692e5f324a63af91e58f63d2c0868aac.ppt

- Количество слайдов: 35

Standard 3 Understand the fundamental concepts and interrelationships of the United States economy in the international marketplace SS. 912. E. 3. 3 Discuss the effect of barriers to trade and why nations sometimes erect barriers to trade or establish free trade zones

Standard 3 Understand the fundamental concepts and interrelationships of the United States economy in the international marketplace SS. 912. E. 3. 3 Discuss the effect of barriers to trade and why nations sometimes erect barriers to trade or establish free trade zones

Before we can fully understand the impact of trade barriers, we have to understand the foreign exchange market and the international flow of goods, services, currency, and capital

Before we can fully understand the impact of trade barriers, we have to understand the foreign exchange market and the international flow of goods, services, currency, and capital

Has the US “lost” or “given away” our manufacturing? Absolutely not, we are still world-class manufacturers If we choose not to manufacturer, we still do a lot of designing and engineering and let others actually manufacture Examples: Nike and Mc. Donald’s

Has the US “lost” or “given away” our manufacturing? Absolutely not, we are still world-class manufacturers If we choose not to manufacturer, we still do a lot of designing and engineering and let others actually manufacture Examples: Nike and Mc. Donald’s

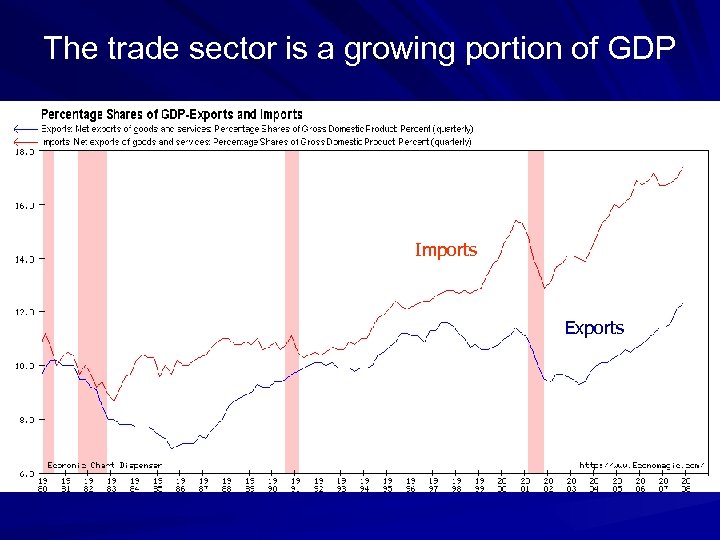

The trade sector is a growing portion of GDP Imports Exports

The trade sector is a growing portion of GDP Imports Exports

Think carefully about the ramifications GDP = Consumption + Investment + Government Purchases + Exports – Imports If Imports = (-18%), then the rest, 82% must come from the US! If GDP is about $14 trillion, 82% is a LOT of domestic production!!!!!!!

Think carefully about the ramifications GDP = Consumption + Investment + Government Purchases + Exports – Imports If Imports = (-18%), then the rest, 82% must come from the US! If GDP is about $14 trillion, 82% is a LOT of domestic production!!!!!!!

Graph of surplus:

Graph of surplus:

Graph of shortage:

Graph of shortage:

The foreign exchange market coordinates all international exchanges

The foreign exchange market coordinates all international exchanges

Video: Dodgeball

Video: Dodgeball

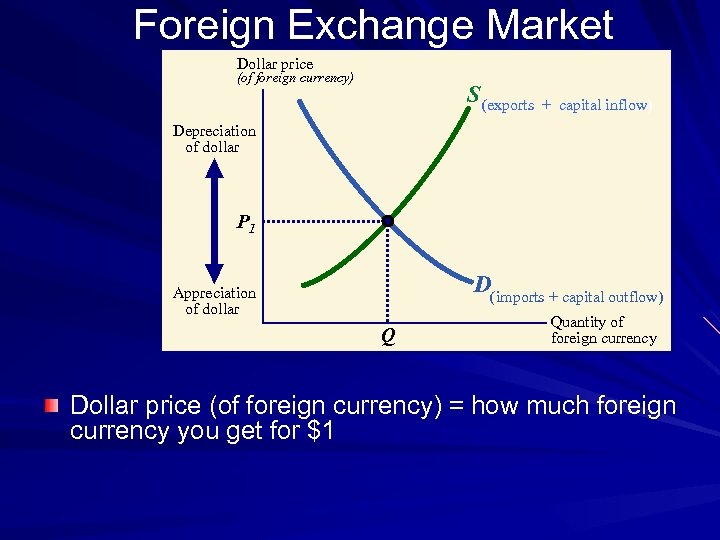

Foreign Exchange Market Dollar price (of foreign currency) S (exports + capital inflow) Depreciation of dollar P 1 D(imports + capital outflow) Appreciation of dollar Q Quantity of foreign currency Dollar price (of foreign currency) = how much foreign currency you get for $1

