64c454a77ca343e83ba949f2407bf948.ppt

- Количество слайдов: 25

Société Générale Premium Review Conference Marco Mangiagalli CFO • Paris, December 5 th 2007

Société Générale Premium Review Conference Marco Mangiagalli CFO • Paris, December 5 th 2007

Disclaimer This presentation contains forward-looking statements regarding future events and the future results of Eni that are based on current expectations, estimates, forecasts, and projections about the industries in which Eni operates and the beliefs and assumptions of the management of Eni. In particular, among other statements, certain statements with regard to management objectives, trends in results of operations, margins, costs, return on equity, risk management and competition are forward-looking in nature. Words such as ‘expects’, ‘anticipates’, ‘targets’, ‘goals’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, variations of such words, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. Therefore, Eni’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, economic conditions globally, the impact of competition, political and economic developments in the countries in which Eni operates, regulatory developments in Italy and internationally and changes in oil prices and in the margins for Eni products. Any forward-looking statements made by or on behalf of Eni speak only as of the date they are made. Eni does not undertake to update forward-looking statements to reflect any changes in Eni’s expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any further disclosures Eni may make in documents it files with the US Securities and Exchange Commission. 2

Disclaimer This presentation contains forward-looking statements regarding future events and the future results of Eni that are based on current expectations, estimates, forecasts, and projections about the industries in which Eni operates and the beliefs and assumptions of the management of Eni. In particular, among other statements, certain statements with regard to management objectives, trends in results of operations, margins, costs, return on equity, risk management and competition are forward-looking in nature. Words such as ‘expects’, ‘anticipates’, ‘targets’, ‘goals’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, variations of such words, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. Therefore, Eni’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, economic conditions globally, the impact of competition, political and economic developments in the countries in which Eni operates, regulatory developments in Italy and internationally and changes in oil prices and in the margins for Eni products. Any forward-looking statements made by or on behalf of Eni speak only as of the date they are made. Eni does not undertake to update forward-looking statements to reflect any changes in Eni’s expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any further disclosures Eni may make in documents it files with the US Securities and Exchange Commission. 2

Delivery on Strategy E&P: gain access to resources in strategic areas G&P: strengthen leadership in Europe R&M: improve competitive positioning Financial discipline 3

Delivery on Strategy E&P: gain access to resources in strategic areas G&P: strengthen leadership in Europe R&M: improve competitive positioning Financial discipline 3

Exploration & Production Delivery on strategy § 2006 -10 production growth raised to 4% CAGR § Over 2. 5 billion boe valuable resources added through acquisitions and exploration § High potential exploration acquired 4

Exploration & Production Delivery on strategy § 2006 -10 production growth raised to 4% CAGR § Over 2. 5 billion boe valuable resources added through acquisitions and exploration § High potential exploration acquired 4

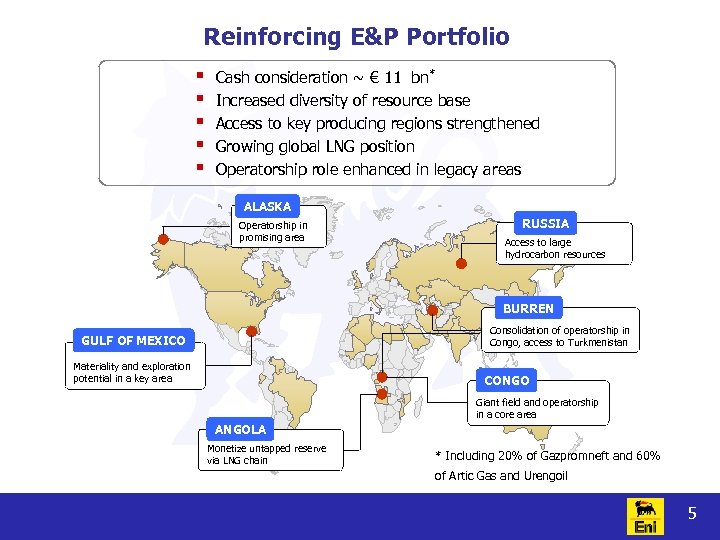

Reinforcing E&P Portfolio § § § Cash consideration ~ € 11 bn* Increased diversity of resource base Access to key producing regions strengthened Growing global LNG position Operatorship role enhanced in legacy areas ALASKA Operatorship in promising area RUSSIA Access to large hydrocarbon resources BURREN Consolidation of operatorship in Congo, access to Turkmenistan GULF OF MEXICO Materiality and exploration potential in a key area CONGO Giant field and operatorship in a core area ANGOLA Monetize untapped reserve via LNG chain * Including 20% of Gazpromneft and 60% of Artic Gas and Urengoil 5

