268804b41c1e2e848489aebcbb97b31a.ppt

- Количество слайдов: 48

Spring Reg Changes 2012 Presenter: Justin Corum

Spring Reg Changes 2012 Presenter: Justin Corum

What is going on? 2

What is going on? 2

Format for Today’s Call 3

Format for Today’s Call 3

Let’s start with VISA Visa US is introducing a new Transaction Integrity fee on debit and prepaid cards. This fee will be assessed on both consumer and commercial, regulated and non-regulated transactions that are either not eligible or fail to meet CPS qualification. This includes transactions from quasi-cash and high risk telemarketing MCCs 5962, 5966, or 5967. Rates will be available on the interchange grid. Q: What is meant by failure to meet CPS Qualifications? Q: How will this fee be applied to my merchants? Q: Will the Transaction Integrity Fee impact just those MCCs listed in the bulletin or will it affect all debit and pre-paid cards? A: Any transaction that does not meet one of the CPS A: For all merchants, regardless of pricing method, this fee will interchange programs has failed to meet CPS qualification. be assessed as a pass through cost to the merchant and will A: All US merchants are subject to this fee, regardless of their This could be caused by not settling a transaction in a timely be detailed within the Card Assessments section of the MCC. manner, not requesting AVS on a key entered transaction, etc. merchant statement. 4

Let’s start with VISA Visa US is introducing a new Transaction Integrity fee on debit and prepaid cards. This fee will be assessed on both consumer and commercial, regulated and non-regulated transactions that are either not eligible or fail to meet CPS qualification. This includes transactions from quasi-cash and high risk telemarketing MCCs 5962, 5966, or 5967. Rates will be available on the interchange grid. Q: What is meant by failure to meet CPS Qualifications? Q: How will this fee be applied to my merchants? Q: Will the Transaction Integrity Fee impact just those MCCs listed in the bulletin or will it affect all debit and pre-paid cards? A: Any transaction that does not meet one of the CPS A: For all merchants, regardless of pricing method, this fee will interchange programs has failed to meet CPS qualification. be assessed as a pass through cost to the merchant and will A: All US merchants are subject to this fee, regardless of their This could be caused by not settling a transaction in a timely be detailed within the Card Assessments section of the MCC. manner, not requesting AVS on a key entered transaction, etc. merchant statement. 4

Visa US is introducing a new Fixed Acquirer Network Fee (FANF). This fee will be charged based on the merchant's MCCs, number of locations, and card present/card not present transaction volume. Rates will be available on the interchange grid. 5

Visa US is introducing a new Fixed Acquirer Network Fee (FANF). This fee will be charged based on the merchant's MCCs, number of locations, and card present/card not present transaction volume. Rates will be available on the interchange grid. 5

FANF (Fixed Acquirer Network Fee) Q: Is the fee assessed on every merchant location? Q: If one MID is processing both card present and card not Q: How will this fee be applied to my merchants? present transactions, will they be assessed both fees? Q: How is merchant location defined? Q: Is this rate variable each month or fixed by merchant? A: Merchant locations are currently defined as individual Merchant IDs. While it is assumed that one mid equals one location, a field will be A: The rate categories are determined based on the number of locations in the available on our back end system to set the number of locations for each relationship (same Tax Id Number) for Card Present transactions or by volume mid. This fee will be available for update in April and additional instructions for Card Not Present transactions. A grid is available on the Elavon Think for requesting this will be provided at that time. Center which details the categories and rates for these fees. For Card A: Yes, merchants could be assessed fees under both fee grids if they accept A: For all merchants, regardless of pricing method, this fee will be assessed as Present, the amount of the fee is assessed for each merchant in the both card present and card not present transactions This applies regardless of A: This rate could fluctuate each month depending on the number of locations a pass through cost to the merchant and will be detailed within the Card relationship. For example if the rate category is $2 and there are three the number of transactions processed. If the merchant accepts even 1 card under the same Tax ID or gross volume in that month. Assessments section of the merchant statement. locations, the merchant relationship is assessed a fee of $6. The Card Not present transaction and 1 card not present transaction, they will see 2 different Present volume is assessed one fee per relationship. If a Headquarter MID is fees based on the 2 tables. identified for the merchant relationship, Elavon will bill the total fee due to the Headquarter MID on file. If no Headquarter MID is identified, the merchant in the relationship with the highest processing volume for the current month will be assessed the fee. 6

FANF (Fixed Acquirer Network Fee) Q: Is the fee assessed on every merchant location? Q: If one MID is processing both card present and card not Q: How will this fee be applied to my merchants? present transactions, will they be assessed both fees? Q: How is merchant location defined? Q: Is this rate variable each month or fixed by merchant? A: Merchant locations are currently defined as individual Merchant IDs. While it is assumed that one mid equals one location, a field will be A: The rate categories are determined based on the number of locations in the available on our back end system to set the number of locations for each relationship (same Tax Id Number) for Card Present transactions or by volume mid. This fee will be available for update in April and additional instructions for Card Not Present transactions. A grid is available on the Elavon Think for requesting this will be provided at that time. Center which details the categories and rates for these fees. For Card A: Yes, merchants could be assessed fees under both fee grids if they accept A: For all merchants, regardless of pricing method, this fee will be assessed as Present, the amount of the fee is assessed for each merchant in the both card present and card not present transactions This applies regardless of A: This rate could fluctuate each month depending on the number of locations a pass through cost to the merchant and will be detailed within the Card relationship. For example if the rate category is $2 and there are three the number of transactions processed. If the merchant accepts even 1 card under the same Tax ID or gross volume in that month. Assessments section of the merchant statement. locations, the merchant relationship is assessed a fee of $6. The Card Not present transaction and 1 card not present transaction, they will see 2 different Present volume is assessed one fee per relationship. If a Headquarter MID is fees based on the 2 tables. identified for the merchant relationship, Elavon will bill the total fee due to the Headquarter MID on file. If no Headquarter MID is identified, the merchant in the relationship with the highest processing volume for the current month will be assessed the fee. 6

VISA FANF Tables Let’s take a look! 7

VISA FANF Tables Let’s take a look! 7

Visa US is adjusting rules on pre-arranged Business 2 Business contracted key-entered transactions. All settled transaction amounts must match the authorization amounts for these transactions or the transaction will be rejected back and will need to be resubmitted with the correct amount. Transactions will be identified on the authorization response message. Field 48 position 4 will have an L for these transactions. This affects merchants that have pre-arranged agreements with commercial card clients. A list of affected MCCs is listed in the Appendix at the end of the document. Q: What are pre-arranged Business 2 Business contracted keyentered transactions and how will this affect my merchants? A: Visa has advised there is no specific merchant impacted by this mandate however accommodations are being made for future business. 8

Visa US is adjusting rules on pre-arranged Business 2 Business contracted key-entered transactions. All settled transaction amounts must match the authorization amounts for these transactions or the transaction will be rejected back and will need to be resubmitted with the correct amount. Transactions will be identified on the authorization response message. Field 48 position 4 will have an L for these transactions. This affects merchants that have pre-arranged agreements with commercial card clients. A list of affected MCCs is listed in the Appendix at the end of the document. Q: What are pre-arranged Business 2 Business contracted keyentered transactions and how will this affect my merchants? A: Visa has advised there is no specific merchant impacted by this mandate however accommodations are being made for future business. 8

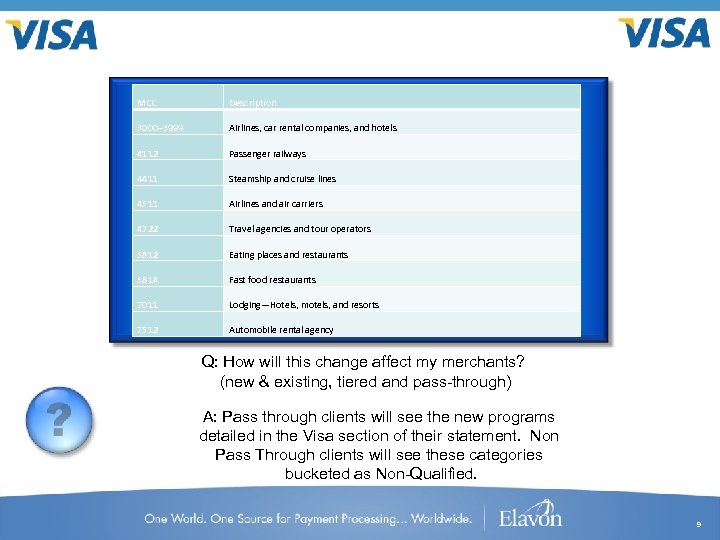

MCC Description 3000– 3999 Visa US is. Airlines, car rental companies, and hotels introducing new Corporate and Purchasing 4112 Passenger railways interchange programs for the travel service MCCs listed 4411 below. CPS requirements must be met. Level 2 is not Steamship and cruise lines required, but can be submitted. 4511 Airlines and air carriers 4722 5814 Travel agencies and tour operators The new rates will be available on the Elavon US Eating places and restaurants Interchange grid. Fast food restaurants 7011 Lodging—Hotels, motels, and resorts 7512 Automobile rental agency Q: How will this change affect my merchants? (new & existing, tiered and pass-through) A: Pass through clients will see the new programs detailed in the Visa section of their statement. Non Pass Through clients will see these categories bucketed as Non-Qualified. 9

