7996db454833968dac640dbda4eae4f7.ppt

- Количество слайдов: 40

Software AG Investor Roadshow USA July 2003

Software AG Investor Roadshow USA July 2003

Software AG Profile n Germany’s second largest software vendor n In the high-end, mission-critical IT business since 1969 n Worldwide customer base of several thousand blue chip companies and public sector organizations n Leader in XML system technology (DBMS and integration) n System integrator for own products and solutions n Listed at Frankfurt stock exchange (Tec. DAX) n Market Cap 325 mio. € / 375 mio. $ - Free Float: 68. 4% Investor Roadshow USA July 2003 2

Software AG Profile n Germany’s second largest software vendor n In the high-end, mission-critical IT business since 1969 n Worldwide customer base of several thousand blue chip companies and public sector organizations n Leader in XML system technology (DBMS and integration) n System integrator for own products and solutions n Listed at Frankfurt stock exchange (Tec. DAX) n Market Cap 325 mio. € / 375 mio. $ - Free Float: 68. 4% Investor Roadshow USA July 2003 2

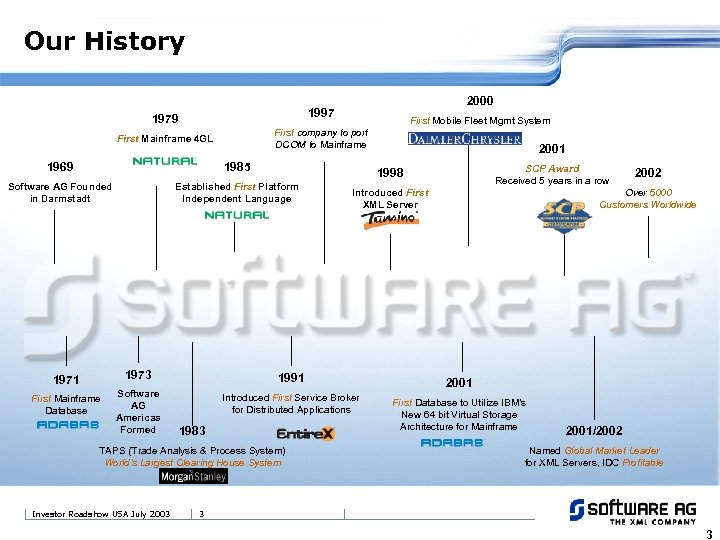

Our History 2000 1997 1979 First Mobile Fleet Mgmt System First company to port DCOM to Mainframe First Mainframe 4 GL 1969 1985 Software AG Founded in Darmstadt Established First Platform Independent Language 2001 SCP Award Received 5 years in a row 1998 Introduced First XML Server Over 5000 Customers Worldwide 1973 1971 First Mainframe Database 2002 1991 Software AG Americas Formed 2001 Introduced First Service Broker for Distributed Applications First Database to Utilize IBM’s New 64 bit Virtual Storage Architecture for Mainframe 1983 TAPS (Trade Analysis & Process System) World’s Largest Clearing House System Investor Roadshow USA July 2003 2001/2002 Named Global Market Leader for XML Servers, IDC Profitable 3 3

Our History 2000 1997 1979 First Mobile Fleet Mgmt System First company to port DCOM to Mainframe First Mainframe 4 GL 1969 1985 Software AG Founded in Darmstadt Established First Platform Independent Language 2001 SCP Award Received 5 years in a row 1998 Introduced First XML Server Over 5000 Customers Worldwide 1973 1971 First Mainframe Database 2002 1991 Software AG Americas Formed 2001 Introduced First Service Broker for Distributed Applications First Database to Utilize IBM’s New 64 bit Virtual Storage Architecture for Mainframe 1983 TAPS (Trade Analysis & Process System) World’s Largest Clearing House System Investor Roadshow USA July 2003 2001/2002 Named Global Market Leader for XML Servers, IDC Profitable 3 3

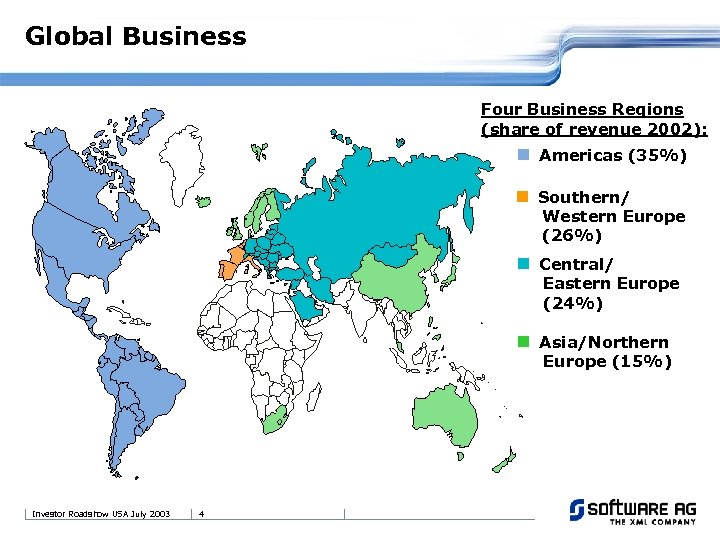

Global Business Four Business Regions (share of revenue 2002): n Americas (35%) n Southern/ Western Europe (26%) n Central/ Eastern Europe (24%) n Asia/Northern Europe (15%) Investor Roadshow USA July 2003 4

Global Business Four Business Regions (share of revenue 2002): n Americas (35%) n Southern/ Western Europe (26%) n Central/ Eastern Europe (24%) n Asia/Northern Europe (15%) Investor Roadshow USA July 2003 4

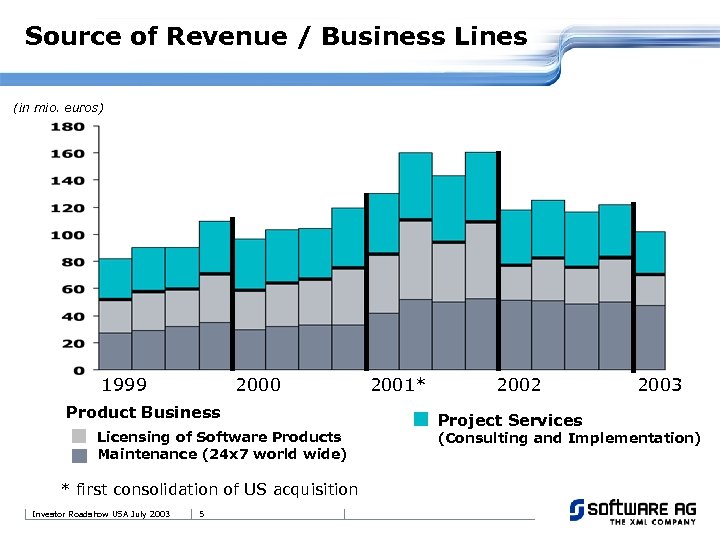

Source of Revenue / Business Lines (in mio. euros) 1999 2000 Product Business Licensing of Software Products Maintenance (24 x 7 world wide) * first consolidation of US acquisition Investor Roadshow USA July 2003 5 2001* 2002 Project Services 2003 (Consulting and Implementation)

Source of Revenue / Business Lines (in mio. euros) 1999 2000 Product Business Licensing of Software Products Maintenance (24 x 7 world wide) * first consolidation of US acquisition Investor Roadshow USA July 2003 5 2001* 2002 Project Services 2003 (Consulting and Implementation)

