65b504d92e75b60800c1c8baf3f0872a.ppt

- Количество слайдов: 41

Standard & Poor’s Ratings Roberto Rivero EMEA Head of Market Development 18 th November 2011 Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. Copyright (c) 2006 Standard & Poor’s, a division of The Mc. Graw-Hill Companies, Inc. All rights reserved.

Agenda • What are Ratings? • How have they performed? • How are they arrived at? • What has changed at Standard & Poor’s? 2. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

What are Ratings? 3. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

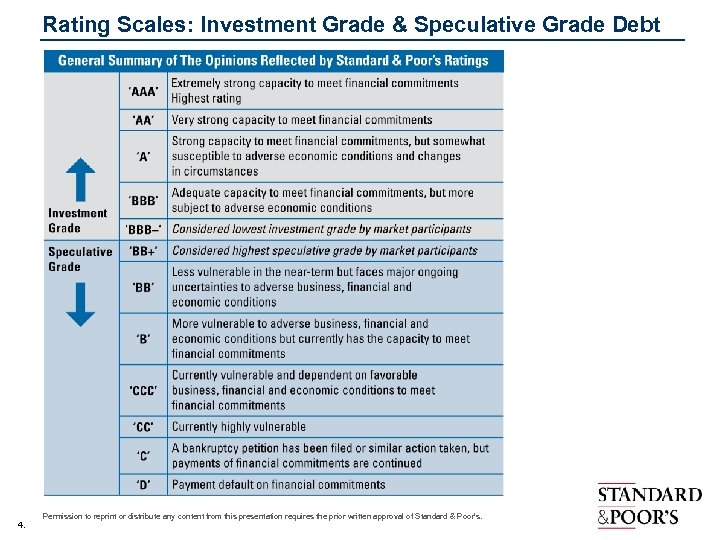

Rating Scales: Investment Grade & Speculative Grade Debt 4. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

What is a Corporate Credit Rating (CCR) or Issue Rating? “Standard & Poor’s opinion on the ability and willingness of an obligor to meet its debts as they fall due, or the ability and willingness of an obligor to respect the financial terms of a particular debt security or other financial obligation. ” For complete definitions of |Standard & Poor’s ratings, and its criteria, please refer to www. standardandpoors. com 5. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

What a Rating is not • a recommendation to “buy” or “sell” investments • a measure of market value • a measure of liquidity • a measure of volatility • an assessment of corporate governance • an appreciation of country risk • a way of defining “good” or “bad” companies • an audit, of the Company or its Auditors • an individual opinion of one single analyst For complete definitions of |Standard & Poor’s ratings, and its criteria, please refer to www. standardandpoors. com 6. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

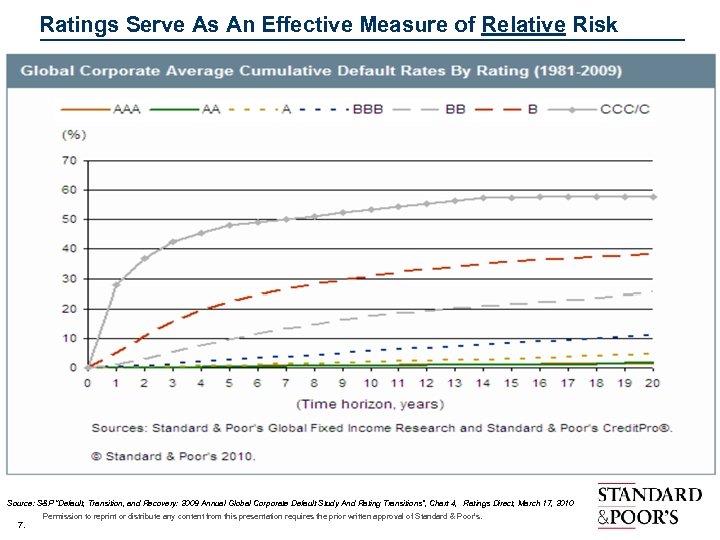

Ratings Serve As An Effective Measure of Relative Risk Source: S&P “Default, Transition, and Recovery: 2009 Annual Global Corporate Default Study And Rating Transitions”, Chart 4, Ratings Direct, March 17, 2010 7. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

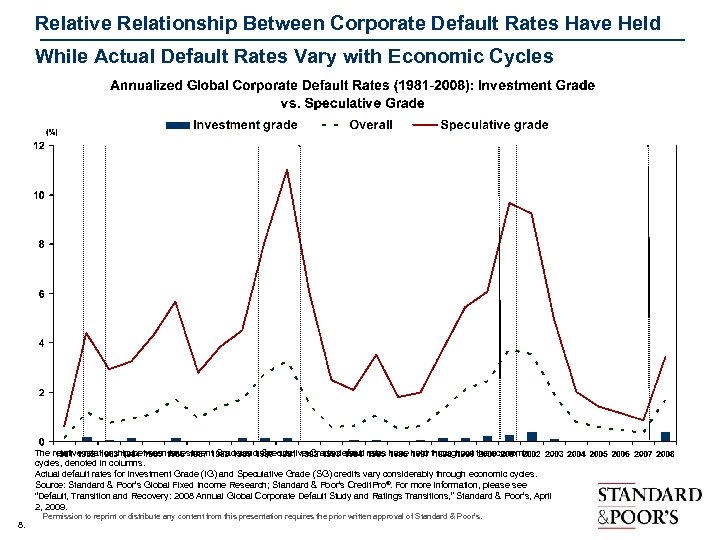

Relative Relationship Between Corporate Default Rates Have Held While Actual Default Rates Vary with Economic Cycles The relative relationship between Investment Grade and Speculative Grade default rates have held throughout the economic cycles, denoted in columns. Actual default rates for Investment Grade (IG) and Speculative Grade (SG) credits vary considerably through economic cycles. Source: Standard & Poor’s Global Fixed Income Research; Standard & Poor’s Credit. Pro®. For more information, please see “Default, Transition and Recovery: 2008 Annual Global Corporate Default Study and Ratings Transitions, ” Standard & Poor’s, April 2, 2009. 8. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

