d0ddc72365c30e3974afb0d3eb379035.ppt

- Количество слайдов: 40

Soft Pull Technology- Best Practices for Both Digital Marketing and Showroom Traffic John Palmer I CEO I Dealer Marketing Services I ceo@promaxunlimited. com

What exactly is Soft Pull Credit Technology? It’s the ability to pre-approve and qualify showroom traffic and internet leads with just a name and address. No Social Security Number required No customer signature or authorization required Not an inquiry on customer’s credit report

Exact Credit Score 689 Available Revolving Credit $12, 867 Trade-in Payment - $289 Balance - $8, 324 APR – 18. 95%

So what’s the catch? ? It seems too good to be true!! A firm offer of credit must be offered in person or mailed for showroom traffic and emailed to internet leads.

There are 6 ways your dealership can start using soft pull technology for spectacular results!

1. Showroom Traffic Putting the customer on the right vehicle from the beginning speeds up the sales process, sells more cars at higher grosses, and increases customer satisfaction. Happy Dealer! Happy Customer!

Special finance is back and at an all time high, but the startling fact is that for most dealerships over 50% of people that they pull a credit bureau on with a score of 639 or below they do not even submit to a lender!! What an opportunity these people represent if they would only be worked correctly from the beginning of the sale!

Leasing is also back at an all time high, but a minimum credit bureau score is usually required “Sorry Bob that we wasted 4 hours this afternoon, but your credit score is 648 and you do not qualify for the special lease payments” 2017 Hyundai Sonata $179 per month 36 month lease

The more accurate information you have the better and higher grossing closer you will be! Customer with good credit (728 score) and high APR on trade-in (7. 25%) – switch the focus from price to interest savings and a sense of urgency to buy before rates go up! Having an accurate payoff working the deal protects your sale and gross – How often is the customer right in guessing their payoff, and when they are way off in which direction is it usually in?

2. Your Dealership Website 4 ways you can benefit 1. Your credit application 2. Your SRPs & VDPs 3. Your customer appraisal tool 4. Your digital shopping experience

Would you put your Social Security Number on a dealership’s online credit application? EXACTLY! Hardly anybody else will either. The bounce rate is over 80%!

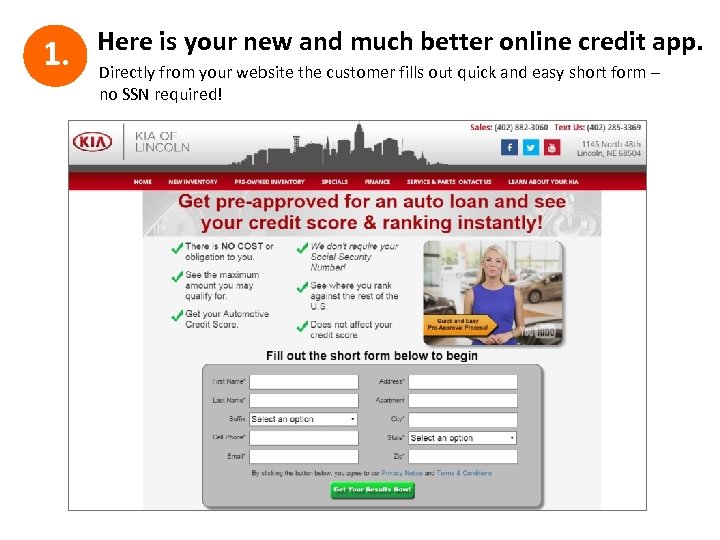

1. Here is your new and much better online credit app. Directly from your website the customer fills out quick and easy short form – no SSN required!

