785aa21150ea92c0cceb6ab9b148511a.ppt

- Количество слайдов: 32

State University – Higher School of Economics Institute for Statistical Studies and Economics of Knowledge ICT Sector in Russia n Alexander Belyaev, BRICS meeting, April 2007 1

State University – Higher School of Economics Institute for Statistical Studies and Economics of Knowledge ICT Sector in Russia n Alexander Belyaev, BRICS meeting, April 2007 1

Contents n ICT sector in Russia n IT Market n Software development for Export Market (case) n Barriers to Growth & State IT Promotion policy 2

Contents n ICT sector in Russia n IT Market n Software development for Export Market (case) n Barriers to Growth & State IT Promotion policy 2

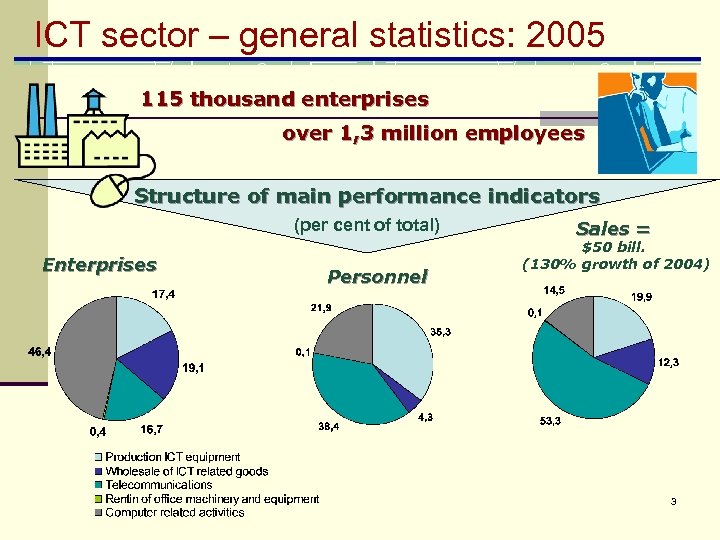

ICT sector – general statistics: 2005 115 thousand enterprises over 1, 3 million employees Structure of main performance indicators (per cent of total) Enterprises Personnel Sales = $50 bill. (130% growth of 2004) 3

ICT sector – general statistics: 2005 115 thousand enterprises over 1, 3 million employees Structure of main performance indicators (per cent of total) Enterprises Personnel Sales = $50 bill. (130% growth of 2004) 3