How have ratings performed? 9. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

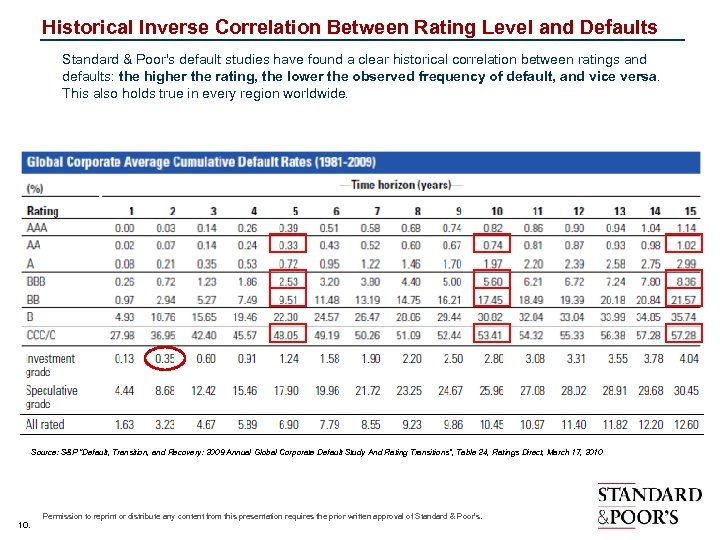

Historical Inverse Correlation Between Rating Level and Defaults Standard & Poor's default studies have found a clear historical correlation between ratings and defaults: the higher the rating, the lower the observed frequency of default, and vice versa. This also holds true in every region worldwide. Source: S&P “Default, Transition, and Recovery: 2009 Annual Global Corporate Default Study And Rating Transitions”, Table 24, Ratings Direct, March 17, 2010 10. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

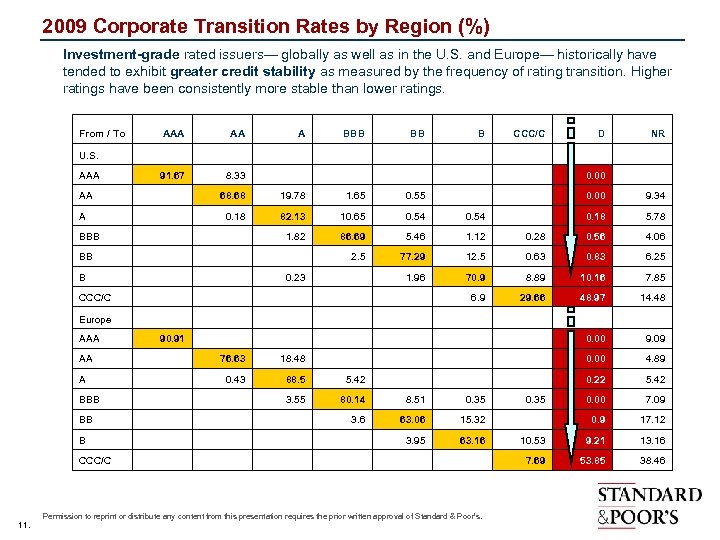

2009 Corporate Transition Rates by Region (%) Investment-grade rated issuers— globally as well as in the U. S. and Europe— historically have tended to exhibit greater credit stability as measured by the frequency of rating transition. Higher ratings have been consistently more stable than lower ratings. From / To AAA AA 91. 67 A BBB BB B CCC/C 8. 33 D NR U. S. AAA AA 0. 00 68. 68 1. 65 0. 55 0. 18 82. 13 10. 65 0. 54 1. 82 86. 69 5. 46 1. 12 2. 5 77. 29 1. 96 BB B 5. 78 0. 28 0. 56 4. 06 12. 5 0. 63 0. 83 6. 25 70. 9 8. 89 10. 16 7. 85 29. 66 48. 97 14. 48 9. 09 4. 89 0. 22 CCC/C 0. 18 0. 00 0. 23 9. 34 0. 00 BBB 0. 00 6. 9 A 19. 78 5. 42 0. 00 7. 09 0. 9 17. 12 10. 53 9. 21 13. 16 7. 69 53. 85 38. 46 Europe AAA AA A BBB BB B 90. 91 76. 63 18. 48 0. 43 88. 5 5. 42 3. 55 80. 14 8. 51 0. 35 3. 6 63. 06 15. 32 3. 95 63. 16 CCC/C 11. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. 0. 35

Over the 2 years 2008 -2009, the “credit crunch”, what proportion of corporates rated investment grade by Standard & Poor’s defaulted? a) 10% b) 20% c) 0. 73% 12. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

In Europe, between mid-2007 and the end of 2009, what proportion of structured securities rated by Standard & Poor’s defaulted? a) 12. 5% b) 25% c) 0. 39% 13. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

In Europe, of those structured securities rated AAA by Standard & Poor’s in mid-2007, what proportion were below investment grade by the end of 2009? a) 50% b) 80% c) 2. 8% 14. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

What proportion of European structured securities rated AAA at June 2007 were still AAA by the end of 2009? a) 50% b) 15% c) 90. 9% 15. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

