990131eac870b513ac9cc9d2dbc2a55b.ppt

- Количество слайдов: 55

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Business Opportunities In An Era of Telecommunications Liberalization Daniel Rosenne Director General, Ministry of Communications rosenned@moc. gov. il

STATE OF ISRAEL Presentation Agenda l Israel’s Telecommunications Market: n n n l General overview Cellular telephony International telecommunications Telecom Liberalization: n l MINISTRY OF COMMUNICATIONS Regulatory reform New frequency allocations The new numbering plan Bezeq in the new era Competition In Broadcasting Services Summary

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Israel’s Telecommunications Market General Overview

STATE OF ISRAEL Israel's Telecommunications MINISTRY OF COMMUNICATIONS l 2. 8 million main telephone lines (47% penetration). l 3 million cellular customers, on three networks: Pelephone, Cellcom & Partner/Orange. (48% penetration). l 1. 1 million cable-TV connected households. (3 operators, 70% of passed households, 92% household coverage).

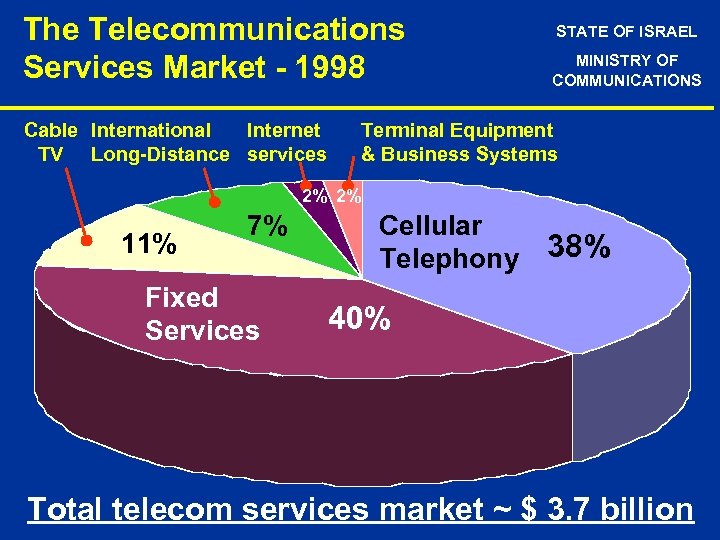

The Telecommunications Services Market - 1998 Cable International Internet TV Long-Distance services STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Terminal Equipment & Business Systems 2% 2% 11% 7% Fixed Services Cellular Telephony 38% 40% Total telecom services market ~ $ 3. 7 billion

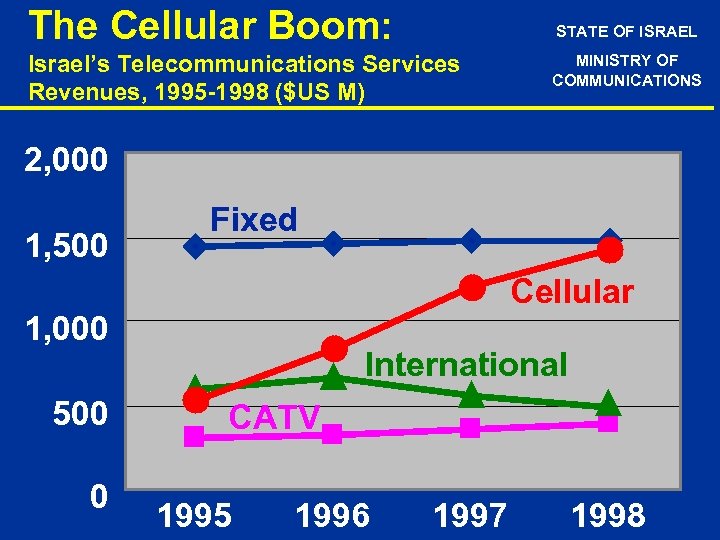

The Cellular Boom: STATE OF ISRAEL Israel’s Telecommunications Services Revenues, 1995 -1998 ($US M) MINISTRY OF COMMUNICATIONS 2, 000 1, 500 Fixed Cellular 1, 000 500 0 International CATV 1995 1996 1997 1998

The Existing Regulatory Environment l STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Separation between regulation and operation (since 1984). Regulation responsibility - Ministry of Communications. l General operating licenses issued to Bezeq, cellular operators & facility-based international long-distance service providers. l Special licenses issued by the Ministry of Communications for value-added services. l Exclusive rights of Bezeq in fixed services canceled as of 1 June 1999.

The Competitive Environment STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Wide competition in customer premise equipment and value-added services. l Limited competition in cellular and international services. l Two monopoly areas: n Bezeq - Domestic fixed services (infrastructure, transmission, data communications & telephony). n Cable TV operators - Multi-channel subscriber television.

Modern Fixed Network l l l STATE OF ISRAEL MINISTRY OF COMMUNICATIONS 100% digital. #7 ISUP signaling. Country-wide Euro ISDN. AIN features. SDH transmission. Country-wide fiber deployment.

Internet Services Profile STATE OF ISRAEL MINISTRY OF COMMUNICATIONS ~30 Internet service providers, 1 million users, 500, 000 dial-up & 5, 000 directly connected customers, 21, 000 domains. l Typical tariffs: ~ $12 monthly fee, including 10 usage hours, ~ $1 for each additional hour. Unlimited access at < $1 per day. l l IIX (Israel Internet e. Xchange) domestic interconnection service. l “Hands-off” overall regulatory policy. l High growth ~ 50% annual.