Foreign Exchange Market Dollar price (of foreign currency) S (exports + capital inflow) Depreciation of dollar P 1 D(imports + capital outflow) Appreciation of dollar Q Quantity of foreign currency Dollar price (of foreign currency) = how much foreign currency you get for $1

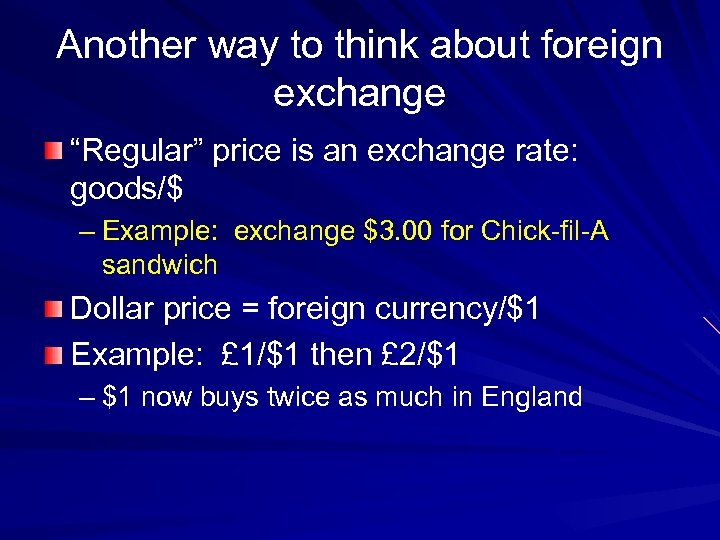

Another way to think about foreign exchange “Regular” price is an exchange rate: goods/$ – Example: exchange $3. 00 for Chick-fil-A sandwich Dollar price = foreign currency/$1 Example: £ 1/$1 then £ 2/$1 – $1 now buys twice as much in England

Another way to think about foreign exchange “Regular” price is an exchange rate: goods/$ – Example: exchange $3. 00 for Chick-fil-A sandwich Dollar price = foreign currency/$1 Example: £ 1/$1 then £ 2/$1 – $1 now buys twice as much in England

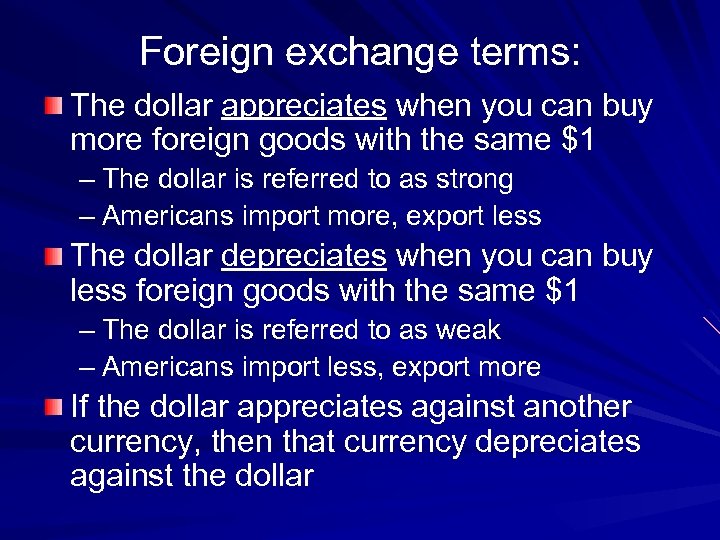

Foreign exchange terms: The dollar appreciates when you can buy more foreign goods with the same $1 – The dollar is referred to as strong – Americans import more, export less The dollar depreciates when you can buy less foreign goods with the same $1 – The dollar is referred to as weak – Americans import less, export more If the dollar appreciates against another currency, then that currency depreciates against the dollar

