880bec1c640086fa8d70fe80d95a46ea.ppt

- Количество слайдов: 41

STOCK EXCHANGE

STOCK EXCHANGE

WHAT IS STOCK EXCHANGE Stock exchange is that place where trading of shares is done in terms of sale and purchase.

WHAT IS STOCK EXCHANGE Stock exchange is that place where trading of shares is done in terms of sale and purchase.

INTRODUCTION : • There are 23 stock exchanges in the India. Mumbai's (earlier known as Bombay), Bombay Stock Exchange is the largest, with over 6, 000 stocks listed. The BSE accounts for over two thirds of the total trading volume in the country. Established in 1875, the exchange is also the oldest in Asia. Among the twenty-two Stock Exchanges recognised by the Government of India under the Securities Contracts (Regulation) Act, 1956, it was the first one to be recognised and it is the only one that had the privilege of getting permanent recognition ab-initio.

INTRODUCTION : • There are 23 stock exchanges in the India. Mumbai's (earlier known as Bombay), Bombay Stock Exchange is the largest, with over 6, 000 stocks listed. The BSE accounts for over two thirds of the total trading volume in the country. Established in 1875, the exchange is also the oldest in Asia. Among the twenty-two Stock Exchanges recognised by the Government of India under the Securities Contracts (Regulation) Act, 1956, it was the first one to be recognised and it is the only one that had the privilege of getting permanent recognition ab-initio.

Name of Indian stock exchange: • • • 1. Bombay stock exchange 2. national stock exchange(Mumbai) 3. Banglore stock exchange 4. Utter pradesh stock exchange(kanpur) 5. Magadh stock exchange(Patna) 6. Ahmedabad stock exchange 7. vadodara stock exchange(Baroda) 8. Bhubaneswar stock exchange 9. Calcutta stock exchange(kolkata) 10. madras stock exchange

Name of Indian stock exchange: • • • 1. Bombay stock exchange 2. national stock exchange(Mumbai) 3. Banglore stock exchange 4. Utter pradesh stock exchange(kanpur) 5. Magadh stock exchange(Patna) 6. Ahmedabad stock exchange 7. vadodara stock exchange(Baroda) 8. Bhubaneswar stock exchange 9. Calcutta stock exchange(kolkata) 10. madras stock exchange

Cont……. • • • 11. Cochin stock exchange 12. coimbatore stock exchange 13. Gauhati stock exchange 14. Hydrabad stock exchange 15. Madhya pradesh stock exchange(indore) 16. Jaipur stock exchange 17. Ludhina stock exchange 18. Mangalore stock exchange 19. Pune stock exchange 20. saurashtrakutch stock exchange

Cont……. • • • 11. Cochin stock exchange 12. coimbatore stock exchange 13. Gauhati stock exchange 14. Hydrabad stock exchange 15. Madhya pradesh stock exchange(indore) 16. Jaipur stock exchange 17. Ludhina stock exchange 18. Mangalore stock exchange 19. Pune stock exchange 20. saurashtrakutch stock exchange

Cont……. • • • Bombay stock exchange : it has 30 companies sripted. Name: 1. ACC 2. BAJAJ 3. AIRTEL 4. BHEI 5. CIPLA 6. DLF 7. GRASIM 8. GUJRAT AMBUJA 9. HDFC 10. HDFC BANK

Cont……. • • • Bombay stock exchange : it has 30 companies sripted. Name: 1. ACC 2. BAJAJ 3. AIRTEL 4. BHEI 5. CIPLA 6. DLF 7. GRASIM 8. GUJRAT AMBUJA 9. HDFC 10. HDFC BANK

CONT…… • • • 11. HERO HONDA 12. HINDALCO 13. HUL 14. ICICI BANK 15. INFICYS 16. ITC 17. L&T 18. MARUTI 19. NTPC 20. ONGC

CONT…… • • • 11. HERO HONDA 12. HINDALCO 13. HUL 14. ICICI BANK 15. INFICYS 16. ITC 17. L&T 18. MARUTI 19. NTPC 20. ONGC

CONT…… • • • 21. RANBAXY 22. RELIANCE COMMUNICATION 23. RELIANCE ENERGY 24. RIL 25. SATYAM 26. SBI 27. TCS 28. TATA MOTERS 29. TATA STEEL 30. WIPRO

