6b0153857fe9118991f60d93c67b9e6e.ppt

- Количество слайдов: 64

Stock Certificate Dematerialization Presentation and Roundtable January 11, 2007

William J. Roberston Vice President JPMorgan Chase 2

Program Agenda • Introduction • Overview • SEC update • DTC update • DRS Sub-Committee update • Frequently Asked Questions & Answers 3

Event Participants William J. Robertson - JP Morgan Chase Lawrence Morillo - Pershing LLC Susan Petersen - SEC Joseph Trezza - DTCC Kathryn Sevcik - Wells Fargo Shareholder Services Kevin Mc. Cosker - Pershing LLC Armando Di Biase - The Bank of New York Donna Fremgen - Merrill Lynch John Hosty - The Northern Trust Company 4

Lawrence Morillo Managing Director Pershing LLC Chairman SIFMA Operations Legal and Regulatory Committee 5

Physical Securities • Objective – Eliminate the issuance, transfer and retention of paper securities certificates • Industry costs - $250 million – Lost and stolen - $49. 4 million • Alternatives to physical securities – Hold in street name – Book-entry only (municipals, governments, options) – Direct Registration System (DRS) 6

Physical Securities • Direct Registration System (DRS) – Security is registered in customer name on the Issuer's books – Either Company or its Transfer Agent holds the security in book-entry form – Customer receives mailings from issuer • • • Statement of ownership Periodic account statement Dividends Annual Reports Proxies Other 7

Physical Securities • States/Other Jurisdictions – Delaware - Industry Milestone – August 1, 2005 • Eliminates requirement to provide physical certificates – Corporations can issue certificates, but are not obligated – Arizona, California, Louisiana, Missouri completed – Puerto Rico – requires change • Limited participation among firms • Contacting firms in Puerto Rico to solicit support 8

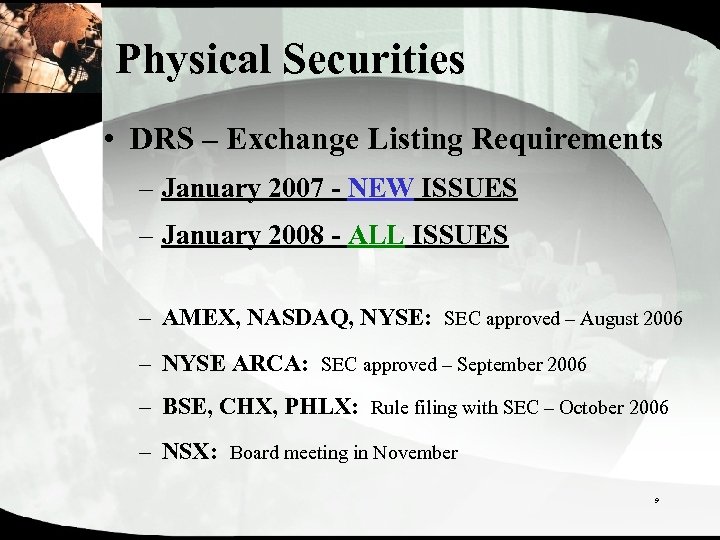

Physical Securities • DRS – Exchange Listing Requirements – January 2007 - NEW ISSUES – January 2008 - ALL ISSUES – AMEX, NASDAQ, NYSE: SEC approved – August 2006 – NYSE ARCA: SEC approved – September 2006 – BSE, CHX, PHLX: Rule filing with SEC – October 2006 – NSX: Board meeting in November 9

