fa59ce7e5a13837de7c98b35785f5836.ppt

- Количество слайдов: 20

Solar Securitization: Challenges, Financial Arrangements and Policy Implications Jacqueline Yujia Tao IAEE Concurrent Session 21 June, Wednesday

Solar Securitization: Challenges, Financial Arrangements and Policy Implications Jacqueline Yujia Tao IAEE Concurrent Session 21 June, Wednesday

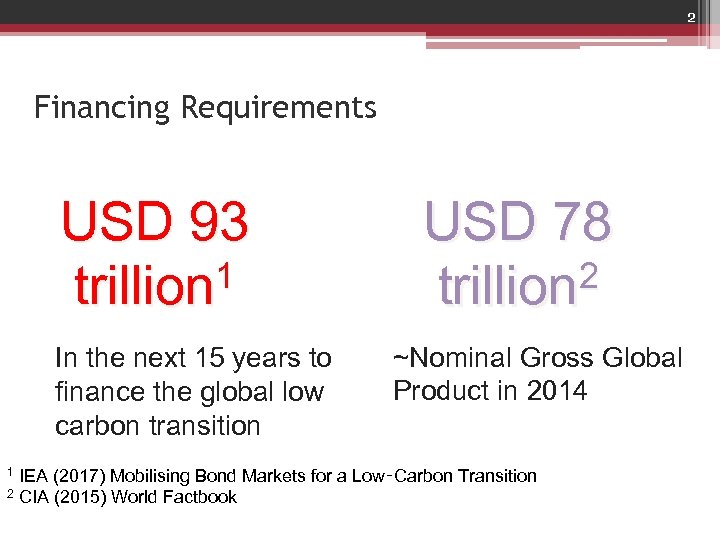

2 Financing Requirements USD 93 1 trillion In the next 15 years to finance the global low carbon transition USD 78 2 trillion ~Nominal Gross Global Product in 2014 IEA (2017) Mobilising Bond Markets for a Low‑Carbon Transition 2 CIA (2015) World Factbook 1

2 Financing Requirements USD 93 1 trillion In the next 15 years to finance the global low carbon transition USD 78 2 trillion ~Nominal Gross Global Product in 2014 IEA (2017) Mobilising Bond Markets for a Low‑Carbon Transition 2 CIA (2015) World Factbook 1

3 What is Solar Securitization? • Securitization is the process of transforming illiquid assets into financial instruments to be traded ▫ Asset-backed bonds ▫ Collateralized Loan Obligation (CLO) ▫ Real Estate Investment Trusts (REITs) • Some considerations: ▫ Utility Scale vs Distributed Applications ▫ Financing or Re-financing

3 What is Solar Securitization? • Securitization is the process of transforming illiquid assets into financial instruments to be traded ▫ Asset-backed bonds ▫ Collateralized Loan Obligation (CLO) ▫ Real Estate Investment Trusts (REITs) • Some considerations: ▫ Utility Scale vs Distributed Applications ▫ Financing or Re-financing

4 Research Methodology • Hypothetical securitization process on existing assets of a solar developer in Singapore • Discounted Cash Flow (DCF) model ▫ Profitability: Net Present Value (NPV), Equivalent Annual Annuity (EAA), Internal Rate of Return (IRR) and discounted payback period ▫ Viability: Debt Service Coverage Ratio • Novelty: differentiate between cash flows of the solar project developer (the originator) and the SPV (trustee).

4 Research Methodology • Hypothetical securitization process on existing assets of a solar developer in Singapore • Discounted Cash Flow (DCF) model ▫ Profitability: Net Present Value (NPV), Equivalent Annual Annuity (EAA), Internal Rate of Return (IRR) and discounted payback period ▫ Viability: Debt Service Coverage Ratio • Novelty: differentiate between cash flows of the solar project developer (the originator) and the SPV (trustee).

