ea629212f50e8290e70b78b0e074eeff.ppt

- Количество слайдов: 29

Storage 2002: Predictions for When Networlds Collide Nick Allen VP and Research Director Gartner, Inc.

Storage 2002: Predictions for When Networlds Collide Nick Allen VP and Research Director Gartner, Inc.

Conclusions Heads Up l Storage Networking will force organizational change l SAN management is an evolving hodge-podge. l SAM will stimulate demand for storage l Hardware product differences will become mostly irrelevant l Vendor support and development capabilities will determine the winners

Conclusions Heads Up l Storage Networking will force organizational change l SAN management is an evolving hodge-podge. l SAM will stimulate demand for storage l Hardware product differences will become mostly irrelevant l Vendor support and development capabilities will determine the winners

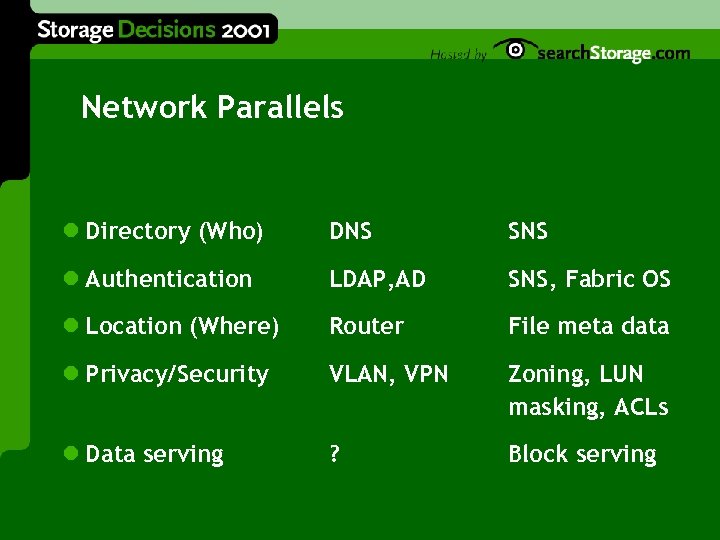

Network Parallels l Directory (Who) DNS SNS l Authentication LDAP, AD SNS, Fabric OS l Location (Where) Router File meta data l Privacy/Security VLAN, VPN Zoning, LUN masking, ACLs l Data serving ? Block serving

Network Parallels l Directory (Who) DNS SNS l Authentication LDAP, AD SNS, Fabric OS l Location (Where) Router File meta data l Privacy/Security VLAN, VPN Zoning, LUN masking, ACLs l Data serving ? Block serving

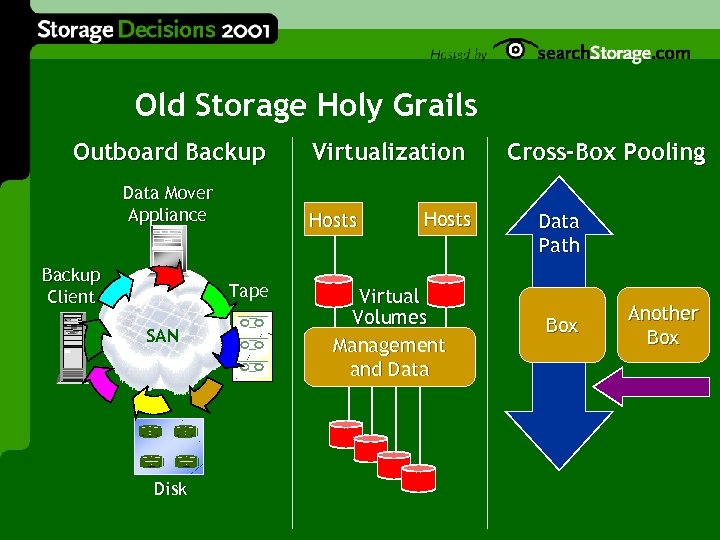

Old Storage Holy Grails Outboard Backup Data Mover Appliance Backup Client Hosts Tape SAN Disk Virtualization Hosts Virtual Volumes Management and Data Cross-Box Pooling Data Path Box Another Box

Old Storage Holy Grails Outboard Backup Data Mover Appliance Backup Client Hosts Tape SAN Disk Virtualization Hosts Virtual Volumes Management and Data Cross-Box Pooling Data Path Box Another Box

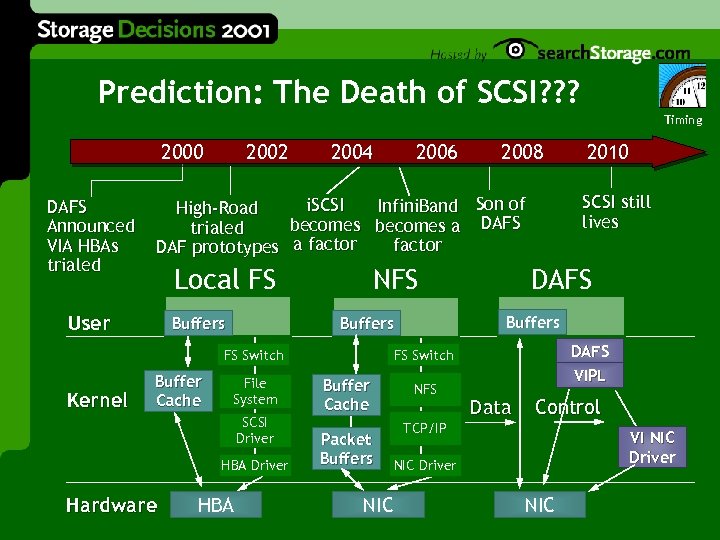

Prediction: The Death of SCSI? ? ? Timing 2000 DAFS Announced VIA HBAs trialed 2002 2004 2006 Local FS Buffers NFS Buffer Cache File System SCSI Driver HBA Driver Hardware HBA DAFS Buffers FS Switch DAFS VIPL FS Switch Buffer Cache Packet Buffers NFS Data Control TCP/IP VI NIC Driver NIC 2010 SCSI still lives i. SCSI Infini. Band Son of High-Road becomes a DAFS trialed factor DAF prototypes a factor User Kernel 2008 NIC

