STOCK MARKET

STOCK MARKET

Stock • An instrument that signifies an ownership position (called equity) in a corporation, and represents a claim on its proportional share in the corporation's assets and profits. • Language usage: – stock = stock of shares = stock capital – share = share of stock = one share – stock (in general) – share (particular company)

Stock • An instrument that signifies an ownership position (called equity) in a corporation, and represents a claim on its proportional share in the corporation's assets and profits. • Language usage: – stock = stock of shares = stock capital – share = share of stock = one share – stock (in general) – share (particular company)

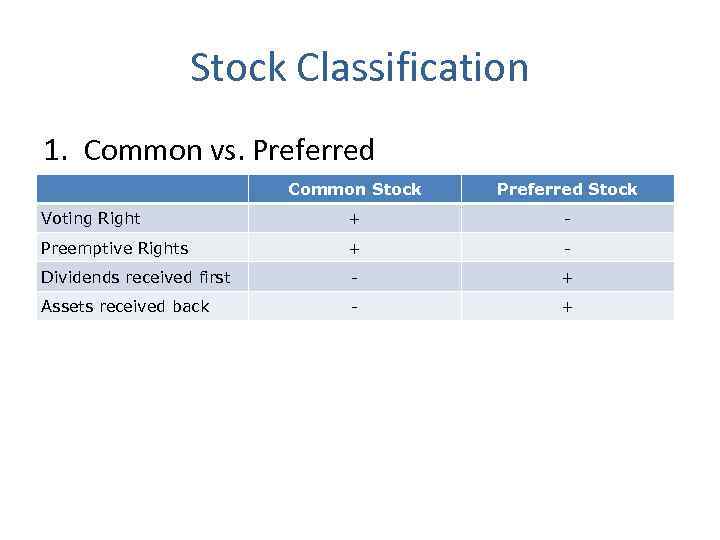

Stock Classification 1. Common vs. Preferred Common Stock Preferred Stock Voting Right + - Preemptive Rights + - Dividends received first - + Assets received back - +

Stock Classification 1. Common vs. Preferred Common Stock Preferred Stock Voting Right + - Preemptive Rights + - Dividends received first - + Assets received back - +

Stock Classification 2. Authorized Shares – the total number of shares of stock authorized when the company was created. Unissued Shares – shares a company retains in its treasury and not issued to the public or to employees are unissued shares. Restricted shares refer to company stock used for employee incentive and compensation plans. Float refers to the number of shares actually available for trade on the open market. Outstanding shares includes all the shares issued by the company, which would be the restricted shares plus the float.

Stock Classification 2. Authorized Shares – the total number of shares of stock authorized when the company was created. Unissued Shares – shares a company retains in its treasury and not issued to the public or to employees are unissued shares. Restricted shares refer to company stock used for employee incentive and compensation plans. Float refers to the number of shares actually available for trade on the open market. Outstanding shares includes all the shares issued by the company, which would be the restricted shares plus the float.

Stock Classification 3. Cyclical vs. Non-cyclical The stock prices of cyclical and non-cyclical stocks relate to how the business cycle changes. Cyclical stocks move more dramatically, both up and down, with the cycle, while non-cyclical stocks show little movement relative to the cycle.

Stock Classification 3. Cyclical vs. Non-cyclical The stock prices of cyclical and non-cyclical stocks relate to how the business cycle changes. Cyclical stocks move more dramatically, both up and down, with the cycle, while non-cyclical stocks show little movement relative to the cycle.

Stock Classification 4. According to the types of business – Basic Materials – Capital Goods – Communications – Consumer Cyclical – Energy – Financial – Health Care – Technology – Transportation

Stock Classification 4. According to the types of business – Basic Materials – Capital Goods – Communications – Consumer Cyclical – Energy – Financial – Health Care – Technology – Transportation