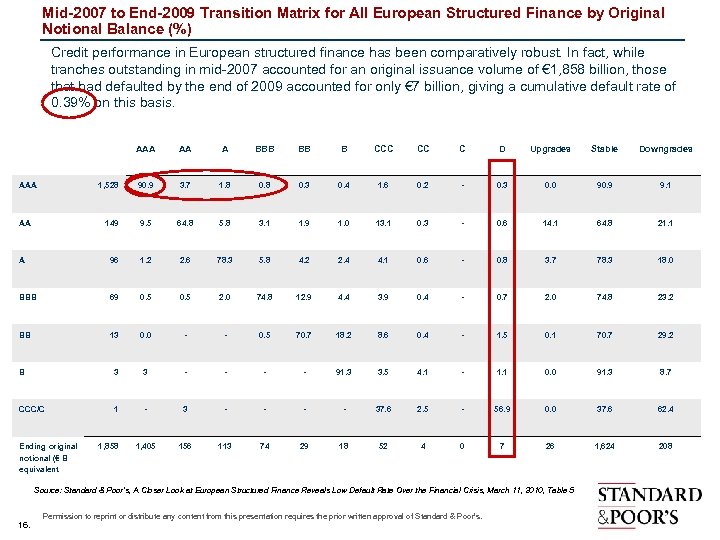

Mid-2007 to End-2009 Transition Matrix for All European Structured Finance by Original Notional Balance (%) Credit performance in European structured finance has been comparatively robust. In fact, while tranches outstanding in mid-2007 accounted for an original issuance volume of € 1, 858 billion, those that had defaulted by the end of 2009 accounted for only € 7 billion, giving a cumulative default rate of 0. 39% on this basis. AAA AA A BBB BB B CCC CC C D Upgrades Stable Downgrades 1, 528 90. 9 3. 7 1. 8 0. 3 0. 4 1. 6 0. 2 - 0. 3 0. 0 90. 9 9. 1 149 9. 5 64. 8 5. 8 3. 1 1. 9 1. 0 13. 1 0. 3 - 0. 6 14. 1 64. 8 21. 1 A 96 1. 2 2. 6 78. 3 5. 8 4. 2 2. 4 4. 1 0. 6 - 0. 8 3. 7 78. 3 18. 0 BBB 69 0. 5 2. 0 74. 8 12. 9 4. 4 3. 9 0. 4 - 0. 7 2. 0 74. 8 23. 2 BB 13 0. 0 - - 0. 5 70. 7 18. 2 8. 6 0. 4 - 1. 5 0. 1 70. 7 29. 2 B 3 3 - - 91. 3 3. 5 4. 1 - 1. 1 0. 0 91. 3 8. 7 CCC/C 1 - 3 - - 37. 6 2. 5 - 56. 9 0. 0 37. 6 62. 4 1, 405 156 113 74 29 18 52 4 0 7 26 1, 624 208 AAA AA Ending original notional (€ B equivalent 1, 858 Source: Standard & Poor’s, A Closer Look at European Structured Finance Reveals Low Default Rate Over the Financial Crisis, March 11, 2010, Table 5 16. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

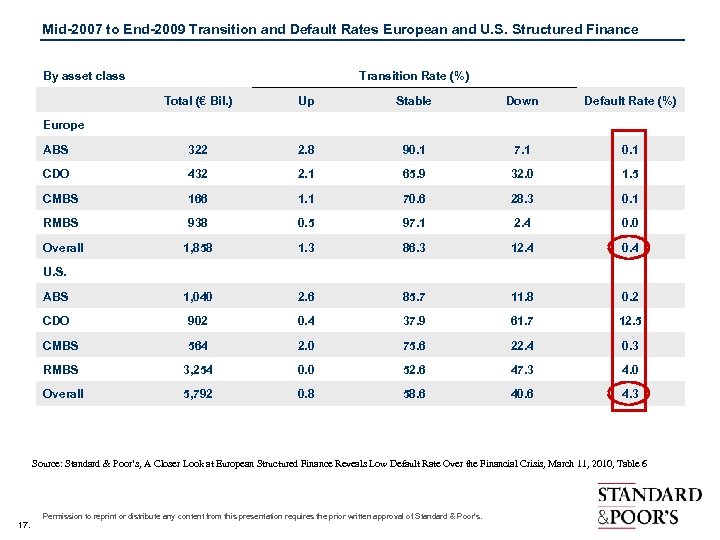

Mid-2007 to End-2009 Transition and Default Rates European and U. S. Structured Finance By asset class Transition Rate (%) Total (€ Bil. ) Up Stable Down Default Rate (%) ABS 322 2. 8 90. 1 7. 1 0. 1 CDO 432 2. 1 65. 9 32. 0 1. 5 CMBS 166 1. 1 70. 6 28. 3 0. 1 RMBS 938 0. 5 97. 1 2. 4 0. 0 Overall 1, 858 1. 3 86. 3 12. 4 0. 4 ABS 1, 040 2. 6 85. 7 11. 8 0. 2 CDO 902 0. 4 37. 9 61. 7 12. 5 CMBS 564 2. 0 75. 6 22. 4 0. 3 RMBS 3, 254 0. 0 52. 6 47. 3 4. 0 Overall 5, 792 0. 8 58. 6 40. 6 4. 3 Europe U. S. Source: Standard & Poor’s, A Closer Look at European Structured Finance Reveals Low Default Rate Over the Financial Crisis, March 11, 2010, Table 6 17. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

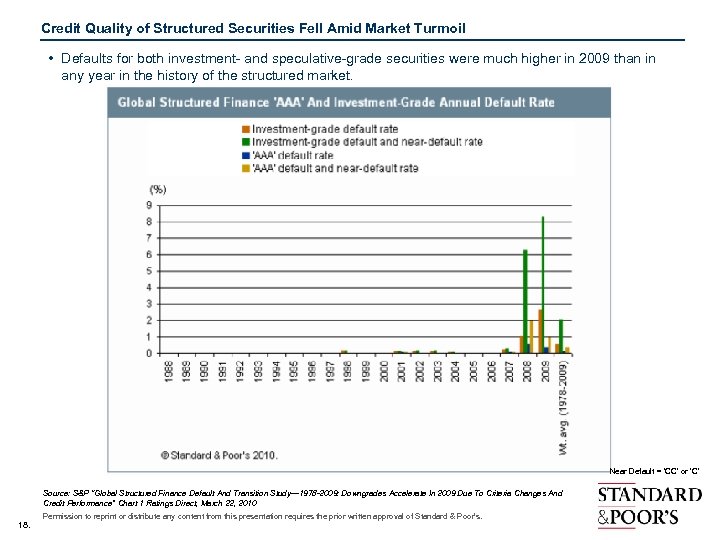

Credit Quality of Structured Securities Fell Amid Market Turmoil • Defaults for both investment- and speculative-grade securities were much higher in 2009 than in any year in the history of the structured market. Near Default = ‘CC’ or ‘C’ Source: S&P “Global Structured Finance Default And Transition Study— 1978 -2009: Downgrades Accelerate In 2009 Due To Criteria Changes And Credit Performance” Chart 1 Ratings Direct, March 22, 2010 18. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

