9f5576c0b13f29fcaa723942df74aa23.ppt

- Количество слайдов: 23

Sources of Capital: Debt Part One: Financial Accounting Irwin/Mc. Graw-Hill 8 © The Mc. Graw-Hill Companies, Inc. , 1999

Loss Contingency Slide 8 -1 A loss contingency is recorded as a liability if both of the following conditions are met: 1. Information available prior to issuance of the financial statements indicates that it is probable that an asset has been impaired or a liability has incurred. 2. The amount of loss can be reasonable estimated. Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

Bonds Slide 8 -2 A bond is a certificate promising to pay its holder-- • a specified sum of money at a stated date, called the maturity date • interest at a stated rate until the maturity date Bon d Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

Types and Features of Bonds ¬ Mortgage bond ¬ Secured bond ¬ Debenture bond Slide 8 -3 A bond can have a combination of these features. ¬ Sinking fund bond ¬ Serial bonds ¬ Callable bonds ¬ Zero-coupon bonds ¬ Convertible bonds ¬ Subordinated bonds Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

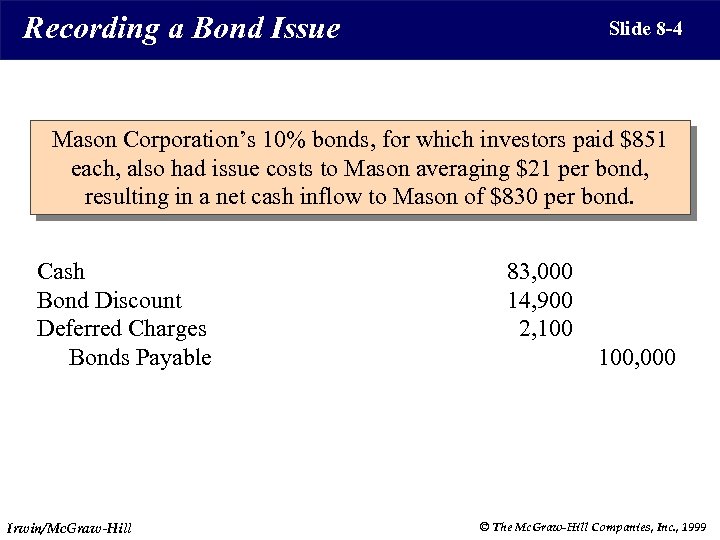

Recording a Bond Issue Slide 8 -4 Mason Corporation’s 10% bonds, for which investors paid $851 each, also had issue costs to Mason averaging $21 per bond, resulting in a net cash inflow to Mason of $830 per bond. Cash Bond Discount Deferred Charges Bonds Payable Irwin/Mc. Graw-Hill 83, 000 14, 900 2, 100, 000 © The Mc. Graw-Hill Companies, Inc. , 1999

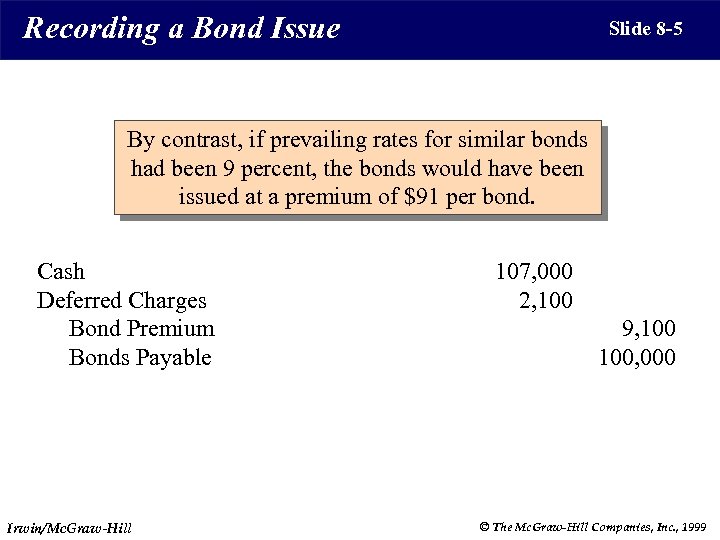

Recording a Bond Issue Slide 8 -5 By contrast, if prevailing rates for similar bonds had been 9 percent, the bonds would have been issued at a premium of $91 per bond. Cash Deferred Charges Bond Premium Bonds Payable Irwin/Mc. Graw-Hill 107, 000 2, 100 9, 100, 000 © The Mc. Graw-Hill Companies, Inc. , 1999