Reinforcing E&P Portfolio § § § Cash consideration ~ € 11 bn* Increased diversity of resource base Access to key producing regions strengthened Growing global LNG position Operatorship role enhanced in legacy areas ALASKA Operatorship in promising area RUSSIA Access to large hydrocarbon resources BURREN Consolidation of operatorship in Congo, access to Turkmenistan GULF OF MEXICO Materiality and exploration potential in a key area CONGO Giant field and operatorship in a core area ANGOLA Monetize untapped reserve via LNG chain * Including 20% of Gazpromneft and 60% of Artic Gas and Urengoil 5

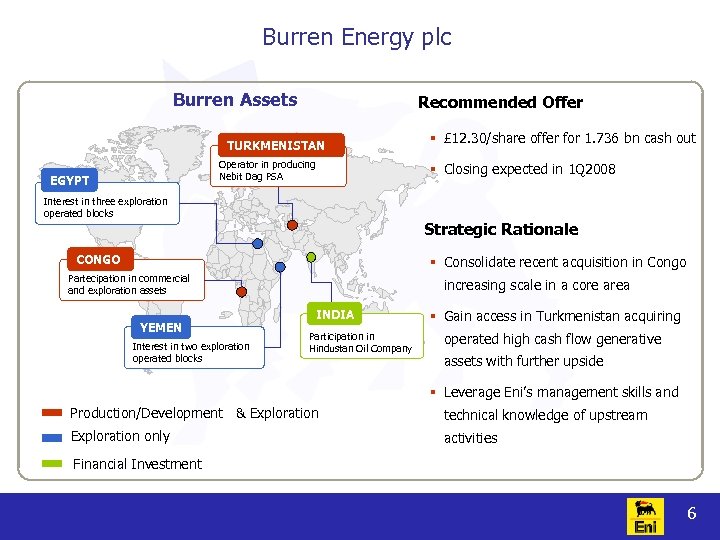

Burren Energy plc Burren Assets Recommended Offer TURKMENISTAN Operator in producing Nebit Dag PSA EGYPT § £ 12. 30/share offer for 1. 736 bn cash out § Closing expected in 1 Q 2008 Interest in three exploration operated blocks Strategic Rationale CONGO § Consolidate recent acquisition in Congo Partecipation in commercial and exploration assets YEMEN Interest in two exploration operated blocks increasing scale in a core area INDIA Participation in Hindustan Oil Company § Gain access in Turkmenistan acquiring operated high cash flow generative assets with further upside § Leverage Eni’s management skills and Production/Development & Exploration technical knowledge of upstream Exploration only activities Financial Investment 6

Burren Energy plc Burren Assets Recommended Offer TURKMENISTAN Operator in producing Nebit Dag PSA EGYPT § £ 12. 30/share offer for 1. 736 bn cash out § Closing expected in 1 Q 2008 Interest in three exploration operated blocks Strategic Rationale CONGO § Consolidate recent acquisition in Congo Partecipation in commercial and exploration assets YEMEN Interest in two exploration operated blocks increasing scale in a core area INDIA Participation in Hindustan Oil Company § Gain access in Turkmenistan acquiring operated high cash flow generative assets with further upside § Leverage Eni’s management skills and Production/Development & Exploration technical knowledge of upstream Exploration only activities Financial Investment 6

