13acc6260f367a6ac33ba9cae0dfa661.ppt

- Количество слайдов: 57

Source #4 An Efficient Capital Market To realize its potential, a nation must have a mechanism that channels capital into wealthcreating projects.

Source #4 An Efficient Capital Market To realize its potential, a nation must have a mechanism that channels capital into wealthcreating projects.

Capital Investment and Its Role in Growth • Capital is anything used to produce something else and helps us produce more goods and services in the future. – Machines, buildings, computers, tools • Capital investment requires consumption sacrifices today. It requires savings. The payoff is increased production and consumption in the future. • A mechanism is needed to channel savings into productive investments. Capital markets perform this function. 2 Common. Sense. Economics. com

Capital Investment and Its Role in Growth • Capital is anything used to produce something else and helps us produce more goods and services in the future. – Machines, buildings, computers, tools • Capital investment requires consumption sacrifices today. It requires savings. The payoff is increased production and consumption in the future. • A mechanism is needed to channel savings into productive investments. Capital markets perform this function. 2 Common. Sense. Economics. com

Capital Markets, Broadly Defined, Include • Loanable funds (mortgages, equity lines of credit, commercial loans, personal loans) • Real estate (residential and nonresidential) • Financial markets (mutual funds, bonds, and the stock market)

Capital Markets, Broadly Defined, Include • Loanable funds (mortgages, equity lines of credit, commercial loans, personal loans) • Real estate (residential and nonresidential) • Financial markets (mutual funds, bonds, and the stock market)

But, Not All Investment Projects Are Productive… • Investment involves risk. Unprofitable and unproductive investments will occur in a world of uncertainty. • Failures play an important role. Losses will lead to business failure and bring unproductive investments to a halt. • Market forces hold investors accountable for their mistakes. This provides a strong incentive to search for and undertake productive projects and avoid ones that are unproductive. • Productive investments promote economic growth.

But, Not All Investment Projects Are Productive… • Investment involves risk. Unprofitable and unproductive investments will occur in a world of uncertainty. • Failures play an important role. Losses will lead to business failure and bring unproductive investments to a halt. • Market forces hold investors accountable for their mistakes. This provides a strong incentive to search for and undertake productive projects and avoid ones that are unproductive. • Productive investments promote economic growth.

Notable Dot. Companies • Google • Pets. com – Most famous • Webvan – largest

Notable Dot. Companies • Google • Pets. com – Most famous • Webvan – largest

Capital Markets and Government Intervention • Governments can and do intervene in capital markets by restricting capital movements, setting interest rates, and using taxes and budgets to allocate capital. • These actions: – Distort market incentives. – Increase the importance of political rather than economic considerations. – Make unproductive investments more likely.

Capital Markets and Government Intervention • Governments can and do intervene in capital markets by restricting capital movements, setting interest rates, and using taxes and budgets to allocate capital. • These actions: – Distort market incentives. – Increase the importance of political rather than economic considerations. – Make unproductive investments more likely.

Former Soviet Union and Eastern Blcok Countries

Former Soviet Union and Eastern Blcok Countries

Fannie Mae and Freddie Mac • Federal National Mortgage Association (Fannie Mae 1968) • Federal Home Loan Mortgage Corporation (Freddie Mac 1970) • Purpose

Fannie Mae and Freddie Mac • Federal National Mortgage Association (Fannie Mae 1968) • Federal Home Loan Mortgage Corporation (Freddie Mac 1970) • Purpose

Fannie Mae and Freddie Mac • Business – – Did not originate mortgages Strictly secondary market Mid 1990’s— 40% of market Prior to 2008— 80%

Fannie Mae and Freddie Mac • Business – – Did not originate mortgages Strictly secondary market Mid 1990’s— 40% of market Prior to 2008— 80%

Fannie Mae and Freddie Mac • How did this happen? – HUD • 1996— 40% • 2000— 50% • 2008— 56% • Subprime Mortgages – No Down Payment – No or Poor Credit History – Incomplete Paper Work

