87ca313717fb5bb29198ab293d6036ad.ppt

- Количество слайдов: 73

SOS Forms Name Reservations Registrations and Change Filings Business and Public Filings Division

SOS Forms Name Reservations Registrations and Change Filings Business and Public Filings Division

Forms Section 4. 006 of the BOC authorizes the SOS to promulgate forms for any filing instrument or report required or permitted to be filed with the SOS. Business and Public Filings Division

Forms Section 4. 006 of the BOC authorizes the SOS to promulgate forms for any filing instrument or report required or permitted to be filed with the SOS. Business and Public Filings Division

Forms 3 SOS will have BOC forms on its website in late December 2005. 3 Some, but not all, forms are on the CD included in materials 3 Use of the forms is permissive, not mandatory. Business and Public Filings Division

Forms 3 SOS will have BOC forms on its website in late December 2005. 3 Some, but not all, forms are on the CD included in materials 3 Use of the forms is permissive, not mandatory. Business and Public Filings Division

New Forms! 3 Mergers (BOC entities only) 3 Conversions (BOC entities only) 3 Exchanges (BOC Entities only) 3 Restated Certificates of Formation 3 Early Adoption of BOC 3 Name change by registered agent Business and Public Filings Division

New Forms! 3 Mergers (BOC entities only) 3 Conversions (BOC entities only) 3 Exchanges (BOC Entities only) 3 Restated Certificates of Formation 3 Early Adoption of BOC 3 Name change by registered agent Business and Public Filings Division

Forms ü To the extent possible, some SOS forms are drafted as “generic” forms in that they can be used for both BOC and non-BOC entities. 7 SOS forms for mergers, conversions, and exchanges are designed for BOC entities only. They will not work for mergers, conversions, or exchanges involving non-BOC entities. Business and Public Filings Division

Forms ü To the extent possible, some SOS forms are drafted as “generic” forms in that they can be used for both BOC and non-BOC entities. 7 SOS forms for mergers, conversions, and exchanges are designed for BOC entities only. They will not work for mergers, conversions, or exchanges involving non-BOC entities. Business and Public Filings Division

Forms Effectiveness of Filing Provision s. Option A: effective upon filing s. Option B: effective at a later date s. Option C: effective upon the occurrence of a future event (New!) Business and Public Filings Division

Forms Effectiveness of Filing Provision s. Option A: effective upon filing s. Option B: effective at a later date s. Option C: effective upon the occurrence of a future event (New!) Business and Public Filings Division

Filing Instruments Formation or registration filings effective on or after Jan. 1, 2006, will not be rejected for: – containing additional information not required by the BOC. – referencing prior law (TBCA, TLLCA, TRLPA, etc. ) – using synonymous terms (e. g. , articles of incorporation, application for certificate of authority, etc. ) Business and Public Filings Division

Filing Instruments Formation or registration filings effective on or after Jan. 1, 2006, will not be rejected for: – containing additional information not required by the BOC. – referencing prior law (TBCA, TLLCA, TRLPA, etc. ) – using synonymous terms (e. g. , articles of incorporation, application for certificate of authority, etc. ) Business and Public Filings Division

Name Reservations Under existing law, name reservations are entityspecific and cannot be transferred or used formation of another entity type. òUnder the BOC, name reservations are “generic. ” An applicant can use a reserved name to form any type of domestic filing entity. Business and Public Filings Division

Name Reservations Under existing law, name reservations are entityspecific and cannot be transferred or used formation of another entity type. òUnder the BOC, name reservations are “generic. ” An applicant can use a reserved name to form any type of domestic filing entity. Business and Public Filings Division

SOS Name Reservation Forms After Jan. 1, 2006, SOS forms will still ask for the selection of an entity type. This does not affect the “generic” nature of the name reservation. Business and Public Filings Division

SOS Name Reservation Forms After Jan. 1, 2006, SOS forms will still ask for the selection of an entity type. This does not affect the “generic” nature of the name reservation. Business and Public Filings Division

Name Reservations • Under prior law, name reservations could not be renewed. • The TBCA was amended effective Sept. 1, 2005, to allow for renewal of corporate name reservations. • By extension, name reservations for nonprofit, PC, and PA names can also be renewed prior to expiration. Business and Public Filings Division

Name Reservations • Under prior law, name reservations could not be renewed. • The TBCA was amended effective Sept. 1, 2005, to allow for renewal of corporate name reservations. • By extension, name reservations for nonprofit, PC, and PA names can also be renewed prior to expiration. Business and Public Filings Division

Name Reservations • Under the BOC, all name reservations can be renewed for additional 120 -day period. • File a new application within 30 days prior to expiration ($40). If not using SOS form, please identify the reservation as a renewal. • Renewal must be made by applicant of record. If not, transfer of name reservation required ($15). Business and Public Filings Division

Name Reservations • Under the BOC, all name reservations can be renewed for additional 120 -day period. • File a new application within 30 days prior to expiration ($40). If not using SOS form, please identify the reservation as a renewal. • Renewal must be made by applicant of record. If not, transfer of name reservation required ($15). Business and Public Filings Division

Certificate of Amendment and Restated Certificate of Formation Uniform requirements for all domestic entities. SOS has promulgated a generic: Certificate of Amendment (Form 424) Restated Certificate of Formation (with further amendments) (Form 414), and Restated Certificate of Formation (without amendments) (Form 415). Business and Public Filings Division

Certificate of Amendment and Restated Certificate of Formation Uniform requirements for all domestic entities. SOS has promulgated a generic: Certificate of Amendment (Form 424) Restated Certificate of Formation (with further amendments) (Form 414), and Restated Certificate of Formation (without amendments) (Form 415). Business and Public Filings Division

Restated Certificate of Formation ü Voting details not required. • Statement of approval still required. ü The restated certificate of formation is to be attached to the SOS form as an exhibit and entitled: “Restated Certificate of Formation of XXX” ü Restated Certificate of Formation may update certificate to reflect current names and addresses of governing persons. Business and Public Filings Division

Restated Certificate of Formation ü Voting details not required. • Statement of approval still required. ü The restated certificate of formation is to be attached to the SOS form as an exhibit and entitled: “Restated Certificate of Formation of XXX” ü Restated Certificate of Formation may update certificate to reflect current names and addresses of governing persons. Business and Public Filings Division

Amended Registration of Foreign Entity ü Foreign filing entity must amend registration within 90 days of any change to its name or the business or activity stated in its registration. § 9. 009. ü Foreign filing entity can amend its BOC registration to show conversion from one entity type to another. ü Foreign filing entity can amend its BOC registration to show merger into another foreign filing entity in order to have the survivor succeed to registration. Business and Public Filings Division

Amended Registration of Foreign Entity ü Foreign filing entity must amend registration within 90 days of any change to its name or the business or activity stated in its registration. § 9. 009. ü Foreign filing entity can amend its BOC registration to show conversion from one entity type to another. ü Foreign filing entity can amend its BOC registration to show merger into another foreign filing entity in order to have the survivor succeed to registration. Business and Public Filings Division

Other Change Filings þ If a registered agent changes his/her/its name, the registered agent (rather than the entity) can file statement with the SOS to show the name change. Business and Public Filings Division

