1808e3c33105672aeb0db7066b03714f.ppt

- Количество слайдов: 84

Stochastic Optimization ESI 6912 NOTES 7: Algorithms and Applications Instructor: Prof. S. Uryasev

Stochastic Optimization ESI 6912 NOTES 7: Algorithms and Applications Instructor: Prof. S. Uryasev

Content 1. Value-at-Risk (Va. R) a. Definition b. Features c. Examples 2. Conditional Value-at-Risk (CVa. R) a. Definition: Continuous and Discrete distribution b. Features c. Examples 3. Formulation of optimization problem a. Definition of a loss function b. Examples: CVa. R in performance function and CVa. R in constraints 4. Optimization techniques a. CVa. R as an optimization problem: Theorem 1 and Theorem 2 b. Reduction to LP 5. Case Studies

Content 1. Value-at-Risk (Va. R) a. Definition b. Features c. Examples 2. Conditional Value-at-Risk (CVa. R) a. Definition: Continuous and Discrete distribution b. Features c. Examples 3. Formulation of optimization problem a. Definition of a loss function b. Examples: CVa. R in performance function and CVa. R in constraints 4. Optimization techniques a. CVa. R as an optimization problem: Theorem 1 and Theorem 2 b. Reduction to LP 5. Case Studies

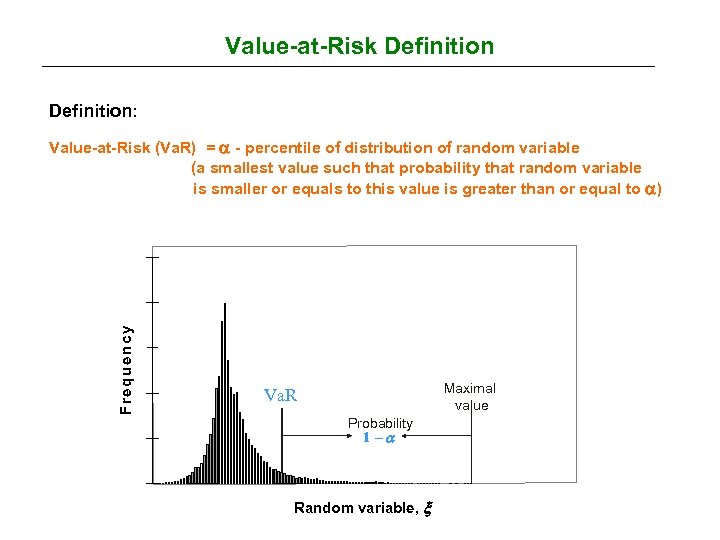

Value-at-Risk Definition: F re q u e n c y Value-at-Risk (Va. R) = - percentile of distribution of random variable (a smallest value such that probability that random variable is smaller or equals to this value is greater than or equal to ) Maximal value Va. R Probability 1 - Random variable,

Value-at-Risk Definition: F re q u e n c y Value-at-Risk (Va. R) = - percentile of distribution of random variable (a smallest value such that probability that random variable is smaller or equals to this value is greater than or equal to ) Maximal value Va. R Probability 1 - Random variable,

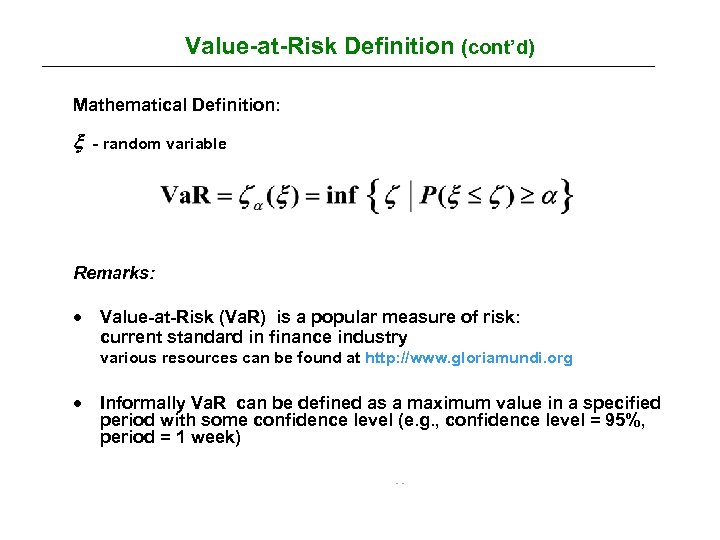

Value-at-Risk Definition (cont’d) Mathematical Definition: - random variable Remarks: · Value-at-Risk (Va. R) is a popular measure of risk: current standard in finance industry various resources can be found at http: //www. gloriamundi. org · Informally Va. R can be defined as a maximum value in a specified period with some confidence level (e. g. , confidence level = 95%, period = 1 week)

Value-at-Risk Definition (cont’d) Mathematical Definition: - random variable Remarks: · Value-at-Risk (Va. R) is a popular measure of risk: current standard in finance industry various resources can be found at http: //www. gloriamundi. org · Informally Va. R can be defined as a maximum value in a specified period with some confidence level (e. g. , confidence level = 95%, period = 1 week)

Value-at-Risk Features • simple convenient representation of risks (one number) • measures downside risk (compared to variance which is impacted by high returns) • applicable to nonlinear instruments, such as options, with nonsymmetric (non-normal) loss distributions • may provide inadequate picture of risks: does not measure losses exceeding Va. R (e. g. , excluding or doubling of big losses in November 1987 may not impact Va. R historical estimates) • reduction of Va. R may lead to stretch of tail exceeding Va. R: risk control with Va. R may lead to increase of losses exceeding Va. R. E. g, numerical experiments 1 show that for a credit risk portfolio, optimization of Va. R leads to 16% increase of average losses exceeding Va. R. Similar numerical experiments conducted at IMES 2. 1 Larsen, N. , Mausser, H. and S. Uryasev. Algorithms for Optimization of Value-At-Risk. Research Report, ISE Dept. , University of Florida, forthcoming. Yamai, Y. and T. Yoshiba. On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall. Institute for Monetary and Economic Studies. Bank of Japan. IMES Discussion Paper 2001 -E-4, 2001. (Can be downloaded: www. imes. boj. or. jp/english/publication/edps/fedps_2001 index. html) 2

Value-at-Risk Features • simple convenient representation of risks (one number) • measures downside risk (compared to variance which is impacted by high returns) • applicable to nonlinear instruments, such as options, with nonsymmetric (non-normal) loss distributions • may provide inadequate picture of risks: does not measure losses exceeding Va. R (e. g. , excluding or doubling of big losses in November 1987 may not impact Va. R historical estimates) • reduction of Va. R may lead to stretch of tail exceeding Va. R: risk control with Va. R may lead to increase of losses exceeding Va. R. E. g, numerical experiments 1 show that for a credit risk portfolio, optimization of Va. R leads to 16% increase of average losses exceeding Va. R. Similar numerical experiments conducted at IMES 2. 1 Larsen, N. , Mausser, H. and S. Uryasev. Algorithms for Optimization of Value-At-Risk. Research Report, ISE Dept. , University of Florida, forthcoming. Yamai, Y. and T. Yoshiba. On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall. Institute for Monetary and Economic Studies. Bank of Japan. IMES Discussion Paper 2001 -E-4, 2001. (Can be downloaded: www. imes. boj. or. jp/english/publication/edps/fedps_2001 index. html) 2

Value-at-Risk Features (cont’d) • since Va. R does not take into account risks exceeding Va. R, it may provide conflicting results at different confidence levels: e. g. , at 95% confidence level, foreign stocks may be dominant risk contributors, and at 99% confidence level, domestic stocks may be dominant risk contributors to the portfolio risk • non-sub-additive and non-convex: non-sub-additivity implies that portfolio diversification may increase the risk • incoherent in the sense of Artzner, Delbaen, Eber, and Heath 1 • difficult to control/optimize for non-normal distributions: Va. R has many extremums 1 Artzner, P. , Delbaen, F. , Eber, J. -M. Heath D. Coherent Measures of Risk, Mathematical Finance, 9 (1999), 203 --228.

Value-at-Risk Features (cont’d) • since Va. R does not take into account risks exceeding Va. R, it may provide conflicting results at different confidence levels: e. g. , at 95% confidence level, foreign stocks may be dominant risk contributors, and at 99% confidence level, domestic stocks may be dominant risk contributors to the portfolio risk • non-sub-additive and non-convex: non-sub-additivity implies that portfolio diversification may increase the risk • incoherent in the sense of Artzner, Delbaen, Eber, and Heath 1 • difficult to control/optimize for non-normal distributions: Va. R has many extremums 1 Artzner, P. , Delbaen, F. , Eber, J. -M. Heath D. Coherent Measures of Risk, Mathematical Finance, 9 (1999), 203 --228.

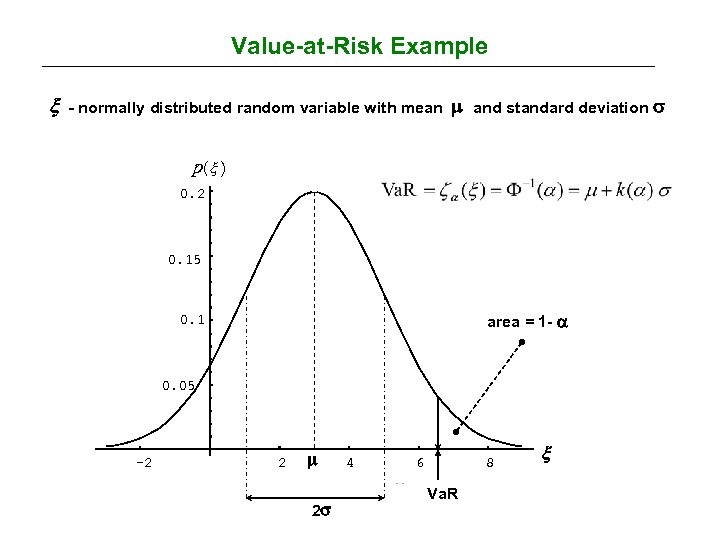

Value-at-Risk Example - normally distributed random variable with mean and standard deviation p( ) 0. 2 0. 15 area = 1 - 0. 1 0. 05 -2 2 2 4 6 8 Va. R

Value-at-Risk Example - normally distributed random variable with mean and standard deviation p( ) 0. 2 0. 15 area = 1 - 0. 1 0. 05 -2 2 2 4 6 8 Va. R

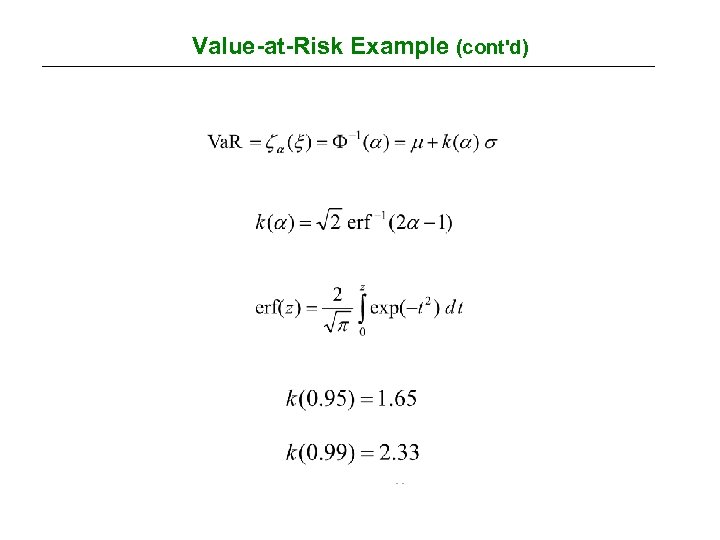

Value-at-Risk Example (cont'd)

Value-at-Risk Example (cont'd)

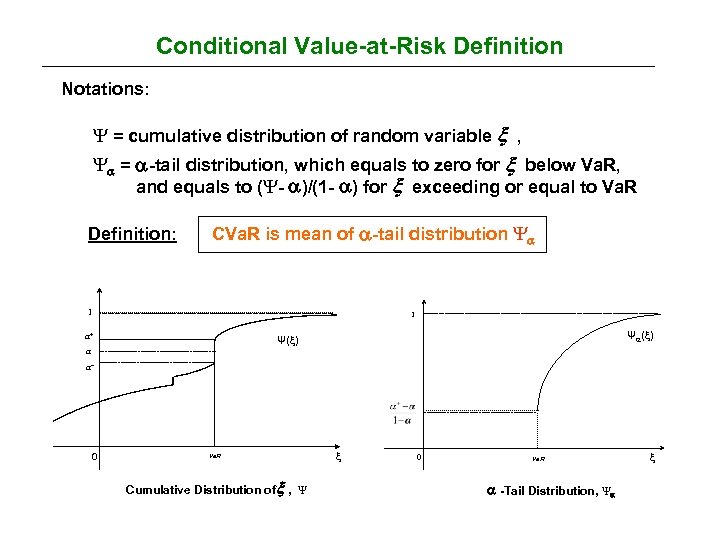

Conditional Value-at-Risk Definition Notations: Ψ = cumulative distribution of random variable , Ψ = -tail distribution, which equals to zero for below Va. R, and equals to (Ψ- )/(1 - ) for exceeding or equal to Va. R Definition: CVa. R is mean of -tail distribution Ψ 1 1 a+ Ψ ( ) Ψ( ) a a- 0 Va. R Cumulative Distribution of , Ψ 0 Va. R -Tail Distribution, Ψ

Conditional Value-at-Risk Definition Notations: Ψ = cumulative distribution of random variable , Ψ = -tail distribution, which equals to zero for below Va. R, and equals to (Ψ- )/(1 - ) for exceeding or equal to Va. R Definition: CVa. R is mean of -tail distribution Ψ 1 1 a+ Ψ ( ) Ψ( ) a a- 0 Va. R Cumulative Distribution of , Ψ 0 Va. R -Tail Distribution, Ψ

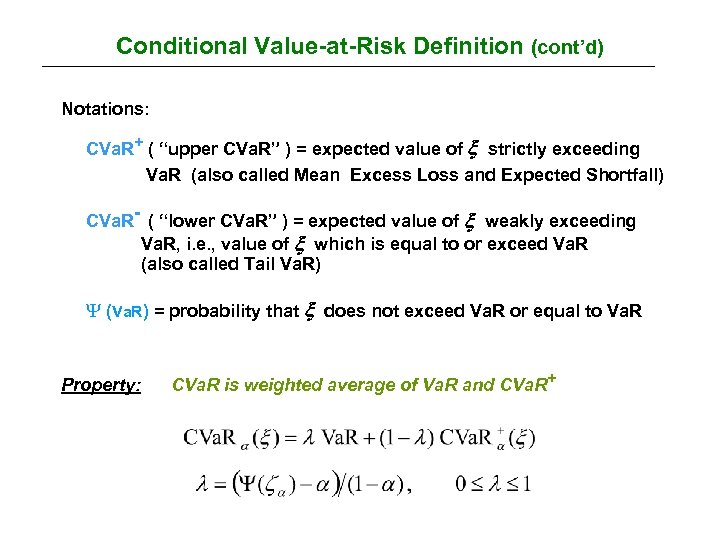

Conditional Value-at-Risk Definition (cont’d) Notations: CVa. R+ ( “upper CVa. R” ) = expected value of strictly exceeding Va. R (also called Mean Excess Loss and Expected Shortfall) CVa. R- ( “lower CVa. R” ) = expected value of weakly exceeding Va. R, i. e. , value of which is equal to or exceed Va. R (also called Tail Va. R) Ψ (Va. R) = probability that does not exceed Va. R or equal to Va. R Property: CVa. R is weighted average of Va. R and CVa. R+

Conditional Value-at-Risk Definition (cont’d) Notations: CVa. R+ ( “upper CVa. R” ) = expected value of strictly exceeding Va. R (also called Mean Excess Loss and Expected Shortfall) CVa. R- ( “lower CVa. R” ) = expected value of weakly exceeding Va. R, i. e. , value of which is equal to or exceed Va. R (also called Tail Va. R) Ψ (Va. R) = probability that does not exceed Va. R or equal to Va. R Property: CVa. R is weighted average of Va. R and CVa. R+

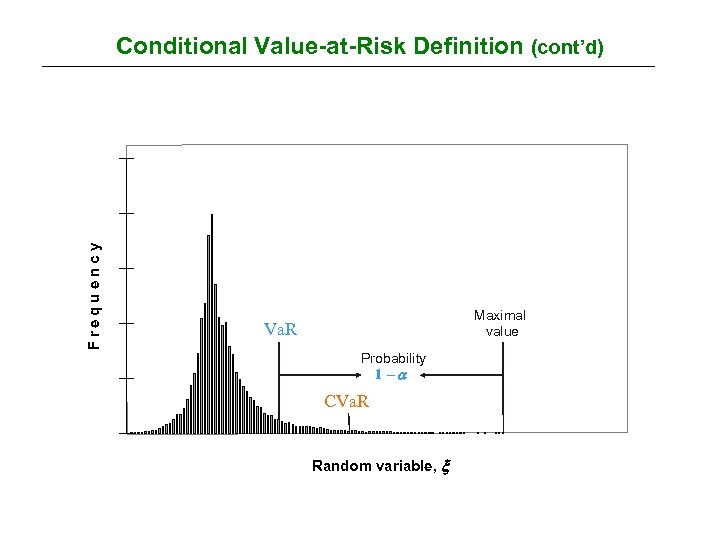

F re q u e n cy Conditional Value-at-Risk Definition (cont’d) Maximal value Va. R Probability 1 - CVa. R Random variable,

F re q u e n cy Conditional Value-at-Risk Definition (cont’d) Maximal value Va. R Probability 1 - CVa. R Random variable,

Conditional Value-at-Risk Features · simple convenient representation of risks (one number) · measures downside risk · applicable to non-symmetric loss distributions · CVa. R accounts for risks beyond Va. R (more conservative than Va. R) · CVa. R is convex with respect to control variables · Va. R CVa. R- CVa. R+ · coherent in the sense of Artzner, Delbaen, Eber and Heath 3: (translation invariant, sub-additive, positively homogeneous, monotonic w. r. t. Stochastic Dominance 1) 1 Rockafellar R. T. and S. Uryasev (2001): Conditional Value-at-Risk for General Loss Distributions. Research Report 2001 -5. ISE Dept. , University of Florida, April 2001. (Can be downloaded: www. ise. ufl. edu/uryasev/cvar 2. pdf) 2 Pflug, G. Some Remarks on the Value-at-Risk and the Conditional Value-at-Risk, in ``Probabilistic Constrained Optimization: Methodology and Applications'' (S. Uryasev ed. ), Kluwer Academic Publishers, 2001. 3 Artzner, P. , Delbaen, F. , Eber, J. -M. Heath D. Coherent Measures of Risk, Mathematical Finance, 9 (1999), 203 --228.