Fannie Mae and Freddie Mac • How did this happen? – HUD • 1996— 40% • 2000— 50% • 2008— 56% • Subprime Mortgages – No Down Payment – No or Poor Credit History – Incomplete Paper Work

Fannie Mae and Freddie Mac • Incentive to originators of mortgages: – Can pass these risky loans off to FM and FM • Housing Boom—unsustainable • Bust later in 2006 • $400 Billion in bad debt

Fannie Mae and Freddie Mac • Incentive to originators of mortgages: – Can pass these risky loans off to FM and FM • Housing Boom—unsustainable • Bust later in 2006 • $400 Billion in bad debt

Federal Reserve’s Part • “Political allocation of credit and the regulatory erosion of lending standards channeled a lot of financial capital into projects that should never have been undertaken. ” (page 65)

Federal Reserve’s Part • “Political allocation of credit and the regulatory erosion of lending standards channeled a lot of financial capital into projects that should never have been undertaken. ” (page 65)

Property Rights • Clearly defined • Enforced • Government allocation of capital

Property Rights • Clearly defined • Enforced • Government allocation of capital

Capital Markets Make a Difference

Capital Markets Make a Difference

Source #5 Monetary Stability A stable monetary policy is essential for the control of inflation, efficient allocation of investment, and achievement of economic stability.

Source #5 Monetary Stability A stable monetary policy is essential for the control of inflation, efficient allocation of investment, and achievement of economic stability.

Money “Money is to an economy what language is to communication. ”

Money “Money is to an economy what language is to communication. ”

Why Do We Need Money? • Barter systems made money necessary. • To barter effectively, both parties must experience a double coincidence of wants. • Barter is awkward and money helps facilitate trade between people.

Why Do We Need Money? • Barter systems made money necessary. • To barter effectively, both parties must experience a double coincidence of wants. • Barter is awkward and money helps facilitate trade between people.

History of Money • Throughout history many things have been used as money – Salt – Cigarettes – Tea

History of Money • Throughout history many things have been used as money – Salt – Cigarettes – Tea

History of Money “The gold and silver money, which circulates in any country, may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either. ” -The Wealth of Nations

History of Money “The gold and silver money, which circulates in any country, may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either. ” -The Wealth of Nations

History of Money • There were problems with these items as money – Easy to duplicate and counterfeit • Gold became preferred

History of Money • There were problems with these items as money – Easy to duplicate and counterfeit • Gold became preferred

Why Gold? • Limited in quantity and difficult to duplicate • Often used as coins or for large purchases gold bars • The problem is it is heavy to carry

Why Gold? • Limited in quantity and difficult to duplicate • Often used as coins or for large purchases gold bars • The problem is it is heavy to carry

History of Money • It is dangerous to carry gold so people would give it to blacksmiths to keep in a safe – This led to paper money and banks • Blacksmiths to Bankers – early on banks were just safety deposit boxes • Later governments started issuing paper money that could be redeemed for gold

History of Money • It is dangerous to carry gold so people would give it to blacksmiths to keep in a safe – This led to paper money and banks • Blacksmiths to Bankers – early on banks were just safety deposit boxes • Later governments started issuing paper money that could be redeemed for gold

History of Money • What makes these things money? – They were accepted in exchange for goods and services which represent real wealth • Money does not create wealth, it is just a way to transfer wealth or encourage people to create wealth

History of Money • What makes these things money? – They were accepted in exchange for goods and services which represent real wealth • Money does not create wealth, it is just a way to transfer wealth or encourage people to create wealth

Two Types of Money • Commodity Money : something that performs the function of money and has alternative, nonmonetary uses. – Examples: Gold, silver, cigarettes • Fiat Money : something that serves as money but has no other important uses. – Examples: Coins, currency, check deposits

Two Types of Money • Commodity Money : something that performs the function of money and has alternative, nonmonetary uses. – Examples: Gold, silver, cigarettes • Fiat Money : something that serves as money but has no other important uses. – Examples: Coins, currency, check deposits

The Functions of Money 1. Medium of exchange …it can be used to purchase goods & services. 2. Unit of account …it is a yardstick people use to compare the relative value of goods & record debts. 3. Store of value …it can be used to transfer purchasing power from the present to the future.

