b03e2b7e165dc6bffd958f9da2c66386.ppt

- Количество слайдов: 21

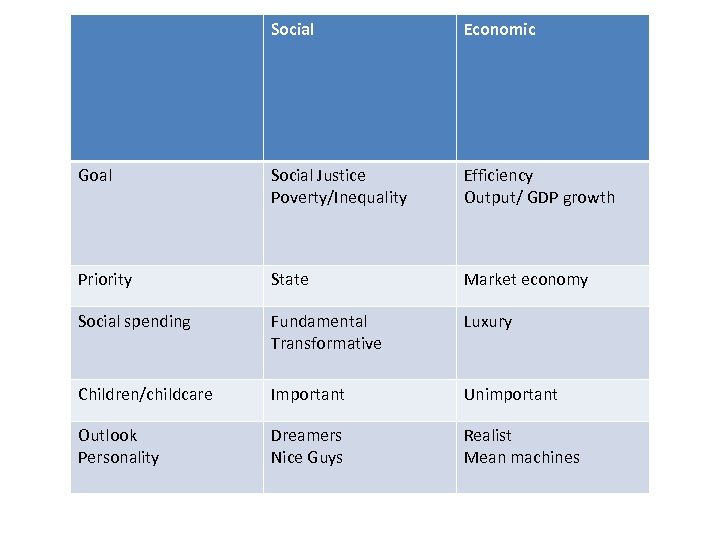

Social Economic Goal Social Justice Poverty/Inequality Efficiency Output/ GDP growth Priority State Market economy Social spending Fundamental Transformative Luxury Children/childcare Important Unimportant Outlook Personality Dreamers Nice Guys Realist Mean machines

Social Economic Goal Social Justice Poverty/Inequality Efficiency Output/ GDP growth Priority State Market economy Social spending Fundamental Transformative Luxury Children/childcare Important Unimportant Outlook Personality Dreamers Nice Guys Realist Mean machines

Social Protection, Redistribution and Economic Growth David Piachaud

Social Protection, Redistribution and Economic Growth David Piachaud

Outline Types of social protection Behavioural effects Social protection and economic growth - Human capital - Investment - Local economy - Macro effects Micro-simulation - South Africa – Redistribution – Economic growth Conclusions

Outline Types of social protection Behavioural effects Social protection and economic growth - Human capital - Investment - Local economy - Macro effects Micro-simulation - South Africa – Redistribution – Economic growth Conclusions

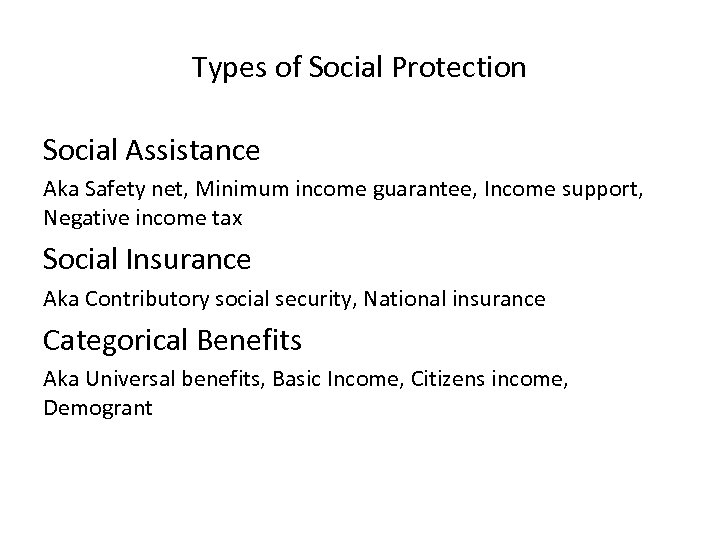

Types of Social Protection Social Assistance Aka Safety net, Minimum income guarantee, Income support, Negative income tax Social Insurance Aka Contributory social security, National insurance Categorical Benefits Aka Universal benefits, Basic Income, Citizens income, Demogrant

