2ee3b2cc7a3ca43bf0a7017fa013c75b.ppt

- Количество слайдов: 25

SOLAR TAX CREDITS Green Homes and Sustainable Communities August 7 and 8, 2008 Jeffrey S. Lesk Nixon Peabody LLP

Affordable Housing New Markets Tax Credits Historic Renewable Energy

Affordable Housing New Markets Tax Credits Historic Renewable Energy

Why Solar? • • Escalating energy costs Uncontrollable costs Unpredictable costs Caps on rental income

Sizing and Selecting Solar Array • • • Consult with Engineer Building Footprint/Configuration Electrical Demand Load Who pays utilities? Cost (consider tax credits, rebates, net metering) • Amount of available LIHTCs

Designing for Solar • • Building Footprint/Configuration Lot Size Land Use Restrictions Battery Back-up/Inversion Equipment (design and location) • Integrated Design • Only part of the energy reduction puzzle

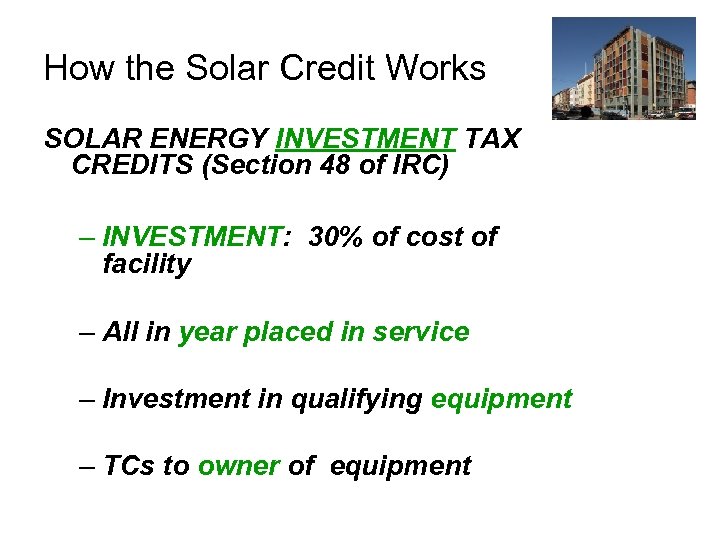

How the Solar Credit Works SOLAR ENERGY INVESTMENT TAX CREDITS (Section 48 of IRC) – INVESTMENT: 30% of cost of facility – All in year placed in service – Investment in qualifying equipment – TCs to owner of equipment

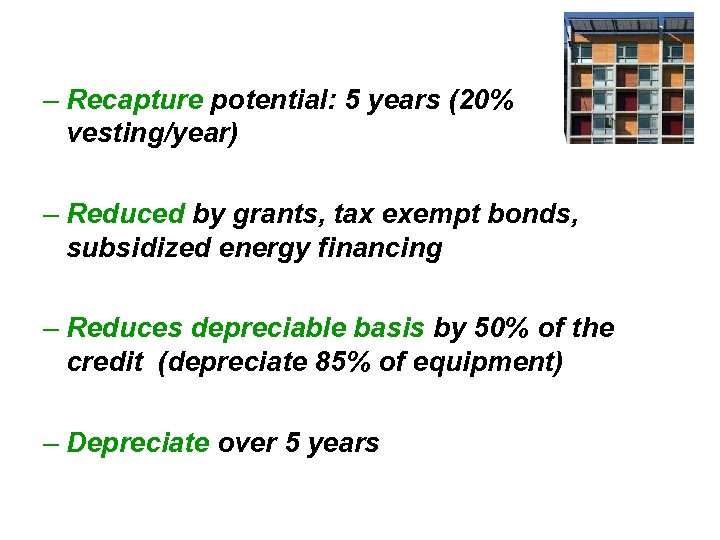

– Recapture potential: 5 years (20% vesting/year) – Reduced by grants, tax exempt bonds, subsidized energy financing – Reduces depreciable basis by 50% of the credit (depreciate 85% of equipment) – Depreciate over 5 years