The Functions of Money 1. Medium of exchange …it can be used to purchase goods & services. 2. Unit of account …it is a yardstick people use to compare the relative value of goods & record debts. 3. Store of value …it can be used to transfer purchasing power from the present to the future.

Characteristics of Money • Portable – easy to transfer from person to person • Uniform – are they all of equality • Generally accepted – will people accept it • Durable – will it last • Stable in value – is it limited in quantity

Characteristics of Money • Portable – easy to transfer from person to person • Uniform – are they all of equality • Generally accepted – will people accept it • Durable – will it last • Stable in value – is it limited in quantity

The Value of Money • The value of money is determined by supply and demand. • The value of money is steady when the supply of money grows slowly (e. g. at approximately the same rate as goods and services).

The Value of Money • The value of money is determined by supply and demand. • The value of money is steady when the supply of money grows slowly (e. g. at approximately the same rate as goods and services).

The Value of Money • When a central bank expands the money supply rapidly relative to the production of goods and services, inflation results because there are too many dollars chasing too few goods and services. • Inflation generates uncertainty, reduces the gains from trade, and thereby retards economic growth.

The Value of Money • When a central bank expands the money supply rapidly relative to the production of goods and services, inflation results because there are too many dollars chasing too few goods and services. • Inflation generates uncertainty, reduces the gains from trade, and thereby retards economic growth.

What is Inflation? • Inflation is about the value of money, not the value of goods • The inflation rate is reported monthly at an annual rate • Important for measuring the Cost of Living

What is Inflation? • Inflation is about the value of money, not the value of goods • The inflation rate is reported monthly at an annual rate • Important for measuring the Cost of Living

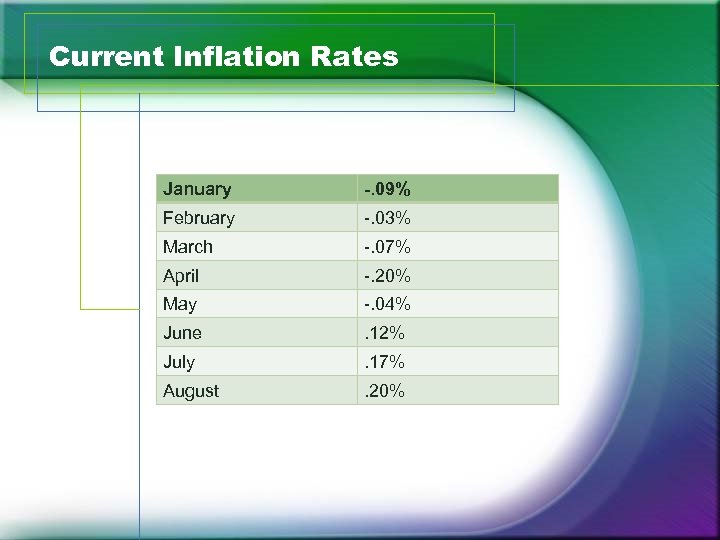

Current Inflation Rates January -. 09% February -. 03% March -. 07% April -. 20% May -. 04% June . 12% July . 17% August . 20%

Current Inflation Rates January -. 09% February -. 03% March -. 07% April -. 20% May -. 04% June . 12% July . 17% August . 20%

Real versus Nominal • An accurate view of the economy requires adjusting nominal prices to real prices in order to make comparisons over time • Nominal is the value at current prices • Real is the value at constant prices – adjusted for inflation

Real versus Nominal • An accurate view of the economy requires adjusting nominal prices to real prices in order to make comparisons over time • Nominal is the value at current prices • Real is the value at constant prices – adjusted for inflation

