658213047e6818b4ed4edeee18242a38.ppt

- Количество слайдов: 20

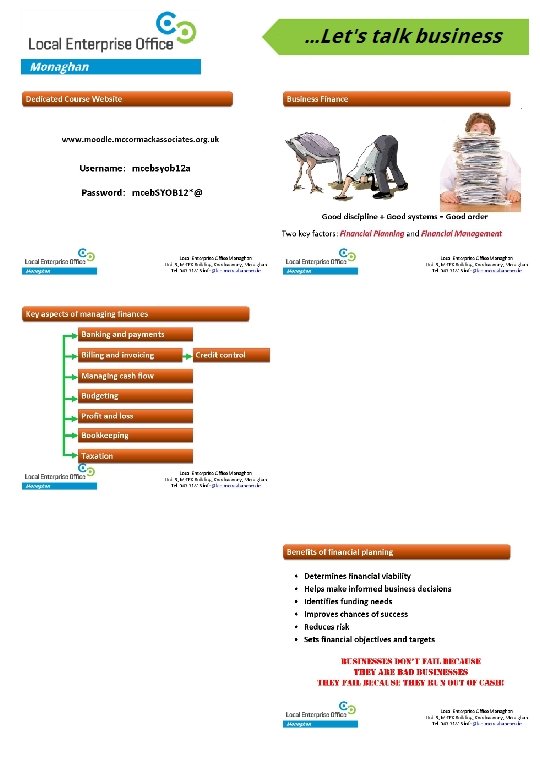

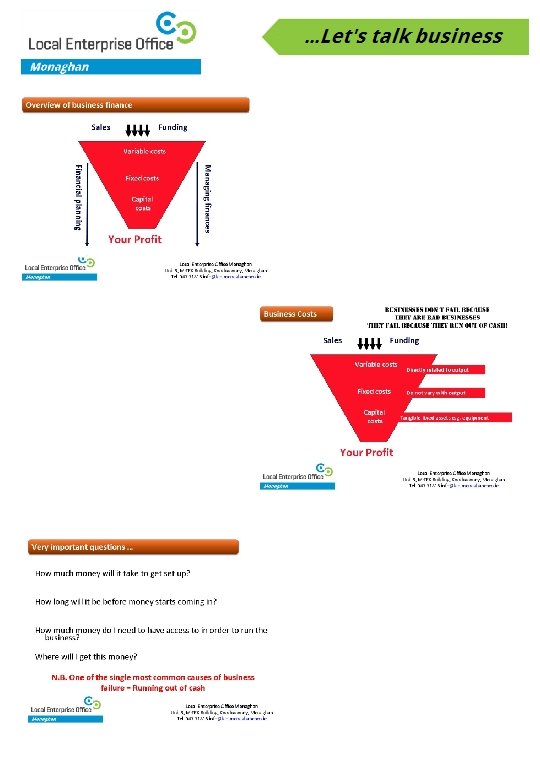

Start Your Own Business Module 5 – Workbook Business Finance All materials and contents made available to all participants may only be used for professional development in the context of this training course. Not to be copied, handed on or reproduced in any format. All material © 2011 Mc. Cormack Associates, Training. People. Biz, New Ways of Working and Sharpen. Your. Skills. com. Access to these materials implies acceptance of these conditions. Ahh. . Finance - the bit everybody worries about but if you get your financial planning right, then financial management will be much easier. Remember, businesses don't fail because of competition alone, they don't fail be cause they are lousy businesses…. businesses fail because they run out of cash! In this session, we’ll see how important it is to ensure that anyone starting a business has full and total command of all the facts and figures relating to their own specific business project. This command of all the facts only comes about as a result of developing a robust business plan based on well researched facts and a cash flow forecast that reflects the true anticipated costs relating to the business. Establishing these costs is vital to building the financial forecasts which in turn informs the business plan. From our own personal financial experience, we all readily recognise the need to plan and manage our financial affairs and in a business context, the same rules apply and we need to ensure that our planning and management systems are fit for purpose. In this session, we'll cover: Cash Flow Forecasting - Concept and purpose, Building a cash flow forecast, Benefits of financial forecasting, Financial policies and their development, Financial risk assessment Payment systems – benefits and costs On-line payment systems Opening a bank account (our shopping list) Managing multiple currencies Bad debt, avoidance, management and recovery While every effort will be made to run the advertised programme, Monaghan Local Enterprise Office and its contractor reserve the right to amend and vary content and subject matter without notice if circumstances require it.

