0135d4f9c40c2af791e88c3bda5c7c10.ppt

- Количество слайдов: 58

Social Studies of the New Retirement

Social Studies of the New Retirement

Rethink Retirement Planning Calculus of Retirement 1 Social Studies of Retirement Source: 1 Adapted from: Milevsky, Moshe Arye. Calculus of retirement income financial models for pension annuities and life insurance. Cambridge: Cambridge UP, 2006. Print.

Rethink Retirement Planning Calculus of Retirement 1 Social Studies of Retirement Source: 1 Adapted from: Milevsky, Moshe Arye. Calculus of retirement income financial models for pension annuities and life insurance. Cambridge: Cambridge UP, 2006. Print.

Rethinking Retirement Planning Calculus of Retirement • Longevity risk • Inflation risk • Market risk

Rethinking Retirement Planning Calculus of Retirement • Longevity risk • Inflation risk • Market risk

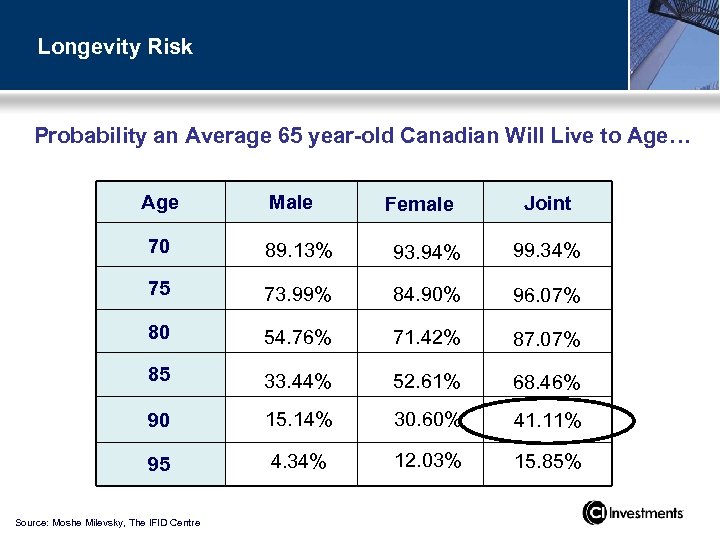

Longevity Risk Probability an Average 65 year-old Canadian Will Live to Age… Age Male Female Joint 70 89. 13% 93. 94% 99. 34% 75 73. 99% 84. 90% 96. 07% 80 54. 76% 71. 42% 87. 07% 85 33. 44% 52. 61% 68. 46% 90 15. 14% 30. 60% 41. 11% 95 4. 34% 12. 03% 15. 85% Source: Moshe Milevsky, The IFID Centre

Longevity Risk Probability an Average 65 year-old Canadian Will Live to Age… Age Male Female Joint 70 89. 13% 93. 94% 99. 34% 75 73. 99% 84. 90% 96. 07% 80 54. 76% 71. 42% 87. 07% 85 33. 44% 52. 61% 68. 46% 90 15. 14% 30. 60% 41. 11% 95 4. 34% 12. 03% 15. 85% Source: Moshe Milevsky, The IFID Centre

Longevity Risk Individual Aging Population Aging Family Aging

Longevity Risk Individual Aging Population Aging Family Aging

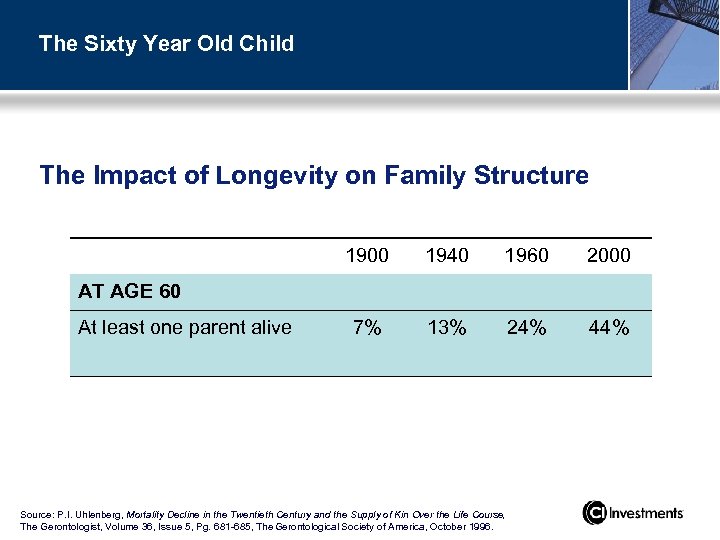

The Sixty Year Old Child The Impact of Longevity on Family Structure 1900 1940 1960 2000 7% 13% 24% 44% AT AGE 60 At least one parent alive Source: P. I. Uhlenberg, Mortality Decline in the Twentieth Century and the Supply of Kin Over the Life Course, The Gerontologist, Volume 36, Issue 5, Pg. 681 -685, The Gerontological Society of America, October 1996.

The Sixty Year Old Child The Impact of Longevity on Family Structure 1900 1940 1960 2000 7% 13% 24% 44% AT AGE 60 At least one parent alive Source: P. I. Uhlenberg, Mortality Decline in the Twentieth Century and the Supply of Kin Over the Life Course, The Gerontologist, Volume 36, Issue 5, Pg. 681 -685, The Gerontological Society of America, October 1996.

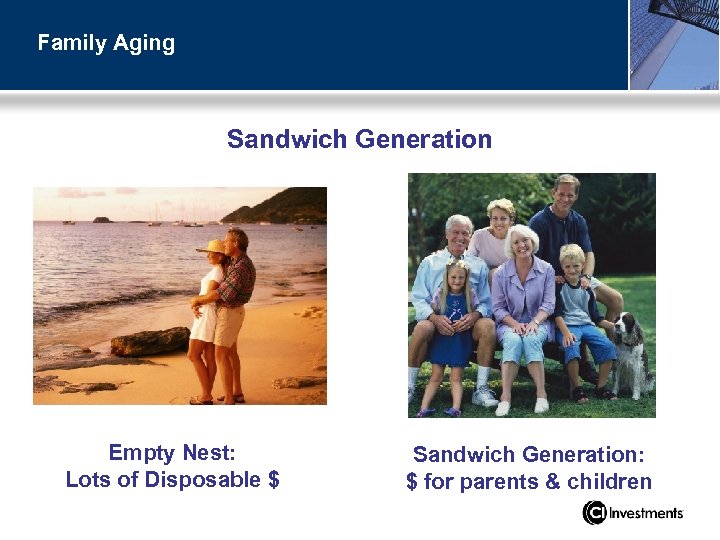

Family Aging Sandwich Generation Empty Nest: Lots of Disposable $ Sandwich Generation: $ for parents & children

Family Aging Sandwich Generation Empty Nest: Lots of Disposable $ Sandwich Generation: $ for parents & children

