02b3001cdc9a0b0527a3ab0f4fb804ce.ppt

- Количество слайдов: 34

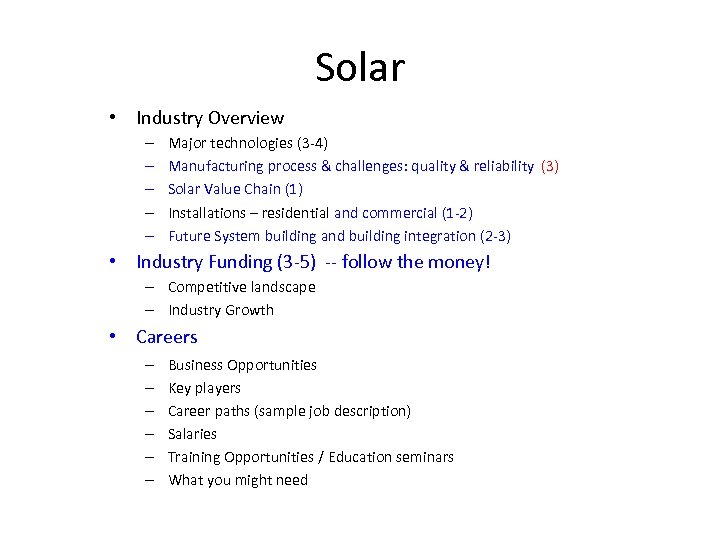

Solar • Industry Overview – – – Major technologies (3 -4) Manufacturing process & challenges: quality & reliability (3) Solar Value Chain (1) Installations – residential and commercial (1 -2) Future System building and building integration (2 -3) • Industry Funding (3 -5) -- follow the money! – Competitive landscape – Industry Growth • Careers – – – Business Opportunities Key players Career paths (sample job description) Salaries Training Opportunities / Education seminars What you might need

Solar • Industry Overview – – – Major technologies (3 -4) Manufacturing process & challenges: quality & reliability (3) Solar Value Chain (1) Installations – residential and commercial (1 -2) Future System building and building integration (2 -3) • Industry Funding (3 -5) -- follow the money! – Competitive landscape – Industry Growth • Careers – – – Business Opportunities Key players Career paths (sample job description) Salaries Training Opportunities / Education seminars What you might need

