9f503f4409ad21a2dde73db0de73f9c1.ppt

- Количество слайдов: 16

Soup 2 Nuts Seminar Funding the Company Through Operations January 19, 2002

Soup 2 Nuts Seminar Funding the Company Through Operations January 19, 2002

Presentation Agenda · Tri. CN = Overview, History, Vision, Team · Dynamics within IP and IC Industries · Tri. CN’s Value, Benefits, Positioning · Funding the company through Sales · Future Funding 2 CONFIDENTIAL, © Tri. CN January 2002

Presentation Agenda · Tri. CN = Overview, History, Vision, Team · Dynamics within IP and IC Industries · Tri. CN’s Value, Benefits, Positioning · Funding the company through Sales · Future Funding 2 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Overview · In business since 1997. · Self-funded and Profitable sinception. · Originally Design Services and Consulting. · Financial · Revenue doubled every year. · Revenue for 2001 = $1. 7 M. · Clients: Over 50 established and start-up companies. 3 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Overview · In business since 1997. · Self-funded and Profitable sinception. · Originally Design Services and Consulting. · Financial · Revenue doubled every year. · Revenue for 2001 = $1. 7 M. · Clients: Over 50 established and start-up companies. 3 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Founders · Combined 50 years experience in data bandwidth density and circuit design. · Ron Nikel (CTO) · Chief Circuit Interconnect Technologist: SGI’s Origin scalable server project. · Hansel Collins (CSO) · Invented DSCC for HIPPI-6400. · John Ellis (VP Signal Integrity) · Obtained patents for FCI relating to HIPPI-6400. Tri. CN Team · Staff of 12: Diverse backgrounds. · Motorola, DEC, MIPS, SGI, Synopsys, FCI, Nortel, CDC. · Staff responsible for over 20 patents in Circuit Design. 4 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Founders · Combined 50 years experience in data bandwidth density and circuit design. · Ron Nikel (CTO) · Chief Circuit Interconnect Technologist: SGI’s Origin scalable server project. · Hansel Collins (CSO) · Invented DSCC for HIPPI-6400. · John Ellis (VP Signal Integrity) · Obtained patents for FCI relating to HIPPI-6400. Tri. CN Team · Staff of 12: Diverse backgrounds. · Motorola, DEC, MIPS, SGI, Synopsys, FCI, Nortel, CDC. · Staff responsible for over 20 patents in Circuit Design. 4 CONFIDENTIAL, © Tri. CN January 2002

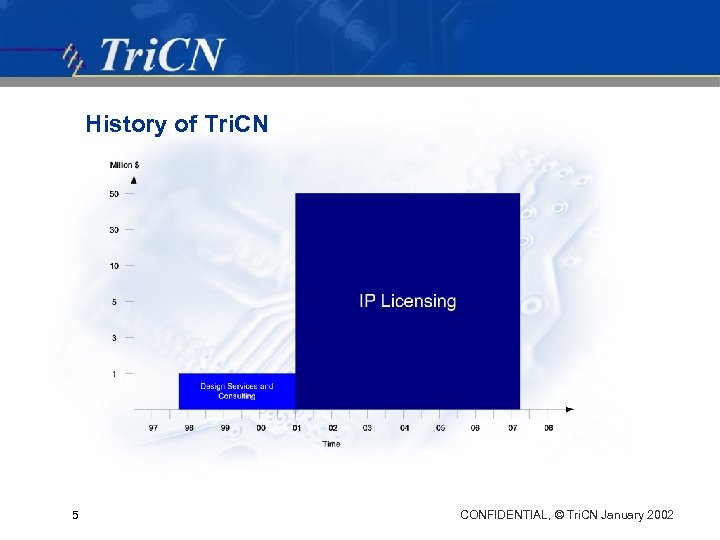

History of Tri. CN 5 CONFIDENTIAL, © Tri. CN January 2002

History of Tri. CN 5 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Today · Developer of High-Bandwidth Interface Intellectual Property (IP). Currently Licensing: · High Speed Application Specific I/O (ASI/O) IP portfolio. · High Speed PLL and Mixed Signal Circuits · Tri. DL (Digital Dynamic Deskewing Link) = High-speed interface technology applied to standard and custom I/Os. 6 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Today · Developer of High-Bandwidth Interface Intellectual Property (IP). Currently Licensing: · High Speed Application Specific I/O (ASI/O) IP portfolio. · High Speed PLL and Mixed Signal Circuits · Tri. DL (Digital Dynamic Deskewing Link) = High-speed interface technology applied to standard and custom I/Os. 6 CONFIDENTIAL, © Tri. CN January 2002