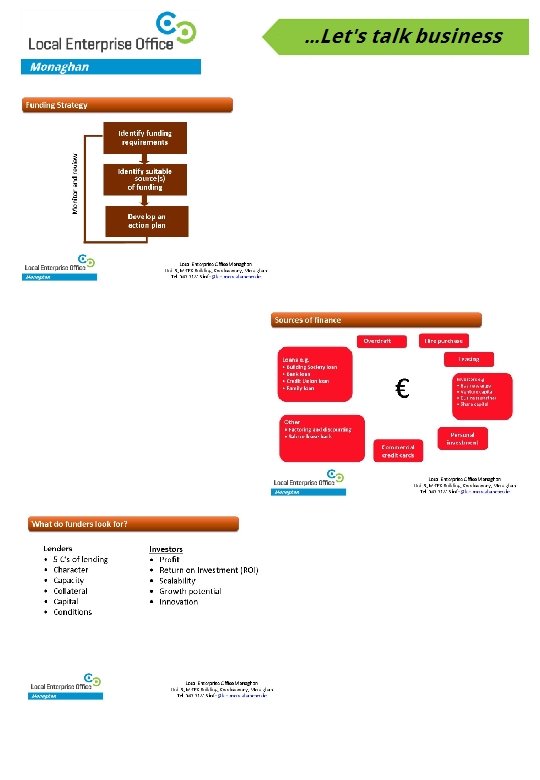

Possible Sources of Business Finance Many owners and would-be entrepreneurs face difficulties as to where they can find a source to finance their business. Here is a list of ways that you might want to consider: 1. Partnership Establish a partnership with company or investors who are willing to put their money in your business. There a two types of partners, the industrial partner and the capital partner. Industrial partners are those who invest their time, skill and effort in the business in exchange for a portion of the income while capital partners invest through contributing cash or property such as machinery to the partnership. In establishing a partnership, your partner may impose a degree of control over your business besides having a portion of your income so make sure to choose a capital partner who has less demands and conditions and who you are comfortable working with. 2. Investors Entice investors into your business. Approach possible investors and present a well formed plan that will convince them to invest. This is somewhat similar to partners. The only difference is that investors can only demand minimum control over the business compared to partners although that will depend on the level of investment. 3. Suppliers Approach suppliers and make propositions. Convince them to give you supplies in a form of loan payable periodically. That way you will have your raw materials without releasing cash before you gain income. 4. Loans Avail of loans. Inquire from banks and financial institutions for possible business loans. However, not all banks support newly opened businesses. They are more inclined to extend loans to businesses that are already operating. For starting businesses you might want to choose other ways of business financing. 5. Credit Cards Get cash advances from credit cards. This is normally used for a quick fix of your troubles but this is not advisable for a long term solution because interest rates on credit cards, can be very punitive. Try to get the introductory rates for lower interests. 6. Lease equipment Lease your equipment. Rather than spending your money to buy new and expensive equipment you might think of leasing them. Leasing generally reduces the amount of money you have to raise. Within the lease period make sure to save enough income to buy your own because leasing is more costly in the long run. 7. Government Help/State Assistance Avail of government programs. Check with the Local Enterprise Office (www. mceb. ie) IDA, FAS to see what is available. 8. Savings Utilise your savings. It is time to use your long time savings for greater purpose. You might be a little hesitant but do not worry because if your business will succeed it will come back to you with twice its value.