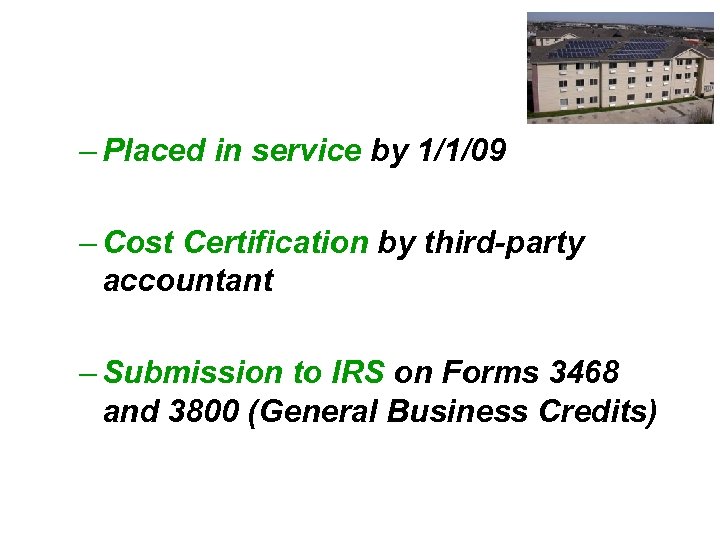

– Placed in service by 1/1/09 – Cost Certification by third-party accountant – Submission to IRS on Forms 3468 and 3800 (General Business Credits)

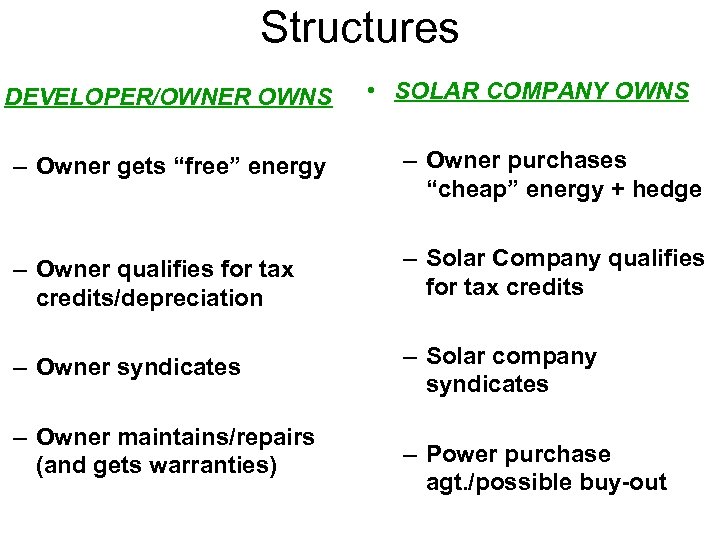

Structures DEVELOPER/OWNER OWNS • SOLAR COMPANY OWNS – Owner gets “free” energy – Owner purchases “cheap” energy + hedge – Owner qualifies for tax credits/depreciation – Solar Company qualifies for tax credits – Owner syndicates – Solar company syndicates – Owner maintains/repairs (and gets warranties) – Power purchase agt. /possible buy-out