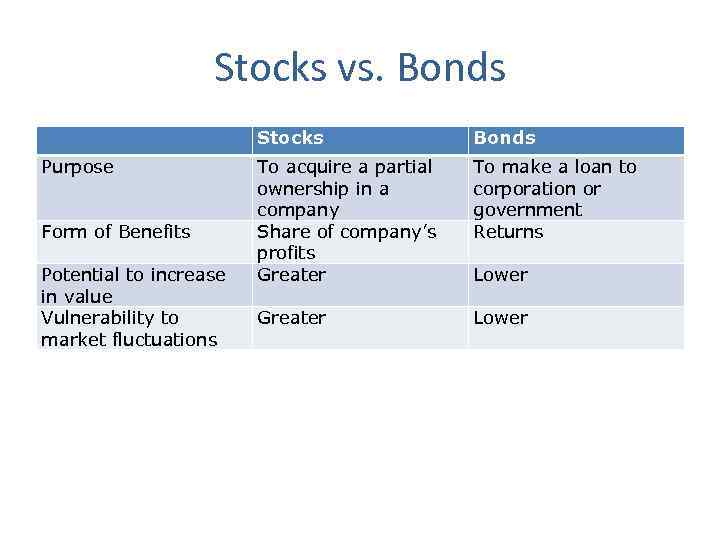

Stocks vs. Bonds Stocks Bonds Purpose To acquire a partial ownership in a company Share of company’s profits Greater To make a loan to corporation or government Returns Greater Lower Form of Benefits Potential to increase in value Vulnerability to market fluctuations Lower

Stocks vs. Bonds Stocks Bonds Purpose To acquire a partial ownership in a company Share of company’s profits Greater To make a loan to corporation or government Returns Greater Lower Form of Benefits Potential to increase in value Vulnerability to market fluctuations Lower

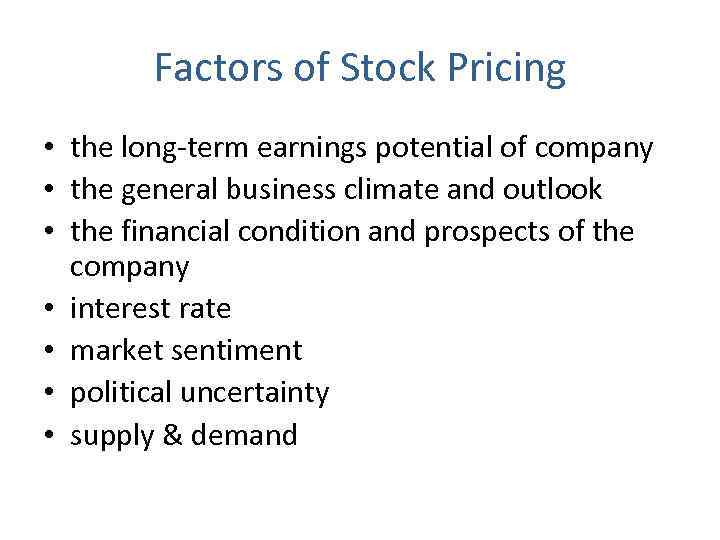

Factors of Stock Pricing • the long-term earnings potential of company • the general business climate and outlook • the financial condition and prospects of the company • interest rate • market sentiment • political uncertainty • supply & demand

Factors of Stock Pricing • the long-term earnings potential of company • the general business climate and outlook • the financial condition and prospects of the company • interest rate • market sentiment • political uncertainty • supply & demand

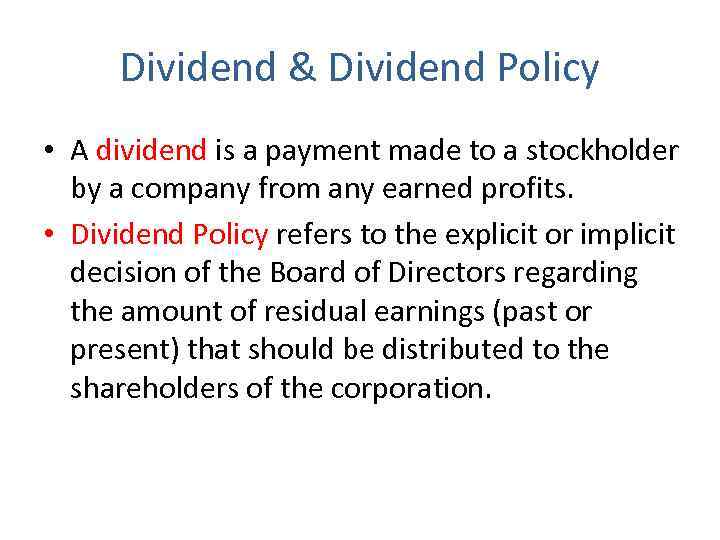

Dividend & Dividend Policy • A dividend is a payment made to a stockholder by a company from any earned profits. • Dividend Policy refers to the explicit or implicit decision of the Board of Directors regarding the amount of residual earnings (past or present) that should be distributed to the shareholders of the corporation.

Dividend & Dividend Policy • A dividend is a payment made to a stockholder by a company from any earned profits. • Dividend Policy refers to the explicit or implicit decision of the Board of Directors regarding the amount of residual earnings (past or present) that should be distributed to the shareholders of the corporation.

