54603d59a0543ed63b7a5b6ce21e9aa9.ppt

- Количество слайдов: 44

solutions client institutional banking Institutional Banking Performance and Strategy Michael Katz Commonwealth Bank of Australia 27 September 2001

institutional banking client solutions Disclaimer The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation, 27 September 2001. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate.

Outline solutions • Strategy institutional banking • Performance 2000/01 client • IB’s Business • People • Environment

institutional banking client solutions IB’s Business An integrated, client focussed capital and risk management business

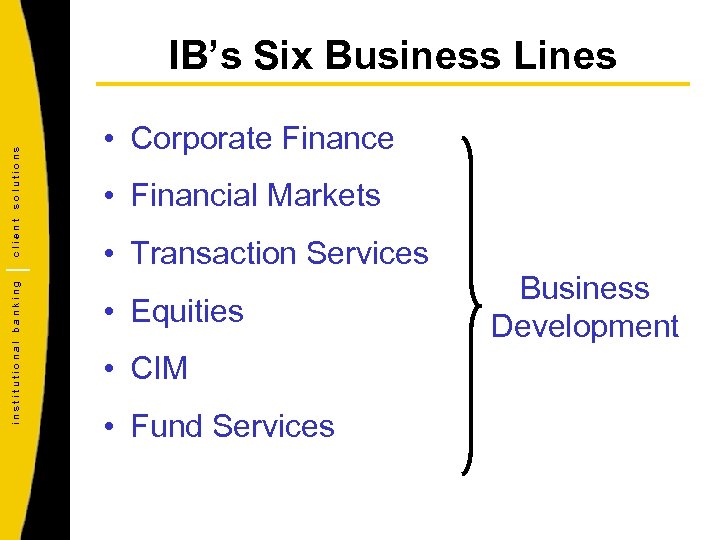

institutional banking client solutions IB’s Six Business Lines • Corporate Finance • Financial Markets • Transaction Services • Equities • CIM • Fund Services Business Development

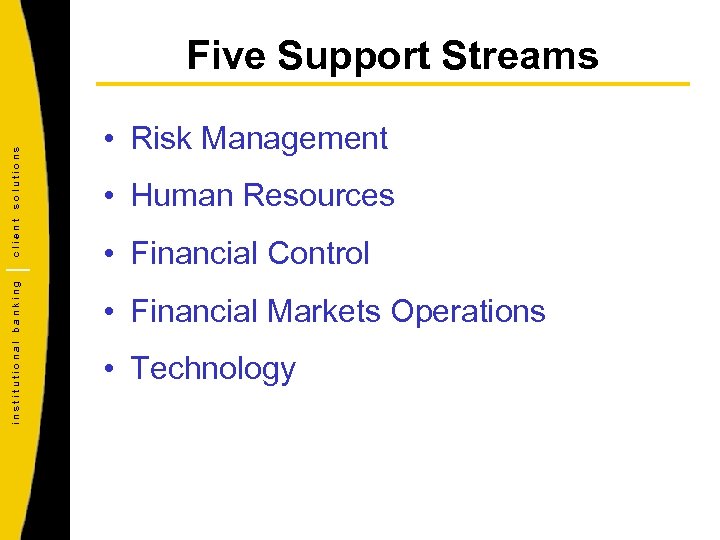

institutional banking client solutions Five Support Streams • Risk Management • Human Resources • Financial Control • Financial Markets Operations • Technology

