Some issues concerning international diversification of investment portfolios D. W. Stewart, Chief Investment Officer J. M. Finn & Co. Salisbury House, London Wall, London EC 2 M 5 TA Authorised and regulated by FSA, Member of the London Stock Exchange plc.

Some issues concerning international diversification of investment portfolios D. W. Stewart, Chief Investment Officer J. M. Finn & Co. Salisbury House, London Wall, London EC 2 M 5 TA Authorised and regulated by FSA, Member of the London Stock Exchange plc.

Journalist: “You’re a legendary film star, and one of the most handsome men in the world. With all the temptations that must come your way, how come you’re still happily married? ” Paul Newman: “Why go out for hamburger, when you can stay at home and have fillet steak? ”

Journalist: “You’re a legendary film star, and one of the most handsome men in the world. With all the temptations that must come your way, how come you’re still happily married? ” Paul Newman: “Why go out for hamburger, when you can stay at home and have fillet steak? ”

Sorry, Paul, but sometimes…. …. Hamburgers are good for you!

Sorry, Paul, but sometimes…. …. Hamburgers are good for you!

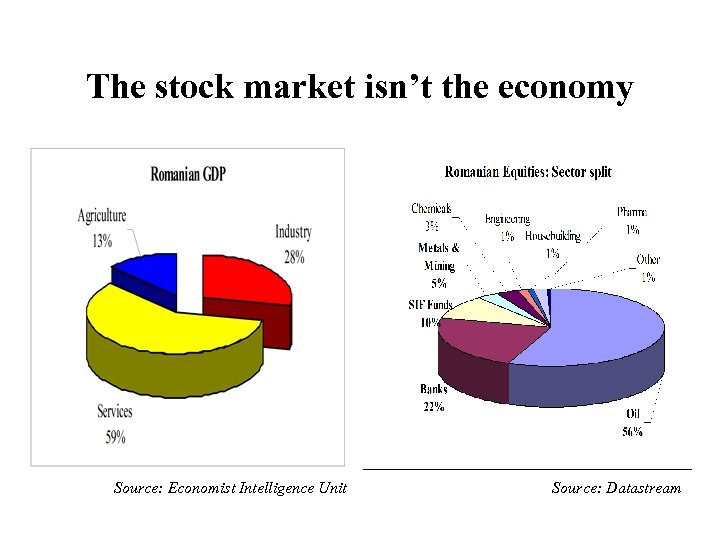

The stock market isn’t the economy Source: Economist Intelligence Unit Source: Datastream

The stock market isn’t the economy Source: Economist Intelligence Unit Source: Datastream

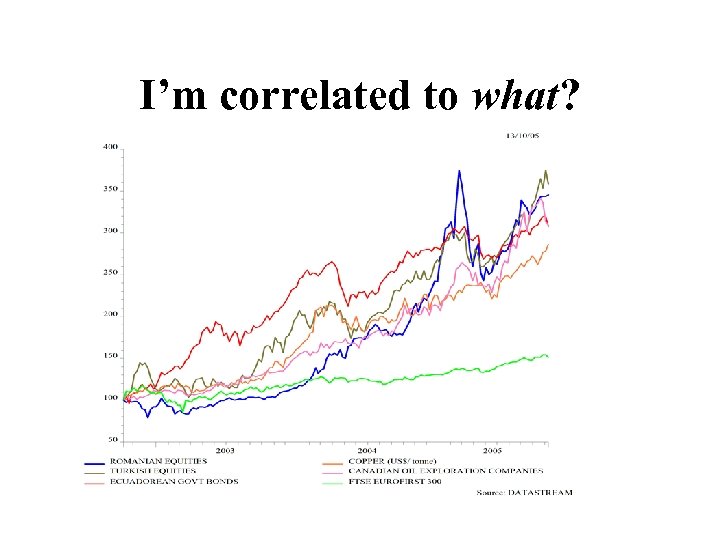

I’m correlated to what?

I’m correlated to what?

The need for international diversification • The Romanian economy is not reflected in the Romanian stockmarket • Longer term, a rise in your portfolios’ liabilities may not be compensated for by a concomitant rise in the stockmarket. This is not good news for your clients. • Shorter term, why care? The Romanian stock market is rising strongly…. • … but for factors completely beyond the control of Romanian investors. If it rises for no direct reason, it can just as easily fall for no reason to do with Romania. You may have no warnings, and no chance to exit. • Romanian investors shouldn’t only stay at home. Risk should be diversified through international investment

The need for international diversification • The Romanian economy is not reflected in the Romanian stockmarket • Longer term, a rise in your portfolios’ liabilities may not be compensated for by a concomitant rise in the stockmarket. This is not good news for your clients. • Shorter term, why care? The Romanian stock market is rising strongly…. • … but for factors completely beyond the control of Romanian investors. If it rises for no direct reason, it can just as easily fall for no reason to do with Romania. You may have no warnings, and no chance to exit. • Romanian investors shouldn’t only stay at home. Risk should be diversified through international investment