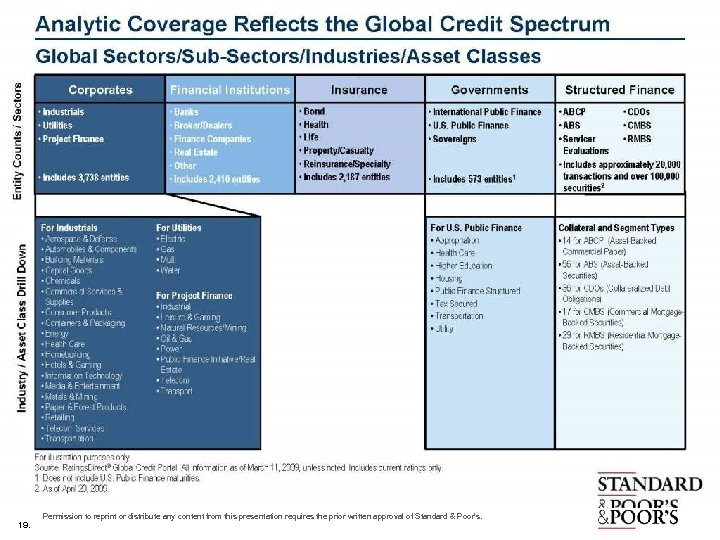

19. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

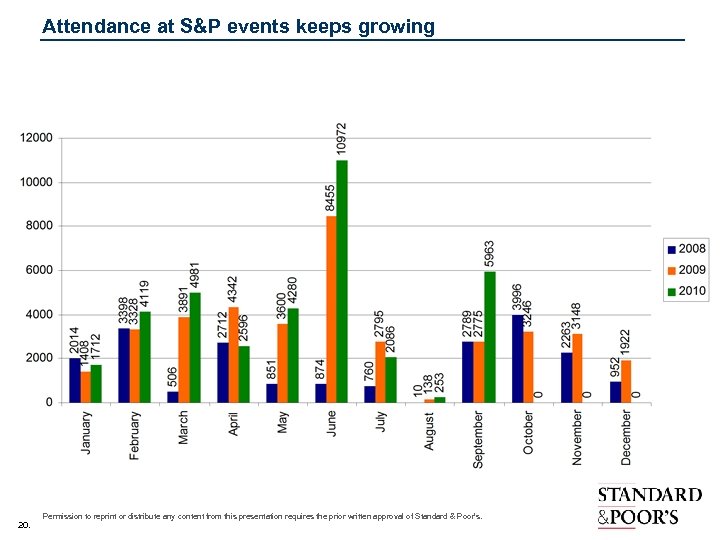

Attendance at S&P events keeps growing 20. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

Bank Support Schemes • Bank of England – Special Liquidity Scheme (SLS) – Announced 13 th April 2008 – Two AAA ratings from S&P / Moody’s / Fitch • European Central Bank – Long-Term Re-Financing Operation/Main Re-Financing Operation – In place before Bo. E’s SLS – One rating (2 for Asset Backed Securities) from S&P / Moody’s / Fitch / DBRS 21. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

How are Credit Ratings arrived at? 22. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

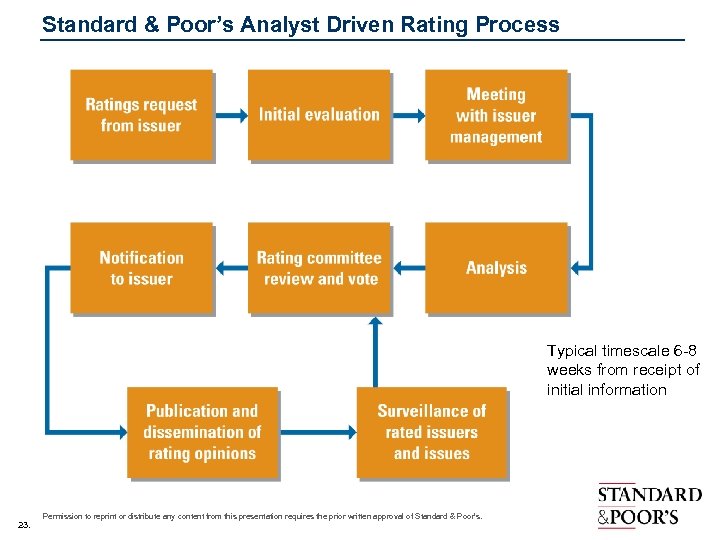

Standard & Poor’s Analyst Driven Rating Process Typical timescale 6 -8 weeks from receipt of initial information 23. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

