521d227ba426c5bf8ad67c985f2c619a.ppt

- Количество слайдов: 29

stewardship & prosperity "Land Grab: The Race for the World's Farmland" Investment in Farmland Farming in Central and Eastern Europe and the Former Soviet Union Carl Atkin Head of Research, Bidwells Agribusiness, UK

stewardship & prosperity “Buy land, they don’t make it any more” Mark Twain (1835 -1910)

stewardship & prosperity

stewardship & prosperity Introduction: Drivers § Demand pull (i) Population (ii) Dietary shift (iii) Policy changes (iv) Bioenergy § Supply Constraints (v) Land (vi) Water and climate change (viii) Technology

stewardship & prosperity Introduction: Types of Agri-Investment § Commodities § Equities § Agricultural Real Estate - (EU CEECs) § Operational Farming – (EU CEECs & FSU) § The Value Chain

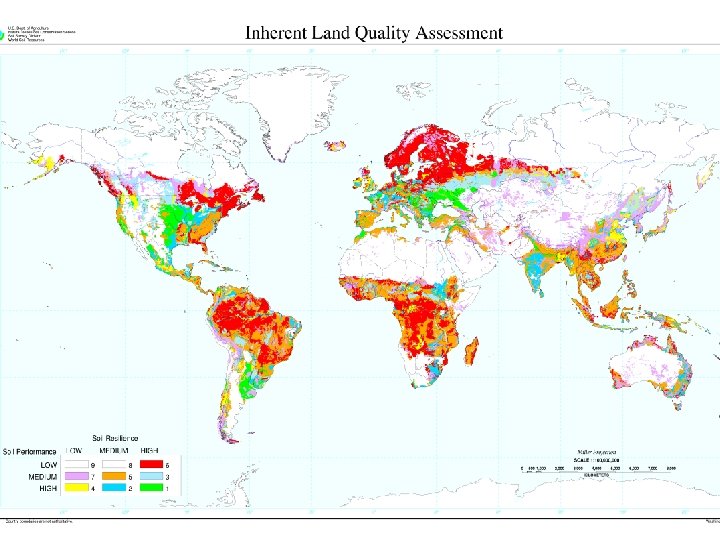

stewardship & prosperity Long Term Competitiveness of Agricultural Regions § Productivity Potential § Water, Climate Change and Sustainability § Costs of Production § Costs to Market § Strong drivers for CEEC and FSU

stewardship & prosperity

stewardship & prosperity Agricultural Real Estate

stewardship & prosperity Operational Farming

stewardship & prosperity Why All the Investment Interest? § Returns – Income and Capital § Real Estate vs Operational Farming vs Both § Operations – in hand; contract; lease § Useful Real Estate Characteristics § Support Environment – SAPS vs SPS etc. § EU Structural Funding § Supply Chain – at both ends § Culture, Management and ‘Localisms’