Conditional Value-at-Risk Features · simple convenient representation of risks (one number) · measures downside risk · applicable to non-symmetric loss distributions · CVa. R accounts for risks beyond Va. R (more conservative than Va. R) · CVa. R is convex with respect to control variables · Va. R CVa. R- CVa. R+ · coherent in the sense of Artzner, Delbaen, Eber and Heath 3: (translation invariant, sub-additive, positively homogeneous, monotonic w. r. t. Stochastic Dominance 1) 1 Rockafellar R. T. and S. Uryasev (2001): Conditional Value-at-Risk for General Loss Distributions. Research Report 2001 -5. ISE Dept. , University of Florida, April 2001. (Can be downloaded: www. ise. ufl. edu/uryasev/cvar 2. pdf) 2 Pflug, G. Some Remarks on the Value-at-Risk and the Conditional Value-at-Risk, in ``Probabilistic Constrained Optimization: Methodology and Applications'' (S. Uryasev ed. ), Kluwer Academic Publishers, 2001. 3 Artzner, P. , Delbaen, F. , Eber, J. -M. Heath D. Coherent Measures of Risk, Mathematical Finance, 9 (1999), 203 --228.

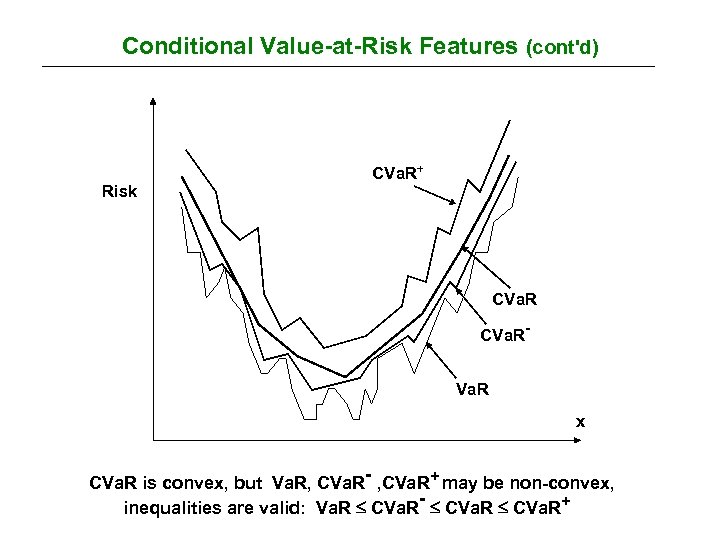

Conditional Value-at-Risk Features (cont'd) Risk CVa. R+ CVa. RVa. R x CVa. R is convex, but Va. R, CVa. R- , CVa. R+ may be non-convex, inequalities are valid: Va. R CVa. R- CVa. R+

Conditional Value-at-Risk Features (cont'd) Risk CVa. R+ CVa. RVa. R x CVa. R is convex, but Va. R, CVa. R- , CVa. R+ may be non-convex, inequalities are valid: Va. R CVa. R- CVa. R+

Conditional Value-at-Risk Features (cont'd) · stable statistical estimates (CVa. R has integral characteristics compared to Va. R which may be significantly impacted by one scenario) · CVa. R is continuous with respect to confidence level , consistent at different confidence levels compared to Va. R ( Va. R, CVa. R-, CVa. R+ may be discontinuous in ) · consistency with mean-variance approach: for normal loss distributions optimal variance and CVa. R portfolios coincide · easy to control/optimize for non-normal distributions; linear programming (LP): can be used for optimization of very large problems (over 1, 000 instruments and scenarios); fast, stable algorithms · loss distribution can be shaped using CVa. R constraints (many LP · can be used in fast online procedures constraints with various confidence levels in different intervals)

Conditional Value-at-Risk Features (cont'd) · stable statistical estimates (CVa. R has integral characteristics compared to Va. R which may be significantly impacted by one scenario) · CVa. R is continuous with respect to confidence level , consistent at different confidence levels compared to Va. R ( Va. R, CVa. R-, CVa. R+ may be discontinuous in ) · consistency with mean-variance approach: for normal loss distributions optimal variance and CVa. R portfolios coincide · easy to control/optimize for non-normal distributions; linear programming (LP): can be used for optimization of very large problems (over 1, 000 instruments and scenarios); fast, stable algorithms · loss distribution can be shaped using CVa. R constraints (many LP · can be used in fast online procedures constraints with various confidence levels in different intervals)

Conditional Value-at-Risk Features (cont'd) · CVa. R for continuous distributions usually coincides with conditional expected loss exceeding Va. R (also called Mean Excess Loss or Expected Shortfall). · However, for non-continuous (as well as for continuous) distributions CVa. R may differ from conditional expected loss exceeding Va. R. · Acerbi et al. 1, 2 recently redefined Expected Shortfall to be consistent with CVa. R definition: · Acerbi et al. 2 proved several nice mathematical results on properties of CVa. R, including asymptotic convergence of sample estimates to CVa. R. 1 Acerbi, C. , Nordio, C. , Sirtori, C. Expected Shortfall as a Tool for Financial Risk Management, Working Paper, can be downloaded: www. gloriamundi. org/var/wps. html 2 Acerbi, C. , and Tasche, D. On the Coherence of Expected Shortfall. Working Paper, can be downloaded: www. gloriamundi. org/var/wps. html

Conditional Value-at-Risk Features (cont'd) · CVa. R for continuous distributions usually coincides with conditional expected loss exceeding Va. R (also called Mean Excess Loss or Expected Shortfall). · However, for non-continuous (as well as for continuous) distributions CVa. R may differ from conditional expected loss exceeding Va. R. · Acerbi et al. 1, 2 recently redefined Expected Shortfall to be consistent with CVa. R definition: · Acerbi et al. 2 proved several nice mathematical results on properties of CVa. R, including asymptotic convergence of sample estimates to CVa. R. 1 Acerbi, C. , Nordio, C. , Sirtori, C. Expected Shortfall as a Tool for Financial Risk Management, Working Paper, can be downloaded: www. gloriamundi. org/var/wps. html 2 Acerbi, C. , and Tasche, D. On the Coherence of Expected Shortfall. Working Paper, can be downloaded: www. gloriamundi. org/var/wps. html

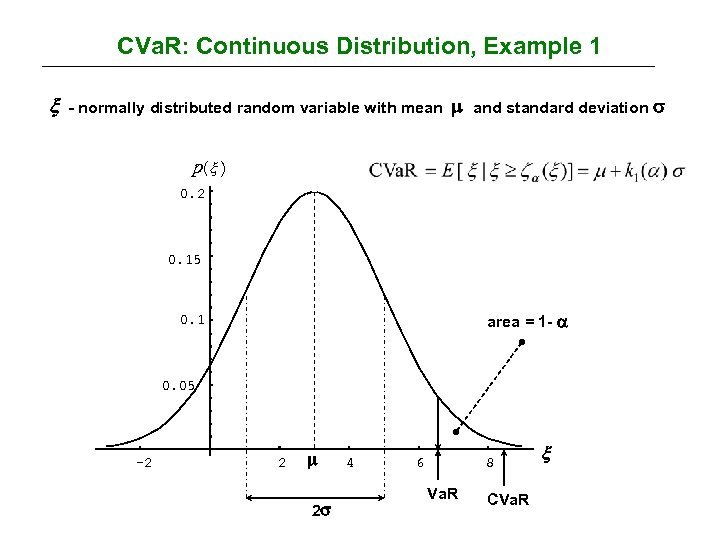

CVa. R: Continuous Distribution, Example 1 - normally distributed random variable with mean and standard deviation p( ) 0. 2 0. 15 area = 1 - 0. 1 0. 05 -2 2 2 4 6 8 Va. R CVa. R

CVa. R: Continuous Distribution, Example 1 - normally distributed random variable with mean and standard deviation p( ) 0. 2 0. 15 area = 1 - 0. 1 0. 05 -2 2 2 4 6 8 Va. R CVa. R

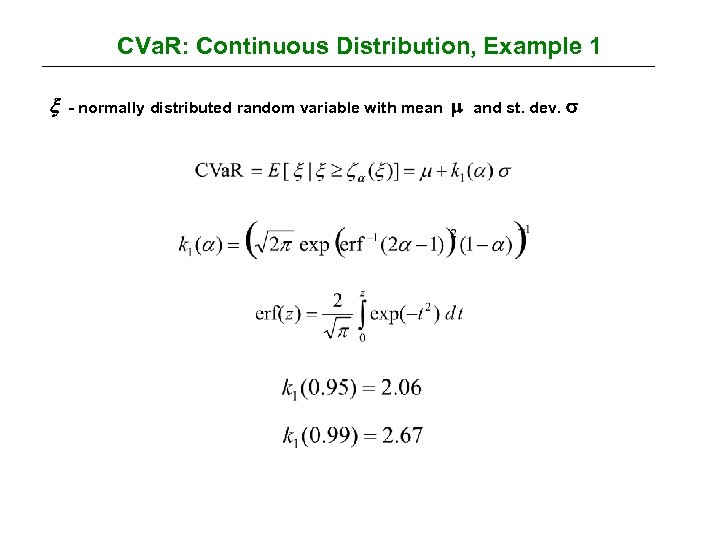

CVa. R: Continuous Distribution, Example 1 - normally distributed random variable with mean and st. dev.

CVa. R: Continuous Distribution, Example 1 - normally distributed random variable with mean and st. dev.

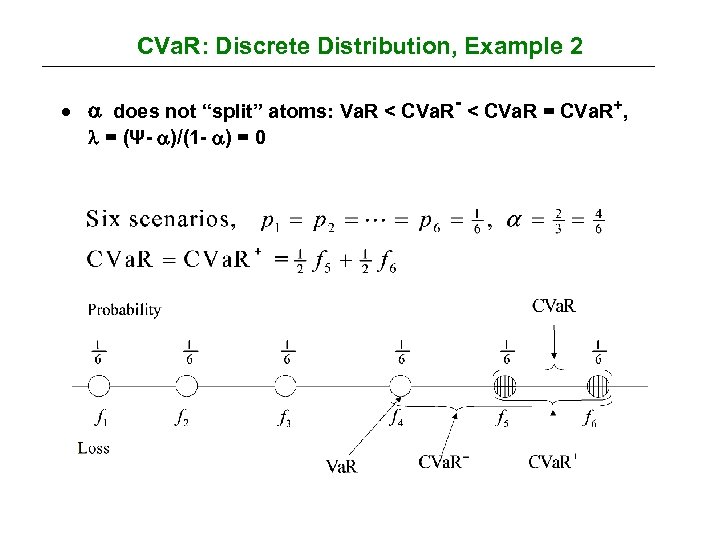

CVa. R: Discrete Distribution, Example 2 · does not “split” atoms: Va. R < CVa. R- < CVa. R = CVa. R+, = (Ψ- )/(1 - ) = 0

CVa. R: Discrete Distribution, Example 2 · does not “split” atoms: Va. R < CVa. R- < CVa. R = CVa. R+, = (Ψ- )/(1 - ) = 0

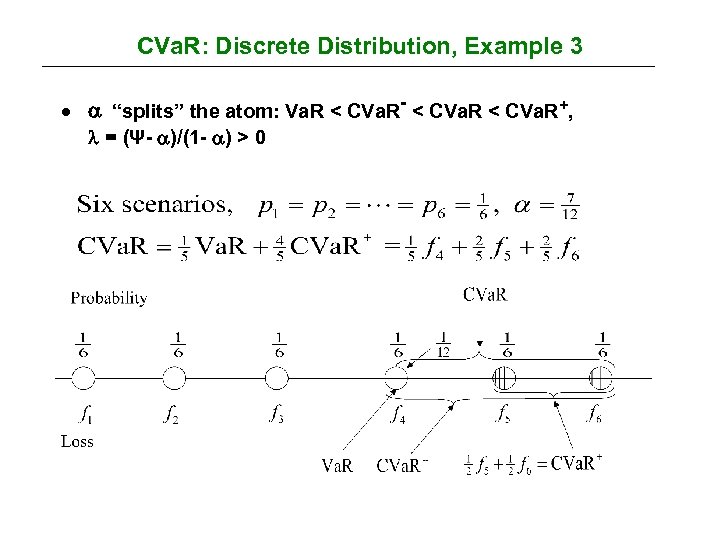

CVa. R: Discrete Distribution, Example 3 · “splits” the atom: Va. R < CVa. R- < CVa. R+, = (Ψ- )/(1 - ) > 0

CVa. R: Discrete Distribution, Example 3 · “splits” the atom: Va. R < CVa. R- < CVa. R+, = (Ψ- )/(1 - ) > 0

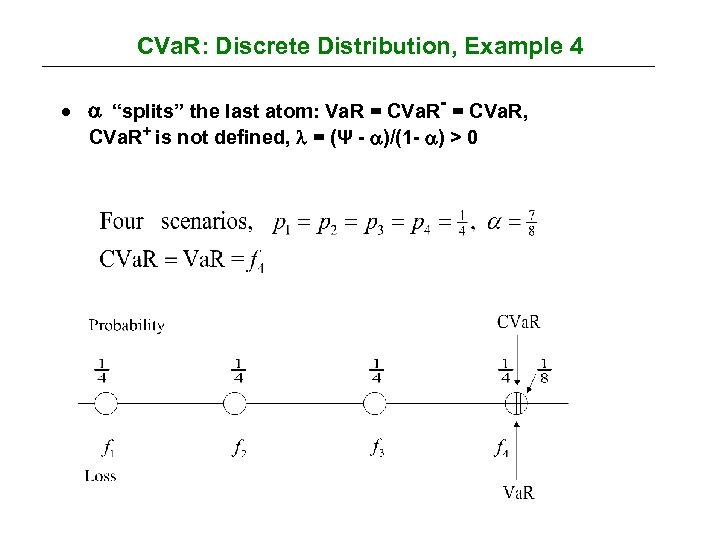

CVa. R: Discrete Distribution, Example 4 · “splits” the last atom: Va. R = CVa. R- = CVa. R, CVa. R+ is not defined, = (Ψ - )/(1 - ) > 0

CVa. R: Discrete Distribution, Example 4 · “splits” the last atom: Va. R = CVa. R- = CVa. R, CVa. R+ is not defined, = (Ψ - )/(1 - ) > 0

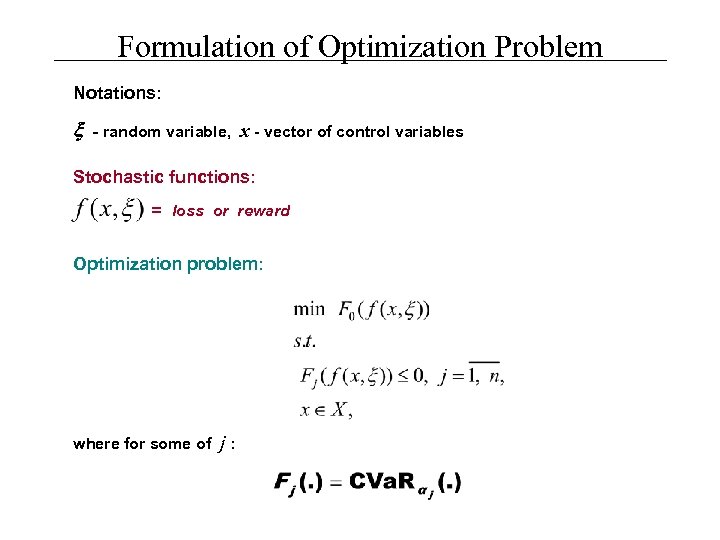

Formulation of Optimization Problem Notations: - random variable, x - vector of control variables Stochastic functions: = loss or reward Optimization problem: where for some of j:

Formulation of Optimization Problem Notations: - random variable, x - vector of control variables Stochastic functions: = loss or reward Optimization problem: where for some of j:

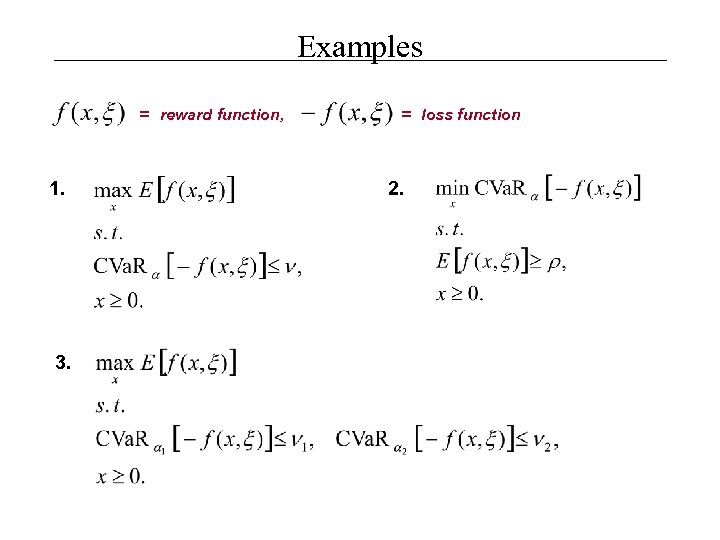

Examples = reward function, 1. 3. = loss function 2.

