74856e723e3dd1ed4c2e85767a888047.ppt

- Количество слайдов: 51

Soup to Nuts Presentation March 3, 2001 Presented by: John Gabbert Director of Research Venture. One

Soup to Nuts Presentation March 3, 2001 Presented by: John Gabbert Director of Research Venture. One

Venture. One Research Venture. One tracks companies from their initial round of venture financing until they achieve liquidity, become profitable with no plans for future financing, or go out of business.

Venture. One Research Venture. One tracks companies from their initial round of venture financing until they achieve liquidity, become profitable with no plans for future financing, or go out of business.

Three Key Elements for a Robust Venture Industry t Fundraising t Investment t Liquidity

Three Key Elements for a Robust Venture Industry t Fundraising t Investment t Liquidity

Fundraising

Fundraising

VC Fundraising Dollars Double From 1999 Contributions to Venture Capital ($B)

VC Fundraising Dollars Double From 1999 Contributions to Venture Capital ($B)

Fundraising Continues at Historical Highs Through 2000 Contributions to Venture Capital ($B)

Fundraising Continues at Historical Highs Through 2000 Contributions to Venture Capital ($B)

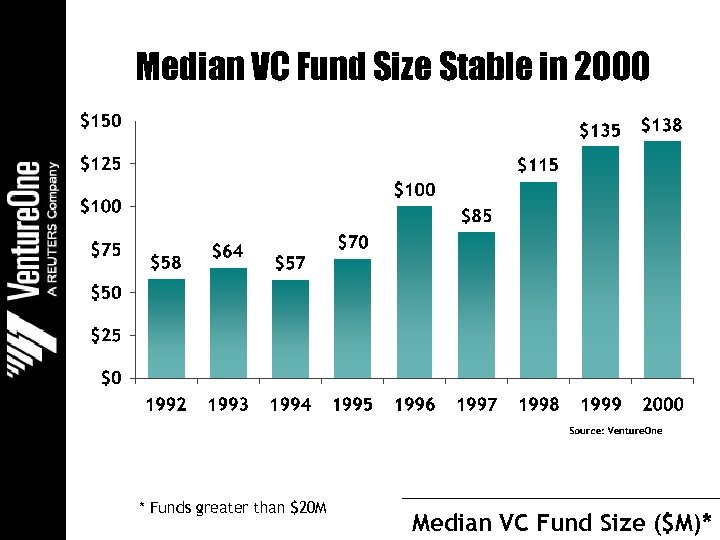

Median VC Fund Size Stable in 2000 * Funds greater than $20 M Median VC Fund Size ($M)*

Median VC Fund Size Stable in 2000 * Funds greater than $20 M Median VC Fund Size ($M)*

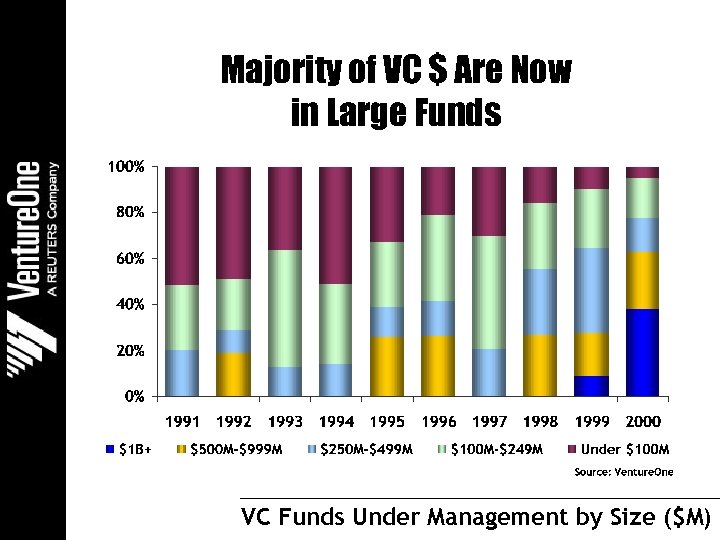

Majority of VC $ Are Now in Large Funds VC Funds Under Management by Size ($M)

Majority of VC $ Are Now in Large Funds VC Funds Under Management by Size ($M)

Fundraising Summary t New commitments to venture capital are at record levels. t Over half of VC dollars are in funds greater than $500 million. t Capital under management per VC partnership continues to rise. t Greatest amount of VC money in history available to invest in entrepreneurship.

Fundraising Summary t New commitments to venture capital are at record levels. t Over half of VC dollars are in funds greater than $500 million. t Capital under management per VC partnership continues to rise. t Greatest amount of VC money in history available to invest in entrepreneurship.

