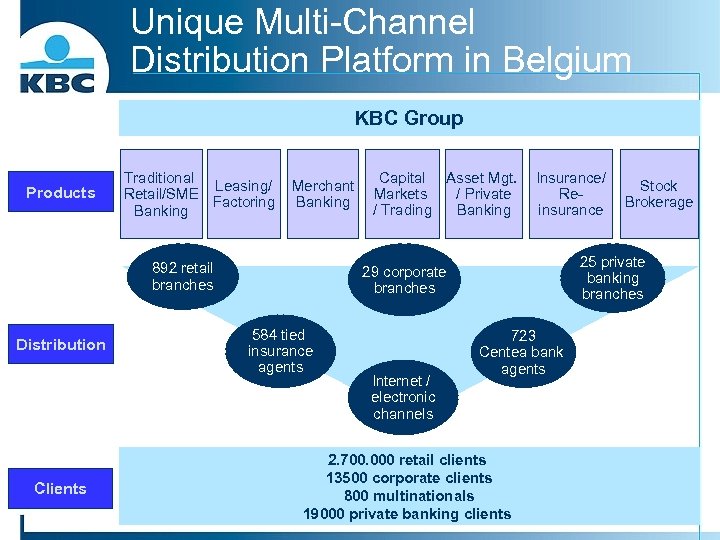

Unique Multi-Channel Distribution Platform in Belgium KBC Group Products Traditional Leasing/ Retail/SME Factoring Banking Merchant Banking 892 retail branches Distribution Clients Capital Asset Mgt. Markets / Private / Trading Banking Insurance/ Reinsurance 25 private banking branches 29 corporate branches 584 tied insurance agents Internet / electronic channels Stock Brokerage 723 Centea bank agents 2. 700. 000 retail clients 13500 corporate clients 800 multinationals 19000 private banking clients dd. 31 -12 -2005

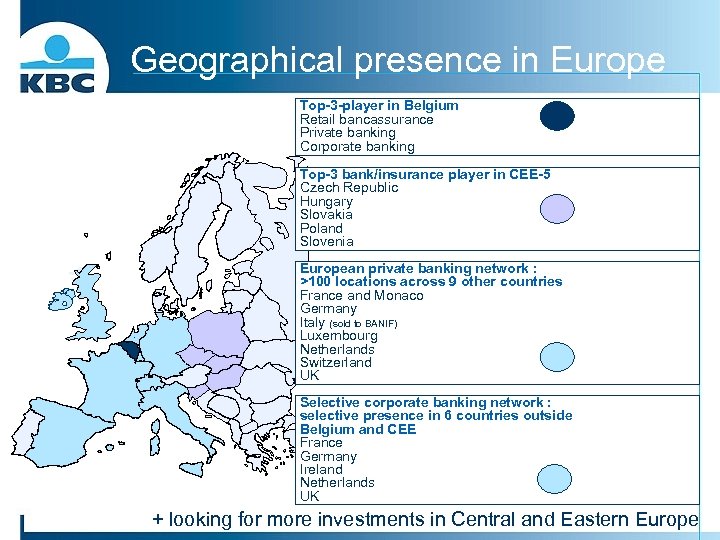

Geographical presence in Europe Top-3 -player in Belgium Retail bancassurance Private banking Corporate banking Top-3 bank/insurance player in CEE-5 Czech Republic Hungary Slovakia Poland Slovenia European private banking network : >100 locations across 9 other countries France and Monaco Germany Italy (sold to BANIF) Luxembourg Netherlands Switzerland UK Selective corporate banking network : selective presence in 6 countries outside Belgium and CEE France Germany Ireland Netherlands UK + looking for more investments in Central and Eastern Europe