Other Change Filings þ If a registered agent changes his/her/its name, the registered agent (rather than the entity) can file statement with the SOS to show the name change. Business and Public Filings Division

Signing False Documents BOC Chapter 4. Filings General Provisions Business and Public Filings Division

Signing False Documents BOC Chapter 4. Filings General Provisions Business and Public Filings Division

False or Fraudulent Filings Under prior law, it was a Class A misdemeanor to knowingly sign a document that was materially false with the intent that it be filed with the SOS. House Bill 1507, effective Sept. 1, 2005, amended the TBCA to increase the offense to a state jail felony if the person signing a document intended to defraud or harm another. Business and Public Filings Division

False or Fraudulent Filings Under prior law, it was a Class A misdemeanor to knowingly sign a document that was materially false with the intent that it be filed with the SOS. House Bill 1507, effective Sept. 1, 2005, amended the TBCA to increase the offense to a state jail felony if the person signing a document intended to defraud or harm another. Business and Public Filings Division

False or Fraudulent Filings BOC penalties for false or fraudulent filing As of Jan. 1, 2006, it is a Class A misdemeanor to knowingly sign a filing instrument that is materially false with the intent that it be filed with the SOS. § 4. 008 – Class A misdemeanor is punishable by a sentence of up to 180 days, a fine of up to $4, 000, or both. Business and Public Filings Division

False or Fraudulent Filings BOC penalties for false or fraudulent filing As of Jan. 1, 2006, it is a Class A misdemeanor to knowingly sign a filing instrument that is materially false with the intent that it be filed with the SOS. § 4. 008 – Class A misdemeanor is punishable by a sentence of up to 180 days, a fine of up to $4, 000, or both. Business and Public Filings Division

False or Fraudulent Filings BOC increases offense to a State jail felony if there is intent to defraud or harm another. – State jail felonies are generally punishable by a sentence of 180 days to 2 years plus a fine of up to $10, 000. Business and Public Filings Division

False or Fraudulent Filings BOC increases offense to a State jail felony if there is intent to defraud or harm another. – State jail felonies are generally punishable by a sentence of 180 days to 2 years plus a fine of up to $10, 000. Business and Public Filings Division

Enforcement The SOS does not have the power to prosecute anyone for criminal violations associated with fraudulent filings. If there is a basis for criminal action, victims can file a complaint with the District or County Attorney. Business and Public Filings Division

Enforcement The SOS does not have the power to prosecute anyone for criminal violations associated with fraudulent filings. If there is a basis for criminal action, victims can file a complaint with the District or County Attorney. Business and Public Filings Division

Civil Liabilities A person may recover civil damages if he incurs a loss caused by: • a forged filing instrument; • a filing instrument that constitutes an offense under § 4. 008; • reasonable reliance upon a false statement of material fact in a filed filing instrument; or • the omission of a material fact that is required to be in a filing instrument. § 4. 007(a) Business and Public Filings Division

Civil Liabilities A person may recover civil damages if he incurs a loss caused by: • a forged filing instrument; • a filing instrument that constitutes an offense under § 4. 008; • reasonable reliance upon a false statement of material fact in a filed filing instrument; or • the omission of a material fact that is required to be in a filing instrument. § 4. 007(a) Business and Public Filings Division

Civil Liabilities An injured person may recover from: • each person who forged or knowingly signed a false instrument; • any managerial official who directed the signing and filing of the filing instrument who knew or should have known of the false statement or omission; or • the entity that authorizes the filing of the filing instrument. § 4. 007(b) Business and Public Filings Division

Civil Liabilities An injured person may recover from: • each person who forged or knowingly signed a false instrument; • any managerial official who directed the signing and filing of the filing instrument who knew or should have known of the false statement or omission; or • the entity that authorizes the filing of the filing instrument. § 4. 007(b) Business and Public Filings Division

Enforcement The SOS does not have authority to bring suit on behalf of parties harmed by a fraudulent filing. Injured parties can initiate their own civil lawsuits. Business and Public Filings Division

Enforcement The SOS does not have authority to bring suit on behalf of parties harmed by a fraudulent filing. Injured parties can initiate their own civil lawsuits. Business and Public Filings Division

Mergers, Conversions & Exchanges Terminations --Voluntary & Involuntary Domestic and Foreign Business and Public Filings Division

Mergers, Conversions & Exchanges Terminations --Voluntary & Involuntary Domestic and Foreign Business and Public Filings Division

Mergers, Conversions & Exchanges Chapter 10 of the BOC governs the general requirements for mergers, interest exchanges, and conversions. Business and Public Filings Division

Mergers, Conversions & Exchanges Chapter 10 of the BOC governs the general requirements for mergers, interest exchanges, and conversions. Business and Public Filings Division

Chapter 10 of the BOC ü The filing of a certificate of merger is required if: Ø any domestic entity that is a party to the merger is a filing entity; or Øany domestic entity to be created under the plan of merger is a filing entity. Business and Public Filings Division

Chapter 10 of the BOC ü The filing of a certificate of merger is required if: Ø any domestic entity that is a party to the merger is a filing entity; or Øany domestic entity to be created under the plan of merger is a filing entity. Business and Public Filings Division

Chapter 10 Terminology “domestic entity” - an organization formed under or the internal affairs are governed by the BOC. “filing entity” - means a domestic entity that is a corporation, limited partnership, limited liability company, professional association, cooperative, or real estate investment trust. Business and Public Filings Division

Chapter 10 Terminology “domestic entity” - an organization formed under or the internal affairs are governed by the BOC. “filing entity” - means a domestic entity that is a corporation, limited partnership, limited liability company, professional association, cooperative, or real estate investment trust. Business and Public Filings Division

Chapter 10 Terminology “non-code organization” - means an organization other than a domestic entity J Includes a foreign corporation, bank, insurance company, or a corporation, LLC, or LP formed under “prior law” that has not elected the BOC, telephone cooperative, etc. Business and Public Filings Division

Chapter 10 Terminology “non-code organization” - means an organization other than a domestic entity J Includes a foreign corporation, bank, insurance company, or a corporation, LLC, or LP formed under “prior law” that has not elected the BOC, telephone cooperative, etc. Business and Public Filings Division

What does this mean? ü Mergers, consolidations, or conversions of non-code organizations that are controlled by special statute will continue to be governed by that special statute. s. For example, Chapter 162 of the Utilities Code will continue to govern telephone cooperative consolidations and mergers, or conversions of a corporation to a telephone cooperative. Business and Public Filings Division

What does this mean? ü Mergers, consolidations, or conversions of non-code organizations that are controlled by special statute will continue to be governed by that special statute. s. For example, Chapter 162 of the Utilities Code will continue to govern telephone cooperative consolidations and mergers, or conversions of a corporation to a telephone cooperative. Business and Public Filings Division

Transitional Filings ü An existing corporation, limited liability company, limited partnership, and general partnership that continues to be governed by “prior law” needs to comply with the prior law governing the entity in order to effect a merger, consolidation, exchange, or conversion. s For example, Article 5. 04 of the TBCA will continue to govern the merger of a Texas corporation formed prior to January 1, 2006, that is merging with a foreign corporation, unless the Texas corporation has filed an early election to adopt the BOC. Business and Public Filings Division