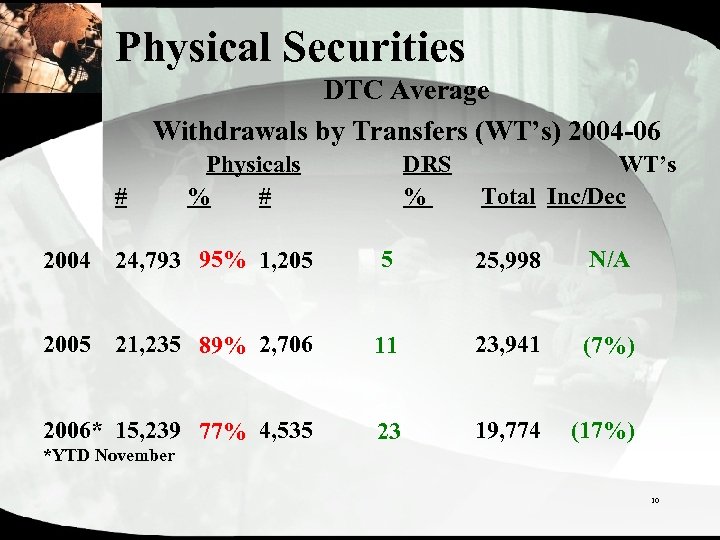

Physical Securities DTC Average Withdrawals by Transfers (WT’s) 2004 -06 # Physicals % # DRS % WT’s Total Inc/Dec 2004 24, 793 95% 1, 205 5 25, 998 N/A 2005 21, 235 89% 2, 706 11 23, 941 (7%) 2006* 15, 239 77% 4, 535 23 19, 774 (17%) *YTD November 10

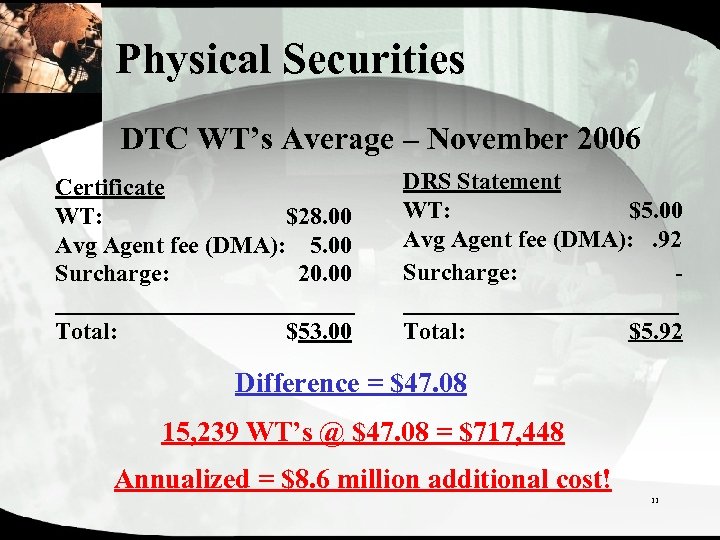

Physical Securities DTC WT’s Average – November 2006 Certificate WT: $28. 00 Avg Agent fee (DMA): 5. 00 Surcharge: 20. 00 _____________ Total: $53. 00 DRS Statement WT: $5. 00 Avg Agent fee (DMA): . 92 Surcharge: ____________ Total: $5. 92 Difference = $47. 08 15, 239 WT’s @ $47. 08 = $717, 448 Annualized = $8. 6 million additional cost! 11