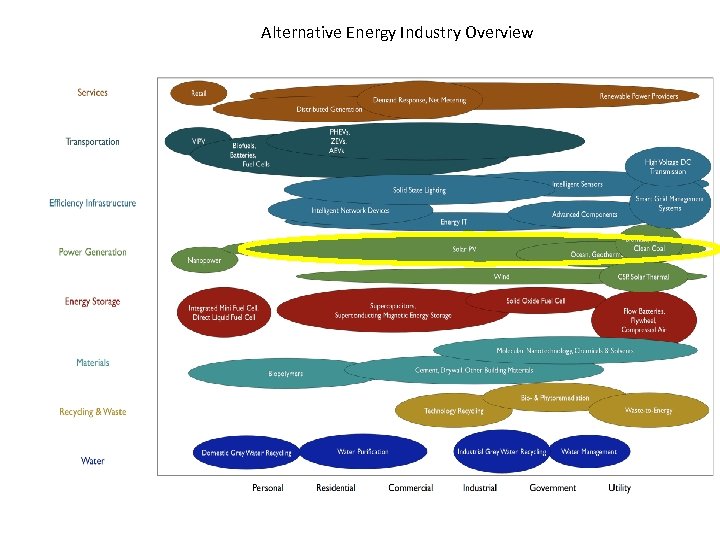

Alternative Energy Industry Overview

Alternative Energy Industry Overview

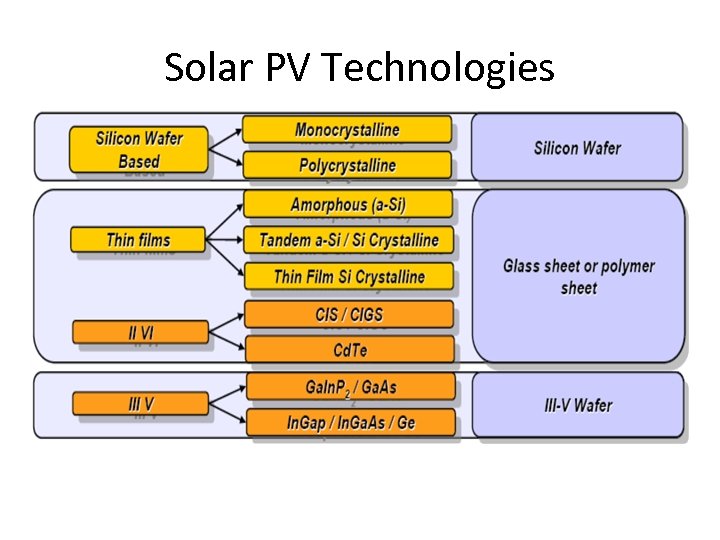

Solar PV Technologies

Solar PV Technologies

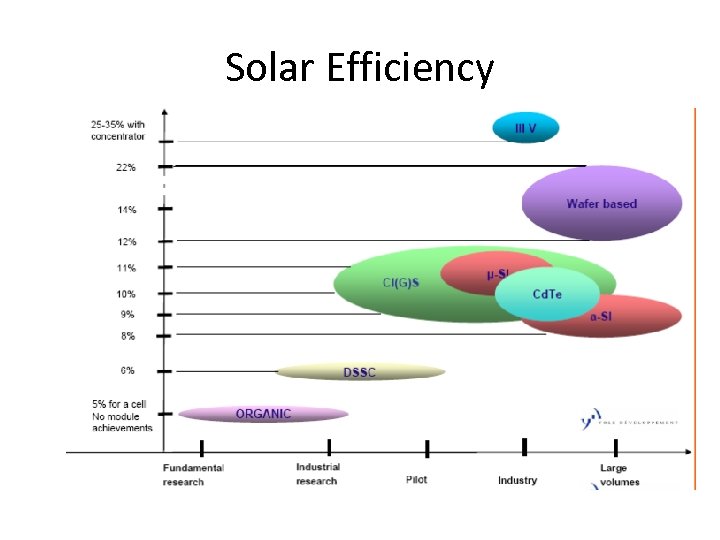

Solar Efficiency

Solar Efficiency

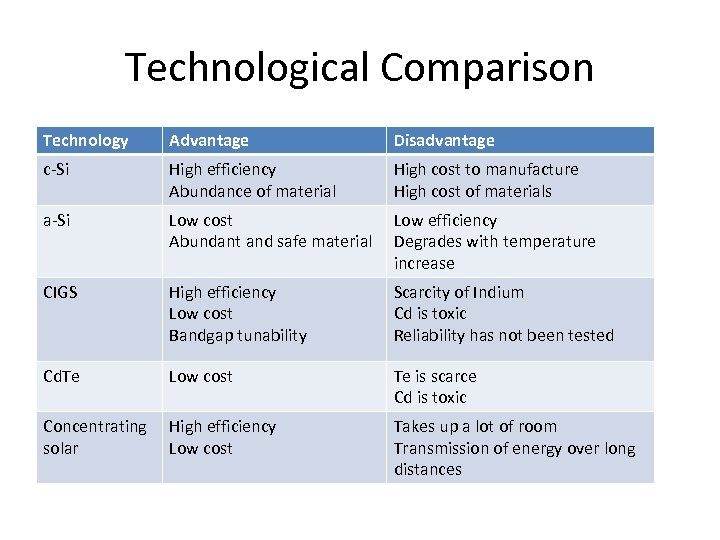

Technological Comparison Technology Advantage Disadvantage c-Si High efficiency Abundance of material High cost to manufacture High cost of materials a-Si Low cost Abundant and safe material Low efficiency Degrades with temperature increase CIGS High efficiency Low cost Bandgap tunability Scarcity of Indium Cd is toxic Reliability has not been tested Cd. Te Low cost Te is scarce Cd is toxic Concentrating solar High efficiency Low cost Takes up a lot of room Transmission of energy over long distances

Technological Comparison Technology Advantage Disadvantage c-Si High efficiency Abundance of material High cost to manufacture High cost of materials a-Si Low cost Abundant and safe material Low efficiency Degrades with temperature increase CIGS High efficiency Low cost Bandgap tunability Scarcity of Indium Cd is toxic Reliability has not been tested Cd. Te Low cost Te is scarce Cd is toxic Concentrating solar High efficiency Low cost Takes up a lot of room Transmission of energy over long distances

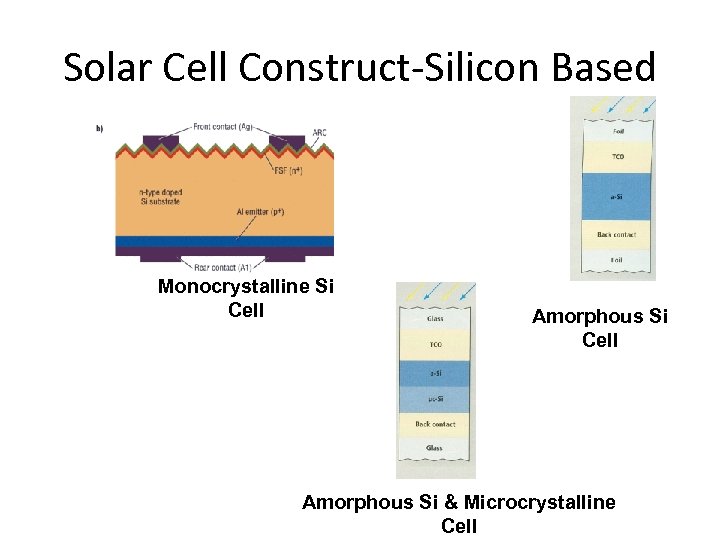

Solar Cell Construct-Silicon Based Monocrystalline Si Cell Amorphous Si & Microcrystalline Cell

Solar Cell Construct-Silicon Based Monocrystalline Si Cell Amorphous Si & Microcrystalline Cell

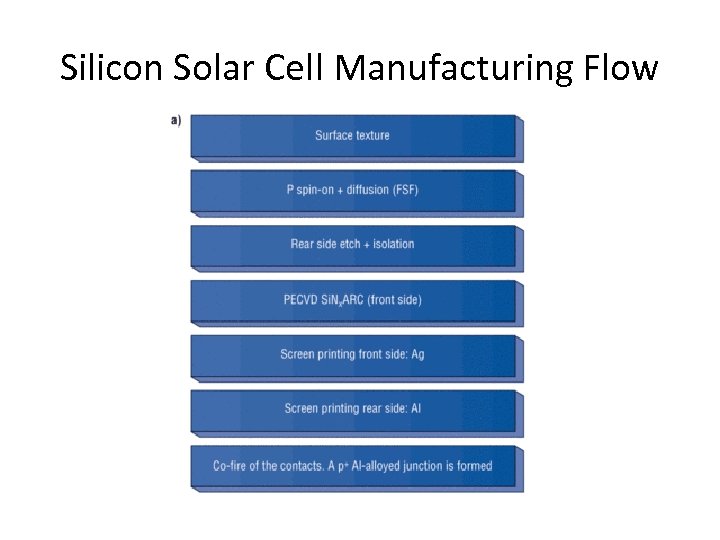

Silicon Solar Cell Manufacturing Flow

Silicon Solar Cell Manufacturing Flow

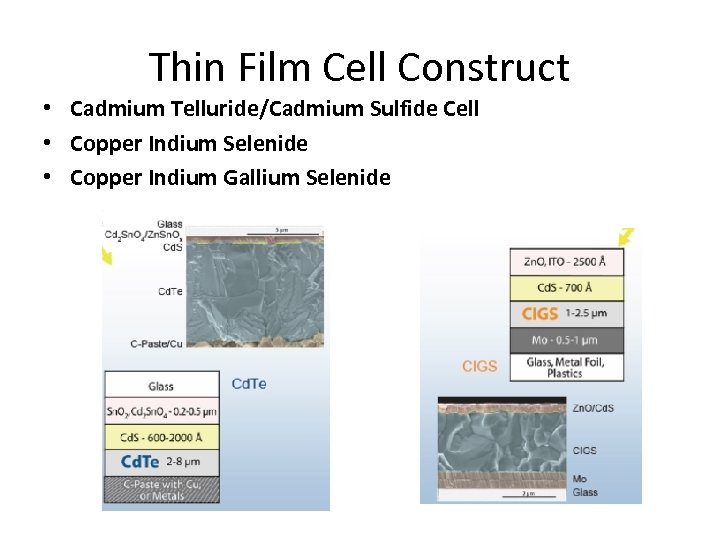

Thin Film Cell Construct • Cadmium Telluride/Cadmium Sulfide Cell • Copper Indium Selenide • Copper Indium Gallium Selenide

