4b010afcc7791afdafe384dfa759a087.ppt

- Количество слайдов: 22

Stanford Annual Conference on Indian Economic Policy Reforms Presentation on Regulating the Financial Sector U. K. Sinha Chairman, Securities and Exchange Board of India June 03, 2016

Stanford Annual Conference on Indian Economic Policy Reforms Presentation on Regulating the Financial Sector U. K. Sinha Chairman, Securities and Exchange Board of India June 03, 2016

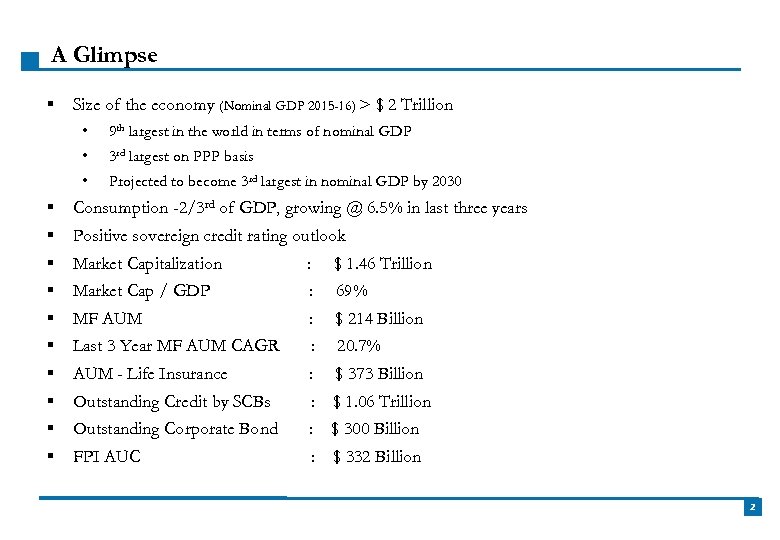

A Glimpse § Size of the economy (Nominal GDP 2015 -16) > $ 2 Trillion • • 3 rd largest on PPP basis • § § § § § 9 th largest in the world in terms of nominal GDP Projected to become 3 rd largest in nominal GDP by 2030 Consumption -2/3 rd of GDP, growing @ 6. 5% in last three years Positive sovereign credit rating outlook Market Capitalization : $ 1. 46 Trillion Market Cap / GDP : 69% MF AUM : $ 214 Billion Last 3 Year MF AUM CAGR : 20. 7% AUM - Life Insurance : $ 373 Billion Outstanding Credit by SCBs : $ 1. 06 Trillion Outstanding Corporate Bond : $ 300 Billion FPI AUC : $ 332 Billion 2

A Glimpse § Size of the economy (Nominal GDP 2015 -16) > $ 2 Trillion • • 3 rd largest on PPP basis • § § § § § 9 th largest in the world in terms of nominal GDP Projected to become 3 rd largest in nominal GDP by 2030 Consumption -2/3 rd of GDP, growing @ 6. 5% in last three years Positive sovereign credit rating outlook Market Capitalization : $ 1. 46 Trillion Market Cap / GDP : 69% MF AUM : $ 214 Billion Last 3 Year MF AUM CAGR : 20. 7% AUM - Life Insurance : $ 373 Billion Outstanding Credit by SCBs : $ 1. 06 Trillion Outstanding Corporate Bond : $ 300 Billion FPI AUC : $ 332 Billion 2

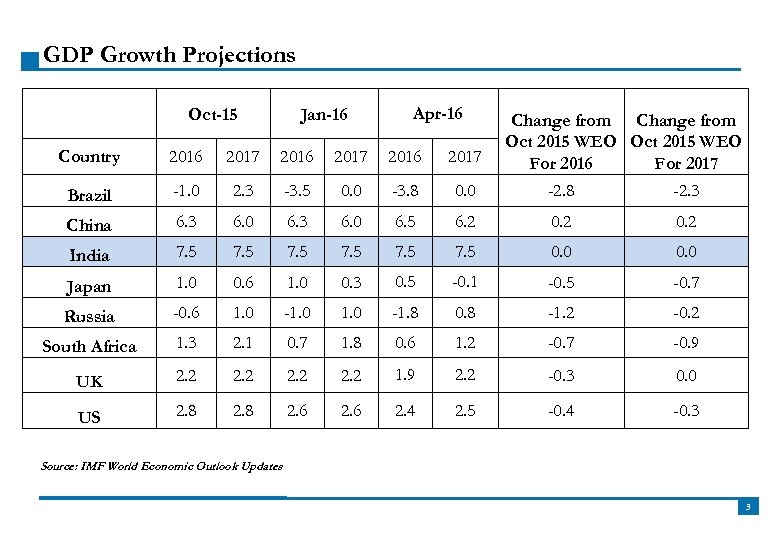

GDP Growth Projections Oct-15 Jan-16 Apr-16 Change from Oct 2015 WEO For 2016 For 2017 Country 2016 2017 Brazil -1. 0 2. 3 -3. 5 0. 0 -3. 8 0. 0 -2. 8 -2. 3 China 6. 3 6. 0 6. 5 6. 2 0. 2 India 7. 5 7. 5 0. 0 Japan 1. 0 0. 6 1. 0 0. 3 0. 5 -0. 1 -0. 5 -0. 7 Russia -0. 6 1. 0 -1. 8 0. 8 -1. 2 -0. 2 South Africa 1. 3 2. 1 0. 7 1. 8 0. 6 1. 2 -0. 7 -0. 9 UK 2. 2 1. 9 2. 2 -0. 3 0. 0 US 2. 8 2. 6 2. 4 2. 5 -0. 4 -0. 3 Source: IMF World Economic Outlook Updates 3

GDP Growth Projections Oct-15 Jan-16 Apr-16 Change from Oct 2015 WEO For 2016 For 2017 Country 2016 2017 Brazil -1. 0 2. 3 -3. 5 0. 0 -3. 8 0. 0 -2. 8 -2. 3 China 6. 3 6. 0 6. 5 6. 2 0. 2 India 7. 5 7. 5 0. 0 Japan 1. 0 0. 6 1. 0 0. 3 0. 5 -0. 1 -0. 5 -0. 7 Russia -0. 6 1. 0 -1. 8 0. 8 -1. 2 -0. 2 South Africa 1. 3 2. 1 0. 7 1. 8 0. 6 1. 2 -0. 7 -0. 9 UK 2. 2 1. 9 2. 2 -0. 3 0. 0 US 2. 8 2. 6 2. 4 2. 5 -0. 4 -0. 3 Source: IMF World Economic Outlook Updates 3

