7f14a3bbed70fba7661a2da1370dba04.ppt

- Количество слайдов: 38

State Street Global Advisor Asia Limited– Analysis of Tracker Fund

Content • Introduction of State Street Global Advisor Asia Limited • Background of Tracker Fund • Trend of Tracker Fund • Comparison on Tracker Fund & Hang Seng UK Index Fund • Advantages of investing Tracker Fund • The Prospect of Tracker Fund

Investment Company - State Street Global Advisor Asia Limited (SSg. A Asia) - regional headquarter of SSg. A : investment management division of State Street Corporation

Background : • State Street Global Advisor (SSga) • Established in 1978 • US$1. 5 trillion

State Street Global Advisor Asia (SSg. A Asis) • 11 investment centers: • Paris, Singapore, Hong Kong -established in HK in 1990 -full investment center in 1997

Solutions: • Defensive/ • aggressive strategies • active /enhance/ passive style

Achievements: • The largest manager of : Institutional assets worldwide Passive international indexed securities Endowment and foundation assets, etc

• The manager of the Tracker fund • Straits Times Index (STI) • ABF Pan Asia Bond Index Fund (PAIF)

Background of Tracker Fund

Tracker Fund • Stays close to the Hang Seng Index • Buying Tracker Fund = Invest on a basket of stock: ~diversification ~low transaction cost

Background of Tracker Fund • Launched on 12 th November, 1999 • Second large IPO in Asia (issue size HK$ 33. 3 billion) • Supported by government Government chose State Street Bank and Trust Co.

Similarities and differences between Track Fund and Common stock Similarities: • Receive cash dividends • Buy or sell tracker Fund in Hong Kong during trading day • Tell the investment performance at any time Difference: • Distribution of Dividend • Nature