Types of Social Protection Social Assistance Aka Safety net, Minimum income guarantee, Income support, Negative income tax Social Insurance Aka Contributory social security, National insurance Categorical Benefits Aka Universal benefits, Basic Income, Citizens income, Demogrant

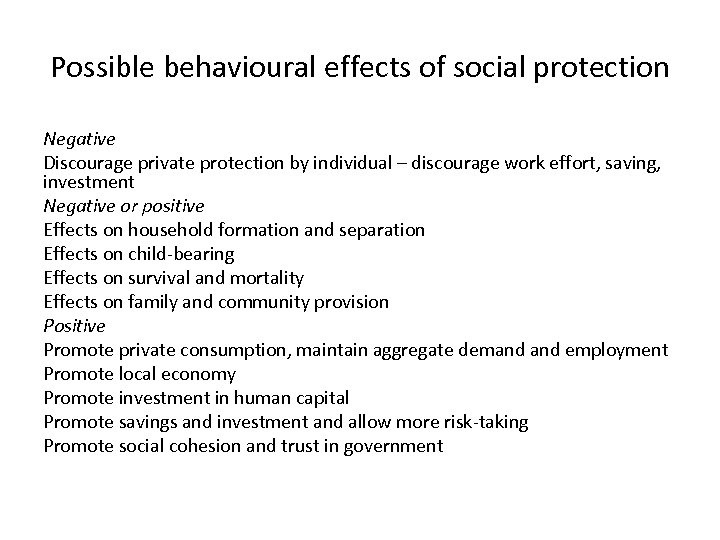

Possible behavioural effects of social protection Negative Discourage private protection by individual – discourage work effort, saving, investment Negative or positive Effects on household formation and separation Effects on child-bearing Effects on survival and mortality Effects on family and community provision Positive Promote private consumption, maintain aggregate demand employment Promote local economy Promote investment in human capital Promote savings and investment and allow more risk-taking Promote social cohesion and trust in government

Possible behavioural effects of social protection Negative Discourage private protection by individual – discourage work effort, saving, investment Negative or positive Effects on household formation and separation Effects on child-bearing Effects on survival and mortality Effects on family and community provision Positive Promote private consumption, maintain aggregate demand employment Promote local economy Promote investment in human capital Promote savings and investment and allow more risk-taking Promote social cohesion and trust in government

Possible effects on economic growth The dismal tradition of economics Four major reasons for hope 1. The protection and encouragement of human capital formation 2. The encouragement of investment and innovation 3. Promoting the local economy and using local knowledge 4. Macro effects

Possible effects on economic growth The dismal tradition of economics Four major reasons for hope 1. The protection and encouragement of human capital formation 2. The encouragement of investment and innovation 3. Promoting the local economy and using local knowledge 4. Macro effects

The protection and encouragement of human capital formation Social protection may: Keep people alive Enable children to be educated Enable health clinic to be reached But little solid evidence Conditional Cash Transfers are Social Protection with Conditions Some evidence on their operation and impact Evidence

The protection and encouragement of human capital formation Social protection may: Keep people alive Enable children to be educated Enable health clinic to be reached But little solid evidence Conditional Cash Transfers are Social Protection with Conditions Some evidence on their operation and impact Evidence

The encouragement of investment and innovation When consumption is minimal, reducing it so as to invest is hard Investment decisions of the poorest - what to plant, when, whether to buy a tin sheet for roofing, whether to kill a goat, whether to send a child to the city – are critical. Far more hangs on these decisions than for wealthy If marginal propensity to consume declines with income and marginal efficiency of capital declines as capital increases, then social protection is good for investment and innovation Evidence

The encouragement of investment and innovation When consumption is minimal, reducing it so as to invest is hard Investment decisions of the poorest - what to plant, when, whether to buy a tin sheet for roofing, whether to kill a goat, whether to send a child to the city – are critical. Far more hangs on these decisions than for wealthy If marginal propensity to consume declines with income and marginal efficiency of capital declines as capital increases, then social protection is good for investment and innovation Evidence