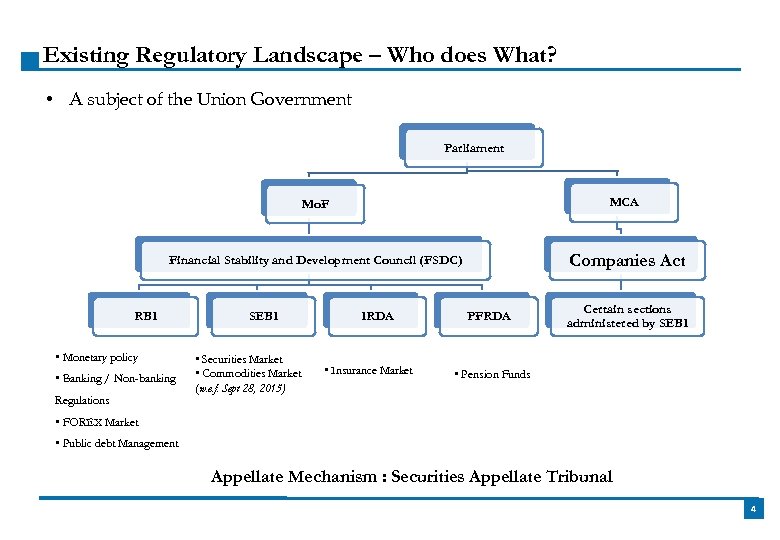

Existing Regulatory Landscape – Who does What? • A subject of the Union Government Parliament Mo. F MCA Financial Stability and Development Council (FSDC) Companies Act RBI • Monetary policy • Banking / Non-banking Regulations SEBI • Securities Market • Commodities Market (w. e. f. Sept 28, 2015) IRDA • Insurance Market PFRDA Certain sections administered by SEBI • Pension Funds • FOREX Market • Public debt Management Appellate Mechanism : Securities Appellate Tribunal 4

Existing Regulatory Landscape – Who does What? • A subject of the Union Government Parliament Mo. F MCA Financial Stability and Development Council (FSDC) Companies Act RBI • Monetary policy • Banking / Non-banking Regulations SEBI • Securities Market • Commodities Market (w. e. f. Sept 28, 2015) IRDA • Insurance Market PFRDA Certain sections administered by SEBI • Pension Funds • FOREX Market • Public debt Management Appellate Mechanism : Securities Appellate Tribunal 4

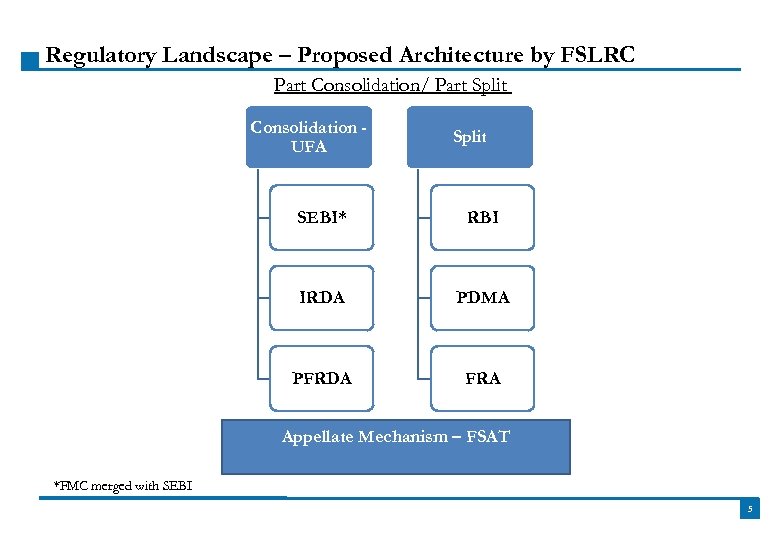

Regulatory Landscape – Proposed Architecture by FSLRC Part Consolidation/ Part Split Consolidation UFA Split SEBI* RBI IRDA PDMA PFRDA FRA Appellate Mechanism – FSAT *FMC merged with SEBI 5

Regulatory Landscape – Proposed Architecture by FSLRC Part Consolidation/ Part Split Consolidation UFA Split SEBI* RBI IRDA PDMA PFRDA FRA Appellate Mechanism – FSAT *FMC merged with SEBI 5

FSDC Mechanism Set up by the Government as the apex level forum in December 2010 with the objective of- • Strengthening and institutionalizing the mechanism for maintaining financial stability • Enhancing inter-regulatory coordination and promoting financial sector development • Monitors macro prudential supervision of the economy, including functioning of large financial conglomerates • Guides financial literacy and financial inclusion initiatives • Coordinating lndia's international interface with FATF, FSB • Headed by Finance Minister, Sub Committee headed by RBI Governor • All regulators are members 6

FSDC Mechanism Set up by the Government as the apex level forum in December 2010 with the objective of- • Strengthening and institutionalizing the mechanism for maintaining financial stability • Enhancing inter-regulatory coordination and promoting financial sector development • Monitors macro prudential supervision of the economy, including functioning of large financial conglomerates • Guides financial literacy and financial inclusion initiatives • Coordinating lndia's international interface with FATF, FSB • Headed by Finance Minister, Sub Committee headed by RBI Governor • All regulators are members 6

Indian Securities Market – Global Standing § Among the top 10 countries in terms of market capitalisation § No. of Equity Trades: NSE-Rank 4 and BSE-Rank 11 § NSE Ranks 1 or 2 in no. of equity derivatives/ currency futures trades § India, a favoured destination for FIIs § SEBI, a Board member of International Organization of Securities Commission (IOSCO) and Member of Financial Stability Board (FSB) § SEBI actively engaged in global standard setting through representations in important IOSCO policy committees § Global standards guide SEBI regulation § FSAP 2012 by WB-IMF: Fully/ Broadly compliant in 22 of 28 principles § IOSCO-BIS Level 1 Assessment of Implementation of FMI Principles : India 1 out of 6 jurisdictions globally with highest ratings on all eight parameters 7

Indian Securities Market – Global Standing § Among the top 10 countries in terms of market capitalisation § No. of Equity Trades: NSE-Rank 4 and BSE-Rank 11 § NSE Ranks 1 or 2 in no. of equity derivatives/ currency futures trades § India, a favoured destination for FIIs § SEBI, a Board member of International Organization of Securities Commission (IOSCO) and Member of Financial Stability Board (FSB) § SEBI actively engaged in global standard setting through representations in important IOSCO policy committees § Global standards guide SEBI regulation § FSAP 2012 by WB-IMF: Fully/ Broadly compliant in 22 of 28 principles § IOSCO-BIS Level 1 Assessment of Implementation of FMI Principles : India 1 out of 6 jurisdictions globally with highest ratings on all eight parameters 7

