afa0253dce0025404272e172898ade84.ppt

- Количество слайдов: 14

Solar PV Project Development A Developer's Perspective of the Building Blocks Necessary for a Successful Project “Same as it ever was …” David Byrne & Brian Eno www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Solar PV Project Development A Developer's Perspective of the Building Blocks Necessary for a Successful Project “Same as it ever was …” David Byrne & Brian Eno www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

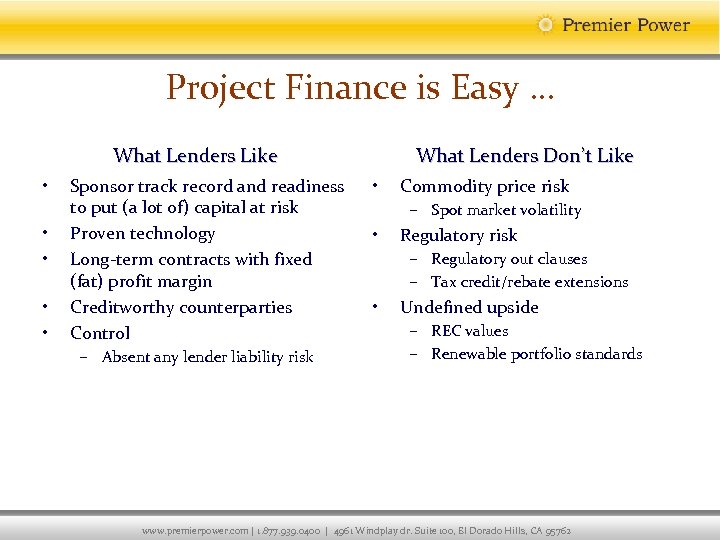

Project Finance is Easy … What Lenders Like • • • Sponsor track record and readiness to put (a lot of) capital at risk Proven technology Long-term contracts with fixed (fat) profit margin Creditworthy counterparties Control – Absent any lender liability risk What Lenders Don’t Like • Commodity price risk – Spot market volatility • Regulatory risk – Regulatory out clauses – Tax credit/rebate extensions • Undefined upside – REC values – Renewable portfolio standards www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Project Finance is Easy … What Lenders Like • • • Sponsor track record and readiness to put (a lot of) capital at risk Proven technology Long-term contracts with fixed (fat) profit margin Creditworthy counterparties Control – Absent any lender liability risk What Lenders Don’t Like • Commodity price risk – Spot market volatility • Regulatory risk – Regulatory out clauses – Tax credit/rebate extensions • Undefined upside – REC values – Renewable portfolio standards www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