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Cellular Telephony Competition Introduced December 1994

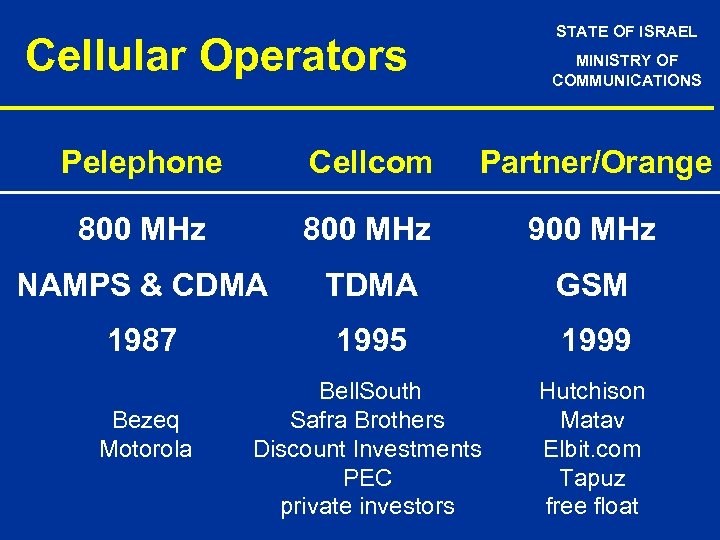

STATE OF ISRAEL Cellular Operators MINISTRY OF COMMUNICATIONS Pelephone Cellcom Partner/Orange 800 MHz 900 MHz NAMPS & CDMA TDMA GSM 1987 1995 1999 Bell. South Safra Brothers Discount Investments PEC private investors Hutchison Matav Elbit. com Tapuz free float Bezeq Motorola

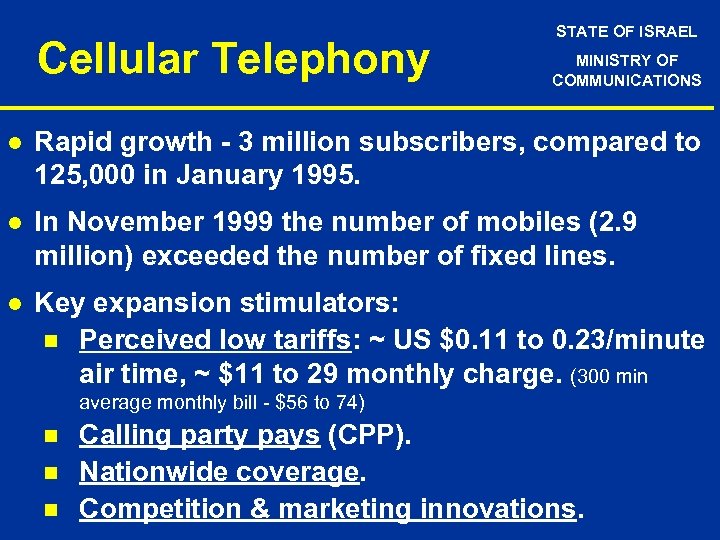

Cellular Telephony STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Rapid growth - 3 million subscribers, compared to 125, 000 in January 1995. l In November 1999 the number of mobiles (2. 9 million) exceeded the number of fixed lines. l Key expansion stimulators: n Perceived low tariffs: ~ US $0. 11 to 0. 23/minute air time, ~ $11 to 29 monthly charge. (300 min average monthly bill - $56 to 74) n n n Calling party pays (CPP). Nationwide coverage. Competition & marketing innovations.

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS International Telecommunications Facilities-Based Competition Introduced in July 1997

International Services Regulatory Environment STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Three facilities-based international long distance service providers and several callback & IBS operators. l Regulation covers: n Maximum tariffs. n Dialing parity. n Interconnect agreements. n International accounting - accounting rates, proportionate return. n Universal service obligations.

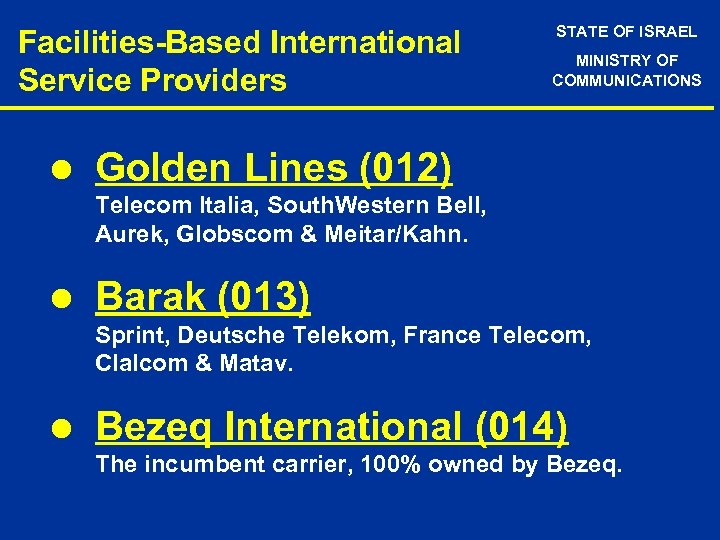

Facilities-Based International Service Providers l STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Golden Lines (012) Telecom Italia, South. Western Bell, Aurek, Globscom & Meitar/Kahn. l Barak (013) Sprint, Deutsche Telekom, France Telecom, Clalcom & Matav. l Bezeq International (014) The incumbent carrier, 100% owned by Bezeq.