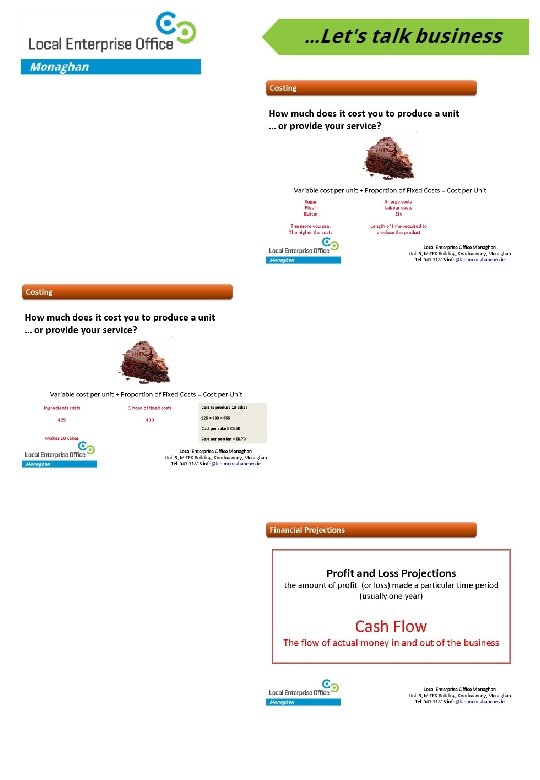

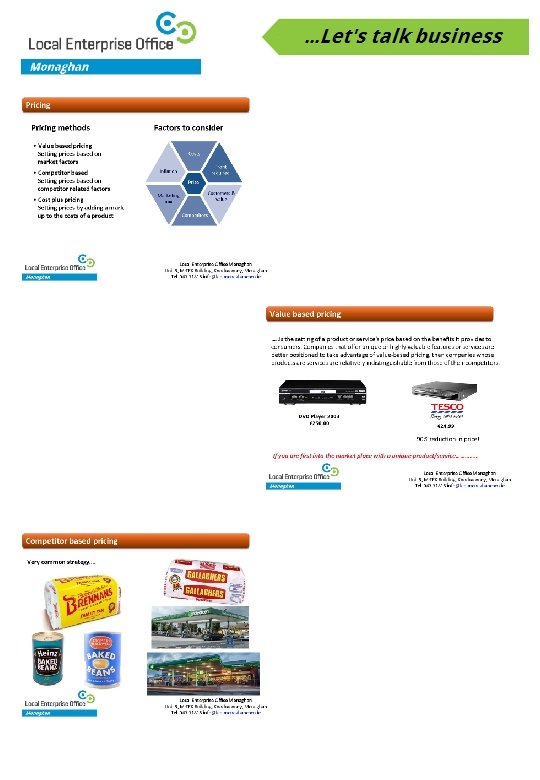

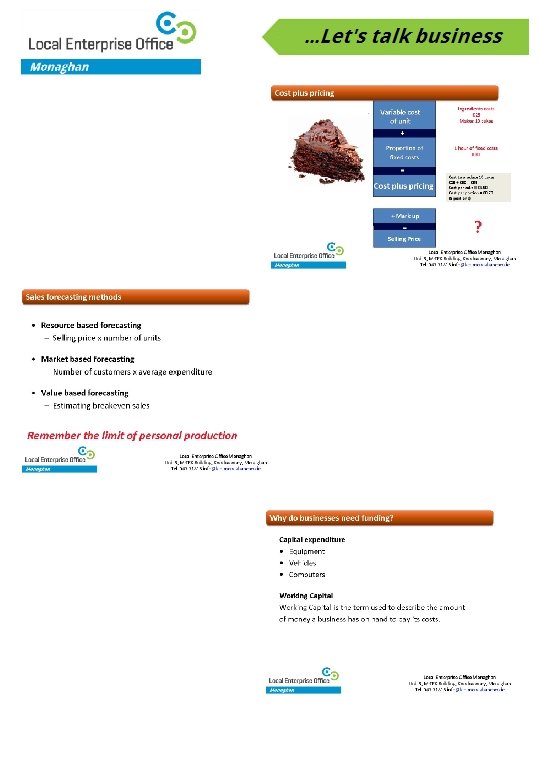

There are many ways to price a product. The four most common strategies are: Premium Pricing. Use a high price where there is a uniqueness about the product or service. This approach is used where a a substantial competitive advantage exists. Such high prices are charge for luxuries such as Cunard Cruises, Savoy Hotel rooms, and business class flights. Pricing Strategies. Penetration Pricing. The price charged for products and services is set artificially low in order to gain market share. Once this is achieved, the price is increased. This approach was used by Sky TV to enter the Irish market. Economy Pricing. This is a no frills low price. The cost of marketing and manufacture are kept at a minimum. Supermarkets often have economy brands for soups, spaghetti, etc. Price Skimming. Charge a high price because you have a substantial competitive advantage. However, the advantage is not sustainable. The high price tends to attract new competitors into the market, and the price inevitably falls due to increased supply. Manufacturers of digital watches used a skimming approach in the 1970 s. Once other manufacturers were tempted into the market and the watches were produced at a lower unit cost, other marketing strategies and pricing approaches are implemented. However there are some other useful pricing strategies in everyday use…. . Psychological Pricing. This approach is used when the marketer wants the consumer to respond on an emotional, rather than rational basis. For example 'price point perspective' 99 cents not one dollar. Product Line Pricing. Where there is a range of product or services the pricing reflect the benefits of parts of the range. For example car washes. Basic wash could be $2, wash and wax $4, and the whole package $6. Optional Product Pricing. Companies will attempt to increase the amount customer spend once they start to buy. Optional 'extras' increase the overall price of the product or service. For example airlines will charge for optional extras such as guaranteeing a window seat or reserving a row of seats next to each other. Captive Product Pricing Where products have complements, companies will charge a premium price where the consumer is captured. For example a razor manufacturer will charge a low price and recoup its margin (and more) from the sale of the only design of blades which fit the razor. Product Bundle Pricing. Here sellers combine several products in the same package. This also serves to move old stock. Videos and CDs are often sold using the bundle approach. Promotional Pricing to promote a product is a very common application. There are many examples of promotional pricing including approaches such as BOGOF (Buy One Get One Free). Geographical Pricing. Geographical pricing is evident where there are variations in price in different parts of the world. For example rarity value, or where shipping costs increase price. Value Pricing. This approach is used where external factors such as recession or increased competition force companies to provide 'value' products and services to retain sales e. g. value meals at Mc. Donalds.

