82e1e2e3bdcc5d404bdd5afbe697f800.ppt

- Количество слайдов: 31

South Africa’s Port Governance and Pricing: Dilemmas and Reforms Dr Mihalis (Micky) Chasomerism 1@ukzn. ac. za INSPIRING GREATNESS

South Africa’s Port Governance and Pricing: Dilemmas and Reforms Dr Mihalis (Micky) Chasomerism 1@ukzn. ac. za INSPIRING GREATNESS

South Africa’s Seaports INSPIRING GREATNESS

South Africa’s Seaports INSPIRING GREATNESS

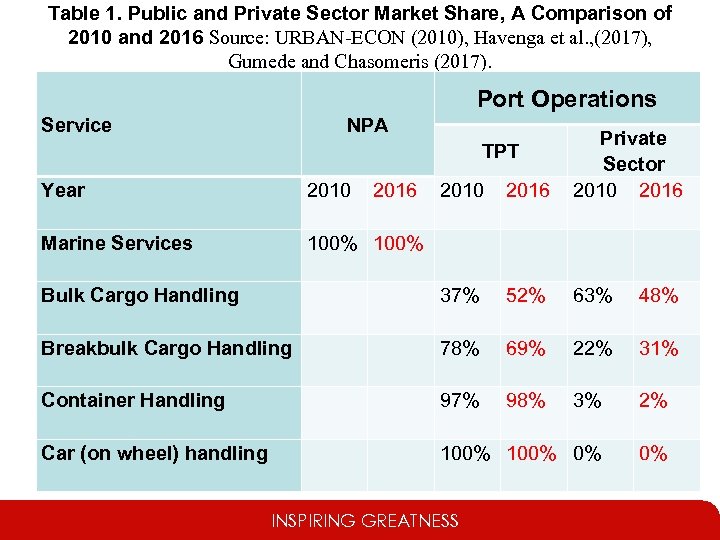

Table 1. Public and Private Sector Market Share, A Comparison of 2010 and 2016 Source: URBAN-ECON (2010), Havenga et al. , (2017), Gumede and Chasomeris (2017). Port Operations Service NPA 2016 Private Sector 2010 2016 100% 37% 52% 63% 48% Breakbulk Cargo Handling 78% 69% 22% 31% Container Handling 97% 98% 3% 2% Car (on wheel) handling 100% 0% 0% TPT Year 2010 Marine Services Bulk Cargo Handling 2016 2010 INSPIRING GREATNESS

Table 1. Public and Private Sector Market Share, A Comparison of 2010 and 2016 Source: URBAN-ECON (2010), Havenga et al. , (2017), Gumede and Chasomeris (2017). Port Operations Service NPA 2016 Private Sector 2010 2016 100% 37% 52% 63% 48% Breakbulk Cargo Handling 78% 69% 22% 31% Container Handling 97% 98% 3% 2% Car (on wheel) handling 100% 0% 0% TPT Year 2010 Marine Services Bulk Cargo Handling 2016 2010 INSPIRING GREATNESS

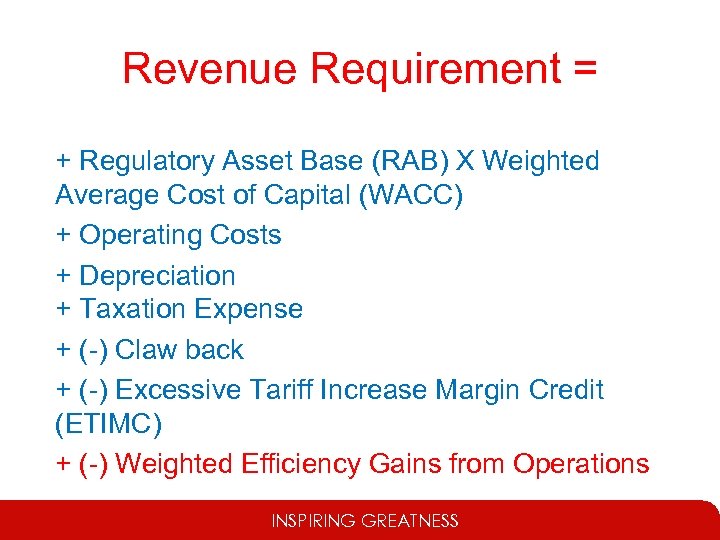

Revenue Requirement = + Regulatory Asset Base (RAB) X Weighted Average Cost of Capital (WACC) + Operating Costs + Depreciation + Taxation Expense + (-) Claw back + (-) Excessive Tariff Increase Margin Credit (ETIMC) + (-) Weighted Efficiency Gains from Operations INSPIRING GREATNESS

Revenue Requirement = + Regulatory Asset Base (RAB) X Weighted Average Cost of Capital (WACC) + Operating Costs + Depreciation + Taxation Expense + (-) Claw back + (-) Excessive Tariff Increase Margin Credit (ETIMC) + (-) Weighted Efficiency Gains from Operations INSPIRING GREATNESS

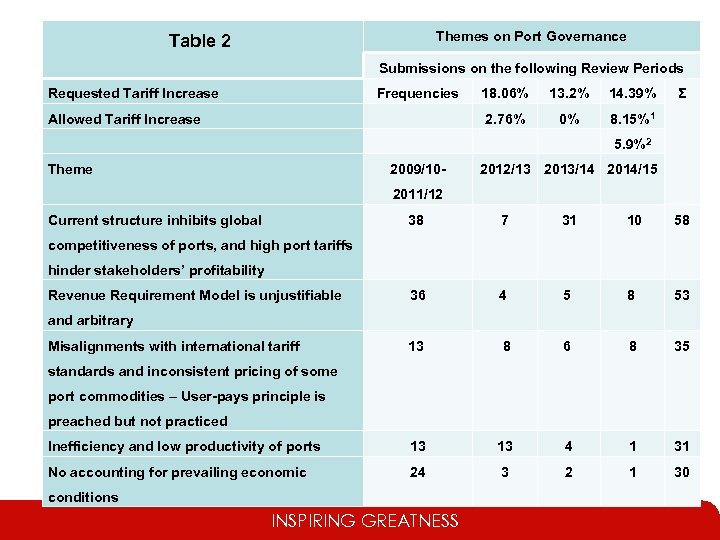

Themes on Port Governance Table 2 Submissions on the following Review Periods Requested Tariff Increase Frequencies 18. 06% 13. 2% 14. 39% Allowed Tariff Increase 2. 76% 0% 8. 15%1 5. 9%2 Theme 2009/10 - Σ 2012/13 2013/14 2014/15 2011/12 Current structure inhibits global 38 7 31 10 58 36 4 5 8 53 13 8 6 8 35 Inefficiency and low productivity of ports 13 13 4 1 31 No accounting for prevailing economic 24 3 2 1 30 competitiveness of ports, and high port tariffs hinder stakeholders’ profitability Revenue Requirement Model is unjustifiable and arbitrary Misalignments with international tariff standards and inconsistent pricing of some port commodities – User-pays principle is preached but not practiced conditions INSPIRING GREATNESS