Prediction: The Death of SCSI? ? ? Timing 2000 DAFS Announced VIA HBAs trialed 2002 2004 2006 Local FS Buffers NFS Buffer Cache File System SCSI Driver HBA Driver Hardware HBA DAFS Buffers FS Switch DAFS VIPL FS Switch Buffer Cache Packet Buffers NFS Data Control TCP/IP VI NIC Driver NIC 2010 SCSI still lives i. SCSI Infini. Band Son of High-Road becomes a DAFS trialed factor DAF prototypes a factor User Kernel 2008 NIC

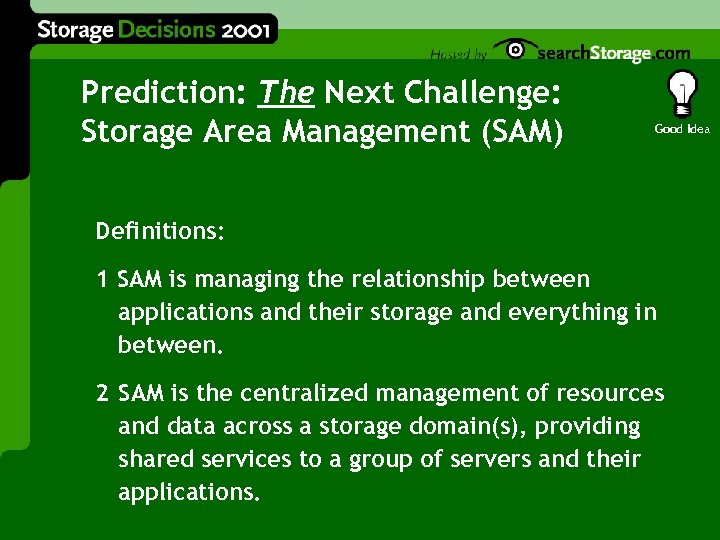

Prediction: The Next Challenge: Storage Area Management (SAM) Good Idea Definitions: 1 SAM is managing the relationship between applications and their storage and everything in between. 2 SAM is the centralized management of resources and data across a storage domain(s), providing shared services to a group of servers and their applications.

Prediction: The Next Challenge: Storage Area Management (SAM) Good Idea Definitions: 1 SAM is managing the relationship between applications and their storage and everything in between. 2 SAM is the centralized management of resources and data across a storage domain(s), providing shared services to a group of servers and their applications.

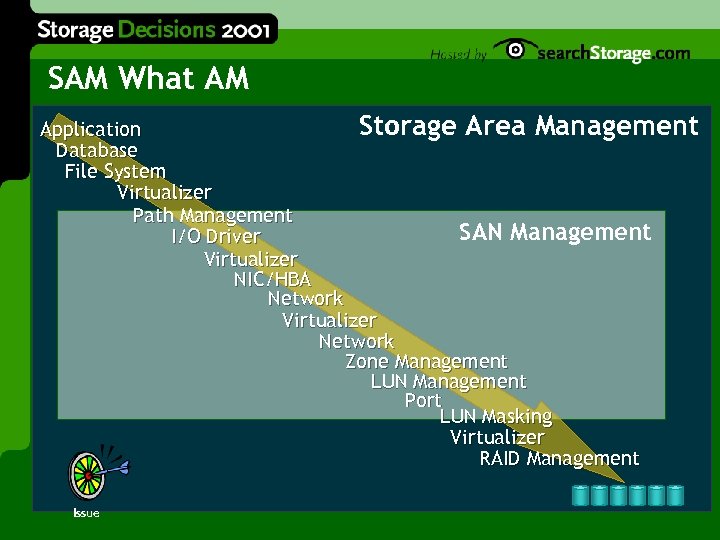

SAM What AM Storage Area Management Application Database File System Virtualizer Path Management SAN Management I/O Driver Virtualizer NIC/HBA Network Virtualizer Network Zone Management LUN Management Port LUN Masking Virtualizer RAID Management Issue

SAM What AM Storage Area Management Application Database File System Virtualizer Path Management SAN Management I/O Driver Virtualizer NIC/HBA Network Virtualizer Network Zone Management LUN Management Port LUN Masking Virtualizer RAID Management Issue

Storage Administrators and Consumers Please give me some more storage. Did my backup happen? How about another terabyte at 5: 15? Yes, at 10: 30 this morning

Storage Administrators and Consumers Please give me some more storage. Did my backup happen? How about another terabyte at 5: 15? Yes, at 10: 30 this morning