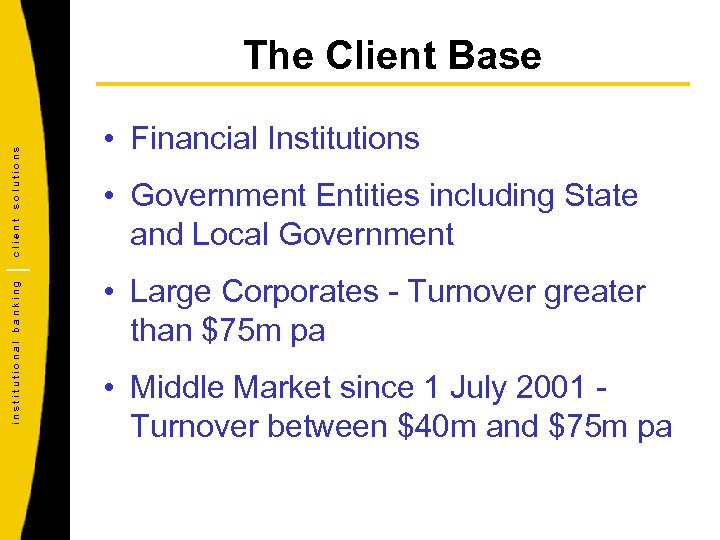

institutional banking client solutions The Client Base • Financial Institutions • Government Entities including State and Local Government • Large Corporates - Turnover greater than $75 m pa • Middle Market since 1 July 2001 Turnover between $40 m and $75 m pa

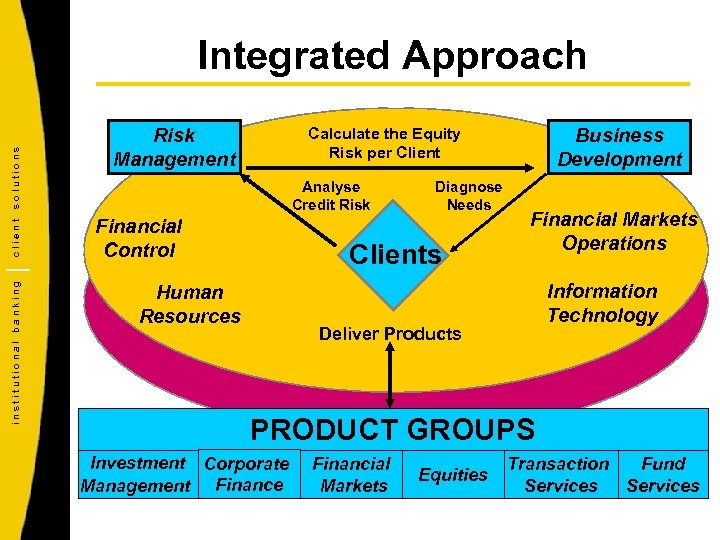

institutional banking client solutions Integrated Approach Risk Management Business Development Calculate the Equity Risk per Client Analyse Credit Risk Financial Control Diagnose Needs Clients Human Resources Financial Markets Operations Information Technology Deliver Products PRODUCT GROUPS Investment Corporate Management Finance Financial Markets Equities Transaction Fund Services

Outline institutional banking client solutions • IB’s Business • Performance 2000/01 • Strategy • People • Environment

institutional banking client solutions Highlights of 2000/01 • Colonial integration completed in Jan 01 • Growth in Corporate Finance and internationalisation • Trading income up 30% • Equities – Implementation of Voice. Broker – Entry to IPOs

institutional banking client solutions Highlights of 2000/01 - contd • Development of Funds Management /Fund Services products focussed on IB’s origination skills • Integration of Middle Market business

