Standard & Poors (1).pptx

- Количество слайдов: 21

Standard & Poor’s st Prepared by 1 group F 1002

Standard & Poor's (S&P) is an American financial services company. It is a division of The Mc. Graw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock market indices, the U. S. -based S&P 500, the Australian S&P/ASX 200, the Canadian S&P/TSX, the Italian S&P/MIB and India's S&P CNX Nifty. The company is one of the Big Three credit-rating agencies, which also include Moody's Investor Service and Fitch Ratings. Its head office is located on 55 Water Street in Lower Manhattan, New York City.

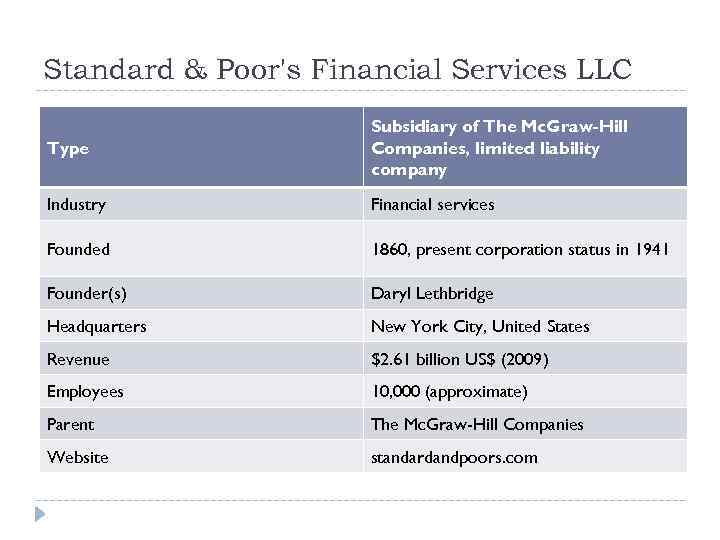

Standard & Poor's Financial Services LLC Type Subsidiary of The Mc. Graw-Hill Companies, limited liability company Industry Financial services Founded 1860, present corporation status in 1941 Founder(s) Daryl Lethbridge Headquarters New York City, United States Revenue $2. 61 billion US$ (2009) Employees 10, 000 (approximate) Parent The Mc. Graw-Hill Companies Website standardandpoors. com

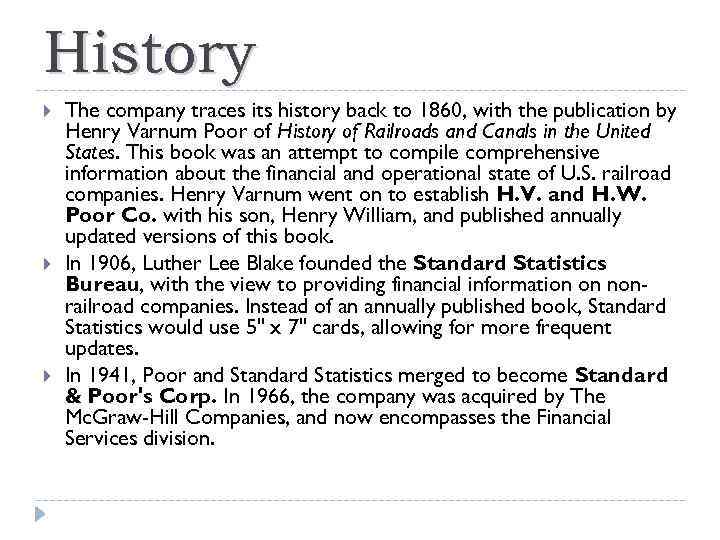

History The company traces its history back to 1860, with the publication by Henry Varnum Poor of History of Railroads and Canals in the United States. This book was an attempt to compile comprehensive information about the financial and operational state of U. S. railroad companies. Henry Varnum went on to establish H. V. and H. W. Poor Co. with his son, Henry William, and published annually updated versions of this book. In 1906, Luther Lee Blake founded the Standard Statistics Bureau, with the view to providing financial information on nonrailroad companies. Instead of an annually published book, Standard Statistics would use 5" x 7" cards, allowing for more frequent updates. In 1941, Poor and Standard Statistics merged to become Standard & Poor's Corp. In 1966, the company was acquired by The Mc. Graw-Hill Companies, and now encompasses the Financial Services division.