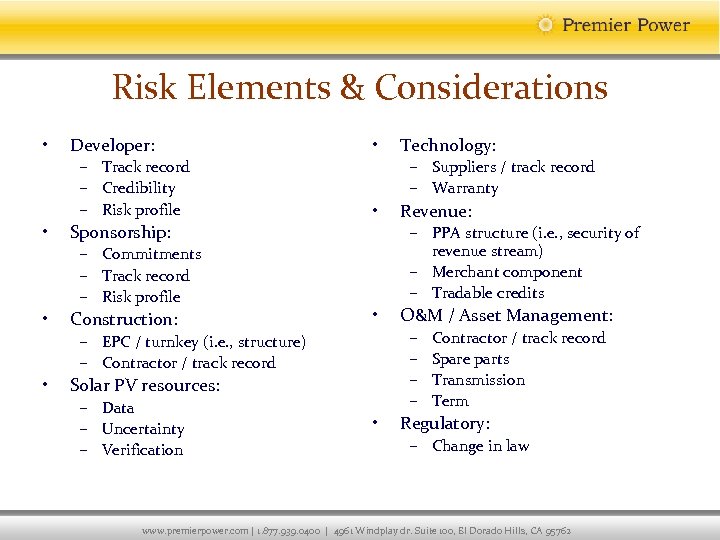

Risk Elements & Considerations • Developer: – Track record – Credibility – Risk profile • Sponsorship: – Commitments – Track record – Risk profile • Construction: • – Suppliers / track record – Warranty • • O&M / Asset Management: – – Solar PV resources: – Data – Uncertainty – Verification Revenue: – PPA structure (i. e. , security of revenue stream) – Merchant component – Tradable credits – EPC / turnkey (i. e. , structure) – Contractor / track record • Technology: • Contractor / track record Spare parts Transmission Term Regulatory: – Change in law www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Risk Elements & Considerations • Developer: – Track record – Credibility – Risk profile • Sponsorship: – Commitments – Track record – Risk profile • Construction: • – Suppliers / track record – Warranty • • O&M / Asset Management: – – Solar PV resources: – Data – Uncertainty – Verification Revenue: – PPA structure (i. e. , security of revenue stream) – Merchant component – Tradable credits – EPC / turnkey (i. e. , structure) – Contractor / track record • Technology: • Contractor / track record Spare parts Transmission Term Regulatory: – Change in law www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

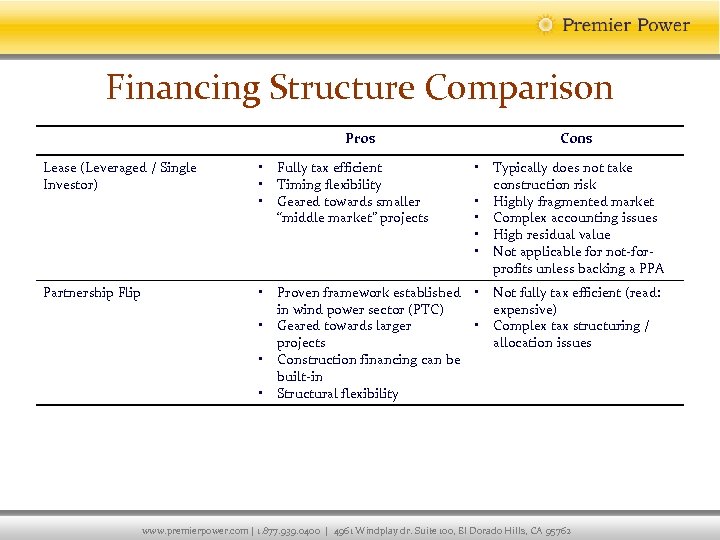

Financing Structure Comparison Pros Cons Lease (Leveraged / Single Investor) • Fully tax efficient • Timing flexibility • Geared towards smaller “middle market” projects • Typically does not take construction risk • Highly fragmented market • Complex accounting issues • High residual value • Not applicable for not-forprofits unless backing a PPA Partnership Flip • Proven framework established • Not fully tax efficient (read: in wind power sector (PTC) expensive) • Geared towards larger • Complex tax structuring / projects allocation issues • Construction financing can be built-in • Structural flexibility www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Financing Structure Comparison Pros Cons Lease (Leveraged / Single Investor) • Fully tax efficient • Timing flexibility • Geared towards smaller “middle market” projects • Typically does not take construction risk • Highly fragmented market • Complex accounting issues • High residual value • Not applicable for not-forprofits unless backing a PPA Partnership Flip • Proven framework established • Not fully tax efficient (read: in wind power sector (PTC) expensive) • Geared towards larger • Complex tax structuring / projects allocation issues • Construction financing can be built-in • Structural flexibility www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