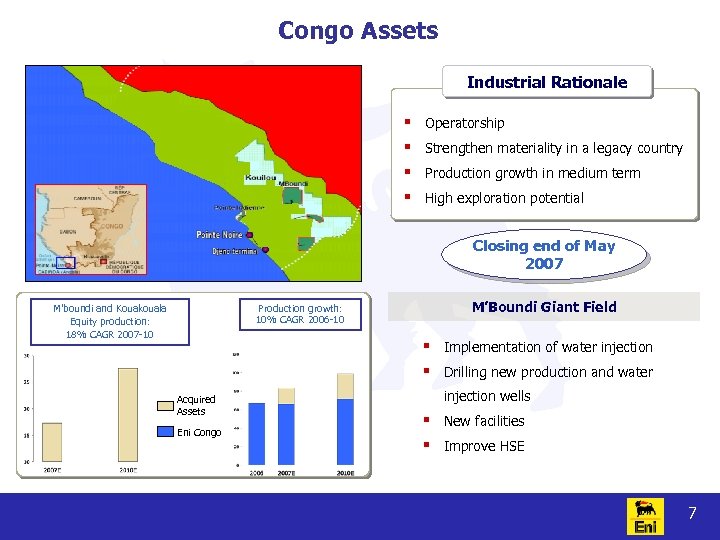

Congo Assets Industrial Rationale § § Operatorship Strengthen materiality in a legacy country Production growth in medium term High exploration potential Closing end of May 2007 M’boundi and Kouakouala Equity production: 18% CAGR 2007 -10 M’Boundi Giant Field Production growth: 10% CAGR 2006 -10 § § Acquired Assets Eni Congo Implementation of water injection Drilling new production and water injection wells § § New facilities Improve HSE 7

Congo Assets Industrial Rationale § § Operatorship Strengthen materiality in a legacy country Production growth in medium term High exploration potential Closing end of May 2007 M’boundi and Kouakouala Equity production: 18% CAGR 2007 -10 M’Boundi Giant Field Production growth: 10% CAGR 2006 -10 § § Acquired Assets Eni Congo Implementation of water injection Drilling new production and water injection wells § § New facilities Improve HSE 7

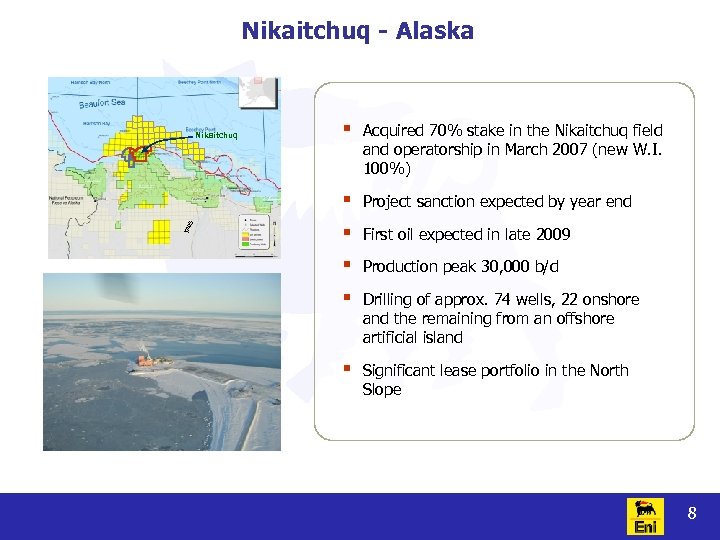

Nikaitchuq - Alaska S TAP Acquired 70% stake in the Nikaitchuq field and operatorship in March 2007 (new W. I. 100%) Project sanction expected by year end § First oil expected in late 2009 § Onshore Pad Location § § Nikaitchuq Production peak 30, 000 b/d § Drilling of approx. 74 wells, 22 onshore and the remaining from an offshore artificial island § Significant lease portfolio in the North Slope 8

Nikaitchuq - Alaska S TAP Acquired 70% stake in the Nikaitchuq field and operatorship in March 2007 (new W. I. 100%) Project sanction expected by year end § First oil expected in late 2009 § Onshore Pad Location § § Nikaitchuq Production peak 30, 000 b/d § Drilling of approx. 74 wells, 22 onshore and the remaining from an offshore artificial island § Significant lease portfolio in the North Slope 8