Foreign exchange terms: The dollar appreciates when you can buy more foreign goods with the same $1 – The dollar is referred to as strong – Americans import more, export less The dollar depreciates when you can buy less foreign goods with the same $1 – The dollar is referred to as weak – Americans import less, export more If the dollar appreciates against another currency, then that currency depreciates against the dollar

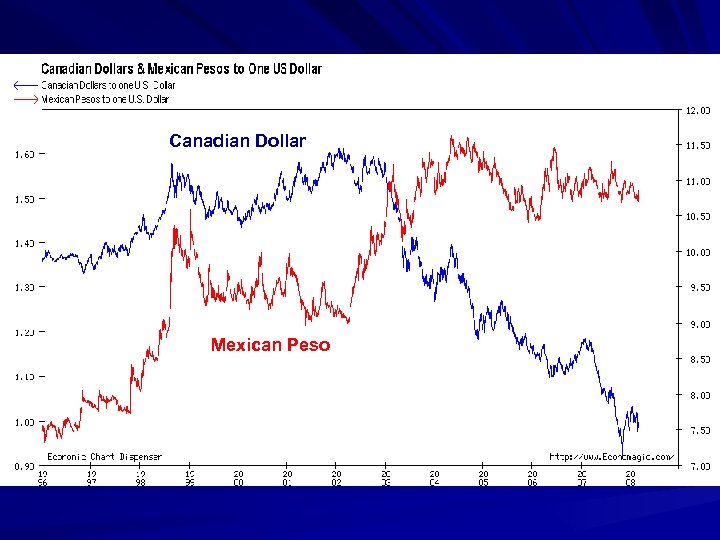

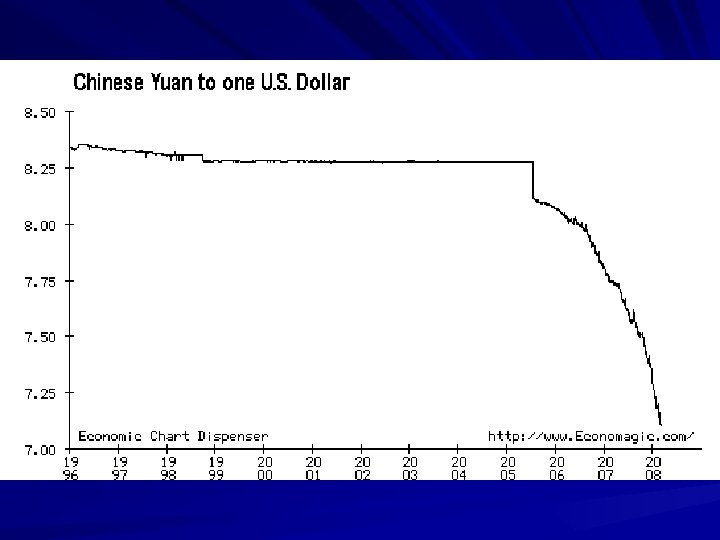

Canadian Dollar Mexican Peso

Canadian Dollar Mexican Peso

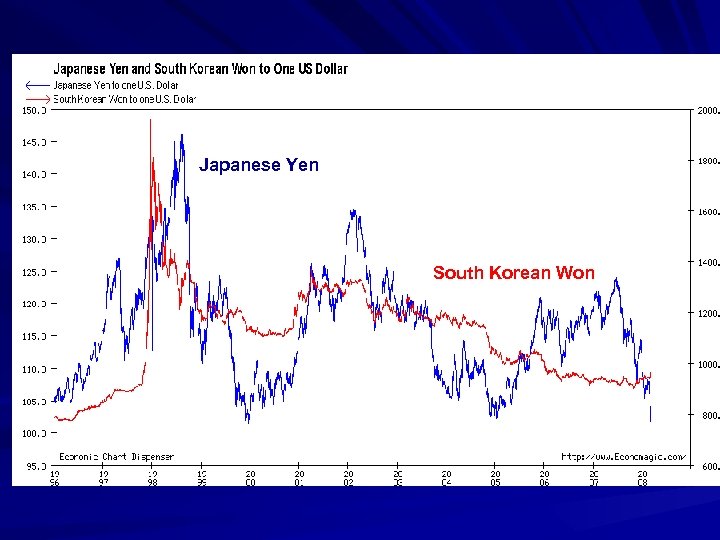

Japanese Yen South Korean Won

Japanese Yen South Korean Won

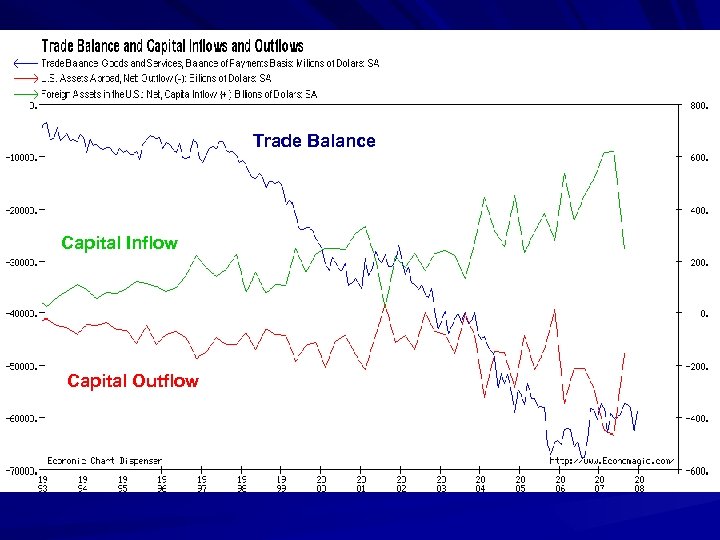

Key relationship: A trade deficit (imports > exports) = inflow of capital (foreigners purchasing US financial and real assets > Americans purchasing foreign assets) A trade surplus (exports > imports) = outflow of capital (Americans purchasing foreign assets > foreigners purchasing US assets)

Key relationship: A trade deficit (imports > exports) = inflow of capital (foreigners purchasing US financial and real assets > Americans purchasing foreign assets) A trade surplus (exports > imports) = outflow of capital (Americans purchasing foreign assets > foreigners purchasing US assets)

Trade Balance Capital Inflow Capital Outflow

Trade Balance Capital Inflow Capital Outflow

Video: Stossel 2011 Economics of trade deficits

Video: Stossel 2011 Economics of trade deficits

