ac1759bae1a6cf23032d6f0a01685bc6.ppt

- Количество слайдов: 25

Spice Communications Limited Investor Presentation 03 Mar 2008

Spice Communications Limited Investor Presentation 03 Mar 2008

PRIVATE & CONFIDENTIAL Spice is poised to become a pan-India player 1

PRIVATE & CONFIDENTIAL Spice is poised to become a pan-India player 1

PRIVATE & CONFIDENTIAL Critical Success Factors Licenses and Allocation of Spectrum • Company is an incumbent and strong player in the states of Punjab & Karnataka, with conspicuous marketshare (~4 million subscribers) • Company had applied for 20 more licenses representing over 90% market opportunity in Aug ‘ 06 and is having 1 st priority based on date of application in 12 circles and 2 nd/ 3 rd priority in balance circles • TDSAT (Telecom Tribunal) has already directed the Dept. of Telecommunications to keep priority of Spice Comm while allocating Spectrum on the same basis Spectrum available for allotment to 2 new players. Spice being one. 2

PRIVATE & CONFIDENTIAL Critical Success Factors Licenses and Allocation of Spectrum • Company is an incumbent and strong player in the states of Punjab & Karnataka, with conspicuous marketshare (~4 million subscribers) • Company had applied for 20 more licenses representing over 90% market opportunity in Aug ‘ 06 and is having 1 st priority based on date of application in 12 circles and 2 nd/ 3 rd priority in balance circles • TDSAT (Telecom Tribunal) has already directed the Dept. of Telecommunications to keep priority of Spice Comm while allocating Spectrum on the same basis Spectrum available for allotment to 2 new players. Spice being one. 2

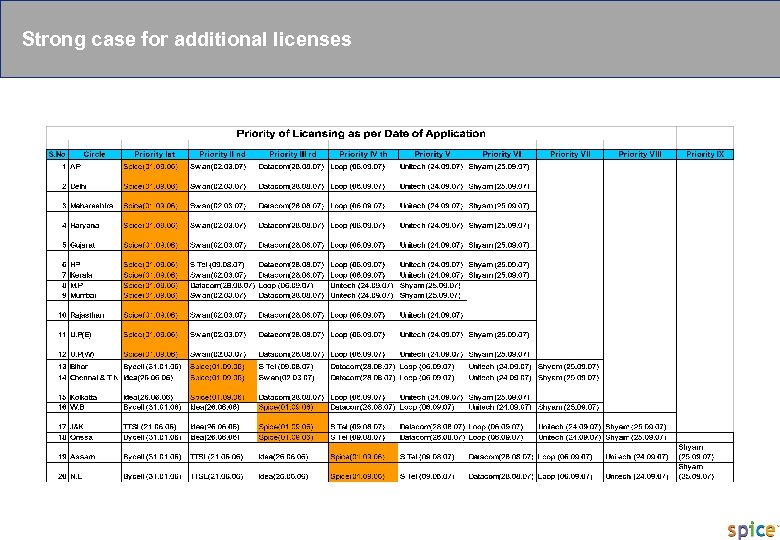

PRIVATE & CONFIDENTIAL Strong case for additional licenses

PRIVATE & CONFIDENTIAL Strong case for additional licenses

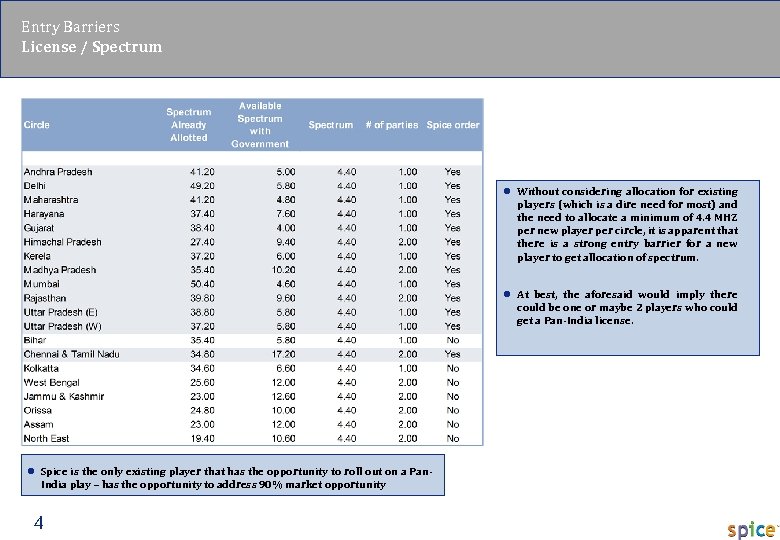

PRIVATE & CONFIDENTIAL Entry Barriers License / Spectrum l Without considering allocation for existing players (which is a dire need for most) and the need to allocate a minimum of 4. 4 MHZ per new player per circle, it is apparent that there is a strong entry barrier for a new player to get allocation of spectrum. l At best, the aforesaid would imply there could be one or maybe 2 players who could get a Pan-India license. l Spice is the only existing player that has the opportunity to roll out on a Pan- India play – has the opportunity to address 90% market opportunity 4