Examples = reward function, 1. 3. = loss function 2.

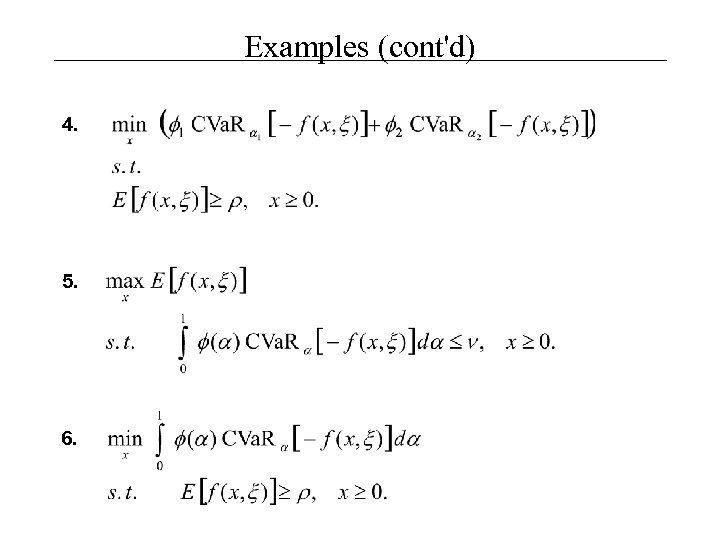

Examples (cont'd) 4. 5. 6.

Examples (cont'd) 4. 5. 6.

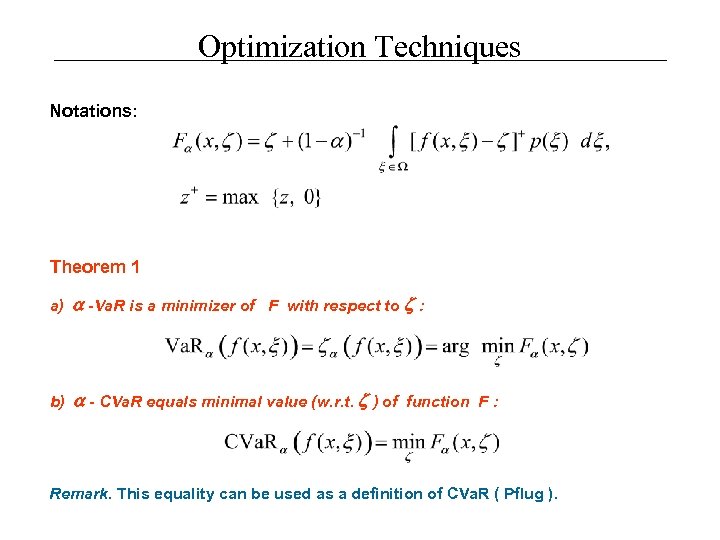

Optimization Techniques Notations: Theorem 1 a) -Va. R is a minimizer of F with respect to : b) - CVa. R equals minimal value (w. r. t. ) of function F : Remark. This equality can be used as a definition of CVa. R ( Pflug ).

Optimization Techniques Notations: Theorem 1 a) -Va. R is a minimizer of F with respect to : b) - CVa. R equals minimal value (w. r. t. ) of function F : Remark. This equality can be used as a definition of CVa. R ( Pflug ).

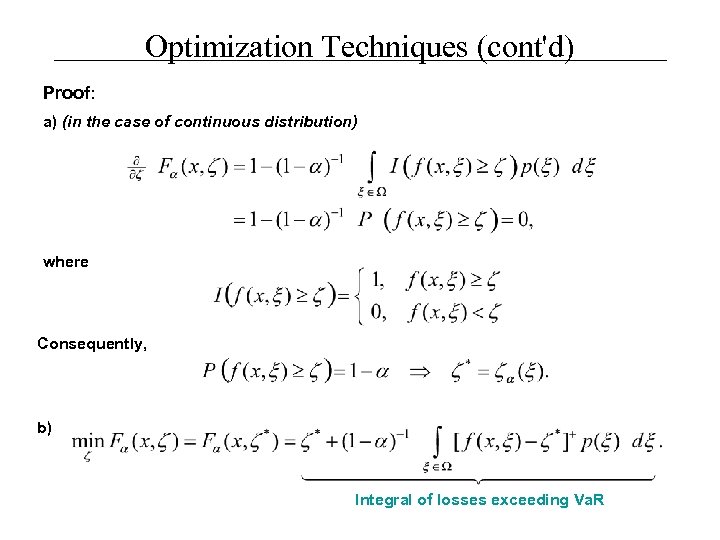

Optimization Techniques (cont'd) Proof: a) (in the case of continuous distribution) where Consequently, b) Integral of losses exceeding Va. R

Optimization Techniques (cont'd) Proof: a) (in the case of continuous distribution) where Consequently, b) Integral of losses exceeding Va. R

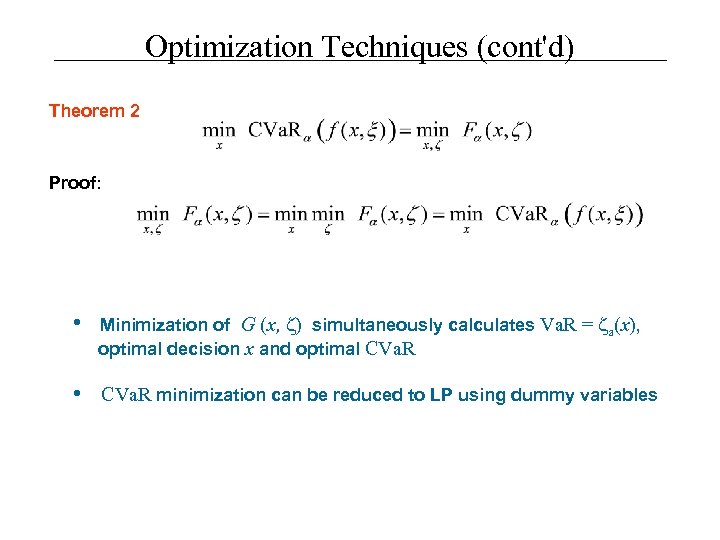

Optimization Techniques (cont'd) Theorem 2 Proof: • Minimization of G (x, ) simultaneously calculates Va. R = a(x), optimal decision x and optimal CVa. R • CVa. R minimization can be reduced to LP using dummy variables

Optimization Techniques (cont'd) Theorem 2 Proof: • Minimization of G (x, ) simultaneously calculates Va. R = a(x), optimal decision x and optimal CVa. R • CVa. R minimization can be reduced to LP using dummy variables

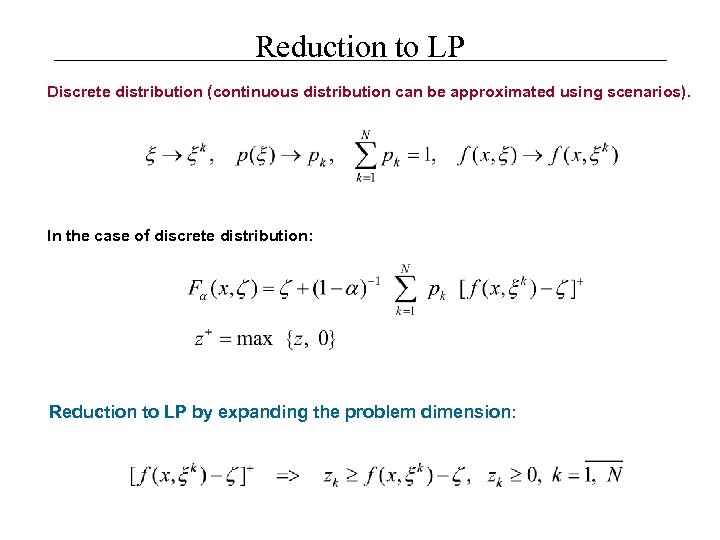

Reduction to LP Discrete distribution (continuous distribution can be approximated using scenarios). In the case of discrete distribution: Reduction to LP by expanding the problem dimension:

Reduction to LP Discrete distribution (continuous distribution can be approximated using scenarios). In the case of discrete distribution: Reduction to LP by expanding the problem dimension:

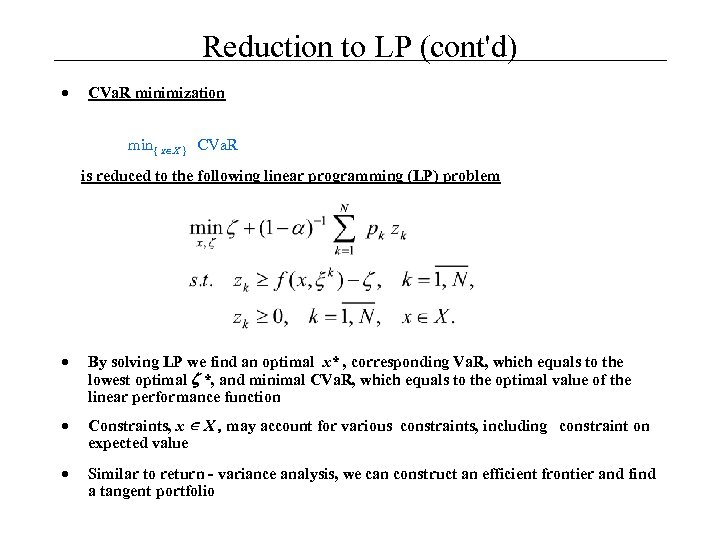

Reduction to LP (cont'd) · CVa. R minimization min{ x X } CVa. R is reduced to the following linear programming (LP) problem · By solving LP we find an optimal x* , corresponding Va. R, which equals to the lowest optimal *, and minimal CVa. R, which equals to the optimal value of the linear performance function · Constraints, x X , may account for various constraints, including constraint on expected value · Similar to return - variance analysis, we can construct an efficient frontier and find a tangent portfolio

Reduction to LP (cont'd) · CVa. R minimization min{ x X } CVa. R is reduced to the following linear programming (LP) problem · By solving LP we find an optimal x* , corresponding Va. R, which equals to the lowest optimal *, and minimal CVa. R, which equals to the optimal value of the linear performance function · Constraints, x X , may account for various constraints, including constraint on expected value · Similar to return - variance analysis, we can construct an efficient frontier and find a tangent portfolio

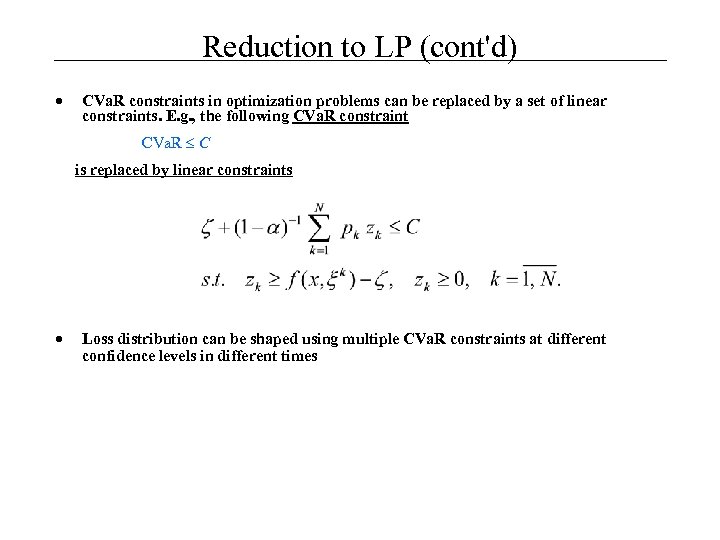

Reduction to LP (cont'd) · CVa. R constraints in optimization problems can be replaced by a set of linear constraints. E. g. , the following CVa. R constraint CVa. R C is replaced by linear constraints · Loss distribution can be shaped using multiple CVa. R constraints at different confidence levels in different times

Reduction to LP (cont'd) · CVa. R constraints in optimization problems can be replaced by a set of linear constraints. E. g. , the following CVa. R constraint CVa. R C is replaced by linear constraints · Loss distribution can be shaped using multiple CVa. R constraints at different confidence levels in different times

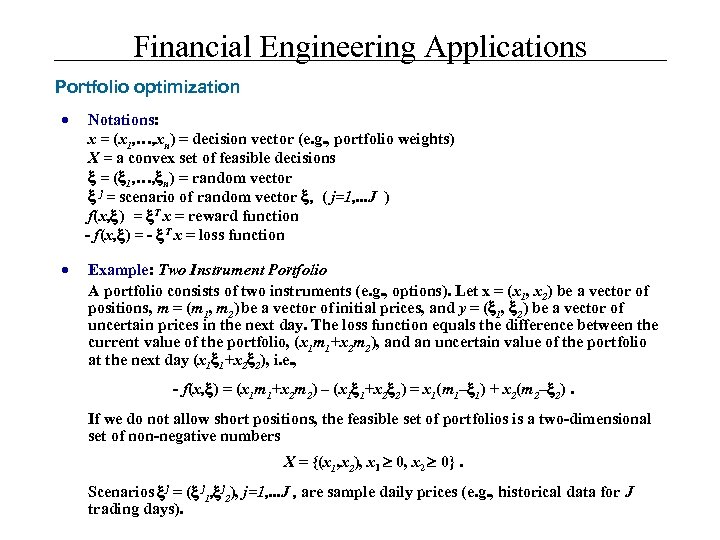

Financial Engineering Applications Portfolio optimization · Notations: x = (x 1, …, xn) = decision vector (e. g. , portfolio weights) X = a convex set of feasible decisions = ( 1, …, n) = random vector j = scenario of random vector , ( j=1, . . . J ) f(x, ) = T x = reward function - f(x, ) = - T x = loss function · Example: Two Instrument Portfolio A portfolio consists of two instruments (e. g. , options). Let x = (x 1, x 2) be a vector of positions, m = (m 1, m 2) be a vector of initial prices, and y = ( 1, 2) be a vector of uncertain prices in the next day. The loss function equals the difference between the current value of the portfolio, (x 1 m 1+x 2 m 2), and an uncertain value of the portfolio at the next day (x 1 1+x 2 2), i. e. , - f(x, ) = (x 1 m 1+x 2 m 2) – (x 1 1+x 2 2) = x 1(m 1– 1) + x 2(m 2– 2). If we do not allow short positions, the feasible set of portfolios is a two-dimensional set of non-negative numbers X = {(x 1, x 2), x 1 0, x 2 0}. Scenarios j = ( j 1, j 2), j=1, . . . J , are sample daily prices (e. g. , historical data for J trading days).

Financial Engineering Applications Portfolio optimization · Notations: x = (x 1, …, xn) = decision vector (e. g. , portfolio weights) X = a convex set of feasible decisions = ( 1, …, n) = random vector j = scenario of random vector , ( j=1, . . . J ) f(x, ) = T x = reward function - f(x, ) = - T x = loss function · Example: Two Instrument Portfolio A portfolio consists of two instruments (e. g. , options). Let x = (x 1, x 2) be a vector of positions, m = (m 1, m 2) be a vector of initial prices, and y = ( 1, 2) be a vector of uncertain prices in the next day. The loss function equals the difference between the current value of the portfolio, (x 1 m 1+x 2 m 2), and an uncertain value of the portfolio at the next day (x 1 1+x 2 2), i. e. , - f(x, ) = (x 1 m 1+x 2 m 2) – (x 1 1+x 2 2) = x 1(m 1– 1) + x 2(m 2– 2). If we do not allow short positions, the feasible set of portfolios is a two-dimensional set of non-negative numbers X = {(x 1, x 2), x 1 0, x 2 0}. Scenarios j = ( j 1, j 2), j=1, . . . J , are sample daily prices (e. g. , historical data for J trading days).