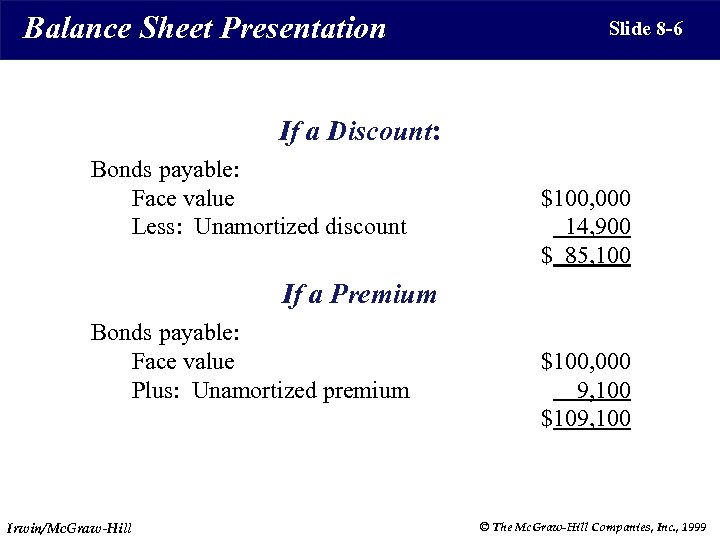

Balance Sheet Presentation Slide 8 -6 If a Discount: Bonds payable: Face value Less: Unamortized discount $100, 000 14, 900 $ 85, 100 If a Premium Bonds payable: Face value Plus: Unamortized premium Irwin/Mc. Graw-Hill $100, 000 9, 100 $109, 100 © The Mc. Graw-Hill Companies, Inc. , 1999

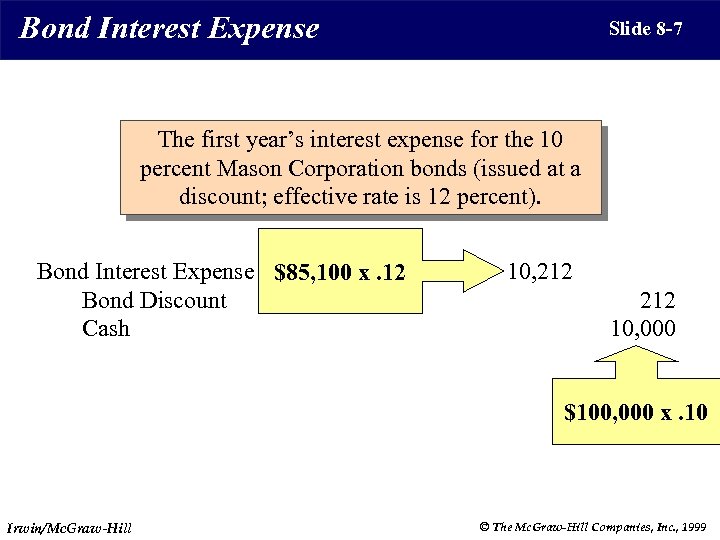

Bond Interest Expense Slide 8 -7 The first year’s interest expense for the 10 percent Mason Corporation bonds (issued at a discount; effective rate is 12 percent). Bond Interest Expense $85, 100 x. 12 Bond Discount Cash 10, 212 10, 000 $100, 000 x. 10 Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

