cb8ad59536e75410553de7218c5c46a9.ppt

- Количество слайдов: 106

State Categorical Flexibility and Federal Funds Workshop Copresented by Sue Burr Ron Bennett Executive Director CCSESA President & CEO SSC Robert Miyashiro Vice President SSC Mike Ricketts Deputy Executive Director CCSESA Michele Huntoon Janelle Kubinec Assoc. Vice President SSC

Introduction and Overview

Thank you to The William and Flora Hewlett Foundation for its generous support for this project and for public education

1 -1 More Federal Money? Less State Money! What a Year Today’s workshop provides up-to-date information, resources, and tools, followed by ongoing support to make the most of new opportunities Shares the high expectations of the federal administration Helps reconcile those with the reality of significant state funding reductions Focuses on student achievement as a key long-term goal in the midst of fiscal survival Tips, ideas, and examples to help advance both fiscal and academic success Answers the question – how can we conduct our business in a different way to ensure not only that we are surviving, but that our students and staff are thriving?

1 -2 Objectives/Expectations for Funding Opportunities and Flexibility California K-12 schools are expected to receive $7 billion in federal stimulus funding over the next two years Big pots include: ¡ State Fiscal Stabilization Funds (SFSF) – $4. 9 billion, including a portion for higher education ¡ Title I – $1. 1 billion ¡ Individuals with Disabilities Education Act (IDEA) – $1. 3 billion Stabilization Funds are very flexible, but come with very high expectations Save jobs and reform education while you’re at it

1 -3 Expectations for Federal Stimulus Funds Governor signed assurances that, while Stabilization Funds would be used to save jobs, California schools are also committed to four areas of reform: Improvements in teacher effectiveness Progress toward college and career-ready standards and rigorous assessments Improvements in low-performing schools Improvements in student learning through enhanced data systems

1 -4 Opportunities with State Categorical Flexibility In response to deep Budget cuts, local educational agencies (LEAs) have been given unprecedented authority to expend funds to best meet the needs of students Funding for 42 programs can be shifted to any education purpose from 2008 -09 through 2012 -13 The Legislature is in the process of developing a revised State Budget with the Governor’s May Revision proposals as a starting point, including options for further flexibility

1 -5 Where we started – September 2008 Where we are – February 2009 Where we’re going – May Revision State of the State

1 -6 2007 The Education Budget – September 2008 2009

1 -7 The Education Budget – September 2008 Small revenue limit cost-of-living adjustment (COLA) – 0. 68% Flat funding for other programs Proposition 98 minimum guarantee funded Many fund shifts, one-time sources, and deferrals But. . .

1 -8 2007 Fiscal Crisis: November 2008 – February 2009 2008 2009 2010

1 -9 Fiscal Crisis: November 2008 – February 2009 Problem Budget gap grows – $42 billion Cash flow crisis Solutions Increase revenues Cut spending – K-12 education takes a $2 billion additional midyear cut ¡ More deferrals “Flex” categorical programs Set 2009 -10 spending levels ¡ K-12 cut another $1 billion (year over year) Initiatives: More borrowing, long-term budget “stabilization”

1 -10 Unprecedented Categorical Flexibility 42 categorical programs $5. 8 billion dollars of the 2008 -09 K-12 Education Budget Approximately 13% of total K-12 state funding Three big programs not in flexibility: Class-Size Reduction (CSR), Economic Impact Aid (EIA), and special education – but. . . CSR-relaxed penalties EIA can be used to support a broad range of activities for low-performing students, along with Title I funding Special education added funding through ARRA

1 -11 2007 2008 2012 The Role of Flexibility and Federal Stimulus Funds 2009 2010 2011

1 -12 The Hole Has Gotten Deeper – February 2009 – June 2009 $24. 3 billion projected deficit with failure of the initiatives

1 -13 What Does This Mean for Planning? Impacts on LEAs will vary, but all will feel the cuts Understand the facts Prepare to make choices Set top priorities Focus on your assets, not deficiencies Make a plan to align resources in support of your priorities

American Recovery and Reinvestment Act

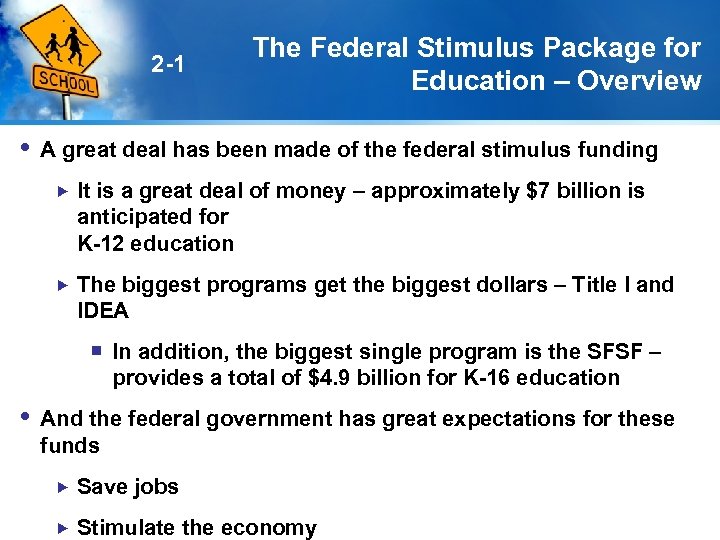

2 -1 The Federal Stimulus Package for Education – Overview A great deal has been made of the federal stimulus funding It is a great deal of money – approximately $7 billion is anticipated for K-12 education The biggest programs get the biggest dollars – Title I and IDEA ¡ In addition, the biggest single program is the SFSF – provides a total of $4. 9 billion for K-16 education And the federal government has great expectations for these funds Save jobs Stimulate the economy

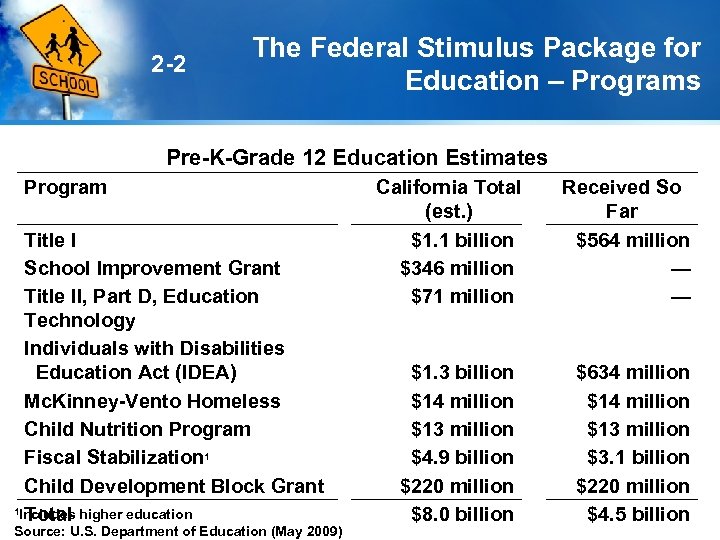

2 -2 The Federal Stimulus Package for Education – Programs Pre-K-Grade 12 Education Estimates Program Title I School Improvement Grant Title II, Part D, Education Technology Individuals with Disabilities Education Act (IDEA) Mc. Kinney-Vento Homeless Child Nutrition Program Fiscal Stabilization 1 Child Development Block Grant 1 Includes higher education Total Source: U. S. Department of Education (May 2009) California Total (est. ) $1. 1 billion $346 million $71 million $1. 3 billion $14 million $13 million $4. 9 billion $220 million $8. 0 billion Received So Far $564 million — — $634 million $13 million $3. 1 billion $220 million $4. 5 billion

2 -3 The Federal Stimulus Package for Education – Programs and Timing The U. S. Department of Education has directed states to issue funding as quickly as possible California was one of the first states to submit an application for the SFSF ¡ So far, 31 states submitted their applications ¡ Funding started to flow in May, but payments will continue throughout the remainder of the summer and fall In addition, there a handful of competitive and needs-based grants that will be awarded later this year Keep an eye open for applications