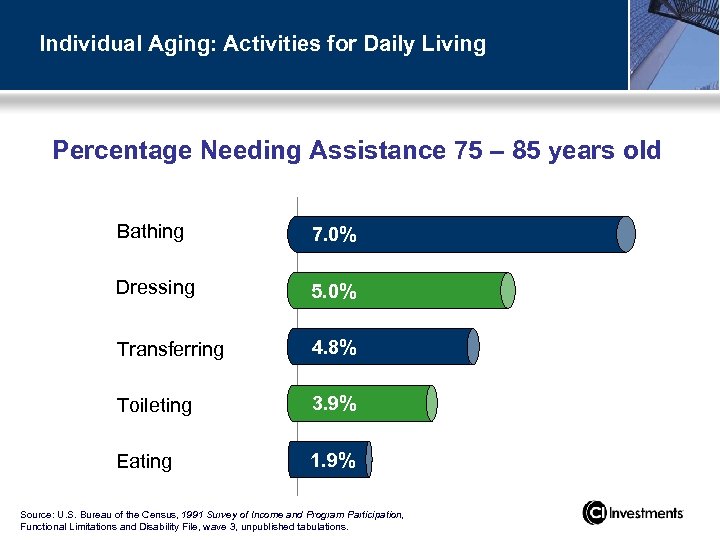

Individual Aging: Activities for Daily Living Percentage Needing Assistance 75 – 85 years old Bathing 7. 0% Dressing 5. 0% Transferring 4. 8% Toileting 3. 9% Eating 1. 9% Source: U. S. Bureau of the Census, 1991 Survey of Income and Program Participation, Functional Limitations and Disability File, wave 3, unpublished tabulations.

Individual Aging: Activities for Daily Living Percentage Needing Assistance 75 – 85 years old Bathing 7. 0% Dressing 5. 0% Transferring 4. 8% Toileting 3. 9% Eating 1. 9% Source: U. S. Bureau of the Census, 1991 Survey of Income and Program Participation, Functional Limitations and Disability File, wave 3, unpublished tabulations.

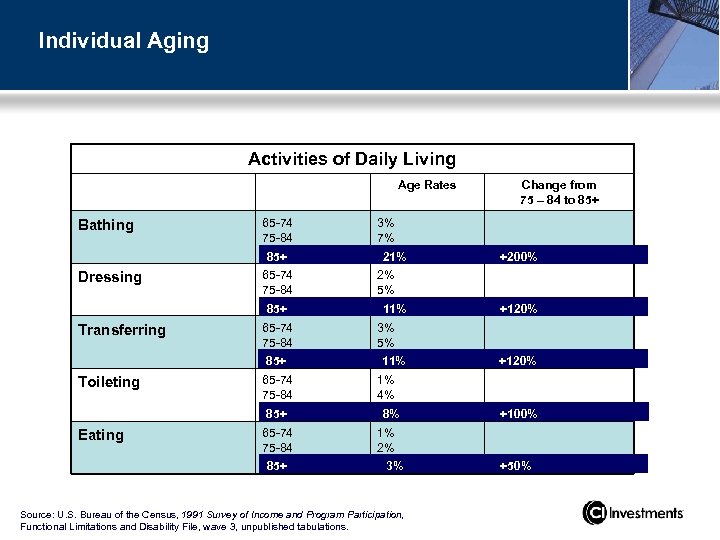

Individual Aging Activities of Daily Living Age Rates Bathing 65 -74 75 -84 85+ Dressing 65 -74 75 -84 85+ Transferring 65 -74 75 -84 85+ Toileting 65 -74 75 -84 85+ Eating 65 -74 75 -84 85+ Change from 75 – 84 to 85+ 3% 7% 21% +200% 2% 5% 11% +120% 3% 5% 11% +120% 1% 4% 8% +100% 1% 2% 3% Source: U. S. Bureau of the Census, 1991 Survey of Income and Program Participation, Functional Limitations and Disability File, wave 3, unpublished tabulations. +50%

Individual Aging Activities of Daily Living Age Rates Bathing 65 -74 75 -84 85+ Dressing 65 -74 75 -84 85+ Transferring 65 -74 75 -84 85+ Toileting 65 -74 75 -84 85+ Eating 65 -74 75 -84 85+ Change from 75 – 84 to 85+ 3% 7% 21% +200% 2% 5% 11% +120% 3% 5% 11% +120% 1% 4% 8% +100% 1% 2% 3% Source: U. S. Bureau of the Census, 1991 Survey of Income and Program Participation, Functional Limitations and Disability File, wave 3, unpublished tabulations. +50%

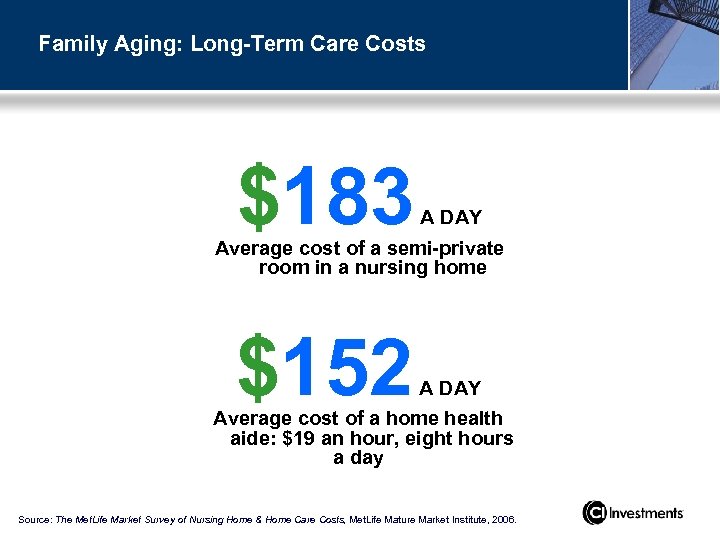

Family Aging: Long-Term Care Costs $183 A DAY Average cost of a semi-private room in a nursing home $152 A DAY Average cost of a home health aide: $19 an hour, eight hours a day Source: The Met. Life Market Survey of Nursing Home & Home Care Costs, Met. Life Mature Market Institute, 2006.

Family Aging: Long-Term Care Costs $183 A DAY Average cost of a semi-private room in a nursing home $152 A DAY Average cost of a home health aide: $19 an hour, eight hours a day Source: The Met. Life Market Survey of Nursing Home & Home Care Costs, Met. Life Mature Market Institute, 2006.

Family Aging The majority of middle age people now have more parents than they have children.

Family Aging The majority of middle age people now have more parents than they have children.

