4795733842615a859a5d8622a64671e1.ppt

- Количество слайдов: 23

STOCKS What are Stocks? How do they work?

STOCKS What are Stocks? How do they work?

What is a Stock? • A stock is share of ownership in a company.

What is a Stock? • A stock is share of ownership in a company.

Initial Public Offering • IPO- Occurs when a company begins to sell stock to the public. • Allows the company to generate income from the initial sale of the stock. • Once the stock is sold to the public the company no longer generates income from that stock.

Initial Public Offering • IPO- Occurs when a company begins to sell stock to the public. • Allows the company to generate income from the initial sale of the stock. • Once the stock is sold to the public the company no longer generates income from that stock.

![Facebook IPO Wikipedia Feb 4, 2014 Offering price May 18, $38. 00[42] ~$90 B[48] Facebook IPO Wikipedia Feb 4, 2014 Offering price May 18, $38. 00[42] ~$90 B[48]](https://present5.com/presentation/4795733842615a859a5d8622a64671e1/image-4.jpg) Facebook IPO Wikipedia Feb 4, 2014 Offering price May 18, $38. 00[42] ~$90 B[48] First day May 18 $38. 23[42] ~$90 B[48] 1 May 21 2 6 2012 Daily Change Net Change 0. 6% $34. 03[42] 11% 10% May 22 $31. 00[42] 8. 9% 18% May 29 $28. 84[42] 9. 6% 24% $69. 17 B[48]

Facebook IPO Wikipedia Feb 4, 2014 Offering price May 18, $38. 00[42] ~$90 B[48] First day May 18 $38. 23[42] ~$90 B[48] 1 May 21 2 6 2012 Daily Change Net Change 0. 6% $34. 03[42] 11% 10% May 22 $31. 00[42] 8. 9% 18% May 29 $28. 84[42] 9. 6% 24% $69. 17 B[48]

How Do Stocks Work? • People buy shares either directly from the company or from a stock broker. • If the company does well the price of the stock typically increases in value. • If the company does poorly the price of the stock typically decreases in value. • http: //finance. yahoo. com/q? s=xel&ql=1

How Do Stocks Work? • People buy shares either directly from the company or from a stock broker. • If the company does well the price of the stock typically increases in value. • If the company does poorly the price of the stock typically decreases in value. • http: //finance. yahoo. com/q? s=xel&ql=1

How do I know how the company is doing? • Companies that issue stock are required to issue quarterly earnings reports that detail how much money the company made during each 3 month period.

How do I know how the company is doing? • Companies that issue stock are required to issue quarterly earnings reports that detail how much money the company made during each 3 month period.

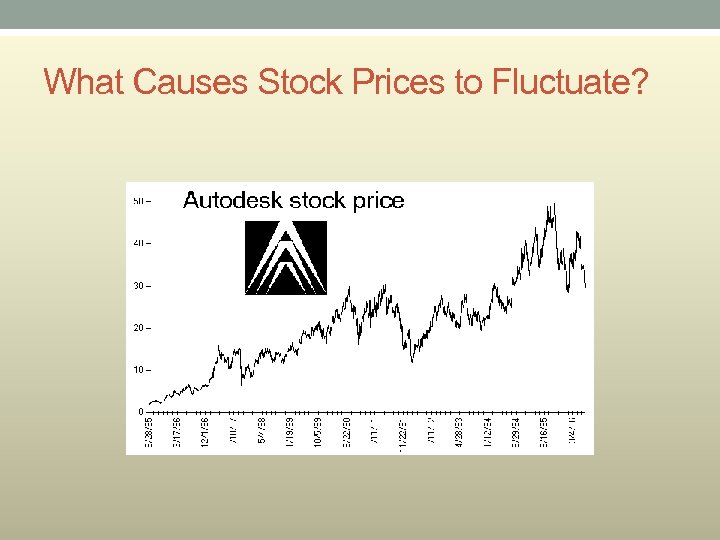

What Causes Stock Prices to Fluctuate?

What Causes Stock Prices to Fluctuate?