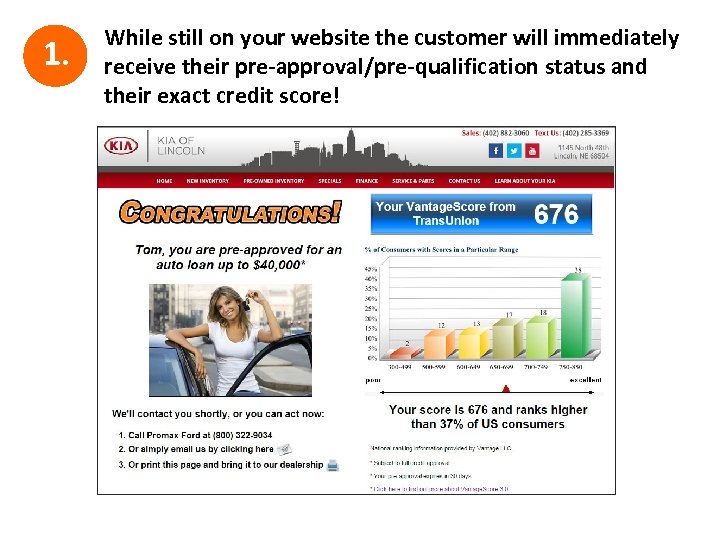

1. While still on your website the customer will immediately receive their pre-approval/pre-qualification status and their exact credit score!

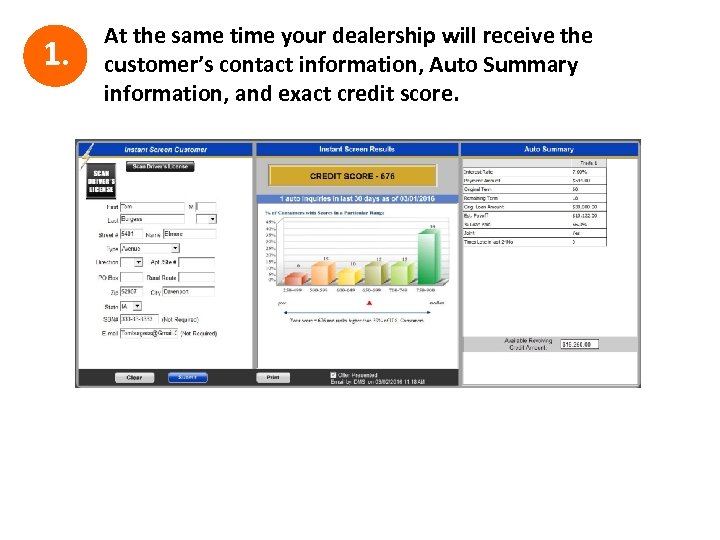

1. At the same time your dealership will receive the customer’s contact information, Auto Summary information, and exact credit score.

