0690f6dd183ac2caab7f9c5e383fd9d3.ppt

- Количество слайдов: 23

Staff Briefing on Reducing Foreclosures December 4, 2009 Morris A. Davis Chris Foote Eileen Mauskopf University of Wisconsin Federal Reserve Bank of Boston Federal Reserve Board Disclaimer: The views expressed here do not reflect the views of the staff of the Federal Reserve Bank of Boston, the Federal Reserve Board, or the Federal Reserve System 1

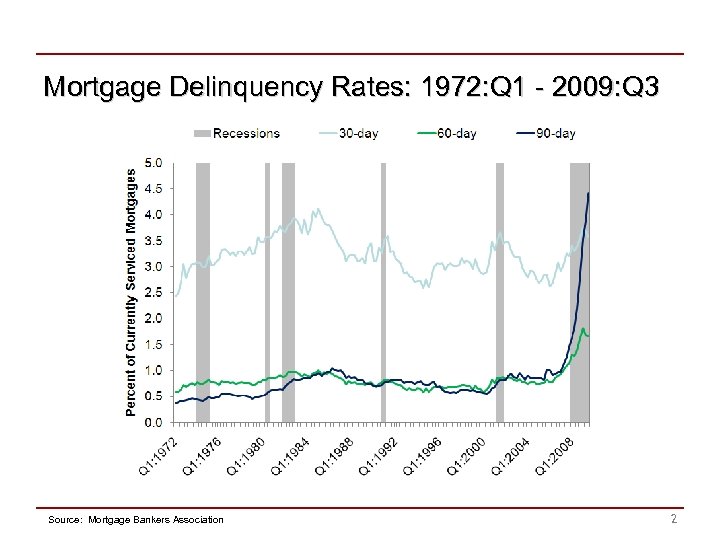

Mortgage Delinquency Rates: 1972: Q 1 - 2009: Q 3 Source: Mortgage Bankers Association 2

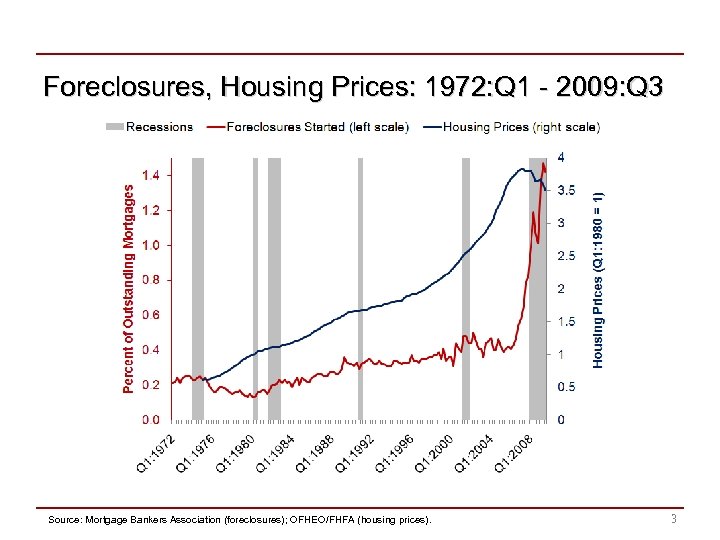

Foreclosures, Housing Prices: 1972: Q 1 - 2009: Q 3 Source: Mortgage Bankers Association (foreclosures); OFHEO/FHFA (housing prices). 3