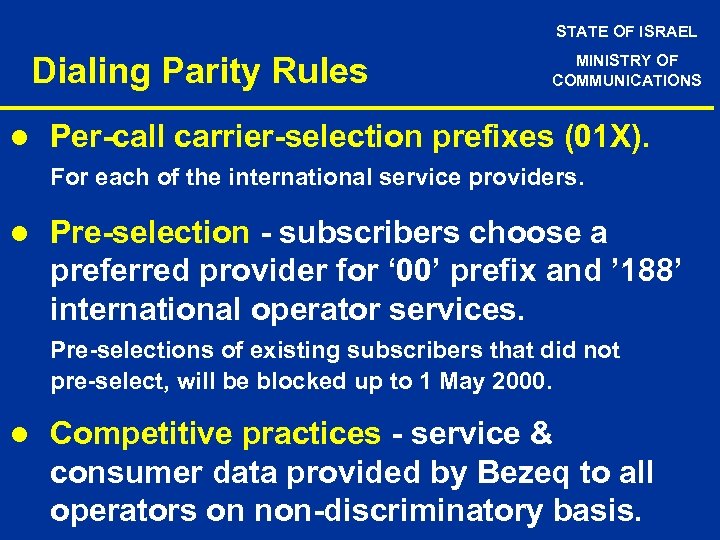

STATE OF ISRAEL Dialing Parity Rules l MINISTRY OF COMMUNICATIONS Per-call carrier-selection prefixes (01 X). For each of the international service providers. l Pre-selection - subscribers choose a preferred provider for ‘ 00’ prefix and ’ 188’ international operator services. Pre-selections of existing subscribers that did not pre-select, will be blocked up to 1 May 2000. l Competitive practices - service & consumer data provided by Bezeq to all operators on non-discriminatory basis.

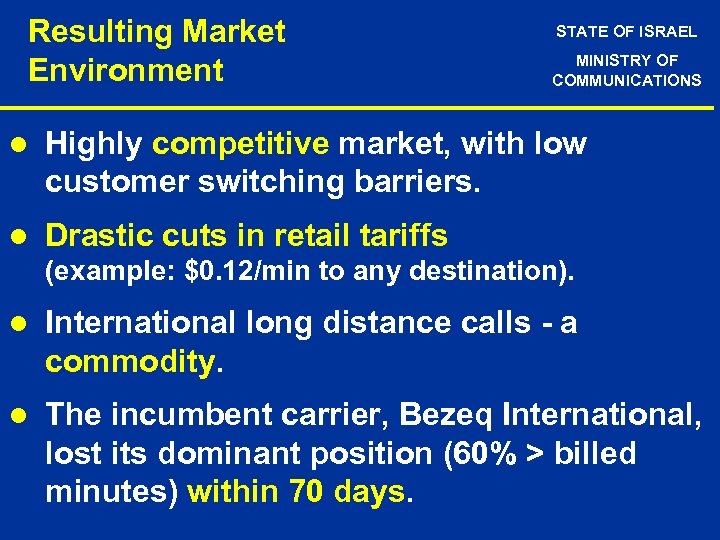

Resulting Market Environment STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Highly competitive market, with low customer switching barriers. l Drastic cuts in retail tariffs (example: $0. 12/min to any destination). l International long distance calls - a commodity. l The incumbent carrier, Bezeq International, lost its dominant position (60% > billed minutes) within 70 days.

![International Traffic [Million Minutes/Year] STATE OF ISRAEL MINISTRY OF COMMUNICATIONS 800 Outgoing 600 400 International Traffic [Million Minutes/Year] STATE OF ISRAEL MINISTRY OF COMMUNICATIONS 800 Outgoing 600 400](https://present5.com/presentation/990131eac870b513ac9cc9d2dbc2a55b/image-19.jpg)

International Traffic [Million Minutes/Year] STATE OF ISRAEL MINISTRY OF COMMUNICATIONS 800 Outgoing 600 400 Incoming 200 0 1996 1997 1998 1999

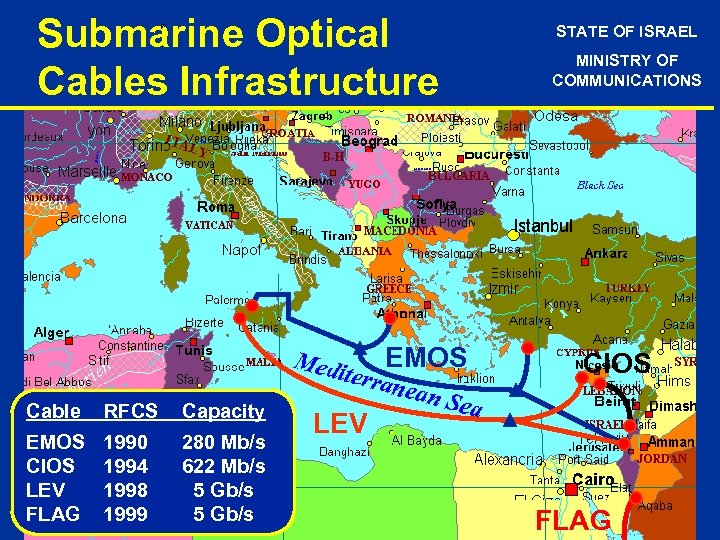

Submarine Optical Cables Infrastructure EMOS Cable RFCS Capacity EMOS CIOS LEV FLAG 1990 1994 1998 1999 280 Mb/s 622 Mb/s 5 Gb/s STATE OF ISRAEL MINISTRY OF COMMUNICATIONS CIOS LEV FLAG

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Telecommunications Liberalization

Regulatory Reform STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Competition in fixed services. l Structural change of the telecommunications sector: n Liberalization. n Privatization. n Re-regulation.