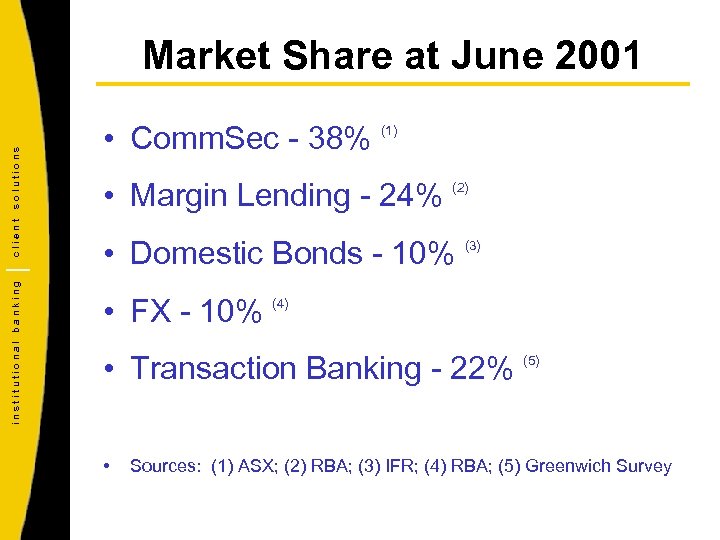

institutional banking client solutions Market Share at June 2001 • Comm. Sec - 38% (1) • Margin Lending - 24% (2) • Domestic Bonds - 10% (3) • FX - 10% (4) • Transaction Banking - 22% (5) • Sources: (1) ASX; (2) RBA; (3) IFR; (4) RBA; (5) Greenwich Survey

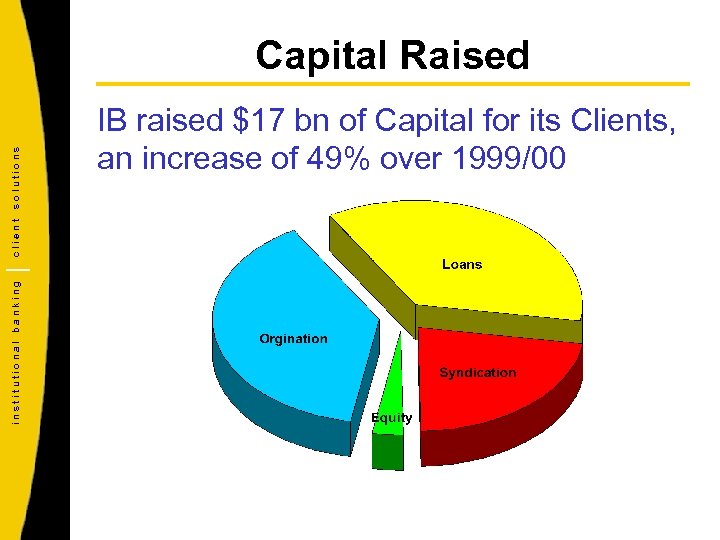

institutional banking client solutions Capital Raised IB raised $17 bn of Capital for its Clients, an increase of 49% over 1999/00

Outline institutional banking client solutions • IB’s Business • Performance 2000/01 • Strategy • People • Environment

institutional banking client solutions IB’s Strategy An integrated, client focussed capital and risk management business operating domestically and in niche markets offshore

institutional banking client solutions Migration to a Flow Business • Commercial banks are a stock business - rely on balances for revenue • Flow business - transition through the balance sheet • IB’s dependency on the lending business is reducing

institutional banking client solutions Competitive Advantage • Broad range of products • Preferred access to both wholesale and retail clients • Developing skills in product integration

institutional banking client solutions What Makes us Different? • Risk Management • Client Service • Products • International • People

institutional banking client solutions Risk Management Superior risk management compared to Investment Banks • Credit Risk • Market Risk • Operational Risk

institutional banking client solutions Credit Risk Management • KMV • Large Credit Exposure Policy • Highly skilled analysis Diversification is key