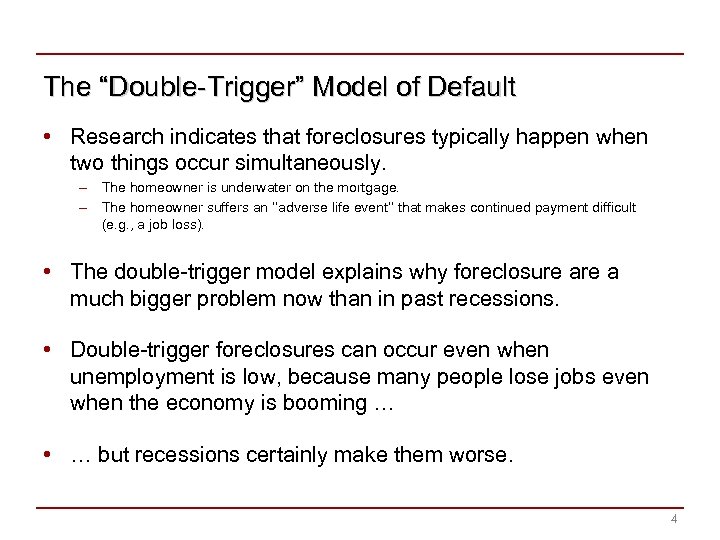

The “Double-Trigger” Model of Default • Research indicates that foreclosures typically happen when two things occur simultaneously. – The homeowner is underwater on the mortgage. – The homeowner suffers an ‘’adverse life event’’ that makes continued payment difficult (e. g. , a job loss). • The double-trigger model explains why foreclosure a much bigger problem now than in past recessions. • Double-trigger foreclosures can occur even when unemployment is low, because many people lose jobs even when the economy is booming … • … but recessions certainly make them worse. 4

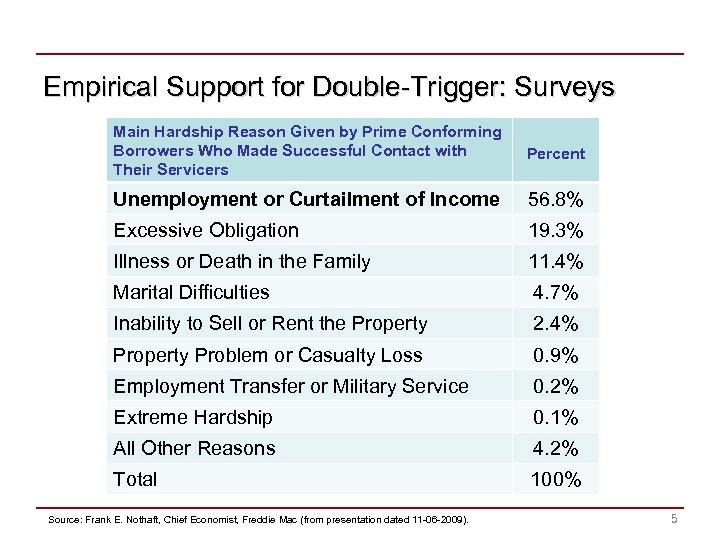

Empirical Support for Double-Trigger: Surveys Main Hardship Reason Given by Prime Conforming Borrowers Who Made Successful Contact with Their Servicers Percent Unemployment or Curtailment of Income 56. 8% Excessive Obligation 19. 3% Illness or Death in the Family 11. 4% Marital Difficulties 4. 7% Inability to Sell or Rent the Property 2. 4% Property Problem or Casualty Loss 0. 9% Employment Transfer or Military Service 0. 2% Extreme Hardship 0. 1% All Other Reasons 4. 2% Total 100% Source: Frank E. Nothaft, Chief Economist, Freddie Mac (from presentation dated 11 -06 -2009). 5