Investment

Investment

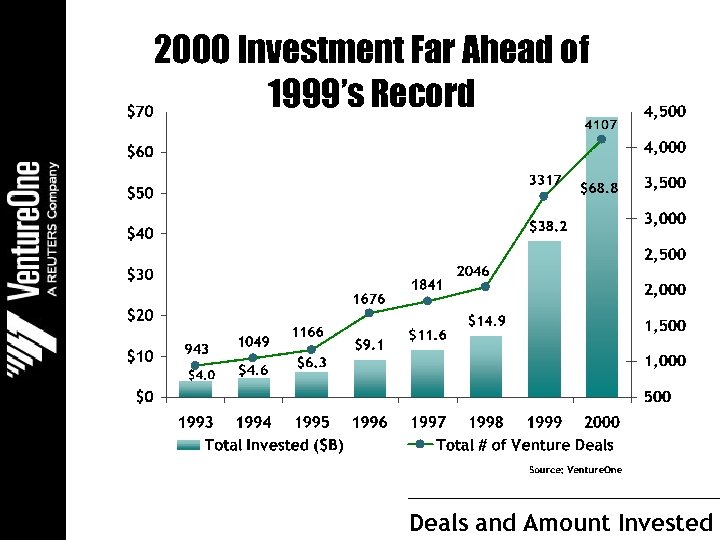

2000 Investment Far Ahead of 1999’s Record Deals and Amount Invested

2000 Investment Far Ahead of 1999’s Record Deals and Amount Invested

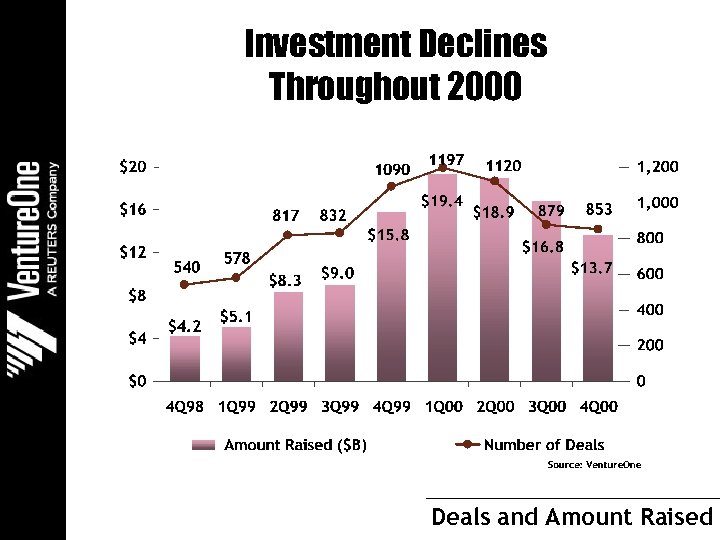

Investment Declines Throughout 2000 Deals and Amount Raised

Investment Declines Throughout 2000 Deals and Amount Raised

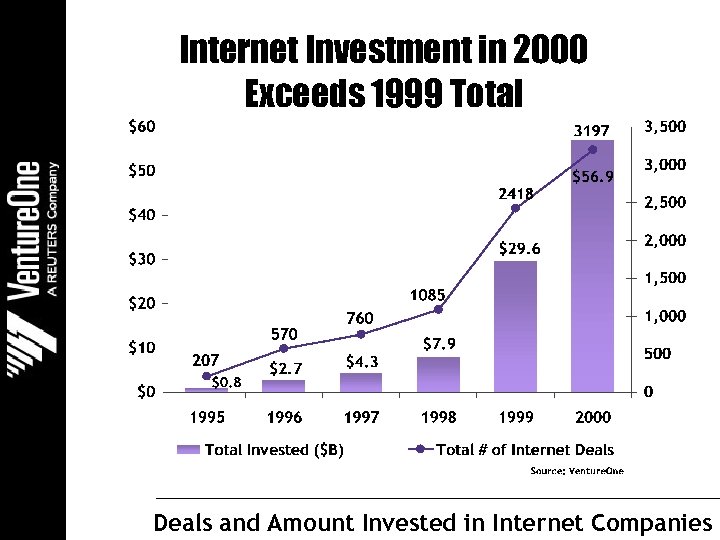

Internet Investment in 2000 Exceeds 1999 Total Deals and Amount Invested in Internet Companies

Internet Investment in 2000 Exceeds 1999 Total Deals and Amount Invested in Internet Companies

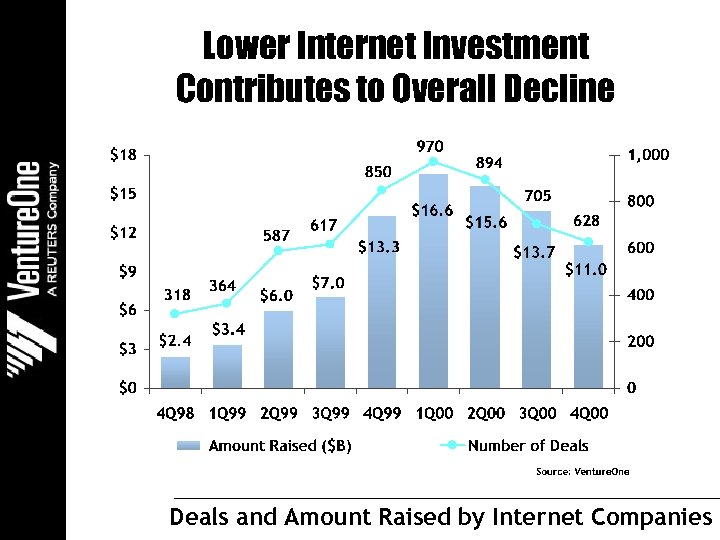

Lower Internet Investment Contributes to Overall Decline Deals and Amount Raised by Internet Companies

Lower Internet Investment Contributes to Overall Decline Deals and Amount Raised by Internet Companies

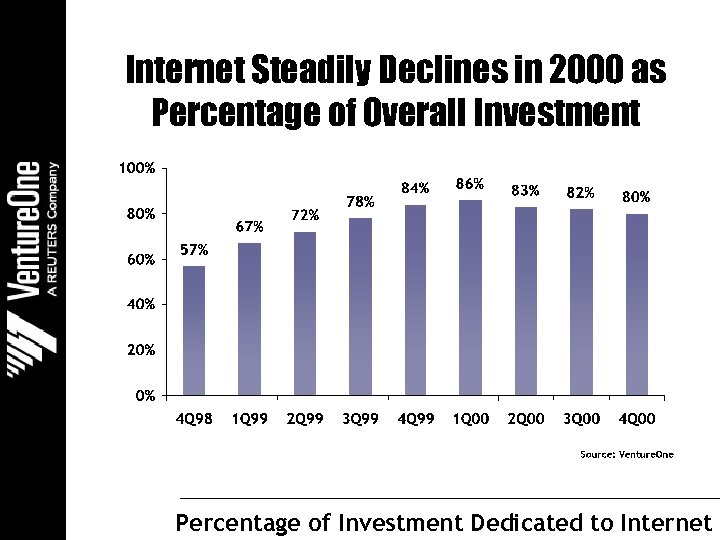

Internet Steadily Declines in 2000 as Percentage of Overall Investment Percentage of Investment Dedicated to Internet

Internet Steadily Declines in 2000 as Percentage of Overall Investment Percentage of Investment Dedicated to Internet

More Money Placed in the Hands of Entrepreneurs Median Amount Invested Per Round ($M)

More Money Placed in the Hands of Entrepreneurs Median Amount Invested Per Round ($M)

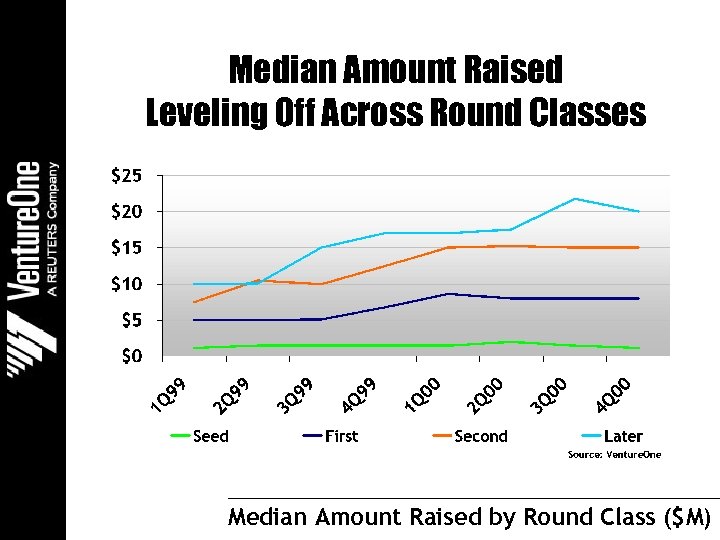

Median Amount Raised Leveling Off Across Round Classes Median Amount Raised by Round Class ($M)

Median Amount Raised Leveling Off Across Round Classes Median Amount Raised by Round Class ($M)