Trend of Tracker Fund

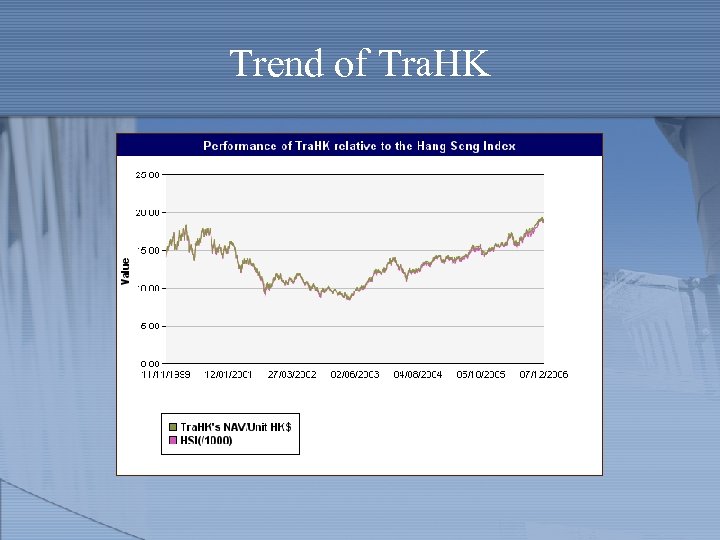

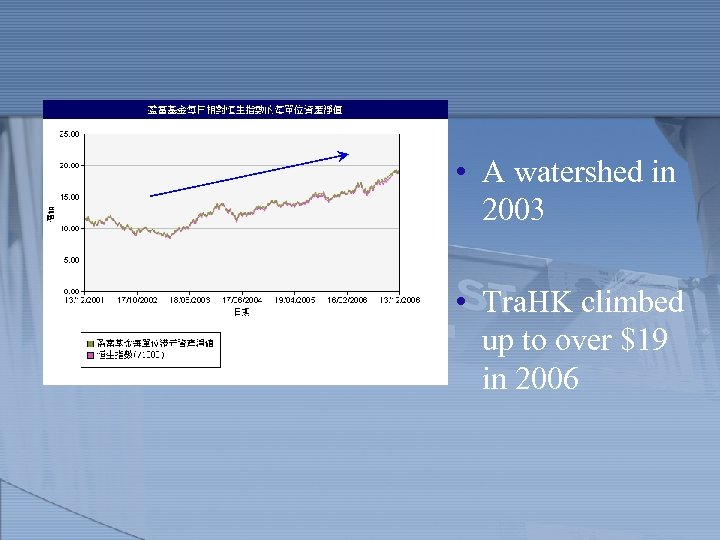

Trend of Tra. HK

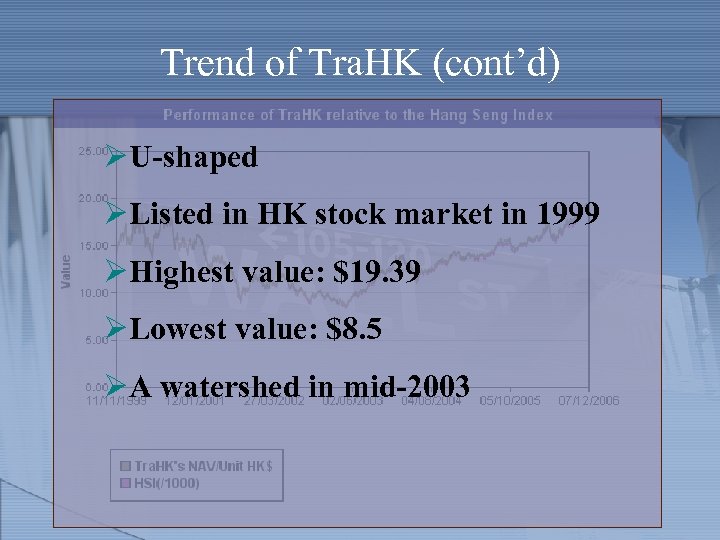

Trend of Tra. HK (cont’d) ØU-shaped ØListed in HK stock market in 1999 ØHighest value: $19. 39 ØLowest value: $8. 5 ØA watershed in mid-2003

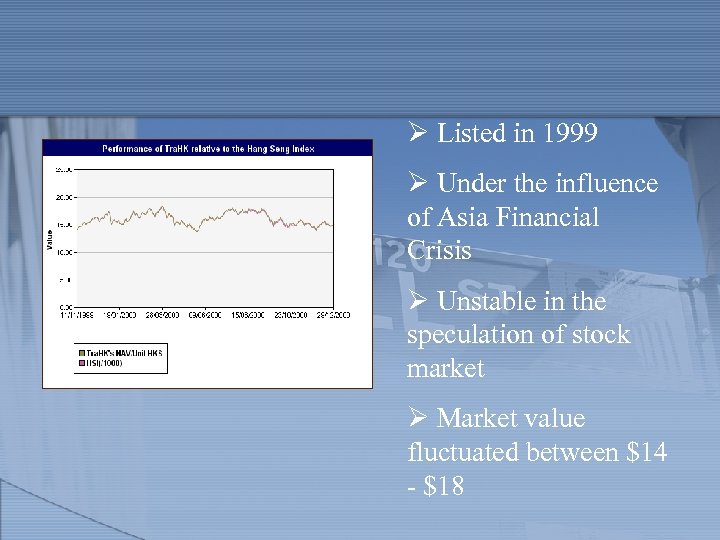

Ø Listed in 1999 Ø Under the influence of Asia Financial Crisis Ø Unstable in the speculation of stock market Ø Market value fluctuated between $14 - $18

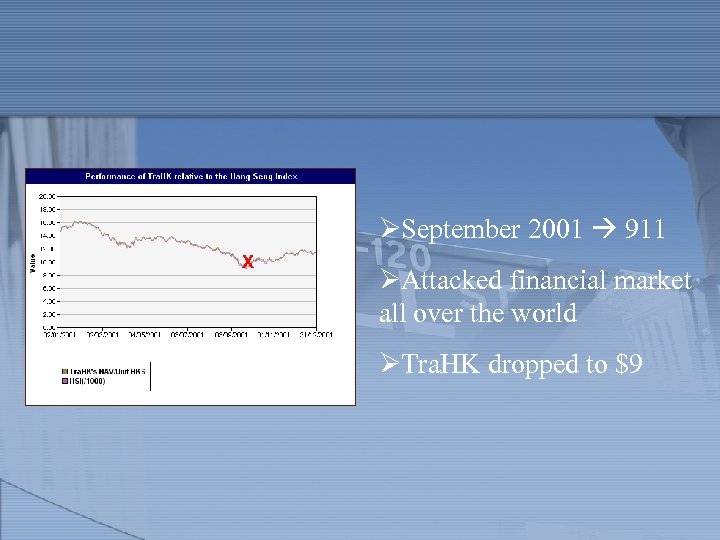

ØSeptember 2001 911 X ØAttacked financial market all over the world ØTra. HK dropped to $9