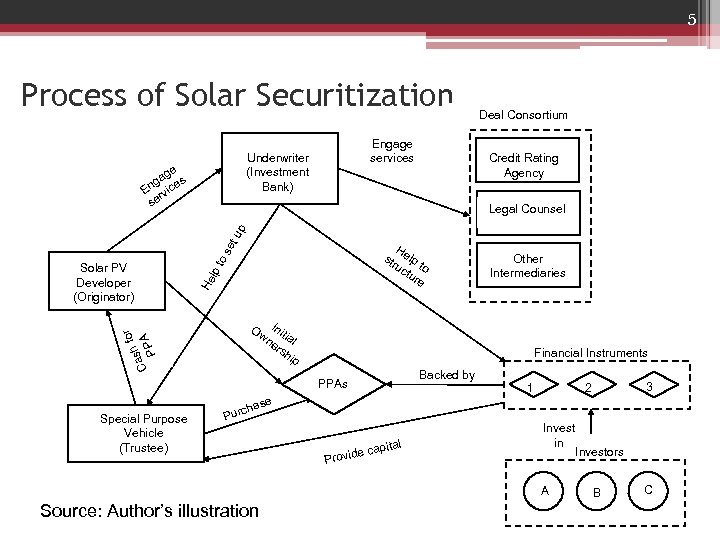

5 Process of Solar Securitization Engage services Underwriter (Investment Bank) ge ga es En rvic se Deal Consortium Credit Rating Agency up Legal Counsel for ash A C P P lp He Solar PV Developer (Originator) to se t H str elp uc to tur e Ow Init ne ial rs hip Financial Instruments PPAs Special Purpose Vehicle (Trustee) Other Intermediaries Backed by 1 3 2 ase ch Pur apital vide c Pro Invest in A Source: Author’s illustration Investors B C

5 Process of Solar Securitization Engage services Underwriter (Investment Bank) ge ga es En rvic se Deal Consortium Credit Rating Agency up Legal Counsel for ash A C P P lp He Solar PV Developer (Originator) to se t H str elp uc to tur e Ow Init ne ial rs hip Financial Instruments PPAs Special Purpose Vehicle (Trustee) Other Intermediaries Backed by 1 3 2 ase ch Pur apital vide c Pro Invest in A Source: Author’s illustration Investors B C

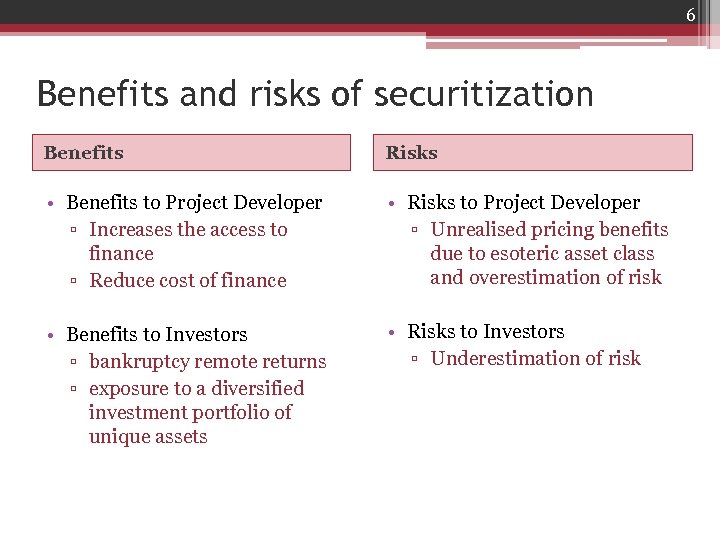

6 Benefits and risks of securitization Benefits Risks • Benefits to Project Developer ▫ Increases the access to finance ▫ Reduce cost of finance • Risks to Project Developer ▫ Unrealised pricing benefits due to esoteric asset class and overestimation of risk • Benefits to Investors ▫ bankruptcy remote returns ▫ exposure to a diversified investment portfolio of unique assets • Risks to Investors ▫ Underestimation of risk