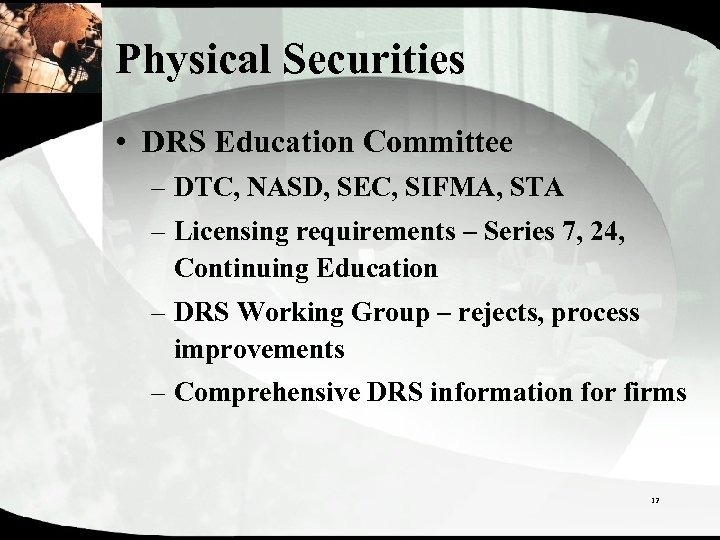

Physical Securities • DRS Education Committee – DTC, NASD, SEC, SIFMA, STA – Licensing requirements – Series 7, 24, Continuing Education – DRS Working Group – rejects, process improvements – Comprehensive DRS information for firms 12

Physical Securities • DRS Education – Next Steps – Firms – Registered Reps/Operations/Customers • Education becomes more important as DRS increases • Alternatives to physical certificates – Hold in street name, book-entry, DRS • DTC – “Paper Torture Article” – Consider DRS not physical certificates • Firms should mandate DRS default – NOW! • DTC may request a rule change 13

Physical Securities “Inefficiency = Risk” Ron Kessler – AG Edwards 14

Susan Petersen Special Counsel Division of Market Regulation U. S. Securities & Exchange Commission 15

SEC Update • DRS Regulatory Perspective – State Laws – Exchange Listing requirements – Future direction 16

Joseph Trezza Vice President Depository Trust & Clearing Corporation 17

DTC Update • • • DRS Update/Next Steps WT’s Deposits Non-Transferables DTC Custody Future 18

DTC Update • DRS Update – August 2006 • SEC approved rules - all exchange listed issues must be DRS eligible – January 1, 2007: NEW ISSUES – January 1, 2008: ALL ISSUES – September 2006 • DTC filed new Transfer Agent requirements – DRS – FAST 19

DTC Update • DRS Next Steps – Underwriter awareness • Information to Syndicate Operations Division • Letters to all underwriters • DTC articles – U. S. Facilities shut down – Eliminate “Hold and Bust” function • Minimal transaction volumes - 2 “Busts” per day • Certificate transactions continue to decline 20

DTC Update • DRS Next Steps – Discuss cost of Certificates vs. Statements – Continue to raise certificate fees for DRS eligible issues • Cover full cost of processing – Lower DRS Statement cost 21

DTC Update • DRS Next Steps – January 2007 • All IPO’s to join DRS • Begin discussions of eliminating certificates for DRS eligible issues • Info exchange - DTCC Board, SIFMA, Industry – 3 Q 2007: Implement DRS enhancements • Move “all” shares • Move “all”, sell fractions, terminate account 22

DTC Update • DRS Next Steps – January 2008 • Migrate all exchange listed issues – 2 Q 2008 • Discuss DTC default to DRS “statement only” – Currently 80% of WT’s are DRS eligible issues 23

DTC Update • WT’s – 2007 Projection • Avg. WT’s certificate volumes 22% • WT’s DRS statement volumes 50% – 3 Q 2007 • Discuss limited processing days for WT’s 24

DTC Update • WT’s – Mid 2008 • Prepare to eliminate DMD processing – 4 Q 2008 • Retire DMD functionality for DRS issues • All WT’s to DMA for DRS eligible issues 25

DTC Update • Deposits − 4 Q 2007 • Certificate Automated Select Service (CASS) • Phase I − Agent participation − Certificate verification process • Phase II − Explore agent capacity − Willingness to participate − Truncate certificate @ depository 26

DTC Update • Non-Transferables – 2006 • Over 1 million certificates in vault • PREM, destruction process continues – 350, 000 certificates destroyed in 2006 – 33% of current inventory • Economies of scale diminish – January 2007 • Fees increase - $7. 00 per position – 3 Q 2007 • Explore eliminating new deposits • Consider additional fee increases 27