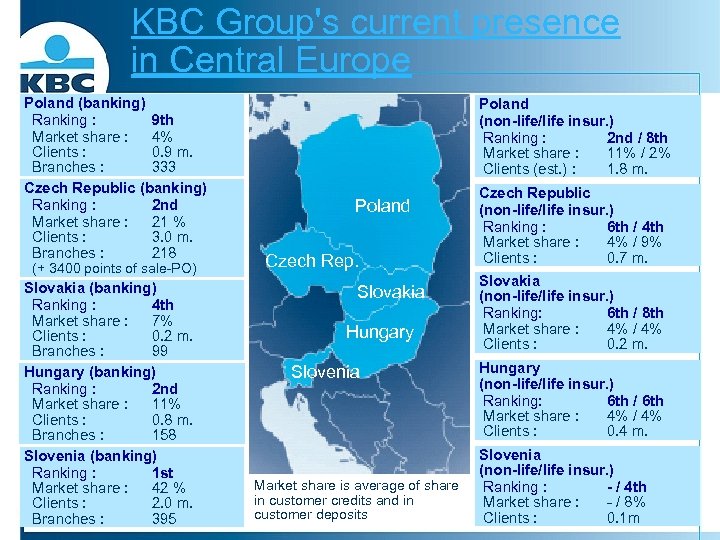

KBC Group's current presence in Central Europe Poland (banking) Ranking : 9 th Market share : 4% Clients : 0. 9 m. Branches : 333 Czech Republic (banking) Ranking : 2 nd Market share : 21 % Clients : 3. 0 m. Branches : 218 (+ 3400 points of sale-PO) Slovakia (banking) Ranking : 4 th Market share : 7% Clients : 0. 2 m. Branches : 99 Hungary (banking) Ranking : 2 nd Market share : 11% Clients : 0. 8 m. Branches : 158 Slovenia (banking) Ranking : 1 st Market share : 42 % Clients : 2. 0 m. Branches : 395 Poland (non-life/life insur. ) Ranking : 2 nd / 8 th Market share : 11% / 2% Clients (est. ) : 1. 8 m. Poland Czech Rep. Slovakia Hungary Slovenia Market share is average of share in customer credits and in customer deposits Czech Republic (non-life/life insur. ) Ranking : 6 th / 4 th Market share : 4% / 9% Clients : 0. 7 m. Slovakia (non-life/life insur. ) Ranking: 6 th / 8 th Market share : 4% / 4% Clients : 0. 2 m. Hungary (non-life/life insur. ) Ranking: 6 th / 6 th Market share : 4% / 4% Clients : 0. 4 m. Slovenia (non-life/life insur. ) Ranking : - / 4 th Market share : - / 8% Clients : 0. 1 m

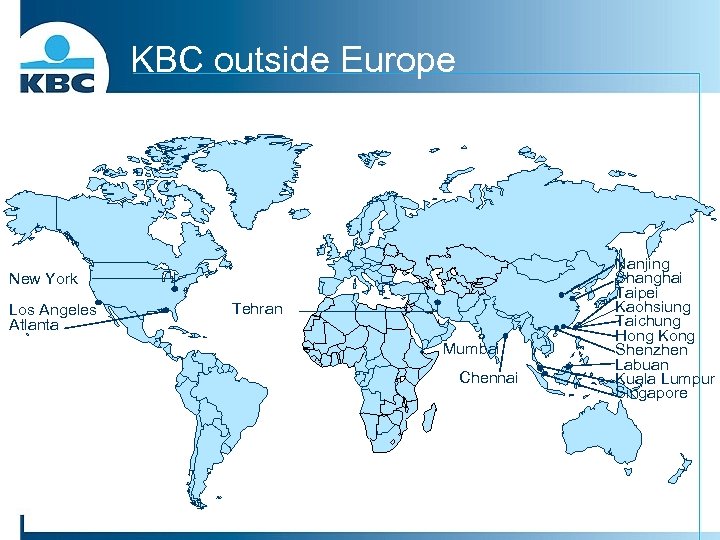

KBC outside Europe New York Los Angeles Atlanta Tehran Mumbai Chennai Nanjing Shanghai Taipei Kaohsiung Taichung Hong Kong Shenzhen Labuan Kuala Lumpur Singapore

KBC Group ICT

ICT in a bank: boring or not?