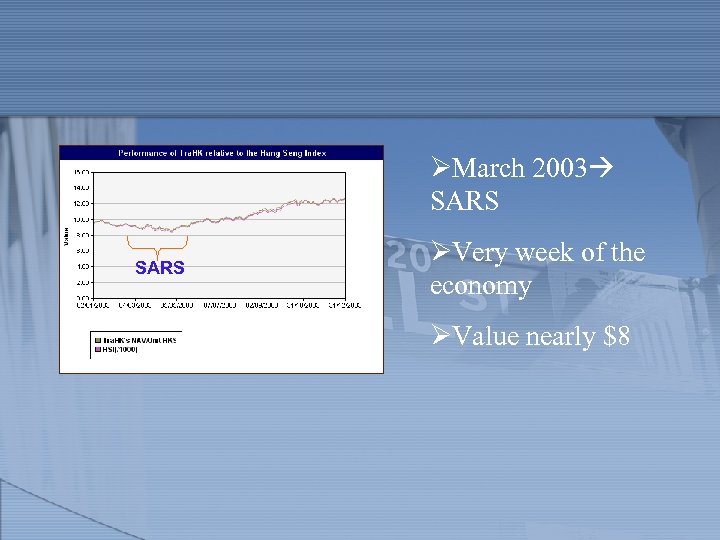

ØMarch 2003 SARS ØVery week of the economy ØValue nearly $8

• A watershed in 2003 • Tra. HK climbed up to over $19 in 2006

Comparison on Tracker Fund & Hang Seng UK Index Fund

Comparison between two index fund Tracker Fund Vs. Hang Seng UK Index Fund State Street Global Advisors Vs. Hang Seng Bank Management

Objectives Tracker Fund: • performance of the Hang Seng Index. Hang Seng UK Index • performance of the FTSE 100 Index (英國富時指數)

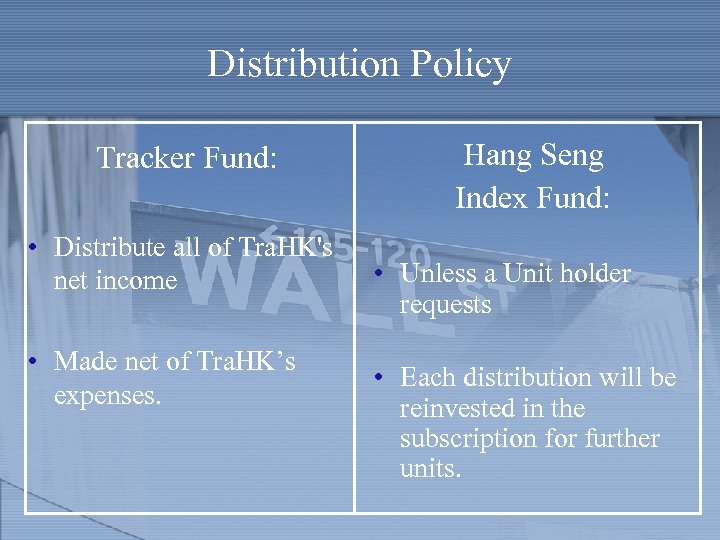

Distribution Policy Tracker Fund: • Distribute all of Tra. HK's net income • Made net of Tra. HK’s expenses. Hang Seng Index Fund: • Unless a Unit holder requests • Each distribution will be reinvested in the subscription for further units.

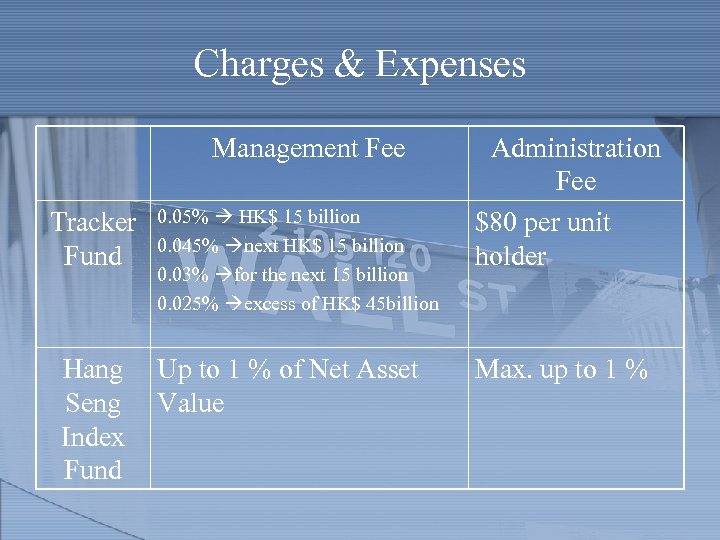

Charges & Expenses Management Fee Tracker Fund Hang Seng Index Fund 0. 05% HK$ 15 billion 0. 045% next HK$ 15 billion 0. 03% for the next 15 billion 0. 025% excess of HK$ 45 billion Up to 1 % of Net Asset Value Administration Fee $80 per unit holder Max. up to 1 %