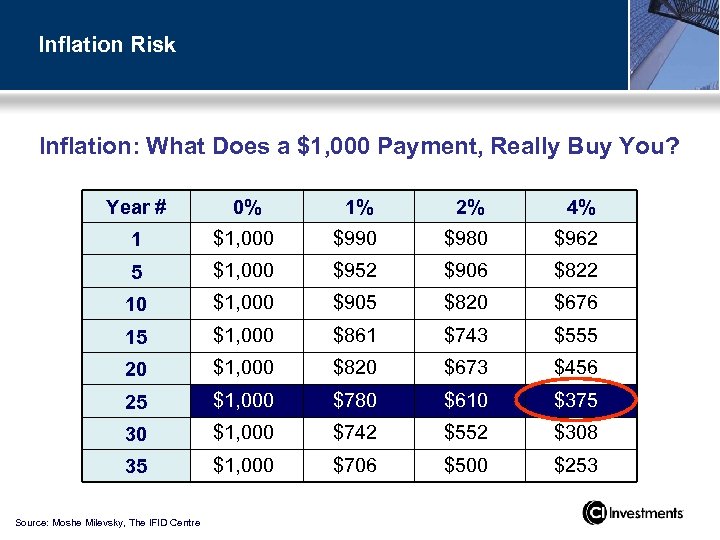

Inflation Risk Inflation: What Does a $1, 000 Payment, Really Buy You? Year # 0% 1% 2% 4% 1 $1, 000 $990 $980 $962 5 $1, 000 $952 $906 $822 10 $1, 000 $905 $820 $676 15 $1, 000 $861 $743 $555 20 $1, 000 $820 $673 $456 25 $1, 000 $780 $610 $375 30 $1, 000 $742 $552 $308 35 $1, 000 $706 $500 $253 Source: Moshe Milevsky, The IFID Centre

Inflation Risk Inflation: What Does a $1, 000 Payment, Really Buy You? Year # 0% 1% 2% 4% 1 $1, 000 $990 $980 $962 5 $1, 000 $952 $906 $822 10 $1, 000 $905 $820 $676 15 $1, 000 $861 $743 $555 20 $1, 000 $820 $673 $456 25 $1, 000 $780 $610 $375 30 $1, 000 $742 $552 $308 35 $1, 000 $706 $500 $253 Source: Moshe Milevsky, The IFID Centre

Market Risk • Sequence of Returns Matters

Market Risk • Sequence of Returns Matters

Rethinking Retirement Planning Calculus of Retirement Social Studies of Retirement

Rethinking Retirement Planning Calculus of Retirement Social Studies of Retirement

Rethinking Retirement Planning Social Studies of Retirement • Market opportunity • Relationship management • Solutions

Rethinking Retirement Planning Social Studies of Retirement • Market opportunity • Relationship management • Solutions

Market Opportunity

Market Opportunity

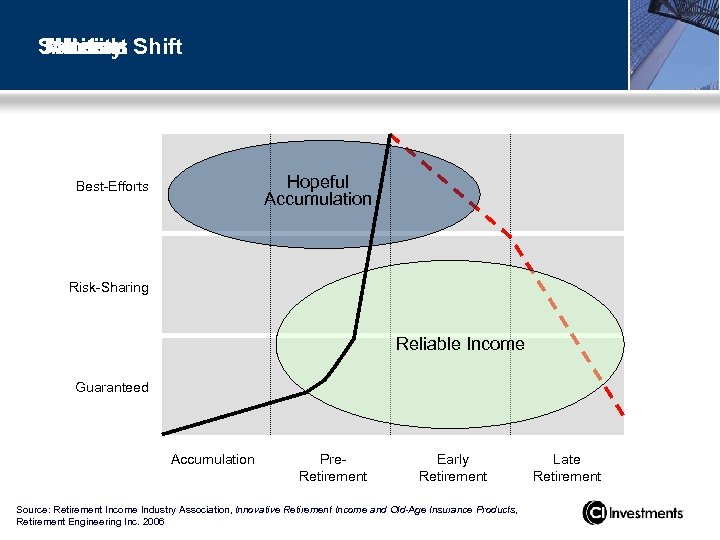

Solution Shift Mindset Activity Needs Hopeful Accumulation Best-Efforts Risk-Sharing Reliable Income Guaranteed Accumulation Pre. Retirement Early Retirement Source: Retirement Income Industry Association, Innovative Retirement Income and Old-Age Insurance Products, Retirement Engineering Inc. 2006 Late Retirement

Solution Shift Mindset Activity Needs Hopeful Accumulation Best-Efforts Risk-Sharing Reliable Income Guaranteed Accumulation Pre. Retirement Early Retirement Source: Retirement Income Industry Association, Innovative Retirement Income and Old-Age Insurance Products, Retirement Engineering Inc. 2006 Late Retirement

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 Source: 1 Investor Economics Household Balance Sheet, 2006 and 2005 edition.

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 Source: 1 Investor Economics Household Balance Sheet, 2006 and 2005 edition.

Large Market & Inefficient Investments • Significant assets are held in tax inefficient investments such as: • $647 billion in near cash deposits with the chartered banks 1 • $71. 2 billion in fixed income mutual funds 2 • $12. 1 billion in CSBs 3 Source: 1 Department of Finance. Bank of Canada Banking and Financial Statistics Publication. 2010. Print. , 2 IFIC, December 2009, 3 Department of Finance. The Fiscal Monitor. Publication. 2010. Print.

Large Market & Inefficient Investments • Significant assets are held in tax inefficient investments such as: • $647 billion in near cash deposits with the chartered banks 1 • $71. 2 billion in fixed income mutual funds 2 • $12. 1 billion in CSBs 3 Source: 1 Department of Finance. Bank of Canada Banking and Financial Statistics Publication. 2010. Print. , 2 IFIC, December 2009, 3 Department of Finance. The Fiscal Monitor. Publication. 2010. Print.

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 • 51% of Canadian retirees say they had no idea of what they wanted their retirement to look like 2 Source: 1 Investor Economics Household Balance Sheet, 2003 and 2005 edition. 2 Common vision lacking among retired couples: survey. Transcontinental Media inc. , 2010. Web.

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 • 51% of Canadian retirees say they had no idea of what they wanted their retirement to look like 2 Source: 1 Investor Economics Household Balance Sheet, 2003 and 2005 edition. 2 Common vision lacking among retired couples: survey. Transcontinental Media inc. , 2010. Web.

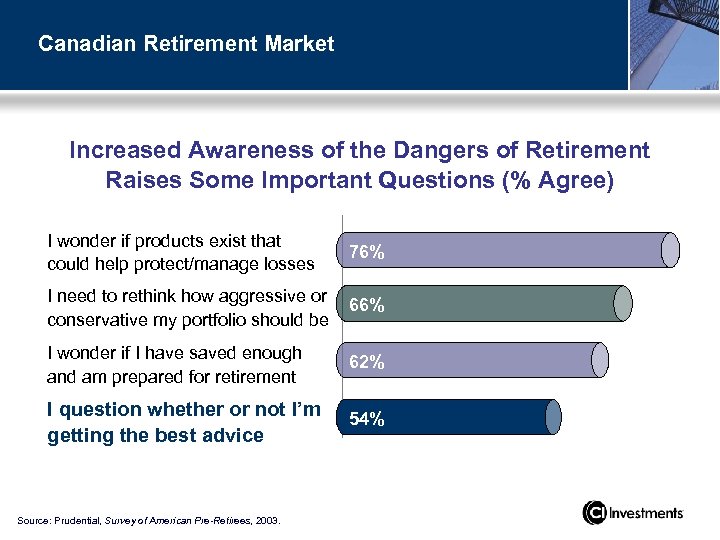

Canadian Retirement Market Increased Awareness of the Dangers of Retirement Raises Some Important Questions (% Agree) I wonder if products exist that could help protect/manage losses 76% I need to rethink how aggressive or conservative my portfolio should be 66% I wonder if I have saved enough and am prepared for retirement 62% I question whether or not I’m getting the best advice 54% Source: Prudential, Survey of American Pre-Retirees, 2003.

