56eda280ca678ca984e74f55f88f9daf.ppt

- Количество слайдов: 73

State Benefits Too important to leave to chance!

Possible sources of State retirement income • • Basic State pension Graduated pension State Second Pension (previously SERPS) Pension Credit means tested

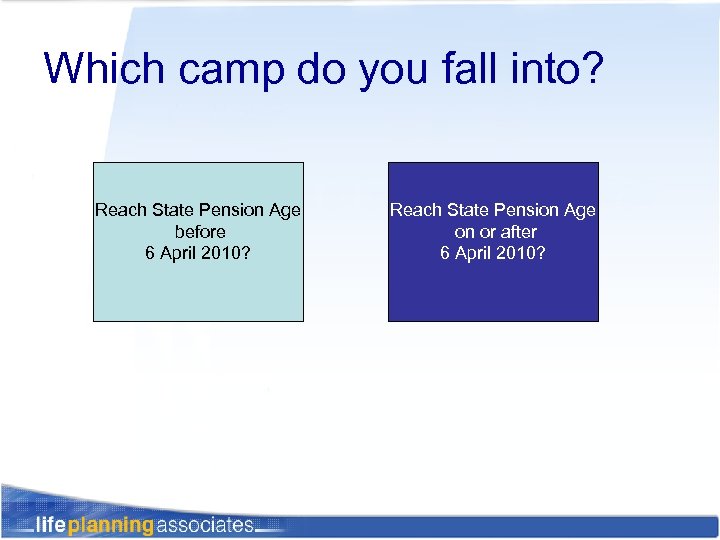

Which camp do you fall into? Reach State Pension Age before 6 April 2010? Reach State Pension Age on or after 6 April 2010?

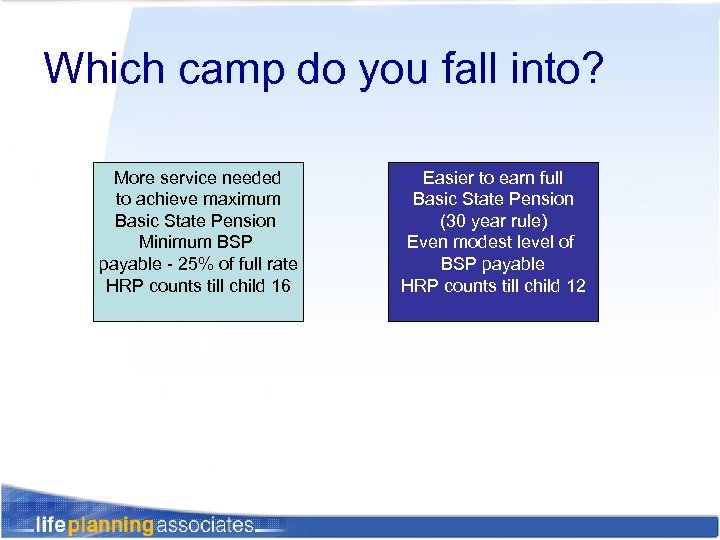

Which camp do you fall into? More service needed to achieve maximum Basic State Pension Minimum BSP payable - 25% of full rate HRP counts till child 16 Easier to earn full Basic State Pension (30 year rule) Even modest level of BSP payable HRP counts till child 12

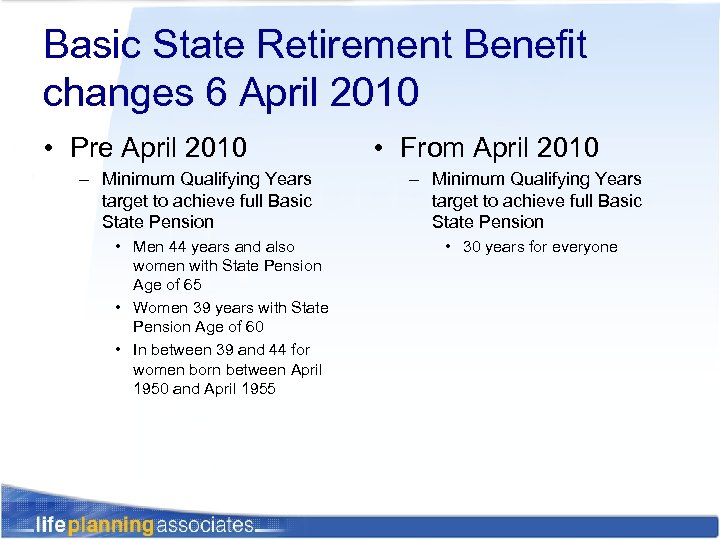

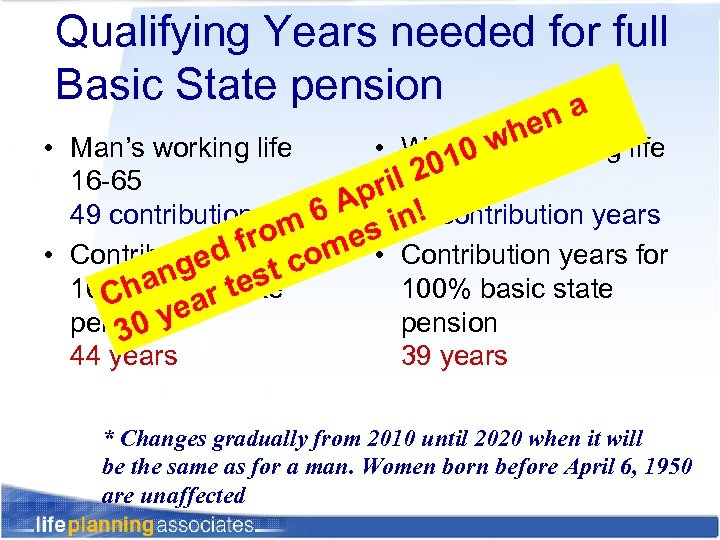

Basic State Retirement Benefit changes 6 April 2010 • Pre April 2010 – Minimum Qualifying Years target to achieve full Basic State Pension • Men 44 years and also women with State Pension Age of 65 • Women 39 years with State Pension Age of 60 • In between 39 and 44 for women born between April 1950 and April 1955 • From April 2010 – Minimum Qualifying Years target to achieve full Basic State Pension • 30 years for everyone