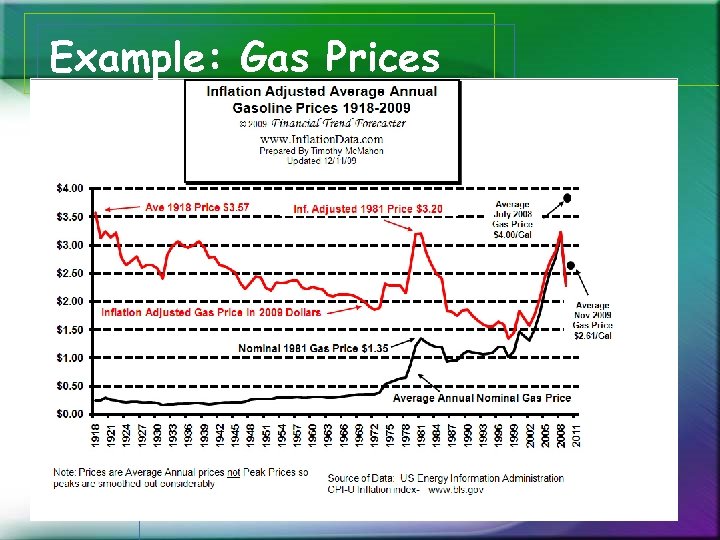

Example: Gas Prices

Example: Gas Prices

Measuring Inflation • Consumer Price Index (CPI) – measure of price changes over a period of time – attempts to measure the price changes in about 400 goods and services

Measuring Inflation • Consumer Price Index (CPI) – measure of price changes over a period of time – attempts to measure the price changes in about 400 goods and services

Measuring the Cost of Living • In determining the cost of living, the Bureau of Labor Statistics (BLS) first identifies a “market basket” of goods and services the typical consumer buys • Annually, the BLS surveys consumers to determine what they buy and the overall cost of the goods and services they buy

Measuring the Cost of Living • In determining the cost of living, the Bureau of Labor Statistics (BLS) first identifies a “market basket” of goods and services the typical consumer buys • Annually, the BLS surveys consumers to determine what they buy and the overall cost of the goods and services they buy

Calculating the Consumer Price Index and the Inflation Rate § Fix the Basket - Determine what goods are most important to the typical consumer § Items are weighted based on consumption

Calculating the Consumer Price Index and the Inflation Rate § Fix the Basket - Determine what goods are most important to the typical consumer § Items are weighted based on consumption

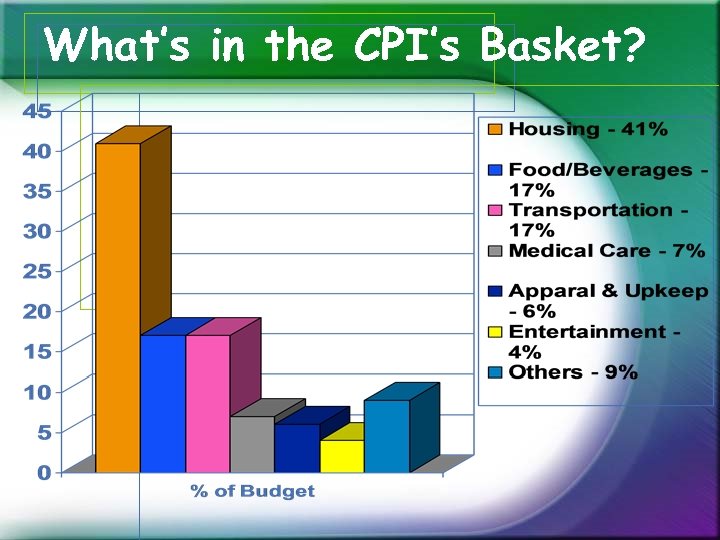

What’s in the CPI’s Basket?

What’s in the CPI’s Basket?

