e4a3ae0a73b176f391f553d96a9928ee.ppt

- Количество слайдов: 53

Stock Analysis: Technical and Fundamental Analysis By Jiroj Buranasiri, CFA j

I. Technical analysis II. Fundamental analysis j

I. Technical analysis: outline A. What is it about? B. Analysis C. Sources of information E. For further study j

A. What is it about? Technical analysis focuses on demand & supply by studying the movement of price and volume. n Its objective is to find market trend and how long the trend will continue to make investment decision – Buy, Hold, or Sell. n j

A. What is it about? n Trends: n n n up-trend, down-trend, or sideway (sideway-up, sideway-down) j

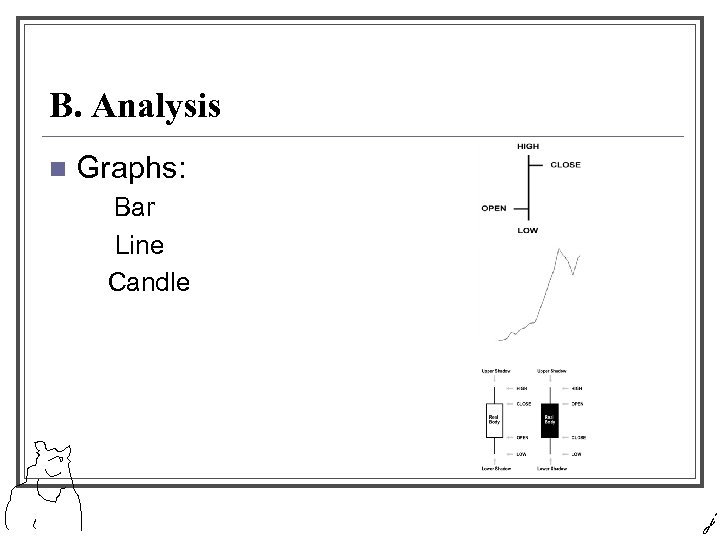

B. Analysis n Graphs: Bar Line Candle j

B. Analysis Graphs: bar, line, candle n Techniques: n n n Moving Average (MA) Exponential Moving Average (EMA) Moving Average Convergence/Divergence (MACD) Money Flow Index (MFI) Rate of Change (ROC) j

B. Analysis n Techniques: n n n n Relative Strength Index (RSI) Stochastic Volume +MA William % R Parabolic Bollinger bands j

B. Analysis n Techniques n n n Fibonacci Dow theory Elliot wave j

Remarks Price moves in trend. n History repeats itself. n Volume normally goes with trend. n Volume typically leads price during bull move. n Rising price with falling volume is abnormal. n j

C. Sources of information Efinancethai, n Reuters , n Bloomberg, n Etc. n j

C. For further study n Book n n Technical Analysis: The Complete Resource for Financial Market Technicians by Charles D. Kirkpatrick and Julie R. Dahlquist, FT Press, The Investor's Guide to Technical Analysis by Curt Renz and Curt Renz, Mc. Graw-Hill, Etc. Website: http: //finance. yahoo. com, http: //stockcharts. com j

II. Fundamental analysis: outline A. What is it about? B. Analysis C. Sources of information D. For further study j

A. What is it about? Finding fair value of stocks. n Objective is to check if market price is cheap, fair, expensive for investment – Buy, Hold, or Sell or to explain the change of market price. n j

B. Analysis: stock valuation process 1. Understand firm and stock’s nature 2. Forecast 3. Choose valuation method 4. Make decision j

1. Understand firm and its stock’s nature n From company itself n n n Financial statements, IR From other sources n n n Research paper, Firm’s competitors Etc. j

2. Forecast Make assumptions n Information, information n j

Information’s issues What information is relevant? News concerning risk and return n When will it come out? n j

Getting start (use consolidated) Restatements and work from restated statements. n Analyze relevant data and forecast: revenue break-down, cost break-down n j

Analysis: Top down n Bottom up n Top down and bottom up n j

Top down / Bottom up n Top down: n n n Bottom up n n Economy -> industry -> firm -> stock Globalization – impact. Firm -> industry -> economy Top down and bottom up: n Economy <-> industry <-> firm <-> stock j

Economy Economic variables: GDP growth rate, unemployment rate, etc. n Economic life cycle: changing n Domestic & international: globalization impact n j

Industry Porter’s 5 forces n Boston matrix: star, dog, cash cow, question mark n Change in external factors: social, regulations, consumer’s taste, etc. n Industry life cycle: sun-rise, sun-set n j

Company Management quality n Accounting – clean, dirty n Business nature - income, cost, margin’s volatility, key success factors, position, strength, weakness etc. n Financing n Growth opportunity n j

Company n Dream & do j

Remarks If the success (failure) is consistent or temporary. n Past success doesn’t guarantee future success. n j

Understand the stock’s nature Major investors n Sensitive to foreign fund flows n Defensive or cyclical n Etc. n j