My investment approach • Step 1: Avoid the nightmares • Step 2: Prudently diversify amongst the remaining options

My investment approach • Step 1: Avoid the nightmares • Step 2: Prudently diversify amongst the remaining options

The key to diversification • Effective diversification is NOT about negating or diluting existing investment decisions • It IS about finding uncorrelated investment opportunities • But how to find lack of correlation? Don’t we all live in one big “global economy”? • Actually, no…

The key to diversification • Effective diversification is NOT about negating or diluting existing investment decisions • It IS about finding uncorrelated investment opportunities • But how to find lack of correlation? Don’t we all live in one big “global economy”? • Actually, no…

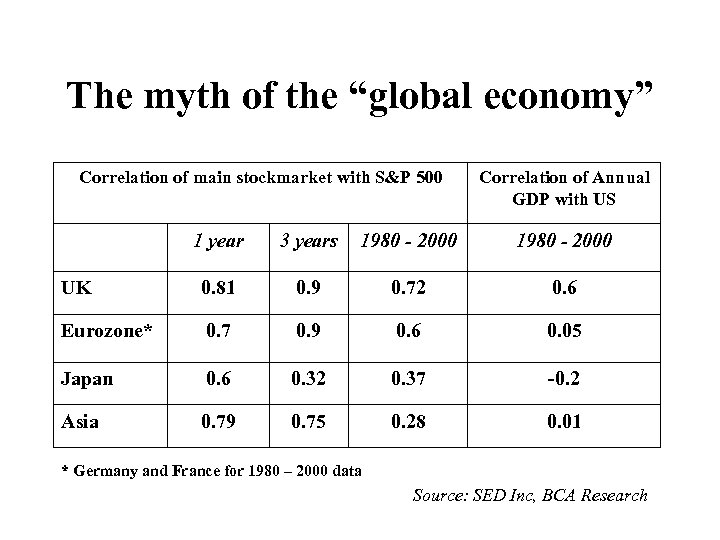

The myth of the “global economy” Correlation of main stockmarket with S&P 500 Correlation of Annual GDP with US 1 year 3 years 1980 - 2000 UK 0. 81 0. 9 0. 72 0. 6 Eurozone* 0. 7 0. 9 0. 6 0. 05 Japan 0. 6 0. 32 0. 37 -0. 2 Asia 0. 79 0. 75 0. 28 0. 01 * Germany and France for 1980 – 2000 data Source: SED Inc, BCA Research

The myth of the “global economy” Correlation of main stockmarket with S&P 500 Correlation of Annual GDP with US 1 year 3 years 1980 - 2000 UK 0. 81 0. 9 0. 72 0. 6 Eurozone* 0. 7 0. 9 0. 6 0. 05 Japan 0. 6 0. 32 0. 37 -0. 2 Asia 0. 79 0. 75 0. 28 0. 01 * Germany and France for 1980 – 2000 data Source: SED Inc, BCA Research

Implications & Opportunities • Economies are uncorrelated, but stock markets are correlated. Doesn’t this imply that similar economic exposures are being priced differently around the world? • Some of these exposures will be uncorrelated to the elements of one’s existing portfolio • Thus, an investor might wish to look around the world to see where are the “cheapest” units of economic growth determined by factors such as demographic change

Implications & Opportunities • Economies are uncorrelated, but stock markets are correlated. Doesn’t this imply that similar economic exposures are being priced differently around the world? • Some of these exposures will be uncorrelated to the elements of one’s existing portfolio • Thus, an investor might wish to look around the world to see where are the “cheapest” units of economic growth determined by factors such as demographic change

Where are the “nightmares”? • The security of the herd is illusory: crowded spaces are dangerous places • Risk appetite is very high around the world • There are two specific risks in the global investment environment: Oil and the US Consumer. • Oil has implications for the vast majority of otherwise uncorrelated economies.

Where are the “nightmares”? • The security of the herd is illusory: crowded spaces are dangerous places • Risk appetite is very high around the world • There are two specific risks in the global investment environment: Oil and the US Consumer. • Oil has implications for the vast majority of otherwise uncorrelated economies.

Conclusions • Investment risk should be diversified on international markets. • Effective diversification IS about finding uncorrelated investment opportunities. • This IS achievable, because we don’t live in a unified “global economy”. • Avoid the nightmares, then diversify amongst what’s left.

Conclusions • Investment risk should be diversified on international markets. • Effective diversification IS about finding uncorrelated investment opportunities. • This IS achievable, because we don’t live in a unified “global economy”. • Avoid the nightmares, then diversify amongst what’s left.

VĂ MULŢUMESC

VĂ MULŢUMESC