83cc513d407befe8345edac53c7c49a9.ppt

- Количество слайдов: 12

Stamp Duty Implication on Conversion of Firm/ LLCs into an LLP Argus Partners Solicitors & Advocates 1 st Floor, 238 B AJC Bose Road, Kolkata 700 020 Mumbai I Delhi I Bangalore I Chennai

Stamp Duty Implication on Conversion of Firm/ LLCs into an LLP Argus Partners Solicitors & Advocates 1 st Floor, 238 B AJC Bose Road, Kolkata 700 020 Mumbai I Delhi I Bangalore I Chennai

What we do Our expertise and our practice covers the following areas: • MERGERS & ACQUISITIONS • GENERAL CORPORATE • REAL ESTATE & REAL ESTATE FINANCING • LITIGATION AND ARBITRATION • POLICY • ESTATE AND SUCCESSION PLANNING • BANKING & FINANCE • COMPETITION • EMPLOYMENT AND LABOUR • PROJECT • EDUCATION • INDIRECT TAX 2

What we do Our expertise and our practice covers the following areas: • MERGERS & ACQUISITIONS • GENERAL CORPORATE • REAL ESTATE & REAL ESTATE FINANCING • LITIGATION AND ARBITRATION • POLICY • ESTATE AND SUCCESSION PLANNING • BANKING & FINANCE • COMPETITION • EMPLOYMENT AND LABOUR • PROJECT • EDUCATION • INDIRECT TAX 2

Where are we? OUR OFFICES MUMBAI 11 B Nirmal, 11 th Floor, Nariman Point, Mumbai 400021 T: +91 22 67362222 F: +91 22 67362211 E: mumbai@argus-p. com DELHI Express Building 9 -10, Bahadurshah Zafar Marg New Delhi 110002 T: +91 11 2370 1284/5/7 F: +91 11 2370 1286 E: delhi@argus-p. com DELHI KOLKATA 1 st Floor, 238 B AJC Bose Road Kolkata 700020 T: +91 33 4065 0155/ 56 F: +91 33 4065 0157 E: kolkata@argus-p. com BANGALORE Bharath Apartments No. 44/I, 4 B, Race Course Road, Fairfield Layout Bangalore 560001 T: +91 80 41738 222 F: +91 80 4173 8111 E: bangalore@argus-p. com CHENNAI Old no. 38, New no. 14, II Floor, ‘B’ Portion, KNS Estate, Karpagambal Nagar, Mylapore Chennai 600004 T: +91 44 2498 5814 F: +91 44 4201 5849 KOLKATA MUMBAI BANGALORE Contact us at: communications@argus-p. com CHENNAI 3

Where are we? OUR OFFICES MUMBAI 11 B Nirmal, 11 th Floor, Nariman Point, Mumbai 400021 T: +91 22 67362222 F: +91 22 67362211 E: mumbai@argus-p. com DELHI Express Building 9 -10, Bahadurshah Zafar Marg New Delhi 110002 T: +91 11 2370 1284/5/7 F: +91 11 2370 1286 E: delhi@argus-p. com DELHI KOLKATA 1 st Floor, 238 B AJC Bose Road Kolkata 700020 T: +91 33 4065 0155/ 56 F: +91 33 4065 0157 E: kolkata@argus-p. com BANGALORE Bharath Apartments No. 44/I, 4 B, Race Course Road, Fairfield Layout Bangalore 560001 T: +91 80 41738 222 F: +91 80 4173 8111 E: bangalore@argus-p. com CHENNAI Old no. 38, New no. 14, II Floor, ‘B’ Portion, KNS Estate, Karpagambal Nagar, Mylapore Chennai 600004 T: +91 44 2498 5814 F: +91 44 4201 5849 KOLKATA MUMBAI BANGALORE Contact us at: communications@argus-p. com CHENNAI 3