Competitive Dynamics within IP and IC Industries High-Speed Semiconductor Segment · Bleeding Edge Technology: Faster, Smaller, Less Power · Long Development Cycles: 1 -4 years · Weak Economic Climate: Downsizing = Buy (vs. Build) · Consolidation: Quick way to Advance Technology · Increased Fabless Foundry Model Based IC Production Bleeding Edge 7 Long Development Weak Economy Consolidation Strong Fabless Foundry CONFIDENTIAL, © Tri. CN January 2002

Competitive Dynamics within IP and IC Industries High-Speed Semiconductor Segment · Bleeding Edge Technology: Faster, Smaller, Less Power · Long Development Cycles: 1 -4 years · Weak Economic Climate: Downsizing = Buy (vs. Build) · Consolidation: Quick way to Advance Technology · Increased Fabless Foundry Model Based IC Production Bleeding Edge 7 Long Development Weak Economy Consolidation Strong Fabless Foundry CONFIDENTIAL, © Tri. CN January 2002

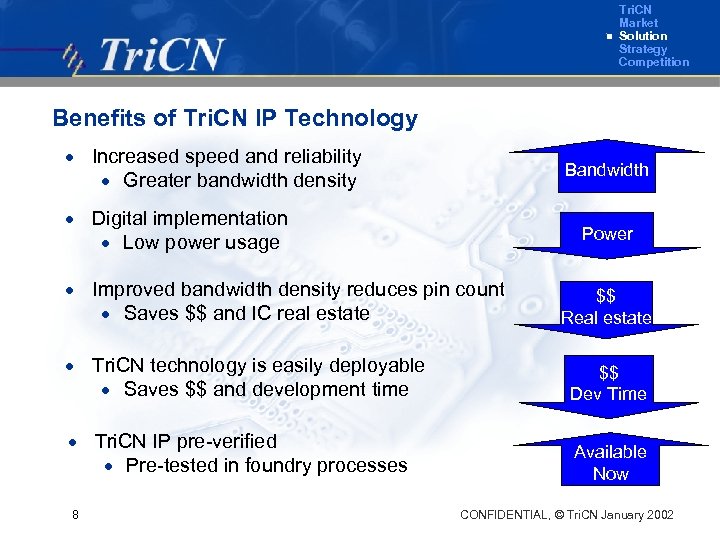

Tri. CN Market Solution Strategy Competition Benefits of Tri. CN IP Technology · Increased speed and reliability · Greater bandwidth density Bandwidth · Digital implementation · Low power usage Power · Improved bandwidth density reduces pin count · Saves $$ and IC real estate $$ Real estate · Tri. CN technology is easily deployable · Saves $$ and development time $$ Dev Time · Tri. CN IP pre-verified · Pre-tested in foundry processes Available Now 8 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Market Solution Strategy Competition Benefits of Tri. CN IP Technology · Increased speed and reliability · Greater bandwidth density Bandwidth · Digital implementation · Low power usage Power · Improved bandwidth density reduces pin count · Saves $$ and IC real estate $$ Real estate · Tri. CN technology is easily deployable · Saves $$ and development time $$ Dev Time · Tri. CN IP pre-verified · Pre-tested in foundry processes Available Now 8 CONFIDENTIAL, © Tri. CN January 2002