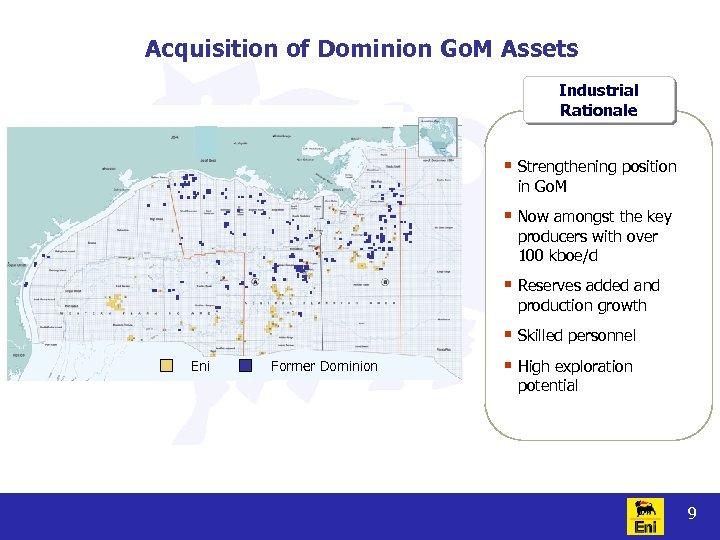

Acquisition of Dominion Go. M Assets Industrial Rationale § Strengthening position in Go. M § Now amongst the key producers with over 100 kboe/d § Reserves added and production growth § Skilled personnel Eni Former Dominion § High exploration potential 9

Acquisition of Dominion Go. M Assets Industrial Rationale § Strengthening position in Go. M § Now amongst the key producers with over 100 kboe/d § Reserves added and production growth § Skilled personnel Eni Former Dominion § High exploration potential 9

Dominion - Increased Materiality in a Key Area Acquired assets New Go. M combined kboe/d Production growth: > 25% CAGR 2006 -10 § Closing on July 2 nd § 222 Mboe of 2 P reserves added § Eni production from 32 kboe/d in 2006 to 110 kboe/d in 4 Q 2007 § ~ 80% of acquired production in deepwater § 60% operated assets § Successful integration of staff and activities: • Retained 95% of former Dominion staff, skilled and experienced; 250 resources currently in the New Orleans office Deepwater Shelf 10

Dominion - Increased Materiality in a Key Area Acquired assets New Go. M combined kboe/d Production growth: > 25% CAGR 2006 -10 § Closing on July 2 nd § 222 Mboe of 2 P reserves added § Eni production from 32 kboe/d in 2006 to 110 kboe/d in 4 Q 2007 § ~ 80% of acquired production in deepwater § 60% operated assets § Successful integration of staff and activities: • Retained 95% of former Dominion staff, skilled and experienced; 250 resources currently in the New Orleans office Deepwater Shelf 10

Arctic Gas and Urengoil § Strategic partnership with Gazprom § Significant breakthrough in Russian upstream § Access to large resource base § Sustain production growth in the long term § Leverage on operational skills and technology “SINT” Assets Gazprom Neft (key areas) After Gazprom exercises its call option (to acquire a 51% interest within 2 years): ü Eni’s cash consideration: US$ 0. 63 bn ü Eni’s interest: 30% ü Resources: ~ 1. 5 billion boe Moscow Noyabsk Khanty Mansyisk Omsk ü Development Capex around $3 USD/boe 11

Arctic Gas and Urengoil § Strategic partnership with Gazprom § Significant breakthrough in Russian upstream § Access to large resource base § Sustain production growth in the long term § Leverage on operational skills and technology “SINT” Assets Gazprom Neft (key areas) After Gazprom exercises its call option (to acquire a 51% interest within 2 years): ü Eni’s cash consideration: US$ 0. 63 bn ü Eni’s interest: 30% ü Resources: ~ 1. 5 billion boe Moscow Noyabsk Khanty Mansyisk Omsk ü Development Capex around $3 USD/boe 11

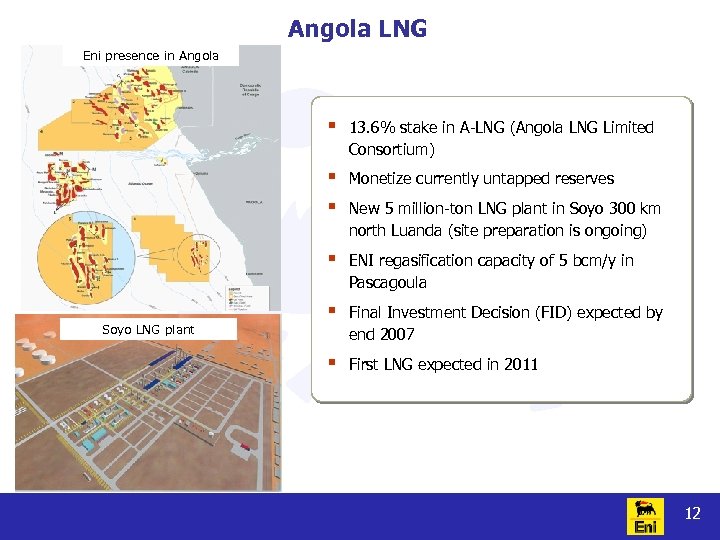

Angola LNG Eni presence in Angola § § § Monetize currently untapped reserves § Soyo LNG plant 13. 6% stake in A-LNG (Angola LNG Limited Consortium) ENI regasification capacity of 5 bcm/y in Pascagoula § Final Investment Decision (FID) expected by end 2007 § First LNG expected in 2011 New 5 million-ton LNG plant in Soyo 300 km north Luanda (site preparation is ongoing) 12