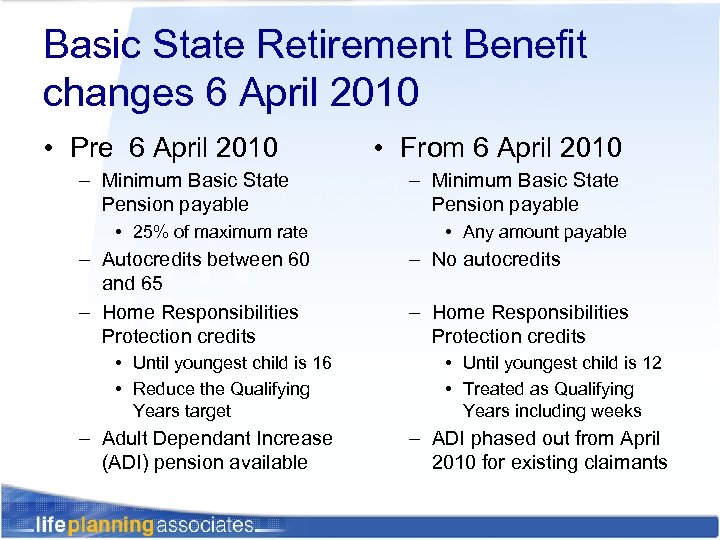

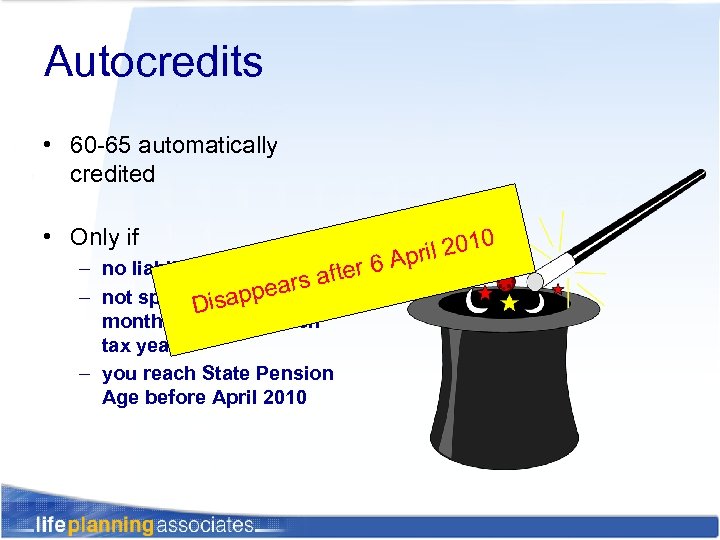

Basic State Retirement Benefit changes 6 April 2010 • Pre 6 April 2010 – Minimum Basic State Pension payable • 25% of maximum rate – Autocredits between 60 and 65 – Home Responsibilities Protection credits • Until youngest child is 16 • Reduce the Qualifying Years target – Adult Dependant Increase (ADI) pension available • From 6 April 2010 – Minimum Basic State Pension payable • Any amount payable – No autocredits – Home Responsibilities Protection credits • Until youngest child is 12 • Treated as Qualifying Years including weeks – ADI phased out from April 2010 for existing claimants

Home Responsibilities Protection and gaps • In 2008 the Government launched an investigation to find why thousands of women were not receiving the right level of pension • Problem relates to failure to highlight entitlement to HRP on a woman’s NI record • Also gaps for years between April 1996 and April 2002 can be made good (to ‘buy back’ the missing years at a special rate) – The Pension, Disability and Carers Service is reviewing the NI records of a group of around 73, 000 women who could use the special terms to claim some backdated pension for a past period

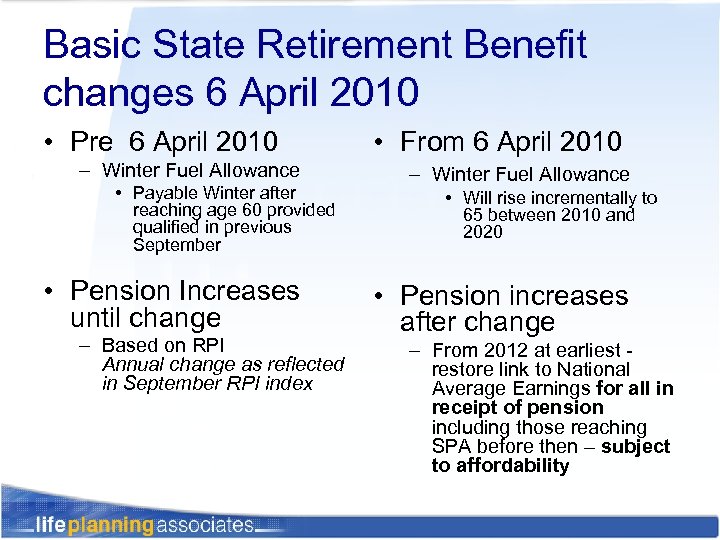

Basic State Retirement Benefit changes 6 April 2010 • Pre 6 April 2010 – Winter Fuel Allowance • Payable Winter after reaching age 60 provided qualified in previous September • Pension Increases until change – Based on RPI Annual change as reflected in September RPI index • From 6 April 2010 – Winter Fuel Allowance • Will rise incrementally to 65 between 2010 and 2020 • Pension increases after change – From 2012 at earliest restore link to National Average Earnings for all in receipt of pension including those reaching SPA before then – subject to affordability

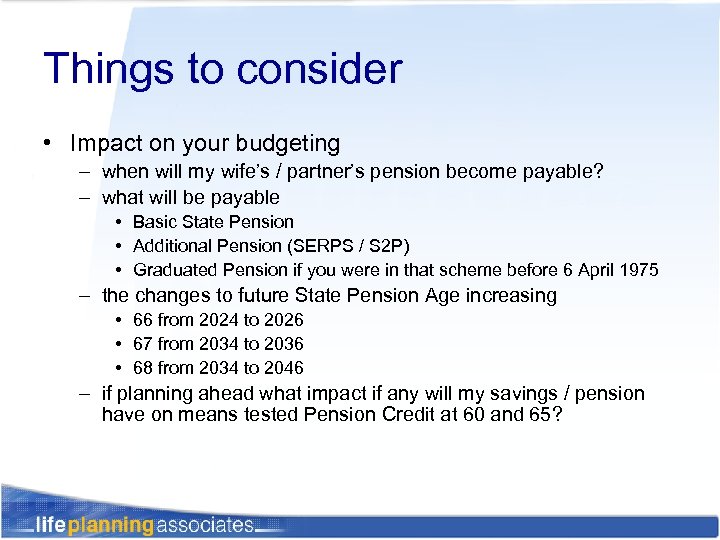

Things to consider • Impact on your budgeting – when will my wife’s / partner’s pension become payable? – what will be payable • Basic State Pension • Additional Pension (SERPS / S 2 P) • Graduated Pension if you were in that scheme before 6 April 1975 – the changes to future State Pension Age increasing • 66 from 2024 to 2026 • 67 from 2034 to 2036 • 68 from 2034 to 2046 – if planning ahead what impact if any will my savings / pension have on means tested Pension Credit at 60 and 65?

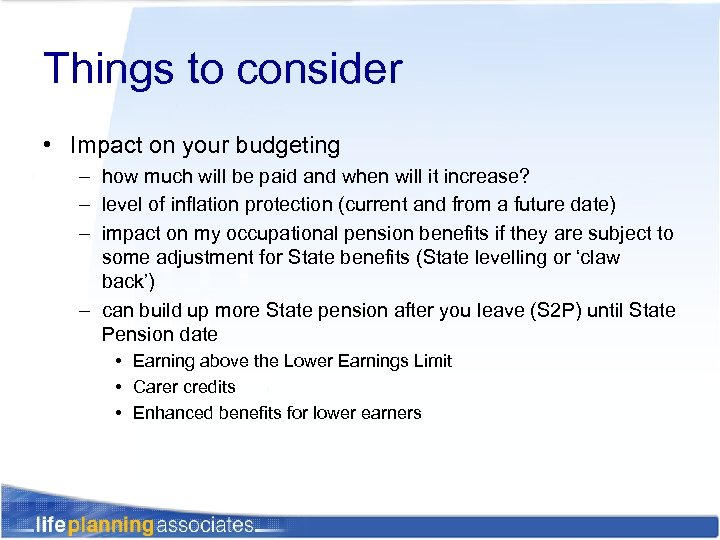

Things to consider • Impact on your budgeting – how much will be paid and when will it increase? – level of inflation protection (current and from a future date) – impact on my occupational pension benefits if they are subject to some adjustment for State benefits (State levelling or ‘claw back’) – can build up more State pension after you leave (S 2 P) until State Pension date • Earning above the Lower Earnings Limit • Carer credits • Enhanced benefits for lower earners

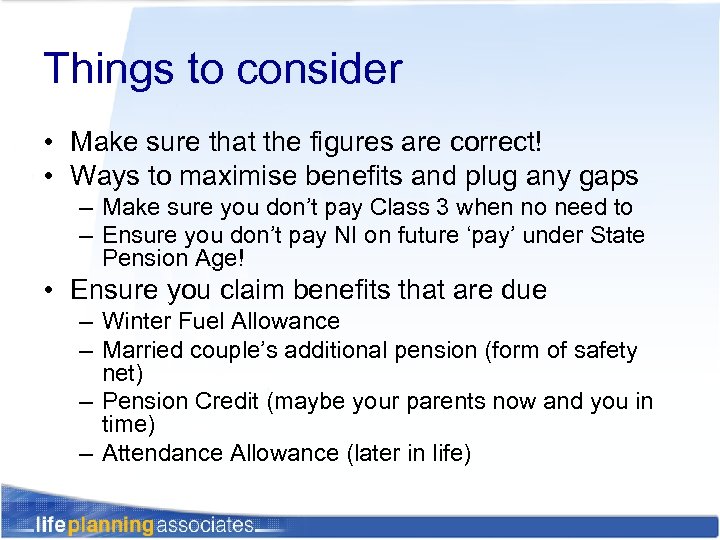

Things to consider • Make sure that the figures are correct! • Ways to maximise benefits and plug any gaps – Make sure you don’t pay Class 3 when no need to – Ensure you don’t pay NI on future ‘pay’ under State Pension Age! • Ensure you claim benefits that are due – Winter Fuel Allowance – Married couple’s additional pension (form of safety net) – Pension Credit (maybe your parents now and you in time) – Attendance Allowance (later in life)