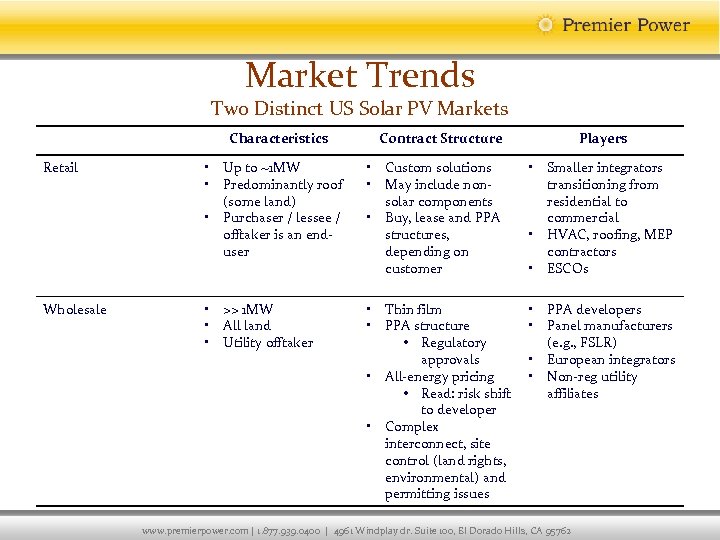

Market Trends Two Distinct US Solar PV Markets Characteristics Contract Structure Players Retail • Up to ~1 MW • Predominantly roof (some land) • Purchaser / lessee / offtaker is an enduser • Custom solutions • May include nonsolar components • Buy, lease and PPA structures, depending on customer • Smaller integrators transitioning from residential to commercial • HVAC, roofing, MEP contractors • ESCOs Wholesale • >> 1 MW • All land • Utility offtaker • Thin film • PPA structure • Regulatory approvals • All-energy pricing • Read: risk shift to developer • Complex interconnect, site control (land rights, environmental) and permitting issues • PPA developers • Panel manufacturers (e. g. , FSLR) • European integrators • Non-reg utility affiliates www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Market Trends Two Distinct US Solar PV Markets Characteristics Contract Structure Players Retail • Up to ~1 MW • Predominantly roof (some land) • Purchaser / lessee / offtaker is an enduser • Custom solutions • May include nonsolar components • Buy, lease and PPA structures, depending on customer • Smaller integrators transitioning from residential to commercial • HVAC, roofing, MEP contractors • ESCOs Wholesale • >> 1 MW • All land • Utility offtaker • Thin film • PPA structure • Regulatory approvals • All-energy pricing • Read: risk shift to developer • Complex interconnect, site control (land rights, environmental) and permitting issues • PPA developers • Panel manufacturers (e. g. , FSLR) • European integrators • Non-reg utility affiliates www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

