021844a385c26e0b0b8ab51918a26e5e.ppt

- Количество слайдов: 49

State of Oregon Division of Finance and Corporate Securities Protecting Yourself from Identity Theft and Financial Fraud

State of Oregon Division of Finance and Corporate Securities Protecting Yourself from Identity Theft and Financial Fraud

State of Oregon Division of Finance and Corporate Securities Eric Kleinman Investor Information Coordinator (503) 947 -7492 dcbs. dfcsmail@state. or. us

State of Oregon Division of Finance and Corporate Securities Eric Kleinman Investor Information Coordinator (503) 947 -7492 dcbs. dfcsmail@state. or. us

What We Will Cover Today Oregon’s Financial Fraud Agencies Common misconceptions about fraud ID Theft and Self Defense What to do if you become a victim Rules to Remember Resources You Can Use

What We Will Cover Today Oregon’s Financial Fraud Agencies Common misconceptions about fraud ID Theft and Self Defense What to do if you become a victim Rules to Remember Resources You Can Use

State of Oregon Financial Fraud Agencies The mission of the Division of Finance and Corporate Securities (DFCS): “To encourage the widest possible range of financial services, products, and information for Oregonians, delivered in a safe, sound, and fraudfree manner. ”

State of Oregon Financial Fraud Agencies The mission of the Division of Finance and Corporate Securities (DFCS): “To encourage the widest possible range of financial services, products, and information for Oregonians, delivered in a safe, sound, and fraudfree manner. ”

Financial Fraud Agencies The Division of Finance and Corporate Securities: Registers all securities offerings Licenses brokerage and investment advisory firms and their salespeople Investigates violations of securities laws

Financial Fraud Agencies The Division of Finance and Corporate Securities: Registers all securities offerings Licenses brokerage and investment advisory firms and their salespeople Investigates violations of securities laws

State of Oregon Financial Fraud Agencies The Oregon Department of Justice Consumer Fraud Division: To protect Oregonians from fraud and illegal activities designed to deny them of their property.

State of Oregon Financial Fraud Agencies The Oregon Department of Justice Consumer Fraud Division: To protect Oregonians from fraud and illegal activities designed to deny them of their property.

Financial Fraud Agencies The Dept. of Justice Consumer Fraud Division: Operates the Consumer Fraud Hotline Informs Oregonians about consumer laws Works with other state, local, and federal agencies to prevent fraud

Financial Fraud Agencies The Dept. of Justice Consumer Fraud Division: Operates the Consumer Fraud Hotline Informs Oregonians about consumer laws Works with other state, local, and federal agencies to prevent fraud

Financial Fraud Misconceptions Definition of economic crime: Crimes committed for financial gain that depend upon deception and fraud rather than violence or physical force.

Financial Fraud Misconceptions Definition of economic crime: Crimes committed for financial gain that depend upon deception and fraud rather than violence or physical force.

Financial Fraud Misconceptions Identity Theft is the fastest growing crime in the United States, with as many as 1. 9 million new victims each year. Oregon Ranks 9 th Nationally in ID Theft

Financial Fraud Misconceptions Identity Theft is the fastest growing crime in the United States, with as many as 1. 9 million new victims each year. Oregon Ranks 9 th Nationally in ID Theft

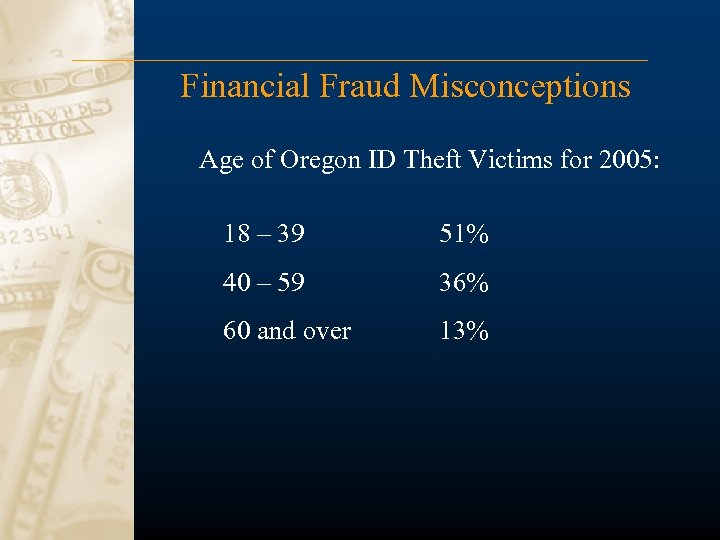

Financial Fraud Misconceptions Age of Oregon ID Theft Victims for 2005: 18 – 39 51% 40 – 59 36% 60 and over 13%