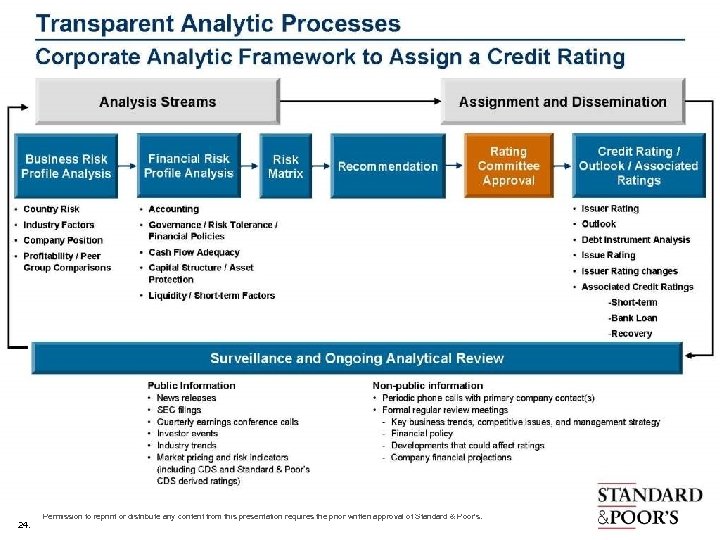

24. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

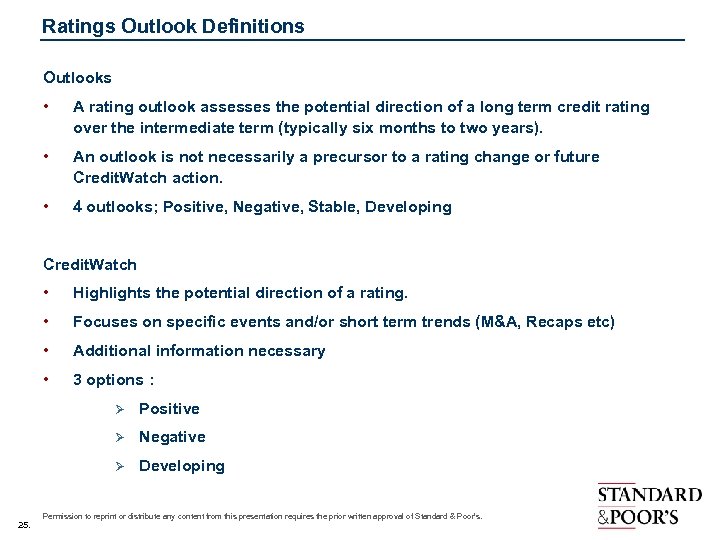

Ratings Outlook Definitions Outlooks • A rating outlook assesses the potential direction of a long term credit rating over the intermediate term (typically six months to two years). • An outlook is not necessarily a precursor to a rating change or future Credit. Watch action. • 4 outlooks; Positive, Negative, Stable, Developing Credit. Watch • Highlights the potential direction of a rating. • Focuses on specific events and/or short term trends (M&A, Recaps etc) • Additional information necessary • 3 options : Ø Ø Negative Ø 25. Positive Developing Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

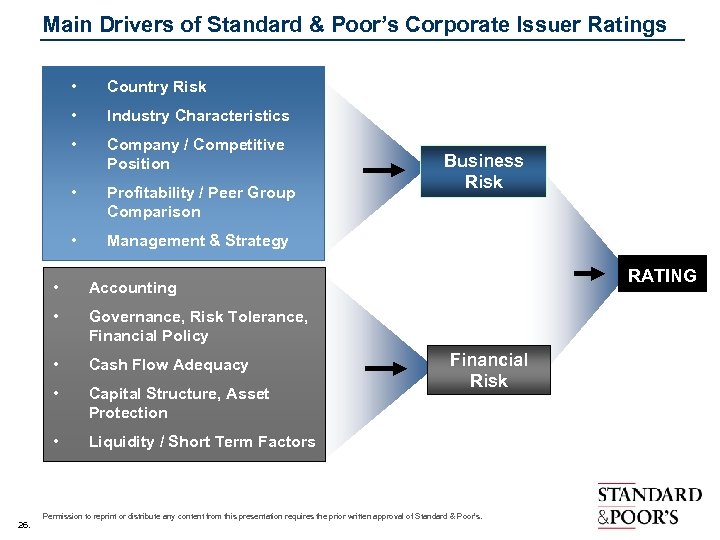

Main Drivers of Standard & Poor’s Corporate Issuer Ratings • Country Risk • Industry Characteristics • Company / Competitive Position • Profitability / Peer Group Comparison • Management & Strategy • Cash Flow Adequacy • Capital Structure, Asset Protection • 26. Governance, Risk Tolerance, Financial Policy • RATING Accounting • Business Risk Liquidity / Short Term Factors Financial Risk Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

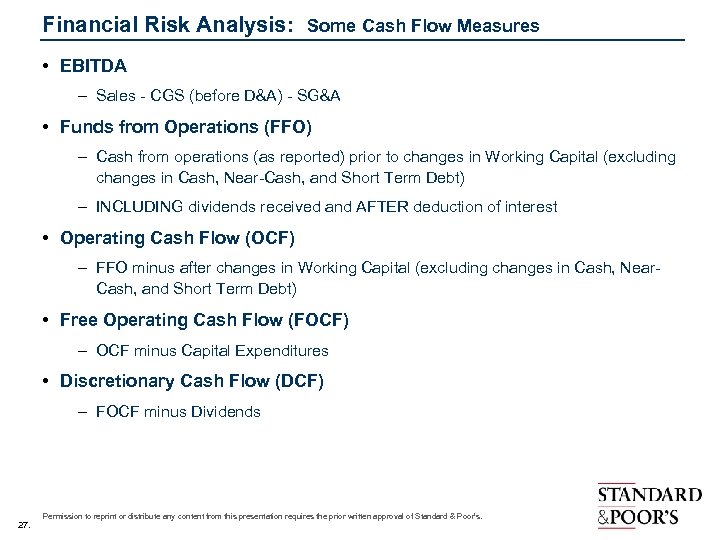

Financial Risk Analysis: Some Cash Flow Measures • EBITDA – Sales - CGS (before D&A) - SG&A • Funds from Operations (FFO) – Cash from operations (as reported) prior to changes in Working Capital (excluding changes in Cash, Near-Cash, and Short Term Debt) – INCLUDING dividends received and AFTER deduction of interest • Operating Cash Flow (OCF) – FFO minus after changes in Working Capital (excluding changes in Cash, Near. Cash, and Short Term Debt) • Free Operating Cash Flow (FOCF) – OCF minus Capital Expenditures • Discretionary Cash Flow (DCF) – FOCF minus Dividends 27. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