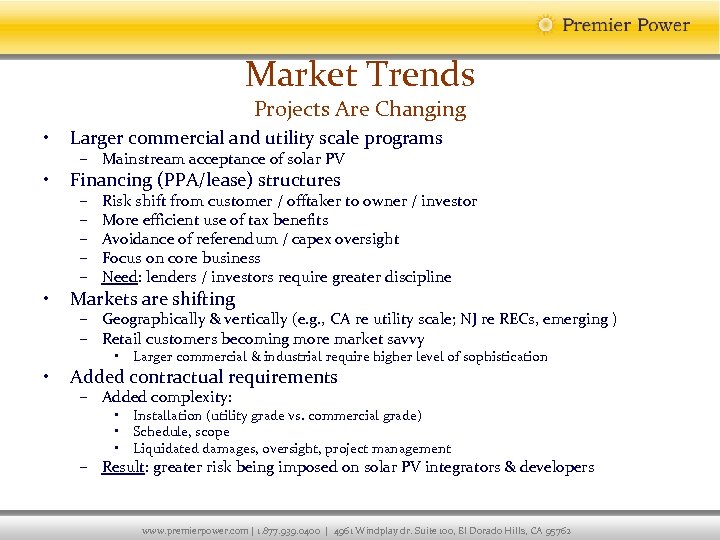

Market Trends Projects Are Changing • Larger commercial and utility scale programs • Financing (PPA/lease) structures • Markets are shifting • – Mainstream acceptance of solar PV – – – Risk shift from customer / offtaker to owner / investor More efficient use of tax benefits Avoidance of referendum / capex oversight Focus on core business Need: lenders / investors require greater discipline – Geographically & vertically (e. g. , CA re utility scale; NJ re RECs, emerging ) – Retail customers becoming more market savvy • Larger commercial & industrial require higher level of sophistication Added contractual requirements – Added complexity: • Installation (utility grade vs. commercial grade) • Schedule, scope • Liquidated damages, oversight, project management – Result: greater risk being imposed on solar PV integrators & developers www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Market Trends Projects Are Changing • Larger commercial and utility scale programs • Financing (PPA/lease) structures • Markets are shifting • – Mainstream acceptance of solar PV – – – Risk shift from customer / offtaker to owner / investor More efficient use of tax benefits Avoidance of referendum / capex oversight Focus on core business Need: lenders / investors require greater discipline – Geographically & vertically (e. g. , CA re utility scale; NJ re RECs, emerging ) – Retail customers becoming more market savvy • Larger commercial & industrial require higher level of sophistication Added contractual requirements – Added complexity: • Installation (utility grade vs. commercial grade) • Schedule, scope • Liquidated damages, oversight, project management – Result: greater risk being imposed on solar PV integrators & developers www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

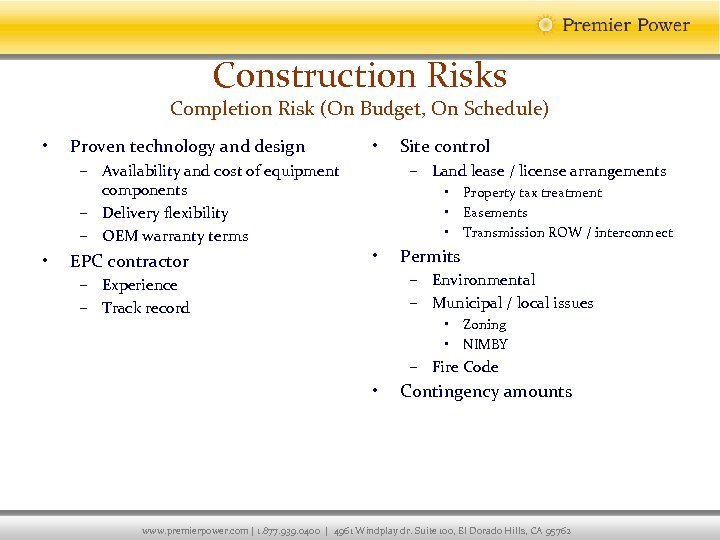

Construction Risks Completion Risk (On Budget, On Schedule) • Proven technology and design – Availability and cost of equipment components – Delivery flexibility – OEM warranty terms • EPC contractor • Site control – Land lease / license arrangements • Property tax treatment • Easements • Transmission ROW / interconnect • Permits – Environmental – Municipal / local issues – Experience – Track record • Zoning • NIMBY – Fire Code • Contingency amounts www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Construction Risks Completion Risk (On Budget, On Schedule) • Proven technology and design – Availability and cost of equipment components – Delivery flexibility – OEM warranty terms • EPC contractor • Site control – Land lease / license arrangements • Property tax treatment • Easements • Transmission ROW / interconnect • Permits – Environmental – Municipal / local issues – Experience – Track record • Zoning • NIMBY – Fire Code • Contingency amounts www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