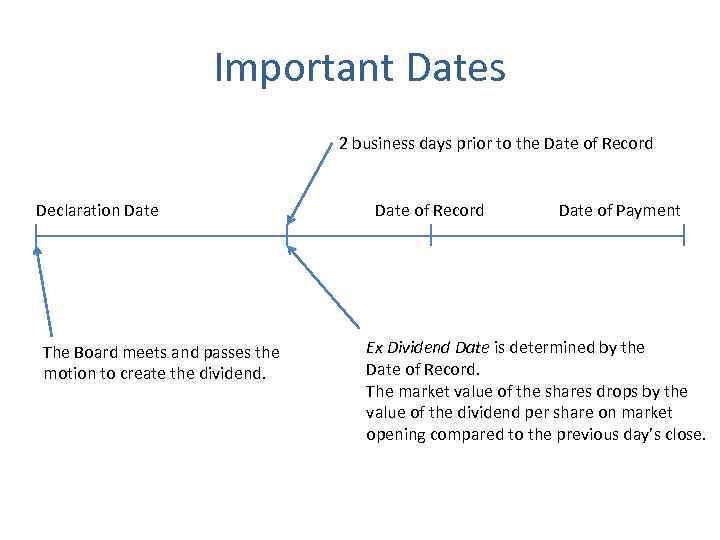

Important Dates 2 business days prior to the Date of Record Declaration Date The Board meets and passes the motion to create the dividend. Date of Record Date of Payment Ex Dividend Date is determined by the Date of Record. The market value of the shares drops by the value of the dividend per share on market opening compared to the previous day’s close.

Important Dates 2 business days prior to the Date of Record Declaration Date The Board meets and passes the motion to create the dividend. Date of Record Date of Payment Ex Dividend Date is determined by the Date of Record. The market value of the shares drops by the value of the dividend per share on market opening compared to the previous day’s close.

Types of Dividends • Cash Dividends • Property Dividends • Stock Dividend

Types of Dividends • Cash Dividends • Property Dividends • Stock Dividend

Ratios • Dividend Payout Ratio – the percentage of net income that is paid out in the form of dividend. • Dividend yield tells the investor how much he is earning on a common stock from the dividend alone based on the current market price. Dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share.

Ratios • Dividend Payout Ratio – the percentage of net income that is paid out in the form of dividend. • Dividend yield tells the investor how much he is earning on a common stock from the dividend alone based on the current market price. Dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share.

Bull & Bear Markets Bear Market Bull Market • indicates the overall market downturn • “bearish” stock • slowdown in an economy • investors unloading the stocks • decrease in stock prices • upward movement of the market • “bullish” stock • economy with reasonable interest rates and low unemployment rates • new investors willing to buy • increase in stock prices

Bull & Bear Markets Bear Market Bull Market • indicates the overall market downturn • “bearish” stock • slowdown in an economy • investors unloading the stocks • decrease in stock prices • upward movement of the market • “bullish” stock • economy with reasonable interest rates and low unemployment rates • new investors willing to buy • increase in stock prices

Stock Indexes • Stock Index - the statistical average of a particular stock exchange or sector. • Price weighted index - is based solely on the price of stocks. • Market value weighted - the index that takes into account the size of the companies. • Market-share weighted index - is based on the number of shares.

Stock Indexes • Stock Index - the statistical average of a particular stock exchange or sector. • Price weighted index - is based solely on the price of stocks. • Market value weighted - the index that takes into account the size of the companies. • Market-share weighted index - is based on the number of shares.

Stock Market “Stock market” is a term used to describe the physical location where the buying and selling of stocks take place as well as the overall activity of the market within a particular country. The correct term to be used in pertaining to the physical location for trading stocks is “stock exchange. ” Every country may have a couple of different stock exchanges that are usually traded on only one exchange although a lot of large corporations may be listed in several different locations.

Stock Market “Stock market” is a term used to describe the physical location where the buying and selling of stocks take place as well as the overall activity of the market within a particular country. The correct term to be used in pertaining to the physical location for trading stocks is “stock exchange. ” Every country may have a couple of different stock exchanges that are usually traded on only one exchange although a lot of large corporations may be listed in several different locations.

Fundamental Analysis • Fundamental analysis is a technique that attempts to determine a security’s value by focusing on underlying factors that affect a company's actual business and its future prospects. • Assumption #1: the price on the stock market does not fully reflect a stock’s “real” (intrinsic) value • Assumption #2: in the long run, the stock market will reflect the fundamentals

Fundamental Analysis • Fundamental analysis is a technique that attempts to determine a security’s value by focusing on underlying factors that affect a company's actual business and its future prospects. • Assumption #1: the price on the stock market does not fully reflect a stock’s “real” (intrinsic) value • Assumption #2: in the long run, the stock market will reflect the fundamentals

Fundamental Factors • Quantitative – capable of being measured or expressed in numerical terms. • Qualitative – related to or based on the quality or character of something, often as opposed to its size or quantity.