Themes on Port Governance Table 2 Submissions on the following Review Periods Requested Tariff Increase Frequencies 18. 06% 13. 2% 14. 39% Allowed Tariff Increase 2. 76% 0% 8. 15%1 5. 9%2 Theme 2009/10 - Σ 2012/13 2013/14 2014/15 2011/12 Current structure inhibits global 38 7 31 10 58 36 4 5 8 53 13 8 6 8 35 Inefficiency and low productivity of ports 13 13 4 1 31 No accounting for prevailing economic 24 3 2 1 30 competitiveness of ports, and high port tariffs hinder stakeholders’ profitability Revenue Requirement Model is unjustifiable and arbitrary Misalignments with international tariff standards and inconsistent pricing of some port commodities – User-pays principle is preached but not practiced conditions INSPIRING GREATNESS

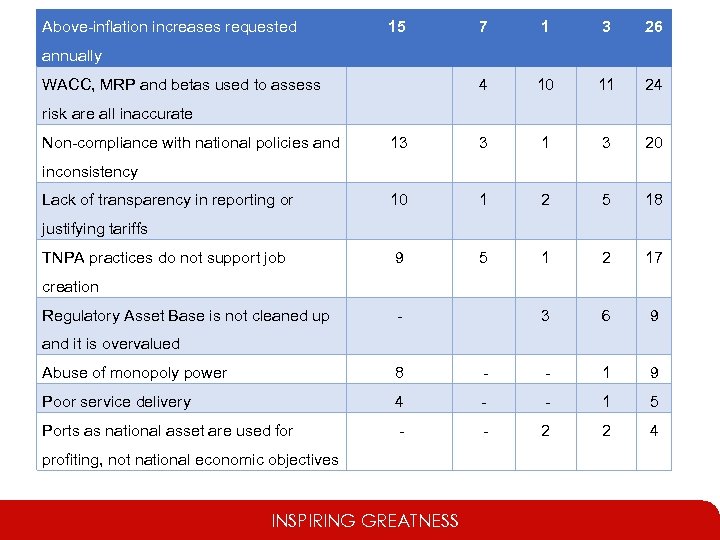

Above-inflation increases requested 15 7 1 3 26 4 10 11 24 13 3 1 3 20 10 1 2 5 18 9 5 1 2 17 3 6 9 annually WACC, MRP and betas used to assess risk are all inaccurate Non-compliance with national policies and inconsistency Lack of transparency in reporting or justifying tariffs TNPA practices do not support job creation Regulatory Asset Base is not cleaned up - and it is overvalued Abuse of monopoly power 8 - - 1 9 Poor service delivery 4 - - 1 5 Ports as national asset are used for - - 2 2 4 profiting, not national economic objectives INSPIRING GREATNESS

Above-inflation increases requested 15 7 1 3 26 4 10 11 24 13 3 1 3 20 10 1 2 5 18 9 5 1 2 17 3 6 9 annually WACC, MRP and betas used to assess risk are all inaccurate Non-compliance with national policies and inconsistency Lack of transparency in reporting or justifying tariffs TNPA practices do not support job creation Regulatory Asset Base is not cleaned up - and it is overvalued Abuse of monopoly power 8 - - 1 9 Poor service delivery 4 - - 1 5 Ports as national asset are used for - - 2 2 4 profiting, not national economic objectives INSPIRING GREATNESS

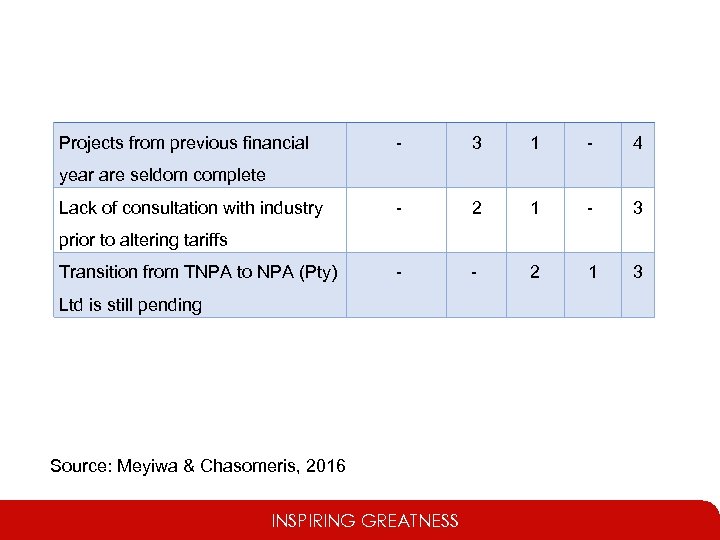

Projects from previous financial - 3 1 - 4 - 2 1 - 3 - - 2 1 3 year are seldom complete Lack of consultation with industry prior to altering tariffs Transition from TNPA to NPA (Pty) Ltd is still pending Source: Meyiwa & Chasomeris, 2016 INSPIRING GREATNESS

Projects from previous financial - 3 1 - 4 - 2 1 - 3 - - 2 1 3 year are seldom complete Lack of consultation with industry prior to altering tariffs Transition from TNPA to NPA (Pty) Ltd is still pending Source: Meyiwa & Chasomeris, 2016 INSPIRING GREATNESS