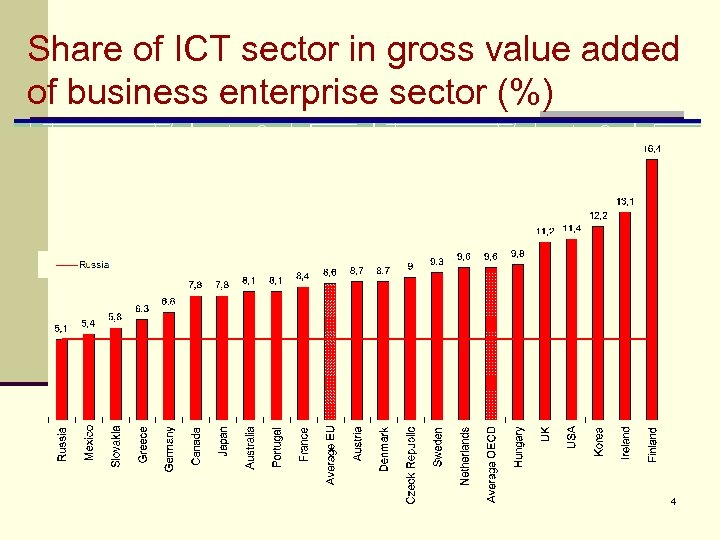

Share of ICT sector in gross value added of business enterprise sector (%) 4

Share of ICT sector in gross value added of business enterprise sector (%) 4

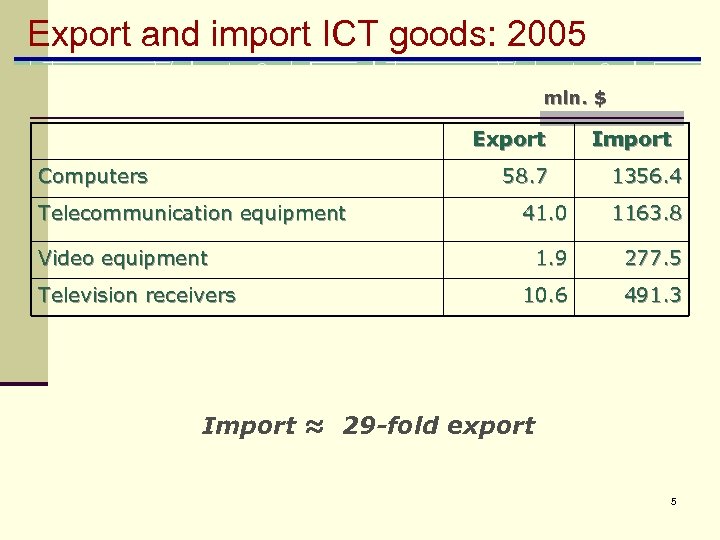

Export and import ICT goods: 2005 mln. $ Export Computers 58. 7 Telecommunication equipment Video equipment Television receivers Import 1356. 4 41. 0 1163. 8 1. 9 277. 5 10. 6 491. 3 Import ≈ 29 -fold export 5

Export and import ICT goods: 2005 mln. $ Export Computers 58. 7 Telecommunication equipment Video equipment Television receivers Import 1356. 4 41. 0 1163. 8 1. 9 277. 5 10. 6 491. 3 Import ≈ 29 -fold export 5

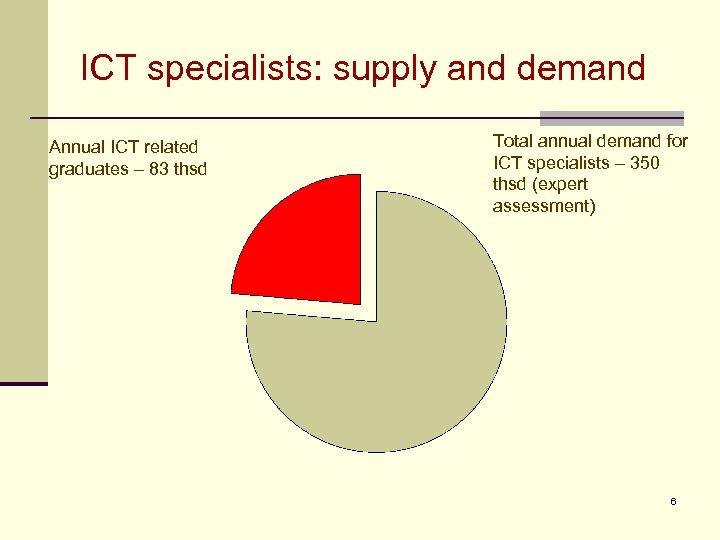

ICT specialists: supply and demand Annual ICT related graduates – 83 thsd Total annual demand for ICT specialists – 350 thsd (expert assessment) 6

ICT specialists: supply and demand Annual ICT related graduates – 83 thsd Total annual demand for ICT specialists – 350 thsd (expert assessment) 6

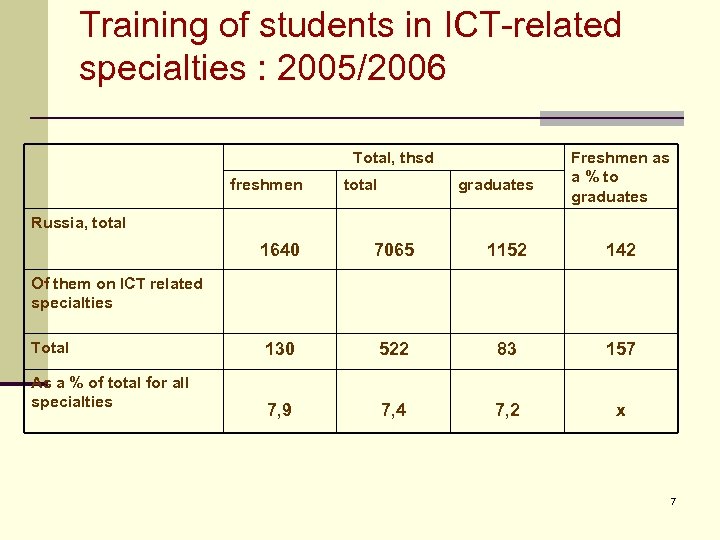

Training of students in ICT-related specialties : 2005/2006 Total, thsd freshmen total graduates Freshmen as a % to graduates Russia, total 1640 7065 1152 142 130 522 83 157 7, 9 7, 4 7, 2 х Of them on ICT related specialties Total As a % of total for all specialties 7