3. Choose valuation methods n Choosing criteria: n n n Characteristics of firm Data: availability, quality Valuation methods n n Discount cash flows Price multiples j

Discount cash flows n Discount rate n n Cash flows n n CAPM, APT Dividends, Free cash flow for firm (FCFF), Free cash flow for equity (FCFE), Residual income (RI) Growth rate n = ROE x b j

Price multiples n Price Multiples n n Link to competitors, industry, past Link to company’s fundamentals – discount cash flows j

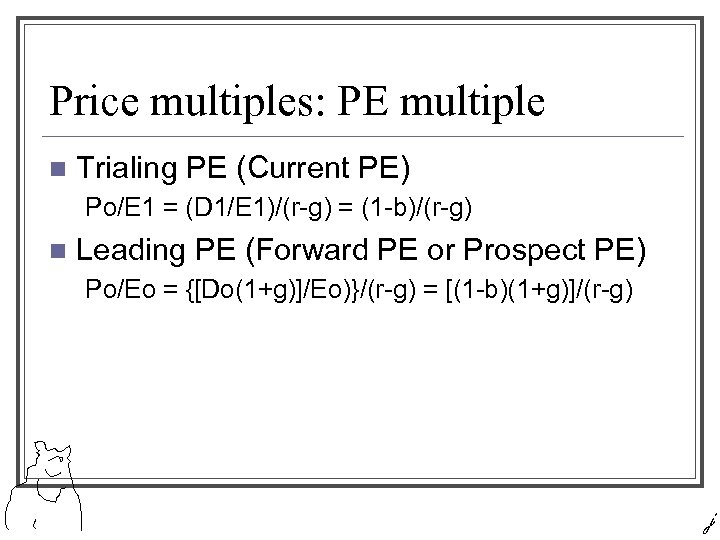

Price multiples: PE multiple n Trialing PE (Current PE) Po/E 1 = (D 1/E 1)/(r-g) = (1 -b)/(r-g) n Leading PE (Forward PE or Prospect PE) Po/Eo = {[Do(1+g)]/Eo)}/(r-g) = [(1 -b)(1+g)]/(r-g) j

Price multiples: PBV multiple Book Value is unlikely to be negative. n Compared to earnings, book Value is less manipulated. n PBV = (ROE-g)/(r-g( n j

Price multiples: P adj BV multiple n Adjusted BV = BV – (NPV – Acc. Provision( j

Price multiples: PS multiple No negative sales n Sales is less likely to be manipulated. n Po/So =(Eo/So)(1 -b)(1+g)/(r-g) n But sales might not mean profit. (No information on cost structure) j

Price multiples: PCF n Cash flow n n n EPS + non-cash charge CFO FCFE EBITDA Less manipulation j

4. Make decision Buy (undervalued, buy, trading buy, strong buy( n Sell n Hold n j

Some technical terms in fundamental analysis n n n ARPU GRM Baglog BDI NIM L/D ratio CAR CASA CAPEX OPEX P&L B. E. 1. 1 j

C. Sources of information Anything affecting company’s earnings (growth, volatility) n n Newspaper: local (Bangkok Post, The Nation, Bangkokbiznews, etc. ) and international (The New York Times, Financial times, etc. ) Internet: www. settrade. com, www. set. or. th, www. sec. or. th, www. bot. or. th, www. nesdb. go. th, www. worldbank. org, www. imf. org, http: //www. efinancethai. net, etc. j

C. Sources of information n Reuter, Bloomberg, Setsmarts, E-financethai Analyst meeting, opportunity day Company presentation j

For novice What data? To under stand a company’s nature, start with 56 -1 form, company’s presentation, investment analysis paper, opportunity day meeting and company’s annual report n Where to find? n When it will be release? n j

Financial data (SEC, SET) n Why SEC, SET? To be fair to public, companies should not provide financial data to a particular investor (or group) before public. j