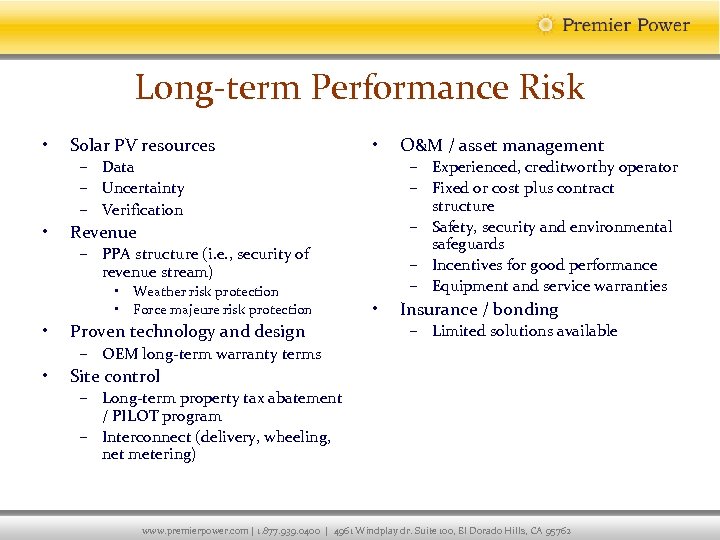

Long-term Performance Risk • Solar PV resources • – Data – Uncertainty – Verification • – Experienced, creditworthy operator – Fixed or cost plus contract structure – Safety, security and environmental safeguards – Incentives for good performance – Equipment and service warranties Revenue – PPA structure (i. e. , security of revenue stream) • Weather risk protection • Force majeure risk protection • Proven technology and design O&M / asset management • Insurance / bonding – Limited solutions available – OEM long-term warranty terms • Site control – Long-term property tax abatement / PILOT program – Interconnect (delivery, wheeling, net metering) www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Long-term Performance Risk • Solar PV resources • – Data – Uncertainty – Verification • – Experienced, creditworthy operator – Fixed or cost plus contract structure – Safety, security and environmental safeguards – Incentives for good performance – Equipment and service warranties Revenue – PPA structure (i. e. , security of revenue stream) • Weather risk protection • Force majeure risk protection • Proven technology and design O&M / asset management • Insurance / bonding – Limited solutions available – OEM long-term warranty terms • Site control – Long-term property tax abatement / PILOT program – Interconnect (delivery, wheeling, net metering) www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

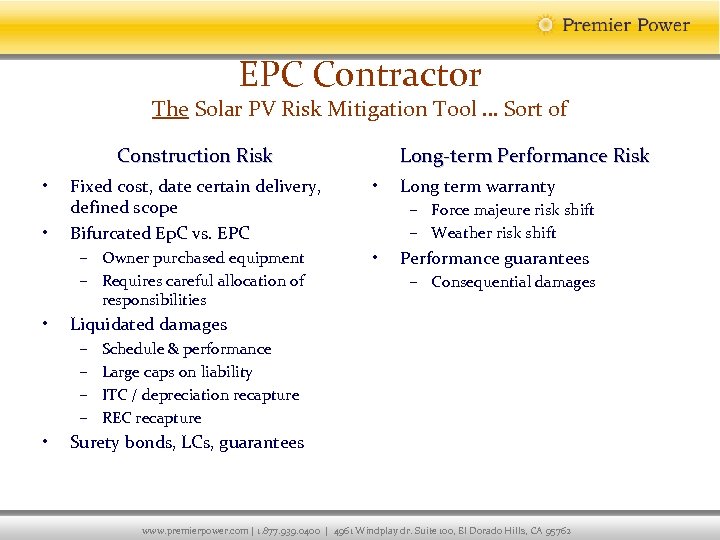

EPC Contractor The Solar PV Risk Mitigation Tool … Sort of Construction Risk • Long-term Performance Risk • • – Owner purchased equipment – Requires careful allocation of responsibilities • Fixed cost, date certain delivery, defined scope Bifurcated Ep. C vs. EPC • – Force majeure risk shift – Weather risk shift Performance guarantees – Consequential damages Liquidated damages – – • Long term warranty Schedule & performance Large caps on liability ITC / depreciation recapture REC recapture Surety bonds, LCs, guarantees www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

EPC Contractor The Solar PV Risk Mitigation Tool … Sort of Construction Risk • Long-term Performance Risk • • – Owner purchased equipment – Requires careful allocation of responsibilities • Fixed cost, date certain delivery, defined scope Bifurcated Ep. C vs. EPC • – Force majeure risk shift – Weather risk shift Performance guarantees – Consequential damages Liquidated damages – – • Long term warranty Schedule & performance Large caps on liability ITC / depreciation recapture REC recapture Surety bonds, LCs, guarantees www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