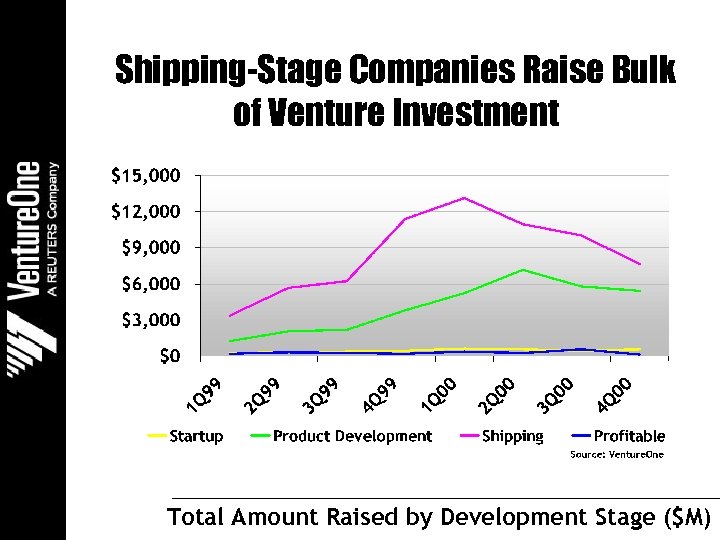

Shipping-Stage Companies Raise Bulk of Venture Investment Total Amount Raised by Development Stage ($M)

Shipping-Stage Companies Raise Bulk of Venture Investment Total Amount Raised by Development Stage ($M)

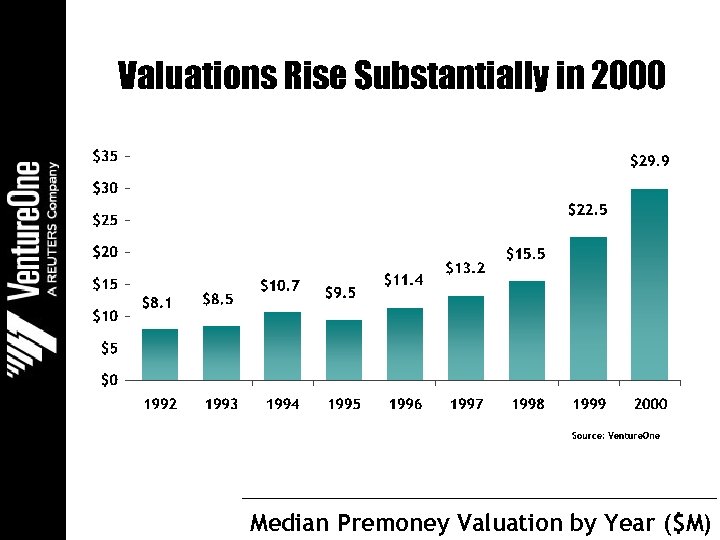

Valuations Rise Substantially in 2000 Median Premoney Valuation by Year ($M)

Valuations Rise Substantially in 2000 Median Premoney Valuation by Year ($M)

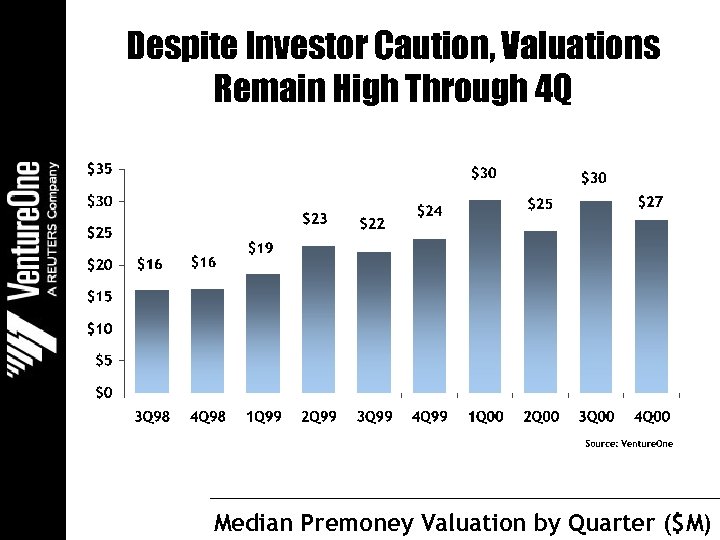

Despite Investor Caution, Valuations Remain High Through 4 Q Median Premoney Valuation by Quarter ($M)

Despite Investor Caution, Valuations Remain High Through 4 Q Median Premoney Valuation by Quarter ($M)

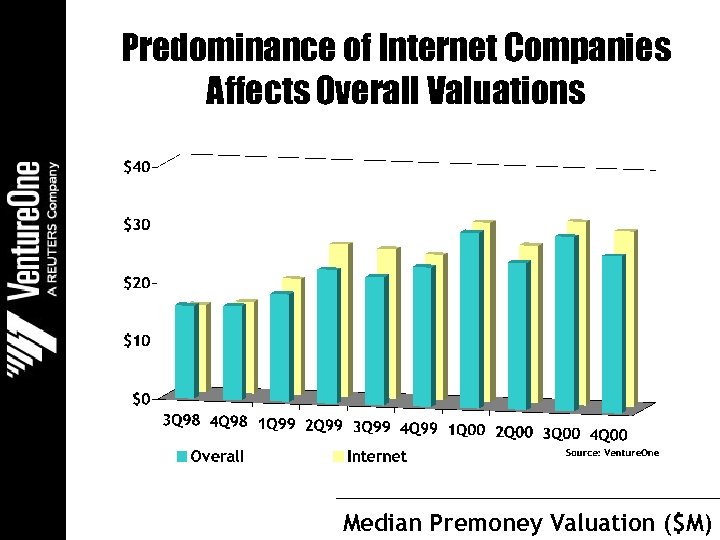

Predominance of Internet Companies Affects Overall Valuations Median Premoney Valuation ($M)

Predominance of Internet Companies Affects Overall Valuations Median Premoney Valuation ($M)

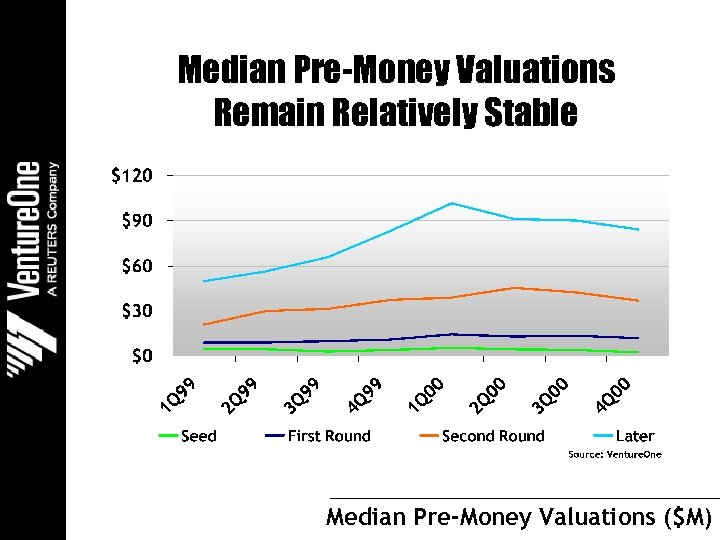

Median Pre-Money Valuations Remain Relatively Stable Median Pre-Money Valuations ($M)