Fundamental Factors • Quantitative – capable of being measured or expressed in numerical terms. • Qualitative – related to or based on the quality or character of something, often as opposed to its size or quantity.

Quantitative Factors • Financial Statement – Auditor’s Report – Balance Sheet – Income Statement – Cash Flow

Quantitative Factors • Financial Statement – Auditor’s Report – Balance Sheet – Income Statement – Cash Flow

Quantitative Factors • Financial Tools – Earnings per Share (net earnings / outstanding shares) – Price to Earning Ratio (price per share / earnings per share) – Price to Sales Ratio (stock price * outstanding shares / total revenues) – Price to Book Ratio (current price per share / book value per share) – Dividend Yield (annual dividend per share / price per share) – Dividend Payout Ratio (dividend / net income) – Throughput, OE, Inventory

Quantitative Factors • Financial Tools – Earnings per Share (net earnings / outstanding shares) – Price to Earning Ratio (price per share / earnings per share) – Price to Sales Ratio (stock price * outstanding shares / total revenues) – Price to Book Ratio (current price per share / book value per share) – Dividend Yield (annual dividend per share / price per share) – Dividend Payout Ratio (dividend / net income) – Throughput, OE, Inventory

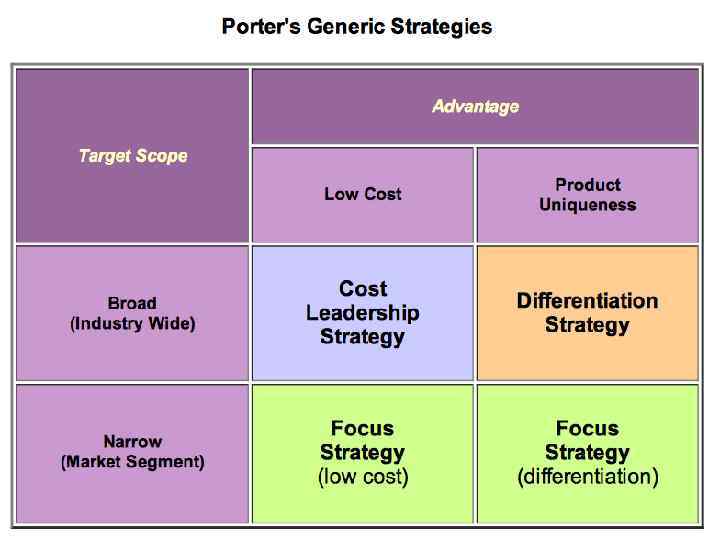

Qualitative Factors • The Company: – Business Model – Competitive Advantage – Management • The Industry: – Customers – Market Share – Industry Growth – Competition – Regulation

Qualitative Factors • The Company: – Business Model – Competitive Advantage – Management • The Industry: – Customers – Market Share – Industry Growth – Competition – Regulation

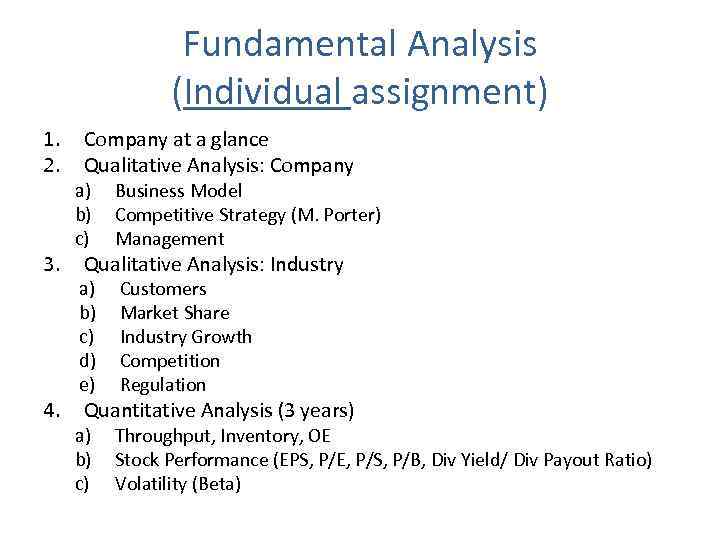

Fundamental Analysis (Individual assignment) 1. 2. 3. 4. Company at a glance Qualitative Analysis: Company a) b) c) Business Model Competitive Strategy (M. Porter) Management a) b) c) d) e) Customers Market Share Industry Growth Competition Regulation a) b) c) Throughput, Inventory, OE Stock Performance (EPS, P/E, P/S, P/B, Div Yield/ Div Payout Ratio) Volatility (Beta) Qualitative Analysis: Industry Quantitative Analysis (3 years)