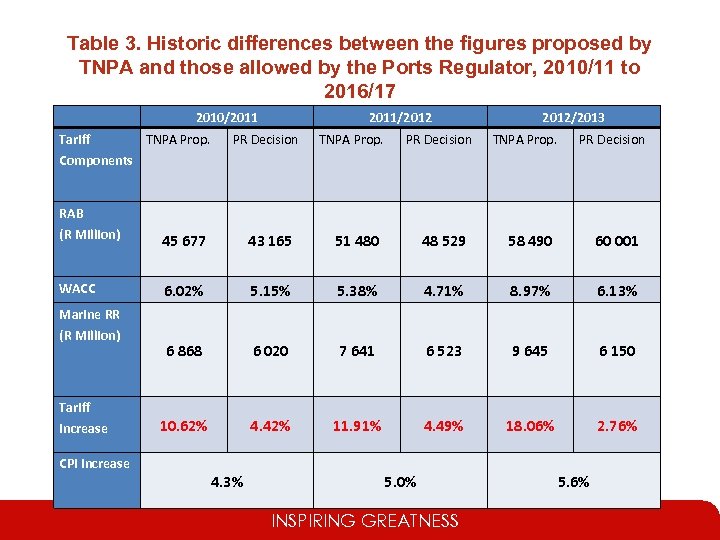

Table 3. Historic differences between the figures proposed by TNPA and those allowed by the Ports Regulator, 2010/11 to 2016/17 2010/2011 Tariff TNPA Prop. 2011/2012 PR Decision TNPA Prop. PR Decision 2012/2013 TNPA Prop. PR Decision Components RAB (R Million) 45 677 43 165 51 480 48 529 58 490 60 001 WACC 6. 02% 5. 15% 5. 38% 4. 71% 8. 97% 6. 13% 6 868 6 020 7 641 6 523 9 645 6 150 10. 62% 4. 42% 11. 91% 4. 49% 18. 06% 2. 76% Marine RR (R Million) Tariff Increase CPI Increase 4. 3% 5. 0% INSPIRING GREATNESS 5. 6%

Table 3. Historic differences between the figures proposed by TNPA and those allowed by the Ports Regulator, 2010/11 to 2016/17 2010/2011 Tariff TNPA Prop. 2011/2012 PR Decision TNPA Prop. PR Decision 2012/2013 TNPA Prop. PR Decision Components RAB (R Million) 45 677 43 165 51 480 48 529 58 490 60 001 WACC 6. 02% 5. 15% 5. 38% 4. 71% 8. 97% 6. 13% 6 868 6 020 7 641 6 523 9 645 6 150 10. 62% 4. 42% 11. 91% 4. 49% 18. 06% 2. 76% Marine RR (R Million) Tariff Increase CPI Increase 4. 3% 5. 0% INSPIRING GREATNESS 5. 6%

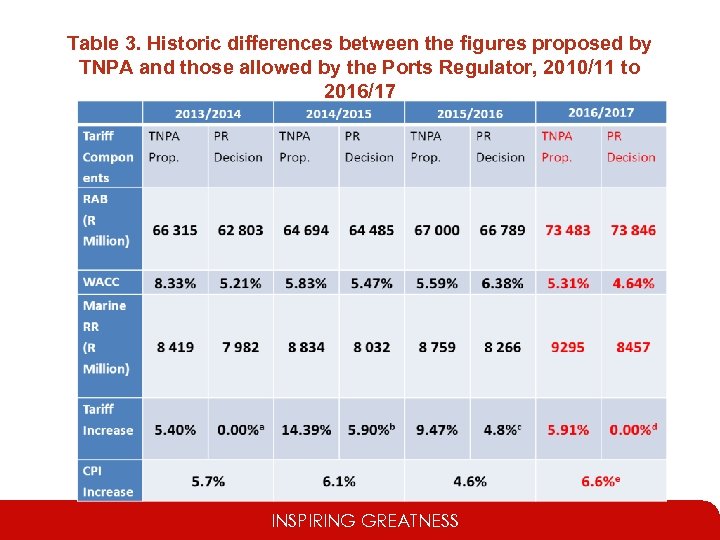

Table 3. Historic differences between the figures proposed by TNPA and those allowed by the Ports Regulator, 2010/11 to 2016/17 INSPIRING GREATNESS

Table 3. Historic differences between the figures proposed by TNPA and those allowed by the Ports Regulator, 2010/11 to 2016/17 INSPIRING GREATNESS

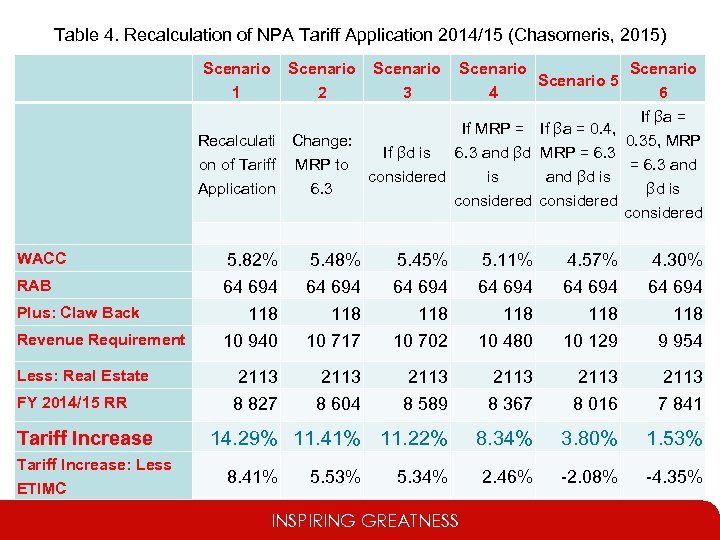

Table 4. Recalculation of NPA Tariff Application 2014/15 (Chasomeris, 2015) WACC RAB Plus: Claw Back Revenue Requirement Less: Real Estate FY 2014/15 RR Tariff Increase: Less ETIMC Scenario Scenario 5 1 2 3 4 6 If βa = If MRP = If βa = 0. 4, Recalculati Change: 0. 35, MRP If βd is 6. 3 and βd MRP = 6. 3 on of Tariff MRP to = 6. 3 and considered is and βd is Application 6. 3 βd is considered 5. 82% 64 694 118 10 940 5. 48% 64 694 118 10 717 5. 45% 64 694 118 10 702 5. 11% 64 694 118 10 480 4. 57% 64 694 118 10 129 4. 30% 64 694 118 9 954 2113 8 827 2113 8 604 2113 8 589 2113 8 367 2113 8 016 2113 7 841 14. 29% 11. 41% 11. 22% 8. 34% 3. 80% 1. 53% 2. 46% -2. 08% -4. 35% 8. 41% 5. 53% 5. 34% INSPIRING GREATNESS