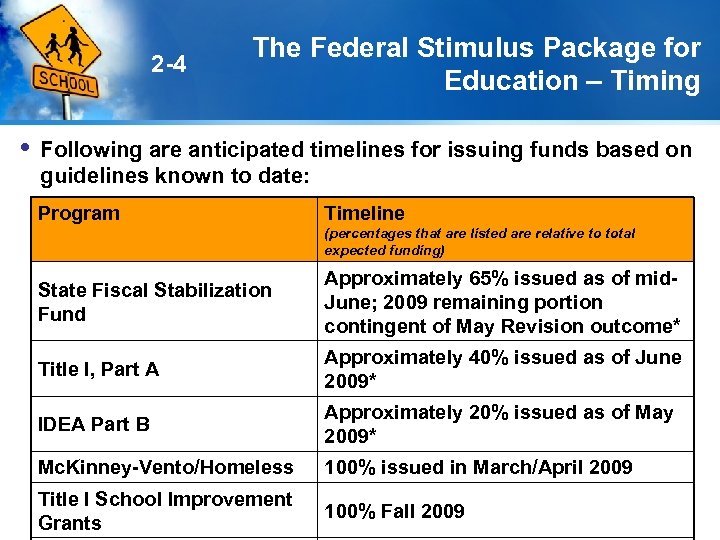

2 -4 The Federal Stimulus Package for Education – Timing Following are anticipated timelines for issuing funds based on guidelines known to date: Program Timeline (percentages that are listed are relative to total expected funding) State Fiscal Stabilization Fund Approximately 65% issued as of mid. June; 2009 remaining portion contingent of May Revision outcome* Title I, Part A Approximately 40% issued as of June 2009* IDEA Part B Approximately 20% issued as of May 2009* Mc. Kinney-Vento/Homeless 100% issued in March/April 2009 Title I School Improvement Grants 100% Fall 2009

2 -5 General Guidance – Using the Funds Very little action was required to receive the first increment of funding, but subsequent payments will be in large part dependent on meeting all assurances General rule of thumb: Follow all the rules that accompany the non-ARRA portion of funding for each program The SFSF is the only “new” program and the most flexible The best use of the funds is to pay for one-time investments in the form of activities that improve the infrastructure (human and physical) of the educational system

2 -6 General Guidance – Management of the Funds There are separate resource codes for all ARRA funds All funds must be legally obligated by September 30, 2011 Legally obligated expenditures are the amounts of orders placed, contracts and sub-grants awarded, services received, and similar transactions during a given period, which will require payment during the same or future period Existing program and accounting rules apply: Office of Management and Budget (OMB) A-87 and A-133 ¡ Supplement, Not Supplant Maintenance-of-effort (MOE) Title I set asides, allocation plans, carryover limits, site council involvement

2 -7 General Guidance – Accountability and Reporting Quarterly expenditure and activity reports will be required within ten days of the end of each quarter The first report is expected for the quarter ending June 30, 2009 Reports will need to include the following details: The total amounts of funds received The amounts of grant funds expended on or obligated to projects or activities The name, description, and evaluation of the project or activity's completion status An estimate of the number of jobs that were saved or created with the ARRA funds For infrastructure investments, the purpose, total cost, and rationale for funding the investment Specific guidance is not yet available from the US Department of Education regarding how information will be reported, but expect reporting

2 -8 General Guidance – Accountability and Reporting ARRA places heavy emphasis on transparency and accountability The Recovery Act Accountability and Transparency Board has been established to conduct oversight of instances of fraud, waste, and abuse The Office of Inspector General (OIG) will conduct audits of ARRA implementation activities ¡ Several other agencies are amid the auditing ranks, including State Bureau of Audits, Department of Finance Investigative Unit, and General Accounting Office A hotline and whistleblower protection is specified under regulations to ARRA

2 -9 State Fiscal Stabilization Funding – Overview SFSF is offered to help state’s stabilize funding for K-16 education The funding must be distributed by each state to local educational agencies (LEAs) and higher education following a very specific formula But once received by an LEA, funds may be used toward a broad range of purposes – funds may be used for activities allowed under: Elementary and Secondary Education Act (ESEA), including Impact Aid IDEA general education activities are allowed under Impact Aid. Most As a result, when working out plans for how to spend this resources, worry Carl Perkins Career and Technical Education first about how to best meet local educational agency priorities and needs Adult Education and Family Literacy and less about whether it’s allowed since it probably is allowed under Impact Aid.

2 -10 State Fiscal Stabilization Funding – How Much and Why The ARRA legislation requires states to issue SFSF dollars to offset reductions in state funding to K-12 and higher education based on each state's primary funding formula The SFSF funding must be provided to K-12 and higher education proportional to the reductions made to each segment ¡ States must maintain 2005 -06 level of funding or higher ¡ The level of backfill is to the higher of 2008 -09 or 200910 level of funding California has based the SFSF apportionments to K-12 on revenue limit and categorical funding reduction amounts as of the Budget Act enacted in February 2009

2 -11 State Fiscal Stabilization Funding – How Much and Why The distribution of California's $4. 9 billion share of ARRA SFSF changes based on the May Revision proposals Based on SSC's analysis, the added cuts to K-12 and higher education would drop K-12's share of the funds from $3. 7 billion to $3. 2 billion SFSF Restoration Levels Enacted Budget (February 2009) (in millions) 200809 K-12 Education Higher Education 200910 Total SSC's Estimates Based on May Revision Proposals (May 2009) (in millions) 200809 $2, 565 $1, 110 $3, 67 $3, 183 5 $537 $663 $1, 20 $1, 692 200910 Total $0 $3, 183 $0 $1, 692

2 -12 State Fiscal Stabilization Funding – How Much and Why California has received 67% of the total $4. 9 billion SFSF entitlement: The California Department of Education (CDE) has issued $2. 49 billion to LEAs based on cuts in the 2008 -09 Budget Act enacted February 2009 ¡ $1. 6 billion based on revenue limit cuts ¡ $886 million based on categorical cuts How much more should LEAs expect? ¡ Depends in large part on outcome of the May Revision ¡ Presuming that the proposed May Revision reductions to K-12 and higher education are made, School Services estimates that an additional $690 million will be provided to K-12 education and a total of $1. 7 billion to higher education

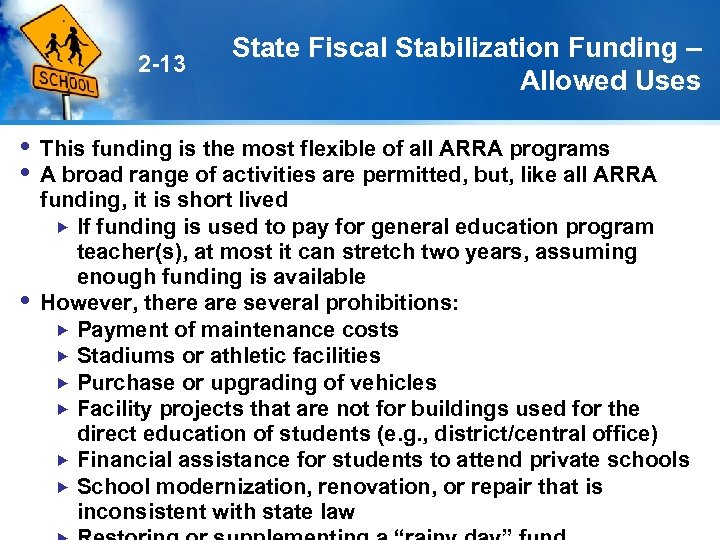

2 -13 State Fiscal Stabilization Funding – Allowed Uses This funding is the most flexible of all ARRA programs A broad range of activities are permitted, but, like all ARRA funding, it is short lived If funding is used to pay for general education program teacher(s), at most it can stretch two years, assuming enough funding is available However, there are several prohibitions: Payment of maintenance costs Stadiums or athletic facilities Purchase or upgrading of vehicles Facility projects that are not for buildings used for the direct education of students (e. g. , district/central office) Financial assistance for students to attend private schools School modernization, renovation, or repair that is inconsistent with state law

2 -14 State Fiscal Stabilization Funding – Accountability Requirements Subject to the same reporting requirements as all ARRA funds Expect quarterly activity and reporting requirements as of quarter ending September 30, 2009 Requires details regarding use of funds, including jobs created or saved ¡ As of yet, there is not a clear definition for how this is to be calculated and reported