6 Benefits and risks of securitization Benefits Risks • Benefits to Project Developer ▫ Increases the access to finance ▫ Reduce cost of finance • Risks to Project Developer ▫ Unrealised pricing benefits due to esoteric asset class and overestimation of risk • Benefits to Investors ▫ bankruptcy remote returns ▫ exposure to a diversified investment portfolio of unique assets • Risks to Investors ▫ Underestimation of risk

7 Data • hypothetical asset pool of 125 MW, based on examining all projects undertaken by the leading solar developer in Singapore. • Both primary data sources and secondary sources • 25 year contract based on variable prices pegged to a benchmark price (Singapore Power Low tension electricity tariff during peak hours) • Variability of annual electricity prices was modelled using a Geometric Brownian Motion (GBM) stochastic approach

7 Data • hypothetical asset pool of 125 MW, based on examining all projects undertaken by the leading solar developer in Singapore. • Both primary data sources and secondary sources • 25 year contract based on variable prices pegged to a benchmark price (Singapore Power Low tension electricity tariff during peak hours) • Variability of annual electricity prices was modelled using a Geometric Brownian Motion (GBM) stochastic approach

8 Scenario Setting Base case scenario Full-securitization in Year 3 Partial securitization in Year 3

8 Scenario Setting Base case scenario Full-securitization in Year 3 Partial securitization in Year 3

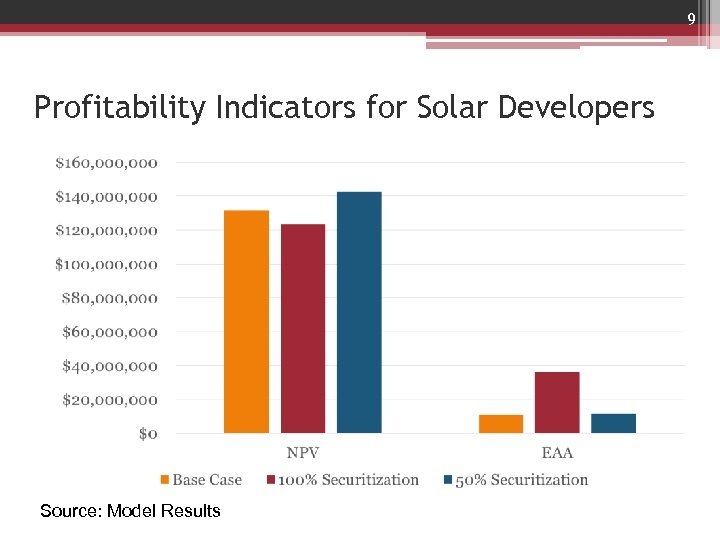

9 Profitability Indicators for Solar Developers Source: Model Results

9 Profitability Indicators for Solar Developers Source: Model Results

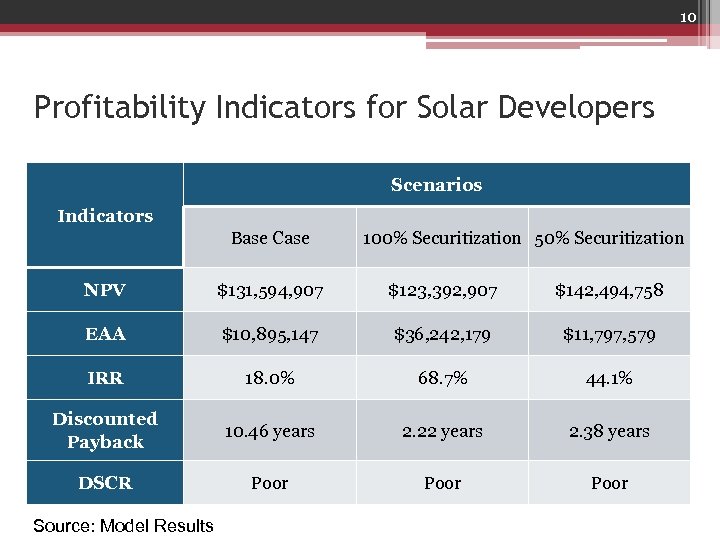

10 Profitability Indicators for Solar Developers Scenarios Indicators Base Case 100% Securitization 50% Securitization NPV $131, 594, 907 $123, 392, 907 $142, 494, 758 EAA $10, 895, 147 $36, 242, 179 $11, 797, 579 IRR 18. 0% 68. 7% 44. 1% Discounted Payback 10. 46 years 2. 22 years 2. 38 years DSCR Poor Source: Model Results