Financial Fraud Misconceptions Age of Oregon ID Theft Victims for 2005: 18 – 39 51% 40 – 59 36% 60 and over 13%

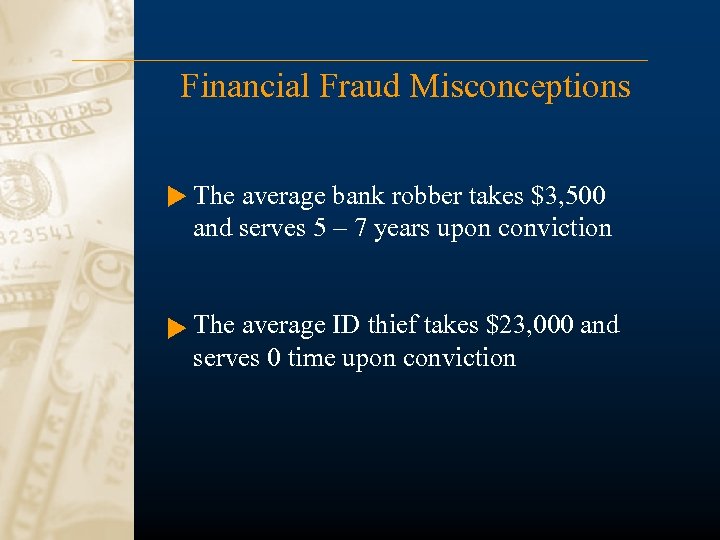

Financial Fraud Misconceptions The average bank robber takes $3, 500 and serves 5 – 7 years upon conviction The average ID thief takes $23, 000 and serves 0 time upon conviction

Financial Fraud Misconceptions The average bank robber takes $3, 500 and serves 5 – 7 years upon conviction The average ID thief takes $23, 000 and serves 0 time upon conviction

Financial Fraud Misconceptions Cost of fraud: Americans lose $300 billion every year to financial fraud of all types. Almost $9 billion of that is from ID Theft.

Financial Fraud Misconceptions Cost of fraud: Americans lose $300 billion every year to financial fraud of all types. Almost $9 billion of that is from ID Theft.

Financial Fraud Misconceptions More than 1/3 of ID Theft is perpetrated by a friend, family member, co-worker, or caregiver It’s impossible to completely prevent odds You can reduce the chances of being a victim

Financial Fraud Misconceptions More than 1/3 of ID Theft is perpetrated by a friend, family member, co-worker, or caregiver It’s impossible to completely prevent odds You can reduce the chances of being a victim

ID Theft and Self Defense How Do ID Thieves Get Our Information? Increase of online personal information Illegal access of credit bureau data Illegal sale of information by employees “Pretexting” Scams Theft of information from mailbox, wallet, purse, or trash receptacles “Phishing” scams

ID Theft and Self Defense How Do ID Thieves Get Our Information? Increase of online personal information Illegal access of credit bureau data Illegal sale of information by employees “Pretexting” Scams Theft of information from mailbox, wallet, purse, or trash receptacles “Phishing” scams

ID Theft and Self Defense What Do ID Thieves Do With It? ID Theft Manifests Primarily in Two Ways: Fraudulent Application: Establishing a new credit relationship Account Takeover: Assuming an existing credit relationship

ID Theft and Self Defense What Do ID Thieves Do With It? ID Theft Manifests Primarily in Two Ways: Fraudulent Application: Establishing a new credit relationship Account Takeover: Assuming an existing credit relationship