Price Fluctuation • Stock Prices fluctuate based on the company’s performance. (Radio Shack) • Stock Prices fluctuate based on the overall health of the economy. (Inflation/Employment) • Stock prices fluctuate based on worldwide events. (9/11/2001) • http: //finance. yahoo. com/q? s=AAPL&ql=1

Price Fluctuation • Stock Prices fluctuate based on the company’s performance. (Radio Shack) • Stock Prices fluctuate based on the overall health of the economy. (Inflation/Employment) • Stock prices fluctuate based on worldwide events. (9/11/2001) • http: //finance. yahoo. com/q? s=AAPL&ql=1

How do I Make Money? • There are two basic ways to make money in stocks. • Capital gains- An increase in value that gives the stock a higher worth than the purchase price. • Buy 100 Shares for $10 Each = $1, 000 • Sell the shares for $15 Each = $1, 500 • $1, 500 - $1, 000 = $500 Profit

How do I Make Money? • There are two basic ways to make money in stocks. • Capital gains- An increase in value that gives the stock a higher worth than the purchase price. • Buy 100 Shares for $10 Each = $1, 000 • Sell the shares for $15 Each = $1, 500 • $1, 500 - $1, 000 = $500 Profit

Dividends • Dividends- A percentage of company earnings paid to shareholders on a quarterly basis. • Xel paid. 75 per quarter but cut to. 375 • Not all stocks pay dividends but those that do allow the shareholder to have a stream of income throughout the year or to reinvest the dividends to buy more stock. • Find a stock that pays dividends

Dividends • Dividends- A percentage of company earnings paid to shareholders on a quarterly basis. • Xel paid. 75 per quarter but cut to. 375 • Not all stocks pay dividends but those that do allow the shareholder to have a stream of income throughout the year or to reinvest the dividends to buy more stock. • Find a stock that pays dividends

Daily stock information • Stock Abbreviations • Open and Close Price • 52 Week Range • Stock Charts • Company Profile • Analyst Opinion • YUM • Berkshire Hathaway • Market Data (Top Center) • Most Active Gainers Losers

Daily stock information • Stock Abbreviations • Open and Close Price • 52 Week Range • Stock Charts • Company Profile • Analyst Opinion • YUM • Berkshire Hathaway • Market Data (Top Center) • Most Active Gainers Losers

Value vs Profit/Loss • The value of a stock is simply its worth at any given point. • The value of Harley Davidson (HOG) is $69. 27 • I paid $59. 27 when I bought it. Its’ value has increased $10 but I have not made any profit because I still own the stock. • If I sell the stock for $69. 27 I will then have realized an actual profit of $10 per share.

Value vs Profit/Loss • The value of a stock is simply its worth at any given point. • The value of Harley Davidson (HOG) is $69. 27 • I paid $59. 27 when I bought it. Its’ value has increased $10 but I have not made any profit because I still own the stock. • If I sell the stock for $69. 27 I will then have realized an actual profit of $10 per share.

% Versus $ • A stock that sells for $10 and gains $1 (10%) is more valuable than a stock that sells for a $1, 000 and gains $50 (5%)

% Versus $ • A stock that sells for $10 and gains $1 (10%) is more valuable than a stock that sells for a $1, 000 and gains $50 (5%)

How do I Buy Stock? • The most common way to buy and sell stock is through a Stock Broker. • The Broker will charge a fee. • The fee can be either a percentage. (Example 1 -2%) • Or a flat rate (Example $50 -$100)

How do I Buy Stock? • The most common way to buy and sell stock is through a Stock Broker. • The Broker will charge a fee. • The fee can be either a percentage. (Example 1 -2%) • Or a flat rate (Example $50 -$100)

Stock Markets • Stocks are generally bought or sold in a stock market. • The most common markets in the United States are • NYSE- New York Stock Exchange • NASDAQ- National Association Securities Dealers Automated Quotations System

Stock Markets • Stocks are generally bought or sold in a stock market. • The most common markets in the United States are • NYSE- New York Stock Exchange • NASDAQ- National Association Securities Dealers Automated Quotations System