Median Pre-Money Valuations Remain Relatively Stable Median Pre-Money Valuations ($M)

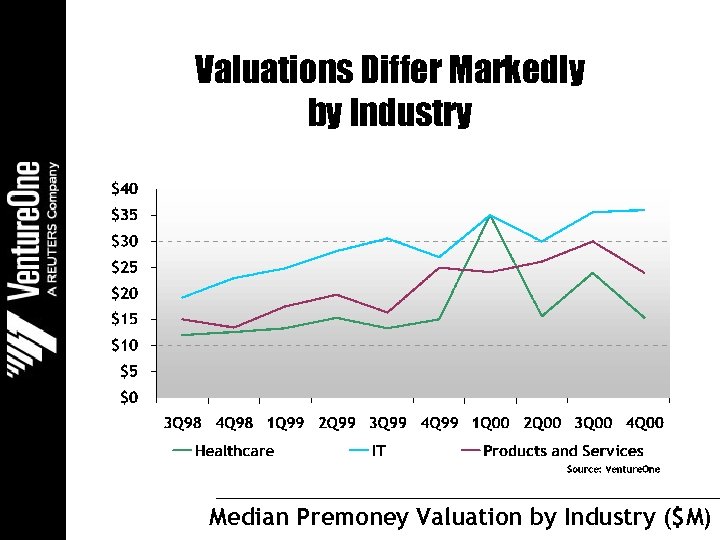

Valuations Differ Markedly by Industry Median Premoney Valuation by Industry ($M)

Valuations Differ Markedly by Industry Median Premoney Valuation by Industry ($M)

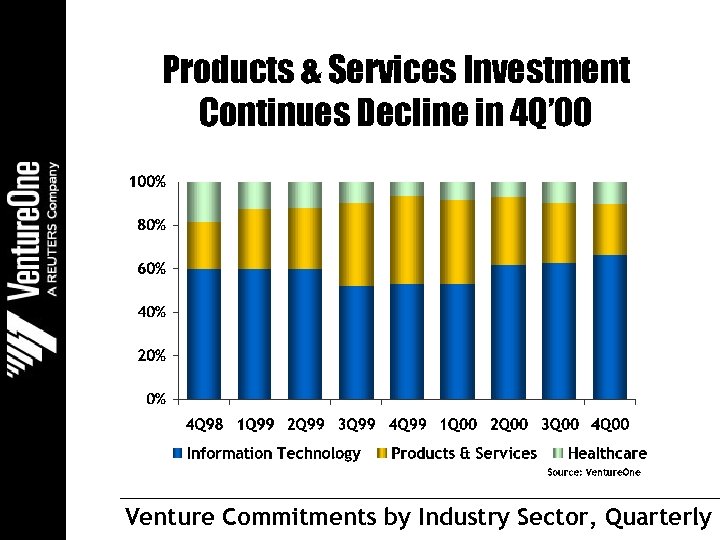

Products & Services Investment Continues Decline in 4 Q’ 00 Venture Commitments by Industry Sector, Quarterly

Products & Services Investment Continues Decline in 4 Q’ 00 Venture Commitments by Industry Sector, Quarterly

Infrastructure Rises as E-Commerce Falls in 2000 Percentage of Internet Investment by Dimension

Infrastructure Rises as E-Commerce Falls in 2000 Percentage of Internet Investment by Dimension

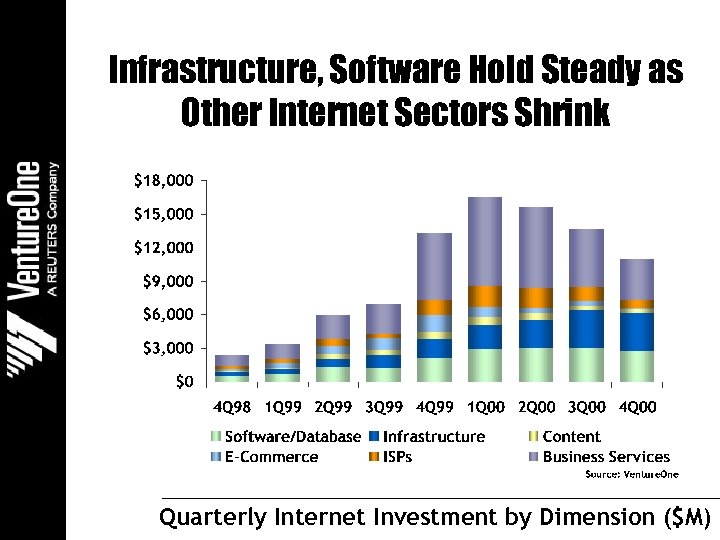

Infrastructure, Software Hold Steady as Other Internet Sectors Shrink Quarterly Internet Investment by Dimension ($M)

Infrastructure, Software Hold Steady as Other Internet Sectors Shrink Quarterly Internet Investment by Dimension ($M)

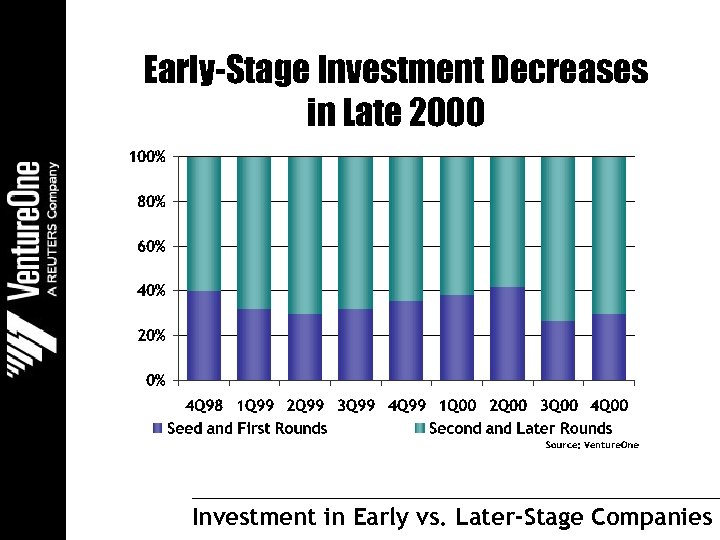

Early-Stage Investment Decreases in Late 2000 Investment in Early vs. Later-Stage Companies

Early-Stage Investment Decreases in Late 2000 Investment in Early vs. Later-Stage Companies