ID Theft and Self Defense Open credit card accounts in your name Establish utility and wireless service Take out loans in your name Apply for employment in your name Rent apartments/buy real estate Open securities trading accounts File Bankruptcy in your name

ID Theft and Self Defense Open credit card accounts in your name Establish utility and wireless service Take out loans in your name Apply for employment in your name Rent apartments/buy real estate Open securities trading accounts File Bankruptcy in your name

ID Theft and Self Defense How To Minimize Your Risk Monitor all of your monthly statements Ask vendors how your information is used Take steps to protect your mail

ID Theft and Self Defense How To Minimize Your Risk Monitor all of your monthly statements Ask vendors how your information is used Take steps to protect your mail

ID Theft and Self Defense How To Minimize Your Risk Shred unneeded receipts, bills, and offers Never put account numbers on envelopes Beware of high risk “favors”: Checks, credit cards, ID Cards, e-mail access

ID Theft and Self Defense How To Minimize Your Risk Shred unneeded receipts, bills, and offers Never put account numbers on envelopes Beware of high risk “favors”: Checks, credit cards, ID Cards, e-mail access

ID Theft and Self Defense How To Minimize Your Risk Never throw away ATM receipts, credit card, or bank statements without shredding them first Never give your credit card info over the phone unless you initiated the call Reconcile your checking account regularly

ID Theft and Self Defense How To Minimize Your Risk Never throw away ATM receipts, credit card, or bank statements without shredding them first Never give your credit card info over the phone unless you initiated the call Reconcile your checking account regularly

ID Theft and Self Defense How To Minimize Your Risk Review your credit report at least three times per year Never throw out prescription bottles without removing your information Beware of people calling themselves “Senior Specialists” or “Medicare Specialists”

ID Theft and Self Defense How To Minimize Your Risk Review your credit report at least three times per year Never throw out prescription bottles without removing your information Beware of people calling themselves “Senior Specialists” or “Medicare Specialists”

ID Theft and Self Defense Who Is Victor Lopez-Flores? He was paid $100 to get a Virginia state ID card for Ahmed Alghamdi.

ID Theft and Self Defense Who Is Victor Lopez-Flores? He was paid $100 to get a Virginia state ID card for Ahmed Alghamdi.

ID Theft and Self Defense What happened to Mr. Alghamdi? He died on September 11, 2001 when the plane he helped hijack crashed into the North Tower of the World Trade Center complex.

ID Theft and Self Defense What happened to Mr. Alghamdi? He died on September 11, 2001 when the plane he helped hijack crashed into the North Tower of the World Trade Center complex.

ID Theft and Self Defense What happened to Mr. Lopez-Flores? By November 20, 2001—just 9 weeks after the attacks—Victor had been arrested, tried, convicted, sentenced, and incarcerated in federal prison.

ID Theft and Self Defense What happened to Mr. Lopez-Flores? By November 20, 2001—just 9 weeks after the attacks—Victor had been arrested, tried, convicted, sentenced, and incarcerated in federal prison.

What to do if you become a victim I If You Think You May Have Been A Victim: Call the Federal Trade Commission at -877 -IDTHEFT for assistance 1 Contact the fraud department of all three credit reporting bureaus Report it to your local police and get a copy of the police report Don’t be embarrassed to report it Don’t delay in reporting it

What to do if you become a victim I If You Think You May Have Been A Victim: Call the Federal Trade Commission at -877 -IDTHEFT for assistance 1 Contact the fraud department of all three credit reporting bureaus Report it to your local police and get a copy of the police report Don’t be embarrassed to report it Don’t delay in reporting it

What to do if you become a victim I If You Think You May Have Been A Victim: Keep copies of all correspondence For charges/debits on existing accounts, ask for the agency’s Fraud Dispute Forms For new unauthorized accounts, ask if the agency accepts the ID Theft Affidavit Be sure to dispute any fraudulent activity already being reported on your credit report

What to do if you become a victim I If You Think You May Have Been A Victim: Keep copies of all correspondence For charges/debits on existing accounts, ask for the agency’s Fraud Dispute Forms For new unauthorized accounts, ask if the agency accepts the ID Theft Affidavit Be sure to dispute any fraudulent activity already being reported on your credit report