2 -15 Title I – Overview The purpose of the Title I ARRA funds is comparable to non. ARRA Title I funds Provides additional support targeted at low income and low performing students With the added expectation that, like other ARRA funds, the following can be accomplished: ¡ Save and create jobs ¡ Improve student achievement ¡ Ensure transparency ¡ Thoughtful use of funds to avoid “funding cliff”

2 -16 Title I – How Much and Why The ARRA Title I funding amounts are based on formulas used for Targeted and Education Finance Incentive Grant formulas for Title I funding These two funding streams require a minimum formula count of ten students and a poverty rate greater than or equal to 5% of the student population The ARRA Title I funds are in addition to Title I base grant amounts, but most LEAs will see a drop in their base grant For 2009 -10, statewide Title I regular entitlements declined relative to 2008 -09 funded levels by 14. 7%, with a median decline of 12. 0% Approximately 77% of LEAs (excluding independent charter Although the Title I ARRA funds generally more than make up schools) are. Title I base grants, the drop ina decline in Title I base for the drop in expected to experience base grant funding the challenge of what to do once Title I ARRA further adds to

2 -17 Title I – Allowed Uses Follow existing Title I rules when determining how to use the new Title I ARRA funds A general rule to follow – Title I funds may be used at only Title I schools, targeted to the needs of Title I eligible students for activities that are supplemental to the core program This could include supplemental supports such as pre-K, after school, summer school, and other support programs

2 -18 Title I – Allowed Uses However, exceptions may arise under the following conditions: A school where 40% or more of the students are lowincome may elect to be “schoolwide” and, under this designation, is allowed to spend the resources in support of any student With the State Budget reductions, it is entirely possible that the definition of “core” program has changed – examples include reductions or elimination of supplemental instructional programs, staff development, staff to support the instructional program ¡ As a result, an expense previously charged to the General Fund may be chargeable to Title I

2 -19 Title I – Accountability Requirements Funding must be used and accounted for consistent with current rules OMB A-87 and A-133 Complete Consolidated Application Part I to determine Title I school eligibility Carryover limited to 15% of entitlement Set asides required for Title I also apply: ¡ 1% Parent Involvement ¡ Homeless Children ¡ Private Schools (if requested)

2 -20 In addition, these set asides apply, but CDE may apply for a waiver of these requirements: ¡ 5% Highly Qualified Teachers (if 100% of teachers are not Highly Qualified) ¡ 10% Professional Development (Program Improvement districts and/or sites) ¡ Up to 20% Supplemental Education Services and Choice (Program Improvement schools) In addition to activity and reporting requirements noted from all ARRA funds, per-pupil expenditure reporting for all Title I schools will be required Awaiting detailed guidance from the U. S. Department of Education First report of such data due from CDE to the U. S. Our Advice: Plan for all set asides until notice is given that waivers have Department of Education approved 31, 2010 by March been Title I – Accountability Requirements

2 -21 IDEA – Overview While certainly not new, the new ARRA IDEA funding presents new opportunities to finally gain some relief from general fund contributions for special education – at least for a short while Additional funding is provided for all the components of IDEA, Part B: Local Assistance Preschool Local Entitlement Special Education Preschool Grants State Institutions

2 -22 IDEA – How Much and Why Funding is distributed to SELPAs based on a formula that includes poverty and student counts Local SELPA allocation plans determine how funding is distributed to member districts There are several key requirements that will affect how much of the funding can be used toward new program costs versus offsetting existing contributions: MOE Program Compliance Proportionality of Services

2 -23 IDEA – Allowed Uses Because of MOE requirements, any “new” federal funding must generally go toward paying for “new” special education program costs While it’s generally not hard to identify new program costs year to year as special education costs have tended to rise rapidly, the ARRA IDEA funds provide a short-term solution to a long-term problem ¡ Funds used for “new” costs that become ongoing costs to the program require an ongoing funding source once ARRA funds disappear

2 -24 All SELPAs must ensure, that each year, the prior year level of state and local financial support for the special education program is sustained IDEA – Maintenance of Effort This is commonly referred to as “maintenance of effort” There are three tests to determine MOE: Expenditure comparison adjusted for “new” federal revenue Expenditure comparison adjusted for allowed conditions

2 -25 MOE Test 1 – expenditure comparison IDEA – Maintenance-of-Effort Explanation Compare current-year expenditures to prior-year expenditures, either in total or on a per-capita basis MOE Test 2 – expenditure comparison adjusted for “new” federal revenue If Test 1 fails, check Test 2 allows the SELPA to treat up to 50% of “new” IDEA, Part B, funds as a reduction to state and local expenditures Recalculate Test 1 with adjustment for “new” revenue Citation: IDEA Regulations Part 300. 203

2 -26 IDEA – Maintenance-of-Effort Explanation IDEA, Part B Funding MOE Calculation *Current-year funding (200910) Less: Prior year’s funding (2008 -09) $1, 500, 0 00 (900, 000) 600, 000 Increase in funding over prior year $300, 000 * Funding includes IDEA regular entitlement and IDEA ARRA funds ** Amount available to reduce local or state and local expenditures in a MOE Test 2 scenario ** 50% increase in funding

2 -27 IDEA – Maintenance-of-Effort Explanation MOE Test 3 – expenditure comparison for exemptions If Test 2 fails, make adjustments for federally allowed exceptions: ¡ A decrease in enrollment of children with disabilities ¡ Voluntary departure of staff, including retirement, who are replaced by lower salaried staff ¡ End of high-cost service because student has exited program ¡ Termination of costly expenditure for long-term purchases Citation: IDEA Regulations Part 300. 204

2 -28 IDEA – Flexibility Option MOE calculation is mathematical, but may be utilized to “free” up local contribution from “new” federal funding Up to 50% of “new” federal funding may be used to offset existing local contributions The “freed up” funding must be used toward activities authorized under ESEA of 1965 (reauthorized as No Child Left Behind [NCLB]) ¡ In effect, this means general operations can be supported under the provisions of Impact Aid Citation: IDEA Regulations Part 300. 205

2 -29 IDEA – Flexibility Option However, to use the 50% flexibility, LEAs must meet several conditions: Demonstrate proportionality of identification Satisfactorily meet all performance requirements Maintain programs that provide Free Appropriate Public Education (FAPE) Go to www. cde. ca. gov/sp/se/ds/datarpts 0607. asp In summary, MOE calculation using 50% of the new funding received rebenches the local or state and local expenditures used for MOE tests The use of 50% amount on appropriate expenditures under ESEA, etc. , must be analyzed to determine the impact on other programs

2 -30 Other Programs – What to Expect Facilities There are several bond programs and grants for facility projects – LEAs with projects that are “shovel ready” should apply for such opportunities ¡ See CD-ROM for a list of opportunities School Improvement Grants Expect funding to be available in fall 2009 targeted to lowperforming schools – funding may be significant Title II, D – Enhancing Education Through Technology $70 million to be divided between formula and competitive grants will be available by fall 2009 ¡ This is more than double the current funding levels – significant increase to a relatively small program

2 -31 Other Programs – What to Expect Teacher Quality Enhancement Teacher Quality Partnership Grants available to support partnerships between K-12 and higher education ¡ Apply directly to U. S. Department of Education – application packet included on CD-ROM

2 -32 Other Programs – What to Expect Child Care Head Start and Early Head Start expansion grants are available ¡ Total of $2. 1 billion for Head Start and $1. 1 billion for Early Head Start ¡ Applications submitted directly to the Administration for Children and Families w Go to www. cde. ca. gov/ar/ec for more information Child Care Development Funds administered through U. S. Health and Human Services ¡ Adds $220 million to support general and targeted child care programs

2 -33 CDE has issued funding for: SFSF Title I, Part A Calculating Local District Grant/ Entitlement Amounts IDEA Since it’s come in parts and pieces, a common and reasonable question to ask is, “How much will we receive? ”

2 -34 As you arrived this morning, we hope you picked up a packet of data that shows the entitlements listed to date Calculating Local District Grant/Entitlement Amounts – Worksheet and Activity The data are also included on the CD-ROM We’d like to give you a few minutes to: Review the amounts listed on the print out Use the worksheet that is provided to calculate how much your LEA can expect based on the amounts issued to date ¡ The worksheet provides the factors that should be used to estimate final grant/entitlement award amounts based on information known to date