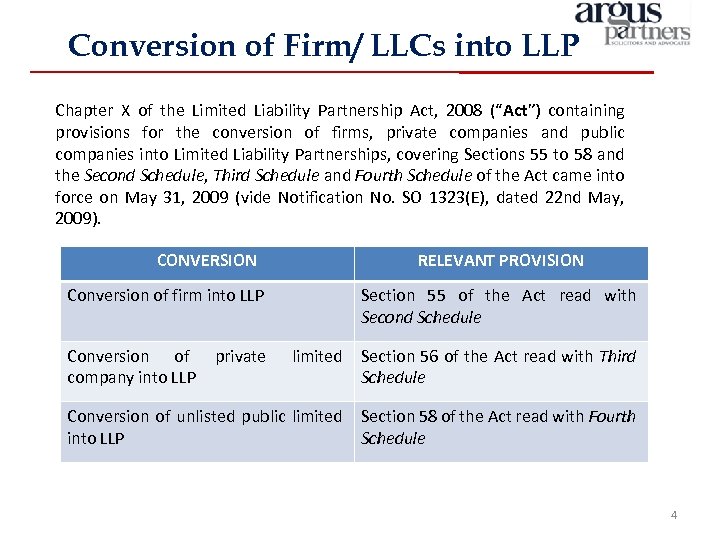

Conversion of Firm/ LLCs into LLP Chapter X of the Limited Liability Partnership Act, 2008 (“Act”) containing provisions for the conversion of firms, private companies and public companies into Limited Liability Partnerships, covering Sections 55 to 58 and the Second Schedule, Third Schedule and Fourth Schedule of the Act came into force on May 31, 2009 (vide Notification No. SO 1323(E), dated 22 nd May, 2009). CONVERSION Conversion of firm into LLP Conversion of company into LLP private RELEVANT PROVISION Section 55 of the Act read with Second Schedule limited Section 56 of the Act read with Third Schedule Conversion of unlisted public limited Section 58 of the Act read with Fourth into LLP Schedule 4

Conversion of Firm/ LLCs into LLP Chapter X of the Limited Liability Partnership Act, 2008 (“Act”) containing provisions for the conversion of firms, private companies and public companies into Limited Liability Partnerships, covering Sections 55 to 58 and the Second Schedule, Third Schedule and Fourth Schedule of the Act came into force on May 31, 2009 (vide Notification No. SO 1323(E), dated 22 nd May, 2009). CONVERSION Conversion of firm into LLP Conversion of company into LLP private RELEVANT PROVISION Section 55 of the Act read with Second Schedule limited Section 56 of the Act read with Third Schedule Conversion of unlisted public limited Section 58 of the Act read with Fourth into LLP Schedule 4

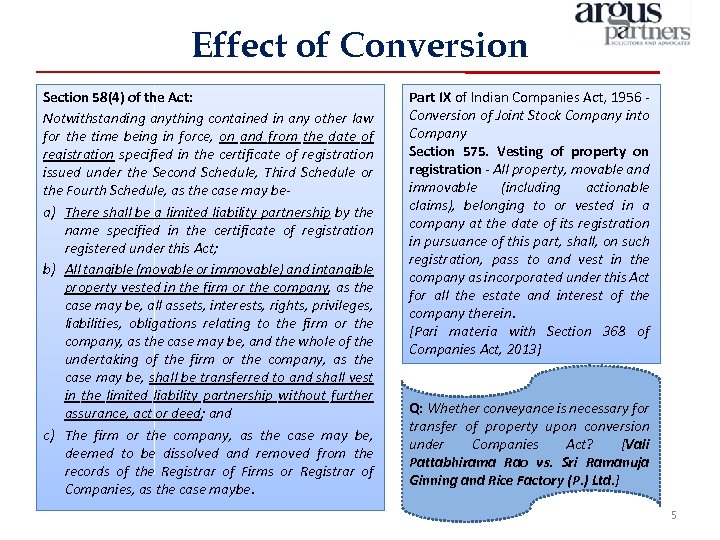

Effect of Conversion Section 58(4) of the Act: Notwithstanding anything contained in any other law for the time being in force, on and from the date of registration specified in the certificate of registration issued under the Second Schedule, Third Schedule or the Fourth Schedule, as the case may bea) There shall be a limited liability partnership by the name specified in the certificate of registration registered under this Act; b) All tangible (movable or immovable) and intangible property vested in the firm or the company, as the case may be, all assets, interests, rights, privileges, liabilities, obligations relating to the firm or the company, as the case may be, and the whole of the undertaking of the firm or the company, as the case may be, shall be transferred to and shall vest in the limited liability partnership without further assurance, act or deed; and c) The firm or the company, as the case may be, deemed to be dissolved and removed from the records of the Registrar of Firms or Registrar of Companies, as the case maybe. Part IX of Indian Companies Act, 1956 - Conversion of Joint Stock Company into Company Section 575. Vesting of property on registration - All property, movable and immovable (including actionable claims), belonging to or vested in a company at the date of its registration in pursuance of this part, shall, on such registration, pass to and vest in the company as incorporated under this Act for all the estate and interest of the company therein. [Pari materia with Section 368 of Companies Act, 2013] Q: Whether conveyance is necessary for transfer of property upon conversion under Companies Act? [Vali Pattabhirama Rao vs. Sri Ramanuja Ginning and Rice Factory (P. ) Ltd. ] 5