Training of students in ICT-related specialties : 2005/2006 Total, thsd freshmen total graduates Freshmen as a % to graduates Russia, total 1640 7065 1152 142 130 522 83 157 7, 9 7, 4 7, 2 х Of them on ICT related specialties Total As a % of total for all specialties 7

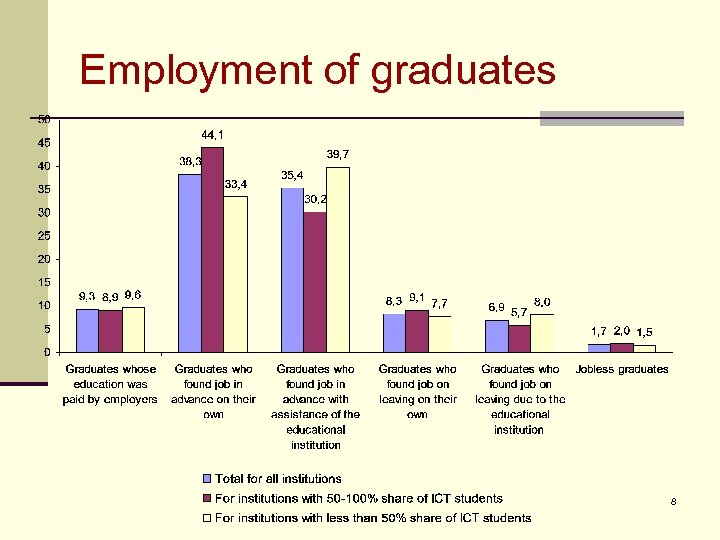

Employment of graduates 8

Employment of graduates 8

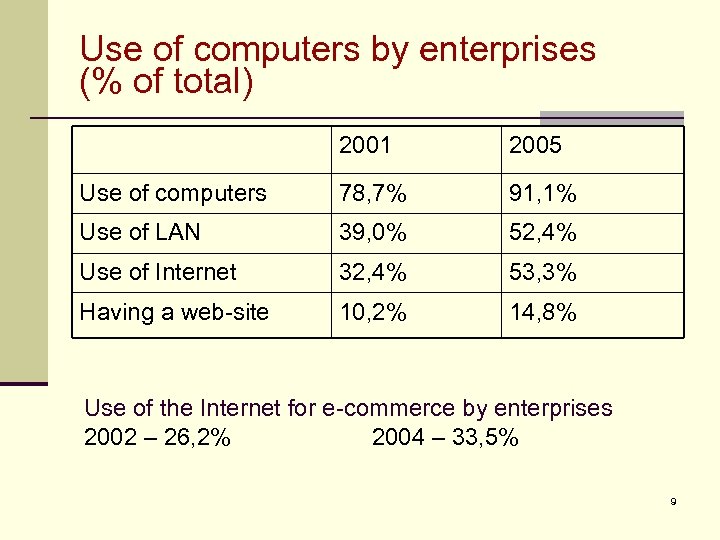

Use of computers by enterprises (% of total) 2001 2005 Use of computers 78, 7% 91, 1% Use of LAN 39, 0% 52, 4% Use of Internet 32, 4% 53, 3% Having a web-site 10, 2% 14, 8% Use of the Internet for e-commerce by enterprises 2002 – 26, 2% 2004 – 33, 5% 9

Use of computers by enterprises (% of total) 2001 2005 Use of computers 78, 7% 91, 1% Use of LAN 39, 0% 52, 4% Use of Internet 32, 4% 53, 3% Having a web-site 10, 2% 14, 8% Use of the Internet for e-commerce by enterprises 2002 – 26, 2% 2004 – 33, 5% 9

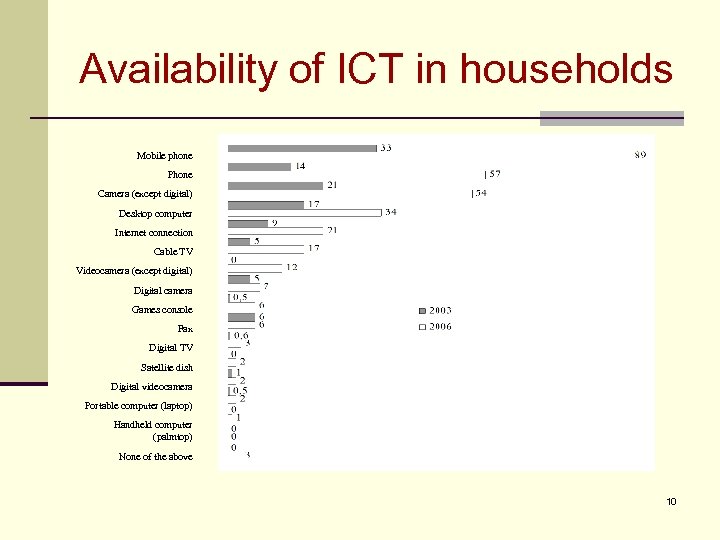

Availability of ICT in households Mobile phone Phone Camera (except digital) Desktop computer Internet connection Cable TV Videocamera (except digital) Digital camera Games console Fax Digital TV Satellite dish Digital videocamera Portable computer (laptop) Handheld computer (palmtop) None of the above 10