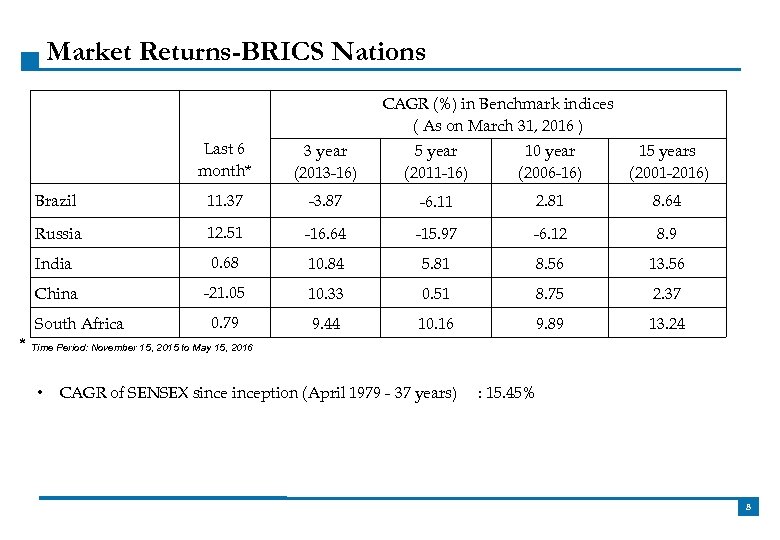

Market Returns-BRICS Nations CAGR (%) in Benchmark indices ( As on March 31, 2016 ) Last 6 month* 3 year (2013 -16) 5 year (2011 -16) 10 year (2006 -16) 15 years (2001 -2016) Brazil 11. 37 -3. 87 -6. 11 2. 81 8. 64 Russia 12. 51 -16. 64 -15. 97 -6. 12 8. 9 India 0. 68 10. 84 5. 81 8. 56 13. 56 China -21. 05 10. 33 0. 51 8. 75 2. 37 0. 79 9. 44 10. 16 9. 89 13. 24 South Africa * Time Period: November 15, 2015 to May 15, 2016 • CAGR of SENSEX sinception (April 1979 - 37 years) : 15. 45% 8

Market Returns-BRICS Nations CAGR (%) in Benchmark indices ( As on March 31, 2016 ) Last 6 month* 3 year (2013 -16) 5 year (2011 -16) 10 year (2006 -16) 15 years (2001 -2016) Brazil 11. 37 -3. 87 -6. 11 2. 81 8. 64 Russia 12. 51 -16. 64 -15. 97 -6. 12 8. 9 India 0. 68 10. 84 5. 81 8. 56 13. 56 China -21. 05 10. 33 0. 51 8. 75 2. 37 0. 79 9. 44 10. 16 9. 89 13. 24 South Africa * Time Period: November 15, 2015 to May 15, 2016 • CAGR of SENSEX sinception (April 1979 - 37 years) : 15. 45% 8

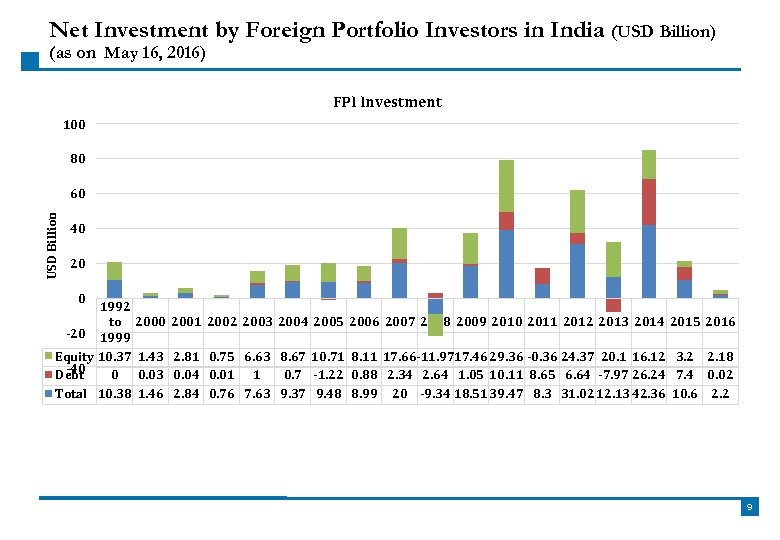

Net Investment by Foreign Portfolio Investors in India (USD Billion) (as on May 16, 2016) FPI Investment 100 80 USD Billion 60 40 20 0 1992 to 2000 -20 1999 Equity 10. 37 1. 43 -40 Debt 0 0. 03 Total 10. 38 1. 46 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2. 81 0. 75 6. 63 8. 67 10. 71 8. 11 17. 66 -11. 9717. 46 29. 36 -0. 36 24. 37 20. 1 16. 12 3. 2 2. 18 0. 04 0. 01 1 0. 7 -1. 22 0. 88 2. 34 2. 64 1. 05 10. 11 8. 65 6. 64 -7. 97 26. 24 7. 4 0. 02 2. 84 0. 76 7. 63 9. 37 9. 48 8. 99 20 -9. 34 18. 51 39. 47 8. 3 31. 02 12. 13 42. 36 10. 6 2. 2 9

Net Investment by Foreign Portfolio Investors in India (USD Billion) (as on May 16, 2016) FPI Investment 100 80 USD Billion 60 40 20 0 1992 to 2000 -20 1999 Equity 10. 37 1. 43 -40 Debt 0 0. 03 Total 10. 38 1. 46 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2. 81 0. 75 6. 63 8. 67 10. 71 8. 11 17. 66 -11. 9717. 46 29. 36 -0. 36 24. 37 20. 1 16. 12 3. 2 2. 18 0. 04 0. 01 1 0. 7 -1. 22 0. 88 2. 34 2. 64 1. 05 10. 11 8. 65 6. 64 -7. 97 26. 24 7. 4 0. 02 2. 84 0. 76 7. 63 9. 37 9. 48 8. 99 20 -9. 34 18. 51 39. 47 8. 3 31. 02 12. 13 42. 36 10. 6 2. 2 9