MCC Description 3000– 3999 Visa US is. Airlines, car rental companies, and hotels introducing new Corporate and Purchasing 4112 Passenger railways interchange programs for the travel service MCCs listed 4411 below. CPS requirements must be met. Level 2 is not Steamship and cruise lines required, but can be submitted. 4511 Airlines and air carriers 4722 5814 Travel agencies and tour operators The new rates will be available on the Elavon US Eating places and restaurants Interchange grid. Fast food restaurants 7011 Lodging—Hotels, motels, and resorts 7512 Automobile rental agency Q: How will this change affect my merchants? (new & existing, tiered and pass-through) A: Pass through clients will see the new programs detailed in the Visa section of their statement. Non Pass Through clients will see these categories bucketed as Non-Qualified. 9

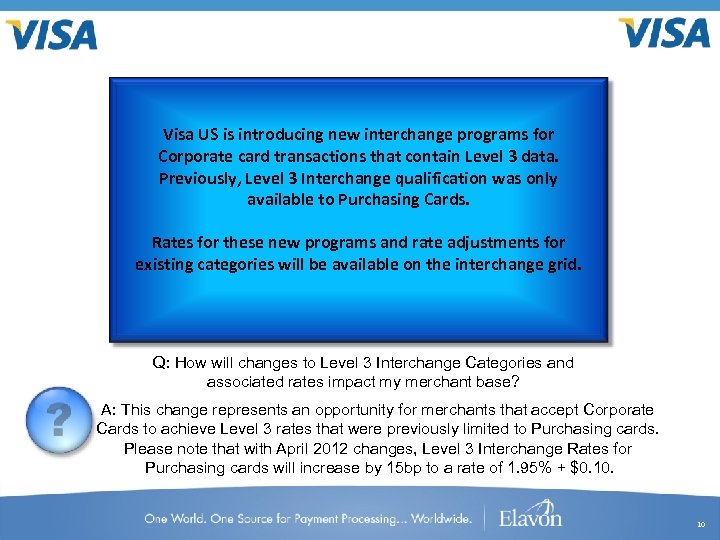

Visa US is introducing new interchange programs for Corporate card transactions that contain Level 3 data. Previously, Level 3 Interchange qualification was only available to Purchasing Cards. Rates for these new programs and rate adjustments for existing categories will be available on the interchange grid. Q: How will changes to Level 3 Interchange Categories and associated rates impact my merchant base? A: This change represents an opportunity for merchants that accept Corporate Cards to achieve Level 3 rates that were previously limited to Purchasing cards. Please note that with April 2012 changes, Level 3 Interchange Rates for Purchasing cards will increase by 15 bp to a rate of 1. 95% + $0. 10. 10

Visa US is introducing new interchange programs for Corporate card transactions that contain Level 3 data. Previously, Level 3 Interchange qualification was only available to Purchasing Cards. Rates for these new programs and rate adjustments for existing categories will be available on the interchange grid. Q: How will changes to Level 3 Interchange Categories and associated rates impact my merchant base? A: This change represents an opportunity for merchants that accept Corporate Cards to achieve Level 3 rates that were previously limited to Purchasing cards. Please note that with April 2012 changes, Level 3 Interchange Rates for Purchasing cards will increase by 15 bp to a rate of 1. 95% + $0. 10. 10

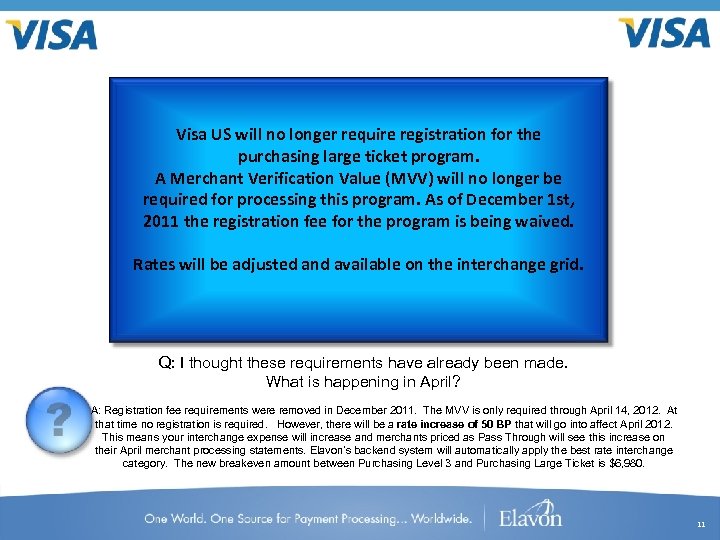

Visa US will no longer require registration for the purchasing large ticket program. A Merchant Verification Value (MVV) will no longer be required for processing this program. As of December 1 st, 2011 the registration fee for the program is being waived. Rates will be adjusted and available on the interchange grid. Q: I thought these requirements have already been made. What is happening in April? A: Registration fee requirements were removed in December 2011. The MVV is only required through April 14, 2012. At that time no registration is required. However, there will be a rate increase of 50 BP that will go into affect April 2012. This means your interchange expense will increase and merchants priced as Pass Through will see this increase on their April merchant processing statements. Elavon’s backend system will automatically apply the best rate interchange category. The new breakeven amount between Purchasing Level 3 and Purchasing Large Ticket is $6, 980. 11

Visa US will no longer require registration for the purchasing large ticket program. A Merchant Verification Value (MVV) will no longer be required for processing this program. As of December 1 st, 2011 the registration fee for the program is being waived. Rates will be adjusted and available on the interchange grid. Q: I thought these requirements have already been made. What is happening in April? A: Registration fee requirements were removed in December 2011. The MVV is only required through April 14, 2012. At that time no registration is required. However, there will be a rate increase of 50 BP that will go into affect April 2012. This means your interchange expense will increase and merchants priced as Pass Through will see this increase on their April merchant processing statements. Elavon’s backend system will automatically apply the best rate interchange category. The new breakeven amount between Purchasing Level 3 and Purchasing Large Ticket is $6, 980. 11

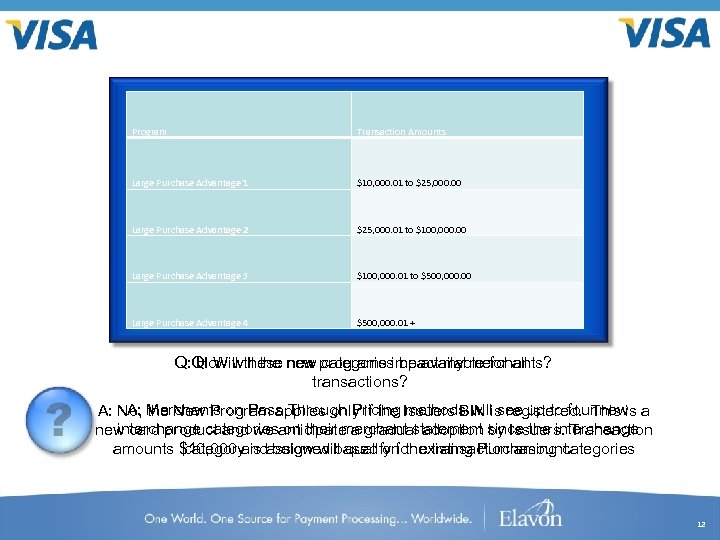

Visa US is introducing a new Purchasing card product with new Program Interchange programs. The interchange programs are Transaction Amounts for card not present, non-travel service MCCs with transaction amounts greater than $10, 000. Level 2 and 3 Large Purchase Advantage 1 $10, 000. 01 to $25, 000. 00 data is not required, but can be submitted. $25, 000. 01 to $100, 000. 00 Transaction amounts below $10, 000. 00 will qualify for existing Purchasing interchange programs. There are 4 Large Purchase Advantage 3 on the transaction amount as listed below. $100, 000. 01 to $500, 000. 00 programs based Large Purchase Advantage 2 $500, 000. 01 + Rates will be available on the interchange grid. Large Purchase Advantage 4 Q: How will the new programs impact my merchants? Q: Will these new categories be available for all transactions? A: Merchants on Pass Through Pricing methods will see up to four new A: No, the New Program applies only if the Issuers BIN is registered. This is a interchange categories on their merchant statement since the interchange new card product and we anticipate a gradual adoption by Issuers. Transaction category is assigned based on the transaction amounts $10, 000 and below will qualify for existing Purchasing categories 12

Visa US is introducing a new Purchasing card product with new Program Interchange programs. The interchange programs are Transaction Amounts for card not present, non-travel service MCCs with transaction amounts greater than $10, 000. Level 2 and 3 Large Purchase Advantage 1 $10, 000. 01 to $25, 000. 00 data is not required, but can be submitted. $25, 000. 01 to $100, 000. 00 Transaction amounts below $10, 000. 00 will qualify for existing Purchasing interchange programs. There are 4 Large Purchase Advantage 3 on the transaction amount as listed below. $100, 000. 01 to $500, 000. 00 programs based Large Purchase Advantage 2 $500, 000. 01 + Rates will be available on the interchange grid. Large Purchase Advantage 4 Q: How will the new programs impact my merchants? Q: Will these new categories be available for all transactions? A: Merchants on Pass Through Pricing methods will see up to four new A: No, the New Program applies only if the Issuers BIN is registered. This is a interchange categories on their merchant statement since the interchange new card product and we anticipate a gradual adoption by Issuers. Transaction category is assigned based on the transaction amounts $10, 000 and below will qualify for existing Purchasing categories 12