DTC Update • DTC Custody (Non-Cede) – 2007 • Growth continues - less fungible certificates • Vault - over half million certificates and growing • All manual processes, no economies of scale – 1 Q 2008 • Recommend “right-sizing” fees – 3 Q 2008 • Plan to retire Envelope Settlement Service (ESS) 28

DTC Update • DTC Custody (Non-Cede) – 1 Q 2009 • Evaluate processing options – Efficiencies – Cost reduction – Location 29

DTC Update • Future – 2008 • DRS/FAST - 400 agents • DRS - over 10, 000 issues • Industry consideration of eliminating certificates – 2010 • Immobilization complete • Few, if any, certificates in system 30

Consensus: Go Paperless 31

Katie Sevcik Senior Vice President Manager of Operations Wells Fargo Shareowner Services Kevin Mc. Cosker Vice President Pershing LLC 32

DRS Sub-Committee Update • Issuer/CUSIP Eligibility – Corporate by-laws must permit the issuance of boo -entry shares – CUSIP must be DTC and FAST eligible – Must provide DTC 10 days notice prior to DRS activation 33

DRS Sub-Committee Update • Transfer Agent Eligibility: – Registered transfer agent (SEC Rule 17 A (c)) – Participates in DTC’s FAST program – Execute a DRS Limited Participant Account agreement – Able to store new data fields: • • Investor account number at the Broker/Dealer firm name DTC participant account number Payment Surety Plan (PSP) number at the transaction level – Capability to match a Profile move request on the prior Transfer Agent’s account number until the shareholder knows their new account number 34

DRS Sub-Committee Update • Broker/Dealer Eligibility – Must be a DTC participant – Must have a Profile Surety Program (PSP) number to initiate share movements – Must honor the investor’s request for a “register and ship” in statement form 35

DRS Sub-Committee Update • The following DRS information will be provided on the DRS Statement or check stub: – Full Registration – DRS Account number at the Transfer Agent identified on the statement as “Account Number” – Number of shares held in DRS (not necessarily shares held in DRIP) – Total number of DRS restricted shares, if applicable – CUSIP number or symbol (must be industry assigned 9 digit number or ISIN number) – Statement Date 36

DRS Sub-Committee Update • All DRIP Statements will include: – Full Registration – DRIP Account number at the Transfer Agent identified on the statement as “Account Number” – Number of shares held in DRIP (not necessarily shares held in DRS) – Total number of DRIP restricted shares, if applicable – CUSIP number or symbol (must be industry assigned 9 digit number or ISIN number) – Statement Date 37

DRS Sub-Committee Update • All DRS Transaction Advices/Statements will include: – Date of the transaction – Investor’s Broker/Bank Custodian account number and firm name for that particular transaction – Number of shares for the transaction – CUSIP number or symbol (must be industry assigned 9 digit number or ISIN number) – DRS Account number at the agent identified on the statement as “Account Number” – Full registration 38

DRS Sub-Committee Update • Moving shares from a DRS account to a Broker or Bank Custodian – Initiated by the receiving Broker/Bank Custodian – Authorization from the end customer is required – Review most recent statement (have investor verify share amount with the agent if the statement is old ) – Request DRS and DRIP accounts only – Compare account details – Verify tax ID with customer (especially joint accounts) – Maintain a list of account number formats – Add to the "Profile" System – Maintain paperwork physically or electronically (based on federal and state law) at the Broker/Bank Custodian 39

DRS Sub-Committee Update • Moving shares from a Broker/Bank Custodian to a DRS account – Initiated by the delivering Broker/Bank Custodian – Authorization required to deliver shares – Broker/Bank Custodian submits a WT’s through DTC and indicates “S” for DRS statement – DTC sends account number to the Broker/Bank Custodian – Transfer Agent sends confirmation to registered holder – Maintain paperwork physically or electronically (based on federal and state law) at the Broker/Bank Custodian 40