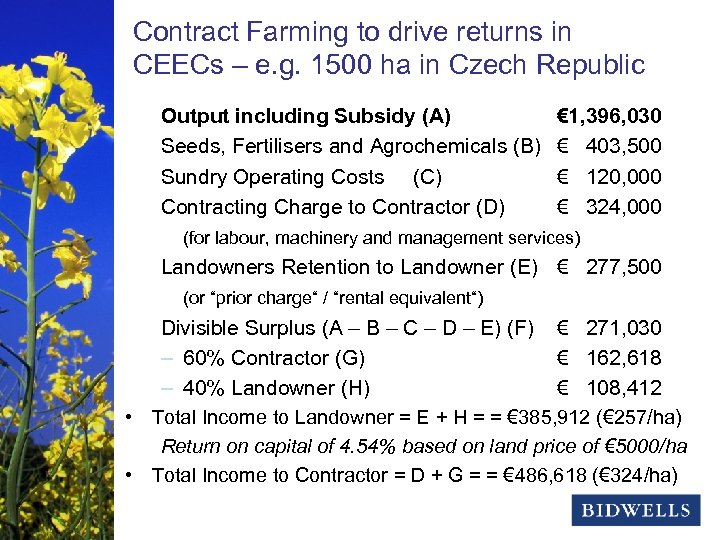

Contract Farming to drive returns in stewardship & prosperity CEECs – e. g. 1500 ha in Czech Republic Output including Subsidy (A) Seeds, Fertilisers and Agrochemicals (B) Sundry Operating Costs (C) Contracting Charge to Contractor (D) € 1, 396, 030 € 403, 500 € 120, 000 € 324, 000 (for labour, machinery and management services) Landowners Retention to Landowner (E) € 277, 500 (or “prior charge“ / “rental equivalent“) Divisible Surplus (A – B – C – D – E) (F) € 271, 030 – 60% Contractor (G) € 162, 618 – 40% Landowner (H) € 108, 412 • Total Income to Landowner = E + H = = € 385, 912 (€ 257/ha) Return on capital of 4. 54% based on land price of € 5000/ha • Total Income to Contractor = D + G = = € 486, 618 (€ 324/ha)

stewardship & Agricultural Real Estate Challenges of prosperity in CEECs & FSU § Land Reform – e. g. Romania § Availability – Market Depth § Price – imperfect markets § Title can be complex – e. g. FSU § Deployment Complex § Leases / Tenancies e. g. France, Poland § Land Locked in Corporates e. g. Germany § Foreign Ownership Legislation e. g. Poland § Management intensive § HR Limiting Factor

stewardship & Land Romania Pre-Parcelled prosperity

stewardship & Land - Ukraine Post Parcelled prosperity

stewardship & Current Issuesprosperity

stewardship & prosperity Operational Farming vs Agric. Real Estate § Operational farming has inherently more risks than other real estate investments. Variables include: § Yield § Price § Land Value § Single Payment / Government Subsidy § Variable Costs § Fixed Costs § And any combination of the above § Risk is managed through: § Risk management on marketing arrangements § Operational excellence § Effective monitoring § Correct structuring of contract arrangements

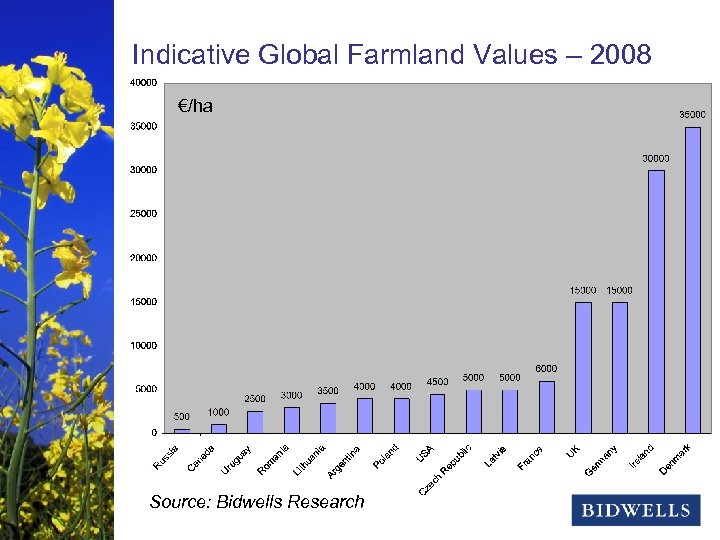

stewardship & prosperity Indicative Global Farmland Values – 2008 €/ha Source: Bidwells Research

stewardship to Consider Other Issues& prosperity § Parcelling and Land Banking § Land Improvement § Grants and Support / Subsidies § Cost of Capital § Risk Premiums

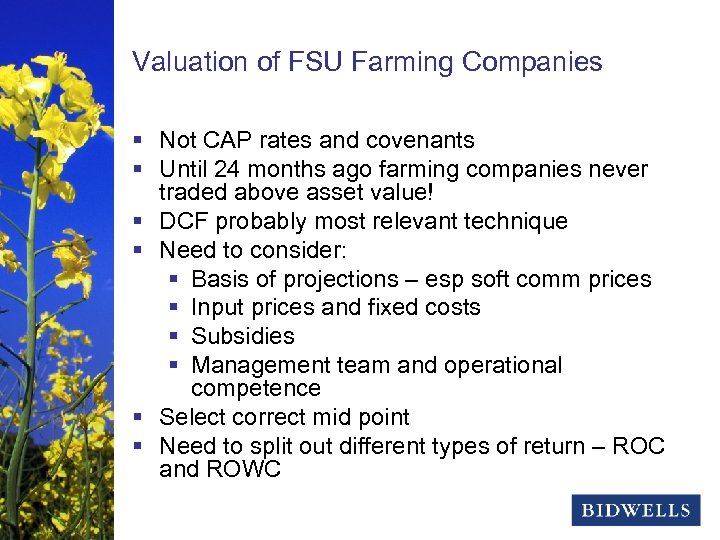

stewardship & prosperity Valuation of FSU Farming Companies § Not CAP rates and covenants § Until 24 months ago farming companies never traded above asset value! § DCF probably most relevant technique § Need to consider: § Basis of projections – esp soft comm prices § Input prices and fixed costs § Subsidies § Management team and operational competence § Select correct mid point § Need to split out different types of return – ROC and ROWC