STATE OF ISRAEL Re-regulation Includes: MINISTRY OF COMMUNICATIONS l Competition rules - open access & nonl l l discrimination. Universal service - obligations, reciprocal compensation (if required). Interconnection - tariffs, technical standards. General license owners - obligations, structural regulation, services, coverage, interconnection. Numbering - administration, portability, new numbering plan. Policy - regulatory activity. National security.

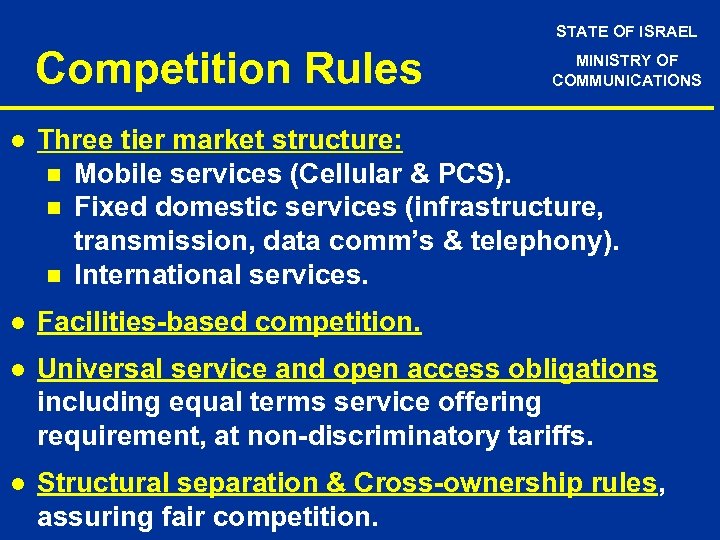

STATE OF ISRAEL Competition Rules MINISTRY OF COMMUNICATIONS l Three tier market structure: n Mobile services (Cellular & PCS). n Fixed domestic services (infrastructure, transmission, data comm’s & telephony). n International services. l Facilities-based competition. l Universal service and open access obligations including equal terms service offering requirement, at non-discriminatory tariffs. l Structural separation & Cross-ownership rules, assuring fair competition.

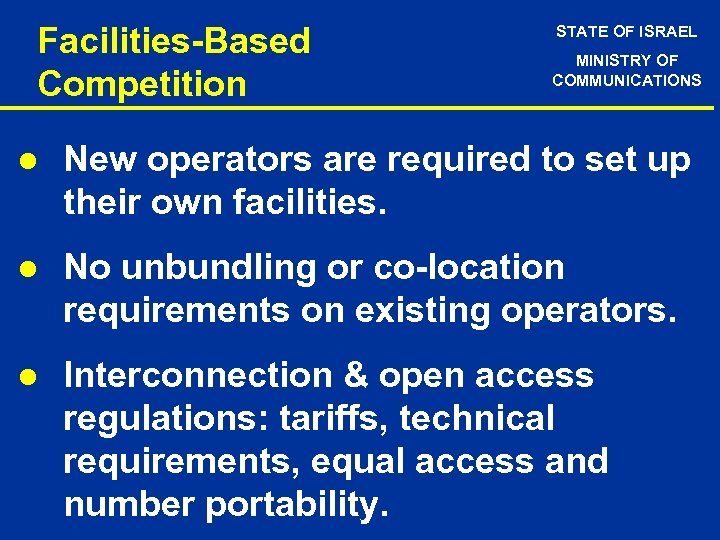

Facilities-Based Competition STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l New operators are required to set up their own facilities. l No unbundling or co-location requirements on existing operators. l Interconnection & open access regulations: tariffs, technical requirements, equal access and number portability.

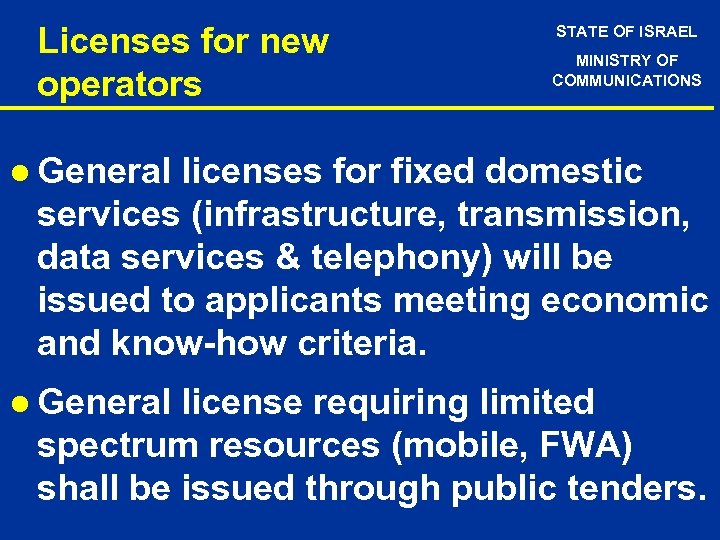

Licenses for new operators STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l General licenses for fixed domestic services (infrastructure, transmission, data services & telephony) will be issued to applicants meeting economic and know-how criteria. l General license requiring limited spectrum resources (mobile, FWA) shall be issued through public tenders.

