Lecture 5.pptx

- Количество слайдов: 22

Socially Responsible Investing Professor Alexander Settles NRU Higher School of Economics

Learning objectives • To be aware of the origins of socially responsible investment • To understand the different approaches that may be used for socially responsible (ethical) investment • To appreciate the role of institutional investors in socially responsible investment

Learning objectives • To be aware of the different ethical indices that may be used to assess the performance of socially responsible funds • To be aware of the evidence analyzing the performance of socially responsible investment funds

Socially Responsible Investment • Involves considering the ethical, social, and environmental performance of companies selected for investment, as well as their financial performance (EIRIS, 2000) • Value of US SRI funds estimated at $3 trillion or $1 out $8 currently under asset management • Value of UK ethical funds increased substantially in the last decade rising from £ 1. 465 bn in 1997 to £ 8. 9 bn in 2007 (EIRIS, 2008) • Ethical investment is another often-used term for socially responsible investment

OECD (1998) • In the global economy, sensitivity to the many societies in which an individual corporation may operate can pose a challenge. Increasingly, however, investors in international capital markets expect corporations to forego certain activities – such as use of child or prison labour, bribery, support of oppressive regimes, and environmental disruption – even when those activities may not be expressly prohibited in a particular jurisdiction in which the corporation operates

Investment Strategies • Investing in companies that meet certain social and/or environmental performance criteria • Using their rights as shareowners to encourage companies to be better corporate citizens, • Allocating the funds’ assets for investment in disadvantaged communities.

Recent UK Legislation • From 3 rd July 2000, pension fund trustees had to take account of the following in their Statement of Investment Principles: • ‘the extent (if at all) to which social, environmental or ethical considerations are taken into account in the selection, retention and realisation of investments’ (amendment to Pensions Act 1995) • This means that pension fund trustees are required to state their policy on social, environmental, and ethical issues.

US Rules and Regulation • Socially Responsible Investing regulation is part of the Investment Company Act of 1940, as amended • SRI investment fund must disclose their policies in their fund documents • Regulated through prospectus and SEC enforcement actions

Institutional investors’ policies • • Friends’ Provident Hermes Pensions Management Ltd Cal. PERS – California State Pension Fund TIAA-CREF

Institutional Investors and SRI • • • Union investing Shareholder campaigns for civil rights South Africa divesture campaigns of the 1980 s Socially responsible investing Initiators of CSR proposals as shareholder resolutions

Institutional investor groups’ policies • US SIF - The Forum for Sustainable and Responsible Investment • NAPF - National Association of Pension Funds • ABI -Association of British Insurers • UKSIF - UK Social Investment Forum • French SIF

CSR Indices • • • Ethibel Sustainability Index Domini Social Index FTSE 4 Good Index Dow Jones Sustainability Index Bi. TC

Examples: TIAA – CREF Social Choice

TIAA - CREF • PORTFOLIO STRATEGIES • The fund seeks a favorable long-term total return that reflects the investment performance of the overall U. S. stock market while giving special consideration to certain social criteria • MSCI, Inc. provides the screening • MSCI ESG Indices