Hand Gestures/Futures • Whether one is buying or selling. This is a simple gesture. If you are buying, put your hands out in front of you, palms • • • facing in, and pull your hands towards you (as if you were pulling the shares you want into your chest. ) For selling, do the opposite: place your hands in front of you palms out, and push your hands away from you (as if discarding of your shares. ) For options: The universal "okay" signal (index finger to thumb, other fingers outstretched) is used to place put orders, while making a letter "C" with your hand indicates a call. The price at which to buy or sell. The signal is simple; the interpretation, less so. Options, securities, and futures generally trade at prices in the double digits: 61, 73, 19, etc, and a one or two point shift can be considered a major move. Thus, traders only indicate the last digit of the sale price, and the broker extrapolates this to the actual price. To indicate this digit, the trader puts his hand out in front of him, palm in. For a 1, simply hold up the index finger straight into the air. For 2, add the middle finger, for 3, the ring, 4, the pinky, and 5 is all fingers. For 6 through 9, the hand is turned sideways so that the fingers go across your body horizontally. Thus with the right hand, a 7 would be the index and middle fingers pointing to one's left. For 0, a fist is used. The amount of shares to be bought or sold. This is done by touching the face. Multiples of 100 are indicated by a fist to the forehead; Multiples of 10 by a mere finger to the forehead; and individual units by a finger to the chin. These are preceded by the same indicators as the pricing digits listed above. So for a sale of 330 options, a trader would first indicate a "3" by holding up 3 fingers, then touch his fist to his forehead (as a general rule, the "3" is also done near the forehead for clarity's sake). He would then indicate a second "3" and touch one finger to his forehead (thus representing 30. ) Beyond the actual information regarding the order itself, there a number of hand signals used to indicate the status of an order, and other procedures on the trading floor. Order filled. The classic "thumbs up", this indicates the order has been registered and processed. Order cancelled. Another universal hand signal, dragging the finger or hand across the throat indicates an order has been cancelled. Order status. A deliberate hands in the air shrug is used to inquire about the status. This is one of the most interesting signals, since it conveys frustration, but is merely a passive signal of inquiry. Order still in process. Placing your index finger out sideways and rolling it in a circle indicates an order is still being worked on. Stop order. Without explaining too much about a stop order, it is in short an order only activated at a certain price, used by traders to minimize losses. This is indicated by punching your open palm with your fist. These signals are not absolutely universal, and many markets have additional signals for additional requirements, but they are the common language of all of the American markets and most European and Asian markets as well. http: //everything 2. com/title/hand+signals+on+the+trading+floor http: //www. youtube. com/watch? v=M 6 m. Wd 3 Ejts. Q

Hand Gestures/Futures • Whether one is buying or selling. This is a simple gesture. If you are buying, put your hands out in front of you, palms • • • facing in, and pull your hands towards you (as if you were pulling the shares you want into your chest. ) For selling, do the opposite: place your hands in front of you palms out, and push your hands away from you (as if discarding of your shares. ) For options: The universal "okay" signal (index finger to thumb, other fingers outstretched) is used to place put orders, while making a letter "C" with your hand indicates a call. The price at which to buy or sell. The signal is simple; the interpretation, less so. Options, securities, and futures generally trade at prices in the double digits: 61, 73, 19, etc, and a one or two point shift can be considered a major move. Thus, traders only indicate the last digit of the sale price, and the broker extrapolates this to the actual price. To indicate this digit, the trader puts his hand out in front of him, palm in. For a 1, simply hold up the index finger straight into the air. For 2, add the middle finger, for 3, the ring, 4, the pinky, and 5 is all fingers. For 6 through 9, the hand is turned sideways so that the fingers go across your body horizontally. Thus with the right hand, a 7 would be the index and middle fingers pointing to one's left. For 0, a fist is used. The amount of shares to be bought or sold. This is done by touching the face. Multiples of 100 are indicated by a fist to the forehead; Multiples of 10 by a mere finger to the forehead; and individual units by a finger to the chin. These are preceded by the same indicators as the pricing digits listed above. So for a sale of 330 options, a trader would first indicate a "3" by holding up 3 fingers, then touch his fist to his forehead (as a general rule, the "3" is also done near the forehead for clarity's sake). He would then indicate a second "3" and touch one finger to his forehead (thus representing 30. ) Beyond the actual information regarding the order itself, there a number of hand signals used to indicate the status of an order, and other procedures on the trading floor. Order filled. The classic "thumbs up", this indicates the order has been registered and processed. Order cancelled. Another universal hand signal, dragging the finger or hand across the throat indicates an order has been cancelled. Order status. A deliberate hands in the air shrug is used to inquire about the status. This is one of the most interesting signals, since it conveys frustration, but is merely a passive signal of inquiry. Order still in process. Placing your index finger out sideways and rolling it in a circle indicates an order is still being worked on. Stop order. Without explaining too much about a stop order, it is in short an order only activated at a certain price, used by traders to minimize losses. This is indicated by punching your open palm with your fist. These signals are not absolutely universal, and many markets have additional signals for additional requirements, but they are the common language of all of the American markets and most European and Asian markets as well. http: //everything 2. com/title/hand+signals+on+the+trading+floor http: //www. youtube. com/watch? v=M 6 m. Wd 3 Ejts. Q

BETA A Stock with a beta greater than 1 is considered more volatile than the market; less than 1 means less volatile. So say your stock gets a beta of 1. 15 -- it has a history of fluctuating 15% more than the S&P. If the market is up, the stock should outperform by 15%. If the market heads lower, the stock should fall by 15% more.