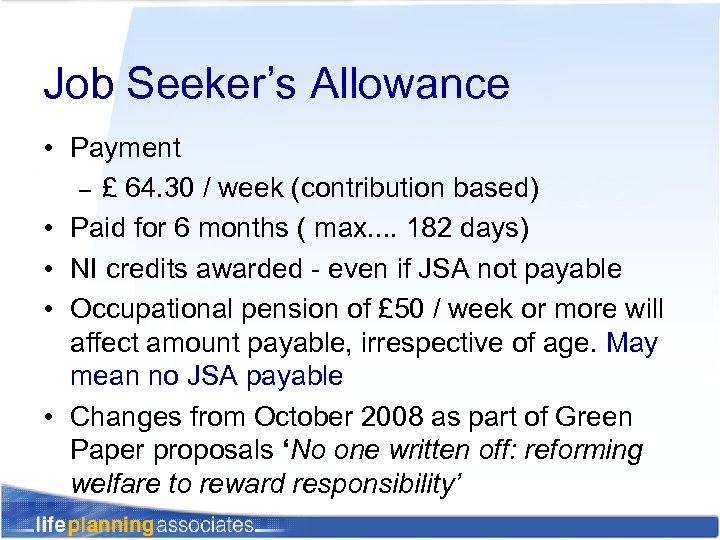

Job Seeker’s Allowance • Payment – £ 64. 30 / week (contribution based) • Paid for 6 months ( max. . 182 days) • NI credits awarded - even if JSA not payable • Occupational pension of £ 50 / week or more will affect amount payable, irrespective of age. May mean no JSA payable • Changes from October 2008 as part of Green Paper proposals ‘No one written off: reforming welfare to reward responsibility’

Employment & Support Allowance • Introduced on 27 th October 2008 • Replaced Incapacity Benefit for new claimants with a focus on a can do attitude not what someone cannot do • Expected to be a temporary benefit for the vast majority of individuals • Anyone already receiving Incapacity Benefit will be transferred to ESA between 2009 and 2013 after a medical assessment (Work Capability Assessment)

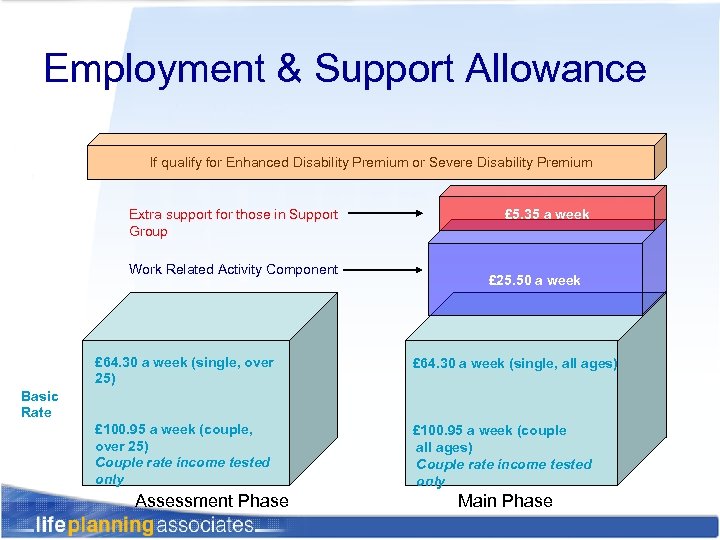

Employment & Support Allowance If qualify for Enhanced Disability Premium or Severe Disability Premium Extra support for those in Support Group Work Related Activity Component £ 5. 35 a week £ 25. 50 a week £ 64. 30 a week (single, over 25) £ 64. 30 a week (single, all ages) £ 100. 95 a week (couple, over 25) Couple rate income tested only £ 100. 95 a week (couple all ages) Couple rate income tested only Basic Rate Assessment Phase Main Phase

State Basic and Graduated Pension- rates (maxima) • Basic (own right) - £ 95. 25 / week • Married woman ( on husband’s record) £ 57. 05 /week • Graduated pension - depends upon number of units ‘earned’. Unit value 11. 53 p each week

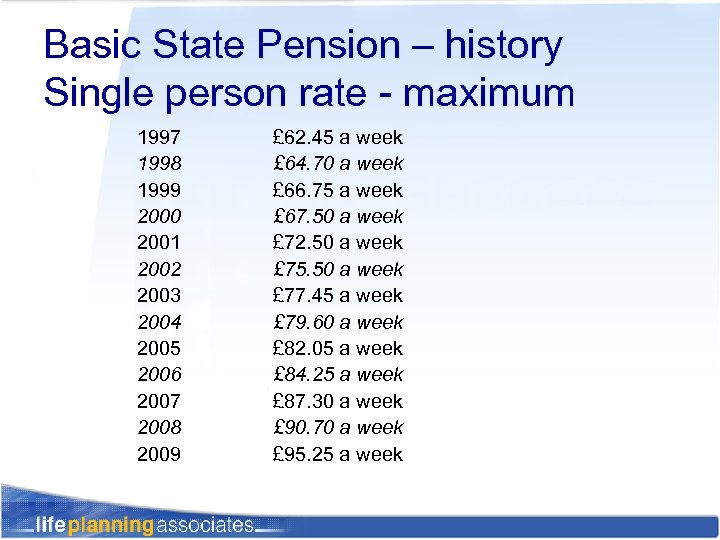

Basic State Pension – history Single person rate - maximum 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 £ 62. 45 a week £ 64. 70 a week £ 66. 75 a week £ 67. 50 a week £ 72. 50 a week £ 75. 50 a week £ 77. 45 a week £ 79. 60 a week £ 82. 05 a week £ 84. 25 a week £ 87. 30 a week £ 90. 70 a week £ 95. 25 a week

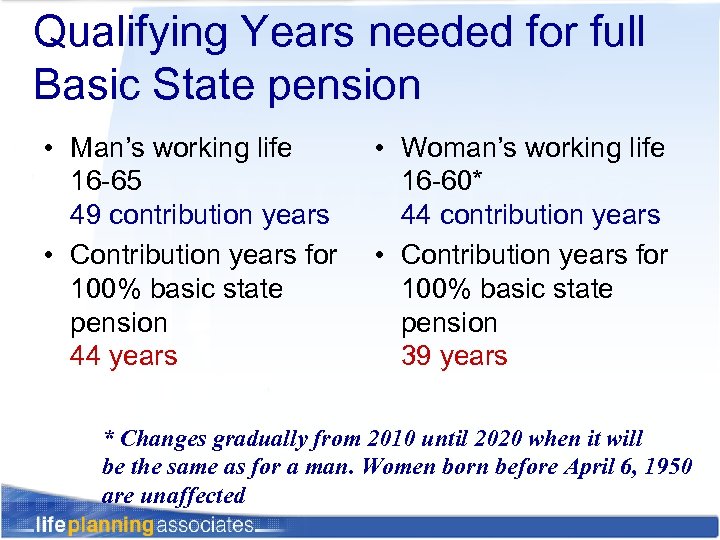

Qualifying Years needed for full Basic State pension • Man’s working life 16 -65 49 contribution years • Contribution years for 100% basic state pension 44 years • Woman’s working life 16 -60* 44 contribution years • Contribution years for 100% basic state pension 39 years * Changes gradually from 2010 until 2020 when it will be the same as for a man. Women born before April 6, 1950 are unaffected