Availability of ICT in households Mobile phone Phone Camera (except digital) Desktop computer Internet connection Cable TV Videocamera (except digital) Digital camera Games console Fax Digital TV Satellite dish Digital videocamera Portable computer (laptop) Handheld computer (palmtop) None of the above 10

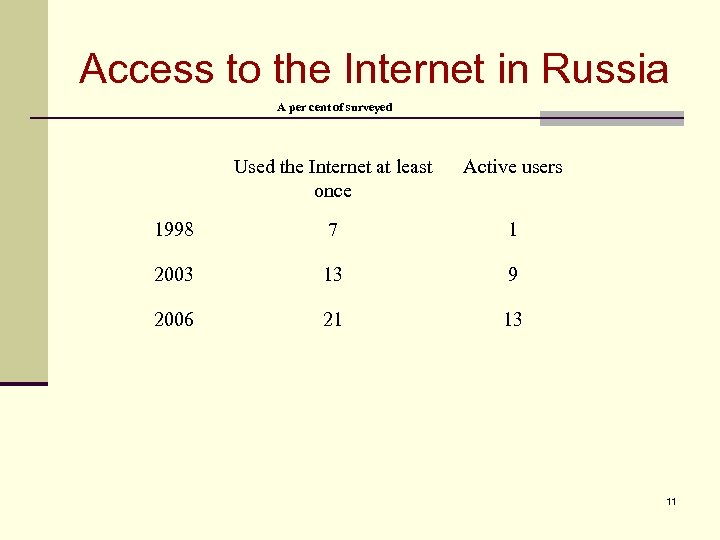

Access to the Internet in Russia A per cent of surveyed Active users 1998 Used the Internet at least once 7 1 2003 13 9 2006 21 13 11

Access to the Internet in Russia A per cent of surveyed Active users 1998 Used the Internet at least once 7 1 2003 13 9 2006 21 13 11

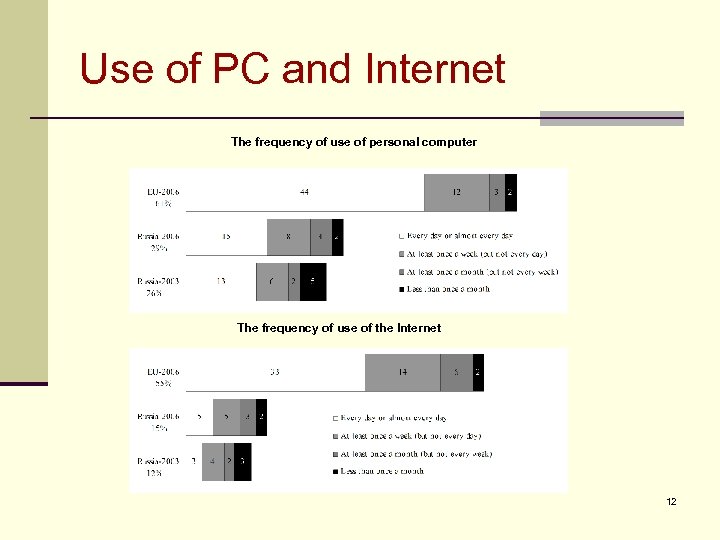

Use of PC and Internet The frequency of use of personal computer The frequency of use of the Internet 12

Use of PC and Internet The frequency of use of personal computer The frequency of use of the Internet 12