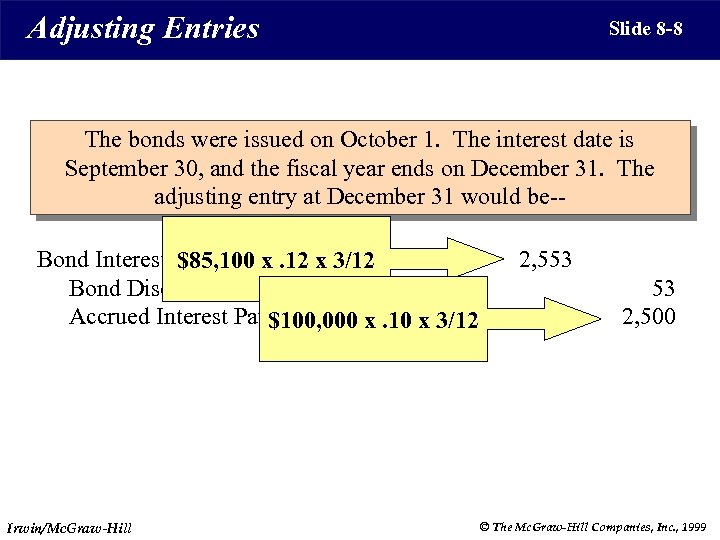

Adjusting Entries Slide 8 -8 The bonds were issued on October 1. The interest date is September 30, and the fiscal year ends on December 31. The adjusting entry at December 31 would be-Bond Interest Expense x. 12 x 3/12 $85, 100 Bond Discount Accrued Interest Payable $100, 000 x. 10 x 3/12 Irwin/Mc. Graw-Hill 2, 553 53 2, 500 © The Mc. Graw-Hill Companies, Inc. , 1999

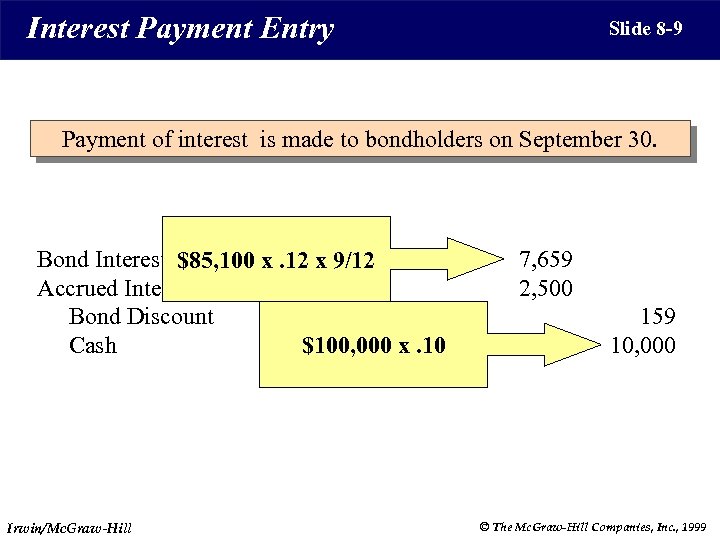

Interest Payment Entry Slide 8 -9 Payment of interest is made to bondholders on September 30. Bond Interest Expense x. 12 x 9/12 $85, 100 Accrued Interest Payable Bond Discount Cash $100, 000 x. 10 Irwin/Mc. Graw-Hill 7, 659 2, 500 159 10, 000 © The Mc. Graw-Hill Companies, Inc. , 1999