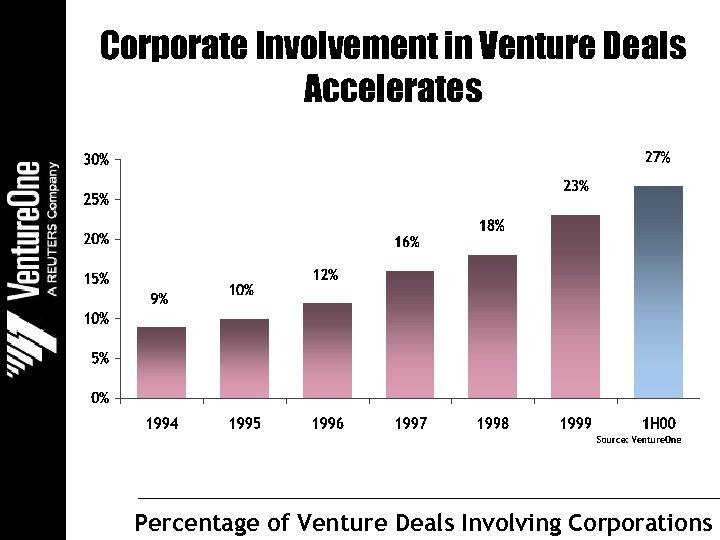

Corporate Involvement in Venture Deals Accelerates Percentage of Venture Deals Involving Corporations

Corporate Involvement in Venture Deals Accelerates Percentage of Venture Deals Involving Corporations

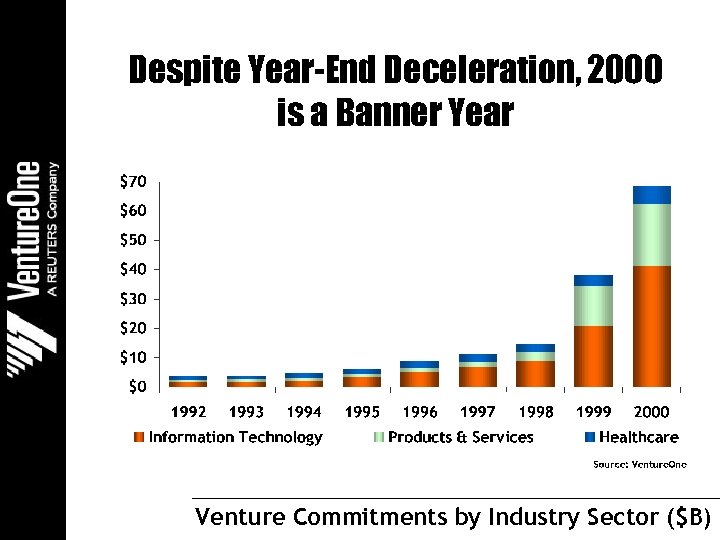

Despite Year-End Deceleration, 2000 is a Banner Year Venture Commitments by Industry Sector ($B)

Despite Year-End Deceleration, 2000 is a Banner Year Venture Commitments by Industry Sector ($B)

Regional Investment

Regional Investment

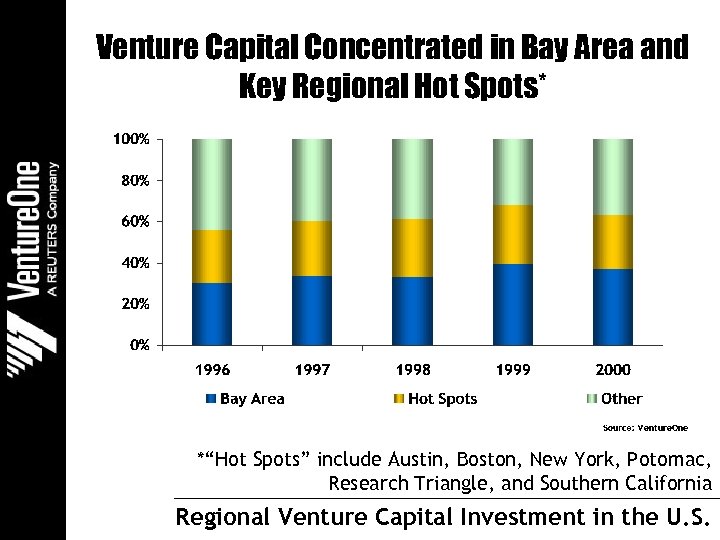

Venture Capital Concentrated in Bay Area and Key Regional Hot Spots* *“Hot Spots” include Austin, Boston, New York, Potomac, Research Triangle, and Southern California Regional Venture Capital Investment in the U. S.

Venture Capital Concentrated in Bay Area and Key Regional Hot Spots* *“Hot Spots” include Austin, Boston, New York, Potomac, Research Triangle, and Southern California Regional Venture Capital Investment in the U. S.