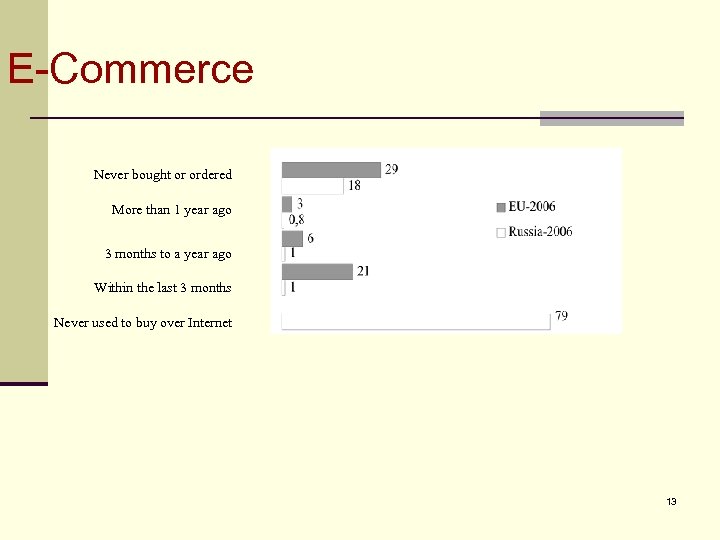

E-Commerce Never bought or ordered More than 1 year ago 3 months to a year ago Within the last 3 months Never used to buy over Internet 13

E-Commerce Never bought or ordered More than 1 year ago 3 months to a year ago Within the last 3 months Never used to buy over Internet 13

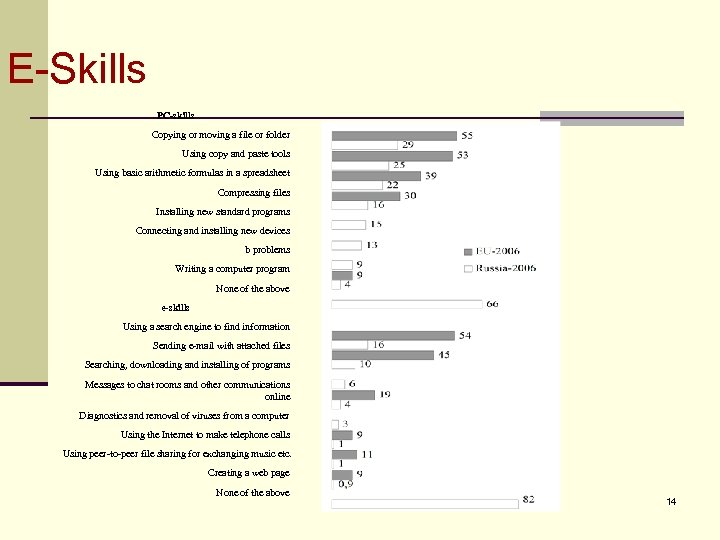

E-Skills PC-skills Copying or moving a file or folder Using copy and paste tools Using basic arithmetic formulas in a spreadsheet Compressing files Installing new standard programs Connecting and installing new devices b problems Writing a computer program None of the above e-skills Using a search engine to find information Sending e-mail with attached files Searching, downloading and installing of programs Messages to chat rooms and other communications online Diagnostics and removal of viruses from a computer Using the Internet to make telephone calls Using peer-to-peer file sharing for exchanging music etc. Creating a web page None of the above 14

E-Skills PC-skills Copying or moving a file or folder Using copy and paste tools Using basic arithmetic formulas in a spreadsheet Compressing files Installing new standard programs Connecting and installing new devices b problems Writing a computer program None of the above e-skills Using a search engine to find information Sending e-mail with attached files Searching, downloading and installing of programs Messages to chat rooms and other communications online Diagnostics and removal of viruses from a computer Using the Internet to make telephone calls Using peer-to-peer file sharing for exchanging music etc. Creating a web page None of the above 14

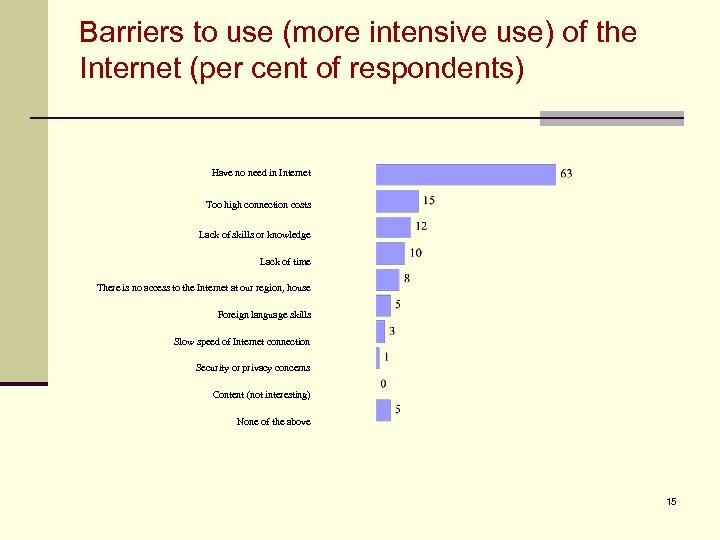

Barriers to use (more intensive use) of the Internet (per cent of respondents) Have no need in Internet Too high connection costs Lack of skills or knowledge Lack of time There is no access to the Internet at our region, house Foreign language skills Slow speed of Internet connection Security or privacy concerns Content (not interesting) None of the above 15