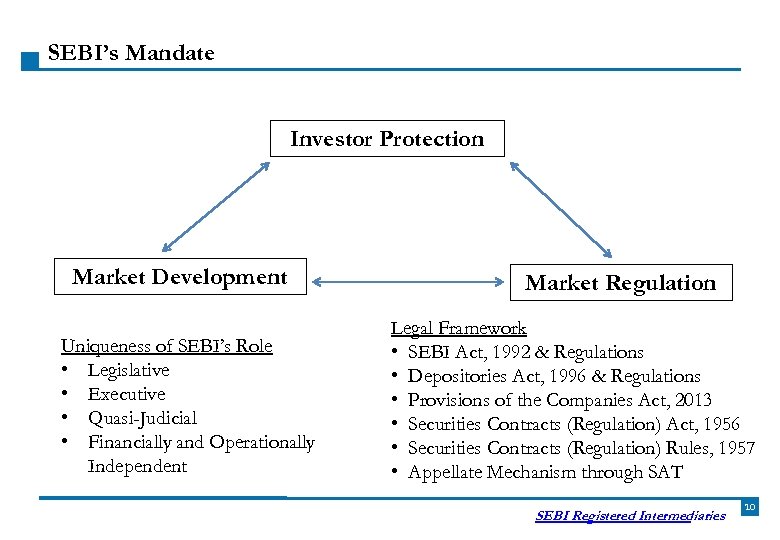

SEBI’s Mandate Investor Protection Market Development Uniqueness of SEBI’s Role • Legislative • Executive • Quasi-Judicial • Financially and Operationally Independent Market Regulation Legal Framework • SEBI Act, 1992 & Regulations • Depositories Act, 1996 & Regulations • Provisions of the Companies Act, 2013 • Securities Contracts (Regulation) Act, 1956 • Securities Contracts (Regulation) Rules, 1957 • Appellate Mechanism through SAT SEBI Registered Intermediaries 10

SEBI’s Mandate Investor Protection Market Development Uniqueness of SEBI’s Role • Legislative • Executive • Quasi-Judicial • Financially and Operationally Independent Market Regulation Legal Framework • SEBI Act, 1992 & Regulations • Depositories Act, 1996 & Regulations • Provisions of the Companies Act, 2013 • Securities Contracts (Regulation) Act, 1956 • Securities Contracts (Regulation) Rules, 1957 • Appellate Mechanism through SAT SEBI Registered Intermediaries 10

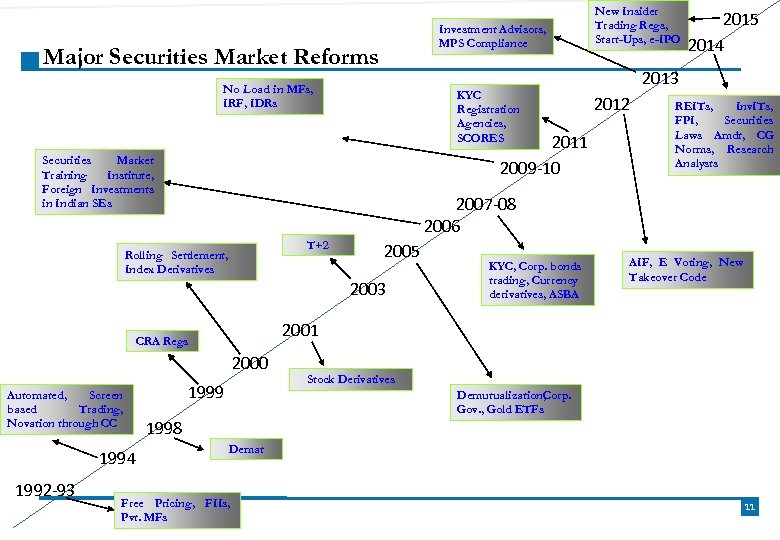

Investment Advisors, MPS Compliance Major Securities Market Reforms No Load in MFs, IRF, IDRs KYC Registration Agencies, SCORES 2011 2009 -10 Securities Market Training Institute, Foreign Investments in Indian SEs T+2 2005 2003 2000 1992 -93 2012 REITs, Inv. ITs, FPI, Securities Laws Amdt, CG Norms, Research Analysts KYC, Corp. bonds trading, Currency derivatives, ASBA AIF, E Voting, New Takeover Code 2001 CRA Regs 1994 2015 2014 2007 -08 2006 Rolling Settlement, Index Derivatives Automated, Screen based Trading, Novation through CC New Insider Trading Regs, Start-Ups, e-IPO 1999 Stock Derivatives Demutualization, Corp. Gov. , Gold ETFs 1998 Demat Free Pricing, FIIs, Pvt. MFs 11

Investment Advisors, MPS Compliance Major Securities Market Reforms No Load in MFs, IRF, IDRs KYC Registration Agencies, SCORES 2011 2009 -10 Securities Market Training Institute, Foreign Investments in Indian SEs T+2 2005 2003 2000 1992 -93 2012 REITs, Inv. ITs, FPI, Securities Laws Amdt, CG Norms, Research Analysts KYC, Corp. bonds trading, Currency derivatives, ASBA AIF, E Voting, New Takeover Code 2001 CRA Regs 1994 2015 2014 2007 -08 2006 Rolling Settlement, Index Derivatives Automated, Screen based Trading, Novation through CC New Insider Trading Regs, Start-Ups, e-IPO 1999 Stock Derivatives Demutualization, Corp. Gov. , Gold ETFs 1998 Demat Free Pricing, FIIs, Pvt. MFs 11

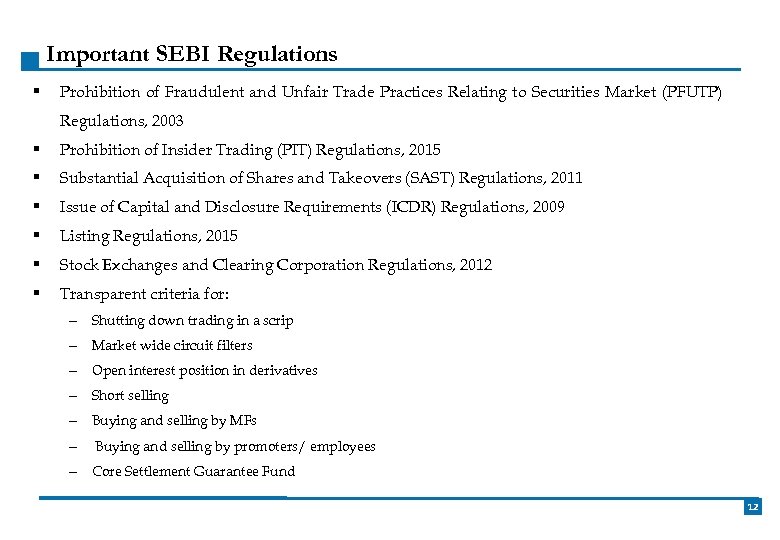

Important SEBI Regulations § Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market (PFUTP) Regulations, 2003 § Prohibition of Insider Trading (PIT) Regulations, 2015 § Substantial Acquisition of Shares and Takeovers (SAST) Regulations, 2011 § Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2009 § Listing Regulations, 2015 § Stock Exchanges and Clearing Corporation Regulations, 2012 § Transparent criteria for: – Shutting down trading in a scrip – Market wide circuit filters – Open interest position in derivatives – Short selling – Buying and selling by MFs – Buying and selling by promoters/ employees – Core Settlement Guarantee Fund 12