Fundamental Analysis (Individual assignment) 1. 2. 3. 4. Company at a glance Qualitative Analysis: Company a) b) c) Business Model Competitive Strategy (M. Porter) Management a) b) c) d) e) Customers Market Share Industry Growth Competition Regulation a) b) c) Throughput, Inventory, OE Stock Performance (EPS, P/E, P/S, P/B, Div Yield/ Div Payout Ratio) Volatility (Beta) Qualitative Analysis: Industry Quantitative Analysis (3 years)

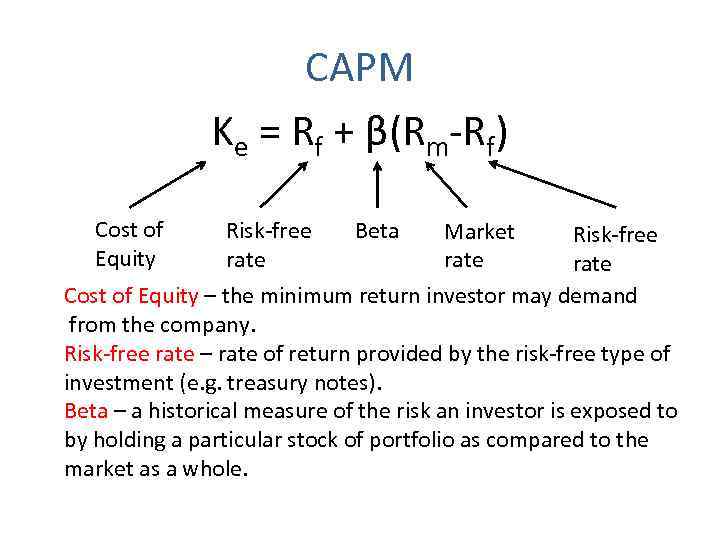

CAPM Ke = Rf + β(Rm-Rf) Cost of Equity Risk-free rate Beta Market Risk-free rate Cost of Equity – the minimum return investor may demand from the company. Risk-free rate – rate of return provided by the risk-free type of investment (e. g. treasury notes). Beta – a historical measure of the risk an investor is exposed to by holding a particular stock of portfolio as compared to the market as a whole.

CAPM Ke = Rf + β(Rm-Rf) Cost of Equity Risk-free rate Beta Market Risk-free rate Cost of Equity – the minimum return investor may demand from the company. Risk-free rate – rate of return provided by the risk-free type of investment (e. g. treasury notes). Beta – a historical measure of the risk an investor is exposed to by holding a particular stock of portfolio as compared to the market as a whole.

FOREIGN EXCHANGE MARKET

FOREIGN EXCHANGE MARKET

Currencies • Currency describes the money or official means of payment in a country or region. • A generally accepted form of money, including coins and paper notes, which is issued by a government and circulated within an economy. • The system or type of money that a country uses

Currencies • Currency describes the money or official means of payment in a country or region. • A generally accepted form of money, including coins and paper notes, which is issued by a government and circulated within an economy. • The system or type of money that a country uses

A Brief History • In 19 th century, the value of a currency was fixed at a certain amount of gold • In 1821, the UK introduced this “gold standard” • In the late 1920 s, the “gold exchange standard” was introduced • In 1931, the U. K. suspended the gold standard and many other countries followed • At the end of World War II – Bretton Woods agreement (abandoned in the 1970 s after the U. S. gave up the gold standard) • Free-floating currencies

A Brief History • In 19 th century, the value of a currency was fixed at a certain amount of gold • In 1821, the UK introduced this “gold standard” • In the late 1920 s, the “gold exchange standard” was introduced • In 1931, the U. K. suspended the gold standard and many other countries followed • At the end of World War II – Bretton Woods agreement (abandoned in the 1970 s after the U. S. gave up the gold standard) • Free-floating currencies