In association with Cash (Flow) Really Is King - Understanding and managing cash flow can make or break your business From Scott Allen, former About. com Guide One of the most important lessons entrepreneurs have to learn, often painfully, is that cash really is king. I'm not talking about paper money -- I'm talking about cash flow. Simply put, it doesn't matter how much money is coming in the future if you don't have enough money to get from here to there. Employees can't wait for pay cheques until your customers pay. Your landlord doesn't care that you're talking to investors and will have the money in a couple of months. Suppliers may not be willing to extend your credit any further and you may not be able to purchase the goods you need in order to deliver to your customer and receive payment. More businesses fail for lack of cash flow than for lack of profit. Why is this? Two main reasons: Business owners are often unrealistic in predicting their cash flow. They tend to overestimate income and underestimate expenses. Business owners fail to anticipate a cash shortage and run out of money, forcing them to suspend or cease operations, even though they have active customers. Let's start by differentiating between profitability and cash flow: Profit is the difference between income and expenses. Income is calculated at the time the sale is booked, rather than when full payment is received. Likewise, expenses are calculated at the time the purchase is made, rather than when you pay the bill. Cash flow is the difference between inflows (actual incoming cash) and outflows (actual outgoing cash). Income is not counted until payment is received and expenses are not calculated until payment is made. Cash flow also includes infusions of working capital from investors or debt financing. Cash flow is often calculated on a monthly basis, since most billing cycles are monthly. Most suppliers will typically allow somewhere close to thirty days to pay. However, in a cash-intensive business with a lot of inventory turnover, such as a restaurant or convenience store, it may be necessary to calculate on a weekly or even daily basis. How to Project Cash Flow Start with the amount of cash on hand - your current bank account balance(s) plus actual currency and coin. Make a list of anticipated inflows - customer payments, collection on bad debts, interest or investment earnings, etc. List not only the amount, but also when it will be coming in. Make a similar list of anticipated outflows - payroll, monthly overhead, and payments on accounts payable or other debt, taxes payable or set aside for future payment, equipment purchases, marketing expenses, etc. Put it all into a spreadsheet in chronological order. If at any point you have negative cash balance, or even a very small one, you have a potential problem.