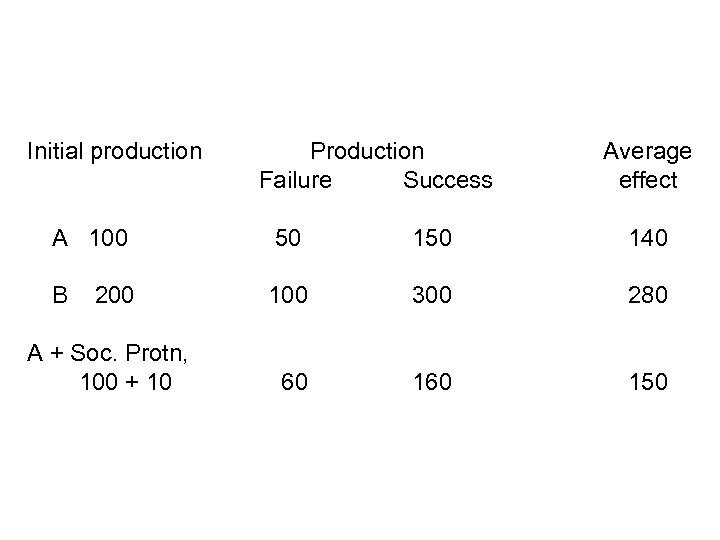

Initial production Production Failure Success Average effect A 100 50 140 B 200 100 300 280 A + Soc. Protn, 100 + 10 60 150

Initial production Production Failure Success Average effect A 100 50 140 B 200 100 300 280 A + Soc. Protn, 100 + 10 60 150

The encouragement of investment and innovation When consumption is minimal, reducing it so as to invest is hard Investment decisions of the poorest - what to plant, when, whether to buy a tin sheet for roofing, whether to kill a goat, whether to send a child to the city – are critical. Far more hangs on these decisions than for wealthy If marginal propensity to consume declines with income and marginal efficiency of capital declines as capital increases, then social protection is good for investment and innovation Evidence

The encouragement of investment and innovation When consumption is minimal, reducing it so as to invest is hard Investment decisions of the poorest - what to plant, when, whether to buy a tin sheet for roofing, whether to kill a goat, whether to send a child to the city – are critical. Far more hangs on these decisions than for wealthy If marginal propensity to consume declines with income and marginal efficiency of capital declines as capital increases, then social protection is good for investment and innovation Evidence

Promoting the local economy and using local knowledge Social protection allows people to spend on what they want based on local knowledge potentially aiding local economy with high local multipler effects By contrast, providing services provided by teachers or doctors who live in more prosperous areas provides little boost to local area But if demand is for goods for which supply cannot be increased the result may be inflation Evidence

Promoting the local economy and using local knowledge Social protection allows people to spend on what they want based on local knowledge potentially aiding local economy with high local multipler effects By contrast, providing services provided by teachers or doctors who live in more prosperous areas provides little boost to local area But if demand is for goods for which supply cannot be increased the result may be inflation Evidence

Macro effects Social cohesion Social stability Economic stabiliser Trust in government Confidence in the future Evidence

Macro effects Social cohesion Social stability Economic stabiliser Trust in government Confidence in the future Evidence

Social protection A microsimulation of South Africa Purpose – To review types of social protection, their relevance, the issues for redistribution and economic growth that they raise. Not to explore detail of income distribution or existing social protection. Data – National Income Dynamics Survey, 2008, 7, 000 households, 28, 000 individuals. Unit of analysis – Individual Measure of welfare – Household income per head Poverty level – SA ‘Lower’ Standard – Rand 515 per head per month

Social protection A microsimulation of South Africa Purpose – To review types of social protection, their relevance, the issues for redistribution and economic growth that they raise. Not to explore detail of income distribution or existing social protection. Data – National Income Dynamics Survey, 2008, 7, 000 households, 28, 000 individuals. Unit of analysis – Individual Measure of welfare – Household income per head Poverty level – SA ‘Lower’ Standard – Rand 515 per head per month