CONT…… • • • 21. RANBAXY 22. RELIANCE COMMUNICATION 23. RELIANCE ENERGY 24. RIL 25. SATYAM 26. SBI 27. TCS 28. TATA MOTERS 29. TATA STEEL 30. WIPRO

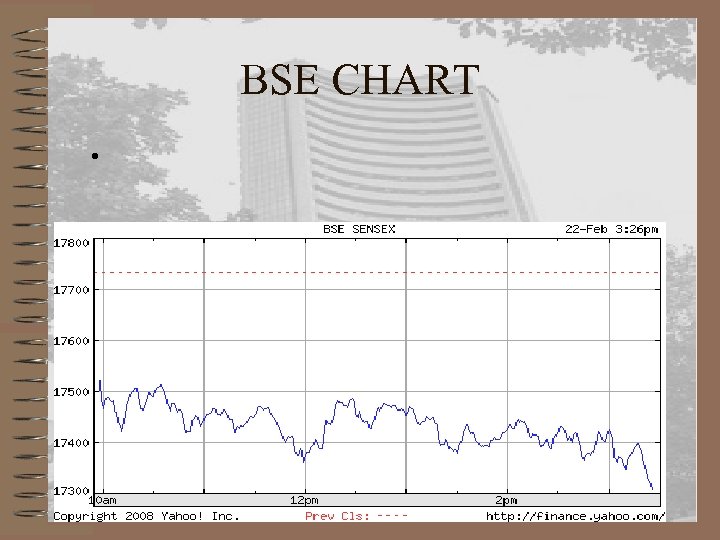

BSE CHART •

BSE CHART •

NSE • The National Stock Exchange (NSE), located in Bombay, is India's first debt market. It was set up in 1993 to encourage stock exchange reform through system modernization and competition. It opened for trading in mid-1994. It was recently accorded recognition as a stock exchange by the Department of Company Affairs. The instruments traded are, treasury bills, government security and bonds issued by public sector companies

NSE • The National Stock Exchange (NSE), located in Bombay, is India's first debt market. It was set up in 1993 to encourage stock exchange reform through system modernization and competition. It opened for trading in mid-1994. It was recently accorded recognition as a stock exchange by the Department of Company Affairs. The instruments traded are, treasury bills, government security and bonds issued by public sector companies

CONT………. • The Organisation: The National Stock Exchange of India Limited has genesis in the report of the High Powered Study Group on Establishment of New Stock Exchanges, which recommended promotion of a National Stock Exchange by financial institutions (FIs) to provide access to investors from all across the country on an equal footing.

CONT………. • The Organisation: The National Stock Exchange of India Limited has genesis in the report of the High Powered Study Group on Establishment of New Stock Exchanges, which recommended promotion of a National Stock Exchange by financial institutions (FIs) to provide access to investors from all across the country on an equal footing.

CONT……… • Based on the recommendations, NSE was promoted by leading Financial Institutions at the behest of the Government of India and was incorporated in November 1992 as a taxpaying company unlike other stock exchanges in the country

CONT……… • Based on the recommendations, NSE was promoted by leading Financial Institutions at the behest of the Government of India and was incorporated in November 1992 as a taxpaying company unlike other stock exchanges in the country

SPECULATION : • Definition : it involves the buying, holding, selling, shortterm selling of stocks, bonds. commodities, currencies, collectibles or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via method like dividends or interest.

SPECULATION : • Definition : it involves the buying, holding, selling, shortterm selling of stocks, bonds. commodities, currencies, collectibles or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via method like dividends or interest.

Kinds of speculation • Bull Market (Tejiwala): In case of that they purchase the shares at current prices to sell at a higher price in the near future and makes a profit if his expectations come true. he is also called a long buyer. • Bear Market (Mandiwala) : He sells security in the hope that he will be able to buy them back at lesser price. It is also called “short selling”.

Kinds of speculation • Bull Market (Tejiwala): In case of that they purchase the shares at current prices to sell at a higher price in the near future and makes a profit if his expectations come true. he is also called a long buyer. • Bear Market (Mandiwala) : He sells security in the hope that he will be able to buy them back at lesser price. It is also called “short selling”.