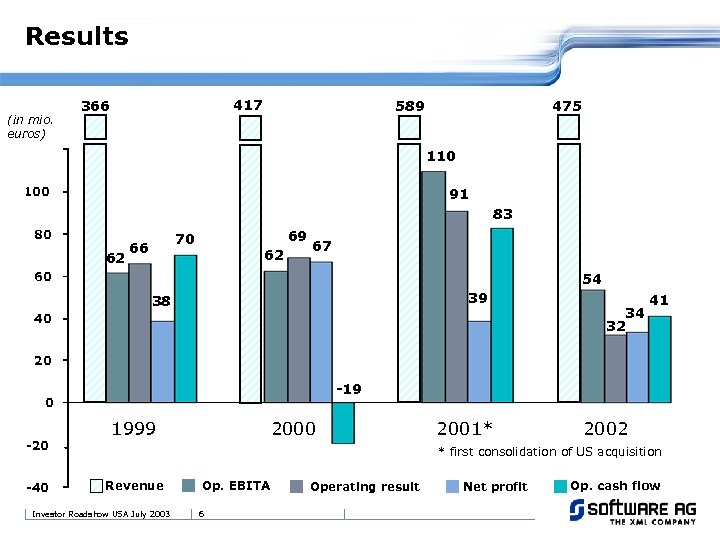

Results (in mio. euros) 417 366 475 589 110 100 91 83 80 62 69 70 66 62 67 60 54 39 38 40 34 32 41 20 -19 0 -20 -40 1999 2000 2001* 2002 * first consolidation of US acquisition Revenue Investor Roadshow USA July 2003 Op. EBITA 6 Operating result Net profit Op. cash flow

Results (in mio. euros) 417 366 475 589 110 100 91 83 80 62 69 70 66 62 67 60 54 39 38 40 34 32 41 20 -19 0 -20 -40 1999 2000 2001* 2002 * first consolidation of US acquisition Revenue Investor Roadshow USA July 2003 Op. EBITA 6 Operating result Net profit Op. cash flow

Strategy

Strategy

Positioning of Software AG n Focus on product business u Licensing of software products u Excellent maintenance services n Global presence n Technology leader in XML n Expansion of the product portfolio to include standardized solutions n System integrator for own products and solutions Investor Roadshow USA July 2003 8

Positioning of Software AG n Focus on product business u Licensing of software products u Excellent maintenance services n Global presence n Technology leader in XML n Expansion of the product portfolio to include standardized solutions n System integrator for own products and solutions Investor Roadshow USA July 2003 8

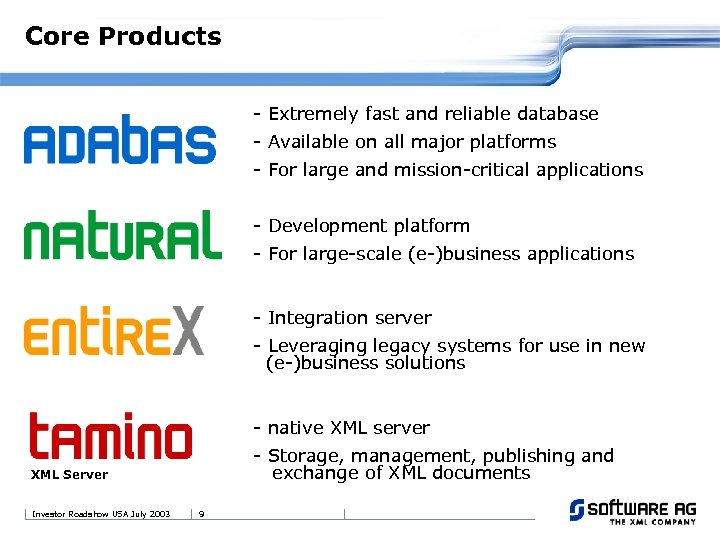

Core Products - Extremely fast and reliable database - Available on all major platforms - For large and mission-critical applications - Development platform - For large-scale (e-)business applications - Integration server - Leveraging legacy systems for use in new (e-)business solutions XML Server Investor Roadshow USA July 2003 9 - native XML server - Storage, management, publishing and exchange of XML documents

Core Products - Extremely fast and reliable database - Available on all major platforms - For large and mission-critical applications - Development platform - For large-scale (e-)business applications - Integration server - Leveraging legacy systems for use in new (e-)business solutions XML Server Investor Roadshow USA July 2003 9 - native XML server - Storage, management, publishing and exchange of XML documents

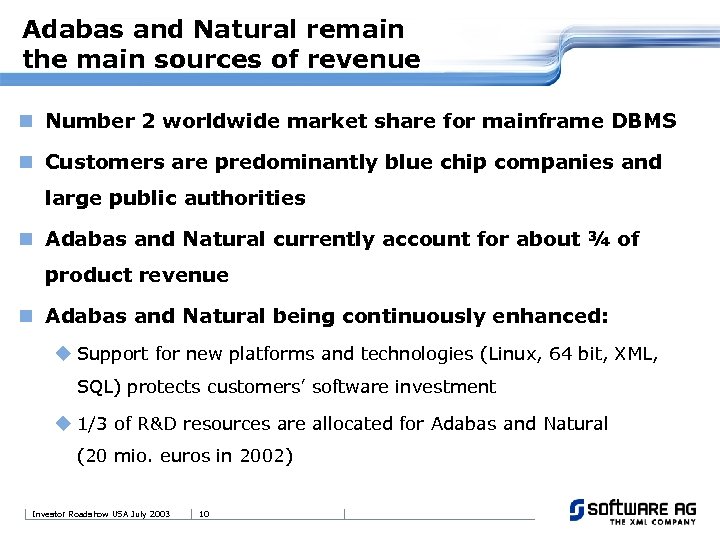

Adabas and Natural remain the main sources of revenue n Number 2 worldwide market share for mainframe DBMS n Customers are predominantly blue chip companies and large public authorities n Adabas and Natural currently account for about ¾ of product revenue n Adabas and Natural being continuously enhanced: u Support for new platforms and technologies (Linux, 64 bit, XML, SQL) protects customers’ software investment u 1/3 of R&D resources are allocated for Adabas and Natural (20 mio. euros in 2002) Investor Roadshow USA July 2003 10

Adabas and Natural remain the main sources of revenue n Number 2 worldwide market share for mainframe DBMS n Customers are predominantly blue chip companies and large public authorities n Adabas and Natural currently account for about ¾ of product revenue n Adabas and Natural being continuously enhanced: u Support for new platforms and technologies (Linux, 64 bit, XML, SQL) protects customers’ software investment u 1/3 of R&D resources are allocated for Adabas and Natural (20 mio. euros in 2002) Investor Roadshow USA July 2003 10

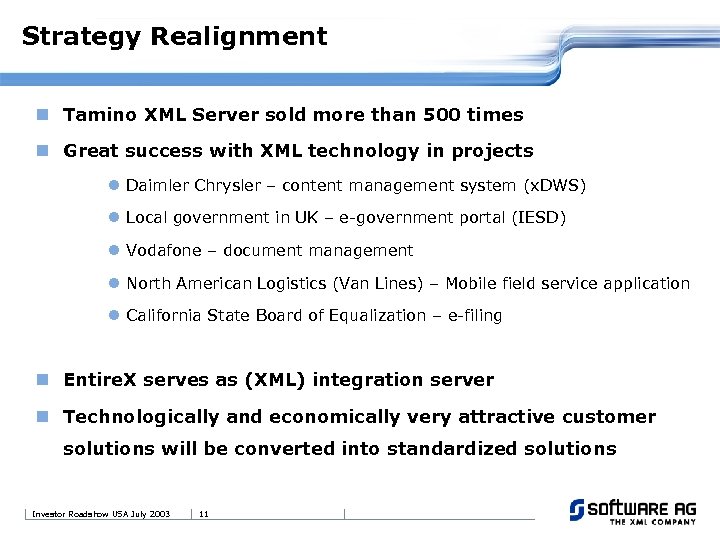

Strategy Realignment n Tamino XML Server sold more than 500 times n Great success with XML technology in projects l Daimler Chrysler – content management system (x. DWS) l Local government in UK – e-government portal (IESD) l Vodafone – document management l North American Logistics (Van Lines) – Mobile field service application l California State Board of Equalization – e-filing n Entire. X serves as (XML) integration server n Technologically and economically very attractive customer solutions will be converted into standardized solutions Investor Roadshow USA July 2003 11