PRIVATE & CONFIDENTIAL Entry Barriers License / Spectrum l Without considering allocation for existing players (which is a dire need for most) and the need to allocate a minimum of 4. 4 MHZ per new player per circle, it is apparent that there is a strong entry barrier for a new player to get allocation of spectrum. l At best, the aforesaid would imply there could be one or maybe 2 players who could get a Pan-India license. l Spice is the only existing player that has the opportunity to roll out on a Pan- India play – has the opportunity to address 90% market opportunity 4

PRIVATE & CONFIDENTIAL Recent developments reinforce our case The Economic Times, New Delhi, Feb 28, 2008 • Recent judgments preserve our priority in Spectrum queue • Further strengthen our case for additional Licenses

PRIVATE & CONFIDENTIAL Recent developments reinforce our case The Economic Times, New Delhi, Feb 28, 2008 • Recent judgments preserve our priority in Spectrum queue • Further strengthen our case for additional Licenses

Financial & Operating Highlights 6

Financial & Operating Highlights 6

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

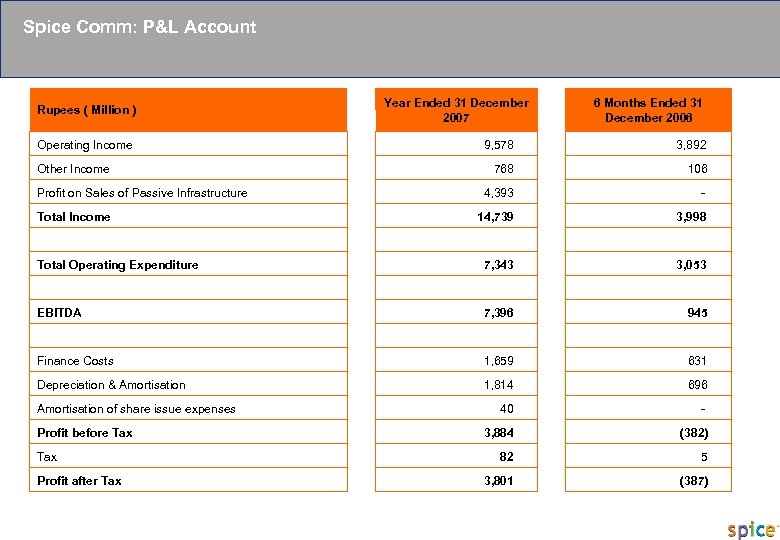

PRIVATE & CONFIDENTIAL Spice Comm: P&L Account Rupees ( Million ) Year Ended 31 December 2007 - 3, 998 7, 343 EBITDA 106 Total Operating Expenditure 14, 739 Total Income 3, 892 4, 393 Profit on Sales of Passive Infrastructure 768 Other Income 6 Months Ended 31 December 2006 9, 578 Operating Income 7, 396 3, 053 945 Finance Costs 1, 659 631 Depreciation & Amortisation 1, 814 696 40 - 3, 884 (382) 82 5 3, 801 (387) Amortisation of share issue expenses Profit before Tax Profit after Tax

PRIVATE & CONFIDENTIAL Spice Comm: P&L Account Rupees ( Million ) Year Ended 31 December 2007 - 3, 998 7, 343 EBITDA 106 Total Operating Expenditure 14, 739 Total Income 3, 892 4, 393 Profit on Sales of Passive Infrastructure 768 Other Income 6 Months Ended 31 December 2006 9, 578 Operating Income 7, 396 3, 053 945 Finance Costs 1, 659 631 Depreciation & Amortisation 1, 814 696 40 - 3, 884 (382) 82 5 3, 801 (387) Amortisation of share issue expenses Profit before Tax Profit after Tax