Qualifying Years needed for full Basic State pension a en hworking life • Man’s working life • Woman’s 0 w 201 16 -65 ril 16 -60* Ap 44 contribution years 6 49 contribution years in! romfor es Contribution years for df c • Contribution years om • ge st 100% an r state 100% basic state Ch basic te yea pension 30 44 years 39 years * Changes gradually from 2010 until 2020 when it will be the same as for a man. Women born before April 6, 1950 are unaffected

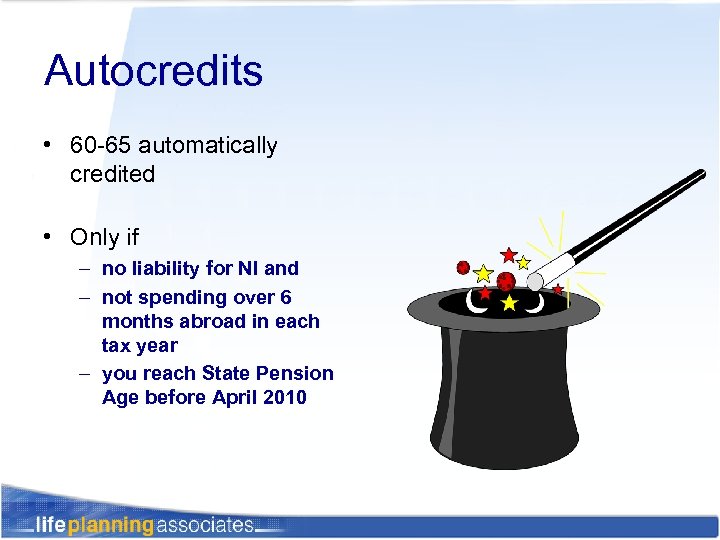

Autocredits • 60 -65 automatically credited • Only if – no liability for NI and – not spending over 6 months abroad in each tax year – you reach State Pension Age before April 2010

Autocredits • 60 -65 automatically credited • Only if – no liability for NI and after 6 rs – not spendingappea over 6 Dis months abroad in each tax year – you reach State Pension Age before April 2010 0 ril 201 Ap

What’s your magic number? A quick test of understanding – current ‘rules’

When am I fully paid up? • Example – Man started working in tax year when 16 – No ‘gaps’ in record

When am I fully paid up? When I’m 55!

Options ( before State Pension Age) • Further employment / self employment • Unemployment ( Job Seeker’s Allowance) • Illness (Employment & Support Allowance / Incapacity Benefit) • Non-employment (Class 3 NI contribution £ 12. 05 a week) • Auto-credits ( men 60 -65)*

Some other angles

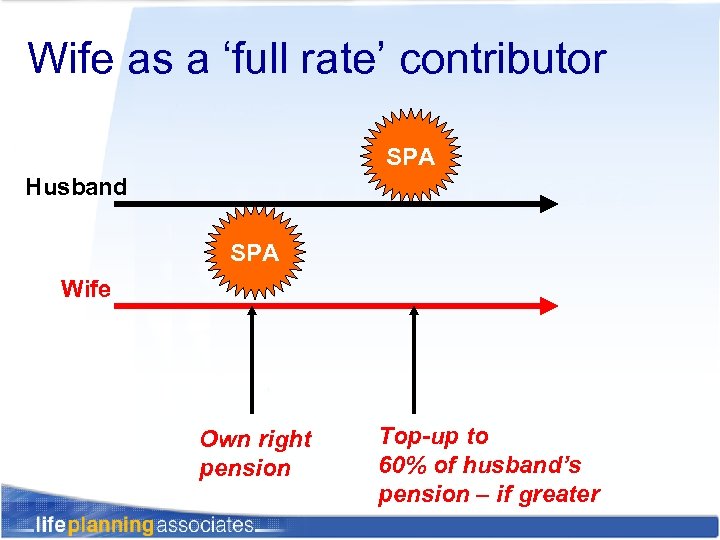

Wife as a ‘full rate’ contributor SPA Husband SPA Wife Own right pension Top-up to 60% of husband’s pension – if greater

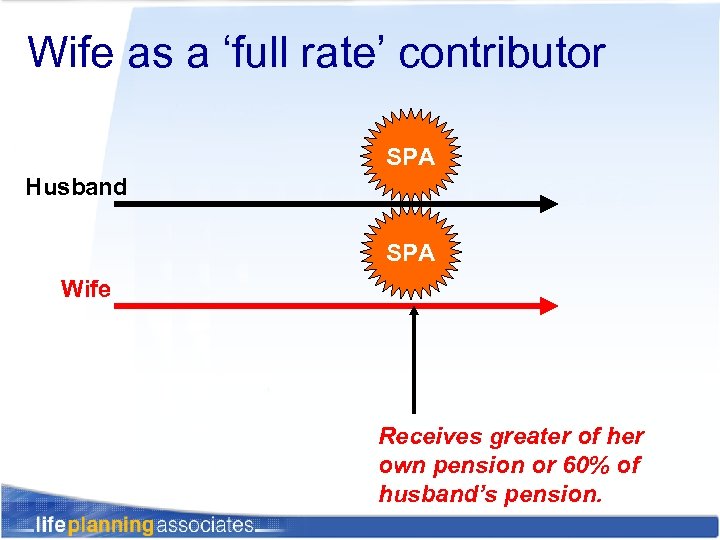

Wife as a ‘full rate’ contributor SPA Husband SPA Wife Receives greater of her own pension or 60% of husband’s pension.

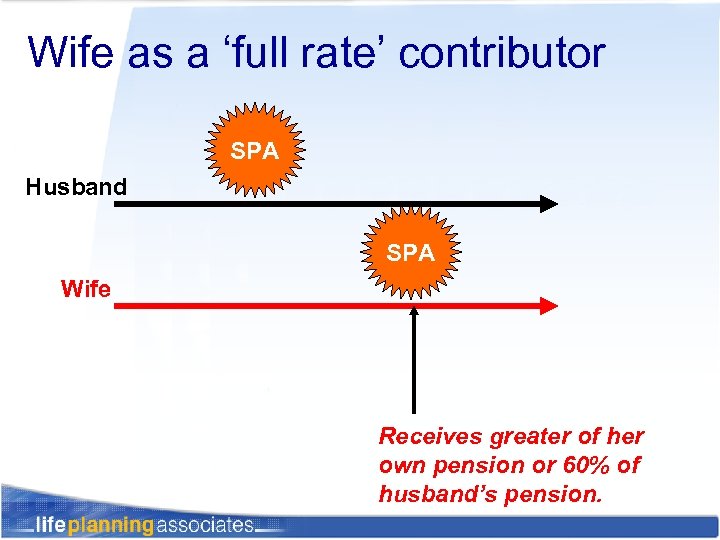

Wife as a ‘full rate’ contributor SPA Husband SPA Wife Receives greater of her own pension or 60% of husband’s pension.