Strategy Realignment n Tamino XML Server sold more than 500 times n Great success with XML technology in projects l Daimler Chrysler – content management system (x. DWS) l Local government in UK – e-government portal (IESD) l Vodafone – document management l North American Logistics (Van Lines) – Mobile field service application l California State Board of Equalization – e-filing n Entire. X serves as (XML) integration server n Technologically and economically very attractive customer solutions will be converted into standardized solutions Investor Roadshow USA July 2003 11

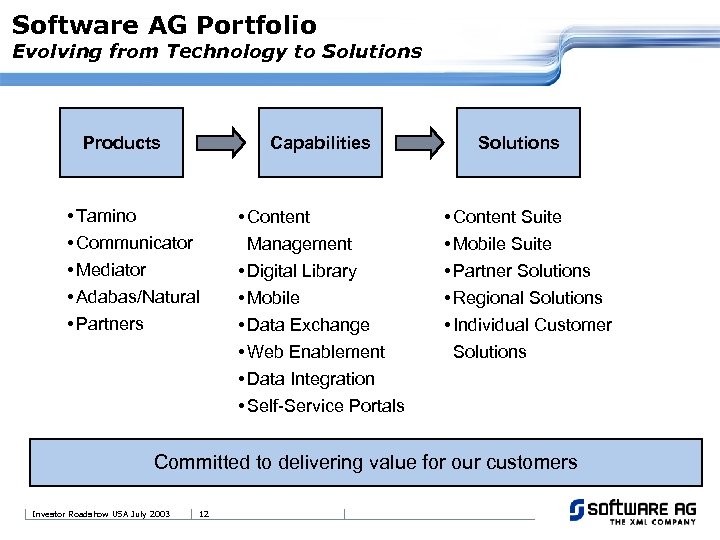

Software AG Portfolio Evolving from Technology to Solutions Products Capabilities • Tamino • Communicator • Mediator • Adabas/Natural • Partners • Content Management • Digital Library • Mobile • Data Exchange • Web Enablement • Data Integration • Self-Service Portals Solutions • Content Suite • Mobile Suite • Partner Solutions • Regional Solutions • Individual Customer Solutions Committed to delivering value for our customers Investor Roadshow USA July 2003 12

Software AG Portfolio Evolving from Technology to Solutions Products Capabilities • Tamino • Communicator • Mediator • Adabas/Natural • Partners • Content Management • Digital Library • Mobile • Data Exchange • Web Enablement • Data Integration • Self-Service Portals Solutions • Content Suite • Mobile Suite • Partner Solutions • Regional Solutions • Individual Customer Solutions Committed to delivering value for our customers Investor Roadshow USA July 2003 12

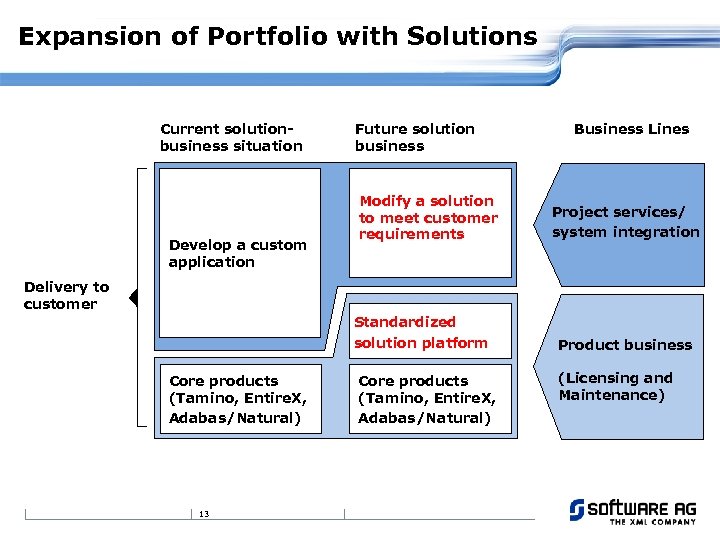

Expansion of Portfolio with Solutions Current solutionbusiness situation Develop a custom application Future solution business Modify a solution to meet customer requirements Business Lines Project services/ system integration Delivery to customer Standardized solution platform Core products (Tamino, Entire. X, Adabas/Natural) 13 Core products (Tamino, Entire. X, Adabas/Natural) Product business (Licensing and Maintenance)

Expansion of Portfolio with Solutions Current solutionbusiness situation Develop a custom application Future solution business Modify a solution to meet customer requirements Business Lines Project services/ system integration Delivery to customer Standardized solution platform Core products (Tamino, Entire. X, Adabas/Natural) 13 Core products (Tamino, Entire. X, Adabas/Natural) Product business (Licensing and Maintenance)

Marketing and Sales

Marketing and Sales

The New Software AG Sales Approach Customer First Strategy Move from Product and “Event” go to market strategy to a proactive consultative sales process focused on understanding client business issues and positioning Software AG solutions/capabilities to meet those needs. Customer First is: n Understanding our customers’ business and finding out how we can provide solutions that meet their needs n A fundamental change, not only in our culture, but in the entire software industry n Equally applicable to our installed base of customers or new prospects n The way we will do business Investor Roadshow USA July 2003 15

The New Software AG Sales Approach Customer First Strategy Move from Product and “Event” go to market strategy to a proactive consultative sales process focused on understanding client business issues and positioning Software AG solutions/capabilities to meet those needs. Customer First is: n Understanding our customers’ business and finding out how we can provide solutions that meet their needs n A fundamental change, not only in our culture, but in the entire software industry n Equally applicable to our installed base of customers or new prospects n The way we will do business Investor Roadshow USA July 2003 15

Focus on Industries n Financial Services n Manufacturing n Pharma n Trade and Logistics n Media n Public Administration Regions will focus on their most important segments Investor Roadshow USA July 2003 16

Focus on Industries n Financial Services n Manufacturing n Pharma n Trade and Logistics n Media n Public Administration Regions will focus on their most important segments Investor Roadshow USA July 2003 16

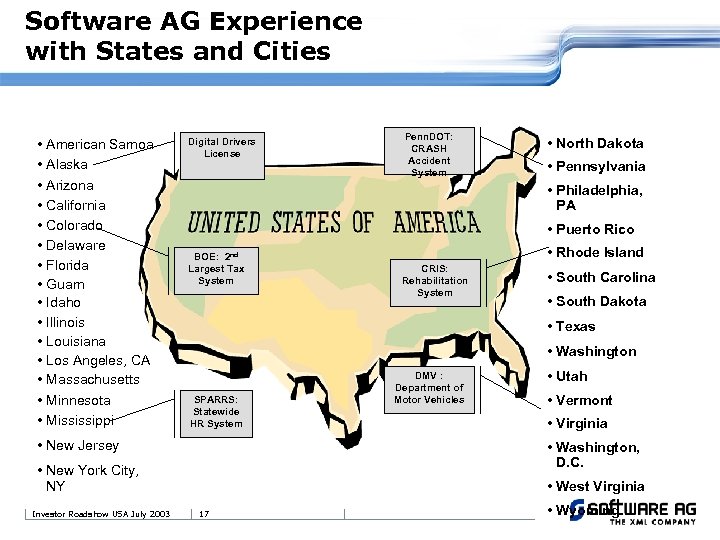

Software AG Experience with States and Cities • American Samoa • Alaska • Arizona • California • Colorado • Delaware • Florida • Guam • Idaho • Illinois • Louisiana • Los Angeles, CA • Massachusetts • Minnesota • Mississippi Digital Drivers License • North Dakota • Pennsylvania • Philadelphia, PA • Puerto Rico BOE: 2 nd Largest Tax System • Rhode Island CRIS: Rehabilitation System • South Carolina • South Dakota • Texas • Washington SPARRS: Statewide HR System • New Jersey DMV : Department of Motor Vehicles • Utah • Vermont • Virginia • Washington, D. C. • New York City, NY Investor Roadshow USA July 2003 Penn. DOT: CRASH Accident System • West Virginia 17 • Wyoming