Canadian Retirement Market Increased Awareness of the Dangers of Retirement Raises Some Important Questions (% Agree) I wonder if products exist that could help protect/manage losses 76% I need to rethink how aggressive or conservative my portfolio should be 66% I wonder if I have saved enough and am prepared for retirement 62% I question whether or not I’m getting the best advice 54% Source: Prudential, Survey of American Pre-Retirees, 2003.

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 • 51% of Canadian retirees say they had no idea of what they wanted their retirement to look like 2 • among non retired Canadians age 35 – 55 years old 52% are not confident that their financial situation in retirement will be adequate 3 Source: 1 Investor Economics Household Balance Sheet, 2003 and 2005 edition. 2 Common vision lacking among retired couples: survey. Transcontinental Media inc. , 2010. Web. http: //www. investmentexecutive. com/client/en/News/Detail. News. asp? id=52213&idsection=3&cat=3. 3 Where Has the Money Gone: The State of Canadian Household Debt in a Stumbling Economy. Publication. The Certified General Accountants Association of Canada, 2009. Web.

Canadian Retirement Market • by 2014, Canadians 55 and over will control almost 72% of investable assets 1 • 51% of Canadian retirees say they had no idea of what they wanted their retirement to look like 2 • among non retired Canadians age 35 – 55 years old 52% are not confident that their financial situation in retirement will be adequate 3 Source: 1 Investor Economics Household Balance Sheet, 2003 and 2005 edition. 2 Common vision lacking among retired couples: survey. Transcontinental Media inc. , 2010. Web. http: //www. investmentexecutive. com/client/en/News/Detail. News. asp? id=52213&idsection=3&cat=3. 3 Where Has the Money Gone: The State of Canadian Household Debt in a Stumbling Economy. Publication. The Certified General Accountants Association of Canada, 2009. Web.

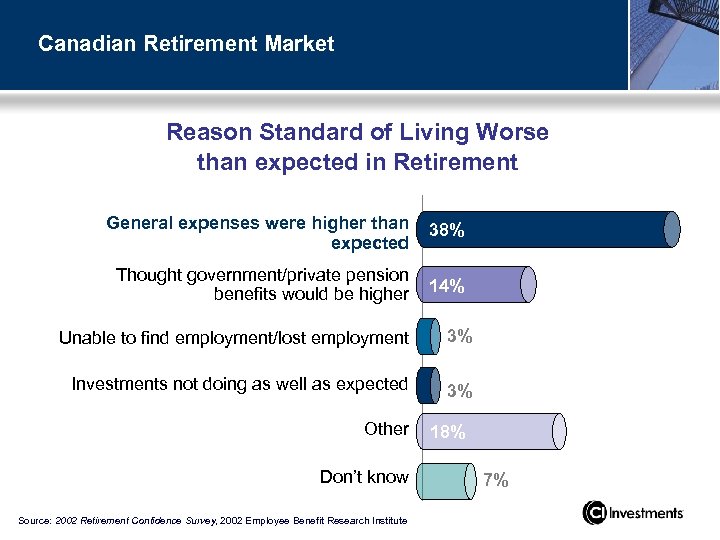

Canadian Retirement Market Reason Standard of Living Worse than expected in Retirement General expenses were higher than expected 38% Thought government/private pension benefits would be higher 14% Unable to find employment/lost employment 3% Investments not doing as well as expected 3% Other Don’t know Source: 2002 Retirement Confidence Survey, 2002 Employee Benefit Research Institute 18% 7%

Canadian Retirement Market Reason Standard of Living Worse than expected in Retirement General expenses were higher than expected 38% Thought government/private pension benefits would be higher 14% Unable to find employment/lost employment 3% Investments not doing as well as expected 3% Other Don’t know Source: 2002 Retirement Confidence Survey, 2002 Employee Benefit Research Institute 18% 7%

Living in Retirement • Change from Linear to Cyclical

Living in Retirement • Change from Linear to Cyclical

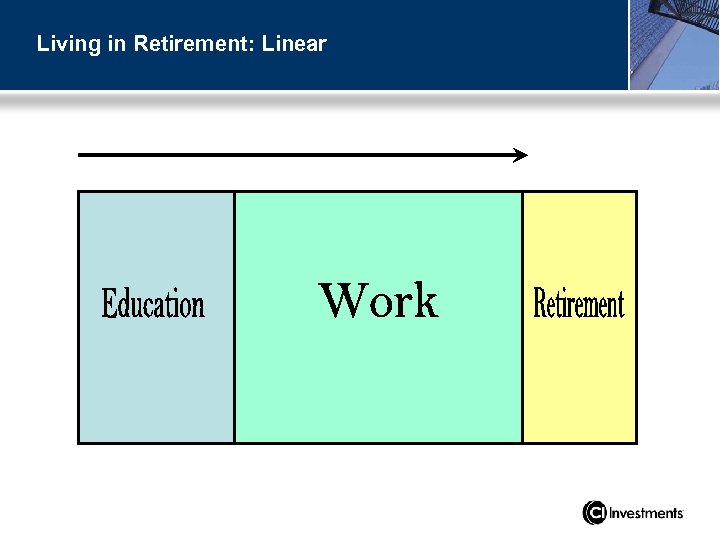

Living in Retirement: Linear

Living in Retirement: Linear

Living in Retirement: Cyclical

Living in Retirement: Cyclical

Relationship Management

Relationship Management

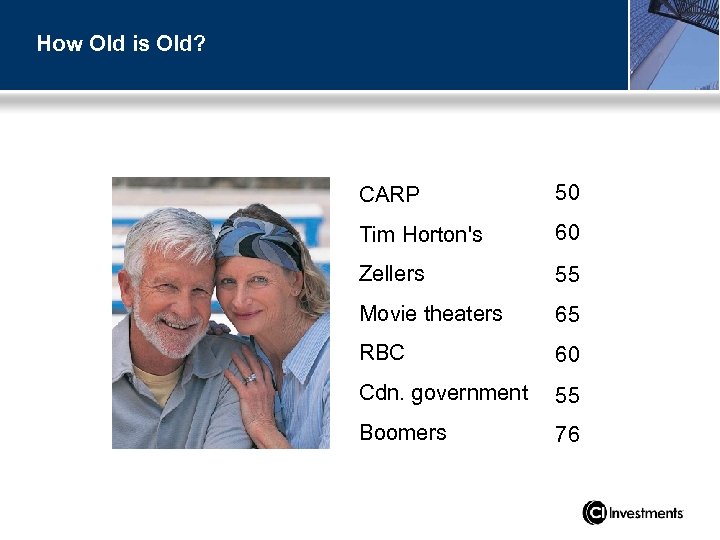

How Old is Old? CARP 50 Tim Horton's 60 Zellers 55 Movie theaters 65 RBC 60 Cdn. government 55 Boomers 76