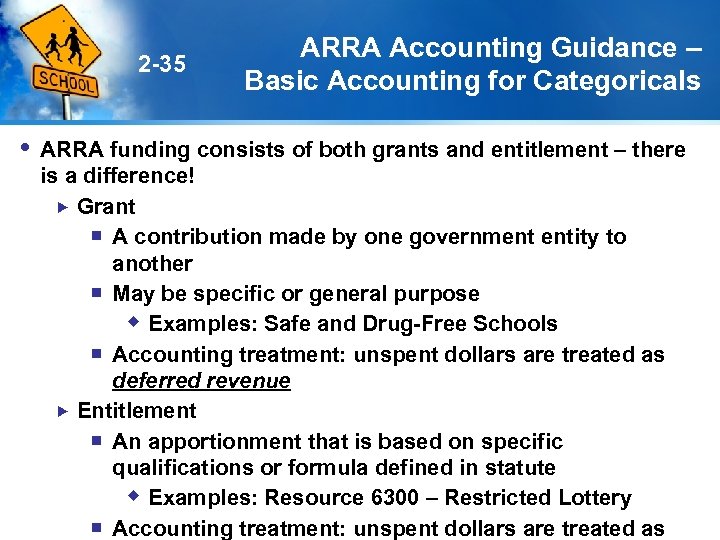

2 -35 ARRA Accounting Guidance – Basic Accounting for Categoricals ARRA funding consists of both grants and entitlement – there is a difference! Grant ¡ A contribution made by one government entity to another ¡ May be specific or general purpose w Examples: Safe and Drug-Free Schools ¡ Accounting treatment: unspent dollars are treated as deferred revenue Entitlement ¡ An apportionment that is based on specific qualifications or formula defined in statute w Examples: Resource 6300 – Restricted Lottery ¡ Accounting treatment: unspent dollars are treated as

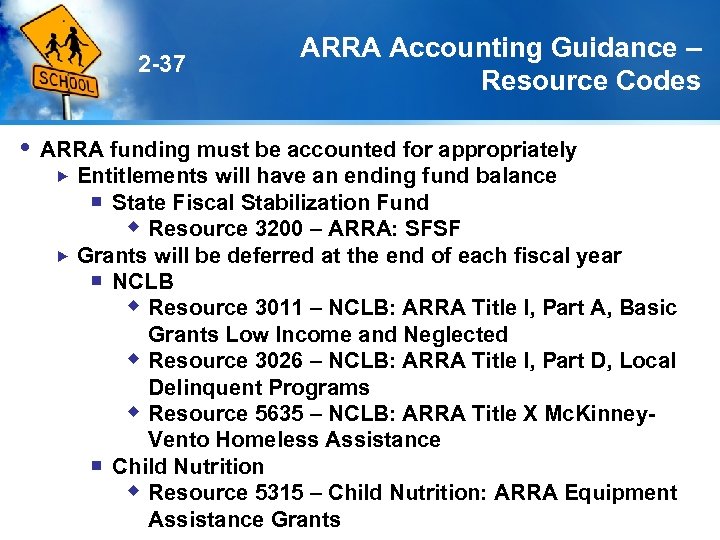

2 -37 ARRA Accounting Guidance – Resource Codes ARRA funding must be accounted for appropriately Entitlements will have an ending fund balance ¡ State Fiscal Stabilization Fund w Resource 3200 – ARRA: SFSF Grants will be deferred at the end of each fiscal year ¡ NCLB w Resource 3011 – NCLB: ARRA Title I, Part A, Basic Grants Low Income and Neglected w Resource 3026 – NCLB: ARRA Title I, Part D, Local Delinquent Programs w Resource 5635 – NCLB: ARRA Title X Mc. Kinney. Vento Homeless Assistance ¡ Child Nutrition w Resource 5315 – Child Nutrition: ARRA Equipment Assistance Grants

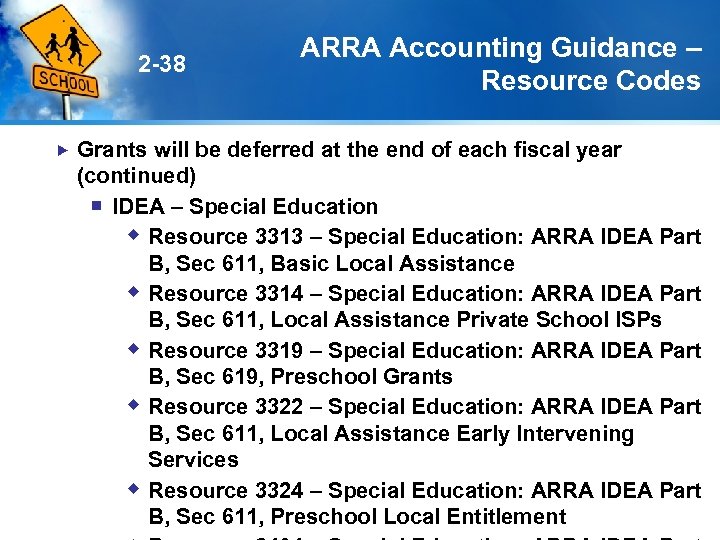

2 -38 ARRA Accounting Guidance – Resource Codes Grants will be deferred at the end of each fiscal year (continued) ¡ IDEA – Special Education w Resource 3313 – Special Education: ARRA IDEA Part B, Sec 611, Basic Local Assistance w Resource 3314 – Special Education: ARRA IDEA Part B, Sec 611, Local Assistance Private School ISPs w Resource 3319 – Special Education: ARRA IDEA Part B, Sec 619, Preschool Grants w Resource 3322 – Special Education: ARRA IDEA Part B, Sec 611, Local Assistance Early Intervening Services w Resource 3324 – Special Education: ARRA IDEA Part B, Sec 611, Preschool Local Entitlement

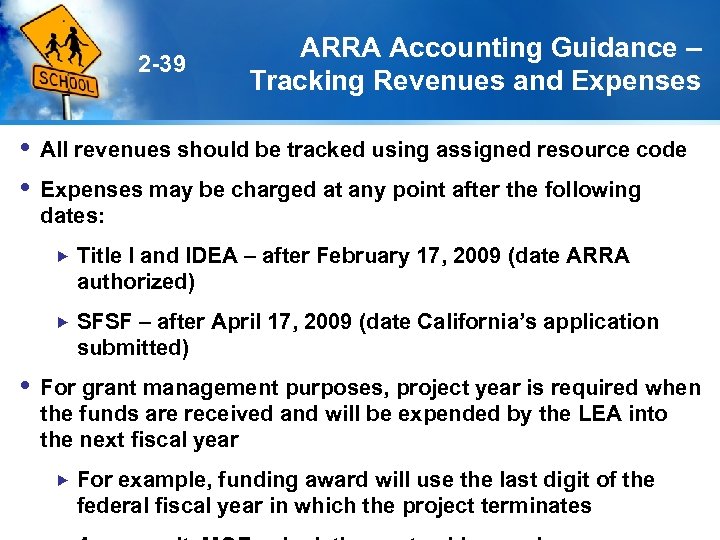

2 -39 ARRA Accounting Guidance – Tracking Revenues and Expenses All revenues should be tracked using assigned resource code Expenses may be charged at any point after the following dates: Title I and IDEA – after February 17, 2009 (date ARRA authorized) SFSF – after April 17, 2009 (date California’s application submitted) For grant management purposes, project year is required when the funds are received and will be expended by the LEA into the next fiscal year For example, funding award will use the last digit of the federal fiscal year in which the project terminates

2 -40 ARRA Accounting Guidance – Tracking Revenues and Expenses Given extensive reporting requirements, take the time to set up account codes to accurately track how and when funds are used Strategies to consider: Use the “goal” field to track project areas Appropriately code “object” to facilitate activity reporting Provide training and support to sites and program administrators to ensure understanding of how to use ARRA resource codes versus other existing federal resource codes Develop detailed project and expenditure plans before spending funds ¡ Identify projects by name ¡ Designate expenses by resource and object See CD-ROM for Reference Account ¡ List primary project contact

2 -41 ARRA Accounting Guidance – Handling Interest The Code of Federal Regulations (CFR), Title 34, Section 80. 21(i), which requires LEAs to submit interest in excess of $100 to the U. S. Department of Education, applies to the ARRA funds Section 80. 21 (i) Interest earned on advances. Except for interest earned on advances of funds exempt under the Intergovernmental Cooperation Act (31 U. S. C. 6501 et seq. ) and the Indian Self-Determination Act (23 U. S. C. 450), grantees and subgrantees shall promptly, but at least quarterly, remit interest earned on advances to the Federal agency. The grantee or subgrantee may keep interest amounts up to $100 per year for administrative Our Advice: Avoid returning interest by charging expenses from 2008 -09 to expenses. these new Resource Codes as of the effective date and monitor regularly.