10 Profitability Indicators for Solar Developers Scenarios Indicators Base Case 100% Securitization 50% Securitization NPV $131, 594, 907 $123, 392, 907 $142, 494, 758 EAA $10, 895, 147 $36, 242, 179 $11, 797, 579 IRR 18. 0% 68. 7% 44. 1% Discounted Payback 10. 46 years 2. 22 years 2. 38 years DSCR Poor Source: Model Results

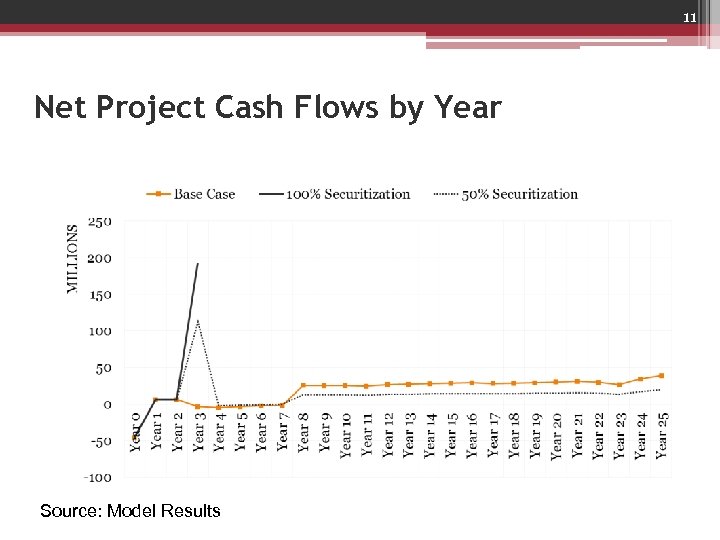

11 Net Project Cash Flows by Year Source: Model Results

11 Net Project Cash Flows by Year Source: Model Results

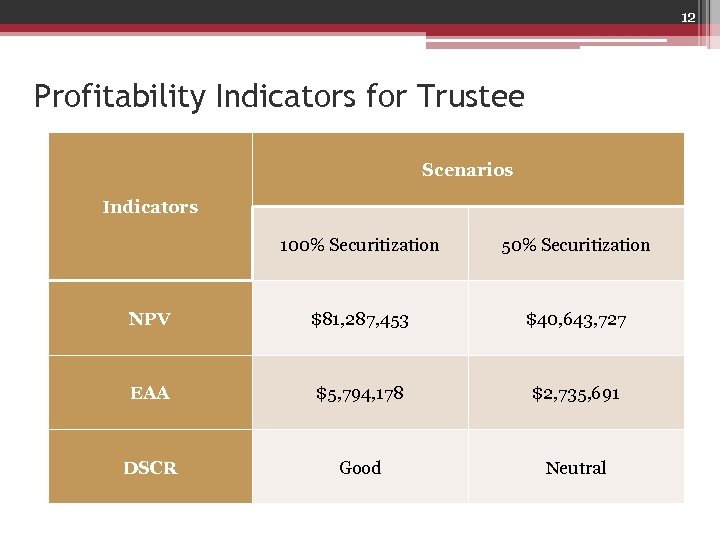

12 Profitability Indicators for Trustee Scenarios Indicators 100% Securitization 50% Securitization NPV $81, 287, 453 $40, 643, 727 EAA $5, 794, 178 $2, 735, 691 DSCR Good Neutral