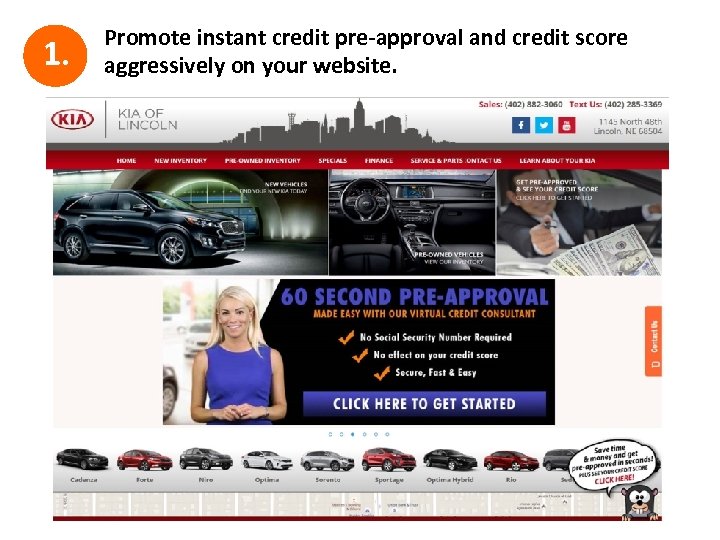

1. Promote instant credit pre-approval and credit score aggressively on your website.

1. Suggested plug-in images!

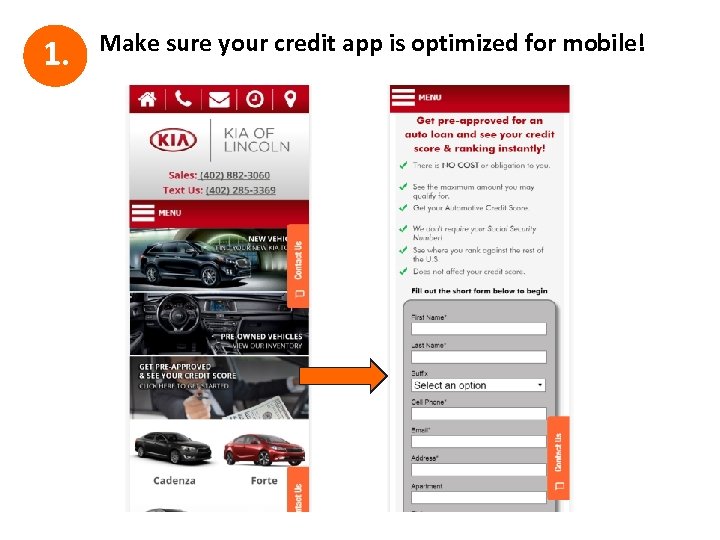

1. Make sure your credit app is optimized for mobile!

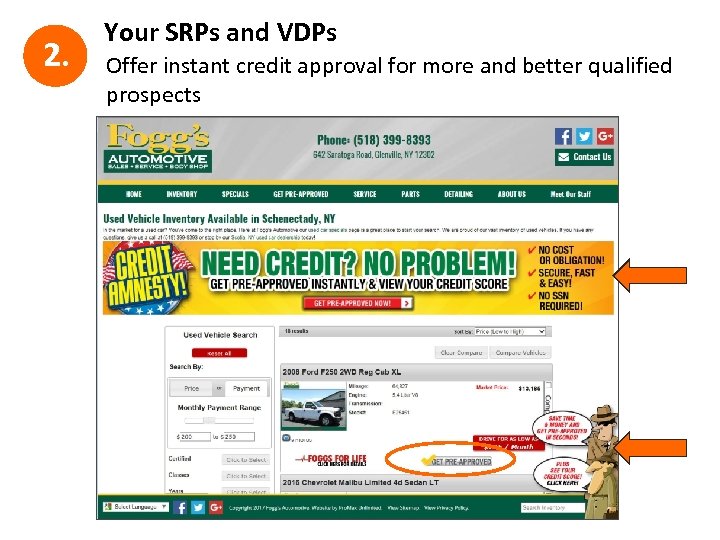

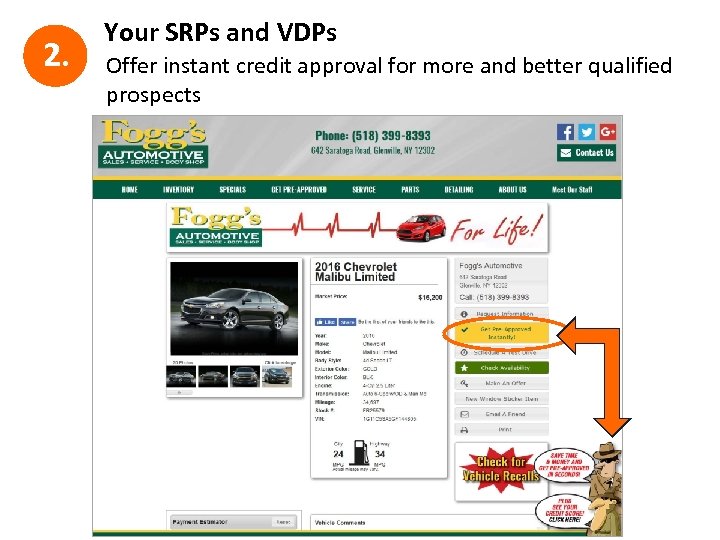