Group ICT n Employees l l l n Services l l n Your ICT, our business Delivering end-to-end ICT solutions (software, hardware, service) Maintenance of ICT solutions Hosting services Network & infrastructure management Clients l l l n Belgium: 1. 820 KBC & 500 external consultants Central Europe: 1. 300 KBC India: 250 Valuesource (100% daughter of KBC) KBC Group Belgium KBC Group international Other corporate clients in the Benelux (Orbay, IFB, …) Turnover: € 650 mn

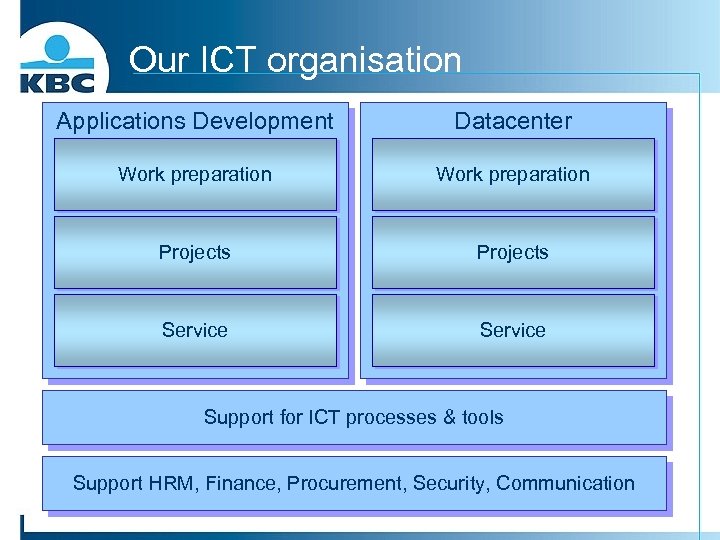

Our ICT organisation n Client focused l l n Organisation l l l n Process driven Matrix organisation & project approach Fast growing international project portfolio Technology & architecture l l n Strong governance & business-ICT alignment Best-in-class ICT services Fast follower in new technologies High availability Architecture driven Integrator of components Multi-sourcing l l Core business by our own people Fixed price outsourcing & package solutions for non-core (e. g. SAP) External consultants for temporary needs India for technical implementations & conversions

A multi-channel distribution platform requires … KBC-M@tic Branches KBC-Phone Call Center Isabel SMS Clients Head office E-business Distribution Channels Product factories

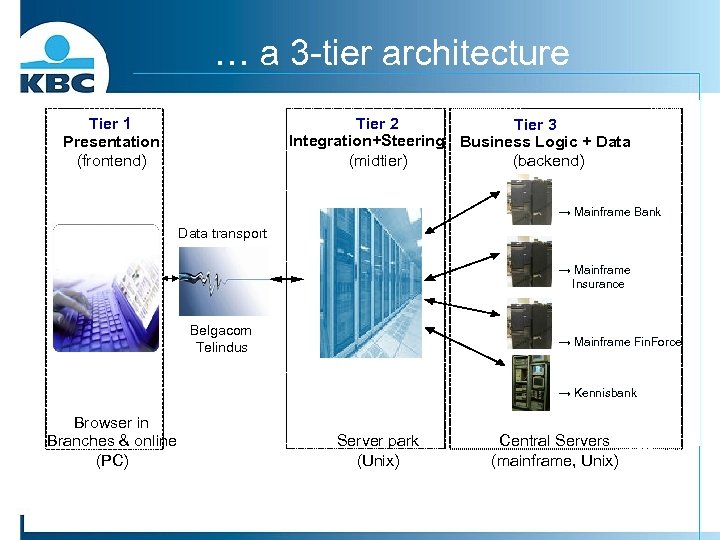

… a 3 -tier architecture Tier 1 Presentation (frontend) Tier 2 Tier 3 Integration+Steering Business Logic + Data (midtier) (backend) → Mainframe Bank Data transport → Mainframe Insurance Belgacom Telindus → Mainframe Fin. Force → Kennisbank Browser in Branches & online (PC) Server park (Unix) Central Servers (mainframe, Unix)