Software AG Experience with States and Cities • American Samoa • Alaska • Arizona • California • Colorado • Delaware • Florida • Guam • Idaho • Illinois • Louisiana • Los Angeles, CA • Massachusetts • Minnesota • Mississippi Digital Drivers License • North Dakota • Pennsylvania • Philadelphia, PA • Puerto Rico BOE: 2 nd Largest Tax System • Rhode Island CRIS: Rehabilitation System • South Carolina • South Dakota • Texas • Washington SPARRS: Statewide HR System • New Jersey DMV : Department of Motor Vehicles • Utah • Vermont • Virginia • Washington, D. C. • New York City, NY Investor Roadshow USA July 2003 Penn. DOT: CRASH Accident System • West Virginia 17 • Wyoming

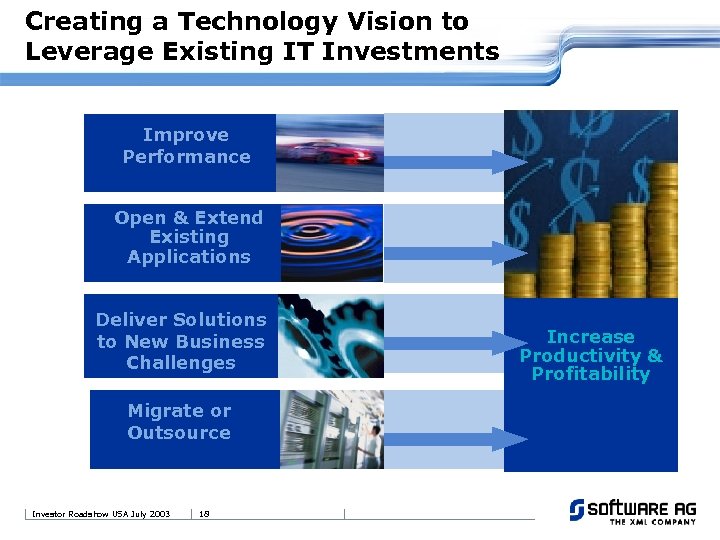

Creating a Technology Vision to Leverage Existing IT Investments Improve Performance Open & Extend Existing Applications Deliver Solutions to New Business Challenges Migrate or Outsource Investor Roadshow USA July 2003 18 Increase Productivity & Profitability

Creating a Technology Vision to Leverage Existing IT Investments Improve Performance Open & Extend Existing Applications Deliver Solutions to New Business Challenges Migrate or Outsource Investor Roadshow USA July 2003 18 Increase Productivity & Profitability

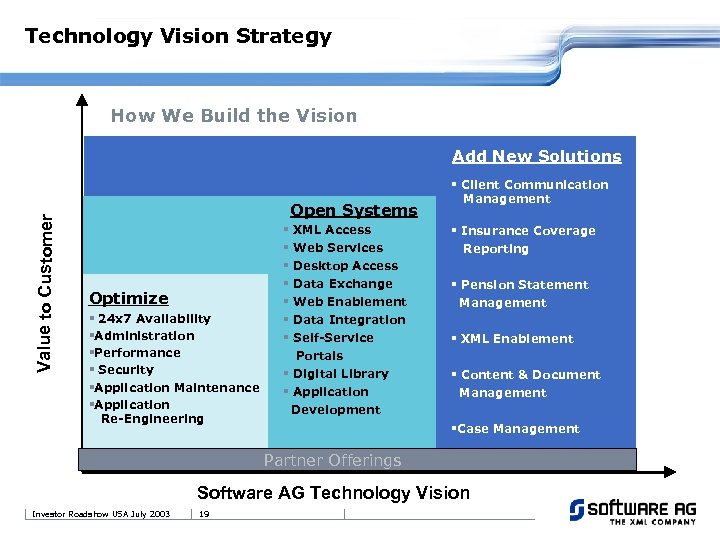

Technology Vision Strategy How We Build the Vision Value to Customer Add New Solutions Open Systems Optimize § 24 x 7 Availability Quick Wins §Administration §Performance § Security §Application Maintenance §Application Re-Engineering § § § § XML Access Web Services Desktop Access Data Exchange Web Enablement Data Integration Self-Service Portals § Digital Library § Application Development § Client Communication Management § Insurance Coverage Reporting § Pension Statement Management § XML Enablement § Content & Document Management §Case Management Partner Offerings Software AG Technology Vision Investor Roadshow USA July 2003 19

Technology Vision Strategy How We Build the Vision Value to Customer Add New Solutions Open Systems Optimize § 24 x 7 Availability Quick Wins §Administration §Performance § Security §Application Maintenance §Application Re-Engineering § § § § XML Access Web Services Desktop Access Data Exchange Web Enablement Data Integration Self-Service Portals § Digital Library § Application Development § Client Communication Management § Insurance Coverage Reporting § Pension Statement Management § XML Enablement § Content & Document Management §Case Management Partner Offerings Software AG Technology Vision Investor Roadshow USA July 2003 19

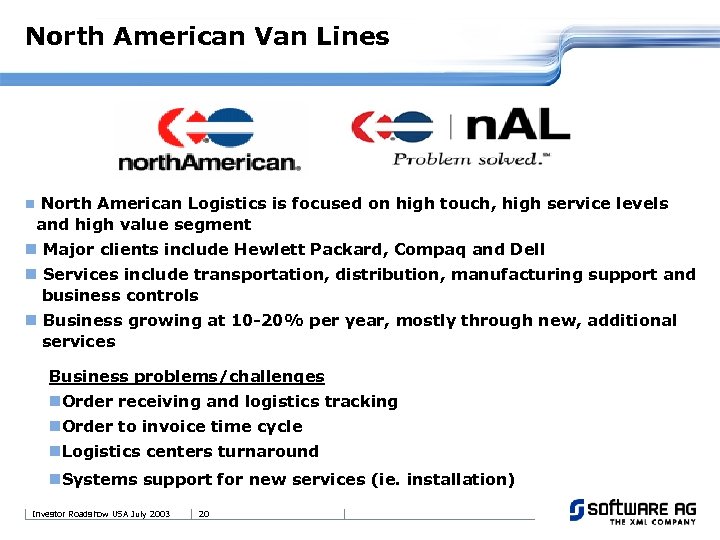

North American Van Lines n North American Logistics is focused on high touch, high service levels and high value segment n Major clients include Hewlett Packard, Compaq and Dell n Services include transportation, distribution, manufacturing support and business controls n Business growing at 10 -20% per year, mostly through new, additional services Business problems/challenges n. Order receiving and logistics tracking n. Order to invoice time cycle n. Logistics centers turnaround n. Systems support for new services (ie. installation) Investor Roadshow USA July 2003 20

North American Van Lines n North American Logistics is focused on high touch, high service levels and high value segment n Major clients include Hewlett Packard, Compaq and Dell n Services include transportation, distribution, manufacturing support and business controls n Business growing at 10 -20% per year, mostly through new, additional services Business problems/challenges n. Order receiving and logistics tracking n. Order to invoice time cycle n. Logistics centers turnaround n. Systems support for new services (ie. installation) Investor Roadshow USA July 2003 20