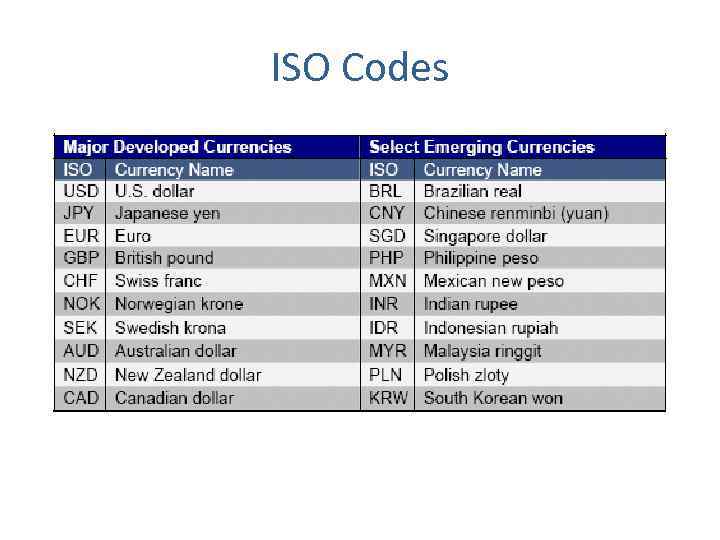

ISO Codes

ISO Codes

How is Exchange Rate Determined? 1. 2. 3. 4. 5. 6. Differentials in Inflation Differentials in Interest Rates Current-Account Deficits Public Debt Terms of Trade Political Stability and Economic Performance

How is Exchange Rate Determined? 1. 2. 3. 4. 5. 6. Differentials in Inflation Differentials in Interest Rates Current-Account Deficits Public Debt Terms of Trade Political Stability and Economic Performance

FOREX vs. Stock Market • • Different Levels Leverage Fundamental Considerations Liquidity 24 hours a day except weekends No Bear Markets in Forex Trading More Freedom

FOREX vs. Stock Market • • Different Levels Leverage Fundamental Considerations Liquidity 24 hours a day except weekends No Bear Markets in Forex Trading More Freedom

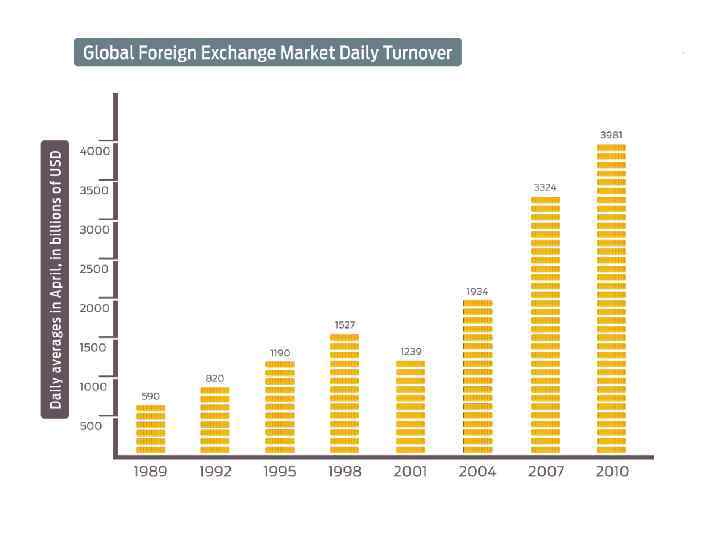

Factors of Turnover Increase • the growing importance of foreign exchange as an asset class • the increased trading activity of highfrequency traders • the emergence of retail investors as an important market segment • the growth of electronic execution (up to $150 billion per day) has lowered transaction costs

Factors of Turnover Increase • the growing importance of foreign exchange as an asset class • the increased trading activity of highfrequency traders • the emergence of retail investors as an important market segment • the growth of electronic execution (up to $150 billion per day) has lowered transaction costs

Leverage • Leverage is a loan that is provided to an investor by the market-maker (broker) that is handling his or her account. • Usually, the amount of leverage provided is either 50: 1, 100: 1 or 200: 1, depending on the broker and the size of the position the investor is trading. • The use of leverage is allowed due to the small fluctuations (around 1% trough the trading day)

Leverage • Leverage is a loan that is provided to an investor by the market-maker (broker) that is handling his or her account. • Usually, the amount of leverage provided is either 50: 1, 100: 1 or 200: 1, depending on the broker and the size of the position the investor is trading. • The use of leverage is allowed due to the small fluctuations (around 1% trough the trading day)