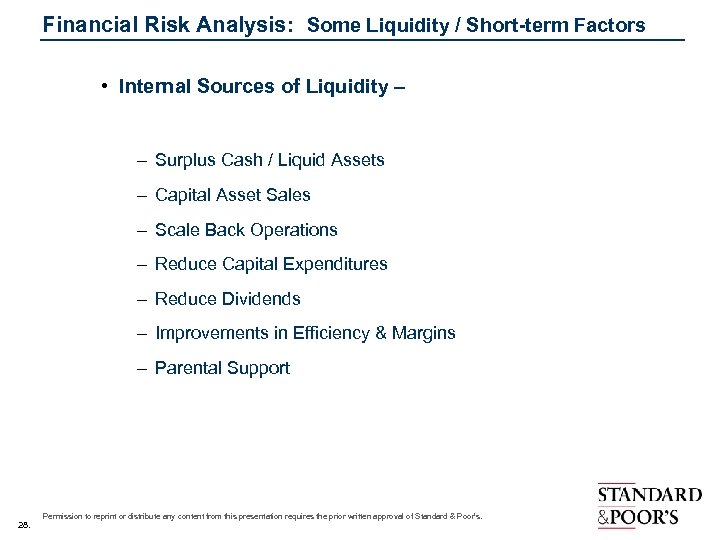

Financial Risk Analysis: Some Liquidity / Short-term Factors • Internal Sources of Liquidity – – Surplus Cash / Liquid Assets – Capital Asset Sales – Scale Back Operations – Reduce Capital Expenditures – Reduce Dividends – Improvements in Efficiency & Margins – Parental Support 28. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

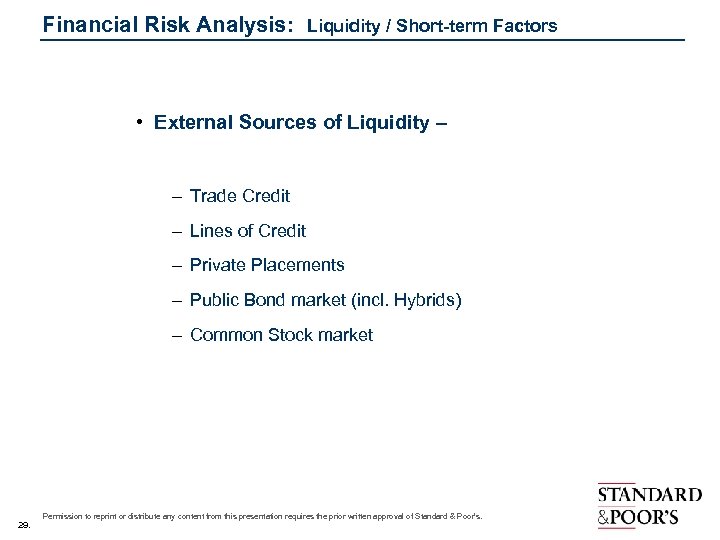

Financial Risk Analysis: Liquidity / Short-term Factors • External Sources of Liquidity – – Trade Credit – Lines of Credit – Private Placements – Public Bond market (incl. Hybrids) – Common Stock market 29. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

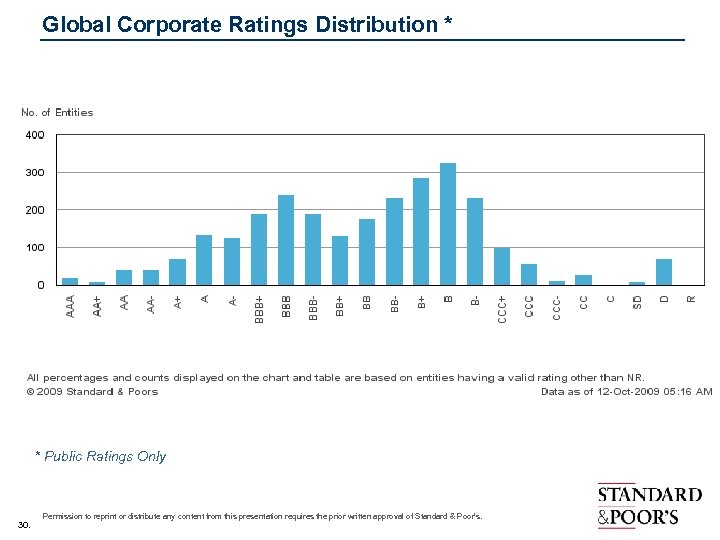

Global Corporate Ratings Distribution * * Public Ratings Only 30. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

What has changed at Standard & Poor’s? 31. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

Examples of recent organisational changes at S&P • Analysts Rotation • Separate reporting lines for Criteria & Quality functions • “Roles & responsibilities” • Ombudsman 32. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