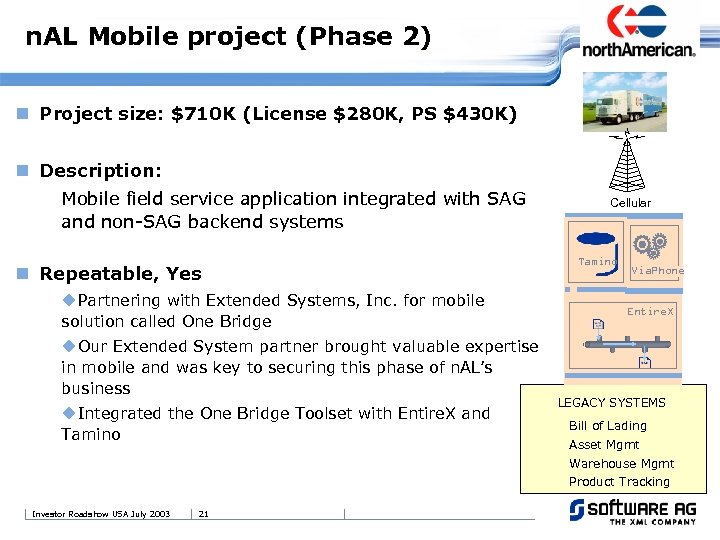

n. AL Mobile project (Phase 2) n Project size: $710 K (License $280 K, PS $430 K) n Description: Mobile field service application integrated with SAG and non-SAG backend systems n Repeatable, Yes u. Partnering with Extended Systems, Inc. for mobile solution called One Bridge u. Our Extended System partner brought valuable expertise in mobile and was key to securing this phase of n. AL’s business u. Integrated the One Bridge Toolset with Entire. X and Tamino Cellular Tamino Via. Phone Entire. X LEGACY SYSTEMS Bill of Lading Asset Mgmt Warehouse Mgmt Product Tracking Investor Roadshow USA July 2003 21

n. AL Mobile project (Phase 2) n Project size: $710 K (License $280 K, PS $430 K) n Description: Mobile field service application integrated with SAG and non-SAG backend systems n Repeatable, Yes u. Partnering with Extended Systems, Inc. for mobile solution called One Bridge u. Our Extended System partner brought valuable expertise in mobile and was key to securing this phase of n. AL’s business u. Integrated the One Bridge Toolset with Entire. X and Tamino Cellular Tamino Via. Phone Entire. X LEGACY SYSTEMS Bill of Lading Asset Mgmt Warehouse Mgmt Product Tracking Investor Roadshow USA July 2003 21

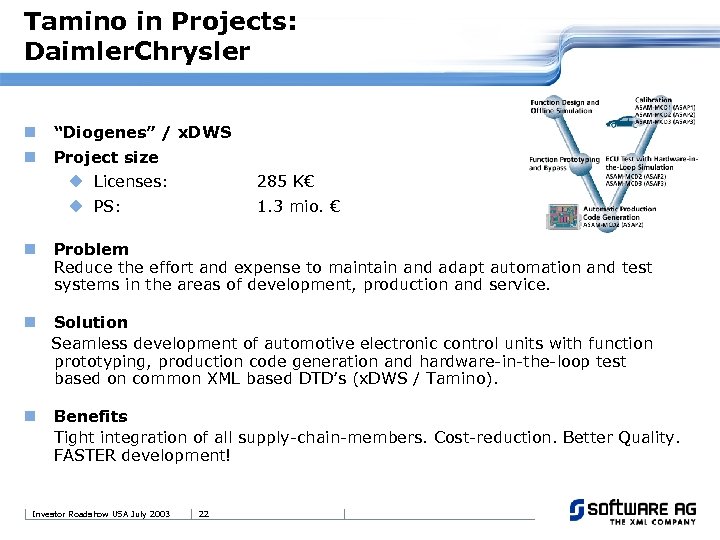

Tamino in Projects: Daimler. Chrysler n “Diogenes” / x. DWS n Project size u Licenses: 285 K€ u PS: 1. 3 mio. € n Problem Reduce the effort and expense to maintain and adapt automation and test systems in the areas of development, production and service. n Solution Seamless development of automotive electronic control units with function prototyping, production code generation and hardware-in-the-loop test based on common XML based DTD’s (x. DWS / Tamino). n Benefits Tight integration of all supply-chain-members. Cost-reduction. Better Quality. FASTER development! Investor Roadshow USA July 2003 22

Tamino in Projects: Daimler. Chrysler n “Diogenes” / x. DWS n Project size u Licenses: 285 K€ u PS: 1. 3 mio. € n Problem Reduce the effort and expense to maintain and adapt automation and test systems in the areas of development, production and service. n Solution Seamless development of automotive electronic control units with function prototyping, production code generation and hardware-in-the-loop test based on common XML based DTD’s (x. DWS / Tamino). n Benefits Tight integration of all supply-chain-members. Cost-reduction. Better Quality. FASTER development! Investor Roadshow USA July 2003 22

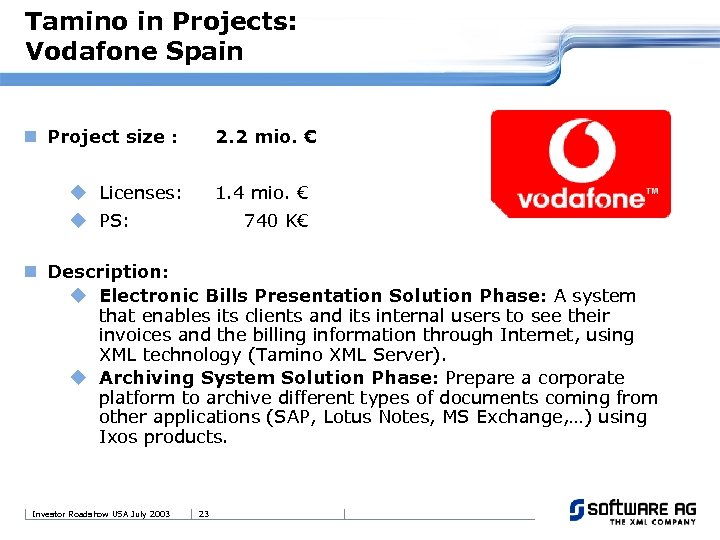

Tamino in Projects: Vodafone Spain n Project size : 2. 2 mio. € u Licenses: 1. 4 mio. € u PS: 740 K€ n Description: u Electronic Bills Presentation Solution Phase: A system that enables its clients and its internal users to see their invoices and the billing information through Internet, using XML technology (Tamino XML Server). u Archiving System Solution Phase: Prepare a corporate platform to archive different types of documents coming from other applications (SAP, Lotus Notes, MS Exchange, …) using Ixos products. Investor Roadshow USA July 2003 23

Tamino in Projects: Vodafone Spain n Project size : 2. 2 mio. € u Licenses: 1. 4 mio. € u PS: 740 K€ n Description: u Electronic Bills Presentation Solution Phase: A system that enables its clients and its internal users to see their invoices and the billing information through Internet, using XML technology (Tamino XML Server). u Archiving System Solution Phase: Prepare a corporate platform to archive different types of documents coming from other applications (SAP, Lotus Notes, MS Exchange, …) using Ixos products. Investor Roadshow USA July 2003 23

1 st Quarter 2003 Financial Report

1 st Quarter 2003 Financial Report

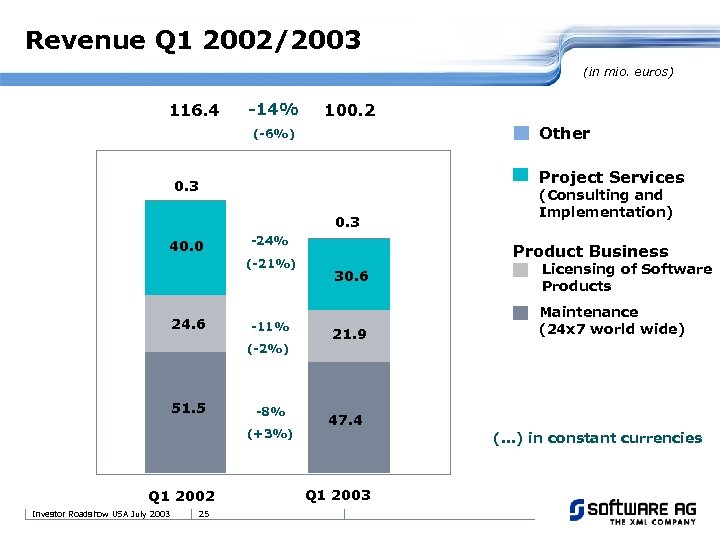

Revenue Q 1 2002/2003 (in mio. euros) 116. 4 -14% 100. 2 Other (-6%) Project Services 0. 3 40. 0 -24% (-21%) 24. 6 -11% (-2%) 51. 5 -8% (+3%) Q 1 2002 Investor Roadshow USA July 2003 25 (Consulting and Implementation) Product Business 30. 6 21. 9 Licensing of Software Products Maintenance (24 x 7 world wide) 47. 4 (. . . ) in constant currencies Q 1 2003