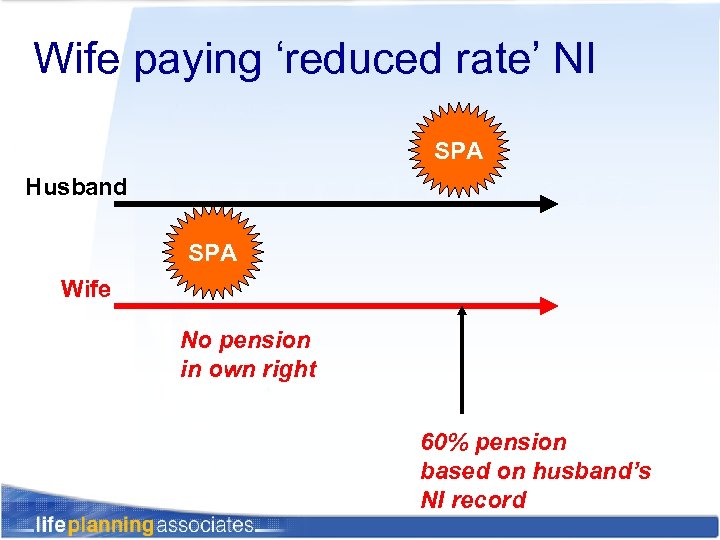

Wife paying ‘reduced rate’ NI SPA Husband SPA Wife No pension in own right 60% pension based on husband’s NI record

Adult Dependant Increase • Available to increase a man’s or woman’s State Pension if another adult is financially dependent upon them • Since the 1980 s, ADIs restricted to recipient’s spouse or person having care of the recipient’s children – Restrictions for a woman claiming for her husband • To claim for her husband she must have been entitled to an ADI of long-term Incapacity Benefit immediately before reaching SPA • Dependency test – The dependent does not have earnings or an occupational / personal pension above the standard rate of Jobseeker’s Allowance (£ 64. 30 a week) , and – Not receiving benefit in their own right above £ 57. 05 a week

Adult Dependant Increase • From 2010 ADIs were set to become available on the same basis as husbands claim for their wives for – Women for their husbands – People in Civil Partnerships • From April 2010 ADIs will no longer be awarded but all existing entitlements will be protected up to 2020

Home Responsibilities Protection • Available only from 6 April 1978 • Protects record for: – main child benefit payees ( child under 16) – those looking after someone receiving specified benefits ( 35 + hours) – those receiving income support while looking after a sick /disabled person at home

Home Responsibilities Protection • Cannot reduce qualifying years for full Basic State pension below 20* ‘old terms’ • Cannot be given for years covered by reduced rate NI contribution election • From April 2002 ‘carers’ and people receiving child benefit for a child under 6 can build up State Second Pension too

Home Responsibilities Protection Some examples Current Rules (Pre 6 April 2010)

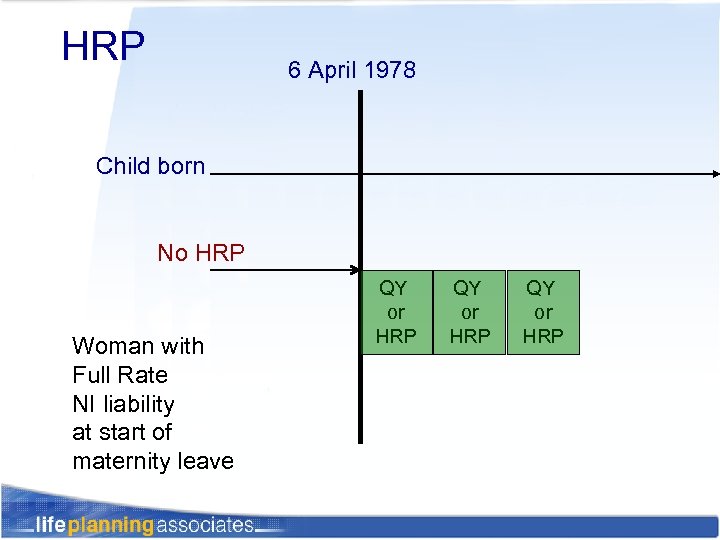

HRP 6 April 1978 Child born No HRP Woman with Full Rate NI liability at start of maternity leave QY or HRP

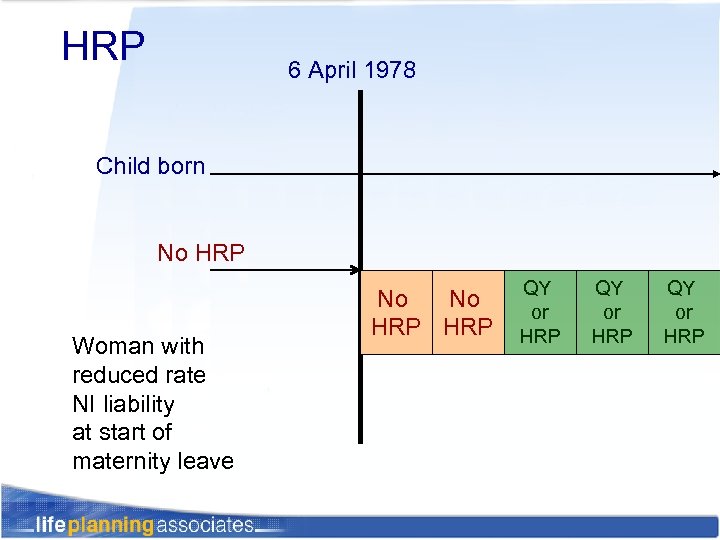

HRP 6 April 1978 Child born No HRP Woman with reduced rate NI liability at start of maternity leave No No HRP QY or HRP

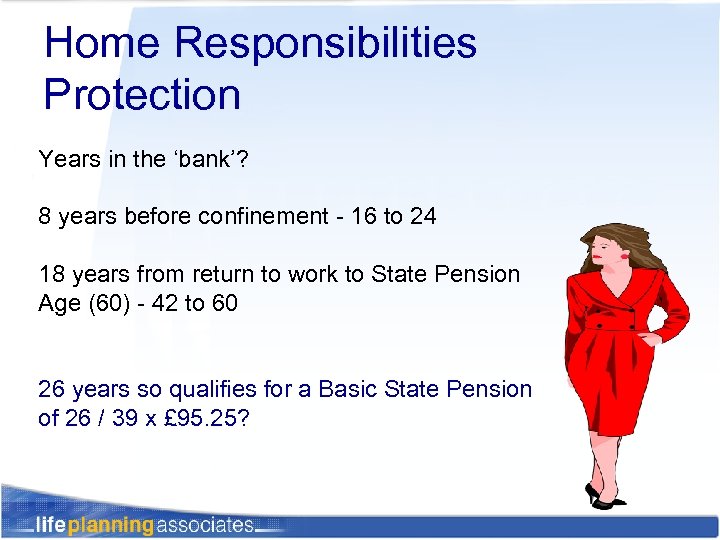

Home Responsibilities Protection An example (Pre April 2010): Left school at 16 and started working straightaway Married 5 years later Stopped working 3 years later for confinement (had two children) Returned to work when 42 (Full time)

Home Responsibilities Protection Years in the ‘bank’? 8 years before confinement - 16 to 24 18 years from return to work to State Pension Age (60) - 42 to 60 26 years so qualifies for a Basic State Pension of 26 / 39 x £ 95. 25?

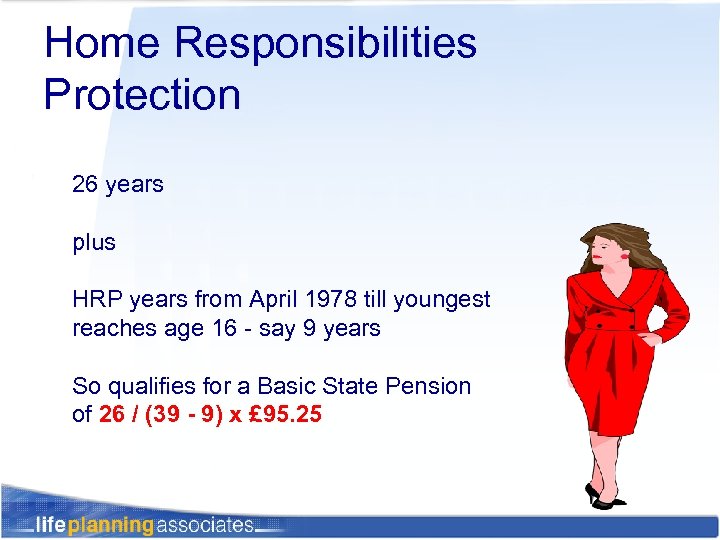

Home Responsibilities Protection 26 years plus HRP years from April 1978 till youngest reaches age 16 - say 9 years So qualifies for a Basic State Pension of 26 / (39 - 9) x £ 95. 25