2 -42 ARRA Accounting Guidance – Federal Accounting Rules Other applicable guidelines Federal Single Audit Act (OMB Circular No. A-133) ¡ Requirement relates to expenditures of federal funds ¡ LEAs must have an audit that covers all funds and accounts and that addresses financial management and compliance with laws and regulations OMB Circular No. A-87 prescribes cost principles ¡ “Establishes principles for determining the allowable costs incurred by state, local, and federally-recognized Indian tribal governments (governmental units) under grants, cost reimbursement contracts, and other agreements with the Federal Government”

2 -43 ARRA Accounting Guidance – Federal Accounting Rules OMB Circular No. A-87 – Time Accounting Section(h)(4) addresses employees paid from multiple funding sources, which is required for ARRA funds Where employees work on multiple activities or cost objectives, a distribution of their salaries or wages will be supported by personnel activity reports or equivalent documentation which meets the standards in subsection (5) unless a statistical sampling system [see subsection (6)] or other substitute system has been approved by the cognizant federal agency, such documentary support will be required where employees work on: ¡ More than one federal award ¡ A federal award and a non-federal award ¡ An indirect cost activity and a direct cost activity

2 -44 ARRA Accounting Guidance – Indirect Cost Indirect cost is allowed under the ARRA funding received under OMB A-87 utilizing the same regulations applied to the regular funding received LEAs should monitor the impact of indirect costs to prevent over recovery in the current period ¡ This rule applies to IDEA, Title I, and SFSF funding

State Categorical Flexibility Details

3 -1 Categorical Program Funding Most, but not all categorical programs are reduced for 2008 -09, with further reduction in 2009 -10 To help offset the impact of categorical and revenue limit cuts, the Budget provides two types of flexibility: Ending balance sweeps – based on 2007 -08 ending balance for state categorical programs with specific exceptions ¡ These transfers may be executed in 2008 -09 or 2009 -10, but do not include ending balances accrued after June 30, 2008 Transfer flexibility for 42 state categorical programs – funds may be transferred from eligible programs to any other educational purpose

3 -2 Impact on Categorical Funding Tier II and III programs are reduced from the 2008 -09 base (in some cases 2007 -08 will be used) By 15. 38% for 2008 -09 By 19. 84% for 2009 -10 Flexibility is not a substitute for adequate funding, but it helps us to bridge terrible economic times 15. 38% Reduction 2008 -09 Original 2007 -08 $100, 000 $99, 480 2009 -10 2008 -09 Revised (reduced by 0. 52% for growth/decline) $84, 180 $79, 743 Plus adjustment for growth/decline Additional 4. 46% Reduction Total reduction from 08 -09 Original, 19. 84% plus growth/decline

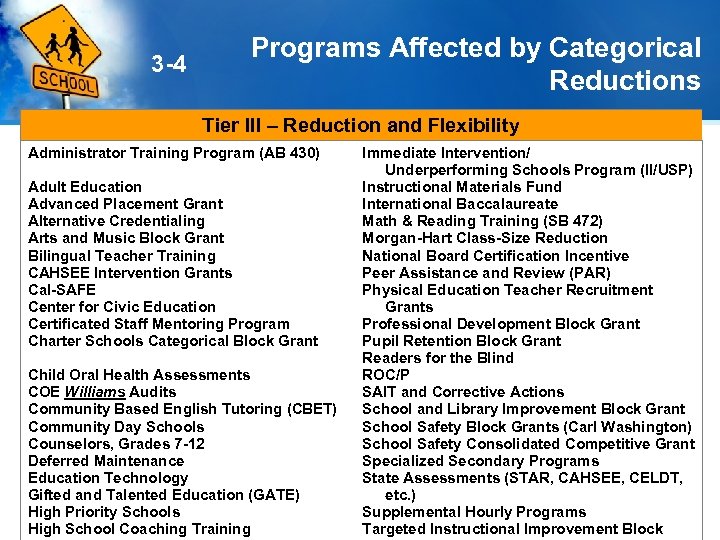

3 -3 Programs Affected by Categorical Reductions Tier I – No Reduction, No Flexibility After School Education and Safety Advancement via Individual Determination Child Development Child Nutrition Economic Impact Aid Federal Resources K-3 Class-Size Reduction Pupil Transportation Quality Education Investment Act School Bus Replacement Special Education State Lottery, including Proposition 20 Tobacco Use Prevention Education (TUPE) Tier II – Funding Reduction, No Flexibility Adults in Correctional Facilities Ag Voc Ed Programs Apprentice Programs Charter School Facility Grants Foster Youth Educational Services English Language Acquisition Program Multi-Track Year Round Grant Program

3 -4 Programs Affected by Categorical Reductions Tier III – Reduction and Flexibility Administrator Training Program (AB 430) Adult Education Advanced Placement Grant Alternative Credentialing Arts and Music Block Grant Bilingual Teacher Training CAHSEE Intervention Grants Cal-SAFE Center for Civic Education Certificated Staff Mentoring Program Charter Schools Categorical Block Grant Child Oral Health Assessments COE Williams Audits Community Based English Tutoring (CBET) Community Day Schools Counselors, Grades 7 -12 Deferred Maintenance Education Technology Gifted and Talented Education (GATE) High Priority Schools High School Coaching Training Immediate Intervention/ Underperforming Schools Program (II/USP) Instructional Materials Fund International Baccalaureate Math & Reading Training (SB 472) Morgan-Hart Class-Size Reduction National Board Certification Incentive Peer Assistance and Review (PAR) Physical Education Teacher Recruitment Grants Professional Development Block Grant Pupil Retention Block Grant Readers for the Blind ROC/P SAIT and Corrective Actions School and Library Improvement Block Grant School Safety Block Grants (Carl Washington) School Safety Consolidated Competitive Grant Specialized Secondary Programs State Assessments (STAR, CAHSEE, CELDT, etc. ) Supplemental Hourly Programs Targeted Instructional Improvement Block

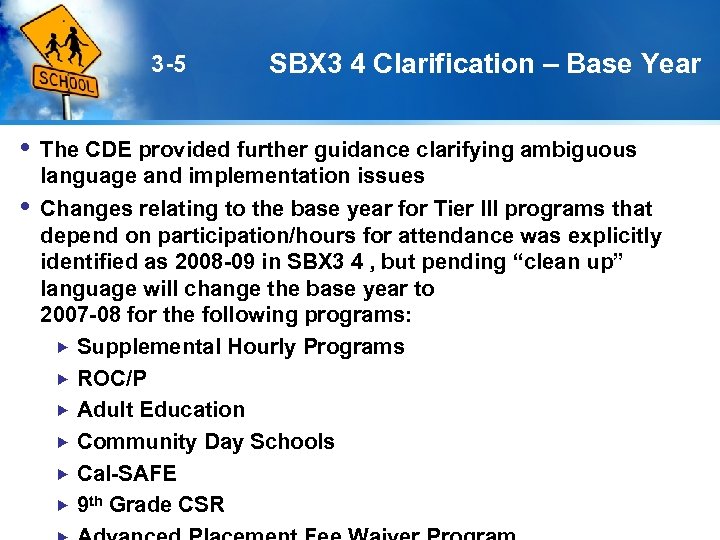

3 -5 SBX 3 4 Clarification – Base Year The CDE provided further guidance clarifying ambiguous language and implementation issues Changes relating to the base year for Tier III programs that depend on participation/hours for attendance was explicitly identified as 2008 -09 in SBX 3 4 , but pending “clean up” language will change the base year to 2007 -08 for the following programs: Supplemental Hourly Programs ROC/P Adult Education Community Day Schools Cal-SAFE 9 th Grade CSR