What to do if you become a victim An Initial Fraud Alert stays on your account for 90 days Use this if your wallet or purse has been stolen or if you otherwise think you may be in imminent danger of having your identity stolen Placing an Initial Fraud Alert entitles you to one free credit report from each of the 3 credit agencies

What to do if you become a victim An Initial Fraud Alert stays on your account for 90 days Use this if your wallet or purse has been stolen or if you otherwise think you may be in imminent danger of having your identity stolen Placing an Initial Fraud Alert entitles you to one free credit report from each of the 3 credit agencies

What to do if you become a victim An Extended Fraud Alert stays on your account for seven years Use this if you are a victim of ID Theft and can provide an Identity Theft Report to the credit reporting agencies Placing an Extended Fraud Alert entitles you to 2 free credit reports within 12 months, and removes you from pre-approved offers for 5 years

What to do if you become a victim An Extended Fraud Alert stays on your account for seven years Use this if you are a victim of ID Theft and can provide an Identity Theft Report to the credit reporting agencies Placing an Extended Fraud Alert entitles you to 2 free credit reports within 12 months, and removes you from pre-approved offers for 5 years

What to do if you become a victim For financial accounts: Close the accounts immediately When you open new accounts, place passwords on them Avoid using common sequences like your mother’s maiden name, birthdates, the last 4 digits of your social security number, or your phone number

What to do if you become a victim For financial accounts: Close the accounts immediately When you open new accounts, place passwords on them Avoid using common sequences like your mother’s maiden name, birthdates, the last 4 digits of your social security number, or your phone number

What to do if you become a victim For your social security number: Place an Initial Fraud Alert on your accounts with each of the three major credit reporting agencies An alert can help stop someone from opening new credit accounts in your name

What to do if you become a victim For your social security number: Place an Initial Fraud Alert on your accounts with each of the three major credit reporting agencies An alert can help stop someone from opening new credit accounts in your name

What to do if you become a victim For your drivers license or other government-issued identification: Contact the agency that issued the identification and notify them of theft/loss Follow the agency’s procedure for replacement Ask the agency to flag your account to make it more difficult for others to get duplicates

What to do if you become a victim For your drivers license or other government-issued identification: Contact the agency that issued the identification and notify them of theft/loss Follow the agency’s procedure for replacement Ask the agency to flag your account to make it more difficult for others to get duplicates

What to do if you become a victim Once resolved, it usually stays resolved Review your credit report every 3 months for a year after losing your information Continue to review annually through your free credit reports

What to do if you become a victim Once resolved, it usually stays resolved Review your credit report every 3 months for a year after losing your information Continue to review annually through your free credit reports

Resources What The Fair and Accurate Credit Transaction Act (FACTA) Does For You: Fraud Alerts can be placed on your accounts You are entitled to one free credit report from each of the 3 credit bureaus each year Difference between credit report and credit score www. annualcreditreport. com

Resources What The Fair and Accurate Credit Transaction Act (FACTA) Does For You: Fraud Alerts can be placed on your accounts You are entitled to one free credit report from each of the 3 credit bureaus each year Difference between credit report and credit score www. annualcreditreport. com

What to do if you become a victim Stay alert for signs of ID Theft: Failing to receive bills or other mail Receiving credit cards you didn’t apply for Being denied credit or offered high rates for no apparent reason Getting calls or letters from debt collectors about merchandise or services you didn’t order

What to do if you become a victim Stay alert for signs of ID Theft: Failing to receive bills or other mail Receiving credit cards you didn’t apply for Being denied credit or offered high rates for no apparent reason Getting calls or letters from debt collectors about merchandise or services you didn’t order

Rules to Remember Salespeople may use misleading titles Only share information when you have initialed contact Always closely review account statements Don’t think that it only happens to others

Rules to Remember Salespeople may use misleading titles Only share information when you have initialed contact Always closely review account statements Don’t think that it only happens to others

Rules to Remember It’s OK to be rude! You can hang up, or leave the office if you’re uncomfortable. Always stay in charge: It’s YOUR identity! Never judge a person’s integrity by how they look, sound, or dress.