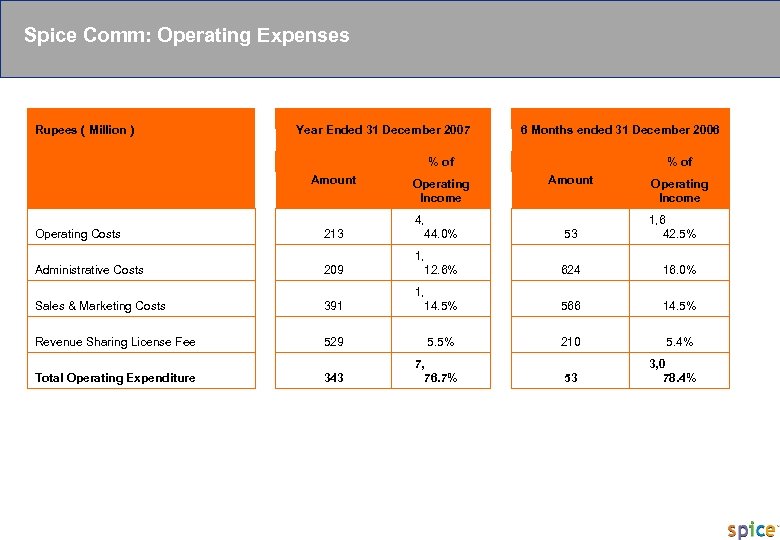

PRIVATE & CONFIDENTIAL Spice Comm: Operating Expenses Rupees ( Million ) Year Ended 31 December 2007 % of Amount 6 Months ended 31 December 2006 % of Amount Operating Income Operating Costs 213 4, 44. 0% 53 1, 6 42. 5% Administrative Costs 209 1, 12. 6% 624 16. 0% Sales & Marketing Costs 391 1, 14. 5% 566 14. 5% Revenue Sharing License Fee 529 5. 5% 210 5. 4% Total Operating Expenditure 343 7, 76. 7% 53 3, 0 78. 4%

PRIVATE & CONFIDENTIAL Spice Comm: Operating Expenses Rupees ( Million ) Year Ended 31 December 2007 % of Amount 6 Months ended 31 December 2006 % of Amount Operating Income Operating Costs 213 4, 44. 0% 53 1, 6 42. 5% Administrative Costs 209 1, 12. 6% 624 16. 0% Sales & Marketing Costs 391 1, 14. 5% 566 14. 5% Revenue Sharing License Fee 529 5. 5% 210 5. 4% Total Operating Expenditure 343 7, 76. 7% 53 3, 0 78. 4%

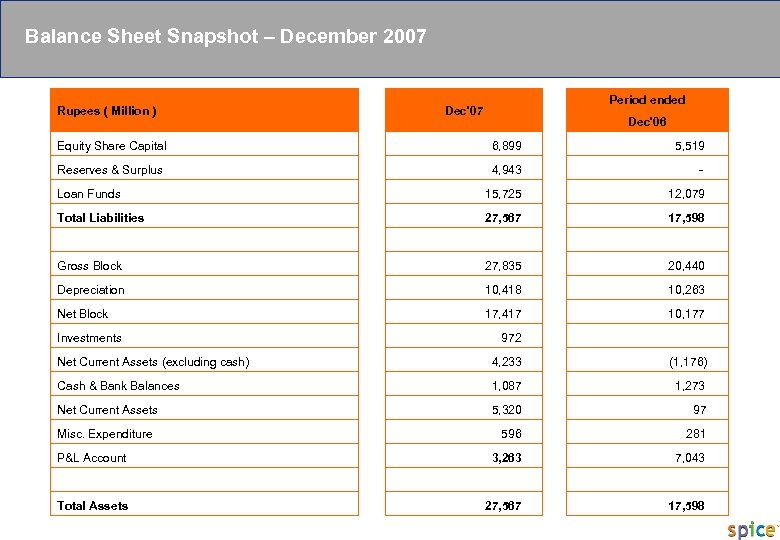

PRIVATE & CONFIDENTIAL Balance Sheet Snapshot – December 2007 Rupees ( Million ) Period ended Dec'07 Dec'06 Equity Share Capital 6, 899 5, 519 Reserves & Surplus 4, 943 - Loan Funds 15, 725 12, 079 Total Liabilities 27, 567 17, 598 Gross Block 27, 835 20, 440 Depreciation 10, 418 10, 263 Net Block 17, 417 10, 177 972 Net Current Assets (excluding cash) 4, 233 (1, 176) Cash & Bank Balances 1, 087 1, 273 Net Current Assets 5, 320 97 596 281 3, 263 7, 043 Investments Misc. Expenditure P&L Account Total Assets 27, 567 17, 598

PRIVATE & CONFIDENTIAL Balance Sheet Snapshot – December 2007 Rupees ( Million ) Period ended Dec'07 Dec'06 Equity Share Capital 6, 899 5, 519 Reserves & Surplus 4, 943 - Loan Funds 15, 725 12, 079 Total Liabilities 27, 567 17, 598 Gross Block 27, 835 20, 440 Depreciation 10, 418 10, 263 Net Block 17, 417 10, 177 972 Net Current Assets (excluding cash) 4, 233 (1, 176) Cash & Bank Balances 1, 087 1, 273 Net Current Assets 5, 320 97 596 281 3, 263 7, 043 Investments Misc. Expenditure P&L Account Total Assets 27, 567 17, 598