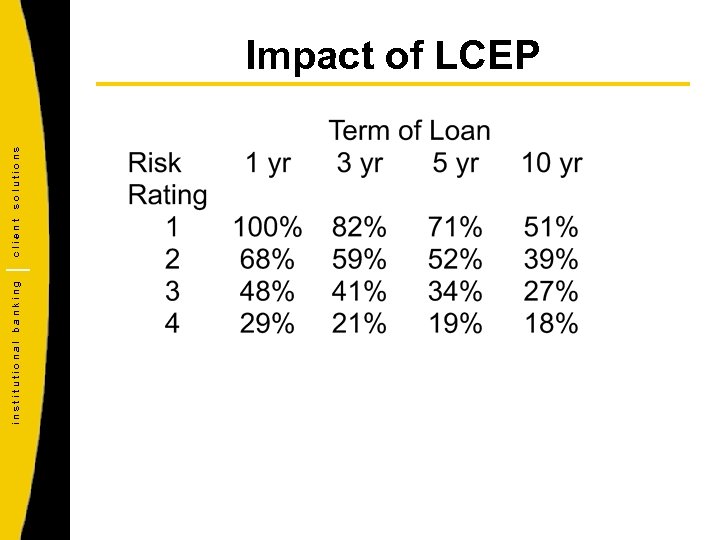

institutional banking client solutions Impact of LCEP

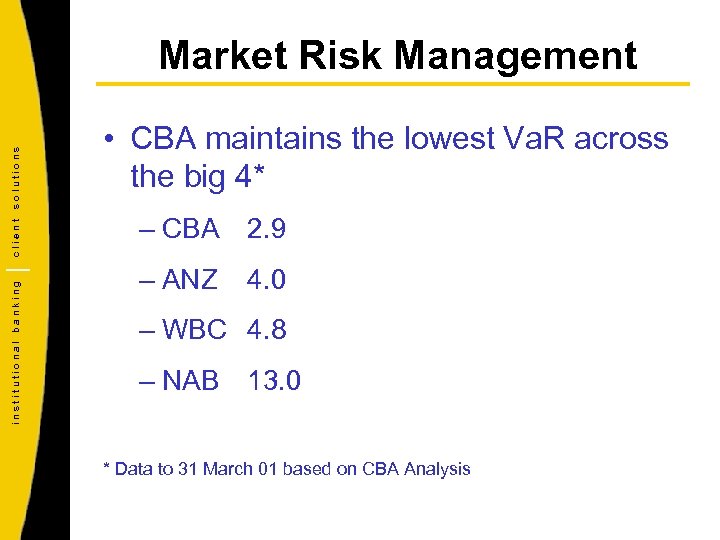

institutional banking client solutions Market Risk Management • CBA maintains the lowest Va. R across the big 4* – CBA 2. 9 – ANZ 4. 0 – WBC 4. 8 – NAB 13. 0 * Data to 31 March 01 based on CBA Analysis

institutional banking client solutions Client Service is Paramount • Unique presence in Australian market place • Have a relatively lower cost base • Will succeed by providing better broader service to the chosen segment • Lack international client and product coverage of global competitors

institutional banking client solutions Better Service is our Business Model is better Business Development, better Risk Management and bundled product delivery • Continuity of Coverage • Quality and Transparency • Responsiveness • Innovation

institutional banking client solutions Innovation • Financial Technology • “Technology” Technology

institutional banking client solutions Innovation Financial Technology • Cross Border Leases • Royal Bank of Scotland • Computer. Fleet

institutional banking client solutions Technology Innovation • Develop technology for client self service • Examples: e. Comm. Corporate Comm. Sec - Voice. Broker • Ensures cost effective service levels

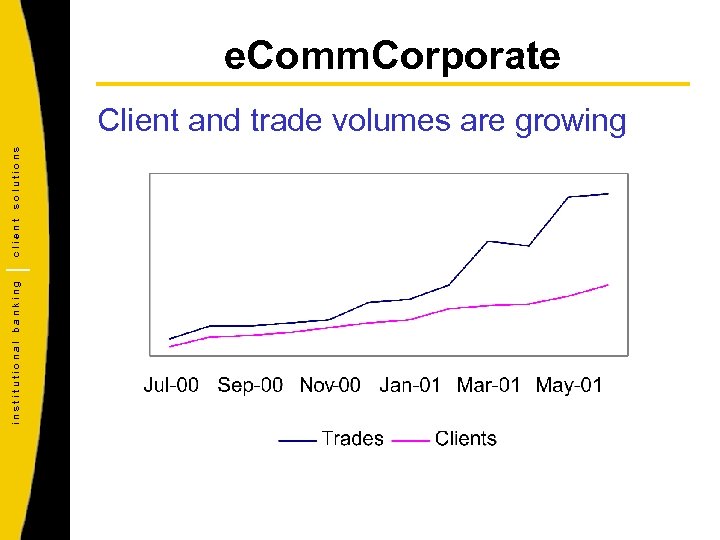

e. Comm. Corporate institutional banking client solutions Client and trade volumes are growing