Important SEBI Regulations § Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market (PFUTP) Regulations, 2003 § Prohibition of Insider Trading (PIT) Regulations, 2015 § Substantial Acquisition of Shares and Takeovers (SAST) Regulations, 2011 § Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2009 § Listing Regulations, 2015 § Stock Exchanges and Clearing Corporation Regulations, 2012 § Transparent criteria for: – Shutting down trading in a scrip – Market wide circuit filters – Open interest position in derivatives – Short selling – Buying and selling by MFs – Buying and selling by promoters/ employees – Core Settlement Guarantee Fund 12

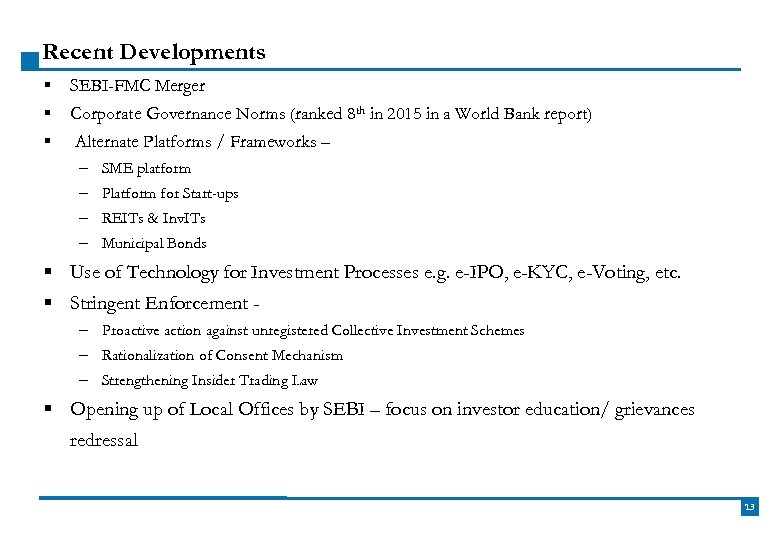

Recent Developments § SEBI-FMC Merger § Corporate Governance Norms (ranked 8 th in 2015 in a World Bank report) § Alternate Platforms / Frameworks – – SME platform – Platform for Start-ups – REITs & Inv. ITs – Municipal Bonds § Use of Technology for Investment Processes e. g. e-IPO, e-KYC, e-Voting, etc. § Stringent Enforcement – Proactive action against unregistered Collective Investment Schemes – Rationalization of Consent Mechanism – Strengthening Insider Trading Law § Opening up of Local Offices by SEBI – focus on investor education/ grievances redressal 13

Recent Developments § SEBI-FMC Merger § Corporate Governance Norms (ranked 8 th in 2015 in a World Bank report) § Alternate Platforms / Frameworks – – SME platform – Platform for Start-ups – REITs & Inv. ITs – Municipal Bonds § Use of Technology for Investment Processes e. g. e-IPO, e-KYC, e-Voting, etc. § Stringent Enforcement – Proactive action against unregistered Collective Investment Schemes – Rationalization of Consent Mechanism – Strengthening Insider Trading Law § Opening up of Local Offices by SEBI – focus on investor education/ grievances redressal 13

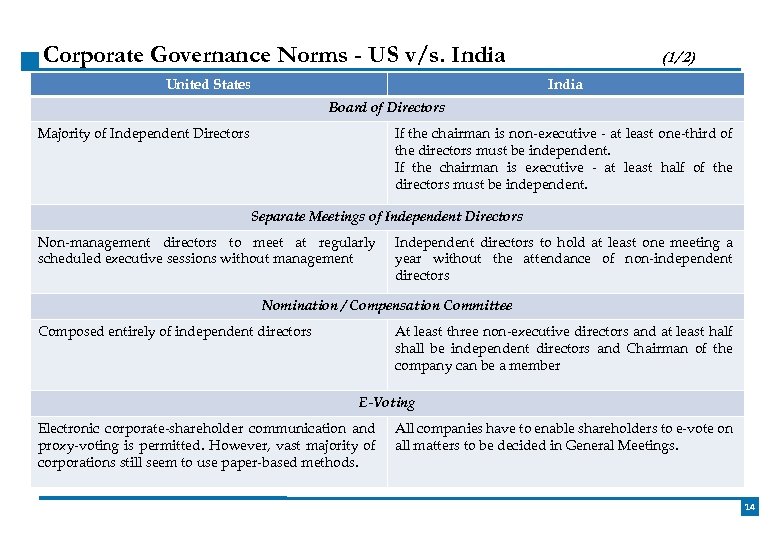

Corporate Governance Norms - US v/s. India United States (1/2) India Board of Directors Majority of Independent Directors If the chairman is non-executive - at least one-third of the directors must be independent. If the chairman is executive - at least half of the directors must be independent. Separate Meetings of Independent Directors Non-management directors to meet at regularly scheduled executive sessions without management Independent directors to hold at least one meeting a year without the attendance of non-independent directors Nomination / Compensation Committee Composed entirely of independent directors At least three non-executive directors and at least half shall be independent directors and Chairman of the company can be a member E-Voting Electronic corporate-shareholder communication and proxy-voting is permitted. However, vast majority of corporations still seem to use paper-based methods. All companies have to enable shareholders to e-vote on all matters to be decided in General Meetings. 14

Corporate Governance Norms - US v/s. India United States (1/2) India Board of Directors Majority of Independent Directors If the chairman is non-executive - at least one-third of the directors must be independent. If the chairman is executive - at least half of the directors must be independent. Separate Meetings of Independent Directors Non-management directors to meet at regularly scheduled executive sessions without management Independent directors to hold at least one meeting a year without the attendance of non-independent directors Nomination / Compensation Committee Composed entirely of independent directors At least three non-executive directors and at least half shall be independent directors and Chairman of the company can be a member E-Voting Electronic corporate-shareholder communication and proxy-voting is permitted. However, vast majority of corporations still seem to use paper-based methods. All companies have to enable shareholders to e-vote on all matters to be decided in General Meetings. 14