How Old is Old? CARP 50 Tim Horton's 60 Zellers 55 Movie theaters 65 RBC 60 Cdn. government 55 Boomers 76

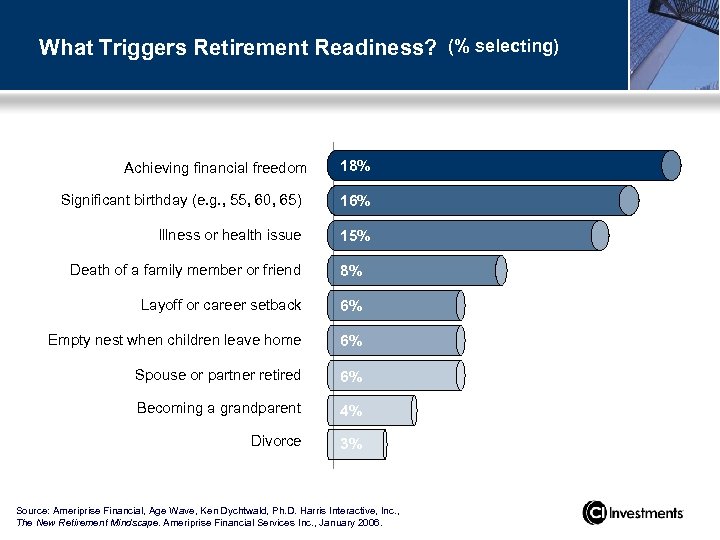

What Triggers Retirement Readiness? (% selecting) Achieving financial freedom 18% Significant birthday (e. g. , 55, 60, 65) 16% Illness or health issue 15% Death of a family member or friend 8% Layoff or career setback 6% Empty nest when children leave home 6% Spouse or partner retired 6% Becoming a grandparent 4% Divorce 3% 54% Source: Ameriprise Financial, Age Wave, Ken Dychtwald, Ph. D. Harris Interactive, Inc. , The New Retirement Mindscape. Ameriprise Financial Services Inc. , January 2006.

What Triggers Retirement Readiness? (% selecting) Achieving financial freedom 18% Significant birthday (e. g. , 55, 60, 65) 16% Illness or health issue 15% Death of a family member or friend 8% Layoff or career setback 6% Empty nest when children leave home 6% Spouse or partner retired 6% Becoming a grandparent 4% Divorce 3% 54% Source: Ameriprise Financial, Age Wave, Ken Dychtwald, Ph. D. Harris Interactive, Inc. , The New Retirement Mindscape. Ameriprise Financial Services Inc. , January 2006.

Retirement Risks Longevity Risk: Will I outlive my money? Inflation Risk: Market Risk: Will a drop in the market set me back? What will a dollar buy me in 20 years?

Retirement Risks Longevity Risk: Will I outlive my money? Inflation Risk: Market Risk: Will a drop in the market set me back? What will a dollar buy me in 20 years?