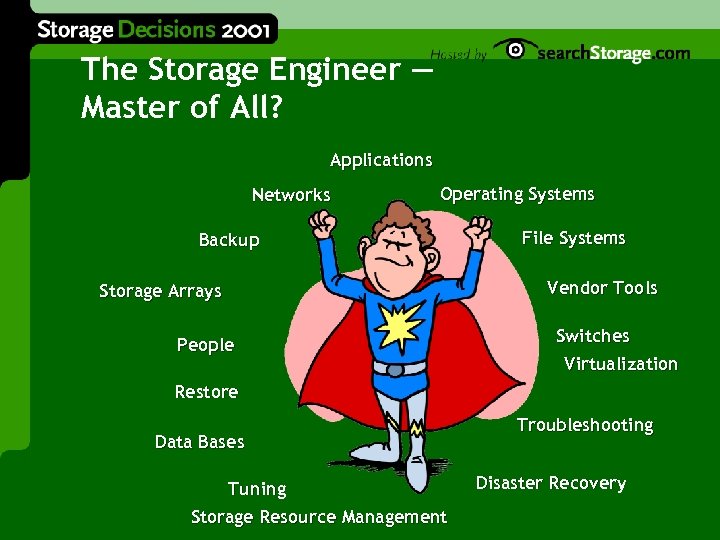

The Storage Engineer — Master of All? Applications Networks Operating Systems Backup File Systems Vendor Tools Storage Arrays People Switches Virtualization Restore Data Bases Tuning Storage Resource Management Troubleshooting Disaster Recovery

The Storage Engineer — Master of All? Applications Networks Operating Systems Backup File Systems Vendor Tools Storage Arrays People Switches Virtualization Restore Data Bases Tuning Storage Resource Management Troubleshooting Disaster Recovery

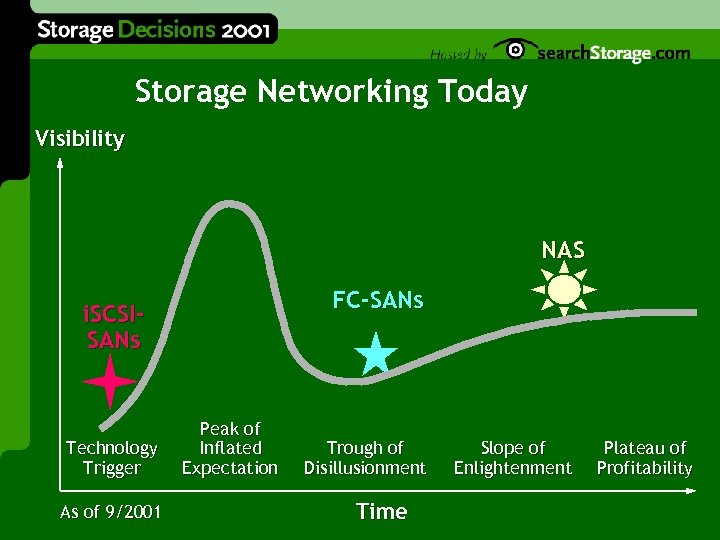

Storage Networking Today Visibility NAS FC-SANs i. SCSISANs Technology Trigger As of 9/2001 Peak of Inflated Expectation Trough of Disillusionment Time Slope of Enlightenment Plateau of Profitability

Storage Networking Today Visibility NAS FC-SANs i. SCSISANs Technology Trigger As of 9/2001 Peak of Inflated Expectation Trough of Disillusionment Time Slope of Enlightenment Plateau of Profitability

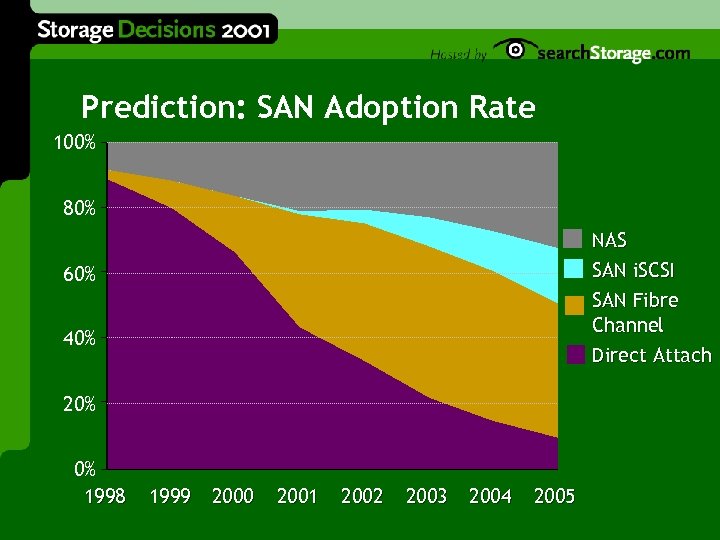

Prediction: SAN Adoption Rate 100% 80% NAS SAN i. SCSI SAN Fibre Channel Direct Attach 60% 40% 20% 0% 1998 1999 2000 2001 2002 2003 2004 2005

Prediction: SAN Adoption Rate 100% 80% NAS SAN i. SCSI SAN Fibre Channel Direct Attach 60% 40% 20% 0% 1998 1999 2000 2001 2002 2003 2004 2005

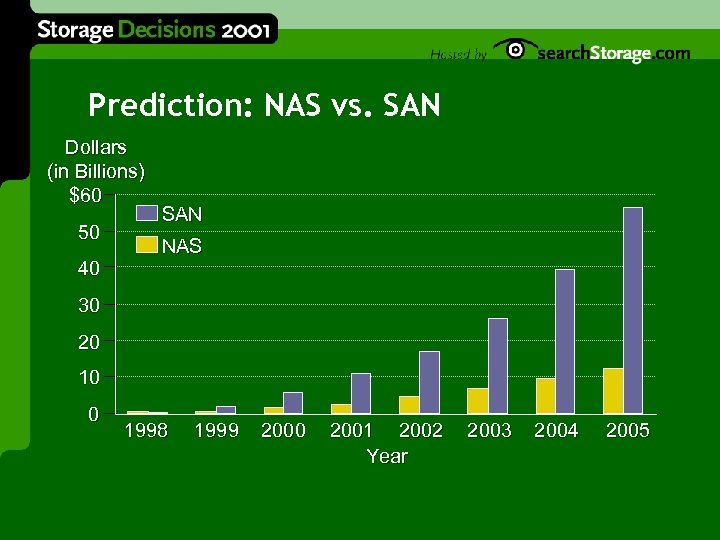

Prediction: NAS vs. SAN Dollars (in Billions) $60 50 40 SAN NAS 30 20 10 0 1998 1999 2000 2001 2002 Year 2003 2004 2005