Cont……………… • Lame duck : When a bear has made contracts to sell securities, find it difficult to meet his commitment due to non-availability of security, , they always struggling. . • Stag : He is that type of speculator who applies for a large number of a shares in a new issue with the intention of selling them at a premium. He is bullish and very cautious.

Cont……………… • Lame duck : When a bear has made contracts to sell securities, find it difficult to meet his commitment due to non-availability of security, , they always struggling. . • Stag : He is that type of speculator who applies for a large number of a shares in a new issue with the intention of selling them at a premium. He is bullish and very cautious.

Forex Market • • • Mar 19, 4: 30 P. M. Currency. IN ; 40. 45(US. DOLLAR) Euro 63. 48 GB Pound 81. 20 Japanese Yen 0. 4072 S'pore Dollar 29. 160

Forex Market • • • Mar 19, 4: 30 P. M. Currency. IN ; 40. 45(US. DOLLAR) Euro 63. 48 GB Pound 81. 20 Japanese Yen 0. 4072 S'pore Dollar 29. 160

BENEFITS OF STOCK EXCHANGE • FROM THE POINT OF VIEW OF COMMUNITY: • 1. It assist the economis development by providing a body of interested investors. • 2. it uploads the position of superior enterprises and assist them in raising further funds. • 3. It encourages capital formation • 4. Government can undertake projects of national importance and social value raising funds through the sale of its securities on the stock exchange. • 5. It is the stock exchanges that central bank of a country can control credit by undertaking open market operations (purchase and sale of securities)

BENEFITS OF STOCK EXCHANGE • FROM THE POINT OF VIEW OF COMMUNITY: • 1. It assist the economis development by providing a body of interested investors. • 2. it uploads the position of superior enterprises and assist them in raising further funds. • 3. It encourages capital formation • 4. Government can undertake projects of national importance and social value raising funds through the sale of its securities on the stock exchange. • 5. It is the stock exchanges that central bank of a country can control credit by undertaking open market operations (purchase and sale of securities)

FROM THE COMPANY POINT OF VIEW • 1. A company whose shares quoted on stock exchange they enjoy better reputation and credit. • 2. The market for the shares of such a company is naturally widened. • 3. The market price of securities is likely to be higher in relation to its earnings, dividends and property values. This raises the bargaining power of the company in the event of a takeover, merger or amalgamation.

FROM THE COMPANY POINT OF VIEW • 1. A company whose shares quoted on stock exchange they enjoy better reputation and credit. • 2. The market for the shares of such a company is naturally widened. • 3. The market price of securities is likely to be higher in relation to its earnings, dividends and property values. This raises the bargaining power of the company in the event of a takeover, merger or amalgamation.

FROM THE INVESTORS POINT OF VIEW • 1. Liquidity of the investment is increased • 2. The securities dealt on a stock exchange are good collateral security for loans. • 3. The stock exchange safeguards interests of investors through strict enforcement of rules and regulations. • 4. The present net worth of investments can be easily known by the daily quotations. • 5. His risk is considerably less when he holds or purchases listed securities.

FROM THE INVESTORS POINT OF VIEW • 1. Liquidity of the investment is increased • 2. The securities dealt on a stock exchange are good collateral security for loans. • 3. The stock exchange safeguards interests of investors through strict enforcement of rules and regulations. • 4. The present net worth of investments can be easily known by the daily quotations. • 5. His risk is considerably less when he holds or purchases listed securities.

ROLE PLAYER • EXTERNAL: --- • 1. SHAREHOLDER • 2. DEBENTURE HOLDER

ROLE PLAYER • EXTERNAL: --- • 1. SHAREHOLDER • 2. DEBENTURE HOLDER

SHAREHOLDER • Shareholders are divided into two parts • 1. Preference shareholder: Preference shareholder are those which have preferential right to the payment of dividend during the life time of the company, and a preferential right to the return of the capital when the company is wound up.

SHAREHOLDER • Shareholders are divided into two parts • 1. Preference shareholder: Preference shareholder are those which have preferential right to the payment of dividend during the life time of the company, and a preferential right to the return of the capital when the company is wound up.