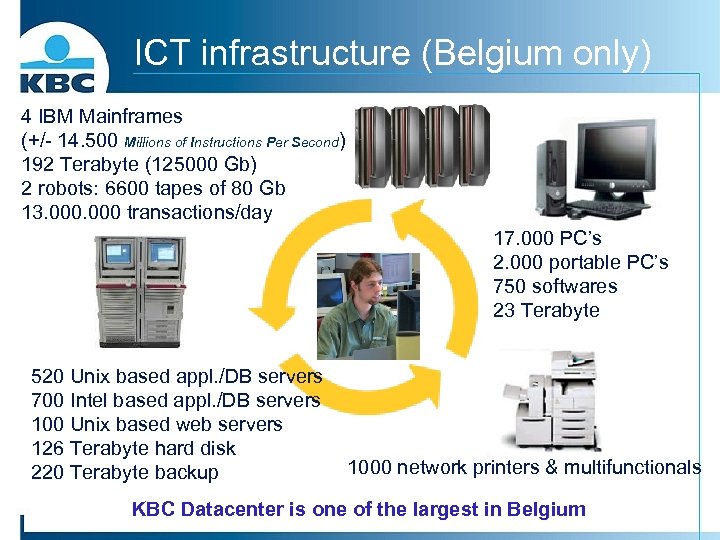

ICT infrastructure (Belgium only) 4 IBM Mainframes (+/- 14. 500 Millions of Instructions Per Second) 192 Terabyte (125000 Gb) 2 robots: 6600 tapes of 80 Gb 13. 000 transactions/day 17. 000 PC’s 2. 000 portable PC’s 750 softwares 23 Terabyte 520 Unix based appl. /DB servers 700 Intel based appl. /DB servers 100 Unix based web servers 126 Terabyte hard disk 220 Terabyte backup 1000 network printers & multifunctionals KBC Datacenter is one of the largest in Belgium

Our ICT organisation Applications Development Datacenter Work preparation Projects Service Support for ICT processes & tools Support HRM, Finance, Procurement, Security, Communication

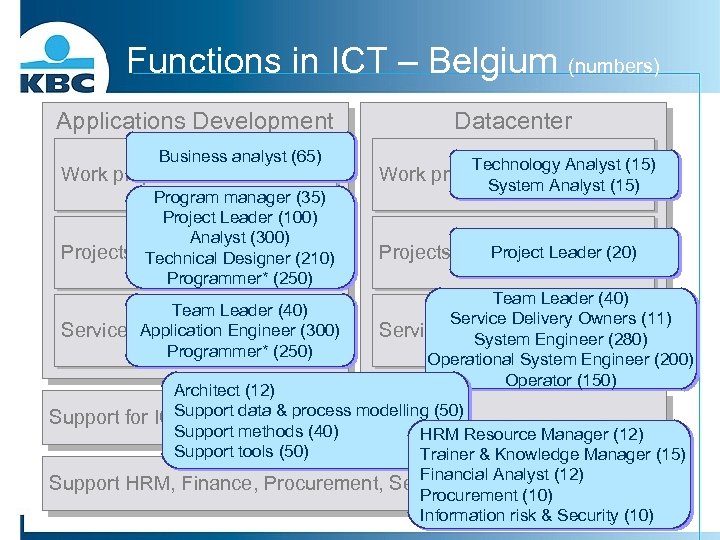

Functions in ICT – Belgium (numbers) Applications Development Business analyst (65) Work preparation Program manager (35) Project Leader (100) Analyst (300) Projects Technical Designer (210) Programmer* (250) Team Leader (40) Service Application Engineer (300) Programmer* (250) Datacenter Technology Analyst (15) Work preparation Analyst (15) System Projects Project Leader (20) Team Leader (40) Service Delivery Owners (11) Service System Engineer (280) Operational System Engineer (200) Operator (150) Architect (12) Support data & process Support for ICT processes & tools modelling (50) Support methods (40) HRM Resource Manager (12) Support tools (50) Trainer & Knowledge Manager (15) Financial Analyst (12) Support HRM, Finance, Procurement, Security, Communication Procurement (10) Information risk & Security (10)

The ICT offices Brugge Roeselare Antwerpen Gent Aalst Mechelen Hasselt Leuven Brussel Head offices Data centers Local offices