2. Your SRPs and VDPs Offer instant credit approval for more and better qualified prospects

2. Your SRPs and VDPs Offer instant credit approval for more and better qualified prospects

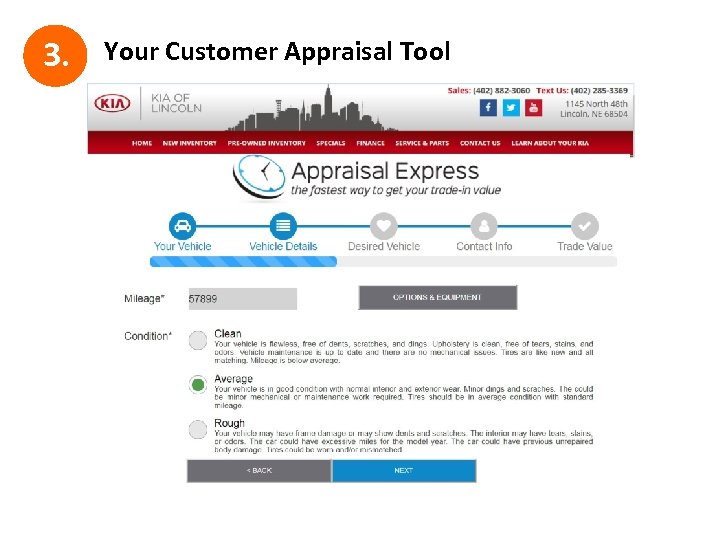

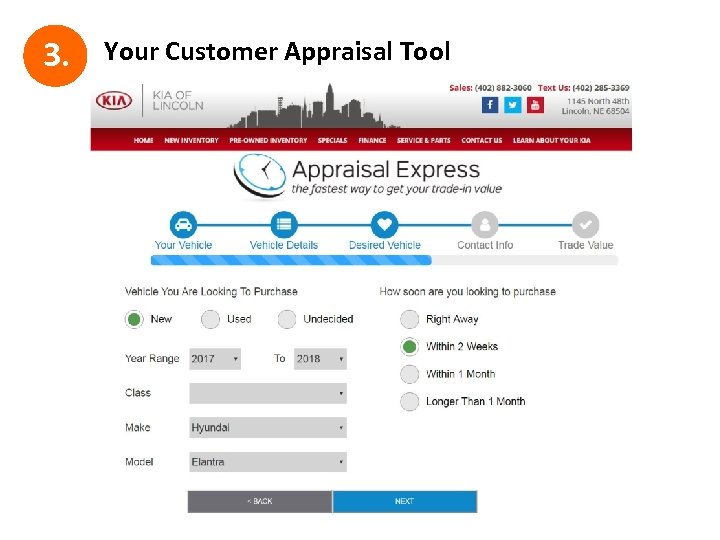

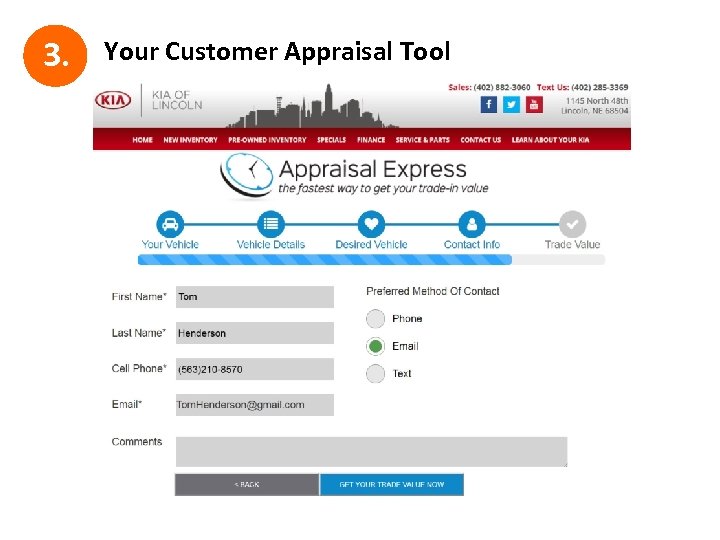

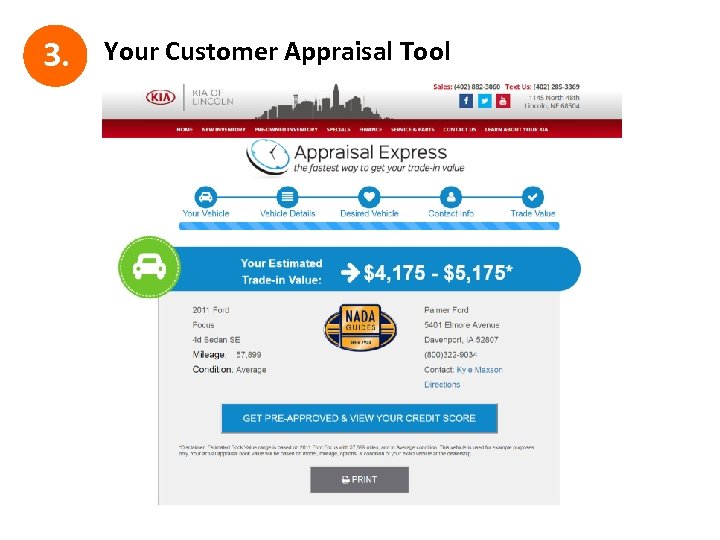