Trade Barriers Main point: Generally, any trade restriction will reduce quantity, increase consumer prices, and create a deadweight loss (elimination of gains from trade). A tariff is a tax on imports (it raises the price so quantity demanded will fall); it reduces imports and generates revenue for the government A quota is a limit on the physical units that can be imported; it generates no revenue

Trade Barriers Main point: Generally, any trade restriction will reduce quantity, increase consumer prices, and create a deadweight loss (elimination of gains from trade). A tariff is a tax on imports (it raises the price so quantity demanded will fall); it reduces imports and generates revenue for the government A quota is a limit on the physical units that can be imported; it generates no revenue

Video: Stossel are boycotts of sweatshop products helpful?

Video: Stossel are boycotts of sweatshop products helpful?

So, why does the US impose trade restrictions? To “protect” certain groups, which gave rise to the term “protectionism” The protected group is helped while others in the US economy are hurt

So, why does the US impose trade restrictions? To “protect” certain groups, which gave rise to the term “protectionism” The protected group is helped while others in the US economy are hurt

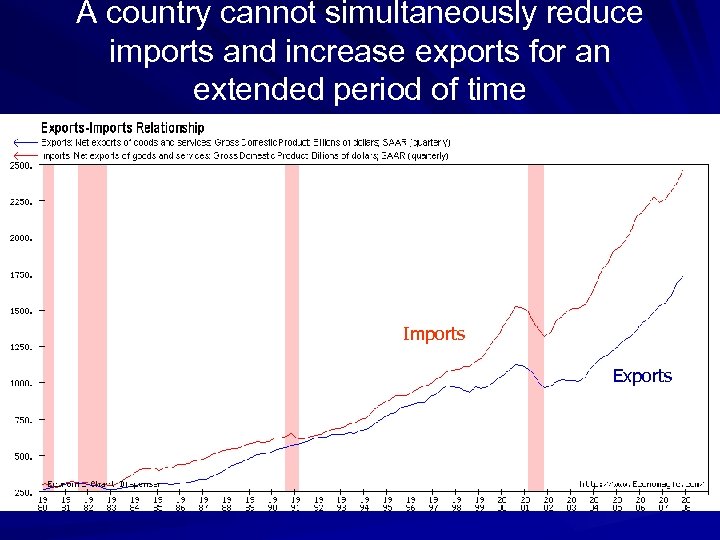

A country cannot simultaneously reduce imports and increase exports for an extended period of time Imports Exports

A country cannot simultaneously reduce imports and increase exports for an extended period of time Imports Exports