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

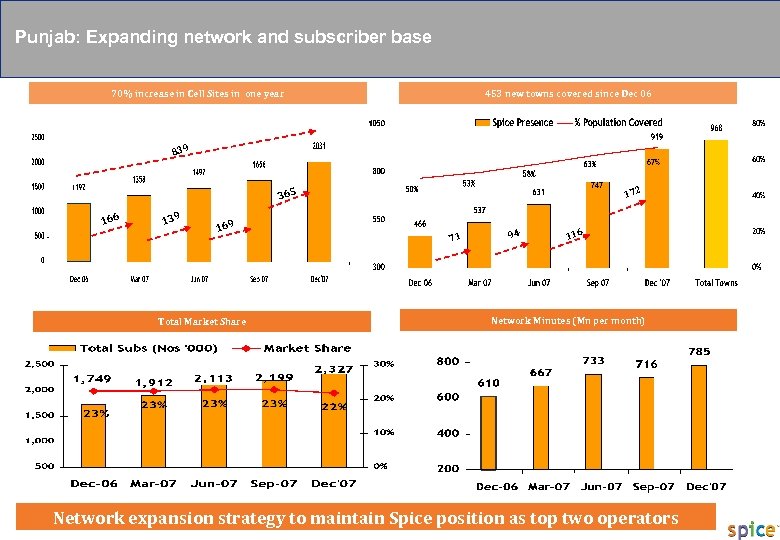

PRIVATE & CONFIDENTIAL Punjab: Expanding network and subscriber base 453 new towns covered since Dec 06 70% increase in Cell Sites in one year 839 172 365 166 139 169 Total Market Share 71 94 116 Network Minutes (Mn per month) Network expansion strategy to maintain Spice position as top two operators

PRIVATE & CONFIDENTIAL Punjab: Expanding network and subscriber base 453 new towns covered since Dec 06 70% increase in Cell Sites in one year 839 172 365 166 139 169 Total Market Share 71 94 116 Network Minutes (Mn per month) Network expansion strategy to maintain Spice position as top two operators

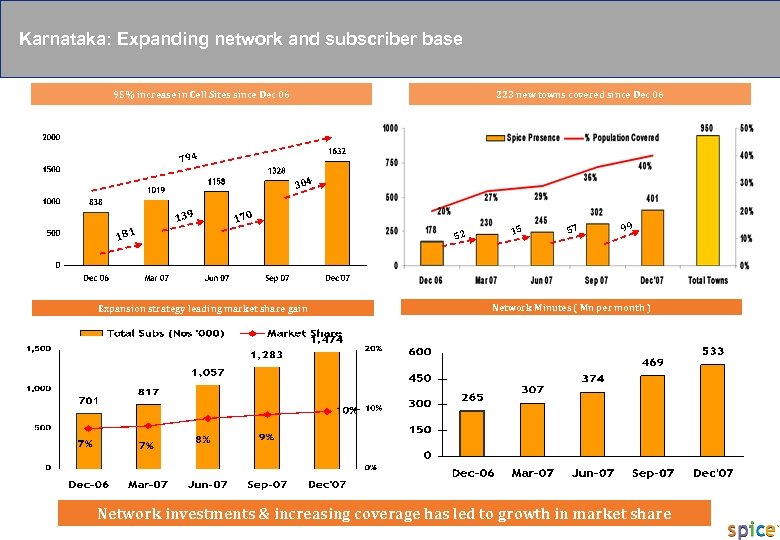

PRIVATE & CONFIDENTIAL Karnataka: Expanding network and subscriber base 223 new towns covered since Dec 06 95% increase in Cell Sites since Dec 06 794 304 139 170 181 Expansion strategy leading market share gain 52 15 57 99 Network Minutes ( Mn per month ) Network investments & increasing coverage has led to growth in market share

PRIVATE & CONFIDENTIAL Karnataka: Expanding network and subscriber base 223 new towns covered since Dec 06 95% increase in Cell Sites since Dec 06 794 304 139 170 181 Expansion strategy leading market share gain 52 15 57 99 Network Minutes ( Mn per month ) Network investments & increasing coverage has led to growth in market share

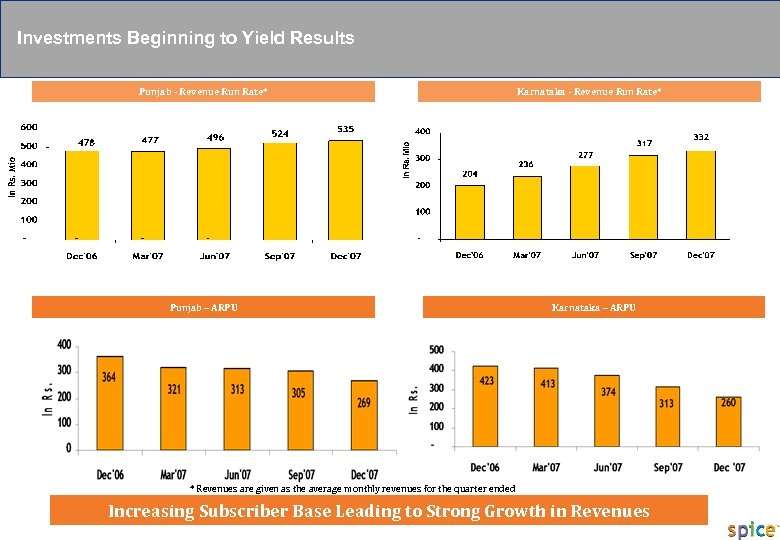

PRIVATE & CONFIDENTIAL Investments Beginning to Yield Results Punjab - Revenue Run Rate* Punjab – ARPU Karnataka - Revenue Run Rate* Karnataka – ARPU * Revenues are given as the average monthly revenues for the quarter ended Increasing Subscriber Base Leading to Strong Growth in Revenues