Calculating the Consumer Price Index and the Inflation Rate § Find the Prices - Find the prices of each of the goods and services in the basket for each point in time

Calculating the Consumer Price Index and the Inflation Rate § Find the Prices - Find the prices of each of the goods and services in the basket for each point in time

Calculating the Consumer Price Index and the Inflation Rate § Compute the Basket’s Cost - Use the data on prices to calculate the cost of the basket of goods and services at different times

Calculating the Consumer Price Index and the Inflation Rate § Compute the Basket’s Cost - Use the data on prices to calculate the cost of the basket of goods and services at different times

Calculating the Consumer Price Index and the Inflation Rate § Choose a Base Year - Designate one year as the base year and compare all other years to it § 1982 -1984 = 100

Calculating the Consumer Price Index and the Inflation Rate § Choose a Base Year - Designate one year as the base year and compare all other years to it § 1982 -1984 = 100

Uses of Consumer Price Index • Compute "real" values for items with dollar values • Cost of living (income) • As one measure of economy's price performance

Uses of Consumer Price Index • Compute "real" values for items with dollar values • Cost of living (income) • As one measure of economy's price performance

Other Price Indexes • Other Price Indexes are computed for: – Specific regions within the country (e. g. Boston, New York, Los Angeles) – Narrow categories of goods and services (e. g. food, clothing, etc. ) – Producer costs of resources (i. e. producer price index) – Core CPI – CPI without food and energy

Other Price Indexes • Other Price Indexes are computed for: – Specific regions within the country (e. g. Boston, New York, Los Angeles) – Narrow categories of goods and services (e. g. food, clothing, etc. ) – Producer costs of resources (i. e. producer price index) – Core CPI – CPI without food and energy

Correcting Economic Variables for the Effects of Inflation • Price indexes are used to correct for the effects of inflation when comparing dollar figures from different times

Correcting Economic Variables for the Effects of Inflation • Price indexes are used to correct for the effects of inflation when comparing dollar figures from different times

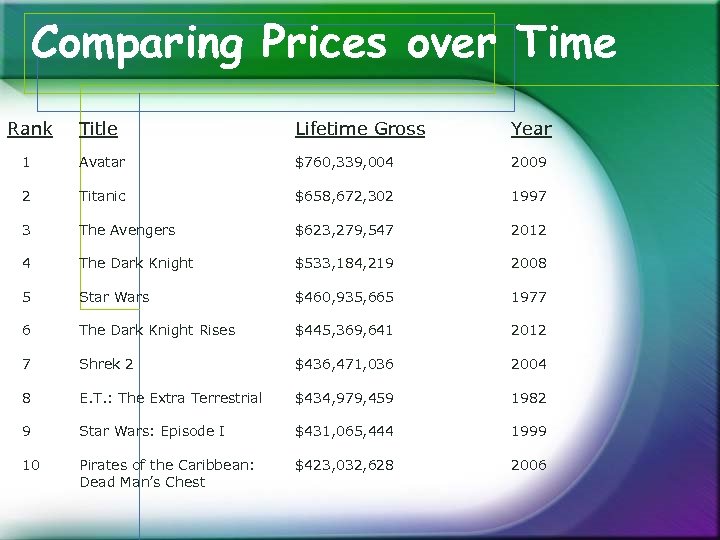

Comparing Prices over Time Rank Title Lifetime Gross Year 1 Avatar $760, 339, 004 2009 2 Titanic $658, 672, 302 1997 3 The Avengers $623, 279, 547 2012 4 The Dark Knight $533, 184, 219 2008 5 Star Wars $460, 935, 665 1977 6 The Dark Knight Rises $445, 369, 641 2012 7 Shrek 2 $436, 471, 036 2004 8 E. T. : The Extra Terrestrial $434, 979, 459 1982 9 Star Wars: Episode I $431, 065, 444 1999 10 Pirates of the Caribbean: Dead Man’s Chest $423, 032, 628 2006

Comparing Prices over Time Rank Title Lifetime Gross Year 1 Avatar $760, 339, 004 2009 2 Titanic $658, 672, 302 1997 3 The Avengers $623, 279, 547 2012 4 The Dark Knight $533, 184, 219 2008 5 Star Wars $460, 935, 665 1977 6 The Dark Knight Rises $445, 369, 641 2012 7 Shrek 2 $436, 471, 036 2004 8 E. T. : The Extra Terrestrial $434, 979, 459 1982 9 Star Wars: Episode I $431, 065, 444 1999 10 Pirates of the Caribbean: Dead Man’s Chest $423, 032, 628 2006