Barriers to use (more intensive use) of the Internet (per cent of respondents) Have no need in Internet Too high connection costs Lack of skills or knowledge Lack of time There is no access to the Internet at our region, house Foreign language skills Slow speed of Internet connection Security or privacy concerns Content (not interesting) None of the above 15

IT Market in Russia 16

IT Market in Russia 16

Volume of IT Market of Russia - Total Volume of IT Market in Russia (2004) - $9, 2 bill. Growth about 30% - Total Volume of IT Market in Russian (2005) - $11, 22 bill. Growth about 22, 1% (Source: Ministry of IT and Communications Russia, IDC) To compare: The global Growth Rate of IT Market: about 6% 17

Volume of IT Market of Russia - Total Volume of IT Market in Russia (2004) - $9, 2 bill. Growth about 30% - Total Volume of IT Market in Russian (2005) - $11, 22 bill. Growth about 22, 1% (Source: Ministry of IT and Communications Russia, IDC) To compare: The global Growth Rate of IT Market: about 6% 17

Share of IT Sector in GDP / Russia Despite of impressive Growth Rate, the Russian IT Sector remains relatively small: 1) Share of IT Sector in GDP of Russia – just 1, 4% To compare: Share of IT Sector in U. S. A. - 5% Volume of IT Market – more than $500 bill. 2) Export share is about 14% of total IT Market Russia. To compare: Israel: IT Export – 70% of IT Market India: IT Export – 80% of IT Market 18

Share of IT Sector in GDP / Russia Despite of impressive Growth Rate, the Russian IT Sector remains relatively small: 1) Share of IT Sector in GDP of Russia – just 1, 4% To compare: Share of IT Sector in U. S. A. - 5% Volume of IT Market – more than $500 bill. 2) Export share is about 14% of total IT Market Russia. To compare: Israel: IT Export – 70% of IT Market India: IT Export – 80% of IT Market 18

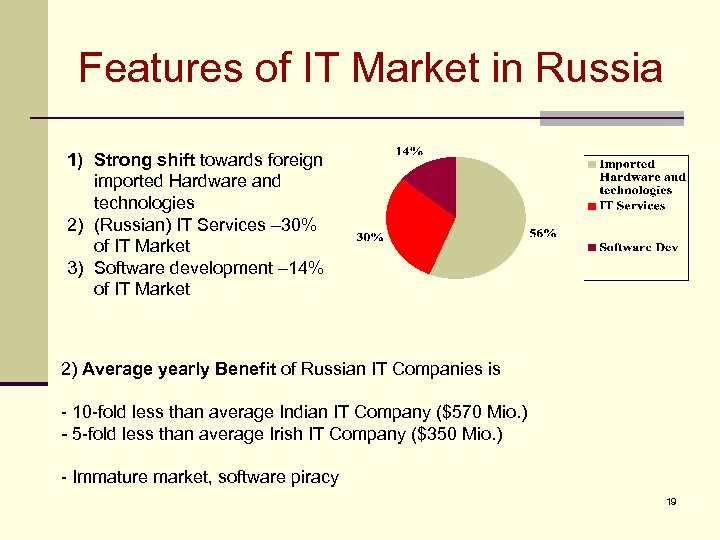

Features of IT Market in Russia 1) Strong shift towards foreign imported Hardware and technologies 2) (Russian) IT Services – 30% of IT Market 3) Software development – 14% of IT Market 2) Average yearly Benefit of Russian IT Companies is - 10 -fold less than average Indian IT Company ($570 Mio. ) - 5 -fold less than average Irish IT Company ($350 Mio. ) - Immature market, software piracy 19

Features of IT Market in Russia 1) Strong shift towards foreign imported Hardware and technologies 2) (Russian) IT Services – 30% of IT Market 3) Software development – 14% of IT Market 2) Average yearly Benefit of Russian IT Companies is - 10 -fold less than average Indian IT Company ($570 Mio. ) - 5 -fold less than average Irish IT Company ($350 Mio. ) - Immature market, software piracy 19