Effect of Conversion Section 58(4) of the Act: Notwithstanding anything contained in any other law for the time being in force, on and from the date of registration specified in the certificate of registration issued under the Second Schedule, Third Schedule or the Fourth Schedule, as the case may bea) There shall be a limited liability partnership by the name specified in the certificate of registration registered under this Act; b) All tangible (movable or immovable) and intangible property vested in the firm or the company, as the case may be, all assets, interests, rights, privileges, liabilities, obligations relating to the firm or the company, as the case may be, and the whole of the undertaking of the firm or the company, as the case may be, shall be transferred to and shall vest in the limited liability partnership without further assurance, act or deed; and c) The firm or the company, as the case may be, deemed to be dissolved and removed from the records of the Registrar of Firms or Registrar of Companies, as the case maybe. Part IX of Indian Companies Act, 1956 - Conversion of Joint Stock Company into Company Section 575. Vesting of property on registration - All property, movable and immovable (including actionable claims), belonging to or vested in a company at the date of its registration in pursuance of this part, shall, on such registration, pass to and vest in the company as incorporated under this Act for all the estate and interest of the company therein. [Pari materia with Section 368 of Companies Act, 2013] Q: Whether conveyance is necessary for transfer of property upon conversion under Companies Act? [Vali Pattabhirama Rao vs. Sri Ramanuja Ginning and Rice Factory (P. ) Ltd. ] 5

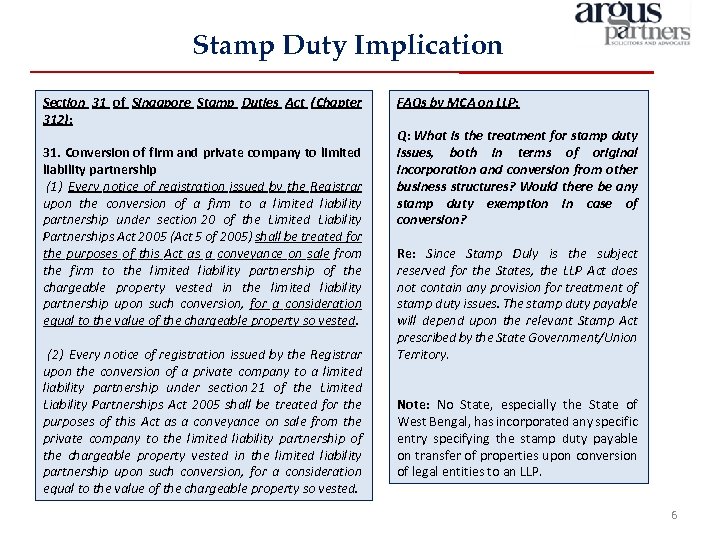

Stamp Duty Implication Section 31 of Singapore Stamp Duties Act (Chapter 312): 31. Conversion of firm and private company to limited liability partnership (1) Every notice of registration issued by the Registrar upon the conversion of a firm to a limited liability partnership under section 20 of the Limited Liability Partnerships Act 2005 (Act 5 of 2005) shall be treated for the purposes of this Act as a conveyance on sale from the firm to the limited liability partnership of the chargeable property vested in the limited liability partnership upon such conversion, for a consideration equal to the value of the chargeable property so vested. (2) Every notice of registration issued by the Registrar upon the conversion of a private company to a limited liability partnership under section 21 of the Limited Liability Partnerships Act 2005 shall be treated for the purposes of this Act as a conveyance on sale from the private company to the limited liability partnership of the chargeable property vested in the limited liability partnership upon such conversion, for a consideration equal to the value of the chargeable property so vested. FAQs by MCA on LLP: Q: What is the treatment for stamp duty issues, both in terms of original incorporation and conversion from other business structures? Would there be any stamp duty exemption in case of conversion? Re: Since Stamp Duly is the subject reserved for the States, the LLP Act does not contain any provision for treatment of stamp duty issues. The stamp duty payable will depend upon the relevant Stamp Act prescribed by the State Government/Union Territory. Note: No State, especially the State of West Bengal, has incorporated any specific entry specifying the stamp duty payable on transfer of properties upon conversion of legal entities to an LLP. 6