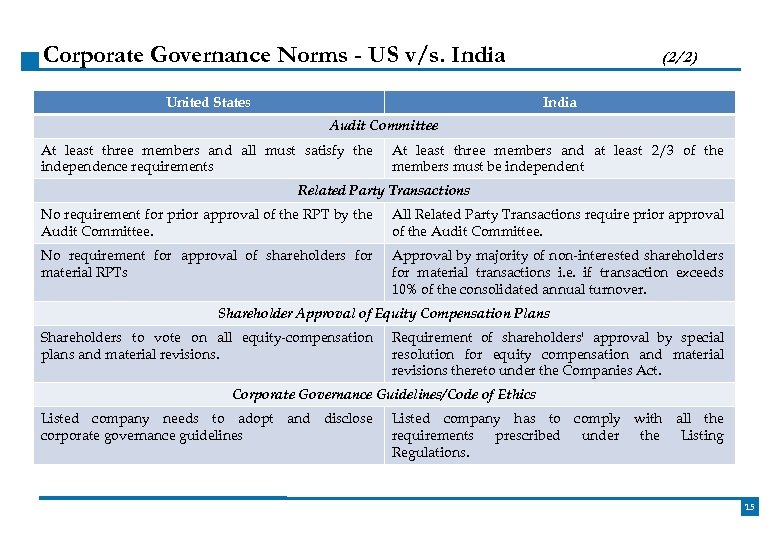

Corporate Governance Norms - US v/s. India United States (2/2) India Audit Committee At least three members and all must satisfy the independence requirements At least three members and at least 2/3 of the members must be independent Related Party Transactions No requirement for prior approval of the RPT by the Audit Committee. All Related Party Transactions require prior approval of the Audit Committee. No requirement for approval of shareholders for material RPTs Approval by majority of non-interested shareholders for material transactions i. e. if transaction exceeds 10% of the consolidated annual turnover. Shareholder Approval of Equity Compensation Plans Shareholders to vote on all equity-compensation plans and material revisions. Requirement of shareholders' approval by special resolution for equity compensation and material revisions thereto under the Companies Act. Corporate Governance Guidelines/Code of Ethics Listed company needs to adopt and disclose corporate governance guidelines Listed company has to comply with all the requirements prescribed under the Listing Regulations. 15

Corporate Governance Norms - US v/s. India United States (2/2) India Audit Committee At least three members and all must satisfy the independence requirements At least three members and at least 2/3 of the members must be independent Related Party Transactions No requirement for prior approval of the RPT by the Audit Committee. All Related Party Transactions require prior approval of the Audit Committee. No requirement for approval of shareholders for material RPTs Approval by majority of non-interested shareholders for material transactions i. e. if transaction exceeds 10% of the consolidated annual turnover. Shareholder Approval of Equity Compensation Plans Shareholders to vote on all equity-compensation plans and material revisions. Requirement of shareholders' approval by special resolution for equity compensation and material revisions thereto under the Companies Act. Corporate Governance Guidelines/Code of Ethics Listed company needs to adopt and disclose corporate governance guidelines Listed company has to comply with all the requirements prescribed under the Listing Regulations. 15

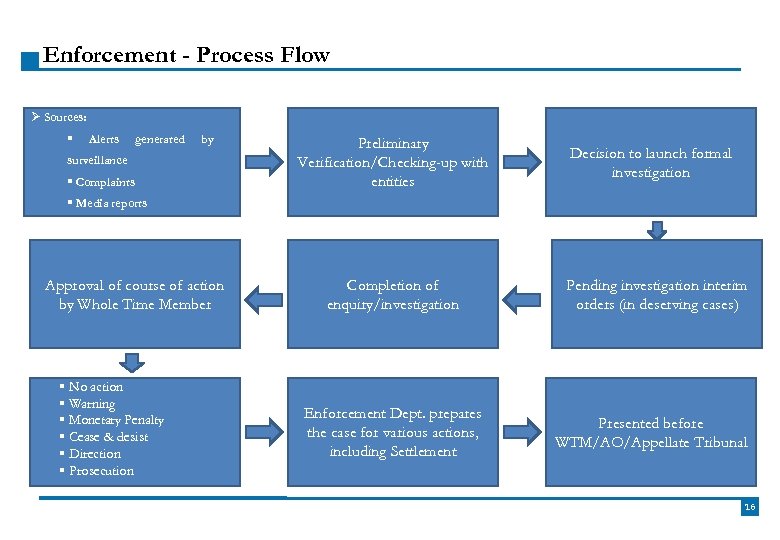

Enforcement - Process Flow Ø Sources: § Alerts generated by surveillance § Complaints Preliminary Verification/Checking-up with entities Decision to launch formal investigation § Media reports Approval of course of action by Whole Time Member § No action § Warning § Monetary Penalty § Cease & desist § Direction § Prosecution Completion of enquiry/investigation Enforcement Dept. prepares the case for various actions, including Settlement Pending investigation interim orders (in deserving cases) Presented before WTM/AO/Appellate Tribunal 16

Enforcement - Process Flow Ø Sources: § Alerts generated by surveillance § Complaints Preliminary Verification/Checking-up with entities Decision to launch formal investigation § Media reports Approval of course of action by Whole Time Member § No action § Warning § Monetary Penalty § Cease & desist § Direction § Prosecution Completion of enquiry/investigation Enforcement Dept. prepares the case for various actions, including Settlement Pending investigation interim orders (in deserving cases) Presented before WTM/AO/Appellate Tribunal 16

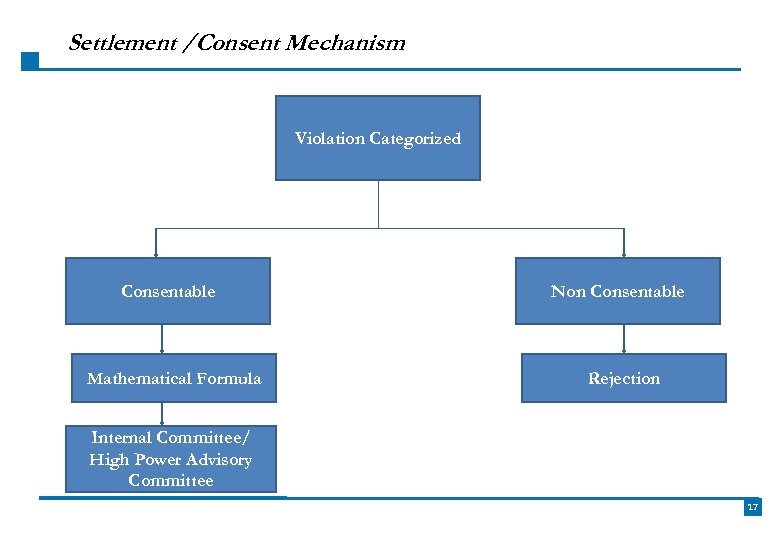

Settlement /Consent Mechanism Violation Categorized Consentable Mathematical Formula Non Consentable Rejection Internal Committee/ High Power Advisory Committee 17