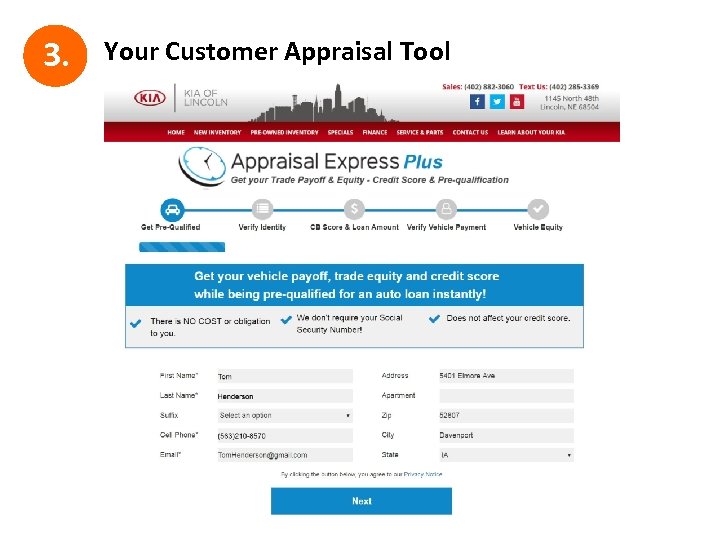

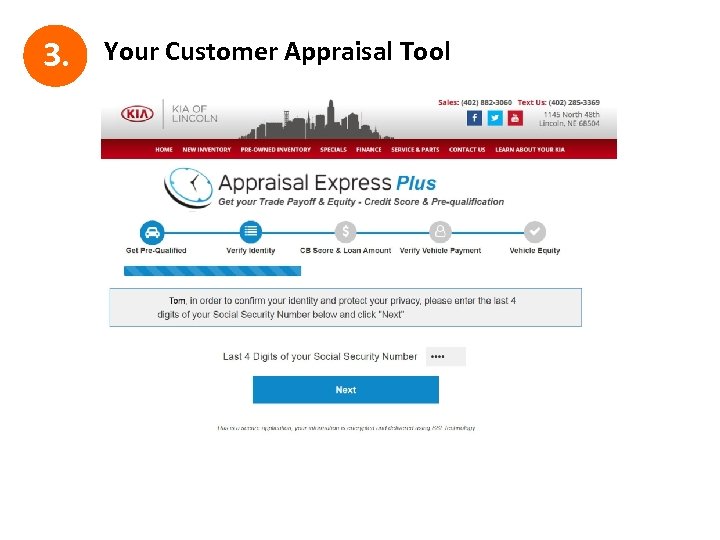

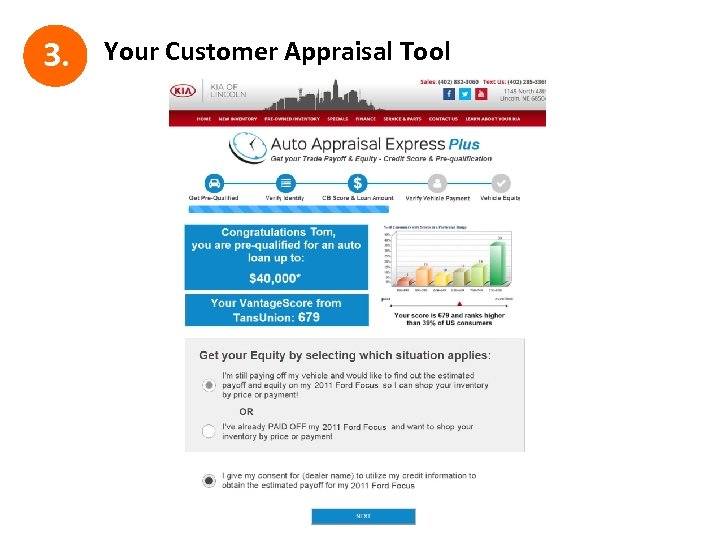

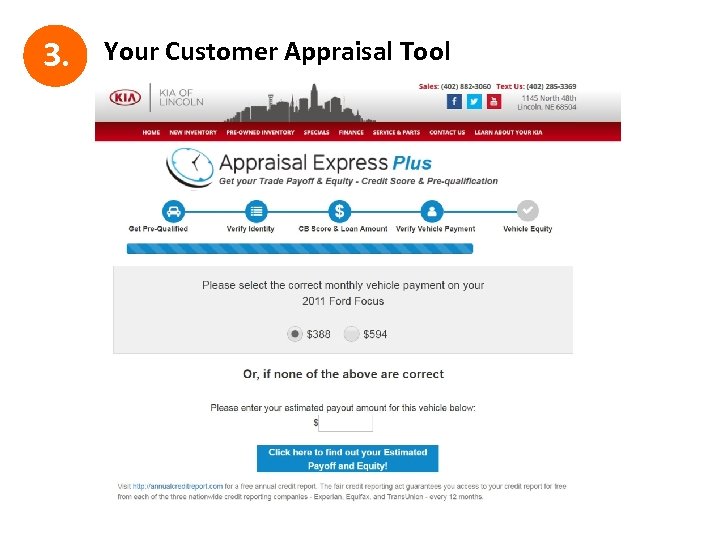

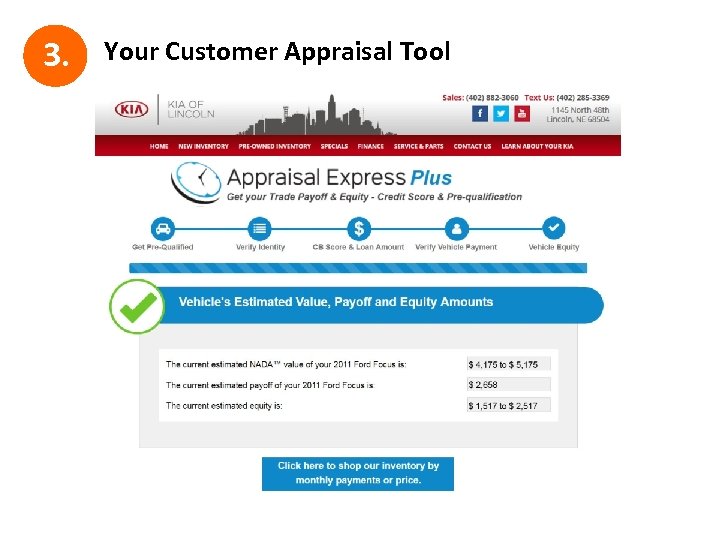

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

3. Your Customer Appraisal Tool

4. Your Digital Shopping Experience Don’t let your prospects “Guess” their credit rating or payoff! Most don’t have a clue.