Transitional Filings ü An existing corporation, limited liability company, limited partnership, and general partnership that continues to be governed by “prior law” needs to comply with the prior law governing the entity in order to effect a merger, consolidation, exchange, or conversion. s For example, Article 5. 04 of the TBCA will continue to govern the merger of a Texas corporation formed prior to January 1, 2006, that is merging with a foreign corporation, unless the Texas corporation has filed an early election to adopt the BOC. Business and Public Filings Division

Cross-Statutory Transactions Q: Can an existing for-profit corporation merge with a corporation formed under the BOC? A: Yes. Both the TBCA and the BOC contemplate and authorize the merger with an “other entity” [TBCA] or “non-code organization” [BOC]. However, care must be taken to comply with the provisions of the formation statute governing each entity; that is, the filing instrument must comply with the requirements of the TBCA and the BOC. The filing instrument may be designated either as “Articles or Certificate of Merger. ” Business and Public Filings Division

Cross-Statutory Transactions Q: Can an existing for-profit corporation merge with a corporation formed under the BOC? A: Yes. Both the TBCA and the BOC contemplate and authorize the merger with an “other entity” [TBCA] or “non-code organization” [BOC]. However, care must be taken to comply with the provisions of the formation statute governing each entity; that is, the filing instrument must comply with the requirements of the TBCA and the BOC. The filing instrument may be designated either as “Articles or Certificate of Merger. ” Business and Public Filings Division

Other Issues ü Although the merger and conversion provisions of the BOC are modeled on existing law, existing law still contains some differences in filing requirements. ü Namely, information relating to the number of outstanding shares & corporate shareholder approval required of an existing domestic corporation. ü These differences must be kept in mind when drafting the articles of merger between a BOC entity and an existing entity that is a “non-code organization. ” Business and Public Filings Division

Other Issues ü Although the merger and conversion provisions of the BOC are modeled on existing law, existing law still contains some differences in filing requirements. ü Namely, information relating to the number of outstanding shares & corporate shareholder approval required of an existing domestic corporation. ü These differences must be kept in mind when drafting the articles of merger between a BOC entity and an existing entity that is a “non-code organization. ” Business and Public Filings Division

Filing Fees Effective January 1, 2006 Merger and Conversion Fees • Fees for filing certificate of merger or conversion standardized to $300. • In addition, fee imposed for filing the certificate of formation for a converted domestic filing entity or for each new domestic filing entity created by a merger. Business and Public Filings Division

Filing Fees Effective January 1, 2006 Merger and Conversion Fees • Fees for filing certificate of merger or conversion standardized to $300. • In addition, fee imposed for filing the certificate of formation for a converted domestic filing entity or for each new domestic filing entity created by a merger. Business and Public Filings Division

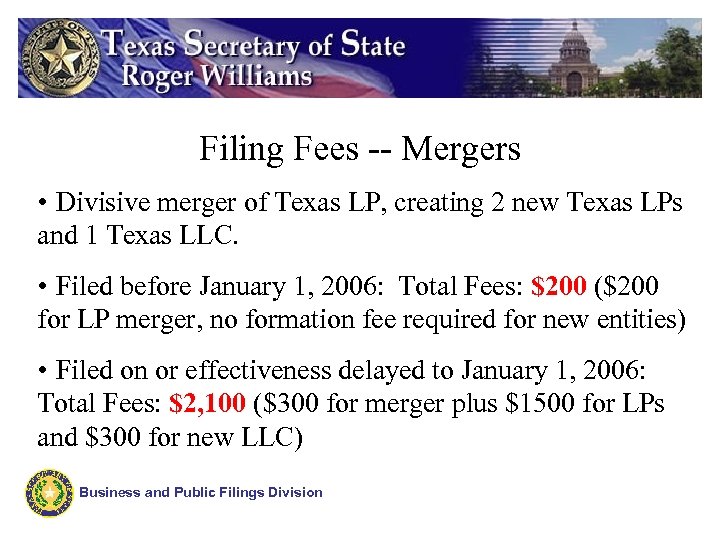

Filing Fees -- Mergers • Divisive merger of Texas LP, creating 2 new Texas LPs and 1 Texas LLC. • Filed before January 1, 2006: Total Fees: $200 ($200 for LP merger, no formation fee required for new entities) • Filed on or effectiveness delayed to January 1, 2006: Total Fees: $2, 100 ($300 for merger plus $1500 for LPs and $300 for new LLC) Business and Public Filings Division

Filing Fees -- Mergers • Divisive merger of Texas LP, creating 2 new Texas LPs and 1 Texas LLC. • Filed before January 1, 2006: Total Fees: $200 ($200 for LP merger, no formation fee required for new entities) • Filed on or effectiveness delayed to January 1, 2006: Total Fees: $2, 100 ($300 for merger plus $1500 for LPs and $300 for new LLC) Business and Public Filings Division

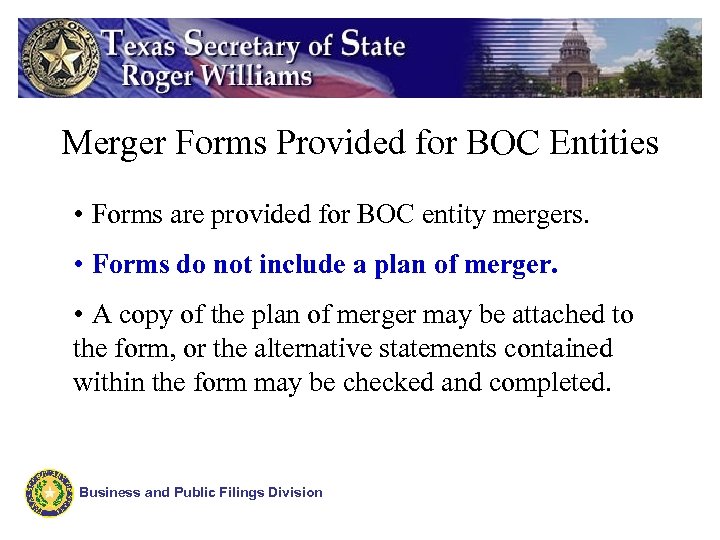

Merger Forms Provided for BOC Entities • Forms are provided for BOC entity mergers. • Forms do not include a plan of merger. • A copy of the plan of merger may be attached to the form, or the alternative statements contained within the form may be checked and completed. Business and Public Filings Division

Merger Forms Provided for BOC Entities • Forms are provided for BOC entity mergers. • Forms do not include a plan of merger. • A copy of the plan of merger may be attached to the form, or the alternative statements contained within the form may be checked and completed. Business and Public Filings Division