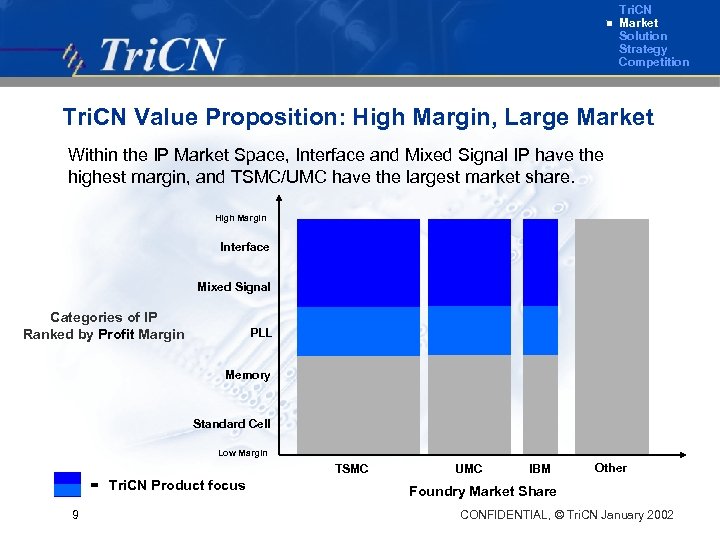

Tri. CN Market Solution Strategy Competition Tri. CN Value Proposition: High Margin, Large Market Within the IP Market Space, Interface and Mixed Signal IP have the highest margin, and TSMC/UMC have the largest market share. High Margin Interface Mixed Signal Categories of IP Ranked by Profit Margin PLL Memory Standard Cell Low Margin TSMC = Tri. CN Product focus 9 UMC IBM Other Foundry Market Share CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Market Solution Strategy Competition Tri. CN Value Proposition: High Margin, Large Market Within the IP Market Space, Interface and Mixed Signal IP have the highest margin, and TSMC/UMC have the largest market share. High Margin Interface Mixed Signal Categories of IP Ranked by Profit Margin PLL Memory Standard Cell Low Margin TSMC = Tri. CN Product focus 9 UMC IBM Other Foundry Market Share CONFIDENTIAL, © Tri. CN January 2002

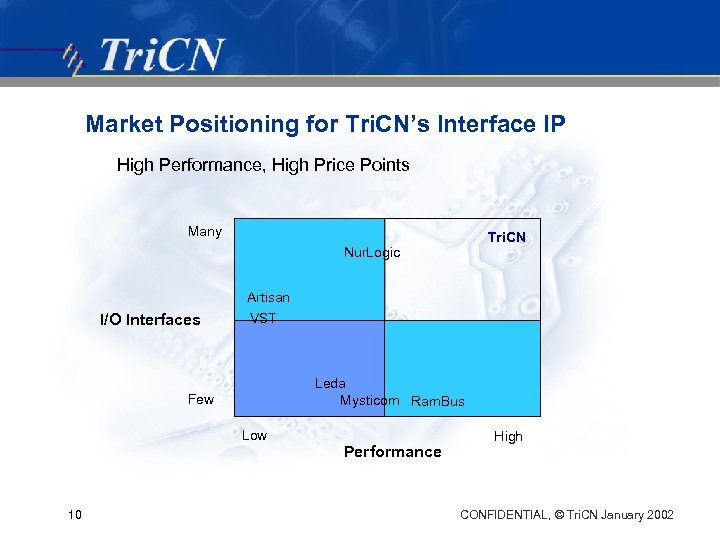

Market Positioning for Tri. CN’s Interface IP High Performance, High Price Points Many Tri. CN Nur. Logic I/O Interfaces Artisan VST Leda Mysticom Ram. Bus Few Low 10 Performance High CONFIDENTIAL, © Tri. CN January 2002

Market Positioning for Tri. CN’s Interface IP High Performance, High Price Points Many Tri. CN Nur. Logic I/O Interfaces Artisan VST Leda Mysticom Ram. Bus Few Low 10 Performance High CONFIDENTIAL, © Tri. CN January 2002

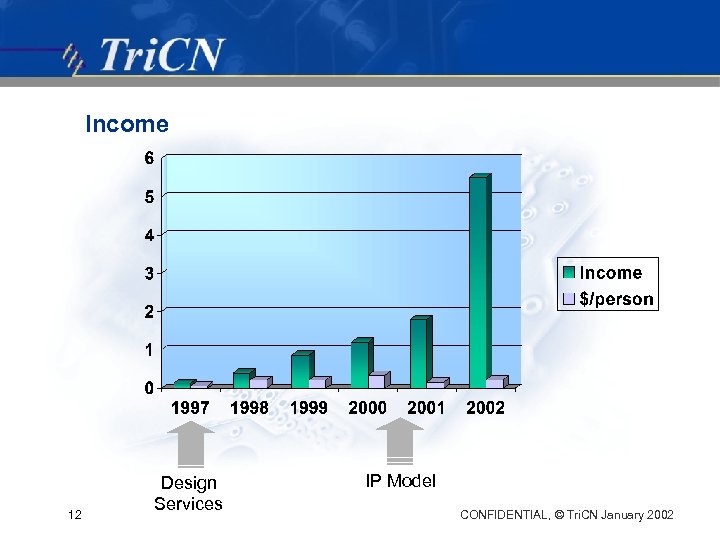

Tri. CN & 2001 Self Funding Decision · Products are high margin, high value, difficult to obtain technology solutions · Profitability easily maintained · Development and support of the products require a small highly skilled engineering team · Requirement for expanded infrastructure minimal · Initiated Marketing and Sales effort · First 3 years – stealth marketing and sales effort · Formalized but minimal efforts in the past year created hockey stick in sales and sales opportunities 11 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN & 2001 Self Funding Decision · Products are high margin, high value, difficult to obtain technology solutions · Profitability easily maintained · Development and support of the products require a small highly skilled engineering team · Requirement for expanded infrastructure minimal · Initiated Marketing and Sales effort · First 3 years – stealth marketing and sales effort · Formalized but minimal efforts in the past year created hockey stick in sales and sales opportunities 11 CONFIDENTIAL, © Tri. CN January 2002