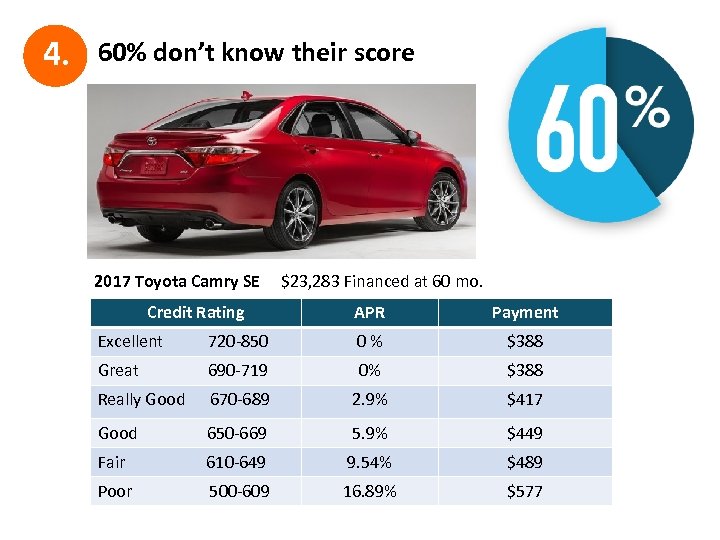

4. 60% don’t know their score 2017 Toyota Camry SE Credit Rating $23, 283 Financed at 60 mo. APR Payment Excellent 720 -850 0% $388 Great 690 -719 0% $388 Really Good 670 -689 2. 9% $417 Good 650 -669 5. 9% $449 Fair 610 -649 9. 54% $489 Poor 500 -609 16. 89% $577