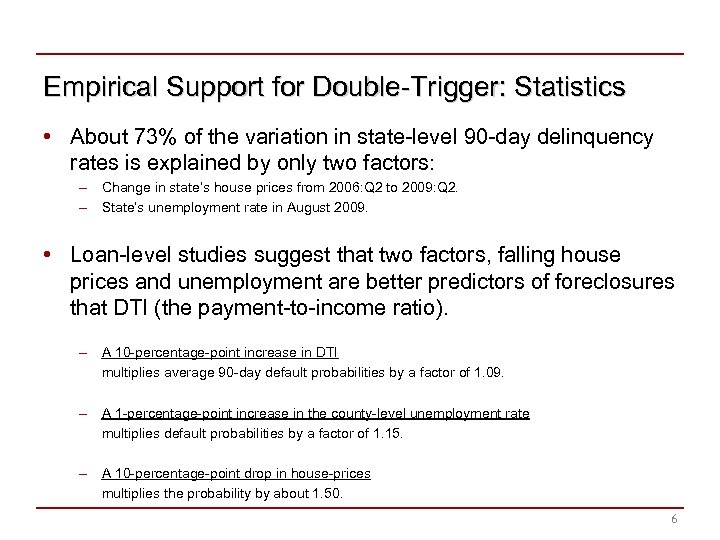

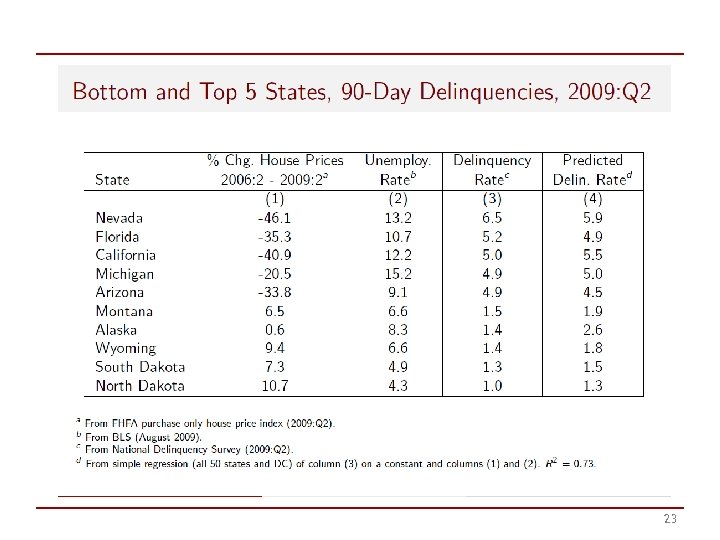

Empirical Support for Double-Trigger: Statistics • About 73% of the variation in state-level 90 -day delinquency rates is explained by only two factors: – Change in state’s house prices from 2006: Q 2 to 2009: Q 2. – State’s unemployment rate in August 2009. • Loan-level studies suggest that two factors, falling house prices and unemployment are better predictors of foreclosures that DTI (the payment-to-income ratio). – A 10 -percentage-point increase in DTI multiplies average 90 -day default probabilities by a factor of 1. 09. – A 1 -percentage-point increase in the county-level unemployment rate multiplies default probabilities by a factor of 1. 15. – A 10 -percentage-point drop in house-prices multiplies the probability by about 1. 50. 6