12 Profitability Indicators for Trustee Scenarios Indicators 100% Securitization 50% Securitization NPV $81, 287, 453 $40, 643, 727 EAA $5, 794, 178 $2, 735, 691 DSCR Good Neutral

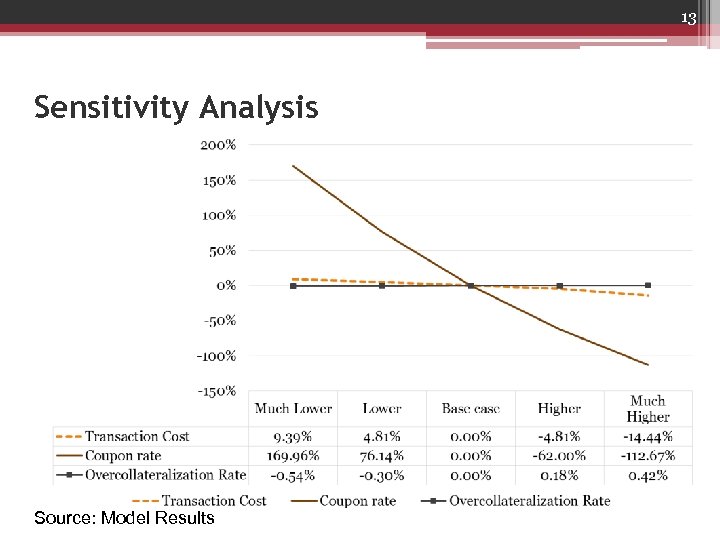

13 Sensitivity Analysis Source: Model Results

13 Sensitivity Analysis Source: Model Results

14 Risk Assessment and Credit Rating • Importance of coupon rate appropriate pricing of risk • Appropriate pricing of risk and the required expertise ▫ Technical performance ▫ Consumer behavior ▫ Technological advances ▫ Complications due to “pooled solar securitization”

14 Risk Assessment and Credit Rating • Importance of coupon rate appropriate pricing of risk • Appropriate pricing of risk and the required expertise ▫ Technical performance ▫ Consumer behavior ▫ Technological advances ▫ Complications due to “pooled solar securitization”

15 Discussion: Cash flow management of Trustee • Over-collateralized cash flows presents opportunity for short-term liquidity management strategies. ▫ If well executed: increased profitability ▫ If poorly executed: potential default Source: Forbes, Assessed from: https: //www. forbes. com/sites/antoinegara/2016/04/13/solarenergy-giant-sunedison-may-be-in-technical-default-according-tocreditsights/#17 bd 612 b 26 ba

15 Discussion: Cash flow management of Trustee • Over-collateralized cash flows presents opportunity for short-term liquidity management strategies. ▫ If well executed: increased profitability ▫ If poorly executed: potential default Source: Forbes, Assessed from: https: //www. forbes. com/sites/antoinegara/2016/04/13/solarenergy-giant-sunedison-may-be-in-technical-default-according-tocreditsights/#17 bd 612 b 26 ba

16 Policy Recommendations • Standardize contractual and technical asset terms • Industry trade meetings: bridge the information gap in the financial industry • Incentivize Investor Demand ▫ Incentivize benchmark bond issuance ▫ Provider of external credit enhancement facilities • Investor Protection through financial regulation

16 Policy Recommendations • Standardize contractual and technical asset terms • Industry trade meetings: bridge the information gap in the financial industry • Incentivize Investor Demand ▫ Incentivize benchmark bond issuance ▫ Provider of external credit enhancement facilities • Investor Protection through financial regulation

17 Thank you! Energy Studies Institute 29 Heng Mui Keng Terrace Block A, #10 -01 Singapore 119620 Jacqueline Tao Tel: (65) 6516 6692 Email: esity@nus. edu. sg