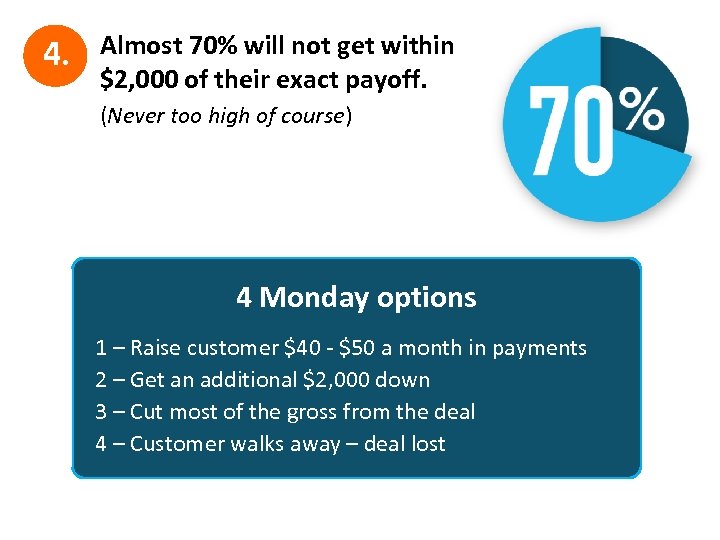

4. Almost 70% will not get within $2, 000 of their exact payoff. (Never too high of course) 4 Monday options 1 – Raise customer $40 - $50 a month in payments 2 – Get an additional $2, 000 down 3 – Cut most of the gross from the deal 4 – Customer walks away – deal lost

3. Your Facebook page Give your “Friends” valuable information about their credit.

3. Your Facebook page Give your “Friends” valuable information about their credit.

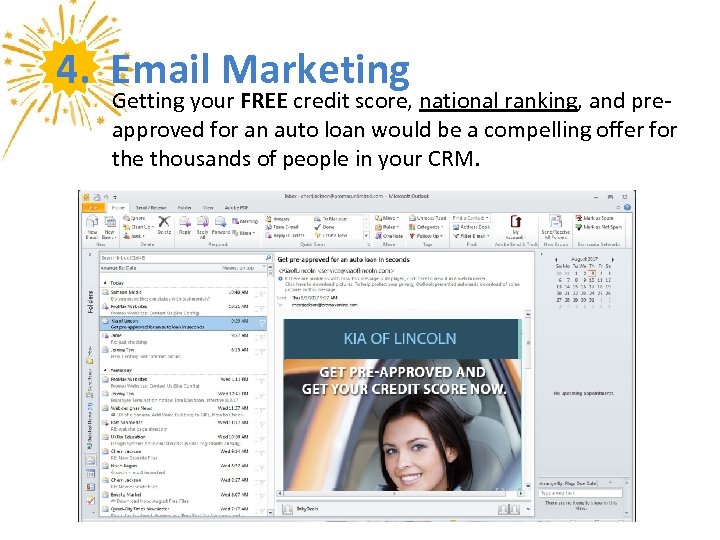

4. Email Marketing Getting your FREE credit score, national ranking, and preapproved for an auto loan would be a compelling offer for the thousands of people in your CRM.