Prediction: NAS vs. SAN Dollars (in Billions) $60 50 40 SAN NAS 30 20 10 0 1998 1999 2000 2001 2002 Year 2003 2004 2005

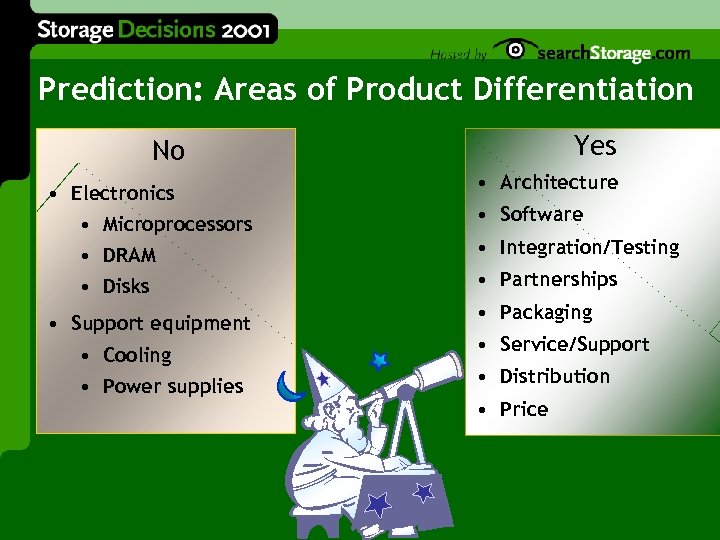

Prediction: Areas of Product Differentiation Yes No • Electronics • Microprocessors • Architecture • Software • DRAM • Integration/Testing • Disks • Partnerships • Support equipment • Cooling • Power supplies • Packaging • Service/Support • Distribution • Price

Prediction: Areas of Product Differentiation Yes No • Electronics • Microprocessors • Architecture • Software • DRAM • Integration/Testing • Disks • Partnerships • Support equipment • Cooling • Power supplies • Packaging • Service/Support • Distribution • Price

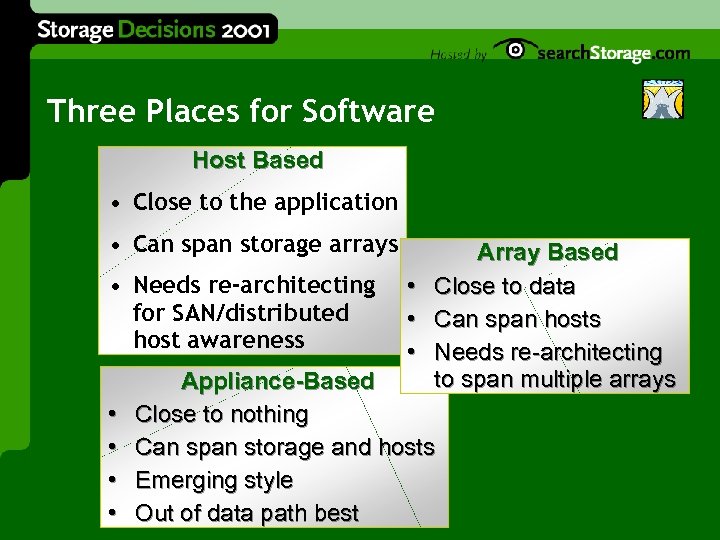

Three Places for Software Host Based • Close to the application • Can span storage arrays • Needs re-architecting for SAN/distributed host awareness • • Array Based Close to data Can span hosts Needs re-architecting to span multiple arrays Appliance-Based Close to nothing Can span storage and hosts Emerging style Out of data path best

Three Places for Software Host Based • Close to the application • Can span storage arrays • Needs re-architecting for SAN/distributed host awareness • • Array Based Close to data Can span hosts Needs re-architecting to span multiple arrays Appliance-Based Close to nothing Can span storage and hosts Emerging style Out of data path best

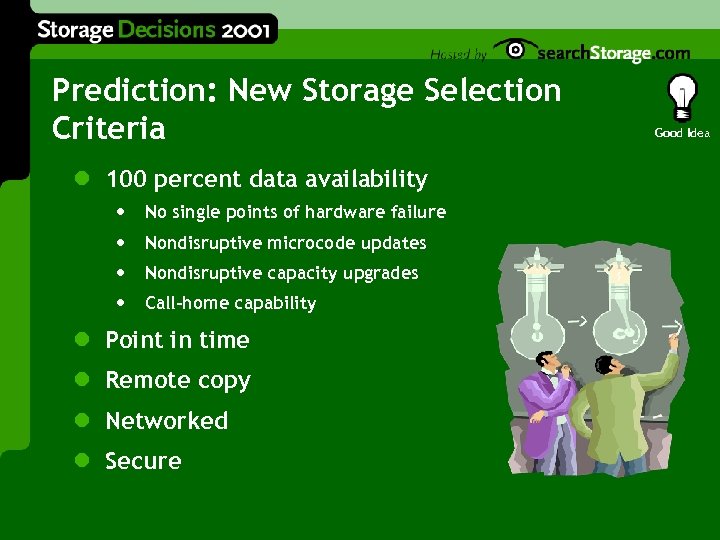

Prediction: New Storage Selection Criteria l 100 percent data availability • No single points of hardware failure • Nondisruptive microcode updates • Nondisruptive capacity upgrades • Call-home capability l Point in time l Remote copy l Networked l Secure Good Idea