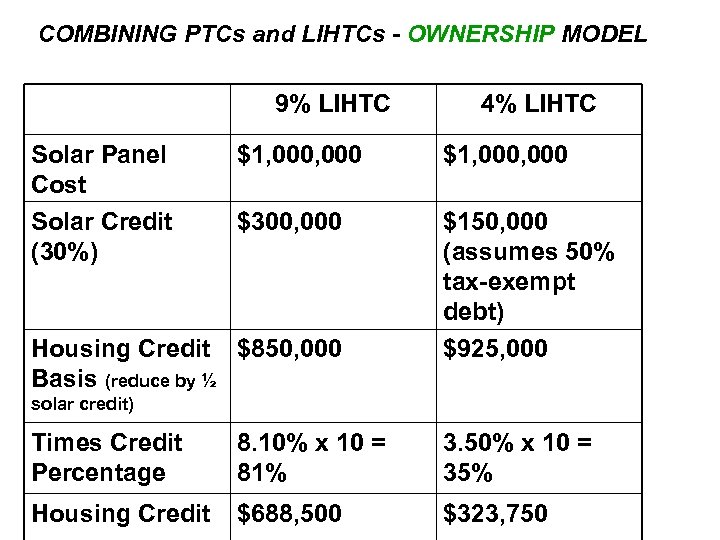

COMBINING PTCs and LIHTCs - OWNERSHIP MODEL 9% LIHTC Solar Panel Cost Solar Credit (30%) 4% LIHTC $1, 000, 000 $300, 000 $150, 000 (assumes 50% tax-exempt debt) $925, 000 Housing Credit $850, 000 Basis (reduce by ½ solar credit) Times Credit Percentage 8. 10% x 10 = 81% 3. 50% x 10 = 35% Housing Credit $688, 500 $323, 750

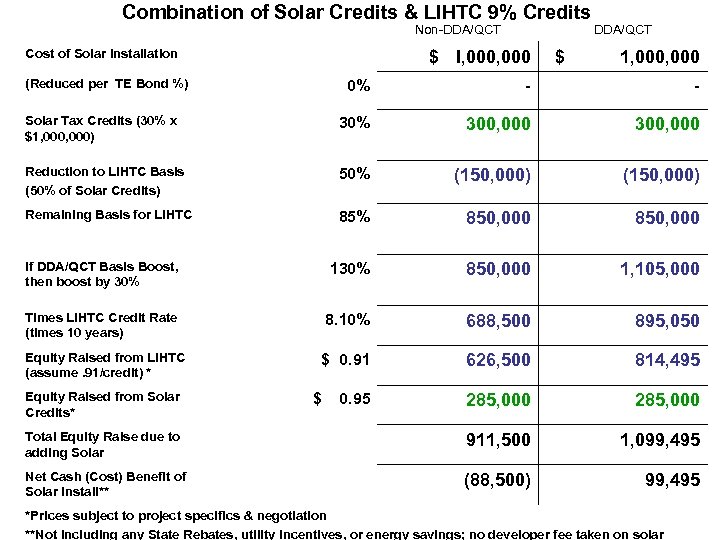

Combination of Solar Credits & LIHTC 9% Credits Non-DDA/QCT Cost of Solar Installation $ I, 000 (Reduced per TE Bond %) $ DDA/QCT 1, 000 0% - - Solar Tax Credits (30% x $1, 000) 30% 300, 000 Reduction to LIHTC Basis (50% of Solar Credits) 50% (150, 000) Remaining Basis for LIHTC 85% 850, 000 If DDA/QCT Basis Boost, then boost by 30% 130% 850, 000 1, 105, 000 Times LIHTC Credit Rate (times 10 years) 8. 10% 688, 500 895, 050 Equity Raised from LIHTC (assume. 91/credit) * $ 0. 91 626, 500 814, 495 285, 000 Total Equity Raise due to adding Solar 911, 500 1, 099, 495 Net Cash (Cost) Benefit of Solar Install** (88, 500) 99, 495 Equity Raised from Solar Credits* $ 0. 95 *Prices subject to project specifics & negotiation **Not including any State Rebates, utility incentives, or energy savings; no developer fee taken on solar