Table 4. Recalculation of NPA Tariff Application 2014/15 (Chasomeris, 2015) WACC RAB Plus: Claw Back Revenue Requirement Less: Real Estate FY 2014/15 RR Tariff Increase: Less ETIMC Scenario Scenario 5 1 2 3 4 6 If βa = If MRP = If βa = 0. 4, Recalculati Change: 0. 35, MRP If βd is 6. 3 and βd MRP = 6. 3 on of Tariff MRP to = 6. 3 and considered is and βd is Application 6. 3 βd is considered 5. 82% 64 694 118 10 940 5. 48% 64 694 118 10 717 5. 45% 64 694 118 10 702 5. 11% 64 694 118 10 480 4. 57% 64 694 118 10 129 4. 30% 64 694 118 9 954 2113 8 827 2113 8 604 2113 8 589 2113 8 367 2113 8 016 2113 7 841 14. 29% 11. 41% 11. 22% 8. 34% 3. 80% 1. 53% 2. 46% -2. 08% -4. 35% 8. 41% 5. 53% 5. 34% INSPIRING GREATNESS

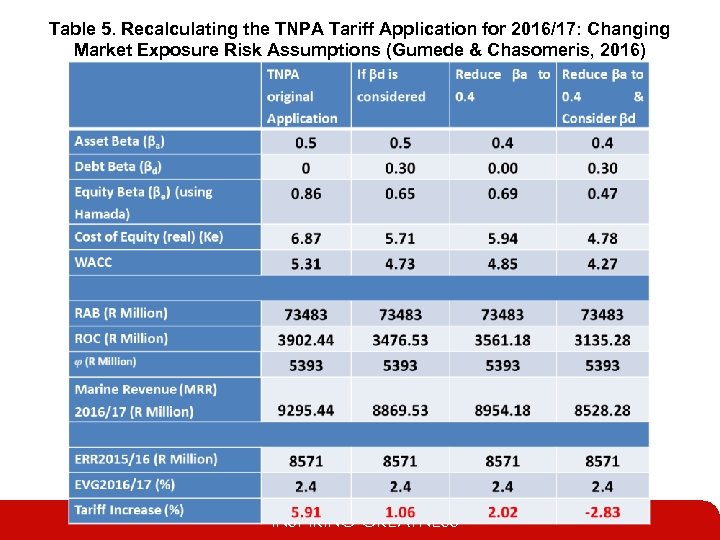

Table 5. Recalculating the TNPA Tariff Application for 2016/17: Changing Market Exposure Risk Assumptions (Gumede & Chasomeris, 2016) INSPIRING GREATNESS

Table 5. Recalculating the TNPA Tariff Application for 2016/17: Changing Market Exposure Risk Assumptions (Gumede & Chasomeris, 2016) INSPIRING GREATNESS

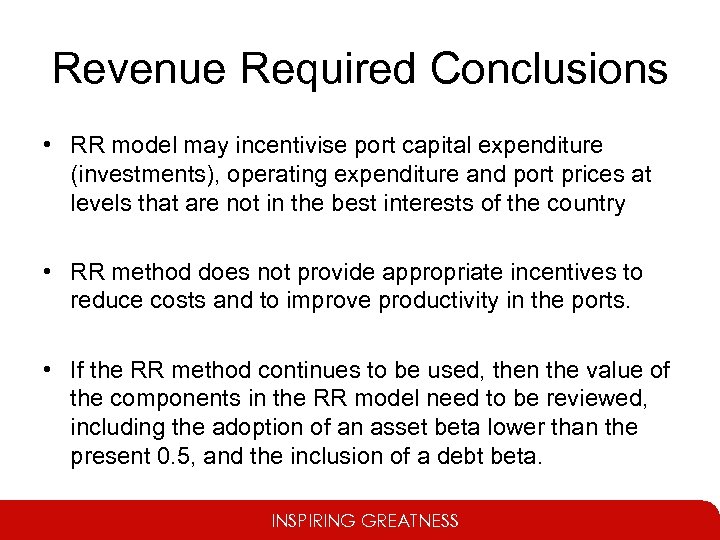

Revenue Required Conclusions • RR model may incentivise port capital expenditure (investments), operating expenditure and port prices at levels that are not in the best interests of the country • RR method does not provide appropriate incentives to reduce costs and to improve productivity in the ports. • If the RR method continues to be used, then the value of the components in the RR model need to be reviewed, including the adoption of an asset beta lower than the present 0. 5, and the inclusion of a debt beta. INSPIRING GREATNESS

Revenue Required Conclusions • RR model may incentivise port capital expenditure (investments), operating expenditure and port prices at levels that are not in the best interests of the country • RR method does not provide appropriate incentives to reduce costs and to improve productivity in the ports. • If the RR method continues to be used, then the value of the components in the RR model need to be reviewed, including the adoption of an asset beta lower than the present 0. 5, and the inclusion of a debt beta. INSPIRING GREATNESS