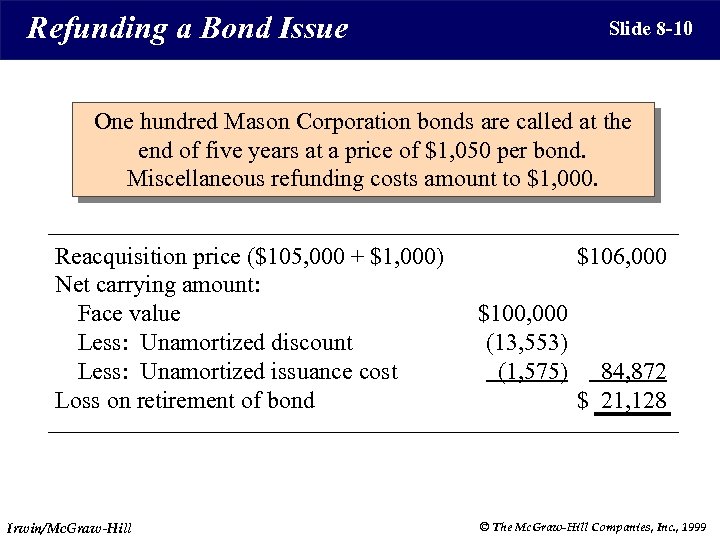

Refunding a Bond Issue Slide 8 -10 One hundred Mason Corporation bonds are called at the end of five years at a price of $1, 050 per bond. Miscellaneous refunding costs amount to $1, 000. Reacquisition price ($105, 000 + $1, 000) Net carrying amount: Face value Less: Unamortized discount Less: Unamortized issuance cost Loss on retirement of bond Irwin/Mc. Graw-Hill $106, 000 $100, 000 (13, 553) (1, 575) 84, 872 $ 21, 128 © The Mc. Graw-Hill Companies, Inc. , 1999

Refunding a Bond Issue Slide 8 -10 One hundred Mason Corporation bonds are called at the end of five years at a price of $1, 050 per bond. Miscellaneous refunding costs amount to $1, 000. Bonds Payable Loss on Retirement of Bonds Cash Bond Discount Deferred Charges (Issuance Costs) Irwin/Mc. Graw-Hill 100, 000 21, 128 106, 000 13, 553 1, 575 © The Mc. Graw-Hill Companies, Inc. , 1999

Capital Leases Slide 8 -11 The Financial Accounting Standards Board has ruled that a lease is a capital lease if one or more of the following criteria are met: • Ownership is transferred to the lessee at the end of the term of the lease • The lessee has an option to purchase the asset at a “bargain” price • The term of the lease is 75 percent or more of the economic life of the asset • The present value of the lease payments is 90 percent or more of the fair value of the property Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

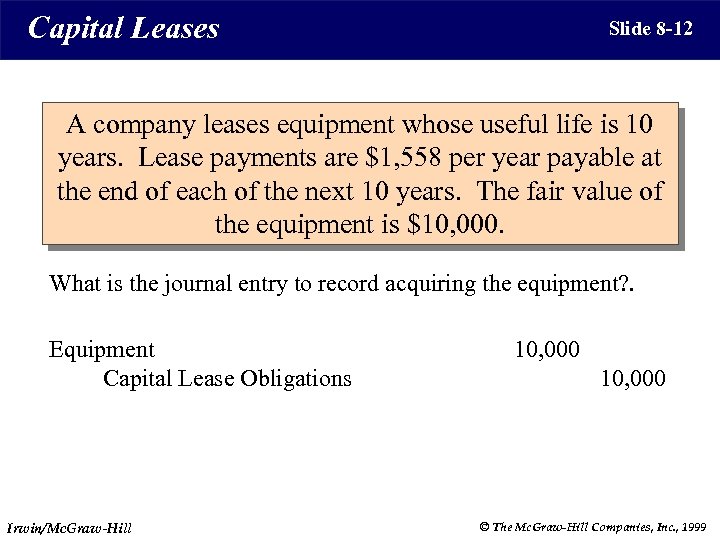

Capital Leases Slide 8 -12 A company leases equipment whose useful life is 10 years. Lease payments are $1, 558 per year payable at the end of each of the next 10 years. The fair value of the equipment is $10, 000. What is the journal entry to record acquiring the equipment? . Equipment Capital Lease Obligations Irwin/Mc. Graw-Hill 10, 000 © The Mc. Graw-Hill Companies, Inc. , 1999