DRS Sub-Committee Update • Known Issues – DRS statements are issued when sending securities for corporate actions or transfers • Broker/Custodian loses control of the assets – Gifting of assets - Statements are issued directly to the recipient of the gift instead of presenter – Statements not sent by all Transfer Agents on a scheduled basis as it is not required by UCC or SEC regulations – Privacy laws restrict agents from divulging information such as the customer’s account number, account registration, tax ID number except to the registered owner of the account 41

DRS Sub-Committee Update • Known Issues (continued) – Certificated IRA Custodial accounts will have new shares issued in DRS form and the statement will be sent to the address on record. This address may be the investor’s address and not the IRA custodian’s. – IRA Custodial accounts are issued in DRS form without the custodians’ acceptance – No way to request “All” shares and liquidate fractions, industry is working on a solution – Transfer Agents are not designated a control location therefore Brokers can not hold DRS accounts on their books – DRS Issues that are held at a Broker in street-name are not always eligible for the Transfer Agent’s Dividend/Reinvestment Plan through DTC 42

DRS Sub-Committee Update • Known Issues (continued) – DRS and Dividend Reinvestment Plans cannot be combined at the Transfer Agent. Therefore, multiple statements may exist, one for each share type. – Restricted shares may be held in DRS, however, they are not eligible to move through the "Profile" System until the restriction is lifted. – Broker/Bank Custodians submitting physical shares through DTC for corporate action processing may also need to request any DRS shares through the "Profile" System. (this occurs when a registered owner holds both physical and DRS shares). 43

DRS Sub-Committee Update • Impact of dematerialization upon custodian – Safekeeping of Securities • Statements cannot be held in lieu of certificates • Restricted Securities – Only non-certificated corporations can be held in DRS • Asset Receipts – Currently activity advices are not sent to the Broker/Bank Custodian once a DRS transaction is complete 44

Armando Di Biase Donna Fremgen Vice President The Bank of New York Merrill Lynch John Hosty The Northern Trust Company Chairman, Bank Depository User Group (BDUG) 45

Frequently Asked Questions • How does a registered owner obtain the most recent DRS or Dividend Reinvestment statement? – Most Transfer Agents have on-line account access. If the investor has signed up for on -line access, they should be able to obtain the required information. If on-line access is not available the investor could also contact the Transfer Agent and request a duplicate statement. (a fee may be assessed for this service) 46

Frequently Asked Questions • How does the Broker or Bank Custodian transfer a registered owner’s entire bookentry position from a DRS/Dividend Reinvestment account to a brokerage account? – Currently an “ALL share” feature is not available in the "Profile" System. The industry is reviewing enhancements to various systems that are required to offer this feature. DTC’s detailed specifications will be reviewed by the DRS Industry Committee in the near future. 47

Frequently Asked Questions • Can the Broker/Bank Custodian request DRS and Dividend Reinvestment Plan shares on one "Profile" System request? – Yes, Transfer Agents are required to move both eligible DRS and Dividend Reinvestment Plan shares through the "Profile" System. The Broker/Bank Custodian combine the shares and submit in one transaction. (Do NOT add securities held by investor in certificate form. ) 48

Frequently Asked Questions • Can a registered owner’s Broker/Bank Custodian request that their DRS shares move to a DRIP Plan through the "Profile" System? – No, the registered owner must contact the Transfer Agent and complete the required Dividend Reinvestment Plan enrollment forms. 49

Frequently Asked Questions • Can fractional shares transfer out of a registered owners DRS/Dividend Reinvestment Plan to the Broker or Custodian if added to the "Profile" System? – No, currently it is not possible to add fractional shares to the "Profile" System or transfer those shares. 50

Frequently Asked Questions • How does a Broker or Custodian liquidate the fractional shares not transferred from a registered owners DRS /Dividend Reinvestment account? – Currently there is no systematic way to liquidate the fractional shares without contacting the transfer agent. – Depending upon the terms of the DRS/Dividend Re-investment plan, some will automatically liquidate other plans require the registered owner contact the Transfer Agent to liquidate. 51