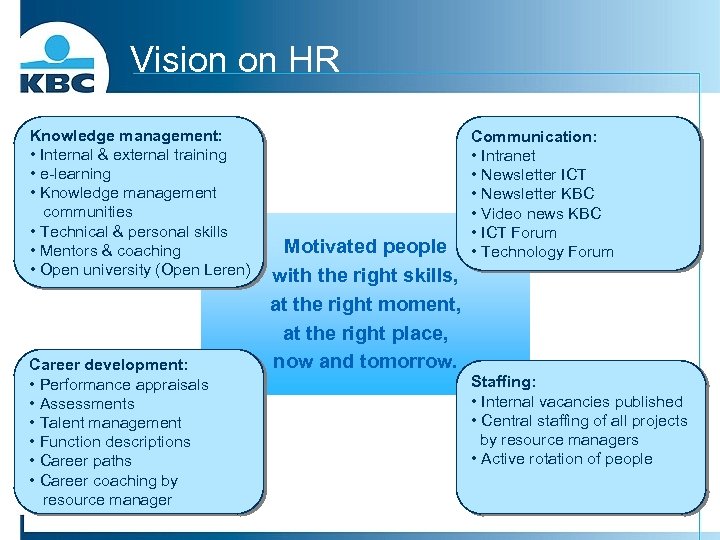

Vision on HR Knowledge management: • Internal & external training • e-learning • Knowledge management communities • Technical & personal skills • Mentors & coaching • Open university (Open Leren) Career development: • Performance appraisals • Assessments • Talent management • Function descriptions • Career paths • Career coaching by resource manager Motivated people with the right skills, at the right moment, at the right place, now and tomorrow. Communication: • Intranet • Newsletter ICT • Newsletter KBC • Video news KBC • ICT Forum • Technology Forum Staffing: • Internal vacancies published • Central staffing of all projects by resource managers • Active rotation of people

Agenda Introduction KBC Group ICT Storage & datamanagement Open Systems Questions & Answers

Storage & datamanagement: agenda n Some thoughts about datacenter strategy n What can you find in our datacenter? n What does this mean for storage? n What are the challenges for today and tomorrow? n How do we start with it?

Datacenter strategy: some thoughts n KBC ICT = preferred supplier of ICT services for KBC Bank & Insurance n Bank & Insurance = main customer of datacenter activities n But also shift of focus towards: l Insourcing n n l Companies member of KBC Group (e. g. KBC Lease) Non KBC companies (e. g. Orbay) Central Europe n n Hosting group wide applications in Belgium Providing server infrastructure services abroad

What’s in our datacenter? n Server infrastructure: number of operating systems l Unix n n n l Sun-Solaris: +/- 500 (essentially application & web servers) HP-UX: +/- 100 (essentially Oracle database servers) IBM-AIX: +/- 20 Windows: +/- 700 (essentially application & SQLS database servers) l l VMWare ESX: +/- 50 (virtualizing 230 Windows o. s. ) Mainframe z/OS

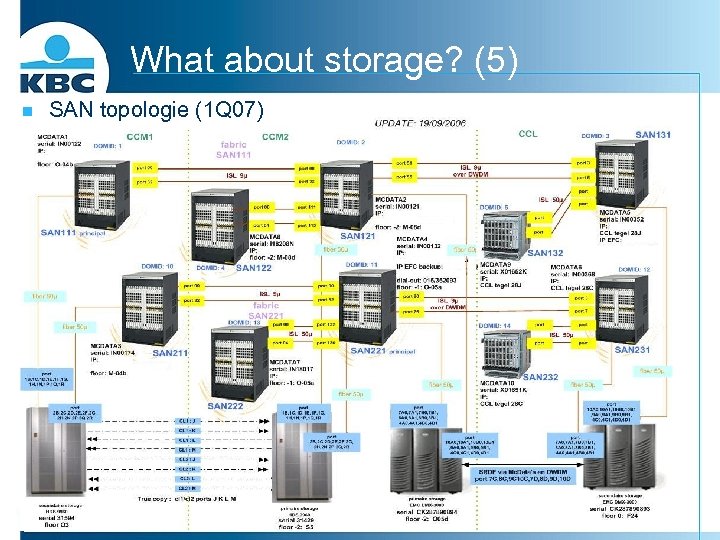

What about storage? n The facts for storage open systems l 2 storage “clouds” - Front end storage by NAS appliances n - Back end storage by SAN infrastructure n l delevering storage for our +1400 Unix and Windows servers All backup up by a central automated tape infrastructure SAN storage cloud: n n n l delevering storage for our +20000 desktops Dispersed over 2 datacenters (Mechelen – Leuven) With a little help from our DWDM network infrastructure All our production data is synchronously replicated from Mechelen to Leuven!! Fibre channel protocol Dual fabrics for redundancy High end storage arrays: 99. 999% availability NAS storage cloud: n n Will be DRP enabled in 2008 Clustered NAS appliances for high availability