PRIVATE & CONFIDENTIAL Investments Beginning to Yield Results Punjab - Revenue Run Rate* Punjab – ARPU Karnataka - Revenue Run Rate* Karnataka – ARPU * Revenues are given as the average monthly revenues for the quarter ended Increasing Subscriber Base Leading to Strong Growth in Revenues

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

PRIVATE & CONFIDENTIAL Financial Statements Operating Parameters Financial Statements Analysis

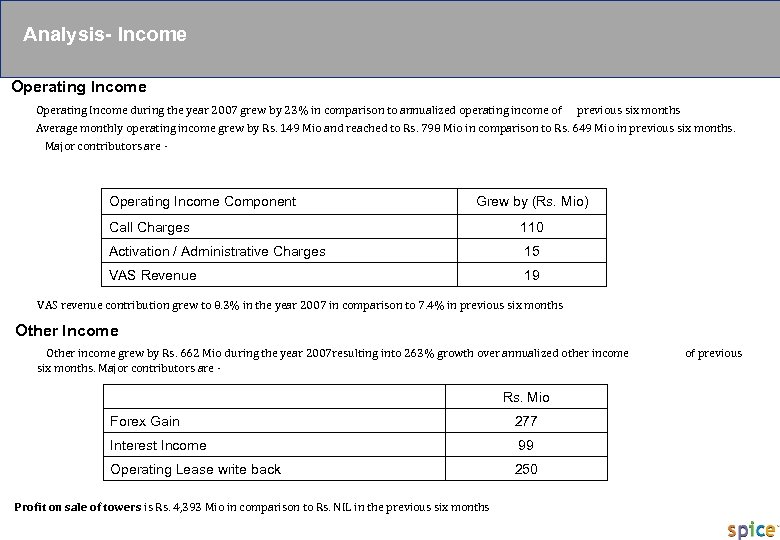

PRIVATE & CONFIDENTIAL Analysis- Income Operating Income during the year 2007 grew by 23% in comparison to annualized operating income of previous six months Average monthly operating income grew by Rs. 149 Mio and reached to Rs. 798 Mio in comparison to Rs. 649 Mio in previous six months. Major contributors are - Operating Income Component Grew by (Rs. Mio) Call Charges 110 Activation / Administrative Charges 15 VAS Revenue 19 VAS revenue contribution grew to 8. 3% in the year 2007 in comparison to 7. 4% in previous six months Other Income Other income grew by Rs. 662 Mio during the year 2007 resulting into 263% growth over annualized other income six months. Major contributors are - Rs. Mio Forex Gain 277 Interest Income 99 Operating Lease write back 250 Profit on sale of towers is Rs. 4, 393 Mio in comparison to Rs. NIL in the previous six months of previous

PRIVATE & CONFIDENTIAL Analysis- Income Operating Income during the year 2007 grew by 23% in comparison to annualized operating income of previous six months Average monthly operating income grew by Rs. 149 Mio and reached to Rs. 798 Mio in comparison to Rs. 649 Mio in previous six months. Major contributors are - Operating Income Component Grew by (Rs. Mio) Call Charges 110 Activation / Administrative Charges 15 VAS Revenue 19 VAS revenue contribution grew to 8. 3% in the year 2007 in comparison to 7. 4% in previous six months Other Income Other income grew by Rs. 662 Mio during the year 2007 resulting into 263% growth over annualized other income six months. Major contributors are - Rs. Mio Forex Gain 277 Interest Income 99 Operating Lease write back 250 Profit on sale of towers is Rs. 4, 393 Mio in comparison to Rs. NIL in the previous six months of previous