Frequently Asked Questions • If the registrations at the Brokerage account and DRS/Dividend Reinvestment account do not match, how do you request DRS/Dividend Reinvestment positions? – The Broker/Bank Custodian is responsible for maintaining any paperwork required when transferring accounts that are not “like to like” registrations. – These requests must be submitted through the "Profile" System under the registered owners account number and Tax ID # for domestic holders. For foreign holders the account number and title is required since a Tax ID is not available. 52

Frequently Asked Questions • Is Legal paperwork required to process a DRS/Dividend Reinvestment transfers (e. g. Corporate Accounts and Estate accounts) ? – The Broker/Bank Custodian must maintain the normal legal paperwork to transfer these types of accounts. Entering the request on the "Profile" System guarantees you have all the proper endorsements required to facilitate the transfer. Please refer to your DRS Profile Surety language. 53

Frequently Asked Questions • What happens if a Broker/Bank Custodian requests a registered investors account through the "Profile" System on payable date of a dividend in a reinvestment plan ? – The shares should move with the initial transaction, but it is a best practice to review the statement after the transaction to ensure all shares have moved. 54

Frequently Asked Questions • Can a registered owner sell a position at their broker while the shares are still held in registered form at the agent (DRS). – Policies vary between brokers, a DRS transaction can be completed in as few as 24 hours. Some firms will allow the sale and expect delivery on settlement date, other firms have established policies to obtain the position before the sale can take place. 55

Frequently Asked Questions • How are Private Placements being addressed? – Private Placements are not currently held in DRS. 56

Frequently Asked Questions • How does a Broker/Bank Custodian get a restriction lifted for the registered owner’s DRS shares? (e. g. 144 shares) (Example 1) – The Broker/Bank Custodian can submit the required paperwork to the Transfer Agent to have the restriction lifted. – Upon completion, the Transfer Agent sends the investor a DRS statement or transaction advice which can be provided to Broker/Bank Custodian to move the shares. OR: 57

Frequently Asked Questions • (Example 2) – The Broker/Bank Custodian should submit the required paperwork to the Transfer Agent to have the restriction lifted and include a stock power with instructions to electronically transfer (DWAC) the shares. – When the restrictions are lifted, the agent will contact the Broker/Bank Custodian and instruct them to request the shares electronically through DTC. The agent will accept the instructions through DTC’s DWAC system. 58

Frequently Asked Questions • Can a registered investor with a DRS account get a physical certificate from the Transfer Agent? – Yes, some issues still have certificates available and a certificate can be requested if the registered owner calls the Transfer Agent directly. – Other DRS issues may only be available in book-entry form. 59

Frequently Asked Questions • What is the turnaround time for processing a DRS transfer? – Transfer Agents have 48 hours to process the request. An additional 24 to 48 hours should be allotted to the Broker/Bank Custodian to review the request and submit it through the "Profile" System. 60

Frequently Asked Questions • Can a Broker/Bank Custodian submit a physical certificate to the Transfer Agent for a reorg, stock split or transfer and get a certificate back? – Yes, if the instructions specifically state issue a new certificate, the Transfer Agent should provide one if available. 61

Open Forum for Questions William J. Robertson - JP Morgan Chase Lawrence Morillo - Pershing LLC Susan Petersen - SEC Joseph Trezza - DTCC Kathryn Sevcik - Wells Fargo Shareowner Services Kevin Mc. Cosker - Pershing LLC Armando Di Biase - The Bank of New York Donna Fremgen - Merrill Lynch John Hosty - The Northern Trust Company 62

Resources • • • BDUG - www. bdug. org DTCC - www. dtcc. com/nomorepaper. com SEC - www. sec. gov SIFMA - www. sia. com STA - www. stai. org 63

Thank you for participating 64

6b0153857fe9118991f60d93c67b9e6e.ppt