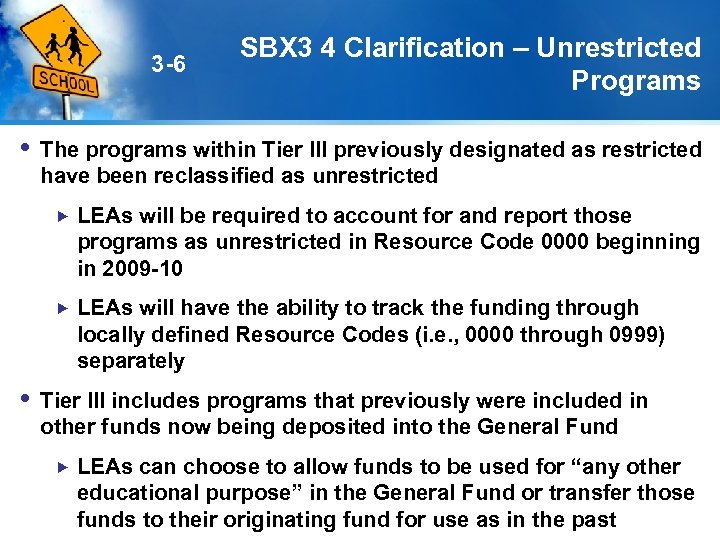

3 -6 SBX 3 4 Clarification – Unrestricted Programs The programs within Tier III previously designated as restricted have been reclassified as unrestricted LEAs will be required to account for and report those programs as unrestricted in Resource Code 0000 beginning in 2009 -10 LEAs will have the ability to track the funding through locally defined Resource Codes (i. e. , 0000 through 0999) separately Tier III includes programs that previously were included in other funds now being deposited into the General Fund LEAs can choose to allow funds to be used for “any other educational purpose” in the General Fund or transfer those funds to their originating fund for use as in the past

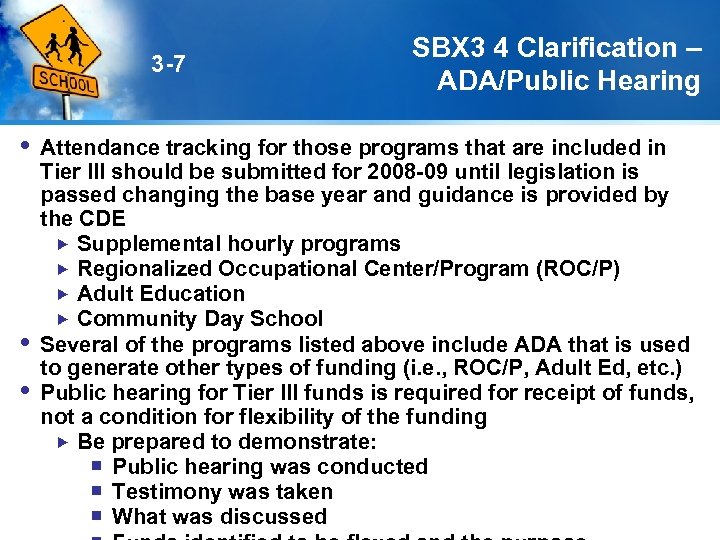

3 -7 SBX 3 4 Clarification – ADA/Public Hearing Attendance tracking for those programs that are included in Tier III should be submitted for 2008 -09 until legislation is passed changing the base year and guidance is provided by the CDE Supplemental hourly programs Regionalized Occupational Center/Program (ROC/P) Adult Education Community Day School Several of the programs listed above include ADA that is used to generate other types of funding (i. e. , ROC/P, Adult Ed, etc. ) Public hearing for Tier III funds is required for receipt of funds, not a condition for flexibility of the funding Be prepared to demonstrate: ¡ Public hearing was conducted ¡ Testimony was taken ¡ What was discussed

3 -8 SBX 3 4 Clarification – Class-Size Reduction K-3 CSR is included in Tier I with no reduction or flexibility However, the penalties were relaxed, allowing for funding on 20: 1 with funding loss of up to 30% when average class sizes exceed 20. 44 students Legislation is pending to cleanup the issue of the number of classes districtwide versus number of grades ¡ This funding will be based on the number of classes included in the 2008 -09 application Grade level implementation is still in place – 1 st, 2 nd, K, or 3 rd Small school district operating one school under AB 1608 (Chapter 743/2000) has not changed the provisions The statute allows for class sizes up to 22. 4: 1 if the district

3 -9 2008 -09 Accounting Changes Eligible ending fund balance as of June 30, 2008, must be transferred prior to closing the books for the period ending June 30, 2009 Use Object Code 8997, Transfers of Restricted Balances The following items can be included in the sweep of restricted ending fund balances: ¡ Deferred revenue ¡ Expenditure-driven grants that funds have not been received to date Flexibility transfers from the restricted accounts to unrestricted, where allowable should use Object 8998, Categorical Flexibility Transfers Accruals set up in the financial system in Resource 0000, or a locally defined Resource(s) will minimize potential problems in 2009 -10

3 -10 Flexibility Transfer See Appendix A for Flexibility Transfer Examples

3 -11 Accounting for Funds Reports used for various purposes Object – classifies expenditures according to the types of items purchased or services obtained ¡ Classifies revenues by the general source and type of revenue Resource – used to classify revenues and resulting expenditures in accordance with restrictions or special reporting requirements placed on either of these aspects of LEA financial activities by law or regulation Goal – provides the framework for charging instructional costs and support costs to the benefiting objectives Function – represents a general operational area in an LEA and groups together related activities

3 -12 Operational Consequences – Reserves, Indirects, Special Education Reserve requirements may increase for Economic Uncertainty and Routine Restricted Maintenance Account due to the appropriation of funding from other funds now classified as unrestricted – Adult Education and Deferred Maintenance Indirect funds used to offset overhead no longer required – a local option Whether the categorical programs return to their previous format in four years or not is still uncertain, but the urge to maintain stability to account for funding as it had in the past is very real ¡ Removing the indirect could have a further impact on the current budget w If there is a return to a “restricted” program, the reality of indirect could create continued confusion

3 -13 Operational Consequences – Community Day School funding for the fifth and sixth hour for the Mandatory Expelled student is excluded from Tier III flexibility The Mandatory ADA is being designated as a continuous appropriation not subject to flexibility ¡ Therefore, tracking of the ADA is required and is included in the 2009 -10 Audit Regulations The waiver portion of the Community Day School program requires splitting the funding between Mandatory and Nonmandatory Expelled students ¡ For example, 40 ADA in Mandatory and 60 ADA in Nonmandatory will split a $100, 000 waiver amount as $40, 000 as non-Tier III and $60, 000 as available for flexibility

3 -14 Operational Consequences – Charter Schools SBX 3 4 prohibits charter schools established in 2008 -09 or later from receiving categorical block grant funding Clean-up legislation is required in order for new charters (those that came into existence after 2008 -09) to be able to receive a share of the State Categorical Block Grant funding due to the Tier III flexibility and revised funding methodology

3 -15 Operational Consequences – Class-Size Reduction LEAs that are growing will not receive additional funding for CSR beyond the number of classes on the 2008 -09 application Legislation is pending that will change the date of the application from December 10, 2008, to January 31, 2009 However, most LEAs met the statutory deadline for submission of the application in November 2008 ¡ This will only apply for those LEAs that resubmitted the application after its due date

Management Guidance

4 -1 The Value of Flexibility and Federal Funding All flexibility options merit serious consideration But keep in mind – flexibility and new federal funding cannot: Restore funding cuts (at least not on an ongoing basis) Alone be the plan Realizing the true benefits of categorical flexibility and the new federal funding requires having a clear sense of purpose and priorities Shifting funding is a shell game until there is a purpose It’s time to take a fresh look We must do more with less state money, but more flexibility and federal funding than we’ve seen before As a result, when planning, immediate red flag words, include “normal” and “usual” – nothing is normal or usual