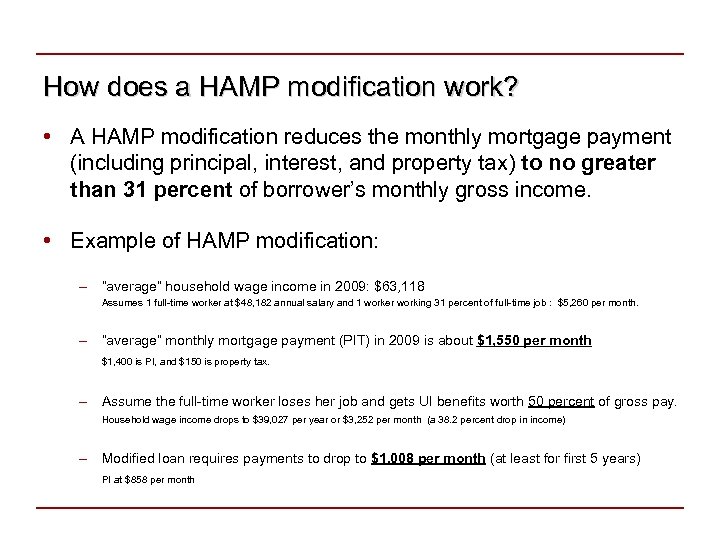

How does a HAMP modification work? • A HAMP modification reduces the monthly mortgage payment (including principal, interest, and property tax) to no greater than 31 percent of borrower’s monthly gross income. • Example of HAMP modification: – “average” household wage income in 2009: $63, 118 Assumes 1 full-time worker at $48, 182 annual salary and 1 worker working 31 percent of full-time job : $5, 260 per month. – “average” monthly mortgage payment (PIT) in 2009 is about $1, 550 per month $1, 400 is PI, and $150 is property tax. – Assume the full-time worker loses her job and gets UI benefits worth 50 percent of gross pay. Household wage income drops to $39, 027 per year or $3, 252 per month (a 38. 2 percent drop in income) – Modified loan requires payments to drop to $1, 008 per month (at least for first 5 years) PI at $858 per month

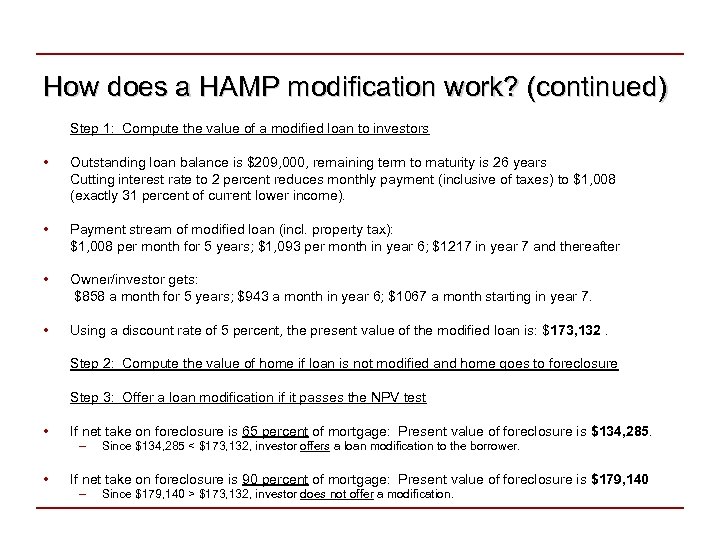

How does a HAMP modification work? (continued) Step 1: Compute the value of a modified loan to investors • Outstanding loan balance is $209, 000, remaining term to maturity is 26 years Cutting interest rate to 2 percent reduces monthly payment (inclusive of taxes) to $1, 008 (exactly 31 percent of current lower income). • Payment stream of modified loan (incl. property tax): $1, 008 per month for 5 years; $1, 093 per month in year 6; $1217 in year 7 and thereafter • Owner/investor gets: $858 a month for 5 years; $943 a month in year 6; $1067 a month starting in year 7. • Using a discount rate of 5 percent, the present value of the modified loan is: $173, 132. Step 2: Compute the value of home if loan is not modified and home goes to foreclosure Step 3: Offer a loan modification if it passes the NPV test • If net take on foreclosure is 65 percent of mortgage: Present value of foreclosure is $134, 285. – • Since $134, 285 < $173, 132, investor offers a loan modification to the borrower. If net take on foreclosure is 90 percent of mortgage: Present value of foreclosure is $179, 140 – Since $179, 140 > $173, 132, investor does not offer a modification.