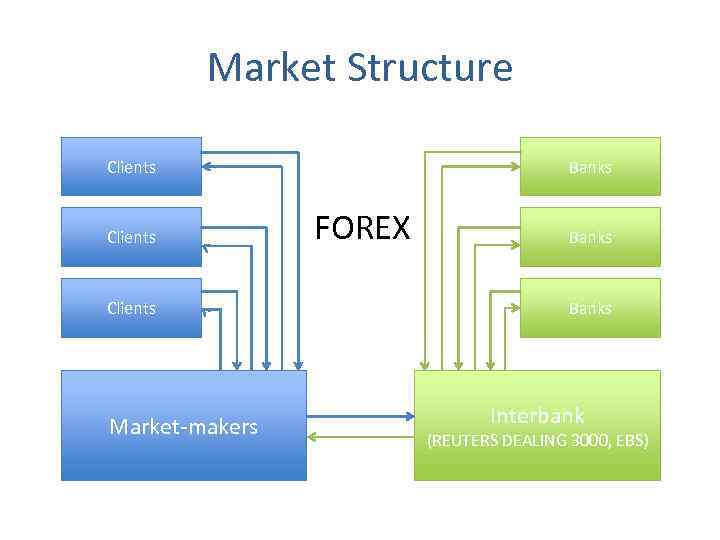

Market Structure Clients Market-makers Banks FOREX Banks Interbank (REUTERS DEALING 3000, EBS)

Market Structure Clients Market-makers Banks FOREX Banks Interbank (REUTERS DEALING 3000, EBS)

Market Participants • Speculators (fast profits due to exchange rates changes) • Banks (currency exchange) • Hedgers (companies, which take costs in one currency and get revenues in another, hence is willing to hedge currency risk) • Investors (Foreign Direct Investments)

Market Participants • Speculators (fast profits due to exchange rates changes) • Banks (currency exchange) • Hedgers (companies, which take costs in one currency and get revenues in another, hence is willing to hedge currency risk) • Investors (Foreign Direct Investments)

Quotations Example: EUR/USD 1. 2931 basis point (pip) Direct exchange rate (for euro) Indirect exchange rate (US dollar) Pip is the smallest price change that a given exchange rate can make. Since most major currency pairs are priced to four decimal places, the smallest change is that of the last decimal point - for most pairs this is the equivalent of 1/100 of one percent, or one basis point. • Bid is the price at which a market maker is willing to buy a security. • Ask is the price a seller is willing to accept for a security, also known as the offer price. • Spread = Bid - Ask • •

Quotations Example: EUR/USD 1. 2931 basis point (pip) Direct exchange rate (for euro) Indirect exchange rate (US dollar) Pip is the smallest price change that a given exchange rate can make. Since most major currency pairs are priced to four decimal places, the smallest change is that of the last decimal point - for most pairs this is the equivalent of 1/100 of one percent, or one basis point. • Bid is the price at which a market maker is willing to buy a security. • Ask is the price a seller is willing to accept for a security, also known as the offer price. • Spread = Bid - Ask • •

Position In investing, any trade that has been established, or entered, that has yet to be closed with an opposing trade. An open position can exist following a buy (long) position, or a sell (short) position. In either case, the position will remain open until an opposing trade has taken place.

Position In investing, any trade that has been established, or entered, that has yet to be closed with an opposing trade. An open position can exist following a buy (long) position, or a sell (short) position. In either case, the position will remain open until an opposing trade has taken place.

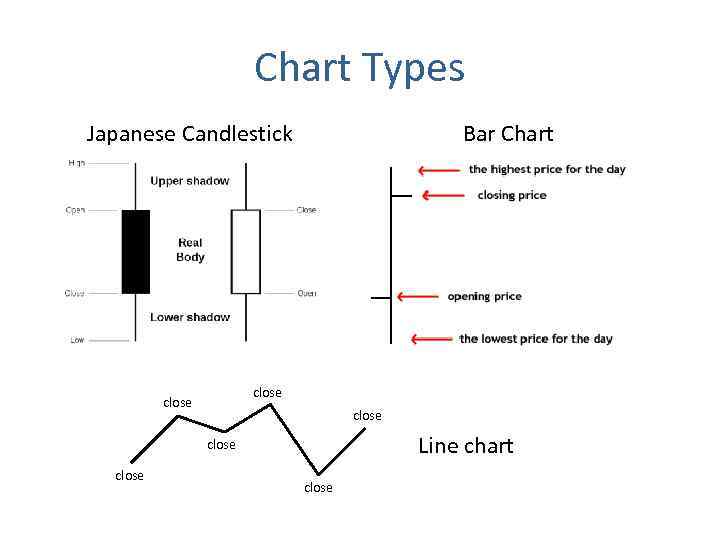

Chart Types Bar Chart Japanese Candlestick close Line chart close

Chart Types Bar Chart Japanese Candlestick close Line chart close

Market Types • • The spot market The futures market The options market The derivatives market – forward contracts – foreign-exchange swaps – forward rate agreement – barrier options