Prediction: New Storage Selection Criteria l 100 percent data availability • No single points of hardware failure • Nondisruptive microcode updates • Nondisruptive capacity upgrades • Call-home capability l Point in time l Remote copy l Networked l Secure Good Idea

Prediction: Non-Product Criteria Become Paramount Product l Solution packaging • • • Ease of installation Nonproduct Low perceived risk Presales service l SAM tools l Service and support l Sales experience • • • Marketing partnerships Education Emotional factors l Total cost of ownership (TCO) Tradeoff

Prediction: Non-Product Criteria Become Paramount Product l Solution packaging • • • Ease of installation Nonproduct Low perceived risk Presales service l SAM tools l Service and support l Sales experience • • • Marketing partnerships Education Emotional factors l Total cost of ownership (TCO) Tradeoff

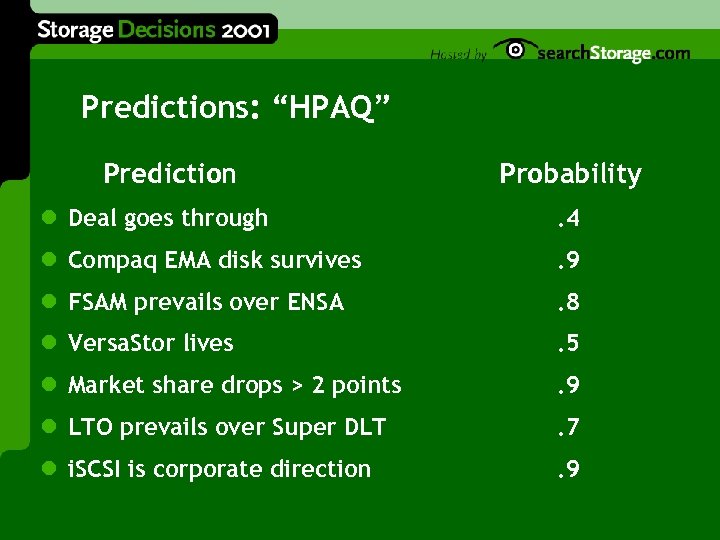

Predictions: “HPAQ” Prediction Probability l Deal goes through . 4 l Compaq EMA disk survives . 9 l FSAM prevails over ENSA . 8 l Versa. Stor lives . 5 l Market share drops > 2 points . 9 l LTO prevails over Super DLT . 7 l i. SCSI is corporate direction . 9

Predictions: “HPAQ” Prediction Probability l Deal goes through . 4 l Compaq EMA disk survives . 9 l FSAM prevails over ENSA . 8 l Versa. Stor lives . 5 l Market share drops > 2 points . 9 l LTO prevails over Super DLT . 7 l i. SCSI is corporate direction . 9

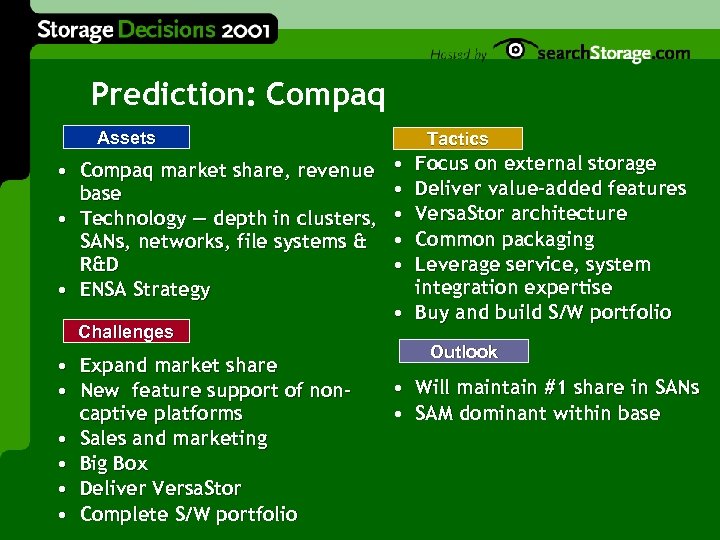

Prediction: Compaq Assets • Compaq market share, revenue base • Technology — depth in clusters, SANs, networks, file systems & R&D • ENSA Strategy Challenges • Expand market share • New feature support of noncaptive platforms • Sales and marketing • Big Box • Deliver Versa. Stor • Complete S/W portfolio Tactics • • • Focus on external storage Deliver value-added features Versa. Stor architecture Common packaging Leverage service, system integration expertise • Buy and build S/W portfolio Outlook • Will maintain #1 share in SANs • SAM dominant within base

Prediction: Compaq Assets • Compaq market share, revenue base • Technology — depth in clusters, SANs, networks, file systems & R&D • ENSA Strategy Challenges • Expand market share • New feature support of noncaptive platforms • Sales and marketing • Big Box • Deliver Versa. Stor • Complete S/W portfolio Tactics • • • Focus on external storage Deliver value-added features Versa. Stor architecture Common packaging Leverage service, system integration expertise • Buy and build S/W portfolio Outlook • Will maintain #1 share in SANs • SAM dominant within base