Weightings of Four Sectors Sector of constituent Stocks Tracker Fund Weighting (%) Hang Seng UK Index Weighting (%) No. of stocks 34 102 Finance 36. 81% 27. 63% Utilities 5. 23% 4. 74% Properties 10. 72% 1. 52% Commerce and Industry 45. 79% 15. 38% Others ---- 50. 27%

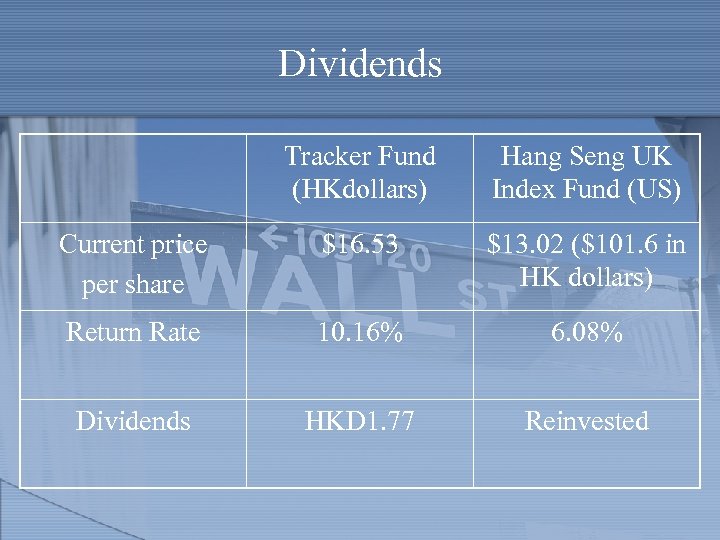

Dividends Tracker Fund (HKdollars) Hang Seng UK Index Fund (US) Current price per share $16. 53 $13. 02 ($101. 6 in HK dollars) Return Rate 10. 16% 6. 08% Dividends HKD 1. 77 Reinvested

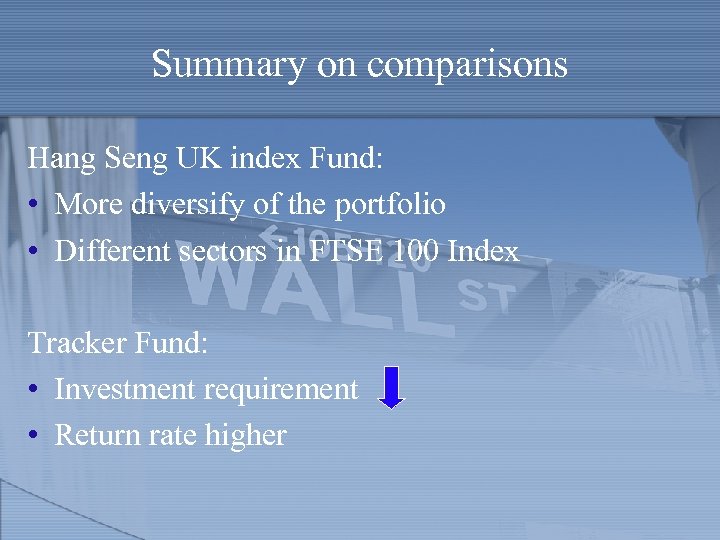

Summary on comparisons Hang Seng UK index Fund: • More diversify of the portfolio • Different sectors in FTSE 100 Index Tracker Fund: • Investment requirement • Return rate higher

Advantages of investing Tracker Fund

(1) Diversification - Adverse proportion between risk and diversification - Tracker Fund Investing in a portfolio of securities 1 -34 shares Hang Seng Index Funds Risk decreases