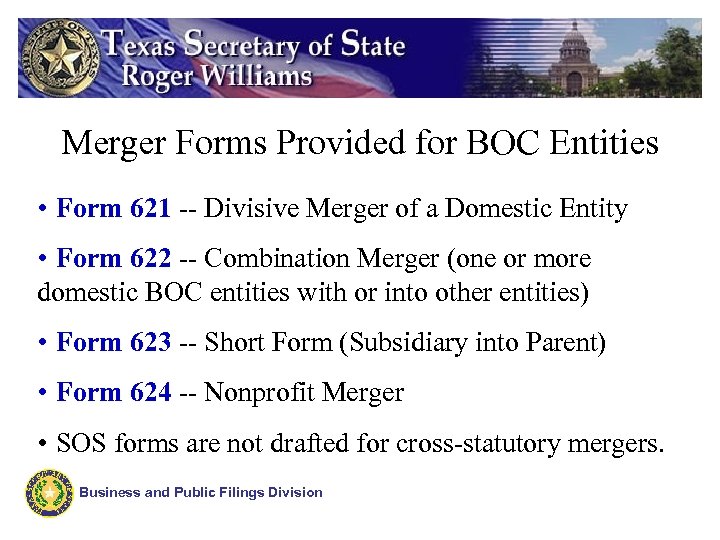

Merger Forms Provided for BOC Entities • Form 621 -- Divisive Merger of a Domestic Entity • Form 622 -- Combination Merger (one or more domestic BOC entities with or into other entities) • Form 623 -- Short Form (Subsidiary into Parent) • Form 624 -- Nonprofit Merger • SOS forms are not drafted for cross-statutory mergers. Business and Public Filings Division

Merger Forms Provided for BOC Entities • Form 621 -- Divisive Merger of a Domestic Entity • Form 622 -- Combination Merger (one or more domestic BOC entities with or into other entities) • Form 623 -- Short Form (Subsidiary into Parent) • Form 624 -- Nonprofit Merger • SOS forms are not drafted for cross-statutory mergers. Business and Public Filings Division

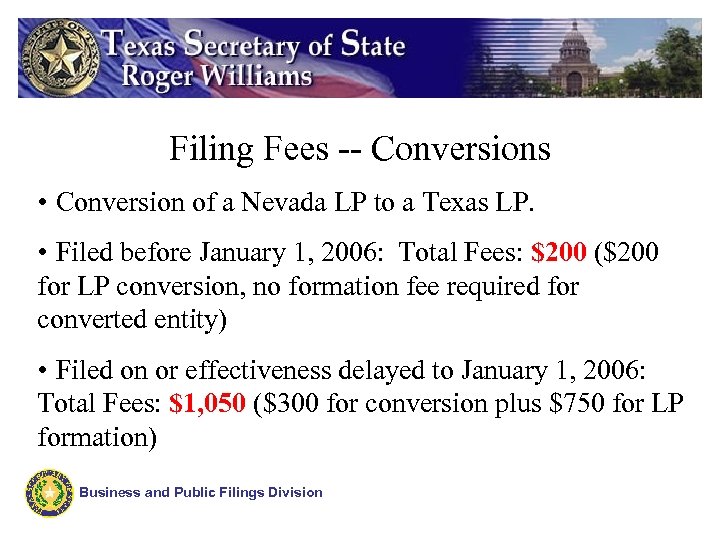

Filing Fees -- Conversions • Conversion of a Nevada LP to a Texas LP. • Filed before January 1, 2006: Total Fees: $200 ($200 for LP conversion, no formation fee required for converted entity) • Filed on or effectiveness delayed to January 1, 2006: Total Fees: $1, 050 ($300 for conversion plus $750 for LP formation) Business and Public Filings Division

Filing Fees -- Conversions • Conversion of a Nevada LP to a Texas LP. • Filed before January 1, 2006: Total Fees: $200 ($200 for LP conversion, no formation fee required for converted entity) • Filed on or effectiveness delayed to January 1, 2006: Total Fees: $1, 050 ($300 for conversion plus $750 for LP formation) Business and Public Filings Division

SOS Conversion Forms • Conversion forms are entity specific. • Conversion forms are in the 600 Series of forms • Forms 631 to 634 (Corporation as converting entity) • Forms 635 to 638 (LLC as converting entity) • Forms 641 to 644 (LP as converting entity) Business and Public Filings Division

SOS Conversion Forms • Conversion forms are entity specific. • Conversion forms are in the 600 Series of forms • Forms 631 to 634 (Corporation as converting entity) • Forms 635 to 638 (LLC as converting entity) • Forms 641 to 644 (LP as converting entity) Business and Public Filings Division

What’s New? TNPCA did not authorize the creation of a nonprofit corporation by conversion. BOC authorizes creation of a nonprofit corporation by conversion. Certificate of formation of converted entity must contain the additional statements relating to the conversion. 7 Domestic nonprofit corporation may not convert to a for-profit entity. Business and Public Filings Division

What’s New? TNPCA did not authorize the creation of a nonprofit corporation by conversion. BOC authorizes creation of a nonprofit corporation by conversion. Certificate of formation of converted entity must contain the additional statements relating to the conversion. 7 Domestic nonprofit corporation may not convert to a for-profit entity. Business and Public Filings Division

Common Errors Still Likely ü Failure to provide tax certificate evidencing good standing or alternatively, a statement in the articles of merger/conversion. ü Failure to set forth all the necessary statements in the articles of merger/conversion or alternative statement and in the certificate of formation of any domestic filing entity created by the merger or by the conversion. Business and Public Filings Division

Common Errors Still Likely ü Failure to provide tax certificate evidencing good standing or alternatively, a statement in the articles of merger/conversion. ü Failure to set forth all the necessary statements in the articles of merger/conversion or alternative statement and in the certificate of formation of any domestic filing entity created by the merger or by the conversion. Business and Public Filings Division

Conversions--Common Errors Still Likely Additional statements regarding creation by conversion and information relating to the converting entity (name, address, date of formation, jurisdiction and organizational form) are often omitted from certificate of formation of converted entity. ü Certificate of Conversion forms promulgated by the SOS do not include a certificate of formation form for the converted domestic filing entity. ü Business and Public Filings Division

Conversions--Common Errors Still Likely Additional statements regarding creation by conversion and information relating to the converting entity (name, address, date of formation, jurisdiction and organizational form) are often omitted from certificate of formation of converted entity. ü Certificate of Conversion forms promulgated by the SOS do not include a certificate of formation form for the converted domestic filing entity. ü Business and Public Filings Division

What’s New? ü A domestic nonprofit corporation may merge with a forprofit entity or non-code organization. The domestic nonprofit may not merge with a for-profit entity if: üThe domestic nonprofit corporation does not continue as the surviving entity; or üIf the nonprofit corporation will lose or impair its taxexempt status. ü Filing fee for this type of transaction: $300. Business and Public Filings Division

What’s New? ü A domestic nonprofit corporation may merge with a forprofit entity or non-code organization. The domestic nonprofit may not merge with a for-profit entity if: üThe domestic nonprofit corporation does not continue as the surviving entity; or üIf the nonprofit corporation will lose or impair its taxexempt status. ü Filing fee for this type of transaction: $300. Business and Public Filings Division

Exchanges--What’s New? ü Under existing law, articles of interest exchange are not required to be filed when: ØOne or more domestic or foreign LLCs or other entities acquire all of the outstanding interests of one or more domestic LLCs; or ØOne or more domestic or foreign LPs or other entities acquires all of the outstanding partnership interests of one or more LPs. ü A certificate of exchange is required to be filed when the LLC or LP whose interests are being acquired is a BOC entity. Business and Public Filings Division