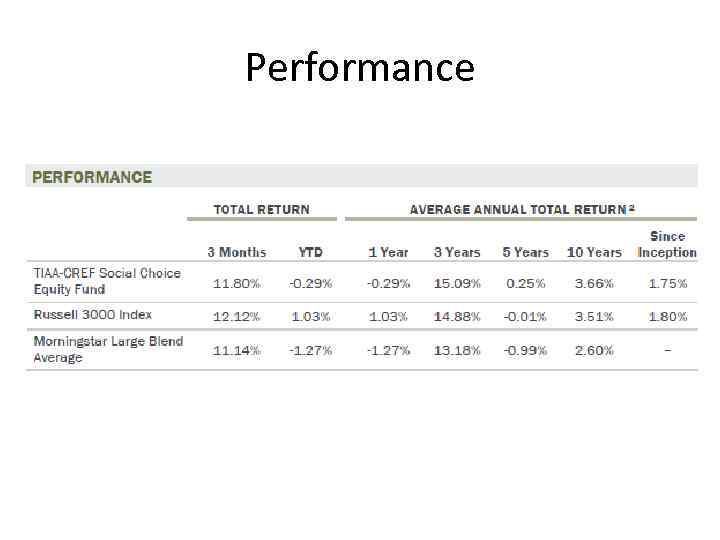

Performance

Social Responsibility Indexes • • • • MSCI ESG ‘Best-in-Class’ Indices MSCI ESG Socially Responsible Indices MSCI ESG Ex Controversial Weapons Indices MSCI ESG ‘Environmental’ Indices Dow Jones Sustainability World Index Dow Jones Sustainability North America Index Dow Jones Sustainability United States 40 Index Dow Jones Sustainability Europe Indexes Dow Jones Sustainability Eurozone 40 Indexes Dow Jones Sustainability Nordic Index Dow Jones Sustainability Asia Pacific Index Dow Jones Sustainability Japan 40 Index Dow Jones Sustainability Korea Index

Impact on shareholder value • Does SRI have a beneficial effect on shareholder value? • OECD (1998) • EU Commission (2008) European Competitiveness Report • Academic studies: mixed evidence • Lower Beta one result

Summary • • SRI is of growing importance Government influence Institutional investors more active in this area Increasing perception that SRI can maintain/increase shareholder value

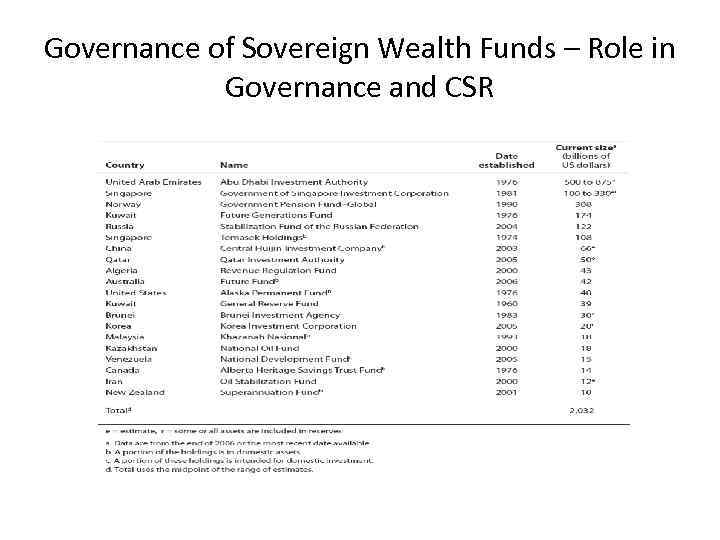

Governance of Sovereign Wealth Funds – Role in Governance and CSR

Norwegian Pension Fund - Global Governance Structure • Ministry of Finance – “Owner” – – – overall responsibility strategic asset allocation (benchmark + risk limits) monitoring and evaluating operational management ethical guidelines reports to Parliament • Central Bank – “Manager” – – – implement investments strategy (benchmark) active management to achieve excess return risk control and reporting exercise the Fund’s ownership rights provide professional advice on investment strategy

Corporate Governance Principles of Fund Manager • Norges Bank engages in corporate governance activities in order to protect the financial interests of our assets under management. Our focus on corporate governance issues is based on the fact that Norges Bank is a long-term investor with very wide range of investments in the markets that constitute the portfolios' investment universe. • Norges Bank assumes that the company boards are ultimately responsible for ensuring that their operations are conducted in a manner that protects the owners' long-term interests. Norges Bank's views on good corporate governance are based on internationally accepted principles that are expressed in the OECD's Principles of Corporate Governance.

Companies Excluded from Fund • • • Vedanta Resources Plc. Sterlite Industries Ltd. Madras Aluminium Company Ltd. DRD Gold Limited Poongsan Corporation Wal-Mart Stores Inc Wal-Mart de Mexico SA de CV Freeport Mc. Mo. Ran Copper & Gold Inc BAE Systems Plc. Boeing Co. Finmeccanica Sp. A. Honeywell International Inc. • • • • Northrop Grumman Corp. United Technologies Corp. Safran SA Alliant Techsystems Inc. EADS Co (European Aeronautic Defence and Space Company) EADS Finance BV General Dynamics Corporation L 3 Communications Holdings Inc. Lockheed Martin Corp. Raytheon Co. Thales SA. Kerr-Mc. Gee Corporation Singapore Technologies Engineering

Lecture 5.pptx