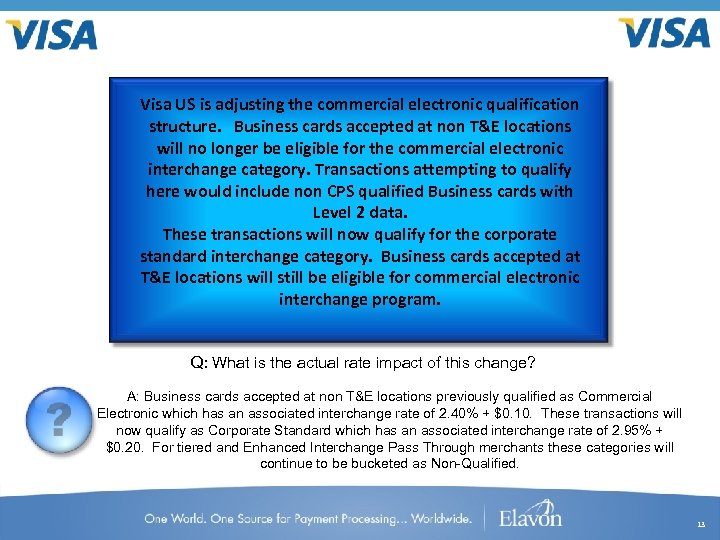

Visa US is adjusting the commercial electronic qualification structure. Business cards accepted at non T&E locations will no longer be eligible for the commercial electronic interchange category. Transactions attempting to qualify here would include non CPS qualified Business cards with Level 2 data. These transactions will now qualify for the corporate standard interchange category. Business cards accepted at T&E locations will still be eligible for commercial electronic interchange program. Q: What is the actual rate impact of this change? A: Business cards accepted at non T&E locations previously qualified as Commercial Electronic which has an associated interchange rate of 2. 40% + $0. 10. These transactions will now qualify as Corporate Standard which has an associated interchange rate of 2. 95% + $0. 20. For tiered and Enhanced Interchange Pass Through merchants these categories will continue to be bucketed as Non-Qualified. 13

Visa US is adjusting the commercial electronic qualification structure. Business cards accepted at non T&E locations will no longer be eligible for the commercial electronic interchange category. Transactions attempting to qualify here would include non CPS qualified Business cards with Level 2 data. These transactions will now qualify for the corporate standard interchange category. Business cards accepted at T&E locations will still be eligible for commercial electronic interchange program. Q: What is the actual rate impact of this change? A: Business cards accepted at non T&E locations previously qualified as Commercial Electronic which has an associated interchange rate of 2. 40% + $0. 10. These transactions will now qualify as Corporate Standard which has an associated interchange rate of 2. 95% + $0. 20. For tiered and Enhanced Interchange Pass Through merchants these categories will continue to be bucketed as Non-Qualified. 13

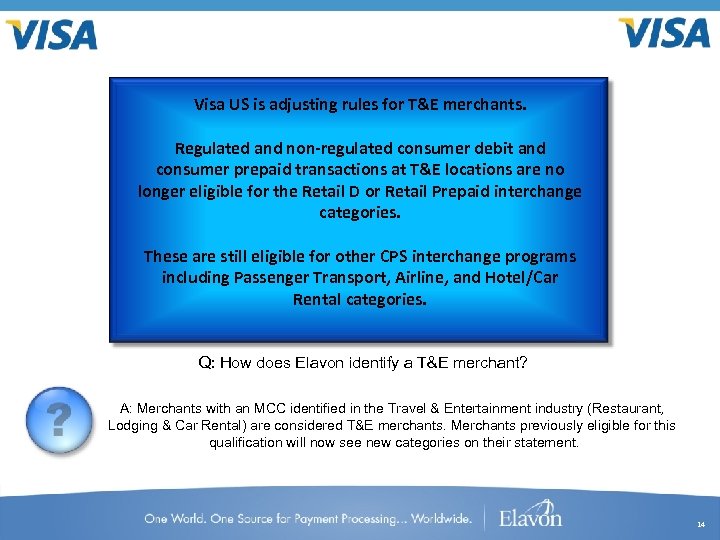

Visa US is adjusting rules for T&E merchants. Regulated and non-regulated consumer debit and consumer prepaid transactions at T&E locations are no longer eligible for the Retail D or Retail Prepaid interchange categories. These are still eligible for other CPS interchange programs including Passenger Transport, Airline, and Hotel/Car Rental categories. Q: How does Elavon identify a T&E merchant? A: Merchants with an MCC identified in the Travel & Entertainment industry (Restaurant, Lodging & Car Rental) are considered T&E merchants. Merchants previously eligible for this qualification will now see new categories on their statement. 14

Visa US is adjusting rules for T&E merchants. Regulated and non-regulated consumer debit and consumer prepaid transactions at T&E locations are no longer eligible for the Retail D or Retail Prepaid interchange categories. These are still eligible for other CPS interchange programs including Passenger Transport, Airline, and Hotel/Car Rental categories. Q: How does Elavon identify a T&E merchant? A: Merchants with an MCC identified in the Travel & Entertainment industry (Restaurant, Lodging & Car Rental) are considered T&E merchants. Merchants previously eligible for this qualification will now see new categories on their statement. 14

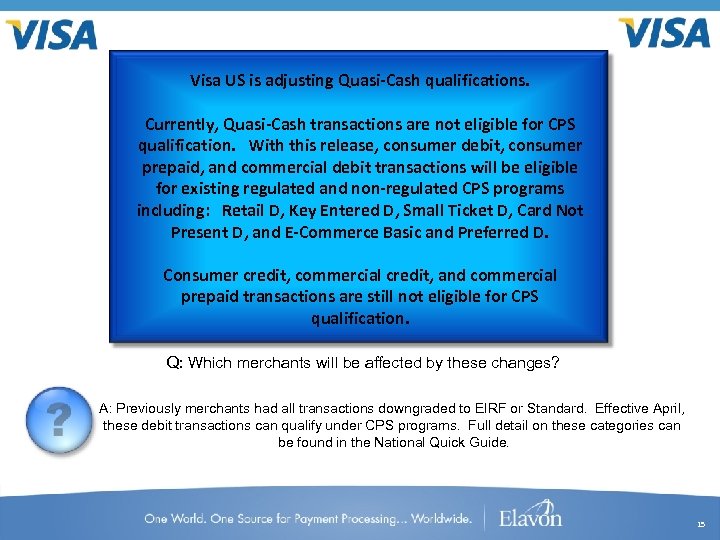

Visa US is adjusting Quasi-Cash qualifications. Currently, Quasi-Cash transactions are not eligible for CPS qualification. With this release, consumer debit, consumer prepaid, and commercial debit transactions will be eligible for existing regulated and non-regulated CPS programs including: Retail D, Key Entered D, Small Ticket D, Card Not Present D, and E-Commerce Basic and Preferred D. Consumer credit, commercial credit, and commercial prepaid transactions are still not eligible for CPS qualification. Q: Which merchants will be affected by these changes? A: Previously merchants had all transactions downgraded to EIRF or Standard. Effective April, these debit transactions can qualify under CPS programs. Full detail on these categories can be found in the National Quick Guide. 15

Visa US is adjusting Quasi-Cash qualifications. Currently, Quasi-Cash transactions are not eligible for CPS qualification. With this release, consumer debit, consumer prepaid, and commercial debit transactions will be eligible for existing regulated and non-regulated CPS programs including: Retail D, Key Entered D, Small Ticket D, Card Not Present D, and E-Commerce Basic and Preferred D. Consumer credit, commercial credit, and commercial prepaid transactions are still not eligible for CPS qualification. Q: Which merchants will be affected by these changes? A: Previously merchants had all transactions downgraded to EIRF or Standard. Effective April, these debit transactions can qualify under CPS programs. Full detail on these categories can be found in the National Quick Guide. 15

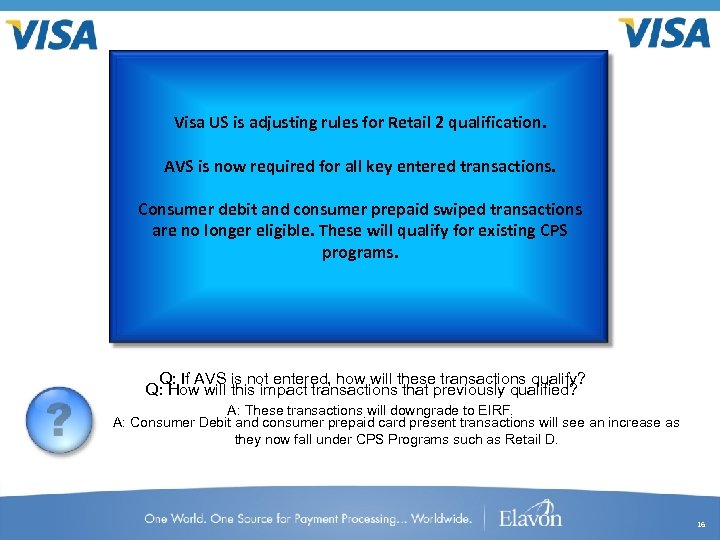

Visa US is adjusting rules for Retail 2 qualification. AVS is now required for all key entered transactions. Consumer debit and consumer prepaid swiped transactions are no longer eligible. These will qualify for existing CPS programs. Q: If AVS is not entered, how will these transactions qualify? Q: How will this impact transactions that previously qualified? A: These transactions will downgrade to EIRF. A: Consumer Debit and consumer prepaid card present transactions will see an increase as they now fall under CPS Programs such as Retail D. 16

