08f26a16418d79d65224bfaf5f2f662e.ppt

- Количество слайдов: 38

Sources of Equity Financing Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -1

Sources of Equity Financing Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -1

The “Secrets” to Successful Financing 1. Choosing the right sources of capital is a decision that will influence a company for a lifetime 2. The money is out there; the key is knowing where to look 3. Creativity counts. Entrepreneurs have to be as creative in their searches for capital as they are in developing their business ideas Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -2

The “Secrets” to Successful Financing 1. Choosing the right sources of capital is a decision that will influence a company for a lifetime 2. The money is out there; the key is knowing where to look 3. Creativity counts. Entrepreneurs have to be as creative in their searches for capital as they are in developing their business ideas Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -2

The “Secrets” to Successful Financing 4. The Internet puts at entrepreneur’s fingertips vast resources of information that can lead to financing 5. Be thoroughly prepared before approaching lenders and investors 6. Looking for “smart” money is more important than looking for “easy” money 7. Plan an exit strategy Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -3

The “Secrets” to Successful Financing 4. The Internet puts at entrepreneur’s fingertips vast resources of information that can lead to financing 5. Be thoroughly prepared before approaching lenders and investors 6. Looking for “smart” money is more important than looking for “easy” money 7. Plan an exit strategy Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -3

Three Types of Capital n n n Chapter 14 Equity Financing Fixed - used to purchase the permanent or fixed assets of the business (e. g. , buildings, land, equipment, etc. ) Working - used to support the small company's normal short-term operations (e. g. , buy inventory, pay bills, wages, or salaries, etc. ) Growth - used to help the small business expand or change its primary direction Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -4

Three Types of Capital n n n Chapter 14 Equity Financing Fixed - used to purchase the permanent or fixed assets of the business (e. g. , buildings, land, equipment, etc. ) Working - used to support the small company's normal short-term operations (e. g. , buy inventory, pay bills, wages, or salaries, etc. ) Growth - used to help the small business expand or change its primary direction Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -4

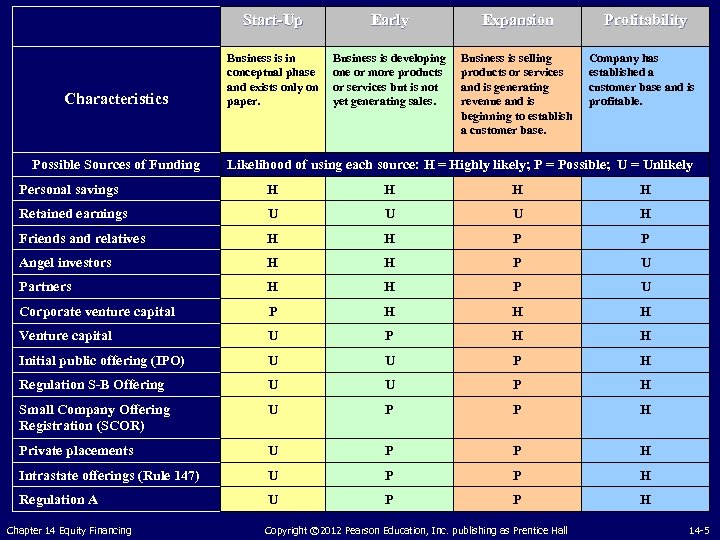

Start-Up Characteristics Possible Sources of Funding Early Expansion Business is in conceptual phase and exists only on paper. Business is developing one or more products or services but is not yet generating sales. Business is selling products or services and is generating revenue and is beginning to establish a customer base. Profitability Company has established a customer base and is profitable. Likelihood of using each source: H = Highly likely; P = Possible; U = Unlikely Personal savings H H Retained earnings U U U H Friends and relatives H H P P Angel investors H H P U Partners H H P U Corporate venture capital P H H H Venture capital U P H H Initial public offering (IPO) U U P H Regulation S-B Offering U U P H Small Company Offering Registration (SCOR) U P P H Private placements U P P H Intrastate offerings (Rule 147) U P P H Regulation A U P P H Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -5