stewardship & prosperity CEEC (within EU) - Overview § Better suited to arable production than livestock – biosecurity issues etc. § Full landownership rights foreigners (albeit with some complications in certain countries) § Access to Black Sea § For most countries, legal and economic stability of EU membership § Interest in Poland, Czech, Hungary, Romania § Also Baltic Countries § Bulgaria (? )

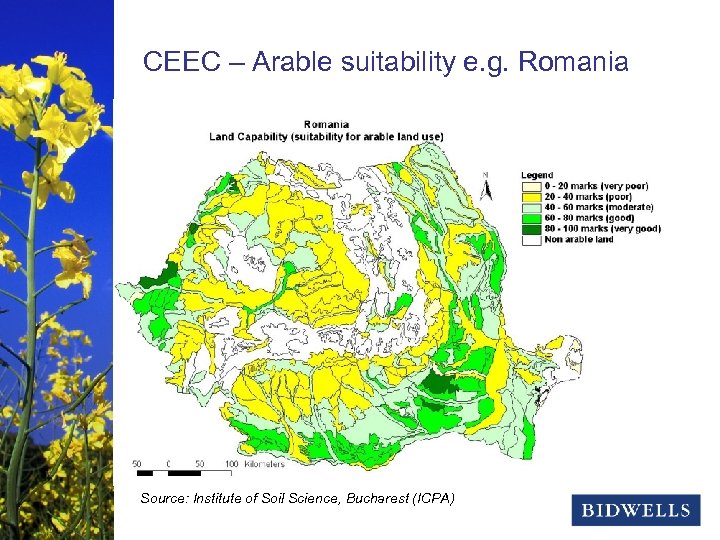

stewardship & prosperity CEEC – Arable suitability e. g. Romania Source: Institute of Soil Science, Bucharest (ICPA)

stewardship & prosperity Former Soviet Union - overview § § § § § Cheap, underutilised land with potential to be brought into arable production Potential to increase yields through management and increasing inputs Large tracts of land available for purchase / lease Access to Black Sea and Europe Variable costs similar to UK Fixed costs approx half of UK Capital investment required in the supply chain intermediaries e. g. processors, storage, transport Agriculture largely arable and vegetable although potential increase in livestock production due to low cost production of grains for feed. Ownership of land by foreigners is limited in Kazakhstan and ownership by locals or foreigners in Russia is complicated and largely forbidden in Ukraine.

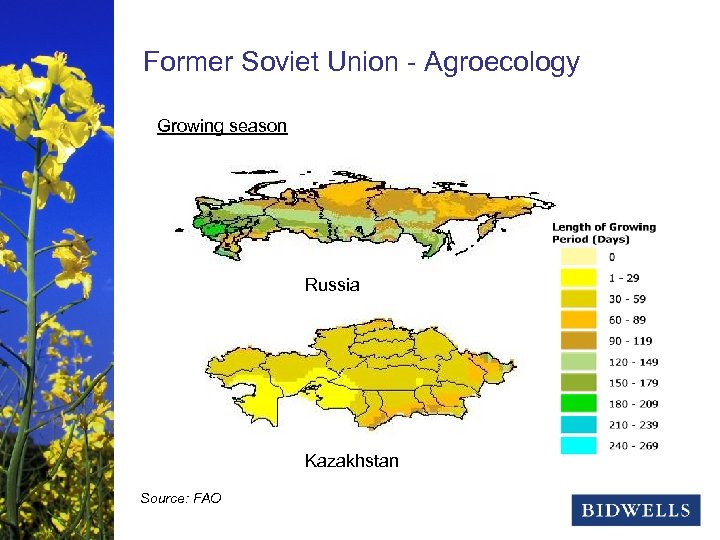

stewardship & prosperity Former Soviet Union - Agroecology Growing season Russia Kazakhstan Source: FAO