Income 12 Design Services IP Model CONFIDENTIAL, © Tri. CN January 2002

Income 12 Design Services IP Model CONFIDENTIAL, © Tri. CN January 2002

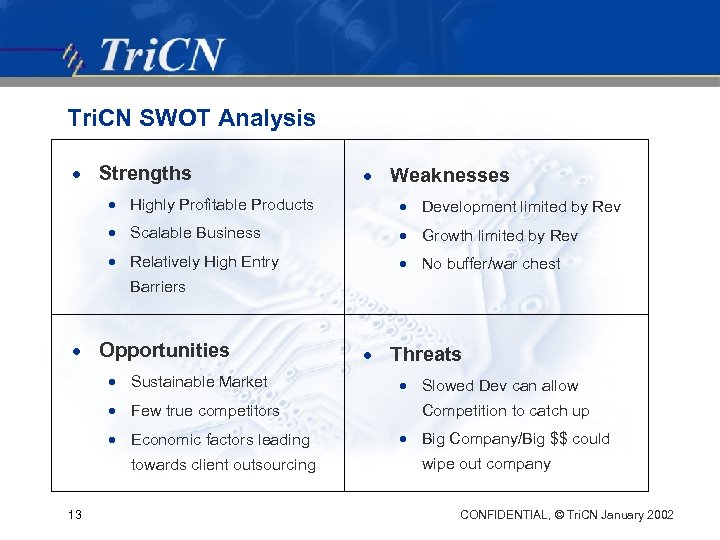

Tri. CN SWOT Analysis · Strengths · Weaknesses · Highly Profitable Products · Development limited by Rev · Scalable Business · Growth limited by Rev · Relatively High Entry · No buffer/war chest Barriers · Opportunities · Sustainable Market · Few true competitors · Economic factors leading towards client outsourcing 13 · Threats · Slowed Dev can allow Competition to catch up · Big Company/Big $$ could wipe out company CONFIDENTIAL, © Tri. CN January 2002

Tri. CN SWOT Analysis · Strengths · Weaknesses · Highly Profitable Products · Development limited by Rev · Scalable Business · Growth limited by Rev · Relatively High Entry · No buffer/war chest Barriers · Opportunities · Sustainable Market · Few true competitors · Economic factors leading towards client outsourcing 13 · Threats · Slowed Dev can allow Competition to catch up · Big Company/Big $$ could wipe out company CONFIDENTIAL, © Tri. CN January 2002

Tri. CN’s Future: 3 Options · Stay with present self-funded model · Build business/valuation as able · Exit via M&A · Limited funding - $1 -3 Million · Accelerate building of business/valuation · Exit via M&A · Larger rounds of funding - $5 + Million Series A · Allows for larger vision - IC Dev, Build through Acquisition · Immediately increases value · More Options for Exit = IPO, further M&A 14 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN’s Future: 3 Options · Stay with present self-funded model · Build business/valuation as able · Exit via M&A · Limited funding - $1 -3 Million · Accelerate building of business/valuation · Exit via M&A · Larger rounds of funding - $5 + Million Series A · Allows for larger vision - IC Dev, Build through Acquisition · Immediately increases value · More Options for Exit = IPO, further M&A 14 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Future Funding Decision · Pros · Accelerates/Ensures Development and R&D · Allows for strategic Business Growth · Buffers against bumps in the road · Reduces Stress · Cons · Reduces Upside · Must report to Board/Investors · Reduces Business Control · Reduces Control of Vision 15 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN Future Funding Decision · Pros · Accelerates/Ensures Development and R&D · Allows for strategic Business Growth · Buffers against bumps in the road · Reduces Stress · Cons · Reduces Upside · Must report to Board/Investors · Reduces Business Control · Reduces Control of Vision 15 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN’s Attractiveness for Funding · Pros · Proven Business · Proven Team · Proven Product · Revenue Stream · Cons · Potential Reduced Upside · Difficult to retarget · Reduced investor pool 16 CONFIDENTIAL, © Tri. CN January 2002

Tri. CN’s Attractiveness for Funding · Pros · Proven Business · Proven Team · Proven Product · Revenue Stream · Cons · Potential Reduced Upside · Difficult to retarget · Reduced investor pool 16 CONFIDENTIAL, © Tri. CN January 2002