Exchanges--What’s New? ü Under existing law, articles of interest exchange are not required to be filed when: ØOne or more domestic or foreign LLCs or other entities acquire all of the outstanding interests of one or more domestic LLCs; or ØOne or more domestic or foreign LPs or other entities acquires all of the outstanding partnership interests of one or more LPs. ü A certificate of exchange is required to be filed when the LLC or LP whose interests are being acquired is a BOC entity. Business and Public Filings Division

Chapter 11 --Terminations ü The new term for the dissolution of a domestic entity. A domestic filing entity must file a “certificate of termination” after the process of winding up the business of an entity. Filing fee: $40 ü SOS Form 651 may be used for the termination of a domestic entity, other than a nonprofit corporation or cooperative association (Form 652). Business and Public Filings Division

Chapter 11 --Terminations ü The new term for the dissolution of a domestic entity. A domestic filing entity must file a “certificate of termination” after the process of winding up the business of an entity. Filing fee: $40 ü SOS Form 651 may be used for the termination of a domestic entity, other than a nonprofit corporation or cooperative association (Form 652). Business and Public Filings Division

Certificate of Termination Required When. . In general, winding up is required when: ü the entity’s duration expires, if not perpetual; ü a voluntary determination to wind up the domestic entity has been made by the domestic entity or the owners, members, or governing authority in the manner specified in the BOC for such entity; or ü an event specified by the BOC requires the winding up or termination of the entity. Business and Public Filings Division

Certificate of Termination Required When. . In general, winding up is required when: ü the entity’s duration expires, if not perpetual; ü a voluntary determination to wind up the domestic entity has been made by the domestic entity or the owners, members, or governing authority in the manner specified in the BOC for such entity; or ü an event specified by the BOC requires the winding up or termination of the entity. Business and Public Filings Division

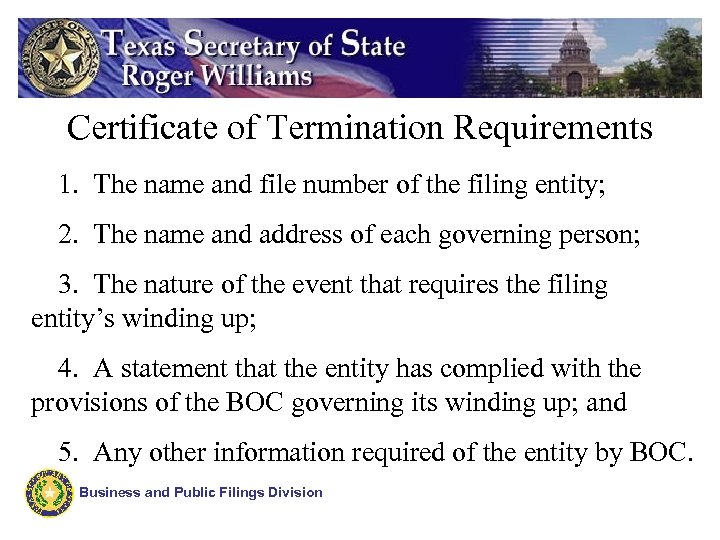

Certificate of Termination Requirements 1. The name and file number of the filing entity; 2. The name and address of each governing person; 3. The nature of the event that requires the filing entity’s winding up; 4. A statement that the entity has complied with the provisions of the BOC governing its winding up; and 5. Any other information required of the entity by BOC. Business and Public Filings Division

Certificate of Termination Requirements 1. The name and file number of the filing entity; 2. The name and address of each governing person; 3. The nature of the event that requires the filing entity’s winding up; 4. A statement that the entity has complied with the provisions of the BOC governing its winding up; and 5. Any other information required of the entity by BOC. Business and Public Filings Division

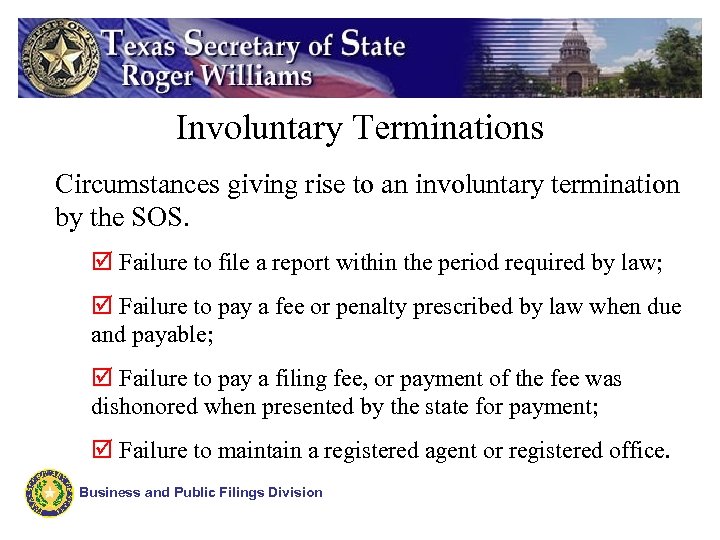

Involuntary Terminations Circumstances giving rise to an involuntary termination by the SOS. þ Failure to file a report within the period required by law; þ Failure to pay a fee or penalty prescribed by law when due and payable; þ Failure to pay a filing fee, or payment of the fee was dishonored when presented by the state for payment; þ Failure to maintain a registered agent or registered office. Business and Public Filings Division

Involuntary Terminations Circumstances giving rise to an involuntary termination by the SOS. þ Failure to file a report within the period required by law; þ Failure to pay a fee or penalty prescribed by law when due and payable; þ Failure to pay a filing fee, or payment of the fee was dishonored when presented by the state for payment; þ Failure to maintain a registered agent or registered office. Business and Public Filings Division

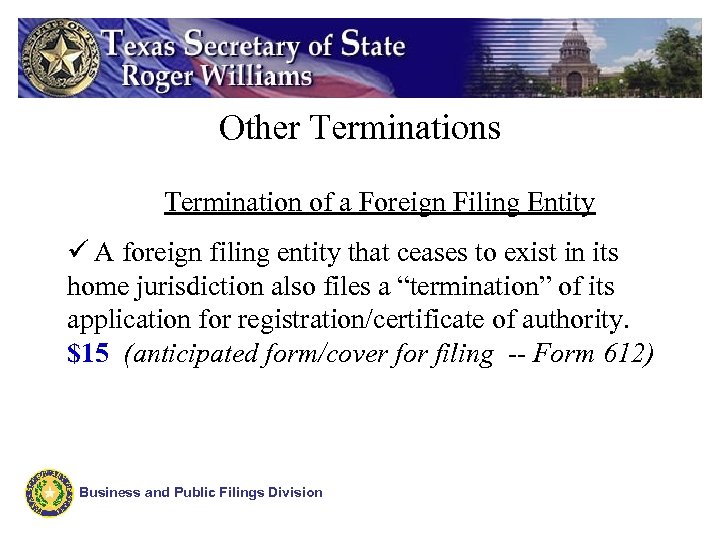

Other Terminations Termination of a Foreign Filing Entity ü A foreign filing entity that ceases to exist in its home jurisdiction also files a “termination” of its application for registration/certificate of authority. $15 (anticipated form/cover for filing -- Form 612) Business and Public Filings Division