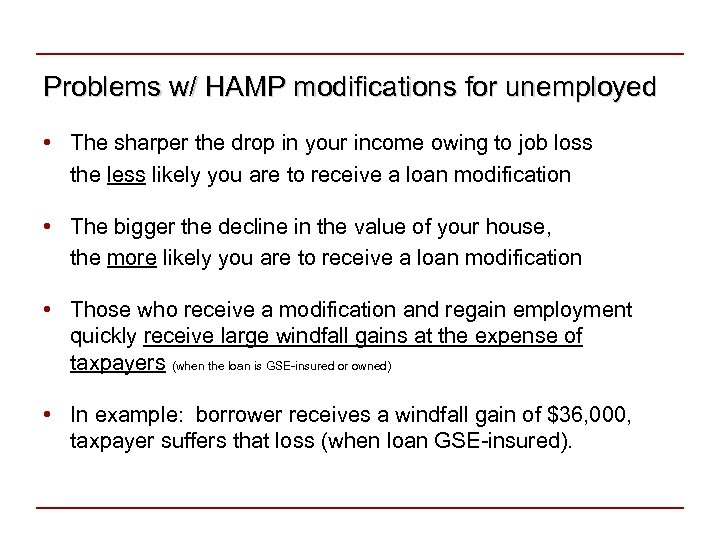

Problems w/ HAMP modifications for unemployed • The sharper the drop in your income owing to job loss the less likely you are to receive a loan modification • The bigger the decline in the value of your house, the more likely you are to receive a loan modification • Those who receive a modification and regain employment quickly receive large windfall gains at the expense of taxpayers (when the loan is GSE-insured or owned) • In example: borrower receives a windfall gain of $36, 000, taxpayer suffers that loss (when loan GSE-insured).

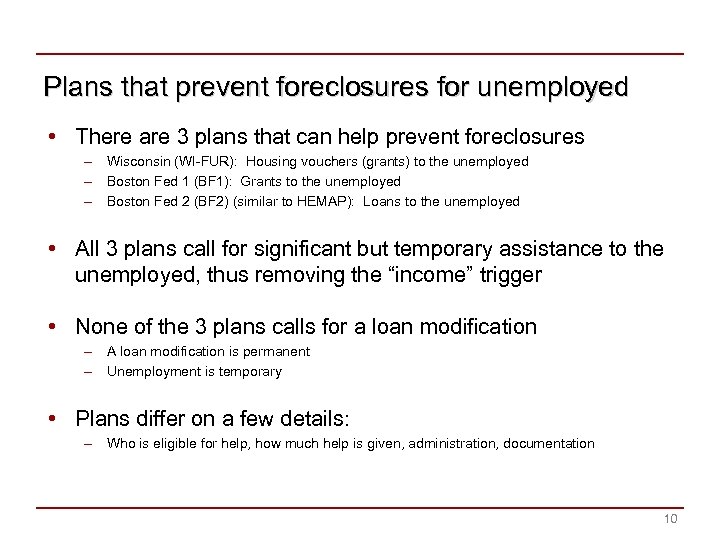

Plans that prevent foreclosures for unemployed • There are 3 plans that can help prevent foreclosures – Wisconsin (WI-FUR): Housing vouchers (grants) to the unemployed – Boston Fed 1 (BF 1): Grants to the unemployed – Boston Fed 2 (BF 2) (similar to HEMAP): Loans to the unemployed • All 3 plans call for significant but temporary assistance to the unemployed, thus removing the “income” trigger • None of the 3 plans calls for a loan modification – A loan modification is permanent – Unemployment is temporary • Plans differ on a few details: – Who is eligible for help, how much help is given, administration, documentation 10