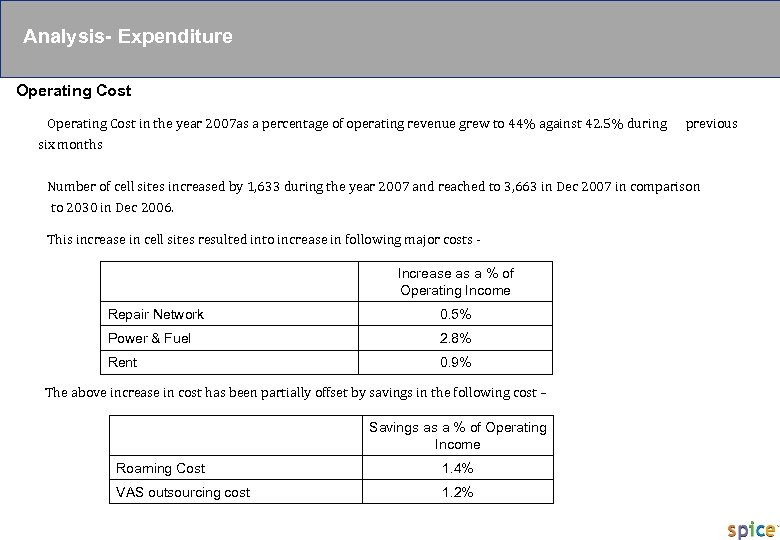

PRIVATE & CONFIDENTIAL Analysis- Expenditure Operating Cost in the year 2007 as a percentage of operating revenue grew to 44% against 42. 5% during previous six months Number of cell sites increased by 1, 633 during the year 2007 and reached to 3, 663 in Dec 2007 in comparison to 2030 in Dec 2006. This increase in cell sites resulted into increase in following major costs Increase as a % of Operating Income Repair Network 0. 5% Power & Fuel 2. 8% Rent 0. 9% The above increase in cost has been partially offset by savings in the following cost – Savings as a % of Operating Income Roaming Cost 1. 4% VAS outsourcing cost 1. 2%

PRIVATE & CONFIDENTIAL Analysis- Expenditure Operating Cost in the year 2007 as a percentage of operating revenue grew to 44% against 42. 5% during previous six months Number of cell sites increased by 1, 633 during the year 2007 and reached to 3, 663 in Dec 2007 in comparison to 2030 in Dec 2006. This increase in cell sites resulted into increase in following major costs Increase as a % of Operating Income Repair Network 0. 5% Power & Fuel 2. 8% Rent 0. 9% The above increase in cost has been partially offset by savings in the following cost – Savings as a % of Operating Income Roaming Cost 1. 4% VAS outsourcing cost 1. 2%

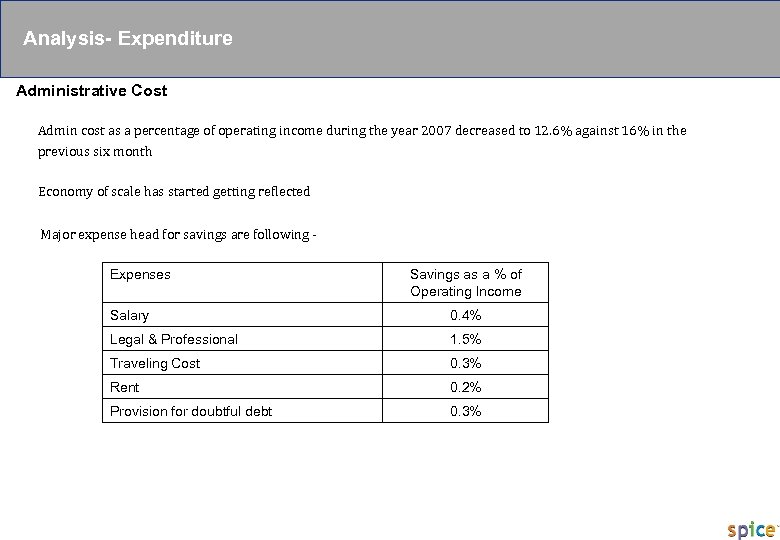

PRIVATE & CONFIDENTIAL Analysis- Expenditure Administrative Cost Admin cost as a percentage of operating income during the year 2007 decreased to 12. 6% against 16% in the previous six month Economy of scale has started getting reflected Major expense head for savings are following Expenses Savings as a % of Operating Income Salary 0. 4% Legal & Professional 1. 5% Traveling Cost 0. 3% Rent 0. 2% Provision for doubtful debt 0. 3%

PRIVATE & CONFIDENTIAL Analysis- Expenditure Administrative Cost Admin cost as a percentage of operating income during the year 2007 decreased to 12. 6% against 16% in the previous six month Economy of scale has started getting reflected Major expense head for savings are following Expenses Savings as a % of Operating Income Salary 0. 4% Legal & Professional 1. 5% Traveling Cost 0. 3% Rent 0. 2% Provision for doubtful debt 0. 3%