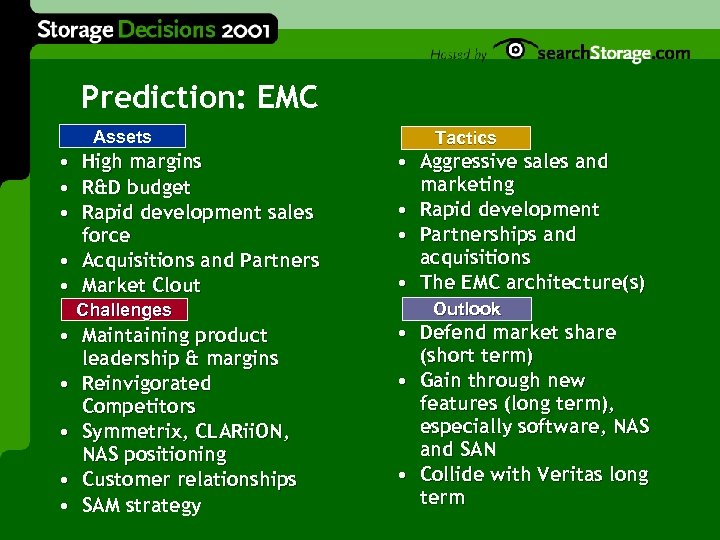

Prediction: EMC Assets • High margins • R&D budget • Rapid development sales force • Acquisitions and Partners • Market Clout Challenges • Maintaining product leadership & margins • Reinvigorated Competitors • Symmetrix, CLARii. ON, NAS positioning • Customer relationships • SAM strategy Tactics • Aggressive sales and marketing • Rapid development • Partnerships and acquisitions • The EMC architecture(s) Outlook • Defend market share (short term) • Gain through new features (long term), especially software, NAS and SAN • Collide with Veritas long term

Prediction: EMC Assets • High margins • R&D budget • Rapid development sales force • Acquisitions and Partners • Market Clout Challenges • Maintaining product leadership & margins • Reinvigorated Competitors • Symmetrix, CLARii. ON, NAS positioning • Customer relationships • SAM strategy Tactics • Aggressive sales and marketing • Rapid development • Partnerships and acquisitions • The EMC architecture(s) Outlook • Defend market share (short term) • Gain through new features (long term), especially software, NAS and SAN • Collide with Veritas long term

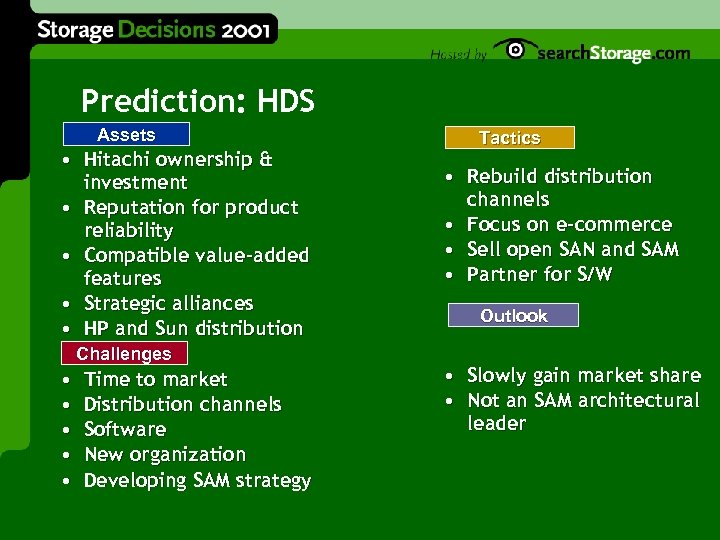

Prediction: HDS Assets • Hitachi ownership & investment • Reputation for product reliability • Compatible value-added features • Strategic alliances • HP and Sun distribution Challenges • • • Time to market Distribution channels Software New organization Developing SAM strategy Tactics • Rebuild distribution channels • Focus on e-commerce • Sell open SAN and SAM • Partner for S/W Outlook • Slowly gain market share • Not an SAM architectural leader

Prediction: HDS Assets • Hitachi ownership & investment • Reputation for product reliability • Compatible value-added features • Strategic alliances • HP and Sun distribution Challenges • • • Time to market Distribution channels Software New organization Developing SAM strategy Tactics • Rebuild distribution channels • Focus on e-commerce • Sell open SAN and SAM • Partner for S/W Outlook • Slowly gain market share • Not an SAM architectural leader

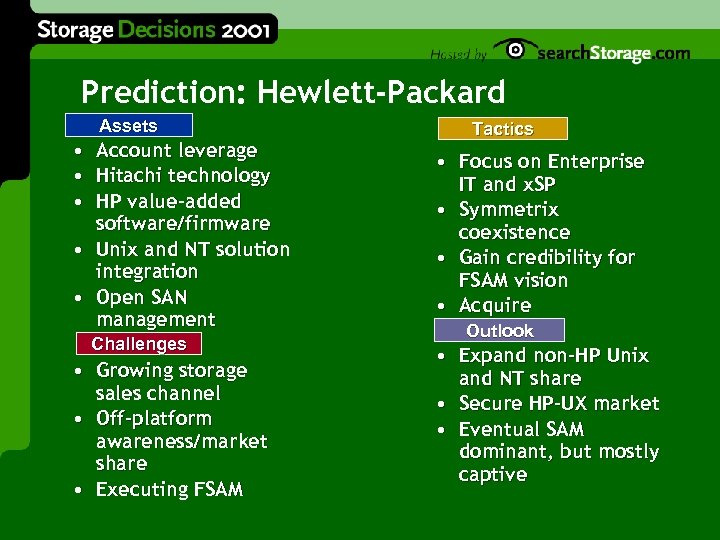

Prediction: Hewlett-Packard Assets • • • Account leverage Hitachi technology HP value-added software/firmware Unix and NT solution integration Open SAN management Challenges • Growing storage sales channel • Off-platform awareness/market share • Executing FSAM Tactics • Focus on Enterprise IT and x. SP • Symmetrix coexistence • Gain credibility for FSAM vision • Acquire Outlook • Expand non-HP Unix and NT share • Secure HP-UX market • Eventual SAM dominant, but mostly captive