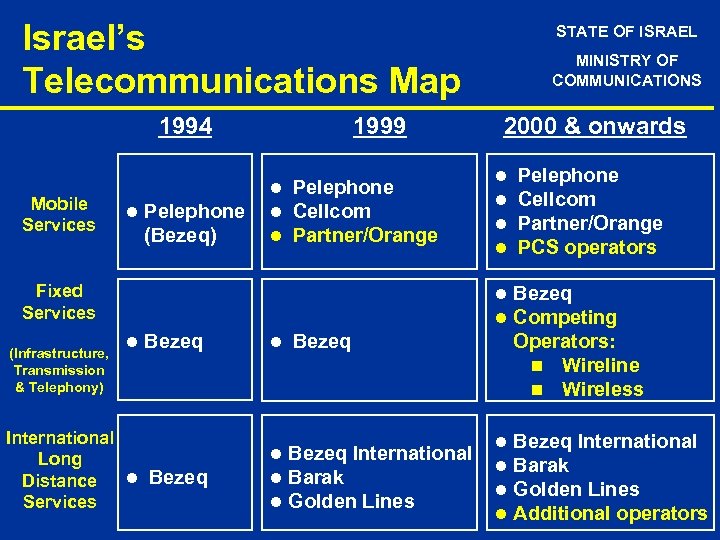

Israel’s Telecommunications Map 1994 Mobile Services 1999 STATE OF ISRAEL MINISTRY OF COMMUNICATIONS 2000 & onwards Pelephone (Bezeq) Pelephone Cellcom Partner/Orange Fixed Services Bezeq l l Bezeq International Barak Golden Lines Pelephone Cellcom Partner/Orange PCS operators Bezeq Competing Operators: n Wireline n Wireless l l Bezeq International Barak Golden Lines Additional operators Bezeq International Long l Bezeq Distance Services l l l l l (Infrastructure, Transmission & Telephony) l

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS New Frequency Allocations The key for competitive and growing marketplace

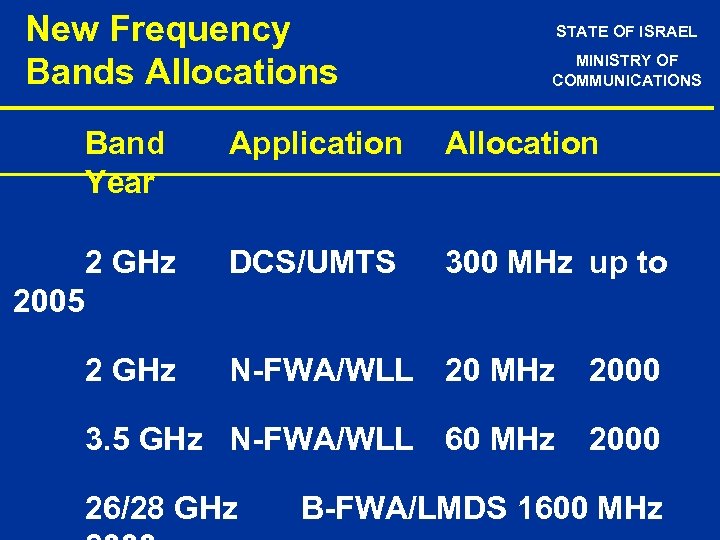

New Frequency Bands Allocations STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Band Year Application Allocation 2 GHz DCS/UMTS 300 MHz up to 2 GHz N-FWA/WLL 20 MHz 2000 3. 5 GHz N-FWA/WLL 60 MHz 2000 2005 26/28 GHz B-FWA/LMDS 1600 MHz

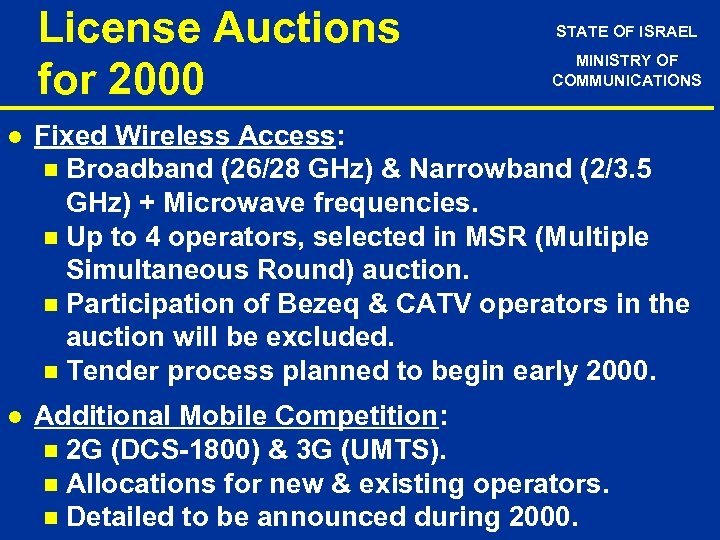

License Auctions for 2000 STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Fixed Wireless Access: n Broadband (26/28 GHz) & Narrowband (2/3. 5 GHz) + Microwave frequencies. n Up to 4 operators, selected in MSR (Multiple Simultaneous Round) auction. n Participation of Bezeq & CATV operators in the auction will be excluded. n Tender process planned to begin early 2000. l Additional Mobile Competition: n 2 G (DCS-1800) & 3 G (UMTS). n Allocations for new & existing operators. n Detailed to be announced during 2000.