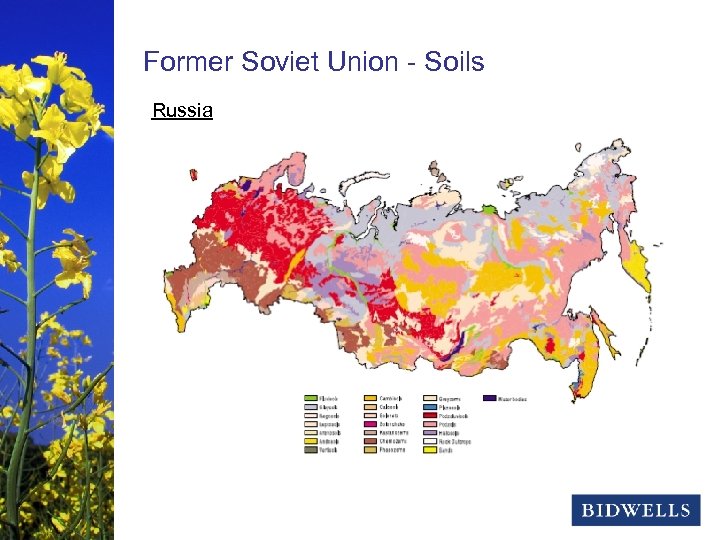

stewardship & prosperity Former Soviet Union - Soils Russia

stewardship & prosperity Impact of ‘The Crisis’ § Concern over FSU especially Ukraine § ‘Retreat’ to safer products within EU § CEEC land price growth slowed but convergence in EU overpowering other drivers § Output down especially in FSU as working capital restricted, especially where land is not available as collateral

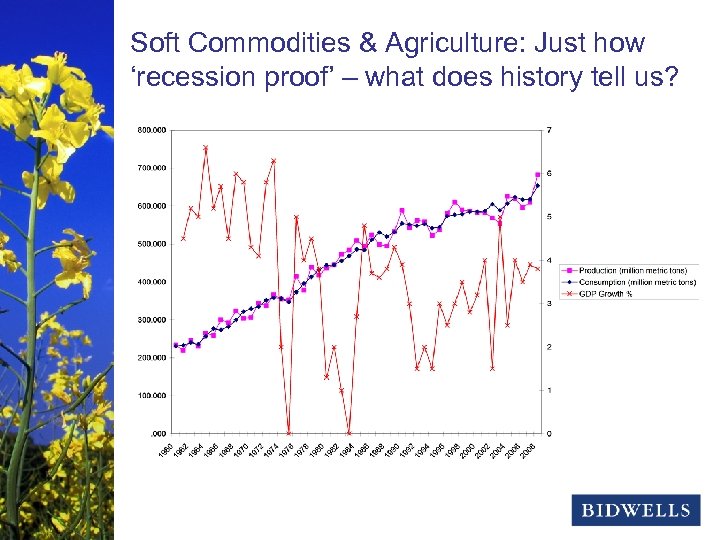

stewardship & prosperity Soft Commodities & Agriculture: Just how ‘recession proof’ – what does history tell us?

stewardship & prosperity Impact of ‘The Land Grab’ § Government View § National § Regional § Local Community View § Supply Chain View § ‘Western’ Operator and Investor View § Many got too big too quick and are now ‘consolidating’ § ‘Dot. com’ bubble burst

stewardship Conclusion & prosperity § Distinction between short term (commodities and equities) and long term (farmland, farming, value chain) investment opportunities § Farmland & Farming has high operational gearing - partners are critical § EU more about real estate and FSU about operations although often a mix of the two § Assessment of opportunities not always easy – how to measure risk premiums etc. § Plenty of ‘cars with nothing under the bonnet’ over the last 18 months – long on fundamentals and short on execution capability § Mixed experiences of agri-investment from government, local communities and investors/operators themselves

stewardship & prosperity Thank You Carl Atkin Partner and Head of Research Bidwells Agribusiness Trumpington Road Cambridge CB 2 9 LD United Kingdom t: + 44 1223 559 539 e: carl. atkin@bidwells. co. uk w: www. bidwells. co. uk/agribusiness

521d227ba426c5bf8ad67c985f2c619a.ppt