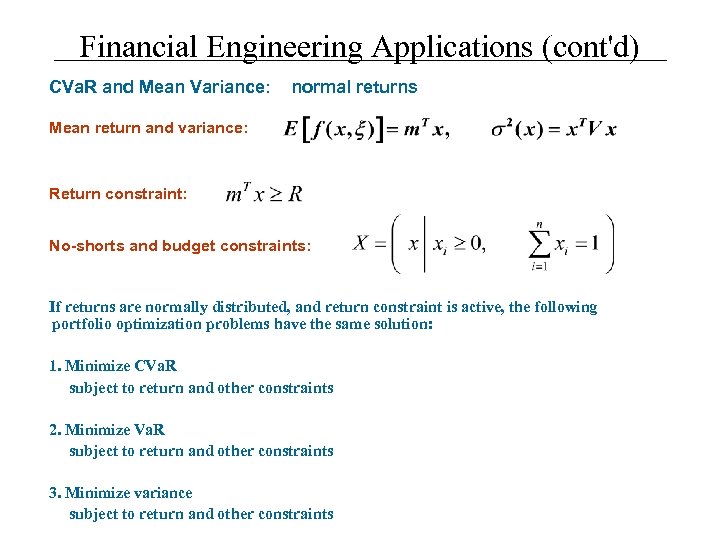

Financial Engineering Applications (cont'd) CVa. R and Mean Variance: normal returns Mean return and variance: Return constraint: No-shorts and budget constraints: If returns are normally distributed, and return constraint is active, the following portfolio optimization problems have the same solution: 1. Minimize CVa. R subject to return and other constraints 2. Minimize Va. R subject to return and other constraints 3. Minimize variance subject to return and other constraints

Financial Engineering Applications (cont'd) CVa. R and Mean Variance: normal returns Mean return and variance: Return constraint: No-shorts and budget constraints: If returns are normally distributed, and return constraint is active, the following portfolio optimization problems have the same solution: 1. Minimize CVa. R subject to return and other constraints 2. Minimize Va. R subject to return and other constraints 3. Minimize variance subject to return and other constraints

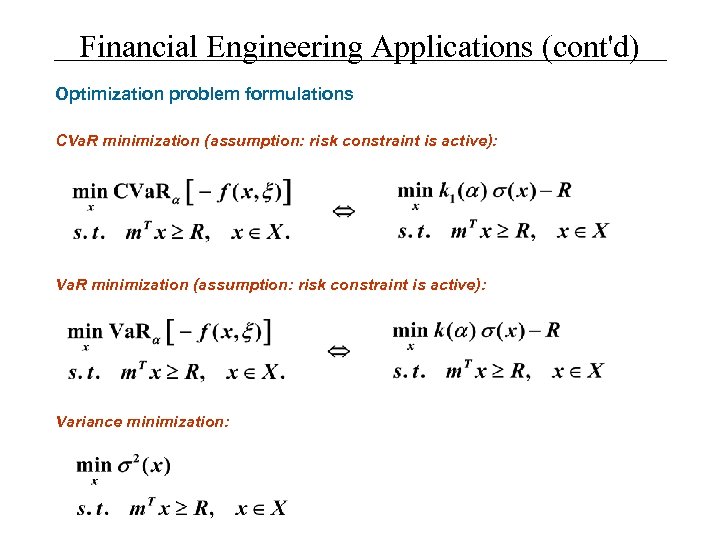

Financial Engineering Applications (cont'd) Optimization problem formulations CVa. R minimization (assumption: risk constraint is active): Variance minimization:

Financial Engineering Applications (cont'd) Optimization problem formulations CVa. R minimization (assumption: risk constraint is active): Variance minimization:

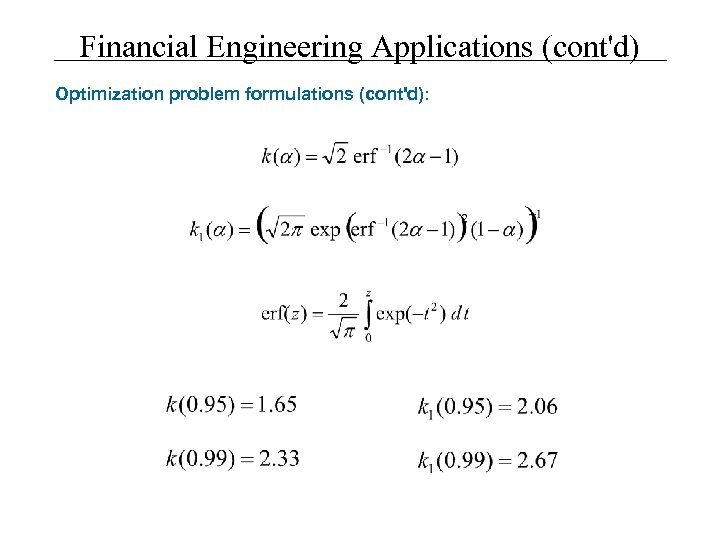

Financial Engineering Applications (cont'd) Optimization problem formulations (cont'd):

Financial Engineering Applications (cont'd) Optimization problem formulations (cont'd):

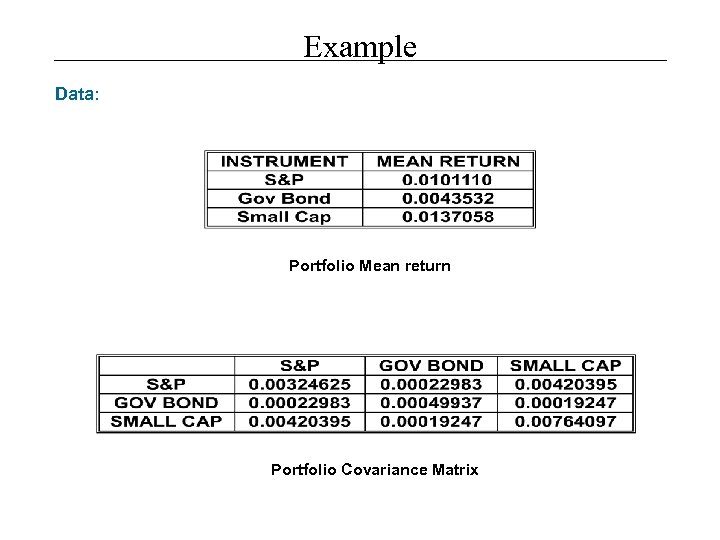

Example Data: Portfolio Mean return Portfolio Covariance Matrix

Example Data: Portfolio Mean return Portfolio Covariance Matrix

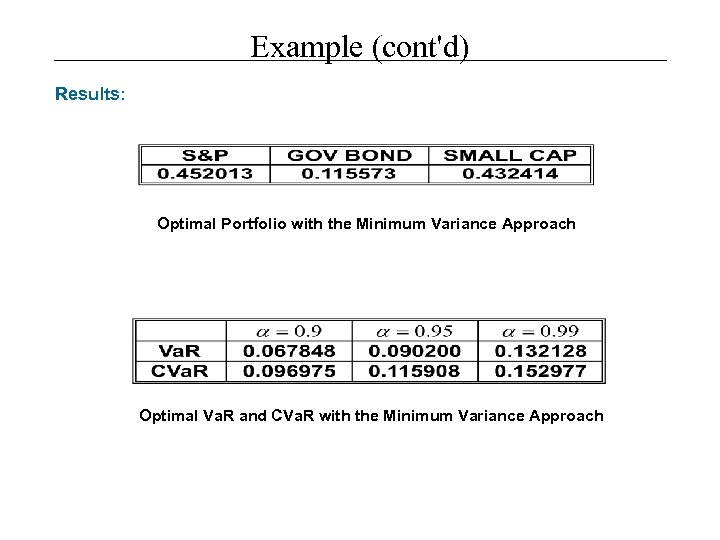

Example (cont'd) Results: Optimal Portfolio with the Minimum Variance Approach Optimal Va. R and CVa. R with the Minimum Variance Approach

Example (cont'd) Results: Optimal Portfolio with the Minimum Variance Approach Optimal Va. R and CVa. R with the Minimum Variance Approach

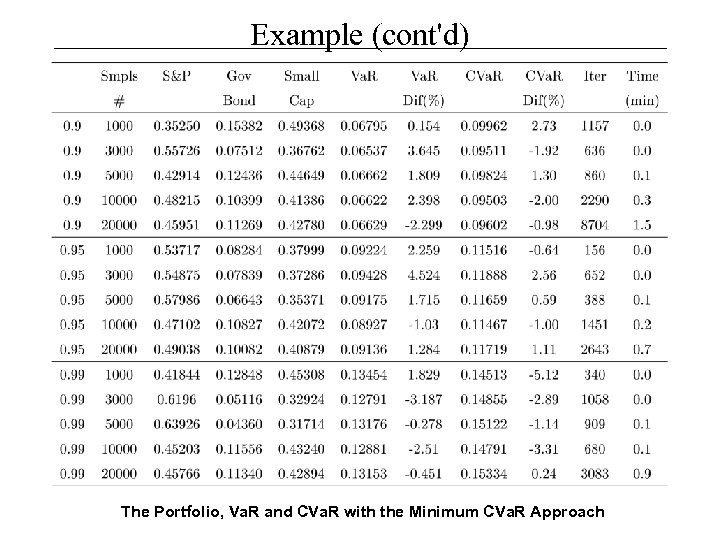

Example (cont'd) The Portfolio, Va. R and CVa. R with the Minimum CVa. R Approach

Example (cont'd) The Portfolio, Va. R and CVa. R with the Minimum CVa. R Approach

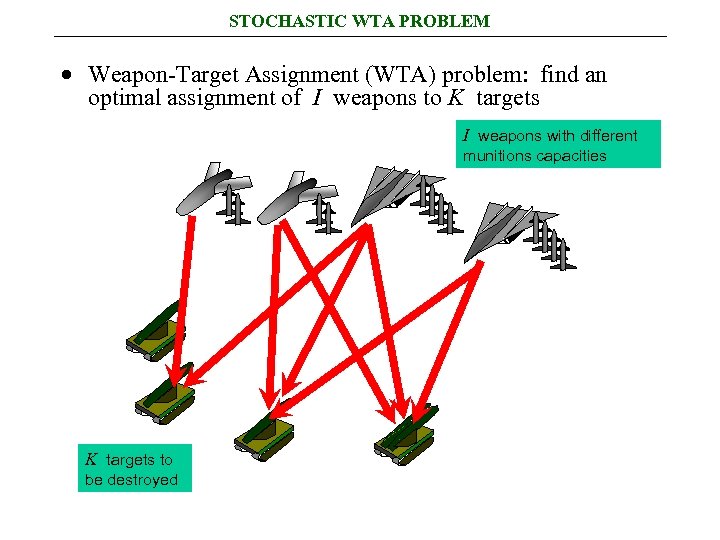

STOCHASTIC WTA PROBLEM · Weapon-Target Assignment (WTA) problem: find an optimal assignment of I weapons to K targets I weapons with different munitions capacities K targets to be destroyed

STOCHASTIC WTA PROBLEM · Weapon-Target Assignment (WTA) problem: find an optimal assignment of I weapons to K targets I weapons with different munitions capacities K targets to be destroyed

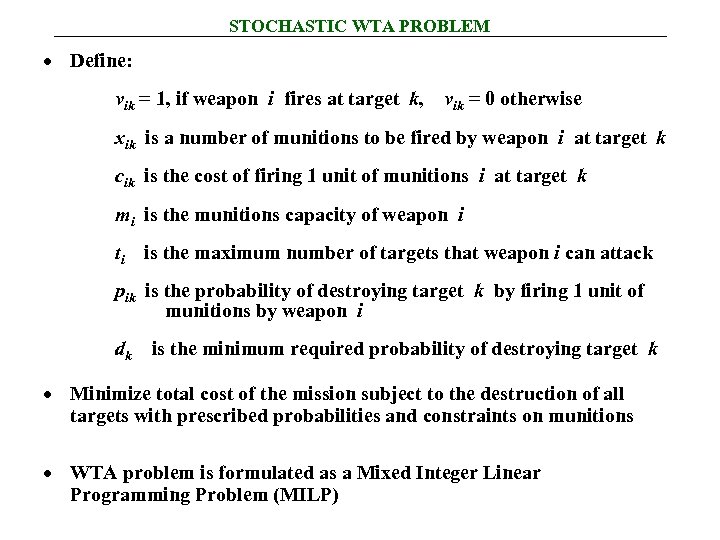

STOCHASTIC WTA PROBLEM · Define: vik = 1, if weapon i fires at target k, vik = 0 otherwise xik is a number of munitions to be fired by weapon i at target k cik is the cost of firing 1 unit of munitions i at target k mi is the munitions capacity of weapon i ti is the maximum number of targets that weapon i can attack pik is the probability of destroying target k by firing 1 unit of munitions by weapon i dk is the minimum required probability of destroying target k · Minimize total cost of the mission subject to the destruction of all targets with prescribed probabilities and constraints on munitions · WTA problem is formulated as a Mixed Integer Linear Programming Problem (MILP)

STOCHASTIC WTA PROBLEM · Define: vik = 1, if weapon i fires at target k, vik = 0 otherwise xik is a number of munitions to be fired by weapon i at target k cik is the cost of firing 1 unit of munitions i at target k mi is the munitions capacity of weapon i ti is the maximum number of targets that weapon i can attack pik is the probability of destroying target k by firing 1 unit of munitions by weapon i dk is the minimum required probability of destroying target k · Minimize total cost of the mission subject to the destruction of all targets with prescribed probabilities and constraints on munitions · WTA problem is formulated as a Mixed Integer Linear Programming Problem (MILP)

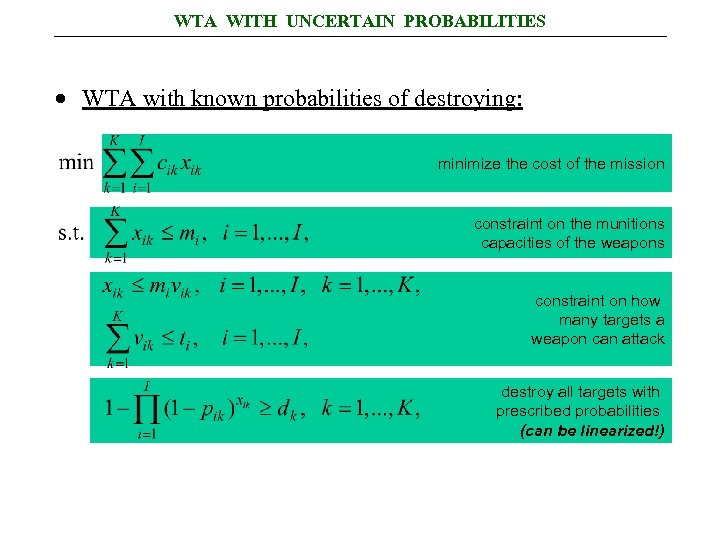

WTA WITH UNCERTAIN PROBABILITIES · WTA with known probabilities of destroying: minimize the cost of the mission constraint on the munitions capacities of the weapons constraint on how many targets a weapon can attack destroy all targets with prescribed probabilities (can be linearized!)

WTA WITH UNCERTAIN PROBABILITIES · WTA with known probabilities of destroying: minimize the cost of the mission constraint on the munitions capacities of the weapons constraint on how many targets a weapon can attack destroy all targets with prescribed probabilities (can be linearized!)

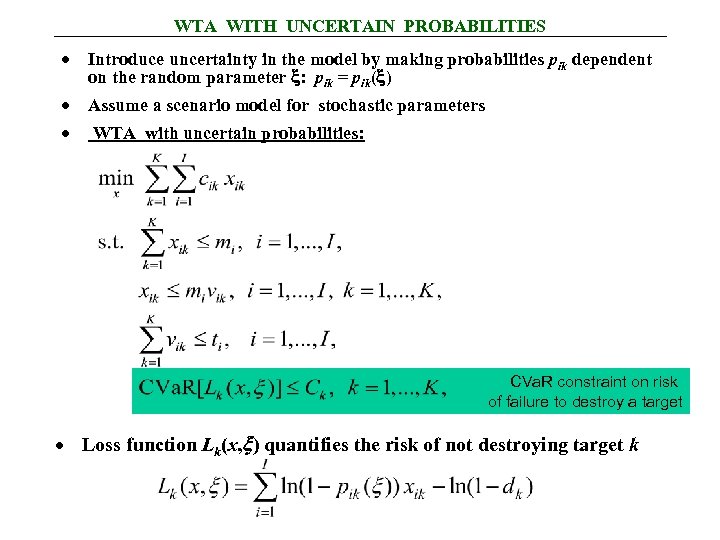

WTA WITH UNCERTAIN PROBABILITIES · Introduce uncertainty in the model by making probabilities pik dependent on the random parameter : pik = pik( ) · Assume a scenario model for stochastic parameters · WTA with uncertain probabilities: CVa. R constraint on risk of failure to destroy a target · Loss function Lk(x, ) quantifies the risk of not destroying target k

WTA WITH UNCERTAIN PROBABILITIES · Introduce uncertainty in the model by making probabilities pik dependent on the random parameter : pik = pik( ) · Assume a scenario model for stochastic parameters · WTA with uncertain probabilities: CVa. R constraint on risk of failure to destroy a target · Loss function Lk(x, ) quantifies the risk of not destroying target k

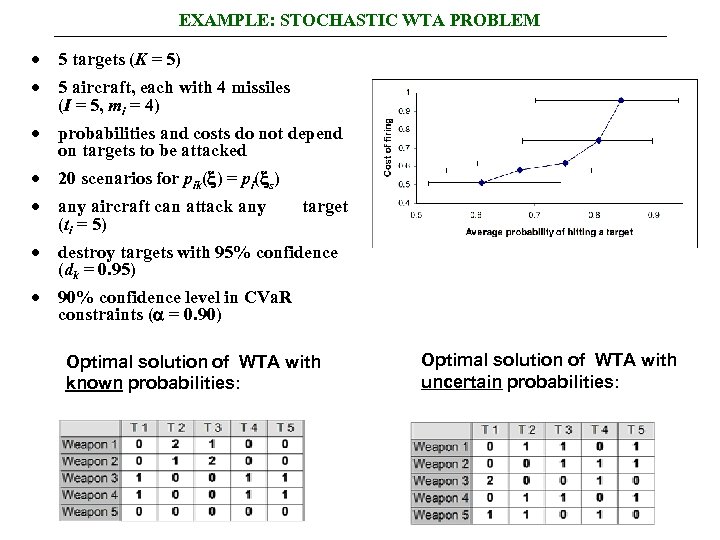

EXAMPLE: STOCHASTIC WTA PROBLEM · 5 targets (K = 5) · 5 aircraft, each with 4 missiles (I = 5, mi = 4) · probabilities and costs do not depend on targets to be attacked · 20 scenarios for pik( ) = pi( s) · any aircraft can attack any target (ti = 5) · destroy targets with 95% confidence (dk = 0. 95) · 90% confidence level in CVa. R constraints ( = 0. 90) Optimal solution of WTA with known probabilities: Optimal solution of WTA with uncertain probabilities:

EXAMPLE: STOCHASTIC WTA PROBLEM · 5 targets (K = 5) · 5 aircraft, each with 4 missiles (I = 5, mi = 4) · probabilities and costs do not depend on targets to be attacked · 20 scenarios for pik( ) = pi( s) · any aircraft can attack any target (ti = 5) · destroy targets with 95% confidence (dk = 0. 95) · 90% confidence level in CVa. R constraints ( = 0. 90) Optimal solution of WTA with known probabilities: Optimal solution of WTA with uncertain probabilities:

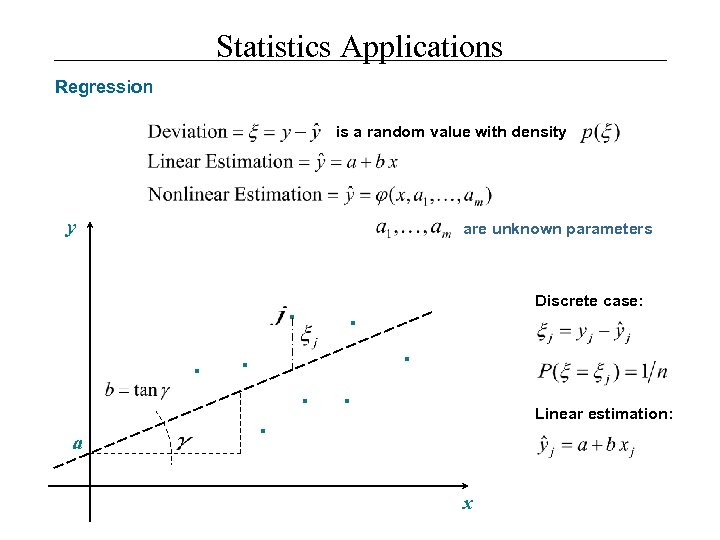

Statistics Applications Regression is a random value with density y are unknown parameters . . a Discrete case: . . . Linear estimation: x

Statistics Applications Regression is a random value with density y are unknown parameters . . a Discrete case: . . . Linear estimation: x

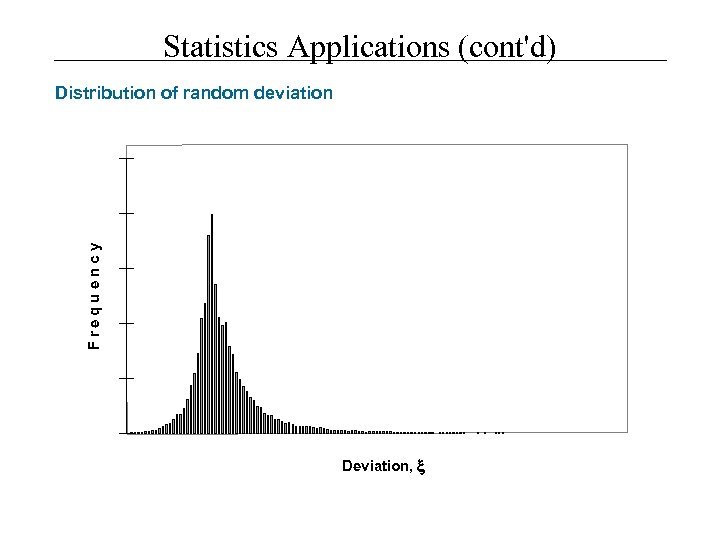

Statistics Applications (cont'd) F re q u e n cy Distribution of random deviation Deviation,

Statistics Applications (cont'd) F re q u e n cy Distribution of random deviation Deviation,

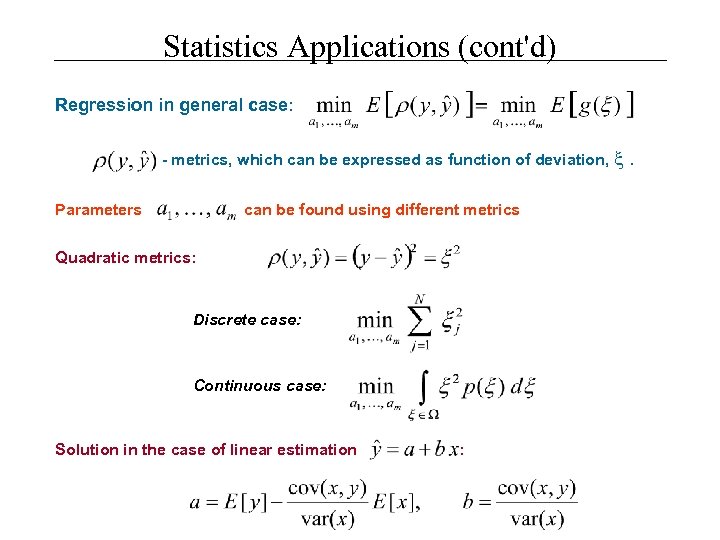

Statistics Applications (cont'd) Regression in general case: - metrics, which can be expressed as function of deviation, Parameters can be found using different metrics Quadratic metrics: Discrete case: Continuous case: Solution in the case of linear estimation : .

Statistics Applications (cont'd) Regression in general case: - metrics, which can be expressed as function of deviation, Parameters can be found using different metrics Quadratic metrics: Discrete case: Continuous case: Solution in the case of linear estimation : .

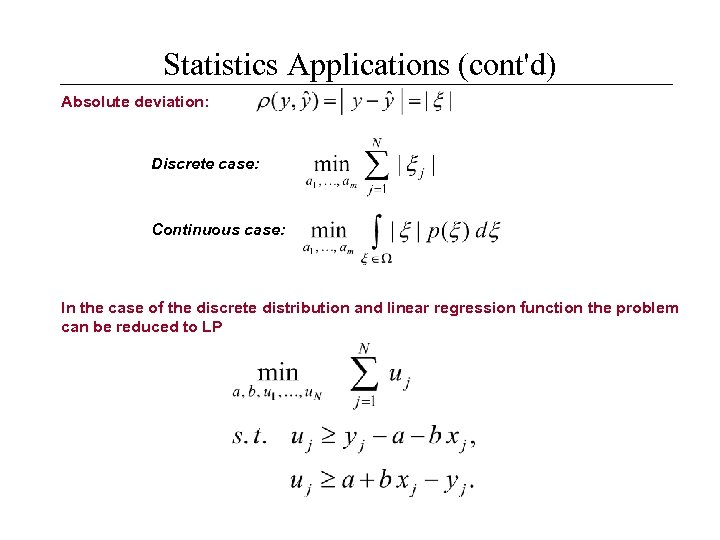

Statistics Applications (cont'd) Absolute deviation: Discrete case: Continuous case: In the case of the discrete distribution and linear regression function the problem can be reduced to LP

Statistics Applications (cont'd) Absolute deviation: Discrete case: Continuous case: In the case of the discrete distribution and linear regression function the problem can be reduced to LP

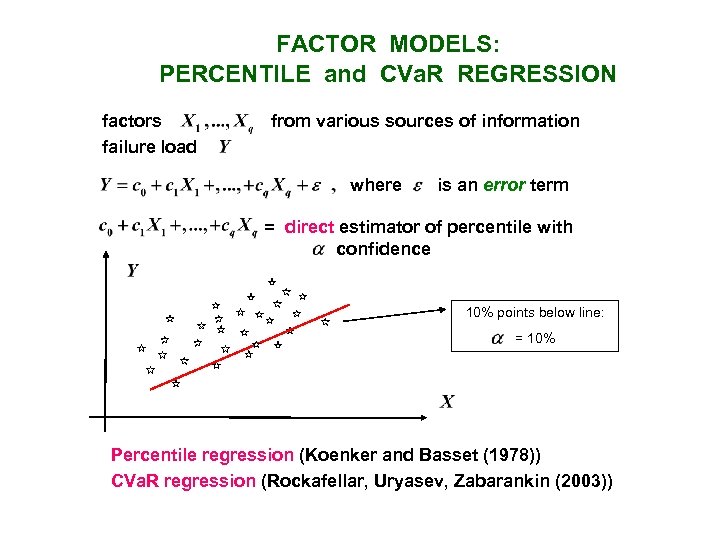

Statistics Applications (cont'd)

Statistics Applications (cont'd)

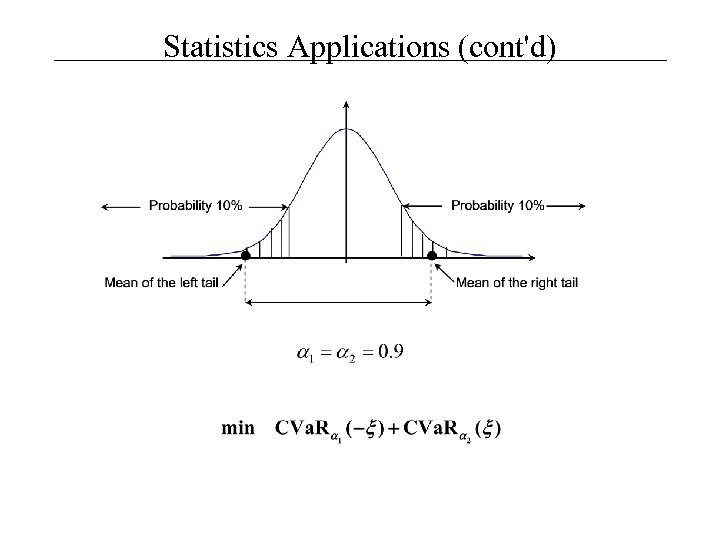

Statistics Applications (cont'd) Reduction to LP (discrete case):

Statistics Applications (cont'd) Reduction to LP (discrete case):

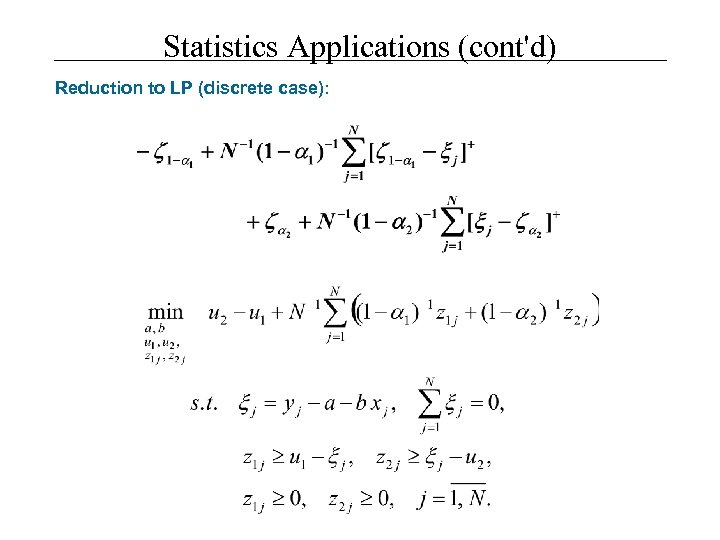

FACTOR MODELS: PERCENTILE and CVa. R REGRESSION factors failure load from various sources of information where is an error term = direct estimator of percentile with confidence 10% points below line: = 10% Percentile regression (Koenker and Basset (1978)) CVa. R regression (Rockafellar, Uryasev, Zabarankin (2003))

FACTOR MODELS: PERCENTILE and CVa. R REGRESSION factors failure load from various sources of information where is an error term = direct estimator of percentile with confidence 10% points below line: = 10% Percentile regression (Koenker and Basset (1978)) CVa. R regression (Rockafellar, Uryasev, Zabarankin (2003))

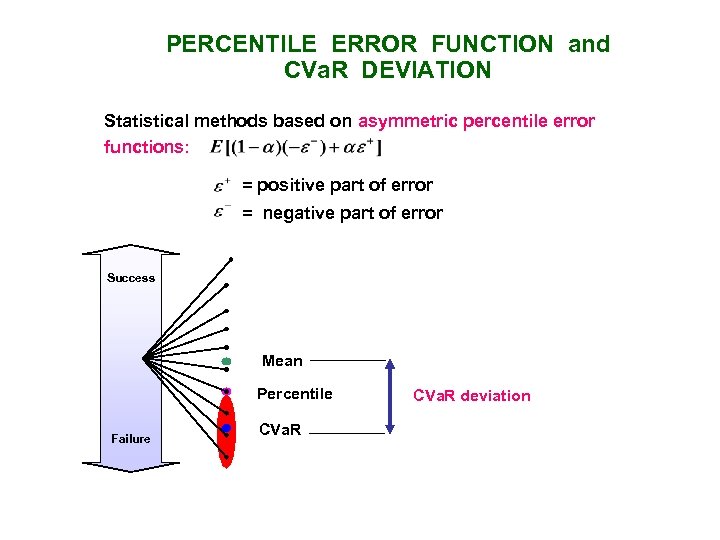

PERCENTILE ERROR FUNCTION and CVa. R DEVIATION Statistical methods based on asymmetric percentile error functions: = positive part of error = negative part of error Success Mean Percentile Failure CVa. R deviation

PERCENTILE ERROR FUNCTION and CVa. R DEVIATION Statistical methods based on asymmetric percentile error functions: = positive part of error = negative part of error Success Mean Percentile Failure CVa. R deviation

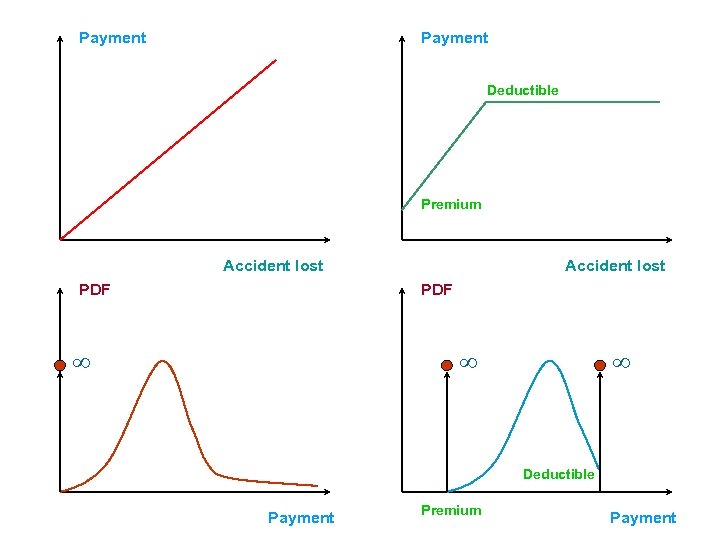

Payment Deductible Premium Accident lost PDF Deductible Payment Premium Payment

Payment Deductible Premium Accident lost PDF Deductible Payment Premium Payment

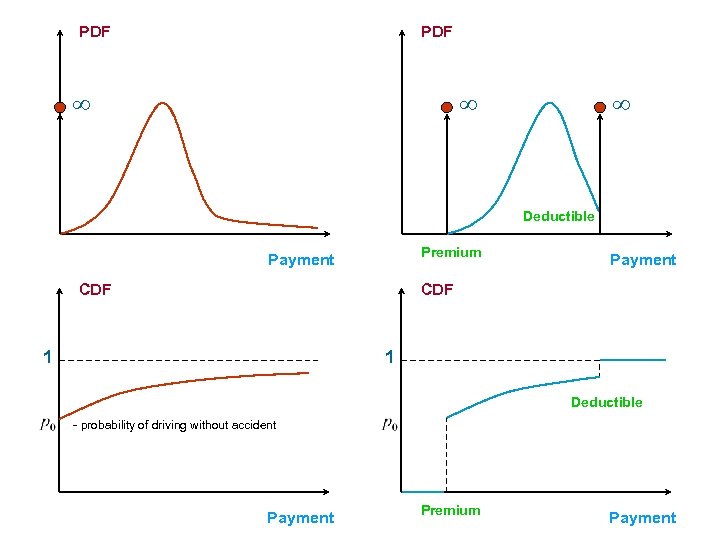

PDF Deductible Premium Payment CDF 1 1 Deductible - probability of driving without accident Payment Premium Payment

PDF Deductible Premium Payment CDF 1 1 Deductible - probability of driving without accident Payment Premium Payment

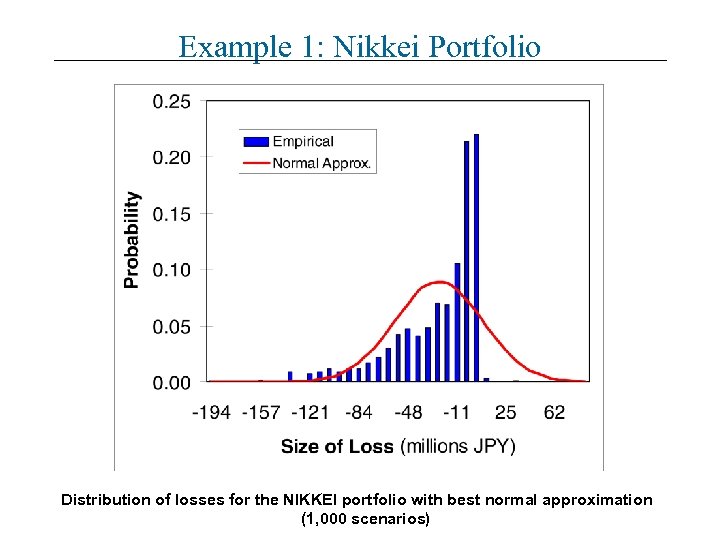

Example 1: Nikkei Portfolio Distribution of losses for the NIKKEI portfolio with best normal approximation (1, 000 scenarios)

Example 1: Nikkei Portfolio Distribution of losses for the NIKKEI portfolio with best normal approximation (1, 000 scenarios)