CHARACTERISTICS OF PREF. SHAREHOLDER • 1. The dividend on them is fixed by the articles of the company. • 2. They get their fixed rate of dividend before any dividend is distributed among the other class of shareholders. • 3. At the time of winding up of the company, the preference shareholder must be paid back their capital before anything is paid to the ordinary shareholders.

CHARACTERISTICS OF PREF. SHAREHOLDER • 1. The dividend on them is fixed by the articles of the company. • 2. They get their fixed rate of dividend before any dividend is distributed among the other class of shareholders. • 3. At the time of winding up of the company, the preference shareholder must be paid back their capital before anything is paid to the ordinary shareholders.

KINDS OF PREF. SHAREHOLDER • 1. Comulative shareholder: These shares are entitled to fixed dividends whethere are profits or loss. If profits are not sufficient to pay in a particular year then that will pay on next year. • 2. Non comulative pref. share: These shares cannot claim arrears of dividends of any year (if not paid due to insufficiency of pfofits ) out of rofits of subsequent year.

KINDS OF PREF. SHAREHOLDER • 1. Comulative shareholder: These shares are entitled to fixed dividends whethere are profits or loss. If profits are not sufficient to pay in a particular year then that will pay on next year. • 2. Non comulative pref. share: These shares cannot claim arrears of dividends of any year (if not paid due to insufficiency of pfofits ) out of rofits of subsequent year.

Cont……. • 3. Participating pref. Shares: These shares receives a fixed rate of dividend in priority to ordinary shares and further, the right to participate in balance of profits in an agreed proportion together with ordinary shares. • 4. Redeemable pref. shares: These are shares which can be purchased back by the company. The company researves its rights to call back or purchased these shares at any time.

Cont……. • 3. Participating pref. Shares: These shares receives a fixed rate of dividend in priority to ordinary shares and further, the right to participate in balance of profits in an agreed proportion together with ordinary shares. • 4. Redeemable pref. shares: These are shares which can be purchased back by the company. The company researves its rights to call back or purchased these shares at any time.

EQUITY SHARES • All shares which are not preference shares are equity shares. These shares do not have a fixed rate of dividend, they are always irredeemable and their holders have normal voting rights. • They are also the owners of the company. • They take dividend

EQUITY SHARES • All shares which are not preference shares are equity shares. These shares do not have a fixed rate of dividend, they are always irredeemable and their holders have normal voting rights. • They are also the owners of the company. • They take dividend

DEBENTURES • A document under the company seal which provides for the payment of a principal sum and interest there on at regular intervals which is usually secured by a fixed or floating charge on the company’s property or undertaking which acknowledges a loan to the company.

DEBENTURES • A document under the company seal which provides for the payment of a principal sum and interest there on at regular intervals which is usually secured by a fixed or floating charge on the company’s property or undertaking which acknowledges a loan to the company.

INTERNAL PLAYERS • The members of the stock exchange can be divided into two parts: • A. Broker: He is a commission agent who transacts business in securities on behalf of nonmembers. They may have number of sub-brokers to canvass and secure business for them. • B. Jobber: He is an independent dealer securities. He purchase and sells securities in his own name. He is not allowed to deal with nonmembers directly. He works for profit.

INTERNAL PLAYERS • The members of the stock exchange can be divided into two parts: • A. Broker: He is a commission agent who transacts business in securities on behalf of nonmembers. They may have number of sub-brokers to canvass and secure business for them. • B. Jobber: He is an independent dealer securities. He purchase and sells securities in his own name. He is not allowed to deal with nonmembers directly. He works for profit.

Tarawaniwala • Non-members : The following categories of non members are also permitted to enter trading hall and transact business on the behalf of members. • Authorized clerks: They are the assistant or agents. They buy or sell on the behalf of employers. They can not transact business on their own account. • Remisers: They are the sub-brokers. He is also called the half commission men.

Tarawaniwala • Non-members : The following categories of non members are also permitted to enter trading hall and transact business on the behalf of members. • Authorized clerks: They are the assistant or agents. They buy or sell on the behalf of employers. They can not transact business on their own account. • Remisers: They are the sub-brokers. He is also called the half commission men.