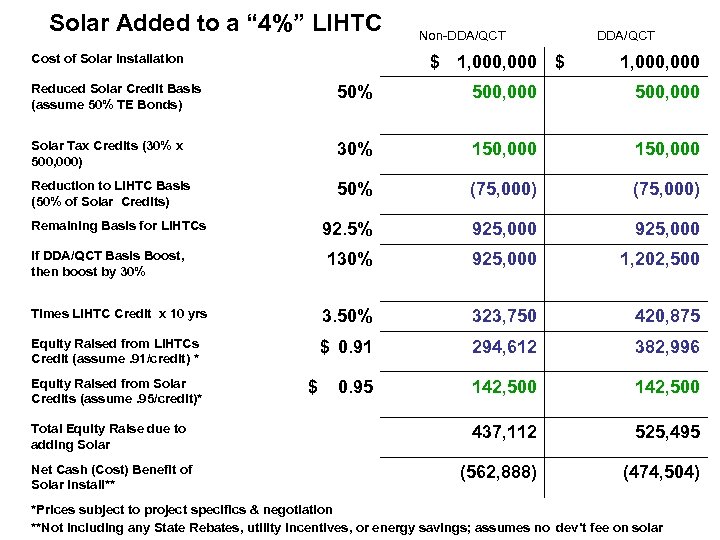

Solar Added to a “ 4%” LIHTC Cost of Solar Installation Non-DDA/QCT $ 1, 000, 000 Reduced Solar Credit Basis (assume 50% TE Bonds) 50% 500, 000 Solar Tax Credits (30% x 500, 000) 30% 150, 000 Reduction to LIHTC Basis (50% of Solar Credits) 50% (75, 000) 92. 5% 925, 000 130% 925, 000 1, 202, 500 Times LIHTC Credit x 10 yrs 3. 50% 323, 750 420, 875 Equity Raised from LIHTCs Credit (assume. 91/credit) * $ 0. 91 294, 612 382, 996 0. 95 142, 500 437, 112 525, 495 (562, 888) (474, 504) Remaining Basis for LIHTCs If DDA/QCT Basis Boost, then boost by 30% Equity Raised from Solar Credits (assume. 95/credit)* Total Equity Raise due to adding Solar Net Cash (Cost) Benefit of Solar Install** $ *Prices subject to project specifics & negotiation **Not including any State Rebates, utility incentives, or energy savings; assumes no dev’t fee on solar

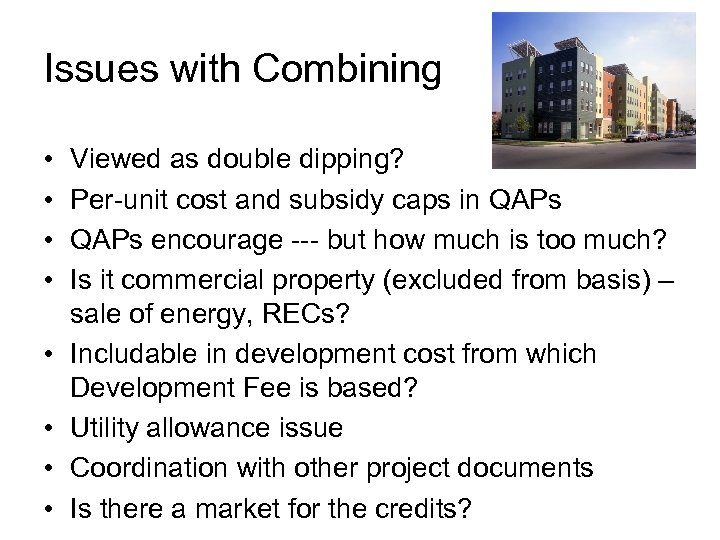

Issues with Combining • • Viewed as double dipping? Per-unit cost and subsidy caps in QAPs encourage --- but how much is too much? Is it commercial property (excluded from basis) – sale of energy, RECs? Includable in development cost from which Development Fee is based? Utility allowance issue Coordination with other project documents Is there a market for the credits?

Investor Reaction • • • First year boost 5 -year ACRS (not all value) Utility savings More predictable energy costs Low recapture potential Qualified selection, installation, maintenance Adequate Insurance Carriage turns back into a pumpkin – 12/31/08 Green is good

Thank you! • Jeffrey S. Lesk • jlesk@nixonpeabody. com

2ee3b2cc7a3ca43bf0a7017fa013c75b.ppt