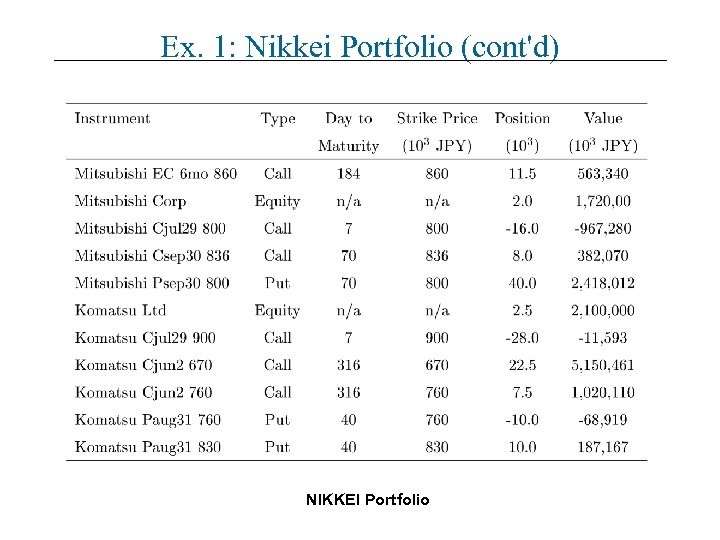

Ex. 1: Nikkei Portfolio (cont'd) NIKKEI Portfolio

Ex. 1: Nikkei Portfolio (cont'd) NIKKEI Portfolio

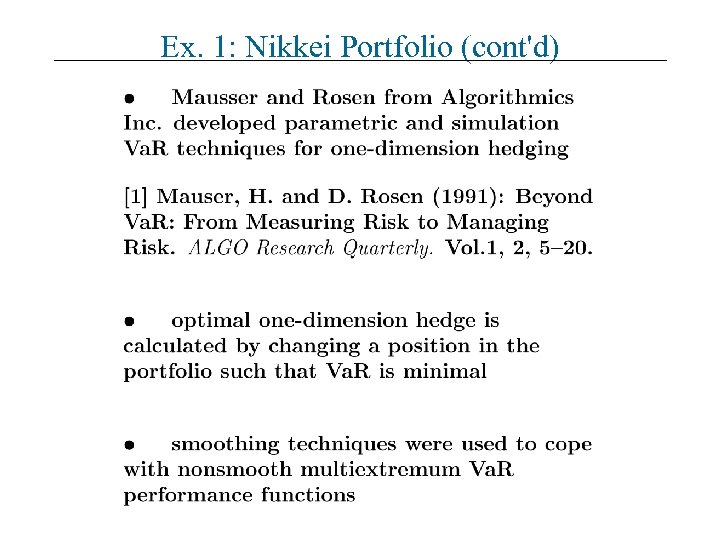

Ex. 1: Nikkei Portfolio (cont'd)

Ex. 1: Nikkei Portfolio (cont'd)

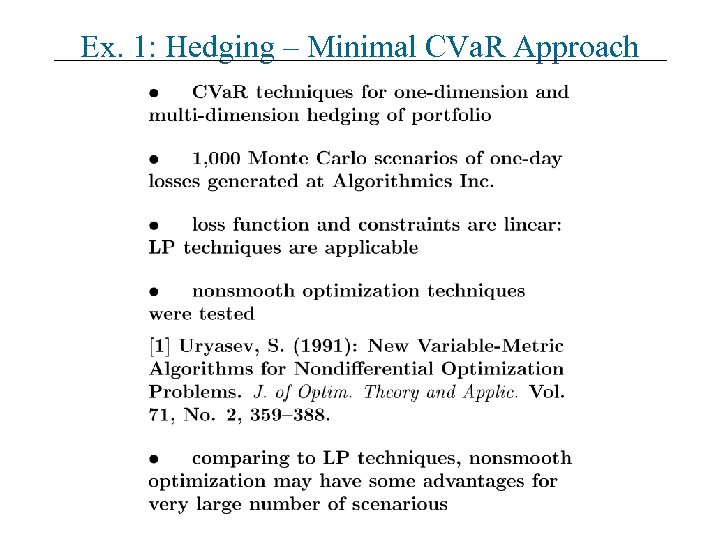

Ex. 1: Hedging – Minimal CVa. R Approach

Ex. 1: Hedging – Minimal CVa. R Approach

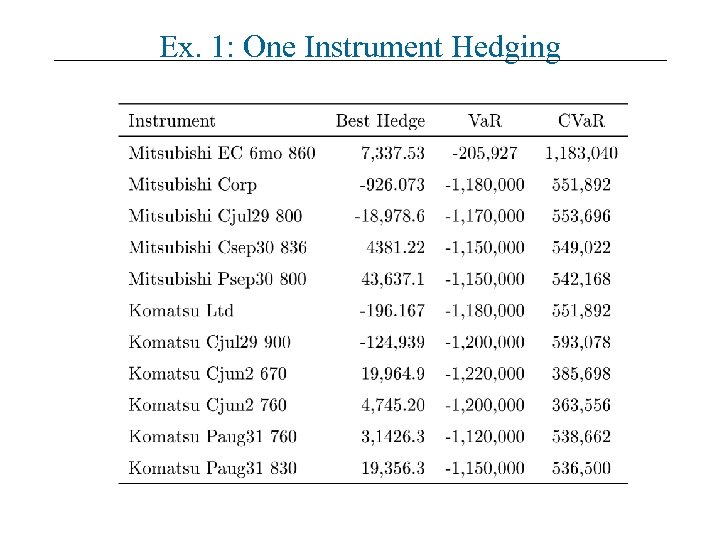

Ex. 1: One Instrument Hedging

Ex. 1: One Instrument Hedging

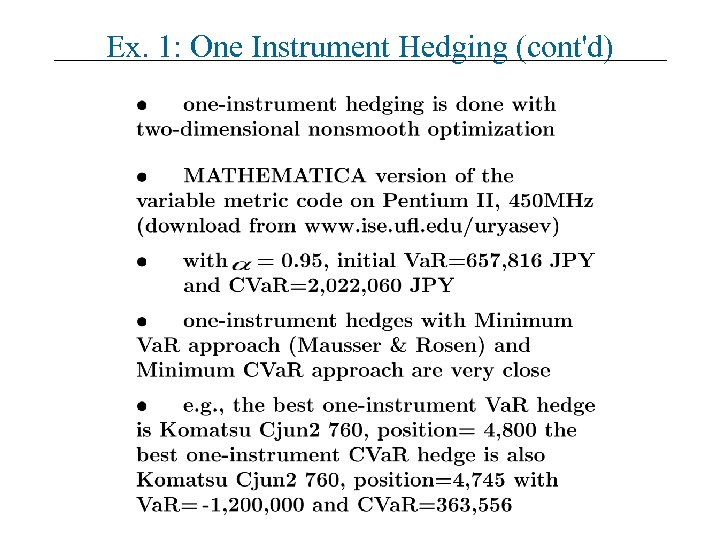

Ex. 1: One Instrument Hedging (cont'd)

Ex. 1: One Instrument Hedging (cont'd)

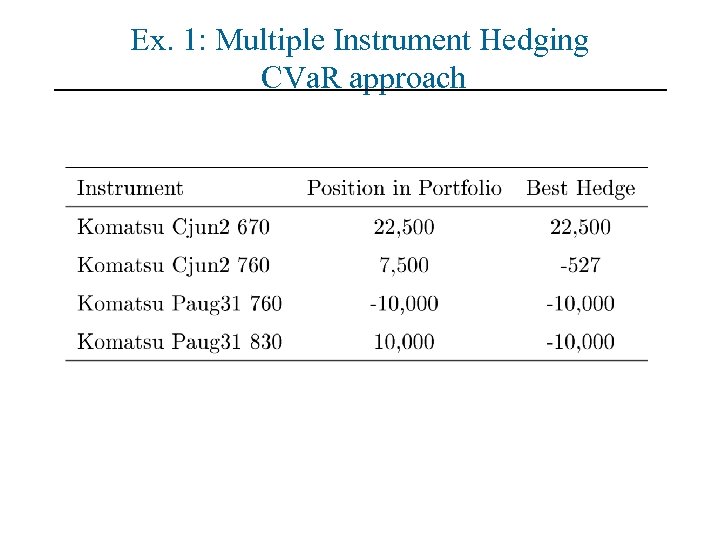

Ex. 1: Multiple Instrument Hedging CVa. R approach

Ex. 1: Multiple Instrument Hedging CVa. R approach

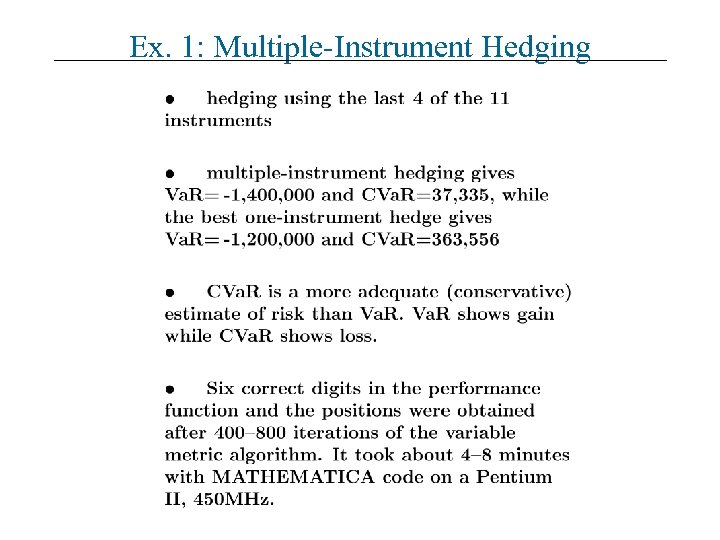

Ex. 1: Multiple-Instrument Hedging

Ex. 1: Multiple-Instrument Hedging

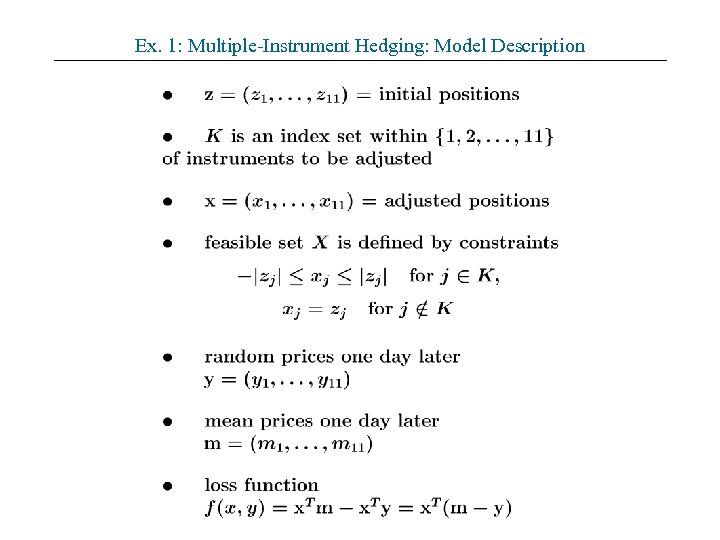

Ex. 1: Multiple-Instrument Hedging: Model Description

Ex. 1: Multiple-Instrument Hedging: Model Description

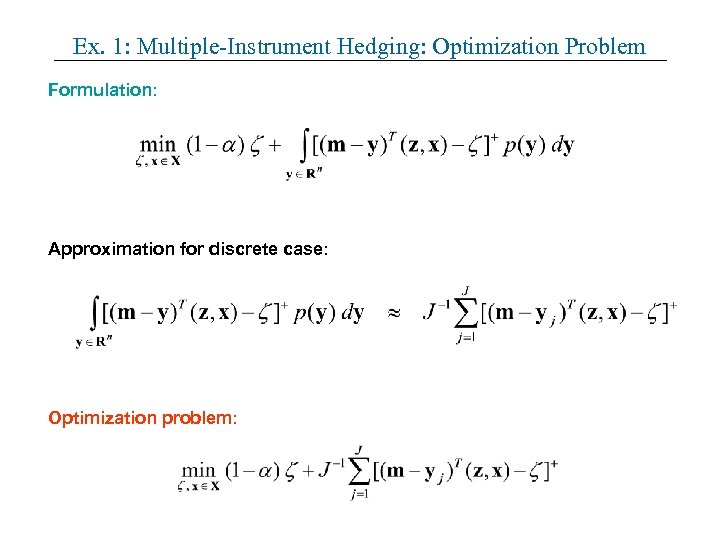

Ex. 1: Multiple-Instrument Hedging: Optimization Problem Formulation: Approximation for discrete case: Optimization problem:

Ex. 1: Multiple-Instrument Hedging: Optimization Problem Formulation: Approximation for discrete case: Optimization problem:

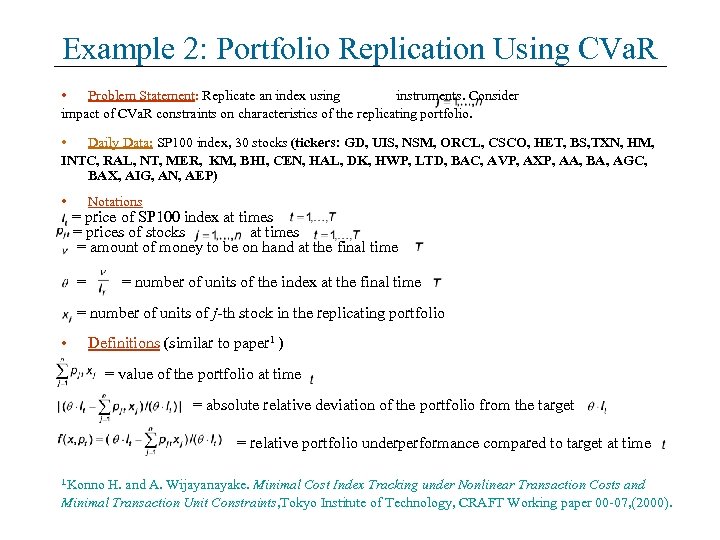

Example 2: Portfolio Replication Using CVa. R • Problem Statement: Replicate an index using instruments. Consider impact of CVa. R constraints on characteristics of the replicating portfolio. • Daily Data: SP 100 index, 30 stocks (tickers: GD, UIS, NSM, ORCL, CSCO, HET, BS, TXN, HM, INTC, RAL, NT, MER, KM, BHI, CEN, HAL, DK, HWP, LTD, BAC, AVP, AXP, AA, BA, AGC, BAX, AIG, AN, AEP) • Notations = price of SP 100 index at times = prices of stocks at times = amount of money to be on hand at the final time = = number of units of the index at the final time = number of units of j-th stock in the replicating portfolio • Definitions (similar to paper 1 ) = value of the portfolio at time = absolute relative deviation of the portfolio from the target = relative portfolio underperformance compared to target at time 1 Konno H. and A. Wijayanayake. Minimal Cost Index Tracking under Nonlinear Transaction Costs and Minimal Transaction Unit Constraints, Tokyo Institute of Technology, CRAFT Working paper 00 -07, (2000).

Example 2: Portfolio Replication Using CVa. R • Problem Statement: Replicate an index using instruments. Consider impact of CVa. R constraints on characteristics of the replicating portfolio. • Daily Data: SP 100 index, 30 stocks (tickers: GD, UIS, NSM, ORCL, CSCO, HET, BS, TXN, HM, INTC, RAL, NT, MER, KM, BHI, CEN, HAL, DK, HWP, LTD, BAC, AVP, AXP, AA, BA, AGC, BAX, AIG, AN, AEP) • Notations = price of SP 100 index at times = prices of stocks at times = amount of money to be on hand at the final time = = number of units of the index at the final time = number of units of j-th stock in the replicating portfolio • Definitions (similar to paper 1 ) = value of the portfolio at time = absolute relative deviation of the portfolio from the target = relative portfolio underperformance compared to target at time 1 Konno H. and A. Wijayanayake. Minimal Cost Index Tracking under Nonlinear Transaction Costs and Minimal Transaction Unit Constraints, Tokyo Institute of Technology, CRAFT Working paper 00 -07, (2000).

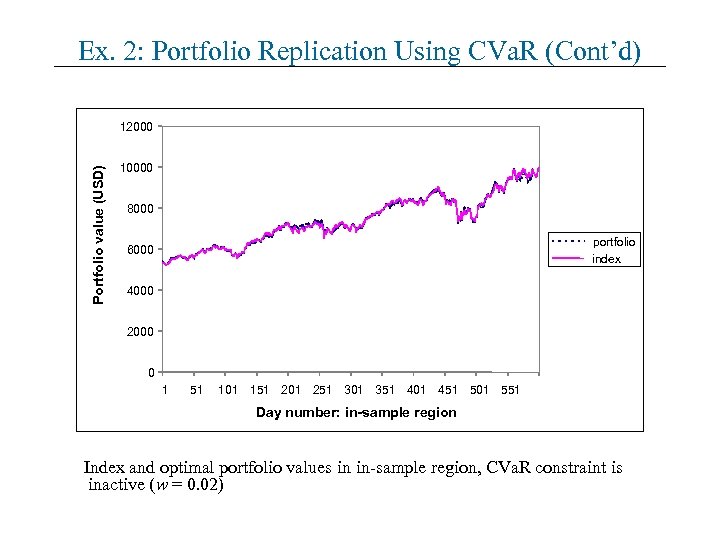

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Portfolio value (USD) 12000 10000 8000 portfolio index 6000 4000 2000 0 1 51 101 151 201 251 301 351 401 451 501 551 Day number: in-sample region Index and optimal portfolio values in in-sample region, CVa. R constraint is inactive (w = 0. 02)

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Portfolio value (USD) 12000 10000 8000 portfolio index 6000 4000 2000 0 1 51 101 151 201 251 301 351 401 451 501 551 Day number: in-sample region Index and optimal portfolio values in in-sample region, CVa. R constraint is inactive (w = 0. 02)

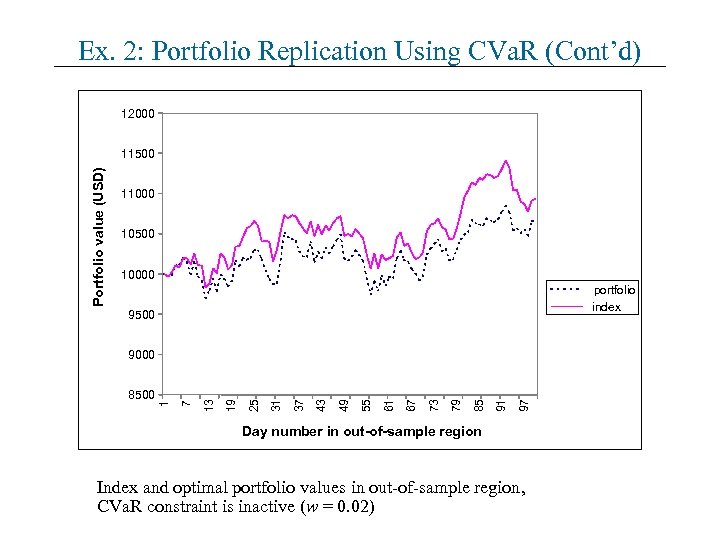

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 12000 Portfolio value (USD) 11500 11000 10500 10000 portfolio index 9500 97 91 85 79 73 67 61 55 49 43 37 31 25 19 13 7 8500 1 9000 Day number in out-of-sample region Index and optimal portfolio values in out-of-sample region, CVa. R constraint is inactive (w = 0. 02)

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 12000 Portfolio value (USD) 11500 11000 10500 10000 portfolio index 9500 97 91 85 79 73 67 61 55 49 43 37 31 25 19 13 7 8500 1 9000 Day number in out-of-sample region Index and optimal portfolio values in out-of-sample region, CVa. R constraint is inactive (w = 0. 02)

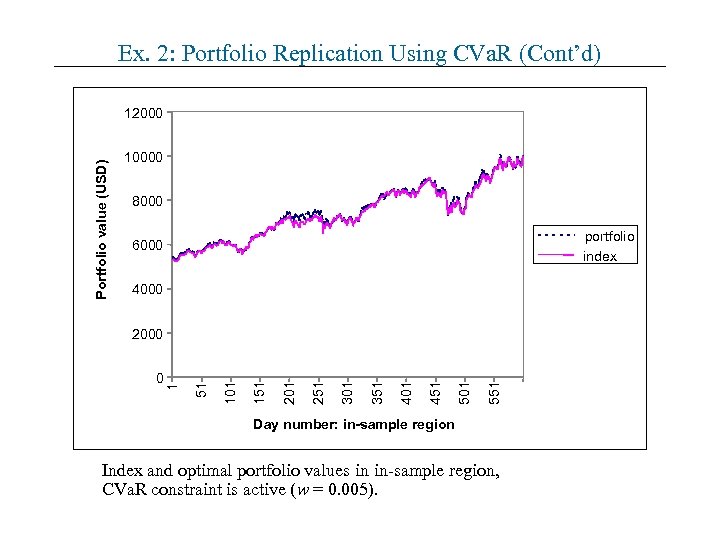

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Portfolio value (USD) 12000 10000 8000 portfolio index 6000 4000 551 501 451 401 351 301 251 201 151 101 51 0 1 2000 Day number: in-sample region Index and optimal portfolio values in in-sample region, CVa. R constraint is active (w = 0. 005).