CAUSES OF PRICE FLUCTUATION • • 1. DAMAND SUPPLY 2. BANK RATE 3. SPECULATIVE PRESSURE 4. ACTIONS OF UNDERWRITERS AND OTHER FINANCIAL INSTITUTIONS • 5. CHANGE IN COMPANY’S BOARD OF DIRECTORS • 6. FINANCIAL POSITION OF THE COMPANY

CAUSES OF PRICE FLUCTUATION • • 1. DAMAND SUPPLY 2. BANK RATE 3. SPECULATIVE PRESSURE 4. ACTIONS OF UNDERWRITERS AND OTHER FINANCIAL INSTITUTIONS • 5. CHANGE IN COMPANY’S BOARD OF DIRECTORS • 6. FINANCIAL POSITION OF THE COMPANY

CONT……. . • • • 7. TRADE CYCLE 8. POLITICAL FACTORS 9. SYMPATHETIC FLUCTUATIONS 10. OTHER FACTORS: A. EXPECTED MONSOON B. PERSONAL HEALTH OF HEAD OF GOVERNMENT OR CHAIRMAN OF THE COMPANY • C. OIL PRICES IN THE INTERNATIONAL MARKET.

CONT……. . • • • 7. TRADE CYCLE 8. POLITICAL FACTORS 9. SYMPATHETIC FLUCTUATIONS 10. OTHER FACTORS: A. EXPECTED MONSOON B. PERSONAL HEALTH OF HEAD OF GOVERNMENT OR CHAIRMAN OF THE COMPANY • C. OIL PRICES IN THE INTERNATIONAL MARKET.

CONT……. • D. CHANGES IN EXCHANGE RATE • E. BORDER TENSION • F. STOCK BROKERS SCAM LIKE HARSHAD MEHTA AND KETHAN PAREKH • G. STRIKES AND LOCK-OUT OF THE COMPANY. • H. NEW BUDGET PROPOSALS • I. LOBERLIZATION AND PRIVATIZATION OF THE COMPANY.

CONT……. • D. CHANGES IN EXCHANGE RATE • E. BORDER TENSION • F. STOCK BROKERS SCAM LIKE HARSHAD MEHTA AND KETHAN PAREKH • G. STRIKES AND LOCK-OUT OF THE COMPANY. • H. NEW BUDGET PROPOSALS • I. LOBERLIZATION AND PRIVATIZATION OF THE COMPANY.

SEBI • It was constituted and made a statutory body by SEBI act 1992. With the coming into effect of SEBI, some of the powers and function exercised by the central government, in respect of regulation of stock exchanges were transferred to the SEBI.

SEBI • It was constituted and made a statutory body by SEBI act 1992. With the coming into effect of SEBI, some of the powers and function exercised by the central government, in respect of regulation of stock exchanges were transferred to the SEBI.

OBJECTIVES OF SEBI • 1. Registring and regulating the working of stock brokers, sub-brokers, share transfer agents, underwriters………. who may be associated securities market in any manner. • 2. Registering and regulating the working of collective investment scheme including mutual funds. • 3. Prohibiting insider trading in securities. • 4. Regulating substantial acquisition of shares and takeovers of companies.

OBJECTIVES OF SEBI • 1. Registring and regulating the working of stock brokers, sub-brokers, share transfer agents, underwriters………. who may be associated securities market in any manner. • 2. Registering and regulating the working of collective investment scheme including mutual funds. • 3. Prohibiting insider trading in securities. • 4. Regulating substantial acquisition of shares and takeovers of companies.

Cont…… • 5. Calling for information from, undertaking inspection, conducting inquiries and audits of stock exchanges and intermediaries and self regulatory organizations in the securities market. • 6. Performing such function and exercising such powers under the provisins of the capital issues(control) act 1947 and SCRA 1956, as may be delegated to it by the central government. • 7. Performing such other functions as may be prescribed.

Cont…… • 5. Calling for information from, undertaking inspection, conducting inquiries and audits of stock exchanges and intermediaries and self regulatory organizations in the securities market. • 6. Performing such function and exercising such powers under the provisins of the capital issues(control) act 1947 and SCRA 1956, as may be delegated to it by the central government. • 7. Performing such other functions as may be prescribed.