Credit ratings As a credit-rating agency (CRA), the company issues credit ratings for the debt of public and private corporations. It is one of several CRAs that have been designated a nationally recognized statistical rating organization by the U. S. Securities and Exchange Commission. S&P issues both short-term and long-term credit ratings.

Long-term credit ratings The company rates borrowers on a scale from AAA to D. Intermediate ratings are offered at each level between AA and CCC (e. g. , BBB+, BBB and BBB-). For some borrowers, the company may also offer guidance (termed a "credit watch") as to whether it is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral). Investment Grade AAA: An obligor rated 'AAA' has extremely strong capacity to meet its financial commitments. 'AAA' is the highest issuer credit rating assigned by Standard & Poor's. AA: An obligor rated 'AA' has very strong capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree. Includes: A: An obligor rated 'A' has strong capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories. AA+: equivalent to Moody's Aa 1 (high quality, with very low credit risk, but susceptibility to long-term risks appears somewhat greater) AA: equivalent to Aa 2 AA-: equivalent to Aa 3 A+: equivalent to A 1 A: equivalent to A 2 BBB: An obligor rated 'BBB' has adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Non-Investment Grade (also known as junk bonds) BB: An obligor rated 'BB' is less vulnerable in the near term than other lower-rated obligors. However, it faces major ongoing uncertainties and exposure to adverse business, financial, or economic conditions, which could lead to the obligor's inadequate capacity to meet its financial commitments. B: An obligor rated 'B' is more vulnerable than the obligors rated 'BB', but the obligor currently has the capacity to meet its financial commitments. Adverse business, financial, or economic conditions will likely impair the obligor's capacity or willingness to meet its financial commitments. CCC: An obligor rated 'CCC' is currently vulnerable, and is dependent upon favorable business, financial, and economic conditions to meet its financial commitments. CC: An obligor rated 'CC' is currently highly vulnerable. C: highly vulnerable, perhaps in bankruptcy or in arrears but still continuing to pay out on obligations CI: past due on interest R: An obligor rated 'R' is under regulatory supervision owing to its financial condition. During the pendency of the regulatory supervision, the regulators may have the power to favor one class of obligations over others or pay some obligations and not others. SD: has selectively defaulted on some obligations D: has defaulted on obligations and S&P believes that it will generally default on most or all obligations NR: not rated

Short-term issue credit ratings The company rates specific issues on a scale from A-1 to D. Within the A-1 category it can be designated with a plus sign (+). This indicates that the issuer's commitment to meet its obligation is very strong. Country risk and currency of repayment of the obligor to meet the issue obligation are factored into the credit analysis and reflected in the issue rating. A-1: obligor's capacity to meet its financial commitment on the obligation is strong A-2: is susceptible to adverse economic conditions however the obligor's capacity to meet its financial commitment on the obligation is satisfactory A-3: adverse economic conditions are likely to weaken the obligor's capacity to meet its financial commitment on the obligation B: has significant speculative characteristics. The obligor currently has the capacity to meet its financial obligation but faces major ongoing uncertainties that could impact its financial commitment on the obligation C: currently vulnerable to nonpayment and is dependent upon favorable business, financial and economic conditions for the obligor to meet its financial commitment on the obligation D: is in payment default. Obligation not made on due date and grace period may not have expired. The rating is also used upon the filing of a bankruptcy petition.