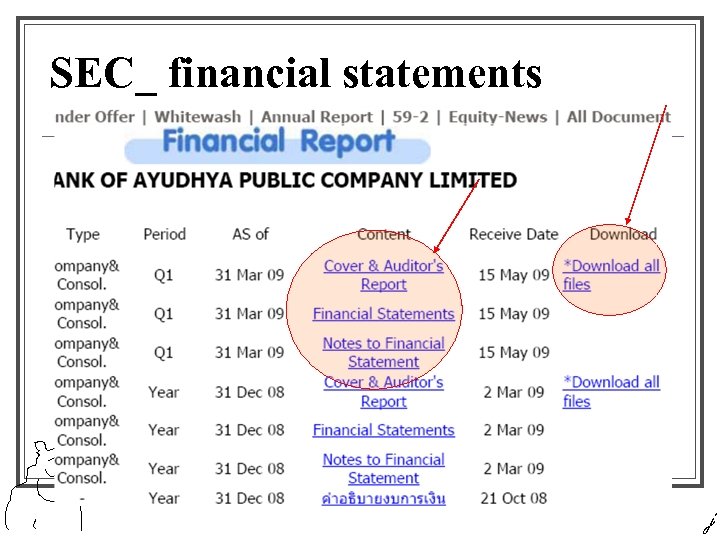

SEC_ financial statements j

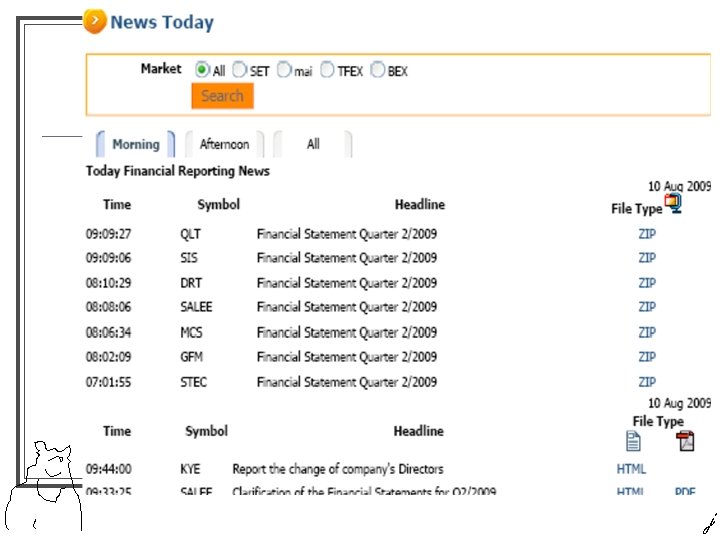

SET_ latest news j

j

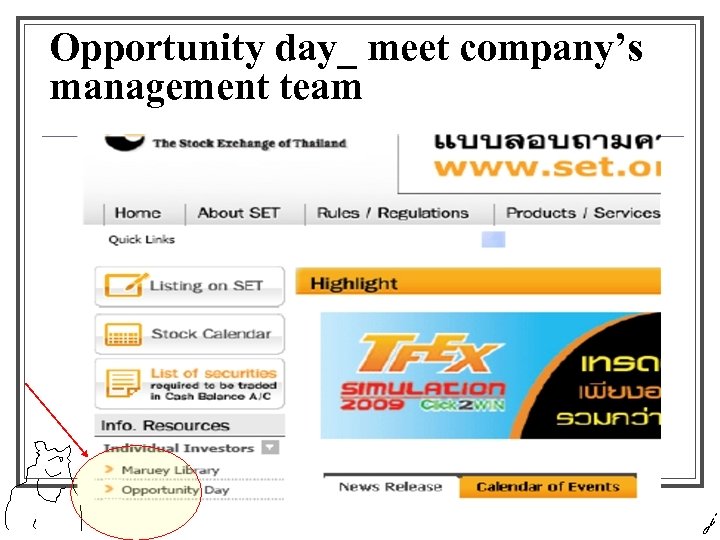

Opportunity day_ meet company’s management team j

Company’s presentation n From company’s website. j

Investment research paper j

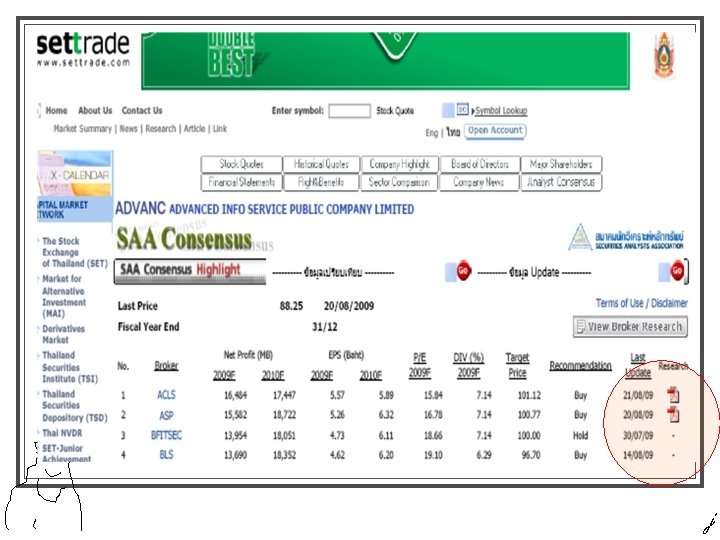

Where to find research paper? n Brokers j

Where to find research paper? n Free? • Free? j

j

For further study n Books: n n n Security analysis, Benjamin Graham and David L. Dodd, Mc. Graw-Hill, The intelligent investor, Benjamin Graham, Harper. Collins Publishers, Analysis of equity investments: valuation, John D. Stowe, Thomas R. Robison, Dennis W. Mc. Leavey, Association for Investment and Research, etc. Research paper Websites: n n www. tsi-thailand. org, www. ft. com, etc. j

Q&A j

Thank you j

e4a3ae0a73b176f391f553d96a9928ee.ppt