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Portfolio value (USD) 12000 10000 8000 portfolio index 6000 4000 551 501 451 401 351 301 251 201 151 101 51 0 1 2000 Day number: in-sample region Index and optimal portfolio values in in-sample region, CVa. R constraint is active (w = 0. 005).

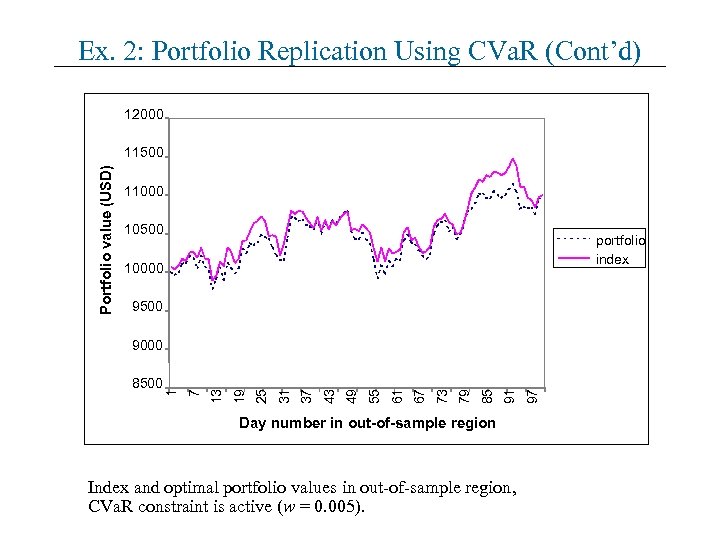

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 12000 Portfolio value (USD) 11500 11000 10500 portfolio index 10000 9500 Day number in out-of-sample region Index and optimal portfolio values in out-of-sample region, CVa. R constraint is active (w = 0. 005). 97 91 85 79 73 67 61 55 49 43 37 31 25 19 13 7 8500 1 9000

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 12000 Portfolio value (USD) 11500 11000 10500 portfolio index 10000 9500 Day number in out-of-sample region Index and optimal portfolio values in out-of-sample region, CVa. R constraint is active (w = 0. 005). 97 91 85 79 73 67 61 55 49 43 37 31 25 19 13 7 8500 1 9000

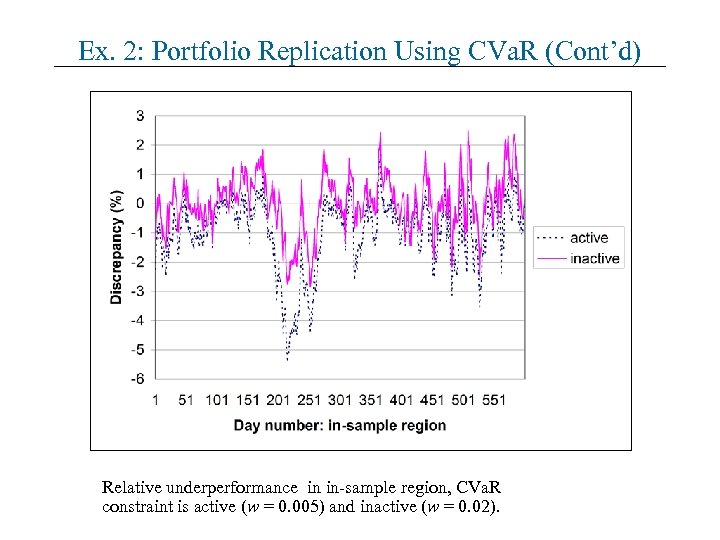

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Relative underperformance in in-sample region, CVa. R constraint is active (w = 0. 005) and inactive (w = 0. 02).

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) Relative underperformance in in-sample region, CVa. R constraint is active (w = 0. 005) and inactive (w = 0. 02).

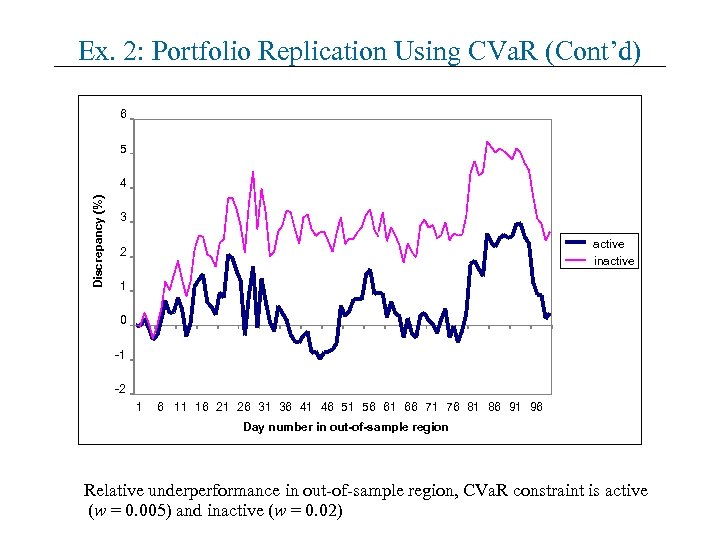

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 6 5 Discrepancy (%) 4 3 active inactive 2 1 0 -1 -2 1 6 11 16 21 26 31 36 41 46 51 56 61 66 71 76 81 86 91 96 Day number in out-of-sample region Relative underperformance in out-of-sample region, CVa. R constraint is active (w = 0. 005) and inactive (w = 0. 02)

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) 6 5 Discrepancy (%) 4 3 active inactive 2 1 0 -1 -2 1 6 11 16 21 26 31 36 41 46 51 56 61 66 71 76 81 86 91 96 Day number in out-of-sample region Relative underperformance in out-of-sample region, CVa. R constraint is active (w = 0. 005) and inactive (w = 0. 02)

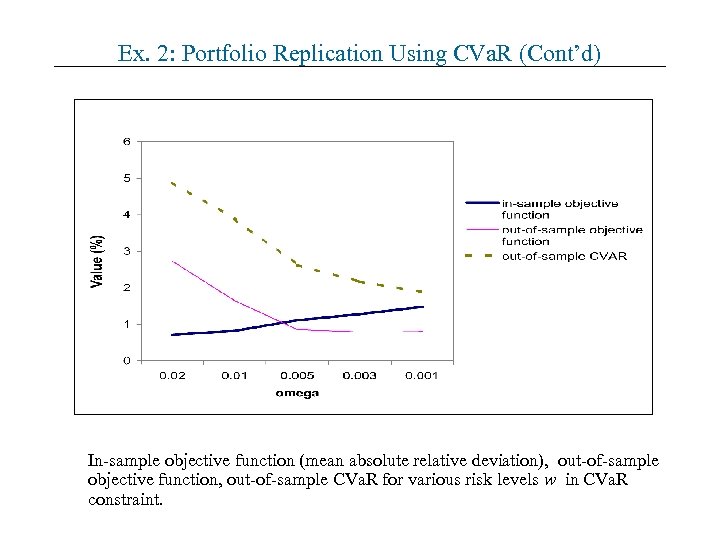

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) In-sample objective function (mean absolute relative deviation), out-of-sample objective function, out-of-sample CVa. R for various risk levels w in CVa. R constraint.

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) In-sample objective function (mean absolute relative deviation), out-of-sample objective function, out-of-sample CVa. R for various risk levels w in CVa. R constraint.

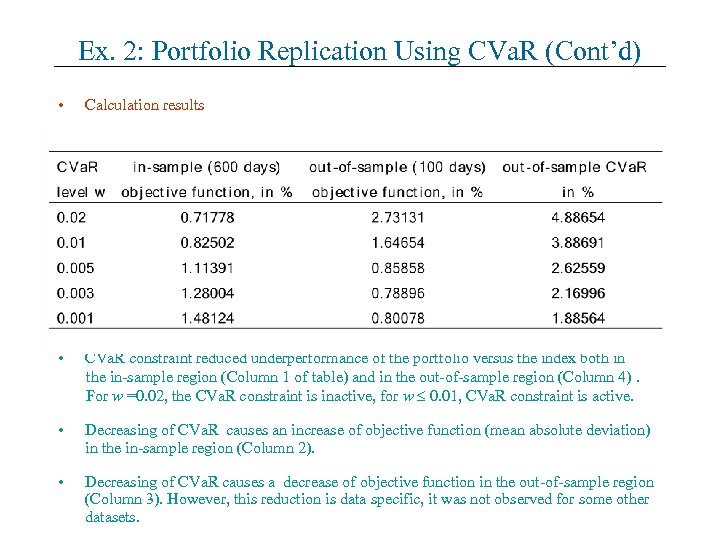

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) • Calculation results • CVa. R constraint reduced underperformance of the portfolio versus the index both in the in-sample region (Column 1 of table) and in the out-of-sample region (Column 4). For w =0. 02, the CVa. R constraint is inactive, for w 0. 01, CVa. R constraint is active. • Decreasing of CVa. R causes an increase of objective function (mean absolute deviation) in the in-sample region (Column 2). • Decreasing of CVa. R causes a decrease of objective function in the out-of-sample region (Column 3). However, this reduction is data specific, it was not observed for some other datasets.

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) • Calculation results • CVa. R constraint reduced underperformance of the portfolio versus the index both in the in-sample region (Column 1 of table) and in the out-of-sample region (Column 4). For w =0. 02, the CVa. R constraint is inactive, for w 0. 01, CVa. R constraint is active. • Decreasing of CVa. R causes an increase of objective function (mean absolute deviation) in the in-sample region (Column 2). • Decreasing of CVa. R causes a decrease of objective function in the out-of-sample region (Column 3). However, this reduction is data specific, it was not observed for some other datasets.

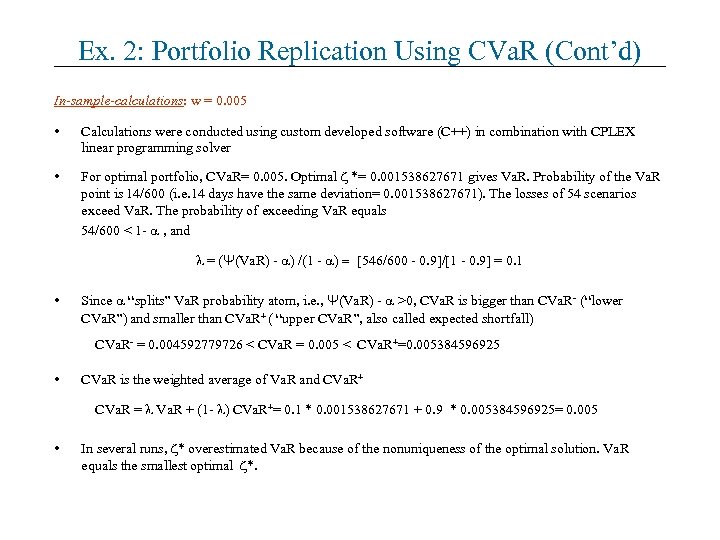

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) In-sample-calculations: w = 0. 005 • Calculations were conducted using custom developed software (C++) in combination with CPLEX linear programming solver • For optimal portfolio, CVa. R= 0. 005. Optimal *= 0. 001538627671 gives Va. R. Probability of the Va. R point is 14/600 (i. e. 14 days have the same deviation= 0. 001538627671). The losses of 54 scenarios exceed Va. R. The probability of exceeding Va. R equals 54/600 < 1 - , and = (Ψ(Va. R) - ) /(1 - ) = [546/600 - 0. 9]/[1 - 0. 9] = 0. 1 • Since “splits” Va. R probability atom, i. e. , Ψ(Va. R) - >0, CVa. R is bigger than CVa. R- (“lower CVa. R”) and smaller than CVa. R+ ( “upper CVa. R”, also called expected shortfall) CVa. R- = 0. 004592779726 < CVa. R = 0. 005 < CVa. R+=0. 005384596925 • CVa. R is the weighted average of Va. R and CVa. R+ CVa. R = Va. R + (1 - ) CVa. R+= 0. 1 * 0. 001538627671 + 0. 9 * 0. 005384596925= 0. 005 • In several runs, * overestimated Va. R because of the nonuniqueness of the optimal solution. Va. R equals the smallest optimal *.

Ex. 2: Portfolio Replication Using CVa. R (Cont’d) In-sample-calculations: w = 0. 005 • Calculations were conducted using custom developed software (C++) in combination with CPLEX linear programming solver • For optimal portfolio, CVa. R= 0. 005. Optimal *= 0. 001538627671 gives Va. R. Probability of the Va. R point is 14/600 (i. e. 14 days have the same deviation= 0. 001538627671). The losses of 54 scenarios exceed Va. R. The probability of exceeding Va. R equals 54/600 < 1 - , and = (Ψ(Va. R) - ) /(1 - ) = [546/600 - 0. 9]/[1 - 0. 9] = 0. 1 • Since “splits” Va. R probability atom, i. e. , Ψ(Va. R) - >0, CVa. R is bigger than CVa. R- (“lower CVa. R”) and smaller than CVa. R+ ( “upper CVa. R”, also called expected shortfall) CVa. R- = 0. 004592779726 < CVa. R = 0. 005 < CVa. R+=0. 005384596925 • CVa. R is the weighted average of Va. R and CVa. R+ CVa. R = Va. R + (1 - ) CVa. R+= 0. 1 * 0. 001538627671 + 0. 9 * 0. 005384596925= 0. 005 • In several runs, * overestimated Va. R because of the nonuniqueness of the optimal solution. Va. R equals the smallest optimal *.

Example 3: Asset Liability Management (ALM) Pension Fund Non-Active Members Active members Payments? Future liabilities? Risk Management

Example 3: Asset Liability Management (ALM) Pension Fund Non-Active Members Active members Payments? Future liabilities? Risk Management

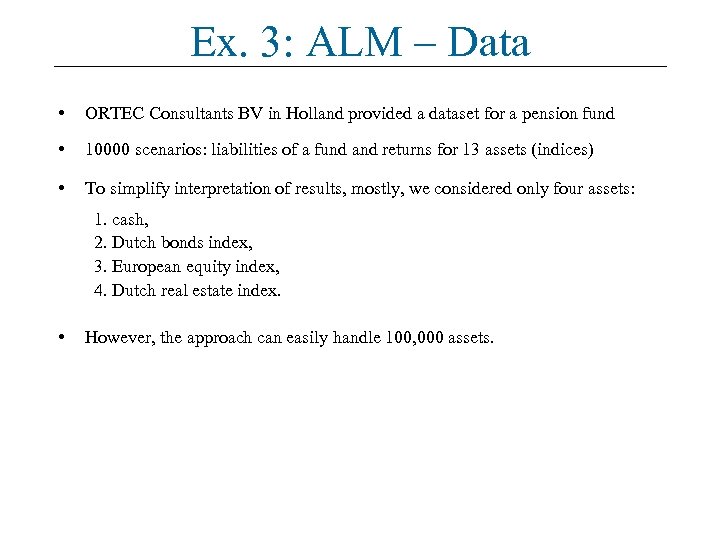

Ex. 3: ALM – Data • ORTEC Consultants BV in Holland provided a dataset for a pension fund • 10000 scenarios: liabilities of a fund and returns for 13 assets (indices) • To simplify interpretation of results, mostly, we considered only four assets: 1. cash, 2. Dutch bonds index, 3. European equity index, 4. Dutch real estate index. • However, the approach can easily handle 100, 000 assets.