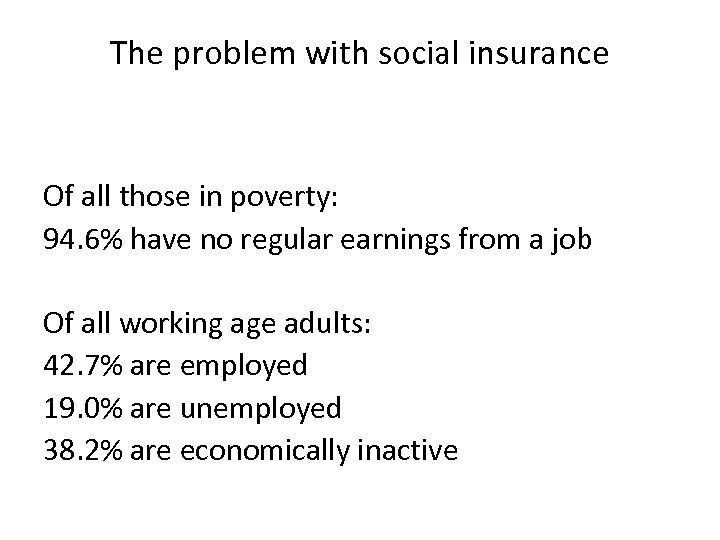

The problem with social insurance Of all those in poverty: 94. 6% have no regular earnings from a job Of all working age adults: 42. 7% are employed 19. 0% are unemployed 38. 2% are economically inactive

The problem with social insurance Of all those in poverty: 94. 6% have no regular earnings from a job Of all working age adults: 42. 7% are employed 19. 0% are unemployed 38. 2% are economically inactive

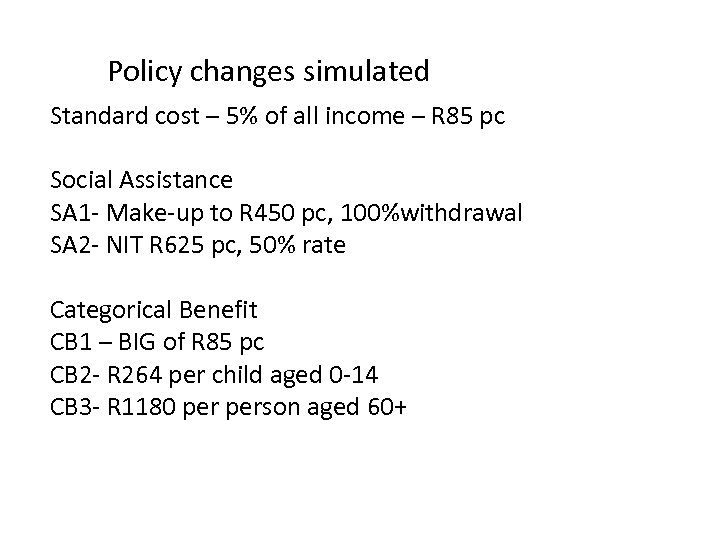

Policy changes simulated Standard cost – 5% of all income – R 85 pc Social Assistance SA 1 - Make-up to R 450 pc, 100%withdrawal SA 2 - NIT R 625 pc, 50% rate Categorical Benefit CB 1 – BIG of R 85 pc CB 2 - R 264 per child aged 0 -14 CB 3 - R 1180 person aged 60+

Policy changes simulated Standard cost – 5% of all income – R 85 pc Social Assistance SA 1 - Make-up to R 450 pc, 100%withdrawal SA 2 - NIT R 625 pc, 50% rate Categorical Benefit CB 1 – BIG of R 85 pc CB 2 - R 264 per child aged 0 -14 CB 3 - R 1180 person aged 60+