Email Marketing Examples

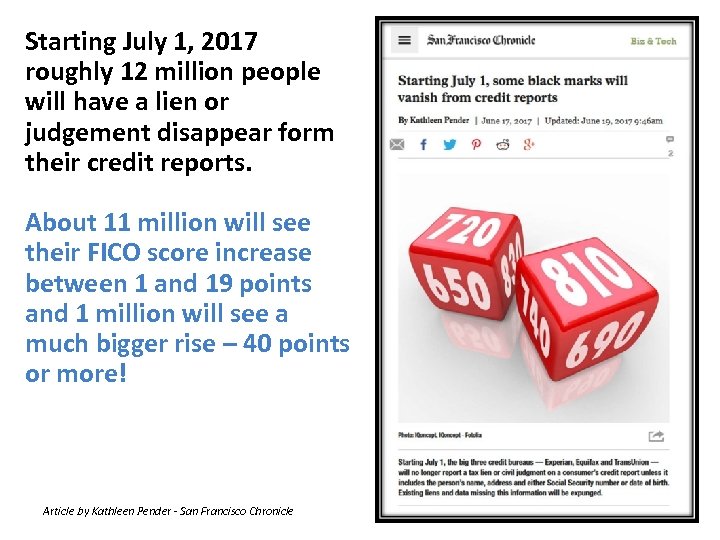

Starting July 1, 2017 roughly 12 million people will have a lien or judgement disappear form their credit reports. About 11 million will see their FICO score increase between 1 and 19 points and 1 million will see a much bigger rise – 40 points or more! Article by Kathleen Pender - San Francisco Chronicle

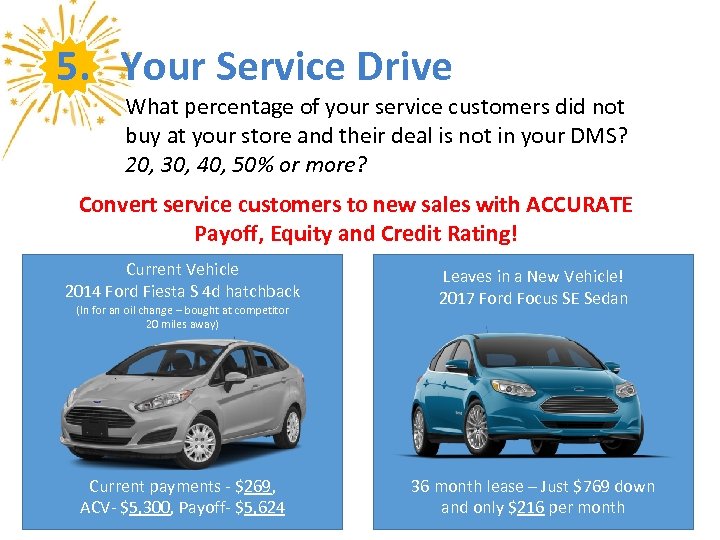

5. Your Service Drive What percentage of your service customers did not buy at your store and their deal is not in your DMS? 20, 30, 40, 50% or more? Convert service customers to new sales with ACCURATE Payoff, Equity and Credit Rating! Current Vehicle 2014 Ford Fiesta S 4 d hatchback (In for an oil change – bought at competitor 20 miles away) Current payments - $269, ACV- $5, 300, Payoff- $5, 624 Leaves in a New Vehicle! 2017 Ford Focus SE Sedan 36 month lease – Just $769 down and only $216 per month

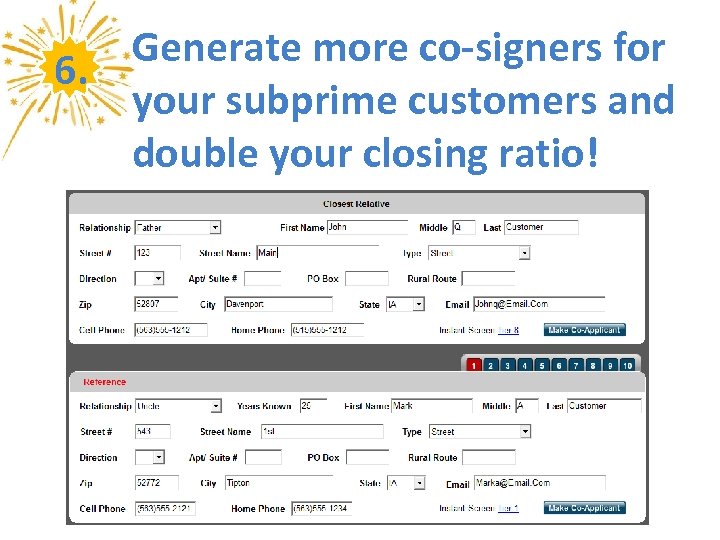

Generate more co-signers for 6. your subprime customers and double your closing ratio!

Contact Info Full Name: John Palmer Company: Dealer Marketing Services Job Title: CEO Email: ceo@promaxunlimited. com Share an important takeaway you received from this session using hashtag #DDWNE

d0ddc72365c30e3974afb0d3eb379035.ppt