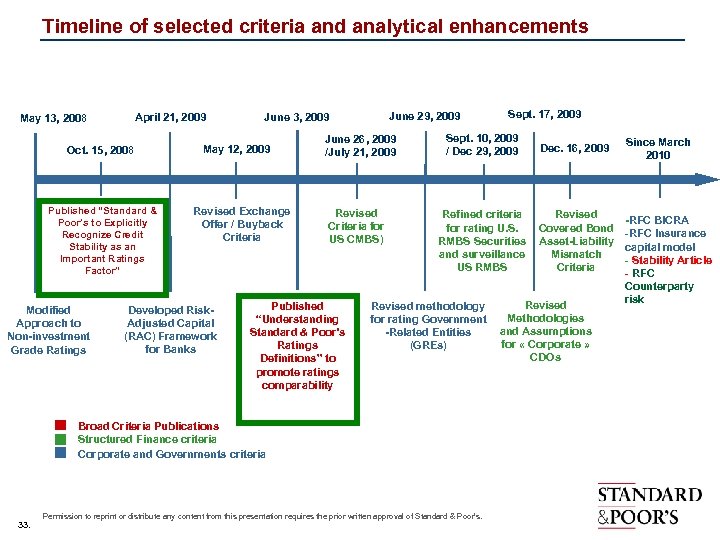

Timeline of selected criteria and analytical enhancements April 21, 2009 May 13, 2008 Oct. 15, 2008 Published “Standard & Poor’s to Explicitly Recognize Credit Stability as an Important Ratings Factor” Modified Approach to Non-investment Grade Ratings May 12, 2009 Revised Exchange Offer / Buyback Criteria Developed Risk. Adjusted Capital (RAC) Framework for Banks June 29, 2009 June 3, 2009 June 26, 2009 /July 21, 2009 Sept. 10, 2009 / Dec 29, 2009 Revised Criteria for US CMBS) Published “Understanding Standard & Poor’s Ratings Definitions” to promote ratings comparability Dec. 16, 2009 Since March 2010 Revised Refined criteria -RFC BICRA Covered Bond for rating U. S. -RFC Insurance RMBS Securities Asset-Liability capital model Mismatch and surveillance - Stability Article Criteria US RMBS - RFC Counterparty risk Revised methodology Methodologies for rating Government and Assumptions -Related Entities for « Corporate » (GREs) CDOs Broad Criteria Publications Structured Finance criteria Corporate and Governments criteria 33. Sept. 17, 2009 Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

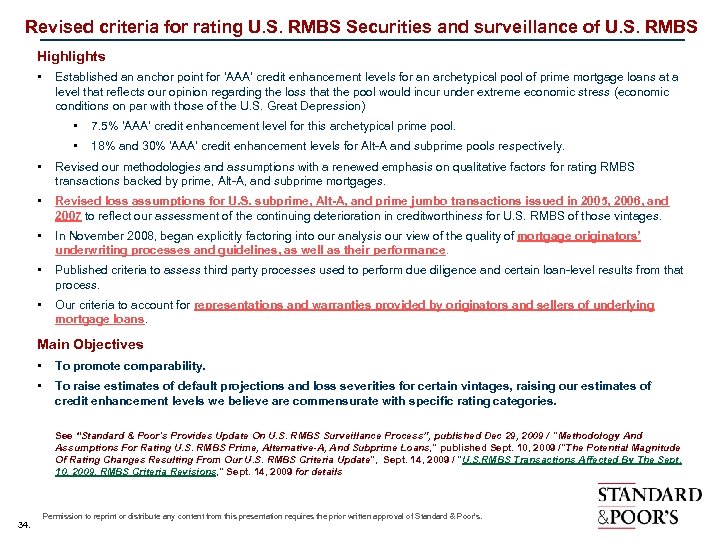

Revised criteria for rating U. S. RMBS Securities and surveillance of U. S. RMBS Highlights • Established an anchor point for ‘AAA’ credit enhancement levels for an archetypical pool of prime mortgage loans at a level that reflects our opinion regarding the loss that the pool would incur under extreme economic stress (economic conditions on par with those of the U. S. Great Depression) • 7. 5% 'AAA' credit enhancement level for this archetypical prime pool. • 18% and 30% 'AAA' credit enhancement levels for Alt-A and subprime pools respectively. • Revised our methodologies and assumptions with a renewed emphasis on qualitative factors for rating RMBS transactions backed by prime, Alt-A, and subprime mortgages. • Revised loss assumptions for U. S. subprime, Alt-A, and prime jumbo transactions issued in 2005, 2006, and 2007 to reflect our assessment of the continuing deterioration in creditworthiness for U. S. RMBS of those vintages. • In November 2008, began explicitly factoring into our analysis our view of the quality of mortgage originators’ underwriting processes and guidelines, as well as their performance. • Published criteria to assess third party processes used to perform due diligence and certain loan-level results from that process. • Our criteria to account for representations and warranties provided by originators and sellers of underlying mortgage loans. Main Objectives • To promote comparability. • To raise estimates of default projections and loss severities for certain vintages, raising our estimates of credit enhancement levels we believe are commensurate with specific rating categories. See “Standard & Poor's Provides Update On U. S. RMBS Surveillance Process”, published Dec 29, 2009 / "Methodology And Assumptions For Rating U. S. RMBS Prime, Alternative-A, And Subprime Loans, " published Sept. 10, 2009 /"The Potential Magnitude Of Rating Changes Resulting From Our U. S. RMBS Criteria Update", Sept. 14, 2009 / "U. S. RMBS Transactions Affected By The Sept. 10, 2009, RMBS Criteria Revisions, " Sept. 14, 2009 for details 34. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

S&P Initiatives: Greater Rigor and Transparency For Investors • Forward Looking – reconciling the past to shape future expectations – Ratings articulate an opinion on credit risk based on future entity-specific and macro environment scenarios – Recovery analysis and supplemental research provide complementary dimension to credit risk analysis • Comparability - across asset classes, vintage and geographies – Ratings intended to be relative ranking of credit risk – Rating category intended to have similar default likelihood across credit securities – ‘AAA’ ratings expected to withstand extreme stress akin to the Great Depression – Cross-sector interdependencies and relationships considered in credit risk assessment • Stability - to understand the impact future credit events may have on ratings – Credit stability explicitly recognized as a factor in ratings – Seek to minimize severe rating transitions or credit cliffs • Clarity - around nature of risks and stresses considered – Deal/sector-level stress scenarios provide insight to impact of credit volatility – Information provided regarding quantitative assessment – What-if scenarios and assumptions underlying rating conclusions published 35. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