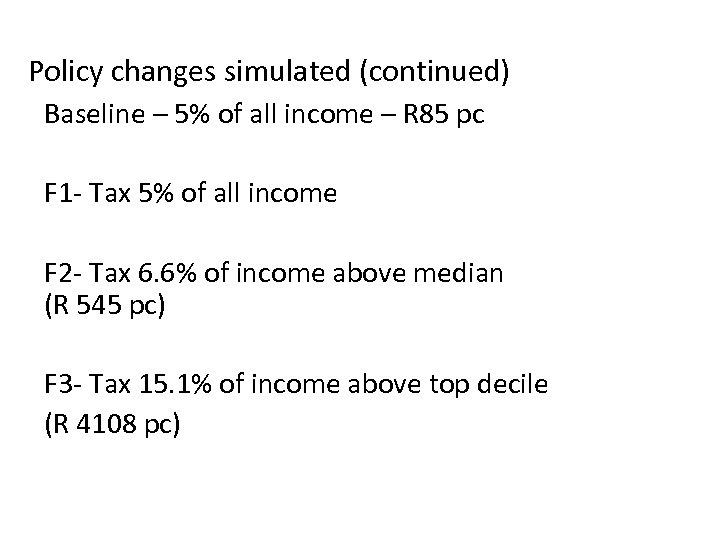

Policy changes simulated (continued) Baseline – 5% of all income – R 85 pc F 1 - Tax 5% of all income F 2 - Tax 6. 6% of income above median (R 545 pc) F 3 - Tax 15. 1% of income above top decile (R 4108 pc)

Policy changes simulated (continued) Baseline – 5% of all income – R 85 pc F 1 - Tax 5% of all income F 2 - Tax 6. 6% of income above median (R 545 pc) F 3 - Tax 15. 1% of income above top decile (R 4108 pc)

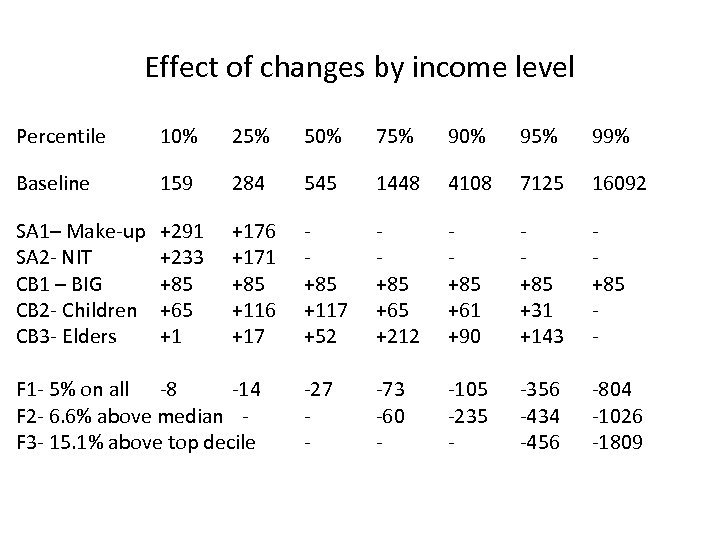

Effect of changes by income level Percentile 10% 25% 50% 75% 90% 95% 99% Baseline 159 284 545 1448 4108 7125 16092 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders +291 +233 +85 +65 +1 +176 +171 +85 +116 +17 +85 +117 +52 +85 +65 +212 +85 +61 +90 +85 +31 +143 +85 - -27 - -73 -60 - -105 -235 - -356 -434 -456 -804 -1026 -1809 F 1 - 5% on all -8 -14 F 2 - 6. 6% above median F 3 - 15. 1% above top decile

Effect of changes by income level Percentile 10% 25% 50% 75% 90% 95% 99% Baseline 159 284 545 1448 4108 7125 16092 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders +291 +233 +85 +65 +1 +176 +171 +85 +116 +17 +85 +117 +52 +85 +65 +212 +85 +61 +90 +85 +31 +143 +85 - -27 - -73 -60 - -105 -235 - -356 -434 -456 -804 -1026 -1809 F 1 - 5% on all -8 -14 F 2 - 6. 6% above median F 3 - 15. 1% above top decile