Visa US is adjusting rules for Retail 2 qualification. AVS is now required for all key entered transactions. Consumer debit and consumer prepaid swiped transactions are no longer eligible. These will qualify for existing CPS programs. Q: If AVS is not entered, how will these transactions qualify? Q: How will this impact transactions that previously qualified? A: These transactions will downgrade to EIRF. A: Consumer Debit and consumer prepaid card present transactions will see an increase as they now fall under CPS Programs such as Retail D. 16

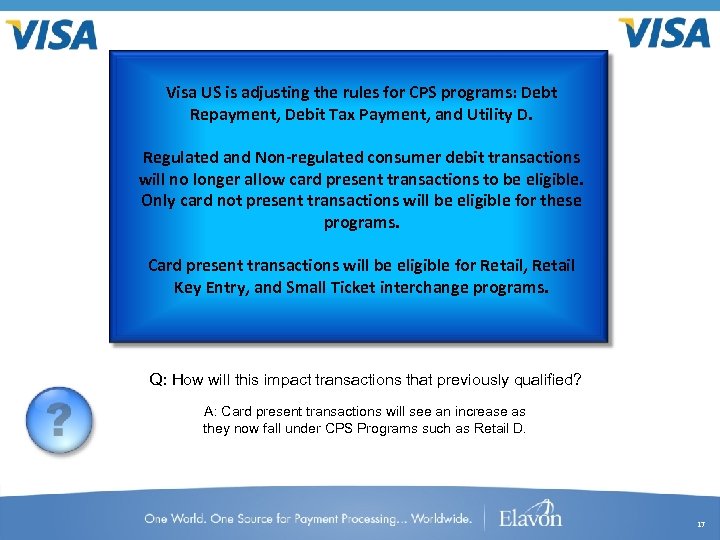

Visa US is adjusting the rules for CPS programs: Debt Repayment, Debit Tax Payment, and Utility D. Regulated and Non-regulated consumer debit transactions will no longer allow card present transactions to be eligible. Only card not present transactions will be eligible for these programs. Card present transactions will be eligible for Retail, Retail Key Entry, and Small Ticket interchange programs. Q: How will this impact transactions that previously qualified? A: Card present transactions will see an increase as they now fall under CPS Programs such as Retail D. 17

Visa US is adjusting the rules for CPS programs: Debt Repayment, Debit Tax Payment, and Utility D. Regulated and Non-regulated consumer debit transactions will no longer allow card present transactions to be eligible. Only card not present transactions will be eligible for these programs. Card present transactions will be eligible for Retail, Retail Key Entry, and Small Ticket interchange programs. Q: How will this impact transactions that previously qualified? A: Card present transactions will see an increase as they now fall under CPS Programs such as Retail D. 17

Visa US is creating a new Business Debit interchange structure. Currently, Visa Business Debit transactions qualify for existing commercial interchange programs. Visa is breaking out Business Debit cards into new interchange programs. These programs include both regulated and non-regulated categories for card present, card not present, and standard qualifications. Instead of following commercial logic, these will follow consumer CPS qualification requirements. Level 2 or 3 data is not required for these interchange categories. Rates will be available on the interchange grid. Q: How will this impact the interchange assessed for commercial debit transactions? A: Today these transactions are charged commercial card rates. In some cases, the new Business Debit rates are lower than the commercial card rates. However, the actual impact by merchant will depend on how they are priced. 18

Visa US is creating a new Business Debit interchange structure. Currently, Visa Business Debit transactions qualify for existing commercial interchange programs. Visa is breaking out Business Debit cards into new interchange programs. These programs include both regulated and non-regulated categories for card present, card not present, and standard qualifications. Instead of following commercial logic, these will follow consumer CPS qualification requirements. Level 2 or 3 data is not required for these interchange categories. Rates will be available on the interchange grid. Q: How will this impact the interchange assessed for commercial debit transactions? A: Today these transactions are charged commercial card rates. In some cases, the new Business Debit rates are lower than the commercial card rates. However, the actual impact by merchant will depend on how they are priced. 18

Visa US is implementing Chip EMV support with the April 2013 regulatory release. Merchants can begin accepting Chip EMV cards after this release. Q: When will Elavon merchants be enabled to accept EMV transactions? A: Elavon is working with the Associations on gaining further information regarding U. S. EMV requirements and the related testing and certification processes. Additionally, we are defining our strategy for each of our product lines, and will be communicating our plans once they have been finalized. Elavon is confident that we will meet or beat the Acquirer-mandated deadline of April 2013. 19

Visa US is implementing Chip EMV support with the April 2013 regulatory release. Merchants can begin accepting Chip EMV cards after this release. Q: When will Elavon merchants be enabled to accept EMV transactions? A: Elavon is working with the Associations on gaining further information regarding U. S. EMV requirements and the related testing and certification processes. Additionally, we are defining our strategy for each of our product lines, and will be communicating our plans once they have been finalized. Elavon is confident that we will meet or beat the Acquirer-mandated deadline of April 2013. 19

Visa is implementing receipt waivers for mobile acceptance. Face to Face transactions on a mobile device may now provide an electronic receipt via Email instead of a printed receipt. As an additional measure the merchant can provide an optional text message receipt; however, an E-mail or printed receipt is still required. Data requirements for an E-mail receipt include: Merchant name, merchant city and country, transaction date, item description, transaction amount, transaction payment type (Visa. . . ), transaction type (sale, refund …), authorization code, and last four digits of the account number. Customers who don’t have or provide an email address must still be provided a print receipt. These waivers will expire with the October 2012 regulatory release when Visa expects to have established permanent mobile receipt rules. This applies to US, Canada, and LAC regions. Q: Which Elavon products support email and text receipts? A: Virtual Merchant mobile allows the merchant to email a receipt to the cardholder. 20

Visa is implementing receipt waivers for mobile acceptance. Face to Face transactions on a mobile device may now provide an electronic receipt via Email instead of a printed receipt. As an additional measure the merchant can provide an optional text message receipt; however, an E-mail or printed receipt is still required. Data requirements for an E-mail receipt include: Merchant name, merchant city and country, transaction date, item description, transaction amount, transaction payment type (Visa. . . ), transaction type (sale, refund …), authorization code, and last four digits of the account number. Customers who don’t have or provide an email address must still be provided a print receipt. These waivers will expire with the October 2012 regulatory release when Visa expects to have established permanent mobile receipt rules. This applies to US, Canada, and LAC regions. Q: Which Elavon products support email and text receipts? A: Virtual Merchant mobile allows the merchant to email a receipt to the cardholder. 20

Let’s Change Gears 21

Let’s Change Gears 21

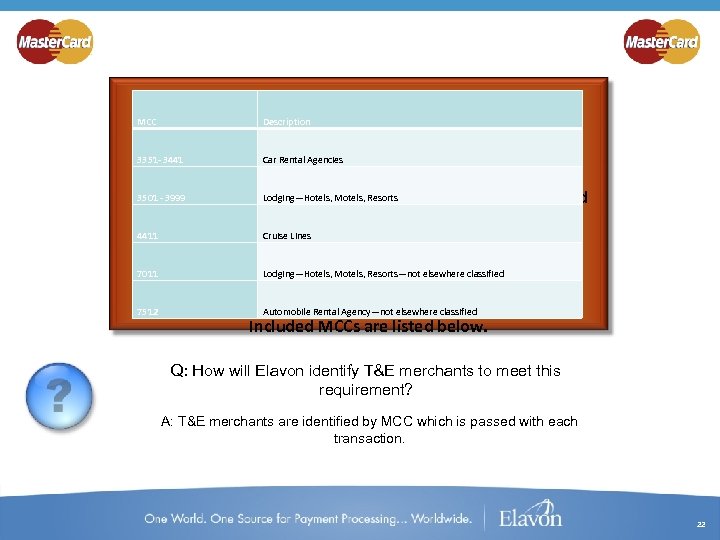

Master. Card is adjusting requirements for T&E processing. Description MCC This change is to improve authorization to settle Car Rental Agencies transaction matching in an effort to improve cardholder 3501 - 3999 Lodging—Hotels, Motels, Resorts open-to-buy amounts. Available with the April release and required in the October 2012 release, all T&E merchants 4411 Cruise Lines (excluding airlines) will need to submit the original authorization Banknet data on all incremental 7011 Lodging—Hotels, Motels, Resorts—not elsewhere classified authorizations. 3351 - 3441 7512 Automobile Rental Agency—not elsewhere classified Included MCCs are listed below. Q: How will Elavon identify T&E merchants to meet this requirement? A: T&E merchants are identified by MCC which is passed with each transaction. 22

Master. Card is adjusting requirements for T&E processing. Description MCC This change is to improve authorization to settle Car Rental Agencies transaction matching in an effort to improve cardholder 3501 - 3999 Lodging—Hotels, Motels, Resorts open-to-buy amounts. Available with the April release and required in the October 2012 release, all T&E merchants 4411 Cruise Lines (excluding airlines) will need to submit the original authorization Banknet data on all incremental 7011 Lodging—Hotels, Motels, Resorts—not elsewhere classified authorizations. 3351 - 3441 7512 Automobile Rental Agency—not elsewhere classified Included MCCs are listed below. Q: How will Elavon identify T&E merchants to meet this requirement? A: T&E merchants are identified by MCC which is passed with each transaction. 22

