SCHOTASTIC PROGRAMMING.pptx

- Количество слайдов: 14

Stochastic Programming

Stochastic Programming

What is Stochastic Programming? Stochastic programs are mathematical programs where some the data incorporated into the objective or constraints is uncertain. Uncertainty is usually characterized by a probability distribution on the parameters. Although the uncertainty is rigorously defined, in practice it can range in detail from a few scenarios (possible outcomes of the data) to specific and precise joint probability distributions. The outcomes are generally described in terms of elements w of a set W. W can be, for example, the set of possible demands over the next few months.

What is Stochastic Programming? Stochastic programs are mathematical programs where some the data incorporated into the objective or constraints is uncertain. Uncertainty is usually characterized by a probability distribution on the parameters. Although the uncertainty is rigorously defined, in practice it can range in detail from a few scenarios (possible outcomes of the data) to specific and precise joint probability distributions. The outcomes are generally described in terms of elements w of a set W. W can be, for example, the set of possible demands over the next few months.

THE SP MODELS: The SP models are: Basic features, Fundamental components, Modelling flexibility - Advantages Important modelling choices: Dynamic structure (length of planning horizon, stages, scenario tree structure & size) Alternative objective functions, Risk measures Representation of uncertainty (Scenario generation) Features giving rise to MIPs Sample application domains in Finance Case Study: International Portfolio Management Criticisms (Capabilities, Limitations, Practicality, Challenges) Issues: Model development, Solution alternatives Current trends (driving forces & positive signs) Future potential – Interesting prospects of practical importance

THE SP MODELS: The SP models are: Basic features, Fundamental components, Modelling flexibility - Advantages Important modelling choices: Dynamic structure (length of planning horizon, stages, scenario tree structure & size) Alternative objective functions, Risk measures Representation of uncertainty (Scenario generation) Features giving rise to MIPs Sample application domains in Finance Case Study: International Portfolio Management Criticisms (Capabilities, Limitations, Practicality, Challenges) Issues: Model development, Solution alternatives Current trends (driving forces & positive signs) Future potential – Interesting prospects of practical importance

Stochastic Programs: Fundamental Characteristics Powerful & flexible framework to support sequential decisionmaking under uncertainty (discrete-time models). Random variables assumed to evolve according to discrete stochastic processes (represented in terms of scenario trees). Capture the interrelationship/interaction between dynamic information processes and dynamic/active decision processes. (Recourse) variables allow adaptations of decisions to information flows. Account for and reveal/quantify the value of decision flexibility. Fundamental Assumptions: Underlying stochastic processes (distributions of r. v. s) are not influenced/dependent by the values of the decision variables. Non-anticipativity: Decisions adapt to available information at the time they are made, but do not depend (invariant wrt) on specific projected future outcomes (no hindsight).

Stochastic Programs: Fundamental Characteristics Powerful & flexible framework to support sequential decisionmaking under uncertainty (discrete-time models). Random variables assumed to evolve according to discrete stochastic processes (represented in terms of scenario trees). Capture the interrelationship/interaction between dynamic information processes and dynamic/active decision processes. (Recourse) variables allow adaptations of decisions to information flows. Account for and reveal/quantify the value of decision flexibility. Fundamental Assumptions: Underlying stochastic processes (distributions of r. v. s) are not influenced/dependent by the values of the decision variables. Non-anticipativity: Decisions adapt to available information at the time they are made, but do not depend (invariant wrt) on specific projected future outcomes (no hindsight).

Fundamental Components of SP models: 1. Description of the underlying (multi-variate) discrete stochastic process for the uncertain parameters; Dynamic information structure (Scenario-tree Generation). 2. Discrete-time dynamic (multi-period) optimization program capturing the structure of the decision process. (1) & (2) often cannot be considered independently.

Fundamental Components of SP models: 1. Description of the underlying (multi-variate) discrete stochastic process for the uncertain parameters; Dynamic information structure (Scenario-tree Generation). 2. Discrete-time dynamic (multi-period) optimization program capturing the structure of the decision process. (1) & (2) often cannot be considered independently.

Applications of Stochastic Programmings Stochastic programming has been applied to a wide variety of areas. Some of the specific problems are part of the Stochastic Programming Test Set. These Specific Problems are: 1. Prdouction Problems 2. Expansion and Planning Problems 3. Finance Problems And Other Models

Applications of Stochastic Programmings Stochastic programming has been applied to a wide variety of areas. Some of the specific problems are part of the Stochastic Programming Test Set. These Specific Problems are: 1. Prdouction Problems 2. Expansion and Planning Problems 3. Finance Problems And Other Models

Applications of Stochastic Programmings Other applications are listed below: Manufacturing Production Planning Manufacturing production capacity planning Electrical generation capacity planning Machine Scheduling Freight scheduling Dairy Farm Expansion planning Macroeconomic modeling and planning Timber management Asset Liability Management Portfolio selection Traffic management Optimal truss design Automobile Dealership invetory management Lake level management