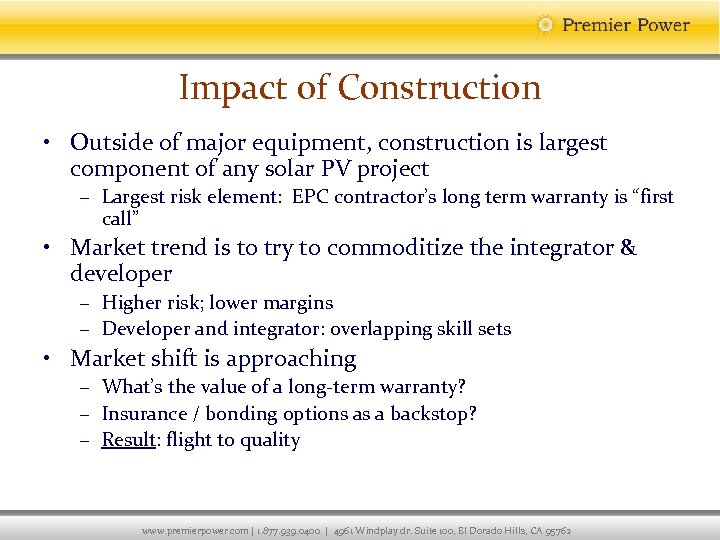

Impact of Construction • Outside of major equipment, construction is largest component of any solar PV project – Largest risk element: EPC contractor’s long term warranty is “first call” • Market trend is to try to commoditize the integrator & developer – Higher risk; lower margins – Developer and integrator: overlapping skill sets • Market shift is approaching – What’s the value of a long-term warranty? – Insurance / bonding options as a backstop? – Result: flight to quality www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Impact of Construction • Outside of major equipment, construction is largest component of any solar PV project – Largest risk element: EPC contractor’s long term warranty is “first call” • Market trend is to try to commoditize the integrator & developer – Higher risk; lower margins – Developer and integrator: overlapping skill sets • Market shift is approaching – What’s the value of a long-term warranty? – Insurance / bonding options as a backstop? – Result: flight to quality www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