Angola LNG Eni presence in Angola § § § Monetize currently untapped reserves § Soyo LNG plant 13. 6% stake in A-LNG (Angola LNG Limited Consortium) ENI regasification capacity of 5 bcm/y in Pascagoula § Final Investment Decision (FID) expected by end 2007 § First LNG expected in 2011 New 5 million-ton LNG plant in Soyo 300 km north Luanda (site preparation is ongoing) 12

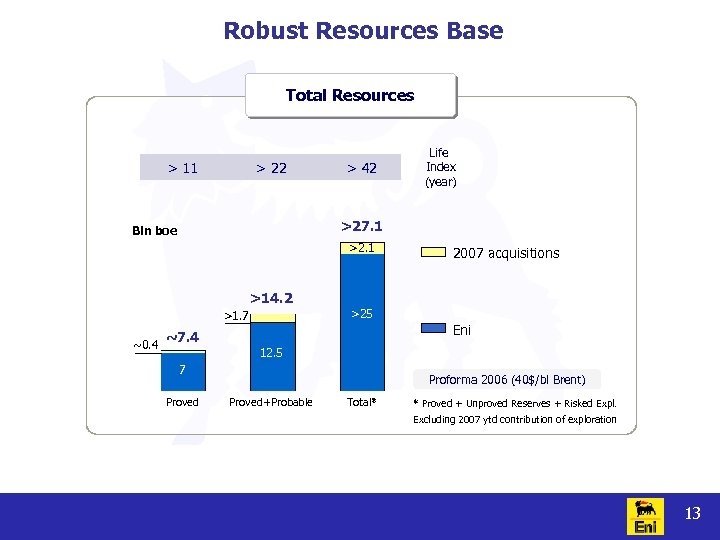

Robust Resources Base Total Resources > 11 > 22 > 42 Life Index (year) >27. 1 Bln boe >2. 1 2007 acquisitions >14. 2 >25 >1. 7 ~0. 4 Eni ~7. 4 12. 5 7 Proved Proforma 2006 (40$/bl Brent) Proved+Probable Total* * Proved + Unproved Reserves + Risked Expl. Excluding 2007 ytd contribution of exploration 13

Robust Resources Base Total Resources > 11 > 22 > 42 Life Index (year) >27. 1 Bln boe >2. 1 2007 acquisitions >14. 2 >25 >1. 7 ~0. 4 Eni ~7. 4 12. 5 7 Proved Proforma 2006 (40$/bl Brent) Proved+Probable Total* * Proved + Unproved Reserves + Risked Expl. Excluding 2007 ytd contribution of exploration 13

Successful Exploration 2007 Exploration Added Resources 2. 8 Bln boe 2. 4 Main resources additions § § New Acreage 2007 new net acreage: approx. 25, 800 sqkm* High Quality Portfolio added Per year § § Cumulative 2003/06 cumulative production Jan-Aug 07 > 450 Mboe added Resources added per year (03 -06): 700 Mboe * Includes Dominion acquisition 14

Successful Exploration 2007 Exploration Added Resources 2. 8 Bln boe 2. 4 Main resources additions § § New Acreage 2007 new net acreage: approx. 25, 800 sqkm* High Quality Portfolio added Per year § § Cumulative 2003/06 cumulative production Jan-Aug 07 > 450 Mboe added Resources added per year (03 -06): 700 Mboe * Includes Dominion acquisition 14

Gas & Power Delivery on strategy § § Leadership in Europe strengthened Upstream & Donwstream gas integrated approach enhanced § South Stream Pipeline: Mo. U for a key EU gas project signed 15

Gas & Power Delivery on strategy § § Leadership in Europe strengthened Upstream & Donwstream gas integrated approach enhanced § South Stream Pipeline: Mo. U for a key EU gas project signed 15