Settlement /Consent Mechanism Violation Categorized Consentable Mathematical Formula Non Consentable Rejection Internal Committee/ High Power Advisory Committee 17

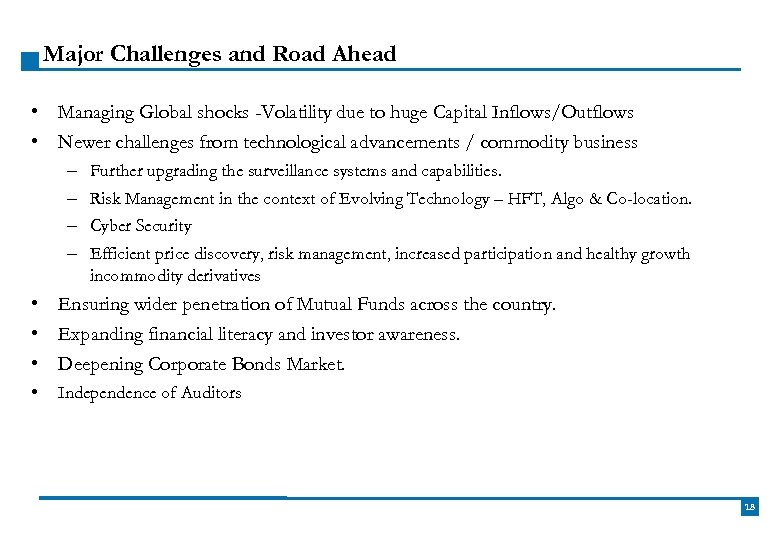

Major Challenges and Road Ahead • Managing Global shocks -Volatility due to huge Capital Inflows/Outflows • Newer challenges from technological advancements / commodity business – – Further upgrading the surveillance systems and capabilities. Risk Management in the context of Evolving Technology – HFT, Algo & Co-location. Cyber Security Efficient price discovery, risk management, increased participation and healthy growth incommodity derivatives • Ensuring wider penetration of Mutual Funds across the country. • Expanding financial literacy and investor awareness. • Deepening Corporate Bonds Market. • Independence of Auditors 18

Major Challenges and Road Ahead • Managing Global shocks -Volatility due to huge Capital Inflows/Outflows • Newer challenges from technological advancements / commodity business – – Further upgrading the surveillance systems and capabilities. Risk Management in the context of Evolving Technology – HFT, Algo & Co-location. Cyber Security Efficient price discovery, risk management, increased participation and healthy growth incommodity derivatives • Ensuring wider penetration of Mutual Funds across the country. • Expanding financial literacy and investor awareness. • Deepening Corporate Bonds Market. • Independence of Auditors 18

19

19

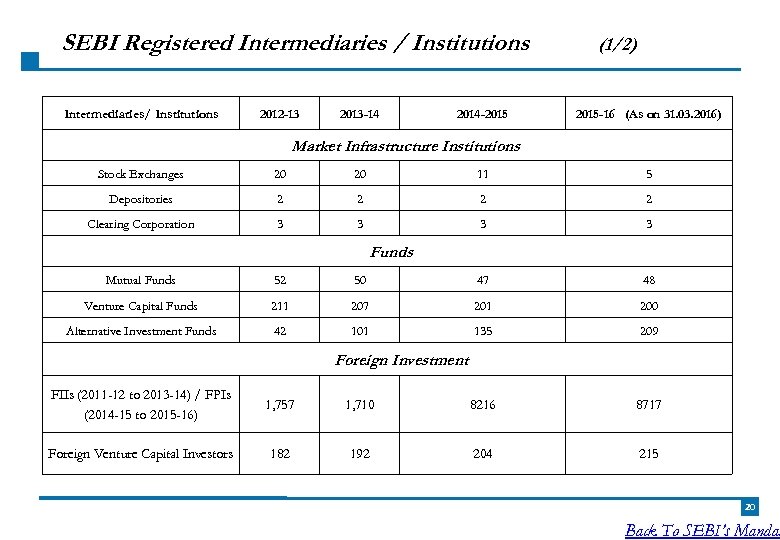

SEBI Registered Intermediaries / Institutions Intermediaries/ Institutions 2012 -13 2013 -14 2014 -2015 (1/2) 2015 -16 (As on 31. 03. 2016) Market Infrastructure Institutions Stock Exchanges 20 20 11 5 Depositories 2 2 Clearing Corporation 3 3 Funds Mutual Funds 52 50 47 48 Venture Capital Funds 211 207 201 200 Alternative Investment Funds 42 101 135 209 Foreign Investment FIIs (2011 -12 to 2013 -14) / FPIs (2014 -15 to 2015 -16) 1, 757 1, 710 8216 8717 Foreign Venture Capital Investors 182 192 204 215 20 Back To SEBI’s Mandat

SEBI Registered Intermediaries / Institutions Intermediaries/ Institutions 2012 -13 2013 -14 2014 -2015 (1/2) 2015 -16 (As on 31. 03. 2016) Market Infrastructure Institutions Stock Exchanges 20 20 11 5 Depositories 2 2 Clearing Corporation 3 3 Funds Mutual Funds 52 50 47 48 Venture Capital Funds 211 207 201 200 Alternative Investment Funds 42 101 135 209 Foreign Investment FIIs (2011 -12 to 2013 -14) / FPIs (2014 -15 to 2015 -16) 1, 757 1, 710 8216 8717 Foreign Venture Capital Investors 182 192 204 215 20 Back To SEBI’s Mandat