Market Types • • The spot market The futures market The options market The derivatives market – forward contracts – foreign-exchange swaps – forward rate agreement – barrier options

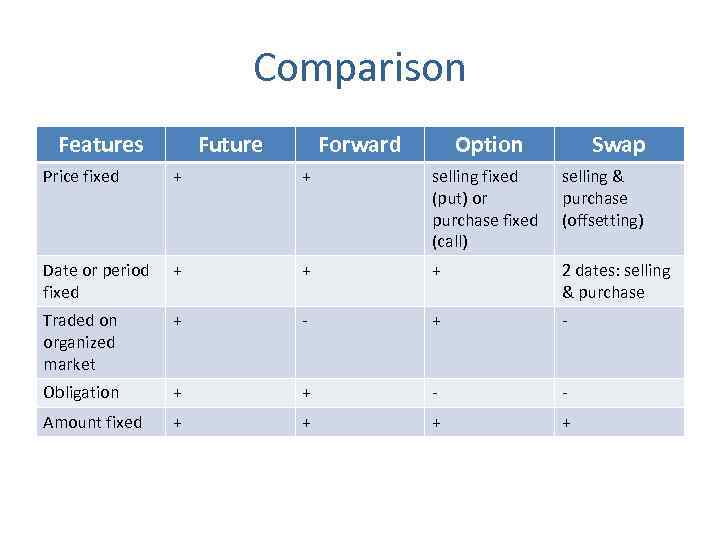

Comparison Features Future Forward Option Swap Price fixed + + selling fixed (put) or purchase fixed (call) selling & purchase (offsetting) Date or period fixed + + + 2 dates: selling & purchase Traded on organized market + - Obligation + + - - Amount fixed + +

Comparison Features Future Forward Option Swap Price fixed + + selling fixed (put) or purchase fixed (call) selling & purchase (offsetting) Date or period fixed + + + 2 dates: selling & purchase Traded on organized market + - Obligation + + - - Amount fixed + +

Technical Analysis • Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. • Technical analysts believe that the historical performance of stocks and markets are indications of future performance.

Technical Analysis • Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. • Technical analysts believe that the historical performance of stocks and markets are indications of future performance.

Technical Analysis Basic assumptions: • The Market Discounts Everything • Price Moves in Trends • History Tends to Repeat Itself

Technical Analysis Basic assumptions: • The Market Discounts Everything • Price Moves in Trends • History Tends to Repeat Itself

Technical Analysis Tools 1. Graphical analysis – – trend lines channel and trading range support and resistance levels figures of technical analysis 2. Indicators – trend-following – oscillators

Technical Analysis Tools 1. Graphical analysis – – trend lines channel and trading range support and resistance levels figures of technical analysis 2. Indicators – trend-following – oscillators

COMMODITY MARKET

COMMODITY MARKET

Commodity • Commodity is a product having commercial value that can be produced, bought, sold, and consumed. • Commodity includes all kinds of goods. • Every kind of movable property other than actionable claims, money and securities.

Commodity • Commodity is a product having commercial value that can be produced, bought, sold, and consumed. • Commodity includes all kinds of goods. • Every kind of movable property other than actionable claims, money and securities.

Commodity Market Types • Spot (“physical” or “cash”) is the market in which goods are sold for cash and delivered immediately. Contracts bought and sold on these markets are immediately effective. • Forward is the market dealing in commodities for future (forward) delivery at prices agreedupon today (date of making the contract). Forward trading is used as a means of hedging against sharp fluctuations in their prices.

Commodity Market Types • Spot (“physical” or “cash”) is the market in which goods are sold for cash and delivered immediately. Contracts bought and sold on these markets are immediately effective. • Forward is the market dealing in commodities for future (forward) delivery at prices agreedupon today (date of making the contract). Forward trading is used as a means of hedging against sharp fluctuations in their prices.

Commodity Exchange • Commodity exchange is an association or a company or any other body corporate that is organizing futures trading in commodities. • Commodities exchange also refers to the physical center where trading takes place. • Examples: Chicago Board of Trade (CBOT), London Metal Exchange (LME), New York Mercantile Exchange (NYMEX), Tokyo Commodity Exchange (TOCOM)

Commodity Exchange • Commodity exchange is an association or a company or any other body corporate that is organizing futures trading in commodities. • Commodities exchange also refers to the physical center where trading takes place. • Examples: Chicago Board of Trade (CBOT), London Metal Exchange (LME), New York Mercantile Exchange (NYMEX), Tokyo Commodity Exchange (TOCOM)