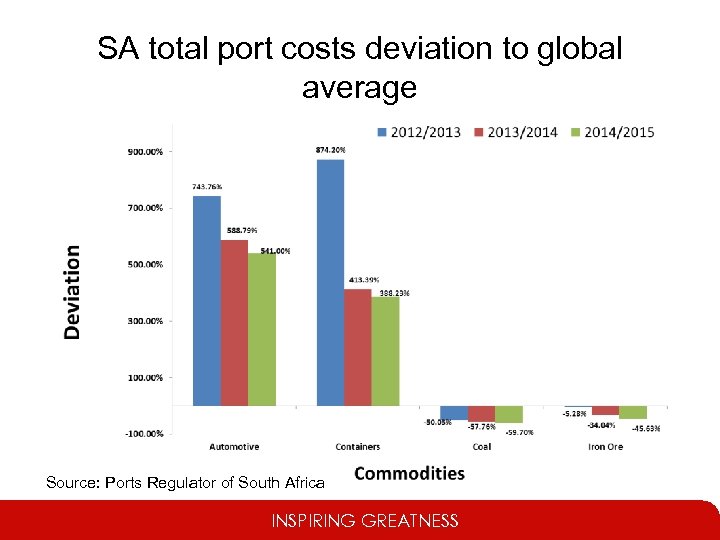

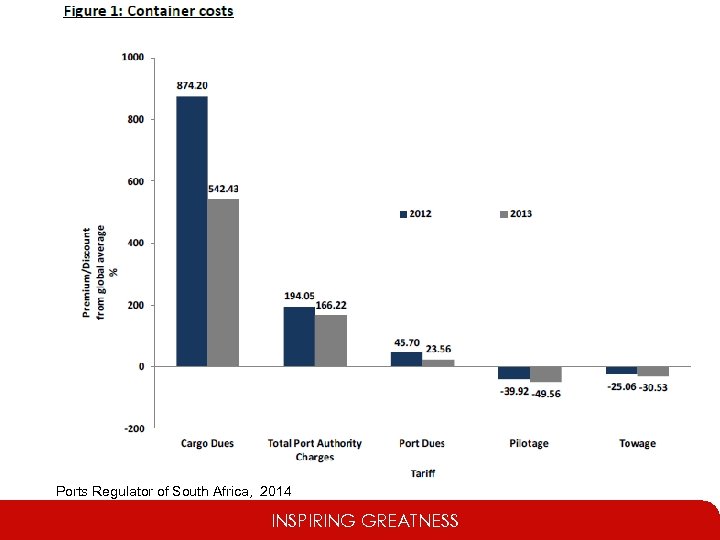

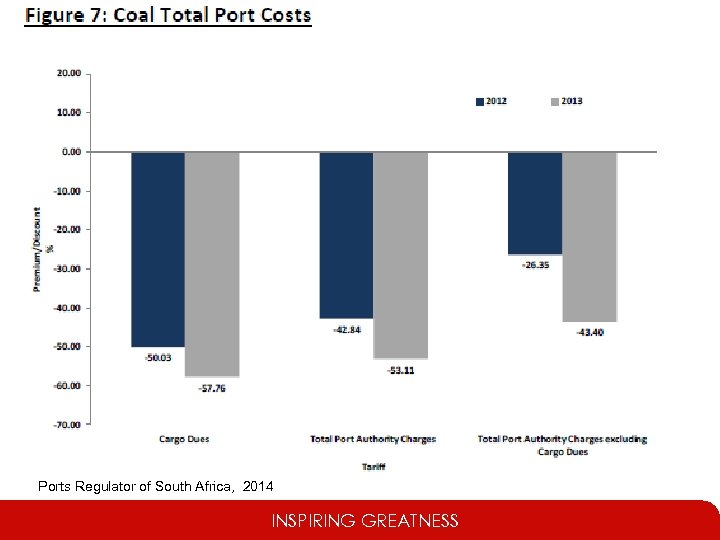

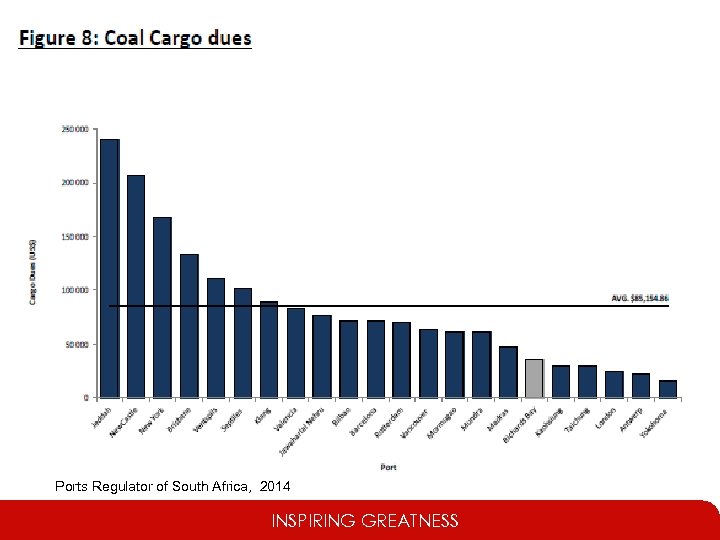

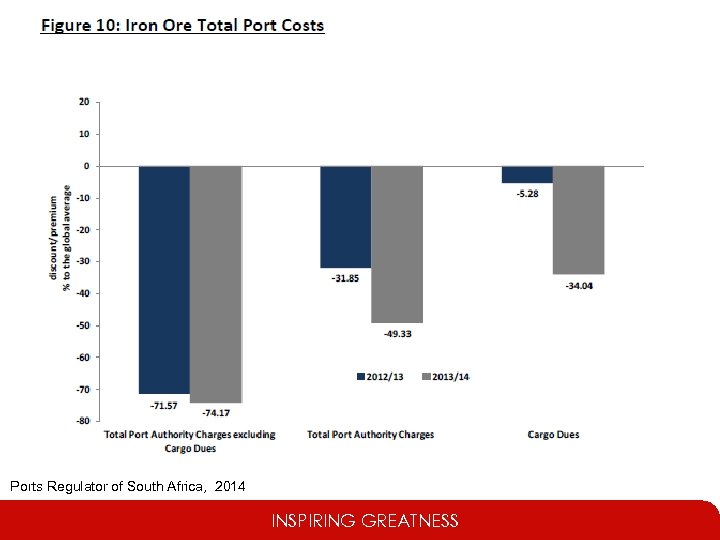

SA total port costs deviation to global average Source: Ports Regulator of South Africa INSPIRING GREATNESS

SA total port costs deviation to global average Source: Ports Regulator of South Africa INSPIRING GREATNESS