BETA A Stock with a beta greater than 1 is considered more volatile than the market; less than 1 means less volatile. So say your stock gets a beta of 1. 15 -- it has a history of fluctuating 15% more than the S&P. If the market is up, the stock should outperform by 15%. If the market heads lower, the stock should fall by 15% more.

Analyst Opinion • Stock professionals who evaluate stocks give their opinions on stocks • Buy- This is stock that is considered a good value • Hold- If you own this stock hold on to it • Sell- If you own this stock sell it. There is something wrong with it or it is projected to go down soon.

Analyst Opinion • Stock professionals who evaluate stocks give their opinions on stocks • Buy- This is stock that is considered a good value • Hold- If you own this stock hold on to it • Sell- If you own this stock sell it. There is something wrong with it or it is projected to go down soon.

Miscellaneous • http: //www. msn. com/en-us/money/stockscreener • Blue Chip- very solid stock. Thought to be safe and a good investment. • Penny Stock- low priced stock. Often very risky either because of poor performance, possible bankruptcy etc… or could be a new company with high risk. • Sector- The general category of a stock. Health Care, Energy, Utilities

Miscellaneous • http: //www. msn. com/en-us/money/stockscreener • Blue Chip- very solid stock. Thought to be safe and a good investment. • Penny Stock- low priced stock. Often very risky either because of poor performance, possible bankruptcy etc… or could be a new company with high risk. • Sector- The general category of a stock. Health Care, Energy, Utilities

Measures of Performance • Dow Jones Industrial Average • The average is computed from the stock prices of 30 of the largest and most widely held public companies in the United States. (Wikipedia 1/09/09) • S&P 500 • The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock markets, the New York Stock Exchange and NASDAQ. Almost all of the stocks included in the index are among the 500 American stocks with the largest market capitalizations. (Wikipedia 1/9/09) • The Dow and the S&P are common measures of the overall stock market.

Measures of Performance • Dow Jones Industrial Average • The average is computed from the stock prices of 30 of the largest and most widely held public companies in the United States. (Wikipedia 1/09/09) • S&P 500 • The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock markets, the New York Stock Exchange and NASDAQ. Almost all of the stocks included in the index are among the 500 American stocks with the largest market capitalizations. (Wikipedia 1/9/09) • The Dow and the S&P are common measures of the overall stock market.

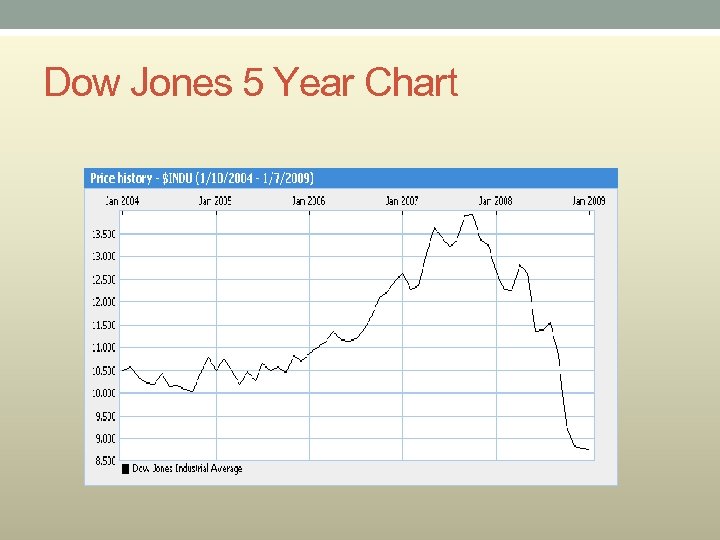

Dow Jones 5 Year Chart

Dow Jones 5 Year Chart

Dow Jones 10 Year Chart Link • http: //investing. money. msn. com/investments/market- index/? symbol=%24 INDU

Dow Jones 10 Year Chart Link • http: //investing. money. msn. com/investments/market- index/? symbol=%24 INDU

Choose Stock • Make a list of 5 Companies that you wish to purchase. • There are stock scouters on each of the main search engines. • Stocks that you buy must be on the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotation (NASDAQ)

Choose Stock • Make a list of 5 Companies that you wish to purchase. • There are stock scouters on each of the main search engines. • Stocks that you buy must be on the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotation (NASDAQ)