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS New NNP (National Numbering Plan)

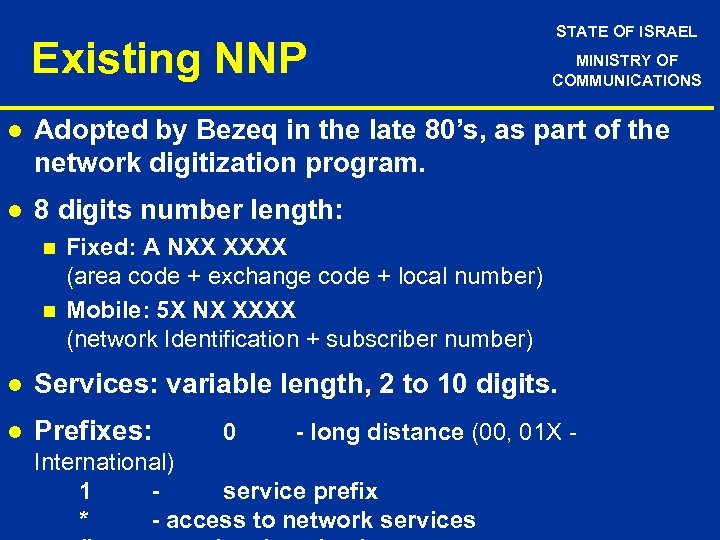

Existing NNP STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Adopted by Bezeq in the late 80’s, as part of the network digitization program. l 8 digits number length: n n Fixed: A NXX XXXX (area code + exchange code + local number) Mobile: 5 X NX XXXX (network Identification + subscriber number) l Services: variable length, 2 to 10 digits. l Prefixes: 0 - long distance (00, 01 X - International) 1 service prefix * - access to network services

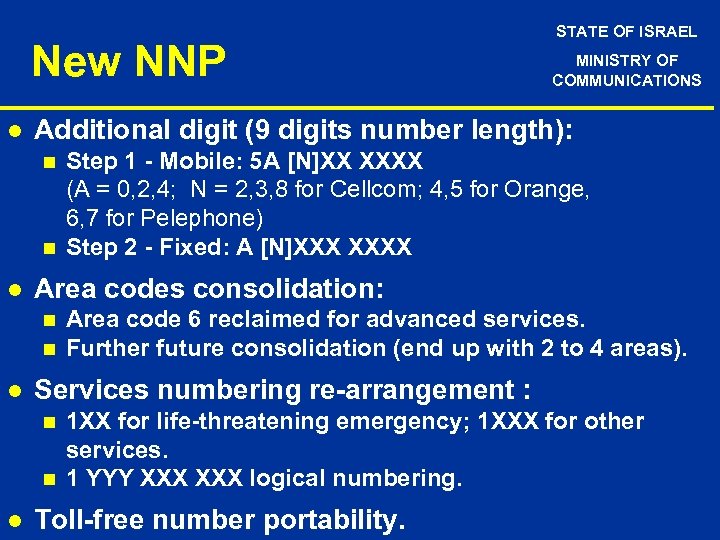

New NNP l n n Area code 6 reclaimed for advanced services. Further future consolidation (end up with 2 to 4 areas). Services numbering re-arrangement : n n l Step 1 - Mobile: 5 A [N]XX XXXX (A = 0, 2, 4; N = 2, 3, 8 for Cellcom; 4, 5 for Orange, 6, 7 for Pelephone) Step 2 - Fixed: A [N]XXX XXXX Area codes consolidation: n l MINISTRY OF COMMUNICATIONS Additional digit (9 digits number length): n l STATE OF ISRAEL 1 XX for life-threatening emergency; 1 XXX for other services. 1 YYY XXX logical numbering. Toll-free number portability.

![Will We Have Enough Telephone Numbers? STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Numbers [Millions] Will We Have Enough Telephone Numbers? STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Numbers [Millions]](https://present5.com/presentation/990131eac870b513ac9cc9d2dbc2a55b/image-34.jpg)

Will We Have Enough Telephone Numbers? STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Numbers [Millions] Number Type Old NNP New NNP Geographic 56 160 - 320 Mobile 8 80 Logical New Services 10 160 - 80 100 Future Use - 240 - 160

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Bezeq In the New Era

Bezeq in the New Era STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Tariff controls, until market share in domestic services (infrastructure, transmission, data services & telephony) falls bellow 60%. l Tariff re-balancing, dealing with access deficit and cross subsidies. l Structural separation. l Universal service obligation.