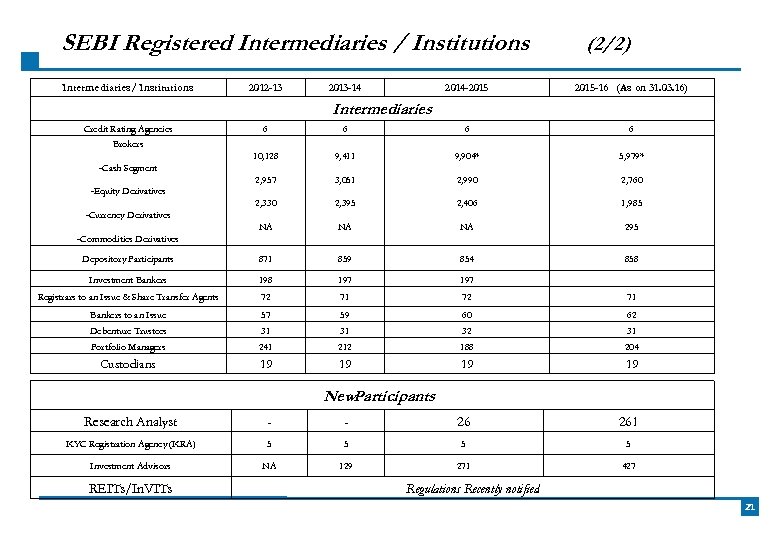

SEBI Registered Intermediaries / Institutions Intermediaries/ Institutions 2012 -13 2013 -14 (2/2) 2014 -2015 -16 (As on 31. 03. 16) Intermediaries Credit Rating Agencies 6 6 10, 128 9, 411 9, 904* 5, 979* 2, 957 3, 051 2, 990 2, 760 2, 330 2, 395 2, 406 1, 985 NA NA NA 295 Depository Participants 871 859 854 858 Investment Bankers 198 197 Registrars to an Issue & Share Transfer Agents 72 71 Bankers to an Issue 57 59 60 62 Debenture Trustees 31 31 32 31 Portfolio Managers 241 212 188 204 Custodians 19 19 Brokers -Cash Segment -Equity Derivatives -Currency Derivatives -Commodities Derivatives New. Participants Research Analyst - - 26 261 KYC Registration Agency (KRA) 5 5 Investment Advisors NA 129 271 427 REITs/In. VITs Regulations Recently notified 21

SEBI Registered Intermediaries / Institutions Intermediaries/ Institutions 2012 -13 2013 -14 (2/2) 2014 -2015 -16 (As on 31. 03. 16) Intermediaries Credit Rating Agencies 6 6 10, 128 9, 411 9, 904* 5, 979* 2, 957 3, 051 2, 990 2, 760 2, 330 2, 395 2, 406 1, 985 NA NA NA 295 Depository Participants 871 859 854 858 Investment Bankers 198 197 Registrars to an Issue & Share Transfer Agents 72 71 Bankers to an Issue 57 59 60 62 Debenture Trustees 31 31 32 31 Portfolio Managers 241 212 188 204 Custodians 19 19 Brokers -Cash Segment -Equity Derivatives -Currency Derivatives -Commodities Derivatives New. Participants Research Analyst - - 26 261 KYC Registration Agency (KRA) 5 5 Investment Advisors NA 129 271 427 REITs/In. VITs Regulations Recently notified 21

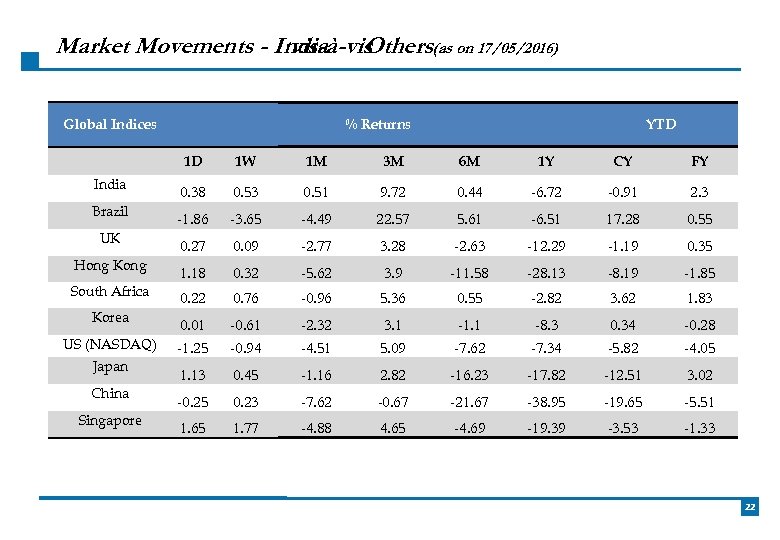

Market Movements - India Others(as on 17/05/2016) vis-à-vis Global Indices India Brazil UK Hong Kong South Africa Korea US (NASDAQ) Japan China Singapore % Returns YTD 1 D 1 W 1 M 3 M 6 M 1 Y CY FY 0. 38 0. 53 0. 51 9. 72 0. 44 -6. 72 -0. 91 2. 3 -1. 86 -3. 65 -4. 49 22. 57 5. 61 -6. 51 17. 28 0. 55 0. 27 0. 09 -2. 77 3. 28 -2. 63 -12. 29 -1. 19 0. 35 1. 18 0. 32 -5. 62 3. 9 -11. 58 -28. 13 -8. 19 -1. 85 0. 22 0. 76 -0. 96 5. 36 0. 55 -2. 82 3. 62 1. 83 0. 01 -1. 25 -0. 61 -0. 94 -2. 32 -4. 51 3. 1 5. 09 -1. 1 -7. 62 -8. 3 -7. 34 0. 34 -5. 82 -0. 28 -4. 05 1. 13 0. 45 -1. 16 2. 82 -16. 23 -17. 82 -12. 51 3. 02 -0. 25 0. 23 -7. 62 -0. 67 -21. 67 -38. 95 -19. 65 -5. 51 1. 65 1. 77 -4. 88 4. 65 -4. 69 -19. 39 -3. 53 -1. 33 22

Market Movements - India Others(as on 17/05/2016) vis-à-vis Global Indices India Brazil UK Hong Kong South Africa Korea US (NASDAQ) Japan China Singapore % Returns YTD 1 D 1 W 1 M 3 M 6 M 1 Y CY FY 0. 38 0. 53 0. 51 9. 72 0. 44 -6. 72 -0. 91 2. 3 -1. 86 -3. 65 -4. 49 22. 57 5. 61 -6. 51 17. 28 0. 55 0. 27 0. 09 -2. 77 3. 28 -2. 63 -12. 29 -1. 19 0. 35 1. 18 0. 32 -5. 62 3. 9 -11. 58 -28. 13 -8. 19 -1. 85 0. 22 0. 76 -0. 96 5. 36 0. 55 -2. 82 3. 62 1. 83 0. 01 -1. 25 -0. 61 -0. 94 -2. 32 -4. 51 3. 1 5. 09 -1. 1 -7. 62 -8. 3 -7. 34 0. 34 -5. 82 -0. 28 -4. 05 1. 13 0. 45 -1. 16 2. 82 -16. 23 -17. 82 -12. 51 3. 02 -0. 25 0. 23 -7. 62 -0. 67 -21. 67 -38. 95 -19. 65 -5. 51 1. 65 1. 77 -4. 88 4. 65 -4. 69 -19. 39 -3. 53 -1. 33 22