Thin Film Cell Construct • Cadmium Telluride/Cadmium Sulfide Cell • Copper Indium Selenide • Copper Indium Gallium Selenide

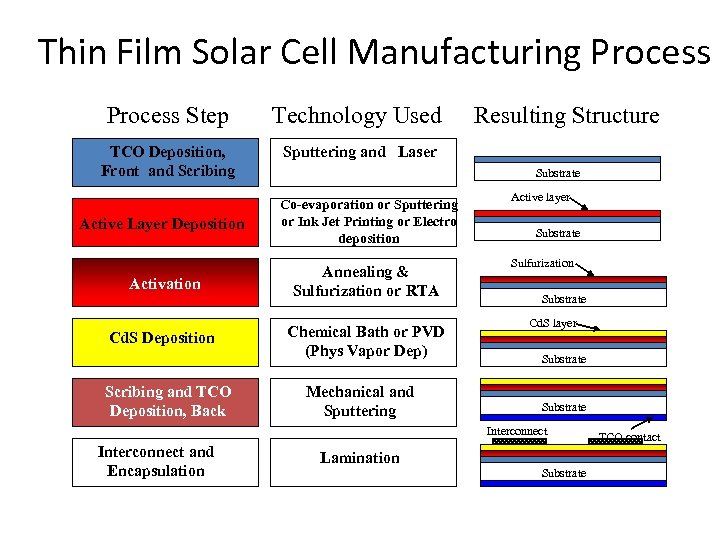

Thin Film Solar Cell Manufacturing Process Step Technology Used TCO Deposition, Front and Scribing Sputtering and Laser Substrate Active Layer Deposition Co-evaporation or Sputtering or Ink Jet Printing or Electro deposition Activation Annealing & Sulfurization or RTA Cd. S Deposition Chemical Bath or PVD (Phys Vapor Dep) Scribing and TCO Deposition, Back Resulting Structure Mechanical and Sputtering Active layer Substrate Sulfurization Substrate Cd. S layer Substrate Interconnect and Encapsulation Lamination Substrate TCO contact

Thin Film Solar Cell Manufacturing Process Step Technology Used TCO Deposition, Front and Scribing Sputtering and Laser Substrate Active Layer Deposition Co-evaporation or Sputtering or Ink Jet Printing or Electro deposition Activation Annealing & Sulfurization or RTA Cd. S Deposition Chemical Bath or PVD (Phys Vapor Dep) Scribing and TCO Deposition, Back Resulting Structure Mechanical and Sputtering Active layer Substrate Sulfurization Substrate Cd. S layer Substrate Interconnect and Encapsulation Lamination Substrate TCO contact

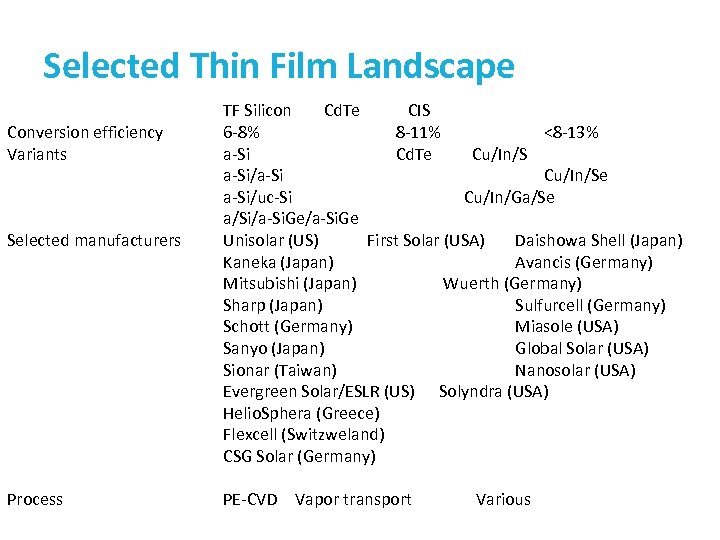

Selected Thin Film Landscape Conversion efficiency Variants Selected manufacturers Process TF Silicon Cd. Te CIS 6 -8% 8 -11% <8 -13% a-Si Cd. Te Cu/In/S a-Si/a-Si Cu/In/Se a-Si/uc-Si Cu/In/Ga/Se a/Si/a-Si. Ge Unisolar (US) First Solar (USA) Daishowa Shell (Japan) Kaneka (Japan) Avancis (Germany) Mitsubishi (Japan) Wuerth (Germany) Sharp (Japan) Sulfurcell (Germany) Schott (Germany) Miasole (USA) Sanyo (Japan) Global Solar (USA) Sionar (Taiwan) Nanosolar (USA) Evergreen Solar/ESLR (US) Solyndra (USA) Helio. Sphera (Greece) Flexcell (Switzweland) CSG Solar (Germany) PE-CVD Vapor transport Various

Selected Thin Film Landscape Conversion efficiency Variants Selected manufacturers Process TF Silicon Cd. Te CIS 6 -8% 8 -11% <8 -13% a-Si Cd. Te Cu/In/S a-Si/a-Si Cu/In/Se a-Si/uc-Si Cu/In/Ga/Se a/Si/a-Si. Ge Unisolar (US) First Solar (USA) Daishowa Shell (Japan) Kaneka (Japan) Avancis (Germany) Mitsubishi (Japan) Wuerth (Germany) Sharp (Japan) Sulfurcell (Germany) Schott (Germany) Miasole (USA) Sanyo (Japan) Global Solar (USA) Sionar (Taiwan) Nanosolar (USA) Evergreen Solar/ESLR (US) Solyndra (USA) Helio. Sphera (Greece) Flexcell (Switzweland) CSG Solar (Germany) PE-CVD Vapor transport Various