Ex. 3: ALM – Data • ORTEC Consultants BV in Holland provided a dataset for a pension fund • 10000 scenarios: liabilities of a fund and returns for 13 assets (indices) • To simplify interpretation of results, mostly, we considered only four assets: 1. cash, 2. Dutch bonds index, 3. European equity index, 4. Dutch real estate index. • However, the approach can easily handle 100, 000 assets.

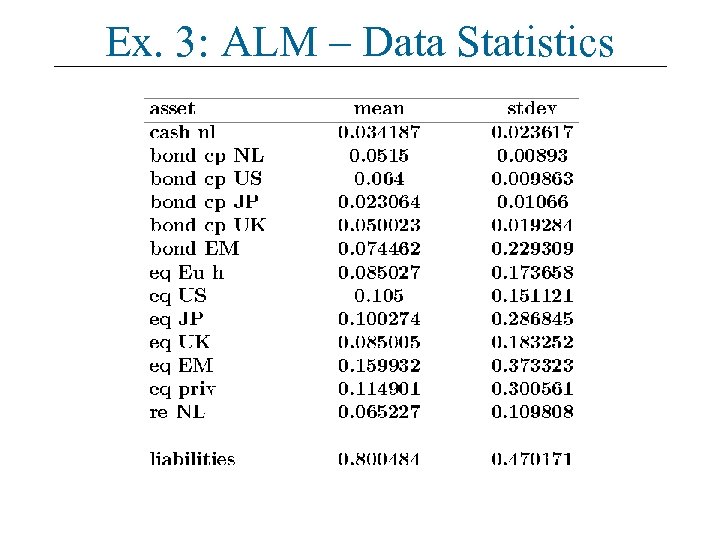

Ex. 3: ALM – Data Statistics

Ex. 3: ALM – Data Statistics

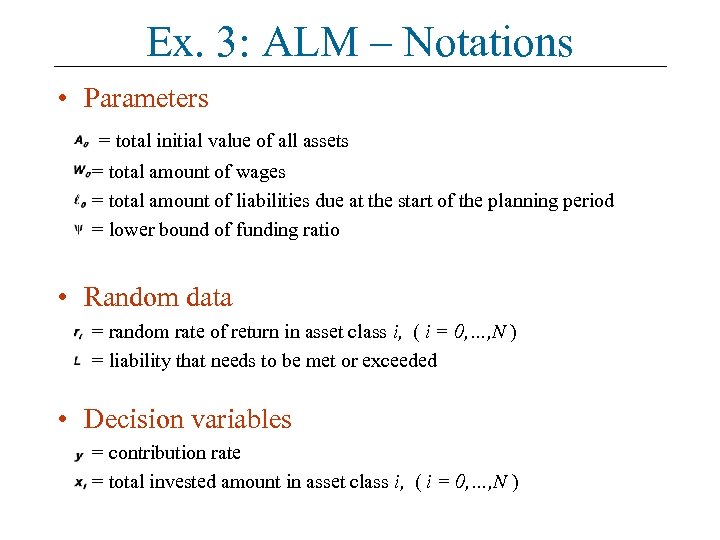

Ex. 3: ALM – Notations • Parameters = total initial value of all assets = total amount of wages = total amount of liabilities due at the start of the planning period = lower bound of funding ratio • Random data = random rate of return in asset class i, ( i = 0, …, N ) = liability that needs to be met or exceeded • Decision variables = contribution rate = total invested amount in asset class i, ( i = 0, …, N )

Ex. 3: ALM – Notations • Parameters = total initial value of all assets = total amount of wages = total amount of liabilities due at the start of the planning period = lower bound of funding ratio • Random data = random rate of return in asset class i, ( i = 0, …, N ) = liability that needs to be met or exceeded • Decision variables = contribution rate = total invested amount in asset class i, ( i = 0, …, N )

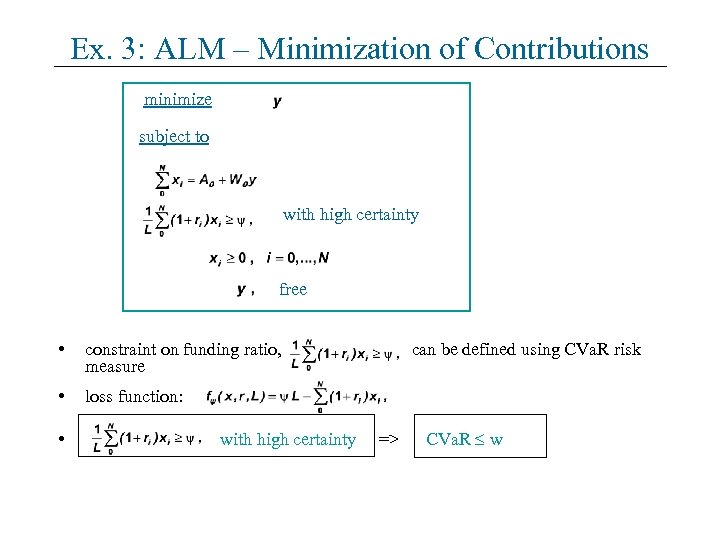

Ex. 3: ALM – Minimization of Contributions minimize subject to with high certainty free • constraint on funding ratio, measure • loss function: • with high certainty can be defined using CVa. R risk => CVa. R w

Ex. 3: ALM – Minimization of Contributions minimize subject to with high certainty free • constraint on funding ratio, measure • loss function: • with high certainty can be defined using CVa. R risk => CVa. R w

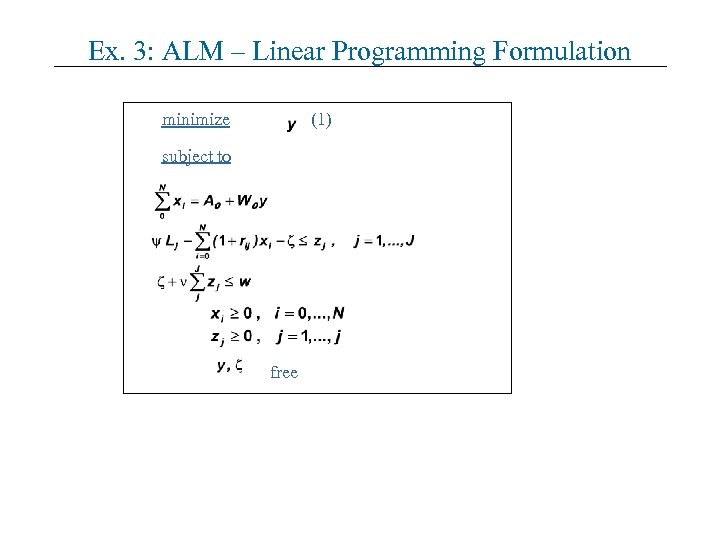

Ex. 3: ALM – Linear Programming Formulation minimize (1) subject to free

Ex. 3: ALM – Linear Programming Formulation minimize (1) subject to free

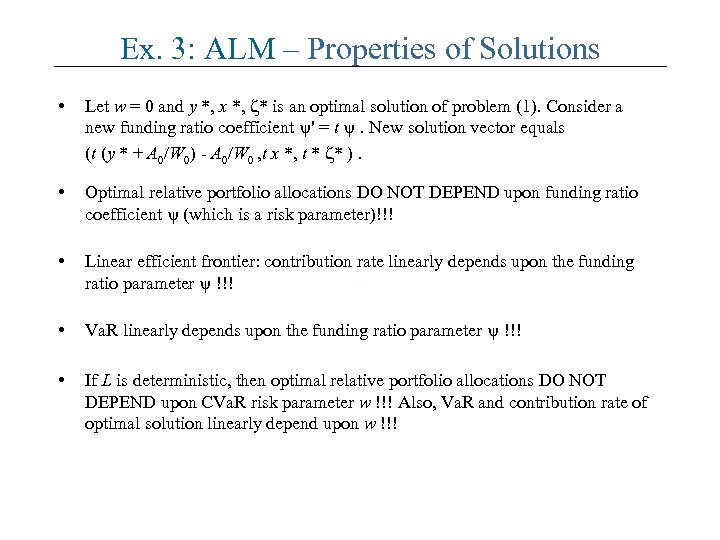

Ex. 3: ALM – Properties of Solutions • Let w = 0 and y *, x *, * is an optimal solution of problem (1). Consider a new funding ratio coefficient ' = t . New solution vector equals (t (y * + A 0/W 0) - A 0/W 0 , t x *, t * * ). • Optimal relative portfolio allocations DO NOT DEPEND upon funding ratio coefficient (which is a risk parameter)!!! • Linear efficient frontier: contribution rate linearly depends upon the funding ratio parameter !!! • Va. R linearly depends upon the funding ratio parameter !!! • If L is deterministic, then optimal relative portfolio allocations DO NOT DEPEND upon CVa. R risk parameter w !!! Also, Va. R and contribution rate of optimal solution linearly depend upon w !!!

Ex. 3: ALM – Properties of Solutions • Let w = 0 and y *, x *, * is an optimal solution of problem (1). Consider a new funding ratio coefficient ' = t . New solution vector equals (t (y * + A 0/W 0) - A 0/W 0 , t x *, t * * ). • Optimal relative portfolio allocations DO NOT DEPEND upon funding ratio coefficient (which is a risk parameter)!!! • Linear efficient frontier: contribution rate linearly depends upon the funding ratio parameter !!! • Va. R linearly depends upon the funding ratio parameter !!! • If L is deterministic, then optimal relative portfolio allocations DO NOT DEPEND upon CVa. R risk parameter w !!! Also, Va. R and contribution rate of optimal solution linearly depend upon w !!!

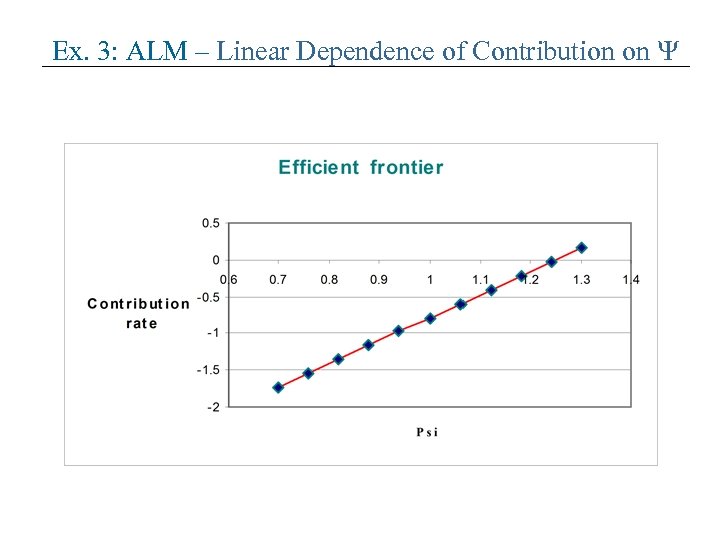

Ex. 3: ALM – Linear Dependence of Contribution on

Ex. 3: ALM – Linear Dependence of Contribution on

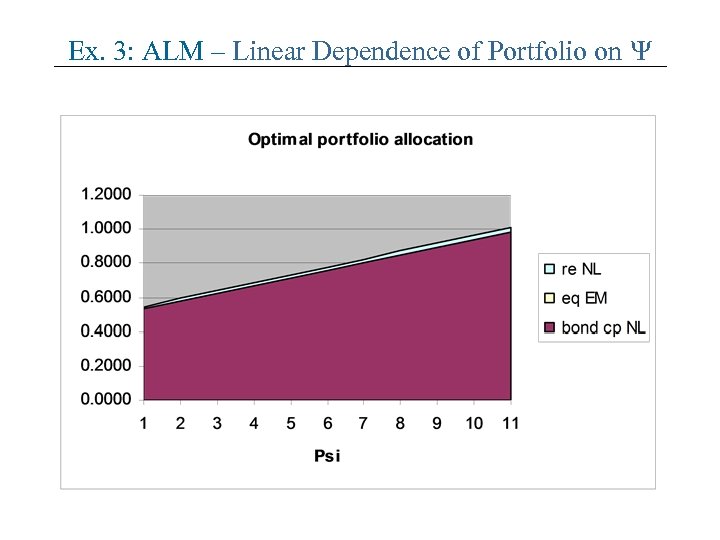

Ex. 3: ALM – Linear Dependence of Portfolio on

Ex. 3: ALM – Linear Dependence of Portfolio on

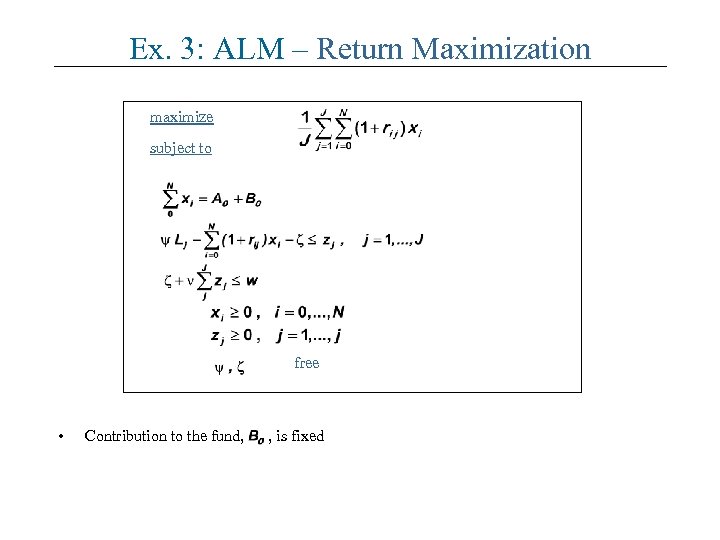

Ex. 3: ALM – Return Maximization maximize subject to free • Contribution to the fund, , is fixed

Ex. 3: ALM – Return Maximization maximize subject to free • Contribution to the fund, , is fixed

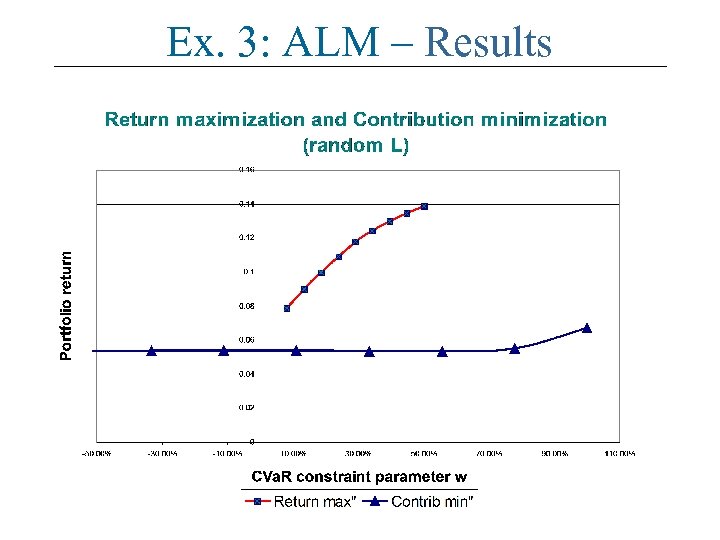

Ex. 3: ALM – Results

Ex. 3: ALM – Results

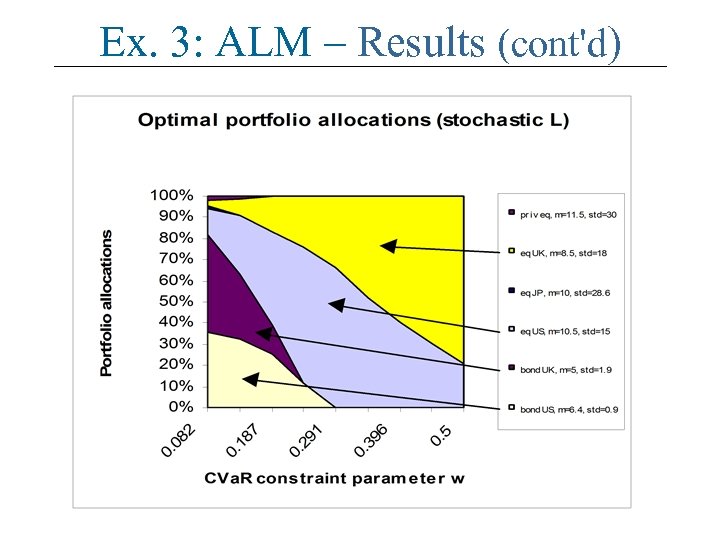

Ex. 3: ALM – Results (cont'd)

Ex. 3: ALM – Results (cont'd)

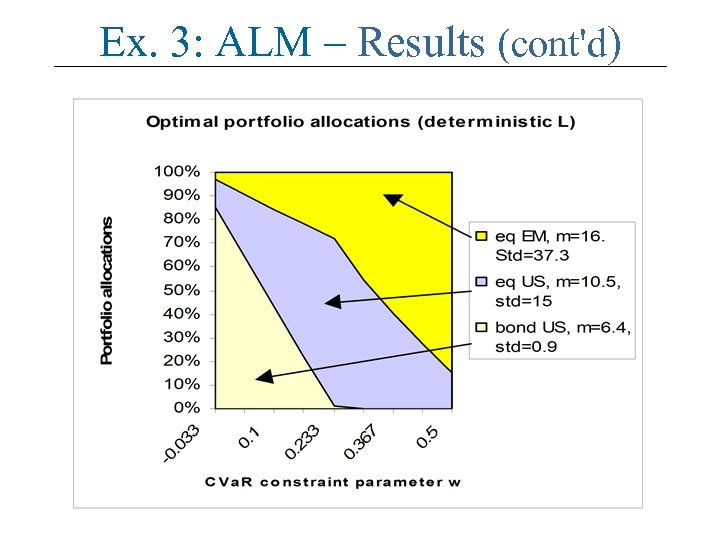

Ex. 3: ALM – Results (cont'd)

Ex. 3: ALM – Results (cont'd)