Stamp Duty Implication Section 31 of Singapore Stamp Duties Act (Chapter 312): 31. Conversion of firm and private company to limited liability partnership (1) Every notice of registration issued by the Registrar upon the conversion of a firm to a limited liability partnership under section 20 of the Limited Liability Partnerships Act 2005 (Act 5 of 2005) shall be treated for the purposes of this Act as a conveyance on sale from the firm to the limited liability partnership of the chargeable property vested in the limited liability partnership upon such conversion, for a consideration equal to the value of the chargeable property so vested. (2) Every notice of registration issued by the Registrar upon the conversion of a private company to a limited liability partnership under section 21 of the Limited Liability Partnerships Act 2005 shall be treated for the purposes of this Act as a conveyance on sale from the private company to the limited liability partnership of the chargeable property vested in the limited liability partnership upon such conversion, for a consideration equal to the value of the chargeable property so vested. FAQs by MCA on LLP: Q: What is the treatment for stamp duty issues, both in terms of original incorporation and conversion from other business structures? Would there be any stamp duty exemption in case of conversion? Re: Since Stamp Duly is the subject reserved for the States, the LLP Act does not contain any provision for treatment of stamp duty issues. The stamp duty payable will depend upon the relevant Stamp Act prescribed by the State Government/Union Territory. Note: No State, especially the State of West Bengal, has incorporated any specific entry specifying the stamp duty payable on transfer of properties upon conversion of legal entities to an LLP. 6

Stamp Duty Implication Analysis of the issue as to applicability of stamp duty on conversion into LLP requires analysis of the interplay of three legislations: Transfer of Property Act, 1882, Indian Stamp Act, 1899 and the Act. Stamp Act To. PA LLP Act 7

Stamp Duty Implication Analysis of the issue as to applicability of stamp duty on conversion into LLP requires analysis of the interplay of three legislations: Transfer of Property Act, 1882, Indian Stamp Act, 1899 and the Act. Stamp Act To. PA LLP Act 7