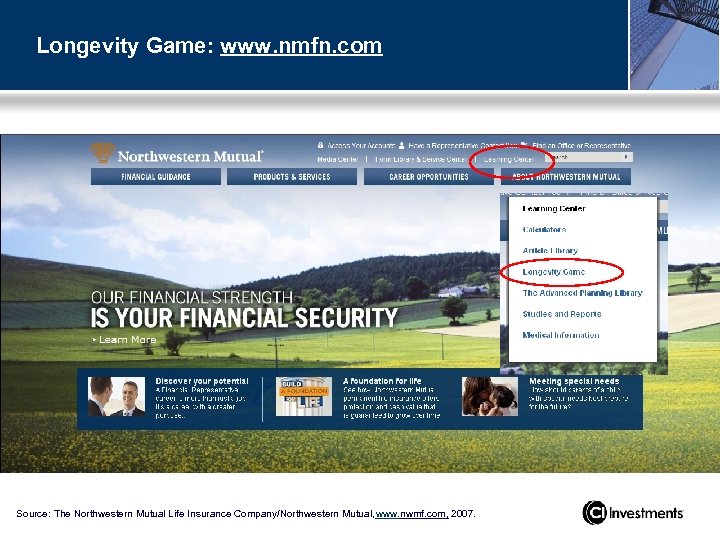

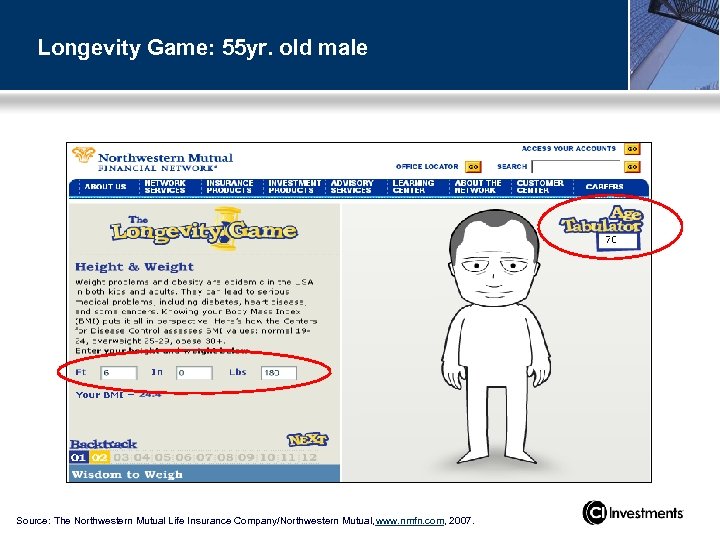

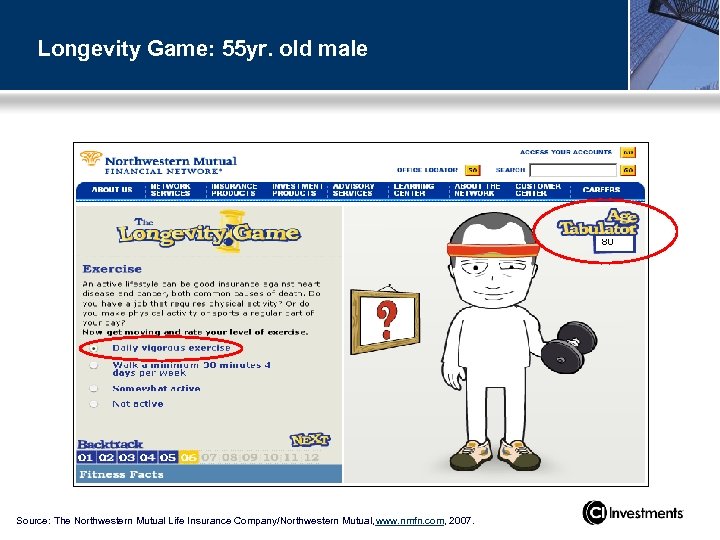

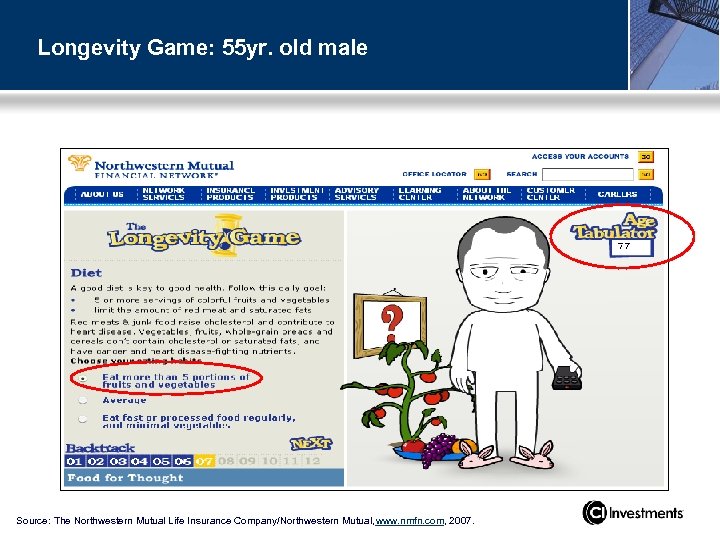

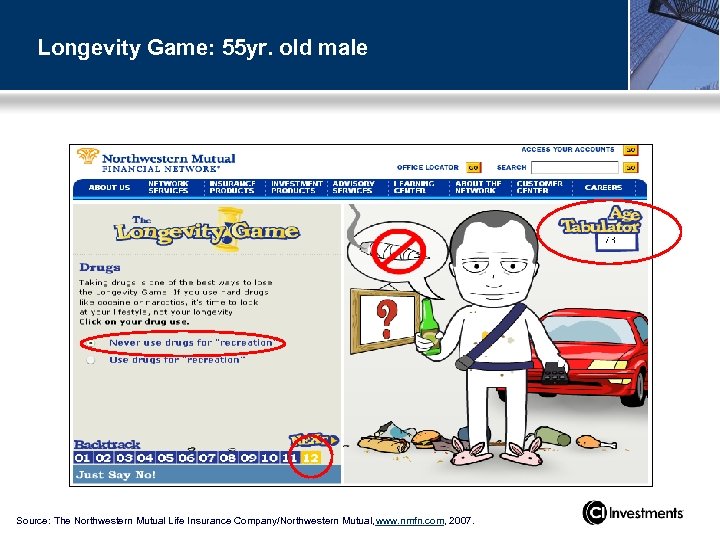

Longevity Risk • Averages • Make it personal • www. livingto 100. com • www. nmfn. com

Longevity Risk • Averages • Make it personal • www. livingto 100. com • www. nmfn. com

Longevity Game: www. nmfn. com Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nwmf. com, 2007.

Longevity Game: www. nmfn. com Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nwmf. com, 2007.

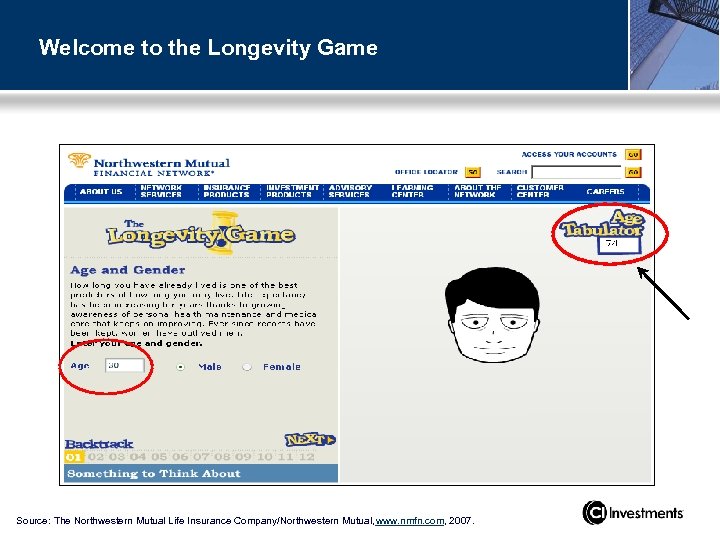

Welcome to the Longevity Game Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Welcome to the Longevity Game Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

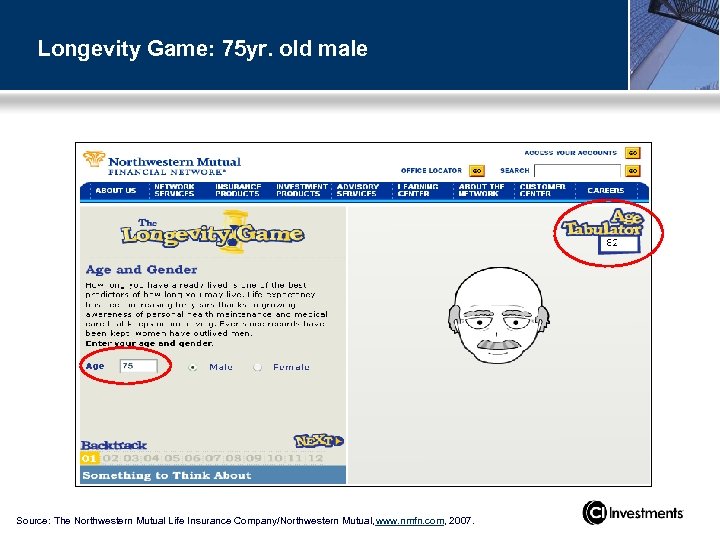

Longevity Game: 75 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 75 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

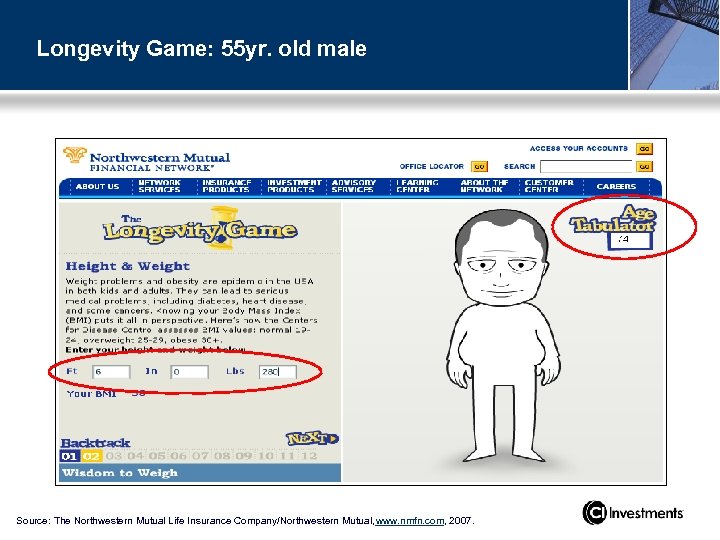

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Longevity Game: 55 yr. old male Source: The Northwestern Mutual Life Insurance Company/Northwestern Mutual, www. nmfn. com, 2007.