Rules to Remember It’s OK to be rude! You can hang up, or leave the office if you’re uncomfortable. Always stay in charge: It’s YOUR identity! Never judge a person’s integrity by how they look, sound, or dress.

Resources Federal Trade Commission 600 Pennsylvania Avenue NW Washington, DC 20580 1 -877 -IDTHEFT www. consumer. gov/idtheft

Resources Federal Trade Commission 600 Pennsylvania Avenue NW Washington, DC 20580 1 -877 -IDTHEFT www. consumer. gov/idtheft

Resources Division of Finance and Corporate Securities 350 Winter Street NE, Room 410 PO Box 14480 Salem, OR 97301 main number: (503) 378 -4140 toll free number: (866) 814 -9710 www. oregondfcs. org eric. d. kleinman@state. or. us

Resources Division of Finance and Corporate Securities 350 Winter Street NE, Room 410 PO Box 14480 Salem, OR 97301 main number: (503) 378 -4140 toll free number: (866) 814 -9710 www. oregondfcs. org eric. d. kleinman@state. or. us

Resources Oregon Department of Justice 1162 Court Street NE Salem, OR 97301 (503) 378 -4400 (877) 877 -9392 www. doj. state. or. us consumer. hotline@doj. state. or. us

Resources Oregon Department of Justice 1162 Court Street NE Salem, OR 97301 (503) 378 -4400 (877) 877 -9392 www. doj. state. or. us consumer. hotline@doj. state. or. us

Resources Securities and Exchange Commission 450 Fifth Street, NW Washington DC, 20549 (202) 942 -7040 (800) SEC-0330 www. sec. gov help@sec. gov

Resources Securities and Exchange Commission 450 Fifth Street, NW Washington DC, 20549 (202) 942 -7040 (800) SEC-0330 www. sec. gov help@sec. gov

Resources National Association of Securities Dealers Two Union Square 601 Union Street Seattle, WA, 98101 (206) 624 -0790 (800) 289 -9999 www. nasdr. com

Resources National Association of Securities Dealers Two Union Square 601 Union Street Seattle, WA, 98101 (206) 624 -0790 (800) 289 -9999 www. nasdr. com

Resources North American Securities Administrators Association 10 G Street NE Suite 710 Washington DC 20002 (202) 737 -0900 www. nasaa. org info@nasaa. org

Resources North American Securities Administrators Association 10 G Street NE Suite 710 Washington DC 20002 (202) 737 -0900 www. nasaa. org info@nasaa. org

Resources Federal Reserve Bank Financial Literacy Site www. Federal. Reserve. Education. org

Resources Federal Reserve Bank Financial Literacy Site www. Federal. Reserve. Education. org

Resources Social Security Administration Fraud Hotline 1 -800 -269 -0271

Resources Social Security Administration Fraud Hotline 1 -800 -269 -0271

Resources US Postal Inspector Service 1 -800 -275 -8777 www. usps. gov

Resources US Postal Inspector Service 1 -800 -275 -8777 www. usps. gov

Resources Equifax 1 -800 -685 -1111 www. equifax. com PO Box 740241 Atlanta, Georgia 30374 -0241

Resources Equifax 1 -800 -685 -1111 www. equifax. com PO Box 740241 Atlanta, Georgia 30374 -0241

Resources Experian 1 -800 -311 -4769 www. experian. com PO Box 9532 Allen, Texas 75013

Resources Experian 1 -800 -311 -4769 www. experian. com PO Box 9532 Allen, Texas 75013

Resources Trans. Union 1 -800 -888 -4213 www. transunion. com Fraud Victim Assistance Division PO Box 6790 Fullerton, California 92834 -6790

Resources Trans. Union 1 -800 -888 -4213 www. transunion. com Fraud Victim Assistance Division PO Box 6790 Fullerton, California 92834 -6790

Resources Tom Martino Consumer Advocate/Radio Personality www. troubleshooter. com

Resources Tom Martino Consumer Advocate/Radio Personality www. troubleshooter. com

Resources Clark Howard Consumer Advocate/Radio Personality www. clarkhoward. com

Resources Clark Howard Consumer Advocate/Radio Personality www. clarkhoward. com