4 -2 Guidelines to Maximize Funding Impact But, let’s also be realistic Projected cuts to state funding will mean less of many things – programs, people, patience, time ¡ Likely cuts implemented by LEAs may include professional development, academic coaching, intervention support programs, administration Which could mean more of some things – pressure to reduce nonclassroom support (e. g. , administrators and academic coaches), larger class sizes, anxiety regarding accountability requirements Cuts will happen, but let’s be smart and avoid cuts in those areas where we have worked hardest to invest time, energy, and resources in recent years For instance, if we have built up Professional Learning

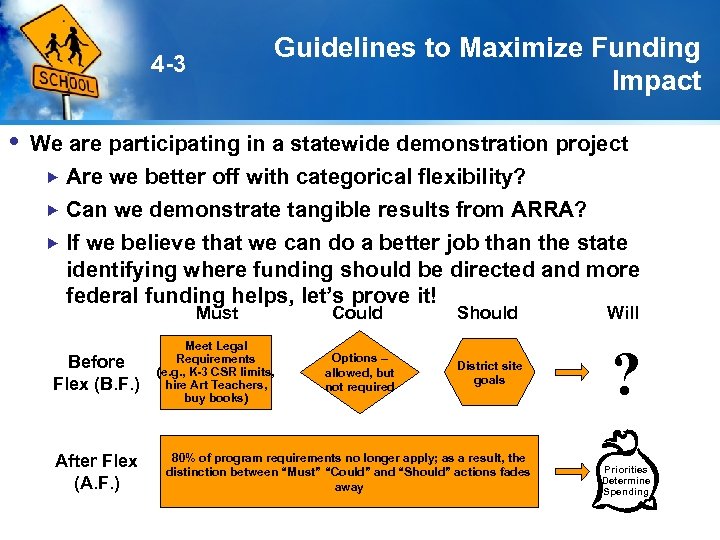

Guidelines to Maximize Funding Impact 4 -3 We are participating in a statewide demonstration project Are we better off with categorical flexibility? Can we demonstrate tangible results from ARRA? If we believe that we can do a better job than the state identifying where funding should be directed and more federal funding helps, let’s prove it! Must Before Flex (B. F. ) After Flex (A. F. ) Could Should Will Meet Legal Requirements (e. g. , K-3 CSR limits, hire Art Teachers, buy books) Options – allowed, but not required District site goals ? 80% of program requirements no longer apply; as a result, the distinction between “Must” “Could” and “Should” actions fades away Priorities Determine Spending

4 -4 Example of Effective Funding Use – Intervention Support Take a close look at what’s been offered and how it’s been funded Some funding may have come from Tier I programs – After School Education and Safety, Title I, Migrant Education, EIA Some funding may have come from Tier III programs – Supplemental Hourly Programs, Targeted Instructional Improvement Block Grant*, CAHSEE Intervention Grants, * School and Library Improvement Block Grant (SLIBG) ¡ Remember, some of the Tier III programs have protected ending fund balances (marked with an asterisk)

4 -5 Example of Effective Funding Use – Intervention Support With the cuts to Tier III programs, it is reasonable and advisable to consider whether Tier I programs and/or new ARRA funds can be used to fund Pre-K, after school, summer school, or other intervention activities What level of program support is required based on student needs and district level priorities? ¡ Consider level of funding and model for delivery (it may not be necessary to staff the same way or offer the same amount of time) Does this require sites to change their school plans? Does the District have carryover funds that can be directed to this activity?

4 -6 Example of Effective Funding Use – Special Education Program Improvement Planning Special education costs have risen at a rate that outpaces revenue growth One reason for this disparity is that statewide growth in special education revenue has not kept pace with general purpose funding ¡ Between 1979 -80 and 2006 -07, statewide average base revenue limits grew by 252% per average daily attendance, but special education funding grew by 195% More funding for special education provides much-needed relief and new opportunities, but we also must proceed with caution Commitments that are made with new money may require

4 -7 Example of Effective Funding Use – Special Education Program Improvement Planning As a result, it is more important than ever to be attentive to the quality of our special education programs Ideas for investing in program improvements that yield dividends: Pay for new program costs – but work to identify program efficiencies Train administrators, teachers, paraprofessionals, and specialists ¡ Improve efficiency, relevance, and quality of work w Potentially avoid complaints or delays in timelines Update assessment tools – ensure that all identified disabilities are found appropriately documented ¡ Avoid forced placements or lack of defense of denial of service

4 -8 Example of Effective Funding Use – Special Education Program Improvement Planning More ideas for the new IDEA funds: Review incidence of disabilities by type ¡ Statewide, approximately 10. 1% of students have identified disabilities that require special education support w Review this data to identify potential gaps in general education program Consider using a portion of “freed” general purpose fund to bolster general education intervention support

4 -9 Example of Effective Funding Use – State Cuts and State Fiscal Stabilization There are many ways that SFSF can be used to soften the blow of state funding cuts A few important considerations when planning: How much funding will be received? How long can the funding last? ¡ LEAs have until September 30, 2011, to spend the funds – but how long they last within this timeframe is a local decision Is the funding supporting a one-time or ongoing cost? What’s the best use of the funds? ¡ Bringing something back ¡ Saving something from being cut ¡ Something new based on present house. Our Advice: Don’t miss the opportunity to cleanneeds Avoiding and restoring cuts is

4 -10 Example of Effective Funding Use – State Cuts and State Fiscal Stabilization Ultimately, the best use is a one-time or limited-term use, but it may not be possible, given the cuts, to realistically or politically use 100% of the funds this way If the funding must be used for personnel: Set the right expectation – a job saved with these funds is a temporary reprieve, not a long-term fix Code and track the use of funds because this must be reported

4 -11 Example of Effective Funding Use – State Cuts and State Fiscal Stabilization Consider alternatives to support student achievement: Pay for staff development that improves the instructional program ¡ Example – professional learning communities, academic coaches, and other staff development If the school year can be reduced (pending legislation), act to make the reduction, but bring back the days on a temporary basis with SFSF ¡ Local collective bargaining units must agree to the change Pay for new instructional materials adoptions ¡ The flexibility allowed by the state extends the timelines for mathematics, but the materials will need to be purchased

4 -12 Example of Effective Funding Use – State Cuts and State Fiscal Stabilization Consider alternatives that may put the LEA on better financial footing: Pay off long-term debt ¡ This may have the benefit of freeing up planned contributions Pay for early-retirement incentive costs ¡ Requires prior permission from the US Department of Education w Alternatively, direct SFSF to a cost that would ordinarily be funded from the General Fund and redirect this funding to pay for the incentive costs

4 -13 Example of Effective Funding Use – Revising Site Allocations in a Sensible Way Overall funding to support sites could go up ARRA Title I funding provides significantly more funding EIA funding avoids cuts and remains bound by prior rules But there are significant cuts that districts may pass along to sites Ability to reclaim most categorical funding at the district level Reduction in SLIBG, Arts and Music Block Grant, Targeted Instructional Improvement Block Grant funding – in many cases this was allocated to sites ¡ In addition, these programs may all be shifted to other educational purposes Decision of how to handle site allocations should be based on

4 -14 Example of Effective Funding Use – Revising Site Allocations in a Sensible Way Make all necessary adjustments and a multiyear plan to facilitate transition Ensure that, if there are fewer dollars, staffing decisions at the site level reflect this adjustment ¡ It may be necessary to develop a plan to transition Develop and follow a plan that allows for revision based on changes to the budget Review current allocation planning methodology The level of funding provided to each site against the needs of each site The distribution of resources across schools in the district The balance between centralized and site-level services and support

4 -15 Planning With the Whole in Mind We no longer have 60+ different categorical programs, nor the rules and regulations that accompanies most of them This means it should be easier to plan, but let’s not overlook the power of past practice It may be convenient to continue acting as though there are individual categorical programs to keep the peace among people and programs, but there is the risk that quantity can diminish quality Making the most of flexibility requires strategic thinking: Goal focus rather than resource focus – money matters, but what we do with it matters most “Spend our most restricted dollar first” continues to apply – spend the federal funds as they expire Plans must be flexible and responsive – expect revisions,