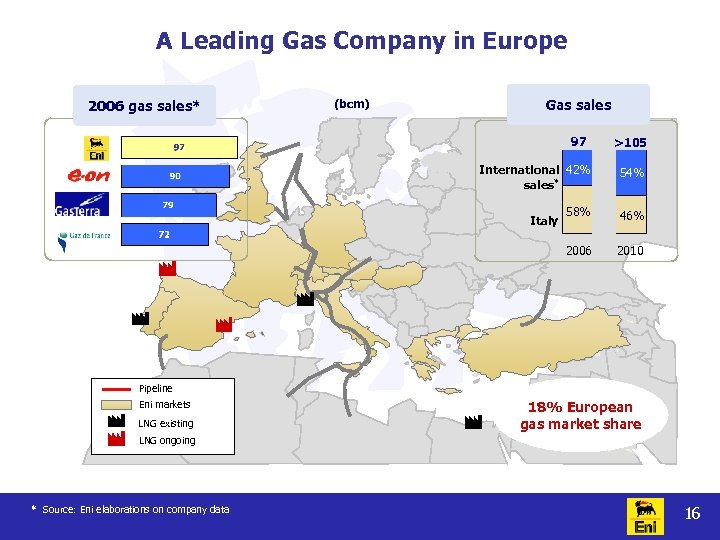

A Leading Gas Company in Europe 2006 gas sales* (bcm) Gas sales 97 >105 International 42% sales* 54% 58% 46% 2006 2010 Italy Pipeline Eni markets LNG existing 18% European gas market share LNG ongoing * Source: Eni elaborations on company data 16

A Leading Gas Company in Europe 2006 gas sales* (bcm) Gas sales 97 >105 International 42% sales* 54% 58% 46% 2006 2010 Italy Pipeline Eni markets LNG existing 18% European gas market share LNG ongoing * Source: Eni elaborations on company data 16

Commercial Exposure to Different Markets Eni UK 100% GVS 50% Branch France 100% Altergaz 27. 5% 50% 33% Adriaplin 51% Eni Trading BV (Blue. Stream) 100% 50% EPAS 49% * Including Extra Europe gas sales and E&P equity gas sold in Europe 17

Commercial Exposure to Different Markets Eni UK 100% GVS 50% Branch France 100% Altergaz 27. 5% 50% 33% Adriaplin 51% Eni Trading BV (Blue. Stream) 100% 50% EPAS 49% * Including Extra Europe gas sales and E&P equity gas sold in Europe 17

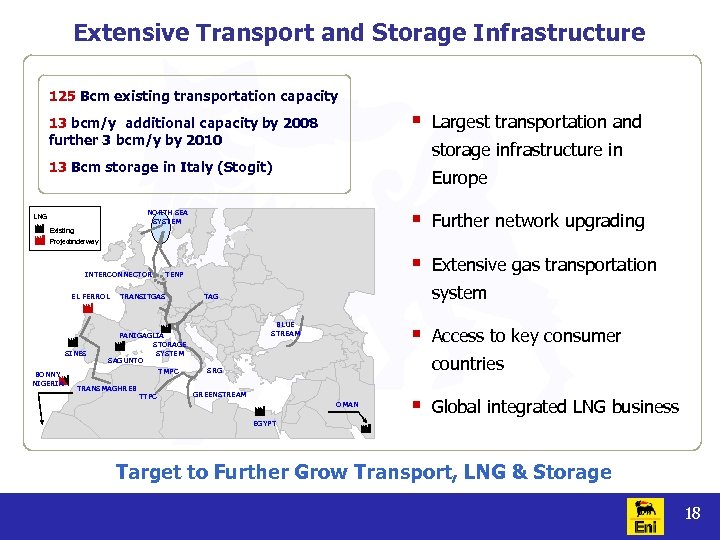

Extensive Transport and Storage Infrastructure 125 Bcm existing transportation capacity § 13 bcm/y additional capacity by 2008 further 3 bcm/y by 2010 storage infrastructure in 13 Bcm storage in Italy (Stogit) Europe § Existing Further network upgrading § NORTH SEA SYSTEM LNG Largest transportation and Extensive gas transportation Project underway INTERCONNECTOR EL FERROL SINES BONNY NIGERIA TENP TRANSITGAS BLUE STREAM PANIGAGLIA STORAGE SYSTEM SAGUNTO TMPC TRANSMAGHREB TTPC system TAG § Access to key consumer countries SRG GREENSTREAM OMAN § Global integrated LNG business EGYPT Target to Further Grow Transport, LNG & Storage 18