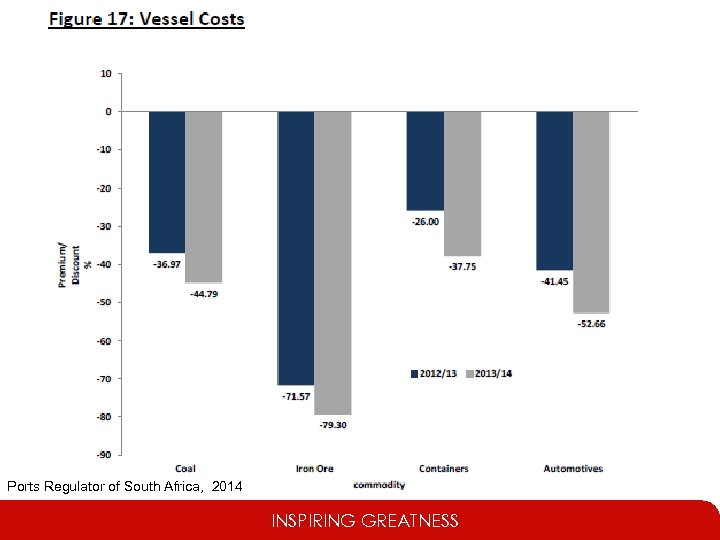

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

Ports Regulator of South Africa, 2014 INSPIRING GREATNESS

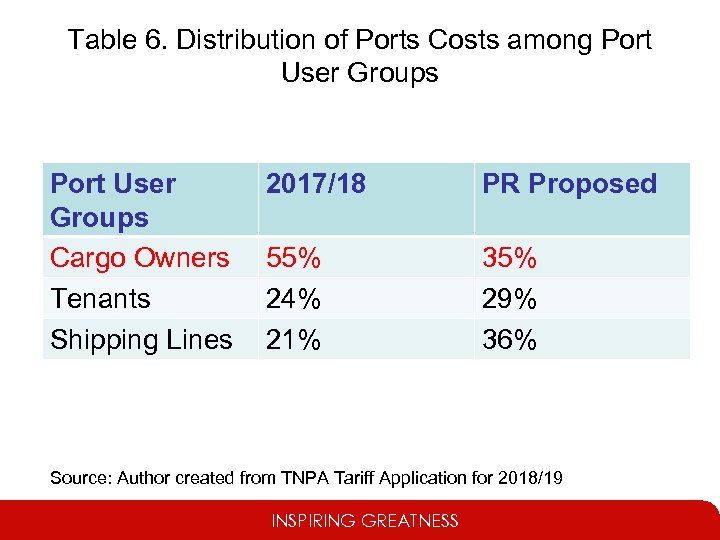

Table 6. Distribution of Ports Costs among Port User Groups Cargo Owners Tenants Shipping Lines 2017/18 PR Proposed 55% 24% 21% 35% 29% 36% Source: Author created from TNPA Tariff Application for 2018/19 INSPIRING GREATNESS

Table 6. Distribution of Ports Costs among Port User Groups Cargo Owners Tenants Shipping Lines 2017/18 PR Proposed 55% 24% 21% 35% 29% 36% Source: Author created from TNPA Tariff Application for 2018/19 INSPIRING GREATNESS

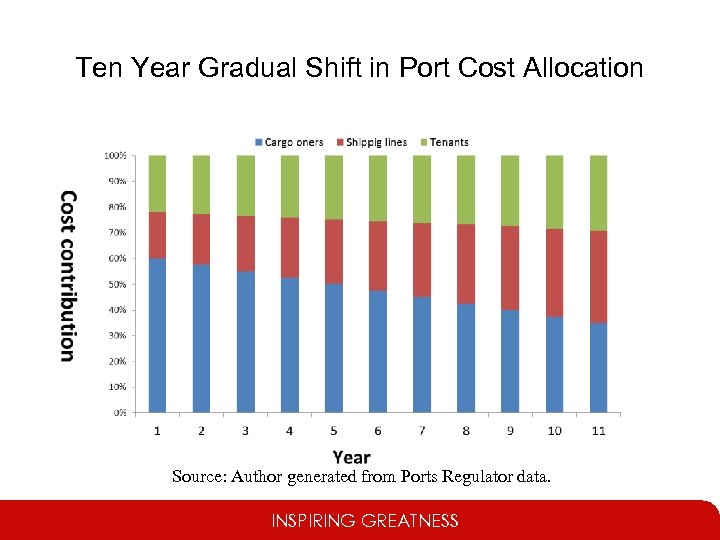

Ten Year Gradual Shift in Port Cost Allocation Source: Author generated from Ports Regulator data. INSPIRING GREATNESS

Ten Year Gradual Shift in Port Cost Allocation Source: Author generated from Ports Regulator data. INSPIRING GREATNESS

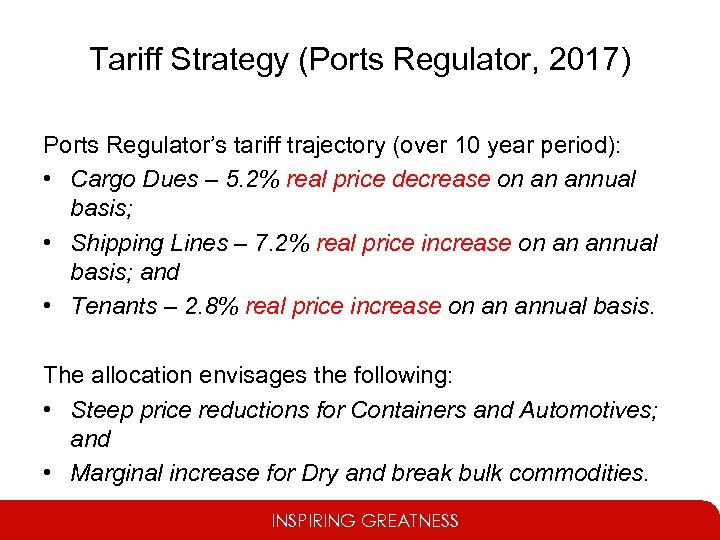

Tariff Strategy (Ports Regulator, 2017) Ports Regulator’s tariff trajectory (over 10 year period): • Cargo Dues – 5. 2% real price decrease on an annual basis; • Shipping Lines – 7. 2% real price increase on an annual basis; and • Tenants – 2. 8% real price increase on an annual basis. The allocation envisages the following: • Steep price reductions for Containers and Automotives; and • Marginal increase for Dry and break bulk commodities. INSPIRING GREATNESS

Tariff Strategy (Ports Regulator, 2017) Ports Regulator’s tariff trajectory (over 10 year period): • Cargo Dues – 5. 2% real price decrease on an annual basis; • Shipping Lines – 7. 2% real price increase on an annual basis; and • Tenants – 2. 8% real price increase on an annual basis. The allocation envisages the following: • Steep price reductions for Containers and Automotives; and • Marginal increase for Dry and break bulk commodities. INSPIRING GREATNESS