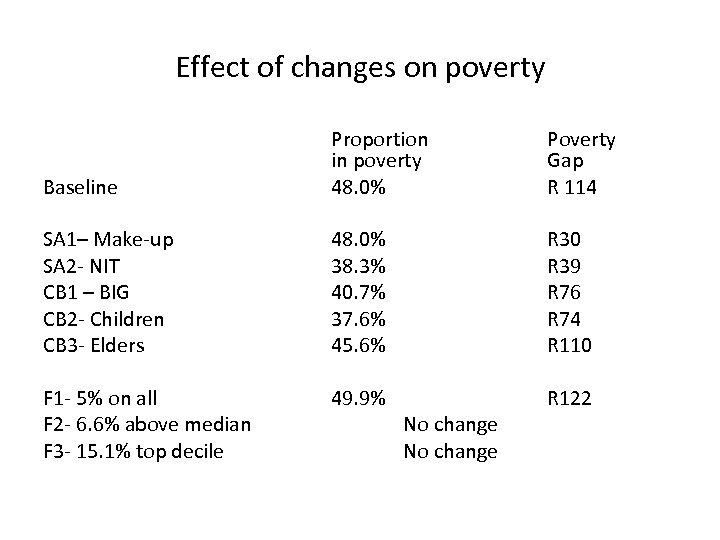

Effect of changes on poverty Baseline Proportion in poverty 48. 0% Poverty Gap R 114 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders 48. 0% 38. 3% 40. 7% 37. 6% 45. 6% R 30 R 39 R 76 R 74 R 110 F 1 - 5% on all F 2 - 6. 6% above median F 3 - 15. 1% top decile 49. 9% R 122 No change

Effect of changes on poverty Baseline Proportion in poverty 48. 0% Poverty Gap R 114 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders 48. 0% 38. 3% 40. 7% 37. 6% 45. 6% R 30 R 39 R 76 R 74 R 110 F 1 - 5% on all F 2 - 6. 6% above median F 3 - 15. 1% top decile 49. 9% R 122 No change

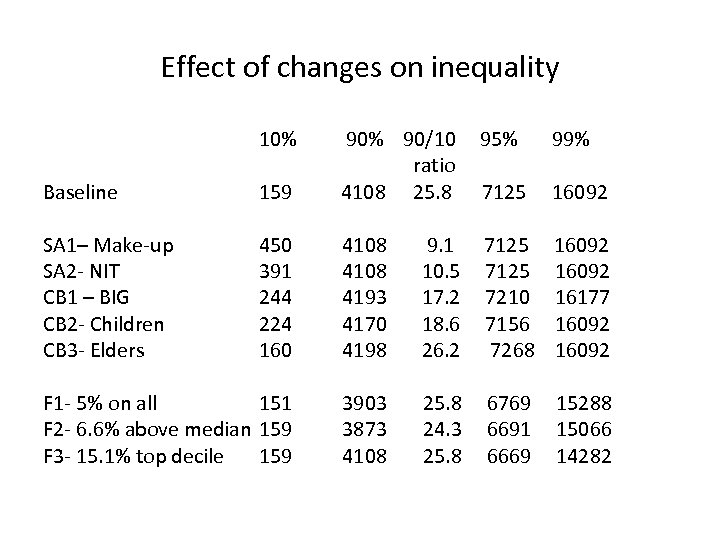

Effect of changes on inequality 10% Baseline 159 90% 90/10 ratio 4108 25. 8 95% 99% 7125 16092 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders 450 391 244 224 160 4108 4193 4170 4198 9. 1 10. 5 17. 2 18. 6 26. 2 7125 7210 7156 7268 16092 16177 16092 F 1 - 5% on all 151 F 2 - 6. 6% above median 159 F 3 - 15. 1% top decile 159 3903 3873 4108 25. 8 24. 3 25. 8 6769 6691 6669 15288 15066 14282

Effect of changes on inequality 10% Baseline 159 90% 90/10 ratio 4108 25. 8 95% 99% 7125 16092 SA 1– Make-up SA 2 - NIT CB 1 – BIG CB 2 - Children CB 3 - Elders 450 391 244 224 160 4108 4193 4170 4198 9. 1 10. 5 17. 2 18. 6 26. 2 7125 7210 7156 7268 16092 16177 16092 F 1 - 5% on all 151 F 2 - 6. 6% above median 159 F 3 - 15. 1% top decile 159 3903 3873 4108 25. 8 24. 3 25. 8 6769 6691 6669 15288 15066 14282