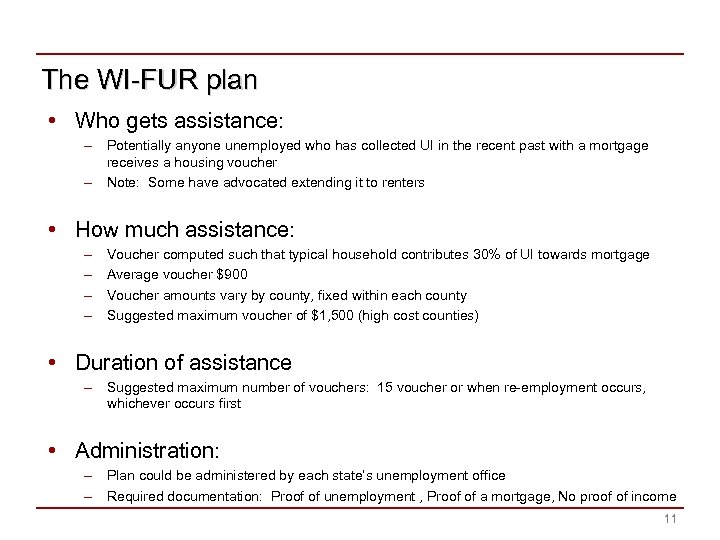

The WI-FUR plan • Who gets assistance: – Potentially anyone unemployed who has collected UI in the recent past with a mortgage receives a housing voucher – Note: Some have advocated extending it to renters • How much assistance: – – Voucher computed such that typical household contributes 30% of UI towards mortgage Average voucher $900 Voucher amounts vary by county, fixed within each county Suggested maximum voucher of $1, 500 (high cost counties) • Duration of assistance – Suggested maximum number of vouchers: 15 voucher or when re-employment occurs, whichever occurs first • Administration: – Plan could be administered by each state’s unemployment office – Required documentation: Proof of unemployment , Proof of a mortgage, No proof of income 11

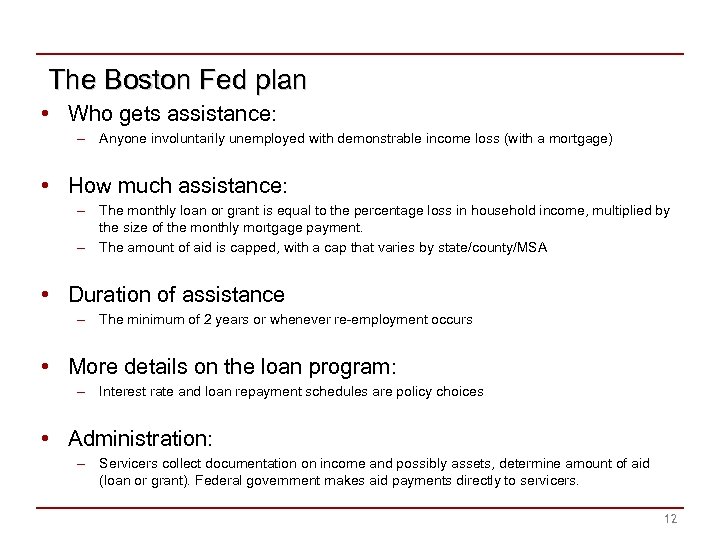

The Boston Fed plan • Who gets assistance: – Anyone involuntarily unemployed with demonstrable income loss (with a mortgage) • How much assistance: – The monthly loan or grant is equal to the percentage loss in household income, multiplied by the size of the monthly mortgage payment. – The amount of aid is capped, with a cap that varies by state/county/MSA • Duration of assistance – The minimum of 2 years or whenever re-employment occurs • More details on the loan program: – Interest rate and loan repayment schedules are policy choices • Administration: – Servicers collect documentation on income and possibly assets, determine amount of aid (loan or grant). Federal government makes aid payments directly to servicers. 12

Program Outlays • We expect gross program outlays (WI-FUR or Bos Fed) of $2 - $3 billion per month at current levels of unemployment • This seems like expensive public policy • However, since about 50% of all mortgages are government insured, doing nothing and allowing foreclosures to occur is also expensive public policy • Why? Foreclosures are costly, and in 50% of cases these costs are borne by U. S. taxpayers 13

Program Costs per Unemployed Homeowner • There is considerable uncertainty, but at one set of “reasonable” parameters, the least-cost alternative to U. S. taxpayers is the WI-FUR or Boston Fed Plan • If we do nothing, U. S. taxpayer bill is $6, 761 – Why? Government guaranteed mortgages: Freddie/Fannie/FHA/VA • If we administer a HAMP mod to the unemployed, U. S. taxpayer bill could average $18, 000 per modification (and likely more) • If we administer the WI-FUR or Boston Fed grant plan U. S. taxpayer bill is about $4, 750 – About $3, 500 in direct aid to unemployed (depends a bit on the plan) + $1, 250 in foreclosure costs (some people will receive aid and still go into foreclosure) – Boston Fed loan program will cost less 14