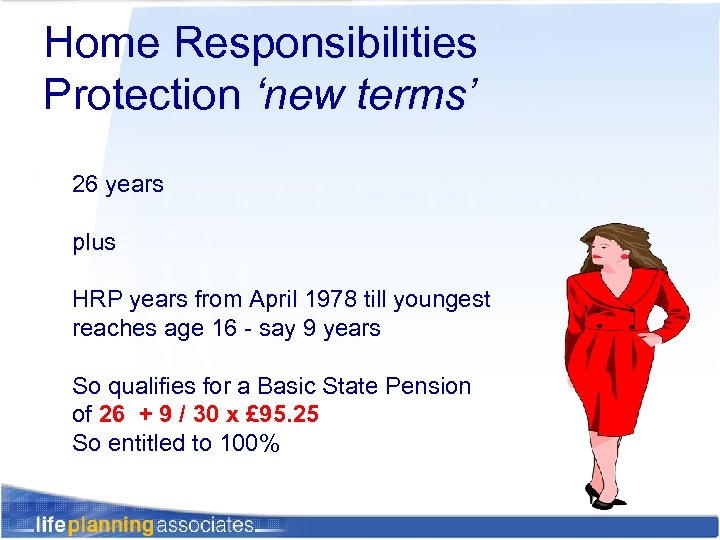

Home Responsibilities Protection ‘new terms’ 26 years plus HRP years from April 1978 till youngest reaches age 16 - say 9 years So qualifies for a Basic State Pension of 26 + 9 / 30 x £ 95. 25 So entitled to 100%

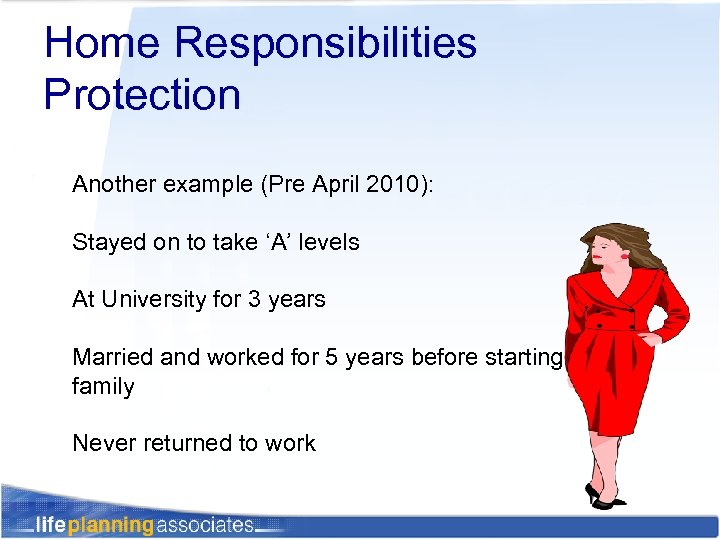

Home Responsibilities Protection Another example (Pre April 2010): Stayed on to take ‘A’ levels At University for 3 years Married and worked for 5 years before starting a family Never returned to work

Home Responsibilities Protection Years in the ‘bank’ 3 years - 16 to 18 University years - blank 5 years while working So appears not to qualify for any Basic State Pension as only 8 years in the ‘bank’

Home Responsibilities Protection But…. 8 years plus HRP years from April 1978 till youngest reaches age 16 - say 15 years So qualifies for a Basic State Pension of 8 / (39 - 15) x £ 95. 25

Home Responsibilities Protection ‘new terms’ But…. 8 years plus HRP years from April 1978 till youngest reaches age 16 - say 15 years So qualifies for a Basic State Pension of 8 + 15 / 30 x £ 95. 25

Home Responsibilities Protection • Changes from 6 April 2010 – HRP replaced by new weekly credits – will not reduce the ‘Qualifying Year’ target – Entitlement will be aligned with future credit counting until the child is 12* – HRP earned before 6 April 2010 will be converted and HRP earned after the child’s 12 th birthday will still continue to count

Divorced people • Can use ex-spouse’s contribution record if it produces a higher Basic State pension • Cannot use if re-marriage occurs before State Pension Age

Widows / widowers • Entitlement to pension protected in a similar way to that of divorced people

Pension forecast • Forecasts – Online – Telephone 0845 3000 168 – Submit form BR 19 • Forecast will give details of – Basic State pension – SERPS / State Second Pension – Graduated pension • Will indicate if Basic State pension can be increased by paying NI for past or future periods

Pension forecast / claim • If you have either live abroad or have worked overseas then contact the International Pension Centre for any claims • If you are living in any EEA country you should claim as follows: – If you have worked in the country you are now living in then claim through the pension institution in that country – if you have not worked in the country you are now living in then claim your pension direct from the International Pension Centre

Claim pension • Previously the Pension Service wrote 4 months before State Pension Date to invite someone to claim their pension • Now they can take applications over the telephone 2 months before expected claim date State Pension claimline 0845 300 1084

National Insurance contributions after State Pension Age • If employed – You must apply for an Age Exemption Certificate (CA 4140) • Visit HMRC website (www. hmrc. gov. uk) • Telephone 0845 302 1479 (lo-call rate) – Then pass it to your Employer If you do not obtain the Age Exemption Certificate Your employer will continue to deduct NI!

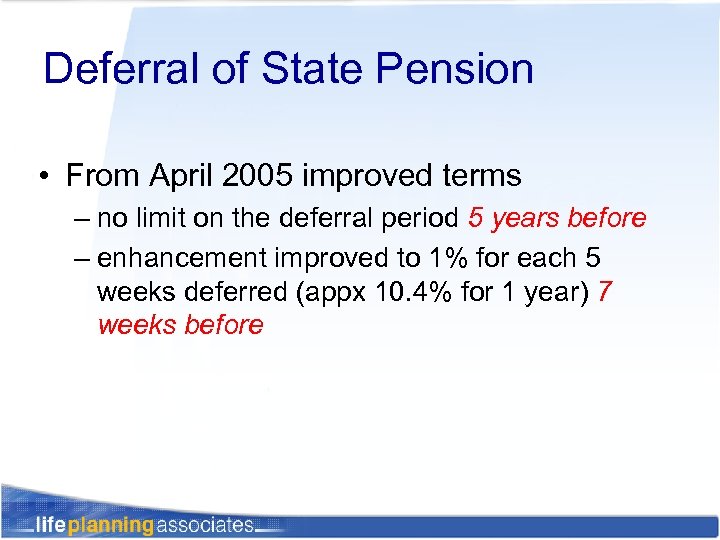

Deferral of State Pension • From April 2005 improved terms – no limit on the deferral period 5 years before – enhancement improved to 1% for each 5 weeks deferred (appx 10. 4% for 1 year) 7 weeks before

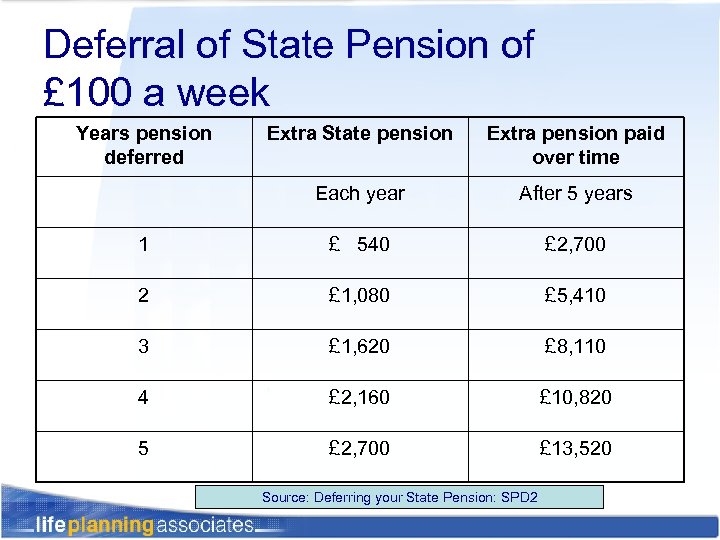

Deferral of State Pension of £ 100 a week Years pension deferred Extra State pension Extra pension paid over time Each year After 5 years 1 £ 540 £ 2, 700 2 £ 1, 080 £ 5, 410 3 £ 1, 620 £ 8, 110 4 £ 2, 160 £ 10, 820 5 £ 2, 700 £ 13, 520 Source: Deferring your State Pension: SPD 2