Start-Up Characteristics Possible Sources of Funding Early Expansion Business is in conceptual phase and exists only on paper. Business is developing one or more products or services but is not yet generating sales. Business is selling products or services and is generating revenue and is beginning to establish a customer base. Profitability Company has established a customer base and is profitable. Likelihood of using each source: H = Highly likely; P = Possible; U = Unlikely Personal savings H H Retained earnings U U U H Friends and relatives H H P P Angel investors H H P U Partners H H P U Corporate venture capital P H H H Venture capital U P H H Initial public offering (IPO) U U P H Regulation S-B Offering U U P H Small Company Offering Registration (SCOR) U P P H Private placements U P P H Intrastate offerings (Rule 147) U P P H Regulation A U P P H Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -5

Equity Capital n n Represents the personal investment of the owner(s) in the business Is called risk capital because investors assume the risk of losing their money if the business fails Does not have to be repaid with interest like a loan does Means that an entrepreneur must give up some ownership in the company to outside investors Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -6

Equity Capital n n Represents the personal investment of the owner(s) in the business Is called risk capital because investors assume the risk of losing their money if the business fails Does not have to be repaid with interest like a loan does Means that an entrepreneur must give up some ownership in the company to outside investors Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -6

Sources of Equity Financing Personal savings n Friends and family members n Angels n Partners n Corporations n Venture capital companies n Public stock sale n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -7

Sources of Equity Financing Personal savings n Friends and family members n Angels n Partners n Corporations n Venture capital companies n Public stock sale n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -7

Personal Savings n n n The first place an entrepreneur should look for money The most common source of equity capital for starting a business GEM study: Average cost to start a business in U. S. is $70, 200 Ø Typical entrepreneur provides 67. 9% of the initial capital requirement Ø Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -8

Personal Savings n n n The first place an entrepreneur should look for money The most common source of equity capital for starting a business GEM study: Average cost to start a business in U. S. is $70, 200 Ø Typical entrepreneur provides 67. 9% of the initial capital requirement Ø Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -8

Friends and Family Members n n After emptying her own pockets, an entrepreneur should turn to those most likely to invest in the business - friends and family members GEM study: Across the globe, the average amount family and friends invest in start-up businesses is $3, 000 Ø In U. S. , average amount is $27, 715 for a total of $100 billion per year Ø n Careful!!! Inherent dangers lurk in family/friendly business deals, especially those that flop Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -9

Friends and Family Members n n After emptying her own pockets, an entrepreneur should turn to those most likely to invest in the business - friends and family members GEM study: Across the globe, the average amount family and friends invest in start-up businesses is $3, 000 Ø In U. S. , average amount is $27, 715 for a total of $100 billion per year Ø n Careful!!! Inherent dangers lurk in family/friendly business deals, especially those that flop Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -9

Friends and Family Members n Guidelines for family and friendship financing deals: Ø Consider the impact of the investment on everyone involved Ø Keep the arrangement “strictly business” Ø Educate “naïve” investors Ø Settle the details up front Ø Never accept more than the investor can afford to lose Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -10

Friends and Family Members n Guidelines for family and friendship financing deals: Ø Consider the impact of the investment on everyone involved Ø Keep the arrangement “strictly business” Ø Educate “naïve” investors Ø Settle the details up front Ø Never accept more than the investor can afford to lose Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -10

Friends and Family Members n Guidelines for family and friendship financing deals: Ø Create a written contract Ø Treat the money as “bridge financing” Ø Develop a payment schedule that suits both parties Ø Have an exit plan Ø Keep everyone informed Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -11

Friends and Family Members n Guidelines for family and friendship financing deals: Ø Create a written contract Ø Treat the money as “bridge financing” Ø Develop a payment schedule that suits both parties Ø Have an exit plan Ø Keep everyone informed Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -11