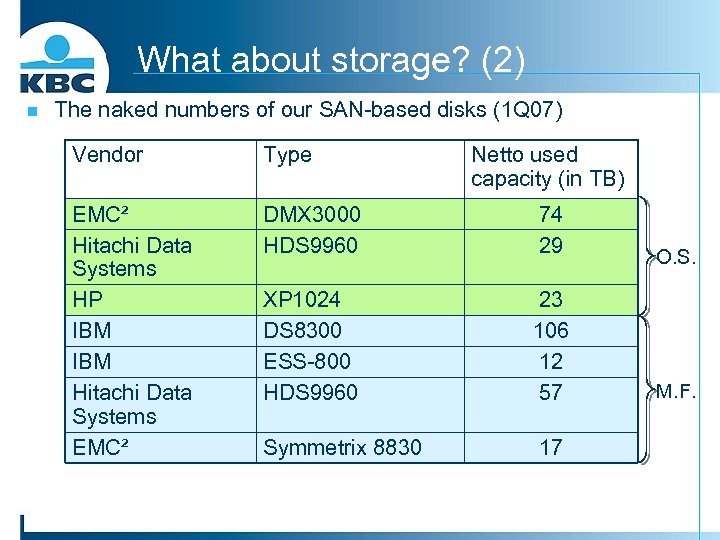

What about storage? (2) n The naked numbers of our SAN-based disks (1 Q 07) Vendor Type Netto used capacity (in TB) EMC² Hitachi Data Systems HP IBM Hitachi Data Systems EMC² DMX 3000 HDS 9960 74 29 XP 1024 DS 8300 ESS-800 HDS 9960 23 106 12 57 Symmetrix 8830 17 O. S. M. F.

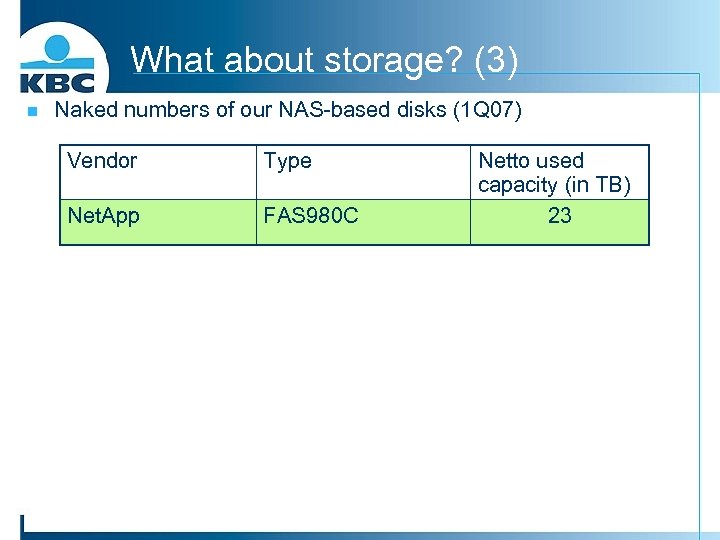

What about storage? (3) n Naked numbers of our NAS-based disks (1 Q 07) Vendor Type Net. App FAS 980 C Netto used capacity (in TB) 23

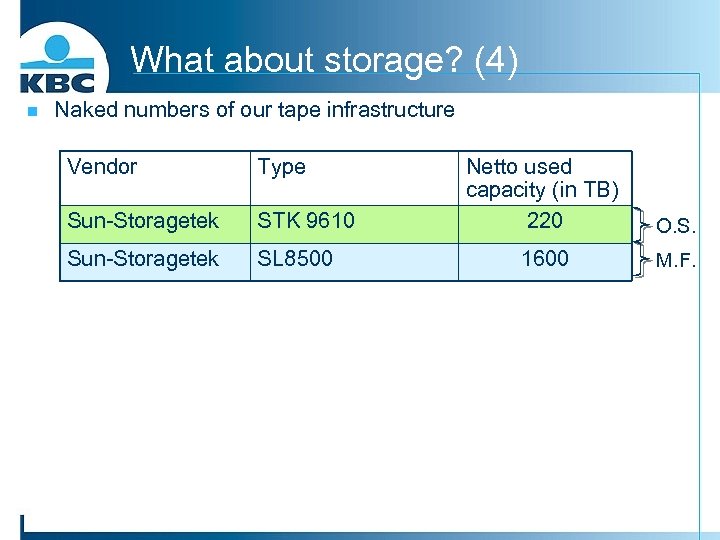

What about storage? (4) n Naked numbers of our tape infrastructure Vendor Type Sun-Storagetek STK 9610 Sun-Storagetek SL 8500 Netto used capacity (in TB) 220 O. S. 1600 M. F.