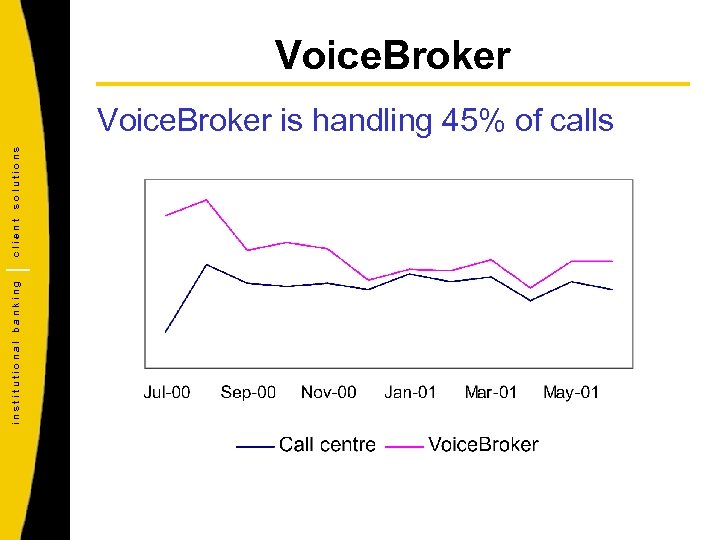

Voice. Broker institutional banking client solutions Voice. Broker is handling 45% of calls

institutional banking client solutions Product Set • Broad product range servicing providers and users of capital - retail & wholesale • Equities business • Corporate Finance focus on risk adjusted return • Exportable products

institutional banking client solutions International Strategy • Product focus rather than client focus • Growth from product initiatives – distribute institutional equity offshore – export Computer. Fleet technology – residual value risk - ships, planes, trains • Develop position as Asian Dollar Bloc specialist - AUD, NZD, HKD

Outline institutional banking client solutions • IB’s Business • Performance 2000/01 • Strategy • People • Environment

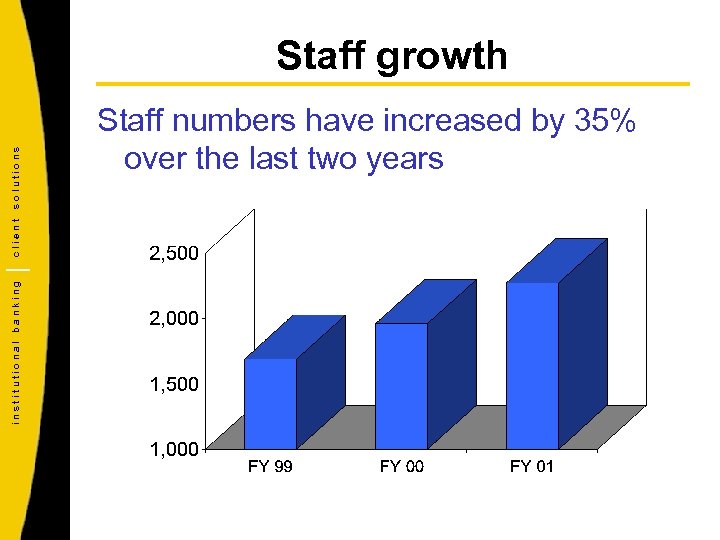

institutional banking client solutions Staff growth Staff numbers have increased by 35% over the last two years

institutional banking client solutions The Best Team • Executive team of 12 with average of 45 and 23 years post-graduate experience each • Intranet based 360 degree performance review for all staff • International staff rotation program - 25 Australian staff posted overseas

institutional banking client solutions Remuneration Model Remuneration system is closely aligned with business performance with incentive payments based on a factor of: • Year on year growth in net profit after tax • Return on Target Equity