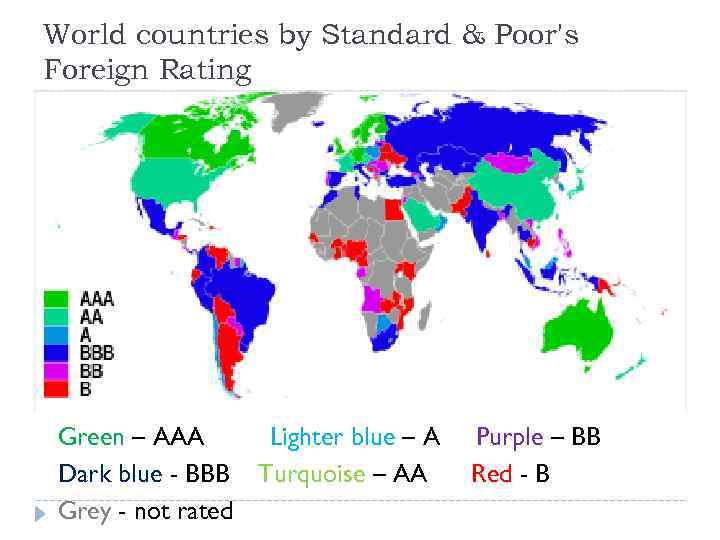

World countries by Standard & Poor's Foreign Rating Green – AAA Lighter blue – A Dark blue - BBB Turquoise – AA Grey - not rated Purple – BB Red - B

Stock market indices It publishes a large number of stock market indices, covering every region of the world, market capitalization level and type of investment (e. g. , indices for REITs and preferred stocks) These indices include: S&P 500 – free-float capitalization-weighted index of the prices of 500 large-capitalization common stocks actively traded in the US. S&P 400 Mid. Cap Index S&P 600 Small. Cap Index

Governance scores (GAMMA) A GAMMA score reflects S&P's opinion of the relative strength of a company's corporate-governance practices as an investor protection against potential governancerelated losses of value or failure to create value. GAMMA is designed for equity investors in emerging markets and is focused on non-financial-risk assessment, and in particular, assessment of corporate- governance risk.

History of CGS and GAMMA scores S&P has developed criteria and methodology for assessing corporate governance since 1998 and has been actively assessing companies' corporate-governance practices since 2000. In 2007, the methodology of stand-alone governance analysis underwent a major overhaul to strengthen the risk focus of the analysis based on the group's experience assigning governance scores. GAMMA analysis focuses on a number of risks that vary in probability and expected impact on shareholder value. Accordingly, S&P's analysis seeks to determine the most vulnerable areas prompt to potential losses in value attributable to governance deficiencies. Recent developments in the international financial markets emphasize the relevance of enterprise risk management and the strategic process to governance quality. GAMMA methodology incorporates two new elements, addressing these areas of investor concern. It also promotes the culture of risk management and long-term strategic thinking among companies.

GAMMA methodology components Shareholder influence Shareholder rights Transparency, audit, and enterprise risk management Board effectiveness, strategic process and incentives

GAMMA scale For the GAMMA score, the S&P uses a numeric scale from one to ten (with ten being the best possible score). At the S&P's discretion, a GAMMA score can be publicly disseminated or used privately. GAMMA-10 and GAMMA-9 – in S&P's opinion, the corporate-governance processes and practices at the company provide a very strong protection against potential governance related losses in value. A company in these scoring categories has, in S&P's opinion, few weaknesses in any of the major areas of governance analysis. GAMMA-8 and GAMMA-7 – in S&P's opinion, the corporate-governance processes and practices at the company provide strong protection against potential governance related losses in value. A company in these scoring categories has, in S&P's opinion, some weaknesses in certain of the major areas of governance analysis. GAMMA-6 and GAMMA-5 – in S&P's opinion, the corporate-governance processes and practices at the company provide moderate protection against potential governance related losses in value. A company in these scoring categories has, in S&P's opinion, weaknesses in several of the major areas of governance analysis. GAMMA-4 and GAMMA-3 – in S&P's opinion, the corporate-governance processes and practices provide weak protection against potential governance related losses in value. A company in these scoring categories has, in S&P's opinion, significant weaknesses in a number of the major areas of governance analysis. GAMMA-2 and GAMMA-1 – in S&P's opinion, the corporate-governance processes and practices provide very weak protection against potential governance related losses in value. A company in these scoring categories has, in S&P's opinion, significant weaknesses in most of the major areas of analysis.

Thank You For Attention

Standard & Poors (1).pptx