Software Development for Export Market 20

Software Development for Export Market 20

Features of Software Export Market - Exists for more than 10 years - More than 500 Companies active - Most companies are SMEs - annual turnover not more than $1 Mio. Biggest Companies Turnover is about $2040 Mio. - Increases rapidly; Annual Growth 2005 is approx. 30% - Despite that (IDC, IBS): “Main Growth driver is market underdevelopment rather than growth of demand”. 21

Features of Software Export Market - Exists for more than 10 years - More than 500 Companies active - Most companies are SMEs - annual turnover not more than $1 Mio. Biggest Companies Turnover is about $2040 Mio. - Increases rapidly; Annual Growth 2005 is approx. 30% - Despite that (IDC, IBS): “Main Growth driver is market underdevelopment rather than growth of demand”. 21

Software export Volume - 2005 Total Software export market volume exceeded $1 Bln. To compare: - Automotive export - $380 Mio. - Nuclear energy technologies export - $850 Mio. 22

Software export Volume - 2005 Total Software export market volume exceeded $1 Bln. To compare: - Automotive export - $380 Mio. - Nuclear energy technologies export - $850 Mio. 22

Market Achievements 1. Russia entered firstly the Offshore 100 rating (Luxoft, CTGroup). 2. 2006 two Russian IT-companies entered Technology Fast 500 Rating: 500 most fastest growing IT-companies of Europe Aplana – Income Growth of 1779% in 5 years Progresstech LLC – Income Growth of 747% in 5 years. 3. 2004 -2005 - 4 leading TNCs established Centres for software Development in Russia (in the first line – high knowledge intensive software incl. R&D) - Intel, establishing most biggest (outside U. S. A. ) software development center - Sun Microsystems - Alcatel - Siemens. 4) Already established centers include: Motorola, LG Electronics, Dell, Samsung и Borland. 23

Market Achievements 1. Russia entered firstly the Offshore 100 rating (Luxoft, CTGroup). 2. 2006 two Russian IT-companies entered Technology Fast 500 Rating: 500 most fastest growing IT-companies of Europe Aplana – Income Growth of 1779% in 5 years Progresstech LLC – Income Growth of 747% in 5 years. 3. 2004 -2005 - 4 leading TNCs established Centres for software Development in Russia (in the first line – high knowledge intensive software incl. R&D) - Intel, establishing most biggest (outside U. S. A. ) software development center - Sun Microsystems - Alcatel - Siemens. 4) Already established centers include: Motorola, LG Electronics, Dell, Samsung и Borland. 23

Advantages for IT Software Oursourcing in Russia Advantages of IT Software outsourcing in Russia: 1. Geographical proximity to U. S. A. , Europe (working time, personal contacts). Moscow to London is a 3 -hours flight. 2. More familiar cultural Framework for Clients from Europe, U. S. A. (compared to India, China). 3. Infrastructure is rated a bit higher than other outsourcing States (Economist — Economist Intelligence Unit, Russia — 59, India — 75, China, Philippines — 66. To compare: Infrastructure of U. S. A. is rated at 16. 24

Advantages for IT Software Oursourcing in Russia Advantages of IT Software outsourcing in Russia: 1. Geographical proximity to U. S. A. , Europe (working time, personal contacts). Moscow to London is a 3 -hours flight. 2. More familiar cultural Framework for Clients from Europe, U. S. A. (compared to India, China). 3. Infrastructure is rated a bit higher than other outsourcing States (Economist — Economist Intelligence Unit, Russia — 59, India — 75, China, Philippines — 66. To compare: Infrastructure of U. S. A. is rated at 16. 24

Market Segment for Russian IT Companies Given that: - Deficit of qualified IT labor-force in Russia - Relatively high labor costs, growth of wages - High share of post-graduated - High State Regulation Burden The Market Segment for Russian IT-Companies would be Software Development projects, that are: - Relatively small - Relatively high R&D share - Require relatively much Client contacts (geographical Advantages) 25

Market Segment for Russian IT Companies Given that: - Deficit of qualified IT labor-force in Russia - Relatively high labor costs, growth of wages - High share of post-graduated - High State Regulation Burden The Market Segment for Russian IT-Companies would be Software Development projects, that are: - Relatively small - Relatively high R&D share - Require relatively much Client contacts (geographical Advantages) 25

Barriers for Growth & State IT Promotion Policy 26

Barriers for Growth & State IT Promotion Policy 26

Underdevelopment of law - Underdevelopment of Information technology related law in general: e. g. Electronic Signature Act: enacted but not functioning. - Intellectual property rights law: not functioning - Tax law not adopted according to needs of IT accounting: uncertainity in tax accounting leads to more risks and expences for IT companies. 27