Master. Card US is adjusting the Small Ticket and Convenience Purchase interchange programs. MCC 5331 Variety Store will be added to the eligible MCC list for these programs. Also, Master. Card is creating new interchange programs for Convenience Purchases – Tier 1. These programs are the same as the existing program, but require registration. Rates will be available on the interchange grid. Q: Is there a cost to register for the Convenience Purchase – Q: How can I register a merchant for this program? Tier 1 program? A: No, this is performance driven and the minimum annual volume must be A: Master. Card will notify each Acquirer of any eligible merchants. This is $1 B in Convenience Purchases qualification today. There also is a not a program where the Acquirer decides which merchants to register. separate qualification rule for merchants with $75 MM annually at Convenience Purchases. MC will notify Elavon if a merchant is eligible. 23

Master. Card US is adjusting the Small Ticket and Convenience Purchase interchange programs. MCC 5331 Variety Store will be added to the eligible MCC list for these programs. Also, Master. Card is creating new interchange programs for Convenience Purchases – Tier 1. These programs are the same as the existing program, but require registration. Rates will be available on the interchange grid. Q: Is there a cost to register for the Convenience Purchase – Q: How can I register a merchant for this program? Tier 1 program? A: No, this is performance driven and the minimum annual volume must be A: Master. Card will notify each Acquirer of any eligible merchants. This is $1 B in Convenience Purchases qualification today. There also is a not a program where the Acquirer decides which merchants to register. separate qualification rule for merchants with $75 MM annually at Convenience Purchases. MC will notify Elavon if a merchant is eligible. 23

Master. Card US is adjusting the Small Ticket regulated interchange structure. Only MCCs 5814 – Fast Food Restaurants and 7841 – Video Rental Stores will be eligible. Regulated transactions under $10. 00 will be eligible for these programs. Rates will be available on the interchange grid Q: How will transactions greater than $10 qualify? Q: How can I get a list of merchants affected by this change? A: These items will be eligible for Restaurant Debit Regulated or Merit III Debit Regulated. A: Please contact your Relationship Manager for a list of merchants in your portfolio that fall into the currently eligible MCCs (5814 or 7841) or a listing of those MCCs which previously qualified for this structure. 24

Master. Card US is adjusting the Small Ticket regulated interchange structure. Only MCCs 5814 – Fast Food Restaurants and 7841 – Video Rental Stores will be eligible. Regulated transactions under $10. 00 will be eligible for these programs. Rates will be available on the interchange grid Q: How will transactions greater than $10 qualify? Q: How can I get a list of merchants affected by this change? A: These items will be eligible for Restaurant Debit Regulated or Merit III Debit Regulated. A: Please contact your Relationship Manager for a list of merchants in your portfolio that fall into the currently eligible MCCs (5814 or 7841) or a listing of those MCCs which previously qualified for this structure. 24

Master. Card US is introducing a new Acquirer’s License fee (MC ALF) assessment. The MC ALF will be assessed on all MC credit and signature debit volume processed. Both international and domestic US volume will be assessed this fee. Rates will be available on the interchange grid. Q: Is the fee assessed on every merchant transaction? Q: How will this fee be applied to my merchants? A: Yes, this fee will be assessed on all Master. Card sales volume. A: For all merchants, regardless of pricing method, this fee will be assessed as a pass through cost to the merchant and will be detailed within the Card Assessments section of the merchant statement. 25

Master. Card US is introducing a new Acquirer’s License fee (MC ALF) assessment. The MC ALF will be assessed on all MC credit and signature debit volume processed. Both international and domestic US volume will be assessed this fee. Rates will be available on the interchange grid. Q: Is the fee assessed on every merchant transaction? Q: How will this fee be applied to my merchants? A: Yes, this fee will be assessed on all Master. Card sales volume. A: For all merchants, regardless of pricing method, this fee will be assessed as a pass through cost to the merchant and will be detailed within the Card Assessments section of the merchant statement. 25

Changing Hats Again… 26

Changing Hats Again… 26

Discover US is modifying the Key Entered and Card Not Present/E-Commerce interchange programs. Premium and Premium Plus cards accepted at MCCs 5812 (Restaurants) and 5814 (Fast Food) are no longer eligible for these categories. Q: How will Premier and Premier Plus cards qualify at MCC’s 5812 and 5814, if they are no longer eligible for these Q: How do I request a list of merchants affected by this categories? change? A: These transactions will fall to the Mid Submission level. A: Please request a list of merchants in MCC 5812 and 5814 from your Relationship Manager. 27

Discover US is modifying the Key Entered and Card Not Present/E-Commerce interchange programs. Premium and Premium Plus cards accepted at MCCs 5812 (Restaurants) and 5814 (Fast Food) are no longer eligible for these categories. Q: How will Premier and Premier Plus cards qualify at MCC’s 5812 and 5814, if they are no longer eligible for these Q: How do I request a list of merchants affected by this categories? change? A: These transactions will fall to the Mid Submission level. A: Please request a list of merchants in MCC 5812 and 5814 from your Relationship Manager. 27

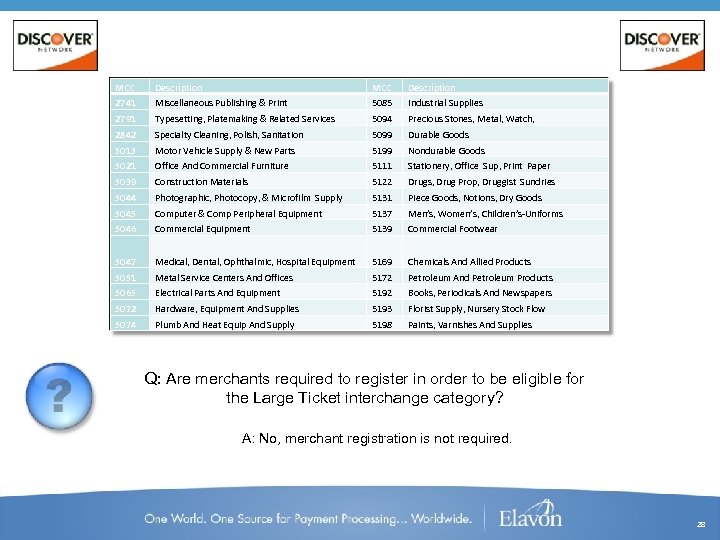

MCC Description 2741 Miscellaneous Publishing & Print 5085 Industrial Supplies 2791 Typesetting, Platemaking & Related Services 5094 Precious Stones, Metal, Watch, 5021 Specialty Cleaning, Polish, Sanitation Discover US is introducing the 5099 Durable Goods Ticket Commercial Large Motor Vehicle Supply & New Parts 5199 Nondurable Goods interchange category. Office And Commercial Furniture 5111 Stationery, Office Sup, Print Paper 5039 Construction Materials 5122 Drugs, Drug Prop, Druggist Sundries 2842 5013 Photographic, Photocopy, & Microfilm Supply 5131 Piece Goods, Notions, Dry Goods The transaction amount must be greater than $5000. Only 5045 Computer & Comp Peripheral Equipment 5137 Men’s, Women’s, Children’s-Uniforms the below MCCs are eligible for 5139 Commercial Footwear this interchange category. 5046 Commercial Equipment Rates will be available on the interchange grid. Neither 5047 Medical, Dental, Ophthalmic, Hospital Equipment 5169 Chemicals And Allied Products Level 2 nor Level 3 data is required on these transactions. 5044 5051 Metal Service Centers And Offices 5172 Petroleum And Petroleum Products 5065 Electrical Parts And Equipment 5192 Books, Periodicals And Newspapers 5072 Hardware, Equipment And Supplies 5193 Florist Supply, Nursery Stock Flow 5074 Plumb And Heat Equip And Supply 5198 Paints, Varnishes And Supplies Q: Are merchants required to register in order to be eligible for the Large Ticket interchange category? A: No, merchant registration is not required. 28

MCC Description 2741 Miscellaneous Publishing & Print 5085 Industrial Supplies 2791 Typesetting, Platemaking & Related Services 5094 Precious Stones, Metal, Watch, 5021 Specialty Cleaning, Polish, Sanitation Discover US is introducing the 5099 Durable Goods Ticket Commercial Large Motor Vehicle Supply & New Parts 5199 Nondurable Goods interchange category. Office And Commercial Furniture 5111 Stationery, Office Sup, Print Paper 5039 Construction Materials 5122 Drugs, Drug Prop, Druggist Sundries 2842 5013 Photographic, Photocopy, & Microfilm Supply 5131 Piece Goods, Notions, Dry Goods The transaction amount must be greater than $5000. Only 5045 Computer & Comp Peripheral Equipment 5137 Men’s, Women’s, Children’s-Uniforms the below MCCs are eligible for 5139 Commercial Footwear this interchange category. 5046 Commercial Equipment Rates will be available on the interchange grid. Neither 5047 Medical, Dental, Ophthalmic, Hospital Equipment 5169 Chemicals And Allied Products Level 2 nor Level 3 data is required on these transactions. 5044 5051 Metal Service Centers And Offices 5172 Petroleum And Petroleum Products 5065 Electrical Parts And Equipment 5192 Books, Periodicals And Newspapers 5072 Hardware, Equipment And Supplies 5193 Florist Supply, Nursery Stock Flow 5074 Plumb And Heat Equip And Supply 5198 Paints, Varnishes And Supplies Q: Are merchants required to register in order to be eligible for the Large Ticket interchange category? A: No, merchant registration is not required. 28