Extensive Transport and Storage Infrastructure 125 Bcm existing transportation capacity § 13 bcm/y additional capacity by 2008 further 3 bcm/y by 2010 storage infrastructure in 13 Bcm storage in Italy (Stogit) Europe § Existing Further network upgrading § NORTH SEA SYSTEM LNG Largest transportation and Extensive gas transportation Project underway INTERCONNECTOR EL FERROL SINES BONNY NIGERIA TENP TRANSITGAS BLUE STREAM PANIGAGLIA STORAGE SYSTEM SAGUNTO TMPC TRANSMAGHREB TTPC system TAG § Access to key consumer countries SRG GREENSTREAM OMAN § Global integrated LNG business EGYPT Target to Further Grow Transport, LNG & Storage 18

Diverse and Growing Portfolio of Gas Bcm 2005 2006 2010 Equity 22 22 21 Contracted 74 76 87 § Diversified gas portfolio § Equity and contracted gas secured to match growing demand § Attractive contractual structure § Competitive supply cost § Significant commercial flexibility Contract “life index” extended to 23 years Equity Contracted 19

Diverse and Growing Portfolio of Gas Bcm 2005 2006 2010 Equity 22 22 21 Contracted 74 76 87 § Diversified gas portfolio § Equity and contracted gas secured to match growing demand § Attractive contractual structure § Competitive supply cost § Significant commercial flexibility Contract “life index” extended to 23 years Equity Contracted 19

An Integrated Company Approach: a Win-Win Deal Access to Russian E&P Access to Eni’s projects Use of Eni’s E&P and pipeline technologies UPSTREAM Joint development of pipeline and LNG projects Strategic Partnership Agreement DOWNSTREAM All gas contracts extended to 2035 Gas sales directly in Italy (up to 3 bcm from 2010) Access to Eni’s projects 20

An Integrated Company Approach: a Win-Win Deal Access to Russian E&P Access to Eni’s projects Use of Eni’s E&P and pipeline technologies UPSTREAM Joint development of pipeline and LNG projects Strategic Partnership Agreement DOWNSTREAM All gas contracts extended to 2035 Gas sales directly in Italy (up to 3 bcm from 2010) Access to Eni’s projects 20

Refining & Marketing Delivery on strategy § § Upgrading investment on track Eastern Europe: § § High quality marketing network acquired Refining capacity increased in high-growth area § Integrated presence strengthened 21

Refining & Marketing Delivery on strategy § § Upgrading investment on track Eastern Europe: § § High quality marketing network acquired Refining capacity increased in high-growth area § Integrated presence strengthened 21

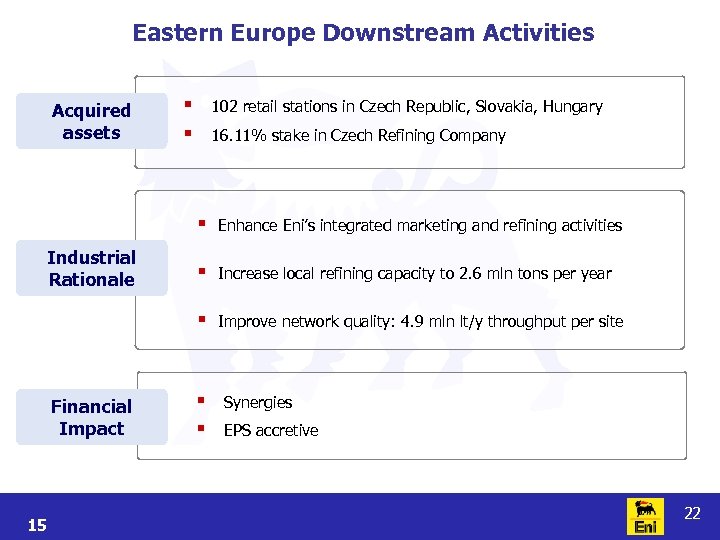

Eastern Europe Downstream Activities Acquired assets § § 102 retail stations in Czech Republic, Slovakia, Hungary 16. 11% stake in Czech Refining Company § Financial Impact 15 § Increase local refining capacity to 2. 6 mln tons per year § Industrial Rationale Enhance Eni’s integrated marketing and refining activities Improve network quality: 4. 9 mln lt/y throughput per site § § Synergies EPS accretive 22