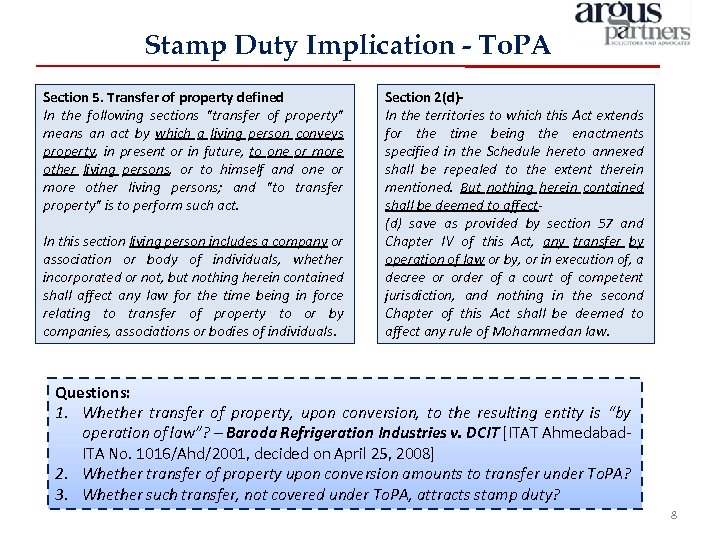

Stamp Duty Implication - To. PA Section 5. Transfer of property defined In the following sections "transfer of property" means an act by which a living person conveys property, in present or in future, to one or more other living persons, or to himself and one or more other living persons; and "to transfer property" is to perform such act. In this section living person includes a company or association or body of individuals, whether incorporated or not, but nothing herein contained shall affect any law for the time being in force relating to transfer of property to or by companies, associations or bodies of individuals. Section 2(d)In the territories to which this Act extends for the time being the enactments specified in the Schedule hereto annexed shall be repealed to the extent therein mentioned. But nothing herein contained shall be deemed to affect(d) save as provided by section 57 and Chapter IV of this Act, any transfer by operation of law or by, or in execution of, a decree or order of a court of competent jurisdiction, and nothing in the second Chapter of this Act shall be deemed to affect any rule of Mohammedan law. Questions: 1. Whether transfer of property, upon conversion, to the resulting entity is “by operation of law”? – Baroda Refrigeration Industries v. DCIT [ITAT Ahmedabad- ITA No. 1016/Ahd/2001, decided on April 25, 2008] 2. Whether transfer of property upon conversion amounts to transfer under To. PA? 3. Whether such transfer, not covered under To. PA, attracts stamp duty? 8

Stamp Duty Implication - To. PA Section 5. Transfer of property defined In the following sections "transfer of property" means an act by which a living person conveys property, in present or in future, to one or more other living persons, or to himself and one or more other living persons; and "to transfer property" is to perform such act. In this section living person includes a company or association or body of individuals, whether incorporated or not, but nothing herein contained shall affect any law for the time being in force relating to transfer of property to or by companies, associations or bodies of individuals. Section 2(d)In the territories to which this Act extends for the time being the enactments specified in the Schedule hereto annexed shall be repealed to the extent therein mentioned. But nothing herein contained shall be deemed to affect(d) save as provided by section 57 and Chapter IV of this Act, any transfer by operation of law or by, or in execution of, a decree or order of a court of competent jurisdiction, and nothing in the second Chapter of this Act shall be deemed to affect any rule of Mohammedan law. Questions: 1. Whether transfer of property, upon conversion, to the resulting entity is “by operation of law”? – Baroda Refrigeration Industries v. DCIT [ITAT Ahmedabad- ITA No. 1016/Ahd/2001, decided on April 25, 2008] 2. Whether transfer of property upon conversion amounts to transfer under To. PA? 3. Whether such transfer, not covered under To. PA, attracts stamp duty? 8

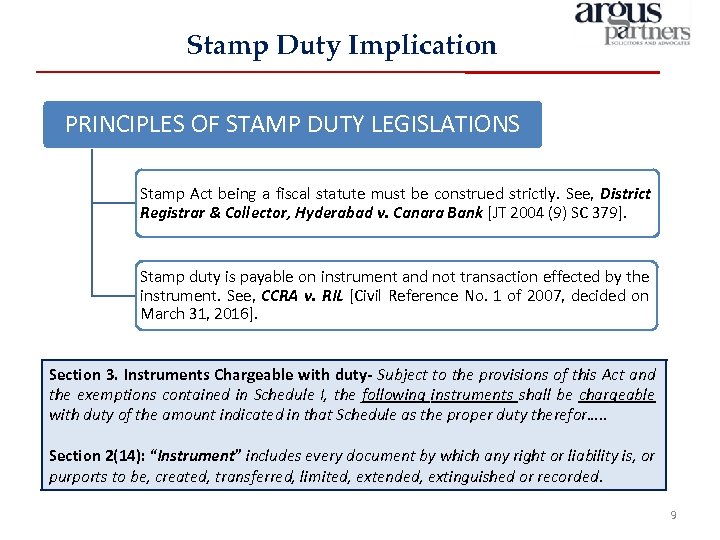

Stamp Duty Implication PRINCIPLES OF STAMP DUTY LEGISLATIONS Stamp Act being a fiscal statute must be construed strictly. See, District Registrar & Collector, Hyderabad v. Canara Bank [JT 2004 (9) SC 379]. Stamp duty is payable on instrument and not transaction effected by the instrument. See, CCRA v. RIL [Civil Reference No. 1 of 2007, decided on March 31, 2016]. Section 3. Instruments Chargeable with duty- Subject to the provisions of this Act and the exemptions contained in Schedule I, the following instruments shall be chargeable with duty of the amount indicated in that Schedule as the proper duty therefor…. . Section 2(14): “Instrument” includes every document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished or recorded. 9