Discover is adjusting international processing fees. Currently, JCB and CUP cards processed through Discover are not subject to international processing fees. These cards will now be assessed these existing fees. Q: I thought all Union Pay processing was routed directly Q: How will these assessments be applied to my merchants? through Union Pay. What CUP transactions would see these international processing fees? A: For all merchants, regardless of pricing method, this fee will be assessed as a pass through cost to the merchant and will be detailed within the Card A: We are only routing all Elavon network authorizations to Union Pay direct. Assessments section of the merchant statement. Merchants on foreign network authorizations may still see CUP transactions processing through the Discover card association. 29

Discover is adjusting international processing fees. Currently, JCB and CUP cards processed through Discover are not subject to international processing fees. These cards will now be assessed these existing fees. Q: I thought all Union Pay processing was routed directly Q: How will these assessments be applied to my merchants? through Union Pay. What CUP transactions would see these international processing fees? A: For all merchants, regardless of pricing method, this fee will be assessed as a pass through cost to the merchant and will be detailed within the Card A: We are only routing all Elavon network authorizations to Union Pay direct. Assessments section of the merchant statement. Merchants on foreign network authorizations may still see CUP transactions processing through the Discover card association. 29

Making the switch once again… 30

Making the switch once again… 30

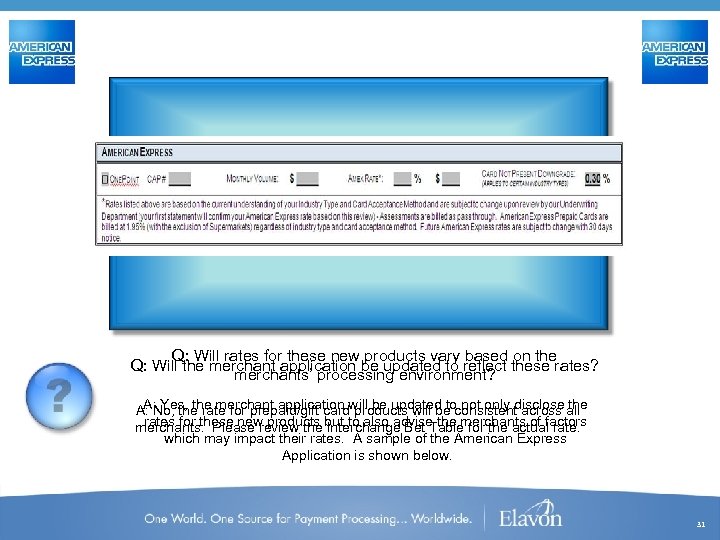

American Express is introducing a new prepaid/gift card product. These cards are eligible for all existing interchange categories. Rates will be available on the interchange grid. Q: Will rates for these new products vary based on the Q: Will the merchant application be updated to reflect these rates? merchants’ processing environment? A: Yes, the merchant application will be updated to not only disclose the A: No, the rate for prepaid/gift card products will be consistent across all rates for these new products but to also advise the merchants of factors merchants. Please review the Interchange Bet Table for the actual rate. which may impact their rates. A sample of the American Express Application is shown below. 31

American Express is introducing a new prepaid/gift card product. These cards are eligible for all existing interchange categories. Rates will be available on the interchange grid. Q: Will rates for these new products vary based on the Q: Will the merchant application be updated to reflect these rates? merchants’ processing environment? A: Yes, the merchant application will be updated to not only disclose the A: No, the rate for prepaid/gift card products will be consistent across all rates for these new products but to also advise the merchants of factors merchants. Please review the Interchange Bet Table for the actual rate. which may impact their rates. A sample of the American Express Application is shown below. 31

American Express is introducing a new international processing fee. Any American Express transaction issued outside of the United States will receive this new fee. Rates will be available on the interchange grid. Q: Will the merchant application be updated to reflect these rates? A: No. This fee is an assessment, while there is no disclosure of the actual assessment amount, the application discloses that assessments will be passed through. 32

American Express is introducing a new international processing fee. Any American Express transaction issued outside of the United States will receive this new fee. Rates will be available on the interchange grid. Q: Will the merchant application be updated to reflect these rates? A: No. This fee is an assessment, while there is no disclosure of the actual assessment amount, the application discloses that assessments will be passed through. 32

And finally… 33

And finally… 33

Interlink is creating a new interchange program. Non. Regulated Pin Debit T&E transactions will qualify for the new Interlink Travel Service program. Rates will be available on the interchange grid. Q: How will Elavon determine which transactions are eligible for this new interchange program? A: A determination of environment is based on MCC which is passed with the transactions. 34

Interlink is creating a new interchange program. Non. Regulated Pin Debit T&E transactions will qualify for the new Interlink Travel Service program. Rates will be available on the interchange grid. Q: How will Elavon determine which transactions are eligible for this new interchange program? A: A determination of environment is based on MCC which is passed with the transactions. 34

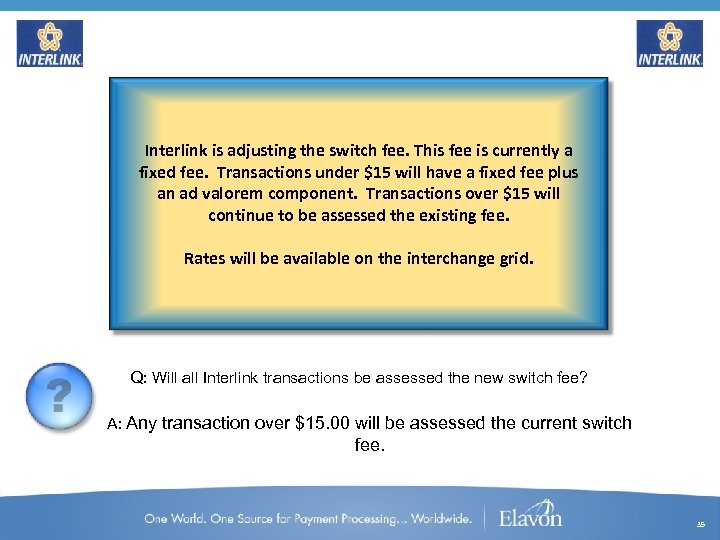

Interlink is adjusting the switch fee. This fee is currently a fixed fee. Transactions under $15 will have a fixed fee plus an ad valorem component. Transactions over $15 will continue to be assessed the existing fee. Rates will be available on the interchange grid. Q: Will all Interlink transactions be assessed the new switch fee? A: Any transaction over $15. 00 will be assessed the current switch fee. 35

Interlink is adjusting the switch fee. This fee is currently a fixed fee. Transactions under $15 will have a fixed fee plus an ad valorem component. Transactions over $15 will continue to be assessed the existing fee. Rates will be available on the interchange grid. Q: Will all Interlink transactions be assessed the new switch fee? A: Any transaction over $15. 00 will be assessed the current switch fee. 35

Impact to MSPs and Merchants 36

Impact to MSPs and Merchants 36

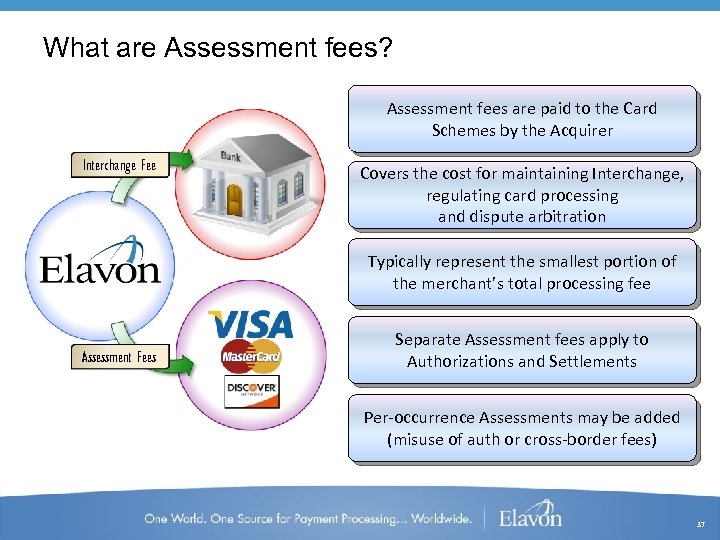

What are Assessment fees? Assessment fees are paid to the Card Schemes by the Acquirer Interchange Fee Covers the cost for maintaining Interchange, regulating card processing and dispute arbitration Typically represent the smallest portion of the merchant’s total processing fee Assessment Fees Separate Assessment fees apply to Authorizations and Settlements Per-occurrence Assessments may be added (misuse of auth or cross-border fees) 37

What are Assessment fees? Assessment fees are paid to the Card Schemes by the Acquirer Interchange Fee Covers the cost for maintaining Interchange, regulating card processing and dispute arbitration Typically represent the smallest portion of the merchant’s total processing fee Assessment Fees Separate Assessment fees apply to Authorizations and Settlements Per-occurrence Assessments may be added (misuse of auth or cross-border fees) 37