Underdevelopment of law - Underdevelopment of Information technology related law in general: e. g. Electronic Signature Act: enacted but not functioning. - Intellectual property rights law: not functioning - Tax law not adopted according to needs of IT accounting: uncertainity in tax accounting leads to more risks and expences for IT companies. 27

Barriers, impeding internal IT Market development 1) Not sufficient qualified demand from State 2) Not sufficient demand from population (low income, no need in IT Technologies) 3) Not-stable business environment – big companies aren’t willing to invest in long-term IT projects 4) Many administrative and tax barriers in general e. g. - High import Taxes for Hardware - High Share of Labor Expenses increase Tax Burden (Social Tax 26%, Income Tax 13%), leads to decreasing of Attractivity for Investors - High Depreciation Rate for Hardware - Uncertainty with Tax regulation for Software, Depreciation terms of software 28

Barriers, impeding internal IT Market development 1) Not sufficient qualified demand from State 2) Not sufficient demand from population (low income, no need in IT Technologies) 3) Not-stable business environment – big companies aren’t willing to invest in long-term IT projects 4) Many administrative and tax barriers in general e. g. - High import Taxes for Hardware - High Share of Labor Expenses increase Tax Burden (Social Tax 26%, Income Tax 13%), leads to decreasing of Attractivity for Investors - High Depreciation Rate for Hardware - Uncertainty with Tax regulation for Software, Depreciation terms of software 28

Barriers, impeding IT export development 1) Licensing: complicated but obligatory 2) Complicated customs clearance procedures The Specifics of Software Export isn’t codified in Law. 3) Given that, the most Software export goes over Internet, what leads to: - Most export-import operations of Russian IT Companies stay in “Grey zone” (half legal) - Value Added Tax Return in Case of Software export doesn’t work 4) Wages are being paid in most cases using “Tax Reduction schemas” 5) Using of “Grey Zone” Business Schemas leads to Difficulties in: - Credit using - Venture financing - Building Partnerships with West Xompanies 29

Barriers, impeding IT export development 1) Licensing: complicated but obligatory 2) Complicated customs clearance procedures The Specifics of Software Export isn’t codified in Law. 3) Given that, the most Software export goes over Internet, what leads to: - Most export-import operations of Russian IT Companies stay in “Grey zone” (half legal) - Value Added Tax Return in Case of Software export doesn’t work 4) Wages are being paid in most cases using “Tax Reduction schemas” 5) Using of “Grey Zone” Business Schemas leads to Difficulties in: - Credit using - Venture financing - Building Partnerships with West Xompanies 29

Overview: IT Market State policy In general: 1) Consistent IT Promotion Policy, facing real Challenges, not emerged. 2) IT Promotion Policy answers just some of IT Sector Development Challenges 2003 -2005 – a unique case for Russia: unter patronage of ITAssociation (APKIT) Business along with Ministry of Communication developed a IT Market development Program. Allthough, this Program remains a concept (not enacted). Reason: there are some Contradictions between Needs of IT Sector Development and “Real state policy”: 1. Orientation on Oil, Gas, Metal Industries (most biggest and statedependent Taxpayers) 2. Official Goal for Tax Authorities: increase Taxes 30

Overview: IT Market State policy In general: 1) Consistent IT Promotion Policy, facing real Challenges, not emerged. 2) IT Promotion Policy answers just some of IT Sector Development Challenges 2003 -2005 – a unique case for Russia: unter patronage of ITAssociation (APKIT) Business along with Ministry of Communication developed a IT Market development Program. Allthough, this Program remains a concept (not enacted). Reason: there are some Contradictions between Needs of IT Sector Development and “Real state policy”: 1. Orientation on Oil, Gas, Metal Industries (most biggest and statedependent Taxpayers) 2. Official Goal for Tax Authorities: increase Taxes 30

Programs for IT Promotion State IT Promotion Programs : 1) Development of Techno-parks (2006 -2010) 2) Direct Federal Program “Electronic Russia” (20022010) – mainly faces Problems of State IT Development, State Reform 3) Special economic Zones – Dubna (Luxsoft) 31

Programs for IT Promotion State IT Promotion Programs : 1) Development of Techno-parks (2006 -2010) 2) Direct Federal Program “Electronic Russia” (20022010) – mainly faces Problems of State IT Development, State Reform 3) Special economic Zones – Dubna (Luxsoft) 31

Thank you! abelyaev@hse. ru 32

Thank you! abelyaev@hse. ru 32