What about storage? (5) n SAN topologie (1 Q 07)

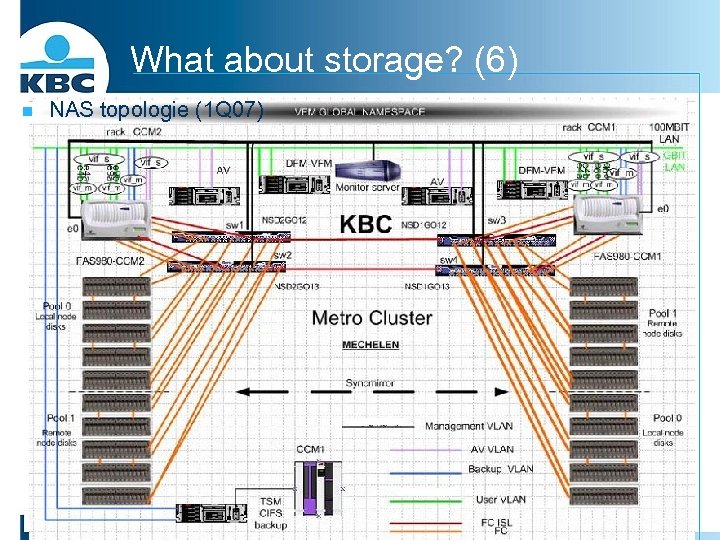

What about storage? (6) n NAS topologie (1 Q 07)

Storage challenges n Controllable growth n Efficient datamanagement n Transparancy for storage admins n Location independence n No loss of critical data n Multi customer n Stable technology

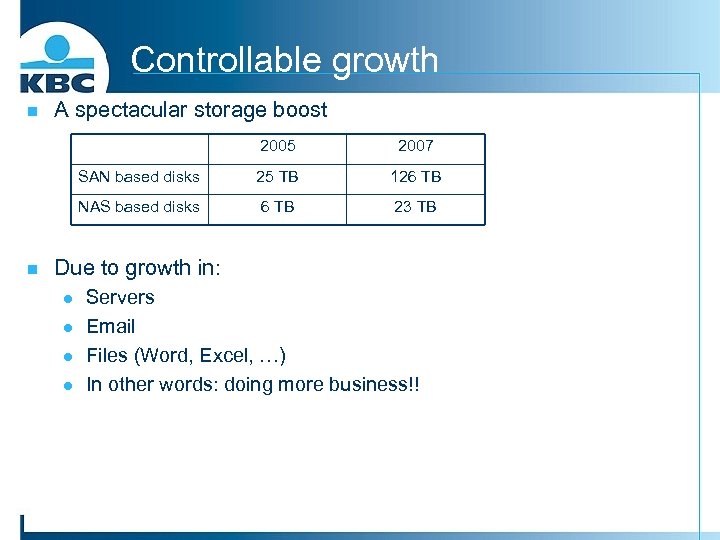

Controllable growth n A spectacular storage boost 2005 SAN based disks 25 TB 126 TB NAS based disks n 2007 6 TB 23 TB Due to growth in: l l Servers Email Files (Word, Excel, …) In other words: doing more business!!