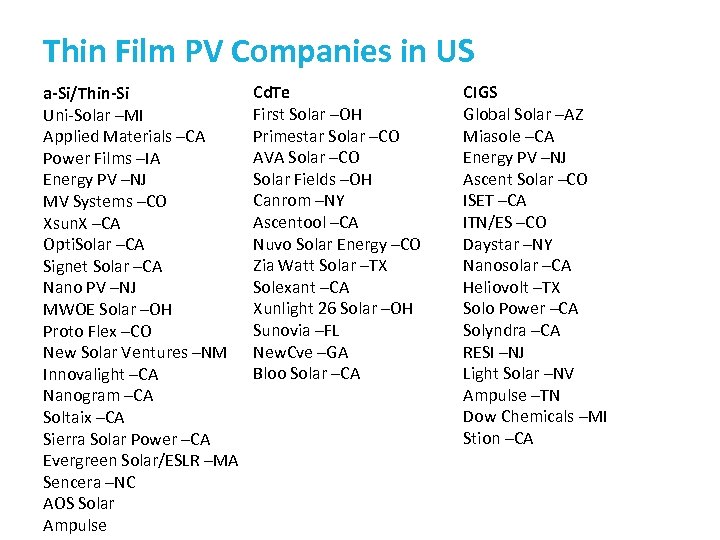

Thin Film PV Companies in US a-Si/Thin-Si Uni-Solar –MI Applied Materials –CA Power Films –IA Energy PV –NJ MV Systems –CO Xsun. X –CA Opti. Solar –CA Signet Solar –CA Nano PV –NJ MWOE Solar –OH Proto Flex –CO New Solar Ventures –NM Innovalight –CA Nanogram –CA Soltaix –CA Sierra Solar Power –CA Evergreen Solar/ESLR –MA Sencera –NC AOS Solar Ampulse Cd. Te First Solar –OH Primestar Solar –CO AVA Solar –CO Solar Fields –OH Canrom –NY Ascentool –CA Nuvo Solar Energy –CO Zia Watt Solar –TX Solexant –CA Xunlight 26 Solar –OH Sunovia –FL New. Cve –GA Bloo Solar –CA CIGS Global Solar –AZ Miasole –CA Energy PV –NJ Ascent Solar –CO ISET –CA ITN/ES –CO Daystar –NY Nanosolar –CA Heliovolt –TX Solo Power –CA Solyndra –CA RESI –NJ Light Solar –NV Ampulse –TN Dow Chemicals –MI Stion –CA

Thin Film PV Companies in US a-Si/Thin-Si Uni-Solar –MI Applied Materials –CA Power Films –IA Energy PV –NJ MV Systems –CO Xsun. X –CA Opti. Solar –CA Signet Solar –CA Nano PV –NJ MWOE Solar –OH Proto Flex –CO New Solar Ventures –NM Innovalight –CA Nanogram –CA Soltaix –CA Sierra Solar Power –CA Evergreen Solar/ESLR –MA Sencera –NC AOS Solar Ampulse Cd. Te First Solar –OH Primestar Solar –CO AVA Solar –CO Solar Fields –OH Canrom –NY Ascentool –CA Nuvo Solar Energy –CO Zia Watt Solar –TX Solexant –CA Xunlight 26 Solar –OH Sunovia –FL New. Cve –GA Bloo Solar –CA CIGS Global Solar –AZ Miasole –CA Energy PV –NJ Ascent Solar –CO ISET –CA ITN/ES –CO Daystar –NY Nanosolar –CA Heliovolt –TX Solo Power –CA Solyndra –CA RESI –NJ Light Solar –NV Ampulse –TN Dow Chemicals –MI Stion –CA

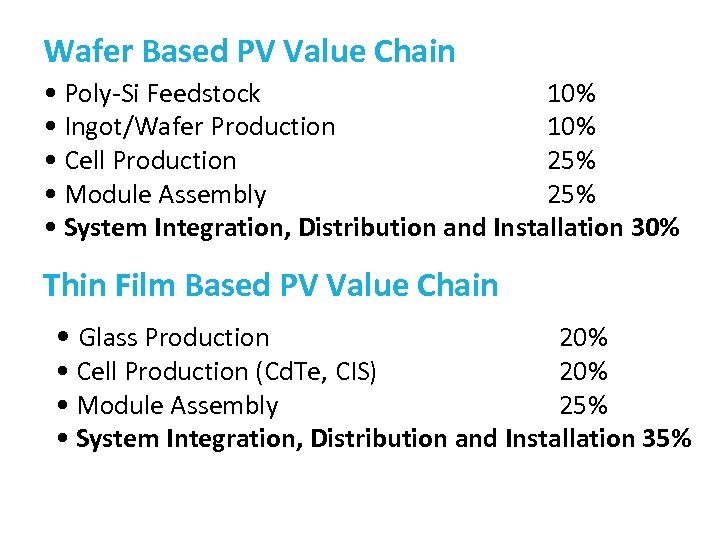

Wafer Based PV Value Chain • Poly-Si Feedstock 10% • Ingot/Wafer Production 10% • Cell Production 25% • Module Assembly 25% • System Integration, Distribution and Installation 30% Thin Film Based PV Value Chain • Glass Production 20% • Cell Production (Cd. Te, CIS) 20% • Module Assembly 25% • System Integration, Distribution and Installation 35%

Wafer Based PV Value Chain • Poly-Si Feedstock 10% • Ingot/Wafer Production 10% • Cell Production 25% • Module Assembly 25% • System Integration, Distribution and Installation 30% Thin Film Based PV Value Chain • Glass Production 20% • Cell Production (Cd. Te, CIS) 20% • Module Assembly 25% • System Integration, Distribution and Installation 35%

Major Polysilicon Manufacturers • • • Wacker -Germany Hemlock –USA LDK - China Dow Corning - USA MEMC -USA REC Silicon -Norway Tokuyama -Japan Mitsubishi Materials -Japan Sumitomo Titanium -Japan

Major Polysilicon Manufacturers • • • Wacker -Germany Hemlock –USA LDK - China Dow Corning - USA MEMC -USA REC Silicon -Norway Tokuyama -Japan Mitsubishi Materials -Japan Sumitomo Titanium -Japan

Si Wafer Start Up • • • 1366 Technologies -MA 21 -Century Silicon - TX 6 N Silicon - ON Advent Solar AE Polysilicon Blue Square Energy - MD Cali. Solar - CA Confluence Solar - MO ET Solar Gamma Solar • Nor. Sun • Peak Sun Silicon -OR • RSI Silicon - PA • SBM Solar - CA • Senergen Devices - CA • Silicon Genesis - CA • Solar Notion • Solaicx - CA • Solar Cell Repower - Norway • Spectra. Watt - OR • Wriota