Other Terminations Termination of a Foreign Filing Entity ü A foreign filing entity that ceases to exist in its home jurisdiction also files a “termination” of its application for registration/certificate of authority. $15 (anticipated form/cover for filing -- Form 612) Business and Public Filings Division

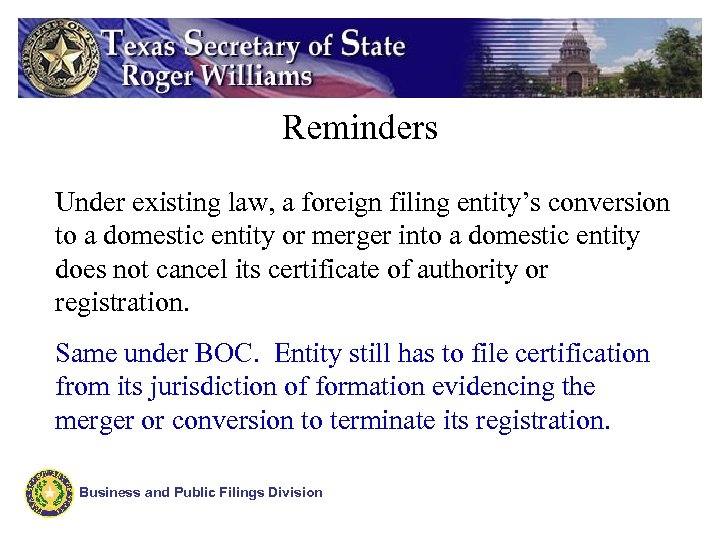

Reminders Under existing law, a foreign filing entity’s conversion to a domestic entity or merger into a domestic entity does not cancel its certificate of authority or registration. Same under BOC. Entity still has to file certification from its jurisdiction of formation evidencing the merger or conversion to terminate its registration. Business and Public Filings Division

Reminders Under existing law, a foreign filing entity’s conversion to a domestic entity or merger into a domestic entity does not cancel its certificate of authority or registration. Same under BOC. Entity still has to file certification from its jurisdiction of formation evidencing the merger or conversion to terminate its registration. Business and Public Filings Division

Reminders Ø Some generic change documents are being revised to satisfy filings for BOC and Non-BOC filing entities. Ø We will continue to accept and maintain existing entity specific forms for the change filings (e. g. , dissolution or cancellation) of domestic/foreign non. BOC entities. Business and Public Filings Division

Reminders Ø Some generic change documents are being revised to satisfy filings for BOC and Non-BOC filing entities. Ø We will continue to accept and maintain existing entity specific forms for the change filings (e. g. , dissolution or cancellation) of domestic/foreign non. BOC entities. Business and Public Filings Division

Reminders Ø Example: Revised Form being developed for Application for Withdrawal of a Foreign Entity that may be used by BOC and Non-BOC Foreign entities. Ø Current SOS Form 607 (Cancellation of LP) is used by both domestic and foreign LPs for cancellation of certificate under TRLPA. Foreign LP that has not elected to adopt the BOC may withdraw its registration by either filing. Business and Public Filings Division

Reminders Ø Example: Revised Form being developed for Application for Withdrawal of a Foreign Entity that may be used by BOC and Non-BOC Foreign entities. Ø Current SOS Form 607 (Cancellation of LP) is used by both domestic and foreign LPs for cancellation of certificate under TRLPA. Foreign LP that has not elected to adopt the BOC may withdraw its registration by either filing. Business and Public Filings Division

Reinstatements “Finality is not the language of politics. ” Benjamin Disraeli “It ain’t over til it’s over. ” Yogi Berra Business and Public Filings Division

Reinstatements “Finality is not the language of politics. ” Benjamin Disraeli “It ain’t over til it’s over. ” Yogi Berra Business and Public Filings Division

Reinstatements 3 BOC Sections 11. 201 and 11. 202 3 Reinstatements under the BOC have longer time periods during which a reinstatement can be filed 3 Change in substantive law 3 Time frames similar for all Code entities Business and Public Filings Division

Reinstatements 3 BOC Sections 11. 201 and 11. 202 3 Reinstatements under the BOC have longer time periods during which a reinstatement can be filed 3 Change in substantive law 3 Time frames similar for all Code entities Business and Public Filings Division

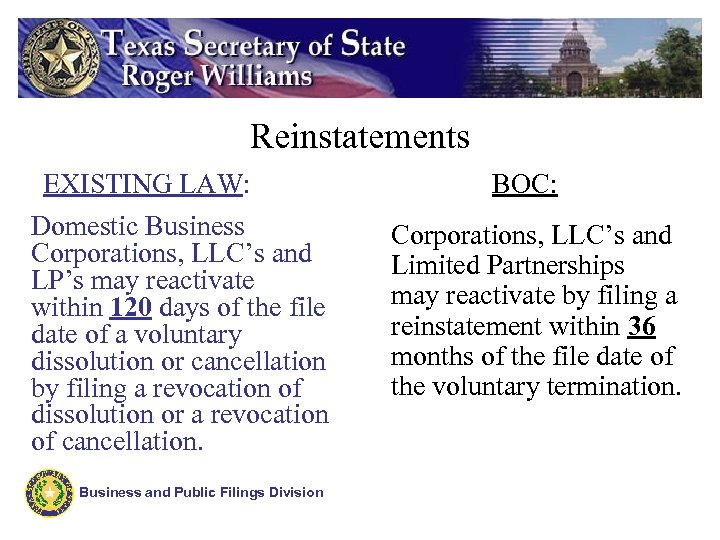

Reinstatements EXISTING LAW: Domestic Business Corporations, LLC’s and LP’s may reactivate within 120 days of the file date of a voluntary dissolution or cancellation by filing a revocation of dissolution or a revocation of cancellation. Business and Public Filings Division BOC: Corporations, LLC’s and Limited Partnerships may reactivate by filing a reinstatement within 36 months of the file date of the voluntary termination.

Reinstatements EXISTING LAW: Domestic Business Corporations, LLC’s and LP’s may reactivate within 120 days of the file date of a voluntary dissolution or cancellation by filing a revocation of dissolution or a revocation of cancellation. Business and Public Filings Division BOC: Corporations, LLC’s and Limited Partnerships may reactivate by filing a reinstatement within 36 months of the file date of the voluntary termination.

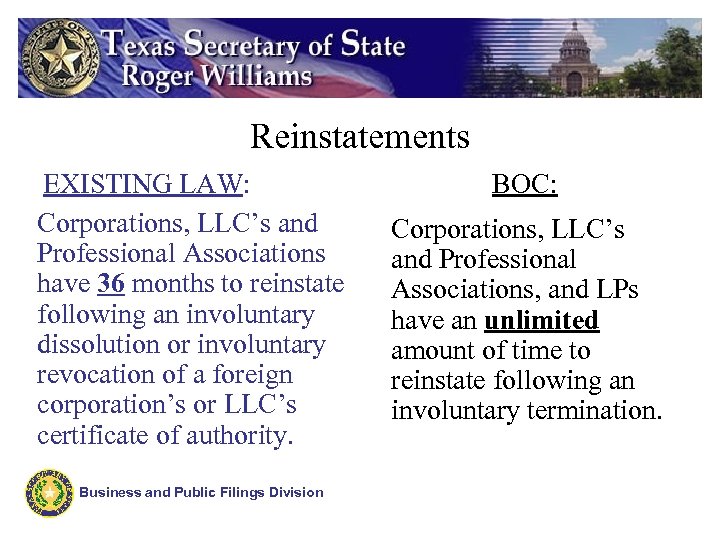

Reinstatements EXISTING LAW: Corporations, LLC’s and Professional Associations have 36 months to reinstate following an involuntary dissolution or involuntary revocation of a foreign corporation’s or LLC’s certificate of authority. Business and Public Filings Division BOC: Corporations, LLC’s and Professional Associations, and LPs have an unlimited amount of time to reinstate following an involuntary termination.