Inflation Risk • Massive impact over time • CPI vs. CPI-E • Make it Personal • CPI – (Your client’s name here)

Inflation Risk • Massive impact over time • CPI vs. CPI-E • Make it Personal • CPI – (Your client’s name here)

Market Risk • Personal situation • Personal Advice

Market Risk • Personal situation • Personal Advice

Solutions

Solutions

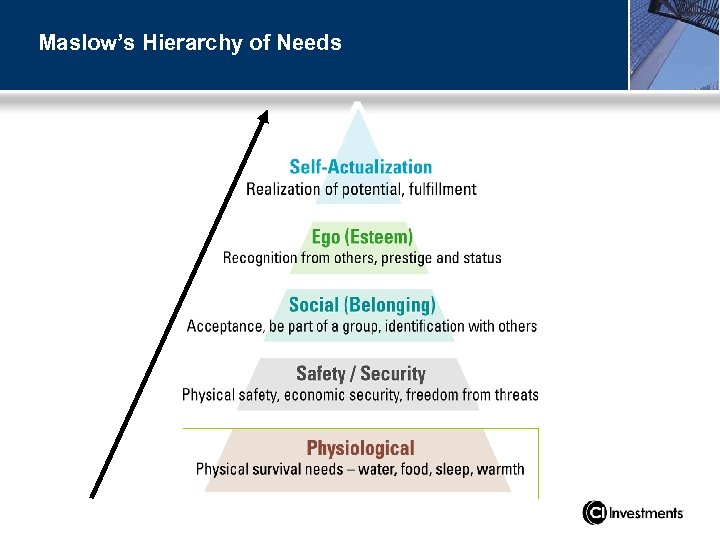

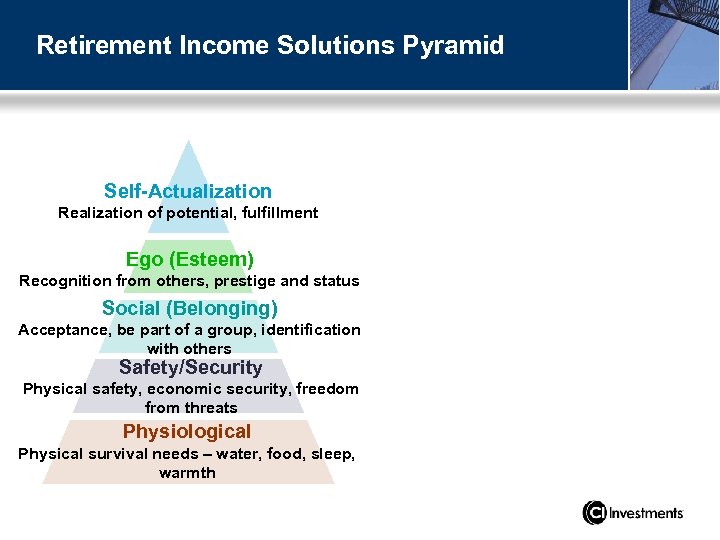

Maslow’s Hierarchy of Needs

Maslow’s Hierarchy of Needs

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Safety/Security Physical safety, economic security, freedom from threats Physiological Physical survival needs – water, food, sleep, warmth

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Safety/Security Physical safety, economic security, freedom from threats Physiological Physical survival needs – water, food, sleep, warmth

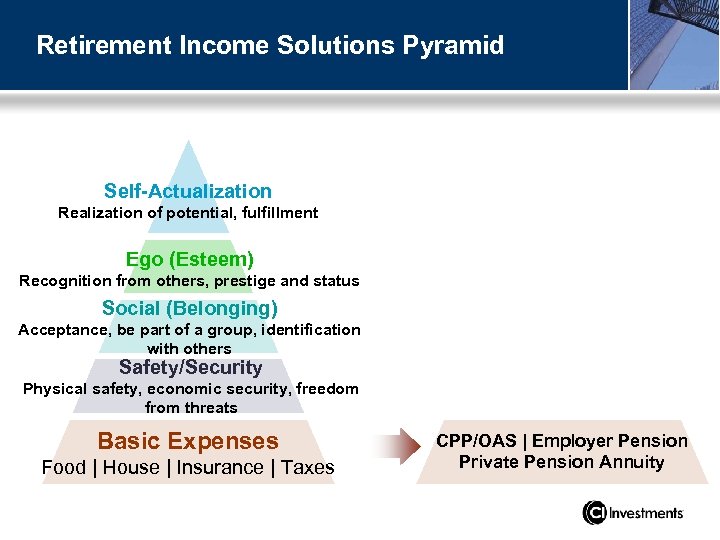

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Safety/Security Physical safety, economic security, freedom from threats Basic Expenses Food | House | Insurance | Taxes CPP/OAS | Employer Pension Private Pension Annuity

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Safety/Security Physical safety, economic security, freedom from threats Basic Expenses Food | House | Insurance | Taxes CPP/OAS | Employer Pension Private Pension Annuity

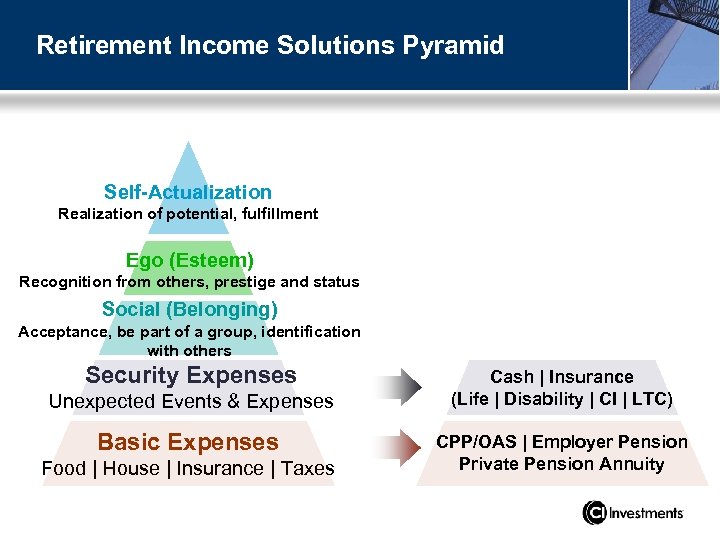

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social (Belonging) Acceptance, be part of a group, identification with others Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