Si Wafer Start Up • • • 1366 Technologies -MA 21 -Century Silicon - TX 6 N Silicon - ON Advent Solar AE Polysilicon Blue Square Energy - MD Cali. Solar - CA Confluence Solar - MO ET Solar Gamma Solar • Nor. Sun • Peak Sun Silicon -OR • RSI Silicon - PA • SBM Solar - CA • Senergen Devices - CA • Silicon Genesis - CA • Solar Notion • Solaicx - CA • Solar Cell Repower - Norway • Spectra. Watt - OR • Wriota

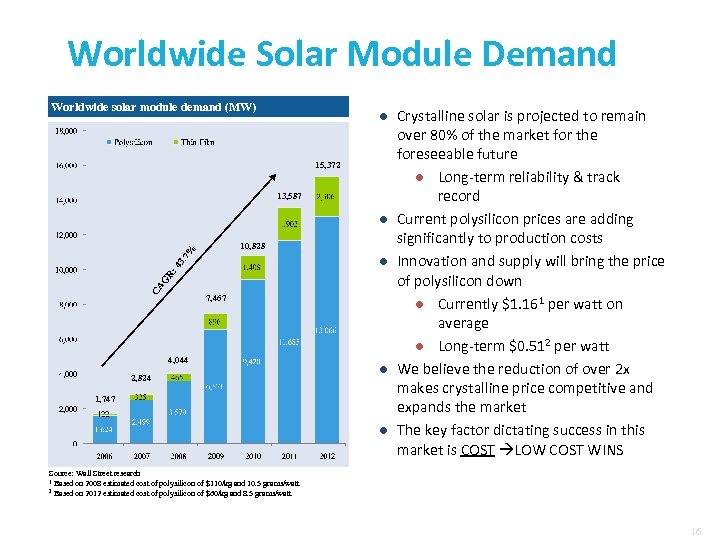

Worldwide Solar Module Demand Worldwide solar module demand (MW) l 15, 372 13, 587 l. 7% 10, 828 CA G R: 43 l 7, 467 4, 044 2, 824 l 1, 747 l Crystalline solar is projected to remain over 80% of the market for the foreseeable future l Long-term reliability & track record Current polysilicon prices are adding significantly to production costs Innovation and supply will bring the price of polysilicon down l Currently $1. 161 per watt on average l Long-term $0. 512 per watt We believe the reduction of over 2 x makes crystalline price competitive and expands the market The key factor dictating success in this market is COST LOW COST WINS Source: Wall Street research 1 Based on 2008 estimated cost of polysilicon of $110/kg and 10. 5 grams/watt 2 Based on 2012 estimated cost of polysilicon of $60/kg and 8. 5 grams/watt 16

Worldwide Solar Module Demand Worldwide solar module demand (MW) l 15, 372 13, 587 l. 7% 10, 828 CA G R: 43 l 7, 467 4, 044 2, 824 l 1, 747 l Crystalline solar is projected to remain over 80% of the market for the foreseeable future l Long-term reliability & track record Current polysilicon prices are adding significantly to production costs Innovation and supply will bring the price of polysilicon down l Currently $1. 161 per watt on average l Long-term $0. 512 per watt We believe the reduction of over 2 x makes crystalline price competitive and expands the market The key factor dictating success in this market is COST LOW COST WINS Source: Wall Street research 1 Based on 2008 estimated cost of polysilicon of $110/kg and 10. 5 grams/watt 2 Based on 2012 estimated cost of polysilicon of $60/kg and 8. 5 grams/watt 16

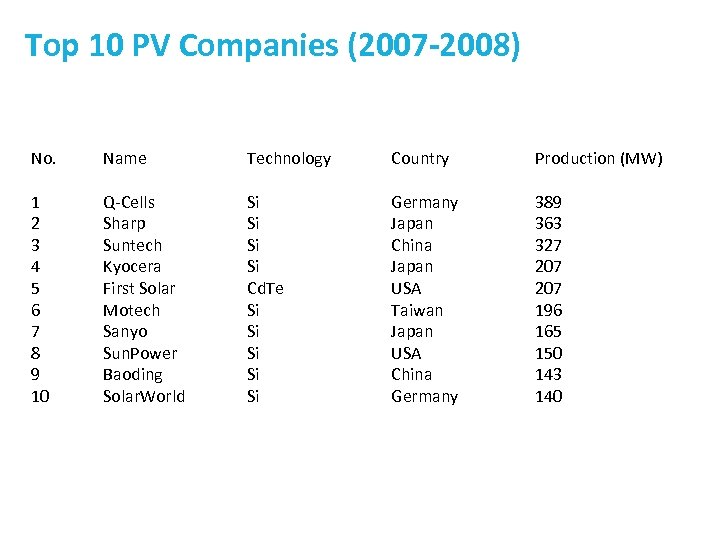

Top 10 PV Companies (2007 -2008) No. Name Technology Country Production (MW) 1 2 3 4 5 6 7 8 9 10 Q-Cells Sharp Suntech Kyocera First Solar Motech Sanyo Sun. Power Baoding Solar. World Si Si Cd. Te Si Si Si Germany Japan China Japan USA Taiwan Japan USA China Germany 389 363 327 207 196 165 150 143 140

Top 10 PV Companies (2007 -2008) No. Name Technology Country Production (MW) 1 2 3 4 5 6 7 8 9 10 Q-Cells Sharp Suntech Kyocera First Solar Motech Sanyo Sun. Power Baoding Solar. World Si Si Cd. Te Si Si Si Germany Japan China Japan USA Taiwan Japan USA China Germany 389 363 327 207 196 165 150 143 140