Deferral of State Pension • From April 2005 improved terms – new option to take a taxable lump sum at time State pension claimed with normal level of State Pension instead of enhanced pension • deferral must be for 1 year at least • lump sum calculated using rate of interest about 2% above Bank of England Base Rate

State Pensions - rates (maxima) ‘earnings related’ • State Earnings Related Pension - 25% of revalued Upper Band Earnings before 2000 then falling away to 20% • April 2002 State Second Pension replaced SERPS • From 6 April 2009 Upper Earnings Limit applies to NI calculation and a lower ceiling set (Upper Accruals Point) for calculation of State Second Pension - a ‘stealth tax’ of 11% for those earning between £ 770 and £ 844 a week in 2009 -10 • Pensions Act 2007 changes coming into effect in tax year 2010 -11 will see further reduction in accrual rate Subject to any deductions for periods of ‘contracted-out’ employment

Pension Credit • Extra cash for single pensioners up to £ 20. 40 a week • Extra cash for couples of up to £ 27. 03 a week Claim Line 0800 99 1234

Pension Credit • Top up to £ 130 a week ( £ 198. 45 a week for a couple) • Reward for savings with additional cash at an initial rate of 60 p reward for every £ of savings income • Pension credit is non-taxable

Additional benefits • £ 10 Xmas bonus tax free in first week of December • Winter Fuel payment £ 250 (£ 400 if aged 80 or more Xmas 2009) • Free – – – NHS prescriptions and eye tests from 60 local public transport nationally TV licence once 75 Free passport when you are 77

Free bus travel and concessions • If over 60 and ‘eligible disabled’ • Applies to free off-peak travel on local buses anywhere in England • Does not apply to certain services Plus • Separate half-price coach concession for older and disabled people that many coach operators participate in

Additional benefits • Age 80 – – Additional 25 p weekly Over 80 pension • If not receiving a Basic State Pension or it is at a low level it will be topped up by the ‘married couples’ supplement (£ 57. 05 in 2009 -10)* provided – – Living in the UK when you claim Must have lived here for 10 years or more in any 20 year period after your 60 th birthday (living in the EU counts)

Self-employment • Need to register as selfemployed • ‘Small Earnings Exception’ if profits under £ 5, 075 a year • Contribution ( Class 2 - flat rate £ 2. 40 / week) • Class 4 contributions ( really a tax) – 8% payable on profits between £ 5, 715 and £ 43, 875 and 1% above £ 43, 875

Self-employment • Employ your spouse or partner in your business and their pay is tax deductible in arriving at your profits • Business expenses reduce profits – PCs, machinery, software – Running expenses even if using your own home

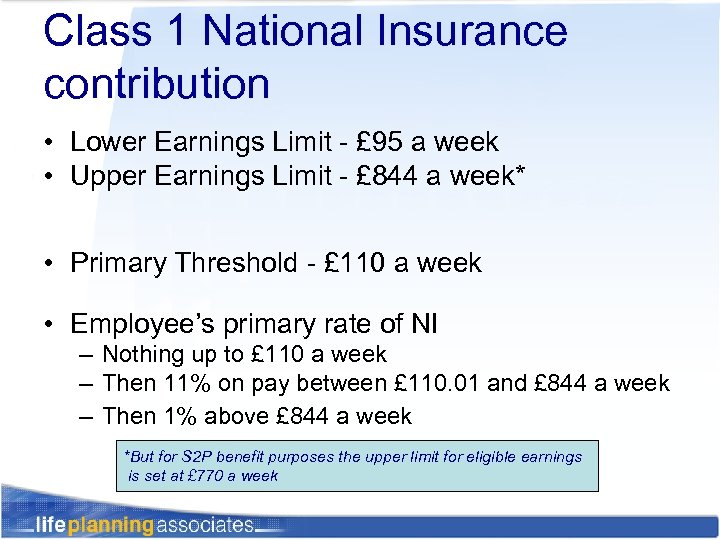

Class 1 National Insurance contribution • Lower Earnings Limit - £ 95 a week • Upper Earnings Limit - £ 844 a week* • Primary Threshold - £ 110 a week • Employee’s primary rate of NI – Nothing up to £ 110 a week – Then 11% on pay between £ 110. 01 and £ 844 a week – Then 1% above £ 844 a week *But for S 2 P benefit purposes the upper limit for eligible earnings is set at £ 770 a week

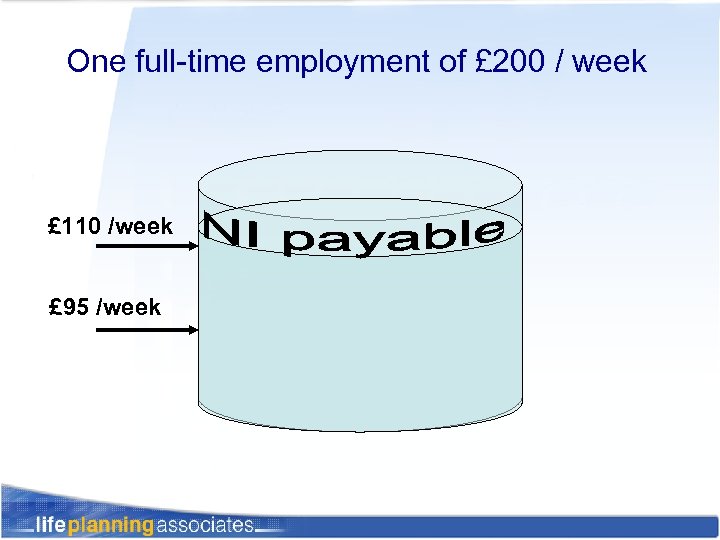

One full-time employment of £ 200 / week £ 110 /week £ 95 /week

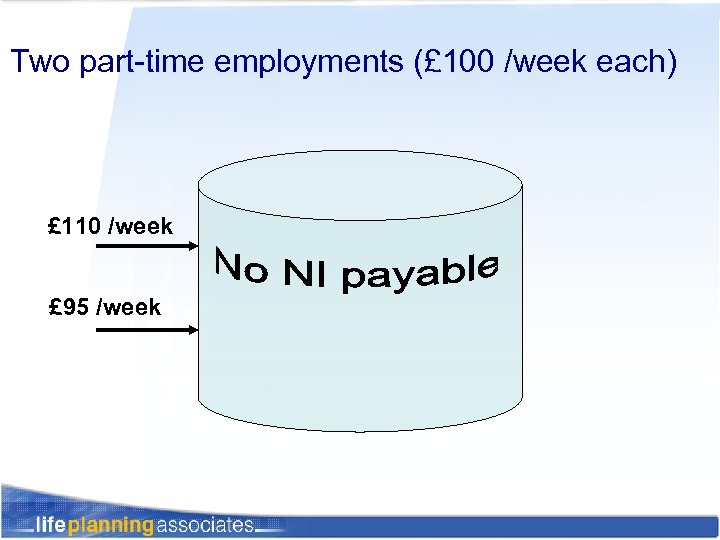

Two part-time employments (£ 100 /week each) £ 110 /week £ 95 /week

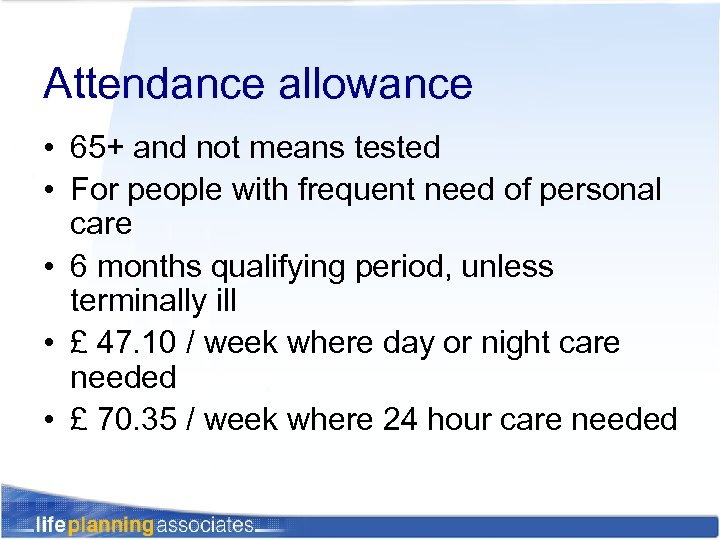

Attendance allowance • 65+ and not means tested • For people with frequent need of personal care • 6 months qualifying period, unless terminally ill • £ 47. 10 / week where day or night care needed • £ 70. 35 / week where 24 hour care needed