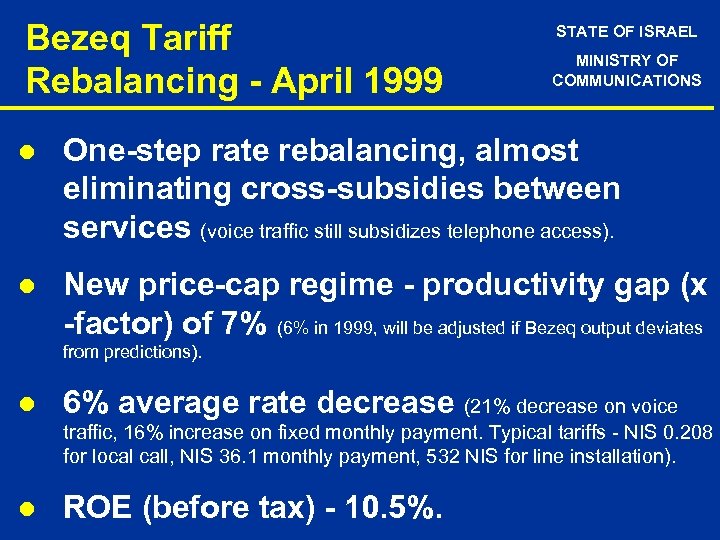

Bezeq Tariff Rebalancing - April 1999 STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l One-step rate rebalancing, almost eliminating cross-subsidies between services (voice traffic still subsidizes telephone access). l New price-cap regime - productivity gap (x -factor) of 7% (6% in 1999, will be adjusted if Bezeq output deviates from predictions). l 6% average rate decrease (21% decrease on voice traffic, 16% increase on fixed monthly payment. Typical tariffs - NIS 0. 208 for local call, NIS 36. 1 monthly payment, 532 NIS for line installation). l ROE (before tax) - 10. 5%.

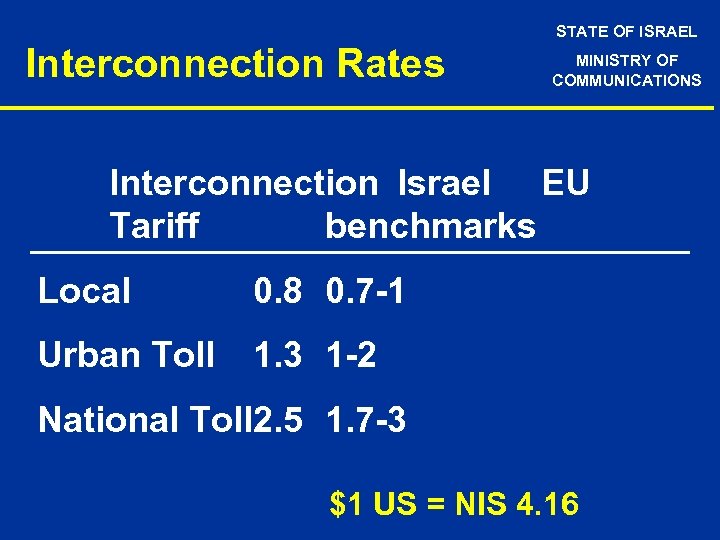

STATE OF ISRAEL Interconnection Rates MINISTRY OF COMMUNICATIONS Interconnection Israel EU Tariff benchmarks Local 0. 8 0. 7 -1 Urban Toll 1. 3 1 -2 National Toll 2. 5 1. 7 -3 $1 US = NIS 4. 16

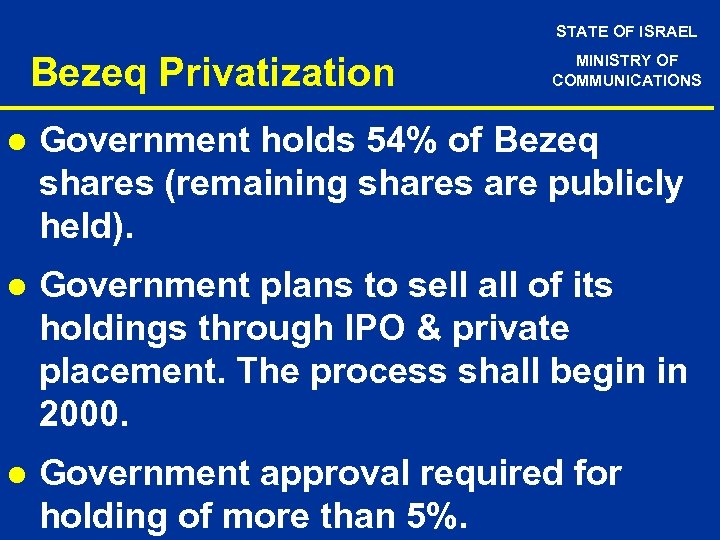

STATE OF ISRAEL Bezeq Privatization MINISTRY OF COMMUNICATIONS l Government holds 54% of Bezeq shares (remaining shares are publicly held). l Government plans to sell all of its holdings through IPO & private placement. The process shall begin in 2000. l Government approval required for holding of more than 5%.

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Competition In Broadcasting Services

STATE OF ISRAEL Broadcasting Networks MINISTRY OF COMMUNICATIONS l Radio n Public radio - 7 national AM/FM radio stations, AM Arabic channel & world-wide short-wave service. n Commercial radio: 14 local FM radio stations. l Television n Public channel (Channel 1). n Commercial channel (Channel 2). l Multi-channel subscriber TV - 3 regional cable TV operators, providing service over 550 MHz (50 channels) systems, including 7 self-provided program channels.