Huge point (that most people don’t understand): Our imports give purchasing power to foreigners. They, in turn, purchase our exports. If we limited imports, we would limit the income of foreigners and they wouldn’t be able to buy as many of our exports. That’s why imports and exports are positively related

Huge point (that most people don’t understand): Our imports give purchasing power to foreigners. They, in turn, purchase our exports. If we limited imports, we would limit the income of foreigners and they wouldn’t be able to buy as many of our exports. That’s why imports and exports are positively related

Here are more accurate statements about free trade: Free trade is harmful to some Americans but is helpful to America More people are helped by free trade than are hurt by free trade (i. e. America experiences a net gain)

Here are more accurate statements about free trade: Free trade is harmful to some Americans but is helpful to America More people are helped by free trade than are hurt by free trade (i. e. America experiences a net gain)

Video: Stossel does outsourcing cost Americans jobs?

Video: Stossel does outsourcing cost Americans jobs?

A study done in 2004 by Professor Matthew J. Slaughter at Dartmouth University found that outsourcing is actually a way of increasing the number of American jobs. He found that employment increased both for American firms involved in outsourcing but also for their affiliates in other countries. While employment in foreign affiliates rose by 2. 8 million jobs, employment in the U. S. parent firms rose even more --by 5. 5 million jobs. In other words, for every one job outsourced, U. S. firms created nearly two jobs in the United States.

A study done in 2004 by Professor Matthew J. Slaughter at Dartmouth University found that outsourcing is actually a way of increasing the number of American jobs. He found that employment increased both for American firms involved in outsourcing but also for their affiliates in other countries. While employment in foreign affiliates rose by 2. 8 million jobs, employment in the U. S. parent firms rose even more --by 5. 5 million jobs. In other words, for every one job outsourced, U. S. firms created nearly two jobs in the United States.

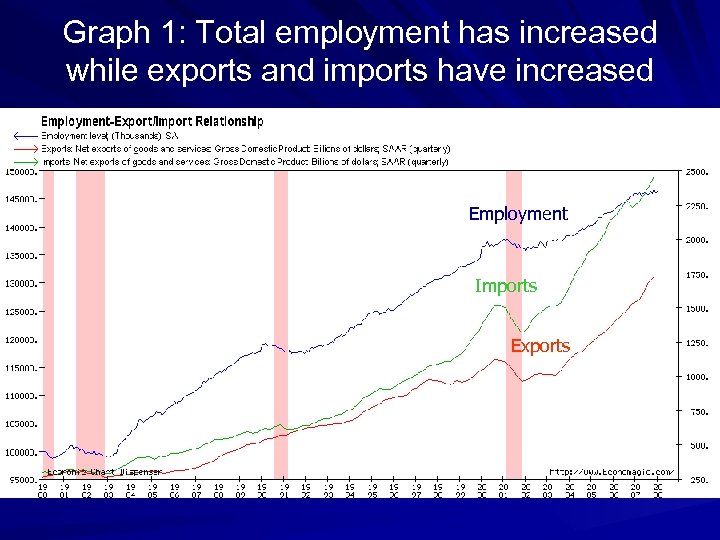

Graph 1: Total employment has increased while exports and imports have increased Employment Imports Exports

Graph 1: Total employment has increased while exports and imports have increased Employment Imports Exports

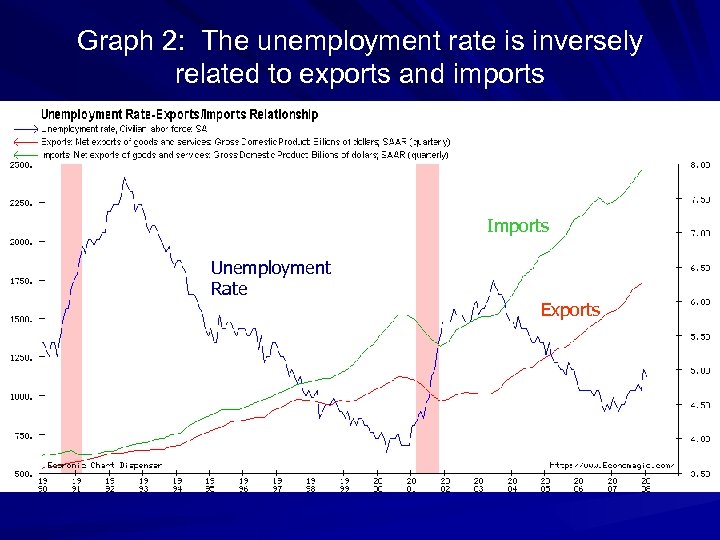

Graph 2: The unemployment rate is inversely related to exports and imports Imports Unemployment Rate Exports