Getting the Business Plan under way Patrick Sutton I've often been asked by business owners what the most important aspect of a business plan is. My answer sometimes surprises them, when I say it's the journey you take in preparing the plan and not the plan itself. A business plan is a road map for success in the future based on your knowledge at a point in time. For established businesses the plan will be reviewed annually whereas for start up businesses the plan should be reviewed regularly, monthly in early stages and then quarterly. The business plan must be continually updated as the business evolves. A business plan follows a standard format and includes an executive summary, business description including its objectives, goals and strategies, product and service analysis, operational and management team, market strategies, supplier details, competitor analysis, capital required and financial forecasts. While the plan may be shared with third parties to secure funding, it should be principally for the business owners' own use. A business plan will start with a very strong and clear executive summary outlining what the promoter is trying to achieve. This is perhaps the most important element of the plan, as many readers won't make it past the executive summary if it doesn't capture their attention. A business plan guidance sheet has been developed by the four accountancy bodies (CCASI) and the Irish Bankers Federation to help SMEs develop their business plan. This guidance can be found on any of the bank websites. There are many pro forma business plans available online, so you will have no problem identifying the various headings required. Sam Walton, founder of supermarket empire Wal. Mart, once said: "Capital isn't scarce, vision is. " Sam was a humble shopkeeper, but wanted to build an empire. He spent a lot of time thinking and researching and working on his business plan. The time invested in developing the plan for any business is where the foundation for success is created. Vision is what drives the future strategy of the business. Walton's vision was simple: he wanted to stay ahead of the opposition. In the early years, he decided he would meet his employees every Saturday morning at 6 am There, they would review the previous week's results and customer feedback and, based on the results, make decisions for the following week, on products, pricing, promotions, logistics, store layout, starring, reports and so on. Walton said that, while he was making these decisions weekly, his opposition was making them monthly or quarterly His strategy clearly worked. Before you jump in and start writing a business plan, I encourage you to carry out brainstorming sessions. If you are on your own, then borrow family or friends to help. I suggest that, where possible, you work with an experienced commercial accountant or business professional who can facilitate thinking process. This will add value and challenge the initial assumptions. Get a whiteboard and cover it with critical information. A business plan, by its nature, is inherently strategic: typically, you set long term goals of three to five years and set out plans on how you intend to get there. At O'Kelly Sutton, we have a series of questions we ask under a number of headings to help develop the strategic intent, including value proposition, customer segments, customer relationships, channels, key activities, key resources, key partners, cost structures and revenue streams. For example, the value proposition is fundamental to the underlying trust of the plan. It addresses questions such as: what value do we deliver to the customer; which one of our customer's problems are we solving; which customer need are we satisfying; and how will we satisfy the customer need. We recommend that an action or implementation plan be added to the business plan. This will help with setting timelines, allocating resources and responsibilities against the actions required to deliver on the goals and objectives. This gives discipline and rigour to the process. The business plan must be underpinned with robust financial forecasts including projected profit and loss, projected cashflow and projected balance sheets with underlying key assumptions. Many investors will want to see "what if' analysis carried out, to help assess the risk of the project. For example, what if some variables are different than expected, such as sales 10 per cent or 20 per cent lower, gross profit percentage 10 per cent or 20 per cent lower, overheads 10 per cent or 20 per cent higher, credit terms turning out to be 30 days longer than expected, and so on? The investor will want to see what level of wriggle room is available for slippage and leakage. Too many plans are built on a knife edge where, if some element doesn't work out according to plan, there's a massive problem from a cashflow point of view. In addition, the assumptions used to prepare the financials should stand up to cross examination. In conclusion, we recommend that you embrace the exercise with lots of enthusiasm, and use it to get your thinking clear. Patrick Sutton of O'Kelly Sutton Chartered Accountants and Business Advisers, Co Kildare, sutton@okellysutton. ie This article was first published in a "Start Your Own Business" supplement to the Sunday Business Post 13 th April 2014 All content remains the copyright of the authors and original publisher. This content is intended for personal and reference use only in the context of personal and/or professional self development programme.

658213047e6818b4ed4edeee18242a38.ppt