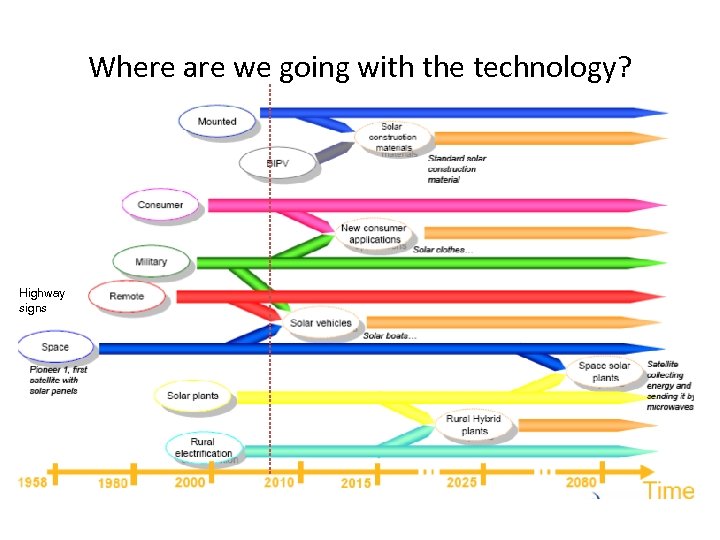

Where are we going with the technology? Highway signs

Where are we going with the technology? Highway signs

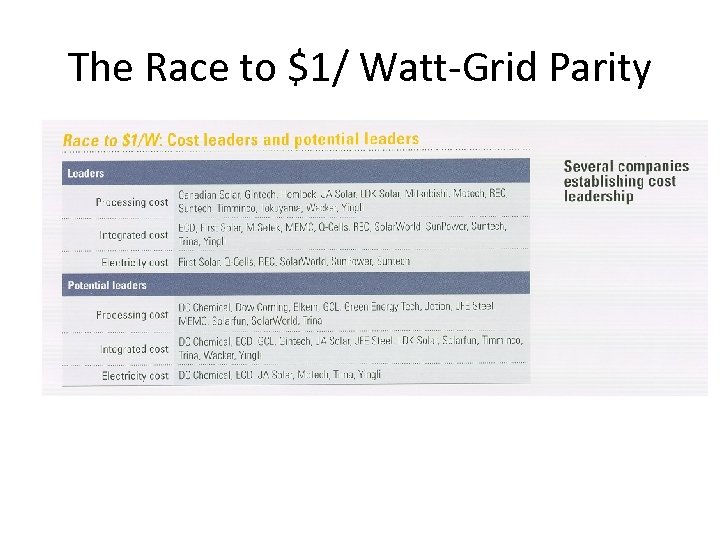

The Race to $1/ Watt-Grid Parity

The Race to $1/ Watt-Grid Parity

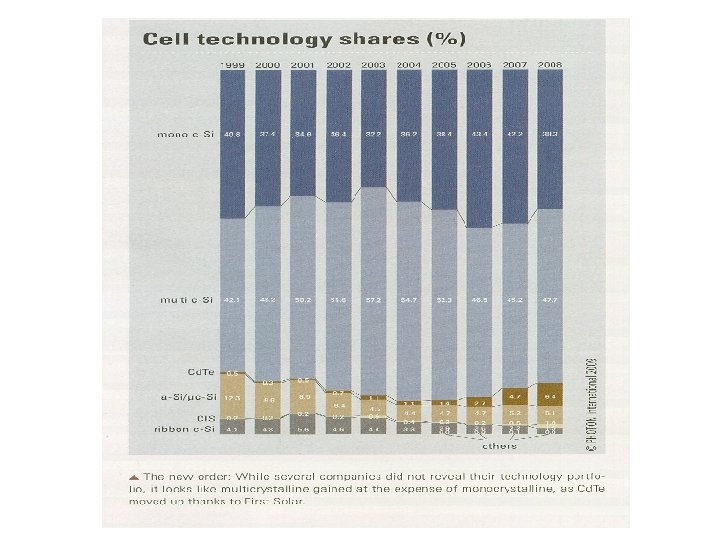

Cell Technology Market Share

Cell Technology Market Share

Case Study • Residential Solar installation • 2000 square foot house • 3. 5 KW system

Case Study • Residential Solar installation • 2000 square foot house • 3. 5 KW system

Residential Solar System (Pros) • Reduce cost of electrical power • Opportunity in remodeling, upgrade home value • Doing “my thing” in improving environment EXAMPLE: 2000 sq ft home: approximately 7600 pound of CO 2 averted per year • Lower energy cost for the future, especially in retirement • Tax incentives, putting tax money to good use • Possible leasing versus purchasing

Residential Solar System (Pros) • Reduce cost of electrical power • Opportunity in remodeling, upgrade home value • Doing “my thing” in improving environment EXAMPLE: 2000 sq ft home: approximately 7600 pound of CO 2 averted per year • Lower energy cost for the future, especially in retirement • Tax incentives, putting tax money to good use • Possible leasing versus purchasing

Residential Solar System (Cons) • Mobile society, not stay around long enough to reap the benefits • Initial outlay of investment, SLOW ROI, 7 to 8 years to break even point • Installation, disruption, possible additional structural needs • Solar panel failure, inverter failure • Having to periodically clean PV panels, breakage and hazard • Other problems, roof leaks, wind damage, etc. • Opportunity cost: – Bathroom remodel plus new heater and insulation (instant ROI if sell home and WITH energy savings – Add a bedroom plus bathroom (226 sq. ft. at $160 per) AND rent it out for $600/month net: break even ROI: 5 years. • NEW TECHNOLOGIES: reduced cost of system, longer life, better output, balance DC to AC inverter integrated systems

Residential Solar System (Cons) • Mobile society, not stay around long enough to reap the benefits • Initial outlay of investment, SLOW ROI, 7 to 8 years to break even point • Installation, disruption, possible additional structural needs • Solar panel failure, inverter failure • Having to periodically clean PV panels, breakage and hazard • Other problems, roof leaks, wind damage, etc. • Opportunity cost: – Bathroom remodel plus new heater and insulation (instant ROI if sell home and WITH energy savings – Add a bedroom plus bathroom (226 sq. ft. at $160 per) AND rent it out for $600/month net: break even ROI: 5 years. • NEW TECHNOLOGIES: reduced cost of system, longer life, better output, balance DC to AC inverter integrated systems

Choosing a Contractor • If need a new roof: roofer/solar contractor may have an advantage as it is VERY CLEAR who is responsible if there are roof leaks. • Get 4 quotes, make sure you are looking at the latest offerings • ISSUES: Poor quality invertors, contractor may not install what they said they would install, undersized DC cables, and may have extra costs to connect to home AC panel/grid thus your ROI is less. • Make sure quotes use same AC rate increase plan 5% to 9% seen in quotes, in this economy will the rate increase slow down? • Re. Grid Power, Next. Energy, Peterson. Dean. Roofing, too many to list