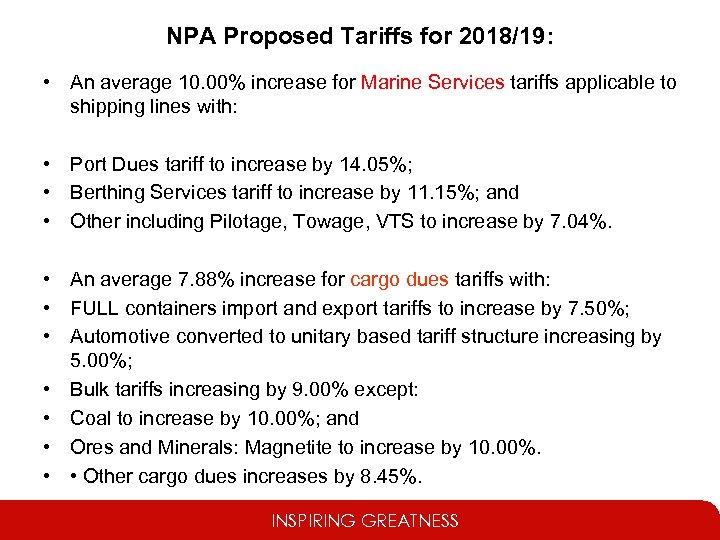

NPA Proposed Tariffs for 2018/19: • An average 10. 00% increase for Marine Services tariffs applicable to shipping lines with: • Port Dues tariff to increase by 14. 05%; • Berthing Services tariff to increase by 11. 15%; and • Other including Pilotage, Towage, VTS to increase by 7. 04%. • An average 7. 88% increase for cargo dues tariffs with: • FULL containers import and export tariffs to increase by 7. 50%; • Automotive converted to unitary based tariff structure increasing by 5. 00%; • Bulk tariffs increasing by 9. 00% except: • Coal to increase by 10. 00%; and • Ores and Minerals: Magnetite to increase by 10. 00%. • • Other cargo dues increases by 8. 45%. INSPIRING GREATNESS

NPA Proposed Tariffs for 2018/19: • An average 10. 00% increase for Marine Services tariffs applicable to shipping lines with: • Port Dues tariff to increase by 14. 05%; • Berthing Services tariff to increase by 11. 15%; and • Other including Pilotage, Towage, VTS to increase by 7. 04%. • An average 7. 88% increase for cargo dues tariffs with: • FULL containers import and export tariffs to increase by 7. 50%; • Automotive converted to unitary based tariff structure increasing by 5. 00%; • Bulk tariffs increasing by 9. 00% except: • Coal to increase by 10. 00%; and • Ores and Minerals: Magnetite to increase by 10. 00%. • • Other cargo dues increases by 8. 45%. INSPIRING GREATNESS

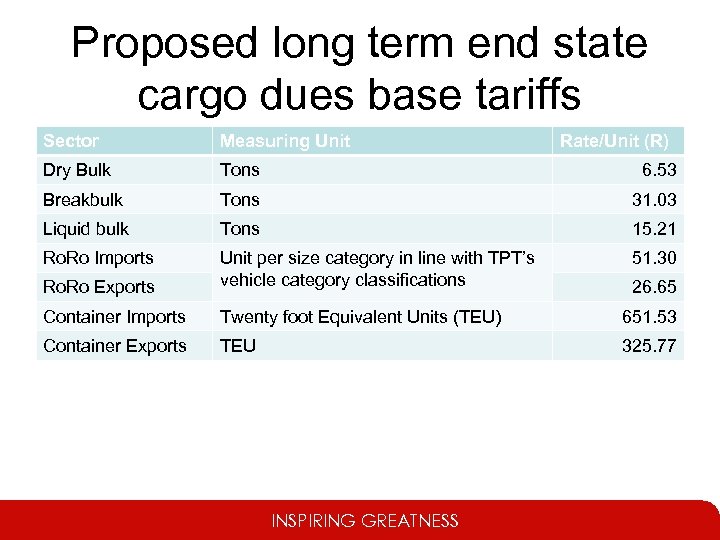

Proposed long term end state cargo dues base tariffs Sector Measuring Unit Dry Bulk Tons 6. 53 Breakbulk Tons 31. 03 Liquid bulk Tons 15. 21 Ro. Ro Imports 51. 30 Ro. Ro Exports Unit per size category in line with TPT’s vehicle category classifications Container Imports Twenty foot Equivalent Units (TEU) 651. 53 Container Exports TEU 325. 77 INSPIRING GREATNESS Rate/Unit (R) 26. 65

Proposed long term end state cargo dues base tariffs Sector Measuring Unit Dry Bulk Tons 6. 53 Breakbulk Tons 31. 03 Liquid bulk Tons 15. 21 Ro. Ro Imports 51. 30 Ro. Ro Exports Unit per size category in line with TPT’s vehicle category classifications Container Imports Twenty foot Equivalent Units (TEU) 651. 53 Container Exports TEU 325. 77 INSPIRING GREATNESS Rate/Unit (R) 26. 65

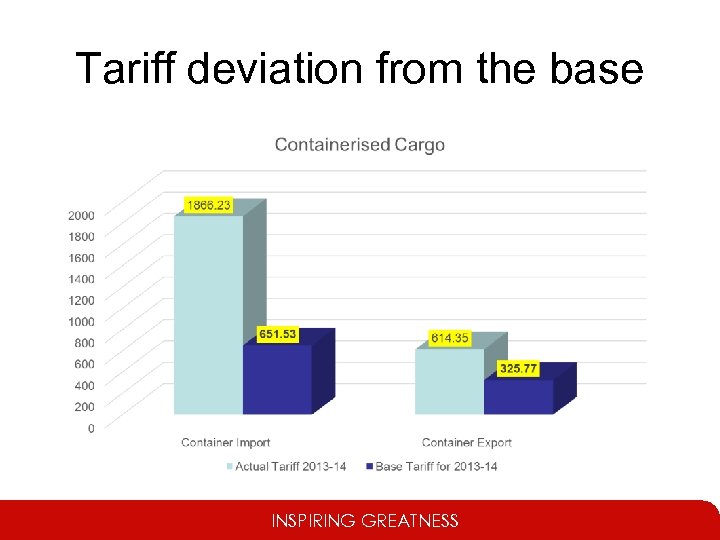

Tariff deviation from the base INSPIRING GREATNESS

Tariff deviation from the base INSPIRING GREATNESS

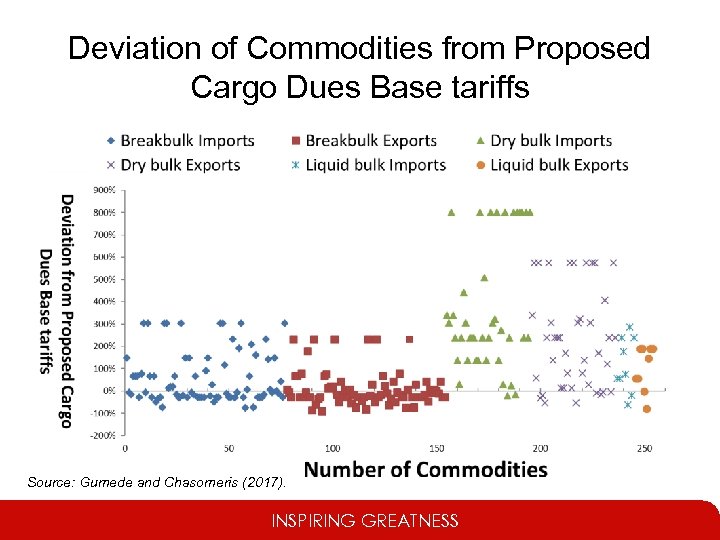

Deviation of Commodities from Proposed Cargo Dues Base tariffs Source: Gumede and Chasomeris (2017). INSPIRING GREATNESS