17 Thank you! Energy Studies Institute 29 Heng Mui Keng Terrace Block A, #10 -01 Singapore 119620 Jacqueline Tao Tel: (65) 6516 6692 Email: esity@nus. edu. sg

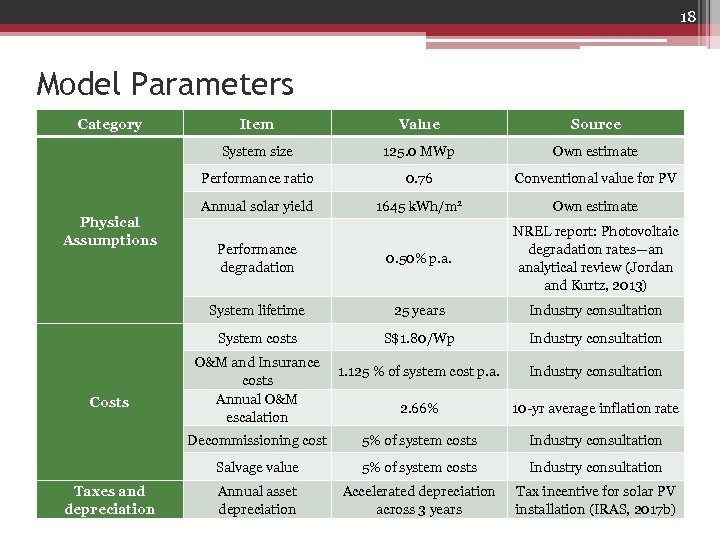

18 Model Parameters Category 125. 0 MWp Own estimate 0. 76 Conventional value for PV Annual solar yield 1645 k. Wh/m 2 Own estimate Performance degradation 0. 50% p. a. NREL report: Photovoltaic degradation rates—an analytical review (Jordan and Kurtz, 2013) System lifetime 25 years Industry consultation System costs S$1. 80/Wp Industry consultation 1. 125 % of system cost p. a. Industry consultation 2. 66% 10 -yr average inflation rate Decommissioning cost 5% of system costs Industry consultation Salvage value Taxes and depreciation Source Performance ratio Costs Value System size Physical Assumptions Item 5% of system costs Industry consultation Annual asset depreciation Accelerated depreciation across 3 years Tax incentive for solar PV installation (IRAS, 2017 b) O&M and Insurance costs Annual O&M escalation

18 Model Parameters Category 125. 0 MWp Own estimate 0. 76 Conventional value for PV Annual solar yield 1645 k. Wh/m 2 Own estimate Performance degradation 0. 50% p. a. NREL report: Photovoltaic degradation rates—an analytical review (Jordan and Kurtz, 2013) System lifetime 25 years Industry consultation System costs S$1. 80/Wp Industry consultation 1. 125 % of system cost p. a. Industry consultation 2. 66% 10 -yr average inflation rate Decommissioning cost 5% of system costs Industry consultation Salvage value Taxes and depreciation Source Performance ratio Costs Value System size Physical Assumptions Item 5% of system costs Industry consultation Annual asset depreciation Accelerated depreciation across 3 years Tax incentive for solar PV installation (IRAS, 2017 b) O&M and Insurance costs Annual O&M escalation