BUY BACK SHARES • In simple term when company re-purchase of its own shares that is called buy back shares.

BUY BACK SHARES • In simple term when company re-purchase of its own shares that is called buy back shares.

MODESS OF REPURCHASE • BASICALLY THERE ARE TWO MODES OF REPURCHASE: • 1. Open market repurchase: company makes an announcement regarding the repurchase of a specified number of shares. The purchases are made anonymously through a broker from the secondary market over a specified period of time. • 2. tender offers: this is basically two types • A. Fixed price tender offers: company announces a fixed price at which it is willing to buy its shares, a maximum number of shares that it will commit to buy and an expiration date for the offer. The offer price is premium over the market price to encourage the shareholder.

MODESS OF REPURCHASE • BASICALLY THERE ARE TWO MODES OF REPURCHASE: • 1. Open market repurchase: company makes an announcement regarding the repurchase of a specified number of shares. The purchases are made anonymously through a broker from the secondary market over a specified period of time. • 2. tender offers: this is basically two types • A. Fixed price tender offers: company announces a fixed price at which it is willing to buy its shares, a maximum number of shares that it will commit to buy and an expiration date for the offer. The offer price is premium over the market price to encourage the shareholder.

Cont…………. • Dutch auction tender offers : In a dutch auction, the company announces the maximum number of shares it wishes to buy and a range of prices at which it will entertain offers. Shareholders who choose to participate must then select a single price in this range at which to tender their shares.

Cont…………. • Dutch auction tender offers : In a dutch auction, the company announces the maximum number of shares it wishes to buy and a range of prices at which it will entertain offers. Shareholders who choose to participate must then select a single price in this range at which to tender their shares.

RULES FOR REPURCHASE UNDER SEBI ACT 1988 • 1. Regulations cover only the listed securities of the company • 2. In case of purchase through the stock exchange an offer for buy back will not remain open for more than 30 days. • 3. Buy back through negotiated deals, spot transactions or private arrangements is not permitted. • 4. In the purchases made through stock exchange, the details under the buy back scheme shall be made available to the stock exchange on daily basis: the details in turn shall be made available to public regularly.

RULES FOR REPURCHASE UNDER SEBI ACT 1988 • 1. Regulations cover only the listed securities of the company • 2. In case of purchase through the stock exchange an offer for buy back will not remain open for more than 30 days. • 3. Buy back through negotiated deals, spot transactions or private arrangements is not permitted. • 4. In the purchases made through stock exchange, the details under the buy back scheme shall be made available to the stock exchange on daily basis: the details in turn shall be made available to public regularly.

HOW RATING IS GIVEN TO THE COMPANY? • Basically rating is given after see the company 'image, management quality, assets quality, auditors quality, accounting accuracy. Rating is not fixed, it may be change. The rating grades are: • AAA: HIGHEST SAFTY • AA: HIGH SAFTY • A: ADEQUATE SAFTY • BBB: MODERATE SAFTY • BB: IN ADEQUATE SAFTY • BC&D: HIGH RISK AND DEFAULT

HOW RATING IS GIVEN TO THE COMPANY? • Basically rating is given after see the company 'image, management quality, assets quality, auditors quality, accounting accuracy. Rating is not fixed, it may be change. The rating grades are: • AAA: HIGHEST SAFTY • AA: HIGH SAFTY • A: ADEQUATE SAFTY • BBB: MODERATE SAFTY • BB: IN ADEQUATE SAFTY • BC&D: HIGH RISK AND DEFAULT

CREDIT RATING AGENCY IN INDIA • • 1. CRISIL 2. ICRA 3. CARE 4. DPCR

CREDIT RATING AGENCY IN INDIA • • 1. CRISIL 2. ICRA 3. CARE 4. DPCR

conclusion • THE STOCK EXCHANGE IS CONSIDERED TO BE THE BAROMETER OF ECONOMIC ACTIVITY.

conclusion • THE STOCK EXCHANGE IS CONSIDERED TO BE THE BAROMETER OF ECONOMIC ACTIVITY.