Prediction: Hewlett-Packard Assets • • • Account leverage Hitachi technology HP value-added software/firmware Unix and NT solution integration Open SAN management Challenges • Growing storage sales channel • Off-platform awareness/market share • Executing FSAM Tactics • Focus on Enterprise IT and x. SP • Symmetrix coexistence • Gain credibility for FSAM vision • Acquire Outlook • Expand non-HP Unix and NT share • Secure HP-UX market • Eventual SAM dominant, but mostly captive

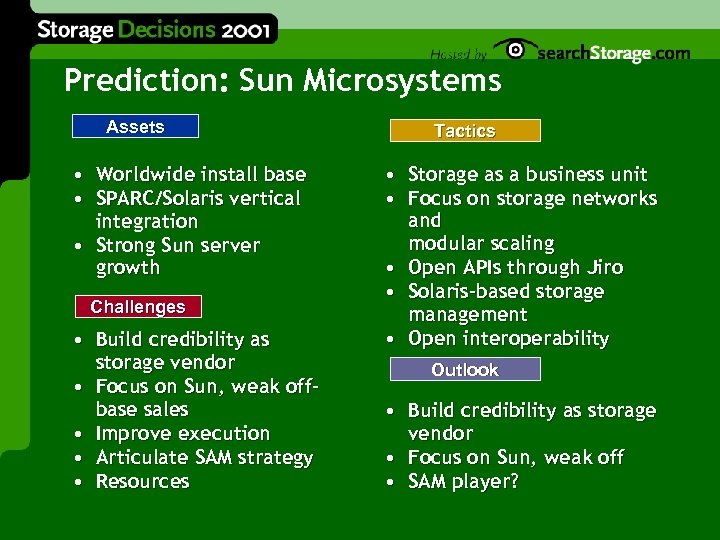

Prediction: Sun Microsystems Assets • Worldwide install base • SPARC/Solaris vertical integration • Strong Sun server growth Challenges • Build credibility as storage vendor • Focus on Sun, weak offbase sales • Improve execution • Articulate SAM strategy • Resources Tactics • Storage as a business unit • Focus on storage networks and modular scaling • Open APIs through Jiro • Solaris-based storage management • Open interoperability Outlook • Build credibility as storage vendor • Focus on Sun, weak off • SAM player?

Prediction: Sun Microsystems Assets • Worldwide install base • SPARC/Solaris vertical integration • Strong Sun server growth Challenges • Build credibility as storage vendor • Focus on Sun, weak offbase sales • Improve execution • Articulate SAM strategy • Resources Tactics • Storage as a business unit • Focus on storage networks and modular scaling • Open APIs through Jiro • Solaris-based storage management • Open interoperability Outlook • Build credibility as storage vendor • Focus on Sun, weak off • SAM player?

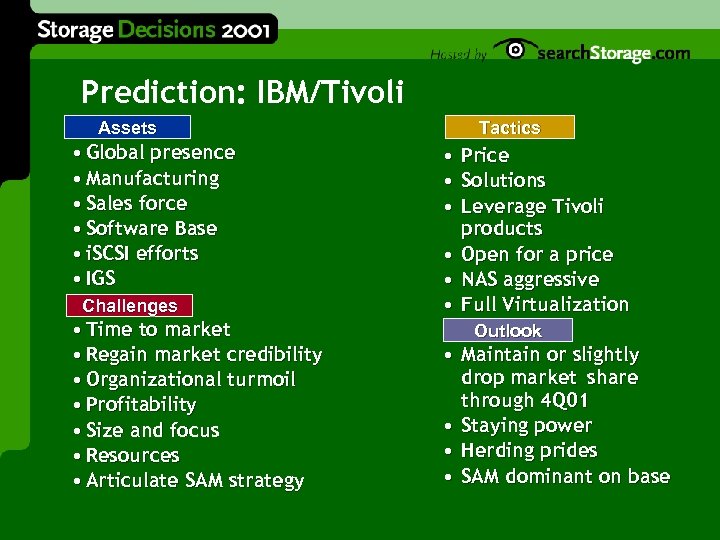

Prediction: IBM/Tivoli Assets • Global presence • Manufacturing • Sales force • Software Base • i. SCSI efforts • IGS Challenges • Time to market • Regain market credibility • Organizational turmoil • Profitability • Size and focus • Resources • Articulate SAM strategy Tactics • • • Price Solutions Leverage Tivoli products • Open for a price • NAS aggressive • Full Virtualization Outlook • Maintain or slightly drop market share through 4 Q 01 • Staying power • Herding prides • SAM dominant on base

Prediction: IBM/Tivoli Assets • Global presence • Manufacturing • Sales force • Software Base • i. SCSI efforts • IGS Challenges • Time to market • Regain market credibility • Organizational turmoil • Profitability • Size and focus • Resources • Articulate SAM strategy Tactics • • • Price Solutions Leverage Tivoli products • Open for a price • NAS aggressive • Full Virtualization Outlook • Maintain or slightly drop market share through 4 Q 01 • Staying power • Herding prides • SAM dominant on base

Prediction: BMC Assets • New management • Application-oriented • Many building blocks done • Large installed base • Time to Market Challenges • Expanding brand • Marketing • Finish out SAM layers • Resources • Piece parts vs. package • Bigger others Tactics • Integrate pieces • Solutions • Consolidate development • Begin marketing • Acquire Outlook • • • Dark horse Steady progress Incomplete solution