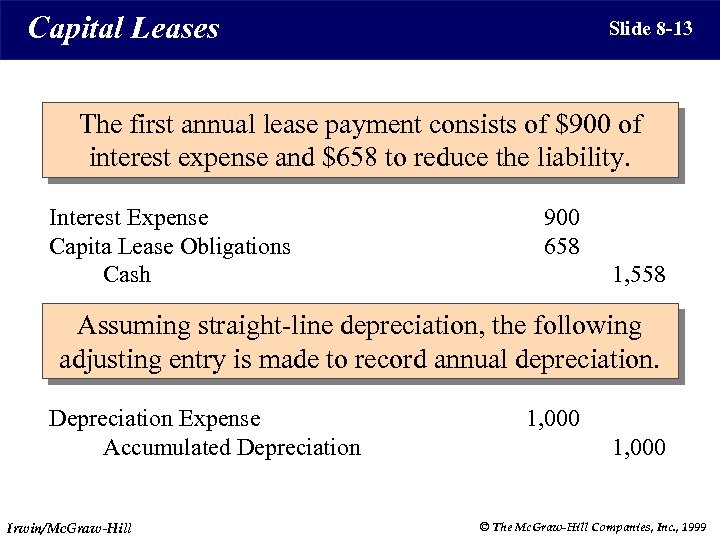

Capital Leases Slide 8 -13 The first annual lease payment consists of $900 of interest expense and $658 to reduce the liability. Interest Expense Capita Lease Obligations Cash 900 658 1, 558 Assuming straight-line depreciation, the following adjusting entry is made to record annual depreciation. Depreciation Expense Accumulated Depreciation Irwin/Mc. Graw-Hill 1, 000 © The Mc. Graw-Hill Companies, Inc. , 1999

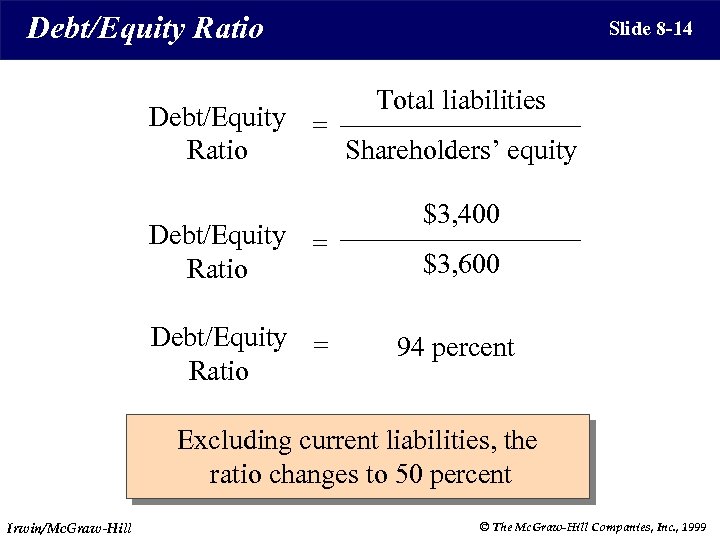

Debt/Equity Ratio Slide 8 -14 Total liabilities Debt/Equity = Shareholders’ equity Ratio Debt/Equity = Ratio $3, 400 $3, 600 94 percent Excluding current liabilities, the ratio changes to 50 percent Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

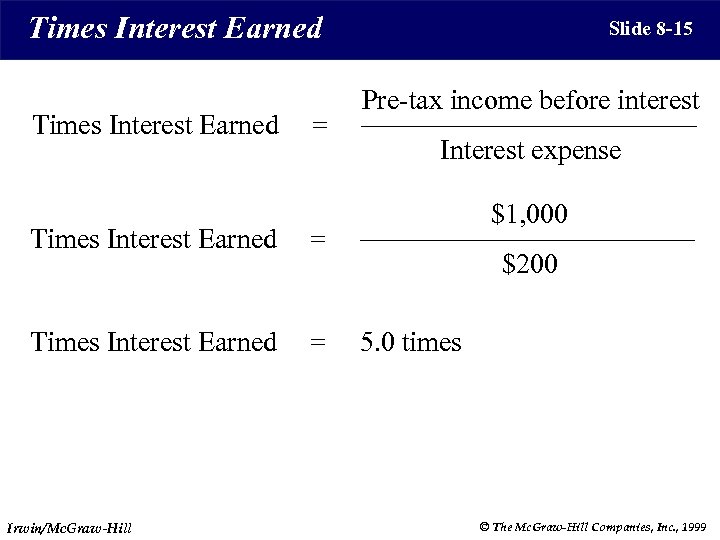

Times Interest Earned = Pre-tax income before interest Interest expense $1, 000 = Times Interest Earned Slide 8 -15 Irwin/Mc. Graw-Hill $200 5. 0 times © The Mc. Graw-Hill Companies, Inc. , 1999