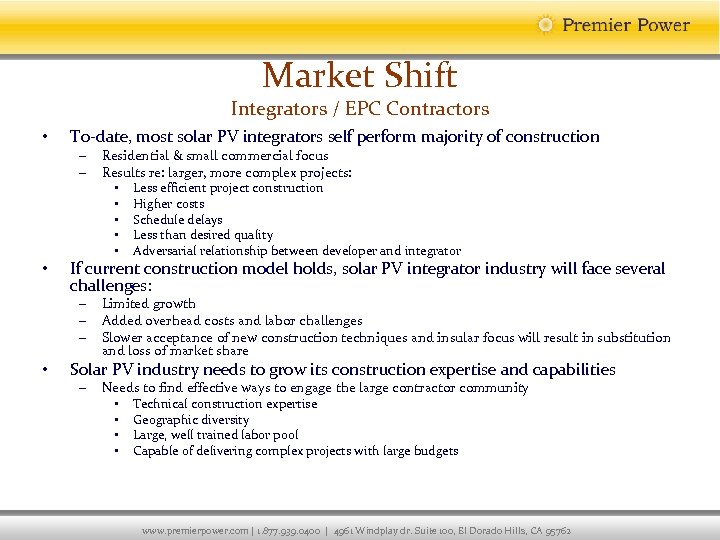

Market Shift Integrators / EPC Contractors • To-date, most solar PV integrators self perform majority of construction • If current construction model holds, solar PV integrator industry will face several challenges: – – – • Residential & small commercial focus Results re: larger, more complex projects: • Less efficient project construction • Higher costs • Schedule delays • Less than desired quality • Adversarial relationship between developer and integrator Limited growth Added overhead costs and labor challenges Slower acceptance of new construction techniques and insular focus will result in substitution and loss of market share Solar PV industry needs to grow its construction expertise and capabilities – Needs to find effective ways to engage the large contractor community • Technical construction expertise • Geographic diversity • Large, well trained labor pool • Capable of delivering complex projects with large budgets www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Market Shift Integrators / EPC Contractors • To-date, most solar PV integrators self perform majority of construction • If current construction model holds, solar PV integrator industry will face several challenges: – – – • Residential & small commercial focus Results re: larger, more complex projects: • Less efficient project construction • Higher costs • Schedule delays • Less than desired quality • Adversarial relationship between developer and integrator Limited growth Added overhead costs and labor challenges Slower acceptance of new construction techniques and insular focus will result in substitution and loss of market share Solar PV industry needs to grow its construction expertise and capabilities – Needs to find effective ways to engage the large contractor community • Technical construction expertise • Geographic diversity • Large, well trained labor pool • Capable of delivering complex projects with large budgets www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

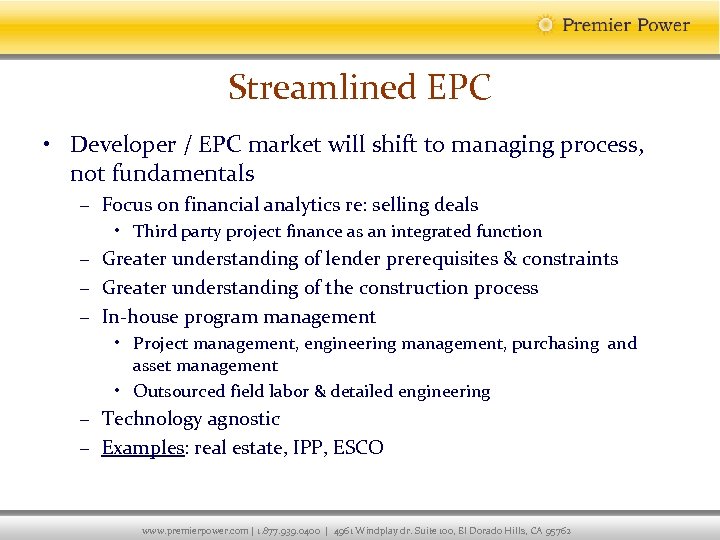

Streamlined EPC • Developer / EPC market will shift to managing process, not fundamentals – Focus on financial analytics re: selling deals • Third party project finance as an integrated function – Greater understanding of lender prerequisites & constraints – Greater understanding of the construction process – In-house program management • Project management, engineering management, purchasing and asset management • Outsourced field labor & detailed engineering – Technology agnostic – Examples: real estate, IPP, ESCO www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

Streamlined EPC • Developer / EPC market will shift to managing process, not fundamentals – Focus on financial analytics re: selling deals • Third party project finance as an integrated function – Greater understanding of lender prerequisites & constraints – Greater understanding of the construction process – In-house program management • Project management, engineering management, purchasing and asset management • Outsourced field labor & detailed engineering – Technology agnostic – Examples: real estate, IPP, ESCO www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

The Bottom Line • The solar PV market continues to evolve – Speed of evolution increasing as project finance comes to the fore – Not yet a mature business • Margins below sustainable levels on a macro basis • Risk allocation not fully thought out • Insurance products still limited – Drive to grid parity • There will be blood – – Consolidation, institutionalization Know your borrower All solar PV is not created equal This is construction: the devil is always in the details www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

The Bottom Line • The solar PV market continues to evolve – Speed of evolution increasing as project finance comes to the fore – Not yet a mature business • Margins below sustainable levels on a macro basis • Risk allocation not fully thought out • Insurance products still limited – Drive to grid parity • There will be blood – – Consolidation, institutionalization Know your borrower All solar PV is not created equal This is construction: the devil is always in the details www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

“A successful project cannot happen without proper planning and preparation. The time to save money and time is on the front end, for once construction begins, money can only be spent” www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762

“A successful project cannot happen without proper planning and preparation. The time to save money and time is on the front end, for once construction begins, money can only be spent” www. premierpower. com | 1. 877. 939. 0400 | 4961 Windplay dr. Suite 100, El Dorado Hills, CA 95762