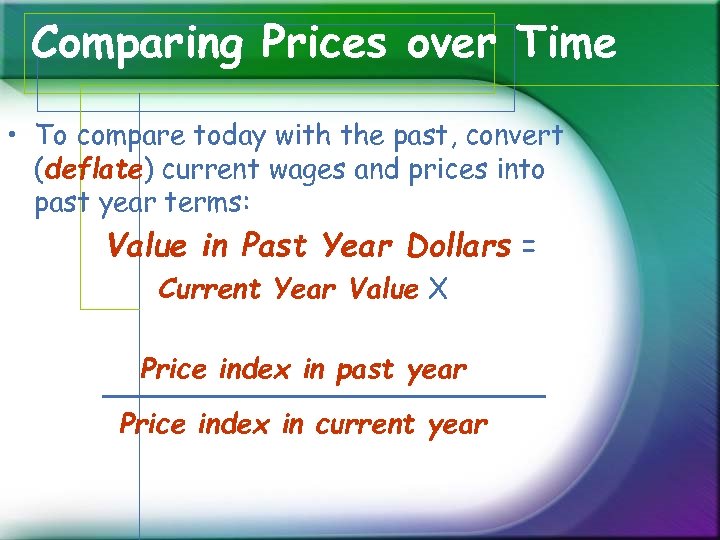

Comparing Prices over Time • To compare today with the past, convert (deflate) current wages and prices into past year terms: Value in Past Year Dollars = Current Year Value X Price index in past year Price index in current year

Comparing Prices over Time • To compare today with the past, convert (deflate) current wages and prices into past year terms: Value in Past Year Dollars = Current Year Value X Price index in past year Price index in current year

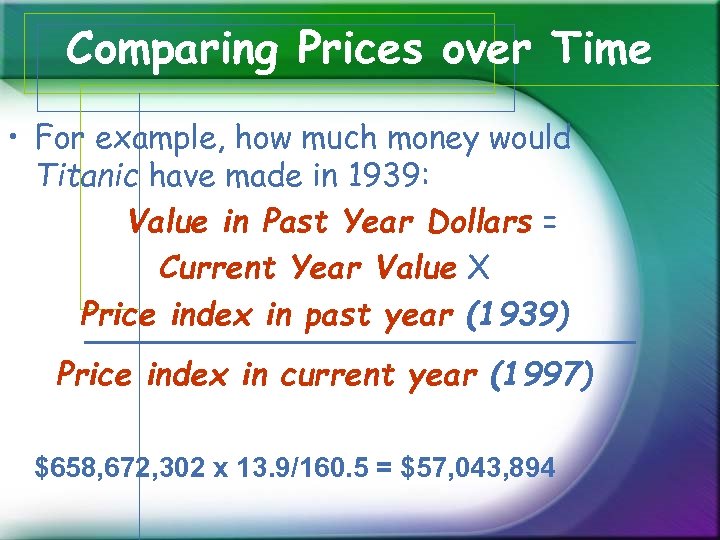

Comparing Prices over Time • For example, how much money would Titanic have made in 1939: Value in Past Year Dollars = Current Year Value X Price index in past year (1939) Price index in current year (1997) $658, 672, 302 x 13. 9/160. 5 = $57, 043, 894

Comparing Prices over Time • For example, how much money would Titanic have made in 1939: Value in Past Year Dollars = Current Year Value X Price index in past year (1939) Price index in current year (1997) $658, 672, 302 x 13. 9/160. 5 = $57, 043, 894