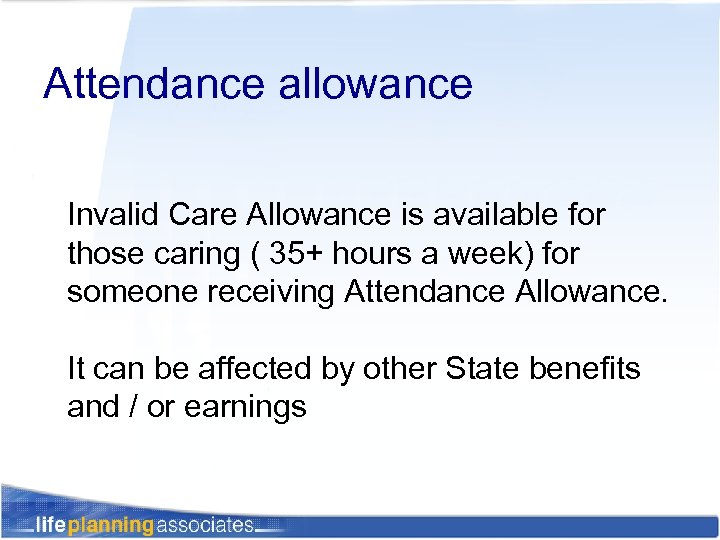

Attendance allowance Invalid Care Allowance is available for those caring ( 35+ hours a week) for someone receiving Attendance Allowance. It can be affected by other State benefits and / or earnings

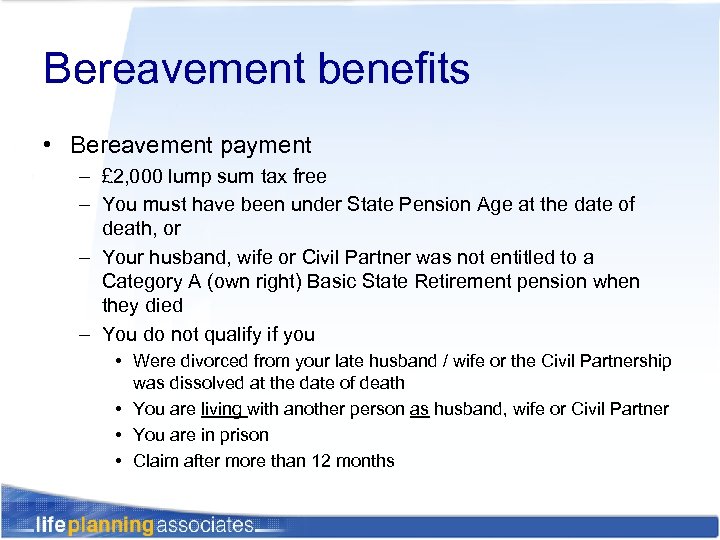

Bereavement benefits • Bereavement payment – £ 2, 000 lump sum tax free – You must have been under State Pension Age at the date of death, or – Your husband, wife or Civil Partner was not entitled to a Category A (own right) Basic State Retirement pension when they died – You do not qualify if you • Were divorced from your late husband / wife or the Civil Partnership was dissolved at the date of death • You are living with another person as husband, wife or Civil Partner • You are in prison • Claim after more than 12 months

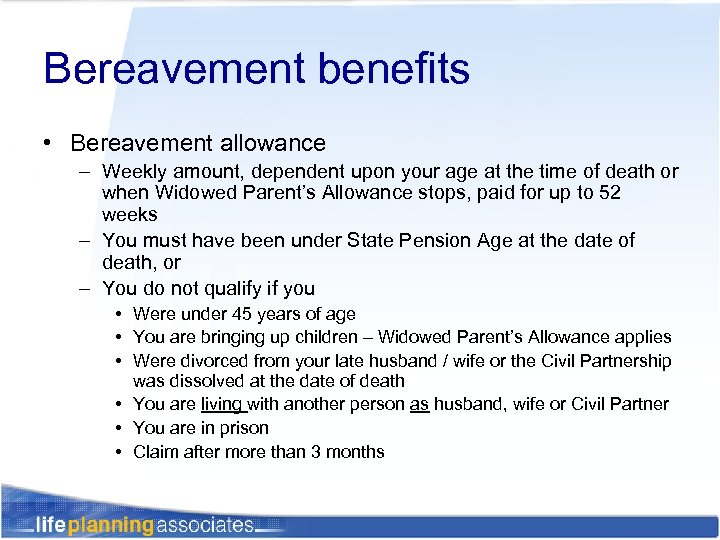

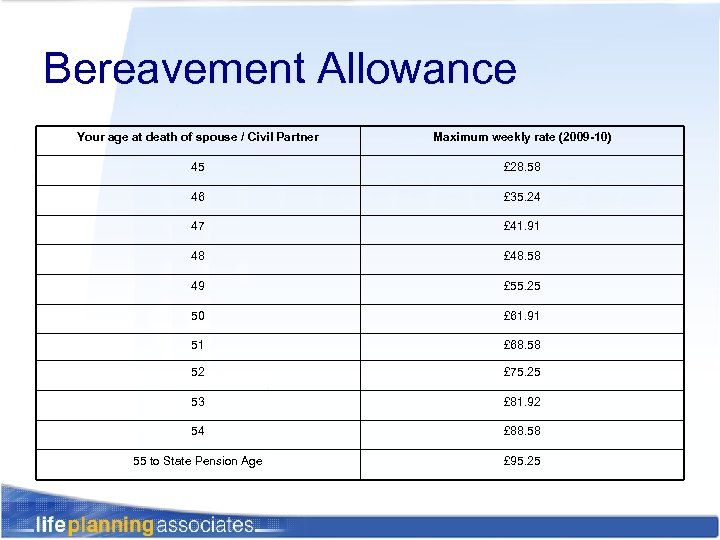

Bereavement benefits • Bereavement allowance – Weekly amount, dependent upon your age at the time of death or when Widowed Parent’s Allowance stops, paid for up to 52 weeks – You must have been under State Pension Age at the date of death, or – You do not qualify if you • Were under 45 years of age • You are bringing up children – Widowed Parent’s Allowance applies • Were divorced from your late husband / wife or the Civil Partnership was dissolved at the date of death • You are living with another person as husband, wife or Civil Partner • You are in prison • Claim after more than 3 months

Bereavement Allowance Your age at death of spouse / Civil Partner Maximum weekly rate (2009 -10) 45 £ 28. 58 46 £ 35. 24 47 £ 41. 91 48 £ 48. 58 49 £ 55. 25 50 £ 61. 91 51 £ 68. 58 52 £ 75. 25 53 £ 81. 92 54 £ 88. 58 55 to State Pension Age £ 95. 25

Widowed Parent’s Allowance • Must be under State Pension Age to receive £ 95. 25 a week (2009 -10) - taxable • Must be entitled to Child Benefit* • A widow and either – expecting your late husband’s baby, or – assuming you were living with your late husband before his death expecting a baby as a result of artificial insemination by donor or in vitro fertilisation • A surviving Civil Partner (woman) – living with your Civil Partner before her death and expecting a baby as a result of artificial insemination by donor or in vitro fertilisation

Details needed for a Basic State Pension assessment (1: 1) • First name • Date of birth – you and husband • Dates – started / stopped/ restarted work – children were born – when started / ended paying married woman’s reduced rate National Insurance – any other breaks

56eda280ca678ca984e74f55f88f9daf.ppt