Choosing a Contractor • If need a new roof: roofer/solar contractor may have an advantage as it is VERY CLEAR who is responsible if there are roof leaks. • Get 4 quotes, make sure you are looking at the latest offerings • ISSUES: Poor quality invertors, contractor may not install what they said they would install, undersized DC cables, and may have extra costs to connect to home AC panel/grid thus your ROI is less. • Make sure quotes use same AC rate increase plan 5% to 9% seen in quotes, in this economy will the rate increase slow down? • Re. Grid Power, Next. Energy, Peterson. Dean. Roofing, too many to list

Considerations for Purchasing a System size Installation location Warranty Initial cost, payment outlay Maintenance Costs Independent system or connected to grid PPA: if you sell your home, can you afford to get out of the agreement? • Investment alternatives: • •

Considerations for Purchasing a System size Installation location Warranty Initial cost, payment outlay Maintenance Costs Independent system or connected to grid PPA: if you sell your home, can you afford to get out of the agreement? • Investment alternatives: • •

What is real system performance? • • • What is advertised performance? How is performance defined? How is performance measured? Solar profile of installation site Weather, dirt Shadowing, daily profile Electrical cable lengths Efficiency versus temperature Inverter

What is real system performance? • • • What is advertised performance? How is performance defined? How is performance measured? Solar profile of installation site Weather, dirt Shadowing, daily profile Electrical cable lengths Efficiency versus temperature Inverter

Calculation of ROI, Parameters • Demographics of Usage – Peak power requirements-Are they to be satisfied? – Average power usage • • Cost of system Tax incentives Actual cost of system System operational parameters – Efficiency – Degradation • • • Power generation Power cost Electrical bill per today’s pricing, – Future inflation, – Future usage increase, decrease • • • System generated power cost in long term Savings Years to crossover point

Calculation of ROI, Parameters • Demographics of Usage – Peak power requirements-Are they to be satisfied? – Average power usage • • Cost of system Tax incentives Actual cost of system System operational parameters – Efficiency – Degradation • • • Power generation Power cost Electrical bill per today’s pricing, – Future inflation, – Future usage increase, decrease • • • System generated power cost in long term Savings Years to crossover point

Considerations for Long Term Operation • System performance degradation – Solar panel efficiency – Weathering, dirt – Sunlight availability, shadowing, • Cost of grid available power, inflation • New technology, upgrading of system – Balancing of modules

Considerations for Long Term Operation • System performance degradation – Solar panel efficiency – Weathering, dirt – Sunlight availability, shadowing, • Cost of grid available power, inflation • New technology, upgrading of system – Balancing of modules

How will new technology affect ROI? • Implementation on current system – Power generation balancing – Anti-weathering coatings – Sunlight reflection onto panels – Solar tracking • Electrical power storage – Addition of storage capability

How will new technology affect ROI? • Implementation on current system – Power generation balancing – Anti-weathering coatings – Sunlight reflection onto panels – Solar tracking • Electrical power storage – Addition of storage capability

Comparative Sample Calculation • Demographics – Home with 2000 square feet • Partitioned into living quarters for one family And 2 separate master bedrooms for single occupants • No air conditioning • Composite roof • Facing south west, plenty of sunlight, no shading • Plenty of roof space for solar panels • • • Comparing Sharp, First Solar, BP Solar and Sunpower PV panel based installations Simple calc, only used the expected AC savings, expected AC cost increases (at 2% and 5% per year rate assumptions), panel degradation and net of tax rebate costs used. NOTE: Assumes CLEAN dust free sap free panels CAUTION: Sales person my use 9% AC cost increases per year other inflation rate items and not take into account panel output degradation to show 2 or 3 X the savings. GOOD NEWS: up to 7600 pound of CO 2 averted per year These solar systems have 7 to 8 year to reach break even point and $28 K to $45 K savings in 18 years (18 years is PPA life and may be the “half life” for the Silcon based panels. )

Comparative Sample Calculation • Demographics – Home with 2000 square feet • Partitioned into living quarters for one family And 2 separate master bedrooms for single occupants • No air conditioning • Composite roof • Facing south west, plenty of sunlight, no shading • Plenty of roof space for solar panels • • • Comparing Sharp, First Solar, BP Solar and Sunpower PV panel based installations Simple calc, only used the expected AC savings, expected AC cost increases (at 2% and 5% per year rate assumptions), panel degradation and net of tax rebate costs used. NOTE: Assumes CLEAN dust free sap free panels CAUTION: Sales person my use 9% AC cost increases per year other inflation rate items and not take into account panel output degradation to show 2 or 3 X the savings. GOOD NEWS: up to 7600 pound of CO 2 averted per year These solar systems have 7 to 8 year to reach break even point and $28 K to $45 K savings in 18 years (18 years is PPA life and may be the “half life” for the Silcon based panels. )

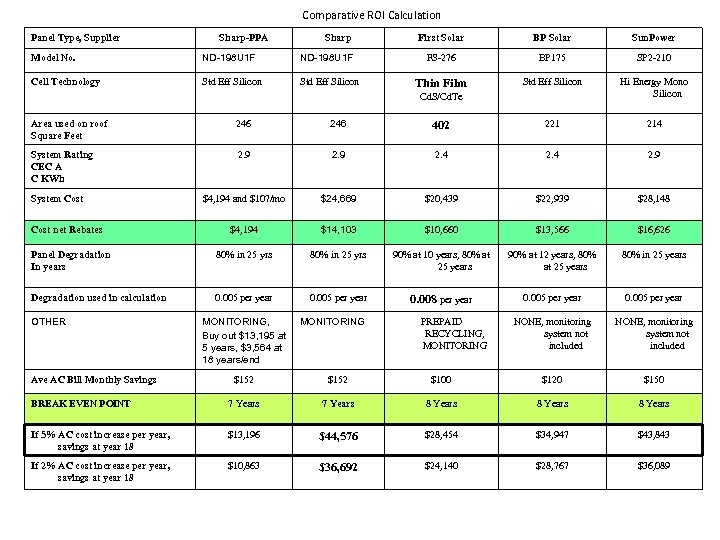

Comparative ROI Calculation Panel Type, Supplier Sharp-PPA Sharp Model No. ND-198 U 1 F Cell Technology Std Eff Silicon First Solar BP Solar Sun. Power FS-276 BP 175 SP 2 -210 Thin Film Std Eff Silicon Hi Energy Mono Silicon Cd. S/Cd. Te Area used on roof Square Feet 246 402 221 214 System Rating CEC A C KWh 2. 9 2. 4 2. 9 $4, 194 and $107/mo $24, 669 $20, 439 $22, 939 $28, 148 $4, 194 $14, 103 $10, 660 $13, 566 $16, 626 Panel Degradation In years 80% in 25 yrs 90% at 10 years, 80% at 25 years 90% at 12 years, 80% at 25 years 80% in 25 years Degradation used in calculation 0. 005 per year 0. 008 per year 0. 005 per year NONE, monitoring system not included System Cost net Rebates OTHER Ave AC Bill Monthly Savings MONITORING, Buy out $13, 195 at 5 years, $3, 564 at 18 years/end MONITORING PREPAID RECYCLING, MONITORING $152 $100 $120 $150 BREAK EVEN POINT 7 Years 8 Years If 5% AC cost increase per year, savings at year 18 $13, 196 $44, 576 $28, 454 $34, 947 $43, 843 If 2% AC cost increase per year, savings at year 18 $10, 863 $36, 692 $24, 140 $28, 767 $36, 089