Supplementary Slides

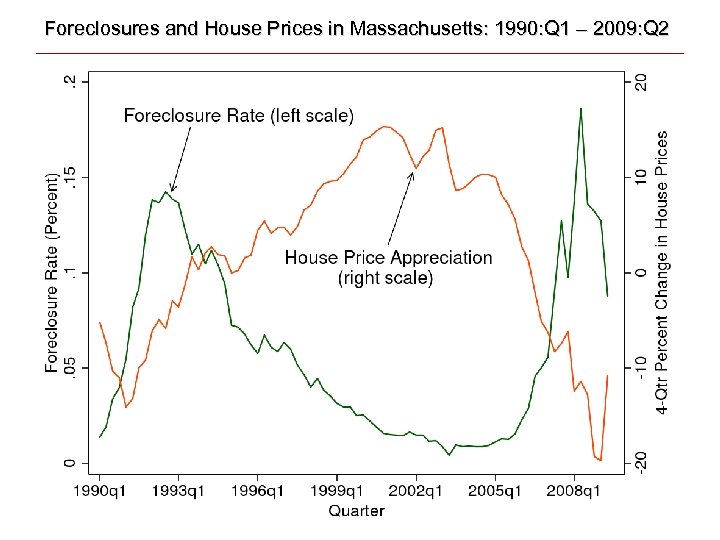

Foreclosures and House Prices in Massachusetts: 1990: Q 1 – 2009: Q 2

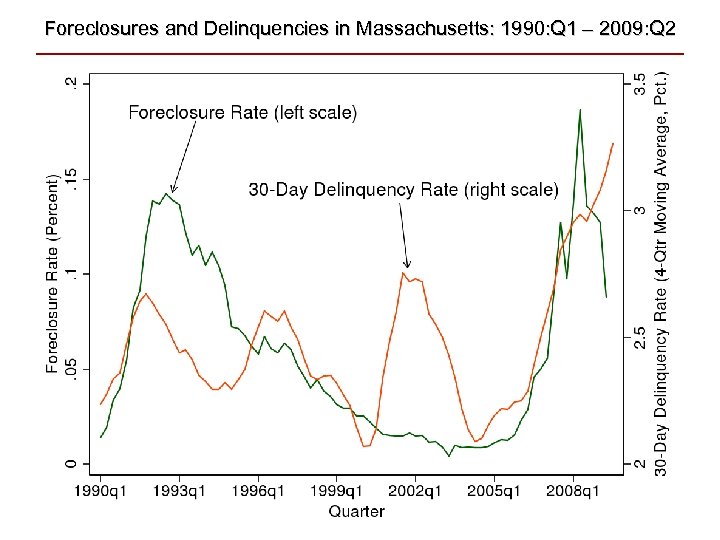

Foreclosures and Delinquencies in Massachusetts: 1990: Q 1 – 2009: Q 2

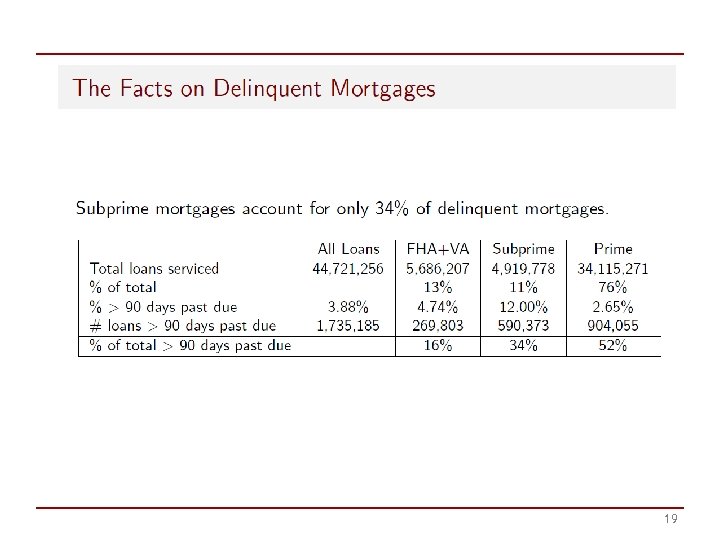

19

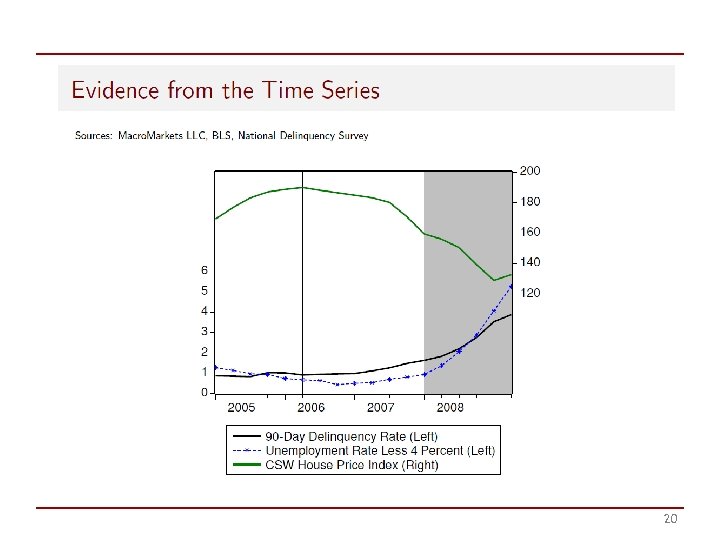

20

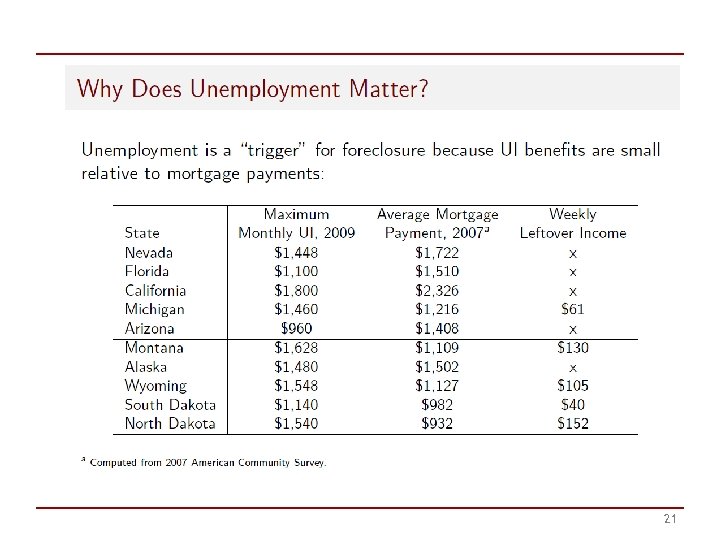

21

![Regression coefficients: Constant 0. 95 (3. 09) Ranges: Delinquency [1. 01, 6. 49] Unemp. Regression coefficients: Constant 0. 95 (3. 09) Ranges: Delinquency [1. 01, 6. 49] Unemp.](https://present5.com/presentation/0690f6dd183ac2caab7f9c5e383fd9d3/image-22.jpg)

Regression coefficients: Constant 0. 95 (3. 09) Ranges: Delinquency [1. 01, 6. 49] Unemp. Rate 0. 20 (4. 90) Unemployment [0. 71, 15. 20] HPI Pct. Change -0. 05 (-7. 34) HPI Pct. Change [-46. 1, 10. 7] 22

23

0690f6dd183ac2caab7f9c5e383fd9d3.ppt