Applications of Stochastic Programmings Other applications are listed below: Manufacturing Production Planning Manufacturing production capacity planning Electrical generation capacity planning Machine Scheduling Freight scheduling Dairy Farm Expansion planning Macroeconomic modeling and planning Timber management Asset Liability Management Portfolio selection Traffic management Optimal truss design Automobile Dealership invetory management Lake level management

Basic Common Features Stage- (node-) wise Fundamental Constraints Asset balance Cash-flow balance Valuation equations (wealth state) Additional application-specific constraints: E. g. , regulatory & managerial requirements

Basic Common Features Stage- (node-) wise Fundamental Constraints Asset balance Cash-flow balance Valuation equations (wealth state) Additional application-specific constraints: E. g. , regulatory & managerial requirements

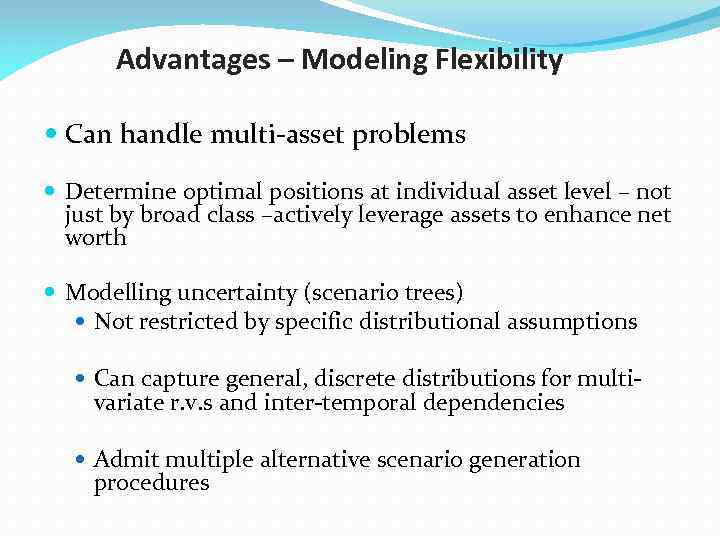

Advantages – Modeling Flexibility Can handle multi-asset problems Determine optimal positions at individual asset level – not just by broad class –actively leverage assets to enhance net worth Modelling uncertainty (scenario trees) Not restricted by specific distributional assumptions Can capture general, discrete distributions for multi- variate r. v. s and inter-temporal dependencies Admit multiple alternative scenario generation procedures

Advantages – Modeling Flexibility Can handle multi-asset problems Determine optimal positions at individual asset level – not just by broad class –actively leverage assets to enhance net worth Modelling uncertainty (scenario trees) Not restricted by specific distributional assumptions Can capture general, discrete distributions for multi- variate r. v. s and inter-temporal dependencies Admit multiple alternative scenario generation procedures

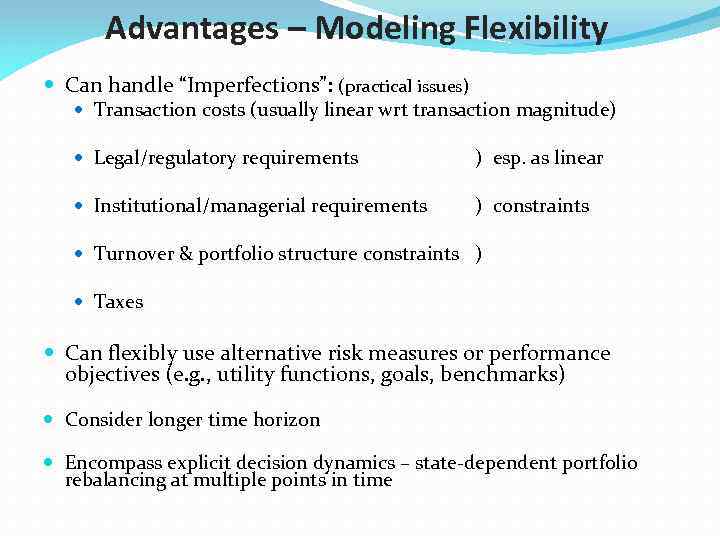

Advantages – Modeling Flexibility Can handle “Imperfections”: (practical issues) Transaction costs (usually linear wrt transaction magnitude) Legal/regulatory requirements ) esp. as linear Institutional/managerial requirements ) constraints Turnover & portfolio structure constraints ) Taxes Can flexibly use alternative risk measures or performance objectives (e. g. , utility functions, goals, benchmarks) Consider longer time horizon Encompass explicit decision dynamics – state-dependent portfolio rebalancing at multiple points in time

Advantages – Modeling Flexibility Can handle “Imperfections”: (practical issues) Transaction costs (usually linear wrt transaction magnitude) Legal/regulatory requirements ) esp. as linear Institutional/managerial requirements ) constraints Turnover & portfolio structure constraints ) Taxes Can flexibly use alternative risk measures or performance objectives (e. g. , utility functions, goals, benchmarks) Consider longer time horizon Encompass explicit decision dynamics – state-dependent portfolio rebalancing at multiple points in time