Prediction: BMC Assets • New management • Application-oriented • Many building blocks done • Large installed base • Time to Market Challenges • Expanding brand • Marketing • Finish out SAM layers • Resources • Piece parts vs. package • Bigger others Tactics • Integrate pieces • Solutions • Consolidate development • Begin marketing • Acquire Outlook • • • Dark horse Steady progress Incomplete solution

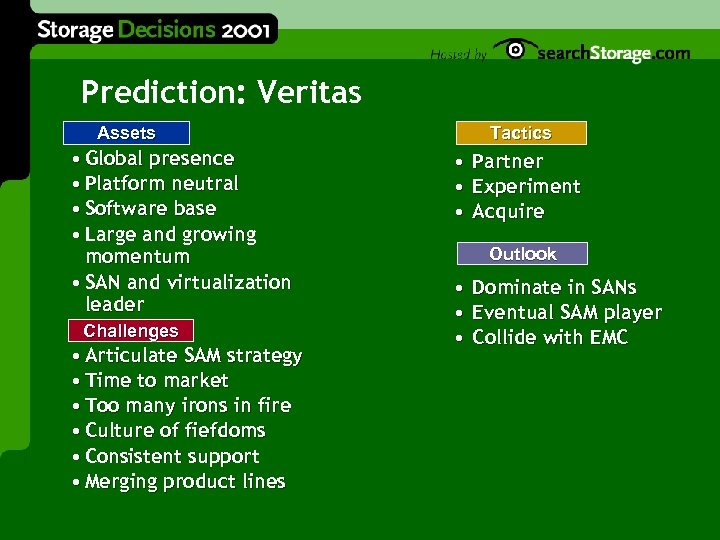

Prediction: Veritas Assets • Global presence • Platform neutral • Software base • Large and growing momentum • SAN and virtualization leader Challenges • Articulate SAM strategy • Time to market • Too many irons in fire • Culture of fiefdoms • Consistent support • Merging product lines Tactics • • • Partner Experiment Acquire Outlook • Dominate in SANs • Eventual SAM player • Collide with EMC

Prediction: Veritas Assets • Global presence • Platform neutral • Software base • Large and growing momentum • SAN and virtualization leader Challenges • Articulate SAM strategy • Time to market • Too many irons in fire • Culture of fiefdoms • Consistent support • Merging product lines Tactics • • • Partner Experiment Acquire Outlook • Dominate in SANs • Eventual SAM player • Collide with EMC

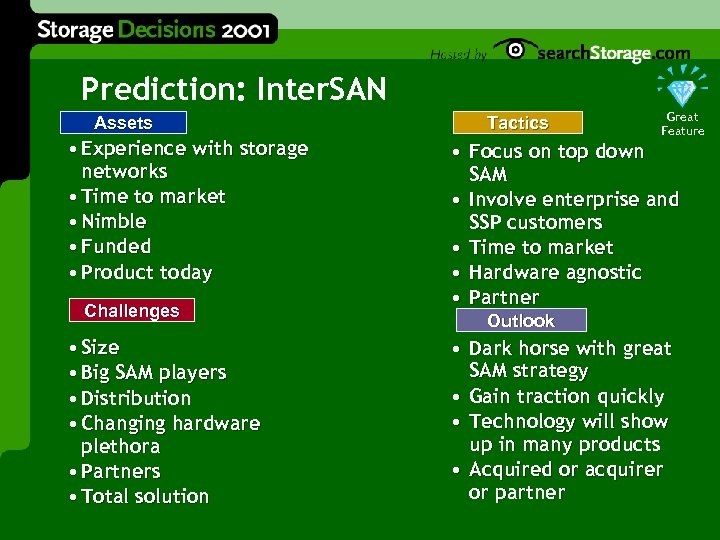

Prediction: Inter. SAN Assets • Experience with storage networks • Time to market • Nimble • Funded • Product today Challenges • Size • Big SAM players • Distribution • Changing hardware plethora • Partners • Total solution Tactics Great Feature • Focus on top down SAM • Involve enterprise and SSP customers • Time to market • Hardware agnostic • Partner Outlook • Dark horse with great SAM strategy • Gain traction quickly • Technology will show up in many products • Acquired or acquirer or partner

Prediction: Inter. SAN Assets • Experience with storage networks • Time to market • Nimble • Funded • Product today Challenges • Size • Big SAM players • Distribution • Changing hardware plethora • Partners • Total solution Tactics Great Feature • Focus on top down SAM • Involve enterprise and SSP customers • Time to market • Hardware agnostic • Partner Outlook • Dark horse with great SAM strategy • Gain traction quickly • Technology will show up in many products • Acquired or acquirer or partner

Recommendations Best Practice l Think SAM, not SAN Don’t Forget l Understand requirements before selecting product/vendor. l Buy full-featured storage only if you need the features. l Focus on software and architecture as differentiation and highest impact. l Include non-product criteria in selecting vendors. l Users must balance vendors’ broader integrated solutions against lockouts. Gotcha

Recommendations Best Practice l Think SAM, not SAN Don’t Forget l Understand requirements before selecting product/vendor. l Buy full-featured storage only if you need the features. l Focus on software and architecture as differentiation and highest impact. l Include non-product criteria in selecting vendors. l Users must balance vendors’ broader integrated solutions against lockouts. Gotcha

Questions? Storage 2002: Predictions for When Networlds Collide Nick Allen VP and Research Director Gartner, Inc.

Questions? Storage 2002: Predictions for When Networlds Collide Nick Allen VP and Research Director Gartner, Inc.