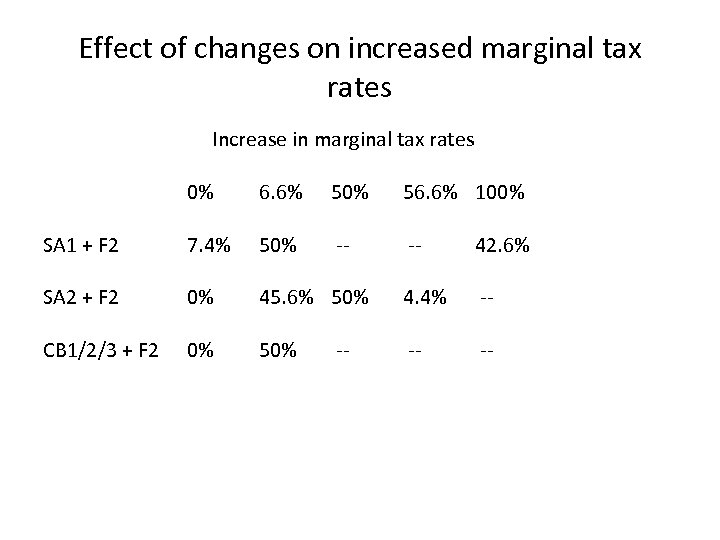

Effect of changes on increased marginal tax rates Increase in marginal tax rates 0% 6. 6% 50% 56. 6% 100% SA 1 + F 2 7. 4% 50% -- -- 42. 6% SA 2 + F 2 0% 45. 6% 50% 4. 4% -- CB 1/2/3 + F 2 0% 50% -- -- --

Effect of changes on increased marginal tax rates Increase in marginal tax rates 0% 6. 6% 50% 56. 6% 100% SA 1 + F 2 7. 4% 50% -- -- 42. 6% SA 2 + F 2 0% 45. 6% 50% 4. 4% -- CB 1/2/3 + F 2 0% 50% -- -- --

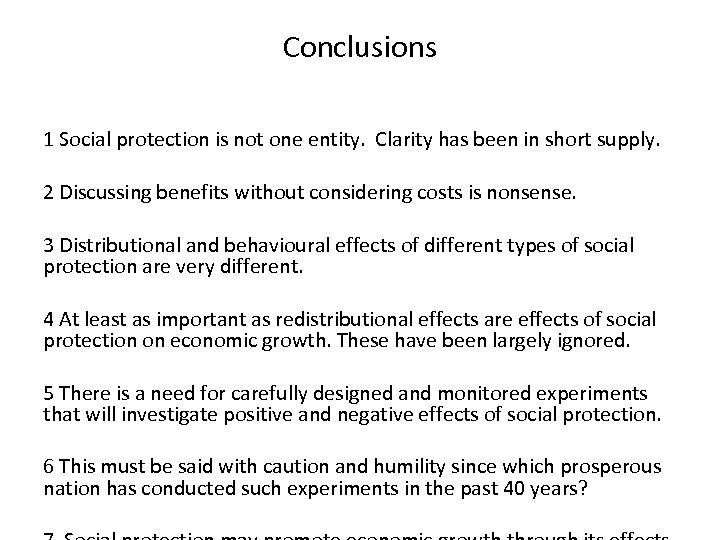

Conclusions 1 Social protection is not one entity. Clarity has been in short supply. 2 Discussing benefits without considering costs is nonsense. 3 Distributional and behavioural effects of different types of social protection are very different. 4 At least as important as redistributional effects are effects of social protection on economic growth. These have been largely ignored. 5 There is a need for carefully designed and monitored experiments that will investigate positive and negative effects of social protection. 6 This must be said with caution and humility since which prosperous nation has conducted such experiments in the past 40 years?

Conclusions 1 Social protection is not one entity. Clarity has been in short supply. 2 Discussing benefits without considering costs is nonsense. 3 Distributional and behavioural effects of different types of social protection are very different. 4 At least as important as redistributional effects are effects of social protection on economic growth. These have been largely ignored. 5 There is a need for carefully designed and monitored experiments that will investigate positive and negative effects of social protection. 6 This must be said with caution and humility since which prosperous nation has conducted such experiments in the past 40 years?