Comparative ROI Calculation Panel Type, Supplier Sharp-PPA Sharp Model No. ND-198 U 1 F Cell Technology Std Eff Silicon First Solar BP Solar Sun. Power FS-276 BP 175 SP 2 -210 Thin Film Std Eff Silicon Hi Energy Mono Silicon Cd. S/Cd. Te Area used on roof Square Feet 246 402 221 214 System Rating CEC A C KWh 2. 9 2. 4 2. 9 $4, 194 and $107/mo $24, 669 $20, 439 $22, 939 $28, 148 $4, 194 $14, 103 $10, 660 $13, 566 $16, 626 Panel Degradation In years 80% in 25 yrs 90% at 10 years, 80% at 25 years 90% at 12 years, 80% at 25 years 80% in 25 years Degradation used in calculation 0. 005 per year 0. 008 per year 0. 005 per year NONE, monitoring system not included System Cost net Rebates OTHER Ave AC Bill Monthly Savings MONITORING, Buy out $13, 195 at 5 years, $3, 564 at 18 years/end MONITORING PREPAID RECYCLING, MONITORING $152 $100 $120 $150 BREAK EVEN POINT 7 Years 8 Years If 5% AC cost increase per year, savings at year 18 $13, 196 $44, 576 $28, 454 $34, 947 $43, 843 If 2% AC cost increase per year, savings at year 18 $10, 863 $36, 692 $24, 140 $28, 767 $36, 089

What you might need • Licenses • Certifications – Engineering – Installation

What you might need • Licenses • Certifications – Engineering – Installation

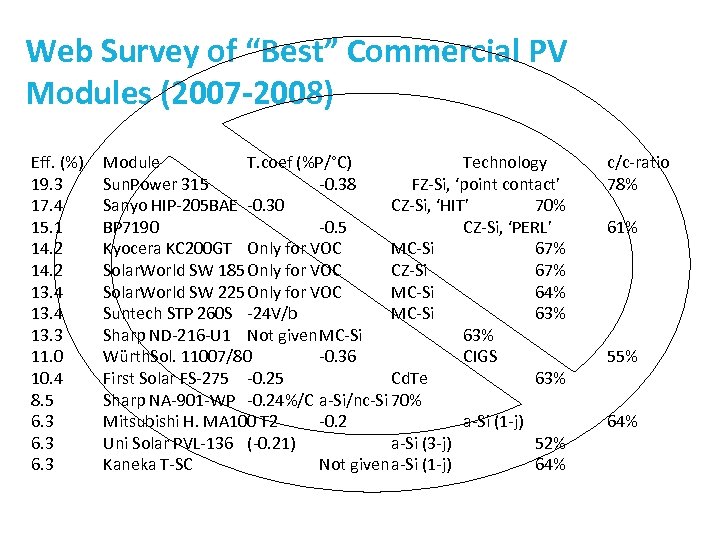

Web Survey of “Best” Commercial PV Modules (2007 -2008) Eff. (%) 19. 3 17. 4 15. 1 14. 2 13. 4 13. 3 11. 0 10. 4 8. 5 6. 3 Module T. coef (%P/°C) Technology Sun. Power 315 -0. 38 FZ-Si, ‘point contact’ Sanyo HIP-205 BAE -0. 30 CZ-Si, ‘HIT’ 70% BP 7190 -0. 5 CZ-Si, ‘PERL’ Kyocera KC 200 GT Only for VOC MC-Si 67% Solar. World SW 185 Only for VOC CZ-Si 67% Solar. World SW 225 Only for VOC MC-Si 64% Suntech STP 260 S -24 V/b MC-Si 63% Sharp ND-216 -U 1 Not given. MC-Si 63% Würth. Sol. 11007/80 -0. 36 CIGS First Solar FS-275 -0. 25 Cd. Te 63% Sharp NA-901 -WP -0. 24%/C a-Si/nc-Si 70% Mitsubishi H. MA 100 T 2 -0. 2 a-Si (1 -j) Uni Solar PVL-136 (-0. 21) a-Si (3 -j) 52% Kaneka T-SC Not givena-Si (1 -j) 64% c/c-ratio 78% 61% 55% 64%

Web Survey of “Best” Commercial PV Modules (2007 -2008) Eff. (%) 19. 3 17. 4 15. 1 14. 2 13. 4 13. 3 11. 0 10. 4 8. 5 6. 3 Module T. coef (%P/°C) Technology Sun. Power 315 -0. 38 FZ-Si, ‘point contact’ Sanyo HIP-205 BAE -0. 30 CZ-Si, ‘HIT’ 70% BP 7190 -0. 5 CZ-Si, ‘PERL’ Kyocera KC 200 GT Only for VOC MC-Si 67% Solar. World SW 185 Only for VOC CZ-Si 67% Solar. World SW 225 Only for VOC MC-Si 64% Suntech STP 260 S -24 V/b MC-Si 63% Sharp ND-216 -U 1 Not given. MC-Si 63% Würth. Sol. 11007/80 -0. 36 CIGS First Solar FS-275 -0. 25 Cd. Te 63% Sharp NA-901 -WP -0. 24%/C a-Si/nc-Si 70% Mitsubishi H. MA 100 T 2 -0. 2 a-Si (1 -j) Uni Solar PVL-136 (-0. 21) a-Si (3 -j) 52% Kaneka T-SC Not givena-Si (1 -j) 64% c/c-ratio 78% 61% 55% 64%

Examples of Thin Film Cells QCell QCell

Examples of Thin Film Cells QCell QCell