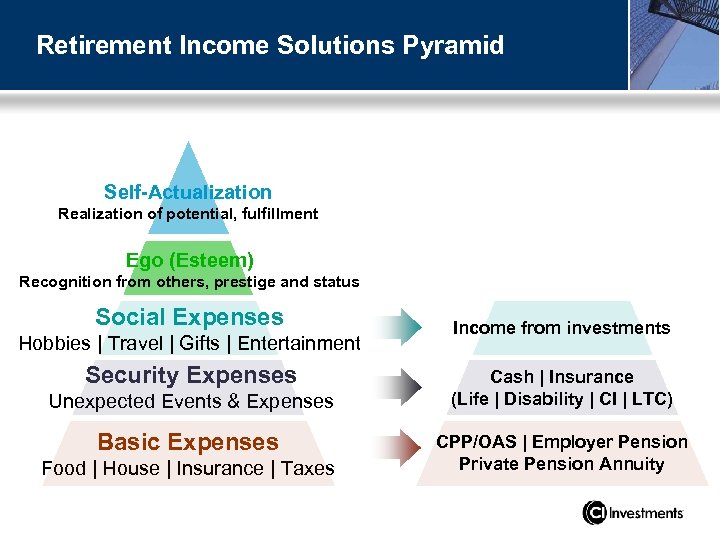

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Ego (Esteem) Recognition from others, prestige and status Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

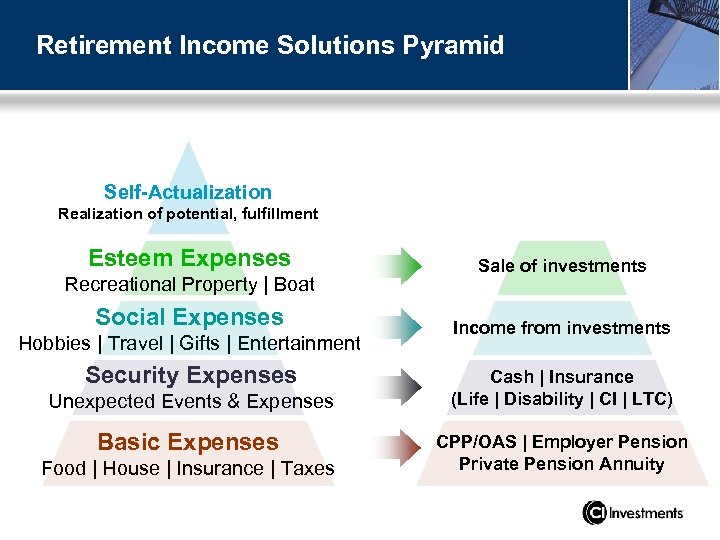

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Esteem Expenses Recreational Property | Boat Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Sale of investments Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

Retirement Income Solutions Pyramid Self-Actualization Realization of potential, fulfillment Esteem Expenses Recreational Property | Boat Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Sale of investments Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

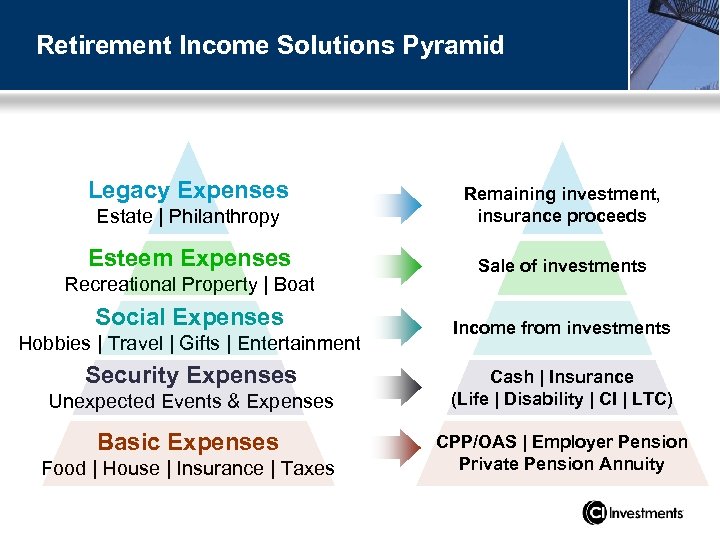

Retirement Income Solutions Pyramid Legacy Expenses Estate | Philanthropy Remaining investment, insurance proceeds Esteem Expenses Sale of investments Recreational Property | Boat Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

Retirement Income Solutions Pyramid Legacy Expenses Estate | Philanthropy Remaining investment, insurance proceeds Esteem Expenses Sale of investments Recreational Property | Boat Social Expenses Hobbies | Travel | Gifts | Entertainment Security Expenses Unexpected Events & Expenses Basic Expenses Food | House | Insurance | Taxes Income from investments Cash | Insurance (Life | Disability | CI | LTC) CPP/OAS | Employer Pension Private Pension Annuity

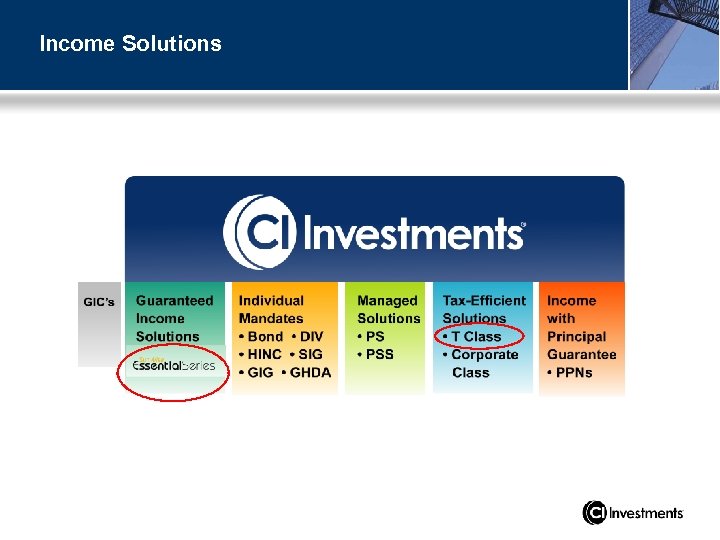

Income Solutions

Income Solutions

Resources • The Boomer Century, Richard Croker • Turning Silver to Gold, Mary Furlong • Advising Mature Clients, Neal Cutler • Future Perfect, David Bond • www. livingto 100. com • www. nmfn. com • www. ci. com • Your CI Wholesaler

Resources • The Boomer Century, Richard Croker • Turning Silver to Gold, Mary Furlong • Advising Mature Clients, Neal Cutler • Future Perfect, David Bond • www. livingto 100. com • www. nmfn. com • www. ci. com • Your CI Wholesaler

www. ci. com/PD

www. ci. com/PD

Please email pd@ci. com if you have any questions or concerns.

Please email pd@ci. com if you have any questions or concerns.

Thank you

Thank you

Disclaimer All charts and illustrations in this guide are for illustrative purposes only. They are not intended to predict or project investment results. ®CI Investments and the CI Investments design are registered trademarks of CI Investments Inc. ®Sun. Wise is a registered trademark of Sun Life Assurance Company of Canada.

Disclaimer All charts and illustrations in this guide are for illustrative purposes only. They are not intended to predict or project investment results. ®CI Investments and the CI Investments design are registered trademarks of CI Investments Inc. ®Sun. Wise is a registered trademark of Sun Life Assurance Company of Canada.