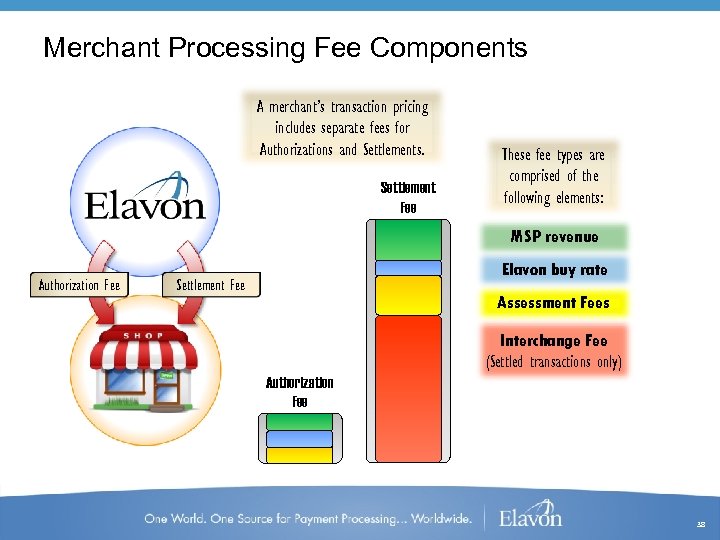

Merchant Processing Fee Components A merchant’s transaction pricing includes separate fees for Authorizations and Settlements. Settlement Fee These fee types are comprised of the following elements: MSP revenue Authorization Fee Elavon buy rate Settlement Fee Assessment Fees Interchange Fee (Settled transactions only) Authorization Fee 38

Merchant Processing Fee Components A merchant’s transaction pricing includes separate fees for Authorizations and Settlements. Settlement Fee These fee types are comprised of the following elements: MSP revenue Authorization Fee Elavon buy rate Settlement Fee Assessment Fees Interchange Fee (Settled transactions only) Authorization Fee 38

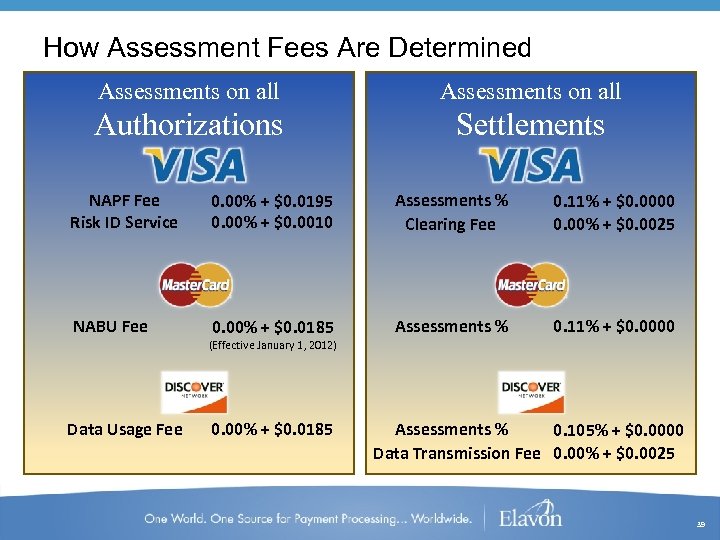

How Assessment Fees Are Determined Assessments on all Authorizations Settlements NAPF Fee Risk ID Service 0. 00% + $0. 0195 0. 00% + $0. 0010 Assessments % Clearing Fee 0. 11% + $0. 0000 0. 00% + $0. 0025 NABU Fee 0. 00% + $0. 0185 Assessments % 0. 11% + $0. 0000 (Effective January 1, 2012) Data Usage Fee 0. 00% + $0. 0185 Assessments % 0. 105% + $0. 0000 Data Transmission Fee 0. 00% + $0. 0025 39

How Assessment Fees Are Determined Assessments on all Authorizations Settlements NAPF Fee Risk ID Service 0. 00% + $0. 0195 0. 00% + $0. 0010 Assessments % Clearing Fee 0. 11% + $0. 0000 0. 00% + $0. 0025 NABU Fee 0. 00% + $0. 0185 Assessments % 0. 11% + $0. 0000 (Effective January 1, 2012) Data Usage Fee 0. 00% + $0. 0185 Assessments % 0. 105% + $0. 0000 Data Transmission Fee 0. 00% + $0. 0025 39

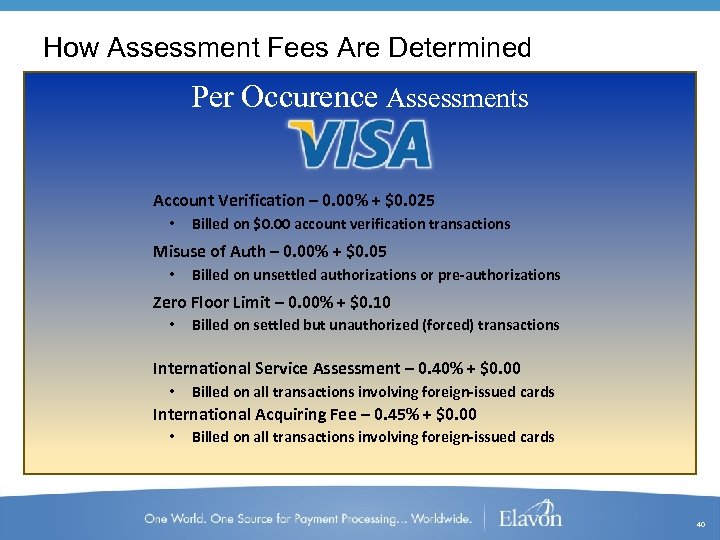

How Assessment Fees Are Determined Per Occurence Assessments Account Verification – 0. 00% + $0. 025 • Billed on $0. 00 account verification transactions Misuse of Auth – 0. 00% + $0. 05 • Billed on unsettled authorizations or pre-authorizations Zero Floor Limit – 0. 00% + $0. 10 • Billed on settled but unauthorized (forced) transactions International Service Assessment – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards International Acquiring Fee – 0. 45% + $0. 00 • Billed on all transactions involving foreign-issued cards 40

How Assessment Fees Are Determined Per Occurence Assessments Account Verification – 0. 00% + $0. 025 • Billed on $0. 00 account verification transactions Misuse of Auth – 0. 00% + $0. 05 • Billed on unsettled authorizations or pre-authorizations Zero Floor Limit – 0. 00% + $0. 10 • Billed on settled but unauthorized (forced) transactions International Service Assessment – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards International Acquiring Fee – 0. 45% + $0. 00 • Billed on all transactions involving foreign-issued cards 40

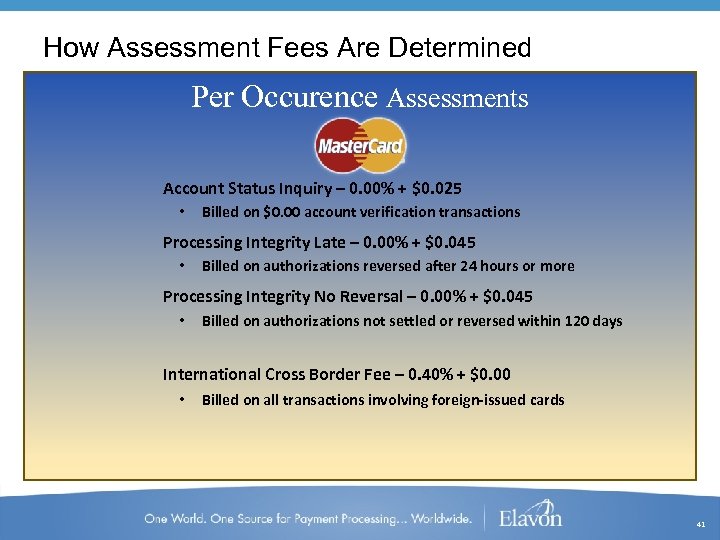

How Assessment Fees Are Determined Per Occurence Assessments Account Status Inquiry – 0. 00% + $0. 025 • Billed on $0. 00 account verification transactions Processing Integrity Late – 0. 00% + $0. 045 • Billed on authorizations reversed after 24 hours or more Processing Integrity No Reversal – 0. 00% + $0. 045 • Billed on authorizations not settled or reversed within 120 days International Cross Border Fee – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards 41

How Assessment Fees Are Determined Per Occurence Assessments Account Status Inquiry – 0. 00% + $0. 025 • Billed on $0. 00 account verification transactions Processing Integrity Late – 0. 00% + $0. 045 • Billed on authorizations reversed after 24 hours or more Processing Integrity No Reversal – 0. 00% + $0. 045 • Billed on authorizations not settled or reversed within 120 days International Cross Border Fee – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards 41

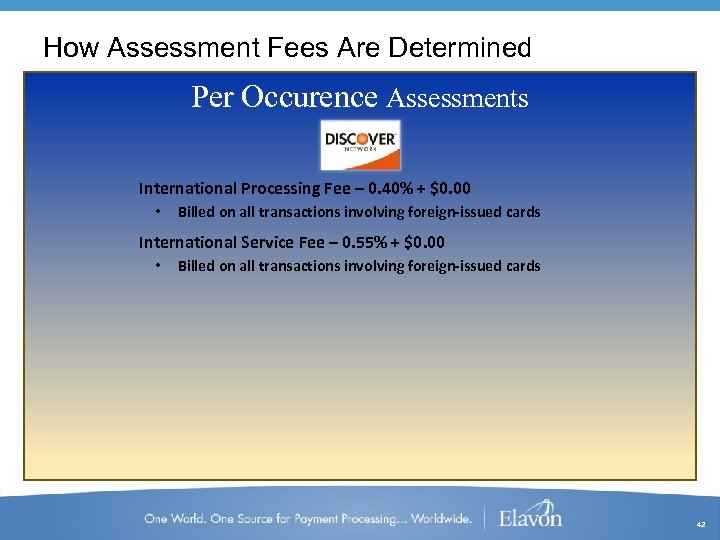

How Assessment Fees Are Determined Per Occurence Assessments International Processing Fee – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards International Service Fee – 0. 55% + $0. 00 • Billed on all transactions involving foreign-issued cards 42