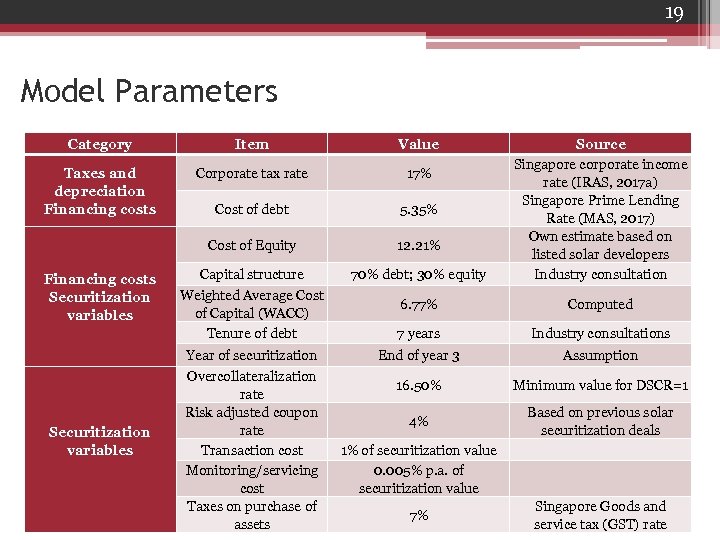

19 Model Parameters Category Item Value Taxes and depreciation Financing costs Corporate tax rate 17% Cost of debt 5. 35% Cost of Equity 12. 21% Capital structure Weighted Average Cost of Capital (WACC) Tenure of debt 70% debt; 30% equity Source Singapore corporate income rate (IRAS, 2017 a) Singapore Prime Lending Rate (MAS, 2017) Own estimate based on listed solar developers Industry consultation 6. 77% Computed 7 years Industry consultations Year of securitization Overcollateralization rate Risk adjusted coupon rate Transaction cost Monitoring/servicing cost Taxes on purchase of assets End of year 3 Assumption 16. 50% Minimum value for DSCR=1 Financing costs Securitization variables 4% 1% of securitization value 0. 005% p. a. of securitization value 7% Based on previous solar securitization deals Singapore Goods and service tax (GST) rate

19 Model Parameters Category Item Value Taxes and depreciation Financing costs Corporate tax rate 17% Cost of debt 5. 35% Cost of Equity 12. 21% Capital structure Weighted Average Cost of Capital (WACC) Tenure of debt 70% debt; 30% equity Source Singapore corporate income rate (IRAS, 2017 a) Singapore Prime Lending Rate (MAS, 2017) Own estimate based on listed solar developers Industry consultation 6. 77% Computed 7 years Industry consultations Year of securitization Overcollateralization rate Risk adjusted coupon rate Transaction cost Monitoring/servicing cost Taxes on purchase of assets End of year 3 Assumption 16. 50% Minimum value for DSCR=1 Financing costs Securitization variables 4% 1% of securitization value 0. 005% p. a. of securitization value 7% Based on previous solar securitization deals Singapore Goods and service tax (GST) rate

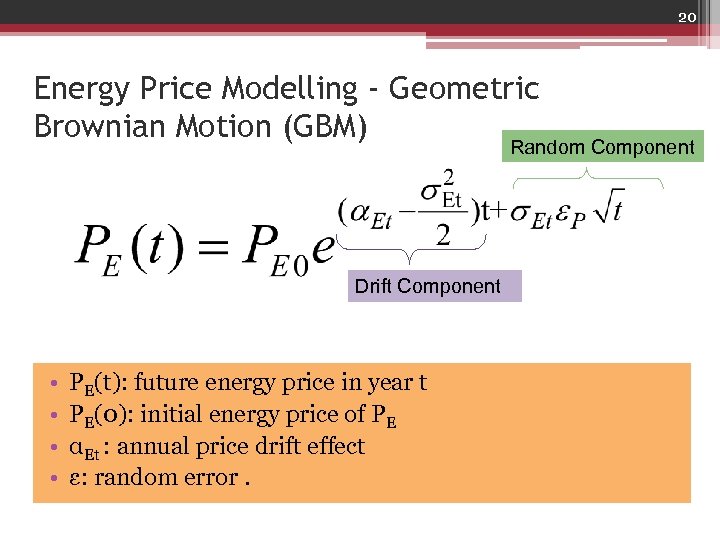

20 Energy Price Modelling - Geometric Brownian Motion (GBM) Random Component Drift Component • • PE(t): future energy price in year t PE(0): initial energy price of PE αEt : annual price drift effect ε: random error.

20 Energy Price Modelling - Geometric Brownian Motion (GBM) Random Component Drift Component • • PE(t): future energy price in year t PE(0): initial energy price of PE αEt : annual price drift effect ε: random error.