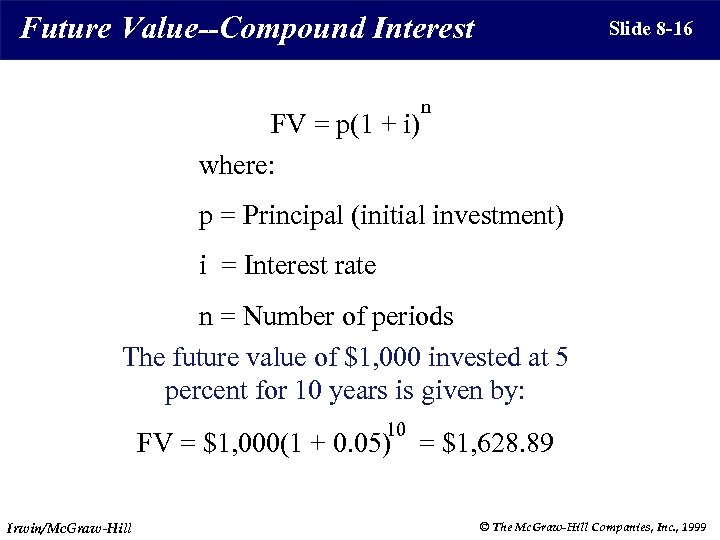

Future Value--Compound Interest FV = p(1 + i) where: Slide 8 -16 n p = Principal (initial investment) i = Interest rate n = Number of periods The future value of $1, 000 invested at 5 percent for 10 years is given by: 10 FV = $1, 000(1 + 0. 05) Irwin/Mc. Graw-Hill = $1, 628. 89 © The Mc. Graw-Hill Companies, Inc. , 1999

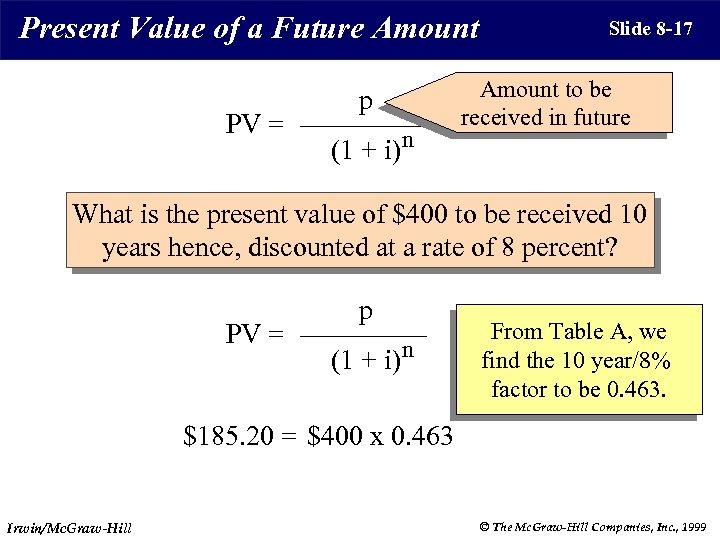

Present Value of a Future Amount PV = p (1 + i) n Slide 8 -17 Amount to be received in future What is the present value of $400 to be received 10 years hence, discounted at a rate of 8 percent? PV = p (1 + i) n From Table A, we find the 10 year/8% factor to be 0. 463. $185. 20 = $400 x 0. 463 Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