“Open Sky” Broadcasting Policy STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Creating competitive broadcasting market. l Key policy ingredients n Public broadcasting - new definitions (goals, structure, finance). n Commercial broadcasting - introduction of second commercial television channel & private country-wide radio stations. n Multi-channel subscriber television introduction of direct broadcasting satellite, in competition with cable television. l Broadcasting digitization - radio & television, terrestrial, cable television & satellite (DAB/DVB).

Competition in Multi-Channel Subscriber TV STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l License for DBS (Direct Broadcasting Satellite) issued January 1999: n n Digital system, 60 -120 cm receiving antennas. Basic package of ~10 channels. Additional pay channels/channel packages. Local content obligations. l Additional independent cable/satellite channels, based on advertisement revenues.

Broadcasting License Tenders for 2000 l STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Second commercial television channel. l Independent cable/satellite channels: n Israeli music. n News (2 channels). n Jewish heritage. n Immigration absorption. n Arabic channel.

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS Summary

STATE OF ISRAEL Israel’s Regulatory Policy MINISTRY OF COMMUNICATIONS l Structural changes - achieving strategic advantage in competitive global markets. l Competition - the key for innovation, entrepreneurship, investment & growth. l Key action areas: n Liberalization. n Re-regulation. n Privatization.

STATE OF ISRAEL Regulation Philosophy MINISTRY OF COMMUNICATIONS l Free and competitive markets promote growth, efficiency, customer satisfaction & economic advantage. l Market restructuring, in transition from monopoly to open and free market, during a short time period, requires active and balanced regulatory intervention. l Once competitive marketplace is achieved, a strong regulator will provide unnecessary intervention, and should be abolished.

STATE OF ISRAEL Proactive Re-regulation MINISTRY OF COMMUNICATIONS l The end of the access monopoly: n Facility-based competition. n Alternative infrastructure: fiber, copper, cable, fixed wireless, satellite. l Simple interconnection rules: n Open access, carrier pre-selection & dialing parity. n Non-discriminatory interconnection tariffs. n Minimum compatibility requirements. l New numbering plan & frequency allocations.

Israel’s Telecom Future: Real and Sustainable Growth STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l Technology-enabled evolution: n From simple fixed voice and narrowband to broadband, mobile, internet & advanced services. n From circuit switching to IP based infrastructure. l Rapid growth: Prediction for additional 1 million fixed connections, 1. 5 million cellular customers & 1 million Internet users by 2003.

Everything Is Internet! STATE OF ISRAEL MINISTRY OF COMMUNICATIONS The Economist, May 2 nd 1998

STATE OF ISRAEL 1999 Was a Good Year MINISTRY OF COMMUNICATIONS l Successful launch of Partner/Orange (3 rd cellular operator). l Balloting for preselection of international longdistance providers. l Issue of DBS license (yes). l Continued CATV industry consolidation. l IPO’s for Partner/Orange & Internet-Gold. l Telecommunications law update (interconnection, numbering, etc. ).

2000 will be an Exciting Year STATE OF ISRAEL MINISTRY OF COMMUNICATIONS l CATV/DBS compromise over content/tiering. l Tender for fixed wireless access licenses. l CATV operators become telecom operators. l Bezeq supplies ADSL services. l Bezeq privatization. l Further IPO’s. l Tender for additional cellular operator/s & additional frequencies for existing cellular operators.

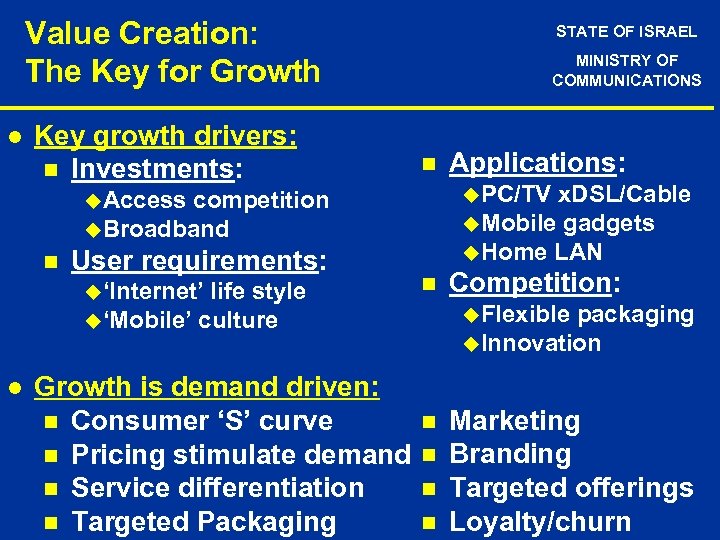

Value Creation: The Key for Growth l Key growth drivers: n Investments: STATE OF ISRAEL MINISTRY OF COMMUNICATIONS n u. PC/TV x. DSL/Cable u. Mobile gadgets u. Home LAN u. Access competition u. Broadband n User requirements: u‘Internet’ life style u‘Mobile’ culture l Growth is demand driven: n Consumer ‘S’ curve n Pricing stimulate demand n Service differentiation n Targeted Packaging Applications: n Competition: u. Flexible packaging u. Innovation n n Marketing Branding Targeted offerings Loyalty/churn

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS http: //www. moc. gov. il

STATE OF ISRAEL MINISTRY OF COMMUNICATIONS The End Thank you for your attention

990131eac870b513ac9cc9d2dbc2a55b.ppt