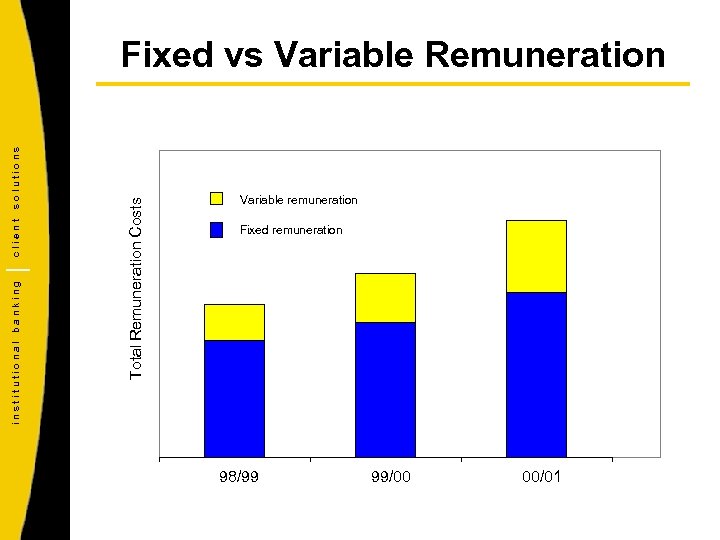

Total Remuneration Costs institutional banking client solutions Fixed vs Variable Remuneration Variable remuneration Fixed remuneration 98/99 99/00 00/01

institutional banking client solutions People Segmentation Strategy Risk and Relationship - Provide client continuity and service levels required - Domestic skill base Product - Provide the focus for international expansion - Have international skill sets - Accept a degree of turnover

Outline institutional banking client solutions • IB’s Business • Performance 2000/01 • Strategy • People • Environment

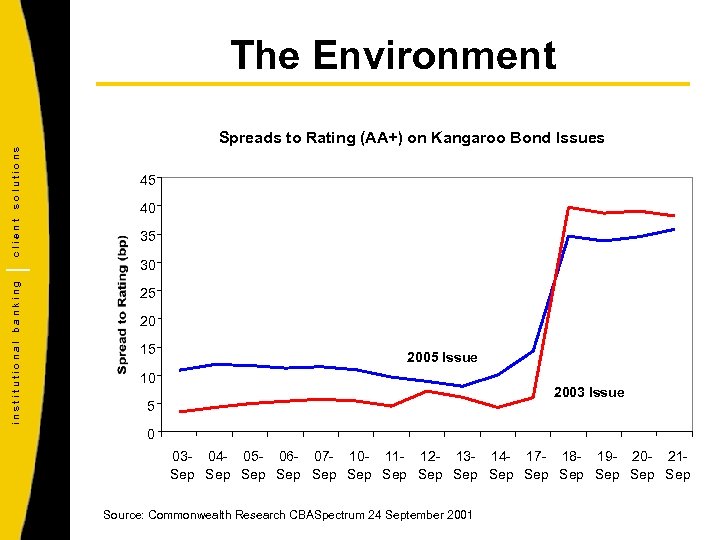

The Environment solutions 45 client Spreads to Rating (AA+) on Kangaroo Bond Issues 35 40 institutional banking 30 25 20 15 2005 Issue 10 2003 Issue 5 0 03 - 04 - 05 - 06 - 07 - 10 - 11 - 12 - 13 - 14 - 17 - 18 - 19 - 20 - 21 Sep Sep Sep Sep Source: Commonwealth Research CBASpectrum 24 September 2001

institutional banking client solutions The Environment We are caught between a rock and a hard place

institutional banking client solutions The Rock The most dangerous words in Financial Services: “This time it’s different”

institutional banking client solutions The Hard Place “Generals (Management) always prepare to fight the last war not the next”

institutional banking client solutions Summary Mean reversion suggests that after 20 years of exceptional growth we should expect a long hard drought

institutional banking client solutions Conclusion • Focus on Costs • Focus on Large Exposures • Focus on Continuity

54603d59a0543ed63b7a5b6ce21e9aa9.ppt