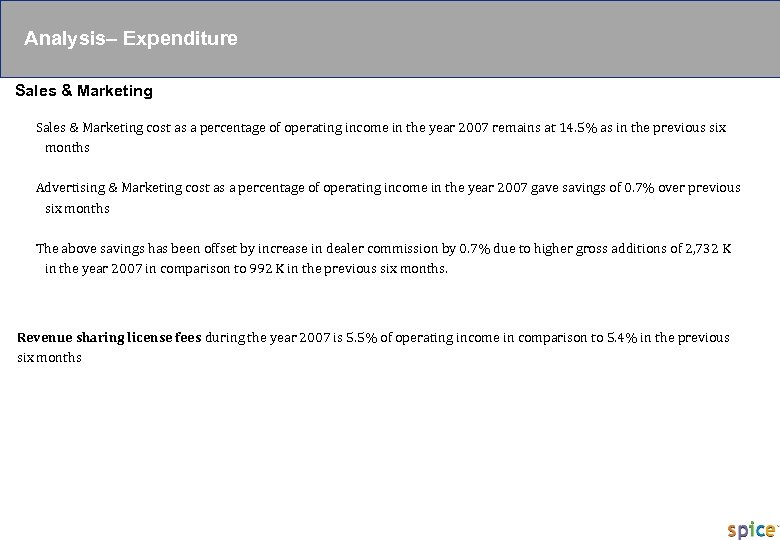

PRIVATE & CONFIDENTIAL Analysis– Expenditure Sales & Marketing cost as a percentage of operating income in the year 2007 remains at 14. 5% as in the previous six months Advertising & Marketing cost as a percentage of operating income in the year 2007 gave savings of 0. 7% over previous six months The above savings has been offset by increase in dealer commission by 0. 7% due to higher gross additions of 2, 732 K in the year 2007 in comparison to 992 K in the previous six months. Revenue sharing license fees during the year 2007 is 5. 5% of operating income in comparison to 5. 4% in the previous six months

PRIVATE & CONFIDENTIAL Analysis– Expenditure Sales & Marketing cost as a percentage of operating income in the year 2007 remains at 14. 5% as in the previous six months Advertising & Marketing cost as a percentage of operating income in the year 2007 gave savings of 0. 7% over previous six months The above savings has been offset by increase in dealer commission by 0. 7% due to higher gross additions of 2, 732 K in the year 2007 in comparison to 992 K in the previous six months. Revenue sharing license fees during the year 2007 is 5. 5% of operating income in comparison to 5. 4% in the previous six months

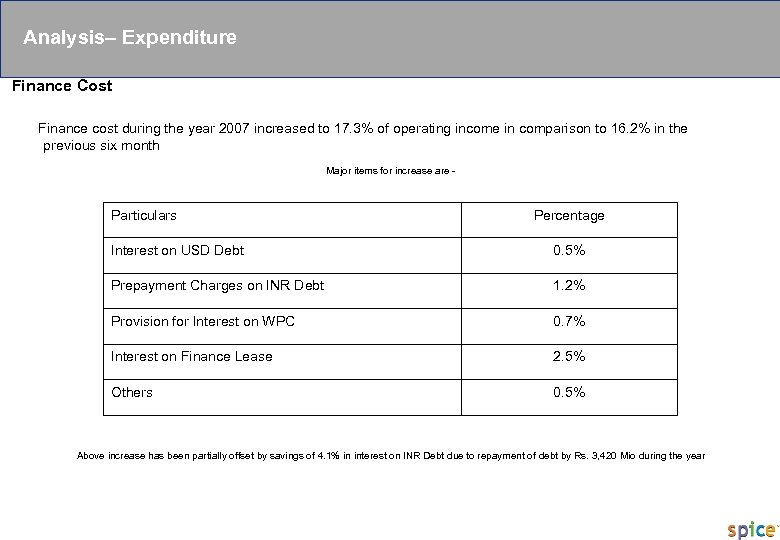

PRIVATE & CONFIDENTIAL Analysis– Expenditure Finance Cost Finance cost during the year 2007 increased to 17. 3% of operating income in comparison to 16. 2% in the previous six month Major items for increase are - Particulars Percentage Interest on USD Debt 0. 5% Prepayment Charges on INR Debt 1. 2% Provision for Interest on WPC 0. 7% Interest on Finance Lease 2. 5% Others 0. 5% Above increase has been partially offset by savings of 4. 1% in interest on INR Debt due to repayment of debt by Rs. 3, 420 Mio during the year

PRIVATE & CONFIDENTIAL Analysis– Expenditure Finance Cost Finance cost during the year 2007 increased to 17. 3% of operating income in comparison to 16. 2% in the previous six month Major items for increase are - Particulars Percentage Interest on USD Debt 0. 5% Prepayment Charges on INR Debt 1. 2% Provision for Interest on WPC 0. 7% Interest on Finance Lease 2. 5% Others 0. 5% Above increase has been partially offset by savings of 4. 1% in interest on INR Debt due to repayment of debt by Rs. 3, 420 Mio during the year