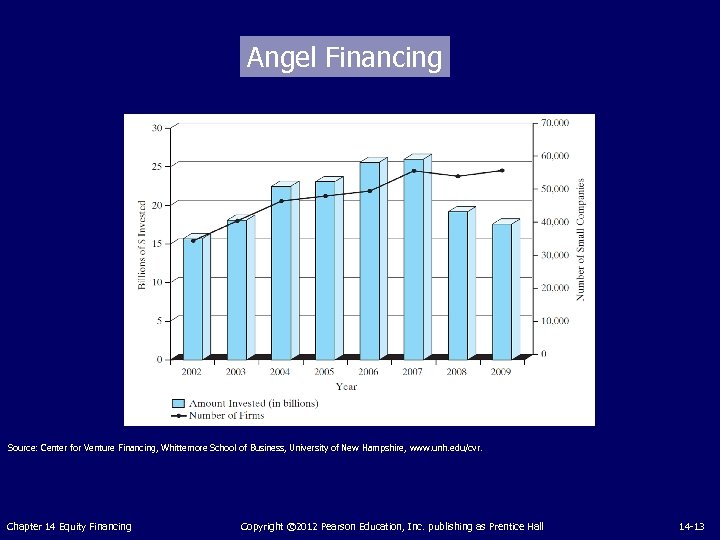

Angels Private investors who invest in emerging business start-ups in exchange for equity stakes in the company n Fastest growing segment of the small business capital market n Center for Venture Research study: 260, 000 angels invest $17. 6 billion a year in 57, 000 small companies n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -12

Angels Private investors who invest in emerging business start-ups in exchange for equity stakes in the company n Fastest growing segment of the small business capital market n Center for Venture Research study: 260, 000 angels invest $17. 6 billion a year in 57, 000 small companies n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -12

Angel Financing Source: Center for Venture Financing, Whittemore School of Business, University of New Hampshire, www. unh. edu/cvr. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -13

Angel Financing Source: Center for Venture Financing, Whittemore School of Business, University of New Hampshire, www. unh. edu/cvr. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -13

Angels n Ideal source of financing for companies that have outgrown the capacity of friends and family members but are still too small to attract the interest of venture capital companies Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -14

Angels n Ideal source of financing for companies that have outgrown the capacity of friends and family members but are still too small to attract the interest of venture capital companies Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -14

Angels Most likely to finance deals in the $10, 000 to $2 million range n Key: finding them! n Angels almost always invest their money locally and can be found through networking n Another avenue: Angel capital networks on the World Wide Web n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -15

Angels Most likely to finance deals in the $10, 000 to $2 million range n Key: finding them! n Angels almost always invest their money locally and can be found through networking n Another avenue: Angel capital networks on the World Wide Web n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -15

Angels Typical angel accepts 14. 5% of the proposals presented and invests an average of $50, 000 in one company per year n An excellent source of “patient money” for investors needing relatively small amounts of capital – often less than $500, 000 n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -16

Angels Typical angel accepts 14. 5% of the proposals presented and invests an average of $50, 000 in one company per year n An excellent source of “patient money” for investors needing relatively small amounts of capital – often less than $500, 000 n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -16

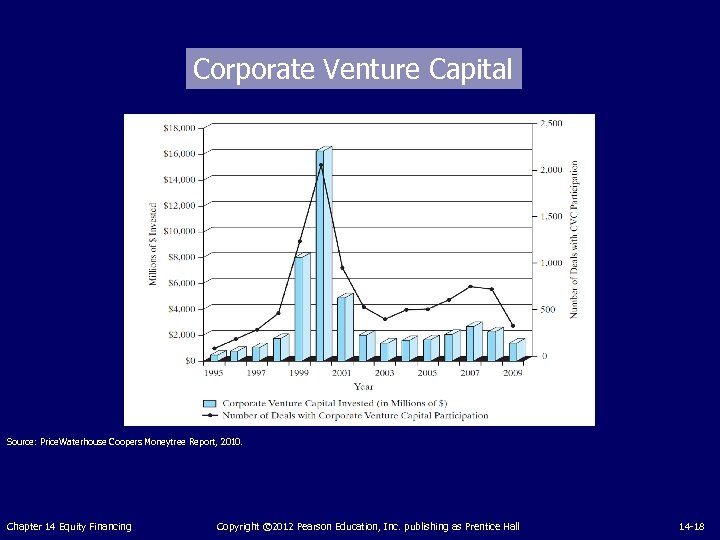

Corporate Venture Capital About 300 large corporations across the globe invest in start-up companies n 13% of all venture capital investments come from corporations n Ø Average CVC investment = $3. 52 million n Capital infusions are just one benefit; corporate partners may share marketing and technical expertise Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -17

Corporate Venture Capital About 300 large corporations across the globe invest in start-up companies n 13% of all venture capital investments come from corporations n Ø Average CVC investment = $3. 52 million n Capital infusions are just one benefit; corporate partners may share marketing and technical expertise Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -17