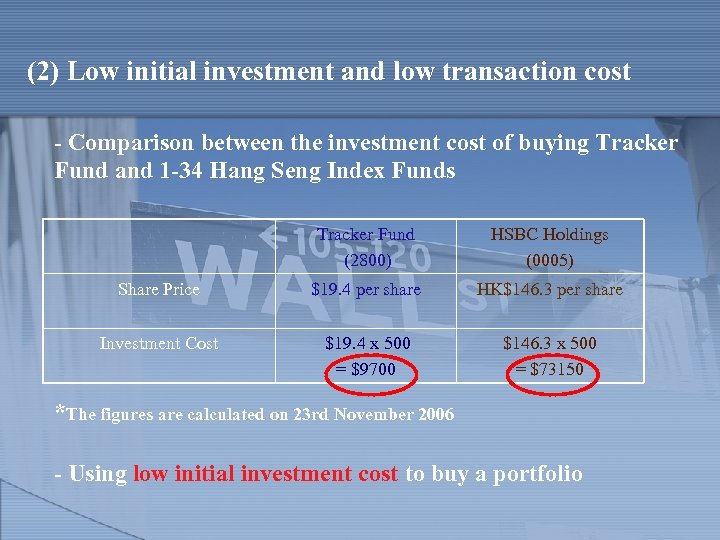

(2) Low initial investment and low transaction cost - Comparison between the investment cost of buying Tracker Fund and 1 -34 Hang Seng Index Funds Tracker Fund (2800) HSBC Holdings (0005) Share Price $19. 4 per share HK$146. 3 per share Investment Cost $19. 4 x 500 = $9700 $146. 3 x 500 = $73150 *The figures are calculated on 23 rd November 2006 - Using low initial investment cost to buy a portfolio

(2) Low initial investment and low transaction cost (con’d) - 0. 1125% stamp duty - less than 0. 25% the brokers’ commission - 0. 011% the transaction cost on Hong Kong Exchanges and Clearing Limited Less than 0. 1%

• (3) Convenience - Investors can buy and sell their Tracker Fund through brokers during the trading hours of the stock exchange - Not limited by the rule—only one dealing per day Transact without the numbers of transaction

• (4) Professional management - State Street Corporation sound expertise and solid investment experience - change the weighting of the predicted performance of 34 Hang Seng Index Funds Focusing on the Hang Seng Index do not necessary to acquire enough securities on different industries

The Prospect of Tracker Fund

Prospect of Tracker Fund • Competitive advantage low transaction cost, trustee fee, low risk • Do the competitive advantage still there in the future? • Others Fund (like Hang Seng Index fund) challenge Tracker Fund

• Comparing Tracker Fund with Hang Seng Index Fund • Return rate • Weight of the sector of constituent stock • Trustee fee

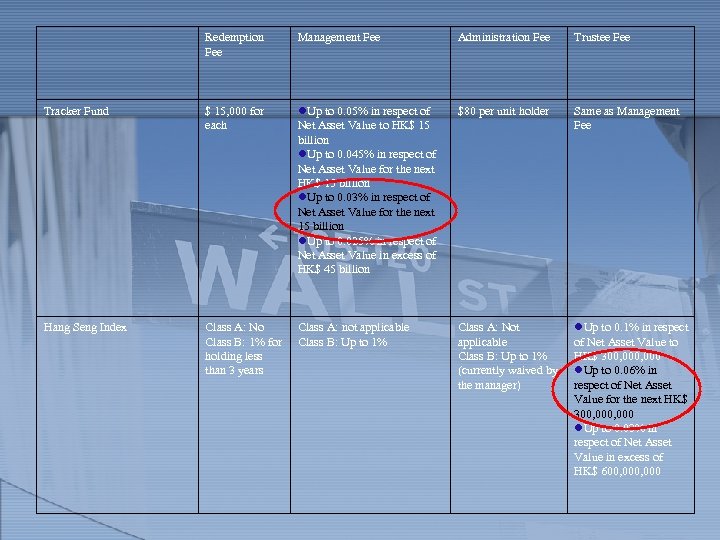

Redemption Fee Management Fee Administration Fee Trustee Fee Tracker Fund $ 15, 000 for each Up to 0. 05% in respect of Net Asset Value to HK$ 15 billion Up to 0. 045% in respect of Net Asset Value for the next HK$ 15 billion Up to 0. 03% in respect of Net Asset Value for the next 15 billion Up to 0. 025% in respect of Net Asset Value in excess of HK$ 45 billion $80 per unit holder Same as Management Fee Hang Seng Index Class A: No Class B: 1% for holding less than 3 years Class A: not applicable Class B: Up to 1% Class A: Not applicable Class B: Up to 1% (currently waived by the manager) Up to 0. 1% in respect of Net Asset Value to HK$ 300, 000 Up to 0. 06% in respect of Net Asset Value for the next HK$ 300, 000 Up to 0. 03% in respect of Net Asset Value in excess of HK$ 600, 000

The End of our presentation Thank you for your attention Cheung Kai Yan, Irene (043011) Chan Hiu Ting, Christine (043019) Wan Kit Ying, Kitty (043020) Law Fong Ting, Fonteyn (043023) Chan Sin Yan, Cyto (043024)

7f14a3bbed70fba7661a2da1370dba04.ppt