Revenue Q 1 2002/2003 (in mio. euros) 116. 4 -14% 100. 2 Other (-6%) Project Services 0. 3 40. 0 -24% (-21%) 24. 6 -11% (-2%) 51. 5 -8% (+3%) Q 1 2002 Investor Roadshow USA July 2003 25 (Consulting and Implementation) Product Business 30. 6 21. 9 Licensing of Software Products Maintenance (24 x 7 world wide) 47. 4 (. . . ) in constant currencies Q 1 2003

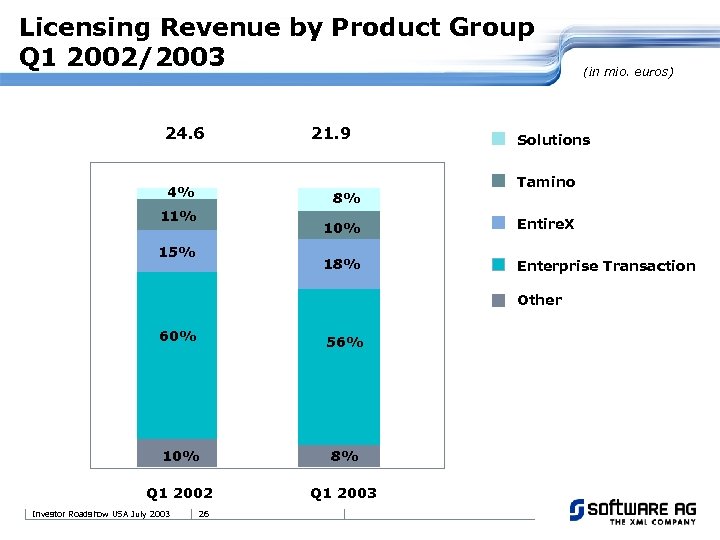

Licensing Revenue by Product Group Q 1 2002/2003 24. 6 4% 21. 9 8% 11% Solutions Tamino 10% Entire. X 18% 15% Enterprise Transaction Other 60% 56% 10% 8% Q 1 2002 Q 1 2003 Investor Roadshow USA July 2003 (in mio. euros) 26

Licensing Revenue by Product Group Q 1 2002/2003 24. 6 4% 21. 9 8% 11% Solutions Tamino 10% Entire. X 18% 15% Enterprise Transaction Other 60% 56% 10% 8% Q 1 2002 Q 1 2003 Investor Roadshow USA July 2003 (in mio. euros) 26

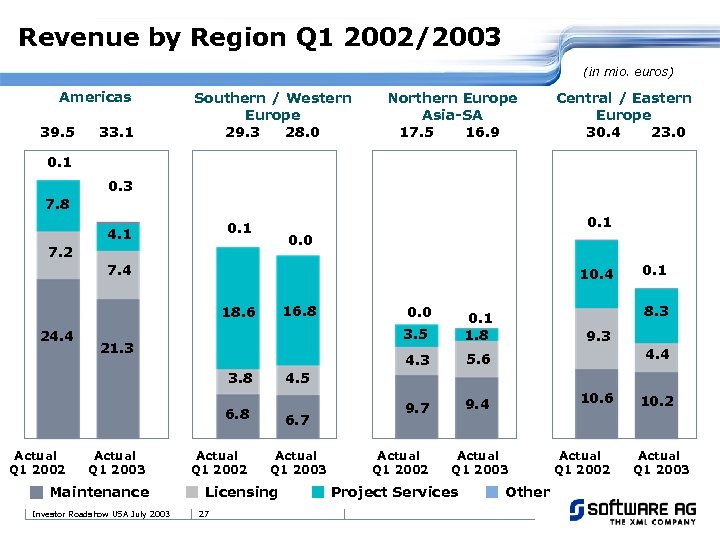

Revenue by Region Q 1 2002/2003 (in mio. euros) Americas 39. 5 33. 1 Southern / Western Europe 29. 3 28. 0 Northern Europe Asia-SA 17. 5 16. 9 Central / Eastern Europe 30. 4 23. 0 0. 1 0. 3 7. 8 0. 1 4. 1 0. 0 7. 2 7. 4 10. 4 16. 8 18. 6 24. 4 3. 5 Maintenance Investor Roadshow USA July 2003 Actual Q 1 2002 6. 7 Actual Q 1 2003 Licensing 27 9. 4 9. 3 4. 4 4. 5 6. 8 Actual Q 1 2003 5. 6 9. 7 8. 3 0. 1 1. 8 4. 3 21. 3 3. 8 Actual Q 1 2002 0. 0 0. 1 Actual Q 1 2002 10. 6 Actual Q 1 2003 Project Services Other Actual Q 1 2002 10. 2 Actual Q 1 2003

Revenue by Region Q 1 2002/2003 (in mio. euros) Americas 39. 5 33. 1 Southern / Western Europe 29. 3 28. 0 Northern Europe Asia-SA 17. 5 16. 9 Central / Eastern Europe 30. 4 23. 0 0. 1 0. 3 7. 8 0. 1 4. 1 0. 0 7. 2 7. 4 10. 4 16. 8 18. 6 24. 4 3. 5 Maintenance Investor Roadshow USA July 2003 Actual Q 1 2002 6. 7 Actual Q 1 2003 Licensing 27 9. 4 9. 3 4. 4 4. 5 6. 8 Actual Q 1 2003 5. 6 9. 7 8. 3 0. 1 1. 8 4. 3 21. 3 3. 8 Actual Q 1 2002 0. 0 0. 1 Actual Q 1 2002 10. 6 Actual Q 1 2003 Project Services Other Actual Q 1 2002 10. 2 Actual Q 1 2003

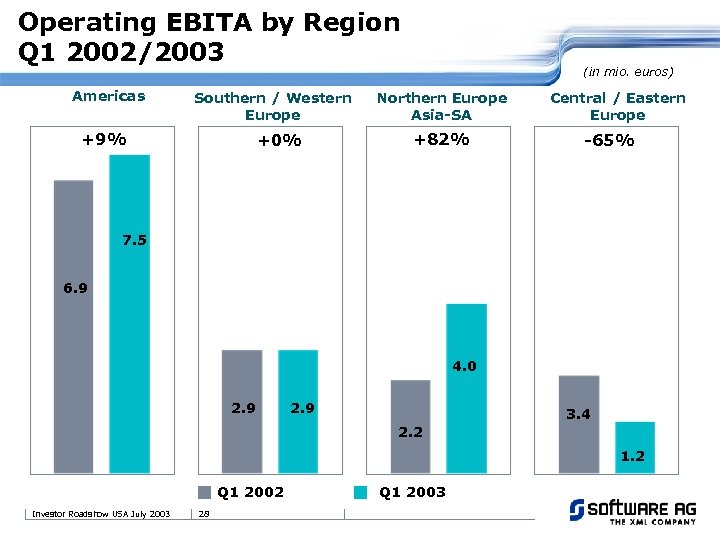

Operating EBITA by Region Q 1 2002/2003 Americas Southern / Western Europe +9% +0% (in mio. euros) Northern Europe Asia-SA +82% Central / Eastern Europe -65% 7. 5 6. 9 4. 0 2. 9 3. 4 2. 2 1. 2 Q 1 2002 Investor Roadshow USA July 2003 28 Q 1 2003