Corporate Venture Capital Source: Price. Waterhouse Coopers Moneytree Report, 2010. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -18

Corporate Venture Capital Source: Price. Waterhouse Coopers Moneytree Report, 2010. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -18

Venture Capital Companies More than 700 venture capital firms operate across the U. S. n Most venture capitalists seek investments in the $3, 000 to $10, 000 range in companies with high-growth and high-profit potential n Ø Average VC investment = $7. 8 million Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -19

Venture Capital Companies More than 700 venture capital firms operate across the U. S. n Most venture capitalists seek investments in the $3, 000 to $10, 000 range in companies with high-growth and high-profit potential n Ø Average VC investment = $7. 8 million Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -19

Venture Capital Companies Business plans are subjected to an extremely rigorous review - less than 1% accepted n GEM study: Only 1 in 10, 000 entrepreneurs worldwide receives VC funding at start-up n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -20

Venture Capital Companies Business plans are subjected to an extremely rigorous review - less than 1% accepted n GEM study: Only 1 in 10, 000 entrepreneurs worldwide receives VC funding at start-up n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -20

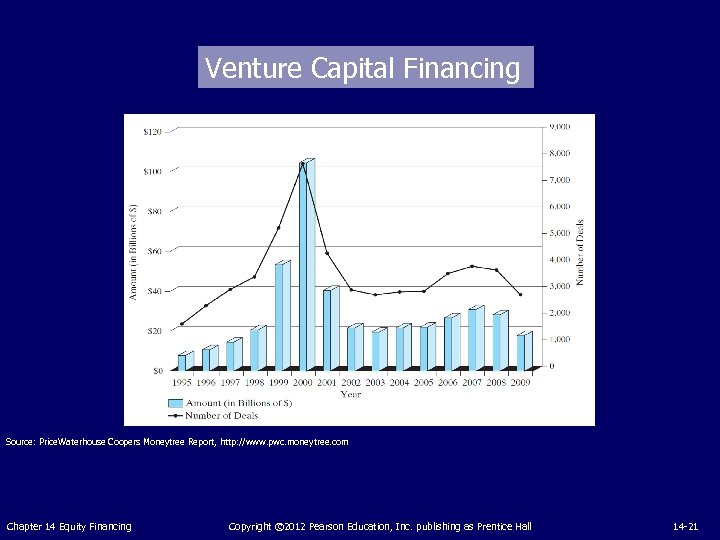

Venture Capital Financing Source: Price. Waterhouse Coopers Moneytree Report, http: //www. pwc. moneytree. com Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -21

Venture Capital Financing Source: Price. Waterhouse Coopers Moneytree Report, http: //www. pwc. moneytree. com Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -21

Venture Capital Companies n n n Usually take an active role in managing the companies in which they invest Focus their investments in specific industries with which they are familiar Invest in a company across several stages Most common stages: Expansion Ø Later-stage Ø Early-stage Ø Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -22

Venture Capital Companies n n n Usually take an active role in managing the companies in which they invest Focus their investments in specific industries with which they are familiar Invest in a company across several stages Most common stages: Expansion Ø Later-stage Ø Early-stage Ø Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -22