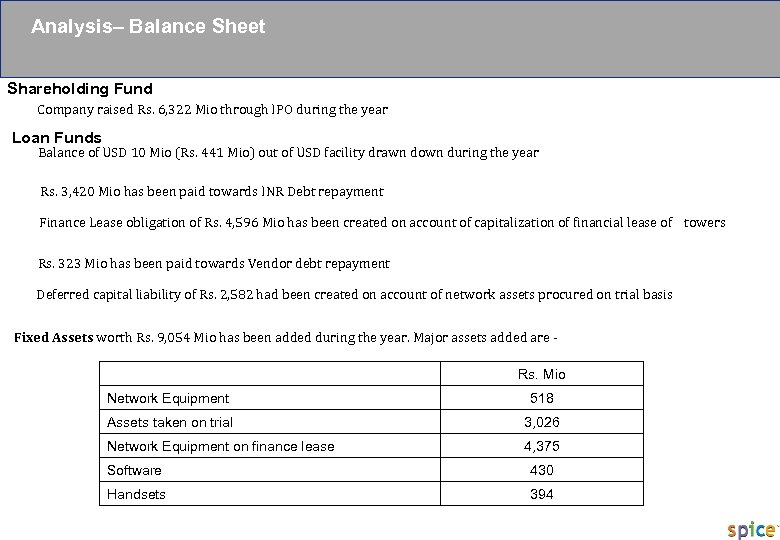

PRIVATE & CONFIDENTIAL Analysis– Balance Sheet Shareholding Fund Company raised Rs. 6, 322 Mio through IPO during the year Loan Funds Balance of USD 10 Mio (Rs. 441 Mio) out of USD facility drawn down during the year Rs. 3, 420 Mio has been paid towards INR Debt repayment Finance Lease obligation of Rs. 4, 596 Mio has been created on account of capitalization of financial lease of towers Rs. 323 Mio has been paid towards Vendor debt repayment Deferred capital liability of Rs. 2, 582 had been created on account of network assets procured on trial basis Fixed Assets worth Rs. 9, 054 Mio has been added during the year. Major assets added are Rs. Mio Network Equipment 518 Assets taken on trial 3, 026 Network Equipment on finance lease 4, 375 Software 430 Handsets 394

PRIVATE & CONFIDENTIAL Analysis– Balance Sheet Shareholding Fund Company raised Rs. 6, 322 Mio through IPO during the year Loan Funds Balance of USD 10 Mio (Rs. 441 Mio) out of USD facility drawn down during the year Rs. 3, 420 Mio has been paid towards INR Debt repayment Finance Lease obligation of Rs. 4, 596 Mio has been created on account of capitalization of financial lease of towers Rs. 323 Mio has been paid towards Vendor debt repayment Deferred capital liability of Rs. 2, 582 had been created on account of network assets procured on trial basis Fixed Assets worth Rs. 9, 054 Mio has been added during the year. Major assets added are Rs. Mio Network Equipment 518 Assets taken on trial 3, 026 Network Equipment on finance lease 4, 375 Software 430 Handsets 394

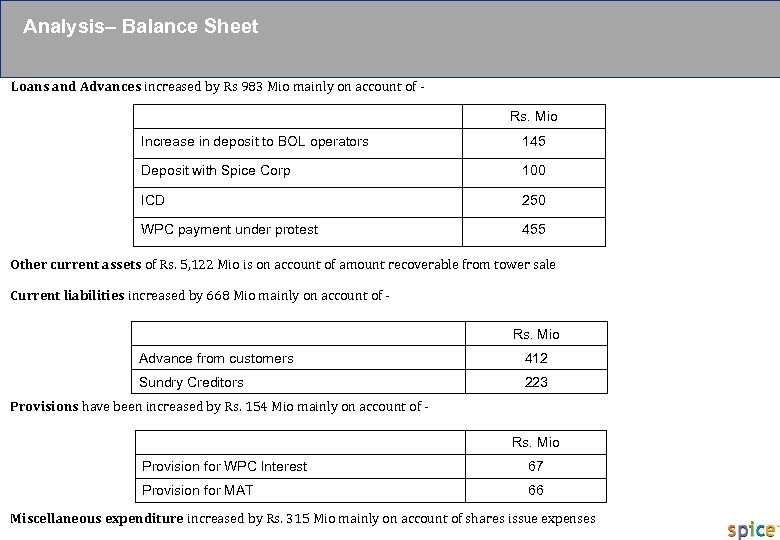

PRIVATE & CONFIDENTIAL Analysis– Balance Sheet Loans and Advances increased by Rs 983 Mio mainly on account of Rs. Mio Increase in deposit to BOL operators 145 Deposit with Spice Corp 100 ICD 250 WPC payment under protest 455 Other current assets of Rs. 5, 122 Mio is on account of amount recoverable from tower sale Current liabilities increased by 668 Mio mainly on account of Rs. Mio Advance from customers 412 Sundry Creditors 223 Provisions have been increased by Rs. 154 Mio mainly on account of Rs. Mio Provision for WPC Interest 67 Provision for MAT 66 Miscellaneous expenditure increased by Rs. 315 Mio mainly on account of shares issue expenses

PRIVATE & CONFIDENTIAL Analysis– Balance Sheet Loans and Advances increased by Rs 983 Mio mainly on account of Rs. Mio Increase in deposit to BOL operators 145 Deposit with Spice Corp 100 ICD 250 WPC payment under protest 455 Other current assets of Rs. 5, 122 Mio is on account of amount recoverable from tower sale Current liabilities increased by 668 Mio mainly on account of Rs. Mio Advance from customers 412 Sundry Creditors 223 Provisions have been increased by Rs. 154 Mio mainly on account of Rs. Mio Provision for WPC Interest 67 Provision for MAT 66 Miscellaneous expenditure increased by Rs. 315 Mio mainly on account of shares issue expenses

PRIVATE & CONFIDENTIAL THANK YOU 24

PRIVATE & CONFIDENTIAL THANK YOU 24