How Assessment Fees Are Determined Per Occurence Assessments International Processing Fee – 0. 40% + $0. 00 • Billed on all transactions involving foreign-issued cards International Service Fee – 0. 55% + $0. 00 • Billed on all transactions involving foreign-issued cards 42

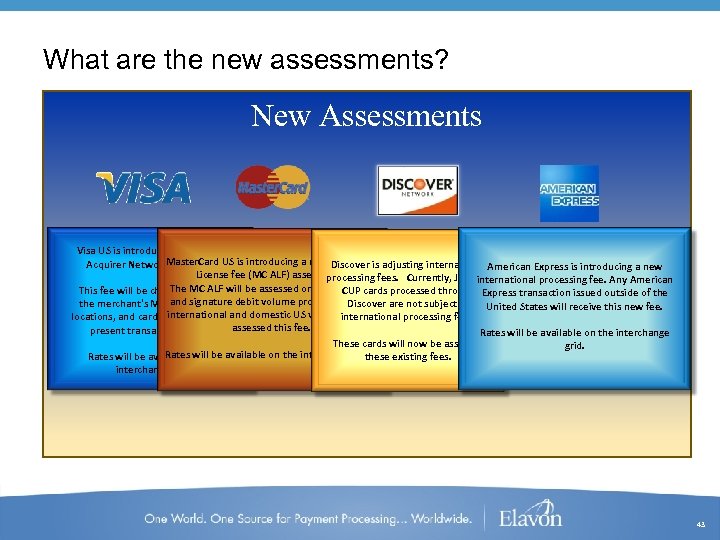

What are the new assessments? New Assessments Visa US is introducing a new Fixed Master. Card Acquirer’s Acquirer Network Fee (FANF). US is introducing a new Discover is adjusting international American Express is introducing a new License fee (MC ALF) assessment. processing fees. Currently, JCB and international processing fee. Any American The MC ALF will This fee will be charged based on be assessed on all MC credit CUP cards processed through Express transaction issued outside of the and signature Both the merchant's MCCs, number of debit volume processed. Discover are not subject to United States will receive this new fee. international and domestic US volumeinternational processing fees. will be locations, and card present/card not present transaction volume. assessed this fee. Rates will be available on the interchange These cards will now be assessed grid. Rates will be available on the interchange grid. existing fees. these interchange grid. 43

What are the new assessments? New Assessments Visa US is introducing a new Fixed Master. Card Acquirer’s Acquirer Network Fee (FANF). US is introducing a new Discover is adjusting international American Express is introducing a new License fee (MC ALF) assessment. processing fees. Currently, JCB and international processing fee. Any American The MC ALF will This fee will be charged based on be assessed on all MC credit CUP cards processed through Express transaction issued outside of the and signature Both the merchant's MCCs, number of debit volume processed. Discover are not subject to United States will receive this new fee. international and domestic US volumeinternational processing fees. will be locations, and card present/card not present transaction volume. assessed this fee. Rates will be available on the interchange These cards will now be assessed grid. Rates will be available on the interchange grid. existing fees. these interchange grid. 43

What Merchant’s Will be Affected? All merchants priced under Tiered and Surcharge pricing methods will see this change effective April 1, 2012. This includes both new and existing merchants. 44

What Merchant’s Will be Affected? All merchants priced under Tiered and Surcharge pricing methods will see this change effective April 1, 2012. This includes both new and existing merchants. 44

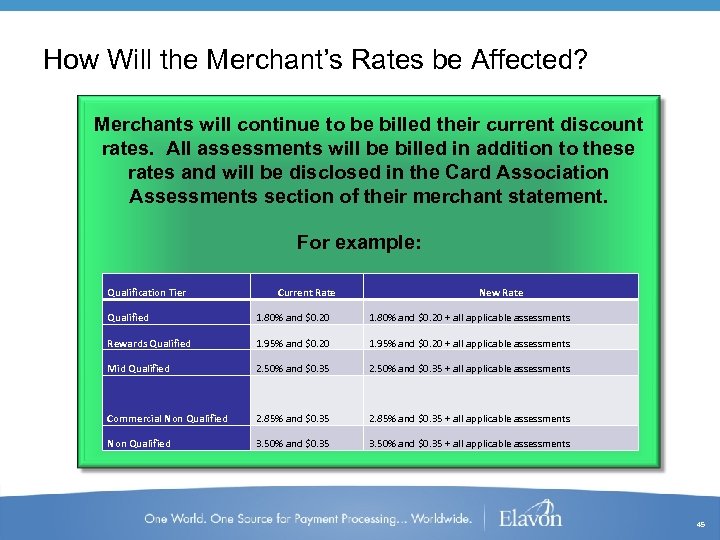

How Will the Merchant’s Rates be Affected? Merchants will continue to be billed their current discount rates. All assessments will be billed in addition to these rates and will be disclosed in the Card Association Assessments section of their merchant statement. For example: Qualification Tier Current Rate New Rate Qualified 1. 80% and $0. 20 + all applicable assessments Rewards Qualified 1. 95% and $0. 20 + all applicable assessments Mid Qualified 2. 50% and $0. 35 + all applicable assessments Commercial Non Qualified 2. 85% and $0. 35 + all applicable assessments Non Qualified 3. 50% and $0. 35 + all applicable assessments 45

How Will the Merchant’s Rates be Affected? Merchants will continue to be billed their current discount rates. All assessments will be billed in addition to these rates and will be disclosed in the Card Association Assessments section of their merchant statement. For example: Qualification Tier Current Rate New Rate Qualified 1. 80% and $0. 20 + all applicable assessments Rewards Qualified 1. 95% and $0. 20 + all applicable assessments Mid Qualified 2. 50% and $0. 35 + all applicable assessments Commercial Non Qualified 2. 85% and $0. 35 + all applicable assessments Non Qualified 3. 50% and $0. 35 + all applicable assessments 45

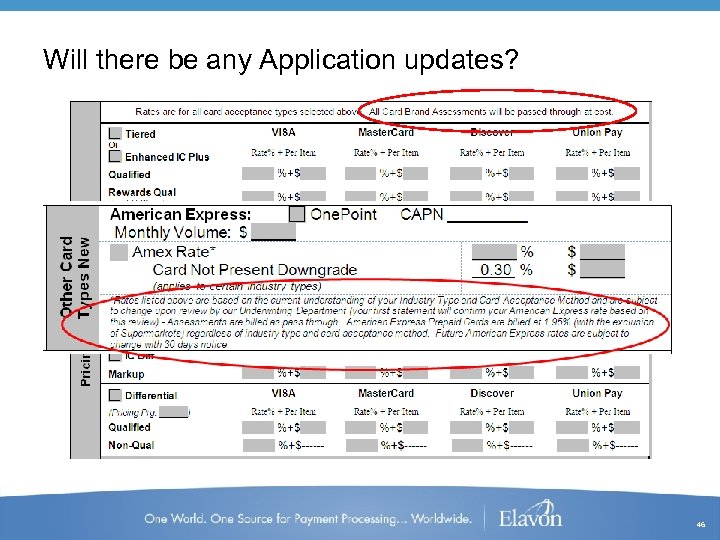

Will there be any Application updates? 46

Will there be any Application updates? 46

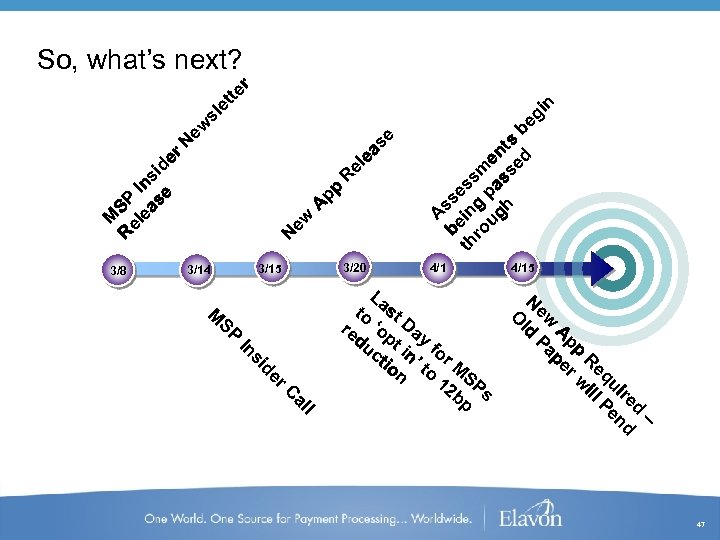

3/8 3/20 3/15 3/14 A be sse th in ss ro g m ug pa en h ss ts ed b eg in R el ea se A pp N ew M R SP el I ea ns se id er N ew sl et te r So, what’s next? 4/1 r de si In l al C – – d d re d uii en u en eq P R iillll R w w pp r A pe ew Pa N ld N d O O SP M La to st re ‘op Da du t y f ct in’ or io to M n 12 SP bp s 4/15 47

3/8 3/20 3/15 3/14 A be sse th in ss ro g m ug pa en h ss ts ed b eg in R el ea se A pp N ew M R SP el I ea ns se id er N ew sl et te r So, what’s next? 4/1 r de si In l al C – – d d re d uii en u en eq P R iillll R w w pp r A pe ew Pa N ld N d O O SP M La to st re ‘op Da du t y f ct in’ or io to M n 12 SP bp s 4/15 47

Questions? 48

Questions? 48