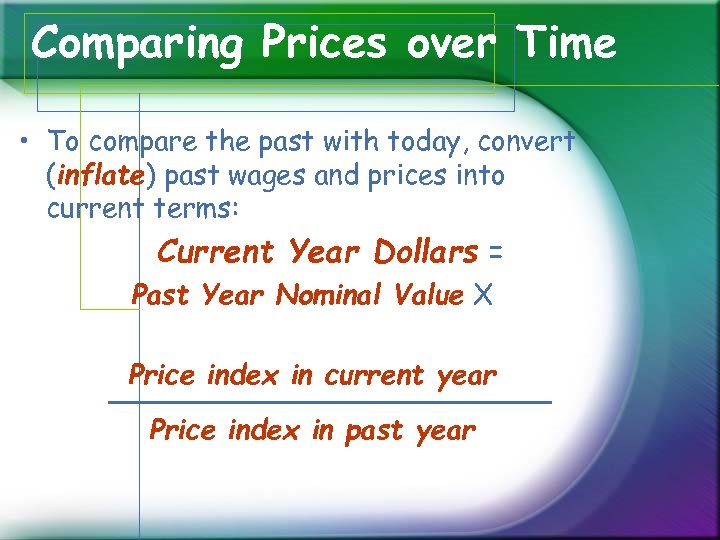

Comparing Prices over Time • To compare the past with today, convert (inflate) past wages and prices into current terms: Current Year Dollars = Past Year Nominal Value X Price index in current year Price index in past year

Comparing Prices over Time • To compare the past with today, convert (inflate) past wages and prices into current terms: Current Year Dollars = Past Year Nominal Value X Price index in current year Price index in past year

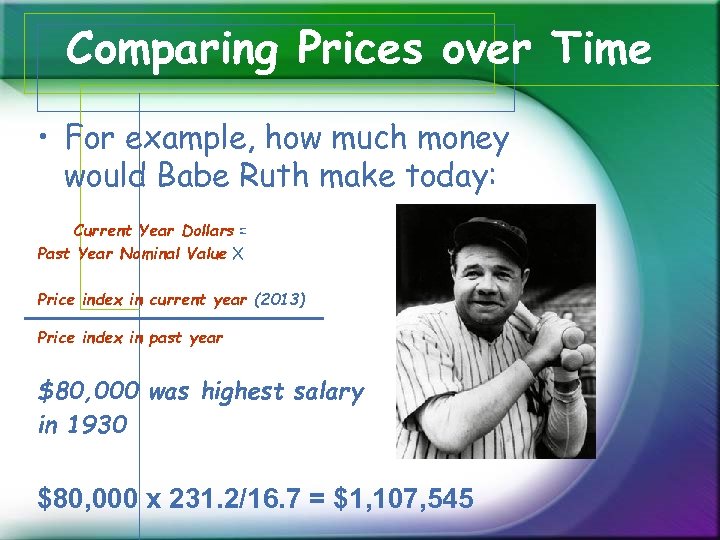

Comparing Prices over Time • For example, how much money would Babe Ruth make today: Current Year Dollars = Past Year Nominal Value X Price index in current year (2013) Price index in past year $80, 000 was highest salary in 1930 $80, 000 x 231. 2/16. 7 = $1, 107, 545

Comparing Prices over Time • For example, how much money would Babe Ruth make today: Current Year Dollars = Past Year Nominal Value X Price index in current year (2013) Price index in past year $80, 000 was highest salary in 1930 $80, 000 x 231. 2/16. 7 = $1, 107, 545