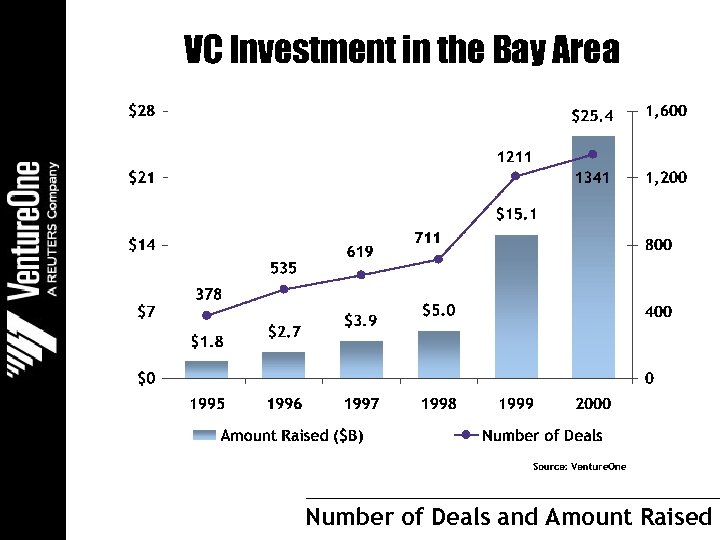

VC Investment in the Bay Area Number of Deals and Amount Raised

VC Investment in the Bay Area Number of Deals and Amount Raised

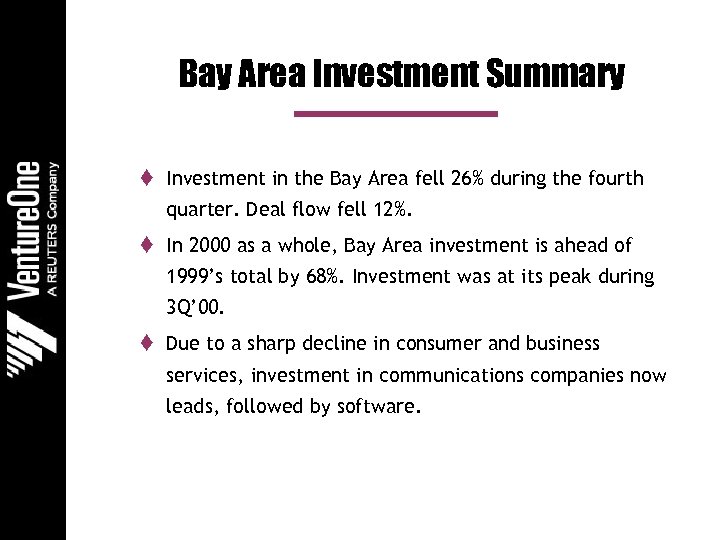

Bay Area Investment Summary t Investment in the Bay Area fell 26% during the fourth quarter. Deal flow fell 12%. t In 2000 as a whole, Bay Area investment is ahead of 1999’s total by 68%. Investment was at its peak during 3 Q’ 00. t Due to a sharp decline in consumer and business services, investment in communications companies now leads, followed by software.

Bay Area Investment Summary t Investment in the Bay Area fell 26% during the fourth quarter. Deal flow fell 12%. t In 2000 as a whole, Bay Area investment is ahead of 1999’s total by 68%. Investment was at its peak during 3 Q’ 00. t Due to a sharp decline in consumer and business services, investment in communications companies now leads, followed by software.

Financing Summary t Despite quarterly declines, VC investment in 2000 nearly doubled 1999’s record. t Internet investment declined from its record high in 1 Q’ 00, but still comprised 83% of overall investment in 2000. t The drop off in consumer and business services investment drove the decline; investment in Internet infrastructure and software/database companies remains strong. t IT receives the most VC investment of any industry. Products & Services absorbed the brunt of the Internet decline, while healthcare investment is at a record high. t The Bay Area still sees bulk of investment, but capital is also concentrated in select “hot spots. ”

Financing Summary t Despite quarterly declines, VC investment in 2000 nearly doubled 1999’s record. t Internet investment declined from its record high in 1 Q’ 00, but still comprised 83% of overall investment in 2000. t The drop off in consumer and business services investment drove the decline; investment in Internet infrastructure and software/database companies remains strong. t IT receives the most VC investment of any industry. Products & Services absorbed the brunt of the Internet decline, while healthcare investment is at a record high. t The Bay Area still sees bulk of investment, but capital is also concentrated in select “hot spots. ”

Liquidity

Liquidity

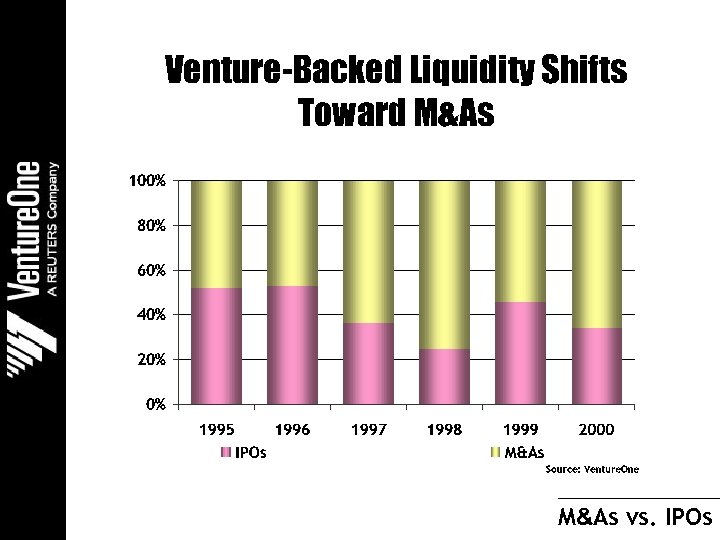

Venture-Backed Liquidity Shifts Toward M&As vs. IPOs

Venture-Backed Liquidity Shifts Toward M&As vs. IPOs

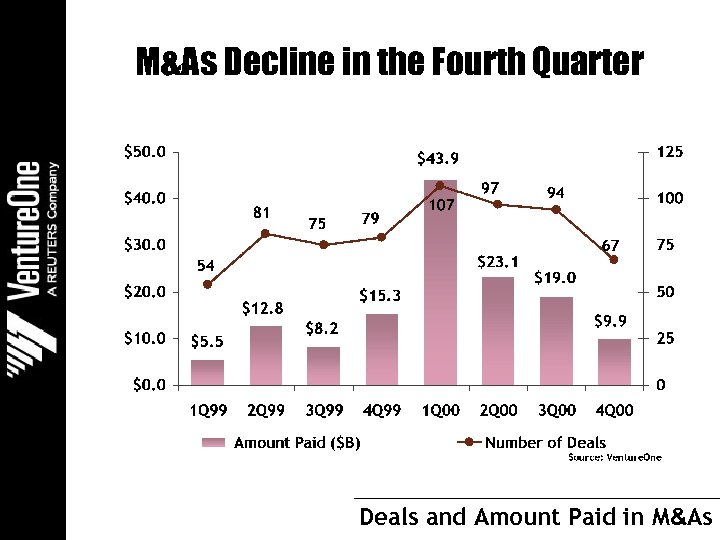

M&As Decline in the Fourth Quarter Deals and Amount Paid in M&As

M&As Decline in the Fourth Quarter Deals and Amount Paid in M&As

Despite a 4 Q Decline, M&A Dollars More Than Double in 2000 Deals and Amount Paid in M&As

Despite a 4 Q Decline, M&A Dollars More Than Double in 2000 Deals and Amount Paid in M&As

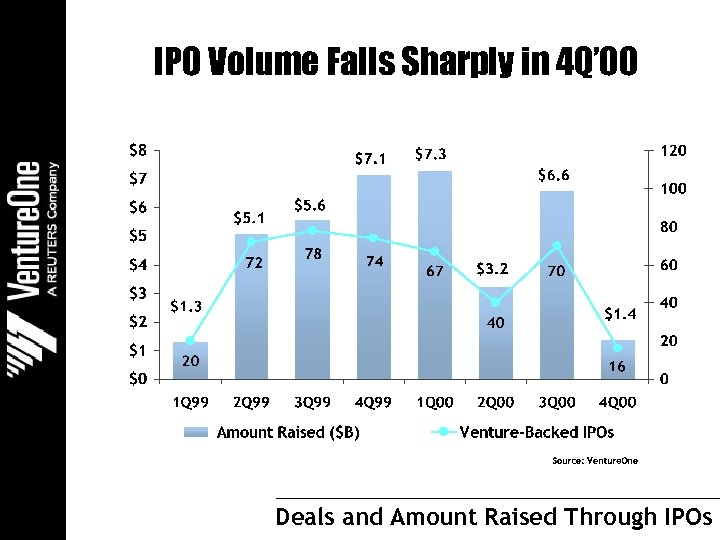

IPO Volume Falls Sharply in 4 Q’ 00 Deals and Amount Raised Through IPOs

IPO Volume Falls Sharply in 4 Q’ 00 Deals and Amount Raised Through IPOs

Despite 4 Q’ 00 Shortfalls, IPO Activity for 2000 Is Strong Deals and Amount Raised Through IPOs