Deviation of Commodities from Proposed Cargo Dues Base tariffs Source: Gumede and Chasomeris (2017). INSPIRING GREATNESS

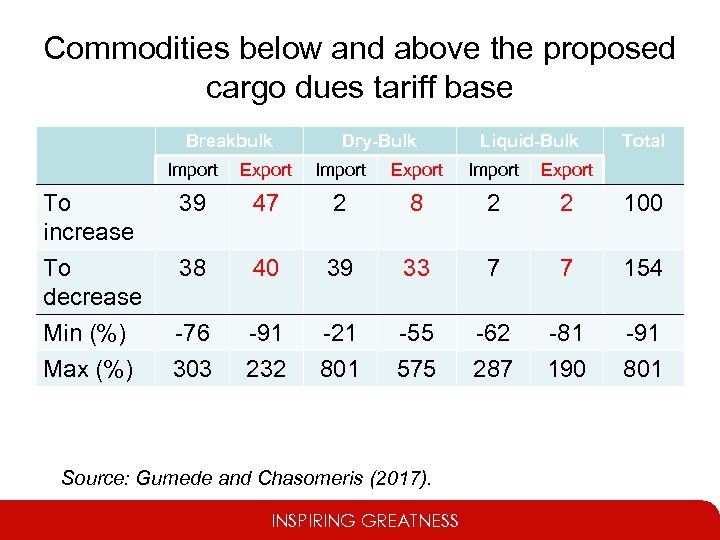

Commodities below and above the proposed cargo dues tariff base Breakbulk Dry-Bulk Liquid-Bulk Total Import To increase To decrease Min (%) Max (%) Export Import Export 39 47 2 8 2 2 100 38 40 39 33 7 7 154 -76 303 -91 232 -21 801 -55 575 -62 287 -81 190 -91 801 Source: Gumede and Chasomeris (2017). INSPIRING GREATNESS

Commodities below and above the proposed cargo dues tariff base Breakbulk Dry-Bulk Liquid-Bulk Total Import To increase To decrease Min (%) Max (%) Export Import Export 39 47 2 8 2 2 100 38 40 39 33 7 7 154 -76 303 -91 232 -21 801 -55 575 -62 287 -81 190 -91 801 Source: Gumede and Chasomeris (2017). INSPIRING GREATNESS

Tariff Structure Conclusions Of the 254 commodity cargo dues examined by Gumede and Chasomeris (2017): • 100 are below the base tariff and therefore being cross subsidised and may experience a relative increase in cargo dues over the next ten years, and • 154 are above and therefore subsidising other cargoes and may experience a relative decrease in cargo dues over the next ten years. The Ports Regulator proposed tariff structure appears to be an improvement, however: • TNPA and the Ports Regulator need to be transparent on the calculation of the base tariffs and provide access to information to allow stakeholders to make a more meaningful contribution towards governance, regulation and the pricing of South Africa’s ports (Gumede & Chasomeris, 2017) INSPIRING GREATNESS

Tariff Structure Conclusions Of the 254 commodity cargo dues examined by Gumede and Chasomeris (2017): • 100 are below the base tariff and therefore being cross subsidised and may experience a relative increase in cargo dues over the next ten years, and • 154 are above and therefore subsidising other cargoes and may experience a relative decrease in cargo dues over the next ten years. The Ports Regulator proposed tariff structure appears to be an improvement, however: • TNPA and the Ports Regulator need to be transparent on the calculation of the base tariffs and provide access to information to allow stakeholders to make a more meaningful contribution towards governance, regulation and the pricing of South Africa’s ports (Gumede & Chasomeris, 2017) INSPIRING GREATNESS

Port Tariff Incentive Programme • “To support Beneficiation, Industrialisation, and Localisation through Port Tariff Regulation. • To create a mechanism in which cross-subsidies can be introduced that are in ‘the public interest’. • The PTIP was published on 31 March 2016 for public comment and widely consulted including government departments. • Currently in the final development phase. • Publication and awareness programme October/November 2017 • Expected implementation: January 2018” Source: Ports Regulator 2017. INSPIRING GREATNESS

Port Tariff Incentive Programme • “To support Beneficiation, Industrialisation, and Localisation through Port Tariff Regulation. • To create a mechanism in which cross-subsidies can be introduced that are in ‘the public interest’. • The PTIP was published on 31 March 2016 for public comment and widely consulted including government departments. • Currently in the final development phase. • Publication and awareness programme October/November 2017 • Expected implementation: January 2018” Source: Ports Regulator 2017. INSPIRING GREATNESS

Any Questions? Contact: Dr Mihalis Chasomeris chasomerism 1@ukzn. ac. za INSPIRING GREATNESS

Any Questions? Contact: Dr Mihalis Chasomeris chasomerism 1@ukzn. ac. za INSPIRING GREATNESS

Discussion questions: 1) What is good and should be celebrated about South Africa’s system of ports? 2) How to improve the productivity and competitiveness of South Africa’s ports? 3) How to improve the pricing of SA’s ports? INSPIRING GREATNESS

Discussion questions: 1) What is good and should be celebrated about South Africa’s system of ports? 2) How to improve the productivity and competitiveness of South Africa’s ports? 3) How to improve the pricing of SA’s ports? INSPIRING GREATNESS

Discussion Questions 4) How to improve the governance of SA’s ports? 5) Are there any tariff rebates or other support for exporters using SA’s ports? 6) Are there any opportunities for increased private sector participation or public private partnerships? INSPIRING GREATNESS

Discussion Questions 4) How to improve the governance of SA’s ports? 5) Are there any tariff rebates or other support for exporters using SA’s ports? 6) Are there any opportunities for increased private sector participation or public private partnerships? INSPIRING GREATNESS