Reinstatements EXISTING LAW: Corporations, LLC’s and Professional Associations have 36 months to reinstate following an involuntary dissolution or involuntary revocation of a foreign corporation’s or LLC’s certificate of authority. Business and Public Filings Division BOC: Corporations, LLC’s and Professional Associations, and LPs have an unlimited amount of time to reinstate following an involuntary termination.

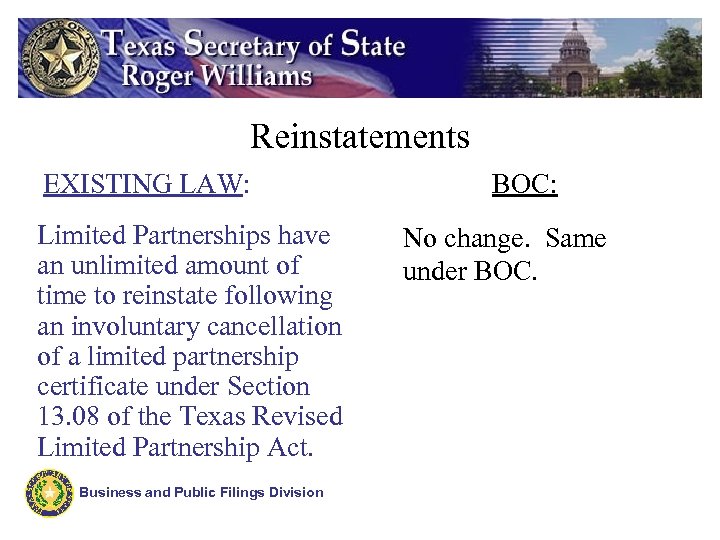

Reinstatements EXISTING LAW: Limited Partnerships have an unlimited amount of time to reinstate following an involuntary cancellation of a limited partnership certificate under Section 13. 08 of the Texas Revised Limited Partnership Act. Business and Public Filings Division BOC: No change. Same under BOC.

Reinstatements EXISTING LAW: Limited Partnerships have an unlimited amount of time to reinstate following an involuntary cancellation of a limited partnership certificate under Section 13. 08 of the Texas Revised Limited Partnership Act. Business and Public Filings Division BOC: No change. Same under BOC.

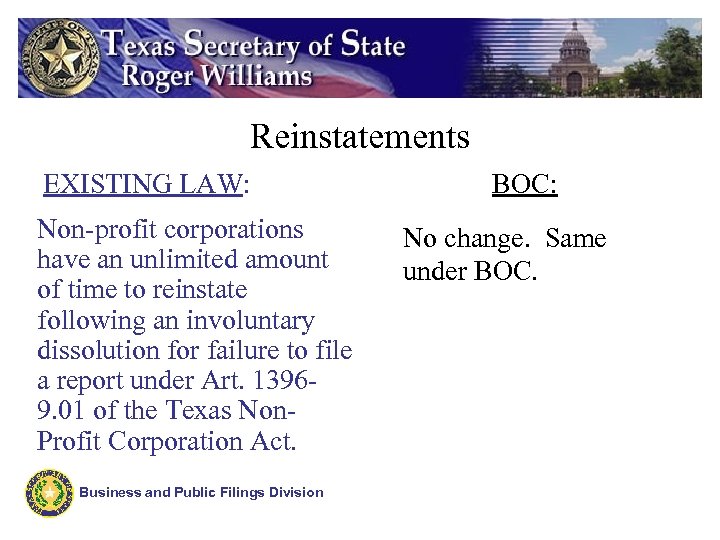

Reinstatements EXISTING LAW: Non-profit corporations have an unlimited amount of time to reinstate following an involuntary dissolution for failure to file a report under Art. 13969. 01 of the Texas Non. Profit Corporation Act. Business and Public Filings Division BOC: No change. Same under BOC.

Reinstatements EXISTING LAW: Non-profit corporations have an unlimited amount of time to reinstate following an involuntary dissolution for failure to file a report under Art. 13969. 01 of the Texas Non. Profit Corporation Act. Business and Public Filings Division BOC: No change. Same under BOC.

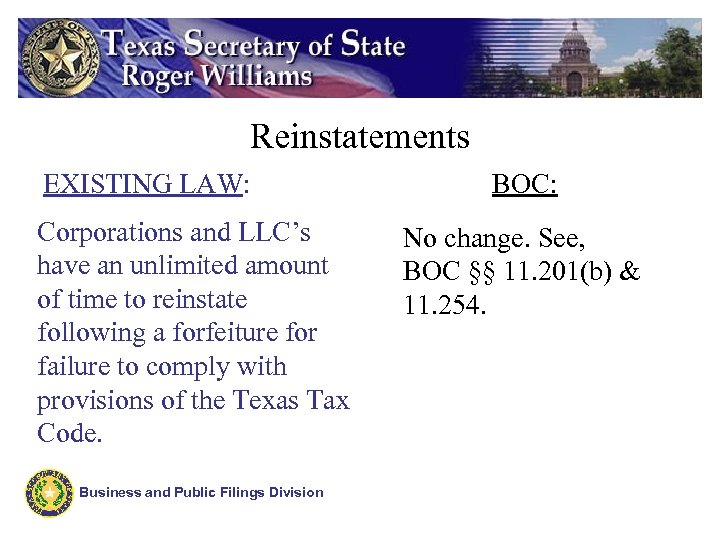

Reinstatements EXISTING LAW: Corporations and LLC’s have an unlimited amount of time to reinstate following a forfeiture for failure to comply with provisions of the Texas Tax Code. Business and Public Filings Division BOC: No change. See, BOC §§ 11. 201(b) & 11. 254.

Reinstatements EXISTING LAW: Corporations and LLC’s have an unlimited amount of time to reinstate following a forfeiture for failure to comply with provisions of the Texas Tax Code. Business and Public Filings Division BOC: No change. See, BOC §§ 11. 201(b) & 11. 254.