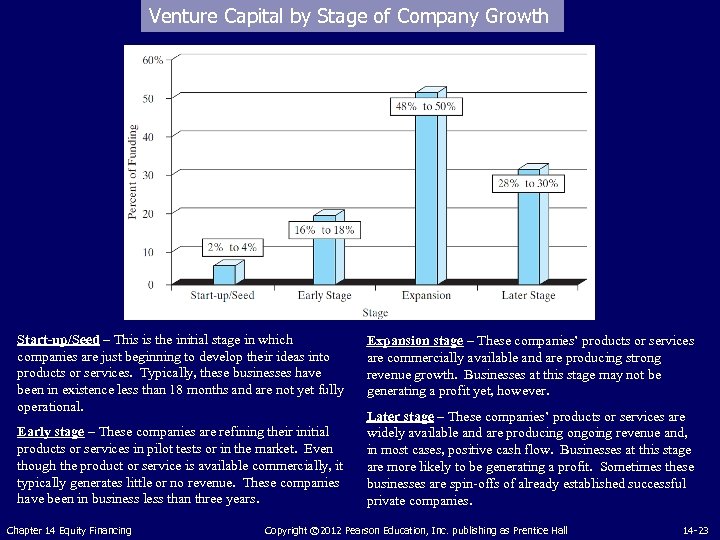

Venture Capital by Stage of Company Growth Start-up/Seed – This is the initial stage in which companies are just beginning to develop their ideas into products or services. Typically, these businesses have been in existence less than 18 months and are not yet fully operational. Early stage – These companies are refining their initial products or services in pilot tests or in the market. Even though the product or service is available commercially, it typically generates little or no revenue. These companies have been in business less than three years. Expansion stage – These companies’ products or services are commercially available and are producing strong revenue growth. Businesses at this stage may not be generating a profit yet, however. Later stage – These companies’ products or services are widely available and are producing ongoing revenue and, in most cases, positive cash flow. Businesses at this stage are more likely to be generating a profit. Sometimes these businesses are spin-offs of already established successful private companies. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -23

Venture Capital by Stage of Company Growth Start-up/Seed – This is the initial stage in which companies are just beginning to develop their ideas into products or services. Typically, these businesses have been in existence less than 18 months and are not yet fully operational. Early stage – These companies are refining their initial products or services in pilot tests or in the market. Even though the product or service is available commercially, it typically generates little or no revenue. These companies have been in business less than three years. Expansion stage – These companies’ products or services are commercially available and are producing strong revenue growth. Businesses at this stage may not be generating a profit yet, however. Later stage – These companies’ products or services are widely available and are producing ongoing revenue and, in most cases, positive cash flow. Businesses at this stage are more likely to be generating a profit. Sometimes these businesses are spin-offs of already established successful private companies. Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -23

What Do Venture Capital Companies Look For? Competent management n Competitive edge n Growth industry n Viable exit strategy n “Intangibles” n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -24

What Do Venture Capital Companies Look For? Competent management n Competitive edge n Growth industry n Viable exit strategy n “Intangibles” n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -24

Going Public Initial public offering (IPO) - when a company raises capital by selling shares of its stock to the public for the first time n Since 2001, average number of companies making IPOs is 139 n Few companies with annual sales below $25 million make IPOs n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -25

Going Public Initial public offering (IPO) - when a company raises capital by selling shares of its stock to the public for the first time n Since 2001, average number of companies making IPOs is 139 n Few companies with annual sales below $25 million make IPOs n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -25

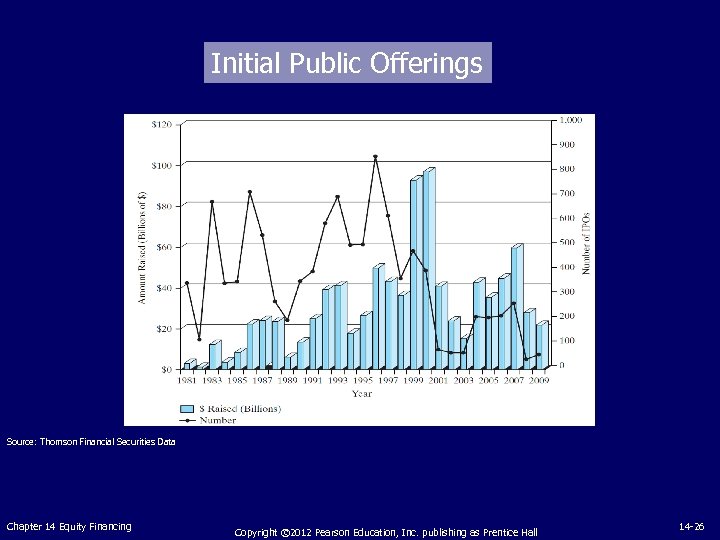

Initial Public Offerings Source: Thomson Financial Securities Data Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -26

Initial Public Offerings Source: Thomson Financial Securities Data Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -26

Advantages of "Going Public" n n n Ability to raise large amounts of capital Improved corporate image Improved access to future financing Attracting and retaining key employees Using stock for acquisitions Listing on a stock exchange Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -27

Advantages of "Going Public" n n n Ability to raise large amounts of capital Improved corporate image Improved access to future financing Attracting and retaining key employees Using stock for acquisitions Listing on a stock exchange Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -27