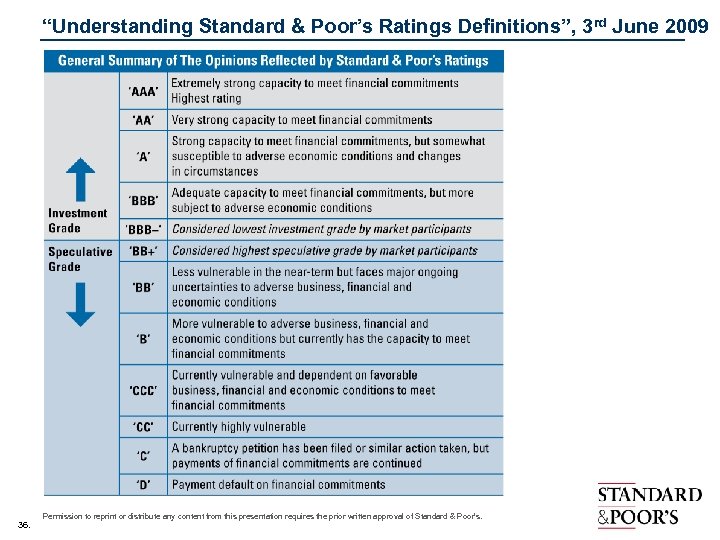

“Understanding Standard & Poor’s Ratings Definitions”, 3 rd June 2009 36. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

AAA scenario – The Great Depression in the US • Real GDP fell by 26. 5% from 1929 to 1933 • Unemployment peaked at 24. 9% in 1933 and was above 20% from 1932 through 1935 • Industrial production declined by 47% • The stock market fell by 85% from September 1929 to July 1932 • Deflation of 25% • Nominal GDP did not recover its 1929 level until 1940 37. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

38. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

www. standardandpoors. com Copyright © 2010 by Standard & Poor’s Financial Services LLC (S&P), a subsidiary of The Mc. Graw-Hill Companies, Inc. All rights reserved. No content (including ratings, credit-related analyses and data, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P. The Content shall not be used for any unlawful or unauthorized purposes. S&P, its affiliates, and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P’s opinions and analyses do not address the suitability of any security. S&P does not act as a fiduciary or an investment advisor. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non–public information received in connection with each analytical process. S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www. standardandpoors. com (free of charge), and www. ratingsdirect. com and www. globalcreditportal. com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www. standardandpoors. com/usratingsfees. Permission to reprint or STANDARD & POOR’S anddistribute any content from this presentation requires the prior written approval of Standard & Poor’s. S&P are registered trademarks of Standard & Poor’s Financial Services LLC. 39.

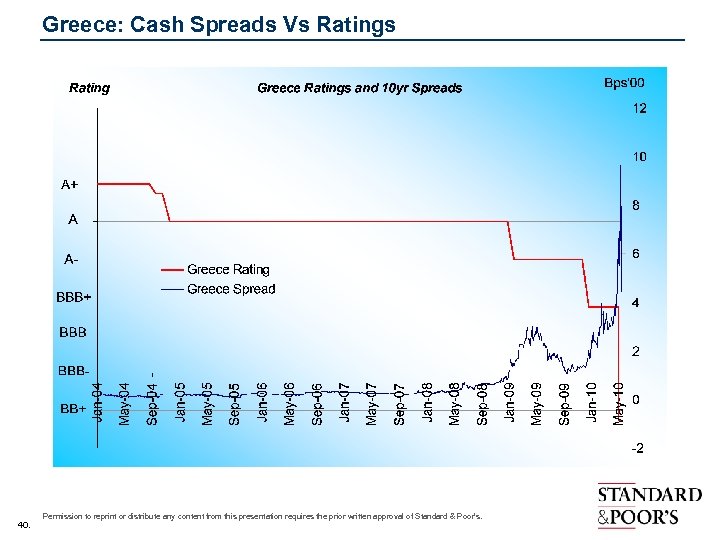

Greece: Cash Spreads Vs Ratings 40. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

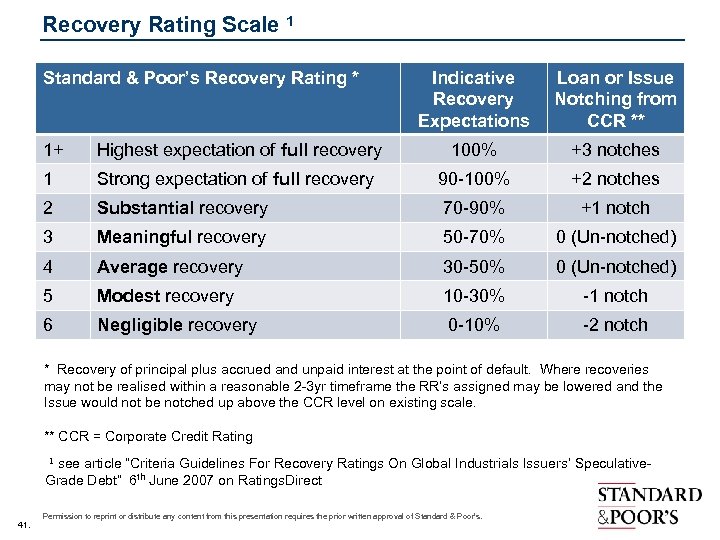

Recovery Rating Scale 1 Standard & Poor’s Recovery Rating * Indicative Recovery Expectations Loan or Issue Notching from CCR ** 1+ Highest expectation of full recovery 100% +3 notches 1 Strong expectation of full recovery 90 -100% +2 notches 2 Substantial recovery 70 -90% +1 notch 3 Meaningful recovery 50 -70% 0 (Un-notched) 4 Average recovery 30 -50% 0 (Un-notched) 5 Modest recovery 10 -30% -1 notch 6 Negligible recovery 0 -10% -2 notch * Recovery of principal plus accrued and unpaid interest at the point of default. Where recoveries may not be realised within a reasonable 2 -3 yr timeframe the RR’s assigned may be lowered and the Issue would not be notched up above the CCR level on existing scale. ** CCR = Corporate Credit Rating 1 see article “Criteria Guidelines For Recovery Ratings On Global Industrials Issuers’ Speculative. Grade Debt” 6 th June 2007 on Ratings. Direct 41. Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s.

65b504d92e75b60800c1c8baf3f0872a.ppt