Operating EBITA by Region Q 1 2002/2003 Americas Southern / Western Europe +9% +0% (in mio. euros) Northern Europe Asia-SA +82% Central / Eastern Europe -65% 7. 5 6. 9 4. 0 2. 9 3. 4 2. 2 1. 2 Q 1 2002 Investor Roadshow USA July 2003 28 Q 1 2003

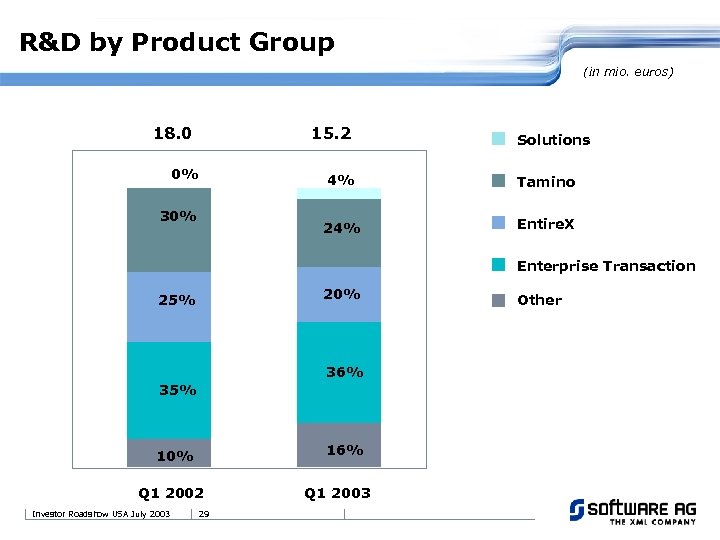

R&D by Product Group (in mio. euros) 18. 0 15. 2 0% Solutions 4% 24% 30% Tamino Entire. X Enterprise Transaction 20% 25% 36% 35% 16% 10% Q 1 2002 Investor Roadshow USA July 2003 29 Q 1 2003 Other

R&D by Product Group (in mio. euros) 18. 0 15. 2 0% Solutions 4% 24% 30% Tamino Entire. X Enterprise Transaction 20% 25% 36% 35% 16% 10% Q 1 2002 Investor Roadshow USA July 2003 29 Q 1 2003 Other

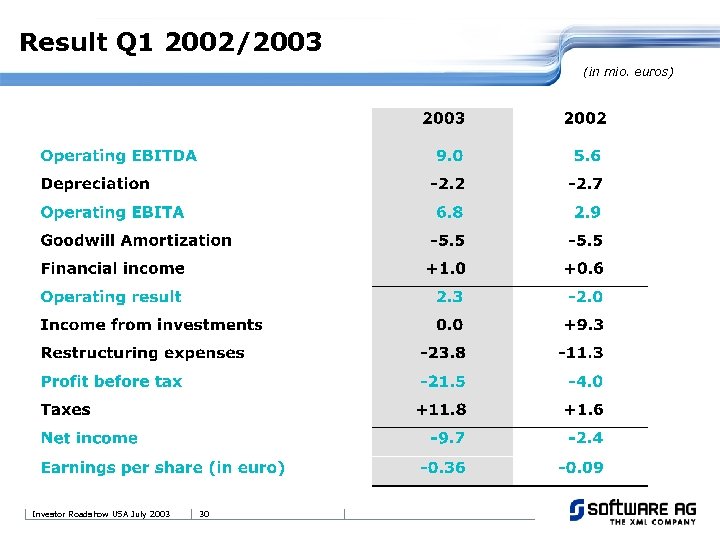

Result Q 1 2002/2003 (in mio. euros) Investor Roadshow USA July 2003 30

Result Q 1 2002/2003 (in mio. euros) Investor Roadshow USA July 2003 30

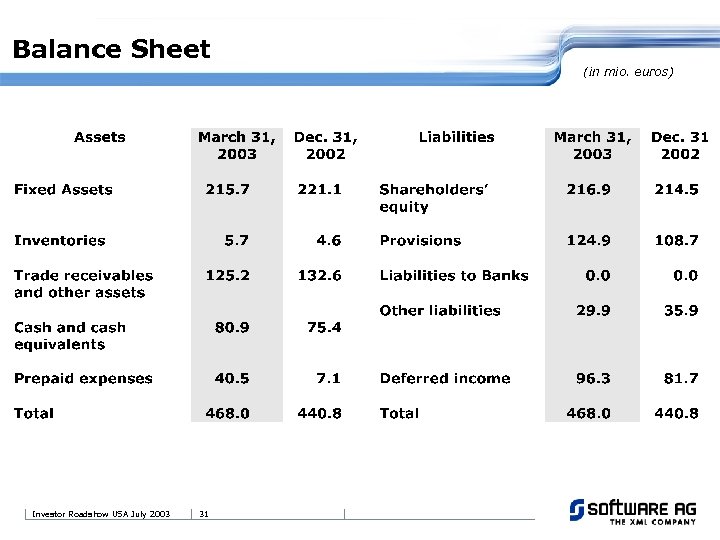

Balance Sheet (in mio. euros) Investor Roadshow USA July 2003 31

Balance Sheet (in mio. euros) Investor Roadshow USA July 2003 31

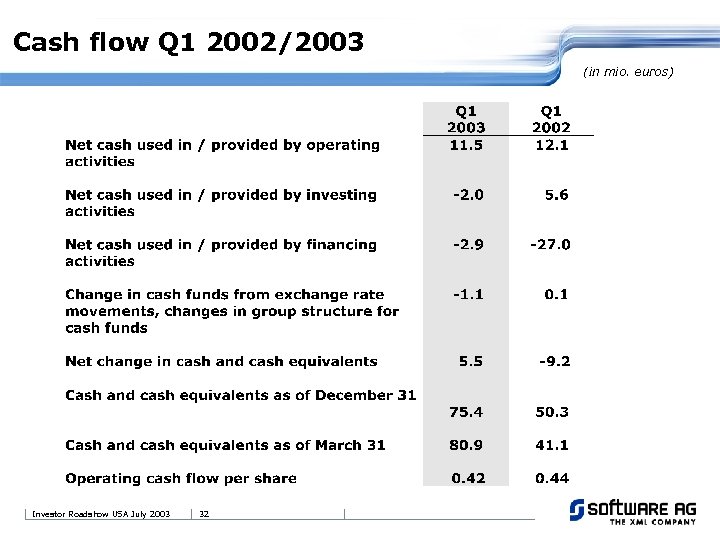

Cash flow Q 1 2002/2003 (in mio. euros) Investor Roadshow USA July 2003 32

Cash flow Q 1 2002/2003 (in mio. euros) Investor Roadshow USA July 2003 32

Rightsizing of the Company n Our medium-term goal is a Profit Margin of 15% (operating result = Pb. T excluding one-time effects) n Savings potential of 55 to 60 million euros annually n Increase in profitability u Alignment of the organization in the regions u Focusing R&D on the future portfolio u Reduction of overhead u Headcount reduction ca. FTE 300 n Approx. 1/3 of the savings will be reinvested in the development of new solutions n Cost cuts in 2003 cover the restructuring expenses Investor Roadshow USA July 2003 33

Rightsizing of the Company n Our medium-term goal is a Profit Margin of 15% (operating result = Pb. T excluding one-time effects) n Savings potential of 55 to 60 million euros annually n Increase in profitability u Alignment of the organization in the regions u Focusing R&D on the future portfolio u Reduction of overhead u Headcount reduction ca. FTE 300 n Approx. 1/3 of the savings will be reinvested in the development of new solutions n Cost cuts in 2003 cover the restructuring expenses Investor Roadshow USA July 2003 33

Outlook 2003 n Full year product revenue same level as 2002 (at constant currency) n Maintenance ensuring about 45% of total revenue n Project services continue to show weakness n Positive operating result (about the amount of 2002) n Positive operating cash flow n Positive net income Investor Roadshow USA July 2003 34