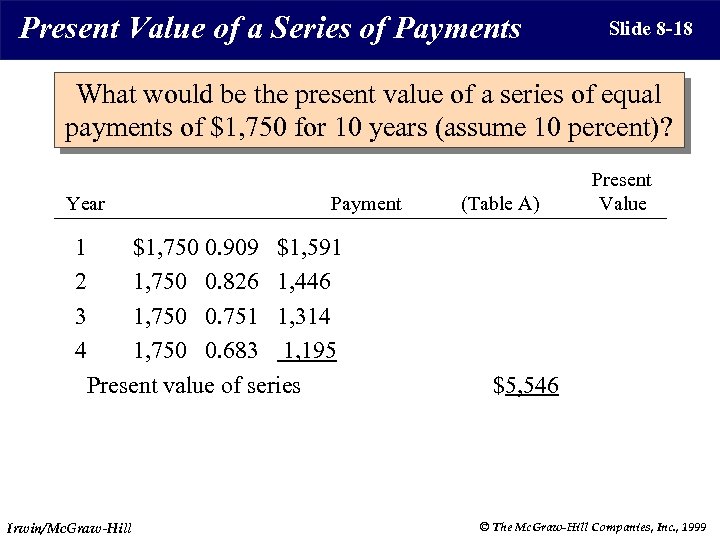

Present Value of a Series of Payments Slide 8 -18 What would be the present value of a series of equal payments of $1, 750 for 10 years (assume 10 percent)? Year Payment $1, 750 0. 909 $1, 591 1, 750 0. 826 1, 446 1, 750 0. 751 1, 314 1, 750 0. 683 1, 195 Present value of series (Table A) Present Value 1 2 3 4 Irwin/Mc. Graw-Hill $5, 546 © The Mc. Graw-Hill Companies, Inc. , 1999

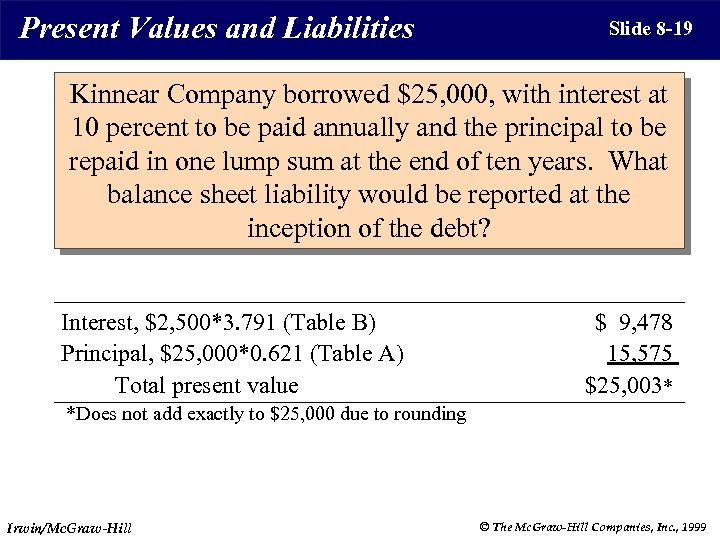

Present Values and Liabilities Slide 8 -19 Kinnear Company borrowed $25, 000, with interest at 10 percent to be paid annually and the principal to be repaid in one lump sum at the end of ten years. What balance sheet liability would be reported at the inception of the debt? Interest, $2, 500*3. 791 (Table B) Principal, $25, 000*0. 621 (Table A) Total present value $ 9, 478 15, 575 $25, 003* *Does not add exactly to $25, 000 due to rounding Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

Present Values and Liabilities Slide 8 -20 Kinnear Company borrowed $25, 000, with interest at 10 percent to be repaid in equal annual amounts at the end of each of the next five years. How much is each equal annual payment? PV of the annuity = Table B Value x Annual for 10 percent/5 payment year factor $25, 000 = 3. 791 x ? $25, 000 Irwin/Mc. Graw-Hill = 3. 791 x $6, 595 © The Mc. Graw-Hill Companies, Inc. , 1999

Chapter 8 The End Irwin/Mc. Graw-Hill © The Mc. Graw-Hill Companies, Inc. , 1999

9f5576c0b13f29fcaa723942df74aa23.ppt