Despite 4 Q’ 00 Shortfalls, IPO Activity for 2000 Is Strong Deals and Amount Raised Through IPOs

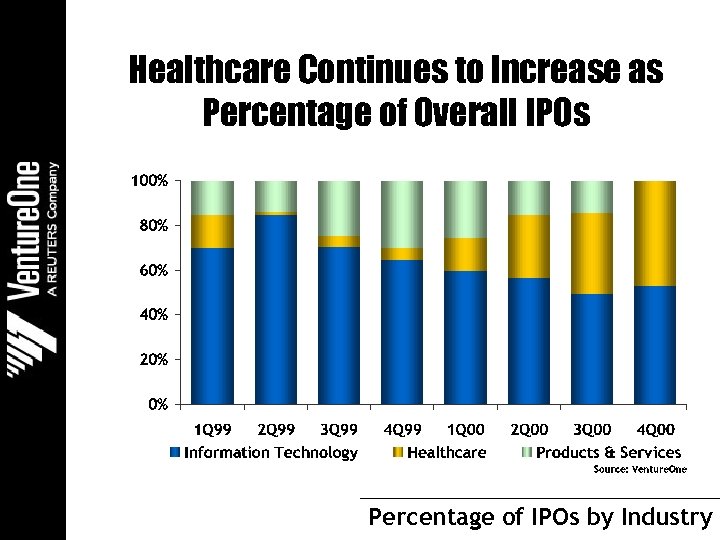

Healthcare Continues to Increase as Percentage of Overall IPOs Percentage of IPOs by Industry

Healthcare Continues to Increase as Percentage of Overall IPOs Percentage of IPOs by Industry

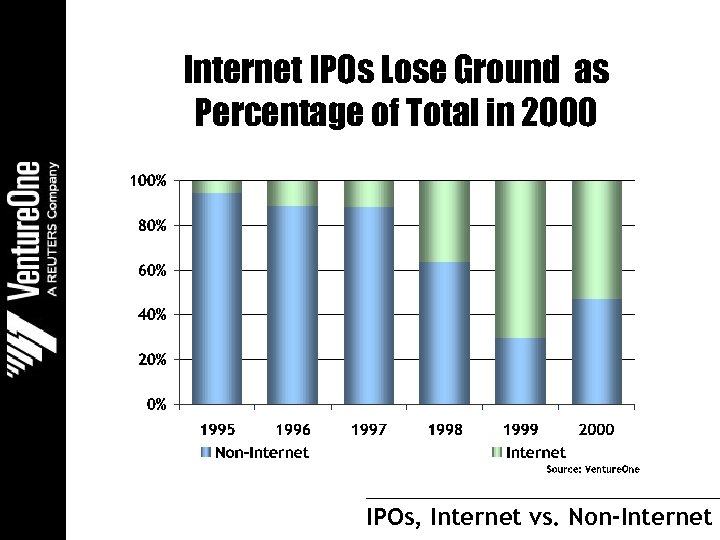

Internet IPOs Lose Ground as Percentage of Total in 2000 IPOs, Internet vs. Non-Internet

Internet IPOs Lose Ground as Percentage of Total in 2000 IPOs, Internet vs. Non-Internet

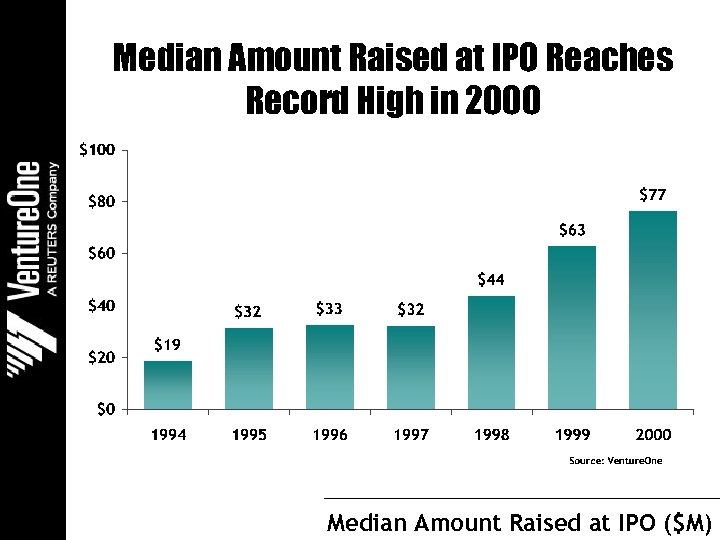

Median Amount Raised at IPO Reaches Record High in 2000 Median Amount Raised at IPO ($M)

Median Amount Raised at IPO Reaches Record High in 2000 Median Amount Raised at IPO ($M)

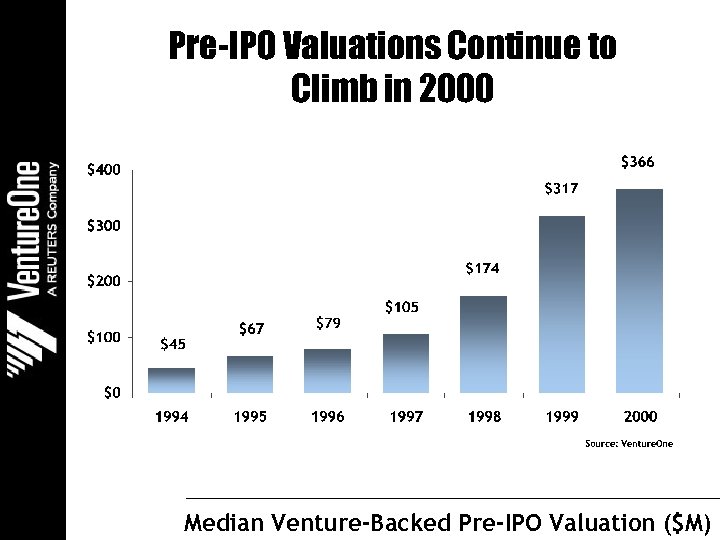

Pre-IPO Valuations Continue to Climb in 2000 Median Venture-Backed Pre-IPO Valuation ($M)

Pre-IPO Valuations Continue to Climb in 2000 Median Venture-Backed Pre-IPO Valuation ($M)