Graph 2: The unemployment rate is inversely related to exports and imports Imports Unemployment Rate Exports

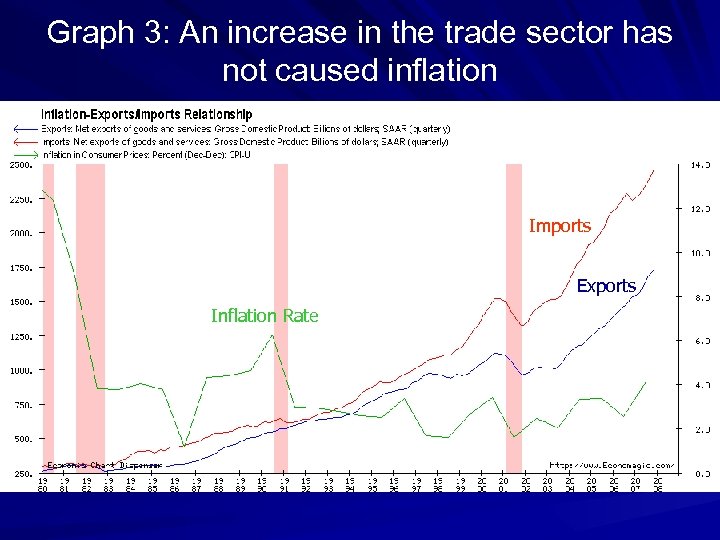

Graph 3: An increase in the trade sector has not caused inflation Imports Exports Inflation Rate

Graph 3: An increase in the trade sector has not caused inflation Imports Exports Inflation Rate

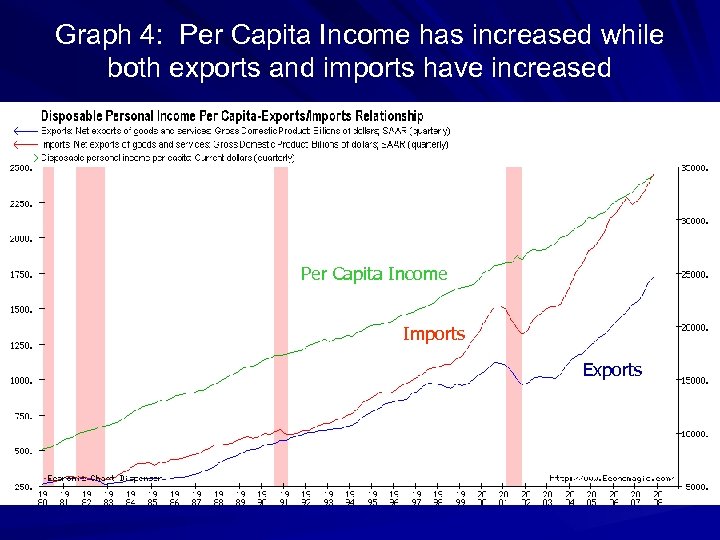

Graph 4: Per Capita Income has increased while both exports and imports have increased Per Capita Income Imports Exports

Graph 4: Per Capita Income has increased while both exports and imports have increased Per Capita Income Imports Exports

Arguments for tariffs that may, in principle, have some merit: 1) National security 2) Infant industry

Arguments for tariffs that may, in principle, have some merit: 1) National security 2) Infant industry

Focus: Understanding Economics in Civics and Government Lesson 17 Making Trade-Offs in Policy Decisions: The Patriot Act

Focus: Understanding Economics in Civics and Government Lesson 17 Making Trade-Offs in Policy Decisions: The Patriot Act

The Great Economics Mysteries Book Chapter 3 Lesson 8 Why Would Mexico Want to Trade with the United States and Canada?

The Great Economics Mysteries Book Chapter 3 Lesson 8 Why Would Mexico Want to Trade with the United States and Canada?

Focus: Understanding Economics in Civics and Government Lesson 20 Economic Freedom and Rights

Focus: Understanding Economics in Civics and Government Lesson 20 Economic Freedom and Rights

Video: Stossel 2011 International tradecriticisms and responses

Video: Stossel 2011 International tradecriticisms and responses