Outlook 2003 n Full year product revenue same level as 2002 (at constant currency) n Maintenance ensuring about 45% of total revenue n Project services continue to show weakness n Positive operating result (about the amount of 2002) n Positive operating cash flow n Positive net income Investor Roadshow USA July 2003 34

Software AG Stock information (as of June 30, 2003)

Software AG Stock information (as of June 30, 2003)

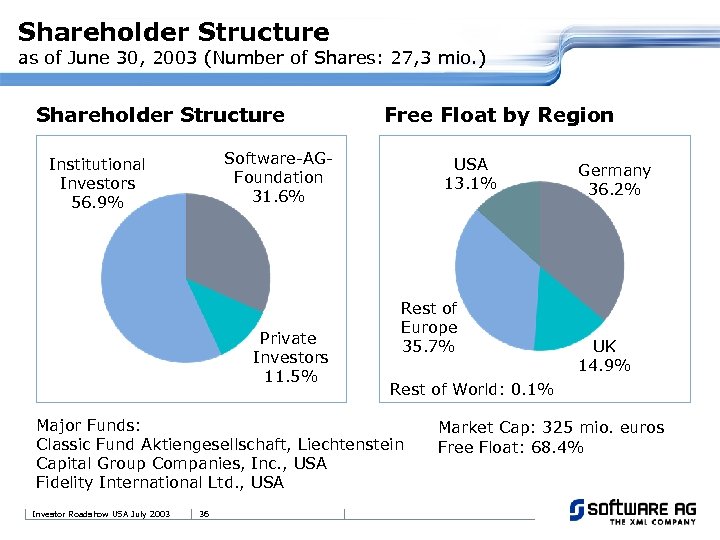

Shareholder Structure as of June 30, 2003 (Number of Shares: 27, 3 mio. ) Shareholder Structure Free Float by Region Software-AGFoundation 31. 6% Institutional Investors 56. 9% Private Investors 11. 5% USA 13. 1% Rest of Europe 35. 7% 36 UK 14. 9% Rest of World: 0. 1% Major Funds: Classic Fund Aktiengesellschaft, Liechtenstein Capital Group Companies, Inc. , USA Fidelity International Ltd. , USA Investor Roadshow USA July 2003 Germany 36. 2% Market Cap: 325 mio. euros Free Float: 68. 4%

Shareholder Structure as of June 30, 2003 (Number of Shares: 27, 3 mio. ) Shareholder Structure Free Float by Region Software-AGFoundation 31. 6% Institutional Investors 56. 9% Private Investors 11. 5% USA 13. 1% Rest of Europe 35. 7% 36 UK 14. 9% Rest of World: 0. 1% Major Funds: Classic Fund Aktiengesellschaft, Liechtenstein Capital Group Companies, Inc. , USA Fidelity International Ltd. , USA Investor Roadshow USA July 2003 Germany 36. 2% Market Cap: 325 mio. euros Free Float: 68. 4%

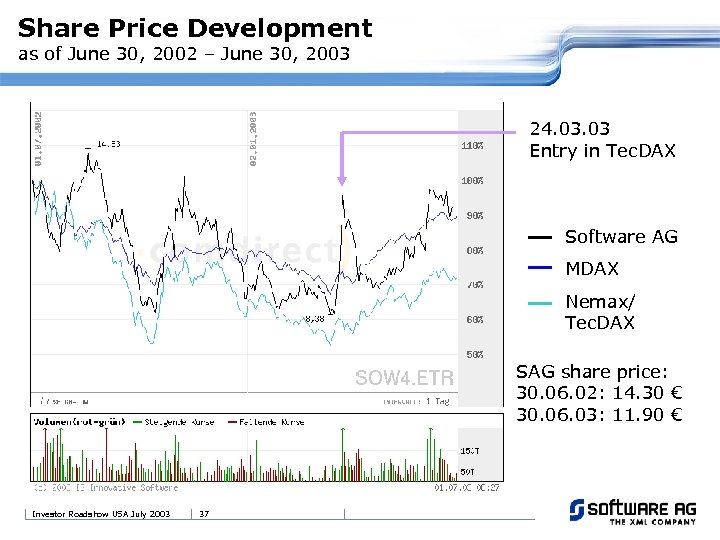

Share Price Development as of June 30, 2002 – June 30, 2003 24. 03 Entry in Tec. DAX Software AG MDAX Nemax/ Tec. DAX SAG share price: 30. 06. 02: 14. 30 € 30. 06. 03: 11. 90 € Investor Roadshow USA July 2003 37

Share Price Development as of June 30, 2002 – June 30, 2003 24. 03 Entry in Tec. DAX Software AG MDAX Nemax/ Tec. DAX SAG share price: 30. 06. 02: 14. 30 € 30. 06. 03: 11. 90 € Investor Roadshow USA July 2003 37

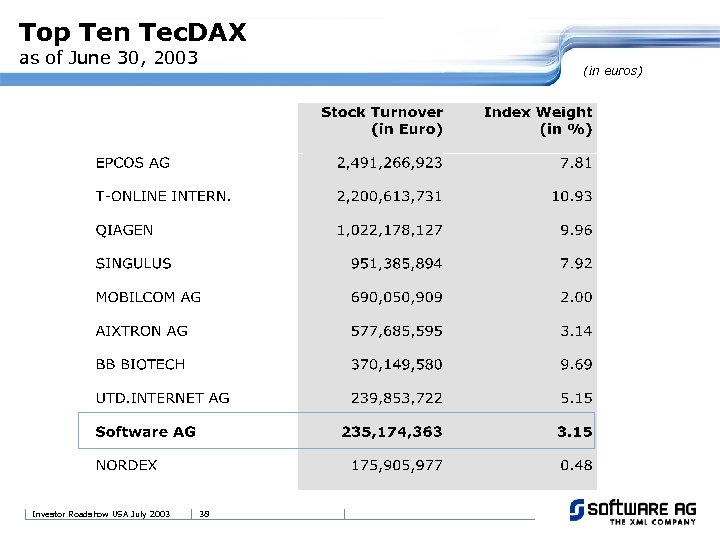

Top Ten Tec. DAX as of June 30, 2003 Investor Roadshow USA July 2003 (in euros) 38

Top Ten Tec. DAX as of June 30, 2003 Investor Roadshow USA July 2003 (in euros) 38

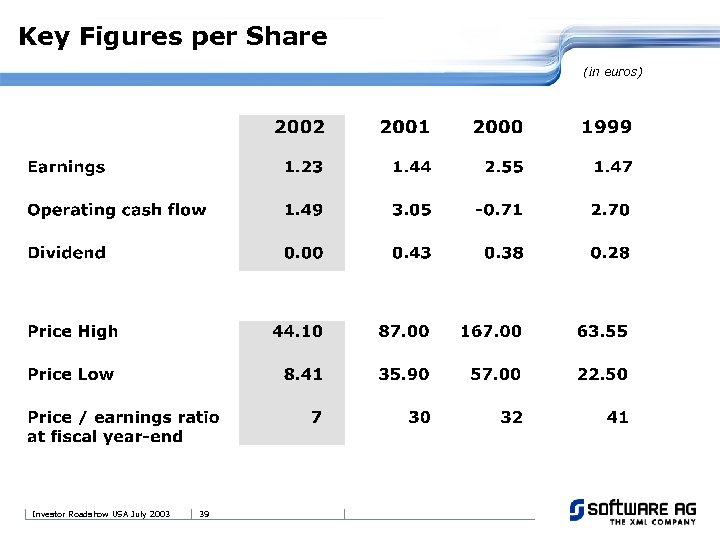

Key Figures per Share (in euros) Investor Roadshow USA July 2003 39

Key Figures per Share (in euros) Investor Roadshow USA July 2003 39

Investor Roadshow USA July 2003

Investor Roadshow USA July 2003