Disadvantages of "Going Public" Dilution of founder's ownership n Loss of control n Loss of privacy n Regulatory requirements and reporting to the SEC n Filing expenses n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -28

Disadvantages of "Going Public" Dilution of founder's ownership n Loss of control n Loss of privacy n Regulatory requirements and reporting to the SEC n Filing expenses n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -28

Disadvantages of "Going Public" Accountability to shareholders n Pressure for short-term performance n Loss of focus n Timing n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -29

Disadvantages of "Going Public" Accountability to shareholders n Pressure for short-term performance n Loss of focus n Timing n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -29

The Registration Process Choose the underwriter n Negotiate a letter of intent n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -30

The Registration Process Choose the underwriter n Negotiate a letter of intent n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -30

Letter of Intent n Two types of underwriting agreements: Ø Firm commitment Ø Best efforts Minimum number of shares offered is usually 400, 000 to 500, 000 n Initial share price is usually between $10 and $20 per share n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -31

Letter of Intent n Two types of underwriting agreements: Ø Firm commitment Ø Best efforts Minimum number of shares offered is usually 400, 000 to 500, 000 n Initial share price is usually between $10 and $20 per share n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -31

The Registration Process Choose the underwriter n Negotiate a letter of intent n Prepare the registration statement n File with the SEC n Wait to “go effective” and road show n Meet state requirements n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -32

The Registration Process Choose the underwriter n Negotiate a letter of intent n Prepare the registration statement n File with the SEC n Wait to “go effective” and road show n Meet state requirements n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -32

Simplified Registrations and Exemptions n Regulations S-B and S-K S-B: Eliminated by the SEC in 2009. Many provisions were transferred into S-K Ø S-K: Registration for companies with annual revenues of less than $75 million or with outstanding publicly held stock worth no more than $75 million. S-K avoids the expense of full-blown registration Ø n Regulation D: Rule 504 - Small Company Offering Registration (SCOR) Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -33

Simplified Registrations and Exemptions n Regulations S-B and S-K S-B: Eliminated by the SEC in 2009. Many provisions were transferred into S-K Ø S-K: Registration for companies with annual revenues of less than $75 million or with outstanding publicly held stock worth no more than $75 million. S-K avoids the expense of full-blown registration Ø n Regulation D: Rule 504 - Small Company Offering Registration (SCOR) Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -33

SCOR Offerings Ceiling is $1 million n Share price must be at least $1 per share n Must file Form U-7, a standardized disclosure statement n Can issue almost any kind of security through SCOR n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -34

SCOR Offerings Ceiling is $1 million n Share price must be at least $1 per share n Must file Form U-7, a standardized disclosure statement n Can issue almost any kind of security through SCOR n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -34

Simplified Registrations and Exemptions n Regulation D: Rule 505 and 506 Ø Private placements Section 4 (6) n Rule 147 (Intrastate offerings) n Regulation A n Ø Offerings up to $5 million over 12 months Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -35

Simplified Registrations and Exemptions n Regulation D: Rule 505 and 506 Ø Private placements Section 4 (6) n Rule 147 (Intrastate offerings) n Regulation A n Ø Offerings up to $5 million over 12 months Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -35

Simplified Registrations and Exemptions n Direct Stock Offerings Ø Go straight to Main Street instead of through underwriters on Wall Street Ø World Wide Web (usually either Regulation A or Regulation D offerings) Ø Typically generate between $300, 000 and $4 million for company n Foreign Stock Markets Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -36

Simplified Registrations and Exemptions n Direct Stock Offerings Ø Go straight to Main Street instead of through underwriters on Wall Street Ø World Wide Web (usually either Regulation A or Regulation D offerings) Ø Typically generate between $300, 000 and $4 million for company n Foreign Stock Markets Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -36

Web Sites Price. Waterhouse. Coopers Money Tree Survey http: //www. pwcmoneytree. com/ n Hoover’s Online IPO Central http: //www. hoovers. com/global/ipo c/index. xhtml n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -37

Web Sites Price. Waterhouse. Coopers Money Tree Survey http: //www. pwcmoneytree. com/ n Hoover’s Online IPO Central http: //www. hoovers. com/global/ipo c/index. xhtml n Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -37

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -38

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall Chapter 14 Equity Financing Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall 14 -38