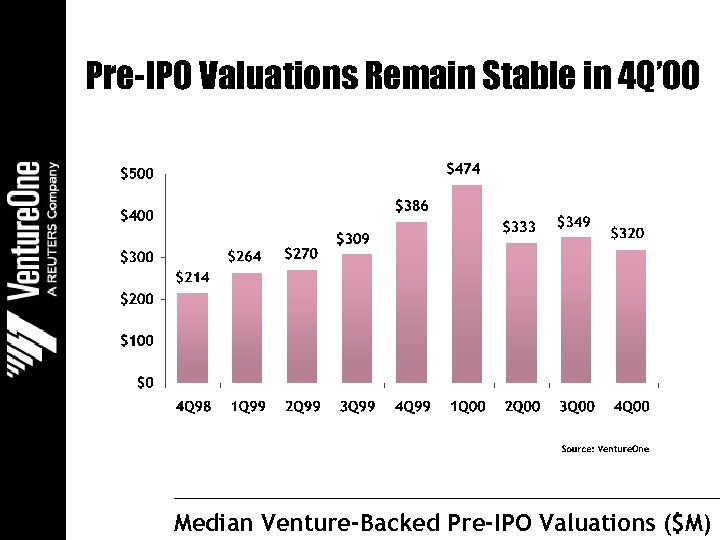

Pre-IPO Valuations Remain Stable in 4 Q’ 00 Median Venture-Backed Pre-IPO Valuations ($M)

Pre-IPO Valuations Remain Stable in 4 Q’ 00 Median Venture-Backed Pre-IPO Valuations ($M)

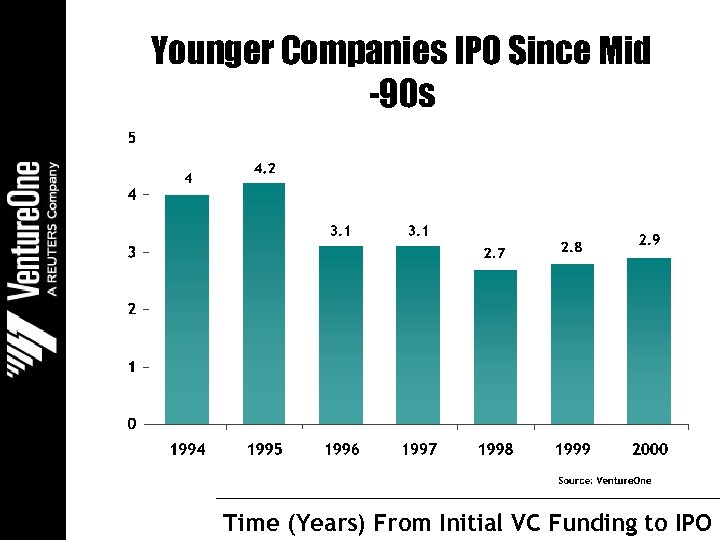

Younger Companies IPO Since Mid -90 s Time (Years) From Initial VC Funding to IPO

Younger Companies IPO Since Mid -90 s Time (Years) From Initial VC Funding to IPO

Liquidity Summary t Both the IPO and M&A markets for venture-backed companies saw substantial decreases in 4 Q’ 00. t IPO volume in 4 Q was at its lowest since 4 Q’ 98. Strong activity earlier in 2000, however, kept annual totals high. t Due to strong interest in biopharmaceuticals, healthcare IPOs raised a record amount in 2000 and saw the largest number of offerings since 1996. t Despite the 4 Q’ 00 decline, 2000 was a record year for M&As. Much of the increase is due to the high number of multibillion-dollar transactions that took place during the year.

Liquidity Summary t Both the IPO and M&A markets for venture-backed companies saw substantial decreases in 4 Q’ 00. t IPO volume in 4 Q was at its lowest since 4 Q’ 98. Strong activity earlier in 2000, however, kept annual totals high. t Due to strong interest in biopharmaceuticals, healthcare IPOs raised a record amount in 2000 and saw the largest number of offerings since 1996. t Despite the 4 Q’ 00 decline, 2000 was a record year for M&As. Much of the increase is due to the high number of multibillion-dollar transactions that took place during the year.

Conclusions t Despite caution, continued liquidity and high valuations will drive VC returns and should continue to fuel an overall healthy VC/entrepreneurship climate in the United States. Overall is not all. t Investors in the US, Europe, and Israel are increasingly pursuing opportunities outside their own borders-opportunities which include co-partnering as well as independent investment. t For more information or details, please contact corpcomm@ventureone. com.

Conclusions t Despite caution, continued liquidity and high valuations will drive VC returns and should continue to fuel an overall healthy VC/entrepreneurship climate in the United States. Overall is not all. t Investors in the US, Europe, and Israel are increasingly pursuing opportunities outside their own borders-opportunities which include co-partnering as well as independent investment. t For more information or details, please contact corpcomm@ventureone. com.

Venture. One Products & Services Online Databases t Venture. Source Online database of venture capital information with more than 11, 000 venture-backed companies, nearly 4, 000 investors—including more than 1, 100 traditional and corporate venture firms with over 2, 200 funds—and nearly 31, 000 financing transactions and 80, 000 key executives. t Compensation. Pro Online salary, bonus, and equity consultant with compensation information from over 800 venture-backed companies.

Venture. One Products & Services Online Databases t Venture. Source Online database of venture capital information with more than 11, 000 venture-backed companies, nearly 4, 000 investors—including more than 1, 100 traditional and corporate venture firms with over 2, 200 funds—and nearly 31, 000 financing transactions and 80, 000 key executives. t Compensation. Pro Online salary, bonus, and equity consultant with compensation information from over 800 venture-backed companies.

Venture. One Products & Services Venture Capital Conferences t The Summit (Spring, San Francisco) Best of breed in venture capital t The Exchange (Summer, Boston) Outstanding East Coast companies t The Premiere (Fall, Washington DC & San Jose) The nation’s best seed-stage companies t Venture Capital Europe (Spring, Paris & Winter, London) Strategies for Europe’s private equity community

Venture. One Products & Services Venture Capital Conferences t The Summit (Spring, San Francisco) Best of breed in venture capital t The Exchange (Summer, Boston) Outstanding East Coast companies t The Premiere (Fall, Washington DC & San Jose) The nation’s best seed-stage companies t Venture Capital Europe (Spring, Paris & Winter, London) Strategies for Europe’s private equity community

Venture. One Products & Services Industry Publications Customized Research t Venture. Edge (quarterly) t Comparable Valuation Reports t Venture. Mail news (weekly) To help determine a t Venture Capital Industry company’s relative value Report (annual) t Venture Capital Sourcebook (annual) t Executive Compensation at Privately Held Startup Companies (semi-annual) t Custom report services To address specific business challenges

Venture. One Products & Services Industry Publications Customized Research t Venture. Edge (quarterly) t Comparable Valuation Reports t Venture. Mail news (weekly) To help determine a t Venture Capital Industry company’s relative value Report (annual) t Venture Capital Sourcebook (annual) t Executive Compensation at Privately Held Startup Companies (semi-annual) t Custom report services To address specific business challenges