Eastern Europe Downstream Activities Acquired assets § § 102 retail stations in Czech Republic, Slovakia, Hungary 16. 11% stake in Czech Refining Company § Financial Impact 15 § Increase local refining capacity to 2. 6 mln tons per year § Industrial Rationale Enhance Eni’s integrated marketing and refining activities Improve network quality: 4. 9 mln lt/y throughput per site § § Synergies EPS accretive 22

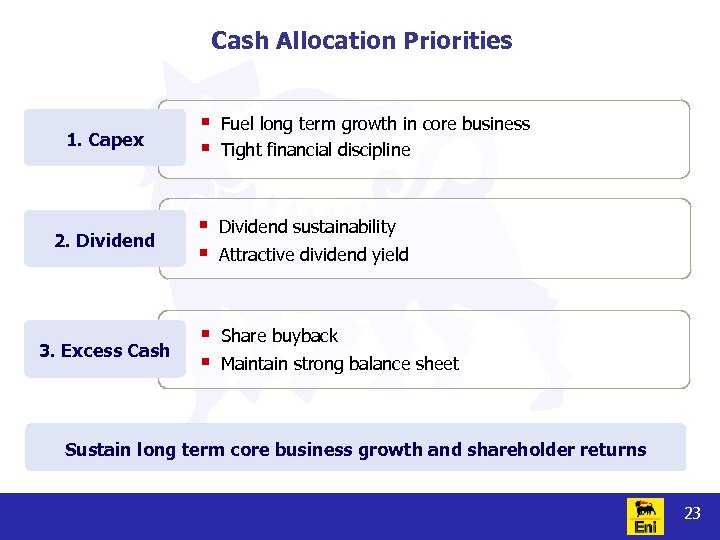

Cash Allocation Priorities 1. Capex § § Fuel long term growth in core business Tight financial discipline 2. Dividend § § Dividend sustainability 3. Excess Cash § § Share buyback Attractive dividend yield Maintain strong balance sheet Sustain long term core business growth and shareholder returns 23

Cash Allocation Priorities 1. Capex § § Fuel long term growth in core business Tight financial discipline 2. Dividend § § Dividend sustainability 3. Excess Cash § § Share buyback Attractive dividend yield Maintain strong balance sheet Sustain long term core business growth and shareholder returns 23

Disciplined Capex Increase Billion € 5. 2 35. 2 1. 9 37. 1 2. 3 § § § 44. 6 4. 0 4. 3 € bln Regulated 2 Refining upgrading 0. 6 Saipem new vessels 1. 1 Others R&M 6. 7 G&P 29. 6 E&P 36% 48% 16% Regulated 2006 -2009 SRG consolidation and forex § § § 2006 -2009 pro-forma E&P incremental inflation Additional Activities 2007 -2010 capex plan PSA Other Strong and selective investment programme 70% of additional capex devoted to grow the business Balancing risk vs return 24

Disciplined Capex Increase Billion € 5. 2 35. 2 1. 9 37. 1 2. 3 § § § 44. 6 4. 0 4. 3 € bln Regulated 2 Refining upgrading 0. 6 Saipem new vessels 1. 1 Others R&M 6. 7 G&P 29. 6 E&P 36% 48% 16% Regulated 2006 -2009 SRG consolidation and forex § § § 2006 -2009 pro-forma E&P incremental inflation Additional Activities 2007 -2010 capex plan PSA Other Strong and selective investment programme 70% of additional capex devoted to grow the business Balancing risk vs return 24

Attractive Dividend & Buy Back 1. 10 0. 90 0. 65 2003 2004 Interim Dividend 2007 § § § 0. 60 2005 €/share 0. 65 0. 45 0. 75 Dividend Share buy back 1. 25 2006 § Dividend up 13. 6% 2006 dividend sustainable in the 2007 -10 period October 2007: 0. 60 € per share 5. 9 billion € 2000 -YTD share buy back (8. 7% of capital) 1. 5 billion € still available 25

Attractive Dividend & Buy Back 1. 10 0. 90 0. 65 2003 2004 Interim Dividend 2007 § § § 0. 60 2005 €/share 0. 65 0. 45 0. 75 Dividend Share buy back 1. 25 2006 § Dividend up 13. 6% 2006 dividend sustainable in the 2007 -10 period October 2007: 0. 60 € per share 5. 9 billion € 2000 -YTD share buy back (8. 7% of capital) 1. 5 billion € still available 25