4 -16 Approach to the Work Get the right people participating School leadership team District support – program, budget, and human resources Parent/student involvement Don’t overlook the base It may be unrealistic to expect that new funding will be available, but how is core supported Plan smart with ARRA increase One-time funds for one-time use, but it may be necessary to soften the blow of cuts to the state by spending other ways Fund priorities Need to know what they are Need to be willing to put money behind what matters

4 -17 Framework for Planning There are many ways to approach planning with flexibility and new federal funding in mind We propose taking a step back from resource and considering goals and priorities as the method to organize funding decisions

4 -18 Framework for Planning Step 1: Determine Areas/Initiative to Organize the Budget – “Bucket List” Select critical areas that capture essential activities that the district/schools must address to meet the needs of all students and demonstrate academic progress Build agreement and understanding that these are the critical needs – cabinet, school board, school site administrators, teachers, Sample Areas Based on Priorities General Operations School Site Allocation Intervention Support English Learner Support Educational Improvement Initiatives Instructional Materials

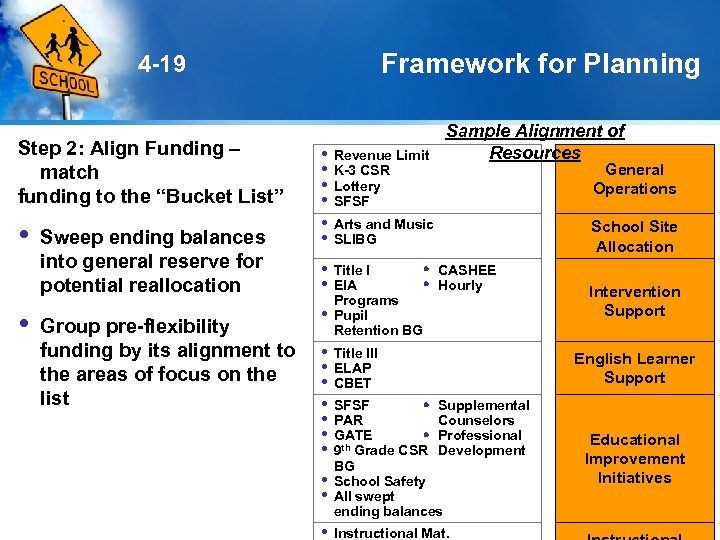

Framework for Planning 4 -19 Step 2: Align Funding – match funding to the “Bucket List” Sweep ending balances into general reserve for potential reallocation Group pre-flexibility funding by its alignment to the areas of focus on the list Sample Alignment of Resources Revenue Limit K-3 CSR Lottery SFSF Arts and Music SLIBG Title I EIA Programs Pupil Retention BG School Site Allocation CASHEE Hourly Title III ELAP CBET SFSF PAR GATE 9 th Grade CSR General Operations Intervention Support English Learner Support Supplemental Counselors Professional Development BG School Safety All swept ending balances Instructional Mat. Educational Improvement Initiatives

4 -20 Step 3: Provide List and Available Budget Information to Program Planners Provide lists to Educational Services team to determine priorities for activities within each area Provide sites with planning targets to develop Single Plan for Student Achievement and site budget Activity lists: Must fit within available resources Should include ordered Framework for Planning Focus Area: Educational Improvement Initiatives Available Resources: Ongoing (sum of program funds) $372, 000 One-time (sum of program funds) $50, 000* Activity Cost 1 CAHSEE-Academic Counseling $120, 000 2 Professional Learning Comm. $156, 600 3 Academic Coaching $50, 000 4 GATE/Enrichment $45, 400 5 Pre-K Early Intervention TOTAL (Onetime/Ongoing) Remaining Balance $50, 000* $372, 000 / $50, 000 $0/$0

4 -21 Framework for Planning Step 4: Analyze Resulting Reductions Focus Area: Educational Improvement Note that Step 3 focuses on building a budget, not cutting to fit a budget Ongoing (sum of program funds) $528, 600 One-time (sum of program funds) $50, 000* As result, it is now necessary to carefully analyze cuts to ensure that they can be made Revise to use Title I ARRA funding to support Professional Learning Communities as a centralized support for all Title I schools Initiatives Available Resources: Activity Cost 1 CAHSEE-Academic Counseling $120, 00 0 2 Professional Learning Comm. $156, 60 0 3 Academic Coaching $50, 000 4 GATE/Enrichment $45, 400 5 Pre-K Early Intervention 6 Health Aide $50, 000* $145, 50 0

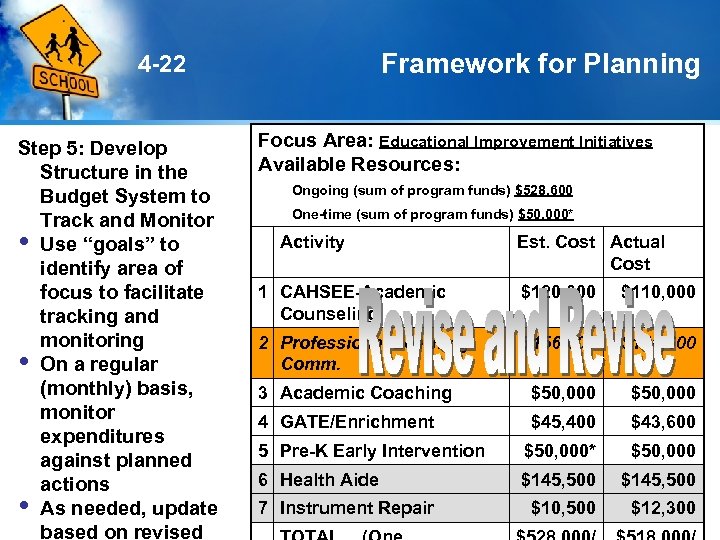

Framework for Planning 4 -22 Step 5: Develop Structure in the Budget System to Track and Monitor Use “goals” to identify area of focus to facilitate tracking and monitoring On a regular (monthly) basis, monitor expenditures against planned actions As needed, update based on revised Focus Area: Educational Improvement Initiatives Available Resources: Ongoing (sum of program funds) $528, 600 One-time (sum of program funds) $50, 000* Activity Est. Cost Actual Cost 1 CAHSEE-Academic Counseling $120, 000 $110, 000 2 Professional Learning Comm. $156, 600 3 Academic Coaching $50, 000 4 GATE/Enrichment $45, 400 $43, 600 5 Pre-K Early Intervention $50, 000* $50, 000 6 Health Aide $145, 500 $10, 500 $12, 300 7 Instrument Repair

4 -23 Available Tools There a number of tools available to support applying these principles to local district budget planning CATWizard: All ARRA federal resources are reflected under the program title (go to: www. sscal. com/tools_resources. cfm) Matrix of Allowed Uses: Supplement what you find in the CATWizard with a one-page reference (included on the CDROM and in the workshop binder) Dynamic Budget Guide: Identify the latest projections for state and federal funding (go to: www. sscal. com/tools_resources. cfm) ARRA Funding Calculation Worksheet: Estimate funding amounts based on CDE’s latest information (included on CD-ROM)

4 -24 Selecting the Best Resource Allowable Uses Matrix

Closing Thoughts

5 -1 Will This New Approach Work to Support All Students? We are participating in a statewide demonstration project, sprinkled with substantial new federal dollars Are we better off when we determine our own destiny? If we believe we can do a better job than the state in identifying where funding should be used, let’s prove it! Maximizing flexibility means following applicable rules – but seeing possibilities beyond the rules This is a true test of an outcomes-based accountability system

5 -2 Doing It Right There are specific requirements and good practices that should be considered: Public Hearings, documentation, and tracking expenditures Prepare and inform sites, board, and community – get the right team involved in planning and implementation Fund priorities – identify them and put the money where it matters most Prepare for even more changes

5 -3 Surviving. . . And Thriving? In both good and bad budget times, we thrive when: We carefully identify and respond to the needs of students We operate with budgets that reflect school and district priorities for high quality instruction We focus our energy on assets, not deficiencies We do our very best with every cent we have – making wise investments on behalf of students

Thank you

cb8ad59536e75410553de7218c5c46a9.ppt