Reinstatements Tax Code Reinstatements (Revivals of Charter) continue to be governed by the Tax Code. See, §§ 171. 312 through 171. 315 of the Texas Tax Code. BOC sets the fee for reinstatements following a tax forfeiture for-profit corporations and LLCs at $75. Business and Public Filings Division

Reinstatements Tax Code Reinstatements (Revivals of Charter) continue to be governed by the Tax Code. See, §§ 171. 312 through 171. 315 of the Texas Tax Code. BOC sets the fee for reinstatements following a tax forfeiture for-profit corporations and LLCs at $75. Business and Public Filings Division

Reinstatement Following a Voluntary Termination • Entity terminated inadvertently or by mistake; • Termination occurred without the approval of the entity’s governing persons when approval required by BOC; • Entity terminated before winding up completed; or • The entity’s legal existence is necessary to convey or assign property, to settle or release a claim or liability, to take an action, or sign an instrument or agreement. Business and Public Filings Division

Reinstatement Following a Voluntary Termination • Entity terminated inadvertently or by mistake; • Termination occurred without the approval of the entity’s governing persons when approval required by BOC; • Entity terminated before winding up completed; or • The entity’s legal existence is necessary to convey or assign property, to settle or release a claim or liability, to take an action, or sign an instrument or agreement. Business and Public Filings Division

BOC Reinstatement Requirements • Reinstatement must be approved in manner provided by the BOC; • Entity name must be available; • Tax clearance for reinstatement; and • If involuntarily terminated, entity must correct circumstances giving rise to involuntary termination. • Reinstatement must provide registered agent/office information. Business and Public Filings Division

BOC Reinstatement Requirements • Reinstatement must be approved in manner provided by the BOC; • Entity name must be available; • Tax clearance for reinstatement; and • If involuntarily terminated, entity must correct circumstances giving rise to involuntary termination. • Reinstatement must provide registered agent/office information. Business and Public Filings Division

Transition Issues Dissolved, Canceled or Revoked Entity • A domestic or foreign filing entity that has been dissolved, canceled, or revoked under prior law may reinstate under prior law or under the BOC. • More liberal time periods may make BOC reinstatement more attractive. • If reinstating under BOC, an early adoption statement must be simultaneously submitted. Business and Public Filings Division

Transition Issues Dissolved, Canceled or Revoked Entity • A domestic or foreign filing entity that has been dissolved, canceled, or revoked under prior law may reinstate under prior law or under the BOC. • More liberal time periods may make BOC reinstatement more attractive. • If reinstating under BOC, an early adoption statement must be simultaneously submitted. Business and Public Filings Division

Reinstatements • A domestic or foreign filing entity that has been dissolved by Court Order may not be reinstated by a BOC filing. Business and Public Filings Division

Reinstatements • A domestic or foreign filing entity that has been dissolved by Court Order may not be reinstated by a BOC filing. Business and Public Filings Division

Limited Liability Partnerships Business and Public Filings Division

Limited Liability Partnerships Business and Public Filings Division

BOC Governs All LLP Filings After January 1, 2006 • New registrations • Renewals • Amendments Business and Public Filings Division

BOC Governs All LLP Filings After January 1, 2006 • New registrations • Renewals • Amendments Business and Public Filings Division

Application of BOC to LLPs Partnership formed and registered as LLP before 1/1/2006: Effective registration under prior law continues to be governed by prior law until expiration of its current term of registration. Renewal governed by BOC. Prior law continues to govern other matters until 1/1/2010, unless BOC earlier adopted. Business and Public Filings Division

Application of BOC to LLPs Partnership formed and registered as LLP before 1/1/2006: Effective registration under prior law continues to be governed by prior law until expiration of its current term of registration. Renewal governed by BOC. Prior law continues to govern other matters until 1/1/2010, unless BOC earlier adopted. Business and Public Filings Division

Application of BOC to LLPs Partnership formed before 1/1/2006, but making its initial registration on or after 1/1/2006: Registration as LLP, renewal of registration and liability of partners governed by BOC. Prior law would continue to govern other matters until 01/01/2010 unless BOC earlier adopted. Business and Public Filings Division

Application of BOC to LLPs Partnership formed before 1/1/2006, but making its initial registration on or after 1/1/2006: Registration as LLP, renewal of registration and liability of partners governed by BOC. Prior law would continue to govern other matters until 01/01/2010 unless BOC earlier adopted. Business and Public Filings Division

Application of BOC to LLPs Domestic or foreign LLPs are not subject to entity name availability standards--Identical and Deceptively Similar Names 3 Name however must include the appropriate organizational designation set forth in Chapter 5. Business and Public Filings Division

Application of BOC to LLPs Domestic or foreign LLPs are not subject to entity name availability standards--Identical and Deceptively Similar Names 3 Name however must include the appropriate organizational designation set forth in Chapter 5. Business and Public Filings Division

Foreign Limited Liability Partnerships. • Annual registration • New registrations of foreign LLPs are governed by BOC even if foreign LLP formed in its home jurisdiction prior to BOC. • Foreign LLP is a limited liability partnership formed in a state other than Texas. • No out-of-country LLPs Business and Public Filings Division

Foreign Limited Liability Partnerships. • Annual registration • New registrations of foreign LLPs are governed by BOC even if foreign LLP formed in its home jurisdiction prior to BOC. • Foreign LLP is a limited liability partnership formed in a state other than Texas. • No out-of-country LLPs Business and Public Filings Division

Foreign Limited Liability Partnerships. • Not a foreign filing entity, however: 3 Many provisions applicable to foreign filing entities made applicable to the foreign LLP. 3 For example, application for registration governed by Section 9. 007 and Section 152. 905 3 Also subject to same late filing penalties as foreign filing entities. Business and Public Filings Division

Foreign Limited Liability Partnerships. • Not a foreign filing entity, however: 3 Many provisions applicable to foreign filing entities made applicable to the foreign LLP. 3 For example, application for registration governed by Section 9. 007 and Section 152. 905 3 Also subject to same late filing penalties as foreign filing entities. Business and Public Filings Division

Foreign Limited Liability Limited Partnerships • • • Dual registration required under the provisions of the TRLPA and TRPA. Dual registration continued under the BOC late filing penalty will be assessed on both registrations if not filed within 90 days of beginning date of doing business in Texas. Business and Public Filings Division

Foreign Limited Liability Limited Partnerships • • • Dual registration required under the provisions of the TRLPA and TRPA. Dual registration continued under the BOC late filing penalty will be assessed on both registrations if not filed within 90 days of beginning date of doing business in Texas. Business and Public Filings Division

Foreign Limited Liability Limited Partnerships TRLPA & TRPA do not authorize involuntary cancellation of a foreign LP or foreign LLP registration for failure to maintain a registered agent/registered office. Failure to maintain a registered agent or registered office address will subject a BOC-entity to involuntary termination under Chapter 11 or involuntary revocation under Chapter 9. Business and Public Filings Division

Foreign Limited Liability Limited Partnerships TRLPA & TRPA do not authorize involuntary cancellation of a foreign LP or foreign LLP registration for failure to maintain a registered agent/registered office. Failure to maintain a registered agent or registered office address will subject a BOC-entity to involuntary termination under Chapter 11 or involuntary revocation under Chapter 9. Business and Public Filings Division

Limited Liability Partnerships-Reminder • The Secretary of State has often sent renewal notices; however, you should always maintain your own tickler system for renewal since the SOS is not required to send a notice of renewal. • Failure to receive a notice of renewal does not extend registration. • Renewal after expiration cannot be filed. Business and Public Filings Division

Limited Liability Partnerships-Reminder • The Secretary of State has often sent renewal notices; however, you should always maintain your own tickler system for renewal since the SOS is not required to send a notice of renewal. • Failure to receive a notice of renewal does not extend registration. • Renewal after expiration cannot be filed. Business and Public Filings Division