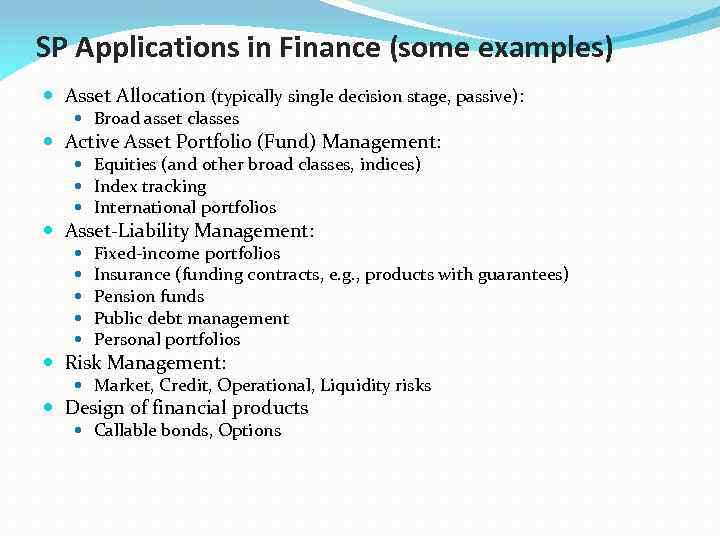

SP Applications in Finance (some examples) Asset Allocation (typically single decision stage, passive): Broad asset classes Active Asset Portfolio (Fund) Management: Equities (and other broad classes, indices) Index tracking International portfolios Asset-Liability Management: Fixed-income portfolios Insurance (funding contracts, e. g. , products with guarantees) Pension funds Public debt management Personal portfolios Risk Management: Market, Credit, Operational, Liquidity risks Design of financial products Callable bonds, Options

SP Applications in Finance (some examples) Asset Allocation (typically single decision stage, passive): Broad asset classes Active Asset Portfolio (Fund) Management: Equities (and other broad classes, indices) Index tracking International portfolios Asset-Liability Management: Fixed-income portfolios Insurance (funding contracts, e. g. , products with guarantees) Pension funds Public debt management Personal portfolios Risk Management: Market, Credit, Operational, Liquidity risks Design of financial products Callable bonds, Options

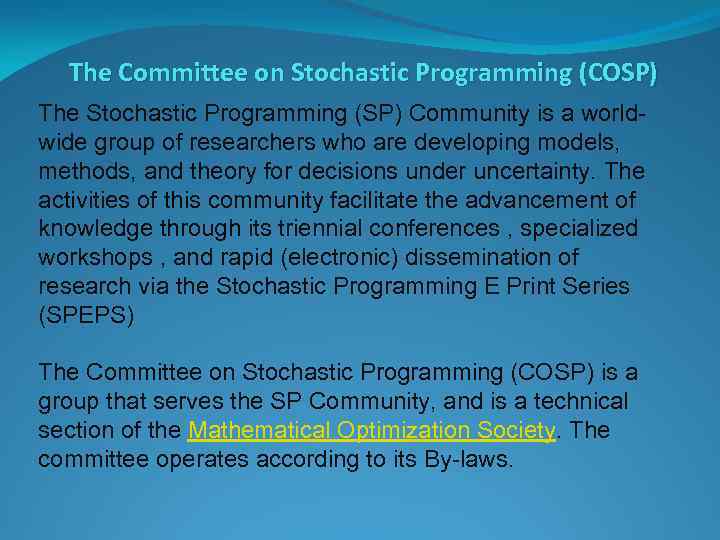

The Committee on Stochastic Programming (COSP) The Stochastic Programming (SP) Community is a worldwide group of researchers who are developing models, methods, and theory for decisions under uncertainty. The activities of this community facilitate the advancement of knowledge through its triennial conferences , specialized workshops , and rapid (electronic) dissemination of research via the Stochastic Programming E Print Series (SPEPS) The Committee on Stochastic Programming (COSP) is a group that serves the SP Community, and is a technical section of the Mathematical Optimization Society. The committee operates according to its By-laws.

The Committee on Stochastic Programming (COSP) The Stochastic Programming (SP) Community is a worldwide group of researchers who are developing models, methods, and theory for decisions under uncertainty. The activities of this community facilitate the advancement of knowledge through its triennial conferences , specialized workshops , and rapid (electronic) dissemination of research via the Stochastic Programming E Print Series (SPEPS) The Committee on Stochastic Programming (COSP) is a group that serves the SP Community, and is a technical section of the Mathematical Optimization Society. The committee operates according to its By-laws.

The Committee on Stochastic Programming (COSP) is a group that serves the SP Community, and is a technical section of the Mathematical Optimization Society. The committee operates according to its bylaws.

The Committee on Stochastic Programming (COSP) is a group that serves the SP Community, and is a technical section of the Mathematical Optimization Society. The committee operates according to its bylaws.

THANK YOU FOR YOUR ATTENTION DONE BY: ALIYEV TURAL GROUP: 013 A

THANK YOU FOR YOUR ATTENTION DONE BY: ALIYEV TURAL GROUP: 013 A