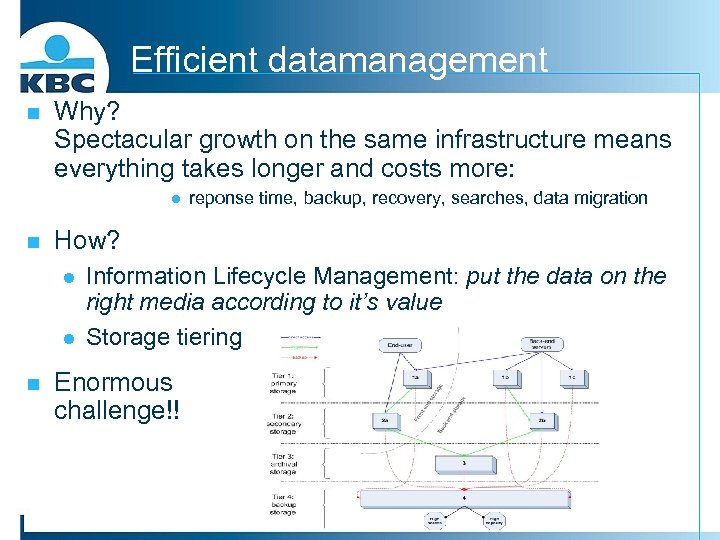

Efficient datamanagement n Why? Spectacular growth on the same infrastructure means everything takes longer and costs more: l n How? l l n reponse time, backup, recovery, searches, data migration Information Lifecycle Management: put the data on the right media according to it’s value Storage tiering Enormous challenge!!

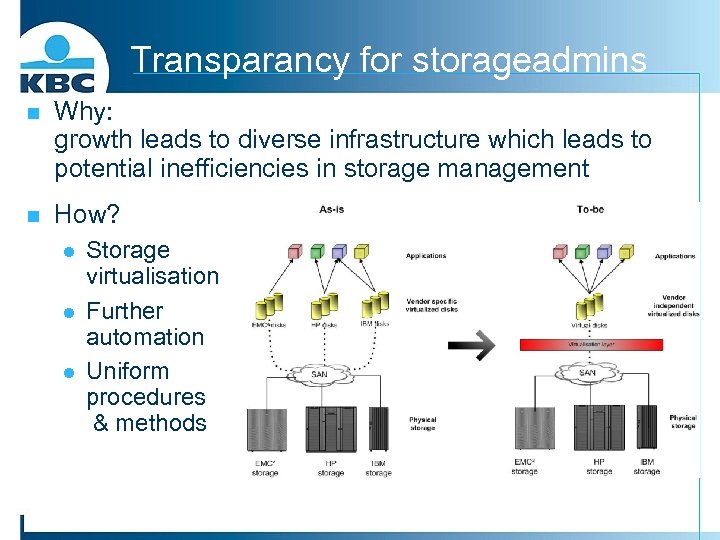

Transparancy for storageadmins n Why: growth leads to diverse infrastructure which leads to potential inefficiencies in storage management n How? l l l Storage virtualisation Further automation Uniform procedures & methods

Location independence n Why? Because we are becoming a European ICT group l l n With different geographically located data centers With different people (language!) How? l Working together with our CE colleagues n l l International teams! Uniform procedures, tools & methods Consolidation

No loss of critical data n Why? l n Our customers wouldn’t be pleased if we did lose their data How? l By designing a backup infrastructure that’s up to the challenge! - Best-of breed tape drives Disk-to-disk backups Data deduplication

Multi customer n Why? l Interference between different storage customer groups is not wanted - n Especially with non-KBC customers How? l l Redesign current storage infrastructure Security - Encryption Separation of duty

Stable technology n Why? l Downtime is not acceptable anymore n How? n By making choices: l l l Going for mainstream technology Not being on the cutting edge of the technology market, but a close follower Market leaders

How do we start with all this? n Some of the projects that will be started in 2007 -2008: l l l l l Pre study BLM (brol lifecycle management) Pre study “SAN switches” Pre study and project “Very large database backup” Pre study and project “Backup end user data” Pre study “design storagecatalogue” RFP new storagebox Pre study “redesign tier 4” Storage workshops with CE …

Agenda Introduction KBC Group ICT Storage & datamanagement Open Systems Questions & Answers

Questions & Answer

KBC werft 150 ICT-ers aan in 2007 Zin om te groeien ? Solliciteren kan via mail met CV naar ictjobs@kbc. be of via www. kbc. be/jobs Wat bieden we? n n n Een ruim opleidingsaanbod en doorgroeimogelijkheden in ICT en business Ruimte voor specialisten en generalisten Een professionele ICT-omgeving met een ruime waaier aan technologieën, processen en business projecten Lokale en internationale mogelijkheden Een competitieve verloning met extralegale voordelen

d15a38d47656cb888457cc38f5208dfd.ppt