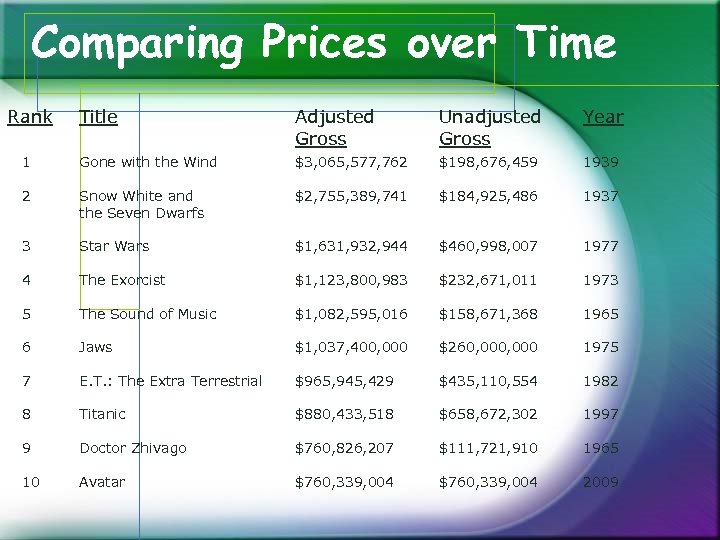

Comparing Prices over Time Rank Title Adjusted Gross Unadjusted Gross Year 1 Gone with the Wind $3, 065, 577, 762 $198, 676, 459 1939 2 Snow White and the Seven Dwarfs $2, 755, 389, 741 $184, 925, 486 1937 3 Star Wars $1, 631, 932, 944 $460, 998, 007 1977 4 The Exorcist $1, 123, 800, 983 $232, 671, 011 1973 5 The Sound of Music $1, 082, 595, 016 $158, 671, 368 1965 6 Jaws $1, 037, 400, 000 $260, 000 1975 7 E. T. : The Extra Terrestrial $965, 945, 429 $435, 110, 554 1982 8 Titanic $880, 433, 518 $658, 672, 302 1997 9 Doctor Zhivago $760, 826, 207 $111, 721, 910 1965 10 Avatar $760, 339, 004 2009

Comparing Prices over Time Rank Title Adjusted Gross Unadjusted Gross Year 1 Gone with the Wind $3, 065, 577, 762 $198, 676, 459 1939 2 Snow White and the Seven Dwarfs $2, 755, 389, 741 $184, 925, 486 1937 3 Star Wars $1, 631, 932, 944 $460, 998, 007 1977 4 The Exorcist $1, 123, 800, 983 $232, 671, 011 1973 5 The Sound of Music $1, 082, 595, 016 $158, 671, 368 1965 6 Jaws $1, 037, 400, 000 $260, 000 1975 7 E. T. : The Extra Terrestrial $965, 945, 429 $435, 110, 554 1982 8 Titanic $880, 433, 518 $658, 672, 302 1997 9 Doctor Zhivago $760, 826, 207 $111, 721, 910 1965 10 Avatar $760, 339, 004 2009

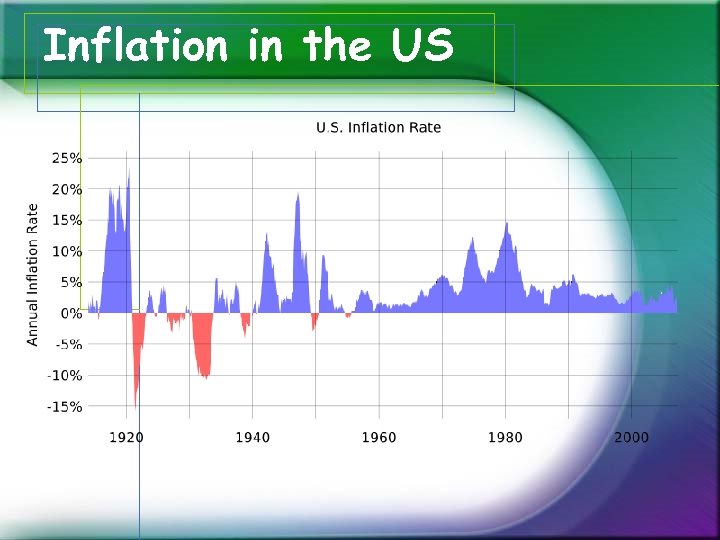

Inflation in the US

Inflation in the US

Conclusion • When comparing dollar values from different times, it is necessary to keep in mind that a dollar today is not the same as a dollar in the past

Conclusion • When comparing dollar values from different times, it is necessary to keep in mind that a dollar today is not the same as a dollar in the past