Stamp Duty Implication PRINCIPLES OF STAMP DUTY LEGISLATIONS Stamp Act being a fiscal statute must be construed strictly. See, District Registrar & Collector, Hyderabad v. Canara Bank [JT 2004 (9) SC 379]. Stamp duty is payable on instrument and not transaction effected by the instrument. See, CCRA v. RIL [Civil Reference No. 1 of 2007, decided on March 31, 2016]. Section 3. Instruments Chargeable with duty- Subject to the provisions of this Act and the exemptions contained in Schedule I, the following instruments shall be chargeable with duty of the amount indicated in that Schedule as the proper duty therefor…. . Section 2(14): “Instrument” includes every document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished or recorded. 9

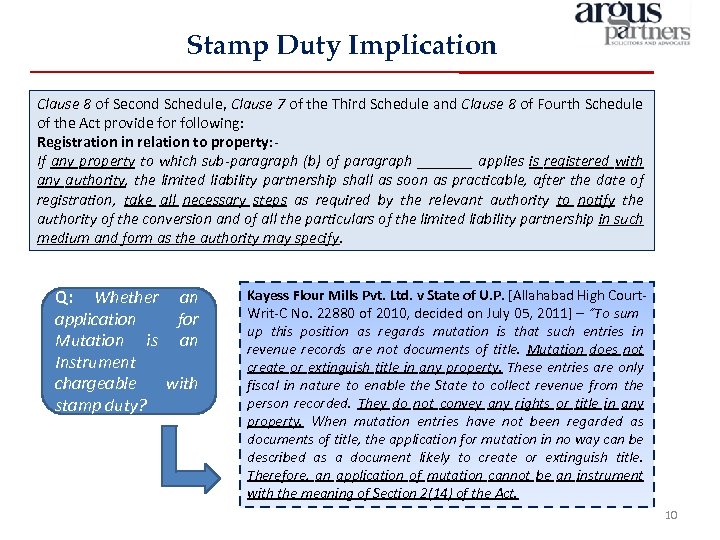

Stamp Duty Implication Clause 8 of Second Schedule, Clause 7 of the Third Schedule and Clause 8 of Fourth Schedule of the Act provide for following: Registration in relation to property: - If any property to which sub-paragraph (b) of paragraph _______ applies is registered with any authority, the limited liability partnership shall as soon as practicable, after the date of registration, take all necessary steps as required by the relevant authority to notify the authority of the conversion and of all the particulars of the limited liability partnership in such medium and form as the authority may specify. Q: Whether an application for Mutation is an Instrument chargeable with stamp duty? Kayess Flour Mills Pvt. Ltd. v State of U. P. [Allahabad High Court. Writ-C No. 22880 of 2010, decided on July 05, 2011] – “To sum up this position as regards mutation is that such entries in revenue records are not documents of title. Mutation does not create or extinguish title in any property. These entries are only fiscal in nature to enable the State to collect revenue from the person recorded. They do not convey any rights or title in any property. When mutation entries have not been regarded as documents of title, the application for mutation in no way can be described as a document likely to create or extinguish title. Therefore, an application of mutation cannot be an instrument with the meaning of Section 2(14) of the Act. 10

Stamp Duty Implication Clause 8 of Second Schedule, Clause 7 of the Third Schedule and Clause 8 of Fourth Schedule of the Act provide for following: Registration in relation to property: - If any property to which sub-paragraph (b) of paragraph _______ applies is registered with any authority, the limited liability partnership shall as soon as practicable, after the date of registration, take all necessary steps as required by the relevant authority to notify the authority of the conversion and of all the particulars of the limited liability partnership in such medium and form as the authority may specify. Q: Whether an application for Mutation is an Instrument chargeable with stamp duty? Kayess Flour Mills Pvt. Ltd. v State of U. P. [Allahabad High Court. Writ-C No. 22880 of 2010, decided on July 05, 2011] – “To sum up this position as regards mutation is that such entries in revenue records are not documents of title. Mutation does not create or extinguish title in any property. These entries are only fiscal in nature to enable the State to collect revenue from the person recorded. They do not convey any rights or title in any property. When mutation entries have not been regarded as documents of title, the application for mutation in no way can be described as a document likely to create or extinguish title. Therefore, an application of mutation cannot be an instrument with the meaning of Section 2(14) of the Act. 10

Questions? 11

Questions? 11

Thank You Solicitors & Advocates Kolkata | Mumbai I Delhi I Bangalore I Chennai 12

Thank You Solicitors & Advocates Kolkata | Mumbai I Delhi I Bangalore I Chennai 12